This article is being co-published with GSMA Intelligence. As the exclusive global network performance data provider to the intelligence unit of the mobile industry trade group GSMA, Ookla® supports their extensive efforts to provide data-driven insights and context on the state of the mobile industry around the world. Speedtest® data is leveraged by GSMA Intelligence analysts and experts on an ongoing basis, including within the recent "Mobile Market Structure and Performance in Europe" report.

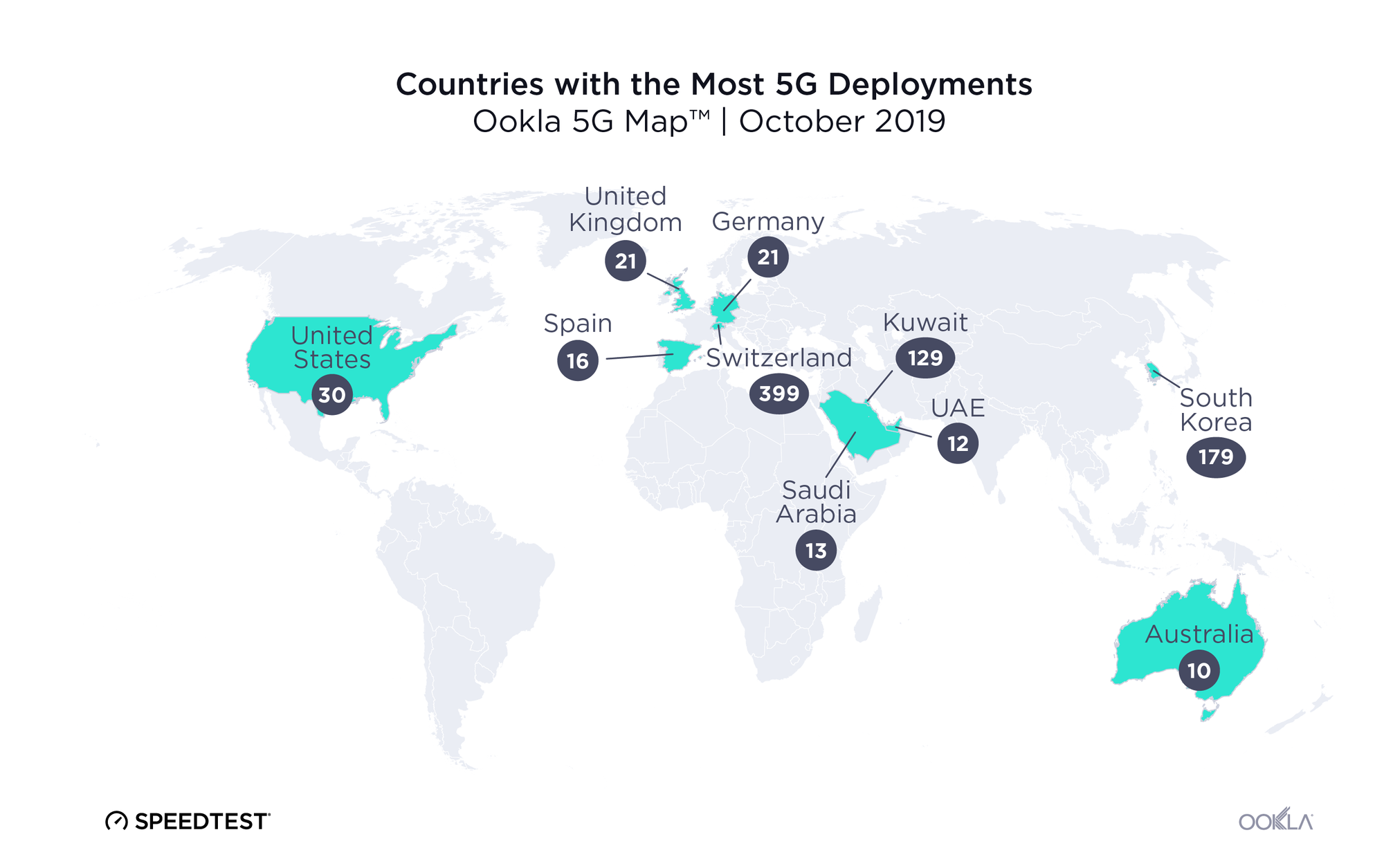

The mobile market in Europe has come to the end of its main phase of investments in fourth generation (4G) mobile networks and operators are now turning their attention to 5G. Services have already been launched in Switzerland and the UK, and more markets expected to launch in 2020, for example Germany and France.

Despite these positive steps, industry analysts do not expect a rapid roll-out of 5G in Europe. On the contrary, most expect 5G deployments in European markets to lag behind countries such as the US, China, Korea and Japan. The reason is that delivering 5G services will require large additional investments, and these will be a lot harder to justify in European markets that have recently delivered lower profit margins than in other parts of the world.

With this largely subdued investment climate, what can be done so that Europe doesn’t lose out on the 5G opportunity? One thing that could change this is competition dynamics. More concentrated market structures (for example with less players) can deliver economies of scale, a more efficient utilization of assets (such as sites and spectrum), and also enable large investments in 5G networks. However, concentrated markets can also raise flags with regulatory and competition authorities that may be concerned about consumer prices being higher.

Understanding the relationship between market structure and the quality, innovation and prices that consumers can expect is therefore crucial. A strong debate exists about the competition dynamics that will deliver best value for consumers in the 5G era. As arguments can be made in both directions, it is important to look at data from the recent past to help draw some lessons that can inform decisions going forward.

This is precisely what GSMA Intelligence did. In a recent study, they evaluate how market structures impacted consumers during the 4G era in Europe. They looked at data covering the period from 2011 to 2018, for 29 European countries. They combined coverage and other publicly available data from operators with network-quality measurement data from Ookla®, a global leader in mobile and broadband network intelligence, testing applications and technology.

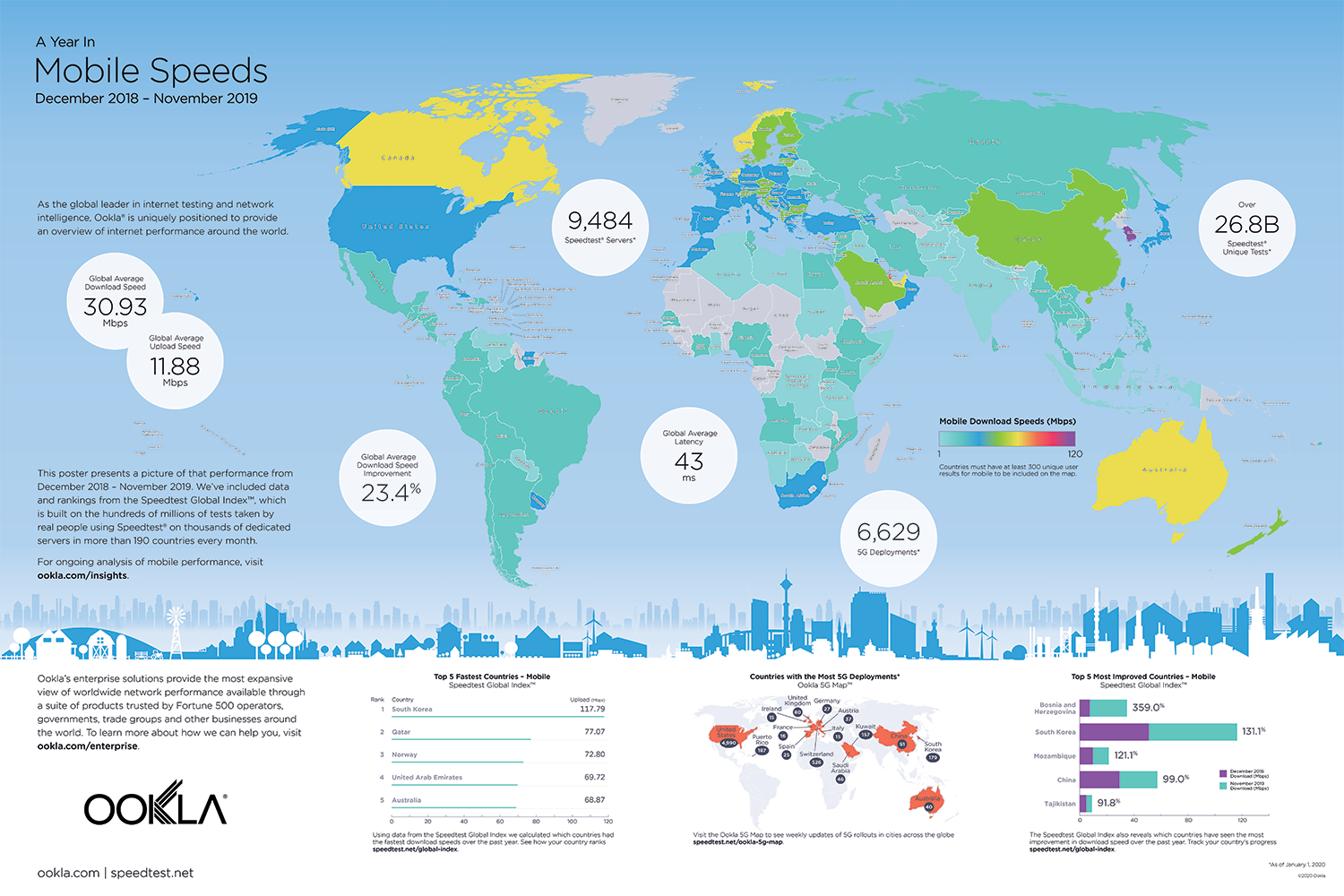

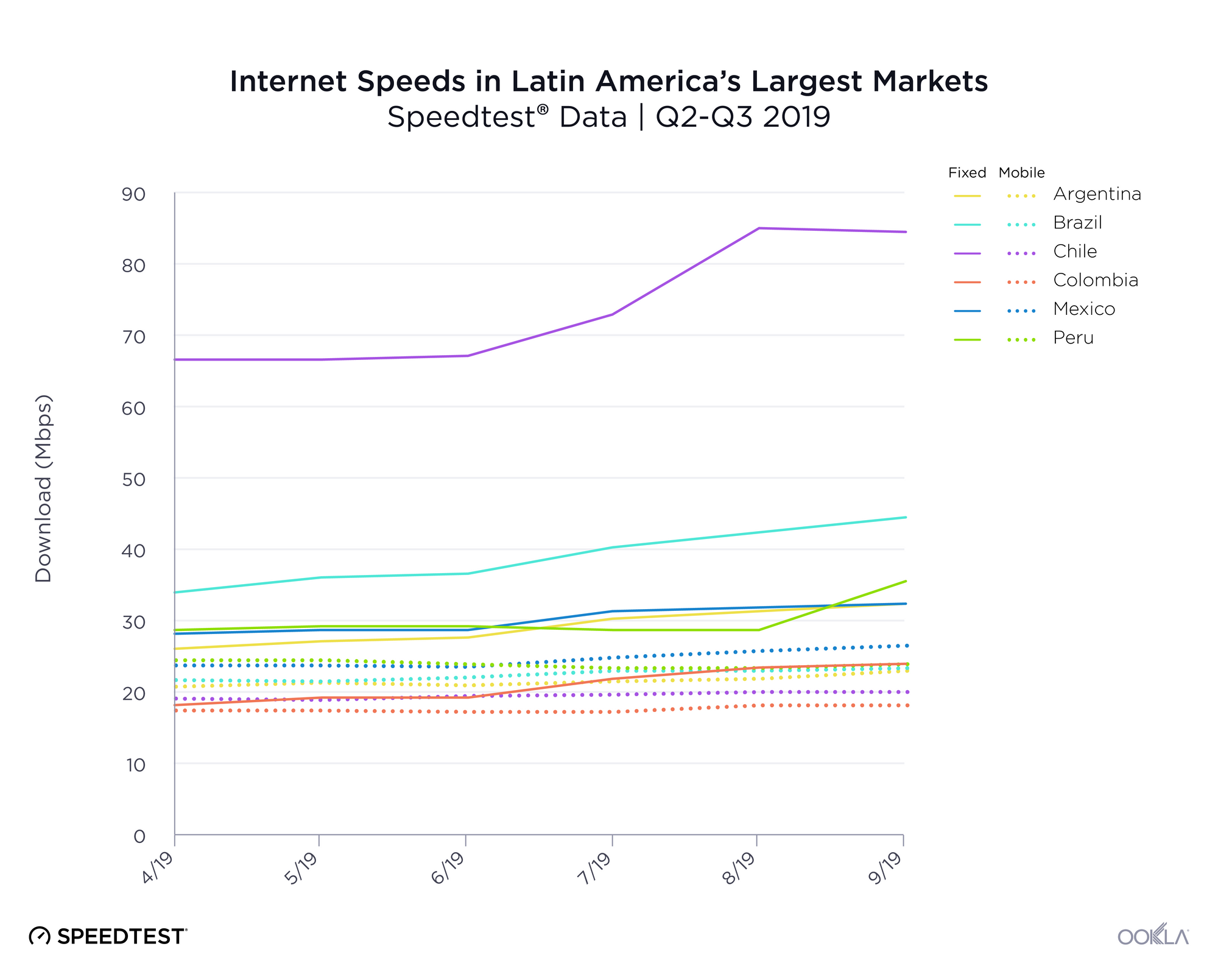

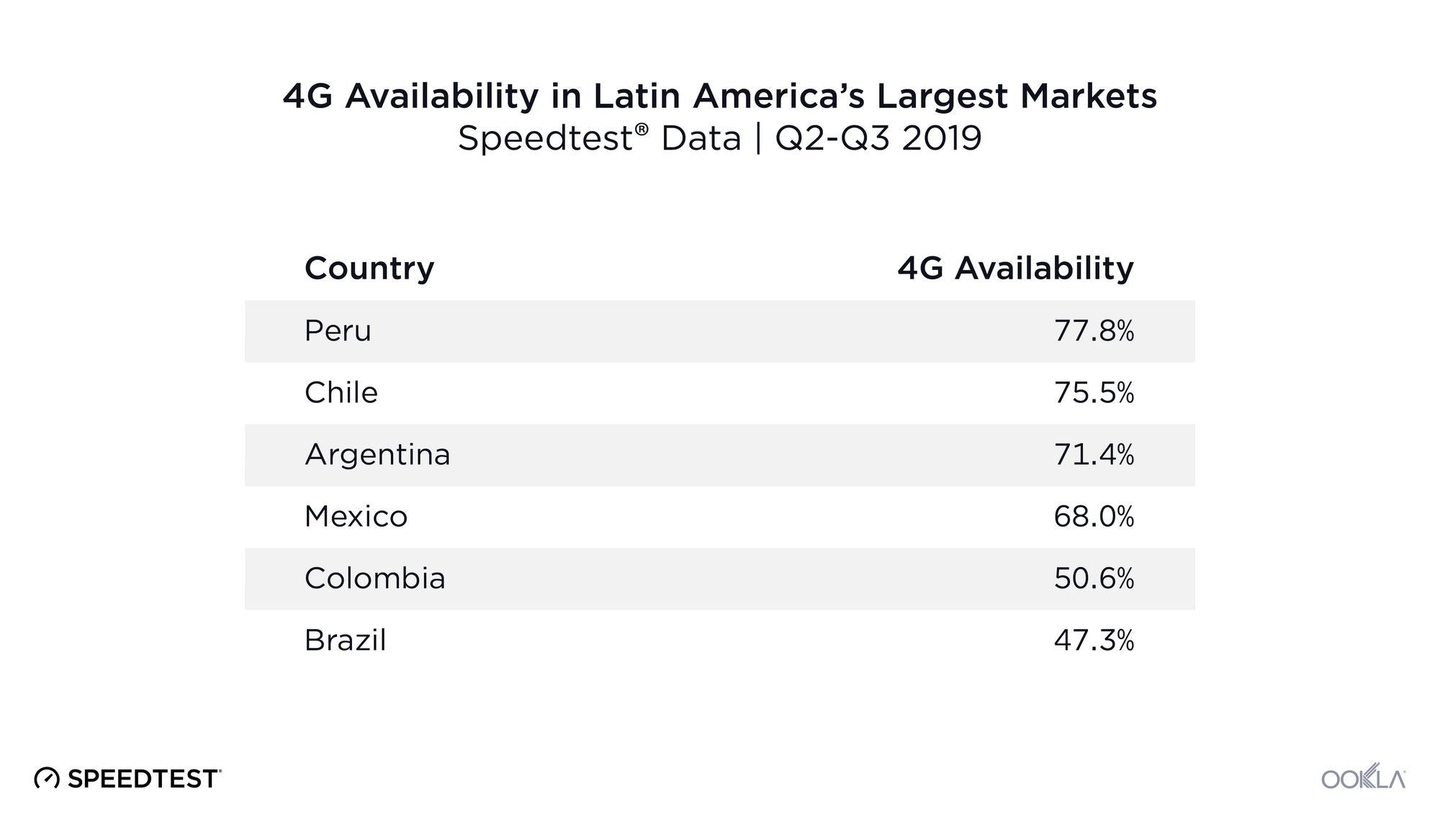

Overall, the 4G era was a positive and expansive one for European mobile consumers everywhere. Already by 2016, 90% of consumers were covered by 4G networks. Since then, operators have delivered greater speeds and lower latencies (signal delay), resulting in a far superior consumer experience today. Download speeds increased on average from 2 Mbps in 2011 to 37 Mbps in 2018. The average price per MB also dropped sharply as mobile data became cheaper and users consumed ever-increasing volumes of data, with average monthly data usage increasing more than twelve-fold.

But while all European consumers experienced improvements during the 4G era, the study shows that European mobile users in three-player markets benefited the most from higher quality and innovation.

By the end of 2018, three-player markets were outperforming four-player markets by 4.5 Mbps in download speeds, and over half of that difference (around 3.5 Mbps) can be attributed to the role of market structure in three-player markets. In particular, operators in more concentrated markets were able to utilize assets more efficiently (especially spectrum) and generate higher returns that allowed them to invest more in their networks. This is an important insight when considering the best ways to unlock the full potential of 5G networks, including advanced applications that require very low latencies, high speeds and plenty of network capacity.

Did this come at the expense of higher prices? On the basis of the pricing data that GSMA Intelligence was able to analyse, it did not. In addition to general improvements in performance, prices also decreased across Europe in the 4G era, indicating more efficiency and better value for consumers over time. Implicit unit prices (i.e. revenue per MB and revenue per user) decreased similarly in both three- and four-player markets.

In other words, during the 4G era, a European consumer in a three-player market experienced on average a better quality mobile broadband service while paying similar prices per MB of data to a consumer in a four-player market.

Does this therefore mean that more consolidation in European markets is the only solution to deliver the right investments for 5G? Not necessarily.

An option that is often touted as an alternative to full consolidation is increased network sharing. GSMA Intelligence’s analysis showed that in the 4G era, progressively deeper levels of network integration delivered improved performance, although they came short of full integration in terms of network quality. Network sharing could therefore also help promote faster deployments of high-performing 5G networks in Europe over the coming years.

Ultimately, every case and country needs to be considered on the basis of its own merits and situation. What works in one country does not necessarily work in another and operator incentives and consumer attitudes to products and services will differ from market to market.

But there is one key lesson from the 4G era that does apply to all countries equally: to support the delivery of high performing 5G networks, policymakers should fully consider all aspects of consumer welfare when assessing the relative advantages of more concentrated markets in merger control, antitrust policy and spectrum management.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.