In a boost of confidence for FWA, both T-Mobile and Verizon announced plans to expand their service beyond their initial subscriber targets

Editor’s note: This report was revised on April 11 to reflect updates to AT&T’s median upload and download speeds.

Key Takeaways:

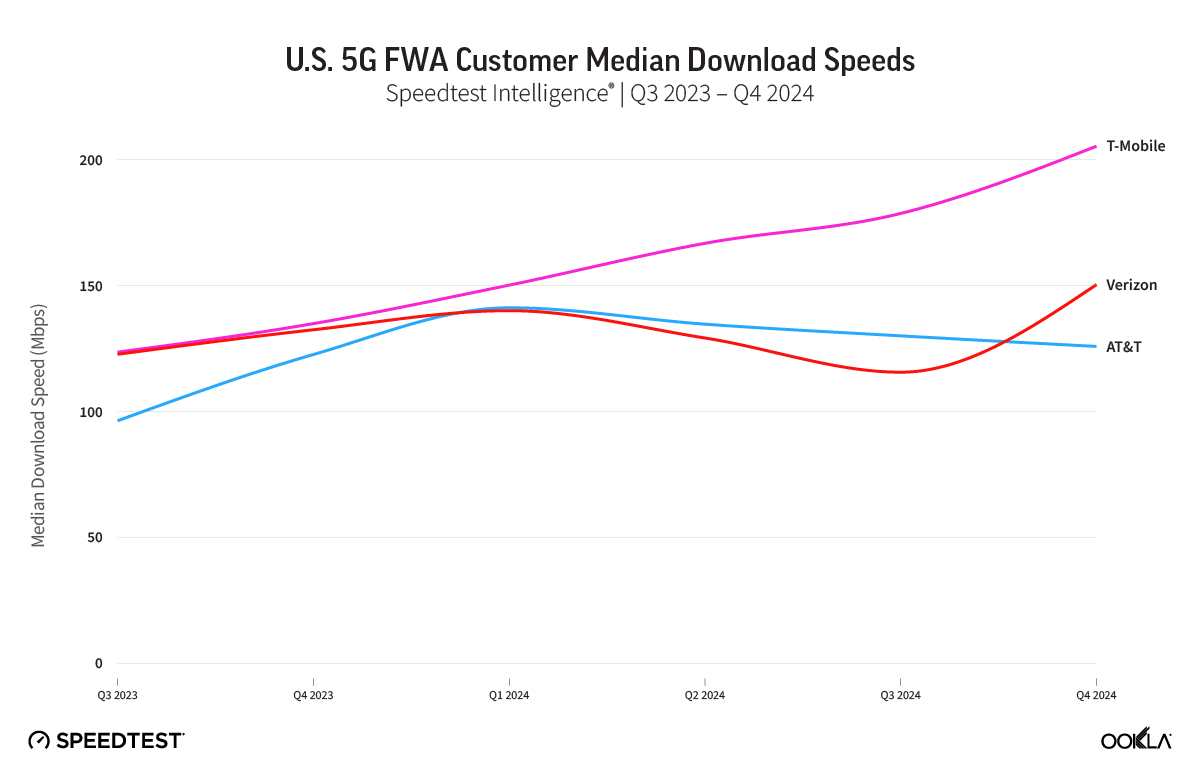

- As of Q4 2024, T-Mobile’s fixed wireless access (FWA) subscriber base now tops 6.43 million. However, that growth in FWA subscribers hasn’t impacted the company’s download speeds. T-Mobile’s FWA median download speeds increased more than 50% from 134.99 Mbps in Q4 2023 to 205.44 Mbps in Q4 2024.

- A late entrant into the FWA space because it launched service in August 2023, AT&T’s Internet Air FWA customers experience strong median download speeds of 125.93 Mbps (as of Q4 2024).

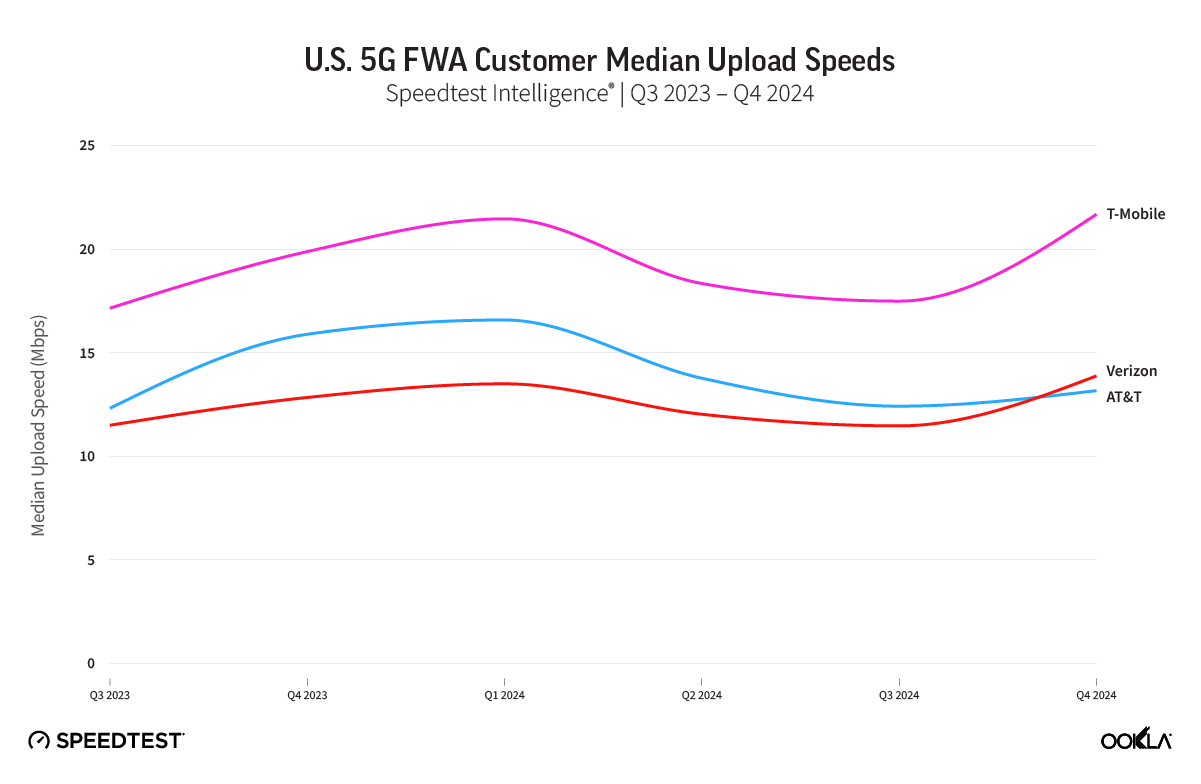

- T-Mobile consistently outpaces the competition when it comes to median upload speeds.

- Verizon and T-Mobile have both recently increased their goals for the number of FWA subscribers they plan to attract by 2028. Verizon increased its goal to 8 million to 9 million by 2028 and T-Mobile increased its goal to 12 million by 2028.

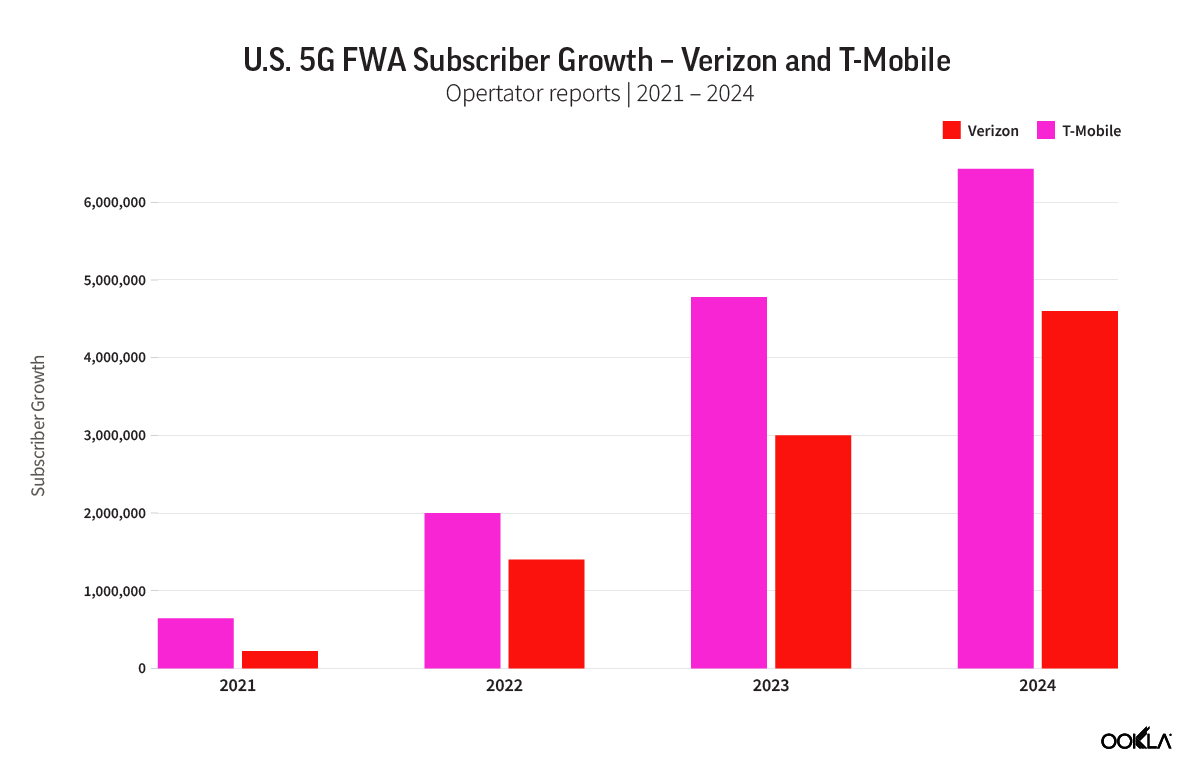

5G fixed wireless access (FWA) has steadily gained popularity in the U.S. over the past four years and now the service has more than 11.5 million subscribers —and that’s just counting the FWA subscribers from the big three nationwide operators. Today FWA is considered a viable broadband competitor, and its traction with customers has caused many cable operators to lose customers to FWA.

Download Speeds on the Rise

Although there have been concerns about traffic from FWA subscribers causing congestion and negatively impacting the performance of both mobile and FWA customers because the same 5G spectrum is being used to deliver both services, Ookla® Speedtest® data found that hasn’t been the case. T-Mobile’s FWA subscriber base, which now tops 6.43 million actually saw its median download speeds increase more than 50% from a median download speed of 134.99 Mbps in Q4 2023 to a median download speed of 205.44 Mbps in Q4 2024. This increase in speed isn’t surprising, as T-Mobile executives told investors during the company’s Capital Markets Day last October that they have seen a 3x increase in customers FWA speeds since the service was launched in Q1 2021.

But T-Mobile isn’t the only operator seeing an increase in FWA speeds. Verizon, which has more than 4.3 million FWA subscribers, saw its median download speed rise more than 12% from 132.55 Mbps in Q4 2023 to 150.47 Mbps in Q4 2024. AT&T, which only launched its Internet Air service in August 2023, ended the year with a median download speed of 125.93 Mbps.

T-Mobile CEO Mike Sievert addressed questions about congestion negatively impacting performance during the company’s recent Q4 2024 earnings call with investors by saying that the company studies algorithms that can determine its network capacity levels in such detail that they know when certain sectors of specific towers are becoming congested. “When approving applicants for fixed [wireless] in the first place we study our algorithm,” Sievert said, adding that if the algorithm says that the sector will continue to have excess capacity, then T-Mobile will approve an applicant for home broadband.

“We don’t see sectors or towers becoming saturated due to fixed wireless,” he added.

T-Mobile’s FWA download speeds steadily increased from Q4 2023 until Q4 2024.

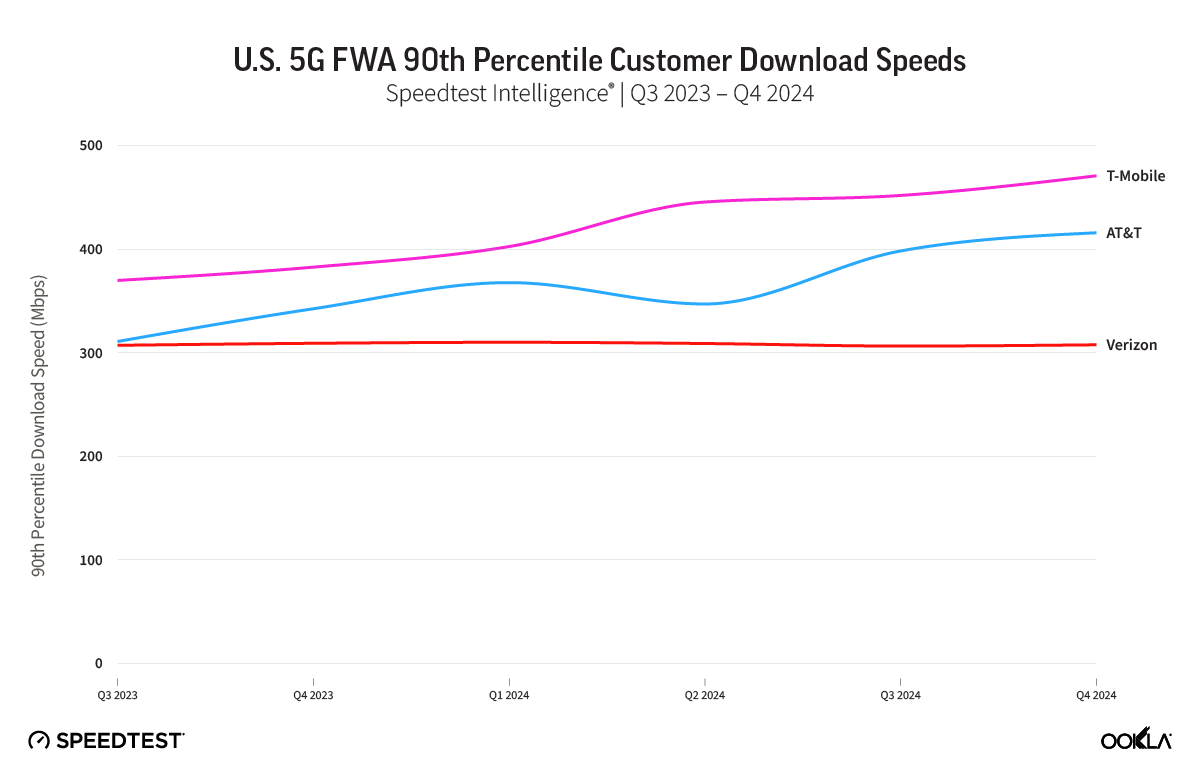

Minimizing Capacity Constraints with Speed Caps

Taking a cue from its cable counterparts, Verizon has started managing its network capacity by capping its FWA download speeds at 300 Mbps. When we looked at the 90th percentile of Download Speeds for Verizon, T-Mobile and AT&T, it appears that Verizon is enforcing those data speed caps, which it spells out in its 5G Home broadband price plan disclosures. The company has three tiers of service for its FWA service. There’s a top-tier 5G Home Plus that provides up to 1 Gbps download speeds using its 5G Ultra Wideband or mmWave spectrum and a mid-tier 5G Home Plus plan that provides up to 300 Mbps download speeds that uses just 5G Ultra Wideband spectrum. The lower tier 5G Home plan provides up to 300 Mbps download speeds using 5G Ultra Wideband or mmWave spectrum. Currently Verizon has the 5G Home Plus plans priced at $55 per month and the lower tier 5G Home plan priced at $35 per month.

Similar to Verizon, T-Mobile offers three tiers of service: All-In Home Internet plan priced at $70 per month (or $55/mo. with a voice line) that features typical download speeds of 133 Mbps to 415 Mbps and includes streaming services Hulu+ and Paramount+; Amplified Home Internet that costs $60 per month (or $45/mo. With a voice line) and features typical download speeds of 133 Mbps to 415 Mbps; and Rely that costs $50 per month (or $35/mo. With a voice line) and features typical download speeds of 87 Mbps to 315 Mbps).

Although Speedtest data doesn’t indicate that T-Mobile is slowing down the speeds or capping the speeds of its FWA customers at this time, T-Mobile does say on its web site that during times of congestion, Home Internet customers that use more than 1.2 TB of data per month might see their speeds reduced due to data prioritization. T-Mobile said it started implementing this soft cap on its new FWA subscribers in January 2024 and expanded it to all its FWA subscribers later that year.

When looking at the 90th percentile of Speedtest users download speeds, it’s evident that Verizon is capping its download speeds slightly above 300 Mbps.

FWA Upload Speeds Are Improving

Upload speeds are becoming increasingly important to consumers and remote workers for activities such as conducting live video calls without lag or doing online collaboration and sharing of files without having hiccups in the workflow.

Our data shows that median FWA upload speeds increased from Q4 2023 to Q4 2024 with T-Mobile’s upload speeds consistently outpacing the competition. T-Mobile’s upload speed increased 9.05% from 19.88 Mbps in Q4 2023 to 21.68 Mbps in Q4 2024.

Verizon saw its median upload speeds increase over 7% from 12.84 Mbps in Q4 2023 to 13.88 in Q4 2024. AT&T’s Internet Air median upload speeds dropped 17.16% from 15.89 Mbps in Q4 2023 to 13.17 Mbps in Q4 2024.

T-Mobile’s upload speeds surpass that of AT&T and Verizon.

Latency Ebbs and Flows

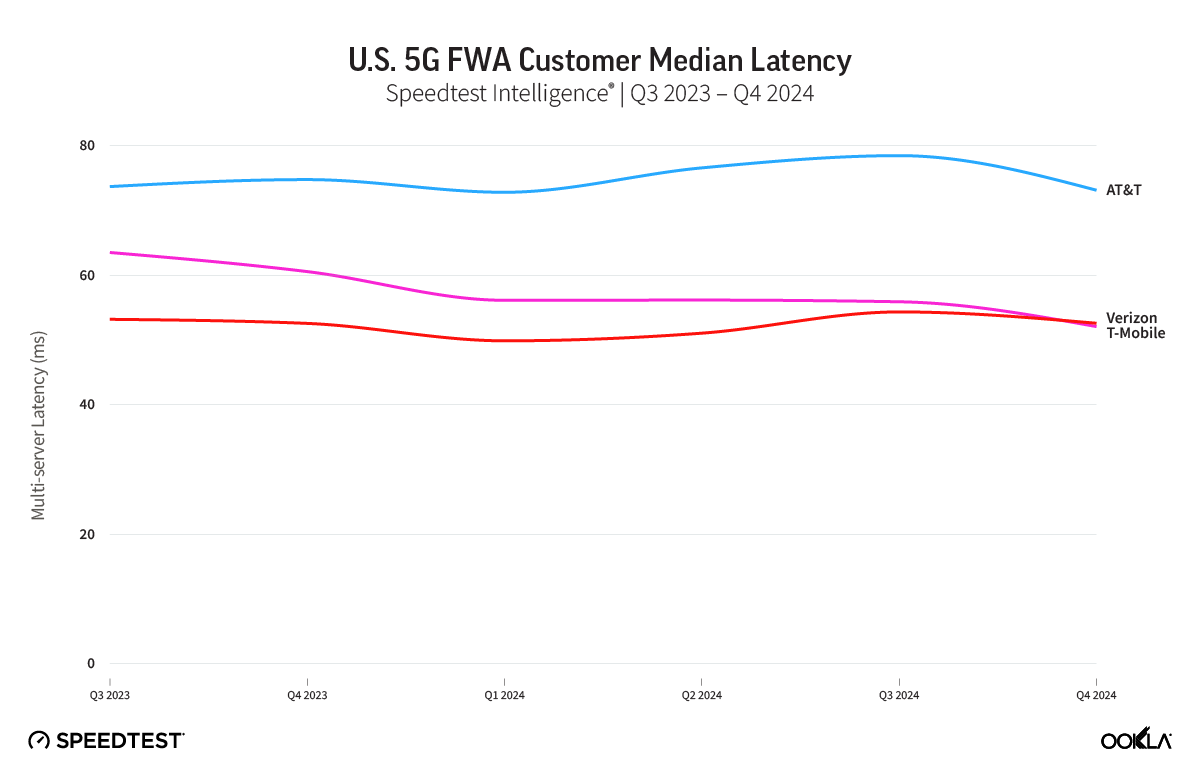

Unlike FWA upload and download speeds that have improved from Q4 2023 until Q4 2024, latency figures have remained somewhat static for Verizon and AT&T while T-Mobile’s latency has declined. Latency is a key measurement because higher latency will impact real-time applications such as online gaming and video conferencing.

AT&T’s latency of 74 milliseconds (ms) in Q4 2023 and 73 ms in Q4 2024 was consistently higher than both T-Mobile and Verizon. T-Mobile saw its latency decline from 61 ms in Q3 2023 to 52 ms in Q4 2024 and Verizon saw its latency rise slightly from 52 ms in Q4 2023 to 53 ms in Q4 2024.

AT&T’s latency was consistently higher than T-Mobile and Verizon.

Moving the Subscriber Goal Post

T-Mobile and Verizon executives are both so bullish on FWA (and the revenue it’s generating for the companies) that both recently increased their FWA subscriber goals.

Verizon doubled the number of FWA subscribers that it plans to acquire to between 8 million to 9 million by 2028, up from the initial goal of attracting 4 million to 5 million customers by the end of this year.

Likewise T-Mobile executives said during the company’s Capital Market Days in October 2024 that they were increasing their FWA customer target to 12 million by 2028, up from its initial goal of providing FWA service to 7 million to 8 million customers by 2025. T-Mobile is planning to continue with its same strategy, which is to deliver FWA in areas where there is fallow spectrum and the network isn’t constrained. This is particularly applicable in rural areas where T-Mobile has spectrum and towers but also fewer mobile users.

AT&T is a bit of a newcomer to the FWA, having just launched its 5G FWA service in August 2023. The company said it ended Q4 2024 with more than 650,000 Internet Air subscribers. However, AT&T CEO John Stankey has publicly stated that the company views FWA as a stopgap tool for capturing customers who don’t have a satisfactory broadband connection, including those using AT&T’s DSL service. FWA allows AT&T to keep those customers but its long-term goal is to eventually upsell them to fiber when it’s available.

Consumers keen on FWA

Since T-Mobile and Verizon first launched their FWA offerings in 2021 they’ve steadily grown their customer base. In fact, FWA is a popular choice for consumers, often because it’s slightly less expensive than fiber or cable but also because it’s easy for them to purchase, install and return if it doesn’t meet their expectations.

According to Recon Analytics, which conducted interviews with 288,490 Americans between July 2023 and December 2024, 44% of respondents said they would choose an FWA provider for their next broadband provider if they had to make that choice, 25% said they would pick a fiber provider and 17% said they would select a cable provider. The remaining said they would choose DSL or a satellite provider.

Likewise, an April 2024 report from JD Power found that 5G FWA users have the highest satisfaction of all broadband providers, with fiber coming in second place.

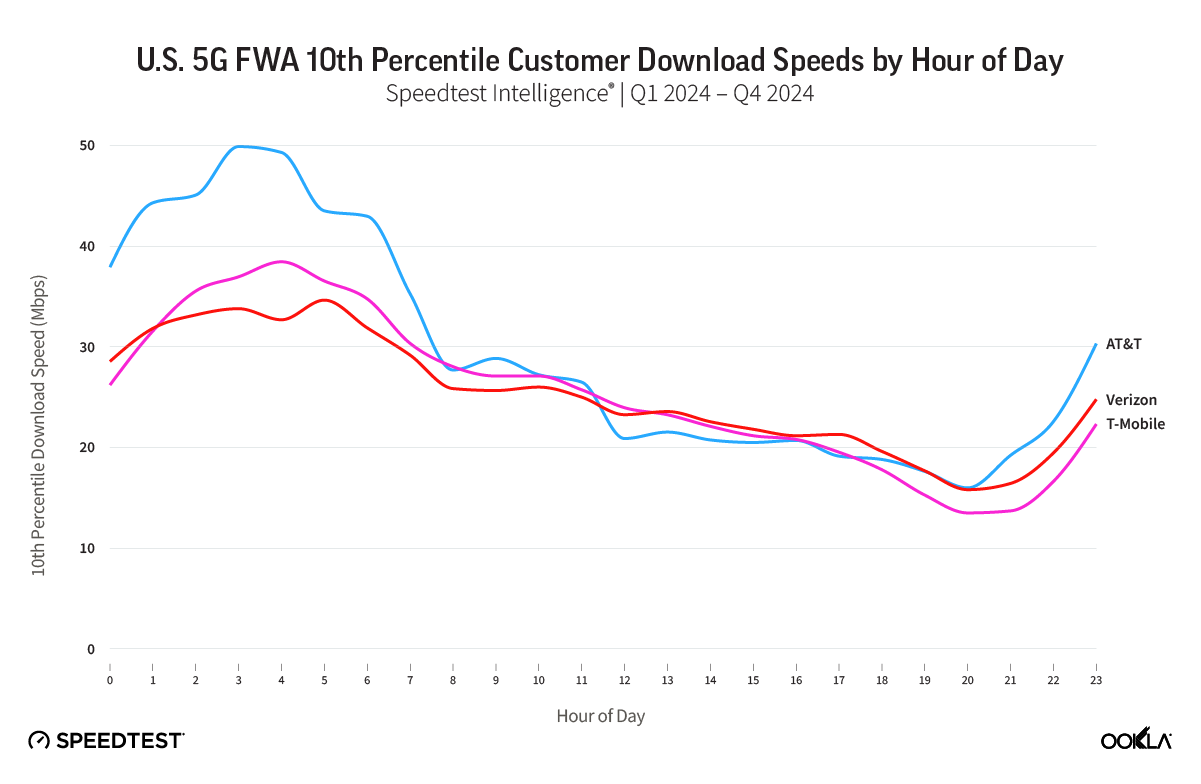

But even though overall satisfaction for FWA is high, when we look at the download speeds of the 10th percentile of Speedtest users by hour of day we see that customers in this category are experiencing some unsatisfactory speeds, particularly in the afternoon and evening when the network is the busiest. According to our data, T-Mobile Speedtest users in the 10th percentile saw their speeds dip to 13.50 Mbps at 8 p.m. while Verizon Speedtest users saw their speeds dip to 15.81 Mbps at that time and AT&T users saw their speeds drop to 15.99 Mbps.

FWA Performance is Evolving

Although T-Mobile, Verizon and AT&T were the focus of this FWA report because they have the most FWA customers, there are smaller regional operators that also offer FWA service such as USCellular, which reported having 150,000 FWA customers at the end of Q4 2024. In addition, Cspire recently launched FWA service to customers in Mississippi and fiber provider BrightSpeed recently said it plans to launch an FWA service in partnership with Verizon. There are many small wireless ISPs also offering FWA using unlicensed spectrum throughout the country.

We expect the FWA market to continue to grow and evolve and we will continue to measure their performance, particularly with these new FWA subscriber goals from T-Mobile and Verizon coupled with AT&T’s FWA growth in the market. Verizon also revealed that it plans to commercially launch an FWA product using millimeter wave (mmWave) spectrum to deliver 1 Gbps speeds to multi-dwelling units (MDUs). That FWA product is currently in customer trials and is expected to launch soon.

It will be interesting to see if U.S. operators are able to continue to deliver strong download and upload speeds to FWA customers and still grow their customer base as rapidly as they have over the past few years.

If you are interested in learning about how 5G FWA is reshaping the broadband market in the Gulf region, please check out this other FWA report from Ookla. To find out more about Speedtest Intelligence® data and insights, please contact us here.

Ookla analyst Kerry Baker contributed to this report.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.