Spain continues to lead Europe in fiber rollout, but lagging mobile performance undermines country’s overall telecoms competitiveness

The dynamism of Spain’s telecoms market stood out among its European peers last year, with a flurry of mergers reshaping the market’s structure and strong investment in next-generation networks, supported by targeted government initiatives, improving outcomes for Spanish consumers. However, while increased fiber and 5G penetration have driven notable year-on-year improvements in overall network performance, Spain’s international competitiveness in telecoms remains highly imbalanced between its fixed and mobile infrastructure.

The country’s credentials as Europe’s preeminent fiber leader remain intact. In 2024, Spain ranked among the top three in the EU for fiber-to-the-premises (FTTP) coverage (95.2%) and the share of fixed broadband subscriptions providing download speeds above 100 Mbps (93.5%), according to the latest edition of the European Commission’s ‘State of the Digital Decade’ report. This continues to position the country significantly ahead of some of the bloc’s largest economies, most notably Germany, which still lags in FTTP coverage (28.8%) due to a slow shift away from cable networks.

Analysis of Speedtest Intelligence® data reveals that median fixed download speeds in Spain increased from 173.32 Mbps to 210.46 Mbps between 2023 and 2024. This trend of improvement was mirrored across other fixed network performance metrics, with upload speeds increasing in the same period from 129.62 Mbps to 155.53 Mbps. In Q3 2024, DIGI achieved a median fixed download speed of 321.21 Mbps in the Spanish market, followed by Jazztel (273.18 Mbps), Orange (262.78 Mbps), Yoigo (255.74 Mbps) and Movistar (180.30 Mbps).

Spain Leads Europe in Fiber Deployment and Adoption, Boasting the Highest Coverage Among the EU's Top 10 Economies

European Commission | DESI 2018 – 2024

Having achieved exceptionally high levels of FTTP penetration across urban, suburban and rural areas—placing Spain among the top three in the European Commission’s DESI 2024 Index for FTTP coverage in sparsely populated rural areas—the focus in Spain is shifting toward enhancing quality of experience (QoE) in core use cases such as gaming and video streaming. Despite boasting higher FTTP coverage and take-up rates, Spain ranks below countries like France in Ookla’s Speedtest Global Index™. This disparity highlights the influence of factors such as Wi-Fi technology—France has a higher penetration of Wi-Fi 6 and 7 in ISP-provided CPE—and tariff provisioned speeds, with a larger share of fiber customers in France subscribing to multi-gigabit plans, on fixed broadband performance.

DIGI’s strong fixed download speed performance in Spain, detailed in Ookla’s Speedtest Connectivity Report for 1H 2024, is underpinned by similar favourable factors. Notably, it was first to market in Spain with a 10 Gbps service, fully leveraging its XGS-PON fiber infrastructure. With highly competitive pricing—starting at just €20 per month for 1 Gbps and €25 per month for 10 Gbps, including Wi-Fi 6 CPE as standard—DIGI has quickly secured a significant share of multi-gigabit capable connections in the Spanish market.

In addition to highlighting the importance of modern CPE and higher tariff-provisioned speeds, DIGI’s business last year exemplified the accelerating consolidation trends in Spain’s highly overbuilt and fragmented fiber market. The acquisition of DIGI’s fiber infrastructure by a Macquarie-led consortium, which solidified wholesale specialist Onivia’s status as the largest of the ‘neutral’ FTTP networks in Spain, dovetailed with developments such as Telefónica’s BlueVia wholesale spin-off, the emergence of MásOrange and Zegona-controlled Vodafone’s ‘FiberCo’ tie-ups with both Telefónica and MásOrange.

As observed in other European markets with significant fiber overbuild, such as the alt-net model in the UK, consolidation is a slow and challenging process. However, Spanish operators continue to pursue it to enhance the economics of their fiber investments in highly overbuilt urban areas, unlocking scale and resources to capture future growth in rural areas where overlapping infrastructure is less common. This begins with small local operators—of which there are hundreds—being absorbed by ‘local consolidators’. These are then integrated into the infrastructure portfolios of regional consolidators, ultimately leading to acquisition by one of the largest traditional players.

Fiber Overbuild from Smaller Players like DIGI Drives Market Share Shift from Incumbents

Analysis of CNMC Market Data | 2022 – 2024

This gradual process of consolidation is reshaping the fiber business model in Spain, as traditional operators separate their infrastructure and service units to support the growth of wholesale offerings. The coming year will provide some insight into whether a consolidated third player can successfully compete and coexist alongside the vertically integrated Telefónica and MásOrange in the long-term.

MásOrange is vying for network leadership in Spain, founded on a significant spectrum advantage

The winds of consolidation have swept through the Spanish mobile market too, culminating last year in the European Commission’s approval of a 50:50 joint venture between MásMóvil and Orange. The merger has pole-vaulted the newly formed ‘MásOrange’ into a leading position in the market, both in subscription and spectrum share. To secure regulatory approval from Brussels, the merging entity committed to divesting 60 MHz of spectrum, including 20 MHz in the 3.5 GHz band, to facilitate the entry of DIGI as a fully-fledged independent mobile operator, effectively restoring the Spanish market to a four-player structure and ‘exerting a strong competitive constraint on the joint venture’.

In addition to diversifying its portfolio of brands through the merger—with Orange and Yoigo catering to the premium segment, Jazztel and MásMóvil focusing on value for money and regional brands like Euskaltel and Telecable serving local needs—MásOrange hopes its consolidated spectrum assets will enable it to achieve network leadership in the Spanish mobile market.

Movistar Revenues Stable YoY in Q3 2024 while Vodafone and MásOrange Face Declines

Analysis of CNMC Market Data | 2022 – 2024

The merged entity’s consolidated network will be primarily based on Orange’s infrastructure, complemented by MásMóvil’s existing site portfolio and the deployment of new greenfield sites. The integration of MásMóvil’s network, which relies entirely on mid- and high-band spectrum and has historically depended on a national roaming agreement with Orange, creates a natural synergy for the merged entity. It enables the integrated network to leverage MásMóvil’s capacity and density in urban areas alongside Orange’s extensive coverage and nationwide reach.

MásOrange is particularly focused on vying to unseat Movistar’s dominance in the premium segment, a position it has long upheld thanks to its emphasis on superior network quality. Movistar emerged as the fastest mobile operator in the Spanish market in Ookla’s Speedtest Connectivity Report for 1H 2024, delivering the highest median download speeds of 82.68 Mbps. This placed Movistar significantly ahead of Orange (56.42 Mbps) and Yoigo (36.73 Mbps).

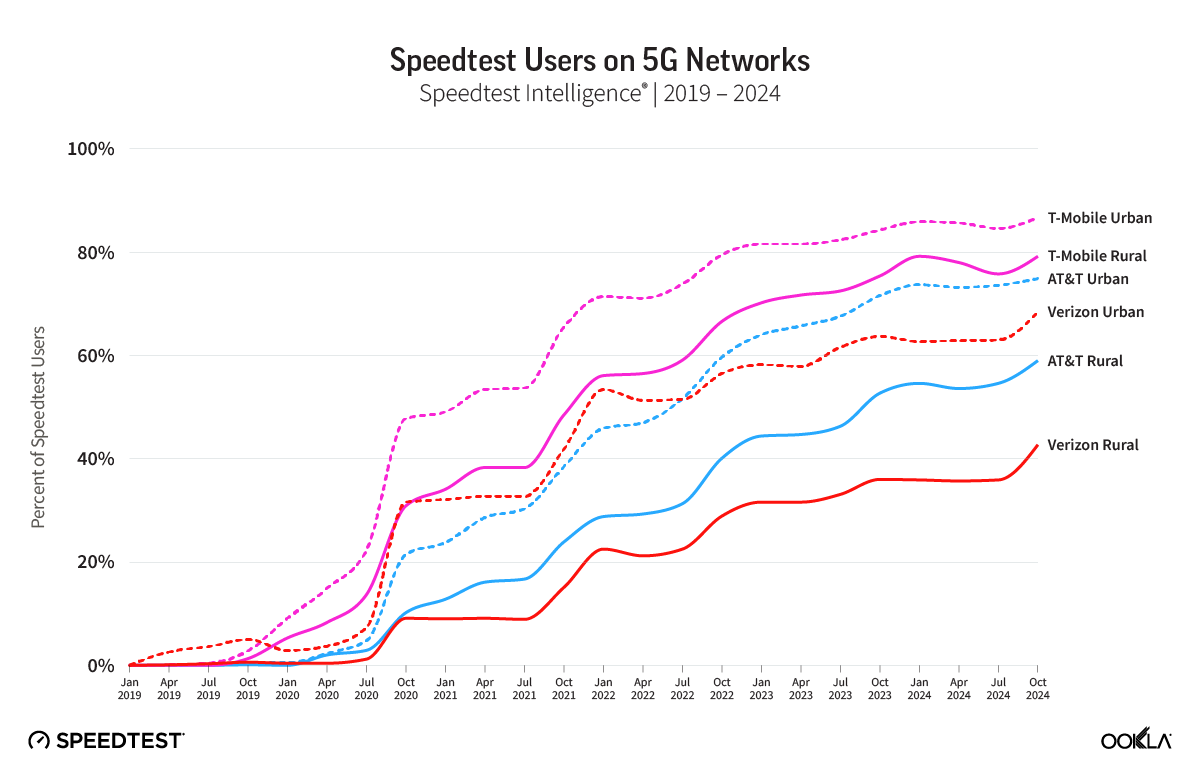

The merged entity’s spectrum advantage is heavily weighted toward mid- and high-bands, which are typically utilised for 5G deployments in urban and suburban areas. According to data published by MásOrange, it holds 37% of all mid- and high-band assets in the Spanish market—compared to 28% and 26% for its closest competitor, Telefónica—giving it a unique opportunity to enhance 5G speed performance and gain a competitive edge.

Movistar has maintained its strong 5G speed performance with a 100 MHz allocation in the 3.5 GHz band, but this is now overshadowed by MasOrange’s expanded allocation of 170 MHz. Capital investment by the merged entity in upgrading the 5G RAN to support advanced carrier aggregation (CA) capabilities and the standalone (SA) architecture will enable it to fully realise the performance benefits of wider channel bandwidth through the extensive deployment of its 3.5 GHz spectrum across its consolidated mobile site grid.

Seville Leads in 5G Download Speed Among Spain's Largest Cities, but Operator Performance Varies Widely

Speedtest Intelligence® | Q3 2024

To establish network leadership in coverage, however, MásOrange will need to move beyond its spectrum advantage and focus on increasing the number of physical sites in rural areas within its integrated network. In Q3 2024, Vodafone and Movistar recorded 4G Availability of 95.1% and 93.4% respectively in the Spanish market, followed by Orange at 92.7% and Yoigo at 91.5%.

In parallel to MásOrange’s network consolidation journey, DIGI is building out its own infrastructure to gradually wean itself off dependence on a national roaming and RAN sharing agreement with Telefónica (which DIGI selected over MásOrange, despite both being options under the merger conditions), starting with urban and suburban areas. The European Commission designed the spectrum divestment remedies to position DIGI to replicate the competitive pressure previously exerted by MásMóvil. The goal is for DIGI to carry a similar share of its total mobile data traffic on its own network in the coming years, at least matching the 40-60% on-net share that MásMóvil achieved pre-merger.

Spain's Rural Provinces Trail in 5G Availability, Highlighting the Importance of Government Support through UNICO

Speedtest Intelligence® | Overall 5G Availability (%) in 2024

More broadly, it is hoped that the substantial long-term investment commitments from DIGI and MásOrange, driven by the consolidation activity, combined with government support through programmes such as Unico, will bolster Spain’s international competitiveness in mobile performance in the coming years. The country has significant catching up to do, ranking 57th in the Speedtest Global Index at the end of 2024 and trailing most of its European peers across a suite of network performance metrics, including download speed, consistency and coverage.

La consolidación cambia las telecomunicaciones españolas en 2025

España sigue a la cabeza en despliegue de fibra en Europa, pero el rezagado desempeño móvil reduce la competitividad del país

El dinamismo del mercado español de telecomunicaciones destacó el año pasado frente al de otros mercados europeos, por fusiones que modificaron la estructura del sector y una fuerte inversión en redes de próxima generación, respaldadas por iniciativas gubernamentales, que supusieron mejoras para los consumidores españoles. Si bien la mayor penetración de la fibra y el 5G han impulsado año tras año notables avances en el rendimiento general de la red, la competitividad internacional de España en telecomunicaciones sigue estando muy desequilibrada entre su infraestructura fija y móvil.

Las credenciales del país como líder europeo en fibra permanecen intactas. En 2024, según la última edición del informe ‘Estado de la Década Digital’ de la Comisión Europea, España se situó entre los tres primeros países de la UE en cobertura de fibra hasta las instalaciones (FTTP), con un 95,21%, y en porcentaje de suscripciones de banda ancha fija con velocidades de descarga superiores a 100 Mbps (93,54%). Esto posicionó al país significativamente por delante de algunas de las economías más grandes del bloque, en particular Alemania, todavía rezagada en cobertura FTTP (28,80%).

Según Speedtest Intelligence la velocidad mediana de descarga fija en España aumentó de 173,32 Mbps a 210,46 Mbps entre 2023 y 2024. Esta tendencia de mejora se reflejó en otras métricas de rendimiento de la red fija, con velocidades medianas de carga que se incrementaron de 129.62 Mbps a 155.53 Mbps en el mismo período. En el tercer trimestre de 2024, DIGI alcanzó una velocidad mediana de descarga fija de 321,21 Mbps, por delante de Jazztel (273,18 Mbps), Orange (262,78 Mbps), Yoigo (255,74 Mbps) y Movistar (180,30 Mbps).

España lidera Europa en despliegue y adopción de fibra, con la mayor cobertura entre las 10 principales economías de la UE

Comisión Europea | DESI 2018-2024

Habiendo alcanzado niveles excepcionalmente altos de penetración de FTTP en áreas urbanas, suburbanas y rurales (que posicionan a España entre los tres primeros del índice DESI 2024 de la Comisión Europea sobre cobertura FTTP en zonas rurales escasamente pobladas), España está cambiando el foco hacia la mejora de la calidad de la experiencia (QoE) para casos de uso como los vídeojuegos y el streaming. A pesar de contar con más cobertura y tasas de aceptación FTTP, España está por debajo de países como Francia en el Índice Global de Speedtest de Ookla.

Este desequilibrio pone de relieve la influencia en el rendimiento de la banda ancha fija de factores como la tecnología Wi-Fi (Francia tiene una mayor penetración de Wi-Fi 6 y 7 en los router proporcionados por los operadores) y las velocidades ofrecidas en la tarifa (con una mayor proporción de clientes de fibra suscritos a planes multi-gigabit en Francia).

El sólido rendimiento de la velocidad de descarga fija de DIGI en España, detallado en Informe de Conectividad de Speedtest, está respaldado por factores favorables similares. Fue el primero en comercializar en España un servicio de 10 Gbps, aprovechando al máximo su infraestructura de fibra XGS-PON. Con precios altamente competitivos (desde sólo 20€ al mes por 1 Gbps y 25€ por 10 Gbps y router Wi-Fi 6 incluido), DIGI se ha asegurado rápidamente una cuota importante de conexiones con capacidad multigigabit en el mercado español.

Además de evidenciar la importancia de un router moderno y velocidades más altas, el negocio de DIGI ejemplificó el año pasado la acelerada tendencia de consolidación en el fragmentado y sobredimensionado mercado español de fibra. La adquisición de la infraestructura de fibra de DIGI por parte de un consorcio liderado por Macquarie, que consolidó el estatus de Onivia como la mayor red FTTP ‘neutra’ en España, coincidió con otros acontecimientos como la escisión de BlueVia de Telefónica, la aparición de MásOrange y las alianzas de ‘FibreCo’ de Vodafone con Telefónica y MásOrange.

Como se observa en otros mercados europeos con un importante despliegue de fibra (como Reino Unido), la consolidación es un proceso lento y desafiante. Sin embargo, los operadores españoles continúan persiguiéndola para mejorar la rentabilidad de sus inversiones en fibra en áreas urbanas altamente edificadas, liberando recursos para aprovechar el crecimiento futuro en áreas rurales donde la superposición de infraestructura es menos común. Esto comienza con la absorción de pequeños operadores locales (de los que hay cientos) por “consolidadores locales”. Luego, éstos se integran en las carteras de infraestructura de los consolidadores regionales, lo que en última instancia conduce a la adquisición por parte de uno de los actores tradicionales más grandes.

El despliegue de fibra por parte de actores más pequeños como DIGI impulsa el cambio en la cuota de mercado de los operadores tradicionales

Análisis de datos de CNMC | 2022-2024

Esta consolidación gradual está modificando el negocio de la fibra en España, mientras que los operadores tradicionales separan sus unidades de infraestructura y servicios para apoyar el crecimiento de la oferta mayorista. Este año se podrá saber si un tercer actor consolidado puede competir y coexistir con éxito a largo plazo con Telefónica y MásOrange.

MásOrange compite por el liderazgo de la red en España, apoyándose en una importante ventaja de espectro

La consolidación también ha afectado al mercado móvil español. A finales del año pasado, la Comisión Europea aprobó la creación de una empresa conjunta entre MásMóvil y Orange. La fusión ha llevado a la recién formada MásOrange a una posición de liderazgo, tanto en suscripción como en cuota de espectro. Para obtener la aprobación de Bruselas, la entidad se comprometió a vender 60 MHz de espectro, incluidos 20 MHz en la banda de 3,5 GHz, para facilitar la entrada de DIGI como un operador móvil independiente de pleno derecho, convirtiendo así el mercado español en una estructura de cuatro actores.

Además de diversificar su cartera de marcas a través de la fusión (con Orange y Yoigo en el segmento premium, Jazztel y MásMóvil centrándose en la relación calidad-precio y Euskaltel y Telecable atendiendo las necesidades locales), MásOrange espera que sus activos de espectro le permitan alcanzar el liderazgo en el mercado móvil español.

Los ingresos de Movistar se mantienen estables interanualmente en el 3T de 2024 mientras que Vodafone y MásOrange afrontan caídas

Análisis de datos de mercado de CNMC | 2022-2024

La red de la entidad se basará principalmente en la infraestructura de Orange, complementada con la cartera de sites existentes de MásMóvil y el despliegue de nuevos. La integración de la red de MásMóvil, que depende íntegramente del espectro de banda media y alta e históricamente ha dependido de un acuerdo de roaming nacional con Orange, crea una sinergia para la entidad: aprovechar la capacidad y densidad de MásMóvil en áreas urbanas junto con la amplia cobertura y alcance nacional de Orange.

MásOrange está centrado en desbancar a Movistar en el segmento premium, que ha liderado durante mucho tiempo gracias a su foco en la calidad superior de la red. Movistar emergió como el operador móvil más rápido del mercado español en el Informe de Conectividad Speedtest de Ookla para el primer semestre de 2024, al ofrecer la velocidad de descarga media más alta de 82,68 Mbps. Esto sitúa a Movistar muy por delante de Orange (56,42 Mbps) y Yoigo (36,73 Mbps).

La ventaja espectral de MásOrange se inclina hacia las bandas medias y altas, normalmente utilizadas para implementaciones 5G en áreas urbanas y suburbanas. De acuerdo con los datos publicados por la compañía, MásOrange cuenta con el 37% de todos los activos de banda media y alta de España (en comparación con el 28% y el 26% de su competidor más cercano, Telefónica), lo que le da una oportunidad única de mejorar el rendimiento de la velocidad 5G y adelantarse a sus competidores.

Movistar ha mantenido su liderazgo en velocidad 5G con una asignación de 100 MHz en la banda de 3,5 GHz, pero esto se ve ahora eclipsado por la asignación de MásOrange de 170 MHz. La inversión de ésta para actualizar la RAN 5G para que cuente con capacidades avanzadas de agregación de operadores y arquitectura independiente (SA), le permitirá aprovechar los beneficios de rendimiento de un ancho de banda mayor a través del amplio despliegue de su espectro de 3,5 GHz en toda su red móvil consolidada.

Sevilla lidera en velocidad de descarga 5G entre las principales ciudades de España, pero el rendimiento de los operadores varía ampliamente

Speedtest Intelligence® | Q3 2024

Sin embargo, para liderar en cobertura de red, MásOrange necesitará ir más allá de su ventaja de espectro y centrarse en incrementar el número de sites físicos en áreas rurales. En el tercer trimestre de 2024, Vodafone y Movistar registraron en el mercado español una disponibilidad 4G del 95,1% y 93,4% respectivamente, seguidas de Orange con un 92,7% y Yoigo con un 91,5%.

Paralelamente a la consolidación de la red de MásOrange, DIGI está construyendo su propia infraestructura para dejar de depender gradualmente de un acuerdo de roaming y del uso compartido de RAN con Telefónica, comenzando con zonas urbanas y suburbanas. La Comisión Europea diseñó los remedies de desinversión de espectro para que DIGI replique la presión competitiva ejercida anteriormente por MásMóvil. El objetivo es que DIGI transporte una proporción similar de su tráfico total de datos móviles en su propia red en los próximos años, al menos igualando la cuota on-net del 40-60% que MásMóvil lograba antes de la fusión.

Provincias rurales de España, a la zaga en disponibilidad de 5G, lo que destaca la importancia del apoyo gubernamental a través de UNICO.

Speedtest Intelligence® | Disponibilidad general 5G (%) en 2024

En términos generales, se espera que los compromisos de inversión a largo plazo de DIGI y MásOrange, impulsados por la consolidación, unidos al apoyo gubernamental con programas como Único, impulsen la competitividad internacional de España en rendimiento móvil en los próximos años. El país tiene mucho por hacer, ya que a finales de 2024 ocupa el puesto 57 en Índice Global de Speedtest, situándose por detrás de la mayoría de sus colegas europeos en rendimiento de red, incluidas velocidad de descarga, coherencia y cobertura.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.