Airlines are using in-flight connectivity to differentiate their service and create brand value

Just as hotels have progressively integrated Wi-Fi connectivity as a standard amenity for their guests, in-flight Wi-Fi is transitioning from a novelty to a convenience to an expected service.

Reflecting this increasing expectation, the American Customer Satisfaction Index (ACSI) this year incorporated “Quality of in-flight Wi-Fi” into its benchmarks for the airline industry. In-flight Wi-Fi placed 21st out of the 21 benchmarks, ranking lower than baggage handling, seat comfort, and even airline food.

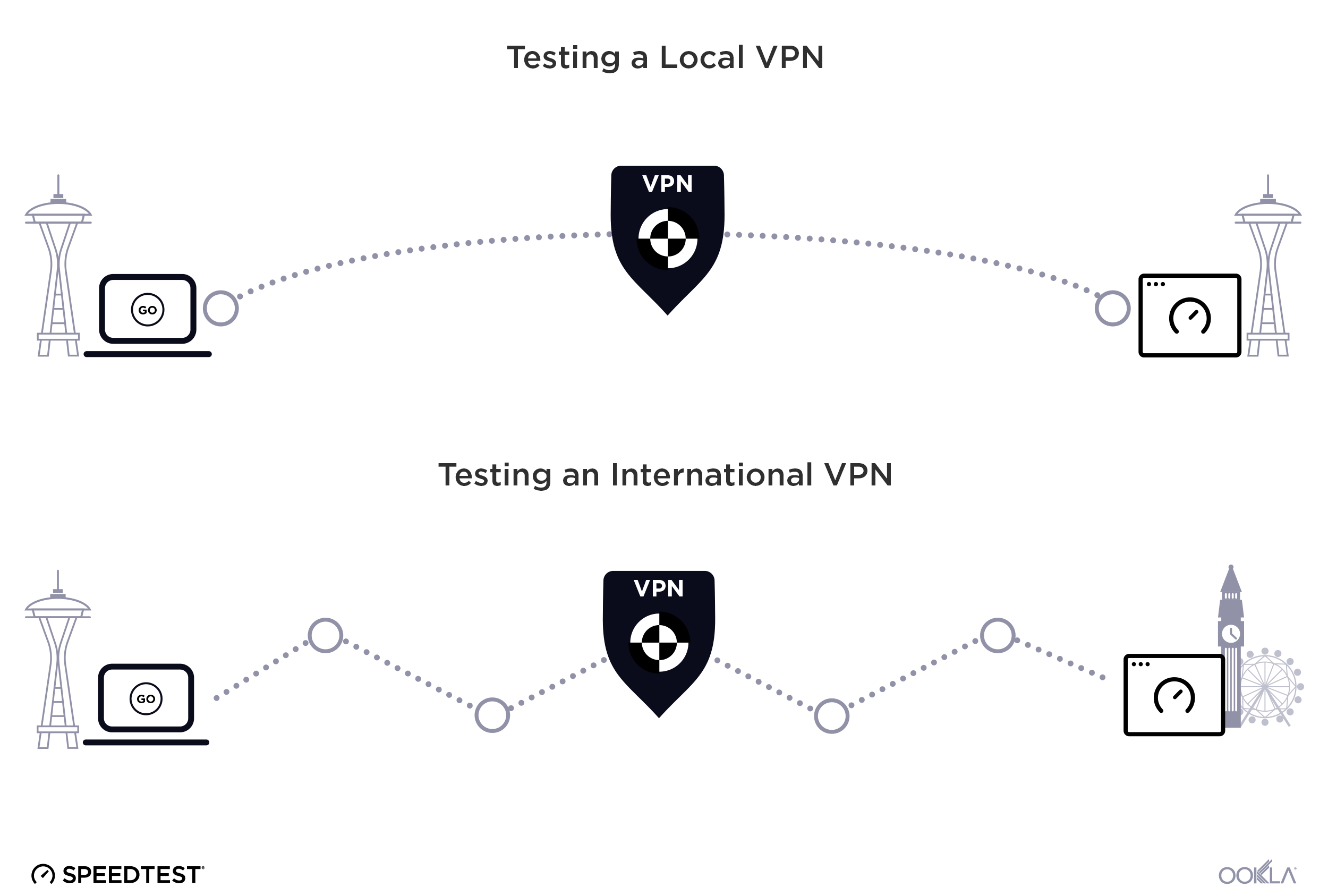

To assess this performance, we analyzed our Speedtest data collected during Q1 2025. We examined performance for individual airlines and for in-flight connectivity service providers.

KEY TAKEAWAYS:

- In-flight Wi-Fi for the majority of users compares very poorly with their experience on terrestrial networks

- Hawaiian Airlines and Qatar Airways stand out as the best performing airlines based on our data

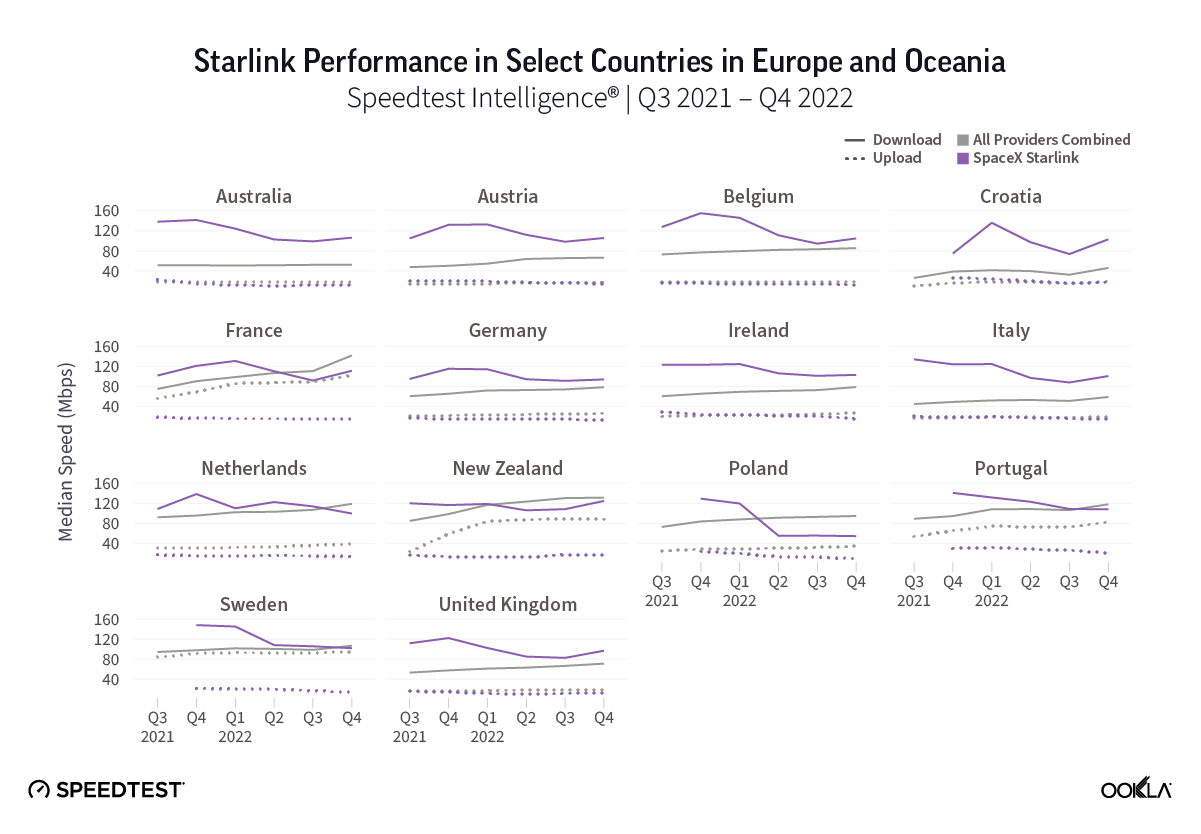

- Starlink’s low-earth orbit (LEO) satellite constellation drives performance for leading airline Wi-Fi

- Expect airlines to ramp up their efforts — in-flight connectivity can be a key point of differentiation for travelers, helps support the premium brand value that many international airlines aspire to create, and is an opportunity to monetize a literally captive audience

Airline In-Flight Wi-Fi Performance – Download / Upload / Latency

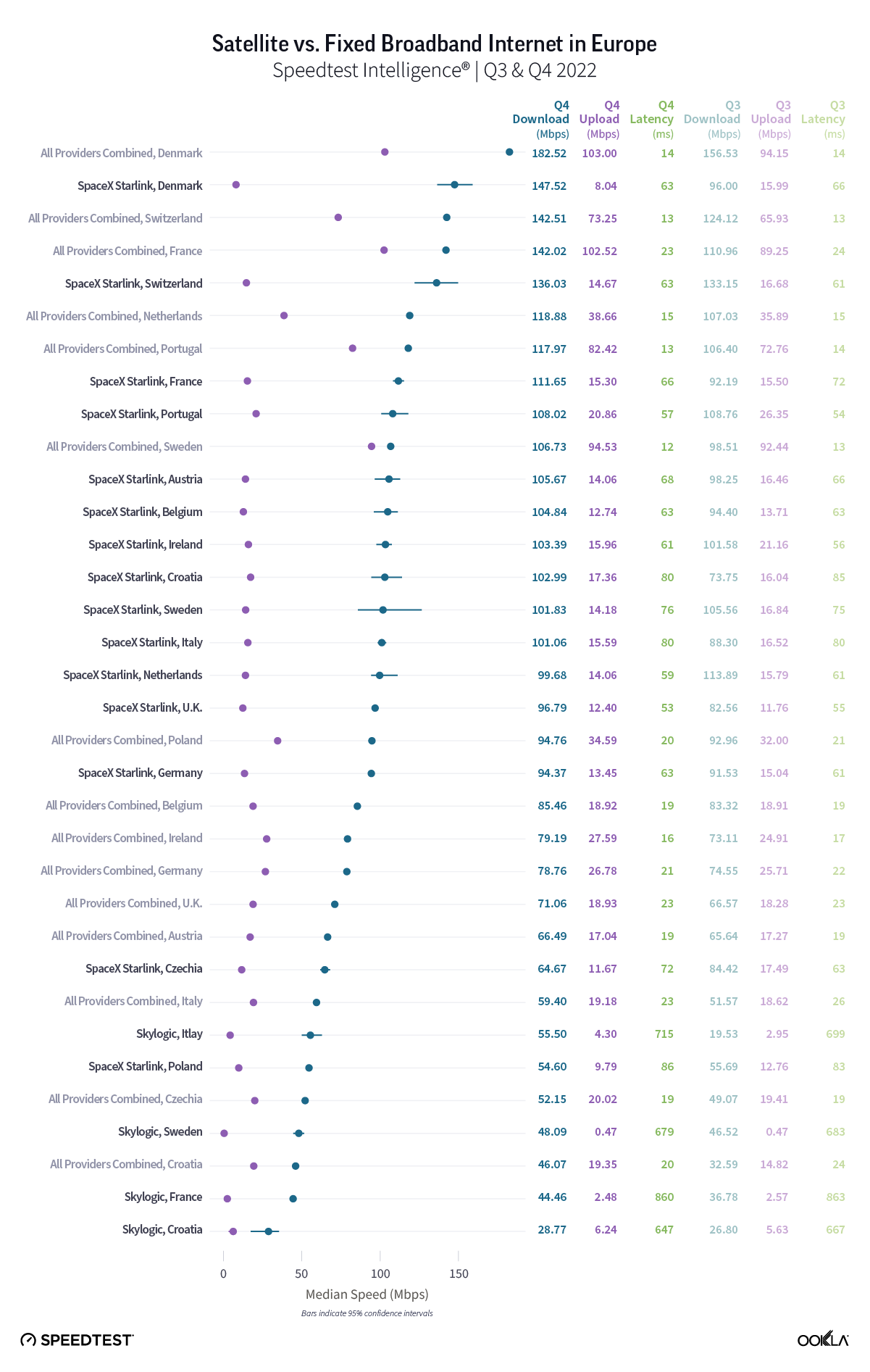

Hawaiian Airlines and Qatar Airways use Starlink’s low-Earth orbit (LEO) satellite constellation to deliver their inflight Wi-Fi, resulting in download speeds and upload speeds and latency that are better than the other airlines.

Many other airlines are also providing very usable speeds. Spirit Airlines, Air Canada, Delta Airlines, Breeze Airlines, American Airlines and Aeromexico all provide 10th percentile (where 90% of the results are faster) download speeds above 10 megabits per second (Mbps) and very respectable median download speeds. Furthermore, upload speeds on most of these airlines tend to support basic uplink connectivity needs like emailing. However, when the upload speed is observed alongside the many high-latency results, real-time uses like gaming or video calling are likely not possible (to the relief of all other passengers).

Lufthansa, at the other end of the download speed ranking, is limited by the Deutsche Telekom LTE ground-to-air network. While Lufthansa may offer other connectivity options, our data shows a significant number of its passengers are still connecting via this poorer-performing service.

Likewise, given the premium brand reputation of carriers like Japan Airlines, Turkish Airlines, and Cathay Pacific, they likely offer better-performing connectivity services on other aircraft. However, as with Lufthansa, our data reveals that a notable portion of their passengers are still encountering a substandard Wi-Fi experience.

Qatar Airways presents additional insight as, along with Starlink as one of its connectivity service providers, it also operates planes with geo-stationary orbit GEO connectivity. This is most evident in the multiserver latency results. While Qatar’s median latency is similar to Hawaiian Airlines, its 10th percentile (the laggiest experience) is much higher, keeping it in the company of other GEO-supported airlines.

Connectivity Service Providers

In our Speedtest samples of in-flight connectivity service providers we collect a mix of GEO, LEO, medium earth orbit (MEO), multi-orbit / hybrid network providers, and even ground-based LTE. Furthermore, the category includes satellite service integrators. These integrators do not own or operate their own satellite constellations. Instead they partner with satellite operators for capacity while managing the business relationship with the airline, including installing and managing the in-flight connectivity system on the aircraft.

In-flight Connectivity Service Providers and Associated Airlines

| Deutsche Telekom | Air France, Cathay Pacific, Condor, Lufthansa |

| Hughes (SES) | Spirit Airlines |

| Inmarsat (Viasat) | Air New Zealand, Qatar Airways |

| Intelsat | Air Canada, Alaska Airlines, American Airlines, United Airlines |

| MTN Satellite Communications | Southwest Airlines |

| Nelco (PAC/Intelsat) | Air India |

| Panasonic Avionics Corporation | Aer Lingus, Air France, American Airlines, ANA, Asiana Airlines, British Airways, Etihad Airways, EVA Air, Fiji Airways, Finnair, Iberia Airlines, ITA Airways, Japan Airlines, KLM, Korean Air, Malaysian Airlines, Scandinavian Airlines, Singapore Airlines, SWISS Airlines, TAP Air Portugal, Thai Airlines, United Airlines, Virgin Atlantic, VoeAzul, WestJet, Zipair Tokyo |

| SITA Switzerland | Qatar Airways |

| SpaceX Starlink | Hawaiian Airlines, Qatar Airways |

| Türk Telekom | Turkish Airlines |

| Viasat | Aeromexico, American Airlines, Breeze Airlines, Delta Airlines, EL AL Airlines, Icelandair, JetBlue, Southwest Airlines, United Airlines, Virgin Atlantic |

- Deutsche Telekom is in the European Aviation Network, a hybrid network that combines a GEO satellite from Viasat/Inmarsat with a ground-based LTE network across Europe.

- Hughes, an EchoStar company, provides GEO satellite internet for consumers and enterprises. In late 2022 it began offering “Hughes Fusion,” a multi-orbit in-flight connectivity solution that can simultaneously communicate with both GEO and LEO satellites. Hughes frequently collaborates with European satellite operator SES, a GEO and MEO provider.

- Intelsat provides in-flight connectivity through its fleet of GEO satellites and offers a multi-orbit solution that combines its GEO network with access to a LEO constellation. Intelsat is in the process of being acquired by SES.

- MTN Satellite Communications, primarily known for its services in the maritime and remote land-based sectors, also provides in-flight connectivity. The company leverages capacity from various satellite operators across different orbits, both GEO and LEO.

- Nelco, a Tata Group enterprise, has partnered with Intelsat to offer its GEO-based connectivity services to airlines operating in Indian airspace.

- Panasonic Avionics Corporation (PAC) – a provider of in-flight entertainment and connectivity systems, does not operate its own satellite constellation. Instead, it partners with various satellite operators, including those with GEO and LEO networks (eg, Eutelsat OneWeb), to offer multi-orbit connectivity service to airline customers.

- SITA Switzerland, a multinational information technology company, partners with satellite network operators, to deliver passenger broadband.

- SpaceX Starlink is rapidly expanding its LEO satellite network, offering high-speed, low-latency internet service to airlines, and is being adopted by several carriers.

- Türk Telekom has been providing in-flight connectivity through partnerships including Panasonic Avionics.

- Viasat operates a constellation of high-capacity GEO satellites. Its services are used by numerous airlines globally. Viasat acquired Inmarsat, another GEO satellite network, in May 2023.

Connectivity Service Provider In-Flight Wi-Fi Performance – Download / Upload / Latency

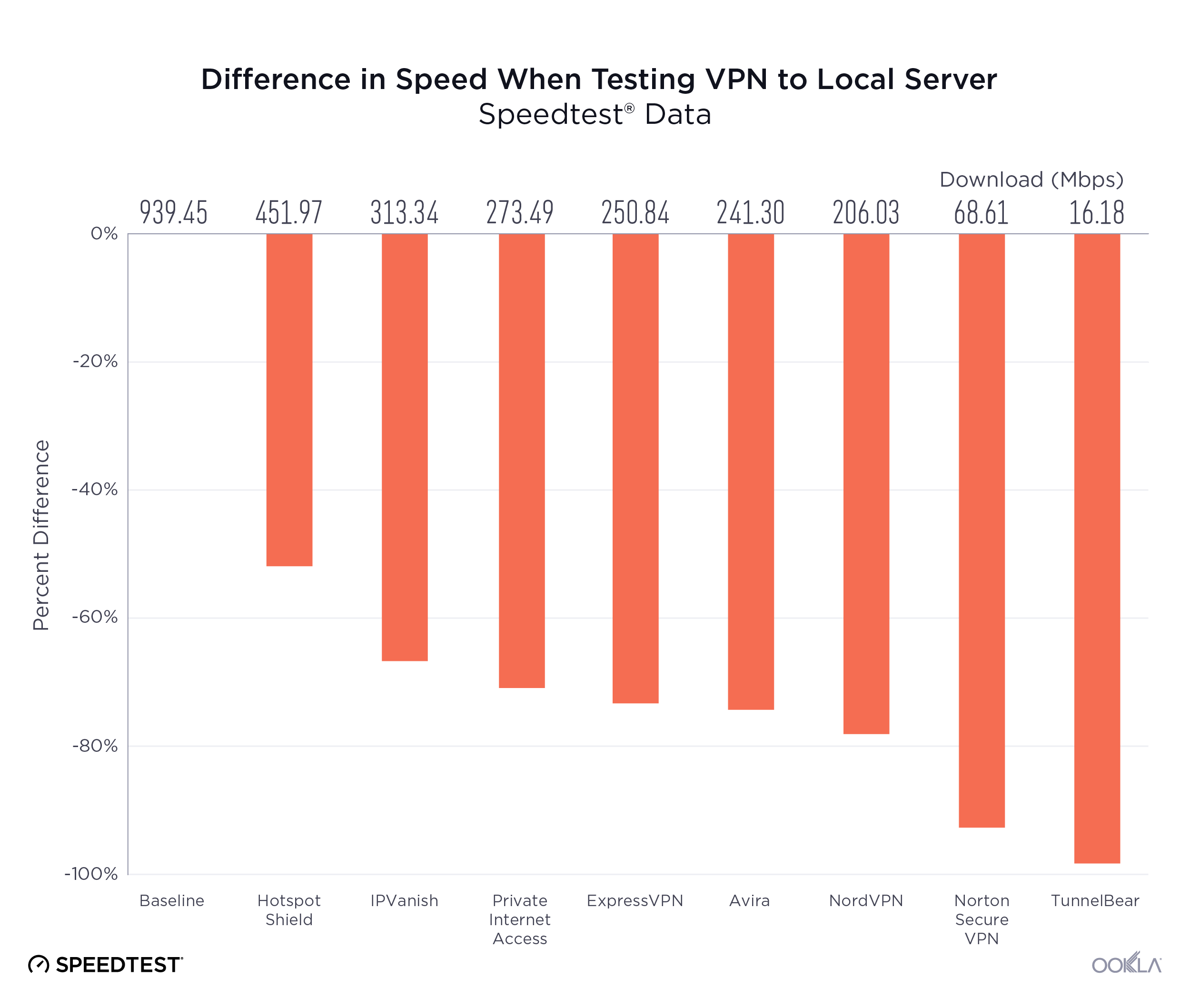

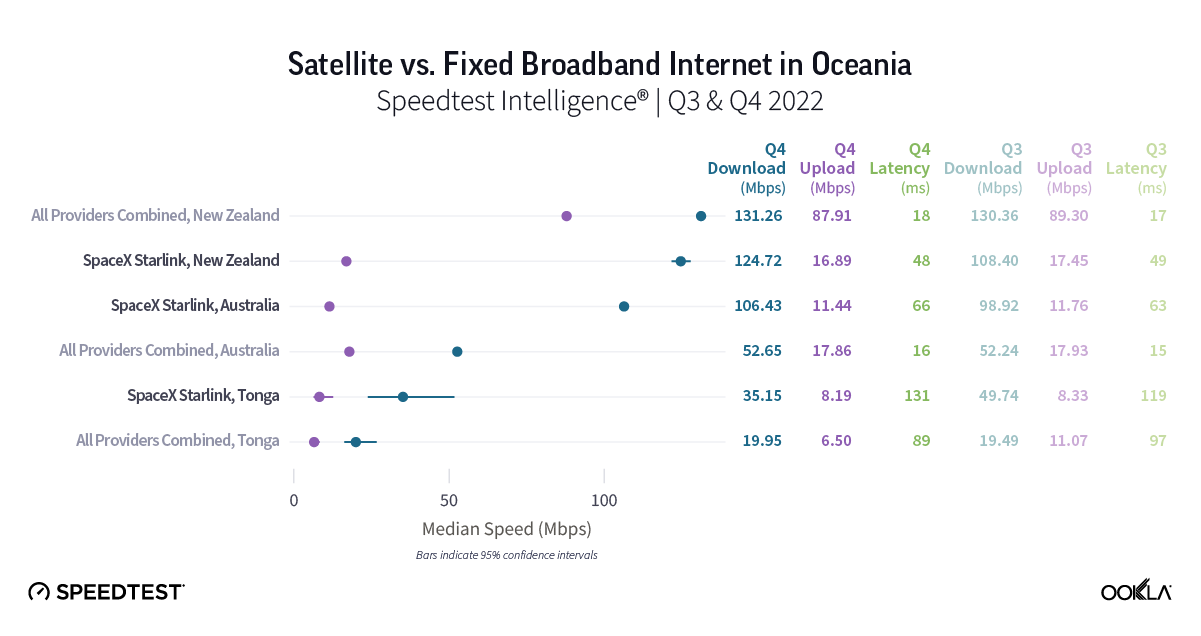

The advantages of its dense LEO constellation compared to the GEOs make SpaceX’s Starlink the clear standout in speeds and latency. Its medians are 152.37 Mbps download speed, 24.16 Mbps upload speed, and 44 milliseconds (ms) multi-server latency.

Hughes and Intelsat, with their multi-orbit offering, deliver solid median download speeds – 84.55 Mbps and 61.61 Mbps, respectively. Viasat performs well on download speed, too, at 50.38 Mbps, given it is a GEO provider.

On the other end of the scale, the LTE ground network of Deutsche Telekom delivers a minimally usable median download speed of 4.14 Mbps. Passengers on these flights may have access to GEO services (which, for example, we see in our data with Air France, though not in sufficient sample size to include in this article), but, as stated above, given we record Speedtest samples on Deutsche Telekom means that passengers are connecting with very slow internet speeds.

Looking more closely at slower download speeds, the 10th percentile reveals a similar pattern to the median, with Starlink still performing well at 65.31 Mbps, and Hughes and Viasat still managing usable download speeds of 28.29 Mbps and 12.78 Mbps, respectively. The rest of the provider speeds tail off and down into the single-digit Mbps, and raises a question: is it the satellite constellation capacity or the onboard Wi-Fi technology (or both) that is the limiting factor? The question of onboard Wi-Fi technology is taken up in the conclusion to this research article.

Examining the uplink, besides Starlink at 24.16 Mbps, only Intelsat provides adequate median upload speeds at 9.96 Mbps. Next, Panasonic Avionics, Turk Telekom (also PAC) and Nelco (also PAC) neatly cluster – 3.65, 3.40 and 2.60 Mbps, respectively – followed by Deutsche Telekom at 2.53 Mbps.

Latency is the starkest separation between LEO and GEO, which is obvious given the orbital altitude differences in distance between them is roughly 60 times or more. Bearing this in mind, Starlink’s median multiserver latency of 44 ms would otherwise seem an outlier compared with all other providers, ranging from 667 ms to 839 ms.

Nowhere to go but up

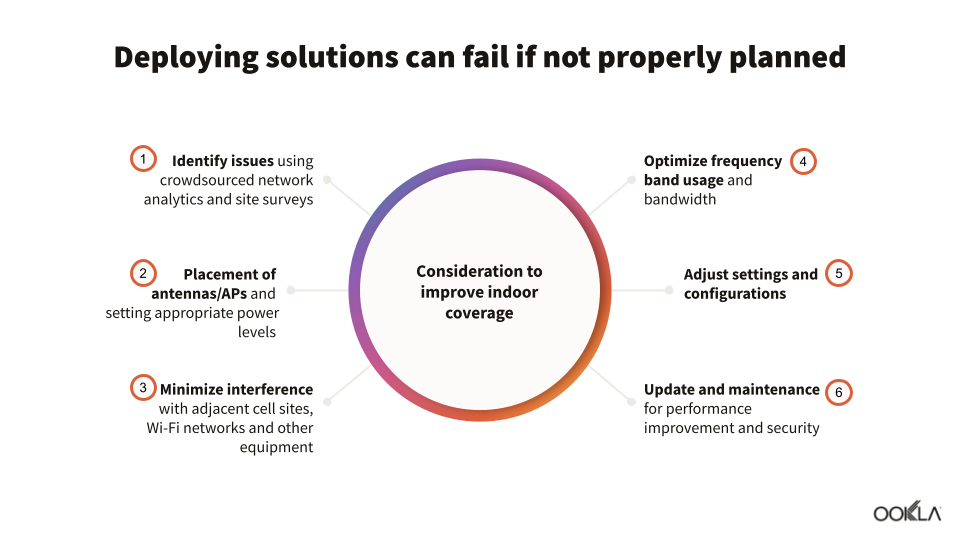

In-flight connectivity isn’t seamless. Depending on airline routes or models of airplanes, different connectivity service providers may be used (or occasionally restricted by governments when crossing over certain territories). Moreover, old equipment on and in the airplanes takes time and expense to upgrade.

However, the upgrades are happening as many airlines see value and opportunity to provide extended services, along with better Wi-FI. For example, United Airlines is not just moving its entire fleet to Starlink for better performance, but also to deepen its customer loyalty relationships. “Access will be free for all MileagePlus customers and includes game-changing inflight entertainment experiences like streaming services, shopping, gaming and more.” SAS is also working with Starlink to enhance its “gate-to-gate” connectivity and offer free high-speed Wi-Fi by the end of this year.

Not all airlines are selecting Starlink. Also announced this year, American Airlines has aligned itself with Viasat and Intelsat, while Delta has gotten on board with Viasat and Hughes, deplaning Intelsat.

Another example of improvement, this time inside the airplane, is Panasonic Avionics offering Wi-Fi 6E. Wi-Fi 6E adds the 6 GHz frequency band to prior Wi-Fi generations (that offered 2.4 GHz and 5 GHz), which has more channels and less interference than older Wi-Fi devices.

Finally, competition is heating up. The likes of Project Kuiper and, perhaps, AST SpaceMobile will add new LEO options, where we see the leading LEO Starlink performing very well in our Speedtest data. Intention to provide “direct-to-device” connectivity to wireless customers from the mobile network operators, helps support the scale of the capital-intensive business case for launching rockets and orbiting satellites.

Watch this space

We will be revisiting this topic soon with updated information and insights. If you are an airline or an in-flight connectivity service provider, we’d like to hear from you to ensure we’re capturing and reflecting your passengers’ Wi-Fi connection experience.

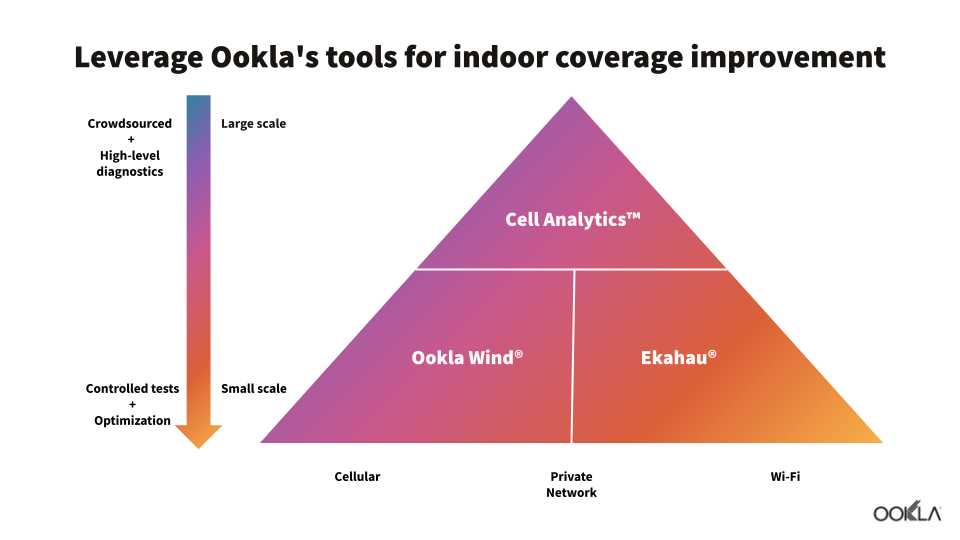

Ookla assists ISPs, venue owners, and companies in designing Wi-Fi networks, monitoring their performance, and optimizing them. Please contact us to learn more about Speedtest Intelligence and Ekahau.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.