Originally published in Spanish on DPL News, February 20, 2025, under the title “La banda ancha en Latinoamérica: el camino ascendente”

To truly address the digital divide, meaningful connectivity starts with robust, accessible broadband internet for all

Telecommunications infrastructure in Latin American countries (LatAm) faces common challenges across the region. These include geographic barriers and economic disparities that hinder deployment. Further, these barriers directly contribute to the so-called “digital divide,” typically depicted as an urban-versus-rural condition. Not unique to LatAm, most countries and governments around the world are grappling with this same problem.

Ensuring broadband access alone is not adequate. Consumers are underserved by slow, unreliable internet connections. Many countries in LatAm are making steady progress toward providing high-speed broadband connectivity at scale.

The ‘Fiber Development Index Analysis 2024’ from the World Broadband Association (WBBA) highlights broadband connectivity’s foundational role in socioeconomic development. Broadband networks drive economic growth by supporting information and communications technology across all sectors, contributing significantly to GDP and employment. Furthermore, broadband enables the digitization of various industries, such as manufacturing, healthcare, and education, leading to increased productivity, efficiency, and business success. The World Bank cites research that finds when fast internet becomes available, employment increases by 13 percent and businesses nearly quadruple their exports.

The social benefits of broadband are equally important. In education, it provides access to better learning materials and facilitates communication between students and teachers, especially during remote learning situations. Other social benefits include remote work, telehealth services, and online banking for underserved populations. These benefits, while hard to quantify, are crucial for societal well-being.

Because of the numerous benefits it provides – including access to information, economic opportunities, education, healthcare, and entertainment – meaningful connectivity, characterized by high-quality and reliable broadband access, is increasingly recognized as a fundamental human right.

In LatAm and Europe, and in many regions across the globe, some countries are rapidly deploying fiber and 5G and emerging as digital leaders, while others are lagging behind; this disparity exists in both regions. For example, Europe has embedded universal gigabit broadband coverage by 2030 as a core pillar of its broader emerging pro-growth industrial strategy to boost the region’s competitiveness and differentiate it through world-class infrastructure. A common approach in LatAm and Europe, is the neutral network as a way to expand broadband coverage and foster competition. For example, in Mexico, Red Compartida is a nationwide wholesale-only wireless network. And in Spain, development of neutral networks through companies like Lyntia and MásMóvil, operate wholesale-only fiber networks used by multiple operators.

This article examines the high-level status of fixed and mobile connectivity of a selection of LatAm countries tending to have large populations, as well as Spain (Spain being the host of the Digital Summit LatAm 2025 in Madrid at the end of February).

Data sources are: (1) OoklaⓇ mobile SpeedtestⓇ data sets are queried, including the Speedtest Global Index of 152 countries, and Speedtest IntelligenceⓇ with focus on 5G insights. And, (2) the Fiber Development Index (FDI) – “a collaboration between Ookla, the WBBA, and Omdia – benchmarks fiber development and performance across 93 countries, the FDI provides crucial insights into actual broadband performance and availability worldwide” for industry stakeholders, policymakers and regulators, service providers and suppliers, supporting the development and growth of the fiber industries. The full FDI list of 93 countries is seen here.

Fixed Connectivity

The Speedtest Global Index current rankings (January 2025) of countries based on median download speeds for fixed connectivity presents many LatAm countries among a mix of countries from other regions for comparison. Three categories are evident. More advanced countries where fiber performance is already strong, including in Chile, seeing well over 200 Megabits per second (Mbps) median download speed. The second group is solidly above 100 Mbps median download speeds where its fiber is deployed. The last group is generally below 100 Mbps, slower to take off and not yet delivering the performance possible with fiber.

Speed is simple to understand, but it only truly matters when one has access to a network that delivers the speed. High speeds on a network with limited availability are probably not as beneficial as medium speeds on a widely available network. To judge the breadth of fiber deployment, the FDI provides a measurement to assist in evaluating this called Fiber-to-the-Home (FTTH).

Up-Right Trends

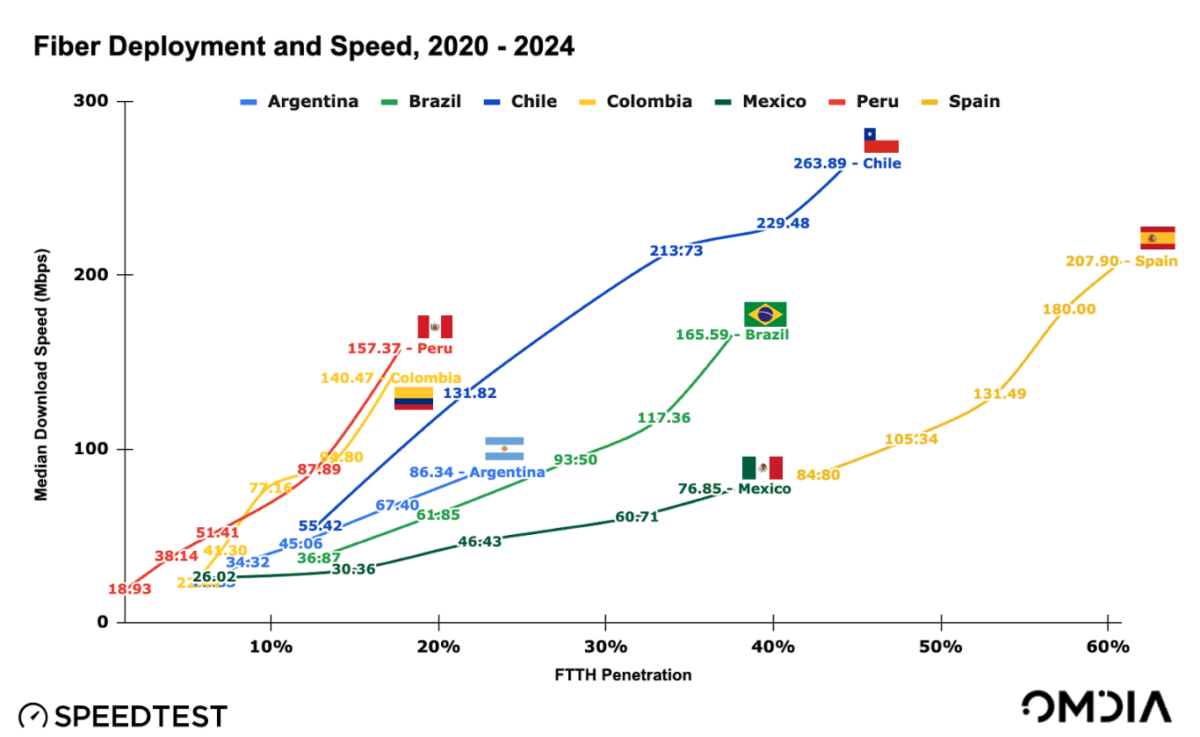

In the chart of Fiber Deployment and Speed, for comparison over five years time (2020 – 2024) and among a selected cohort of larger population countries (not all of LatAm, to keep the visual intelligible), FTTH penetration percentage is on the horizontal axis and median download speed of the fiber connection in Mbps is on the vertical axis. FTTH penetration is the number of FTTH subscriptions divided by the total number of households.

FTTH penetration is often higher in relatively smaller-geography countries because population density tends to be higher as well, resulting in favorable economic conditions for deployment and adoption. This does not describe the morphology of countries in this analysis. Year-to-year consistent progress is clearly evident for all countries (FTTH moving to the right), with Brazil, Chile and Mexico moving the farthest. However, none of the six large LatAm countries approached 50% FTTH penetration, let alone catching Spain.

Download speed showed steady progress as well, though at different rates of improvement. The same three categories as identified early are evident: Chile and Spain in the upper; Brazil, Peru and Colombia in the middle; Argentina and Mexico in the lower. Chile’s rise in performance is particularly commendable, from 55.42 Mbps in 2020 to 263.89 in 2024. On the other hand, Mexico at 76.85 Mbps in 2024, was still not where Spain was at 84.80 Mbps in 2020. In sum, among this cohort, speed performance presents a mix of successes and opportunities.

Excluding Spain, only Chile and Brazil improved on both FTTH and speed axes. Mexico expanded FTTH access, but its speed performance lagged. In the other direction, Peru and Colombia presented limited FTTH deployment, but it’s fast where available. Argentina trailed on both metrics.

It is important to consider that the speeds cited here are median speeds. The median is the middle, which means that half of the speeds were slower (and, of course, half were faster). This matters especially for regulators that are mandating minimum performance targets, often in the context of closing the digital divide. For example, in the European Union’s (EU) goals from its Gigabit Society and Digital Decade policy:

Broadband Europe promotes the Commission’s strategy on Connectivity for a European Gigabit Society by 2025 as well as the vision set by the Digital Decade for Europe’s digital transformation by 2030 to connect European citizens and businesses with very high-capacity networks, which will enable innovative products, services and applications to all citizens and business across the EU.

This Gigabit Society vision for 2025 relies on three main strategic objectives:

- Gigabit connectivity for all of the main socio-economic drivers;

- uninterrupted 5G coverage for all urban areas and major terrestrial transport paths;

- access to connectivity offering at least 100 Mbps for all European households

The ambition of the Digital Decade is that, by 2030, all European households are covered by a Gigabit network and all populated areas are covered by 5G. (Source: Support for Broadband rollout | Shaping Europe’s digital future)

The last two suggest a future where there is fixed service delivering 1,000 Mbps – that is to say, a Gigabit per second (Gbps). Incidentally, Brazil’s regulator Anatel also has a Gigabit target for fixed connectivity speed. And, for mobile networks in 2030, on the cusp of 6G, 5G will be pervasive in the same way that 4G is today. To that point, the next section examines 4G and 5G in these same cohort of countries.

Mobile Connectivity

Mobile is the primary internet access method for many people across LatAm, and sometimes their only internet access method. 4G can provide minimally adequate performance, with the benefit of being a mature and widely deployed technology. 4G networks and devices are abundant.

However, to fulfill the future promise, and enjoy the services and benefits that come with high-speed internet access, 5G is capable. 5G’s superior performance to that of 4G is competitive with fixed broadband, and can sometimes reach consumers where fixed networks might not yet have. Further, some consumers are making a financial decision – only affording one method of internet access. In this case, mobile usually wins this choice over fixed. (Mobile devices also have the benefit of being able to generate a Wi-Fi hotspot, whereas a fixed connection cannot become a mobile phone.)

This section will look at two “availability” metrics, analogous to FTTH penetration, to illustrate the accessibility of 5G. Then, just as with fixed performance above, compare the speed performance of 5G to that of 4G.

What the phone sees

Mobile Technology Generation, 2H 2024

Availability on Service-Active Devices shows the mobile network technology seen by all devices in a given county. This isn’t coverage or the amount of traffic (payload) on a given technology generation. Rather, this is the devices’ perspective of network technology generations (the “G”) available to connect with. In other words, this is a democratic view of available wireless technologies – every device is voting. Note that a 4G device will never see a 5G network, while a 5G device will see all the network technology generations. Just the same for a 3G or 2G device – devices are not “forward compatible” in mobile technology generations.

We can easily draw insights from the Availability on Service-Active Devices chart about the relative “G” availability for each country. Spain is further along in 5G deployment, Chile and Brazil are early in 5G, Mexico is just starting, and Colombia and Argentina are pre-deployment (perhaps in trials).

Less obvious is the velocity of change from one technology generation to the next. The installed base of 4G devices is large and slow to upgrade. Device quality is better and device costs are higher, leading consumers to use older technology for longer. In Spain, all of its operators had launched 5G networks in 2020, and thanks to proactive initiatives under the Universalization of Digital Infrastructures for Cohesion Program (UNICO), 5G coverage has expanded. Rural 5G coverage, as it is in most countries, is still a work-in-progress for UNICO. But also, five years into 5G, Spain still has many non-5G devices.

Thus, a key point this view makes, as obvious as it may be, is that the device is critical to the experience. (This point is also true of fixed networks. For example, an old Wi-Fi router would be a performance bottleneck on a Gigabit fiber connection.) In each new device, modern chipsets and advanced technologies, and spectrum bands and radios, combine to fulfill the potential capabilities of the network.

What the 5G phone sees

The 5G Availability time-series chart illustrates, for 5G devices, the percentage of those 5G devices that spend the majority of their time connected to a 5G network. Highly correlated with Availability on Service-Active Devices – Spain with the most 5G and Argentina with the least 5G – this view indicates the intersection of 5G network deployment and 5G devices.

Again, this is not a view of coverage, though it does suggest the degree of alignment between (network) deployment and (device) distribution. Rhetorically, what is the point of a 5G device without a 5G network?

However, let’s touch on coverage. In lay terms, coverage is usually thought of as geography, and this idea is reinforced with network maps. Networks, actually, and especially new ones, are deployed where the most people live. Scale economies dictate that network coverage is primarily about population, not geography.

For example, Anatel recently announced that Brazil had surpassed its 2027 coverage goal for 5G at 57.67% of the population – it now covers 62.98% of the population. With impressive precision, Anatel’s statement indicates that coverage is about people.

The Anatel news also contained the information that 5G subscriptions had doubled in 2024. Comparing this with data in the 5G Availability time series chart, from Q3-Q4 2023 to Q3-Q4 2024, Brazil 5G Availability went from 16.77% to 31.99% – it nearly doubled.

We have now touched on network availability, devices, and coverage. It’s time to turn to what 5G’s headline feature has been since before 3GPP release 15 in the prior decade. That is, of course, speed.

5G Speed – green means go fast

Based on Speedtest user data in each country in the second half of 2024, there is no question that 5G speeds are faster than 4G. And as we just learned with Brazil’s expanded 5G coverage and growth in devices and subscriptions, millions of Brazilian mobile users are enjoying mobile speed performance more than ten-times faster than their 4G friends. User experience will vary within each country based on the mobile service provider, among other factors.

Speed isn’t just about how fast an individual user gets to experience browsing or downloading. Speed is representative of network capacity. Moreover, speed is the result of the capacity (spectrum amount, technology, site count/density, backhaul) and user demand (number of users and, again, browsing or downloading or streaming…). So, when we look at Argentina’s 5G speed, we know from information above in this report that it is a very new deployment with very few users (Called “unloaded” in network jargon). Consequently, the speeds of newer networks must be considered in this context, to not over-estimate their potential and promise.

Spain offers a sensible counterbalance, though even a three-times faster experience should be encouragement for a Spaniard to ditch their 4G phone.

Don’t wait

Let’s consider meaningful connectivity and the digital divide. One could argue that, according to the findings in this analysis, fixed FTTH connectivity is under-penetrated and 5G mobile service is nascent to the extent that neither delivers meaningful connectivity. In this case, the digital divide, based on some aspirational access and performance objective, could mean most people. However, other countries’ experiences are likely to repeat. As penetration and adoption matures, attended by performance, to a state of meaningful connectivity, there will be those at risk of being left out. This is the real digital divide.

The opportunity is this – don’t wait. Programs and initiatives can pre-emptively address the systemic gaps that could otherwise result. Misses and successes of others can be instructive. There are billions in government funds aimed at this issue.

It is not the purpose of this article to survey each country’s digital divide initiatives, but to identify a few references for further exploration:

- An example of pre-emptive success outside of LatAm, the state broadband office in South Carolina moved on the digital divide issue early and fast, resulting in a higher rural broadband adoption than in urban areas. An inverted divide! (How South Carolina Teamed with Ookla to Become a Rural Broadband Leader)

- Brazilian regulator Anatel has produced its 2023 – 2027 Strategic Plan, wherein it lays out objectives and framework. (Other programs in Brazil can be found at this thorough list Hacking the Gap – Brazil’s Path to Digital Inclusion)

- Recently announced, bridging the digital divide: okla® and efts group join forces to help transform connectivity in latin america

For more information about Ookla and Speedtest Intelligence data and insights, please get in touch.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.