WE, the mobile division of the fixed incumbent Telecom Egypt, launched in 2017. Since its inception, WE has captured nearly 15% of the mobile market in terms of subscribers. This article examines WE’s service and marketing strategies and uses Ookla® Speedtest® data to analyze its network performance. It also explores how the operator attracted subscribers from established players and if their network experience has changed after migrating.

Key Takeaways:

- WE aggressively expanded its 4G network and focused on service convergence to compete with other mobile operators. WE increased its market share by emphasizing 4G services and offering competitive bundles that integrate fixed and mobile services, along with an expanding digital portfolio. As of Q4 2024, WE leads in network performance, boasting a median download speed of 33.38 Mbps and an upload speed of 8.82 Mbps.

- WE has benefited the most from customer churn. Between January 2023 and December 2024, Vodafone’s Speedtest 4G user base expanded by 20.8%, with many new users switching from Vodafone, the market leader in terms of market shares, highlighting WE’s appeal.

- Churners did not experience significant improvements in network performance after changing operators. Some churners experienced some improvements in 4G download and upload speeds after migrating, but this was not the case for all operators. This suggests that other factors, such as pricing, data allowances, and customer service, likely influenced their decision to switch. The imminent launch of 5G in the first half of 2025 will redefine network competition and shape the market for the next decade.

WE focused on great network performance, competitive offerings, and digital services to stand out against incumbent competitors

Egypt is one of Africa’s largest mobile markets, with 113.2 million subscriptions and a penetration rate of 103.6% by the end of 2024, according to the Ministry of Communication and Information Technology (MCIT). Incumbent fixed operator Telecom Egypt launched a mobile brand, ‘WE,’ in September 2017 while retaining a 45% stake in Vodafone, the market leader. Between 2019 and the first half of 2024, WE nearly tripled its mobile subscribers to 13.1 million and increased its market share to 14.2%.

Telecom Egypt has also inked partnerships with all three MNOs, Vodafone, Orange, and e& Egypt (previously known as Etisalat Egypt), to provide fiber transmission services to connect mobile sites and/or international connectivity services such as telephony.

WE adopted a few key strategies to grow its market share in Egypt:

- Rapid network expansion: WE initially signed a national roaming agreement with Etisalat for 2G and 3G traffic, which was terminated in 2022. Then, it signed a five-year national roaming agreement with Orange to replace Etisalat in 2023. This was coupled with the rapid deployment of its own 4G infrastructure, which helped shift traffic from its partners to its network.

- Integrated services: Telecom Egypt expanded its WE brand to incorporate fixed broadband services. This allowed Telecom Egypt to offer bundled fixed and mobile services, an addressable market of nearly 10 million fixed-line customers, with attractive data plans and services to draw customers from established mobile rivals.

- Digital-first approach: WE adopted a digital-first strategy to differentiate itself and expand its portfolio to include digital services. For example, it launched the ‘WE Pay’ digital wallet in November 2019 and the ‘WE Bonus’ loyalty program in January 2021.

- Supporting government initiatives: WE expanded its subscriber base by participating in government-led projects. For example, it added 2.1 million through school digitization projects and social solidarity initiatives in Q2 2022.

WE Mobile Subscribers and Share of the Market, Egypt

Source: Telecom Egypt | 2019–H1 2024

WE Mobile Subscribers and Share of the Market, Egypt

At the beginning of 2024, WE was awarded the first license by the National Telecommunications Regulatory Authority (NTRA) to deploy and operate 5G networks for mobile phones in the country. It is deploying 5G services across major cities, including Giza, Luxor, Aswan, and Alexandria, with a planned launch in the first half of 2025. It will enable WE to offer faster data speeds and increased network capacity, and usher in a new era of the telecom market.

WE is also leading in 4G network performance in Egypt, making it a compelling choice for consumers. According to Speedtest Intelligence® data, it consistently leads the market with median download speeds reaching 33.38 Mbps in Q4 2024 and upload speeds hovering around 9 Mbps.

Network Performance, by Operator, Egypt

Source: Speedtest Intelligence® | Q4 2023 – Q4 2024

Network Performance, by Operator, Egypt

WE has been the primary beneficiary of customer churn

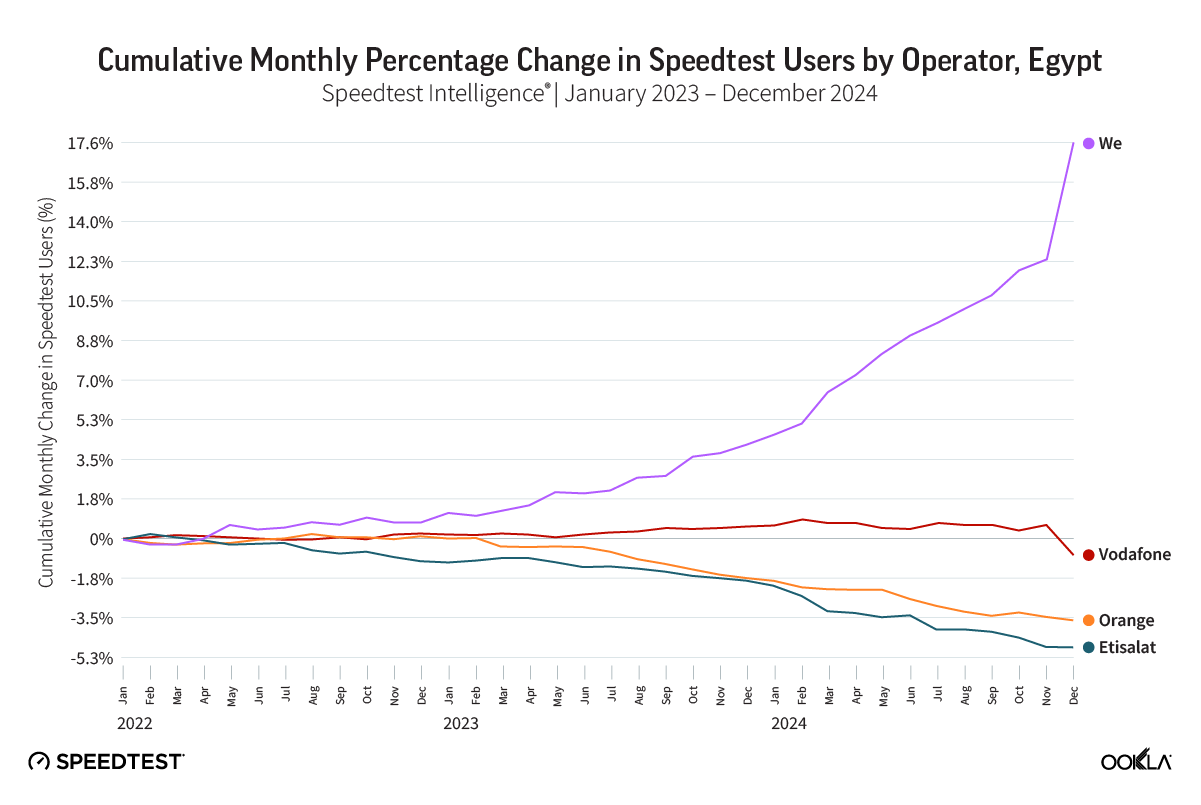

Speedtest Intelligence helps track changes in mobile subscriptions and market share shifts. The chart below shows the cumulative monthly percentage change in Speedtest users between January 2023 and December 2024. A positive trend indicates that a mobile operator acquired more users during that period, while a negative trend signifies that many customers were transferred to other operators. We use the cumulative monthly change in users as a proxy for subscriber churn.

As a fourth player in the market, WE has mainly grown by attracting subscribers from other operators. WE saw a 20.8% cumulative growth in 4G Speedtest users between January 2023 and December 2024. Orange’s Speedtest user base decreased by just over 3.7%, and Vodafone’s Speedtest base shrank by 2.6% over the same period. Etisalat saw an initial increase between February 2023 and June 2023 but experienced subsequent declines, leading to a decrease of 5% in its subscriber base.

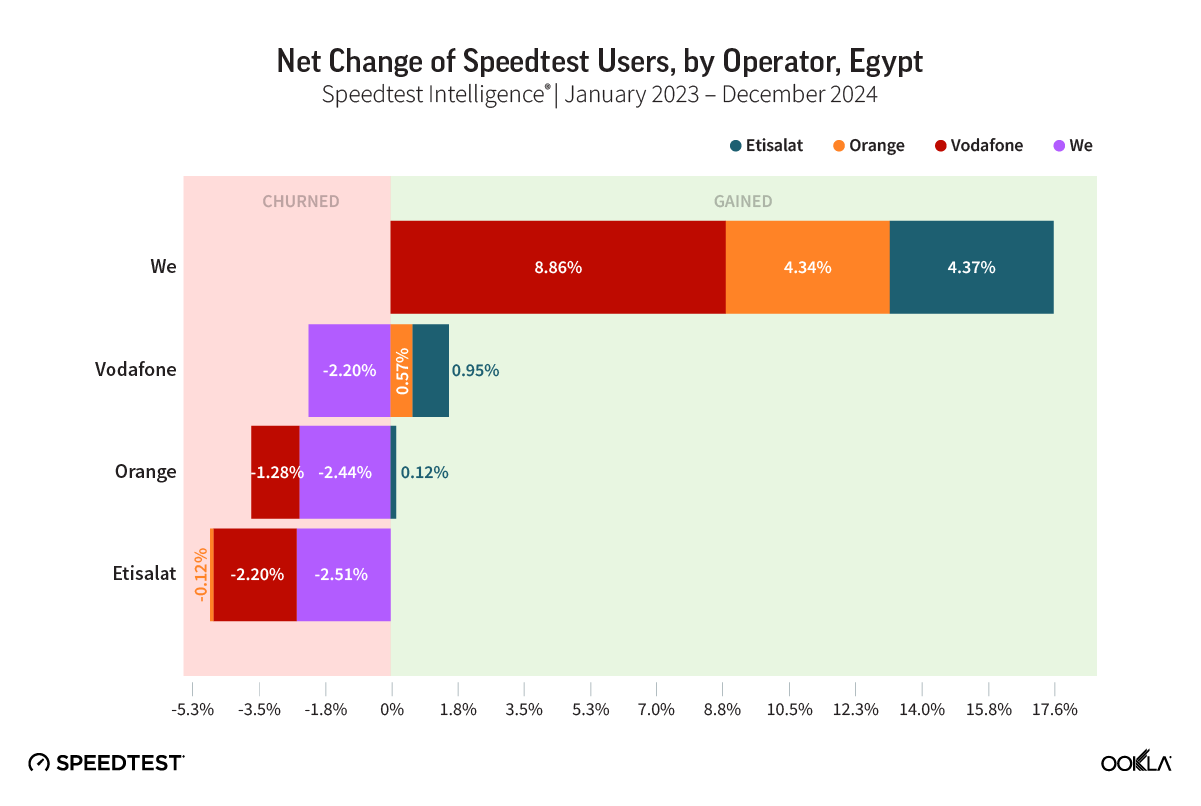

The following two charts show the breakdown of the Speedtest net additions and net losses per operator, which can be considered a proxy for customers’ net additions and losses due to churn. WE experienced the most significant gain in 4G users, with increases of 12.3% from Vodafone, 4.0% from Orange, and 4.5% from Etisalat. Vodafone lost 3.7% of Speedtest users to WE and smaller percentages to other operators. Orange lost 2.7% of its Speedtest base to WE and 1.1% to Vodafone. Etisalat lost the most, mainly to WE (3.5%) and Vodafone (1.5%) over the same period.

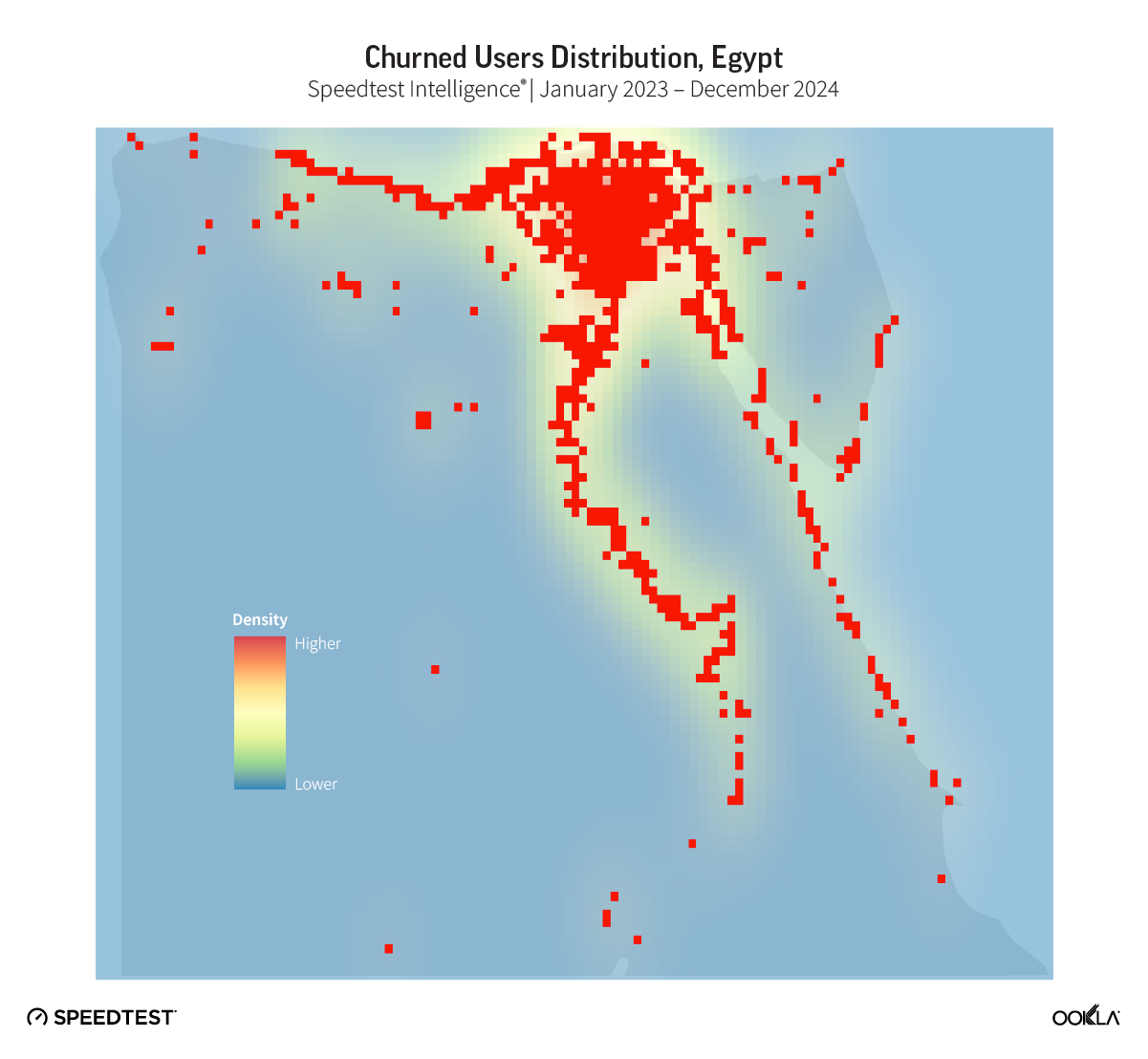

The heatmaps below depict the spatial distribution of 4G Speedtest users who migrated to another operator over the same period. Blue and green depict areas of low churn concentration, and orange and red show locations with high customer attrition levels. Such maps can be valuable for targeted marketing initiatives and network improvement measures to mitigate churn. While the capital city, Cairo, and the northern coastal cities witnessed the highest potential 4G churn, other towns along the Nile River, such as Faiyum, Al Monya, Asyut, and Aswan, experienced similar, albeit less intense, churn.

Churners experienced little to no change in network performance after changing operators

Speedtest Intelligence data provides insights into potential drivers of churn by examining network metrics before and after migration. The charts show the change in median download and upload speeds for customers who churned and the median latency. Results show that customers who migrated from Vodafone or WE experienced some, but not significant, improvements in 4G download and upload speeds after migrating. This suggests that other factors, such as pricing, data allowance, and customer service, likely played a more significant role in the decision to churn.

Change in Download, Upload Speed, and Latency Over 4G for Churners, Per Operator, Egypt

Source: Speedtest Intelligence® | January 2023 – December 2024

Change in Download, Upload Speed, and Latency Over 4G for Churners, Per Operator, Egypt

Using statistical analysis, all Speedtest data were clustered according to customer satisfaction rating (on a 1 to 5 scale), download speed, upload speed, and latency. The first cluster has an average rating of 4.4, indicating high satisfaction, with a median download speed of 62.47 Mbps and a median latency of 28 ms. The churn rate for this group is the highest at 3.3% across all operators. This suggests that even though customers were satisfied with their speeds, they chose to churn due to more attractive data plans or service offerings from the competition.

The second cluster, with a 1.94% churn rate, shows poor user satisfaction with an average rating of 1.71. The median download speed in this group is 17.6 Mbps, and the median latency is 33 ms. Users in this cluster may be dissatisfied with the overall experience, which could be contributing to their attrition. The third cluster, with the highest satisfaction rating (4.8) but a lower churn rate, has a median download speed of 18.79 Mbps and a median latency of 31 ms. This suggests that these users are likely satisfied with their current service and not yet strongly drawn to the competitors’ offerings.

As detailed above, WE has established itself as an innovative player in Egypt’s telecom market, gaining nearly 15% market share in over seven years. Its robust network performance, distinctive marketing strategies, and leverage of its fixed market dominance have solidified its appeal. The commercialization of 5G services in 2025 will introduce new competition dynamics. While WE currently leads in network performance due to its unloaded 4G network, its ability to maintain an edge as competitors launch 5G remains to be seen.

We will continue to monitor the Egyptian telecom market’s evolution. For more information about Speedtest Intelligence data and insights, please contact us.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.