The recent recommendation from the Telecom Regulatory Authority of India (TRAI) around providing an enabling framework for enterprises to build their own private networks is in line with other 5G markets, where governments are looking to drive the digitization of key industries. However, Indian operators see this as limiting their return on investment in the 5G spectrum. Looking at the example of private networks across Europe, and Germany in particular, we believe that Indian telcos shouldn’t see TRAI’s proposal as a threat. Rather, they should use the buzz around the spectrum for verticals as a way to get enterprises interested in digitalization.

The overall financial health of the Indian telecom industry remains fragile. Furthermore, operators’ ability to invest in upgrading their network is negatively impacted by low average revenue per user (ARPU) levels and high regulatory costs. As a result, India’s mobile performance is affected. According to the Speedtest Global Index™, in March 2022 India ranked 120 (out of 142 countries) with a 13.67 Mbps median mobile download speed vs. the global average of 29.96 Mbps. The 5G network rollout will require intensive capital investment and allowing enterprises to have access to dedicated spectrum can potentially limit operators’ 5G-addressable revenue.

The case for 5G in manufacturing

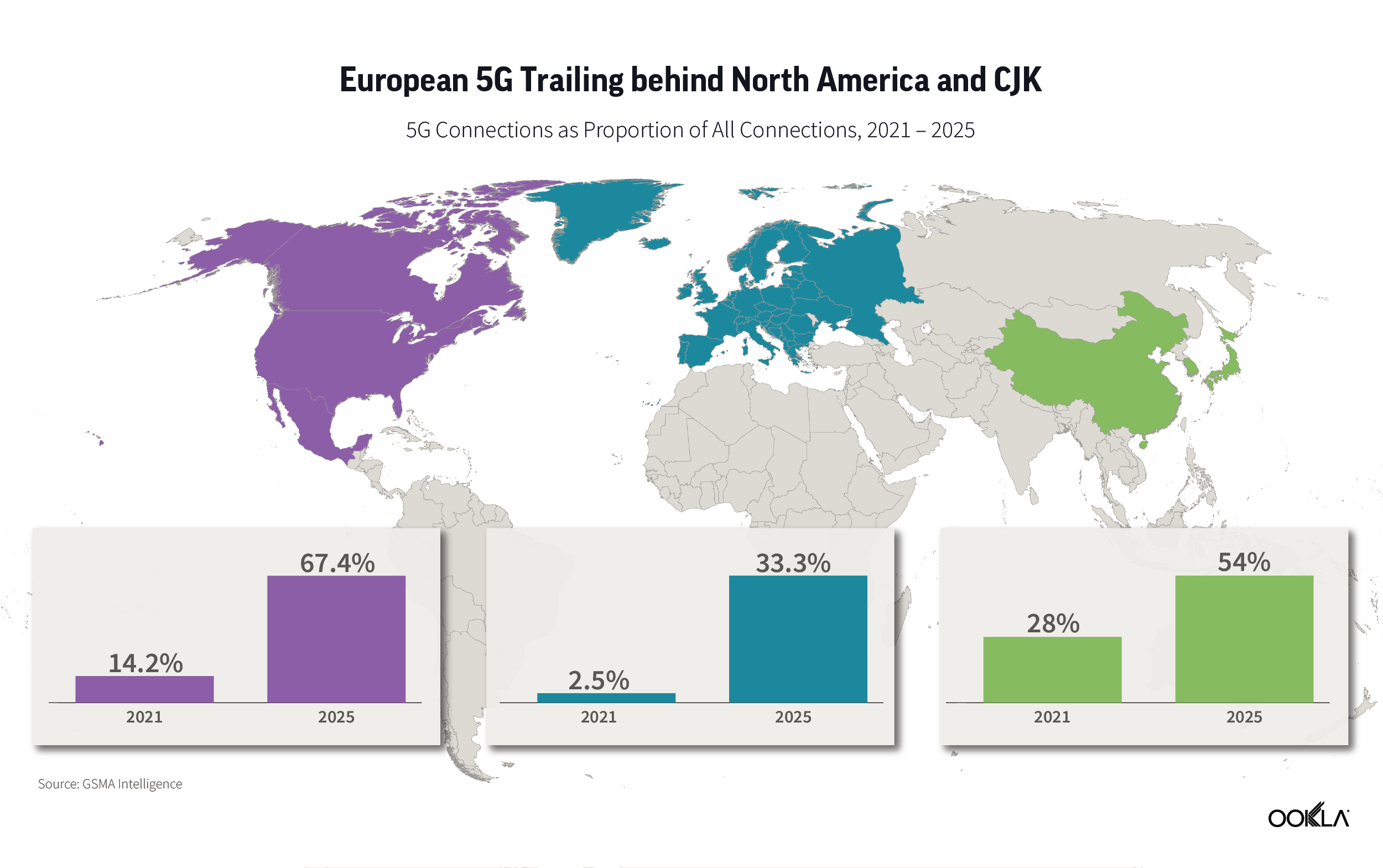

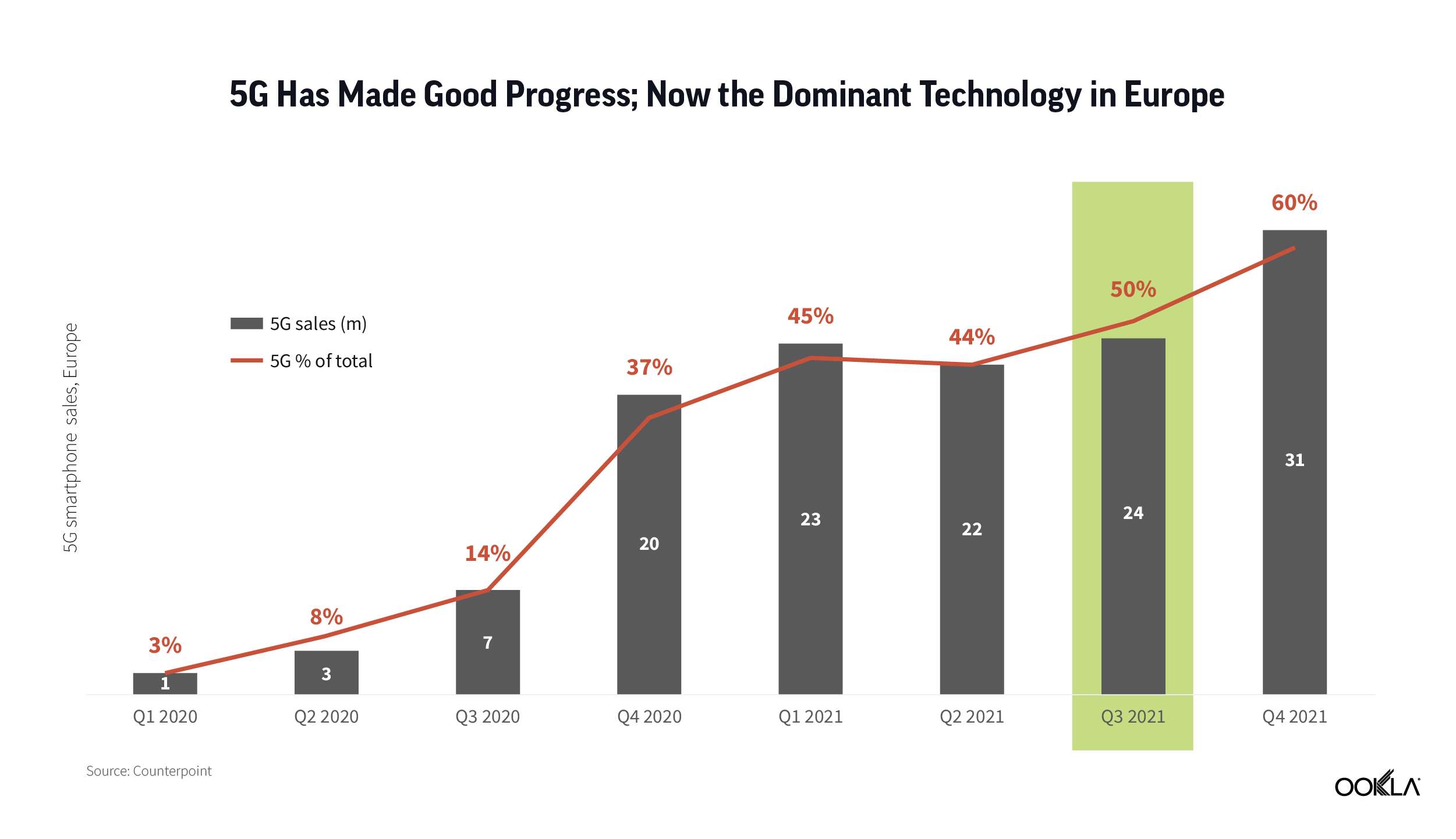

On the consumer side, 5G will boost Indian mobile performance, as we have postulated in our recent article, new 5G launches in Asia Pacific point to a potential 10x increase in median download speeds (5G vs 4G-LTE). However, 5G will also deliver socioeconomic benefits in India, on account of a number of 5G use cases that could enable new applications across all sectors. According to GSMA Intelligence, 5G is expected to contribute around $455 billion to the Indian economy over the next 20 years, accounting for more than 0.6% of GDP by 2040. One of the sectors that stands to benefit from 5G is the manufacturing sector, representing 20% of the total benefit. Retail, ICT and agricultural sectors should also benefit.

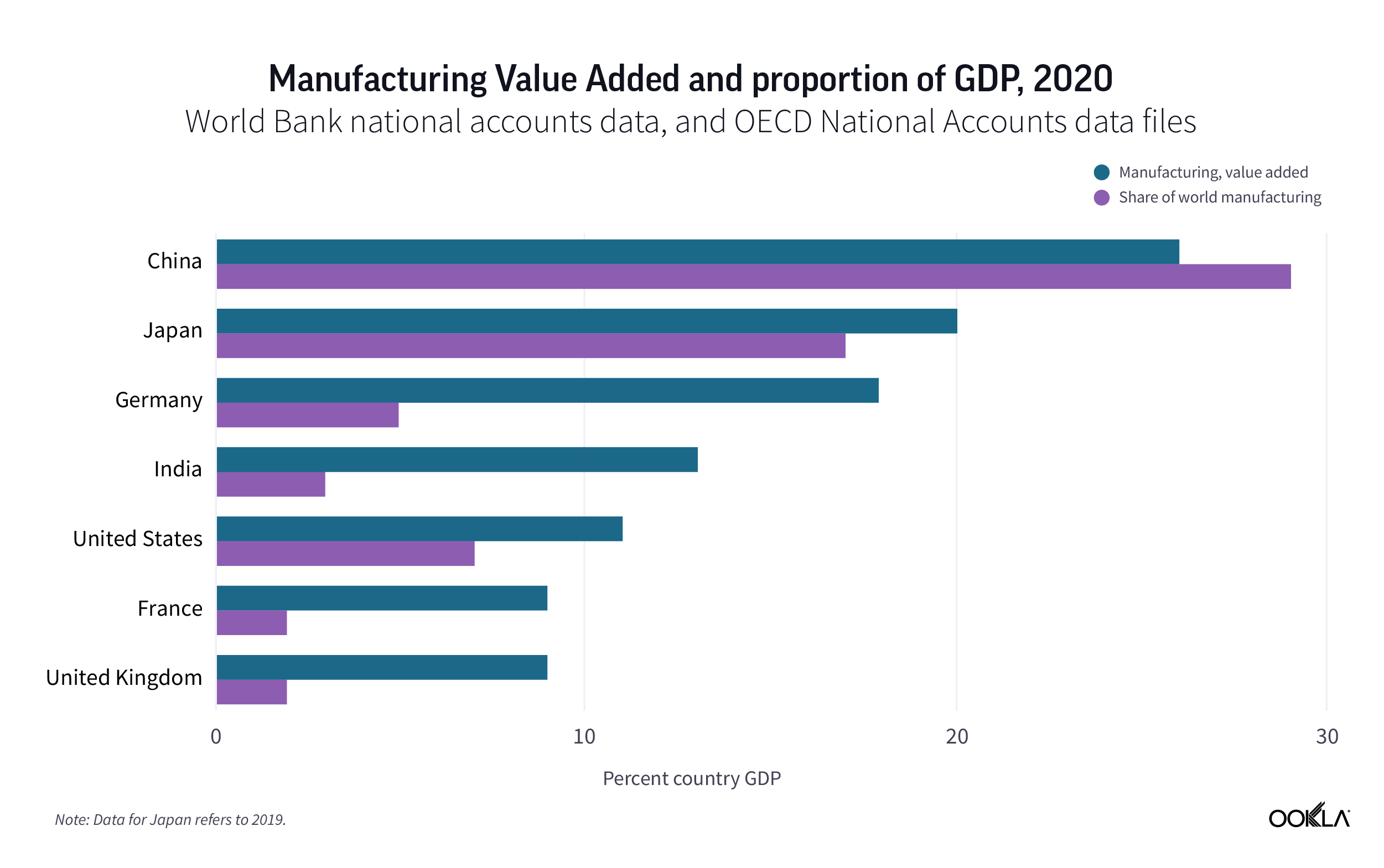

The Indian government has already zeroed in on making India’s manufacturing sector more competitive on a global scene. As such, the “Make in India” goal is to make India self-reliant and also to increase the share of the manufacturing sector to 25% of GDP “in the coming years.”

As of now, this is a distant goal. China is still the world’s manufacturing superpower, accounting for 29% of global manufacturing output in 2020, followed by Japan (17%) and Germany (5%). All of these countries have embarked on digitization strategies.

In addition, manufacturing companies look to optimize and control production processes, improve safety, and reduce costs in order to maximize the return on investment. The COVID-19 pandemic has exacerbated existing challenges and pain points for manufacturers, highlighting the need to improve supply-chain resilience and boost production speed and flexibility. However, even before the pandemic, the manufacturing sector was undergoing digital transformation – the so-called fourth industrial revolution or Industry 4.0, referring to the use of technologies such as machine learning, edge computing, IoT, digital twins, and new networks to aid automation and enable data exchange.

According to Ericsson, typical revenue increases when manufacturers digitize their processes come from increased throughput and quality (2–3%), while typical cost savings originate from improved capital efficiency (5–10%) and decreased manufacturing costs (4–8%). A proportion of manufacturers will need dedicated network resources to meet their transformation goals and ensure data isolation and security. According to the GSMA Intelligence Enterprise in Focus 2020 survey, 22% of manufacturers require location-specific coverage (e.g. factory, campus).

Historically, Wi-Fi has been the connectivity choice for private networks. However, mobile technologies such as 4G/LTE and 5G are better suited to Operational Technologies’ network requirements of high volume, high reliability, mobility, and always-on operations. 5G and 5G Standalone in particular offers the most benefits related to eMBB, massive IoT, and critical IoT. Additionally, enterprises decided to deploy proprietary networks to have more control over their networks; the increased security offered by isolating their data from public networks is an attractive benefit.

Private networks aren’t new

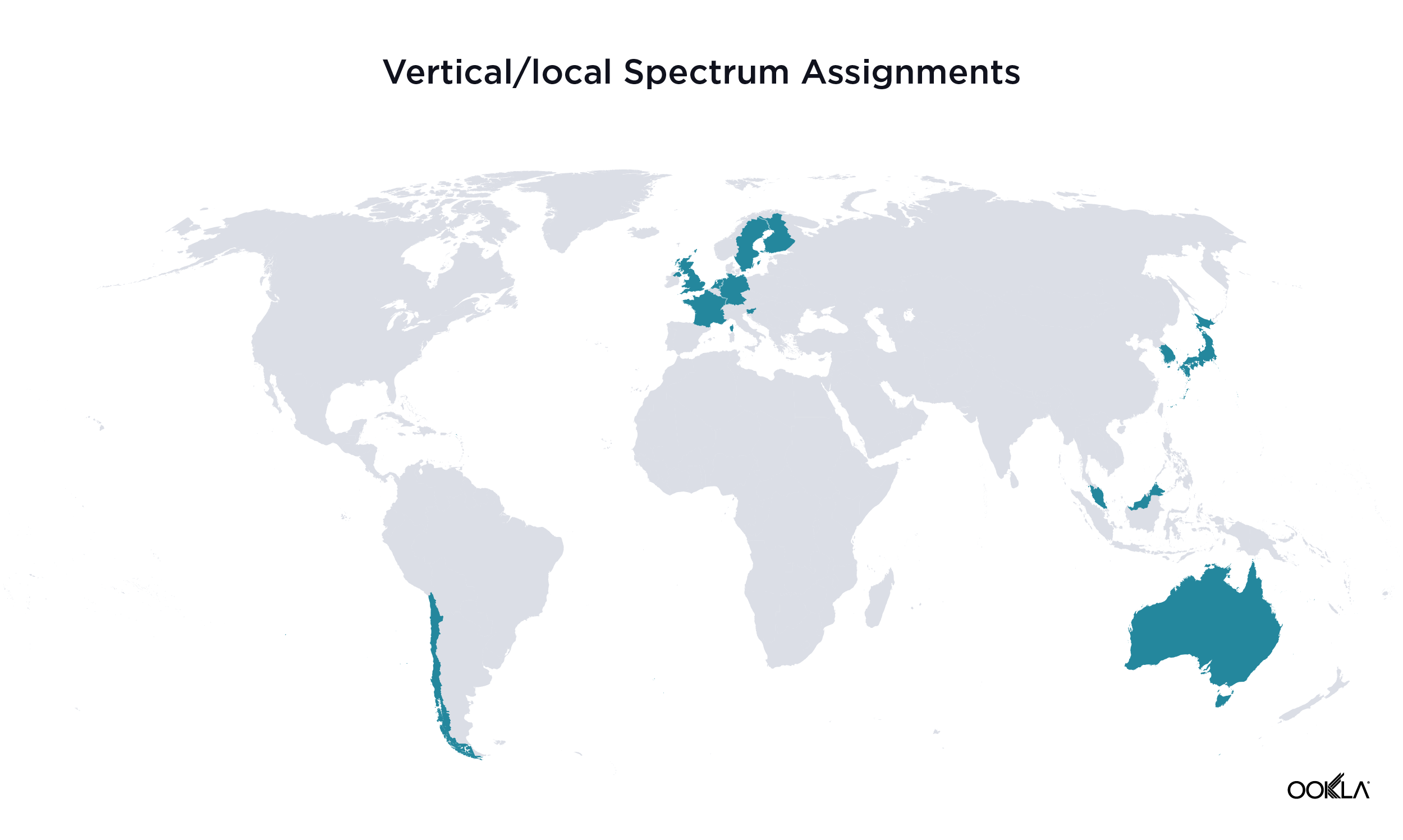

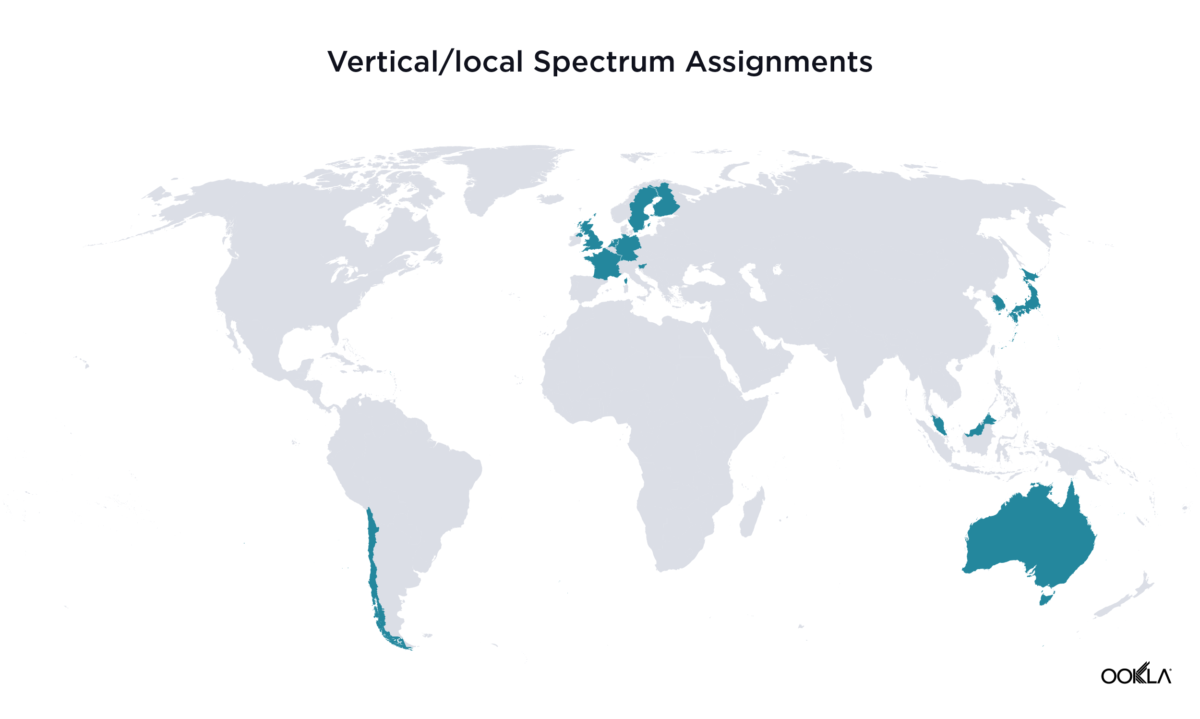

A number of countries are looking to private networks to address Industry 4.0 objectives and awarding spectrum for vertical use e.g. Germany, Japan and France. According to GSA data, as of February 2022 there were 656 organizations deploying LTE or 5G private mobile networks. GSA’s data points to the manufacturing sector as a strong adopter of private mobile networks, with 111 identified companies involved in known pilots or deployments, which is up from 51 at the start of 2021.

Dedicated spectrum available for private mobile networks has already been allocated in France, the United States, Germany, Japan, and the United Kingdom. Germany is considered to be a poster child for Industry 4.0. Afterall, the term “Industry 4.0” was coined at Hannover Messe over a decade ago. It is therefore only natural to look to Germany and its approach to private networks. In Germany, the national regulatory authority (BnetzA) is promoting industrial policy and reserved 100 MHz in the 3,700-3,800 MHz for local networks, noting that the spectrum can be used in particular for Industry 4.0. “By awarding spectrum for local 5G networks, we are creating scope for innovation for enterprises,” stated Jochen Homann, Bundesnetzagentur President. As of April 15, 2022, the Federal Network Agency (BNetzA) received a total of 208 applications for the allocation of frequencies for local 5G networks and granted the same amount.

We have commented on how the private networks landscape is developing in Europe here. Simply assigning spectrum to verticals isn’t enough to drive market adoption. In an upcoming analysis, we will discuss how the French government has prioritized 5G as an avenue to drive digital transformation of the economy via a number of funds. According to the GSA, there were a total of 66 private networks all together in France, Germany, and Japan, despite enterprises being able to acquire spectrum since 2019.

Despite the 208 applications that BNetzA received, the GSA has counted 45 private networks in Germany, with a majority distributed between three verticals: manufacturing (14), power and water utilities (11), and devices testing and lab as a service (seven).

It is important to note that globally, as per the latest GSA data, only 21% of networks were 5G only, and mostly composed of test networks. Until the 5G device ecosystem matures, the majority of private networks will remain 4G/LTE, though using equipment that is 5G ready. Only after the availability of industrial-feature-rich 5G release 16 chipsets, which will happen in the next few years, will the 5G deployments move beyond trials and proof of concept into full scale deployments. Germany is an outlier here: 5G and 5G SA are making headways in Germany. Audi, KUKA, Volkswagen, and Siemens take an active role in testing and deploying 5G SA private networks utilizing localized spectrum in the 3500 MHz band (n78).

The many routes to market

TRAI has proposed an enabling framework for enterprises to build their own private networks via a range of deployment scenarios, including spectrum leasing and dedicated spectrum. The Cellular Operators Association of India (COAI) representing major telecom companies such as Bharti Airtel Ltd, Reliance Jio Infocomm Ltd, and Vodafone Idea Ltd. opposed this, stating that TRAI should: “Disallow private enterprise networks for the financial viability and orderly growth of the telecom industry, which is more than capable of delivering these services to businesses”.

Yes and no. Operators can utilize various deployment models, from public dedicated networks through hybrid networks (network slicing, public/private campus, private RAN with public core) to private networks. Within these various models, network slicing and edge computing add the benefits of QoS, privacy, security, and specific SLAs.

When it comes to private networks, the typical rules of engagement no longer apply, and with network virtualization continuing, the ecosystem of vendors has expanded beyond traditional telco players. Just recently Cisco entered this crowded market that already consists of operators, hyperscalers, startups, and equipment vendors. Amazon’s introduction of AWS Private 5G network is a good example of the growing “coopetition” trend. In some cases, AWS would work with operators to provide 5G core and edge computing capabilities, while in some others, it could compete to offer end-to-end solutions. Nokia is looking to address the enterprise demand in India via working with network operators, but also by working directly with enterprises, as Ricky Corker, Chief Customer Experience Officer, Nokia recently stated.

We can draw lessons by looking at the approach that European operators took when addressing the enterprise opportunity. Deutsche Telekom has been offering campus network solutions for enterprises since 2019, and now operates more than ten such local networks based on 5G non-standalone technology or LTE across Germany. In January 2022, the operator expanded its offering to include location-specific 5G mobile networks for companies based on 5G Standalone Technology (5G SA), powered by the Ericsson Private 5G portfolio. The operator can also position itself as a systems integrator (SI) for 5G private networks for Industry 4.0 by utilizing T-Systems’ credentials and its deal with AWS.

Similarly, Vodafone takes an active role in deploying private networks, and distinguishes three degrees of industrial control depending on a private network setup.

In the first scenario, a dedicated mobile private network (MPN) brings total control to the enterprise because everything stays on site. There is no interoperability with public networks. This is particularly well suited for mission- or business-critical applications that don’t need to interface with the public internet.

The second option is a hybrid private network, which is a blend of public and private infrastructure. It enables interoperability with public networks for those devices and users which move outside the private network, while at the same time giving the end user a choice regarding where the data is stored.

The third option, a virtual private network, uses a dedicated slice of a public 5G network. End-user control over the setup is reduced, but compared to the public network it has a dedicated network resource, and allows for greater data isolation, security and privacy, and further SLA customization (availability and reliability). According to Marc Sauter, head of mobile private networks for Vodafone’s business division, network slicing hinges on future releases of the 5G standard, available from next year. “That is when virtual private networks will be more relevant, and a new market will open up with smaller customers.” Vodafone is also very vocal about the importance of the ecosystem, and working on innovation. In its innovation hub in Milan, Vodafone works with developers and startups, and large companies can play around with 5G use cases.

Leveraging existing credentials and forming partnerships to go beyond core competencies can open up new markets for operators. Partners’ ecosystem is key, and to be successful, operators need to partner across the ecosystem. As enterprises’ needs vary, having a broad portfolio of vendors that can address various verticals, technological, and coverage needs will only stimulate the growth of the market.

Indian telcos have already embarked on this journey. Airtel has partnered with Tech Mahindra for a joint 5G innovation lab to develop “Make in India” use cases for the local and global markets, including customized enterprise-grade private networks. These services will combine Airtel’s integrated connectivity portfolio of 5G ready mobile network, fiber, SDWAN, and IoT along with Tech Mahindra’s SI capabilities.Meanwhile, Vodafone Idea (Vi) joined forces with A5G Networks to enable industry 4.0 and smart mobile edge computing in India. They have jointly set up a pilot private network in Mumbai using existing 4G spectrum.

Rather than seeing spectrum for verticals as a threat, operators can use it as a way to get enterprises, in particular manufacturing companies, interested in digitalization. According to the FICCI-EFESO survey, 36% of organizations will implement “Use of Industry 4.0 technologies for predicting failures in machines, products and processes” in the next 1-2 years, while 22% have already done so. The opportunity is there for the taking.

To learn more about how Ookla® has worked with operators and industries to help plan for 5G growth, contact us.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.