Some countries in the region show clear 5G advancements, while others haven’t yet made much forward movement.

More than five years after the technology first hit Latin America’s shores, 5G is now floating through many of the region’s countries. In some leading areas, 5G speeds are rising and 5G signals abound.

But Latin America’s steps into a 5G future have been uneven. In some countries – like Brazil – the technology has managed to spread far and wide, and download speeds have reached impressive milestones. Users’ satisfaction often tracks with these improvements. In other countries – like Mexico – the rollout of 5G has been a stutter-step affair, with some operators making progress while others fall behind. And in some countries, like Peru, 5G remains in its early days.

Still, there are some hints that advanced 5G services are now making their way into the Latin American region. 5G Standalone (SA) connections are beginning to pop up. 5G private wireless networks are multiplying. And 5G fixed wireless access (FWA) is paving a way for mobile network operators to move beyond the smartphone opportunity among consumers.

Key takeaways:

- Brazil shows clear leadership in many 5G metrics. The country’s median 5G speeds reached 430.83 Mbps in the third quarter of 2025, according to Ookla Speedtest® data, the highest in the region. And 38.5% of the country’s 5G users spent a majority of their time connected to 5G networks, placing Brazil third in this metric, behind Uruguay and Puerto Rico (an unincorporated territory of the United States considered part of Latin America).

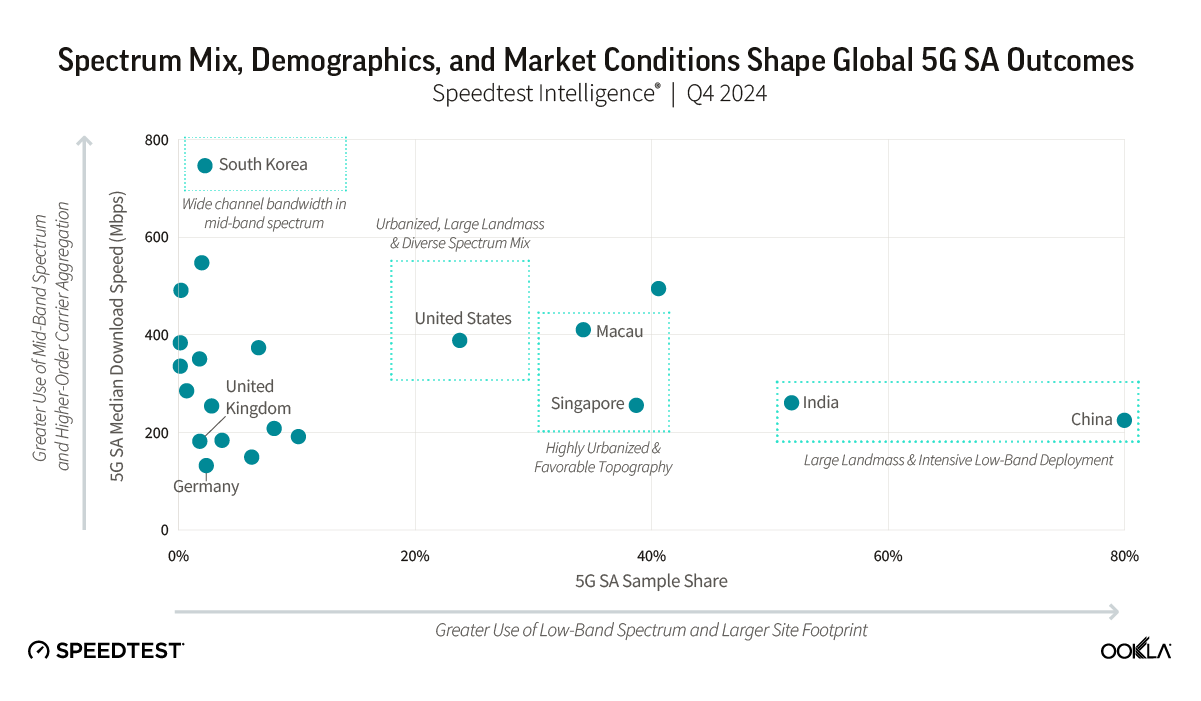

- Not surprisingly, spectrum contributes directly to operators’ 5G performance. 5G providers with 100 MHz of spectrum in the 3.5 GHz band – such as Personal Argentina, Claro Brasil, and Vivo Brasil – generally offer 5G speeds above 300 Mbps.

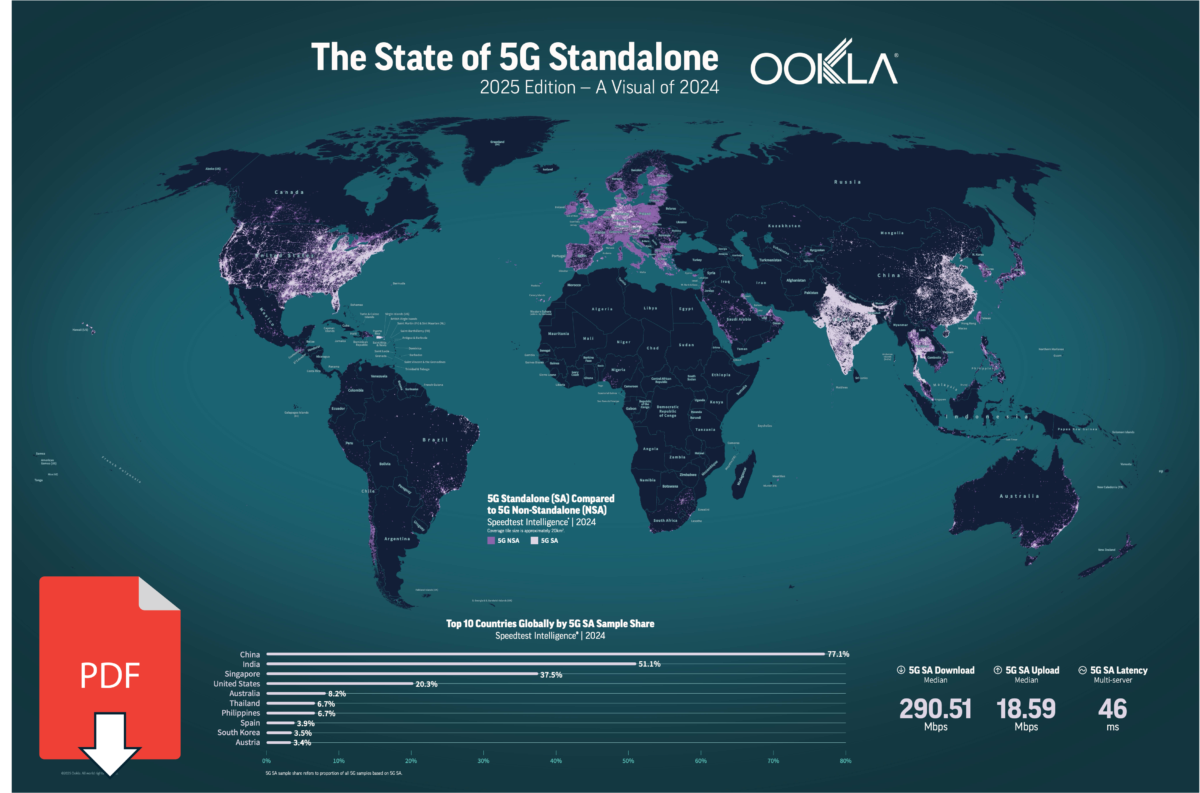

- There are some signals that more advanced technologies are on their way. In the third quarter of 2025, 5G SA connections showed up in Brazil (1.6% of all 5G connections) and Puerto Rico (41.1% of all 5G connections). Moreover, FWA is now available to a growing number of customers in countries like Brazil, Colombia, Mexico, and elsewhere. And 5G private wireless networks are beginning to pop up too.

The tangled history of 5G and Latin America

Uruguay’s state-owned operator Antel, along with vendor Nokia, claimed the first 5G network in Latin America in 2019, using short-range millimeter wave spectrum. The move reflected Uruguay’s ambition to be a technological leader in the region. At just 68,037 square miles, Uruguay is one of the smallest countries in Latin America, making extensive 5G networks there somewhat easier to deploy, at least from a geographic coverage perspective.

But Uruguay’s 5G efforts since then have been somewhat symbolic of the region’s wider struggles to deploy speedy 5G connections on a widespread basis. In 2025 – more than five years after its first foray into 5G – Antel deployed a total of 500 5G cell sites, each with 100 MHz worth of midband 3.5 GHz spectrum. This kind of spectrum supports the speedy, widespread connections often associated with 5G. It was released to Antel in 2023.

Perhaps Latin America’s biggest 5G launch came a year after Antel’s first 5G announcement, in 2020, when Brazil’s three big mobile network operators launched 5G with Dynamic Spectrum Sharing (DSS) technology. Like Antel in Uruguay, this launch too was mostly symbolic, considering DSS allows 5G signals to piggyback on existing 4G LTE spectrum. It generally doesn’t support the snappy speeds available through fat chunks of midband spectrum. Brazil’s real 5G inflection point occurred the following year, in 2021, when the country’s regulator released wide swathes of midband 3.5 GHz spectrum to operators.

Some of Mexico’s operators also stepped into 5G around this same time. For example, AT&T Mexico launched 5G services in the 2.5 GHz band in 2021. And América Móvil’s Telcel used its existing 3.5 GHz holdings for a 5G launch in 2022, eventually expanding the service to 125 cities and 10 million subscribers by 2025.

These launches helped unlock a wave of spectrum auction activity in other leading Latin American countries like Argentina and Colombia in 2023. Other markets continue to trail, however. For example, Costa Rica completed its own 3.5 GHz auction at the beginning of 2025, while Peru wrapped up its 3.5 GHz auction in September 2025.

Speedy connections, if you can get them

The results of all this 5G activity are now clear:

Brazil’s performance was good enough to place it fourth globally in the latest issue of the Speedtest Global IndexTM for mobile performance, behind only the United Arab Emirates, Qatar, and Kuwait.

But commercial 5G launches don’t necessarily equate to widespread 5G connections. Ookla’s Speedtest Intelligence tracks 5G availability, which measures the percentage of 5G active users connected to 5G a majority of the time, based on when a 5G icon is displayed on their device.

Here’s how leading Latin American counties shake out in this ranking:

5G Availability Across Latin America

Speedtest Intelligence | Q3 2025

To put this into perspective, Canada’s overall 5G availability rating clocked in at 73.2% in the third quarter of 2025, while the U.S. sat at 75.2%.

These results are also noteworthy given the relative popularity of fiber networks in Latin American countries like Peru and Chile. Fiber typically supplies the internet piping that powers high-speed 5G cell sites.

To be clear, these broad 5G results in Latin America are due to a confluence of factors. First, operators must get access to suitable spectrum. For 5G, that typically involves large blocks of midband spectrum between 2.5 GHz and 4 GHz. Then, they must invest into the equipment and cell towers necessary to broadcast 5G signals across their spectrum license territories.

And then, of course, they must also sell enough 5G devices and service plans to make that investment worthwhile.

Measuring the importance of spectrum

Spectrum is often described as the “lifeblood” of the wireless industry, and certainly it’s a critical starting block to any successful 5G offering. In Latin America, it’s clear that some regulators not only share this view but have also put it into action.

For example, Brazil’s 2021 spectrum auction was notable in its scale. Major operators in the country – América Móvil’s Claro, TIM Brasil, and Telefônica Brasil’s Vivo – each acquired massive spectrum blocks (100 MHz per operator). Those fat chunks of spectrum – coupled with the speed that Brazil’s regulator, Anatel, free up the spectrum for commercial use – are main reasons why Brazil tops Speedtest charts for the Latin American region.

Other countries have made various efforts at matching Brazil’s lead. For example, Chile, Colombia, Argentina, and Peru have all aligned on the 3.5 GHz band for 5G. Specifically, Colombia’s 2023 auction released four blocks of spectrum in the 3.5 GHz band – each of them 80 MHz wide – to each of the country’s four operators. And Argentina’s 2023 auction released 100 MHz blocks to América Móvil’s Claro and Personal in the 3.3–3.6 GHz range.

This symmetry in spectrum and timing helps ensure economies of scale for 5G equipment across the region, particularly for operators with systems in multiple countries.

Broadly, these spectrum allocations – particularly the breadth of spectrum allocated to each operator – track directly to network performance:

Another important factor in this discussion of spectrum is the manner by which regulators free up spectrum for 5G operators. For example, Brazil’s 2021 auction wasn’t solely designed to funnel auction revenues into government coffers. Instead, Brazilian telecom regulator Anatel allowed auction winners to pay for a portion of their licenses through investment obligations. Meaning, operators can pay for their spectrum by deploying it. Regulators in other countries like Peru have employed a similar strategy, waiving a portion of operators’ annual spectrum fees for 5G deployments in rural or unserved areas.

Meanwhile, Mexico’s approach to spectrum allocation may stand as a cautionary tale. According to the GSMA, Mexico’s spectrum costs are established every year by the country’s Congress, and “this yearly approval process creates uncertainty, as it is impossible for mobile operators to anticipate how these fees will evolve,” the trade association wrote. Indeed, Telefónica’s Movistar in Mexico returned its spectrum holdings to regulators in 2022 in order to become an MVNO on AT&T Mexico’s network. More recently, Mexico’s telecom regulator cancelled a spectrum auction due to a lack of resources.

Broadly, the average amount of spectrum assigned to mobile network operators in Latin American countries increased by 51% between 2016 and 2024, from 267 MHz to 403 MHz, according to the GSMA. But that’s significantly less than the global average, which was 574 MHz in 2024.

Nonetheless, the situation is still developing. According to the GSMA, Paraguay and Peru were among the handful of countries that held spectrum auctions in the third quarter of 2025. And Bolivia, Ecuador, and Colombia are among the countries that have scheduled additional spectrum auctions in the future.

Of course, once regulators release spectrum, operators must then put it into action.

5G shows faster speeds, and faster speeds satisfy

América Móvil is Latin America’s regional 5G behemoth. But the company’s overall capital expenses (capex) have been slowing in recent years following significant spending on spectrum and network infrastructure. Specifically, América Móvil’s capex outlay reached $8.6 billion in 2023, but fell to $7 billion last year. For 2025, the company is on track to spend $6.7 billion.

That slowdown in spending coincides with Telefonica’s exit from many Latin American markets with 5G, due to its plans to focus on its “core” markets in Europe and Brazil.

Millicom, meanwhile, is the company positioned to replace Telefónica as the region’s second-largest telecom operator. Millicom invests over $1 billion annually in its fixed and mobile networks, according to one detailed report on the company’s operations. But that doesn’t necessarily mean Millicom plans to inject 5G into its growing Latin American mobile footprint. Millicom officials have suggested an emphasis on fiber and 4G, deploying 5G only at “the best time.”

There’s also the question of what 5G equipment operators ought to spend all their capex on. Here emerges the Huawei question: Should Latin American operators heed U.S. cybersecurity warnings about the use of gear from Chinese suppliers like Huawei? Many have not.

Despite intense political debate on the topic, Brazil did not ban Huawei as part of its early 5G auctions. Consequently, Huawei supplies significant portions of the 5G radio access network (RAN) for the country’s three big operators. Operators in Peru and Mexico also use equipment from Chinese vendors.

But Huawei doesn’t have a lock on the Latin American market. For example, Sweden’s Ericsson is the sole 5G supplier for Entel Chile. In Argentina, Telefónica’s Movistar selected Ericsson for its network modernization to 5G-ready standards. And América Móvil’s Claro in Colombia and Argentina, and TIM Brasil, selected Finland’s Nokia for broad 5G deployments.

Regardless, once operators pay for the equipment to put 5G to work, they often have some clear progress to show:

And faster speeds can also be traced to customers’ satisfaction. Speedtest Intelligence data in Mexico shows a correlation between swift connections and happy subscribers.

Still, offering faster speeds is just a first step. Operators must also package 5G connections in a way that’s attractive to potential customers. Here too there are signs of forward progress. For example, América Móvil’s Telcel in Mexico promotes 5G to its prepaid users – a nod to the fact that more than 80% of Mexican mobile users subscribe to prepaid plans. And América Móvil’s Claro in Brazil touts the speed of its 5G network in support of its deal with OpenAI to offer ChatGPT to its mobile customers.

As a result of such efforts, GSMA Intelligence predicts 5G will spread to 50% of all Latin American mobile connections by 2030, or 410 million people. That’s just below the 57% global average expected by the firm in that year.

SA, private wireless and FWA hint at the future

The “Non-Standalone” (NSA) version of 5G was released first, and it has been widely adopted on a global basis. However, the “Standalone,” or SA, iteration of 5G is sometimes referred to as the “true” version of 5G. That’s partly because 5G SA doesn’t rely on a 4G core network like the “Non-Standalone” (NSA) version of 5G does. SA also supports advanced services such as network slicing (a technology that can funnel select types of user traffic into speedier pipes).

In Latin America’s shift to SA, Brazil is a standout. According to Speedtest data, roughly 1.6% of all 5G samples in Brazil used 5G SA technology in the third quarter of 2025. Only Puerto Rico ranked higher, with 41.1% of 5G samples using 5G SA technology. That’s likely thanks to T-Mobile’s network in the country; T-Mobile made an early move to 5G SA technology throughout its U.S. operations.

According to GSMA Intelligence, Argentina, Colombia, and Costa Rica are the other Latin American countries with commercial SA networks. But those connections are not yet showing up in Speedtest sample sizes that are statistically relevant.

That said, FWA may be a more tangible service that hints at a future enabled by 5G technology. Fixed wireless allows 5G operators (those with suitable spectrum holdings and FWA-capable equipment) to provide broadband connections into users’ homes and offices. FWA can serve as an alternative to wired connections in remote or rural areas – or as a competitive response to other fixed internet providers.

GSMA Intelligence counts roughly a dozen Latin American countries with FWA services.

Again, Brazil looks the standout here. For example, Claro in Brazil launched its 5G+ FWA offering in 2023 with speeds up to 1 Gbps. The company’s plans cap customers’ monthly usage starting at 200 GB per month. Similarly, Telefônica Brasil’s Vivo launched its Box 5G in 2024 with a 150 GB per month cap.

And Brisanet, a regional challenger in Brazil, is aggressively pursuing 5G FWA with larger data caps. The company counted 37,000 FWA customers in its most recent quarter.

Other Latin American countries are seeing similar FWA outcroppings. América Móvil’s Claro in Colombia launched FWA in 2024 with a 160 GB monthly cap. In Mexico, AT&T’s Internet en Casa offers speeds of around 10 Mbps. And Personal in Argentina counts around 50,000 FWA users.

Yet another signal of the maturation of 5G in Latin America is the arrival of 5G private wireless networks, which can be used by enterprises for applications ranging from autonomous mining to oil refining to industrial manufacturing. These kinds of operations are increasingly popping up in countries including Brazil and Chile.

Regardless, the advancement of FWA, as well as 5G SA, private wireless networks, and other advanced technologies, show that some Latin American denizens are seeing the promise of 5G. This can be attributed to efficient and forward-looking regulators, significant financial commitments by some operators, and a desire among users for ever-faster connections.

But 5G is still in its early days across the full Latin American region, with many countries still lagging significantly in broad 5G rollouts. Spectrum costs – such as those in Mexico – contribute. So too do regulatory delays, such as those that have slowed spectrum auctions in places like Colombia. And that all can affect operator interest in 5G, as seen by Millicom’s intention to continue to leverage 4G until the time for 5G rolls around.

5G en América Latina: focos de evolución

Algunos países de la región muestran claros avances en 5G, mientras que otros aún no han logrado un gran progreso.

Más de cinco años después de que la tecnología llegara por primera vez a las costas de América Latina, el 5G está ahora presente en muchos países de la región. En algunas áreas líderes, las velocidades 5G están aumentando y las señales 5G abundan.

Pero los pasos de América Latina hacia un futuro 5G han sido desiguales. En algunos países, como Brasil, la tecnología ha logrado extenderse a lo largo y ancho de la geografía, y las velocidades de descarga han alcanzado hitos impresionantes. La satisfacción de los usuarios a menudo va a la par de estas mejoras. En otros países, como México, el despliegue del 5G ha sido un proceso a trompicones, con algunos operadores avanzando mientras que otros se quedan atrás. Y en países como Perú, el 5G sigue en sus primeras etapas.

Aun así, hay indicios de que los servicios avanzados de 5G están llegando a la región latinoamericana. Las conexiones 5G Standalone (SA) están comenzando a aparecer. Las redes privadas inalámbricas 5G se están multiplicando. Y el acceso inalámbrico fijo (FWA) 5G está abriendo un camino para que los operadores de redes móviles vayan más allá de la oportunidad del smartphone entre los consumidores.

Conclusiones clave:

- Brasil muestra un claro liderazgo en muchas métricas de 5G. La velocidad mediana de 5G del país alcanzó los 430.83 Mbps en el tercer trimestre de 2025; según datos de Ookla Speedtest®, la más alta de la región. Y el 38.5% de los usuarios de 5G del país pasaron la mayor parte de su tiempo conectados a redes 5G, lo que sitúa a Brasil en tercer lugar en esta métrica, detrás de Uruguay y Puerto Rico.

- Como era de esperar, el espectro contribuye directamente al rendimiento 5G de los operadores. Los proveedores de 5G con 100 MHz de espectro en la banda de 3.5 GHz, como Personal Argentina, Claro Brasil y Vivo Brasil, generalmente ofrecen velocidades 5G superiores a 300 Mbps.

- Hay algunas señales de que tecnologías más avanzadas están en camino. En el tercer trimestre de 2025, las conexiones 5G SA aparecieron en Brasil (1.6% de todas las conexiones 5G) y Puerto Rico (41.1% de todas las conexiones 5G). Además, el FWA está ahora disponible para un número creciente de clientes en países como Brasil, Colombia, México y otros. Y las redes privadas inalámbricas 5G también están empezando a surgir.

La intrincada historia del 5G y América Latina

El operador estatal de Uruguay, Antel, junto con el proveedor Nokia, desplegó la primera red 5G en América Latina en 2019, utilizando espectro de onda milimétrica de corto alcance. La medida reflejó la ambición de Uruguay de ser un líder tecnológico en la región. Con solo 68,037 millas cuadradas, Uruguay es uno de los países más pequeños de América Latina, lo que hace que las redes 5G extensas sean algo más fáciles de implementar allí, al menos desde una perspectiva de cobertura geográfica.

Pero los esfuerzos de 5G de Uruguay desde entonces han sido algo simbólicos de las luchas más amplias de la región para desplegar conexiones 5G rápidas de forma generalizada. En 2025, más de cinco años después de su primera incursión en el 5G, Antel desplegó un total de 500 emplazamientos celulares 5G, cada uno con 100 MHz de espectro de banda media de 3.5 GHz. Este tipo de espectro es compatible con las conexiones rápidas y generalizadas a menudo asociadas con el 5G. Fue liberado a Antel en 2023.

Quizás el mayor lanzamiento de 5G en América Latina se produjo un año después del primer anuncio de 5G de Antel, en 2020, cuando los tres grandes operadores de redes móviles de Brasil lanzaron 5G con tecnología Dynamic Spectrum Sharing (DSS). Al igual que Antel en Uruguay, este lanzamiento también fue en su mayoría simbólico, considerando que el DSS permite que las señales 5G se monten en el espectro 4G LTE existente. Generalmente no es compatible con las velocidades rápidas disponibles a través de grandes porciones de espectro de banda media. El verdadero punto de inflexión del 5G en Brasil ocurrió al año siguiente, en 2021, cuando el regulador del país liberó amplias franjas de espectro de banda media de 3.5 GHz a los operadores.

Algunos de los operadores de México también se adentraron en el 5G en esta misma época. Por ejemplo, AT&T México lanzó servicios 5G en la banda de 2.5 GHz en 2021. Y Telcel de América Móvil utilizó sus tenencias existentes de 3.5 GHz para un lanzamiento de 5G en 2022, expandiendo finalmente el servicio a 125 ciudades y 10 millones de suscriptores para 2025.

Estos lanzamientos ayudaron a desbloquear una ola de actividad de subastas de espectro en otros países líderes de América Latina como Argentina y Colombia en 2023. Sin embargo, otros mercados continúan a la zaga. Por ejemplo, Costa Rica completó su propia subasta de 3.5 GHz a principios de 2025, mientras que Perú concluyó su subasta de 3.5 GHz en septiembre de 2025.

Conexiones rápidas, si las puedes conseguir

Los resultados de toda esta actividad 5G son ahora claros:

El rendimiento de Brasil fue lo suficientemente bueno como para situar al país en cuarto lugar a nivel mundial en la última edición del Speedtest Global IndexTM en rendimiento móvil, solo por detrás de Emiratos Árabes Unidos, Catar y Kuwait.

Pero los lanzamientos comerciales de 5G no equivalen necesariamente a conexiones 5G generalizadas. Speedtest Intelligence de Ookla rastrea la disponibilidad de 5G, que mide el porcentaje de usuarios activos de 5G conectados a 5G la mayor parte del tiempo, basándose en el momento en que se muestra un icono de 5G en su dispositivo.

Así es como se clasifican los principales países de América Latina en este ranking:

Disponibilidad 5G en toda Latinoamérica

Speedtest Intelligence | Q3 2025

Para poner esto en perspectiva, la calificación general de disponibilidad de 5G de Canadá se situó en el 73.2% en el tercer trimestre de 2025, mientras que la de EE. UU. se situó en el 75.2%.

Estos resultados también son dignos de mención dada la popularidad relativa de las redes de fibra en países latinoamericanos como Perú y Chile. La fibra generalmente suministra la tubería de internet que alimenta los emplazamientos celulares 5G de alta velocidad.

Para ser claros, estos amplios resultados de 5G en América Latina se deben a una confluencia de factores. Primero, los operadores deben obtener acceso a un espectro adecuado. Para el 5G, generalmente implica grandes bloques de espectro de banda media entre 2.5 GHz y 4 GHz. Además, deben invertir en el equipo y las torres celulares necesarios para transmitir señales 5G a través de sus territorios de licencia de espectro.

Y luego, por supuesto, también deben vender suficientes dispositivos y planes de servicio 5G para que esa inversión valga la pena.

Midiendo la importancia del espectro

El espectro a menudo se describe como el “alma” de la industria inalámbrica y, ciertamente, es un bloque de partida crítico para cualquier oferta 5G exitosa. En América Latina, está claro que algunos reguladores no solo comparten esta opinión, sino que también la han puesto en acción.

Por ejemplo, la subasta de espectro de Brasil de 2021 fue notable en su escala. Los principales operadores del país —Claro de América Móvil, TIM Brasil y Vivo de Telefônica Brasil— adquirieron cada uno bloques masivos de espectro (100 MHz por operador). Esas grandes porciones de espectro, junto con la velocidad con la que el regulador de Brasil, Anatel, liberó el espectro para uso comercial, son las principales razones por las que Brasil encabeza las listas de Speedtest para la región latinoamericana.

Otros países han realizado diversos esfuerzos para igualar el liderazgo de Brasil. Por ejemplo, Chile, Colombia, Argentina y Perú se han alineado en la banda de 3.5 GHz para 5G. Específicamente, la subasta de Colombia de 2023 liberó cuatro bloques de espectro en la banda de 3.5 GHz —cada uno de 80 MHz de ancho— a cada uno de los cuatro operadores del país. Y la subasta de Argentina de 2023 liberó bloques de 100 MHz a Claro de América Móvil y Personal en el rango de 3.3 a 3.6 GHz.

Esta simetría en el espectro y el momento ayuda a garantizar economías de escala para los equipos 5G en toda la región, particularmente para los operadores con sistemas en múltiples países.

En términos generales, estas asignaciones de espectro, particularmente la amplitud del espectro asignado a cada operador, se correlacionan directamente con el rendimiento de la red:

Otro factor importante en esta discusión sobre el espectro es la forma en que los reguladores liberan el espectro para los operadores de 5G. Por ejemplo, la subasta de Brasil de 2021 no fue diseñada únicamente para canalizar los ingresos de la subasta a las arcas del gobierno. En cambio, el regulador de telecomunicaciones brasileño, Anatel, permitió a los ganadores de la subasta pagar una parte de sus licencias a través de obligaciones de inversión. Es decir, los operadores pueden pagar su espectro desplegándolo. Los reguladores de otros países como Perú han empleado una estrategia similar, eximiendo una parte de las tarifas anuales de espectro de los operadores para despliegues de 5G en zonas rurales o no atendidas.

Mientras tanto, el enfoque de México para la asignación de espectro puede ser una advertencia. Según la GSMA, los costos del espectro de México son establecidos cada año por el Congreso del país, y “este proceso de aprobación anual crea incertidumbre, ya que es imposible para los operadores móviles anticipar cómo evolucionarán estas tarifas”, escribió la asociación comercial. De hecho, Movistar de Telefónica en México devolvió sus tenencias de espectro a los reguladores en 2022 para convertirse en un MVNO en la red de AT&T México. Más recientemente, el regulador de telecomunicaciones de México canceló una subasta de espectro debido a la falta de recursos.

En términos generales, la cantidad promedio de espectro asignado a los operadores de redes móviles en los países latinoamericanos aumentó en un 51% entre 2016 y 2024, de 267 MHz a 403 MHz, según la GSMA. Pero eso es significativamente menor que el promedio mundial, que fue de 574 MHz en 2024.

No obstante, la situación sigue desarrollándose. Según la GSMA, Paraguay y Perú se encontraban entre el puñado de países que celebraron subastas de espectro en el tercer trimestre de 2025. Y Bolivia, Ecuador y Colombia se encuentran entre los países que han programado subastas de espectro adicionales en el futuro.

Por supuesto, una vez que los reguladores liberan el espectro, los operadores deben ponerlo en acción.

El 5G muestra velocidades más rápidas, y velocidades más rápidas son satisfactorias

América Móvil es el gigante regional de 5G de América Latina. Pero los gastos de capital (capex) generales de la compañía se han ralentizado en los últimos años después de un gasto significativo en espectro e infraestructura de red. Específicamente, el capex de América Móvil alcanzó los 8.6 mil millones de dólares en 2023, pero cayó a 7 mil millones el año pasado de dólares. Para 2025, la compañía va en camino de gastar 6.7 mil millones de dólares.

Esa desaceleración en el gasto coincide con la salida de Telefónica de muchos mercados latinoamericanos con 5G, debido a sus planes de centrarse en sus mercados “centrales” en Europa y Brasil.

Millicom, mientras tanto, es la empresa posicionada para reemplazar a Telefónica como el segundo operador de telecomunicaciones más grande de la región. Millicom invierte más de mil millones de dólares anualmente en sus redes fijas y móviles, según un informe detallado sobre las operaciones de la compañía. Pero eso no significa necesariamente que Millicom planee inyectar 5G en su creciente huella móvil latinoamericana. Los funcionarios de Millicom han sugerido un énfasis en la fibra y el 4G, desplegando 5G sólo en “el mejor momento”.

También existe la cuestión de en qué equipos 5G deberían gastar los operadores todo su capex. Aquí surge la pregunta de Huawei: ¿deberían los operadores latinoamericanos prestar atención a las advertencias de ciberseguridad de EE. UU. sobre el uso de equipos de proveedores chinos como Huawei? Muchos no lo han hecho.

A pesar del intenso debate político sobre el tema, Brasil no prohibió a Huawei como parte de sus primeras subastas de 5G. En consecuencia, Huawei suministra porciones significativas de la red de acceso de radio (RAN) 5G para los tres grandes operadores del país. Los operadores de Perú y México también utilizan equipos de proveedores chinos.

Pero Huawei no tiene el control total del mercado latinoamericano. Por ejemplo, la sueca Ericsson es el único proveedor de 5G para Entel Chile. En Argentina, Movistar de Telefónica seleccionó a Ericsson para su modernización de red a estándares listos para 5G. Y Claro de América Móvil en Colombia y Argentina, y TIM Brasil, seleccionaron a Nokia de Finlandia para amplios despliegues de 5G.

En cualquier caso, una vez que los operadores pagan por el equipo para poner el 5G a trabajar, a menudo tienen un progreso claro que mostrar:

Y las velocidades más rápidas también se pueden relacionar con la satisfacción de los clientes. Los datos de Speedtest Intelligence en México muestran una correlación entre las conexiones rápidas y los suscriptores contentos.

Aun así, ofrecer velocidades más rápidas es sólo un primer paso. Los operadores también deben empaquetar las conexiones 5G de una manera que sea atractiva para los clientes potenciales. Aquí también hay señales de progreso. Por ejemplo, Telcel de América Móvil en México promueve el 5G a sus usuarios de prepago, un guiño al hecho de que más del 80% de los usuarios móviles mexicanos se suscriben a planes de prepago. Y Claro de América Móvil en Brasil promociona la velocidad de su red 5G en apoyo de su acuerdo con OpenAI para ofrecer ChatGPT a sus clientes móviles.

Como resultado de tales esfuerzos, GSMA Intelligence predice que el 5G se extenderá al 50% de todas las conexiones móviles latinoamericanas para 2030, o 410 millones de personas. Eso está justo por debajo del promedio mundial del 57% esperado por la firma en ese año.

SA, redes privadas y FWA insinúan el futuro

La versión “No Autónoma” (Non-Standalone, NSA) de 5G se lanzó primero y ha sido ampliamente adoptada a nivel mundial. Sin embargo, la iteración “Autónoma”, o SA, de 5G a veces se denomina la versión “verdadera” de 5G. Eso se debe en parte a que 5G SA no se basa en una red central 4G como lo hace la versión “No Autónoma” (NSA) de 5G. SA también es compatible con servicios avanzados como el network slicing (una tecnología que puede canalizar tipos selectos de tráfico de usuarios a canales más rápidos).

En la transición de América Latina a SA, Brasil es un caso destacado. Según los datos de Speedtest, aproximadamente el 1.6% de todas las muestras de 5G en Brasil utilizaron tecnología 5G SA en el tercer trimestre de 2025. Solo Puerto Rico ocupó un lugar más alto, con un 41.1% de las muestras de 5G utilizando tecnología 5G SA. Es probable que esto se deba a la red de T-Mobile en el país; T-Mobile hizo un movimiento temprano hacia la tecnología 5G SA en todas sus operaciones en EE. UU.

Según GSMA Intelligence, Argentina, Colombia y Costa Rica son los otros países latinoamericanos con redes SA comerciales. Pero esas conexiones aún no aparecen en tamaños de muestra de Speedtest que sean estadísticamente relevantes.

Dicho esto, el FWA puede ser un servicio más tangible que insinúa un futuro habilitado por la tecnología 5G. El fixed wireless o acceso inalámbrico fijo permite a los operadores de 5G (aquellos con tenencias de espectro adecuadas y equipos compatibles con FWA) proporcionar conexiones de banda ancha a los hogares y oficinas de los usuarios. El FWA puede servir como una alternativa a las conexiones por cable en áreas remotas o rurales, o como una respuesta competitiva a otros proveedores de internet fijo.

GSMA Intelligence cuenta aproximadamente una docena de países latinoamericanos con servicios FWA.

Una vez más, Brasil parece ser el destacado aquí. Por ejemplo, Claro en Brasil lanzó su oferta 5G+ FWA en 2023 con velocidades de hasta 1 Gbps. Los planes de la compañía limitan el uso mensual de los clientes a partir de 200 GB por mes. De manera similar, Vivo de Telefônica Brasil lanzó su Box 5G en 2024 con un límite de 150 GB por mes.

Y Brisanet, un retador regional en Brasil, está buscando agresivamente 5G FWA con límites de datos más grandes. La compañía contó con 37.000 clientes FWA en su trimestre más reciente.

Otros países latinoamericanos están experimentando afloramientos de FWA similares. Claro de América Móvil en Colombia lanzó FWA en 2024 con un límite mensual de 160 GB. En México, Internet en Casa de AT&T ofrece velocidades de alrededor de 10 Mbps. Y Personal en Argentina cuenta con alrededor de 50.000 usuarios de FWA.

Otra señal de la maduración del 5G en América Latina es la llegada de las redes inalámbricas privadas 5G, que pueden ser utilizadas por empresas para aplicaciones que van desde la minería autónoma hasta el refinado de petróleo y la fabricación industrial. Este tipo de operaciones están apareciendo cada vez más en países como Brasil y Chile.

En cualquier caso, el avance del FWA, así como el del 5G SA, las redes inalámbricas privadas y otras tecnologías avanzadas, muestran que algunos habitantes de América Latina están viendo la promesa del 5G. Esto se puede atribuir a reguladores eficientes y con visión de futuro, compromisos financieros significativos por parte de algunos operadores y un deseo entre los usuarios de conexiones cada vez más rápidas.

Pero el 5G todavía está en sus primeras etapas en toda la región, con muchos países aún rezagados significativamente en los amplios despliegues de 5G. Los costos del espectro, como los de México, contribuyen. También lo hacen los retrasos regulatorios, como los que han ralentizado las subastas de espectro en lugares como Colombia. Y todo eso puede afectar al interés de los operadores en el 5G, como se ve en la intención de Millicom de seguir aprovechando el 4G hasta que llegue el momento del 5G.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.