Cable has the fastest-growing Wi-Fi 7, but Fiber has the fastest Wi-Fi 7 speeds

Editor’s note: This article was revised on June 12 to reflect that Verizon’s median download speeds are a result of its rate plans and for clarity about cable technology.

Wi-Fi 7 has been around for over a year. If you haven’t noticed this latest generation of Wi-Fi technology, it might be because it is still just gaining a foothold. But even for those who haven’t yet heard of Wi-Fi 7, one can surmise that a new technology generation will have better performance than what’s come before. This article looks at the growth of Wi-Fi 7 in the United States, then compares its performance against prior Wi-Fi generations across top fixed internet service providers (ISP).

Key Takeaways:

- Wi-Fi 7 adoption is less than 2%, according to its share of fixed samples of Speedtest user data. ISPs are beginning to include Wi-Fi 7 routers in their service bundle, which is the primary means for households to acquire routers.

- Wi-Fi 7 speed is faster, as expected, even delivering gig-speed for one fiber ISP. However, cable providers, which are competitive with fiber speeds on the downlink, have much slower uplink speeds and more lag on latency. Cable companies have 30% more of the older Wi-Fi 4 and 5 routers than fiber companies, constraining the potential customer experience.

- Net Promoter Score (NPS) improves with each generation of Wi-Fi, with an immense gulf from -38 for Wi-Fi 4 to +45 for Wi-Fi 7.

Wi-Fi in the U.S. by Technology Standard and the Growth of Wi-Fi 7

Generation breakdown:

- Wi-Fi 4 (802.11n), introduced in 2009, hangs onto 13.0% of Speedtest user samples

- Wi-Fi 5 (802.11ac) arrived in 2013 and registers a 33.0% share

- Wi-Fi 6 (802.11ax) came to market in 2019 and 6E (also 802.11ax) added in early 2021 together account for a majority 52.3% share

- Wi-Fi 7 (802.11be) came along early in 2024 and has garnered just 1.8% through Q1 2025

[NB: 6 and 6E are the same IEEE standard. 6E in this article is 6 GHz only, to allow for discrete analysis of this spectrum band. Wi-Fi 6E router samples on 2.4 GHz or 5 GHz are included with Wi-Fi 6. PC Mag explains.]

Wi-Fi 7’s Early Shoots

Wi-Fi 7 Speedtest user samples as share of total Wi-Fi Speedtest samples, Speedtest Intelligence data:

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 |

| 0.2% | 0.3% | 0.5% | 0.8% | 1.8% |

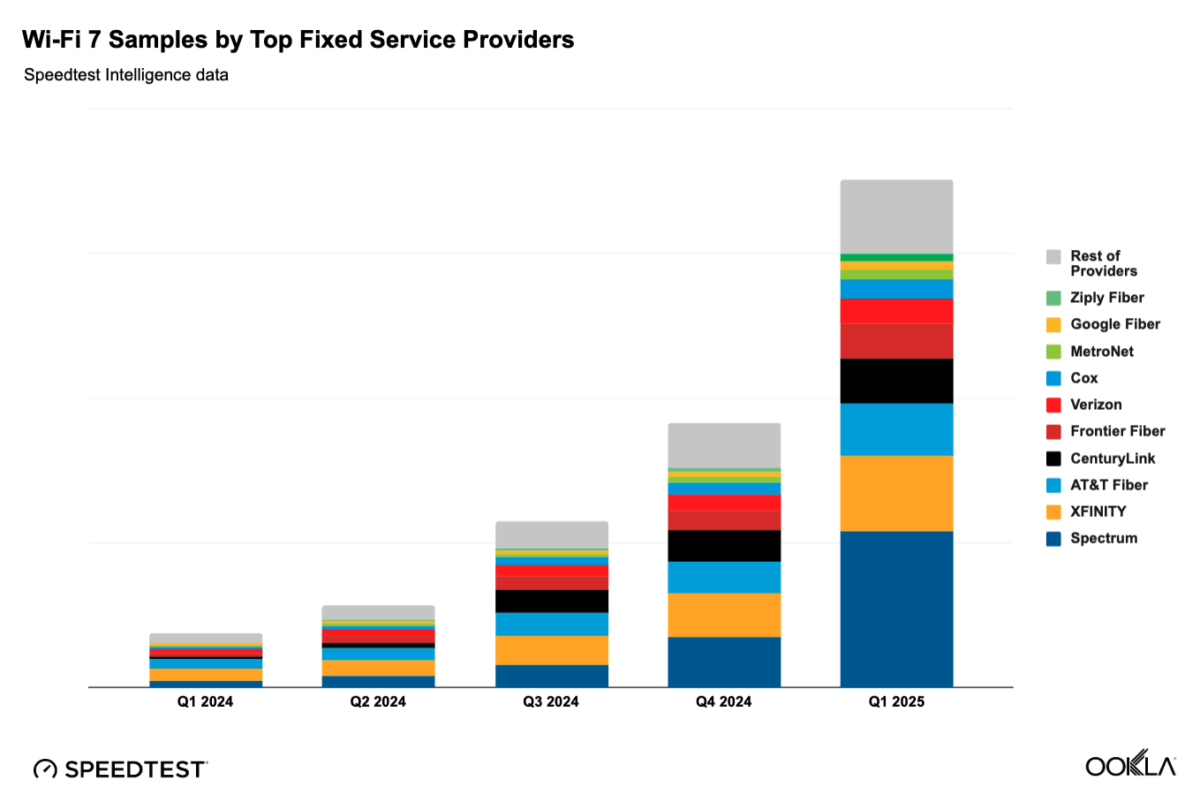

Wi-Fi 7 adoption started slowly and was less than 1% share through all of 2024, but then it more than doubled in Q1 2025 vs. Q4 2024, as more providers began offering Wi-Fi 7 routers as part of the service bundle. The role of ISPs providing equipment is critical. Seventy-one percent (71%) of internet households in the U.S. get their routers from their ISP, according to recent research from Parks Associates. For example, Spectrum (Charter Communications) began offering its Wi-Fi 7 router late last year and tripled its adoption over these two quarters, allowing the company to claim that it is the fastest growing Wi-Fi 7 provider as of Q1 2025.

The ISPs listed in the chart are the ten largest Wi-Fi 7 providers in Speedtest Intelligence data based on total Speedtest user samples on Wi-Fi 7.

Wi-Fi Performance by Generation

For all providers, the increase in median download speed for each Wi-Fi generation is expected. At the top end, Wi-Fi 7 at 764.15 Mbps, even with Wi-Fi 7 including samples from slower bands of 2.4 GHz and 5 GHz, is still faster by 51.64 Mbps than Wi-Fi 6E at 712.51 Mbps. However, among the individual ISPs, there are some ISPs where 6E is faster than Wi-Fi 7. Even with the newest capabilities of Wi-Fi 7, the physical characteristics of a house, for example, can mean that the better coverage propagation characteristics of 2.4 GHz gives a better connection than 6 GHz.

Wi-Fi 7 benefits from double the channel bandwidth and four-times the modulation, as well as a feature called Multi-Link Operation (MLO) which allows data to travel across all frequency bands rather than one. As this analysis is focused on results rather than technical specifications, for those interested in learning more about Wi-Fi 7 capabilities, see The Ultimate Wi-Fi 7 Upgrade Guide by Ekahau (a Ziff Davis company, as is Ookla).

Among the top 10 ISPs, older generation Wi-Fi 4 and Wi-Fi 5 median download speeds generally cluster in similar ranges, respectively, though CenturyLink (Lumen) is slower due to a large portion of its customer base being on slower, copper-based broadband service. In its Q1 2025 earnings report, Lumen reported 1.1 million subscribers on fiber and 1.4 million customers primarily on the slower service.

Verizon’s relatively slower median download speeds on the newer Wi-Fi generations (6, 6E, 7) are likely due to customer rate plan mix.

Frontier, Verizon’s acquisition target, is clearly the fastest on Wi-Fi 7 and records the only gigabit median download speed of 1.011 Gbps.

As with download speeds, the upload speeds for all providers follow the expected path of getting faster with each newer Wi-Fi generation. However, among the ISPs, there is greater variation in the upload than the download. In particular, the cable ISPs – Cox Communications, Spectrum (Charter Communications), Xfinity (Comcast Corporation) – lagging behind the symmetrical speed of fiber, are far below in the uplink speed. The Wi-Fi 7 average of the median upload speeds of the three cable companies is just 64.40 Mbps vs. 595.75 for the seven fiber companies.

On Wi-Fi 4 and 5, the three cable companies average 47.1% of samples (almost half) while the seven fiber companies average 36.3% of samples on these older generations. The Wi-Fi 5 average of the median upload speeds of the three cable companies is just 27.65 Mbps vs. 178.17 Mbps for the seven fiber companies.

If older cable technology tracks with the Wi-Fi router generations, then the cable companies have a slow-to-change portion of their customer base who will need targeted incentives to upgrade. The cellular industry markets its generations and consumers know, for example, that they need a 5G phone to be on a 5G network. But Wi-Fi, as a category, has not educated consumers to the same extent such that consumers could experience better connectivity with, for example, the latest router (assuming they even know the technology generation of their current router). And, given that the vast majority of a consumers’ mobile traffic is via Wi-Fi – and basically all of the home internet – this is an opportunity for the industry to align the network capability with the service plan with the router with the end device.

As with download speed, again Frontier clocks a blazing median upload speed of 0.9 Gbps (866.85 Mbps).

Just as with speeds, latency tracks its improvements by Wi-Fi generation for all providers. However, it is arguable from a consumer relevance perspective that Wi-Fi 5, 6, and 6E provide essentially the same latency experience across all providers.

Also as with speed, the fiber companies (apart from MetroNet) have better performance on latencies than the cable companies. On average for Wi-Fi 7, the cable companies latency is 25 milliseconds (ms) vs. 15 ms for the fiber companies (including MetroNet, and including copper customers mentioned above).

The best performer on latency is the aptly named Ziply Fiber, with as-low-as or lower Wi-Fi 4 latency than other ISPs have on Wi-Fi 7 (12 ms), and Ziply is the only provider in single-digit Wi-Fi 7 latency (8 ms).

Wi-Fi 4 Nostalgia? Sentimental is bad for Sentiment

Speed and lag are critical in determining the customer experience. Customer experience relative to one’s expectations determines customer perception. The customer perception is captured by “sentiment” metrics like ratings or stars, satisfaction percentages, or loyalty and recommendation metrics like Net Promoter Score (NPS).

Taking a look at NPS by Wi-Fi generation, just as seen with download speed, upload speed and latency, each newer generation of Wi-Fi is attended by better consumer sentiment. To be clear, these are Speedtest users’ scores for their ISP by Wi-Fi generation, not a score for the routers themselves.

NPS by Wi-Fi Generation, Speedtest Intelligence data, Q1 2025:

| Wi-FI 4 | Wi-Fi 5 | Wi-Fi 6 | Wi-Fi 6E | Wi-Fi 7 |

| -38 | 3 | 11 | 30 | 45 |

As noted, a legacy of older Wi-Fi router generations in an ISP’s customer base, cable companies having more than fiber providers, limits the customer experience. So too with the transport technology (eg, DOCSIS 3.0). Furthermore, Wi-Fi 7 may need new consumer-premise cabling; some Wi-Fi 7 capable devices may not support the full channel width; and so on. This is to say that technology bottlenecks are possible at each node in the ecosystem. Getting this all lined up to match the service capabilities to the right-fit rate plan that meets the customer needs is Rubik’s Cube. More awareness, better education, and technology transparency will help realize the potential of Wi-Fi 7.

Ookla can assist ISPs, venue owners, and companies in designing Wi-Fi networks, monitoring their performance, and optimizing them. Please contact us to learn more about Speedtest Intelligence and Ekahau.

Other recent Wi-Fi 7 reporting: Wi-Fi 7 in Europe: France Leads in Differentiating Multi-Gigabit Fiber Experiences | Ookla®.

Sidebar

The significant merger and acquisition (M&A) activity among eight of our top ten Wi-Fi 7 providers is noteworthy:

- Verizon to acquire Frontier | News Release

- T‑Mobile and KKR Announce Joint Venture to Acquire Metronet and Offer Leading Fiber Solution to More U.S. Consumers

- BCE to acquire Ziply Fiber

- AT&T to Acquire Lumen’s Mass Markets Fiber Business

- Charter & Cox Announce Definitive Agreement to Combine Companies

That leaves just Google Fiber and Xfinity on our top ten without recent, major M&A news. With so many providers (we count 59 ISPs in our data with Wi-Fi 7 samples, and there are more than a thousand fiber providers in the U.S.) in a capex-intensive industry, scale economics drives consolidation. Furthermore, there is a fiber-first imperative narrative that access technologies will converge over time, which also encourages industry consolidation.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.