Austria has been held up as an example of a pioneer European 5G-market, having announced its 5G Strategy in April 2018, which has since been incorporated in the nation’s Broadband Strategy 2030. This strategy includes a number of 5G targets: commitments to early 5G trials, the rollout of 5G in all state capitals by the end of 2020 (which it has achieved), coverage of all main traffic routes in the country by the end of 2023 and nationwide 5G coverage by the end of 2025. We analyzed Speedtest Intelligence® data from Q1-Q2 2021 to see how performance is tracking two years on from launch. We compared Austrian 5G speeds to those of its regional peers and examined how its operators 5G networks perform across the country.

Key spectrum auctions are opening up Austria’s 5G market

Despite COVID-19 related delays, the Austrian regulator has completed the auction of spectrum in key 5G bands. The first auction in early 2019 saw all three national mobile operators acquire contiguous bands at least equal to the EU’s recommended 80-100 MHz in the C-band. A follow up multi-band auction (which included spectrum in the 700 MHz band) was conducted in September 2020 and included obligations to cover a range of not-spots (areas of zero mobile broadband coverage) and partial not-spots (areas of coverage by only one network operator).

Having access to large contiguous blocks of spectrum in the key C-band will allow Austrian operators to make more efficient use of their spectrum resources and better support high-bandwidth, low-latency 5G use cases. Austria already looks set to advance with standalone (SA) 5G networks, with Drei Austria recently announcing a trial in the capital Vienna and plans to launch a commercial 5G SA network in spring 2022. Notably, operators have complained that the high cost of mobile mast rental has slowed 5G rollout.

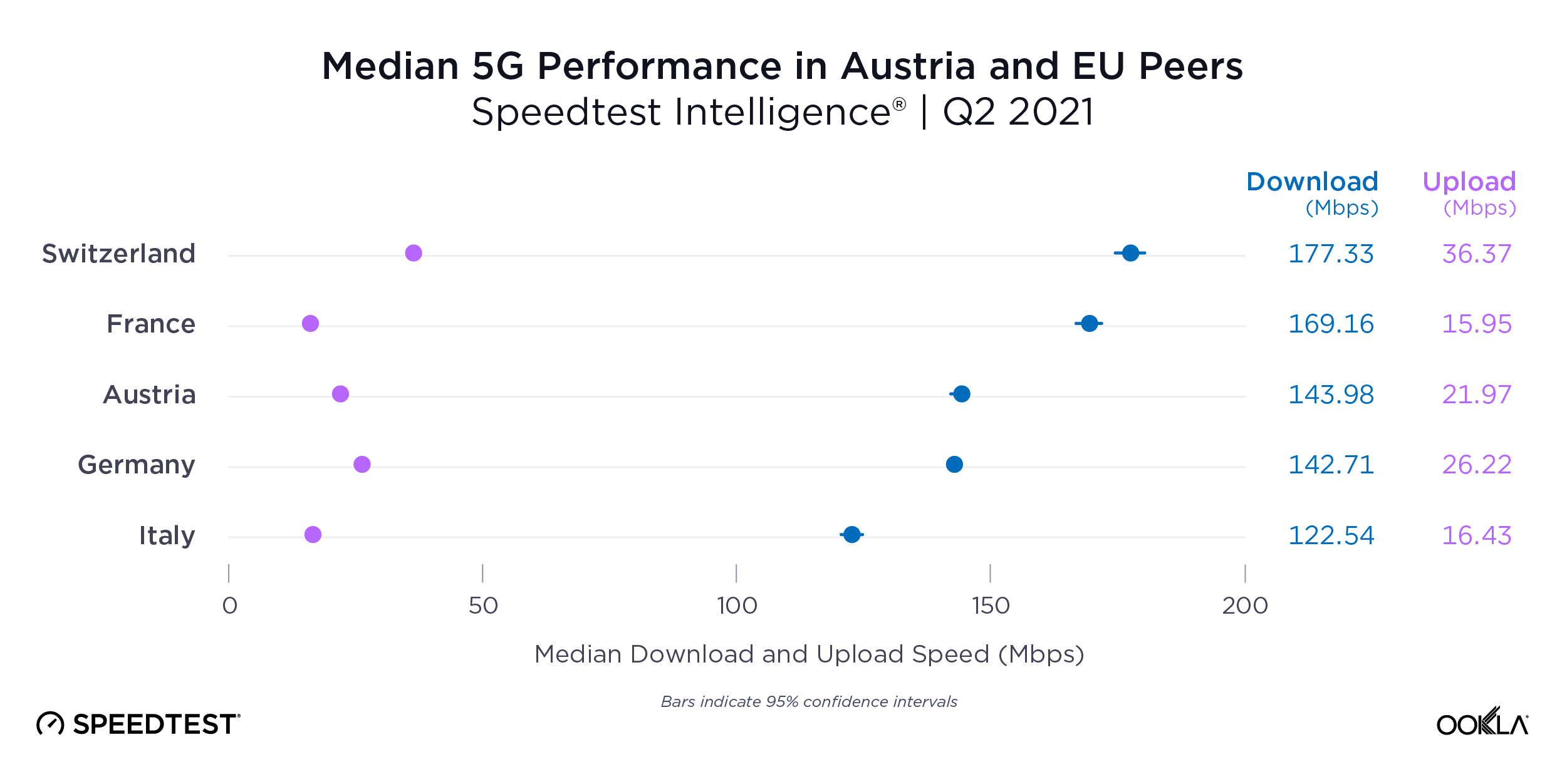

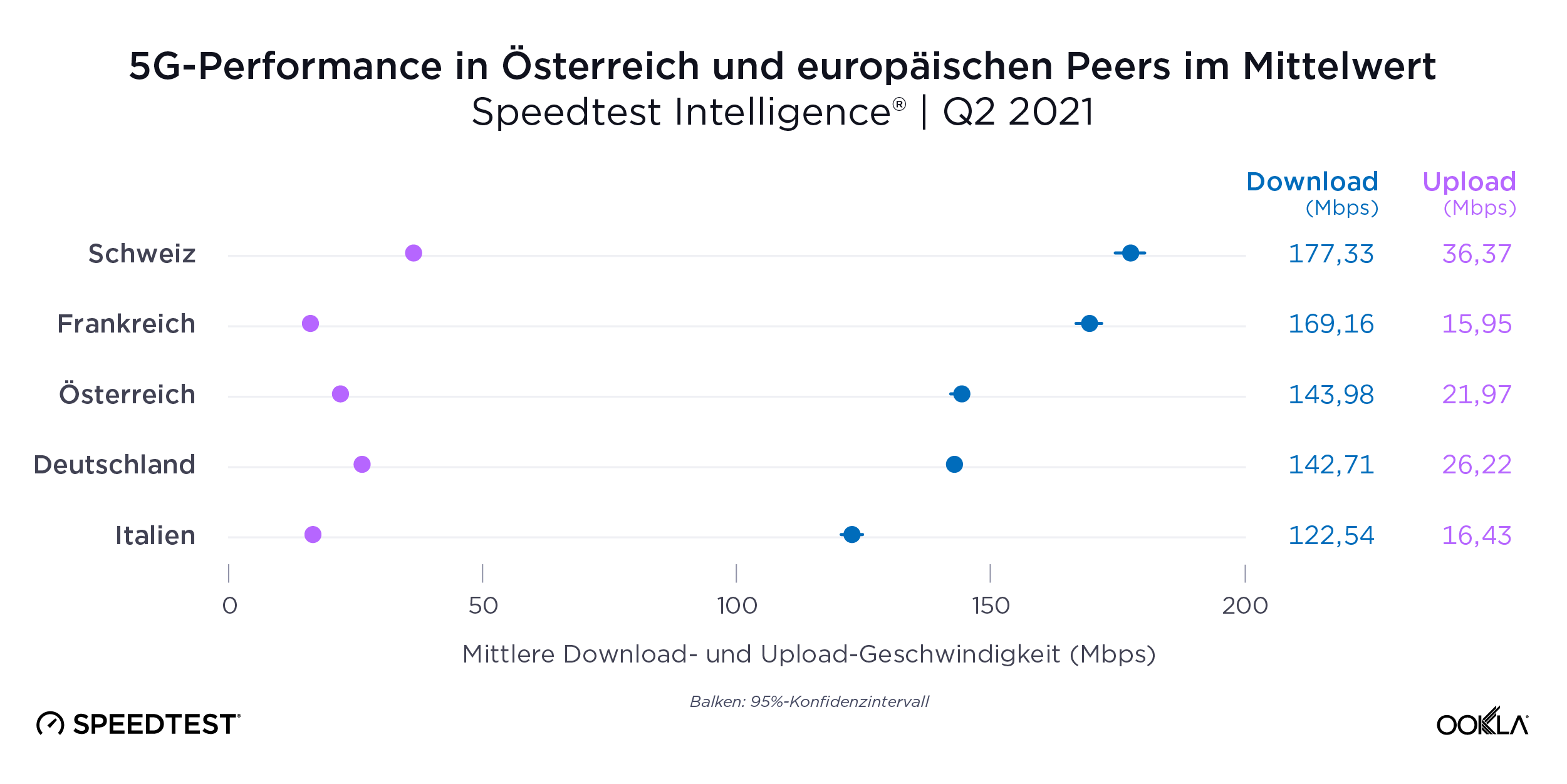

Switzerland had the fastest 5G among Austria’s European peers during Q1-Q2 2021

5G performance has seen some wild swings over the past year in Austria and its European peer countries in the region. Switzerland ended Q2 2021 with the fastest median 5G download speed on this list at 177.33 Mbps, followed by France (169.16 Mbps), Austria (143.98 Mbps), Germany (142.71 Mbps) and Italy (122.54 Mbps).

Switzerland was also fastest for median upload speed over 5G during Q2 2021 at 36.37 Mbps, followed by Germany (26.22 Mbps), Austria (21.97 Mbps), Italy (16.43 Mbps) and France (15.95 Mbps). We often see 5G speeds decline after the initial launch period as more users adopt the technology, which adds congestion to cell sites. Additionally, the use of Dynamic Spectrum Sharing (DSS) allows operators to expand 5G coverage through the use of existing spectrum bands and incorporates bands at lower frequencies that can lead to slower median speeds.

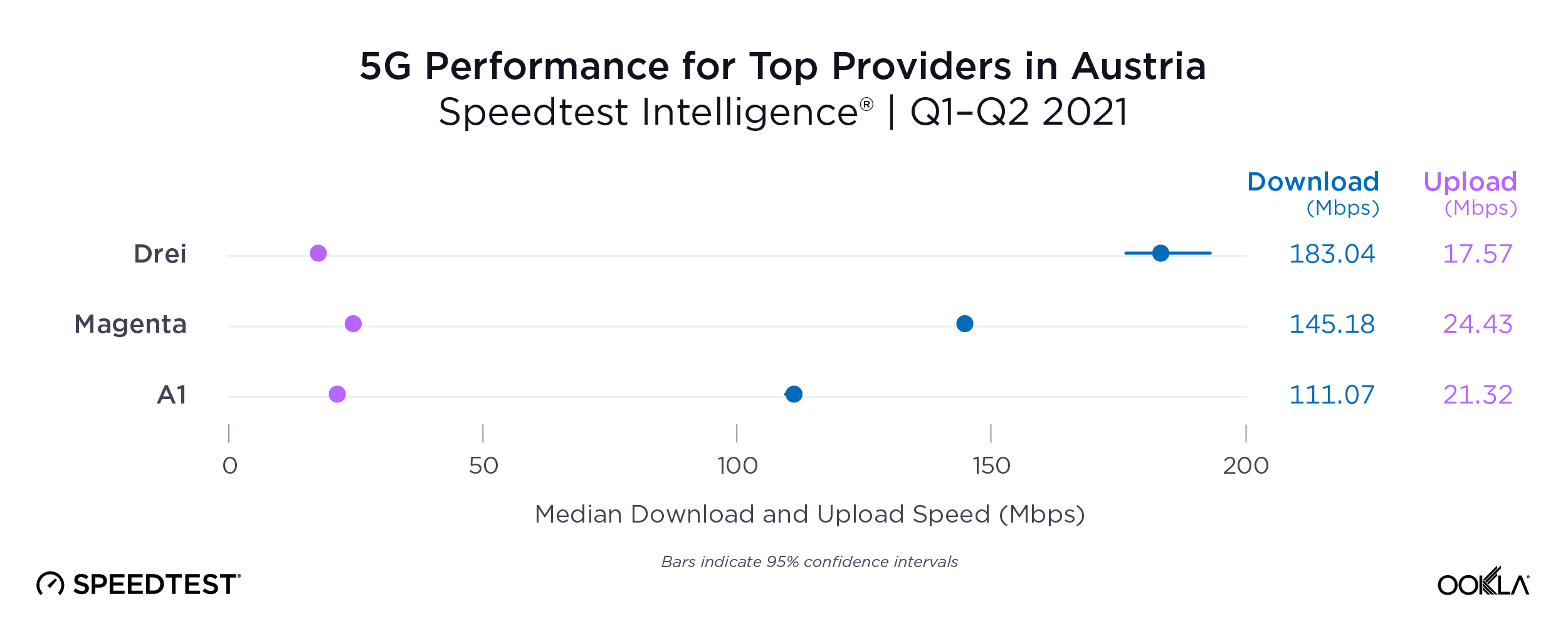

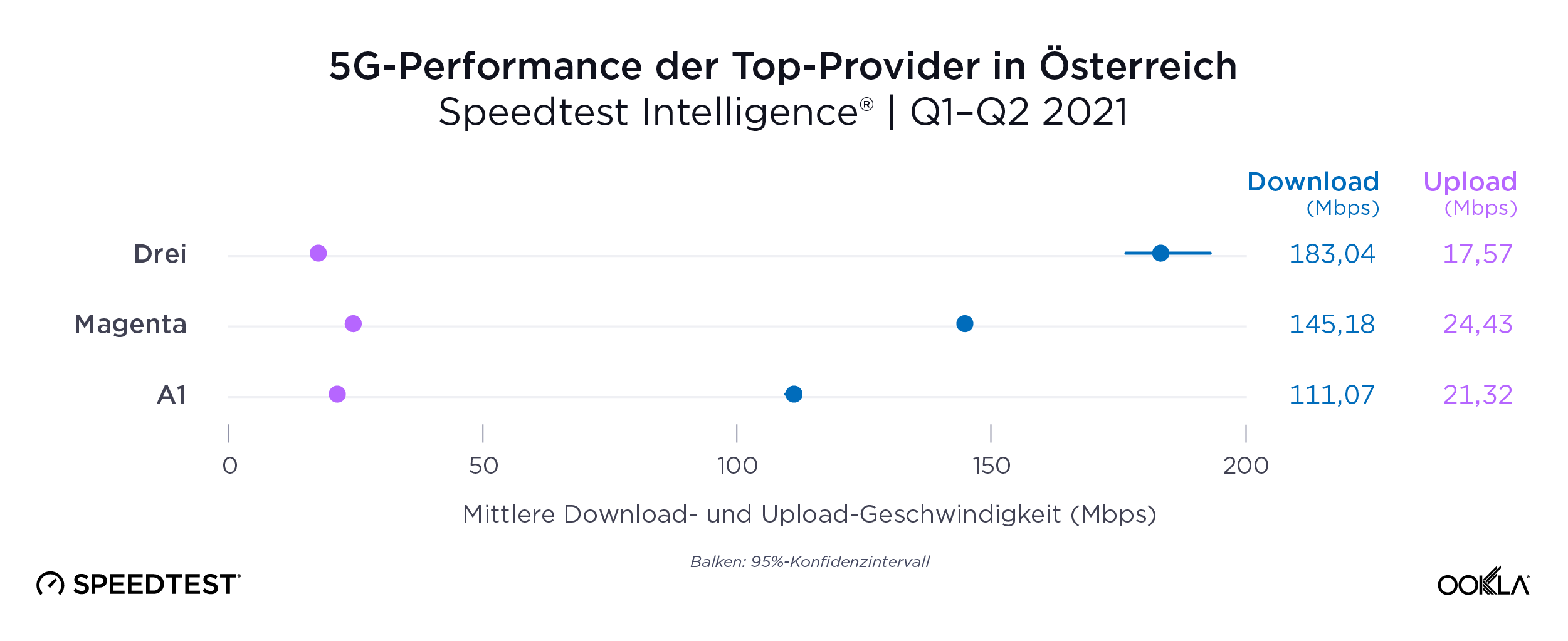

Drei Austria was the fastest operator in Austria for 5G

5G performance varied widely among Austria’s top providers during Q1-Q2 2021 but Drei Austria had the fastest median 5G download speed at 183.04 Mbps. Accounting for statistical uncertainty, this was at least 21% faster than the nearest competitor. Magenta Telekom and A1 Telekom had slower 5G download speeds at 145.18 Mbps and 111.07 Mbps, respectively. For median 5G upload speeds, Magenta Telekom placed first at 24.43 Mbps.

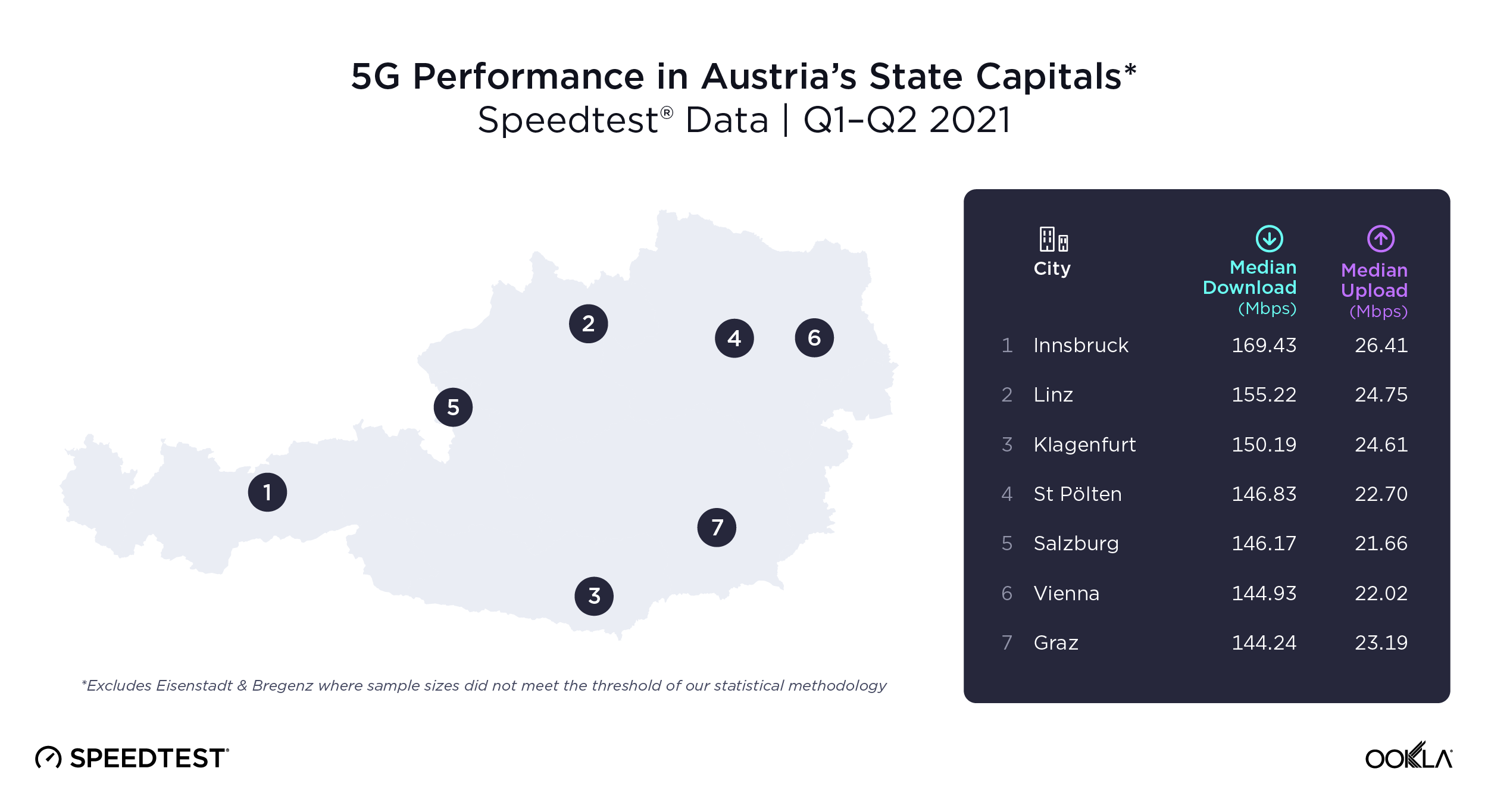

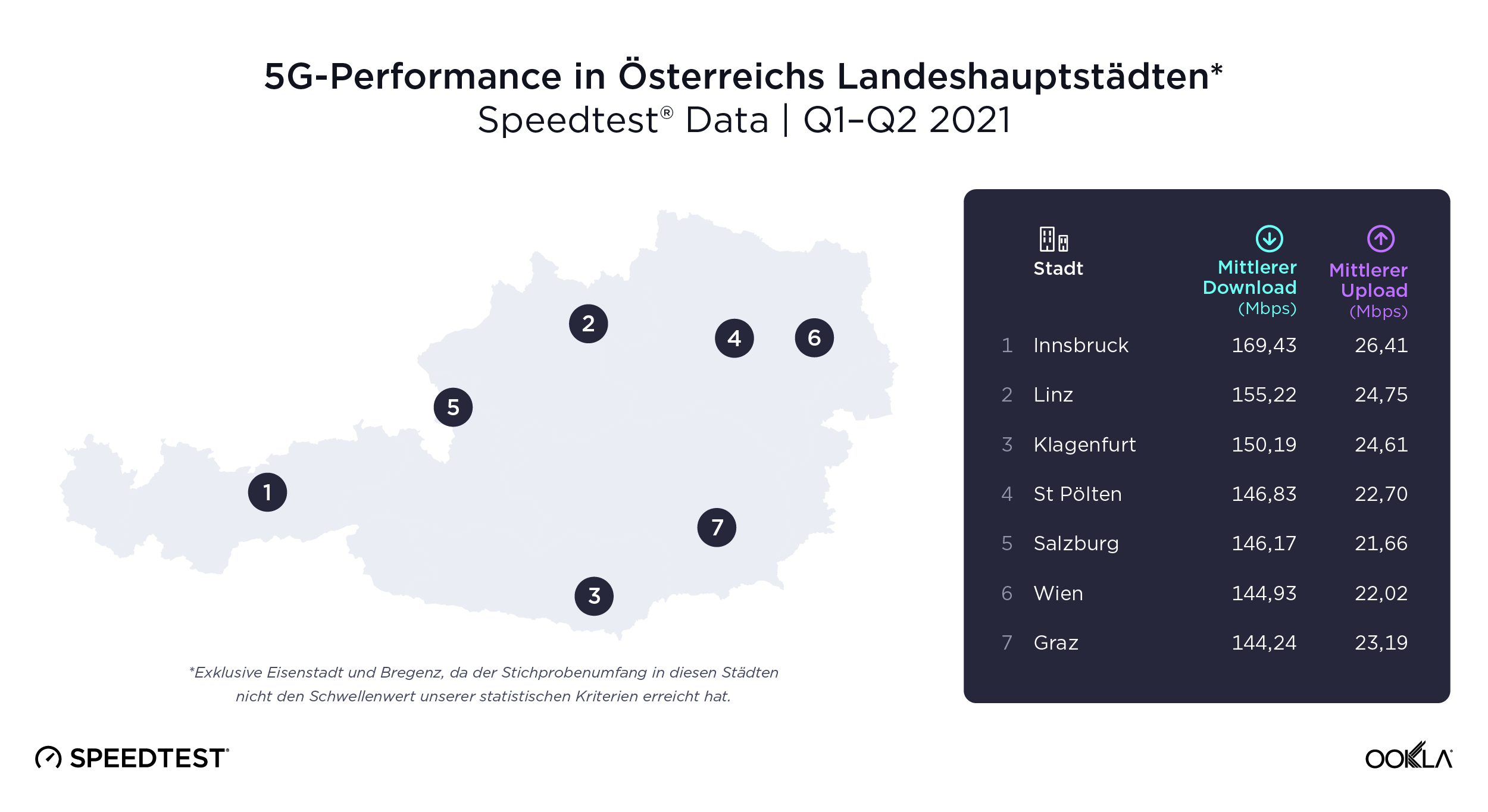

Innsbruck trumps Vienna on 5G download and upload speeds

While there was no statistical winner among Austrian capitals, Innsbruck had a median 5G download speed at 169.43 Mbps, which was demonstrably faster than Vienna’s median download speed of 144.93 Mbps. Since there was no clear winner among all state capitals, this indicates operators’ 5G rollouts to date have not prioritized any single state capital, and that they are currently managing the balance between providing 5G capacity with demand on the new network. Within the capital Vienna, Drei Austria’s 5G network showed the fastest performance during Q1-Q2 2021 achieving a median download speed of 193.66 Mbps.

Austria has clearly seen a ramp up in mobile network speeds with the arrival of 5G. We’ll be interested to see if other providers make the necessary investments to catch up to Drei. This could bring up speeds across the country and improve Austria’s standing relative to its peers in the Speedtest Global Index™, where it ranked 31st for mobile speed in July 2021. Learn more about how Speedtest Intelligence can help you benchmark your 5G performance against competitors.

5G in Österreich im Performance-Test zwei Jahre nach dem Start

Österreich gilt als einer der 5G-Pioniermärkte in Europa. Bereits im April 2018 verkündete Österreich seine 5G-Strategie, die inzwischen in die nationale Breitbandstrategie 2030 integriert wurde. Diese Strategie enthält eine Reihe von 5G-Zielen: eine Verpflichtungen zu ersten frühzeitigen 5G-Tests, die mittlerweile bereits umgesetzt Einführung von 5G in allen Landeshauptstädten zum Zeitpunkt Ende 2020, die Abdeckung aller Hauptverkehrswege des Landes bis Ende 2023 und eine landesweite 5G-Versorgung bis Ende 2025.

Zwei Jahre nach dem kommerziellen 5G-Start in Österreich haben wir unsere Speedtest Intelligence® Daten aus Q1-Q2 2021 analysiert, um zu sehen, wie sich die Performance von 5G im Land entwickelt hat. Wir haben untersucht, wie die 5G-Netze der Betreiber im ganzen Land abschneiden, und die 5G-Übertragungsraten jenen vergleichbarer europäischer Länder in der Region gegenübergestellt.

Frequenzauktionen machen Weg frei für Österreichs 5G-Markt

Trotz COVID-19-bedingter Verzögerungen hat die österreichische Regulierungsbehörde die Versteigerung der Frequenzbänder für 5G mittlerweile abgeschlossen. Bei der ersten Auktion Anfang 2019 erwarben alle drei nationalen Mobilfunkbetreiber zusammenhängende Bänder, die mindestens den von der EU empfohlenen 80-100 MHz im C-Band entsprechen. Eine nachfolgende Multi-Band-Auktion, die auch Frequenzen im 700-MHz-Band umfasste, wurde im September 2020 durchgeführt und beinhaltete Verpflichtungen zur Abdeckung einer Reihe von Not-Spots (Gebiete ohne mobile Breitbandabdeckung) und von partiellen Not-Spots (Gebiete mit Abdeckung durch nur einen Netzbetreiber).

Der Zugang zu großen, zusammenhängenden Frequenzblöcken im wichtigen C-Band wird es den österreichischen Betreibern ermöglichen, ihre Frequenzressourcen effizienter zu nutzen und 5G-Anwendungsfälle mit hoher Bandbreite und geringer Latenz noch besser zu unterstützen. Österreich scheint hierfür auch bereits mit 5G standalone (SA)-Netzen voranzukommen. Drei Austria hat kürzlich einen Test in der Hauptstadt Wien angekündigt und plant, schon im Frühjahr 2022 ein kommerzielles 5G SA-Netz in Betrieb zu nehmen. Zugleich beklagen die Betreiber jedoch, dass die hohen Kosten für die Anmietung von Mobilfunkmasten die Einführung von 5G verlangsamt haben.

Schweiz mit schnellstem 5G unter Österreichs Peers in Q1-Q2 2021

Die 5G-Performance hat im vergangenen Jahr in Österreich und anderen vergleichbaren europäischen Ländern in der Region stark geschwankt. Im Q2 2021 hatte die Schweiz die Nase vorne mit einer mittleren 5G-Download-Geschwindigkeit von 177,33 Mbps, gefolgt von Frankreich (169,16 Mbps), Österreich (143,98 Mbps), Deutschland (142,71 Mbps) und Italien (122,54 Mbps).

Auch bei den Upload-Raten erreichte die Schweiz in Q2 2021 mit 36,37 Mbit/s bei 5G den besten Mittelwert, gefolgt von Deutschland (26,22 Mbit/s), Österreich (21,97 Mbit/s), Italien (16,43 Mbit/s) und Frankreich (15,95 Mbit/s). Nach der anfänglichen Einführungsphase sinken die 5G-Geschwindigkeiten häufig, denn die Zahl der 5G-Kunden steigt allmählich an, was zu einer stärkeren Belastung der Mobilfunkstandorte führt. Außerdem nutzen die Betreiber zunehmend bestehende Frequenzbänder für 5G mittels Dynamic Spectrum Sharing (DSS). Die Betreiber sind so in der Lage, die 5G-Abdeckung zu erweitern und niedrigere Frequenzbänder einzubeziehen. Die durchschnittliche Übertragungsgeschwindigkeit kann sich dadurch verlangsamen.

Drei mit schnellstem 5G-Netz in Österreichs in Q1-Q2 2021

Die 5G-Performance hat in Q1-Q2 2021 zwischen den österreichischen Top-Providern stark variiert. Drei Austria hatte mit 183,04 Mbit/s im Mittelwert die schnellste 5G-Download-Geschwindigkeit. Unter Berücksichtigung der statistischen Schwankungsbreite war das 5G Netz von Drei damit mindestens 21 % schneller als jenes des nächsten Mitbewerbers. Magenta Telekom und A1 Telekom erreichten langsamere 5G-Download-Geschwindigkeiten von 145,18 Mbit/s bzw. 111,07 Mbit/s. Bei der mittleren 5G-Upload-Rate lag Magenta Telekom mit 24,43 Mbit/s an erster Stelle.

Innsbruck übertrumpft Wien bei 5G-Download- und Upload

Unter den österreichischen Landeshauptstädten zeigte sich statistisch betrachtet kein eindeutiger Gewinner. In der mittleren Download-Geschwindigkeit war 5G in Innsbruck mit 169,43 Mbit/s aber augenscheinlich schneller als Wien mit 144,93 Mbit/s. Dass es keinen eindeutigen Gewinner unter den Landeshauptstädten gab, lässt darauf schließen, dass die Betreiber beim 5G-Rollout bisher keine Region signifikant priorisiert haben und dass ihnen derzeit eine gute Balance zwischen der Bereitstellung von 5G-Kapazität und der Nachfrage im neuen Netz gelingt.

In der Hauptstadt Wien erreichte das 5G-Netz von Drei Austria in Q1-Q2 2021 die schnellsten Übertragungsraten mit einer mittleren Download-Geschwindigkeit von 193,66 Mbit/s.

Die Geschwindigkeit der Mobilfunknetze in Österreich hat sich mit der Einführung von 5G deutlich erhöht. Wir sind gespannt, ob die anderen Anbieter die notwendigen Investitionen tätigen, um zu Drei aufzuschließen. Das könnte die Internet-Geschwindigkeiten im ganzen Land erhöhen und Österreichs Position im Vergleich zu anderen Ländern im Speedtest Global Index™ verbessern. Zuletzt lag Österreich im Juli 2021 bei der Mobilfunk-Geschwindigkeit auf Platz 31. Erfahren Sie mehr darüber, wie Speedtest Intelligence Ihnen helfen kann, Ihre 5G-Leistung mit jener Ihrer Wettbewerber zu vergleichen.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.