Mexican ISPs look to consolidate their positions following significant network investment

The Mexican market has witnessed a rapid transition to fiber over the last few years, led by market incumbent Telmex, as well as challengers Totalplay and Megacable. While Telmex still holds a sizable lead on its rivals in terms of market share of broadband connections, it is facing intense competitive pressure, with both Totalplay and Megacable seeing sustained increases in net additions, based on Speedtest samples.

Our analysis of Ookla SpeedtestⓇ data reveals a marked transition, particularly among Totalplay’s customer base, towards adoption of higher speed tariffs in excess of 100 Mbps. We also see that fiber connections help deliver improved user experience for key use cases such as online gaming and video calling. However, Wi-Fi remains a bottleneck in the home, with a significant proportion of Mexican households still using legacy Wi-Fi customer premises equipment (CPE).

Key Takeaways

- Positive net broadband additions for leading fiber ISPs. Totalplay and Megacable are consistently gaining customers, up 3.3% and 2.8% respectively, based on migration of Speedtest users between the ISPs in 1H 2025. Telmex followed with 1% growth, while izzi, which relies more on its older hybrid-fiber coax (HFC) network, has experienced significant user churn over the last several quarters.

- Leading fiber ISPs are delivering superior speeds and quality of experience. While Telmex continues to lead the market based on broadband connections market share, its rivals outpace it on key performance indicators. Totalplay recorded a median download speed of 160.48 Mbps in 1H 2025, followed by Megacable with 94.08 Mbps, Telmex with 78.00 Mbps, and izzi with 74.50 Mbps. Greater adoption of faster fiber services among its customer base also helped drive leads for Totalplay on gaming latency, where it recorded a median of 66 ms, followed by Megacable with 77 ms, both ahead of Telmex with 82 ms.

- Consumers are migrating to faster speed tiers, especially on networks supporting faster performance. In Chihuahua, over half of Totalplay’s customers (51.5%) receive speeds over 100 Mbps based on Speedtest data. The provider saw its share of users recording speeds in excess of 300 Mbps grow significantly, from 11.7% in Q3 2024 to 19.2% in Q2 2025. By contrast, Telmex and izzi had more than 70% of users recording less than 100 Mbps, of which, a majority experienced less than 50 Mbps.

- The benefits of fast fiber are often limited by outdated in-home Wi-Fi CPE. Many users cannot achieve the full speed of their broadband plan because of their Wi-Fi routers. This issue is most pronounced for customers of izzi and Telmex; in Chihuahua, 56% of izzi customers and 46% of Telmex customers use Wi-Fi 4 or older, compared to just 33% for Totalplay.

- Network quality directly impacts the experience of latency-sensitive applications like online gaming. Fiber providers hold a distinct advantage for gamers. Totalplay delivered the lowest gaming latency at 66 ms in Chihuahua, followed by Megacable with 77 ms, and Telmex with 82 ms. Izzi lagged behind with a median latency of 114 ms, due to reliance on its hybrid-fiber coaxial (HFC) network. For reference, NVIDIA recommends a latency to its data centers of less than 80 ms, for its cloud gaming service GeForce NOW.

- Net promoter scores (NPS) are remarkably consistent across all major ISPs. For the lowest speed tier (0-50 Mbps), every provider recorded a deeply negative NPS, with an average of -41. In stark contrast, sentiment becomes strongly positive for the highest speed tiers. For customers on plans over 300 Mbps, NPS scores climb to +49 on average. This demonstrates that faster connectivity is not just a technical specification but a key driver of a more positive and valued customer experience.

Mexico lags regional peers in median download speeds

The Mexican broadband market remains heavily weighted towards former incumbent Telmex, which is nearing the end of a transition from DSL to fiber. GSMA Intelligence data shows that Telmex had a market share of broadband connections of just under 40% as of Q4 2024. Telmex competes against three other major ISPs with market shares of close to 20% each— Totalplay, a pure fiber ISP, Megacable, a cable ISP rapidly migrating its user base to fiber, and izzi, a cable ISP which continues to rely heavily on its HFC network.

Despite a relatively high market concentration, the Mexican fixed broadband market has undergone a rapid transformation, driven by aggressive investment in fiber optic infrastructure. Telmex has been central to this by migrating its user base from copper to fiber. During its Q2 2025 results, Carlos García Moreno, financial director of América Móvil, said that 91% of Telmex users were on fiber, up from 67% just two years ago.

Competition has been fierce, with Megacable also expanding its fiber optic network, maintaining a capex-to-revenue ratio in excess of 30% in 2024, and while this has fallen in 2025, it still remains above 20%. Totalplay is in a similar position, spending in excess of 20% of revenues on capex during 2025, and while it is not focused on further geographic expansion, it continues to reinforce its lead on network speeds in the market, recently launching a symmetrical 10 Gbps rate plan complete with a Wi-Fi 7 CPE, taking advantage of the performance supported by the latest generation of Wi-Fi technologies.

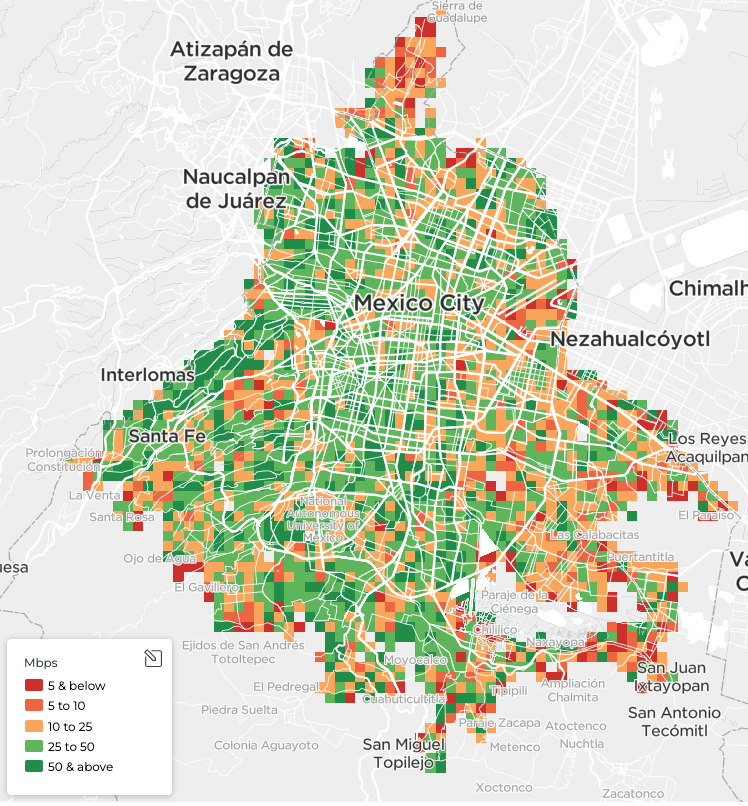

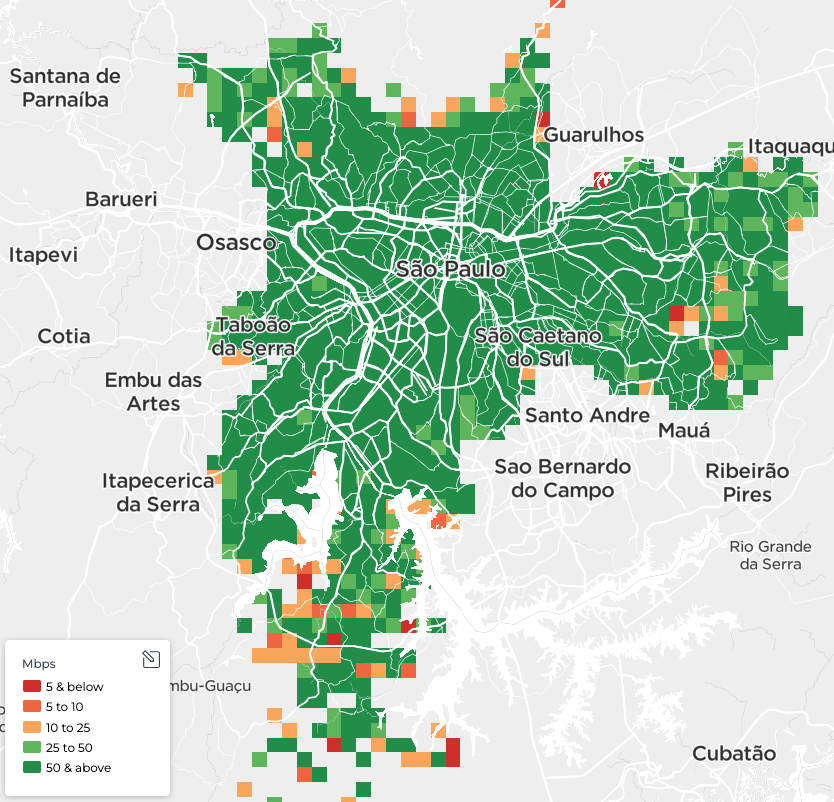

This race to deploy fiber in the last mile in Mexico is helping drive faster median network speeds, however Mexico continues to lag behind many regional peers. It placed 68th globally on the Speedtest Global Index for August 2025, well behind Chile which placed 2nd, Peru in 20th, Brazil in 28th, Colombia in 30th, and Argentina in 56th.

A rising tide of fiber across Mexican cities

Across all ISPs combined, Mexican median download speeds increased by 18.78 Mbps year-on-year, to reach 91.55 Mbps in Q2 2025, fueled by the continued migration to fiber. Upload speeds increased at a faster rate, up 33.73 Mbps to reach 72.50 Mbps, thanks in part to Totalplay’s move to offer symmetrical speeds as covered in a previous Ookla Research article. With Mexican cities the focal point for fiber expansion in the market, we examined ISP performance across a selection of cities – Chihuahua, León, Mexico City, and Puebla, to show the impact of this fiber rollout:

- Mexico City: Totalplay cemented its lead, with its median download speed increasing significantly from 120.18 Mbps in Q2 2024 to 198.62 Mbps in Q2 2025. Megacable also saw a significant jump to 96.28 Mbps, while Telmex and izzi posted more modest gains.

- Chihuahua: Totalplay again demonstrated the most dramatic growth, with speeds increasing from 93.79 Mbps to 142.27 Mbps year-on-year, while Telmex and izzi also both made gains.

- León: The trend continued, with Totalplay’s median speed rising to 138.16 Mbps and Megacable and Telmex both seeing year-on-year improvements.

- Puebla: Totalplay again recorded the highest median download speed of any provider, reaching 163.79 Mbps in Q2 2025, while Megacable and Telmex both saw more modest improvements.

Analysis of speed tiers shows user migration to faster rate plans

Part of the challenge for ISPs is convincing users to upgrade to faster broadband rate plans. Broadband price plans typically start at around 350-400 MXN per month (approximately USD $20), with both Telmex and Megacable offering the lowest priced packages for 50 Mbps, while izzi offers a 30 Mbps service at a similar price point. Totalplay on the other hand has sought to differentiate on performance, with its lowest tier at least double that of its rivals, at 100 Mbps, but for this it charges MXN 529 (closer to $30).

Chihuahua

Examining the spread of Speedtest samples across different speed brackets, shows that a much greater share of Totalplay (51.5%) customers in Chihuahua opt for faster connections (in excess of 100+ Mbps), compared to Megacable (30.2%), Telmex (27.4%), and izzi (21.6%).

There were only minor changes for both izzi and Telmex, based on Q3 2024 vs. Q2 2025 data. izzi shows a minor uptick in the share of users with speeds between 50-100 Mbps, at the expense of the higher speed tier of 100-300 Mbps. Telmex has a slightly more positive outcome, with a decline in its share of users with the slowest speeds (0-50 Mbps), coupled with a rise in those with speeds of 50-100 Mbps, reflecting its continued migration of users from copper to fiber. Totalplay and Megacable recorded more significant swings among their user bases. For Megacable, we saw a decline in users with speeds between 100-300 Mbps, while the share of users with 300+ Mbps, as well as 0-50 Mbps and 50-100 Mbps all increased. Totalplay saw the most positive outcome among the ISPs, with a just under 5% increase in users with speeds between 100-300 Mbps, while its share of users with speeds in excess of 300 Mbps ramped up strongly from 11.7% to 19.2%.

León

For León, we compared Telmex, Megacable and Totalplay, but excluded izzi, which did not have sufficient samples to be included. Here we see better performance from Megacable, with 48.9% of its users recording speeds of 100 Mbps or greater in Q2 2025, and with its share of samples with speeds between 100-300 Mbps and in excess of 300 Mbps both picking up, largely at the expense of samples between 0-50 Mbps. Totalplay was a similar story – recording a sizeable decline in samples between 0-50 Mbps, and with both 100-300 Mbps and 300+ Mbps tiers seeing sample share grow strongly.

Telmex, while again exhibiting more marginal changes in its user’s distribution by speed tiers, did record a positive trend of a decline in samples between 0-50 Mbps, with users recording 50-100 Mbps, and 100-300 Mbps both increasing.

Legacy Wi-Fi remains a key limiting factor in the market

While many users subscribe to faster fiber rate plans, their real-world experience can be limited by another factor: the quality of their in-home Wi-Fi network. Data from Q2 2025 shows a significant number of users are still on legacy, slower Wi-Fi standards (Wi-Fi 4 and 5), which can prevent them from realizing the full benefit of fiber broadband performance.

This issue is more prevalent among Telmex and izzi customers. In Chihuahua, 56% of izzi customers and 46% of Telmex customers were using Wi-Fi 4 or worse, compared to just 33% for Totalplay and 38% for Megacable. Conversely, customers of Totalplay and Megacable have much greater access to more modern Wi-Fi CPE. 24% of Totalplay customers in Chihuahua used routers supporting Wi-Fi 6, 6E, or 7, compared to just 2% of izzi customers. A similar pattern is observed in León, where 26% of Totalplay customers utilize more modern Wi-Fi equipment, followed by Megacable with 22%, both far outpacing Telmex with just 6%.

Advanced fiber providers offer QoE performance gains

For demanding applications like online gaming, raw speed is only part of the equation; low latency is paramount for a smooth, responsive experience. Here, the advantage of advanced fiber providers becomes even clearer.

Totalplay delivered the lowest gaming latency in both Chihuahua (66 ms) and León (81 ms), placing it a step ahead of its peers. Megacable also performed well with 77 ms and 91 ms, respectively. In contrast, izzi’s HFC network recorded significantly higher latency, measuring 114 ms in Chihuahua and 127 ms in León, a level that can negatively impact the gameplay for more immersive, latency sensitive games.

This performance advantage extends to other real-time applications, such as video calling, which requires a low latency and jitter for a seamless experience. In Chihuahua, Totalplay consistently provided lower latency for video calls than its competitors in both Q3 2024 and Q2 2025, while both Megacable and Telmex recorded improvements of approximately 10ms. In León, the improvements were less pronounced, with Megacable and Totalplay recording similar latencies, while Telmex was marginally behind, but showing improvement.

Market impact: performance driving customer acquisition

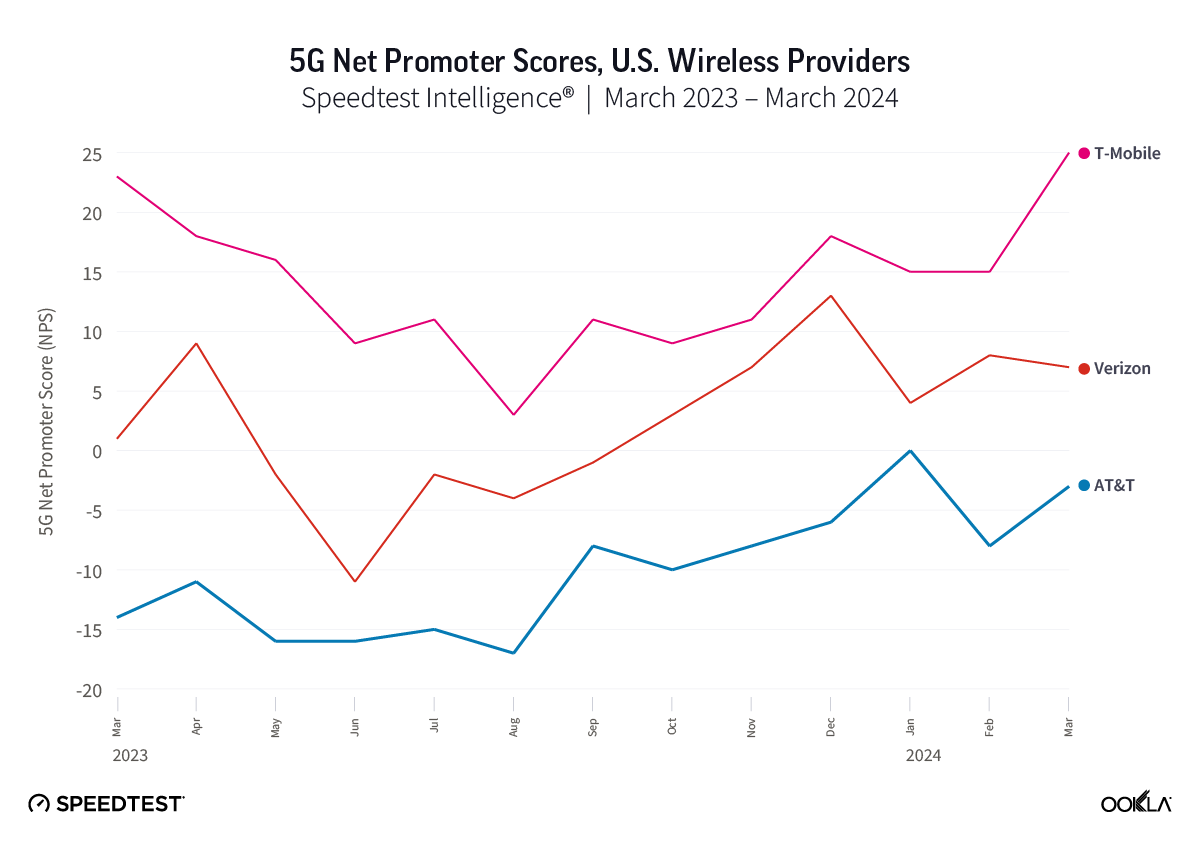

The superior network performance offered by leading ISPs has a direct and measurable impact on customer satisfaction, which in turn drives customer loyalty. When we analyze customer sentiment using Net Promoter Score (NPS), a clear and powerful trend emerges: customers on higher-speed tiers consistently report greater satisfaction.

This trend is remarkably consistent across all major ISPs. For the lowest speed tier (0-50 Mbps), every provider recorded a deeply negative NPS, with an average of -41. In stark contrast, sentiment becomes strongly positive for the highest speed tiers. For customers on plans over 300 Mbps, NPS scores climb +49 on average. This demonstrates that faster connectivity is not just a technical specification but a key driver of a more positive and valued customer experience.

Ultimately, customer satisfaction—or lack thereof—is a strong predictor of customer loyalty. When this satisfaction data is viewed alongside customer migration patterns, the market dynamics become even clearer. Looking across the Mexican market, net flow analysis of Speedtest users between Q3 2023 and Q1 2025 shows a consistent pattern of customer churn away from izzi, which posted losses of 11.1%, 11.5%, and 10.2% across the three periods analyzed. Izzi, which has not pursued fiber in the same way as the three other ISPs, is clearly seeing customers opt for more advanced fiber alternatives in the market, with Megacable, Telmex, and Totalplay net recipients. Of the three predominantly fiber ISPs, Totalplay and Megacable consistently recorded net customer gains.

Net flow of Speedtest users, Mexico

Speedtest data, H1 2024 – H1 2025

Market outlook: pressure on ISPs to cater to demand for improved performance

The competitive landscape in Mexico’s fixed broadband market will continue to be defined by the performance of fiber networks. As fiber deployments continue to mature, ISPs will have to carefully manage their customer bases, looking to balance speed tier upgrades with consumer price elasticity. They should not ignore key quality of experience indicators, and other performance bottlenecks such as outdated Wi-Fi CPE, all of which can impact consumer sentiment, and churn. Addressing this challenge by pairing advanced fiber networks with modern Wi-Fi 6 or 7 CPE—as Totalplay has begun to do —will be critical for monetizing network investments and meeting the expectations of a consumer base that is actively migrating to faster, higher-quality service tiers.

Subscribe to Ookla Research for regular insights into global network performance trends.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.