Key messages:

- Fixed performance in Indonesia continues to lag behind regional peers. While Indonesian fixed broadband network performance continues to improve quarter over quarter, Ookla® Speedtest Intelligence® shows that Indonesia lags behind many of its regional peers on key metrics such as median download speed and the penetration of more advanced routers supporting 5 GHz Wi-Fi, and this disparity is growing.

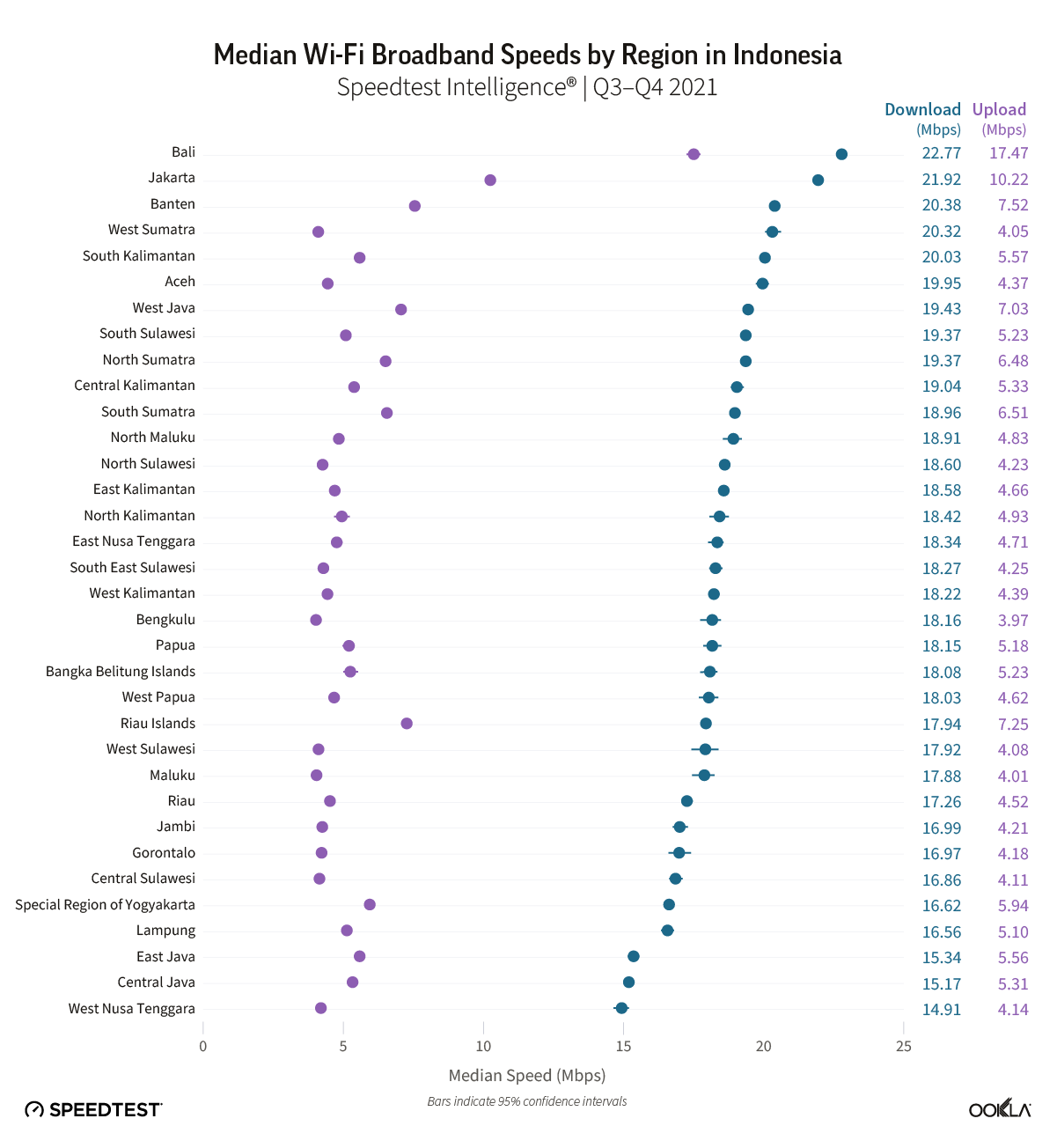

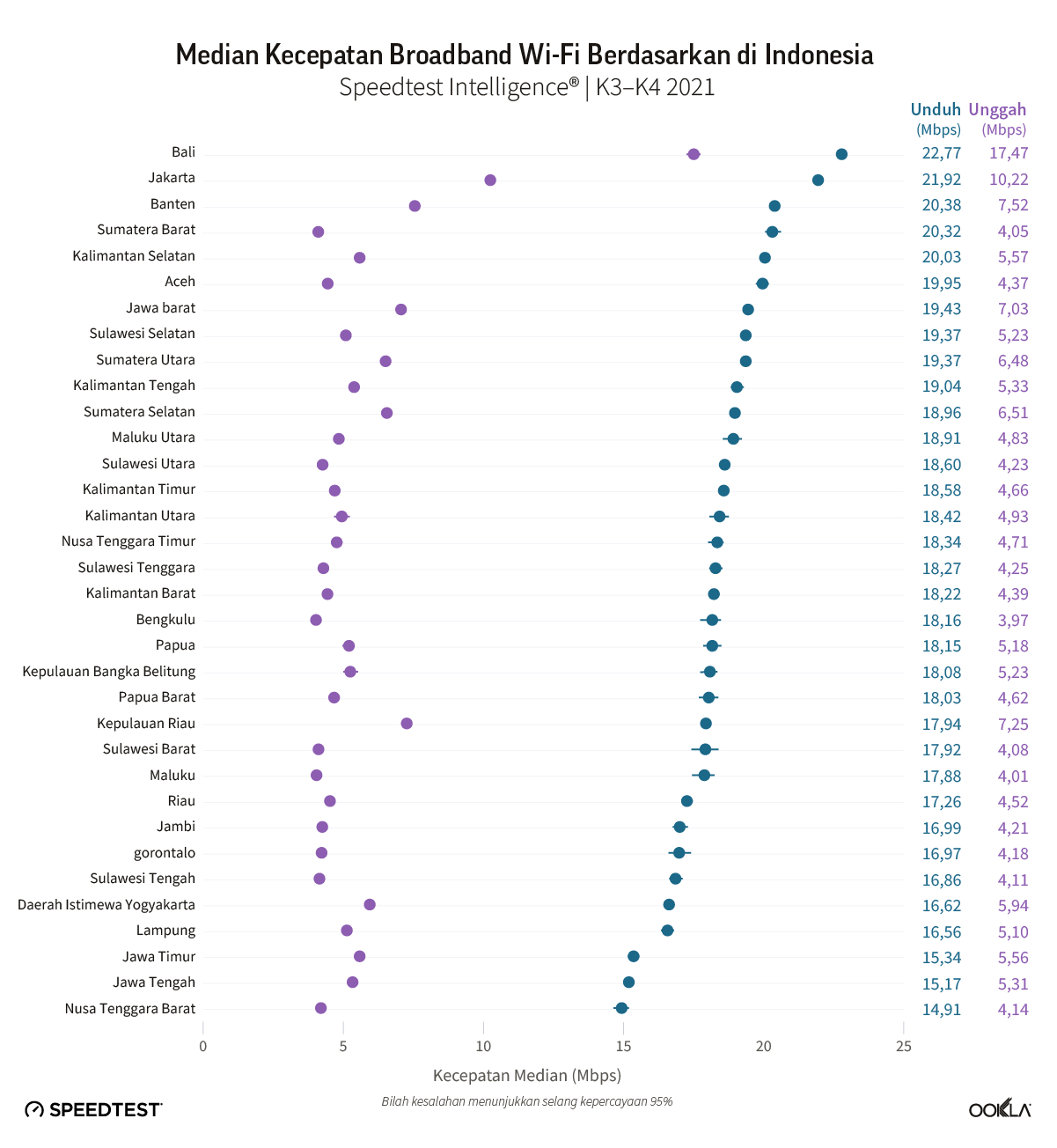

- East and Central Java among the slowest performing Indonesian regions. Most regions of Indonesia achieve similar median download speeds. However there remain outliers: Bali was the top-performing region, and the more populous regions of East and Central Java continued to record some of the slowest performance in the market.

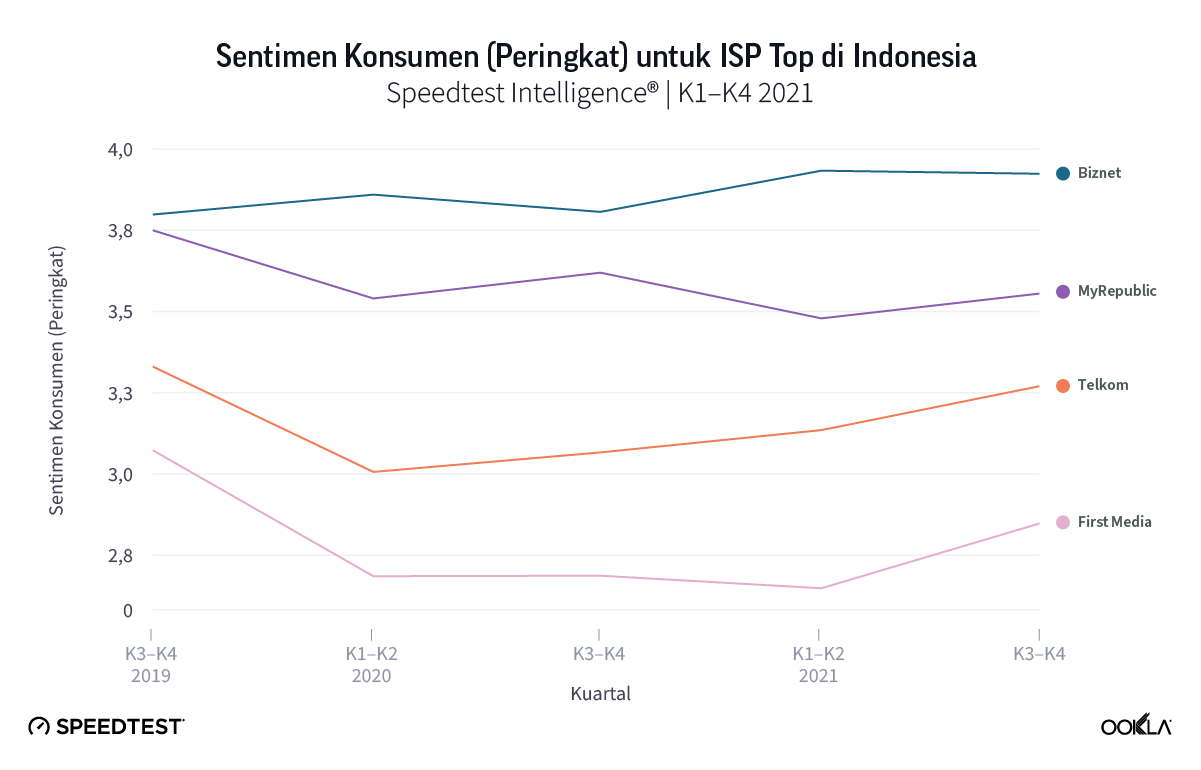

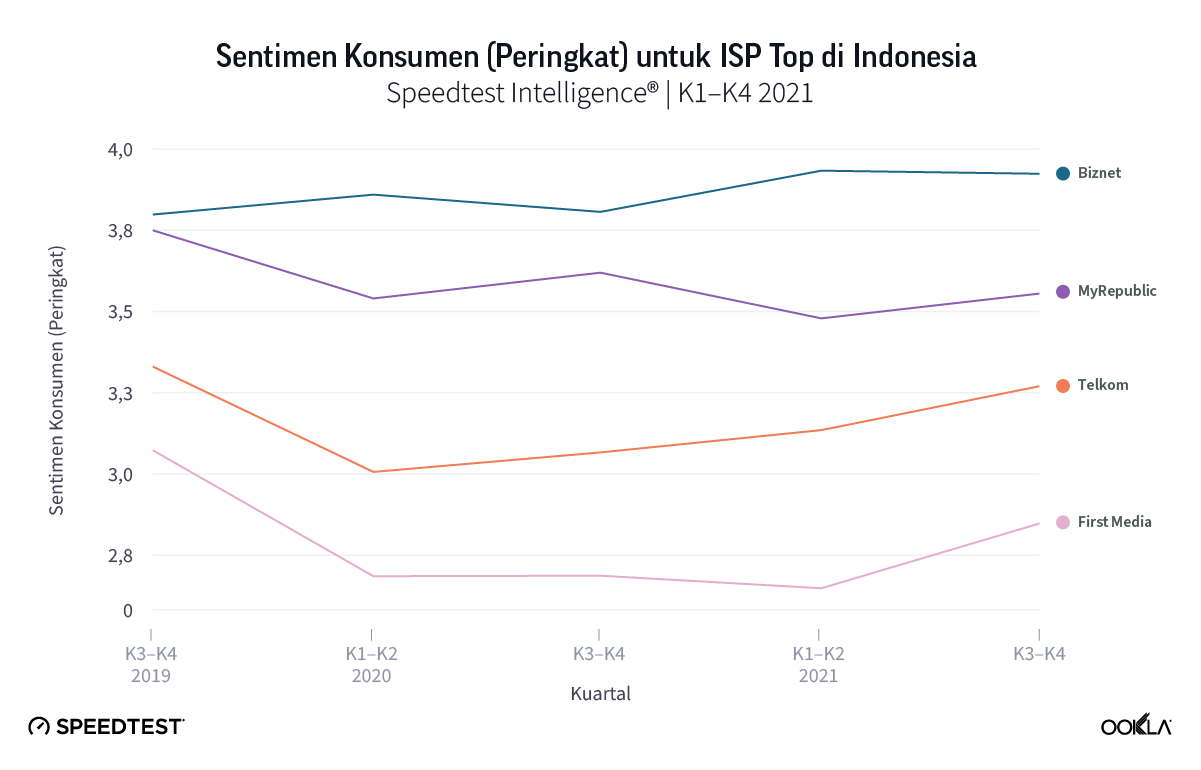

- Faster speeds equal happier customers. Consumer sentiment towards fixed broadband providers in Indonesia, as measured by Ookla’s 5-Star Rating, tracks closely with network performance over the past year.

- Competition ramps up in the Indonesian fixed broadband market. Speedtest Intelligence® sample data for Q3-Q4 2021 shows 306 ISPs active in the market. Of these, four major national network operators meet our threshold to be considered top providers (with a minimum of 3% of samples) — Telkom, First Media, MyRepublic, and Biznet. At a regional level, this list of top providers expands to ten, including CBN, MNC Play, StarNet, PT Global Media Data Prima, MTM Bali, and GlobalXtreme.

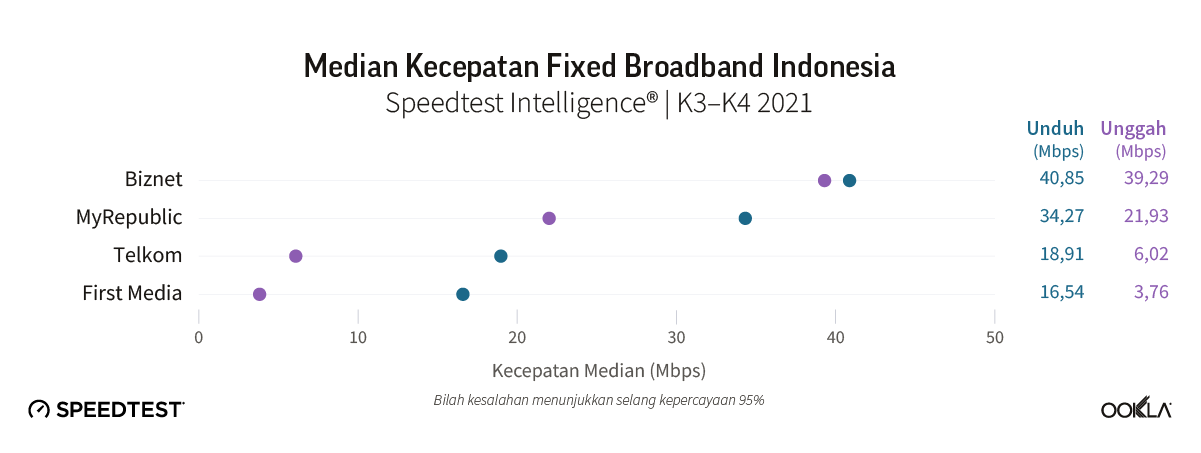

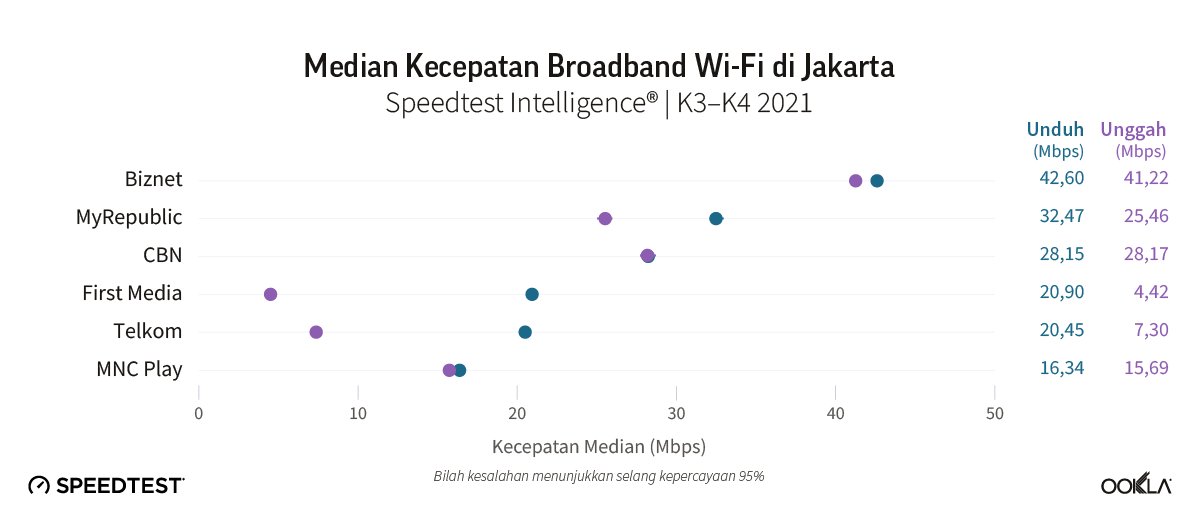

- Biznet leads the market in fixed broadband network performance according to Speedtest Intelligence. Biznet is the leading operator both nationally and in many of Indonesia’s regions, achieving almost symmetrical download and upload speeds.

Singapore leads in fixed broadband network speeds in Southeast Asia

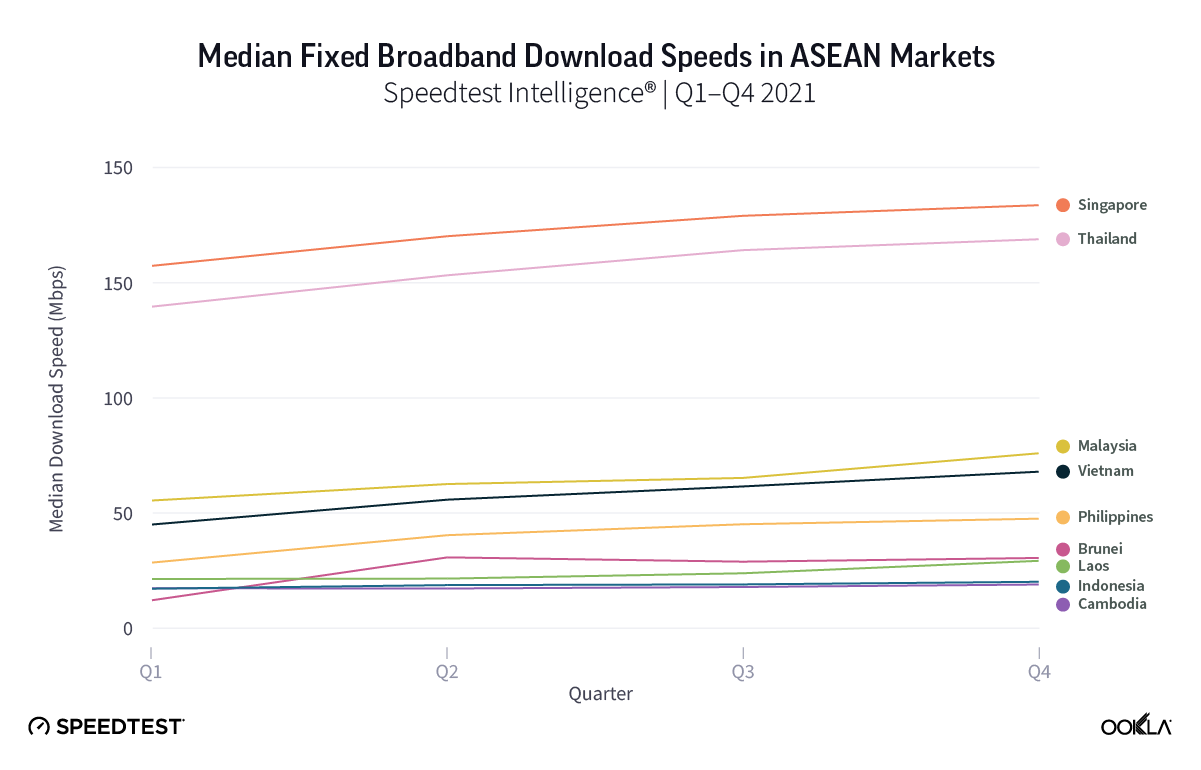

Indonesia ranks 114th on the Speedtest® Global IndexTM for median fixed download speeds, based on data for May 2022. According to Speedtest Intelligence, fixed broadband speeds in the country have increased over the past year, from a median download speed of 17.37 Mbps in March 2021 to 21.23 Mbps in March 2022. Fixed broadband upload speeds in the market have improved by a greater margin, from 4.95 Mbps in March 2021, to 9.73 Mbps in March 2022. However, as with its mobile market, and despite its improving trajectory, Indonesia’s fixed broadband performance continues to lag behind many of its regional peers.

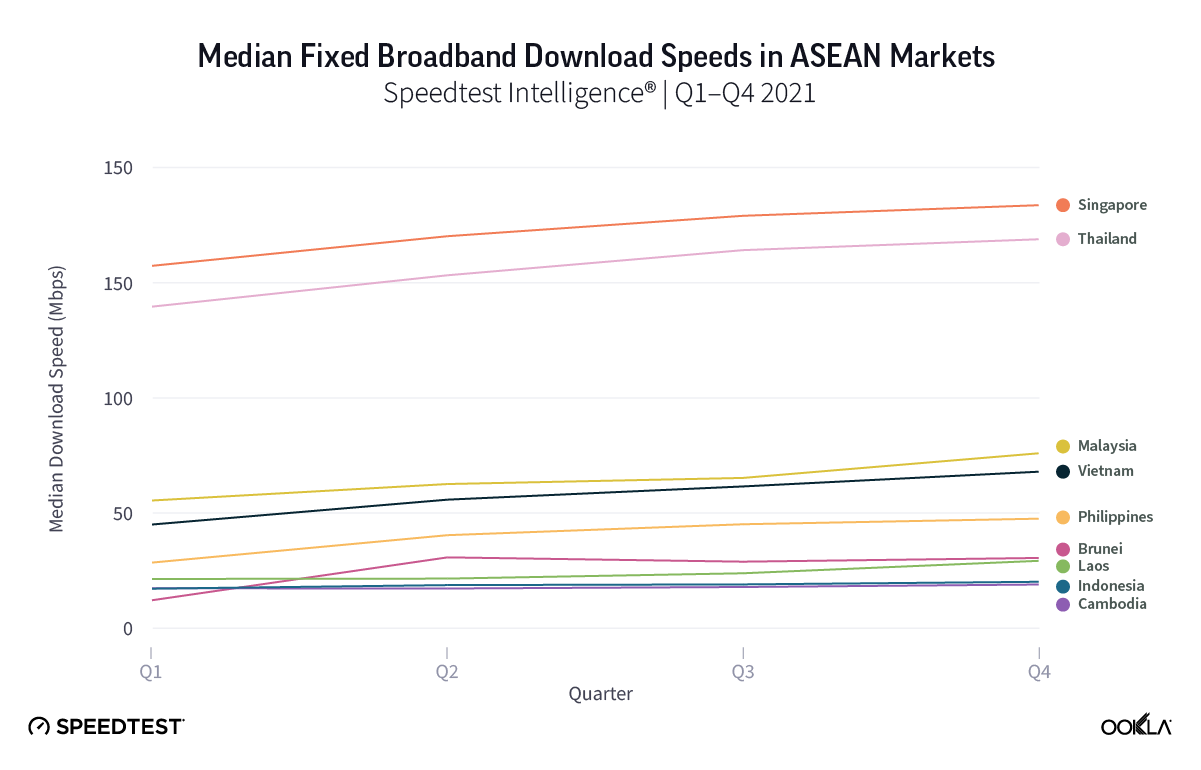

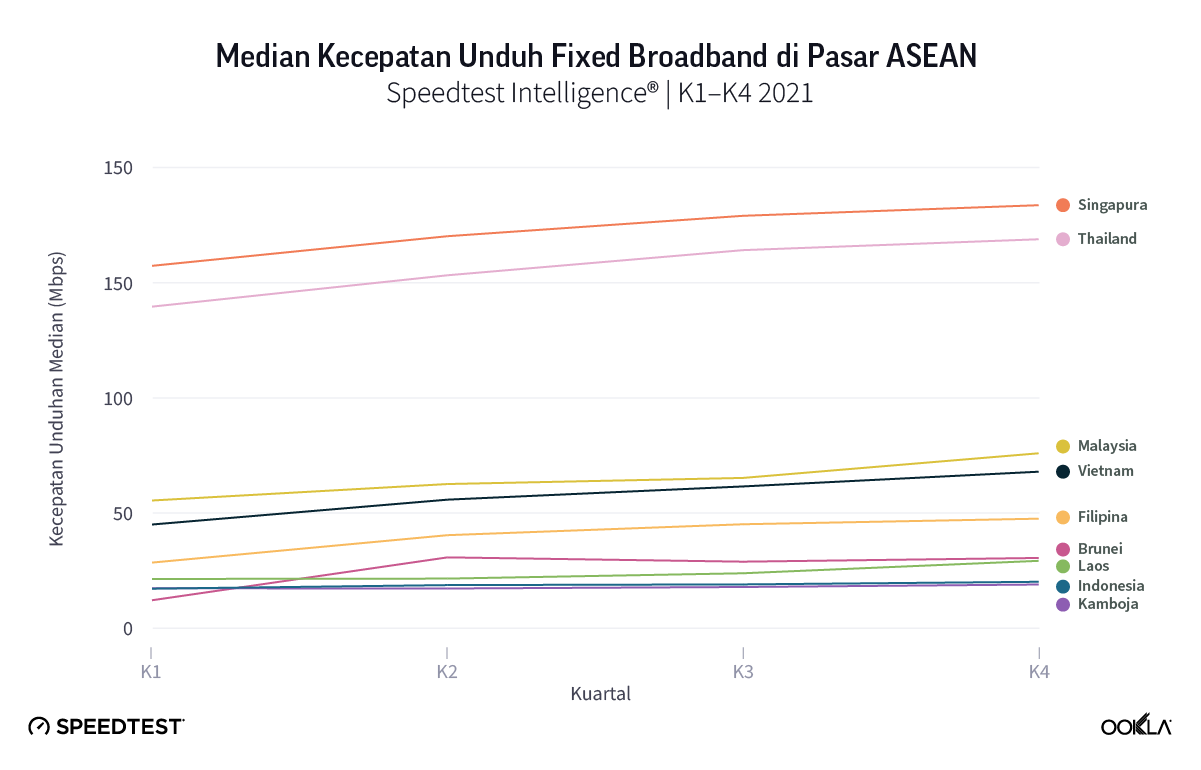

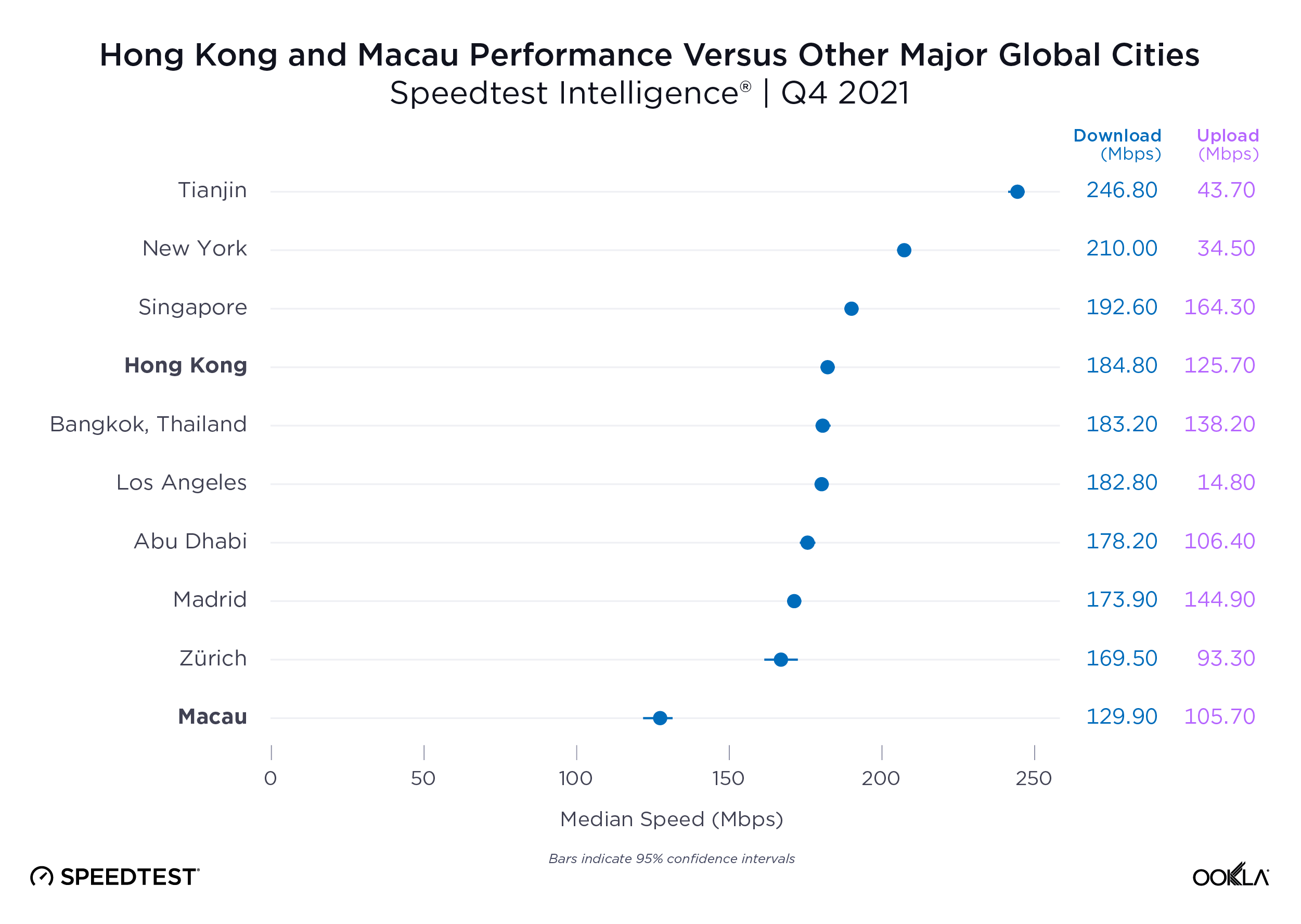

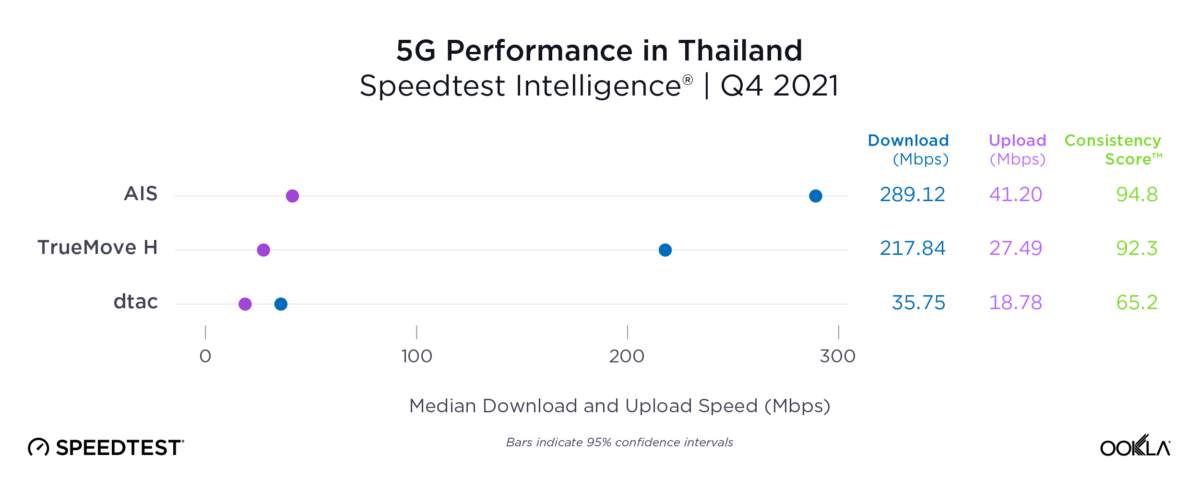

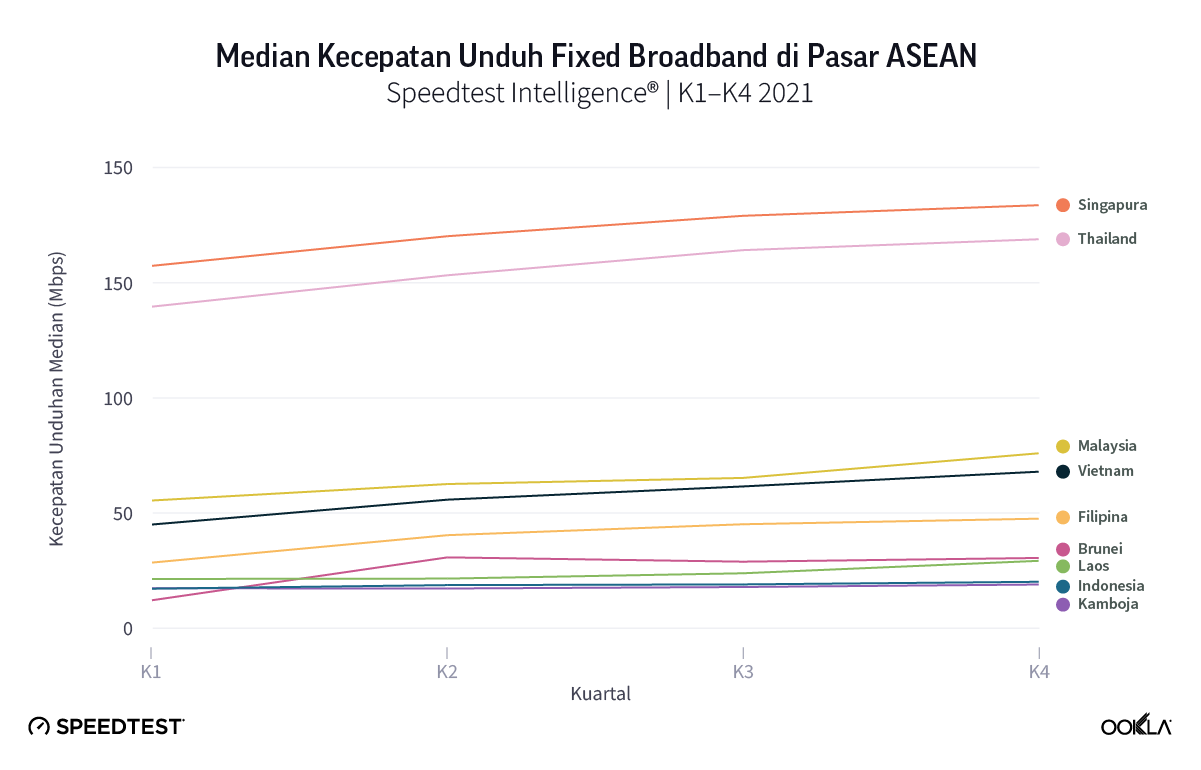

Looking at performance across 2021 in Southeast Asian markets, Singapore and Thailand continue to maintain a sizable performance gap compared to their regional peers, with both achieving median fixed broadband download speeds in excess of 150 Mbps during Q4 2021. There was also clear separation in performance between Malaysia (75.91 Mbps), Vietnam (67.91 Mbps), and the Philippines (47.50 Mbps). Of the remaining four markets, Brunei and Laos achieved speeds of close to 30 Mbps, while Indonesia and Cambodia were the slowest fixed-line markets, recording median download speeds of 20.08 Mbps and 18.89 Mbps respectively.

We used data from Speedtest Intelligence to evaluate fixed broadband performance in Indonesia during Q3-Q4 2021. Our analysis examines fixed broadband speeds at the country and provider-level. We also examine Wi-Fi performance as a subset of total fixed broadband samples in order to assess the speed delivered to end-user devices and look at the share of samples that utilize routers that support 5 GHz over Wi-Fi.

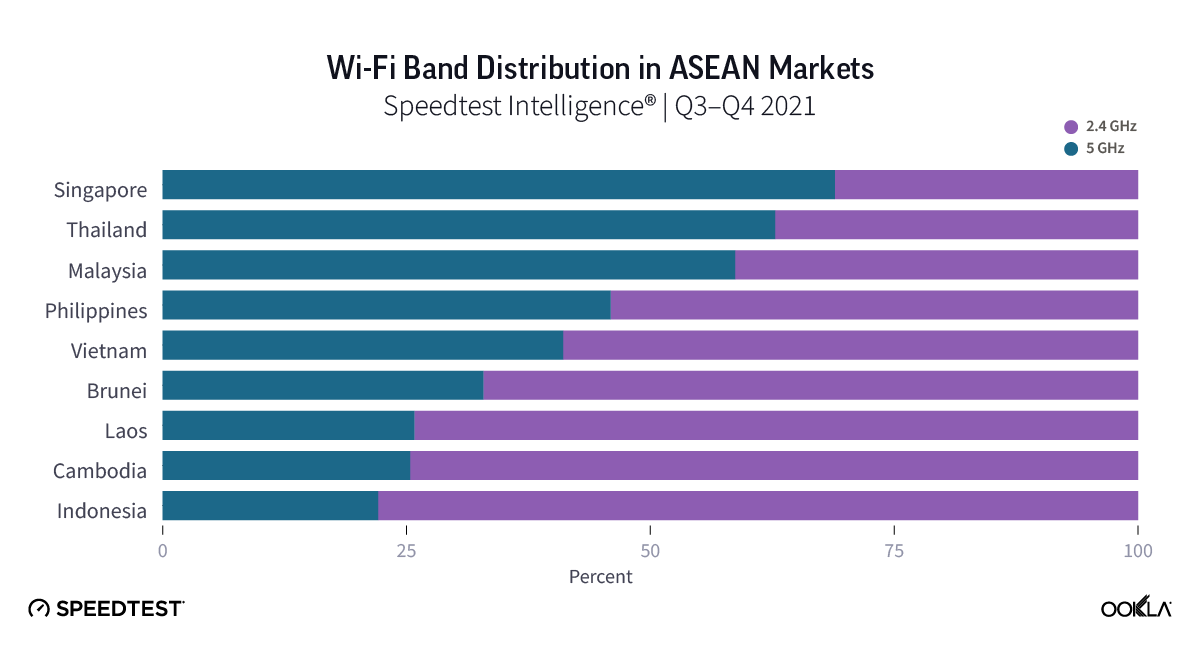

Operators worldwide are increasingly offering home networking solutions in order to help improve Wi-Fi speeds and coverage within the home. In Indonesia, First Media, Biznet, and MyRepublic offer mesh networking solutions, while some ISPs also offer the option to upgrade to routers that support the 5 GHz band. This offers greater channel bandwidth and typically lower interference than Wi-Fi over the 2.4 GHz band, allowing for improved performance for high bandwidth activities such as gaming and streaming high definition video content.

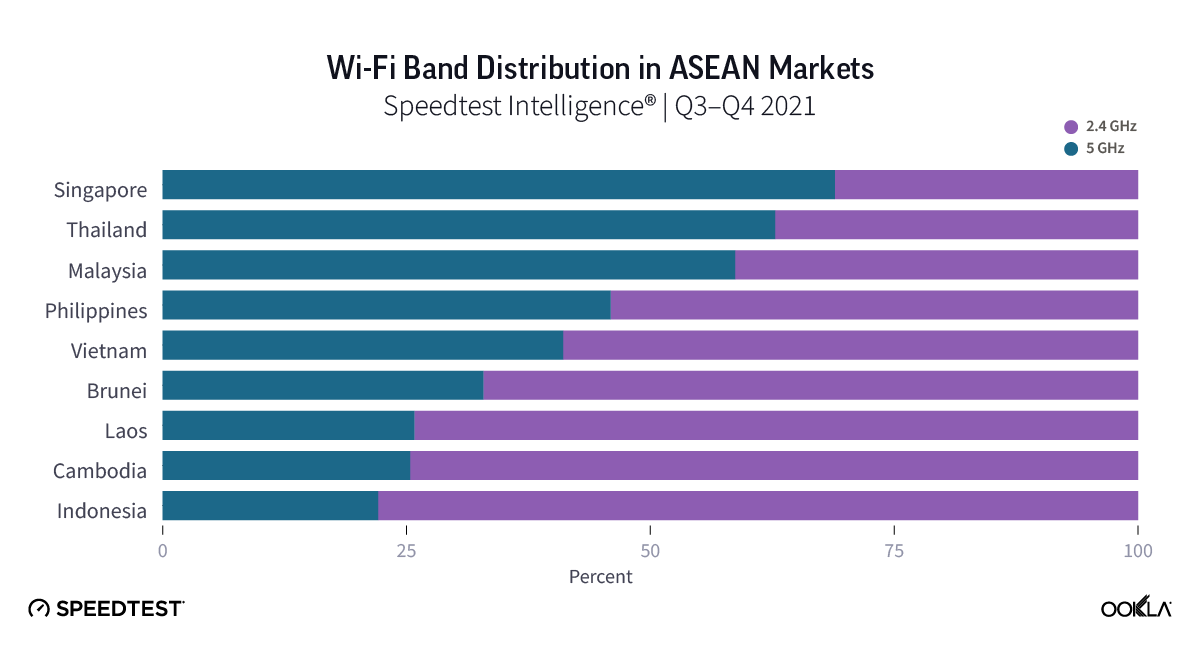

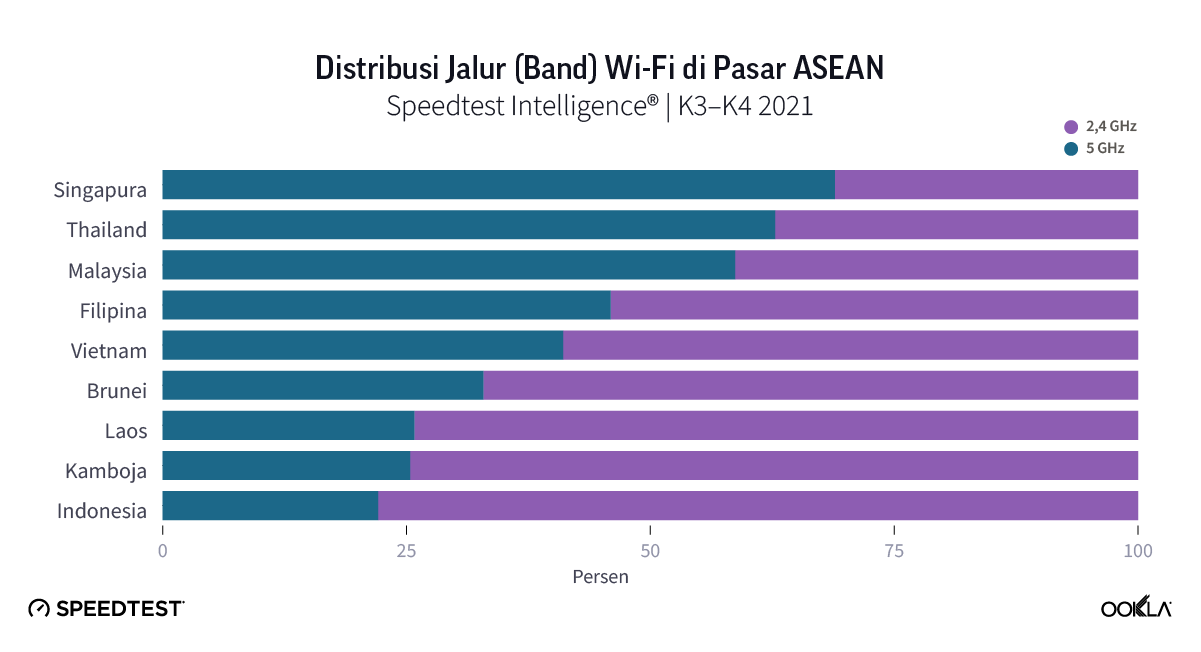

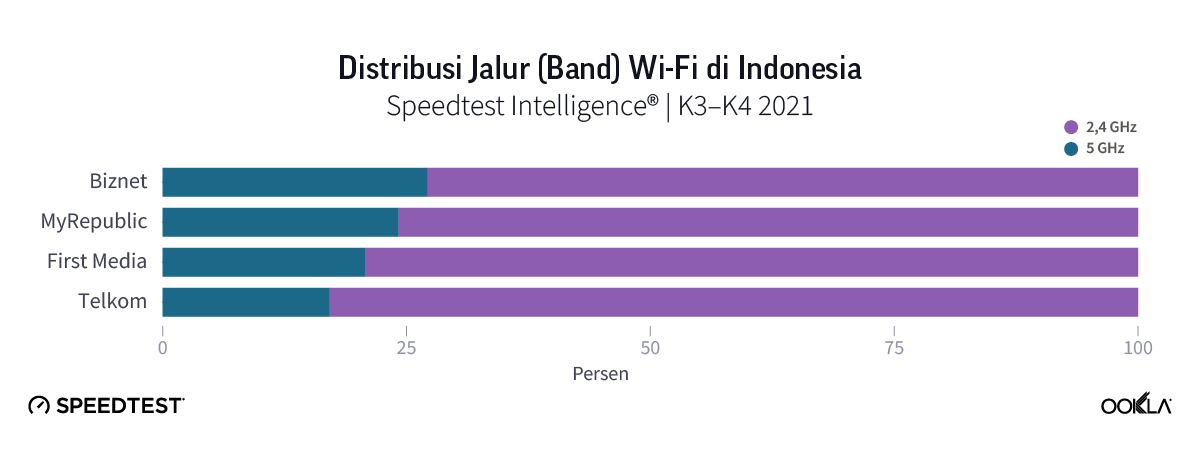

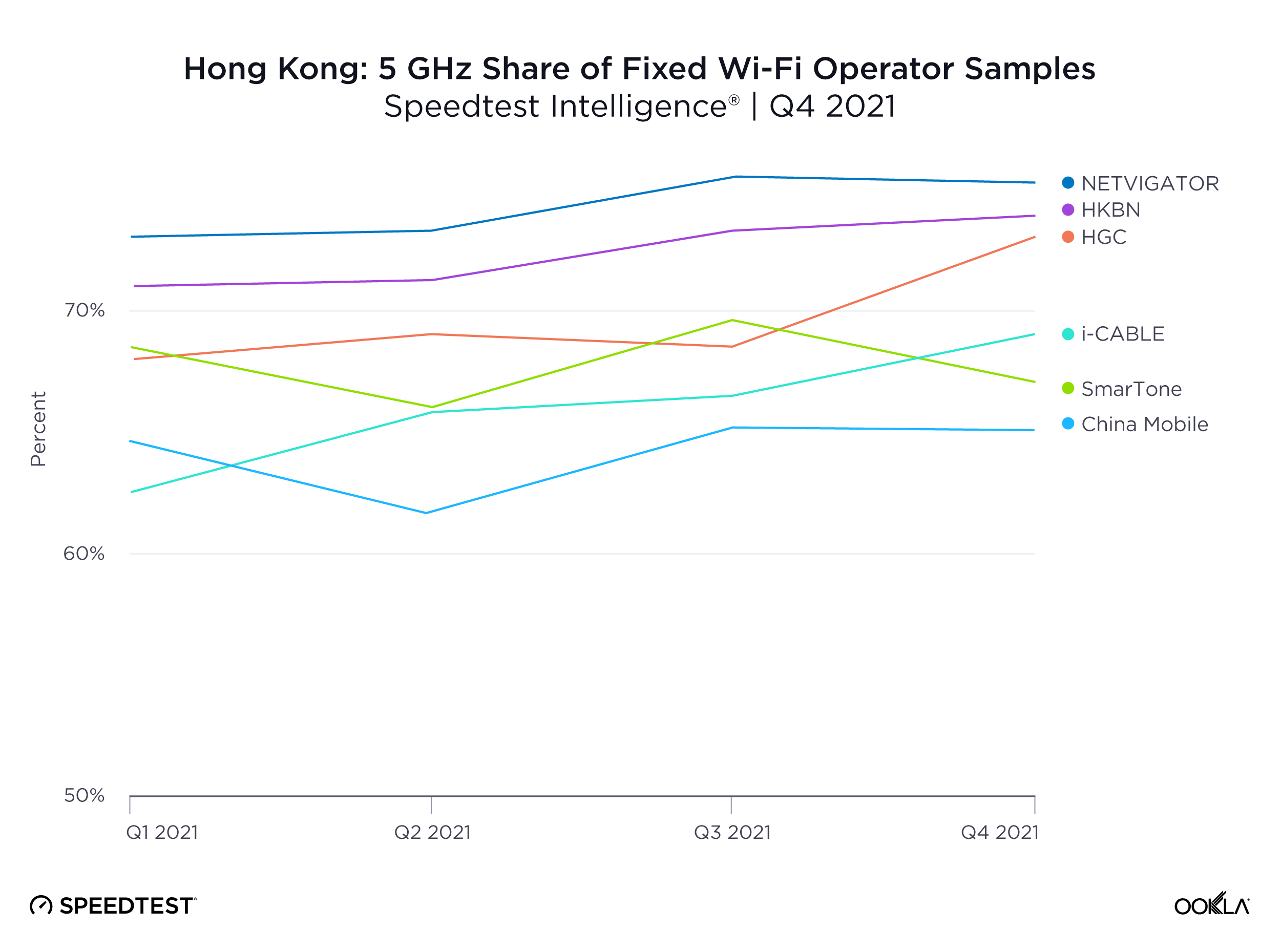

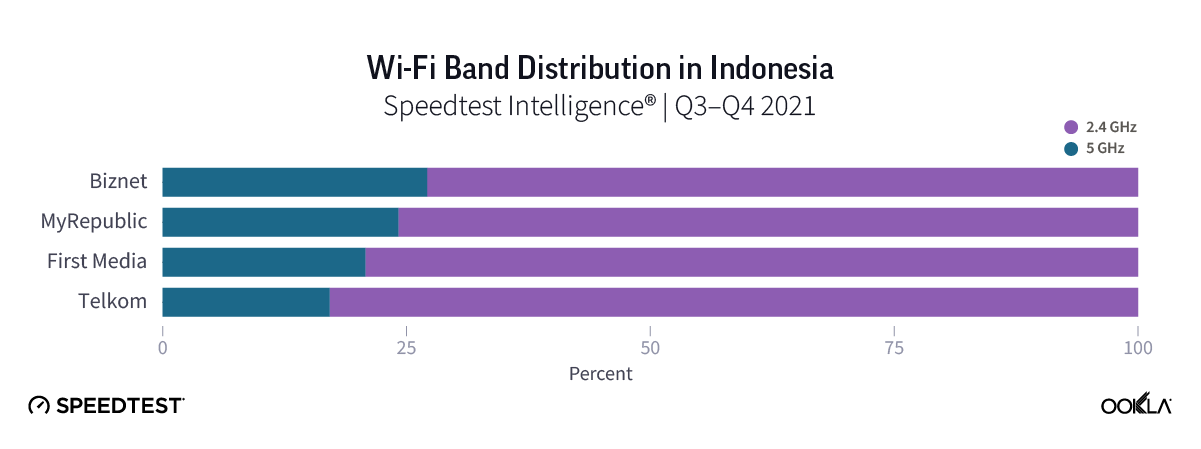

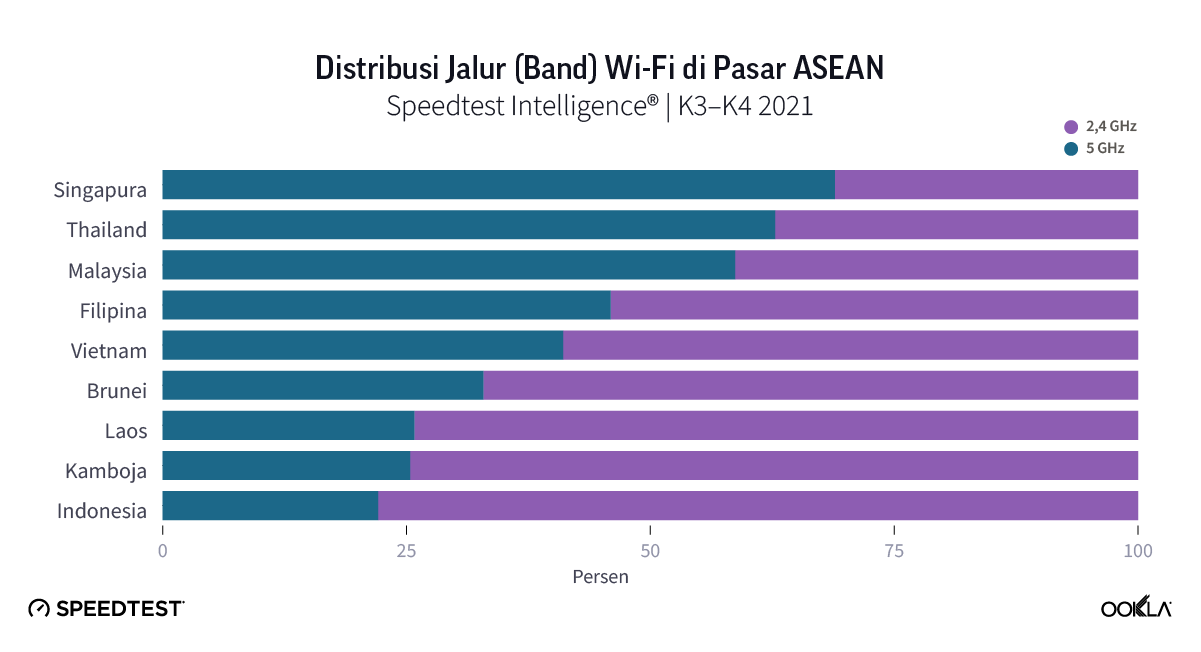

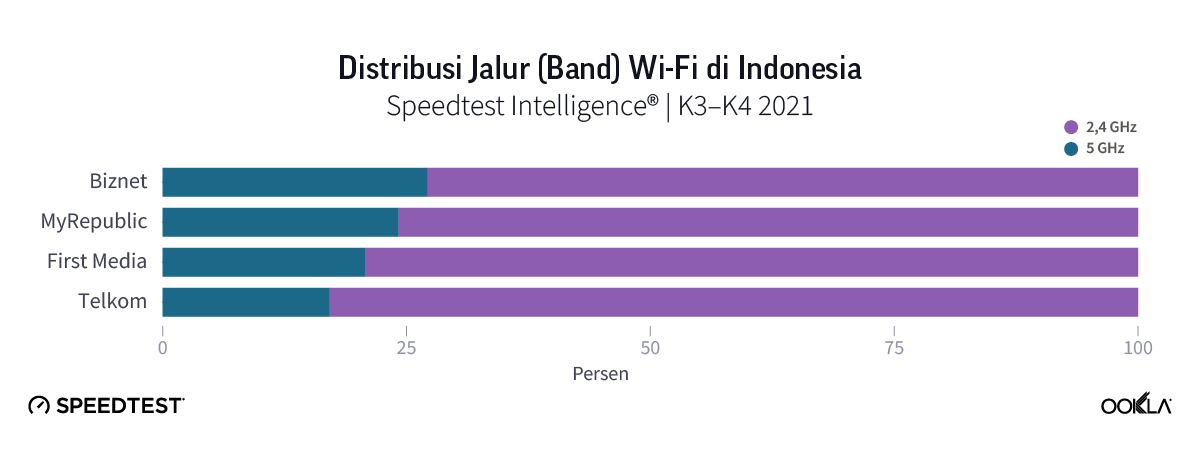

Looking at the distribution of fixed Wi-Fi Speedtest samples run over 2.4 GHz versus 5 GHz Wi-Fi connections, regional leaders Singapore and Thailand are joined by Malaysia as the only markets on this list with a majority of samples recorded using 5 GHz. Indonesia again came last with 5 GHz connections accounting for only 22% of samples.

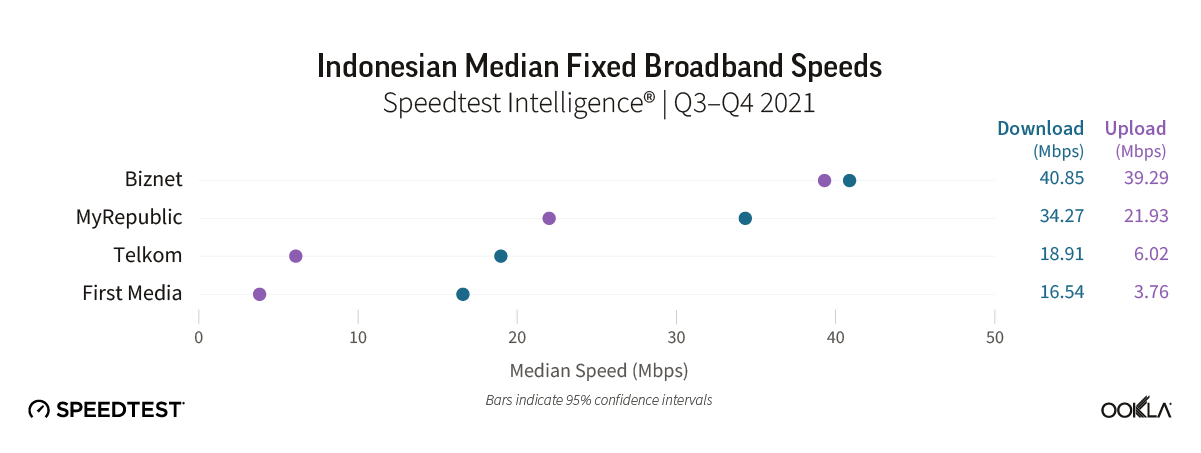

Biznet leading in Indonesia nationwide fixed broadband download speed

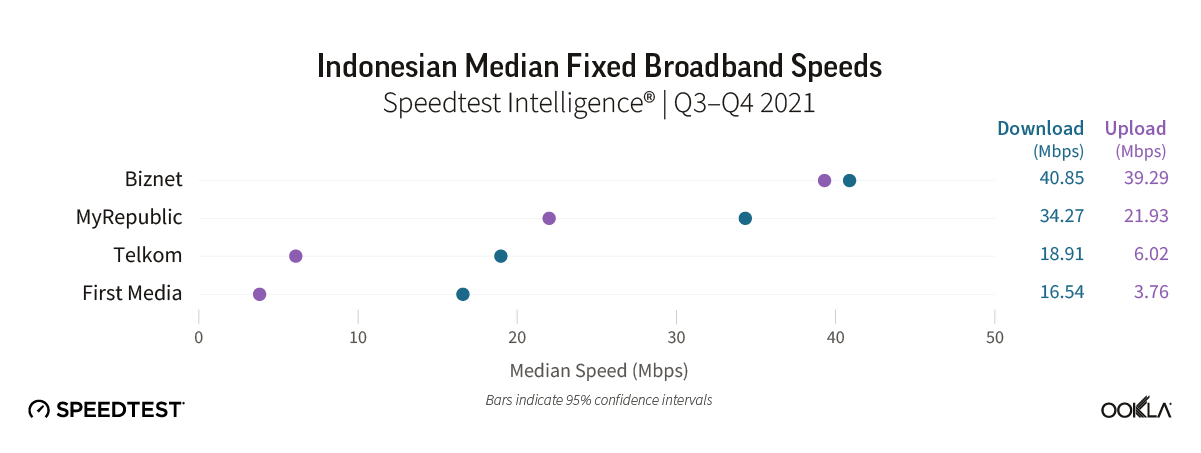

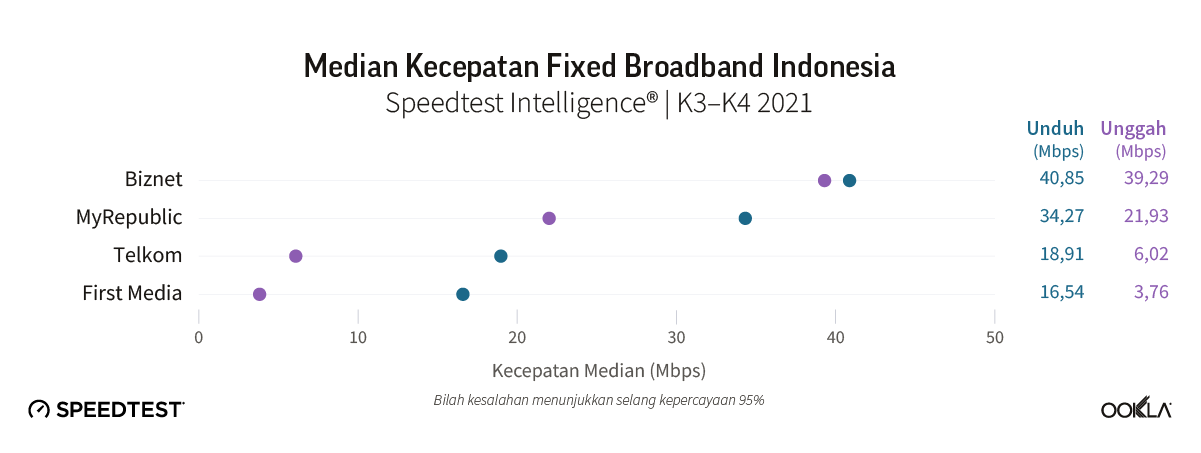

Our statistical methodology sets a minimum threshold of 3% of samples for an operator to be considered a top provider and part of our analysis. Using this methodology, Biznet was the fastest fixed broadband operator for both median download and upload speeds in Q3-Q4 2021, followed by My Republic. Biznet attained almost symmetrical results of 40.85 Mbps download and 39.29 Mbps upload, with My Republic achieving 34.27 Mbps download 21.93 Mbps upload. As of May 2022, Biznet’s fiber optic network extends to a total of more than 64,000 km, with its access network currently passing over 1.46 million households. In a bid to compete more aggressively with Telkom’s IndiHome service, Biznet launched an IPTV service in February 2020. The remaining two national ISPs, Telkom and First Media, lagged behind, achieving median download speeds of 18.91 Mbps and 16.54 Mbps respectively.

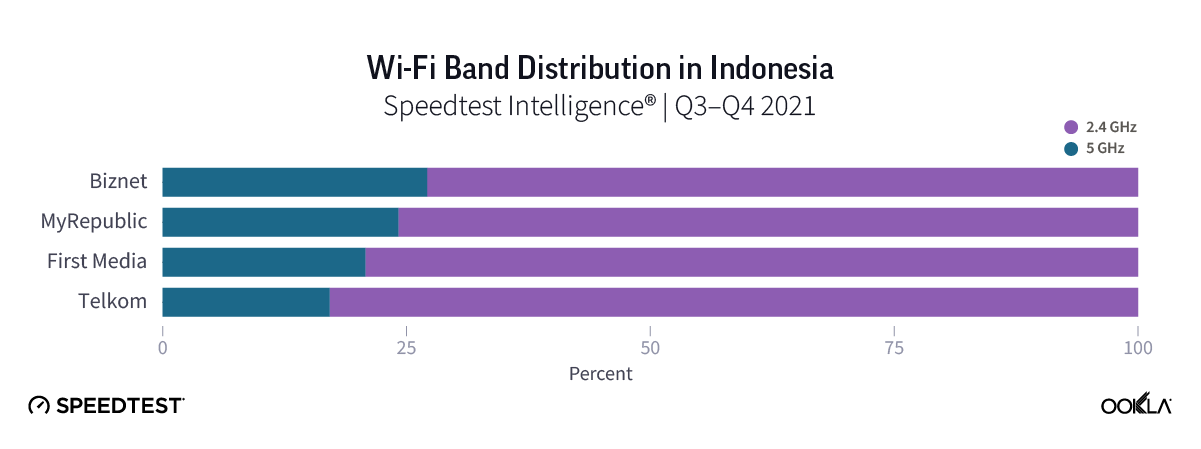

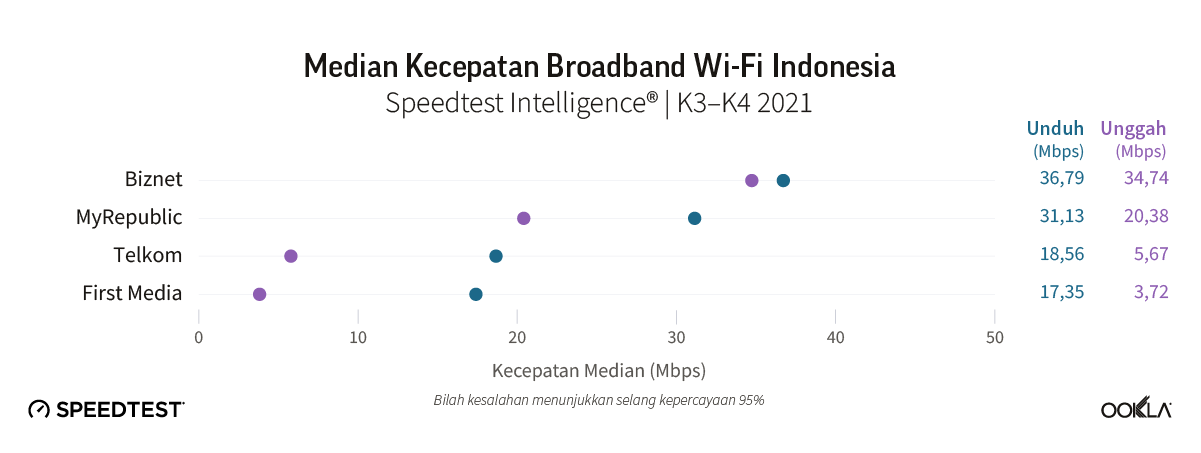

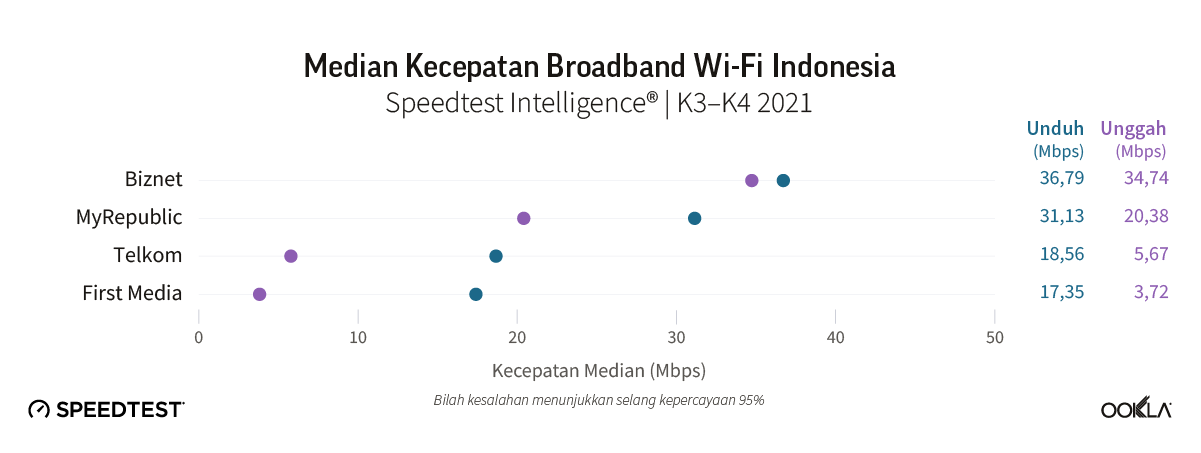

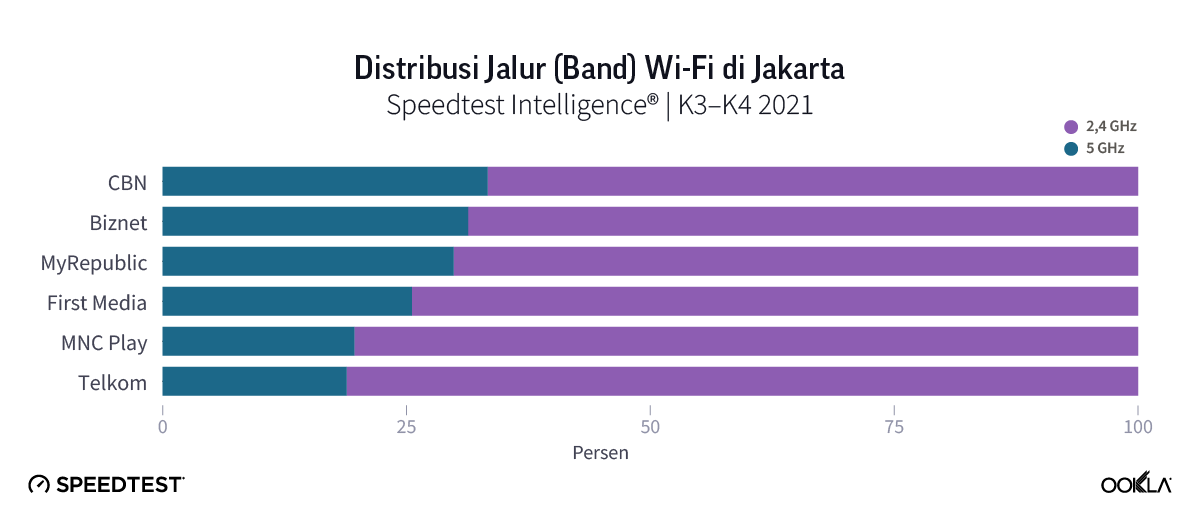

Looking at the split of samples from 2.4 GHz versus 5 GHz Wi-Fi connections shows some divergence between the market leaders, Biznet and MyRepublic and First Media and Telkom. However, all four fixed broadband operators recorded in excess of 70% of tests using 2.4 GHz Wi-Fi connections. If we look at Wi-Fi performance in Indonesia as a subset of total fixed broadband samples, then a similar picture emerges, with Biznet and My Republic outperforming both Telkom and First Media.

Consumer sentiment tracks network performance

There is a clear positive correlation between fixed network performance and consumer sentiment within the Indonesian fixed broadband market. Based on the mean of Speedtest 5-Star Ratings in the market, Biznet was the top-rated fixed operator in Q3-Q4 2021 with a score of 3.9, while First Media placed last with a score of 2.8.

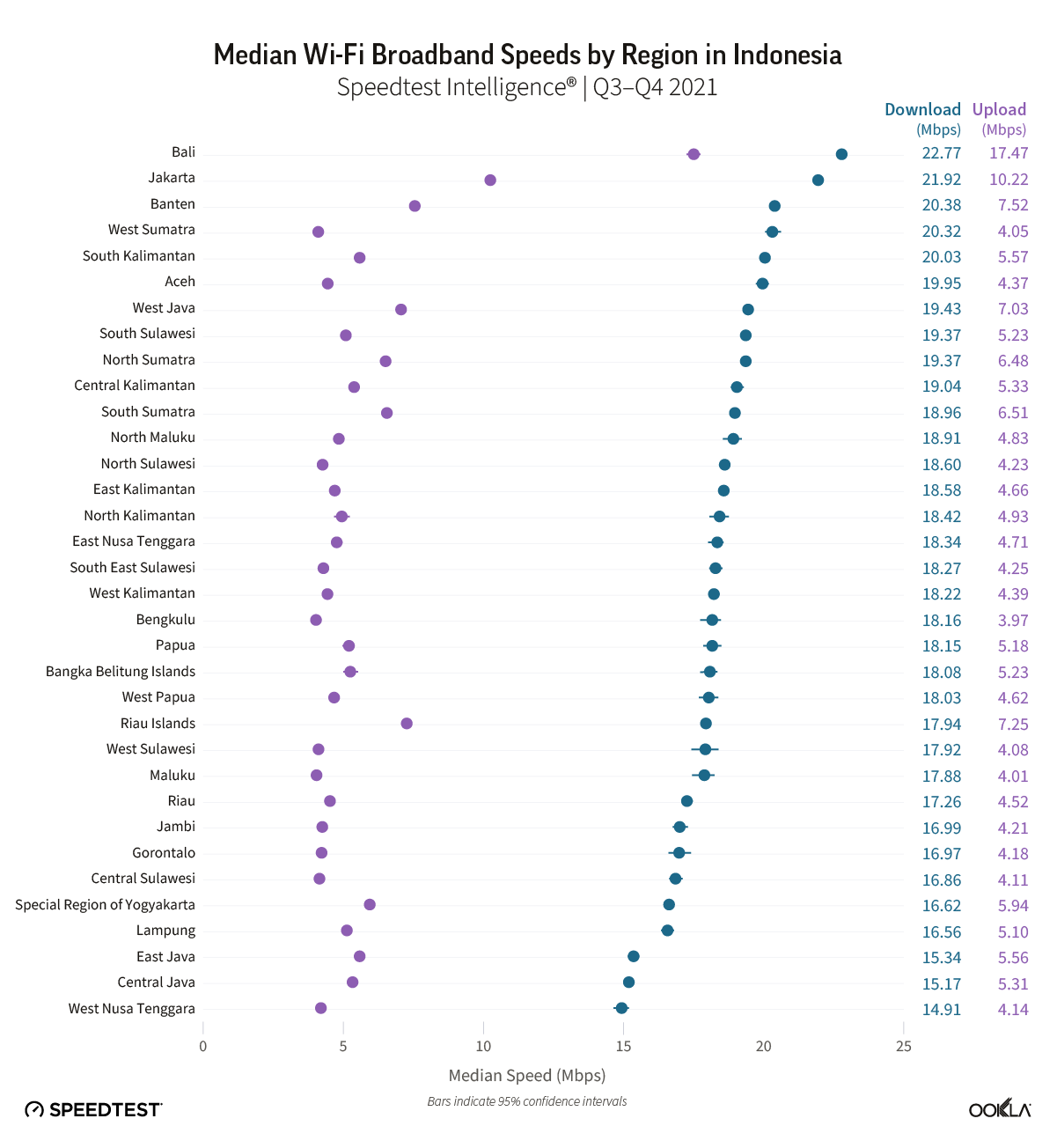

Regional disparities in fixed broadband download speeds over Wi-Fi persist

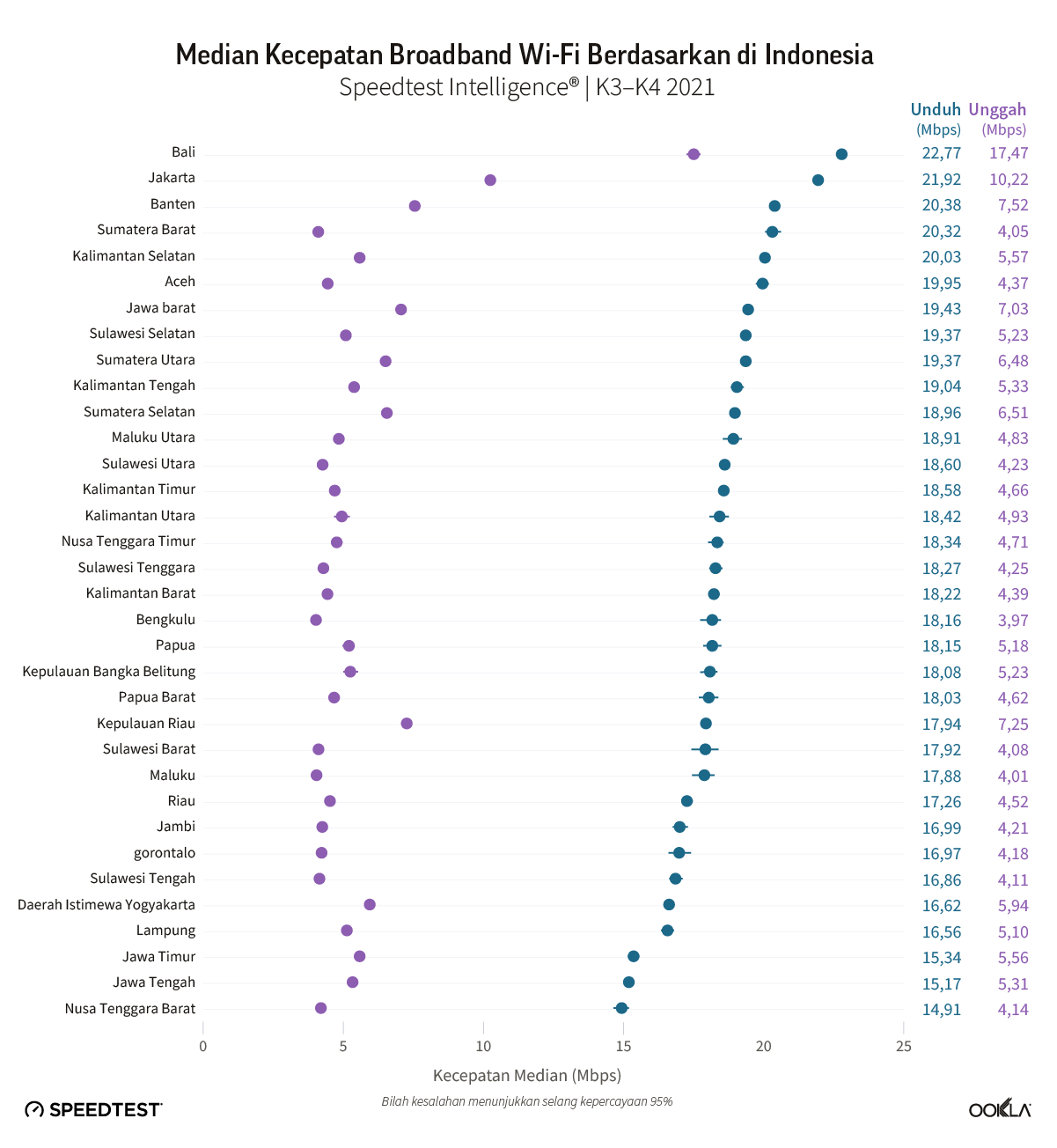

Despite the Indonesian Broadband Plan’s goal to improve speeds across Indonesia, some regional disparities in median download and upload speeds persist. For a broad section of Indonesia’s regions, download speeds show little variation, ranging between 16 Mbps and 20 Mbps. There are however outliers. Tourist hotspot Bali, which has also emerged as a popular destination for digital nomad workers, and the Indonesian capital Jakarta occupied the top two positions nationally during Q3-Q4 2021, with download speeds of 22.77 Mbps and 21.92 Mbps respectively.

At the other end of the scale, two of the country’s most populous regions, East and Central Java, scored some of the lowest median download speeds at 15.34 Mbps and 15.17 Mbps, respectively. Upload speeds across the market show much more variation, ranging from a high of 17.47 Mbps in Bali, to a low of 3.97 Mbps in Bengkulu.

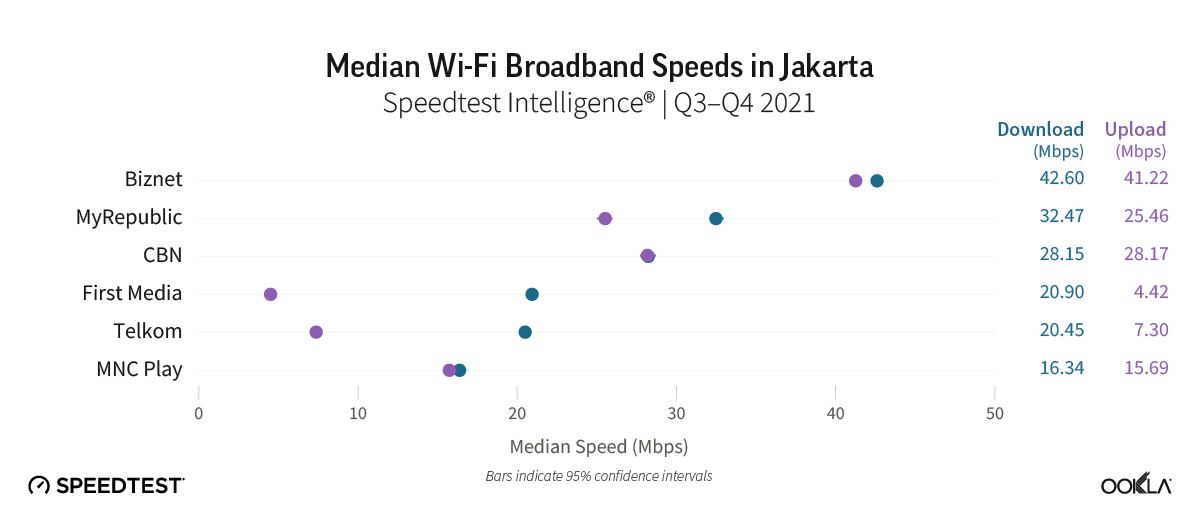

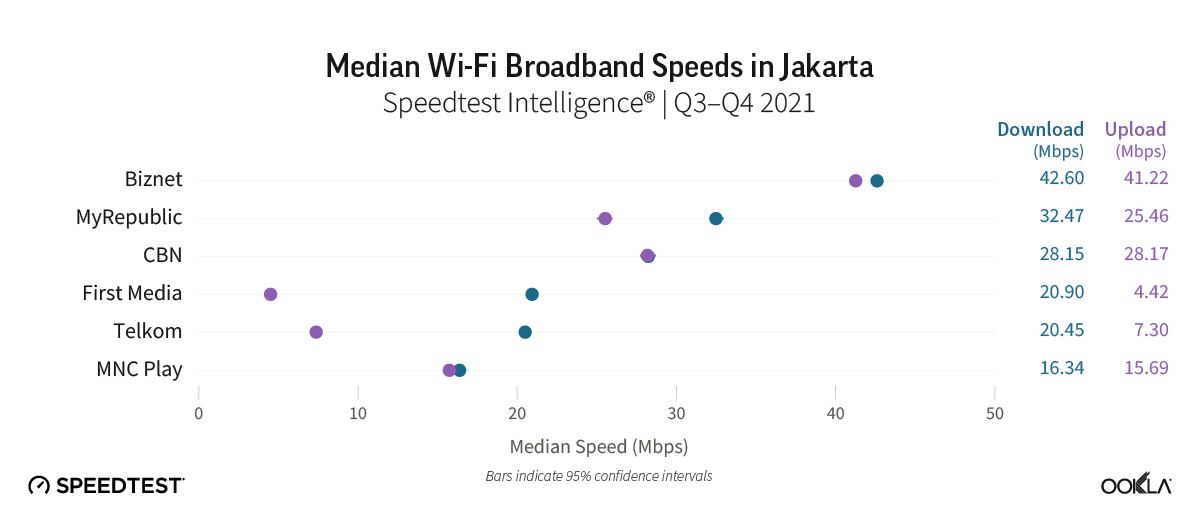

Biznet leading in Jakarta Region for Wi-Fi download speeds

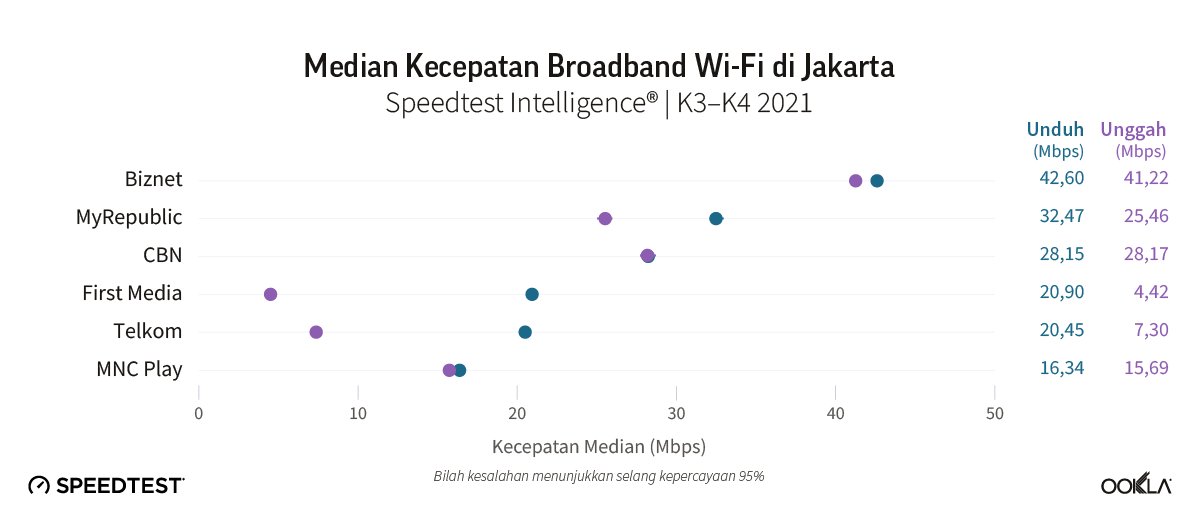

Biznet was the fastest fixed provider in the Indonesian capital Jakarta during Q3-Q4 2021, recording near symmetrical speeds for median download (42.59 Mbps) and upload (41.22 Mbps). It was followed by MyRepublic, with a download speed of 32.47 Mbps and upload of 25.46 Mbps, and CBN which also achieved symmetrical speeds at about 28 Mbps. Wi-Fi performance for the remaining three providers, First Media, Telkom, and MNC Play lagged behind, with First Media and Telkom recording upload speeds well below the competition, both below 10 Mbps.

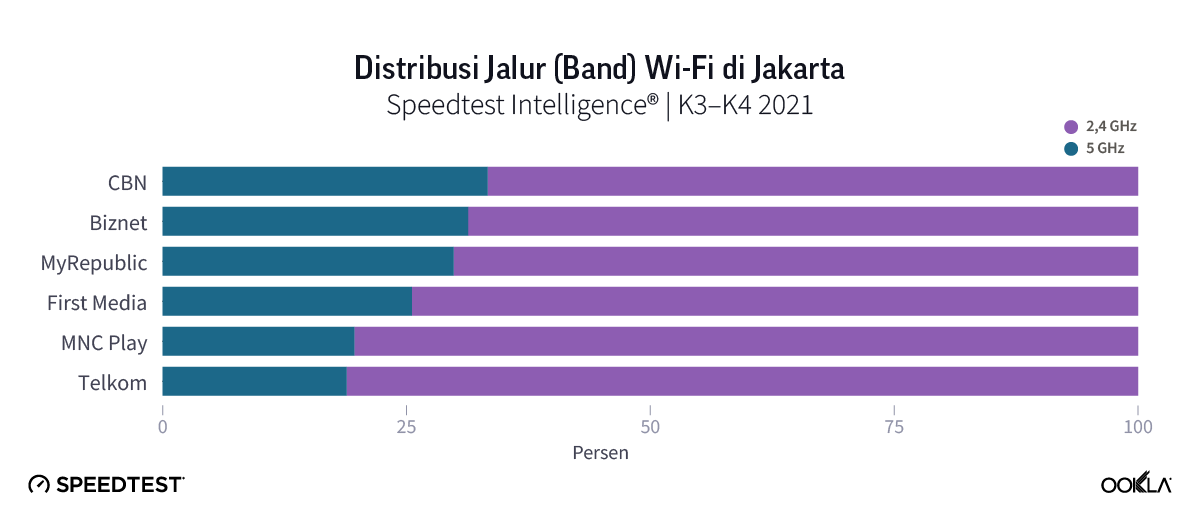

One in three Speedtest samples for provider CBN utilized 5 GHz Wi-Fi, the largest share of any operator in Jakarta. Biznet, MyRepublic and First Media followed, while Telkom and MNC Play showed the lowest share of samples using 5 GHz Wi-Fi.

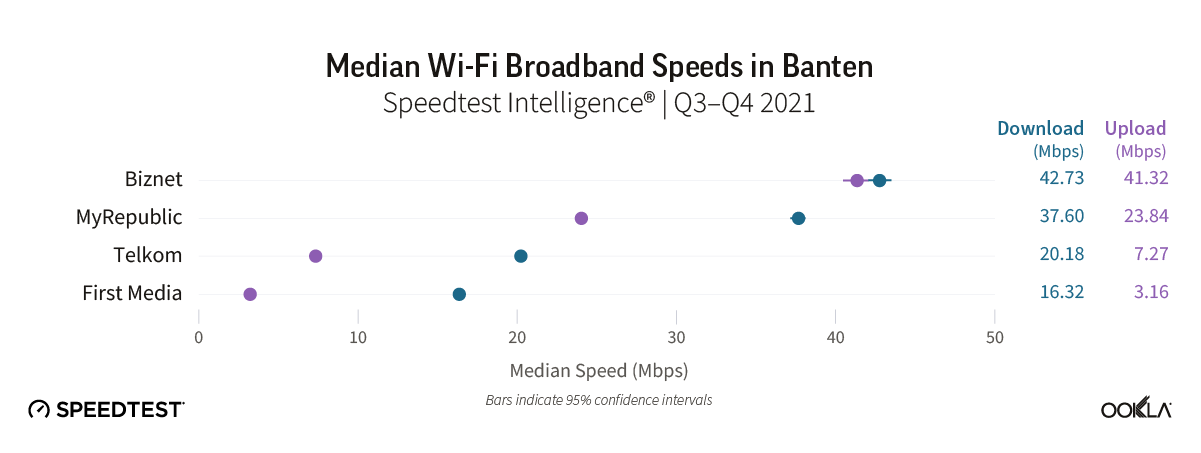

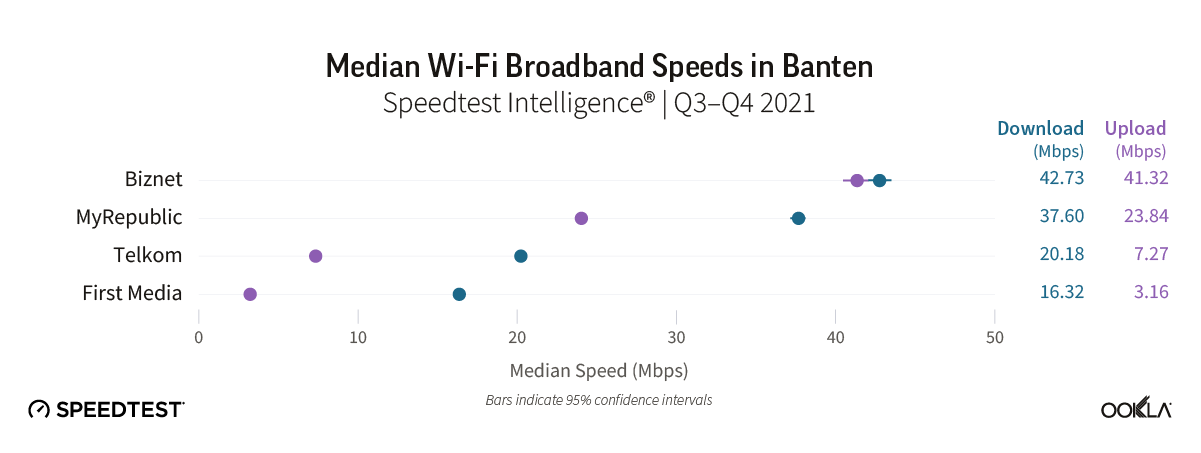

MyRepublic leading in Banten Region fixed broadband download speed over Wi-Fi

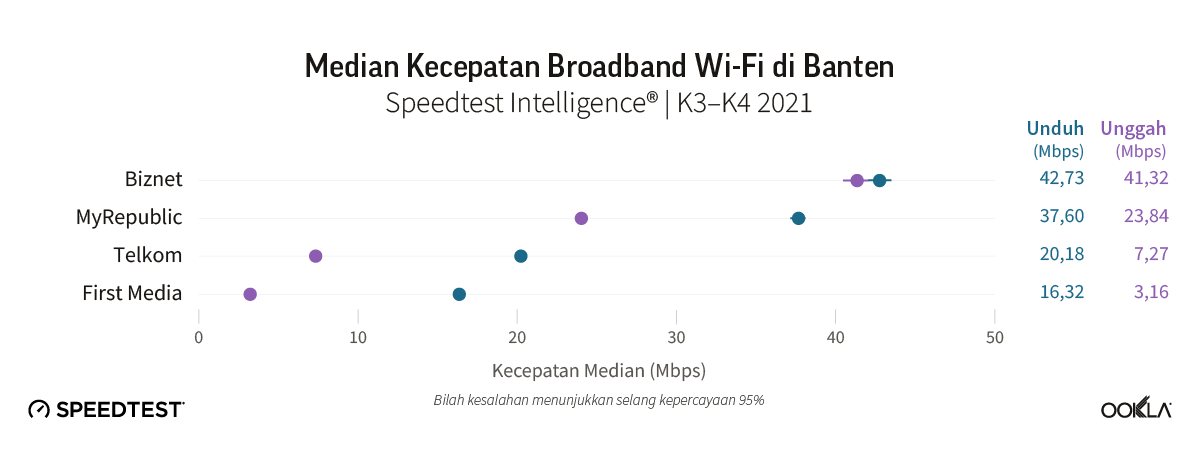

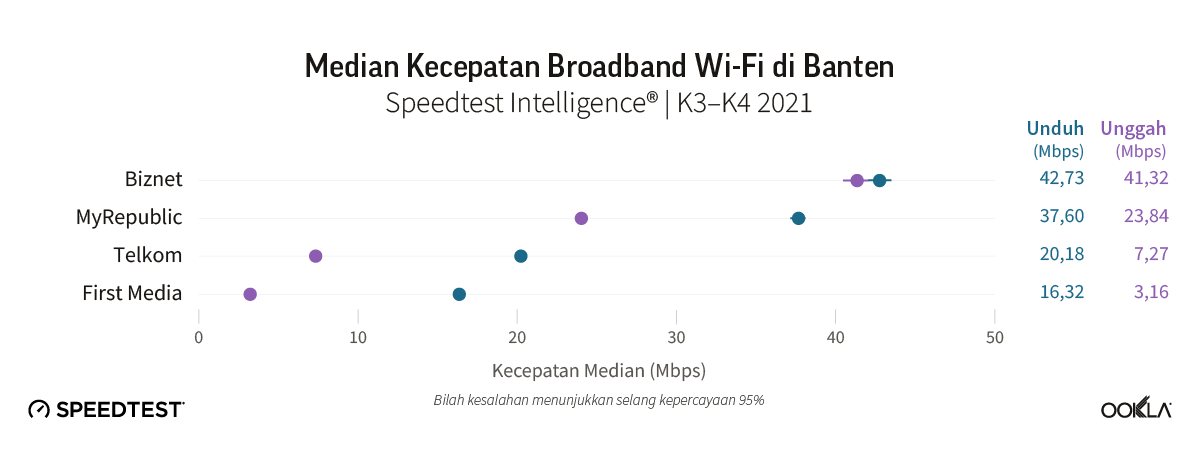

In Banten, the westernmost province of the island of Java, Biznet was the fastest provider over Wi-Fi. Biznet has extended its reach in this region, and obtained sufficient samples (in excess of 3% of the market) to be included as a top provider in our analysis of Banten. Biznet recorded a median download speed of 42.73 Mbps and upload of 41.32 Mbps.

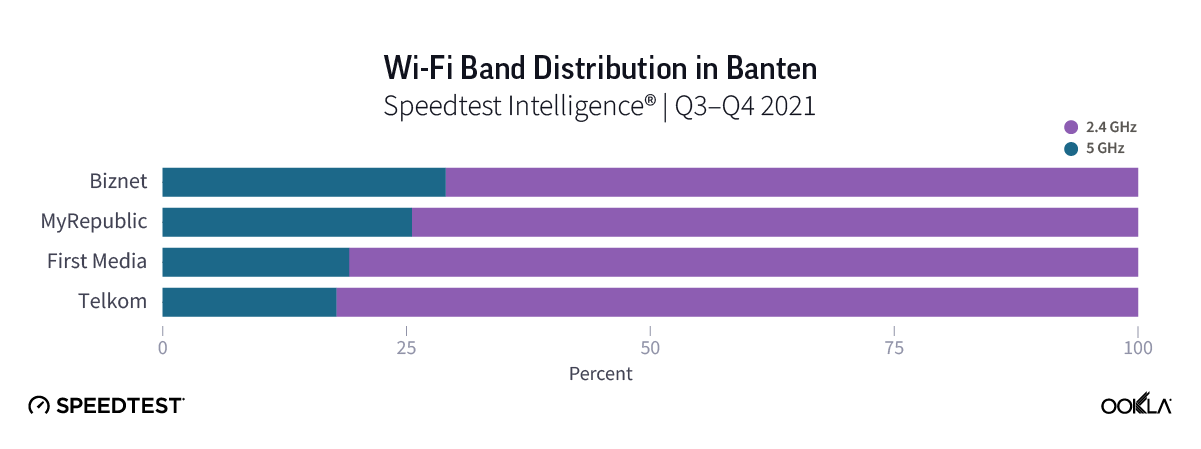

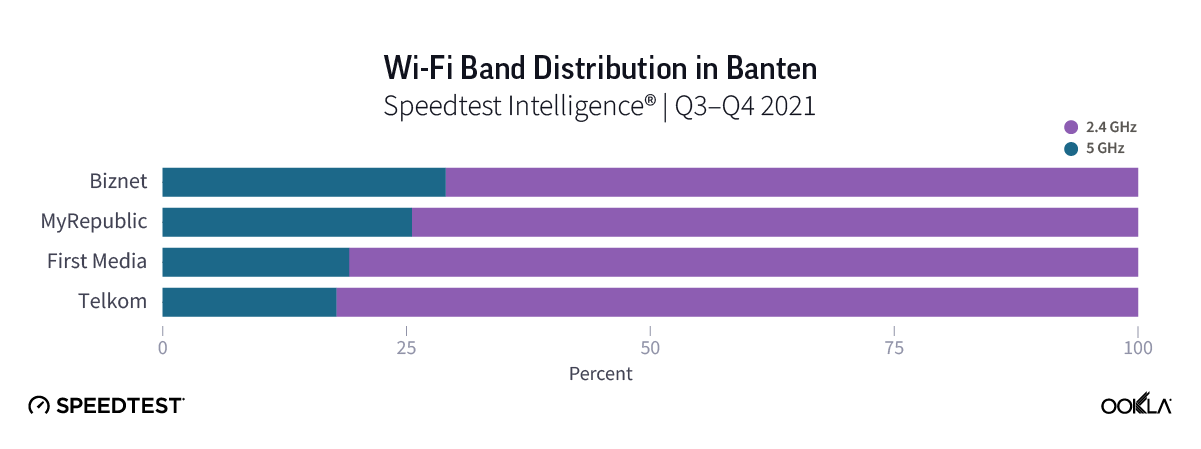

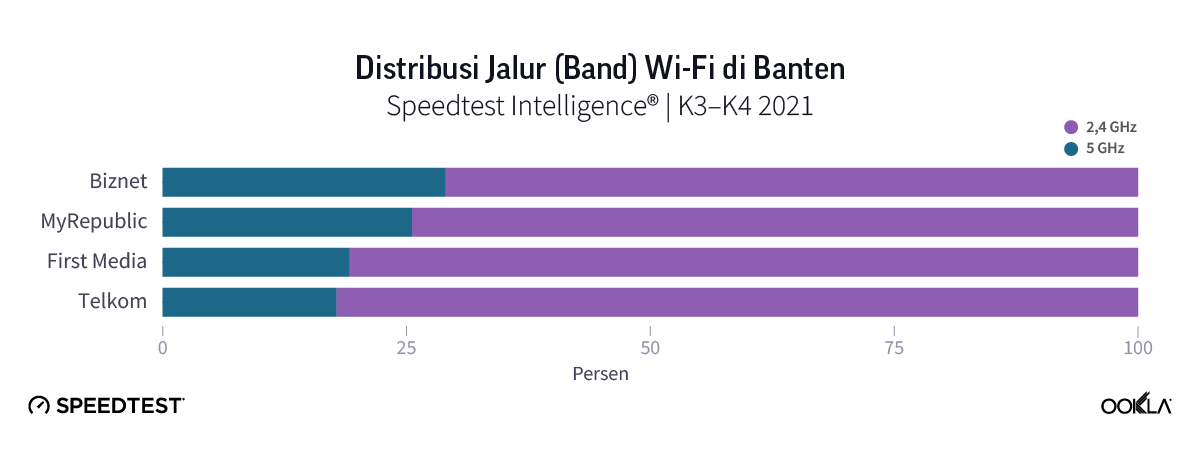

Biznet also led the region for use of 5 GHz Wi-Fi, at 29% of samples. MyRepublic followed with a download speed of 37.60 Mbps and upload of 23.84 Mbps, setting it apart from both Telkom and First Media.

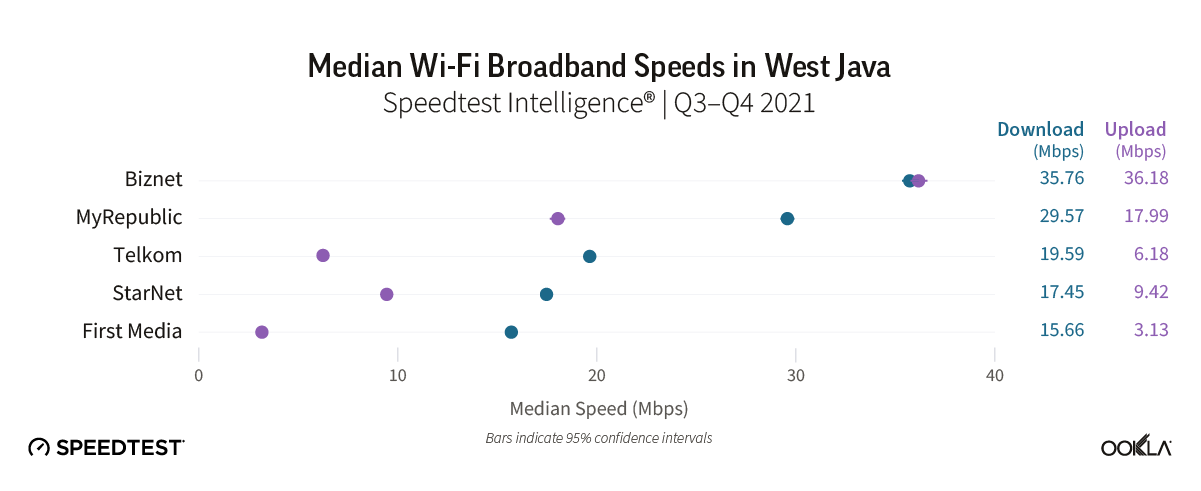

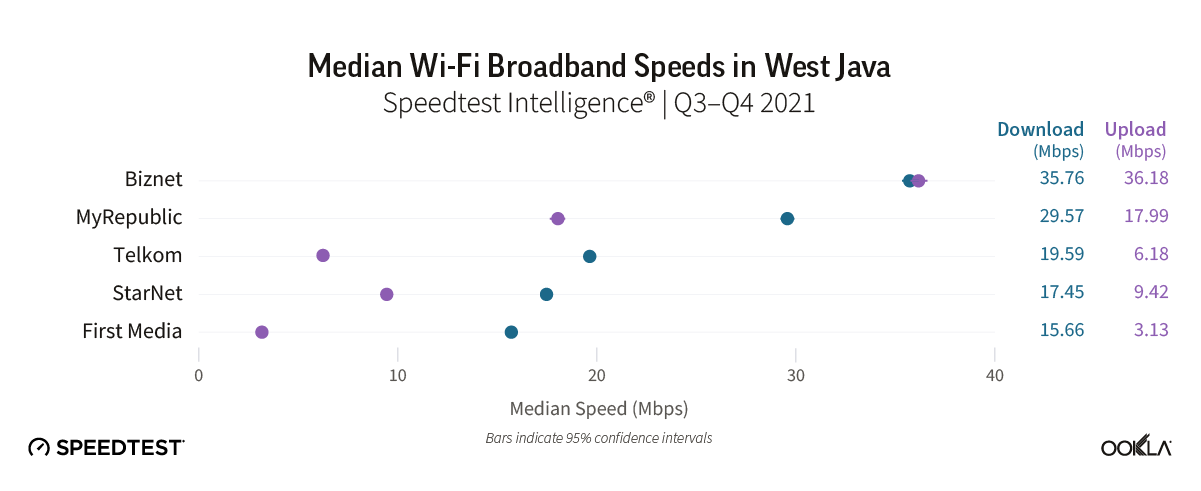

Biznet leading in West Java Region fixed broadband download speed over Wi-Fi

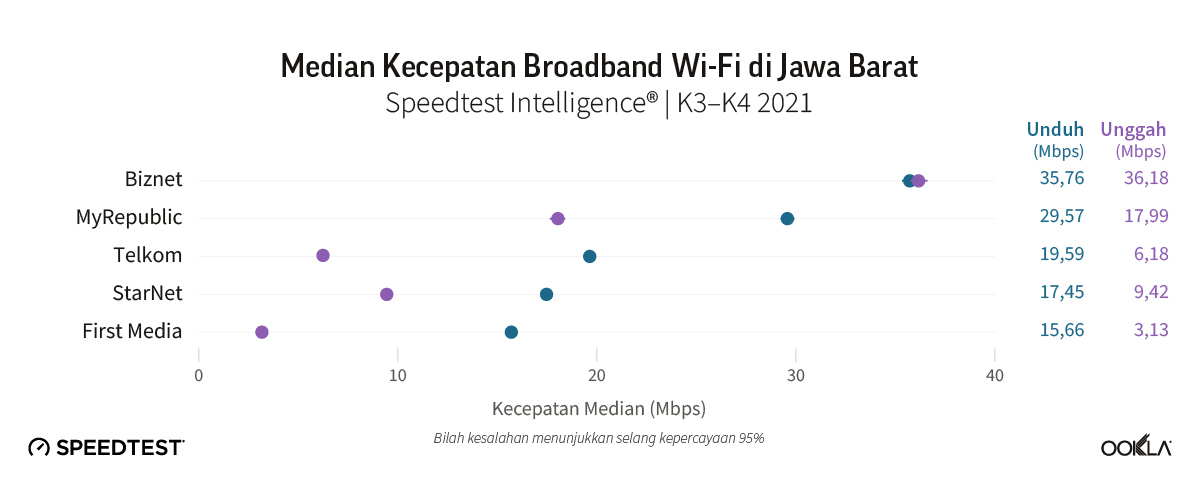

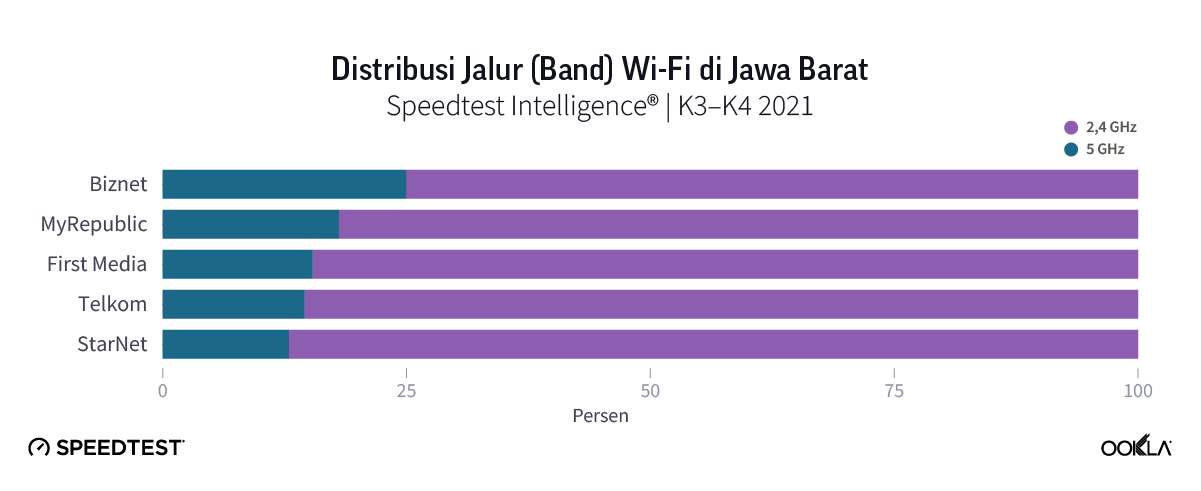

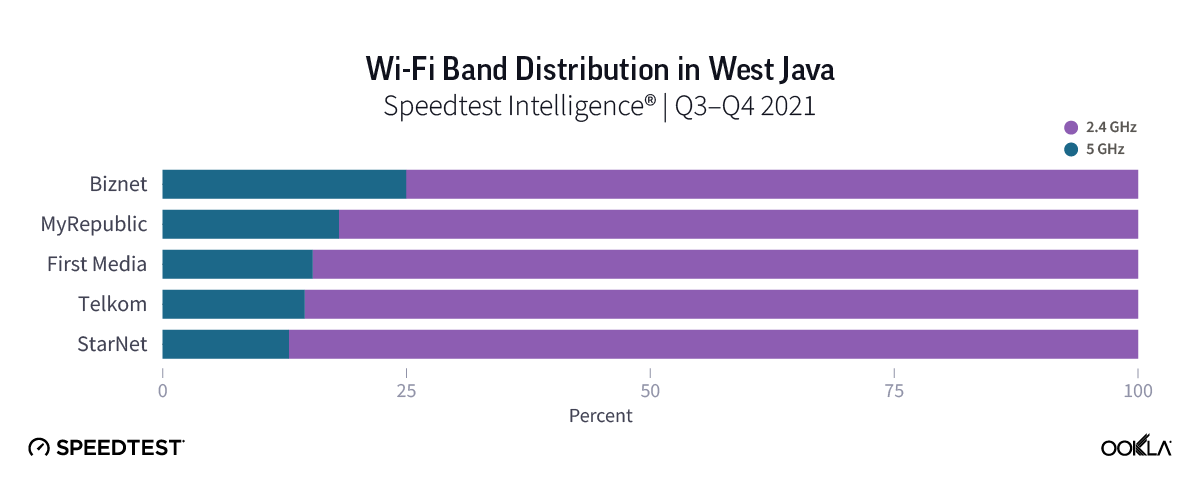

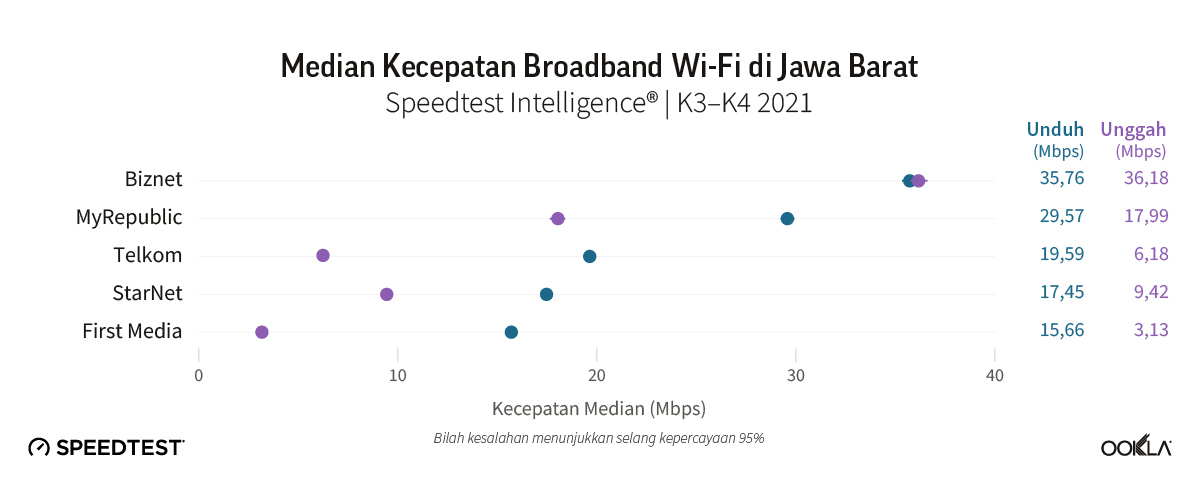

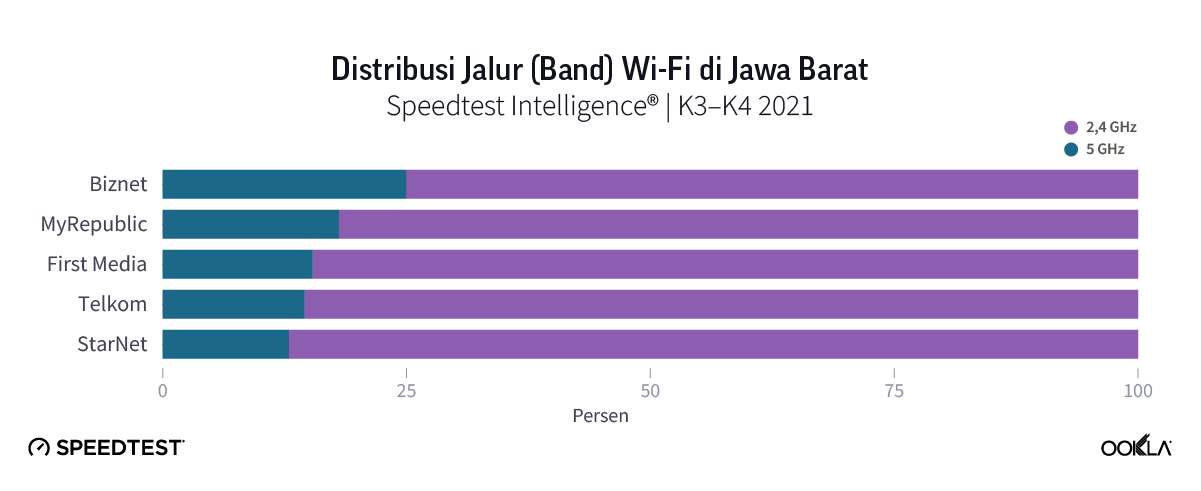

As the most populous region in Indonesia, West Java saw more providers meet the minimum statistical threshold to be included in our analysis. Biznet was once again the fastest provider over Wi-Fi, albeit with slower speeds than in its other coverage regions, at 36.18 Mbps for median download and 35.76 Mbps for upload speed. MyRepublic was the second placed operator for download speeds, recording 29.57 Mbps, followed by Telkom, StarNet, and First Media.

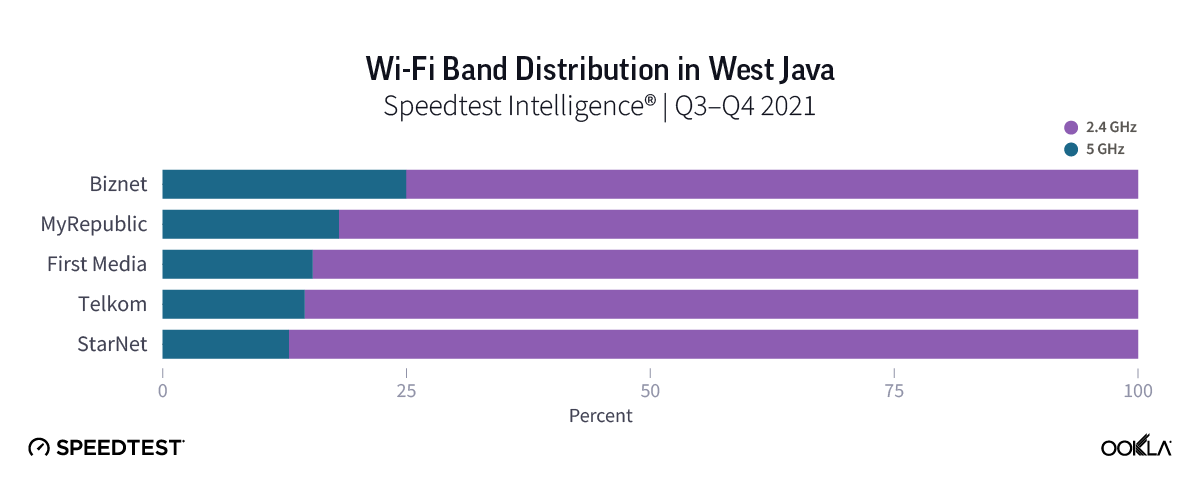

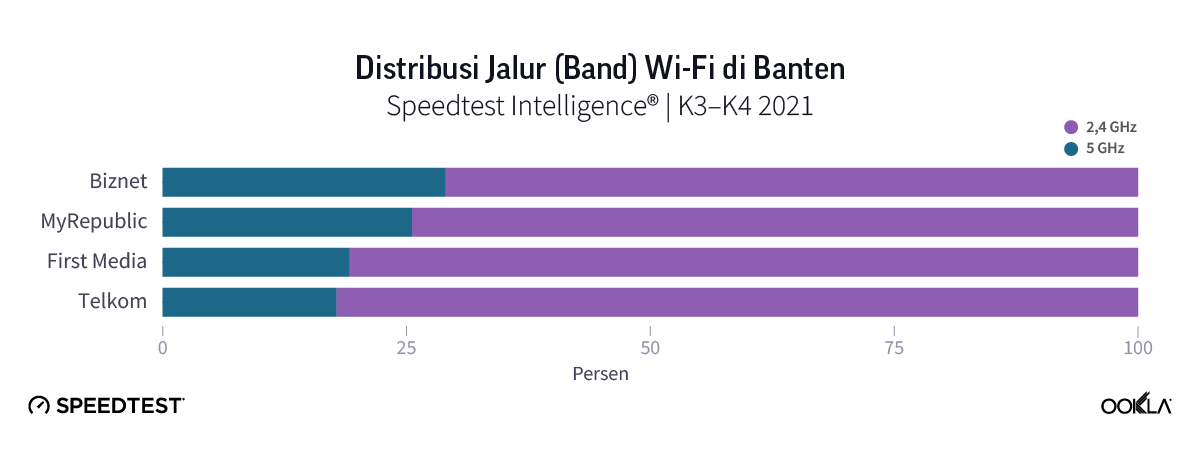

Providers in West Java generally recorded slower speeds than in other regions, and the distribution of Wi-Fi samples between 2.4 GHz and 5 GHz also skewed further towards 2.4 GHz than elsewhere, with First Media, Telkom, and StarNet all recording approximately 85% of samples over 2.4 GHz.

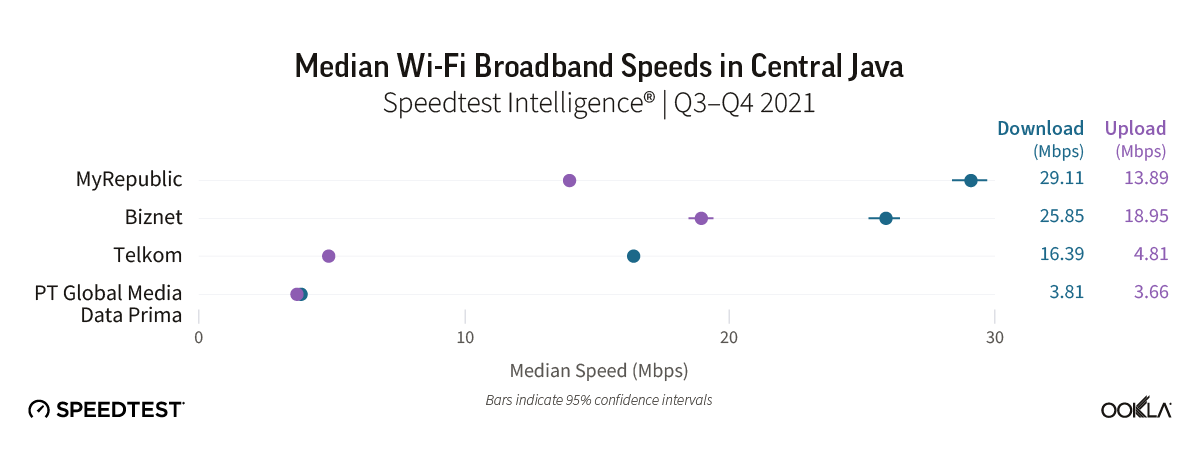

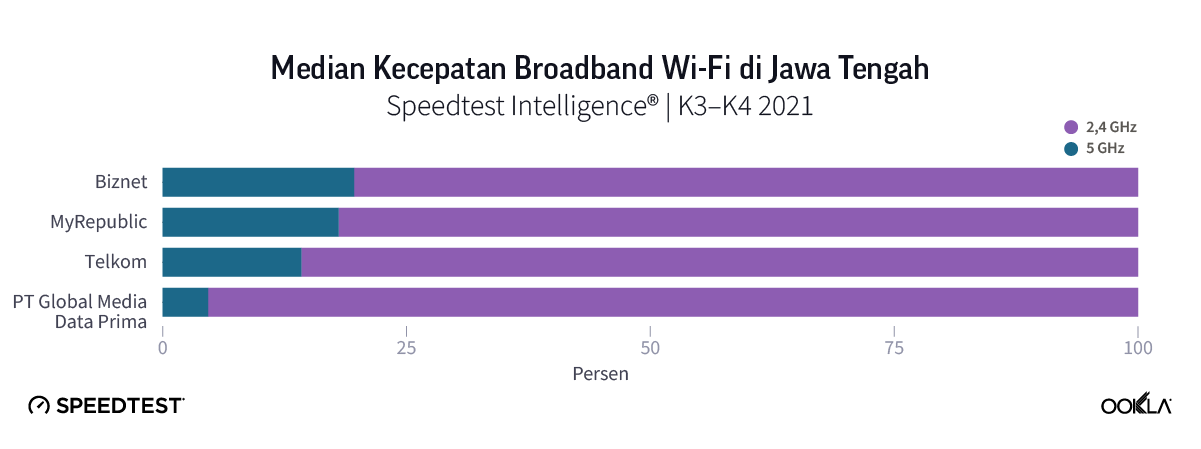

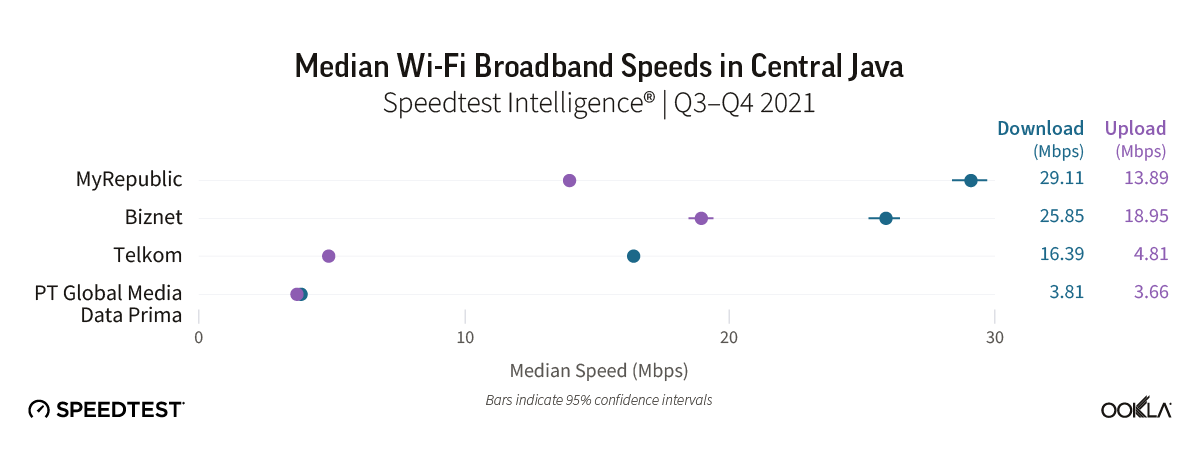

MyRepublic leading in Central Java Region Wi-Fi fixed broadband download speed

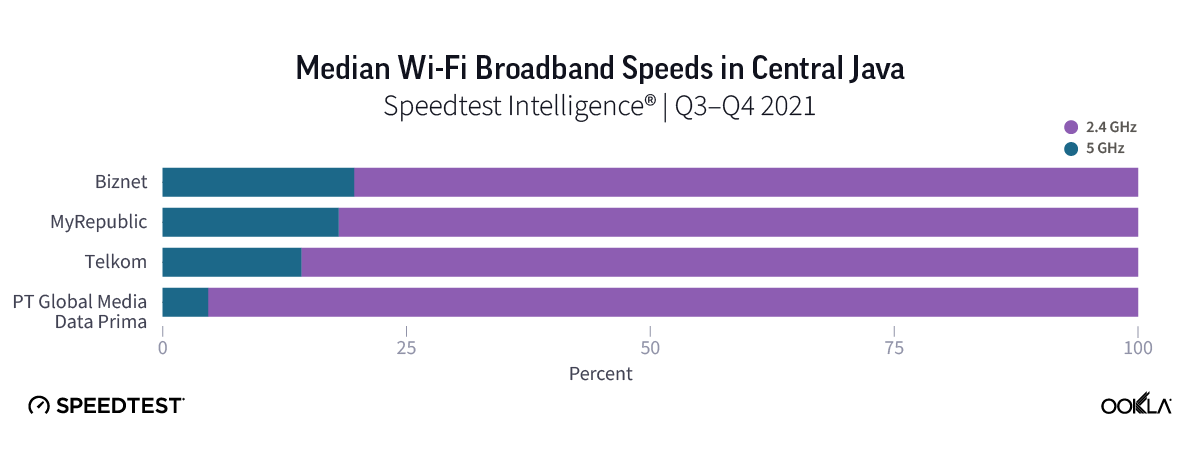

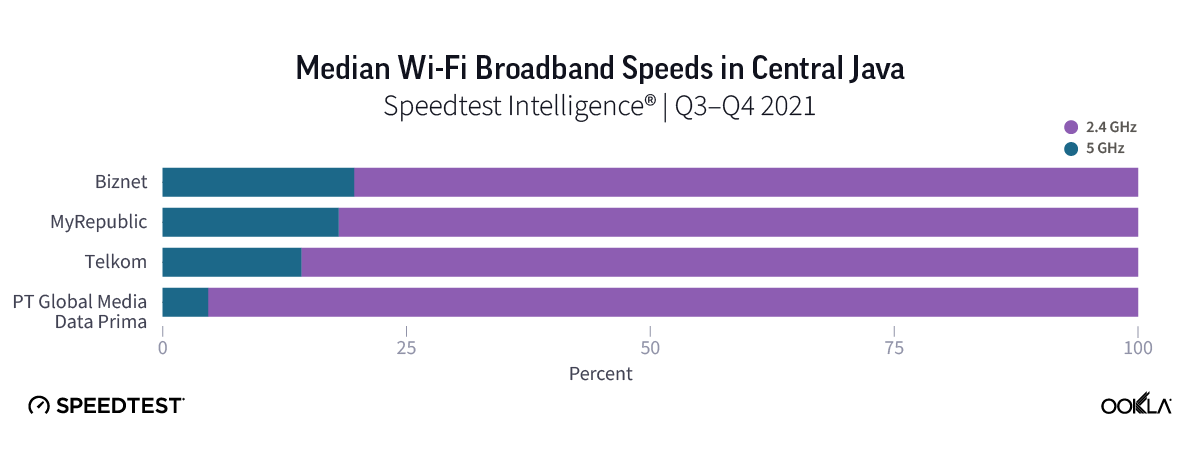

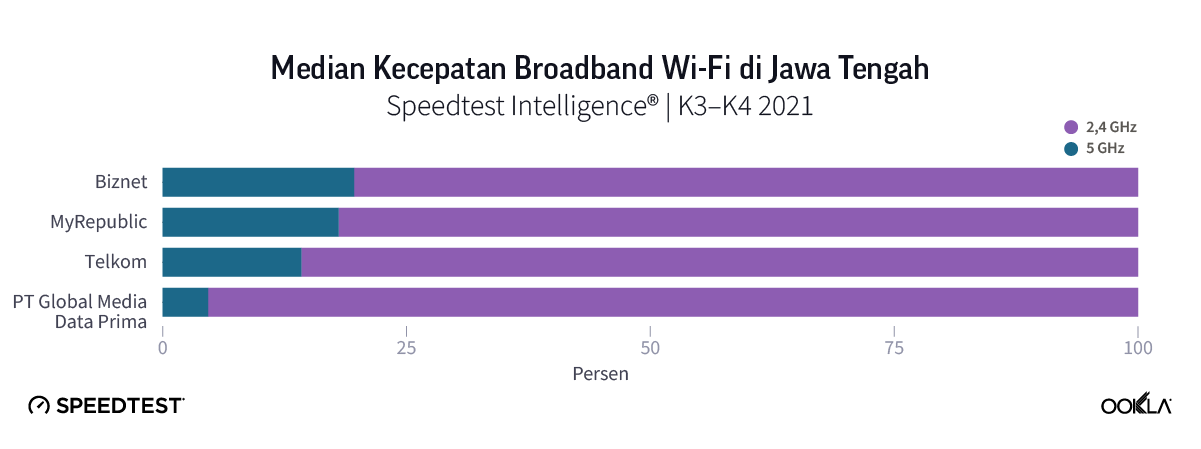

In Central Java, in contrast to most other Indonesian regions, MyRepublic outperformed Biznet on median Wi-Fi download speeds, recording 29.11 Mbps during Q3-Q4 2021. Biznet followed with 25.85 Mbps, but also recorded the fastest upload speed of 18.95 Mbps. Telkom followed with a download speed of 16.39 Mbps, while PT Global Media Data Prima lagged behind the rest of the region with a median download speed of 3.81 Mbps. It also recorded the lowest proportion of Wi-Fi samples using 5 GHz, at only 5%.

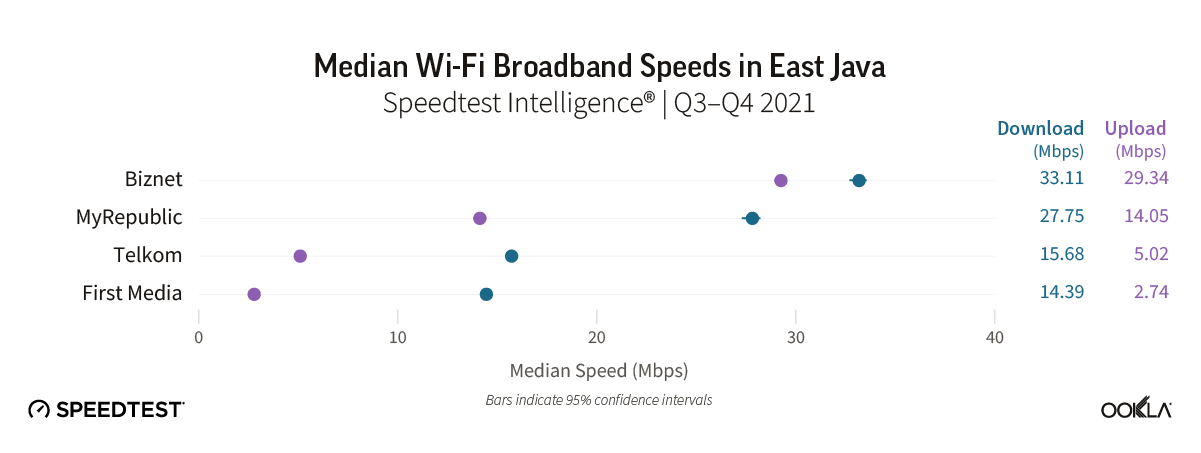

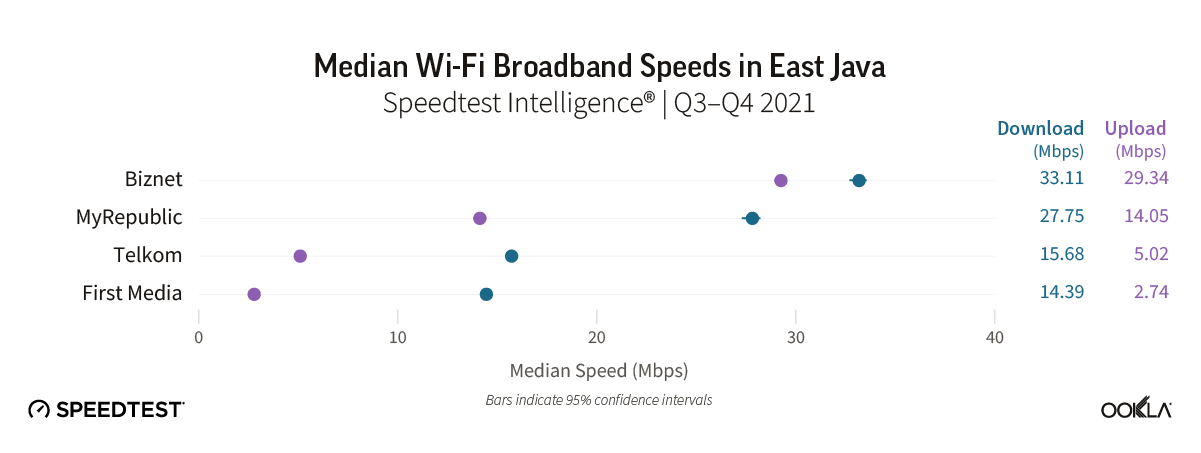

Biznet leading in East Java Region for Wi-Fi fixed broadband download speed

East Java saw a return to form for Biznet as the fastest performing provider over Wi-Fi, with a median download speed of 33.11 Mbps and upload speed 29.34 Mbps. It was closely followed in terms of download speeds by MyRepublic with 27.75 Mbps. Telkom and First Media came next with download speeds of 15.68 Mbps and 14.39 Mbps respectively, while their upload speeds lagged far behind their rivals.

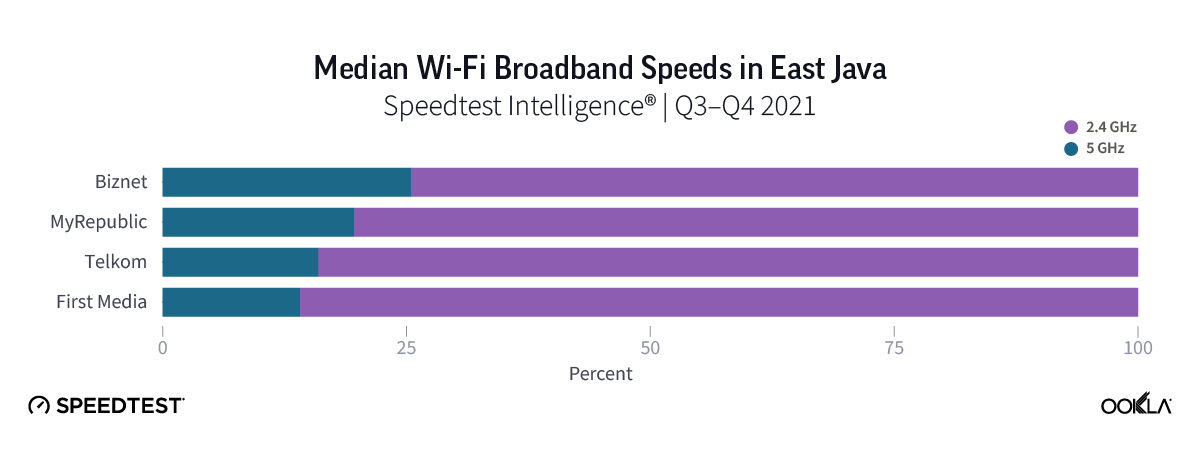

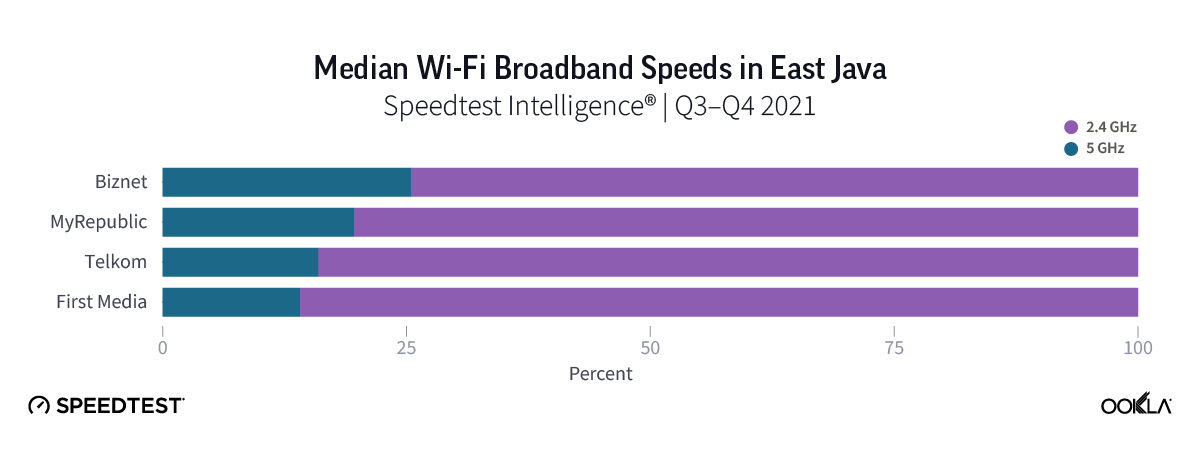

Wi-Fi distribution showed a similar story, with Telkom and First Media scoring the lowest share of samples over 5 GHz, at 16% and 14%, respectively.

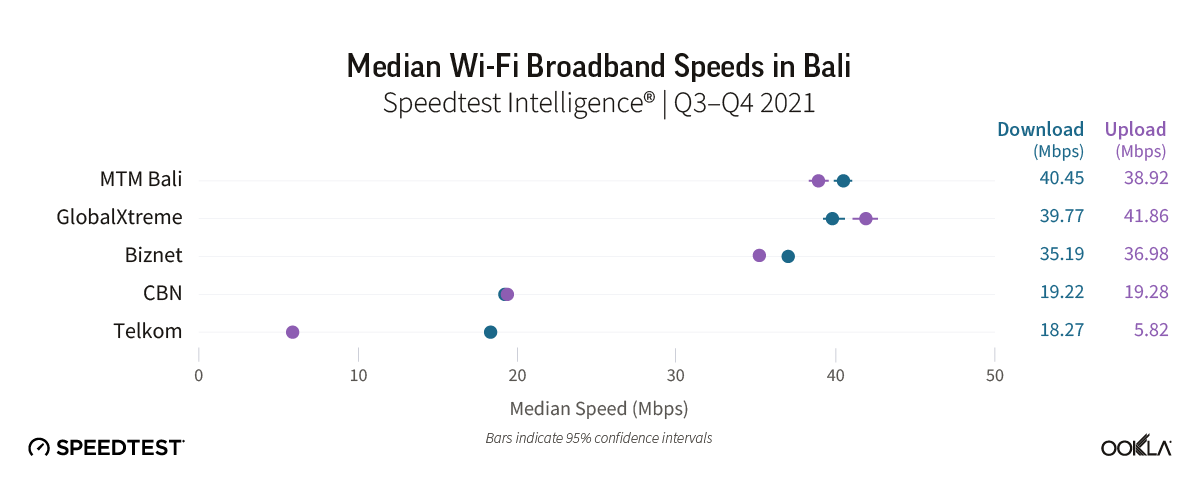

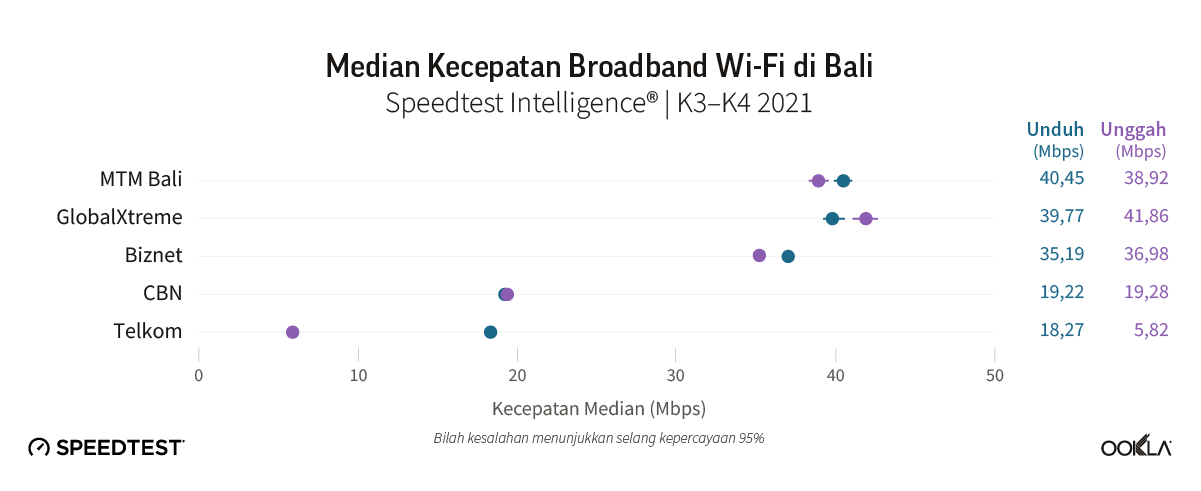

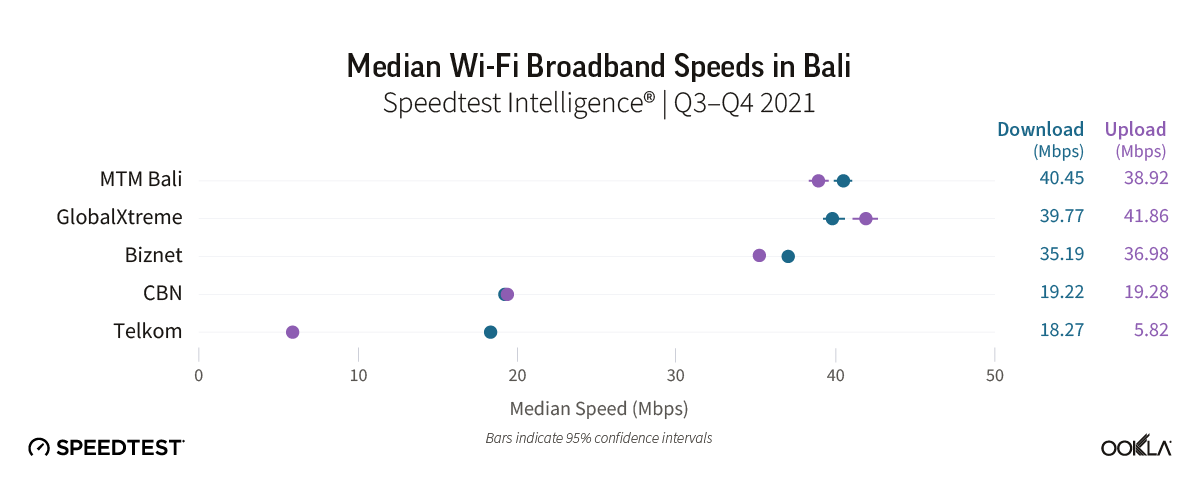

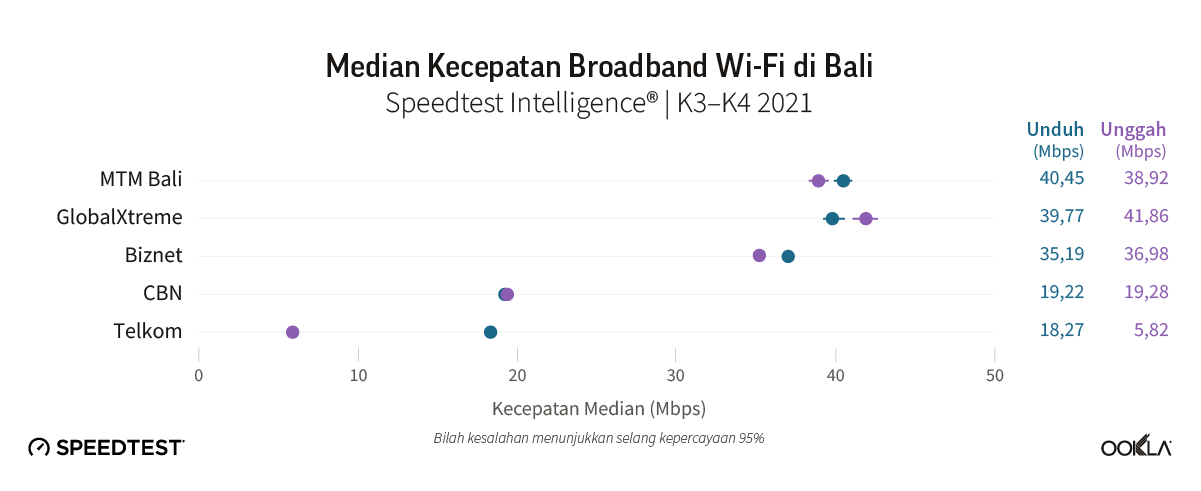

MTM Bali leading in Bali Region fixed broadband download speed over Wi-Fi

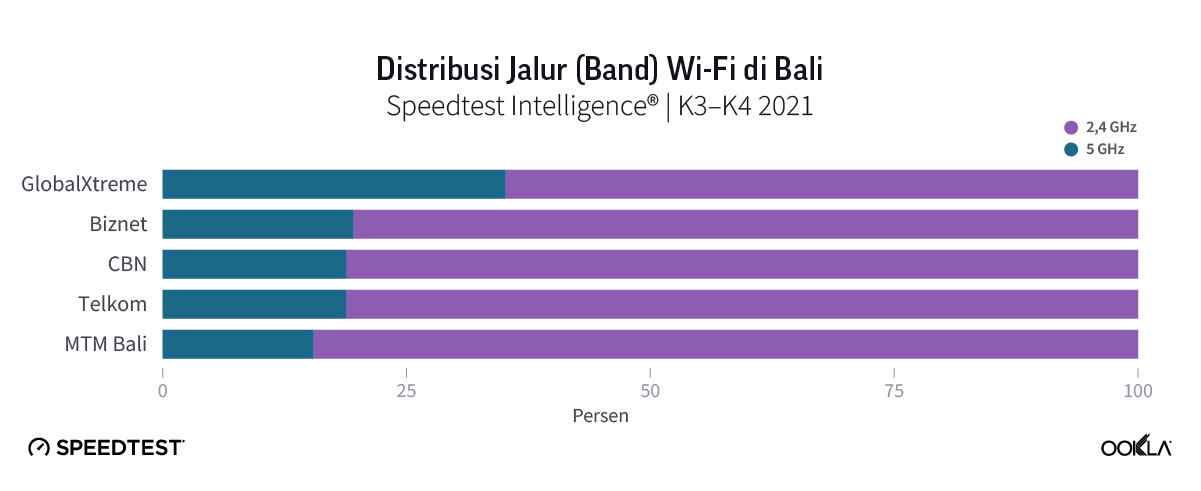

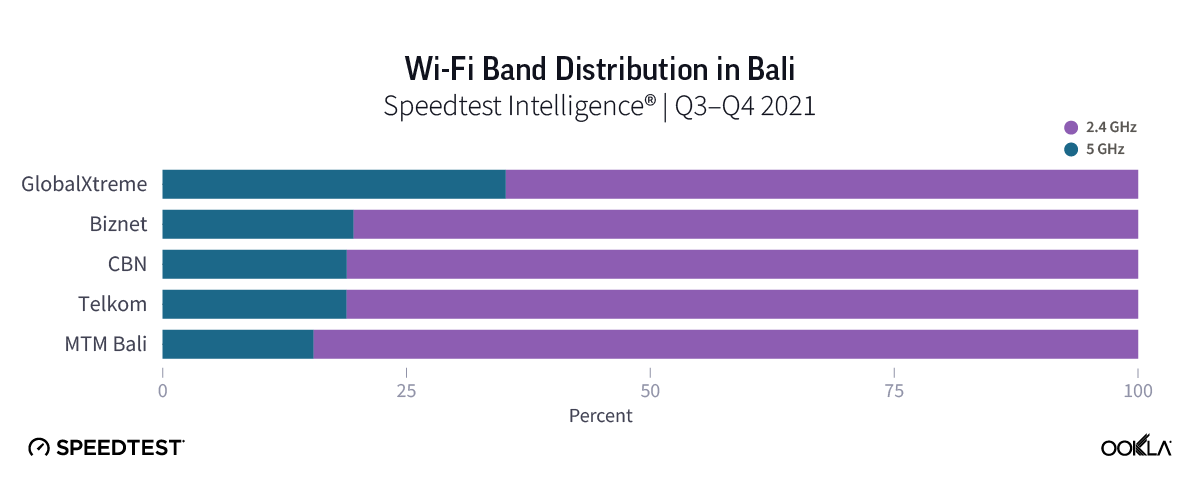

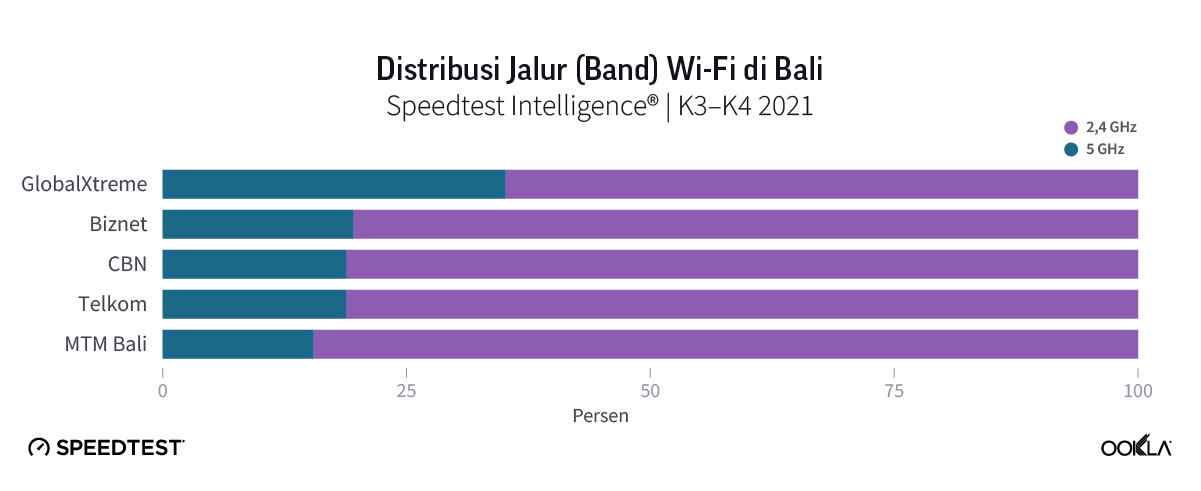

Bali was the most competitive region in this analysis in terms of top speeds among providers, with three providers all recording similar median download and upload speeds of close to 40 Mbps. We could not declare a statistical winner based on median Wi-Fi download speeds, with both MTM Bali and GlobalXtreme’s download speeds in the same range, although GlobalXtreme’s upload speeds were demonstrably faster.

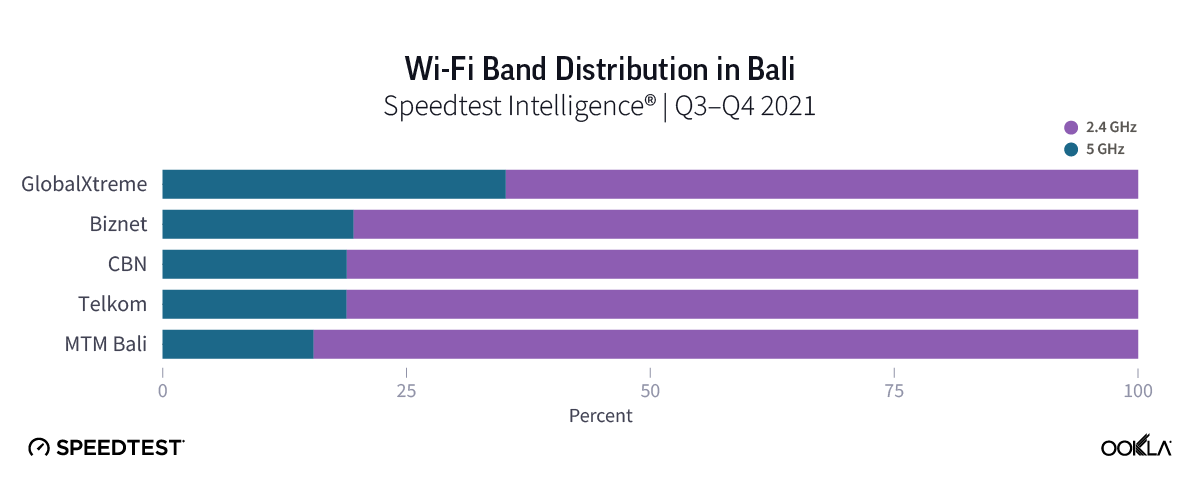

GlobalXtreme also recorded the highest share of 5 GHz Wi-Fi samples, at 35% of total, far outpacing the competition, with the remaining operators achieving 20% or less.

Indonesian fixed broadband outlook

Fixed broadband penetration among Indonesian households remains low, at below 20% according to most estimates. Mobile internet remains the dominant access technology in the market, but the move to working and studying at home as a result of the COVID-19 pandemic has driven more households to subscribe to fixed broadband services. Competition is ramping up in the market, with smaller players such as Biznet and MyRepublic actively rolling out networks and targeting gains from Telkom, which still maintains a majority market share of broadband connections. The recent news that Axiata Group and its Indonesian subsidiary XL Axiata have signed a non-binding agreement to acquire a majority share of Indonesian broadband provider LinkNet is further evidence that providers see strong opportunity for growth. We expect this will help accelerate network rollout and the provision of more sophisticated bundled broadband services in the market, which in turn will help drive up Indonesian fixed broadband speeds, particularly in the densely populated regions covered in this report.

Performa Jaringan Fixed Broadband di Indonesia Semakin Tertinggal dari Rekan-rekannya di Satu Kawasan

Pesan utama:

- Performa jaringan fixed di Indonesia terus tertinggal dari rekan-rekannya di satu kawasan. Meskipun performa jaringan fixed broadband di Indonesia terus meningkat dari kuartal ke kuartal, Ookla® Speedtest Intelligence® menunjukkan bahwa Indonesia tertinggal dari banyak rekannya di satu kawasan pada metrik utama seperti median kecepatan unduh dan penetrasi router yang lebih canggih yang mendukung Wi-Fi 5 GHz, dan perbedaan ini semakin besar.

- Jawa Timur dan Jawa Tengah termasuk wilayah di Indonesia yang paling lambat performanya. Sebagian besar wilayah di Indonesia mencapai median kecepatan unduh yang sama. Namun masih ada beberapa pencilan (outlier): Bali adalah wilayah dengan performa terbaik, dan wilayah-wilayah di Jawa Timur dan Jawa Tengah yang penduduknya lebih padat terus mengalami performa yang paling lambat di pasar.

- Dengan kecepatan yang lebih tinggi, pelanggan pun lebih bahagia. Sentimen konsumen terhadap penyedia jaringan fixed broadband di Indonesia, yang diukur dengan Peringkat Bintang 5 Ookla, berkaitan erat dengan performa jaringan selama setahun terakhir.

- Persaingan kian sengit di pasar jaringan fixed broadband Indonesia. Data sampel Speedtest Intelligence® untuk K3-K4 2021 menunjukkan 306 ISP aktif di pasar. Dari jumlah tersebut, empat operator jaringan nasional utama memenuhi ambang batas kami untuk dianggap sebagai penyedia teratas (dengan minimal 3% sampel) – Telkom, First Media, MyRepublic, dan Biznet. Di tingkat regional, daftar penyedia teratas ini berkembang menjadi sepuluh, termasuk CBN, MNC Play, StarNet, PT Global Media Data Prima, MTM Bali, dan GlobalXtreme.

- Biznet memimpin pasar dalam performa jaringan fixed broadband menurut Speedtest Intelligence. Biznet merupakan operator terkemuka, baik secara nasional maupun di banyak wilayah di Indonesia, dengan kecepatan unduh dan unggahnya yang hampir simetris.

Singapura memimpin dalam kecepatan jaringan fixed broadband di Asia Tenggara

Indonesia menempati peringkat ke-114 pada Speedtest® Global IndexTM untuk median kecepatan unduh tetap (fixed download), berdasarkan data Mei 2022. Menurut Speedtest Intelligence, kecepatan fixed broadband di negara ini telah meningkat selama setahun terakhir, dari median kecepatan unduh 17,37 Mbps pada Maret 2021 menjadi 21,23 Mbps pada Maret 2022. Kecepatan unggah fixed broadband di pasar telah meningkat dengan margin yang lebih besar, dari 4,95 Mbps pada Maret 2021, menjadi 9,73 Mbps pada Maret 2022. Namun, sebagaimana pasar selulernya, dan meskipun lintasannya membaik, performa fixed broadband Indonesia terus tertinggal dari banyak rekannya di satu kawasan

Mengamati performa selama tahun 2021 di pasar Asia Tenggara, kesenjangan performa yang cukup besar terus terjadi antara Singapura dan Thailand dibandingkan dengan rekan-rekan keduanya di satu kawasan, di mana keduanya mencapai median kecepatan unduh tetap (fixed download) lebih dari 150 Mbps selama K4 2021. Juga terjadi perbedaan performa antara Malaysia (75,91 Mbps), Vietnam (67,91 Mbps), dan Filipina (47,50 Mbps). Dari keempat pasar yang tersisa, Brunei dan Laos kecepatannya nyaris 30 Mbps, sementara Indonesia dan Kamboja menjadi pasar fixed-line yang paling lambat, dengan median kecepatan unduh masing-masing 20,08 Mbps dan 18,89 Mbps.

Kami menggunakan data dari Speedtest Intelligence untuk mengevaluasi performa fixed broadband di Indonesia selama K3-K4 2021. Analisis kami memeriksa kecepatan fixed broadband di tingkat negara dan penyedia. Kami juga memeriksa performa Wi-Fi sebagai subset dari total sampel fixed broadband untuk menilai kecepatan yang dikirimkan ke perangkat pengguna akhir dan melihat pangsa sampel yang menggunakan router yang mendukung 5 GHz melalui Wi-Fi.

Semakin banyak operator di seluruh dunia yang menawarkan solusi jaringan rumah untuk membantu meningkatkan kecepatan dan jangkauan Wi-Fi di dalam rumah. Di Indonesia, First Media, Biznet, dan MyRepublic menawarkan solusi jaringan mesh, sedangkan beberapa ISP juga menawarkan opsi untuk melakukan upgrade ke router yang mendukung jalur (band) 5 GHz. Dengan jalur ini, bandwidth saluran yang dihasilkan menjadi lebih besar dan gangguan yang ditimbulkan pun biasanya lebih rendah daripada Wi-Fi di jalur (band) 2,4 GHz, yang memungkinkan peningkatan performa untuk aktivitas bandwidth tinggi seperti bermain game dan streaming konten video definisi tinggi.

Mencermati distribusi sampel Speedtest untuk fixed Wi-Fi yang berjalan pada koneksi Wi-Fi 2,4 GHz versus koneksi Wi-Fi 5 GHz, pemimpin di kawasan ini, Singapura dan Thailand, berikut Malaysia, menjadi satu-satunya pasar di daftar ini yang mayoritas sampelnya tercatat menggunakan 5 GHz. Indonesia kembali berada di urutan terakhir dengan koneksi 5 GHz yang hanya menyumbang 22% sampel.

Biznet memimpin di Indonesia secara nasional pada kecepatan unduh fixed broadband

Metodologi statistik kami menetapkan ambang batas minimal 3% sampel bagi operator agar dapat dipertimbangkan sebagai penyedia teratas dan bagian dari analisis kami. Dengan menggunakan metodologi ini, Biznet menjadi operator fixed broadband tercepat untuk median kecepatan unduh dan unggah selama K3-K4 2021, disusul oleh My Republic. Biznet meraih hasil yang hampir simetris dari kecepatan unduh 40,85 Mbps dan kecepatan unggah 39,29 Mbps, sedangkan My Republic mencapai kecepatan unduh 34,27 Mbps dan kecepatan unggah 21,93 Mbps. Hingga Mei 2022, jaringan fiber optik Biznet meluas hingga mencapai total lebih dari 64.000 km, dengan jaringan aksesnya saat ini yang mencakup lebih dari 1,46 juta rumah tangga. Untuk bersaing lebih agresif dengan layanan IndiHome Telkom, Biznet meluncurkan layanan IPTV pada Februari 2020. Dua ISP nasional lainnya, Telkom dan First Media, tertinggal, yang masing-masing mencapai median kecepatan unduh 18,91 Mbps dan 16,54 Mbps.

Mencermati pemisahan sampel dari koneksi Wi-Fi 2,4 GHz versus koneksi Wi-Fi 5 GHz, terlihat adanya perbedaan antarpemimpin pasar, antara Biznet dan MyRepublic serta First Media dan Telkom. Namun, keempat operator fixed broadband tersebut mencatat lebih dari 70% tes menggunakan koneksi Wi-Fi 2,4 GHz. Jika kita mengamati performa Wi-Fi di Indonesia sebagai bagian dari total sampel fixed broadband, maka muncul gambar serupa, di mana Biznet dan My Republic mengungguli Telkom dan First Media.

Sentimen konsumen mengikuti jejak performa jaringan

Ada korelasi positif yang jelas antara performa jaringan tetap (fixed) dan sentimen konsumen di pasar fixed broadband Indonesia. Berdasarkan rata-rata (mean) Peringkat Bintang 5 Speedtest di pasar, Biznet menjadi operator tetap (fixed) dengan peringkat teratas di K3-K4 2021 dan skor 3,9, sedangkan First Media menempati posisi terakhir dengan skor 2,8.

Kesenjangan di tingkat regional dalam hal kecepatan unduh fixed broadband melalui Wi-Fi tetap terjadi

Terlepas dari tujuan Rencana Broadband Indonesia untuk meningkatkan kecepatan di seluruh Indonesia, tetap terjadi sejumlah kesenjangan di tingkat regional dalam hal median kecepatan unduh dan unggah. Bagi sebagian besar wilayah di Indonesia, kecepatan unduh menunjukkan adanya sedikit variasi, berkisar antara 16 Mbps dan 20 Mbps. Namun terdapat beberapa pencilan (outlier). Bali, sebagai hotspot wisata dan berkembang menjadi tujuan populer bagi pekerja nomaden digital, dan Jakarta, sebagai ibukota Indonesia, menempati dua posisi teratas secara nasional selama K3-K4 2021, dengan kecepatan unduh masing-masing 22,77 Mbps dan 21,92 Mbps.

Sementara itu, dua wilayah terpadat di negeri ini, Jawa Timur dan Tengah, menghasilkan median kecepatan unduh terendah, masing-masing 15,34 Mbps dan 15,17 Mbps. Kecepatan unggah di seluruh pasar menunjukkan variasi yang lebih banyak, mulai dari tertinggi 17,47 Mbps di Bali, hingga terendah 3,97 Mbps di Bengkulu.

Biznet memimpin di wilayah Jakarta dalam kecepatan unduh Wi-Fi

Biznet adalah penyedia broadband fixed tercepat di Jakarta, ibukota Indonesia, selama K3-K4 2021, dengan kecepatan yang hampir simetris untuk median unduh (42,59 Mbps) dan unggah (41,22 Mbps). Disusul oleh MyRepublic, dengan kecepatan unduh 32,47 Mbps dan unggah 25,46 Mbps, serta CBN yang juga mencapai kecepatan simetris sekitar 28 Mbps. Performa Wi-Fi untuk tiga provider lainnya, First Media, Telkom, dan MNC Play justru tertinggal, di mana First Media dan Telkom mencapai kecepatan unggah jauh di bawah pesaing, keduanya kurang dari 10 Mbps.

Satu dari tiga sampel Speedtest untuk penyedia CBN menggunakan Wi-Fi 5 GHz, yang terbesar di antara seluruh operator di Jakarta. Biznet, MyRepublic, dan First Media menyusul, sementara Telkom dan MNC Play menunjukkan sampel terendah dengan menggunakan Wi-Fi 5 GHz.

MyRepublic memimpin di wilayah Banten dalam kecepatan unduh fixed broadband melalui Wi-Fi

Di Banten, provinsi paling barat di Pulau Jawa, Biznet menjadi penyedia tercepat melalui Wi-Fi. Biznet telah memperluas jangkauannya di wilayah ini, dan memperoleh sampel yang cukup (lebih dari 3% dari pasar) untuk dimasukkan sebagai penyedia teratas dalam analisis kami di Banten. Biznet mencatat median kecepatan unduh 42,73 Mbps dan unggah 41,32 Mbps.

Biznet juga memimpin di wilayah tersebut dalam penggunaan Wi-Fi 5 GHz, pada 29% sampel. MyRepublic mengekor dengan kecepatan unduh 37,60 Mbps dan unggah 23,84 Mbps, sehingga tampak berbeda dari Telkom dan First Media.

Biznet memimpin di wilayah Jawa Barat dalam kecepatan unduh fixed broadband melalui Wi-Fi

Sebagai wilayah terpadat di Indonesia, Jawa Barat memiliki lebih banyak penyedia yang memenuhi ambang batas statistik minimal untuk dimasukkan dalam analisis kami. Biznet sekali lagi menjadi penyedia tercepat yang menggunakan Wi-Fi, meskipun dengan kecepatan yang lebih lambat daripada di wilayah cakupan lainnya, pada 36,18 Mbps untuk median unduh dan 35,76 Mbps untuk kecepatan unggah. MyRepublic menjadi operator di urutan kedua untuk kecepatan unduh, mencatat 29,57 Mbps, diikuti oleh Telkom, StarNet, dan First Media.

Para penyedia jaringan di Jawa Barat umumnya meraih kecepatan yang lebih lambat daripada di daerah lain, dan distribusi sampel Wi-Fi antara 2,4 GHz dan 5 GHz juga condong lebih jauh ke arah 2,4 GHz daripada di tempat lain, di mana First Media, Telkom, dan StarNet semuanya merekam sekitar 85% sampel pada 2,4 GHz.

MyRepublic memimpin di wilayah Jawa Tengah dalam kecepatan unduh fixed broadband melalui Wi-Fi

Di Jawa Tengah, berbedar dari sebagian besar wilayah Indonesia lainnya, MyRepublic mengungguli Biznet pada median kecepatan unduh Wi-Fi, mencapai 29,11 Mbps selama K3-K4 2021. Biznet menyusul dengan kecepatan unggah 25,85 Mbps, namun sekaligus mencatat kecepatan unggah tercepat 18,95 Mbps. Telkom menyusul dengan kecepatan unduh 16,39 Mbps, sedangkan PT Global Media Data Prima jauh tertinggal dari wilayah lainnya dengan median kecepatan unduh 3,81 Mbps. Penyedia ini juga mencatat proporsi terendah sampel Wi-Fi menggunakan 5 GHz, hanya 5%.

Biznet memimpin di wilayah Jawa Timur dalam kecepatan unduh fixed broadband melalui Wi-Fi

Jawa Timur kembali hadir untuk Biznet sebagai penyedia dengan performa tercepat melalui Wi-Fi, dengan median kecepatan unduh 33,11 Mbps dan kecepatan unggah 29,34 Mbps. Selanjutnya diikuti oleh MyRepublic dalam hal kecepatan unduh dengan 27,75 Mbps. Telkom dan First Media berada di urutan berikutnya dengan kecepatan unduh masing-masing 15,68 Mbps dan 14,39 Mbps, sementara kecepatan unggah mereka tertinggal jauh di belakang saingan-saingan mereka.

Distribusi Wi-Fi menunjukkan hal yang senada, di mana Telkom dan First Media mencetak persentase sampel terendah pada 5 GHz, masing-masing sebesar 16% dan 14%.

MTM Bali memimpin di wilayah Bali dalam kecepatan unduh fixed broadband melalui Wi-Fi

Bali merupakan wilayah yang paling kompetitif pada analisis ini dalam hal kecepatan tertinggi di antara para penyedia, dengan tiga penyedia semuanya merekam median kecepatan unduh dan unggah serupa yang mendekati 40 Mbps. Kami tidak dapat menyatakan pemenang statistik berdasarkan median kecepatan unduh Wi-Fi, dengan kecepatan unduh MTM Bali dan GlobalXtreme dalam kisaran yang sama, meskipun kecepatan unggah GlobalXtreme terbukti lebih cepat.

GlobalXtreme juga mencatat persentase tertinggi dari sampel Wi-Fi 5 GHz, pada 35% dari total, jauh melampaui persaingan, dengan para operator yang lain mencapai 20% atau kurang.

Prospek fixed broadband di Indonesia

Penetrasi fixed broadband dalam lingkup rumah tangga di Indonesia tetap rendah, di bawah 20% menurut sebagian besar perkiraan. Internet seluler tetap menjadi teknologi akses yang dominan di pasar, tetapi peralihan ke opsi bekerja dan belajar di rumah sebagai akibat dari pandemi COVID-19 telah mendorong lebih banyak rumah tangga untuk berlangganan layanan fixed broadband. Persaingan semakin meningkat di pasar, di mana para pemain yang lebih kecil seperti Biznet dan MyRepublic aktif meluncurkan jaringan dan menargetkan keuntungan dari Telkom, yang masih mempertahankan pangsa pasar mayoritas koneksi broadband. Berita yang muncul baru-baru ini yang menyatakan bahwa Axiata Group dan anak perusahaannya di Indonesia, XL Axiata, telah menandatangani perjanjian yang tidak mengikat untuk mengakuisisi mayoritas saham penyedia broadband Indonesia, LinkNet, menjadi bukti lebih lanjut bahwa para penyedia melihat adanya peluang besar untuk pertumbuhan. Kami berharap hal ini akan membantu mempercepat peluncuran jaringan dan penyediaan layanan broadband bundel yang lebih canggih di pasar, yang pada gilirannya akan membantu meningkatkan kecepatan fixed broadband Indonesia, terutama di wilayah-wilayah padat penduduk yang diulas pada laporan ini.