Record power outages have crippled mobile network infrastructure, underscoring the need for network hardening as severe weather events become more frequent.

The UK and Ireland are in recovery mode after Storm Éowyn wreaked havoc on electricity and telecoms infrastructure in recent days. With record wind gusts exceeding 180 km/h recorded in Ireland and a ‘major incident’ declared on the Isle of Man, the storm has been historic in both its strength and the extent of the damage caused across the islands.

Key Takeaways:

- Storm Éowyn triggered a rapid, severe and sustained decline in mobile performance across all operators in Ireland and parts of the UK, particularly Northern Ireland and Scotland, on a scale not seen before. On the day the storm made landfall (24th January), median mobile download speeds in Ireland (10.04 Mbps) were 78% lower than the preceding 7-day average of 47.43 Mbps, while median latency was 23% higher at 47.6 ms. In Scotland and Northern Ireland, mobile download speeds at the 10th percentile—a critical metric reflecting the poorest network performance—dropped significantly on the same day, falling by 63% to 2.19 Mbps and by 74% to 1.31 Mbps, respectively, compared to the 7-day average.

- Network disruptions drove a dramatic deterioration in quality of experience (QoE) in bread-and-butter consumer applications. Consistency—an important metric indicating the proportion of Speedtest samples meeting minimum download and upload speed thresholds—dropped sharply on the day of the storm, falling by over 20 percentage points to 60.3% in Northern Ireland and by nearly 40 percentage points to 52.3% in Ireland compared to the preceding 7-day average. On the day following the storm (25th January), as power restoration efforts were still in their early stages, Video Score—a key indicator of QoE in gaming activities—remained significantly suppressed, falling by over 23 points compared to the preceding 7-day average in Northern Ireland.

- The unprecedented scale of impact on telecoms infrastructure serves as the latest and most high-profile call to action for hardening networks against increasingly frequent and severe storms in the UK and Ireland. Record daily consumer-initiated Speedtest volumes and a 62% surge in Speedtests conducted on Starlink connections in Ireland on the storm day, compared to the preceding 7-day average, highlight the severity of the telecoms infrastructure disruptions as consumers scrambled to troubleshoot issues and turned to alternative connectivity solutions like satellite.

Ireland’s state electricity supplier, ESB Networks, reported “unprecedented” power outages affecting over 725,000 premises (equivalent to as much as one-third of all homes in the country), with restoration times expected to exceed a week in the hardest-hit areas. The extensive damage to the electricity grid has had severe knock-on effects on both fixed and mobile network infrastructure, with well over a thousand mobile sites taken offline due to disruptions to mains power and downed trees causing damage to overhead fibre cabling along roads.

The impacts have been significant across operators. In Ireland, Eir reported that fixed broadband faults were affecting 160,000 premises, with more than 900 mobile sites knocked offline, while Vodafone said more than 10% of its mobile site footprint was affected. Similarly, in the UK, there were elevated reports of network outages across telecoms operators on Downdetector, with the largest concentration of disruptions in the worst hit areas in Scotland and Northern Ireland.

This storm, the most severe to date, follows a series of disruptive weather events across the UK and Ireland during recent winter months. In December, Ookla published detailed research on the impact of Storm Darragh, highlighting the unique challenges posed by widespread, prolonged power outages on mobile networks. These challenges included a dual strain: increased network load as fixed broadband outages shifted traffic to mobile infrastructure and a diminished mobile site grid due to power outages at mobile sites. Together, these factors significantly degrade mobile network performance, reducing overall network availability and pushing more subscribers into the cell edge.

Mobile users in Ireland see marked declines across all performance metrics, with network impacts continuing

Analysis of Speedtest Intelligence® data highlights the significant impact of Storm Éowyn on mobile network performance in Ireland. Download and upload speeds saw sharp and sustained declines, accompanied by increased latency and jitter across all operators nationwide. The deterioration started early on Friday morning, 24th January, as the storm made landfall. While some recovery was observed the following day (25th January), all performance metrics remain materially below pre-storm levels nationally.

Despite the absence of active network sharing in Ireland—limited to cooperation on passive infrastructure, which relies on a common mains power supply at shared sites—the storm’s impacts were felt similarly across operators. Notably, the performance profile across operators during the storm closely mirrored pre-storm trends. For instance, Three maintained its lead in download speed and demonstrated a faster recovery on this metric compared to other operators.

Storm Éowyn Blows Down Mobile Performance in Ireland Across All Metrics and Operators

Speedtest Intelligence® | January 2025

In addition to a decline in metrics like Consistency—designed to measure the proportion of Speedtest samples reflecting a consistent quality of experience (QoE)—the storm-induced network disruptions led to a substantial increase in failed or partially completed Speedtest sessions across all operators on the day of the storm. Similarly, the severe decline in 10th percentile performance—where aggregate download speeds plummeted by over 87%, from a 7-day average of 3.97 Mbps to just 0.51 Mbps—highlights the extent of performance degradation experienced by Irish mobile users at the bottom end.

Storm Éowyn Triggers Sharp Deterioration in Consistency Across All Operators

Speedtest Intelligence® | January 2025

On the day of the storm, Consistency dropped to a low of 38% at 09:00 on Friday nationally and remained below 55% in the evening. While there was an improvement the following day (25th January), reaching a high of 66% at 16:00, the overall profile remains significantly below the pre-storm baseline.

Storm Éowyn Triggers Sharp, Sustained Decline in Consistency Across Ireland

Speedtest Intelligence® | January 2025

It is notable that the limited penetration of battery backup solutions in Ireland’s mobile site grid—typically providing only four to eight hours of power where available—stands in sharp contrast to regions like the Nordics and Australia, which have implemented comprehensive policy measures to harden telecoms infrastructure, as highlighted in a recent Ookla article. This shortfall has resulted in a disproportionate reliance on stationary and mobile generators in the Irish context.

While mobile generators have high operating costs, which limit their feasibility for prolonged or widespread deployment across the mobile site grid in Ireland, they offer operators valuable deployment flexibility. Mobile operators can proactively position generators at key sites based on forecasted storm tracks and leverage distributed fuel dumps across the country to enable rapid refueling during post-storm operations.

Analysis of Speedtest Intelligence data underlines the impact of these efforts on service continuity and restoration. On the morning of the storm, Eir publicly reported deploying mobile generators to key sites in County Cork—one of the worst-affected areas—to restore mobile services ahead of mains power being restored. This proactive approach (which all operators adopted) is reflected in a sharp recovery of Eir’s Consistency score in Cork, which rebounded from as low as 59% on the day of the storm to as high as 95% the following day. This rate of recovery outpaced other operators in the county for this metric, highlighting the important role of rapid power restoration using generator solutions.

Mobile network disruptions extend to Scotland and Northern Ireland

While Ireland experienced some of the most severe and widespread impacts of Storm Éowyn, it was not alone. In Northern Ireland, power outages affecting 30% of premises at their peak were reported by NIE Networks, the primary energy provider in the region. Similarly, in Scotland, over 100,000 homes were left without power, with restoration efforts expected to continue for several days. These widespread power outages have impacted mobile site uptime in both regions.

Storm Éowyn's Impact on Consistency was more pronounced in Northern Ireland than Scotland

Speedtest Intelligence® | January 2025

Speedtest Intelligence data indicates a decline in mobile performance across multiple metrics among operators in Northern Ireland and Scotland, with Northern Ireland experiencing the greatest impact. Mobile download speeds at the 10th percentile plummeted on the day of the storm, falling 63% to 2.19 Mbps in Scotland and 74% to 1.31 Mbps in Northern Ireland relative to the seven-day average before the storm.

Storm Éowyn Pulls Down Mobile Performance Across Several Metrics in Scotland and Northern Ireland

Speedtest Intelligence® | January 2025

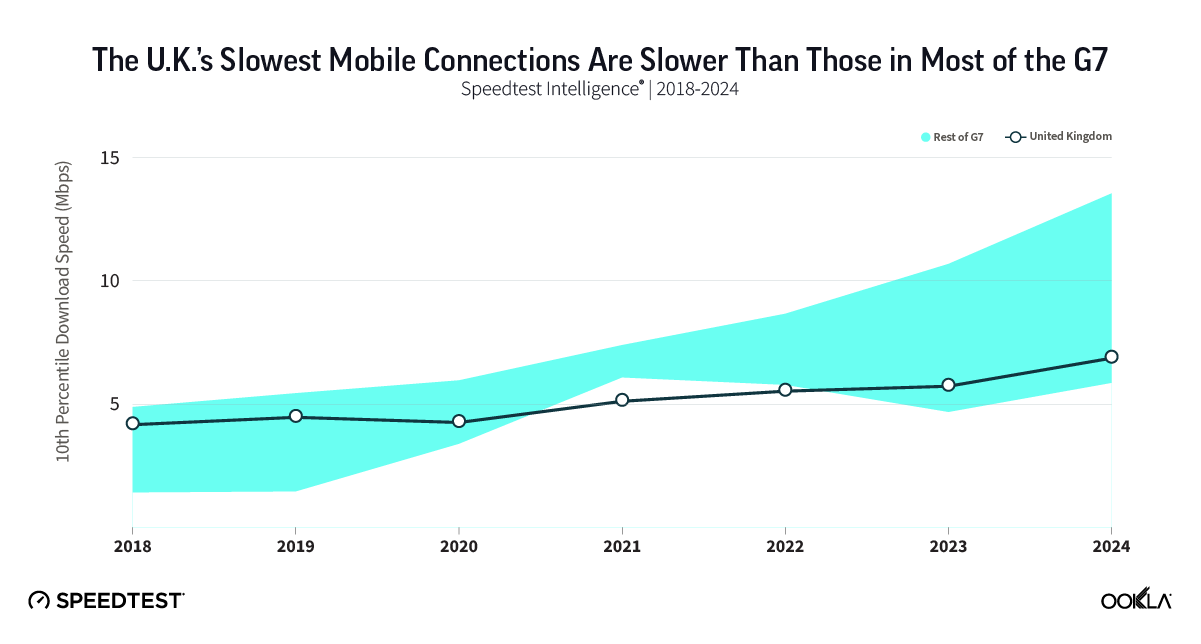

Similar to Ireland, the penetration of battery backup solutions installed at mobile sites in the UK remains limited. In its latest annual ‘Connected Nations‘ report, Ofcom noted that only around 20% of all mobile sites in the UK have some backup functionality at the RAN for more than 15 minutes, while only around 5% of sites are able to withstand a six-hour power loss (excluding battery backup for transmission traffic). It has consulted on revised ‘Resilience Guidance’ for the UK’s telecoms operators, published a call for input (CFI) on power backup for mobile networks and is now working with the government to determine if additional resilience measures are needed.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.