Variation in outage scale and duration across mobile operators during the April 28th event reinforces the case that robust power resilience is now the single most decisive factor in preserving service continuity in mobile networks

The Iberian grid collapse stands as the starkest demonstration yet of the fragility of mobile network infrastructure precisely when it is needed most. Public scrutiny following the historic event has centred on understanding and ultimately mitigating the societal vulnerabilities stemming from mobile networks’ inherent reliance on a constant grid power supply, which is increasingly difficult to guarantee as severe events become more frequent.

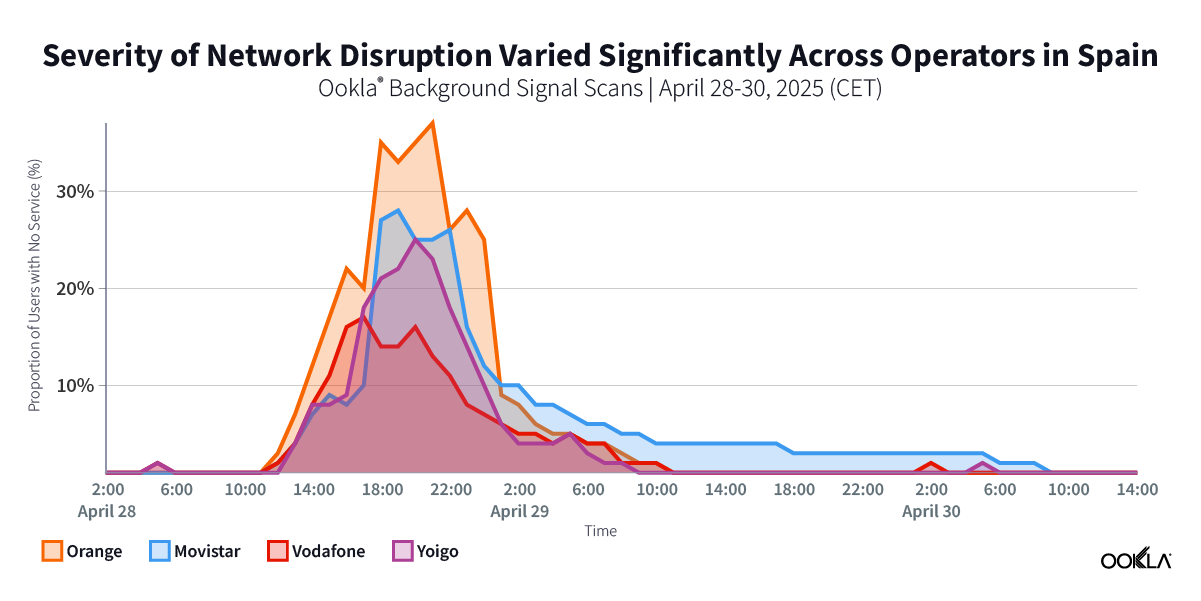

For the first time, and with the goal of fostering deeper understanding of the interdependence between mobile and power infrastructure in Europe, Ookla is publishing detailed data exposing the scale and geographic distribution of mobile network disruptions caused by the April 28th event. Building on our earlier analysis, this research reveals that the impact of the power outage on mobile network infrastructure varied significantly across operators, with differing levels of power backup penetration likely a critical factor shaping the severity experienced by end users.

Key Takeaways:

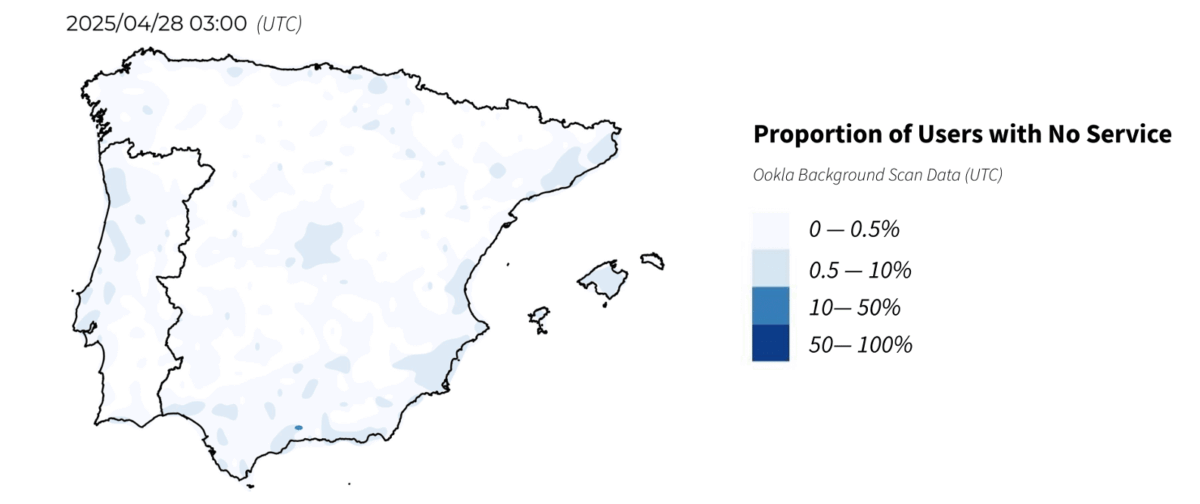

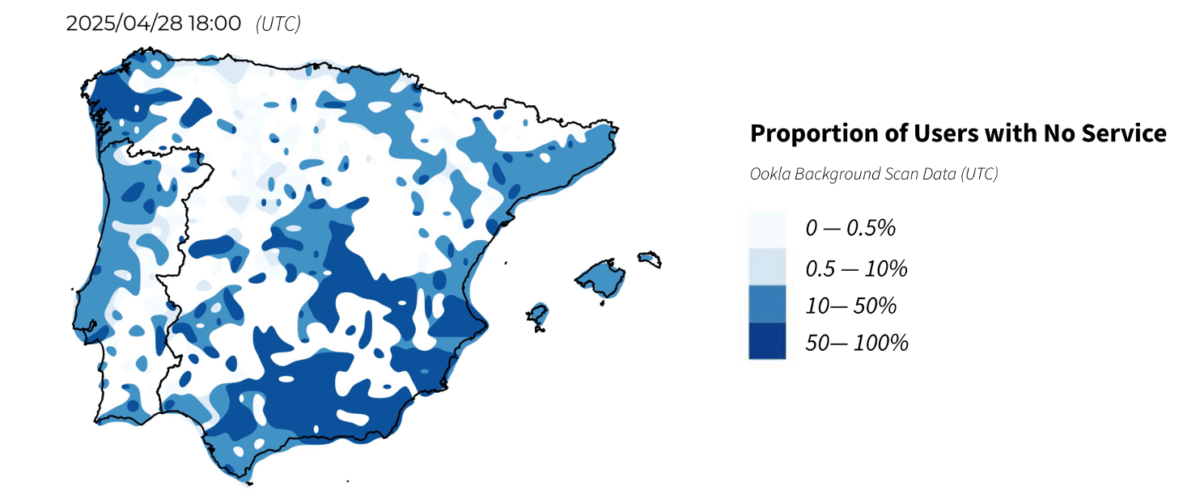

- At the peak of the April 28th blackout, more than half of all mobile network users across large parts of Spain were left completely without mobile signal. The proportion of mobile network users experiencing complete service loss (unable to call, text, or use data due to sites going dark) surged from a pre-blackout baseline of under 0.5% to more than 50% across extensive areas of Spain at the peak late on April 28th. This indicates a severe, widespread, and historic collapse of the mobile site grid that deepened throughout the afternoon and evening on the day of the blackout as available power backups were progressively depleted.

- The timing and distribution of mobile network outages closely tracked the pattern of power grid events, underlining the telecom infrastructure’s vulnerability to even brief interruptions in power supply. Within 30 minutes of the grid failure (by 13:00 CET), the proportion of users with no service surged as small cells and sites with minimal power backup and battery autonomy went offline. After two hours, about 12% of users on the most affected operator had no service. Outage growth then slowed, suggesting that remaining macro sites, likely equipped with four-to-six hour battery banks, kept operating until their reserves ran out, leading to a final sharp wave of service loss in the late evening. The restoration of mobile services tracked the geographically-phased re-energisation of the power grid, with network disruptions persisted longer into the night in parts of Andalusia and Galicia.

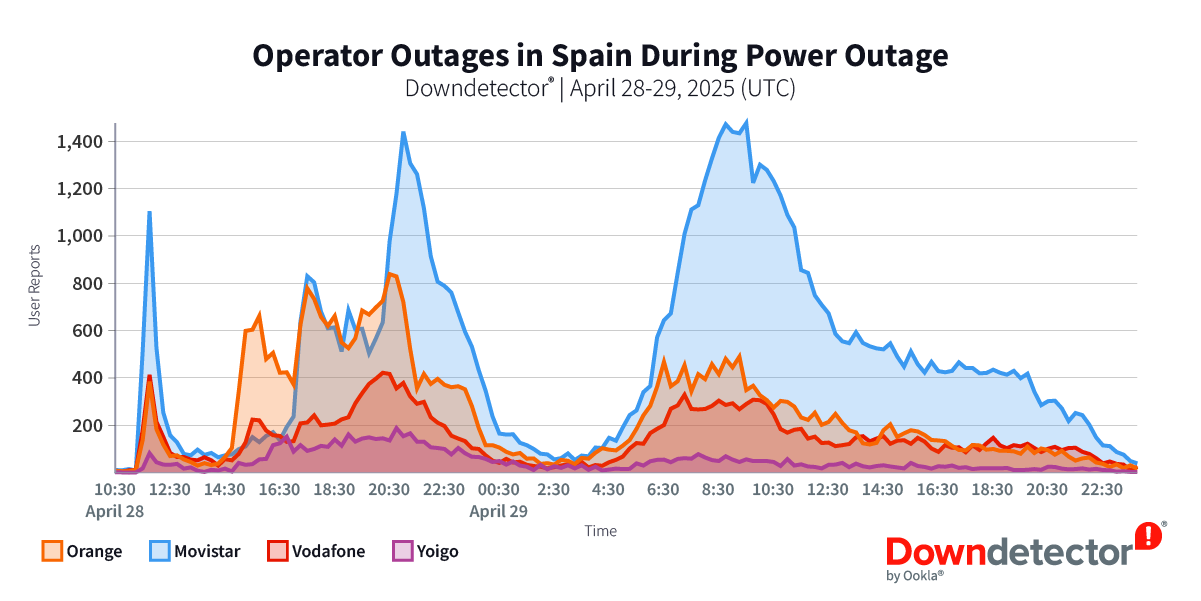

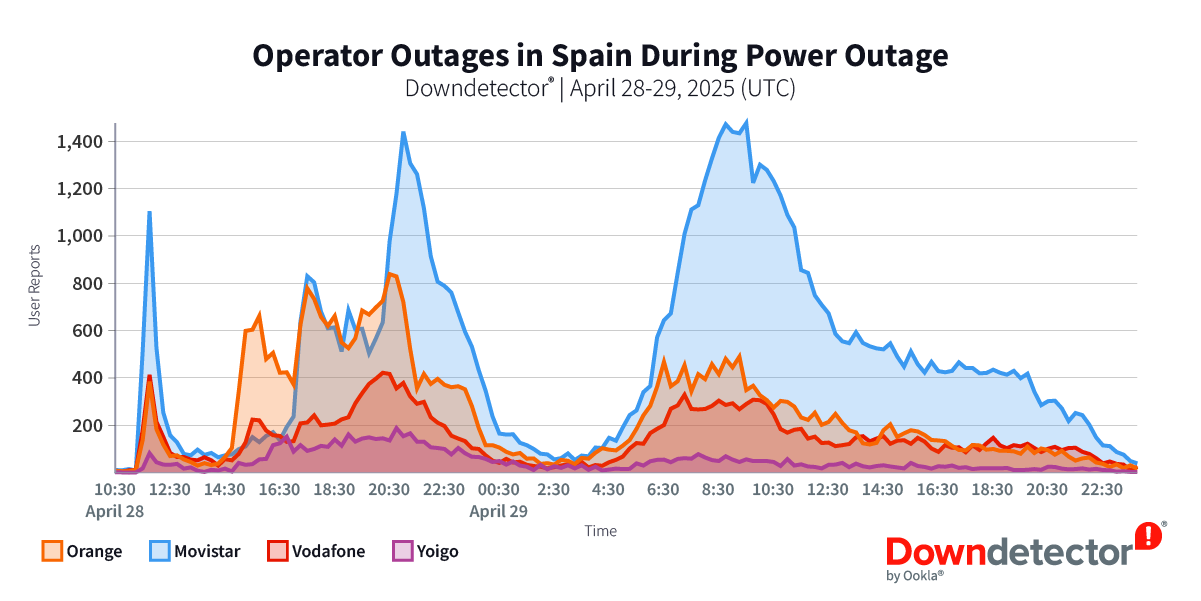

- While severe network outages were observed across all Spanish operators during the blackout, mobile users on the Vodafone network were less likely to experience a complete service loss. Four-to-eight hours after the grid collapse, the interval in which every operator hit its worst point in terms of service loss, Vodafone’s subscribers were, on average, less than half as likely to be left without service as subscribers on Orange’s network and notably less likely than subscribers on Movistar or Yoigo as well.

- Morocco’s mobile site footprint remained operational throughout April 28th since domestic grid supply was unaffected. However, the country’s reliance on Spain for international connectivity in deeper network layers resulted in cascading failures and severe service degradation. The proportion of mobile users experiencing no service on the Orange Maroc and Maroc Telecom networks remained consistent with the pre-blackout baseline on April 28th, confirming there were no sustained network disruptions at the mobile site level due to grid failure, unlike in Spain and Portugal. However, analysis of Speedtest Intelligence data reveals significant performance degradation still occurred in Morocco, with the median load time for popular websites increasing by more than 20% compared to the same day in the previous week. The quality of experience (QoE) for Orange Maroc subscribers was particularly impacted during the blackout, reportedly due to disruptions in upstream subsea connectivity between Morocco and mainland Spain.

Power Resilience and Energy Management Strategies Shape the Anatomy of Network Outages

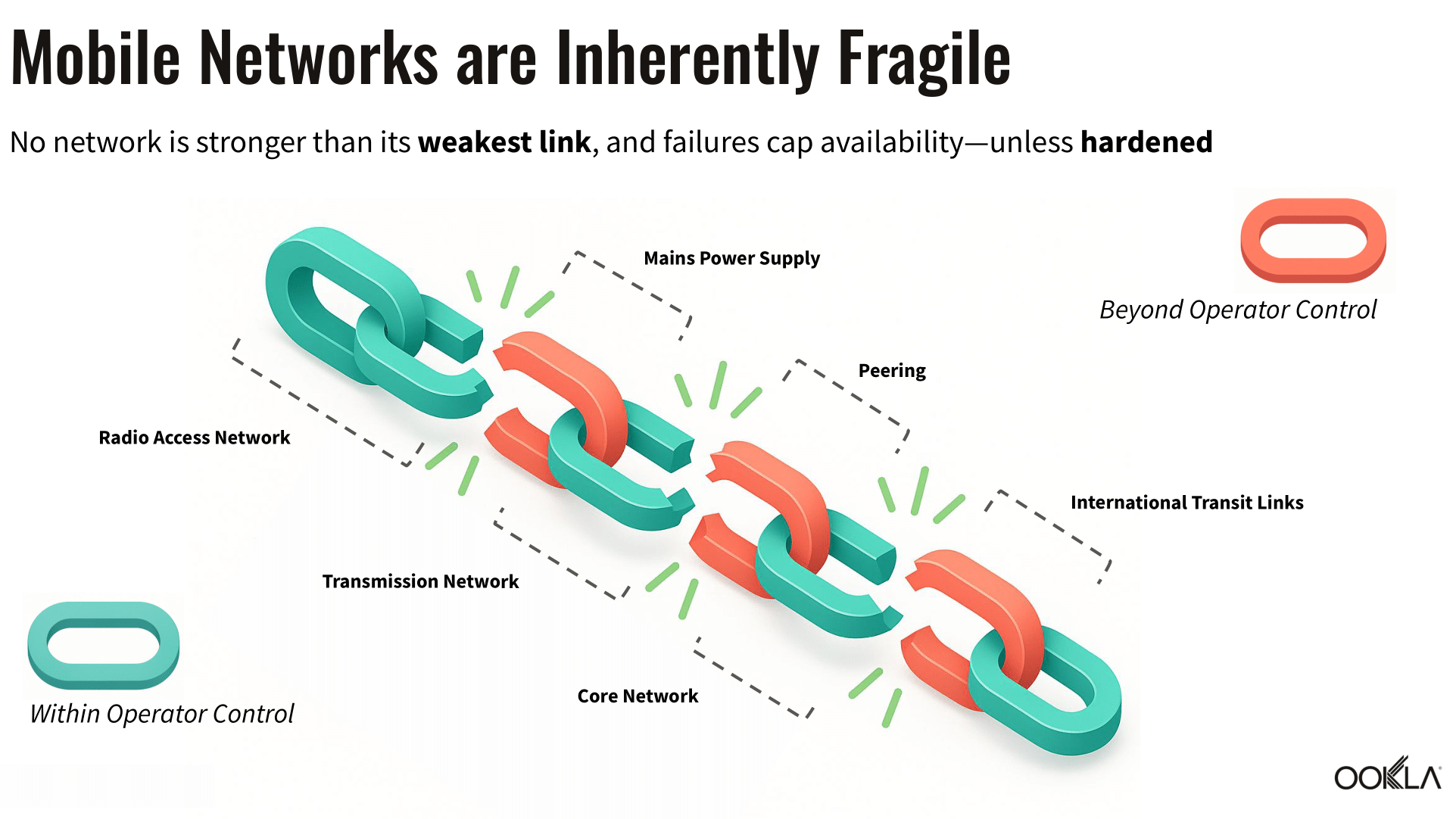

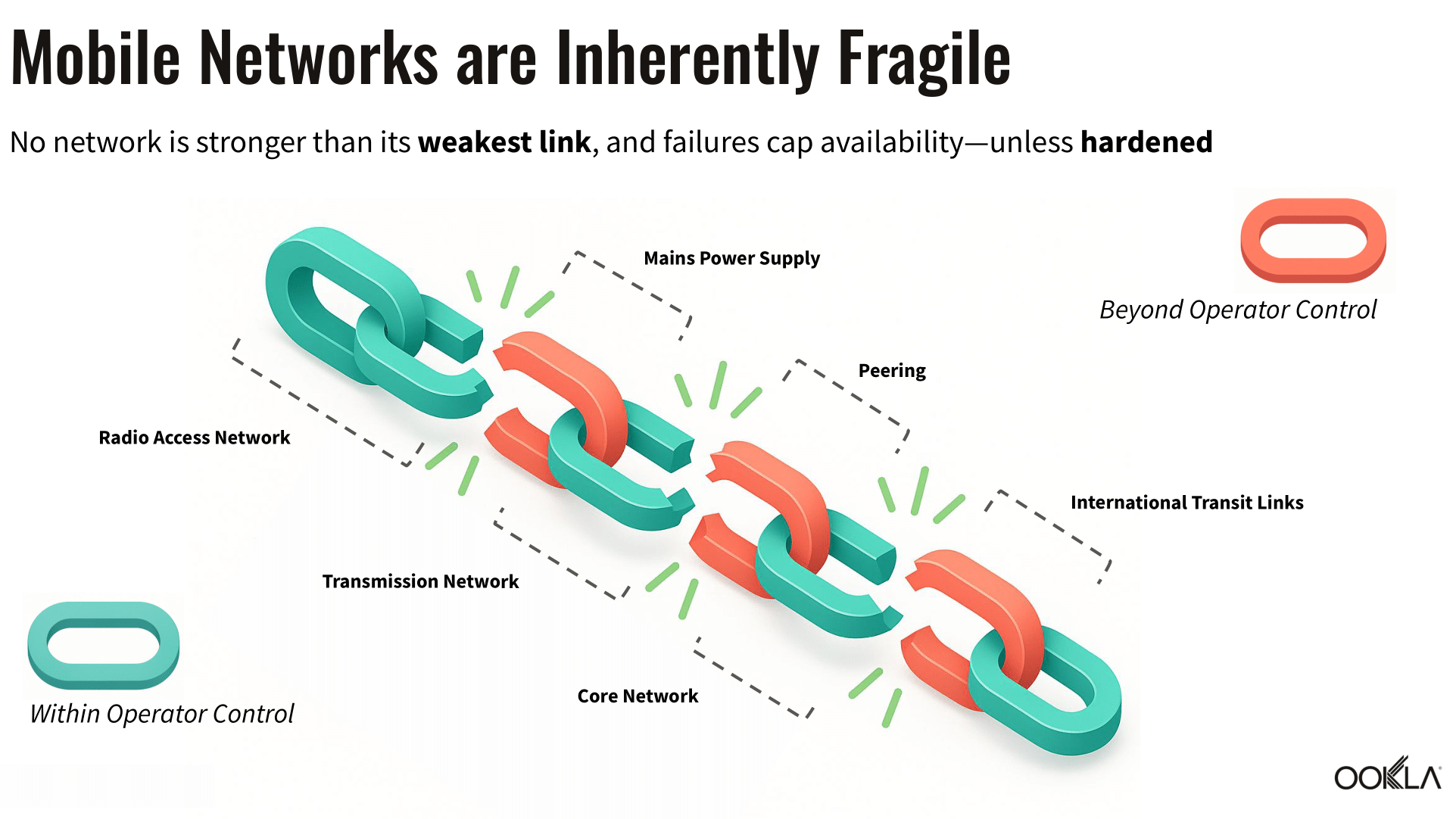

The Iberian grid collapse exemplifies a type of stress test becoming increasingly common in Europe—the ability of mobile network infrastructure to withstand prolonged, severe external shocks beyond direct operator, ensuring continuity of service precisely when it is most critical for public safety and societal functioning.

Beyond the April 28th blackout, recent events in the UK and Ireland, where winter storms (especially Storm Éowyn) caused extensive localized damage to electricity distribution networks, and in France, where substation vandalism resulted in brief but severe blackouts in Cannes and Nice, highlight electricity supply disruptions as a principal vulnerability for mobile networks reliant entirely on grid power. These disruptions add to other external vulnerabilities faced by operators, such as terrestrial or subsea fiber connectivity, upstream cloud links, and third-party peering connections.

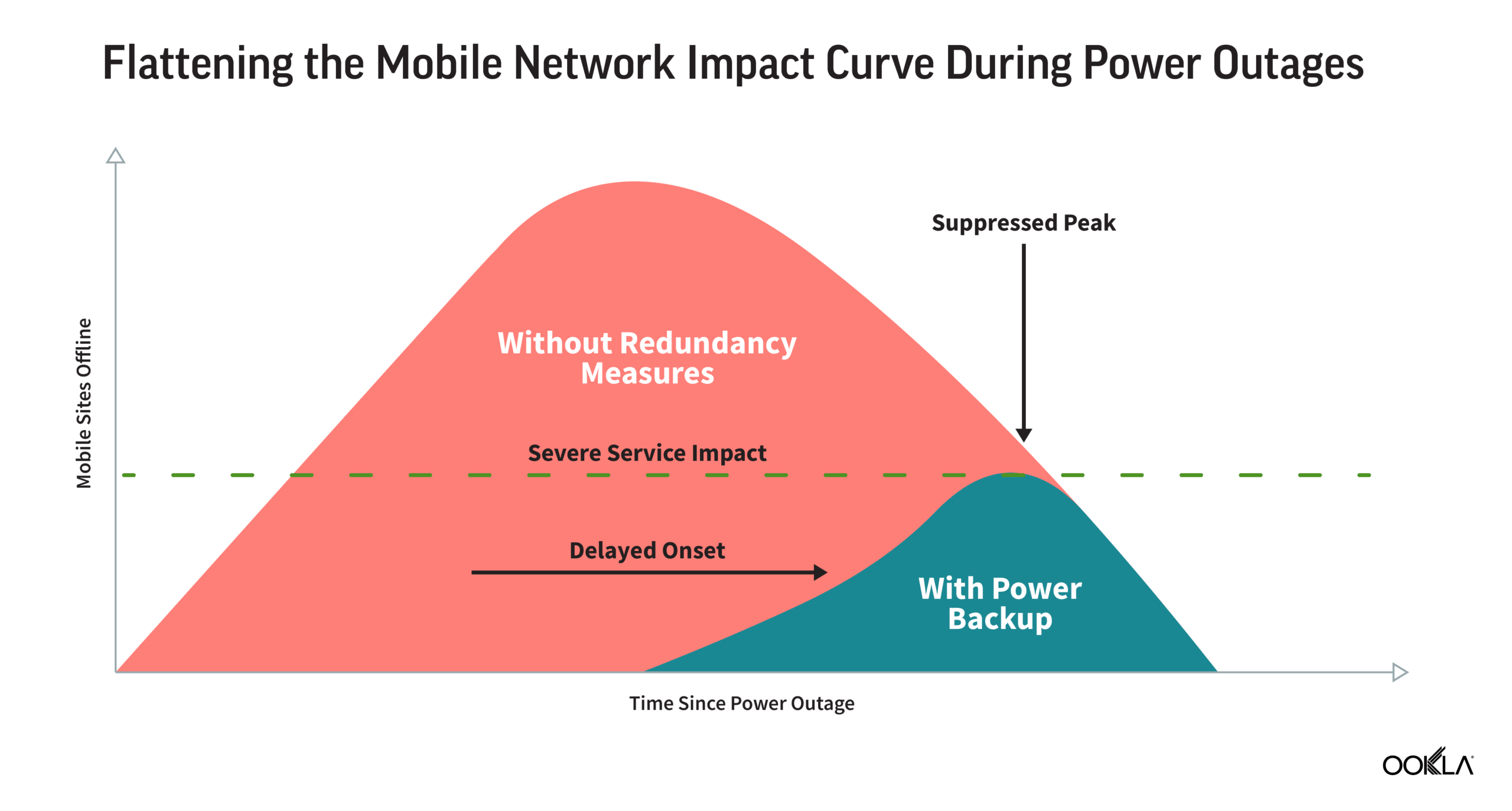

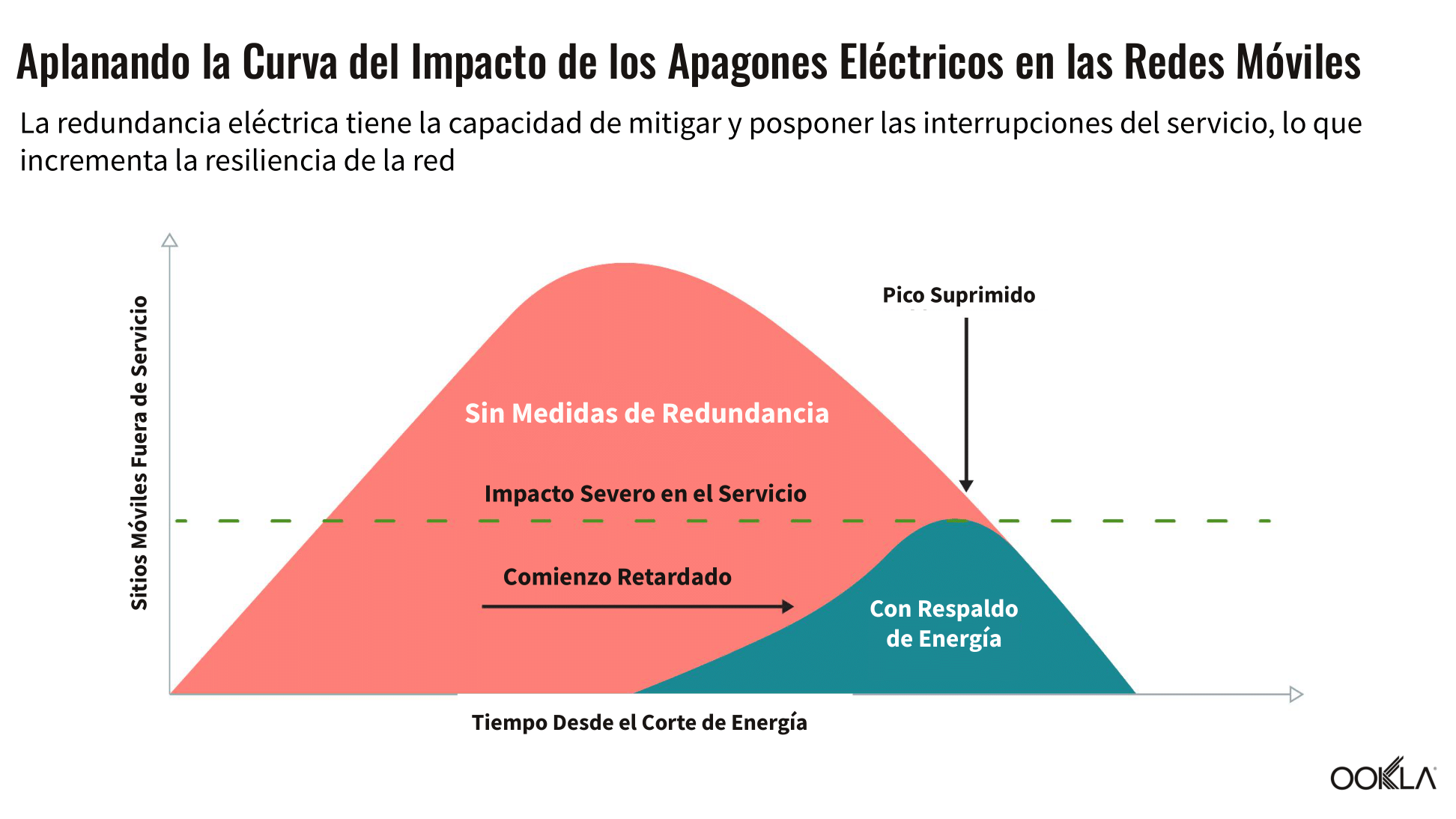

Power resilience, particularly through battery and generator backup systems at mobile sites, has emerged as a key proactive measure to mitigate network outages resulting from electricity grid disruptions. Simply put, backup power serves a role analogous to public health measures in a pandemic: it strategically delays the onset of outages (extending the operational hours before sites lose power) and reduces the peak severity (limiting the total number of sites simultaneously affected).

Capital investments in network hardening tools like power redundancy can therefore “flatten” the service-impact curve during an outage event in the same way public health measures flattened the infection curve during the coronavirus pandemic. Prolonged and wide-area grid disruptions like the one on April 28th, however, demonstrate that no single measure is a silver bullet and long-term power autonomy is often not economically viable across a large proportion of the site footprint.

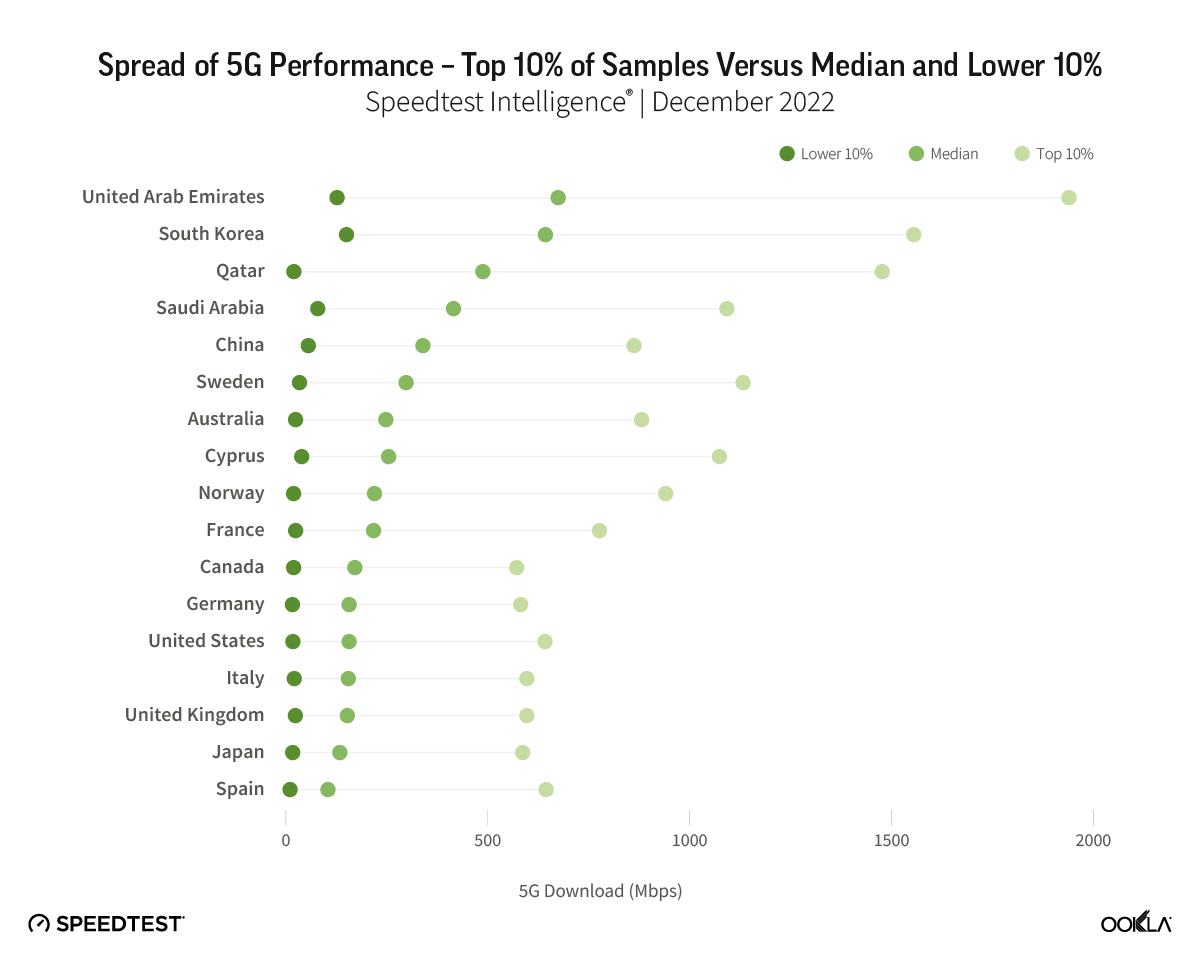

Recognizing this, mobile operators typically implement aggressive energy management measures during power disruptions to maximize site uptime and strategically allocate network resources based on user priority. These measures may include throttling site transmit power to reduce coverage footprints, limiting spectrum diversity to limit carrier aggregation and overall capacity, and temporarily disabling newer technologies such as 5G and Massive MIMO to extend battery and generator runtime.

Differences in the extent of power backup deployment and the strategic use of energy conservation and load-shedding measures shape the anatomy of network outages. Such variations among operators may arise from a diversity of fuel choices for backup power (e.g., batteries might offer long-term monetization potential, including opportunities for resale to the grid, but typically have shorter runtimes), network configurations (such as RAN sharing arrangements and site types, with dense urban small cells facing greater physical constraints for power backup deployments), and subscriber base characteristics (e.g., operators serving a larger rural subscriber base face more complex and costly challenges in enhancing network resilience).

Iberian Grid Collapse Cascaded through Mobile Networks in Spain, Moving in Lockstep with Power Disruptions

Analysis of Ookla® background signal scan data reveals that the April 28th event placed unprecedented stress on mobile networks in Spain, triggering a rapid collapse in site grid density. The historic scale of this collapse severely curtailed the coverage footprint of operator infrastructure, pushing a significant share of Spanish mobile subscribers into a ‘no service’ state, unable to connect to a nearby mobile site and thus temporarily unable to make calls, send texts, or use data.

Geospatial sequencing of the ‘no service’ data calculates the average probability that a mobile network user was left without signal during any given time window and serves as a proxy for the overall proportion of subscribers left with no network access. This methodology illustrates that the impact of the power blackout quickly cascaded through Spain’s mobile networks (closely mirroring the infection curve analogy described earlier):

- Baseline (Pre-Blackout): Mobile sites were operating as normal. The average proportion of subscribers without service was less than 0.5%, reflecting the very high levels of network availability typical of Spain.

- Initial Impact (Immediate Aftermath of Blackout): The grid collapsed at ~12:33 CET across the Iberian Peninsula, triggering rectifiers or uninterruptible power supply (UPS) devices at mobile sites to switch over to backup batteries or generators (where these were installed and adequately charged or fueled).

Within 30 minutes of the voltage drop, the proportion of subscribers without service had climbed well above the pre-event baseline across Spain and the outage curve entered a phase of runaway growth. This limited initial outage impact likely reflected the immediate loss of a small portion of the overall site footprint in areas where power backup was either absent or severely limited in capacity—most commonly at small cell sites in dense urban environments, where physical space restricts battery or generator installations, or at remote rural sites lacking redundancy (or featuring generators that took longer to switch over and come online).

Notably, the balanced geographical spread of subscribers beginning to experience no service on their devices (i.e. losing network access) at the start of the network outages suggests that the timing of impacts was broadly consistent across Spain, affecting both rural and urban regions. However, the initial severity was more pronounced in areas along the east and south coasts, as well as in the interior of the country, potentially indicating a lower level of power autonomy at sites in these areas.

- Ramp-Up (2-8 Hours After Blackout): Within two hours of the blackout, the most affected operator had already seen ~12% of users left with no service. After this point, the rate of outage growth slowed temporarily for several hours. This pattern suggests that the power backup profile of Spanish mobile sites was bi- or tri-modal, with a tiered approach to backup capacity employed by operators (i.e., site autonomy was clustered into configurations like two, four or six-hour power resilience, with battery discharge rates determined by amp-hour capacity and site load at each location).

As a result of this tiered approach to power autonomy and site load variability, a portion of sites continued operating, likely in a reduced state with aggressive energy conservation measures in place (reflected in marked performance degradation observed in Speedtest Intelligence® data), throughout the afternoon and evening of April 28th.

The eventual depletion of larger power reserves, typically found at major macro sites on lattice or monopole towers, triggered a final sharp wave of network outages four to eight hours after the blackout began. The loss of these wide-area ‘umbrella’ sites in the evening resulted in a substantial share of Spanish mobile subscribers experiencing no service by 21:00 CET, with severe network outages geographically distributed across all of Spain. - Peak (8-10 Hours After Blackout): The impact of the blackout on mobile network infrastructure in Spain peaked between 21:00 and 22:00 CET, with more than half of all mobile subscribers left without service across many regions by late evening, just before power began to return. By this stage (about ten hours after the initial power loss), even the most capable battery backups were likely exhausted, leaving only those sites powered by mobile or stationary generators still operational (especially where strategic fuel deliveries could extend uptime).

- Recovery (Remainder of April 28th and 29th): Cross-analysis of geospatial sequencing of the no service data with nighttime light emissions detailed in NASA satellite imagery reveals that the recovery of mobile services and the site grid footprint in Spain closely tracked the pattern of grid re-energization. The proportion of users without service began to decline in the mid-afternoon and early evening in the areas where power was first restored, as the grid operator carried out a phased nationwide black-start. This early network recovery was most evident in regions such as the Basque Country, Catalonia, and Castile and León.

Significant network outages continued into the night in parts of Andalusia and Galicia, meanwhile, mirroring the slower pace of power restoration in these regions. In some parts of Andalusia, for example, more than half of subscribers remained without service by 6:00 a.m. the following morning, only regaining connectivity once power was restored shortly afterwards. The direct relationship between the timing of power restoration and mobile network recovery highlights that operators are wholly dependent on the grid for service continuity once backup systems are inevitably depleted.

Breadth and Depth of Power Autonomy Drives Differences in Network Resilience Outcomes

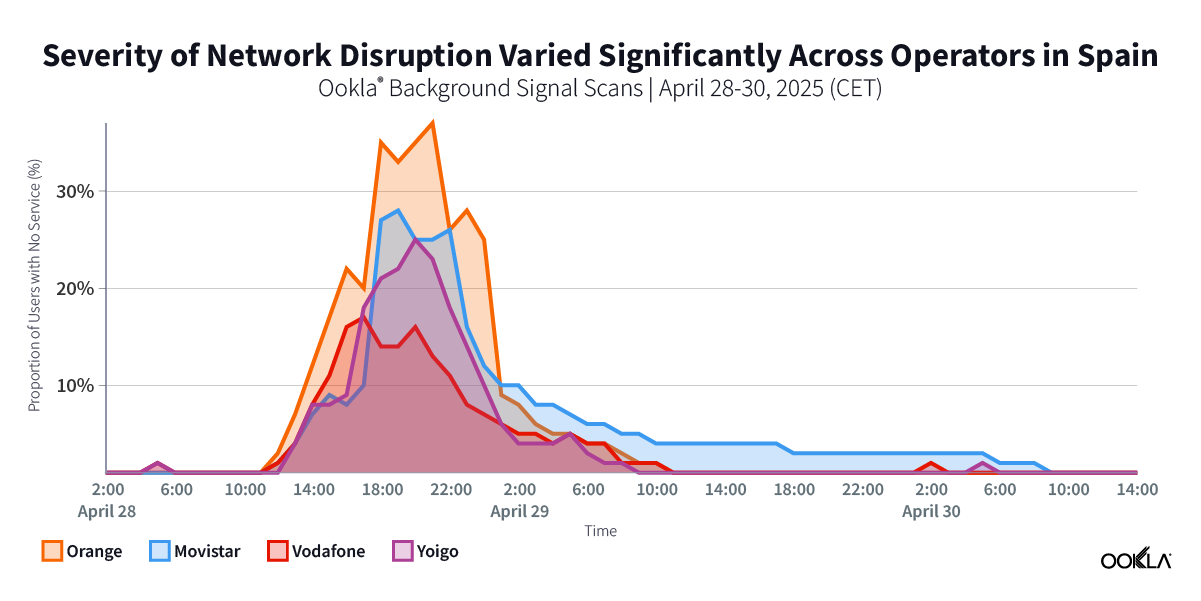

The infection curve analogy provides a potent mechanism to visualize and compare network outage profiles and site resilience among Spain’s mobile operators during the blackout. The shape of these outage curves transforms the ‘no service’ data into a story about both network topology and the breadth and depth of power backup deployed across different operators.

In the context of the outage curves, the point where each curve rises from the baseline reflects the level of power autonomy or battery/generator depth. The height of the peak shows how evenly that autonomy is distributed across the site footprint, while the length of the tail can reveal the geographical skew of subscribers within each operator’s network.

On April 28th, Vodafone exhibited the earliest and lowest outage peak in Spain. The probability that a subscriber on its network was left without service peaked at about half that of Orange and notably below other operators. This early yet suppressed peak indicates a thin but widely deployed power autonomy layer in its network, with small cells (featuring short UPS reserves) dropping out quickly, while most large macro sites carrying modest batteries or generators with different configurations likely kept at least one carrier alive for several hours. This approach of spreading shallow reserves across most sites flattened Vodafone’s outage peak but also pulled it forward in time.

While Orange’s outage curve did not reach its peak until several hours after Vodafone, it is indicative of a strategy that concentrated on thick battery or generator backup at key sites but left a broad swath of sites vulnerable to synchronized collapse (as reflected in the sharp no service spikes), the higher peak suggests a larger share of its subscriber base was likely left with no service during the blackout.

Movistar’s outage profile fell between Vodafone and Orange in both the timing and height of its peak during the blackout, but the recovery of its site footprint was significantly more protracted—taking nearly twice as long (almost a day and a half) as the other operators for the proportion of subscribers with no service to drop below 2%. This is likely an artifact of the unique scale of its rural site and subscriber footprint in Spain, where power backup is often more reliant on generators that require manual intervention and are more limited in deployment due to the economic challenges posed by installation in remote areas.

Network Resilience is about more than Power Redundancy

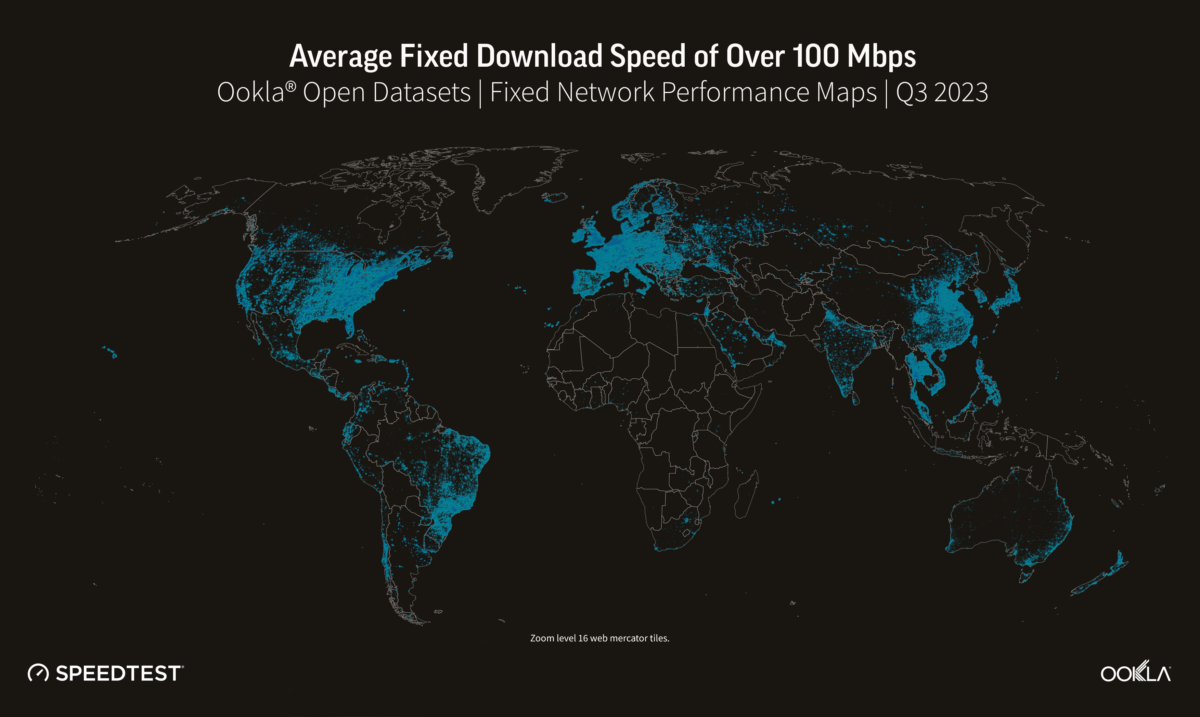

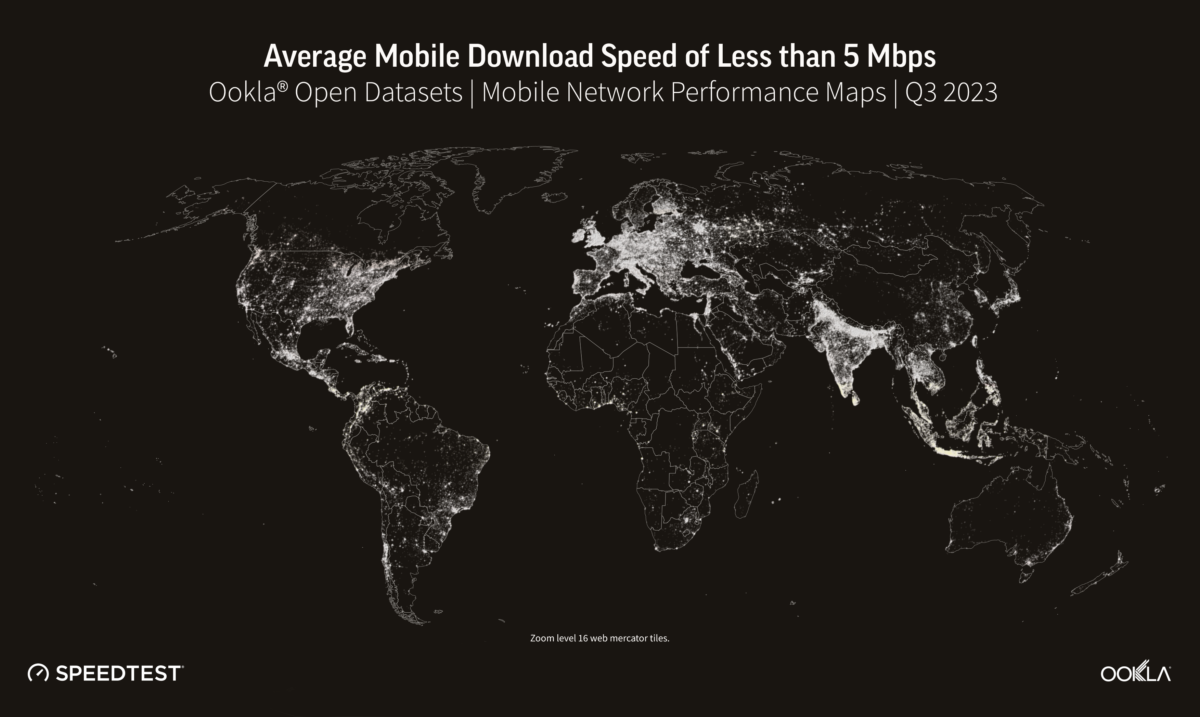

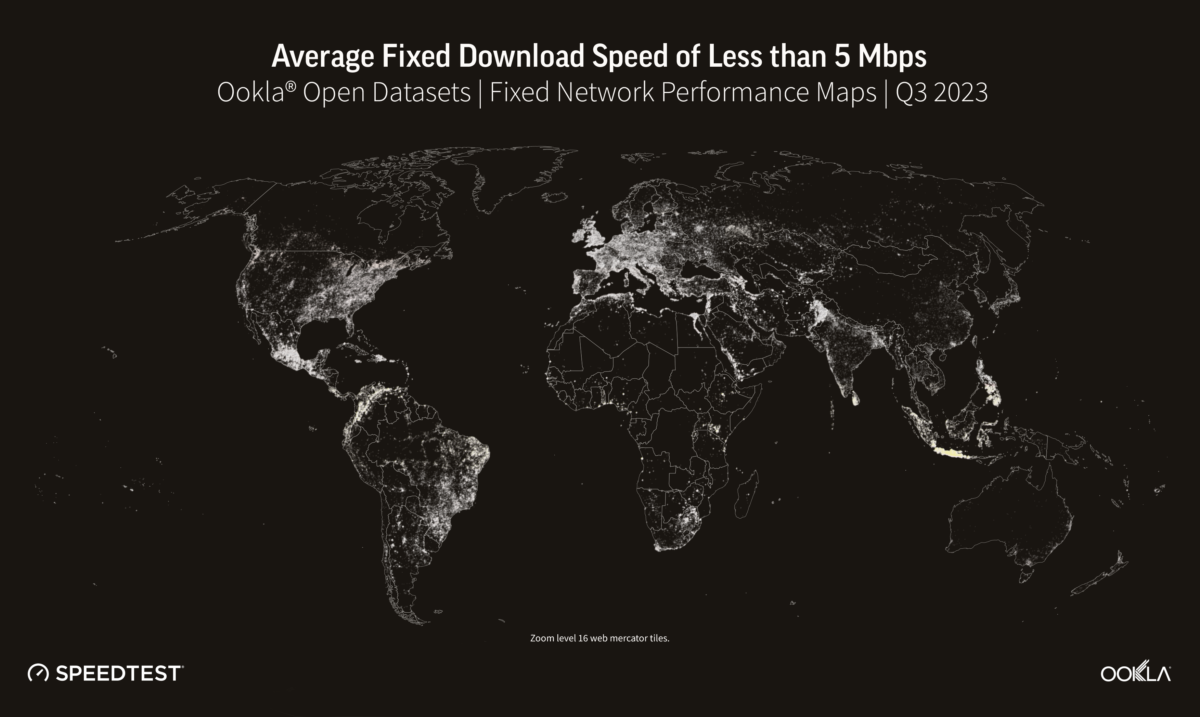

While the Iberian blackout may have been a black swan event, the wider global trend of escalating climate, energy, and security-driven shocks impacting multiple layers of telecom infrastructure—often beyond the direct control of mobile operators—has elevated network resilience from a secondary consideration to a core design principle. This shift is reflected in more robust policy oversight (as exemplified in countries like Norway and Finland) and is likely to be underpinned by fiscal subsidies that seek to support the deployment of more power resilience solutions at mobile sites.

Network resilience is, however, more than keeping the lights on; it also depends on other important factors like having diverse, independent paths to the wider internet. On the day of the blackout, Moroccan operators that funnel most of their international traffic through Spanish landing stations lost those paths when the grid collapse knocked Spanish routers and data centers offline.

Since the subsea capacity and routing of some Moroccan operators was dependent on a highly concentrated upstream Spain-centered corridor, there was limited immediate fail-over and users experienced sharp service degradation, even though power and equipment inside Morocco never went down. By contrast, operators that had additional fibers to France or Italy suffered more minor disruptions, highlighting how geographic and upstream diversity are just as critical to mobile network resilience as local power autonomy.

Cómo Se Comportaron Las Redes Móviles Españolas Durante El Colapso De La Red Ibérica

La variación en la escala y duración de las interrupciones entre los operadores de telefonía móvil durante el evento del 28 de abril refuerza la idea de que una sólida capacidad de recuperación energética es ahora el factor más decisivo para garantizar la continuidad del servicio en las redes móviles.

El colapso de la red ibérica es la demostración más clara de la fragilidad de la infraestructura de las redes móviles precisamente cuando más se necesita. El debate público tras el histórico suceso se ha centrado en comprender y, en última instancia, mitigar las vulnerabilidades sociales derivadas de la dependencia inherente de las redes móviles de un suministro constante de energía de la red, que es cada vez más difícil de garantizar a medida que los incidentes graves se hacen más frecuentes.

Por primera vez, y con el objetivo de fomentar una comprensión más profunda de la interdependencia entre la infraestructura móvil y la eléctrica en Europa, Ookla publica datos detallados que muestran la escala y la distribución geográfica de las interrupciones de la red móvil causadas por el apagón del 28 de abril. Sobre la base de nuestro análisis anterior, esta investigación revela que el impacto del corte de energía en la infraestructura de red móvil varió significativamente entre los operadores, y que los diferentes niveles de penetración de la energía de respaldo son probablemente un factor crítico que determina la gravedad que experimentan los usuarios finales.

Principales Conclusiones:

- En el punto álgido del apagón del 28 de abril, más de la mitad de los usuarios de redes móviles de amplias zonas de España se quedaron completamente sin señal móvil. La proporción de usuarios de redes móviles que experimentaron una pérdida completa del servicio (sin poder llamar, enviar mensajes de texto o utilizar datos debido a que los sitios se habían quedado sin señal) pasó de un valor de referencia previo al apagón inferior al 0,5% a más del 50% en amplias zonas de España en el punto álgido del 28 de abril. Esto indica un colapso grave, generalizado e histórico de la red de telefonía móvil que se agravó durante la tarde y la noche del día del apagón a medida que se agotaban progresivamente las reservas de energía disponibles.

- El momento y la distribución de los cortes de la red móvil siguieron el patrón de los incidentes de la red eléctrica, lo que evidencia la vulnerabilidad de la infraestructura de telecomunicaciones a las interrupciones, incluso breves, del suministro eléctrico. En los 30 minutos siguientes al fallo de la red (a las 13:00 CET), la proporción de usuarios sin servicio aumentó a medida que se desconectaban las células pequeñas y los emplazamientos con un mínimo de reserva de energía y autonomía de batería. Al cabo de dos horas, alrededor del 12% de los usuarios del operador más afectado carecían de servicio. El aumento de los cortes se ralentizó a continuación, lo que sugiere que los macroemplazamientos restantes, probablemente equipados con bancos de baterías de cuatro a seis horas de autonomía, siguieron funcionando hasta que se agotaron sus reservas, lo que provocó una última y brusca oleada de pérdidas de servicio a última hora de la tarde. El restablecimiento de los servicios móviles siguió el ritmo de la reenergización geográficamente escalonada de la red eléctrica, con interrupciones de la red que se prolongaron hasta bien entrada la noche en partes de Andalucía y Galicia.

- Aunque durante el apagón se observaron graves cortes de red en todos los operadores españoles, los usuarios de telefonía móvil de la red de Vodafone tuvieron menos probabilidades de sufrir una pérdida completa del servicio. Entre cuatro y ocho horas después del colapso de la red, el intervalo en el que cada operador alcanzó su peor punto en términos de pérdida de servicio, los abonados de Vodafone tuvieron, de media, menos de la mitad de probabilidades de quedarse sin servicio que los abonados de la red de Orange y notablemente menos probabilidades también que los abonados de Movistar o Yoigo.

- La red de telefonía móvil de Marruecos permaneció operativa durante todo el 28 de abril, ya que el suministro de la red nacional no se vio afectado. Sin embargo, la dependencia del país de España para la conectividad internacional en capas más profundas de la red provocó fallos en cascada y una grave degradación del servicio. La proporción de usuarios de telefonía móvil sin servicio en las redes de Orange Maroc y Maroc Telecom se mantuvo el 28 de abril en el mismo nivel que antes del apagón, lo que confirma que no se produjeron interrupciones sostenidas de la red en los emplazamientos de telefonía móvil debido a fallos de la red, a diferencia de lo ocurrido en España y Portugal. Sin embargo, el análisis de los datos de Speedtest Intelligence revela que en Marruecos se siguió produciendo una degradación significativa del rendimiento, con un aumento de más del 20% en el tiempo medio de carga de los sitios web más populares en comparación con el mismo día de la semana anterior. La calidad de la experiencia (QoE) de los abonados de Orange Maroc se vio especialmente afectada durante el apagón, al parecer debido a interrupciones en la conectividad submarina ascendente entre Marruecos y España continental.

La resiliencia eléctrica y las estrategias de gestión de la energía determinan la anatomía de los cortes de red

El colapso de la red ibérica ejemplifica un tipo de prueba de resistencia cada vez más habitual en Europa: la capacidad de la infraestructura de redes móviles para resistir perturbaciones externas graves y prolongadas más allá del operador directo, garantizando la continuidad del servicio, precisamente cuando es más crítico para la seguridad pública y el funcionamiento de la sociedad.

Más allá del apagón del 28 de abril, los recientes sucesos en el Reino Unido e Irlanda, donde las tormentas invernales (especialmente la tormenta Éowyn) causaron grandes daños localizados en las redes de distribución eléctrica, y en Francia, donde el vandalismo en subestaciones provocó breves pero graves apagones en Cannes y Niza, ponen de manifiesto que las interrupciones del suministro eléctrico son una de las principales vulnerabilidades de las redes móviles que dependen totalmente de la red eléctrica. Estas interrupciones se suman a otras vulnerabilidades externas a las que se enfrentan los operadores, como la conectividad de fibra terrestre o submarina, los enlaces ascendentes en la nube y las conexiones igualitarias de terceros.

La resiliencia energética, en particular mediante sistemas de baterías y generadores de reserva en los emplazamientos móviles, ha surgido como una medida proactiva clave para mitigar los cortes de red derivados de las interrupciones de la red eléctrica. En pocas palabras, la energía de reserva desempeña un papel análogo al de las medidas de salud pública en una pandemia: retrasa estratégicamente el inicio de los cortes (ampliando las horas operativas antes de que los sites se queden sin energía) y reduce la gravedad máxima (limitando el número total de sitios afectados simultáneamente).

Por tanto, las inversiones de capital en herramientas de refuerzo de la red, como la redundancia de energía, pueden “aplanar” la curva de impacto del servicio durante un apagón, del mismo modo que las medidas de salud pública aplanaron la curva de infección durante la pandemia de coronavirus. Sin embargo, las interrupciones prolongadas y generalizadas de la red, como la del 28 de abril, demuestran que ninguna medida por sí sola es la panacea y que la autonomía energética a largo plazo no suele ser económicamente viable en una gran proporción de la huella del emplazamiento.

Conscientes de ello, los operadores de telefonía móvil suelen aplicar medidas agresivas de gestión de la energía durante las interrupciones del suministro para maximizar el tiempo de actividad de los emplazamientos y asignar estratégicamente los recursos de red en función de la prioridad de los usuarios. Estas medidas pueden incluir el estrangulamiento de la potencia de transmisión del emplazamiento para reducir las huellas de cobertura, la limitación de la diversidad del espectro para limitar la agregación de portadoras y la capacidad global, y la desactivación temporal de tecnologías más nuevas como 5G y Massive MIMO para ampliar el tiempo de funcionamiento de la batería y el generador.

Las diferencias en el alcance del despliegue de respaldo de energía y el uso estratégico de medidas de conservación de la energía y reducción de la carga conforman la anatomía de los cortes de red. Estas variaciones entre operadores pueden deberse a la diversidad de combustibles elegidos para la energía de reserva (por ejemplo, las baterías pueden ofrecer un potencial de monetización a largo plazo, incluidas las oportunidades de reventa a la red, pero suelen tener tiempos de funcionamiento más cortos), configuraciones de red (como los acuerdos de compartición de RAN y los tipos de emplazamientos, con pequeñas células urbanas densas que se enfrentan a mayores limitaciones físicas para los despliegues de energía de reserva) y características de la base de abonados (por ejemplo, los operadores que atienden a una base de abonados rurales más grande se enfrentan a retos más complejos y costosos para mejorar la resiliencia de la red).

El colapso de la red ibérica se propagó en cascada a través de las redes móviles en España, moviéndose al unísono con las interrupciones del suministro eléctrico

El análisis de los datos de escaneo de señales de fondo de Ookla® revela que el incidente del 28 de abril provocó una tensión sin precedentes en las redes móviles de España, desencadenando un rápido colapso en la densidad de la red. La escala histórica de este colapso redujo gravemente la huella de cobertura de la infraestructura del operador, empujando a una parte significativa de los abonados móviles españoles a un estado de “sin servicio”, incapaces de conectarse a un sitio móvil cercano y, por tanto, temporalmente incapaces de hacer llamadas, enviar mensajes de texto o utilizar datos.

La secuenciación geoespacial de los datos de “sin servicio” calcula la probabilidad media de que un usuario de red móvil se quedara sin señal durante una ventana temporal determinada y sirve como indicador de la proporción global de abonados que se quedan sin acceso a la red. Esta metodología ilustra que el impacto del apagón se propagó rápidamente en cascada por las redes móviles españolas (reflejando fielmente la analogía de la curva de infección descrita anteriormente):

- Línea de base (antes del apagón). Los sitios móviles funcionaban con normalidad. La proporción media de abonados sin servicio era inferior al 0,5%, lo que refleja los altísimos niveles de disponibilidad de red típicos de España.

- Impacto inicial (inmediatamente después del apagón). La red se colapsó en torno a las 12:33 CET en toda la Península Ibérica, lo que provocó que los rectificadores o los dispositivos de alimentación ininterrumpida (SAI) de las ubicaciones móviles pasaran a utilizar baterías o generadores de reserva (cuando éstos estaban instalados y adecuadamente cargados o alimentados).

A los 30 minutos de la caída de tensión, la proporción de abonados sin servicio había superado con creces la línea de base anterior al incidente en toda España y la curva de cortes entró en una fase de crecimiento descontrolado. Es probable que este impacto inicial limitado de los cortes reflejara la pérdida inmediata de una pequeña parte de la huella total del emplazamiento en zonas en las que no había suministro eléctrico de reserva o su capacidad era muy limitada, normalmente en emplazamientos de células pequeñas en entornos urbanos densos, donde el espacio físico restringe la instalación de baterías o generadores, o en emplazamientos rurales remotos sin redundancia (o con generadores que tardaron más en conectarse).

Cabe destacar que la distribución geográfica equilibrada de los abonados que empezaron a quedarse sin servicio en sus dispositivos (es decir, a perder el acceso a la red) al inicio de los cortes de red sugiere que el momento de los impactos fue en general coherente en toda España, afectando tanto a regiones rurales como urbanas. Sin embargo, la gravedad inicial fue más pronunciada en las zonas situadas a lo largo de las costas este y sur, así como en el interior del país, lo que podría indicar un menor nivel de autonomía eléctrica en los emplazamientos de estas zonas.

- Recuperación (2-8 horas después del apagón). A las dos horas del apagón, el operador más afectado ya había visto cómo en torno al 12% de los usuarios se quedaban sin servicio. A partir de ese momento, el ritmo de crecimiento de los cortes disminuyó temporalmente durante varias horas. Este patrón sugiere que el perfil de reserva de energía de los sitios móviles españoles era bimodal o trimodal, con un enfoque escalonado de la capacidad de reserva empleada por los operadores (es decir, la autonomía de los sitios se agrupaba en configuraciones como resiliencia de energía de dos, cuatro o seis horas, con tasas de descarga de la batería determinadas por la capacidad de amperios-hora y la carga del sitio en cada ubicación).

Como resultado de este enfoque escalonado de la autonomía energética y de la variabilidad de la carga del emplazamiento, una parte de los emplazamientos siguieron funcionando, probablemente en un estado reducido con medidas agresivas de conservación de la energía (reflejadas en la marcada degradación del rendimiento observada en los datos de Speedtest Intelligence®), durante toda la tarde y noche del 28 de abril.

El agotamiento final de las grandes reservas de energía, que suelen encontrarse en los principales macro-emplazamientos situados en torres de celosía o monoposte, desencadenó una última oleada de cortes de red entre cuatro y ocho horas después del inicio del apagón. La pérdida de estos emplazamientos “paraguas” de área amplia por la noche provocó que una parte sustancial de los abonados móviles españoles se quedaran sin servicio a las 21:00 CET, con graves cortes de red distribuidos geográficamente por toda España. - Pico (8-10 horas después del apagón). El impacto del apagón en la infraestructura de la red móvil en España alcanzó su punto álgido entre las 21:00 y las 22:00 CET, con más de la mitad de todos los abonados móviles sin servicio en muchas regiones a última hora de la tarde, justo antes de que empezara a volver la electricidad. Para entonces (unas diez horas después de la pérdida inicial de energía), incluso las baterías de reserva más potentes estaban probablemente agotadas, por lo que sólo quedaban operativas las instalaciones alimentadas por generadores móviles o fijos (especialmente en los casos en que el suministro estratégico de combustible podía prolongar el tiempo de actividad).

- Recuperación (resto de los días 28 y 29 de abril). El análisis cruzado de la secuencia geoespacial de los datos de ausencia de servicio con las emisiones de luz nocturnas detalladas en las imágenes de satélite de la NASA revela que la recuperación de los servicios móviles y la huella de la red de los emplazamientos en España siguieron de cerca el patrón de reenergización de la red. La proporción de usuarios sin servicio empezó a disminuir a media tarde y a primera hora de la noche en las zonas donde primero se restableció el suministro eléctrico, a medida que el operador de la red realizaba un arranque en negro por fases en todo el país. Esta recuperación temprana de la red fue más evidente en regiones como el País Vasco, Cataluña y Castilla y León.

Mientras tanto, en algunas zonas de Andalucía y Galicia los cortes de red continuaron durante la noche, reflejando el ritmo más lento del restablecimiento del suministro eléctrico en estas regiones. En algunas zonas de Andalucía, por ejemplo, más de la mitad de los abonados seguían sin servicio a las 6 de la mañana del día siguiente, y sólo recuperaron la conectividad cuando se restableció el suministro poco después. La relación directa entre el momento del restablecimiento del suministro eléctrico y la recuperación de la red móvil pone de manifiesto que los operadores dependen totalmente de la red para la continuidad del servicio una vez que los sistemas de reserva se agotan inevitablemente.

La amplitud y la profundidad de la autonomía eléctrica determinan las diferencias en los resultados de la recuperación de la red

La analogía de la curva de infección proporciona un potente mecanismo para visualizar y comparar los perfiles de interrupción de la red y la capacidad de recuperación de los emplazamientos entre los operadores móviles españoles durante el apagón. La forma de estas curvas de cortes transforma los datos de “ausencia de servicio” en una historia sobre la topología de la red y la amplitud y profundidad de la reserva de energía desplegada por los distintos operadores.

En el contexto de las curvas de interrupciones, el punto en el que cada curva se eleva desde la línea de base refleja el nivel de autonomía eléctrica o la profundidad de la batería/generador. La altura del pico muestra hasta qué punto la autonomía se distribuye uniformemente a través de la huella del sitio, mientras que la longitud de la cola puede revelar el sesgo geográfico de los abonados dentro de la red de cada operador.

El 28 de abril, Vodafone exhibió el pico de cortes más temprano y más bajo de España. La probabilidad de que un abonado de su red se quedara sin servicio alcanzó un máximo de aproximadamente la mitad que el de Orange y notablemente por debajo de otros operadores. Este pico, temprano pero suprimido, indica una capa de autonomía energética delgada pero ampliamente desplegada en su red, con células pequeñas (que cuentan con reservas cortas de SAI) que se quedan sin servicio rápidamente, mientras que la mayoría de los grandes macroemplazamientos que llevan baterías modestas o generadores con diferentes configuraciones probablemente mantuvieron vivo al menos a un operador durante varias horas. Este planteamiento de repartir reservas poco profundas entre la mayoría de los emplazamientos aplanó el pico de cortes de Vodafone, pero también lo adelantó en el tiempo.

Aunque la curva de cortes de Orange no alcanzó su pico hasta varias horas después que la de Vodafone, es indicativa de una estrategia que se concentró en una reserva de baterías o generadores de gran capacidad en los emplazamientos clave, pero que dejó una amplia franja de emplazamientos vulnerables al colapso sincronizado (como reflejan los fuertes picos sin servicio), el pico más alto sugiere que una mayor parte de su base de abonados probablemente se quedó sin servicio durante el apagón.

El perfil de interrupción de Movistar se situó entre el de Vodafone y Orange tanto en el momento como en la altura de su pico durante el apagón, pero la recuperación de su huella de sitios fue significativamente más prolongada, tardando casi el doble de tiempo (casi un día y medio) que los otros operadores para que la proporción de abonados sin servicio cayera por debajo del 2%. Es probable que esto se deba a la escala única de su presencia rural y de abonados en España, donde la energía de reserva suele depender más de generadores que requieren intervención manual y cuyo despliegue es más limitado debido a las dificultades económicas que plantea la instalación en zonas remotas.

La resiliencia de la red va más allá de la redundancia energética

Si bien el apagón en la Península Ibérica pudo haber sido un evento inesperado, la creciente tendencia global de crisis climáticas, energéticas y de seguridad que impactan múltiples capas de la infraestructura de telecomunicaciones —a menudo fuera del control directo de los operadores móviles— ha elevado la resiliencia de la red de una consideración secundaria a un principio de diseño fundamental. Este cambio se refleja en una supervisión política más exhaustiva (como se ejemplifica en países como Noruega y Finlandia) y es probable que se sustente en subsidios fiscales que buscan apoyar el despliegue de más soluciones de resiliencia energética en las estaciones móviles.

La resiliencia de la red, sin embargo, va más allá de mantener las luces encendidas; también depende de otros factores importantes, como contar con rutas diversas e independientes hacia una internet más amplia. El día del apagón, los operadores marroquíes que canalizan la mayor parte de su tráfico internacional a través de estaciones de aterrizaje españolas perdieron esas rutas cuando el colapso de la red dejó fuera de servicio a los routers y centros de datos españoles.

Dado que la capacidad submarina y el enrutamiento de algunos operadores marroquíes dependían de un corredor de aguas arriba altamente concentrado y centrado en España, la conmutación por error inmediata fue limitada y los usuarios experimentaron una fuerte degradación del servicio, a pesar de que el suministro eléctrico y los equipos dentro de Marruecos nunca se interrumpieron. Por el contrario, los operadores que contaban con fibra adicional con Francia o Italia sufrieron interrupciones menores, lo que pone de manifiesto cómo la diversidad geográfica y de aguas arriba es tan crucial para la resiliencia de la red móvil como la disponibilidad de energía local.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.