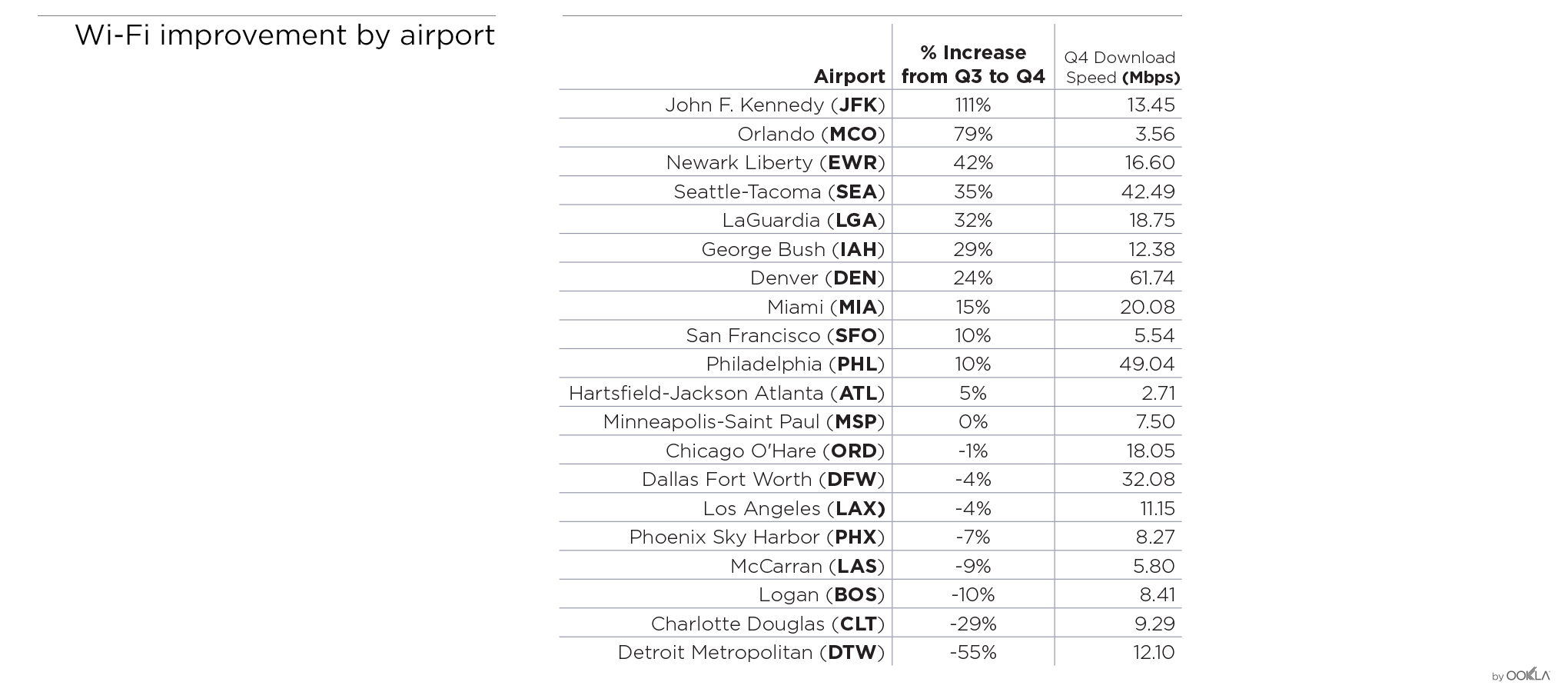

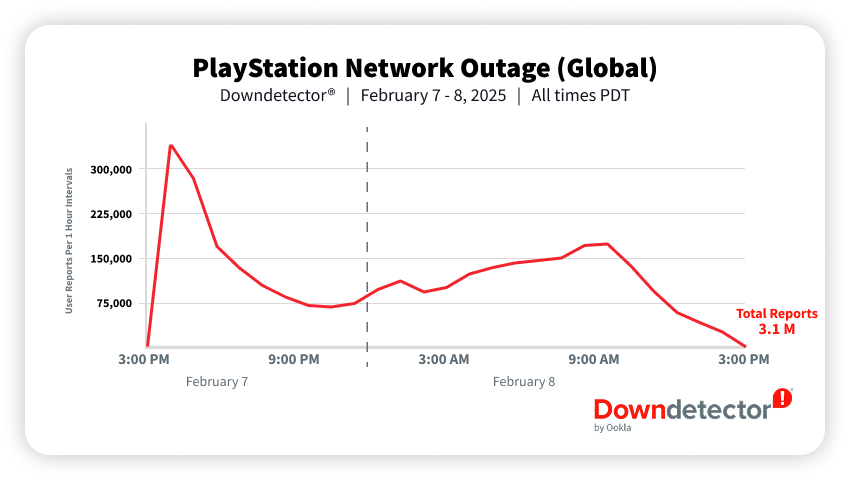

On February 7th, signs of a major outage impacting the gaming industry surfaced on Downdetector as early as 3:00 PM PDT. The outage, experienced by PlayStation Network (PSN), lasted over 24 hours and generated more than 3 million reports globally in Downdetector. This article provides a full breakdown of the outage as seen through Downdetector data and PlayStation’s response.

This isn’t the first time PlayStation has faced an outage of this magnitude, leaving gamers uncertain about resolution timelines. Just last October, a PlayStation outage generated over 600,000 reports in Downdetector and lasted more than four hours. However, for many longtime PlayStation users, this incident sparked flashbacks to the infamous 2011 PlayStation Network breach—a cyberattack that led to a 23-day outage.

While this recent outage was nowhere near as prolonged, it underscored the need for swift response and transparency from affected companies.

February 7th

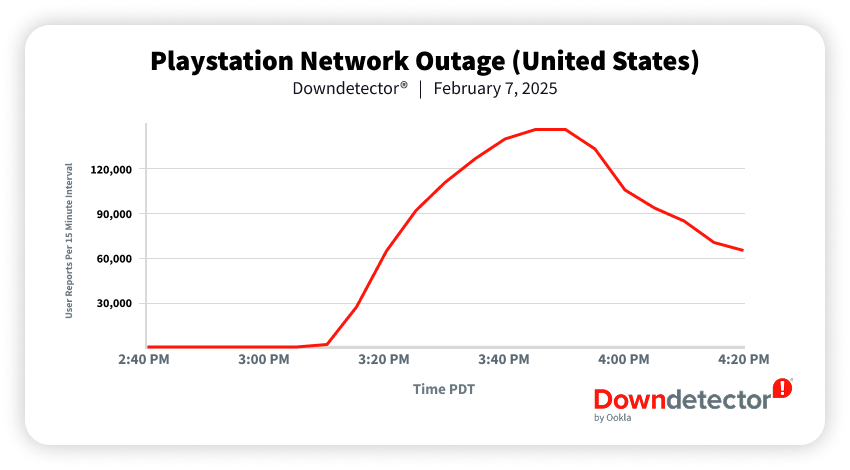

3:00 PM PDT — Signs of a Massive Gaming Outage Surface

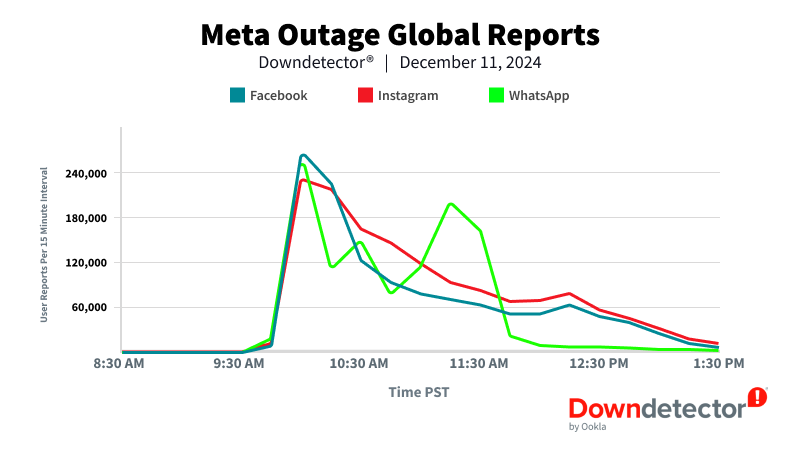

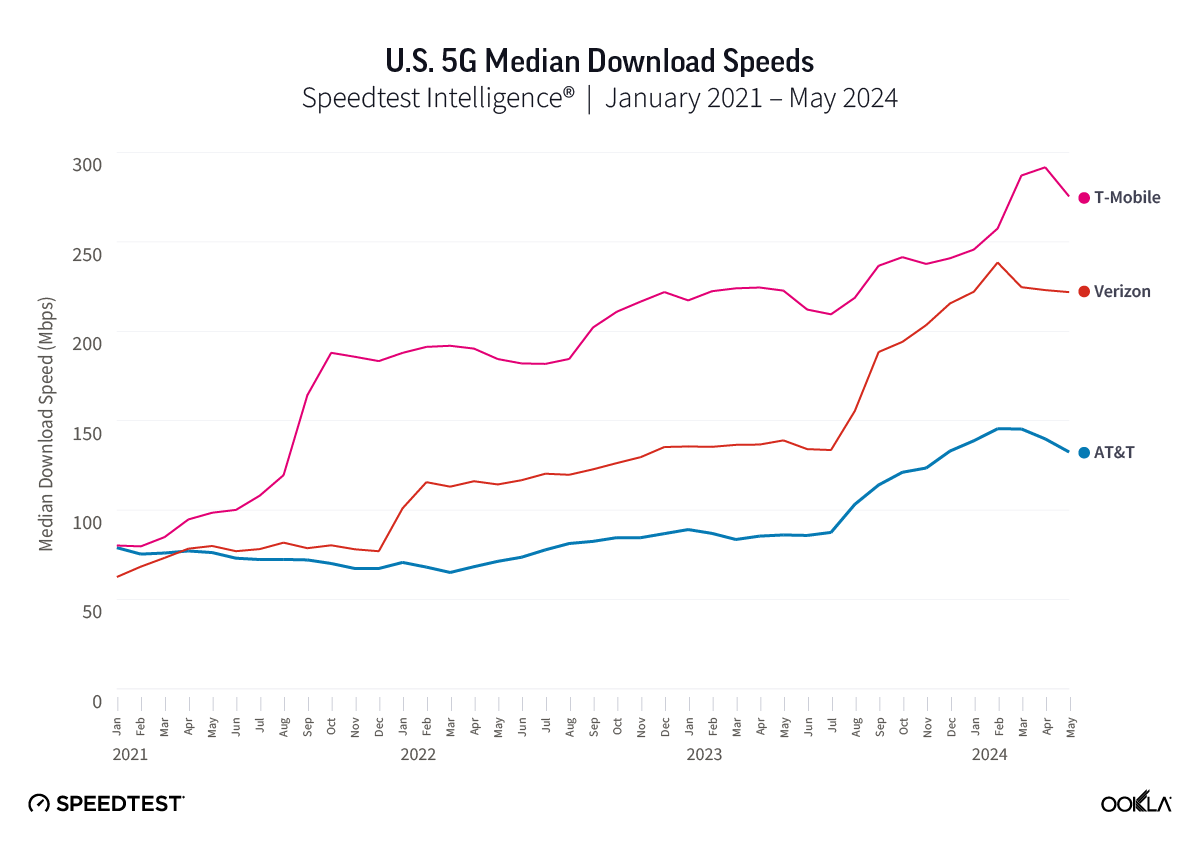

Downdetector began receiving a sudden spike in reports on gaming services, signaling the early stages of a significant disruption. Over the next few minutes, many major games and services, in addition to PSN, flooded the Downdetector homepage with reports of an outage. Meanwhile, Steam and Xbox users remained largely unaffected. With these insights, it became clear almost immediately that the issue was limited to PSN, well before PSN’s own status page showed signs of a disruption.

3:45 PM PDT — Outage Numbers Peak

With the source of the issue identified, reports for PSN peaked as users flooded to Downdetector to report, track, and discuss the ongoing disruption. Over the course of the outage, Downdetector remained a popular forum for discussion as gamers waited for any signs of resolution.

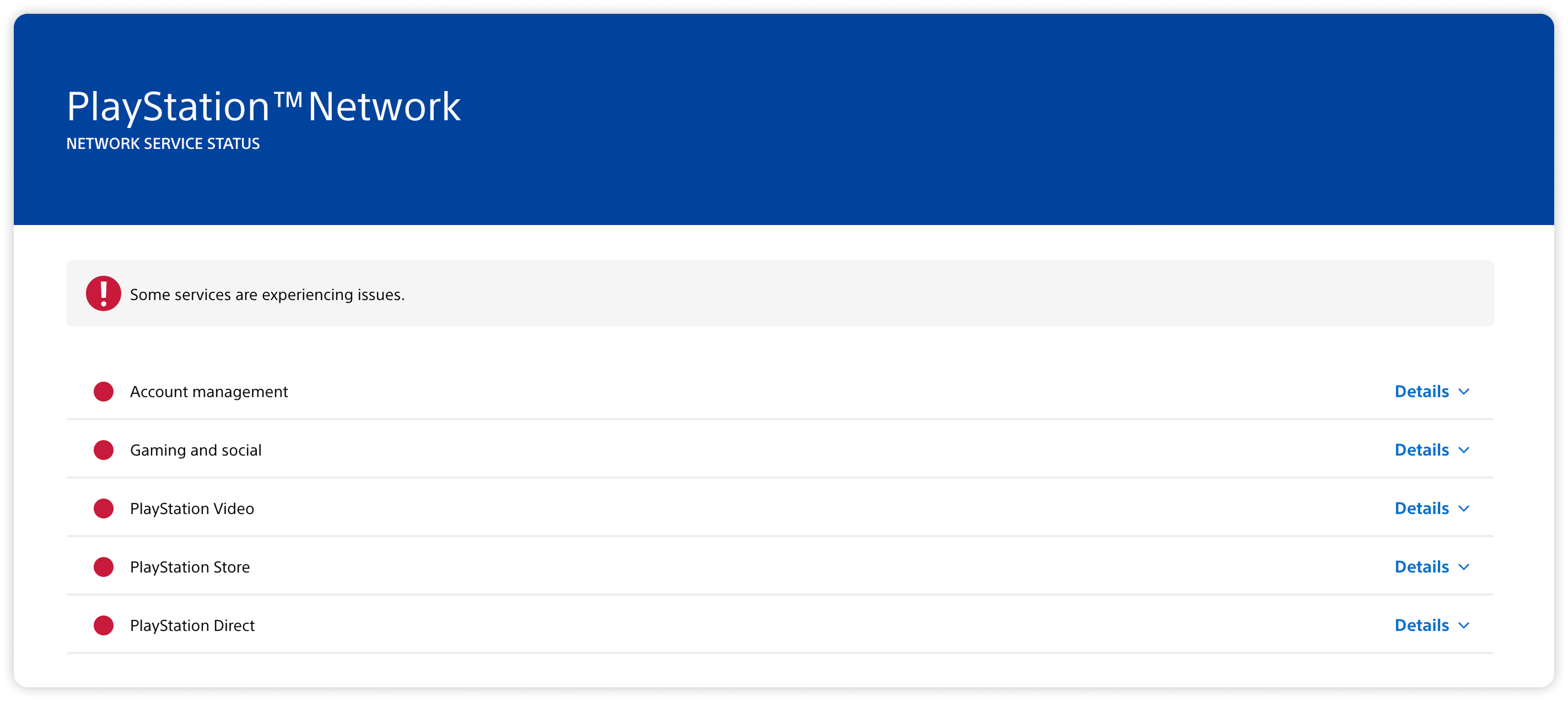

4:00 PM PDT — PlayStation Status Page Updated

Almost an hour after Downdetector users were already well aware of the outage, PlayStation acknowledged the issue by updating their status page with a vague message: “Some services are experiencing issues.”

5:46 PM PDT — PlayStation Acknowledges Outage Publicly

Even after the status page was updated, it took until 5:46 PM for PlayStation to release a public statement on their X page, Ask PlayStation. Users were met with a message that offered no insight into the causes of the disruption or any timeline for resolution.

February 8th

2:00 PM PDT — Global Reports Exceed 3 Million

As the outage continued into the next day, the volume of reports surpassed 3 million globally, with the most reports coming from the United States, Germany, United Kingdom, and France. While the number of new reports began to slow down, Downdetector’s comment section remained active. Downdetector received more than 30,000 comments, ranging from anger and frustration to lighthearted exchanges as gamers looked for alternative ways to pass the time. This ongoing flood of commentary underscored how Downdetector served not only as a monitoring tool but also as a real-time forum for users to vent, discuss, and stay informed during disruptions.

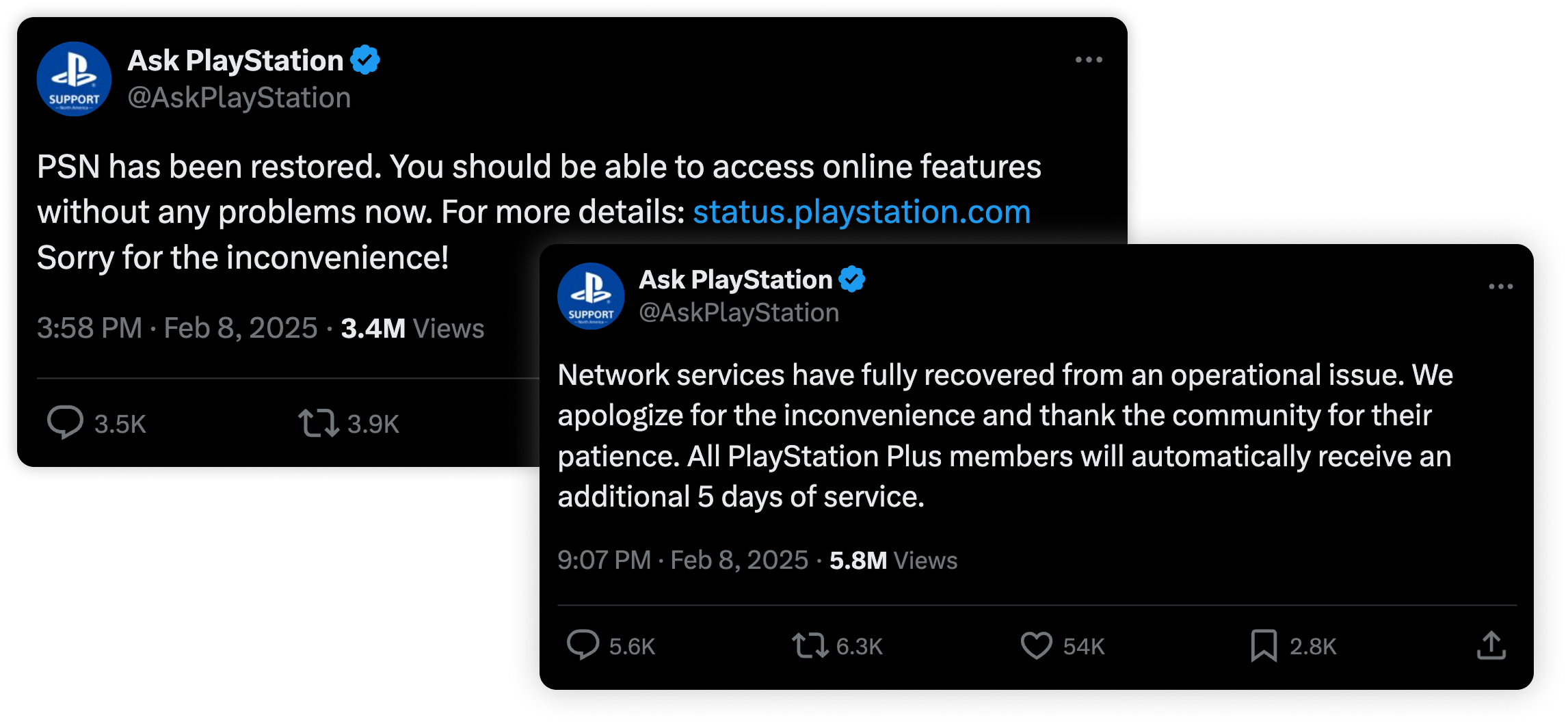

3:58 PM PDT — Outage Resolved

More than 24 hours after the outage first appeared on Downdetector, PlayStation announced that the issue had finally been resolved via a post on X. While the official cause of the outage remains unknown, later that night another update was posted, attributing the cause to an “operational issue” and offering 5 free days of PlayStation Plus membership to existing members as a gesture of goodwill.

Throughout the duration of the outage, Downdetector demonstrated the power of real-time, crowdsourced insights, with user reports helping identify the source of the disruption and when the issue was resolved. Thanks to the continuous stream of comments and reports from gamers, Downdetector served as a vital resource for users looking for updates on the situation in real-time, ahead of any official statements.

For businesses, Downdetector provides access to dashboards that deliver early alerts, enable outage correlation, and allow for direct communication with users, ensuring a proactive approach to incident management. Learn how you can leverage Downdetector to be better prepared for outages here.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.