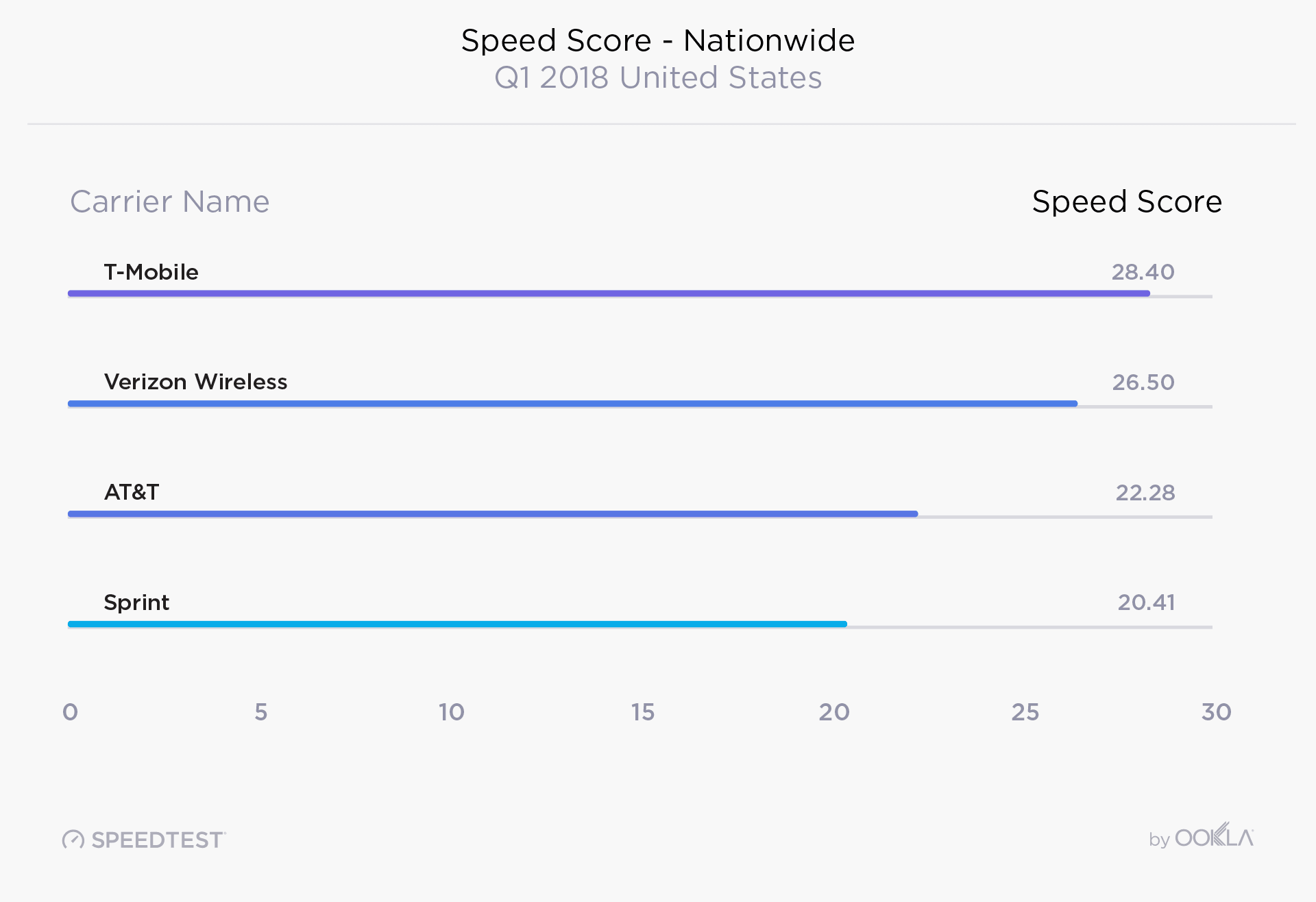

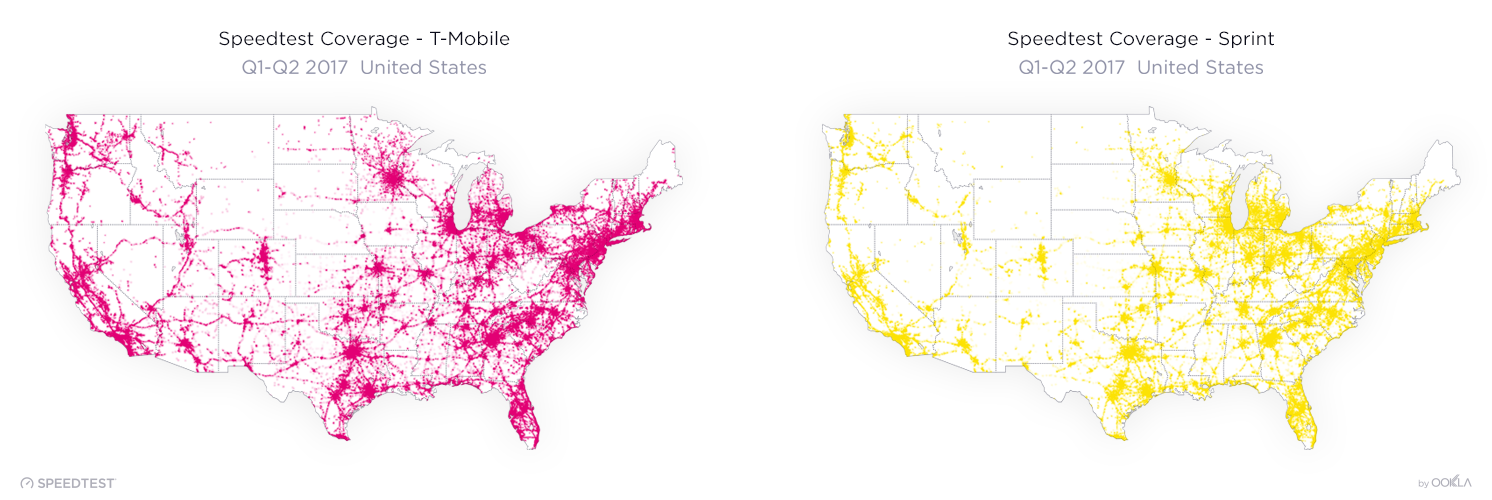

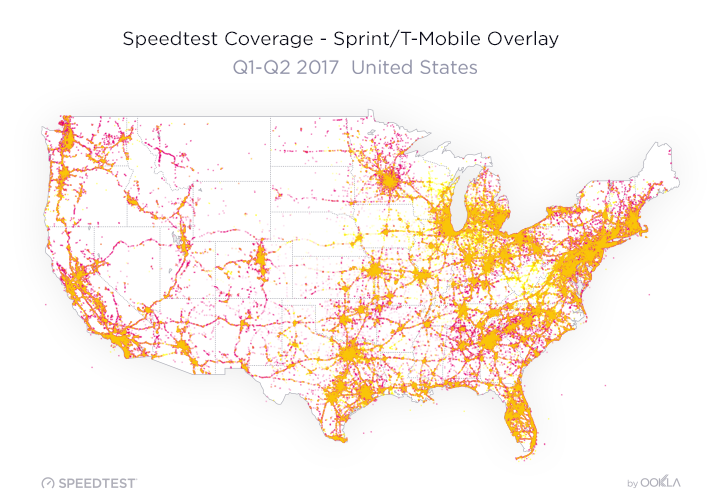

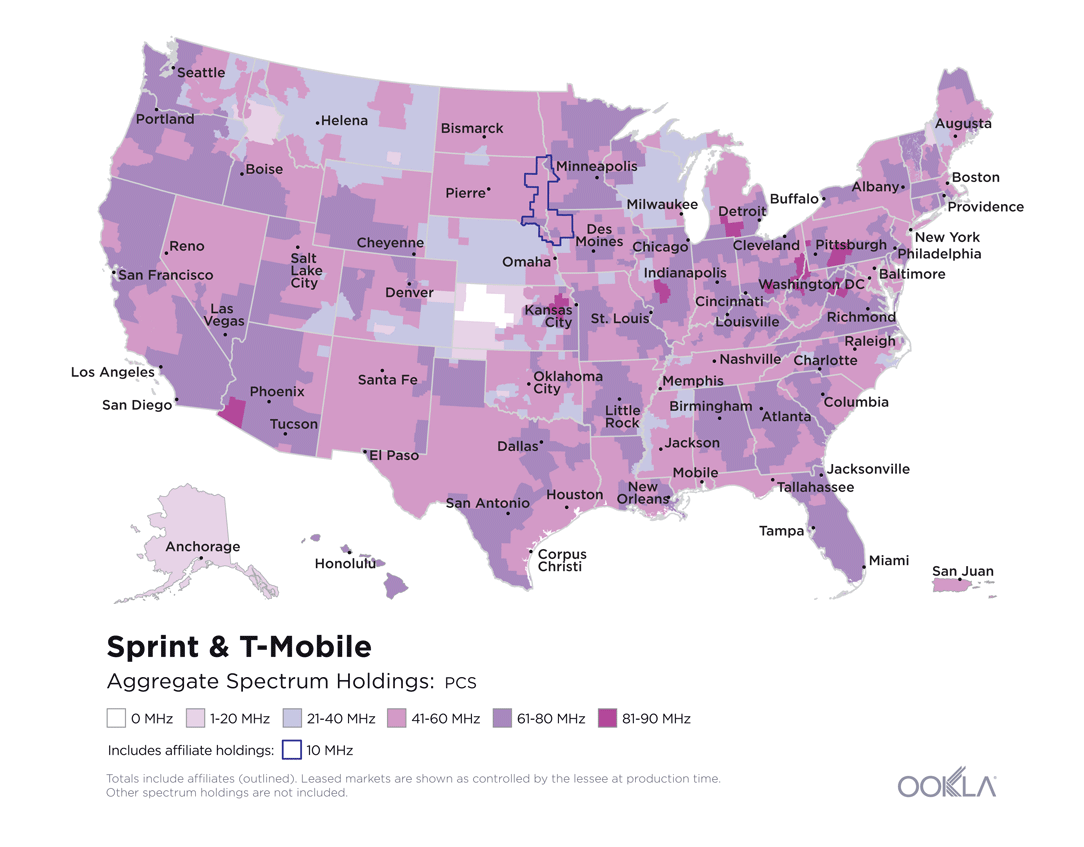

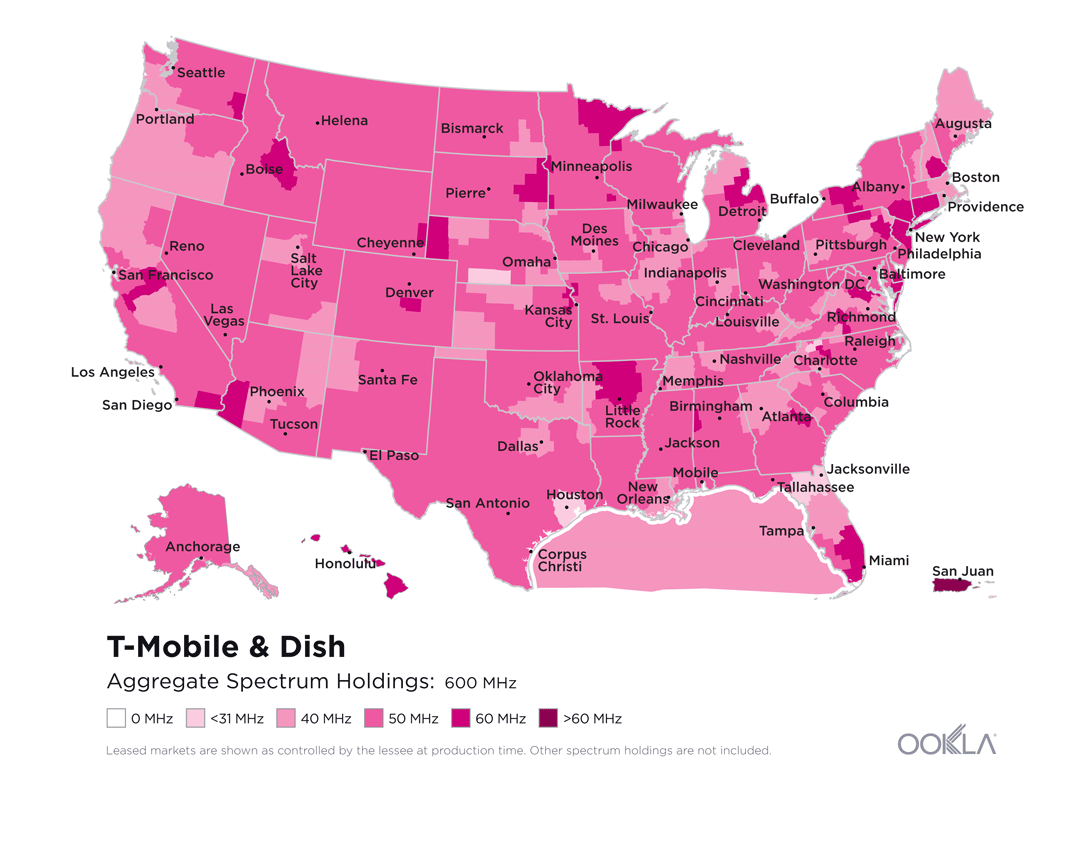

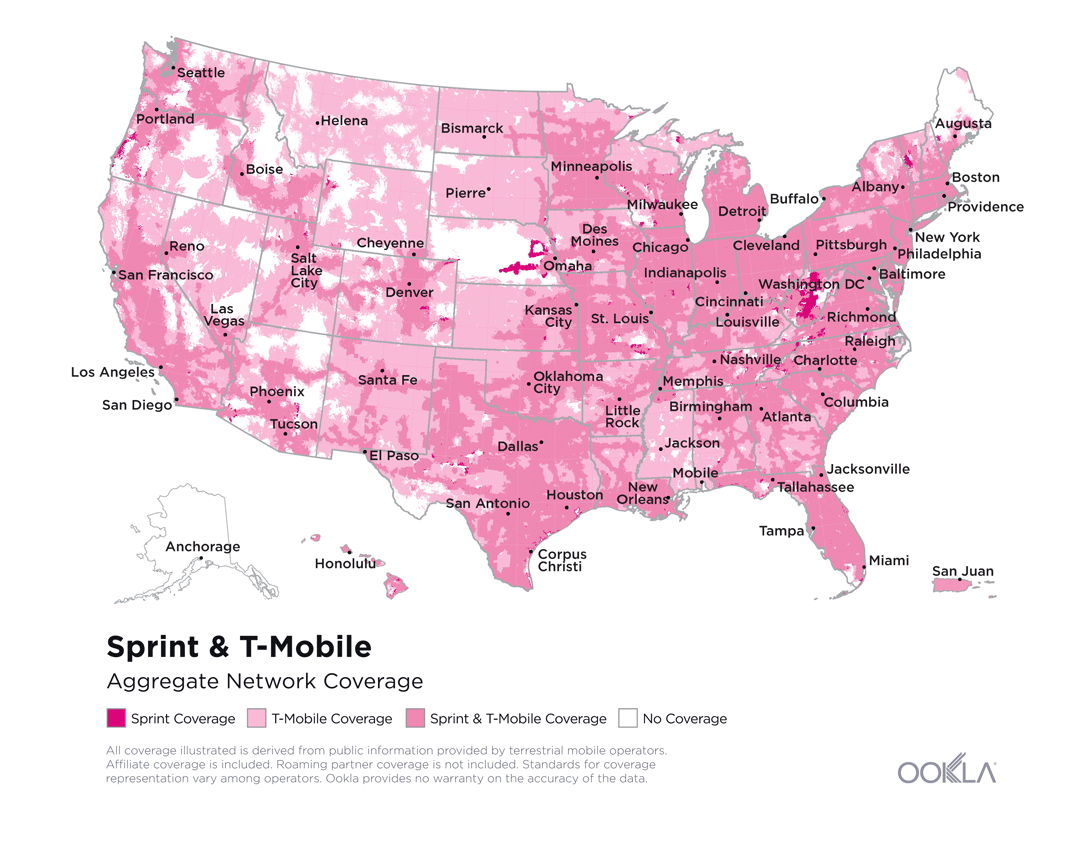

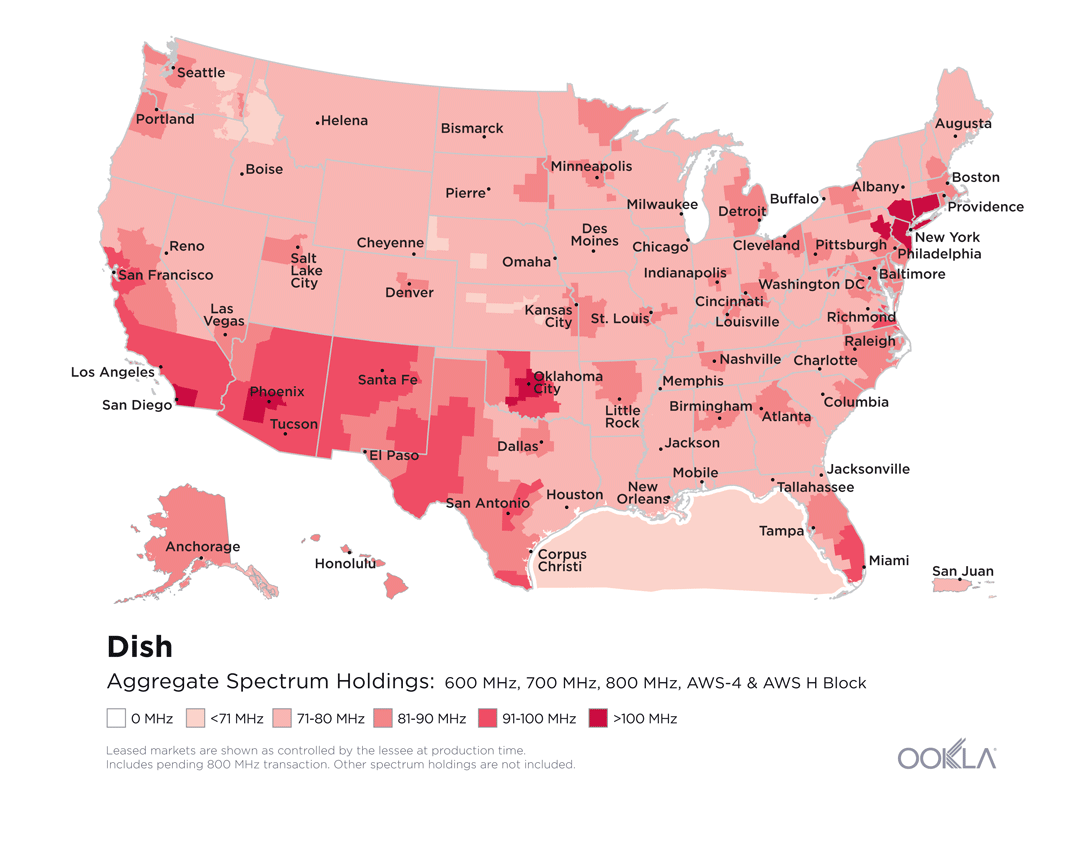

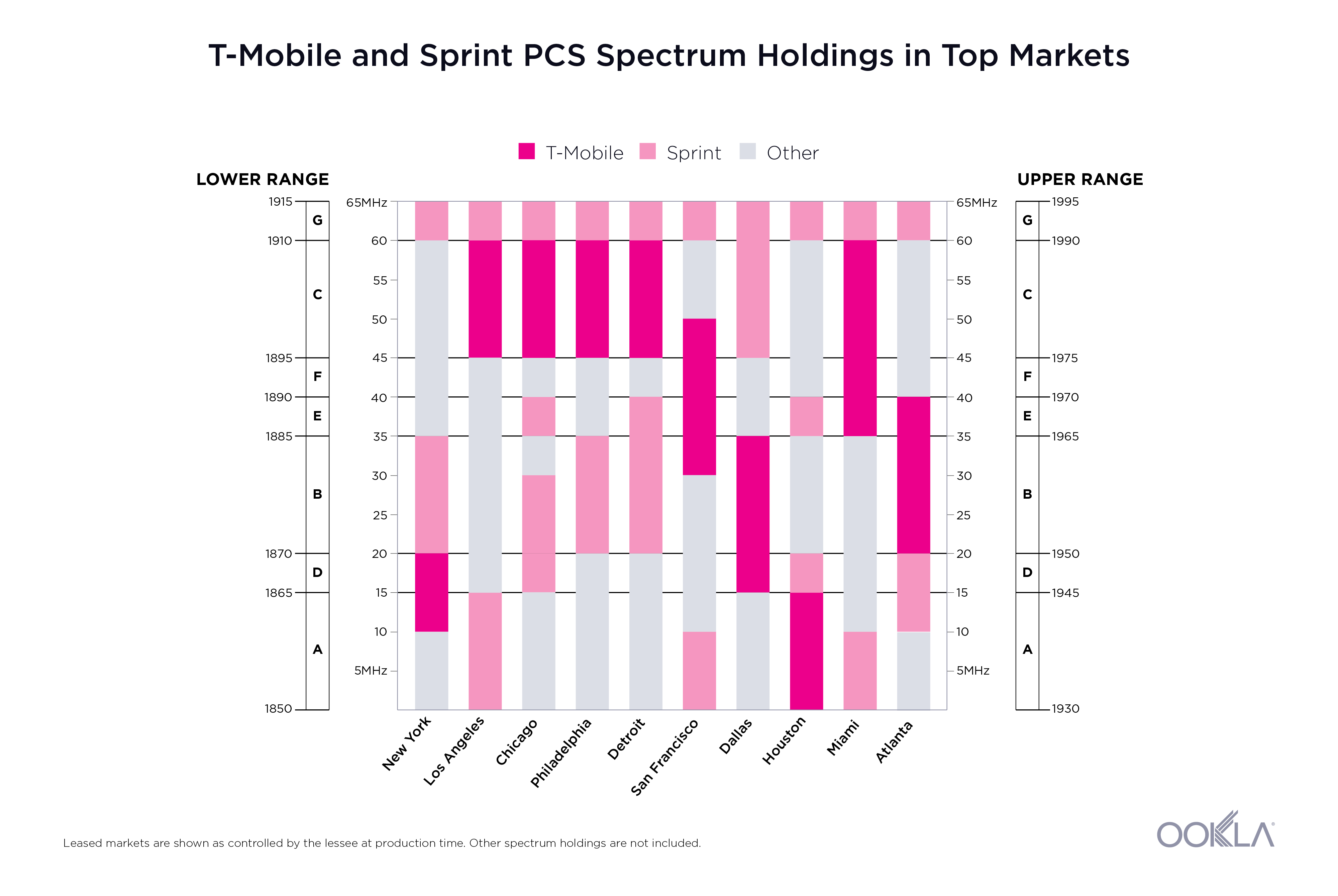

After almost two years and numerous legal battles, T-Mobile and Sprint are finally one. Equipped with a vast arsenal of spectrum assets, the new company aims to create an unparalleled 5G experience from urban areas to underserved rural communities across America. The biggest prize of this merger is 150 MHz of Sprint’s 2.5 GHz spectrum across top 100 markets. Combining Sprint and T-Mobile assets, T-Mobile now controls 319 MHz of sub-6GHz spectrum nationwide, and they have already started injecting some of this valuable capacity into the network and making it available to Americans.

The Philadelphia experiment

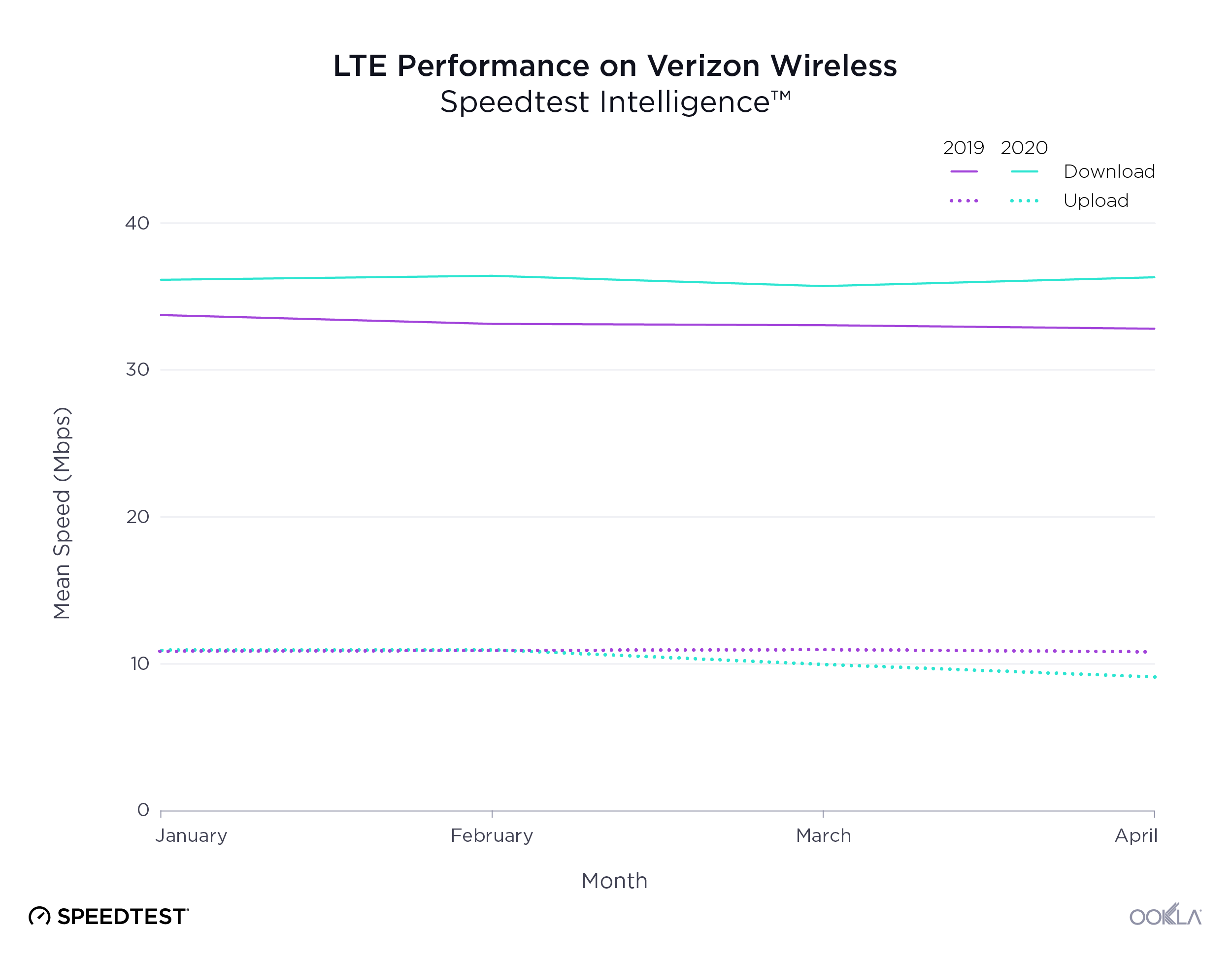

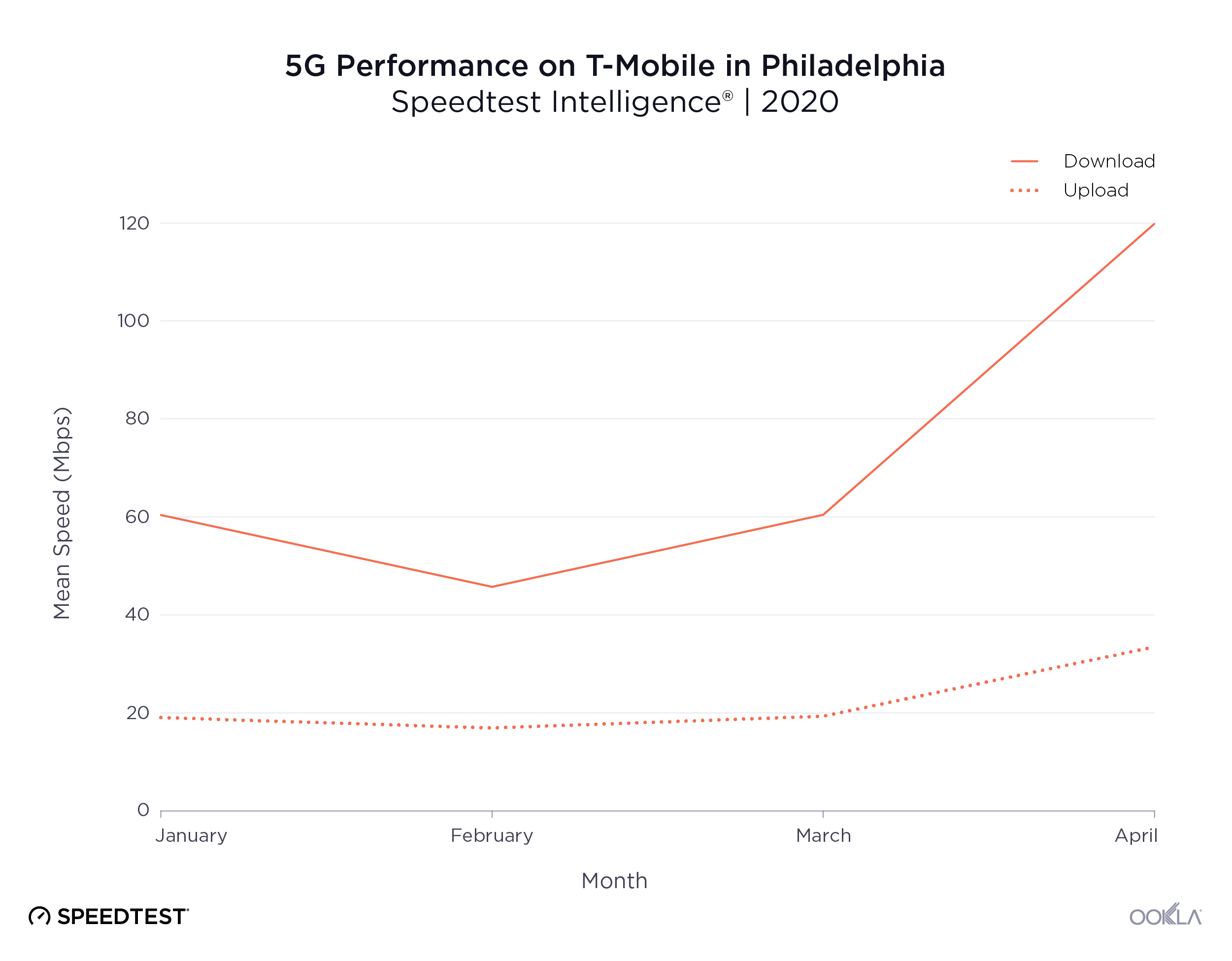

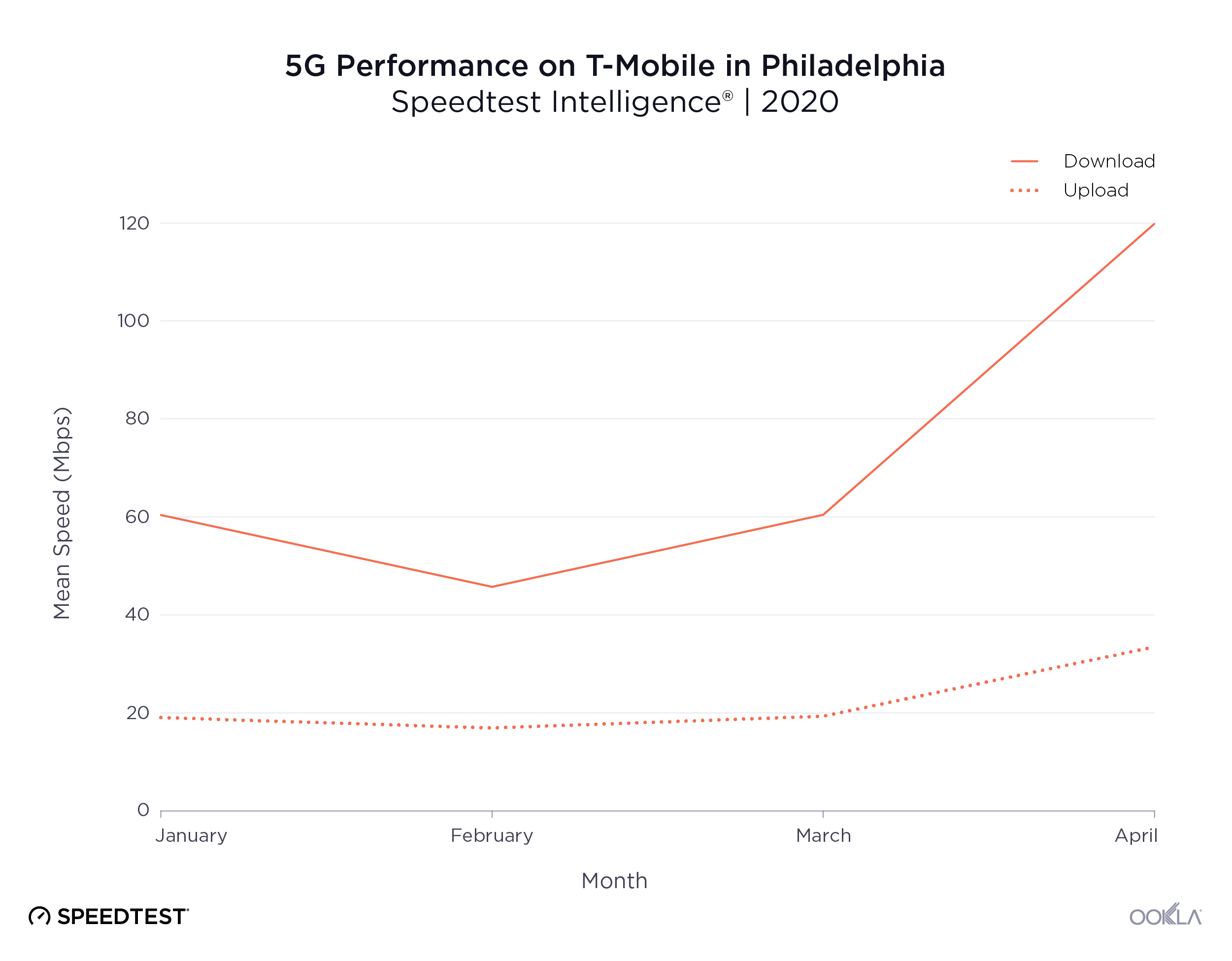

Because of the leasing and permitting work done in Philadelphia months ahead of the April 1, 2020 merger approval, T-Mobile was able to activate a number of 2.5 GHz (n41) sites on day one, followed by the official market launch on April 21. Massive MIMO radios were overlaid on T-Mobile’s existing cell sites, adding 60 MHz of spectrum in the 2.5 GHz band. Since Philadelphia wasn’t one of the nine markets where Sprint launched 5G, the fallow 2.5 GHz spectrum was readily available for use. T-Mobile had already covered Philadelphia with 5G in the 600 MHz band (n71), and the 2.5 GHz layer should provide a much-needed capacity boost. We can already see the increase in performance over the past four months.

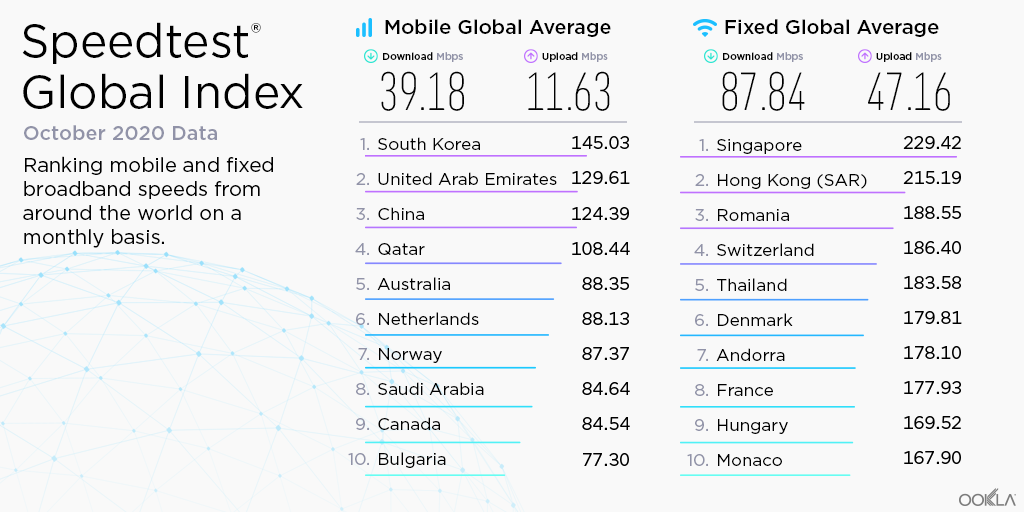

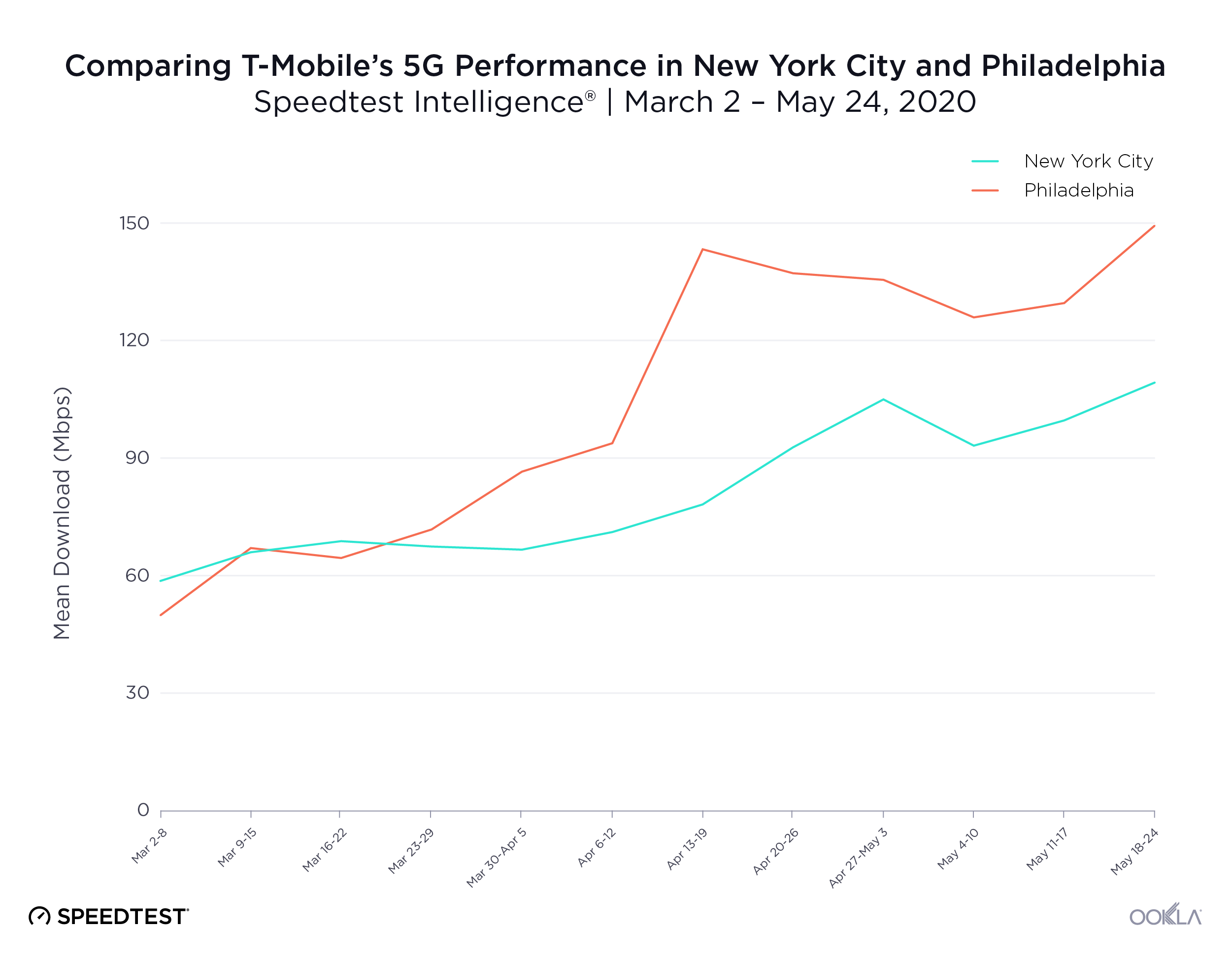

An analysis of all 5G tests taken on T-Mobile’s network in Philadelphia shows mean download speeds doubling during the month of April. A huge jump from 60.40 Mbps to 119.82 Mbps coincides with the rollout of 5G on the fresh mid-band spectrum. During the same month, we observed peak 5G download speeds exceeding 700 Mbps. Mean latency also fell from 30 ms to 21 ms over the period. Unlike the millimeter wave frequencies, which could offer greater speeds in a very small footprint, the 2.5 GHz band provides a good balance between coverage and capacity for mobile use.

T-Mobile’s layer cake in Manhattan

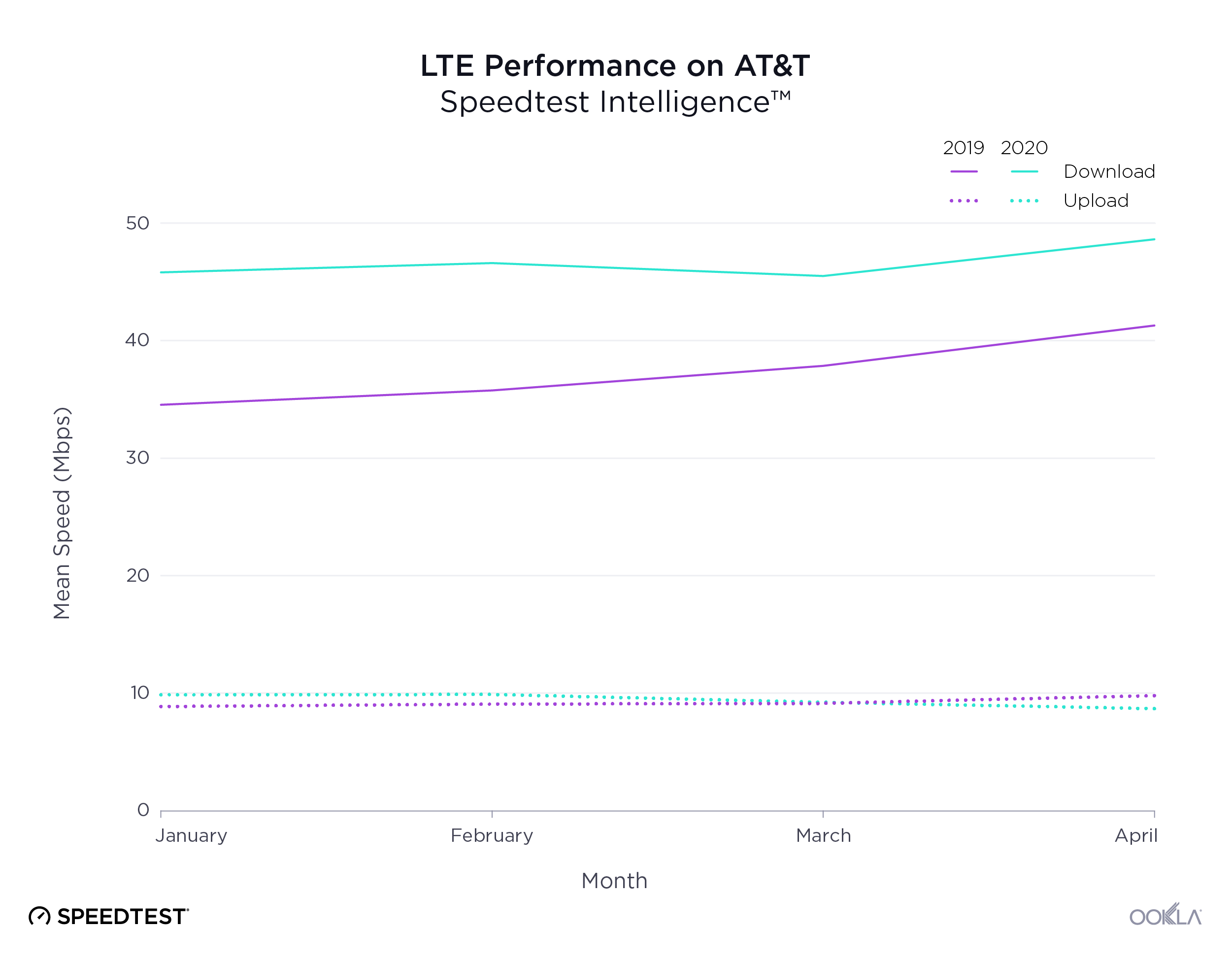

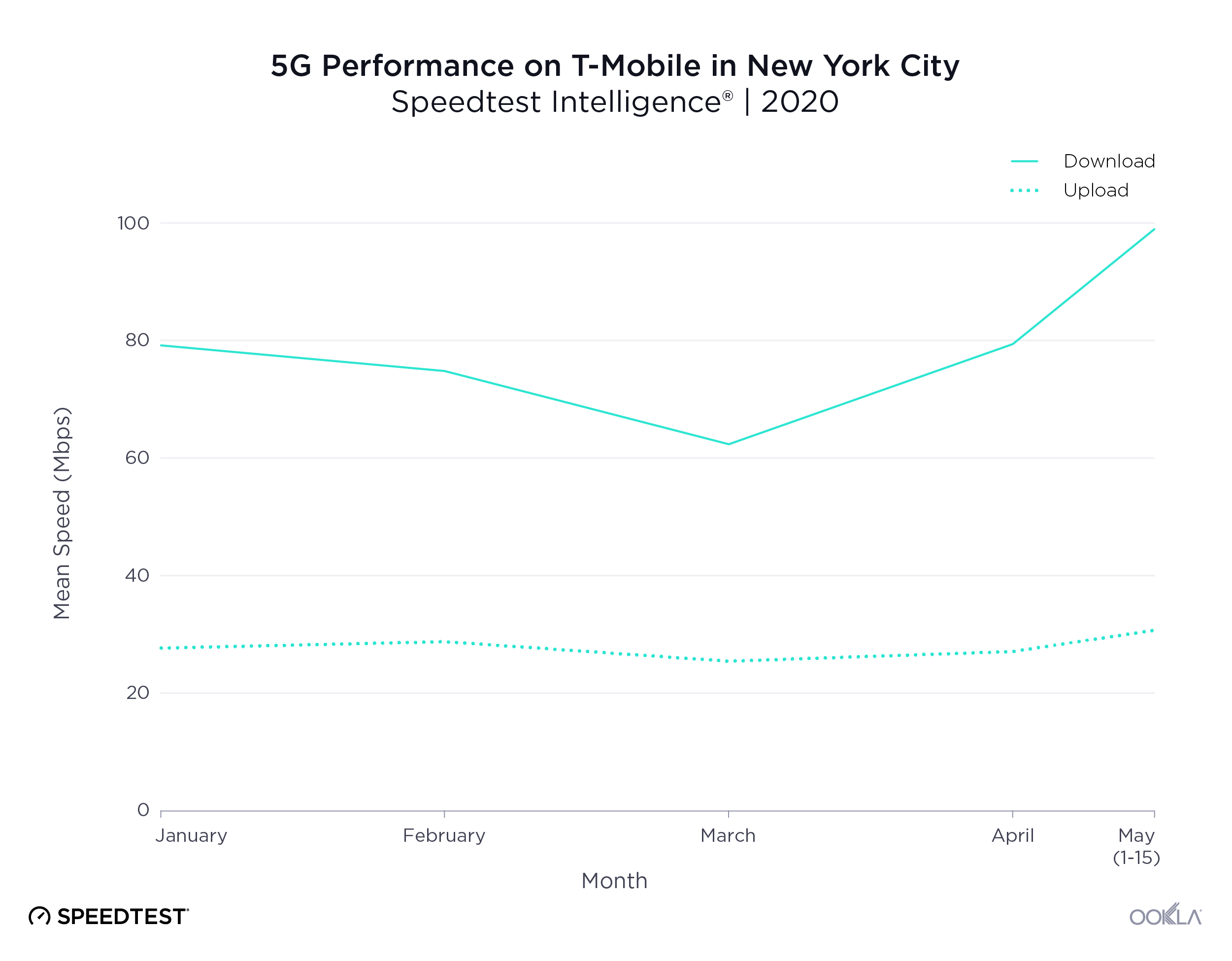

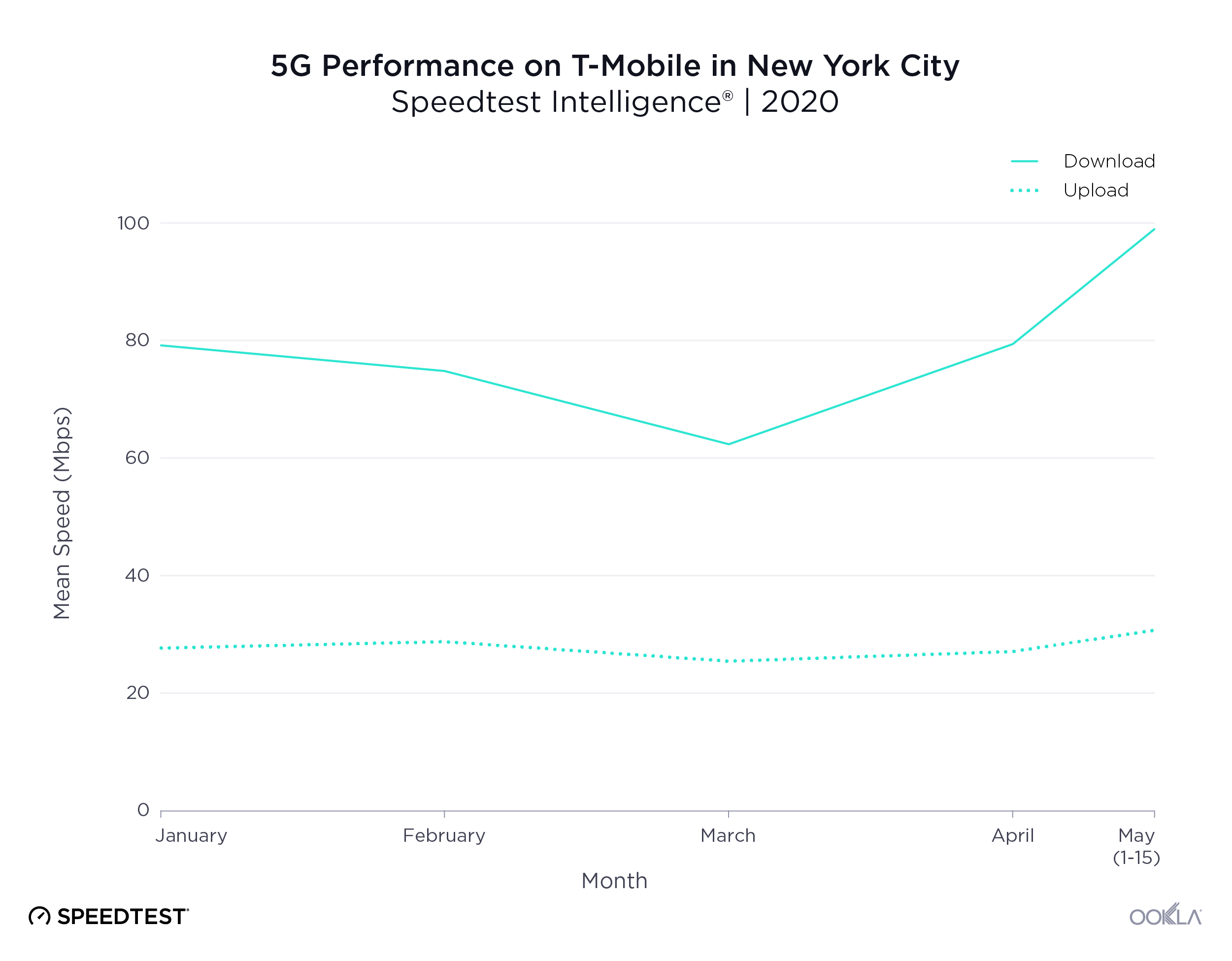

On May 5, T-Mobile launched its second mid-band 5G market in New York City. This launch marked the world’s first 5G network built on low, mid and high frequency bands. Paired with the multi-gigabit fiber backhaul, this 5G network is designed to deliver uncompromised performance. T-Mobile calls this the “Layer Cake 5G strategy.”

Mean download speeds of T-Mobile’s 5G network in New York City increased from 79.18 Mbps in January 2020 to 98.96 Mbps in May (as seen through the 15th of the month). This represents a 25.0% jump across all three 5G layers. Mean upload speeds have also improved 11.0% during the same period.

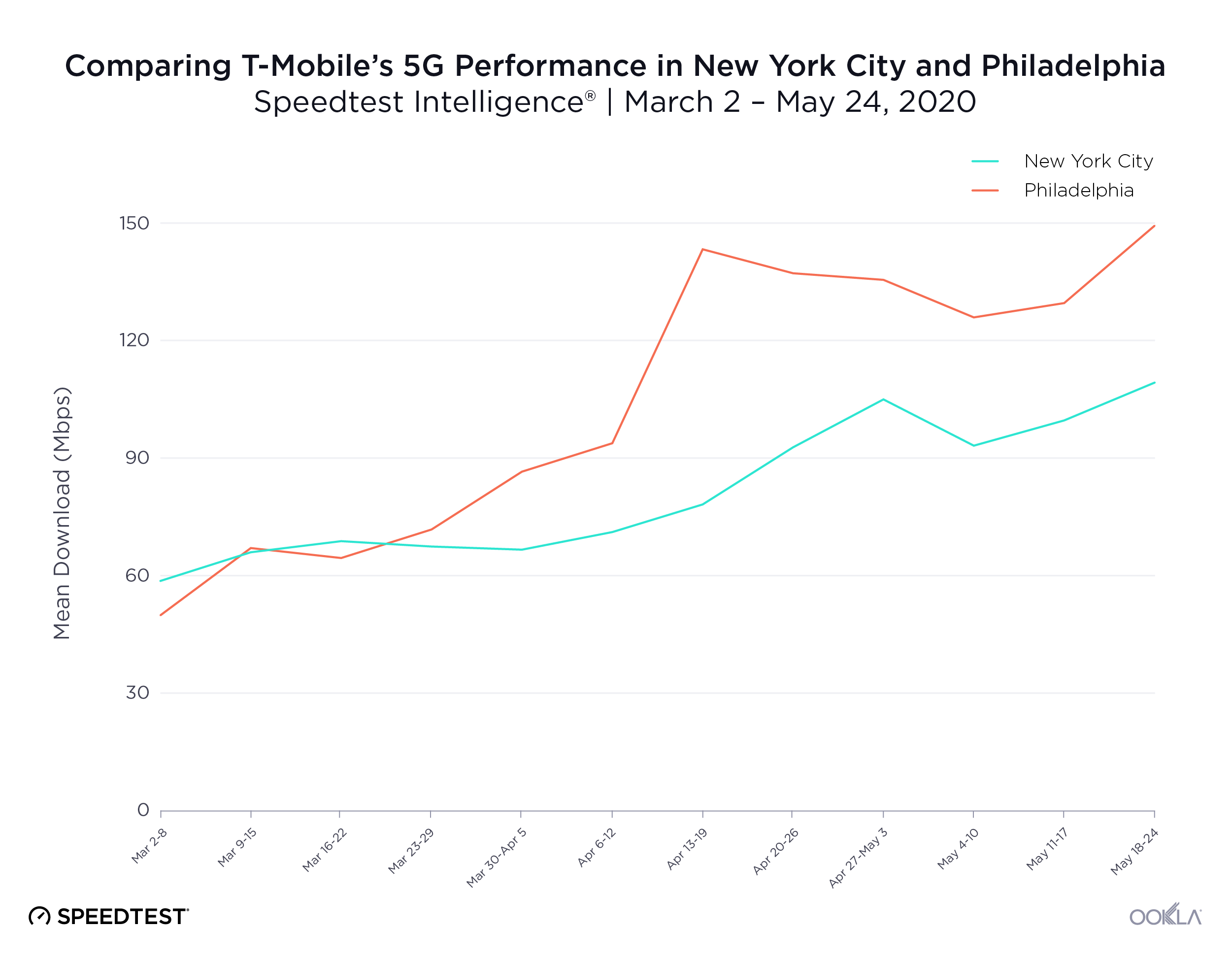

Analyzing week-over-week performance, Speedtest Intelligence® offers unique insights on the upward-trending download speeds on T-Mobile’s 5G across these two markets. A combination of additional 600 MHz spectrum explained in our previous article and the new 2.5 GHz 5G layer were likely the main drivers behind this improved performance.

Field testing the layers of 5G

Users are typically not aware of the layers of technologies that they’re utilizing when they connect to a 5G network. To better understand the performance and capabilities of T-Mobile’s layer cake 5G network, I looked at the performance of each individual 5G layer separately. This process involved running over 300 tests on the ground in New York City between May 5 and 19 (while fully complying with the social distancing and health guidelines) and logging modem diagnostic messages. This allowed me to observe individual throughput contributions across three different 5G layers on two different devices, the Samsung Galaxy S20 Ultra 5G and the OnePlus 8 Pro. While both devices are powered by Qualcomm’s latest Snapdragon 865 5G Mobile Platform, only the Samsung Galaxy S20 Ultra 5G (and S20+ 5G) has the required mmWave hardware components to fully access the 5G spectrum layer cake. The open-market OnePlus 8 Pro could only access sub-6 GHz 5G.

According to T-Mobile’s published map of projected 2.5 GHz coverage, the newly launched mid-band 5G layer is mostly available in the eastern parts of Manhattan. That meant a quick ride to the areas east of Herald Square in Midtown as well as parts of East Village. Keep in mind that the walk tests were collected on a recently launched and lightly loaded mid-band 5G network. This report samples what this network is capable of and should not be considered predictive of future performance under normal use.

LAA boosts speeds

License Assisted Access (LAA) is LTE technology that leverages the unlicensed 5 GHz spectrum. While often overlooked, this technology has been deployed on T-Mobile sites in New York City since 2017, and adds ample downlink capacity (40-60MHz) using Ericsson’s micro Radio 2205, “assisted” by the anchor in the licensed LTE mid-band. This can significantly boost download speeds on capable devices, while at the same time offloading traffic from the licensed spectrum and improving the LTE experience for all users served by that cell.

In Manhattan, many low-build rooftop sites with Ericsson AIR 5121 mmWave radios originally received the LAA treatment and are excellent candidates to receive (or have already received) the 2.5 GHz 5G overlay. This means these NYC sites would gain 40-60 MHz of LAA downlink capacity in addition to the full three layer 5G deployed in the 600 MHz low-band, 2.5 GHz mid-band, the 28 GHz mmWave high-band spectrum and LTE. This would open up a variety of options in terms of network scheduling and capacity management.

What each NR layer contributes to download speeds

Based on personal field test data logged over the course of the last eight months, the observed peak download contribution of the NR physical layer (PHY) on Sprint’s (now decommissioned) 2.5 GHz 5G network using Nokia radio and 40 MHz bandwidth was 367 Mbps, achieved on Sprint’s 5G launch day in New York City, August 27, 2019.

T-Mobile’s new 2.5 GHz deployment — leveraging the same amount of spectrum, Ericsson AIR 6488 radio access, under similar network conditions — produced a peak downlink NR contribution in excess of 541 Mbps, an improvement in spectral efficiency of 47 percent. The downlink NR contribution measures the portion of the download speed arriving at the device only from the 5G layer, the remainder of the download speed comes from LTE.

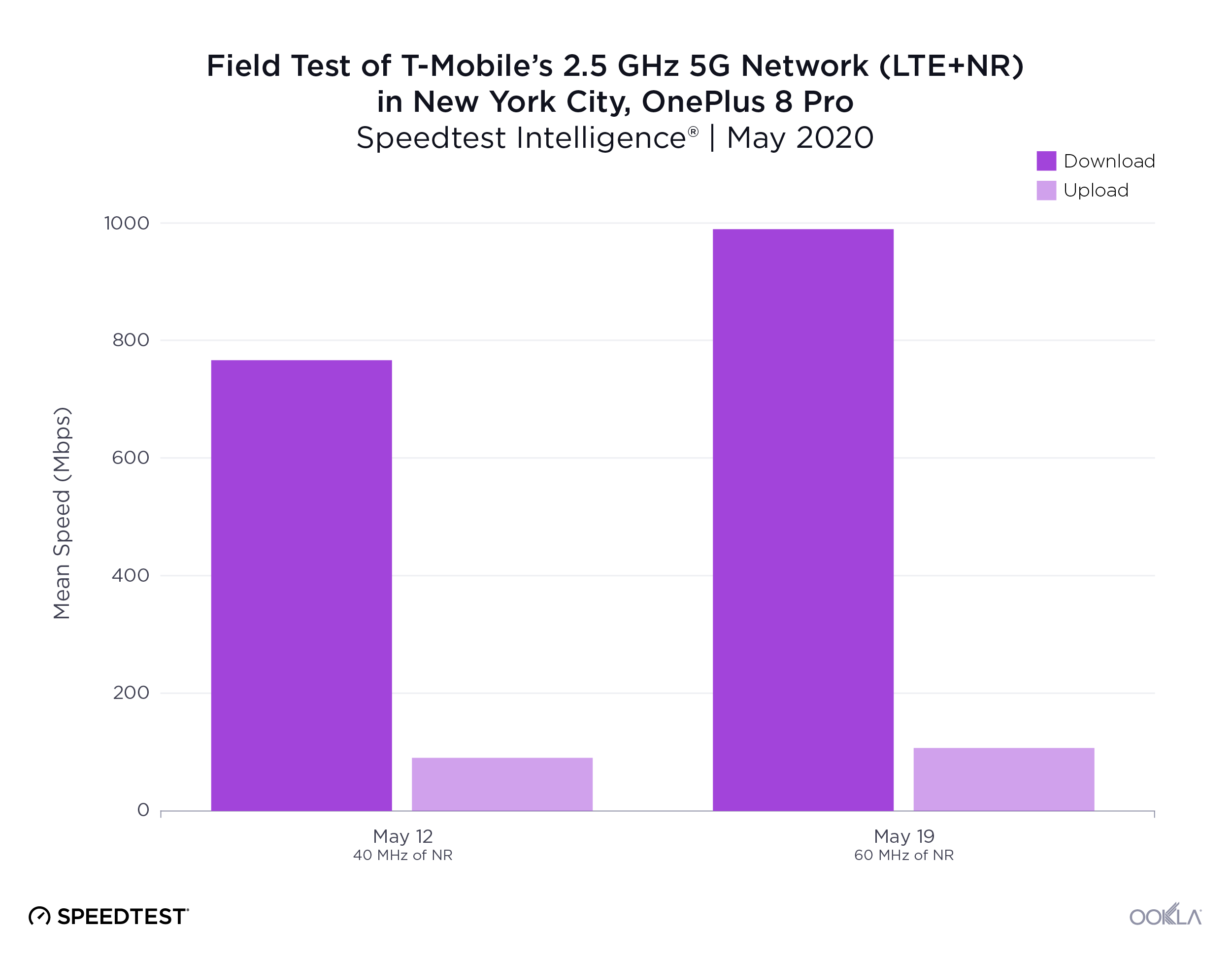

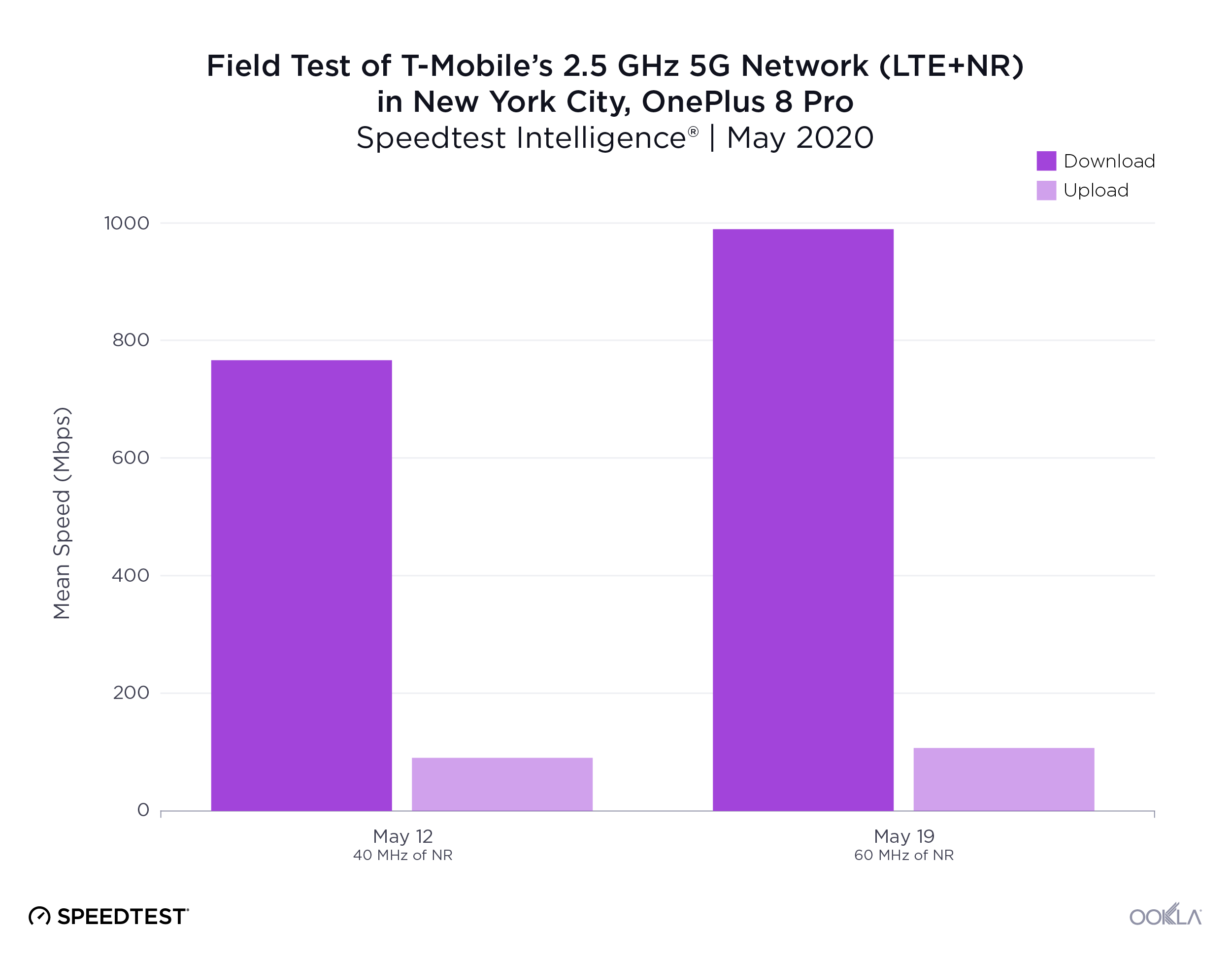

Furthermore, on May 19, the NR bandwidth on some sites was increased from 40 MHz to 60 MHz, and I’ve since observed a peak NR downlink contribution approaching 900 Mbps. The increased bandwidth was observed on three locations in the East Village, while the majority of 2.5 GHz sites are still at 40 MHz. We should stress again that these peak 5G speeds are meant to show the full potential of this new network deployment and have been achieved in good outdoor signal conditions, on a lightly loaded 5G network.

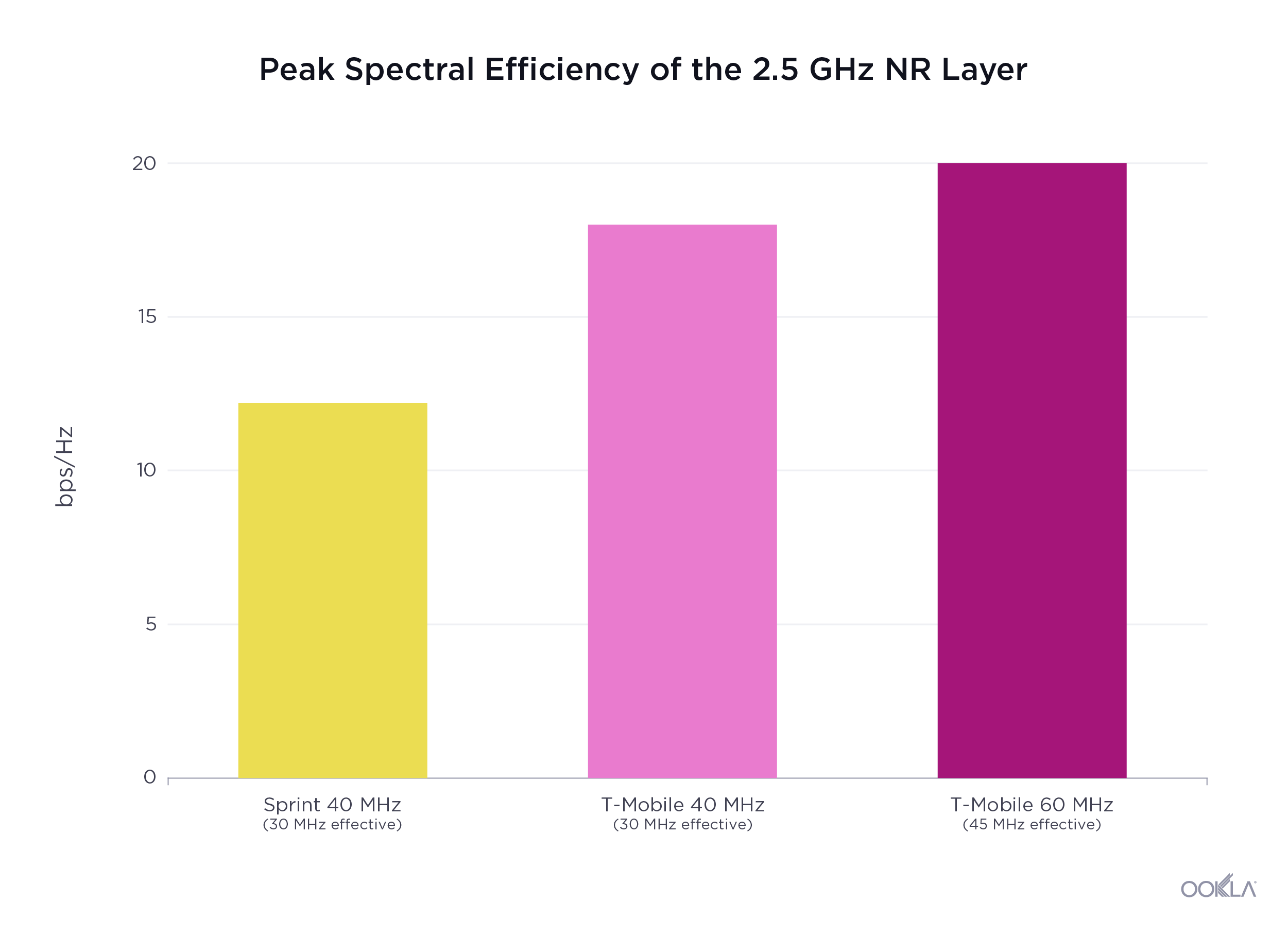

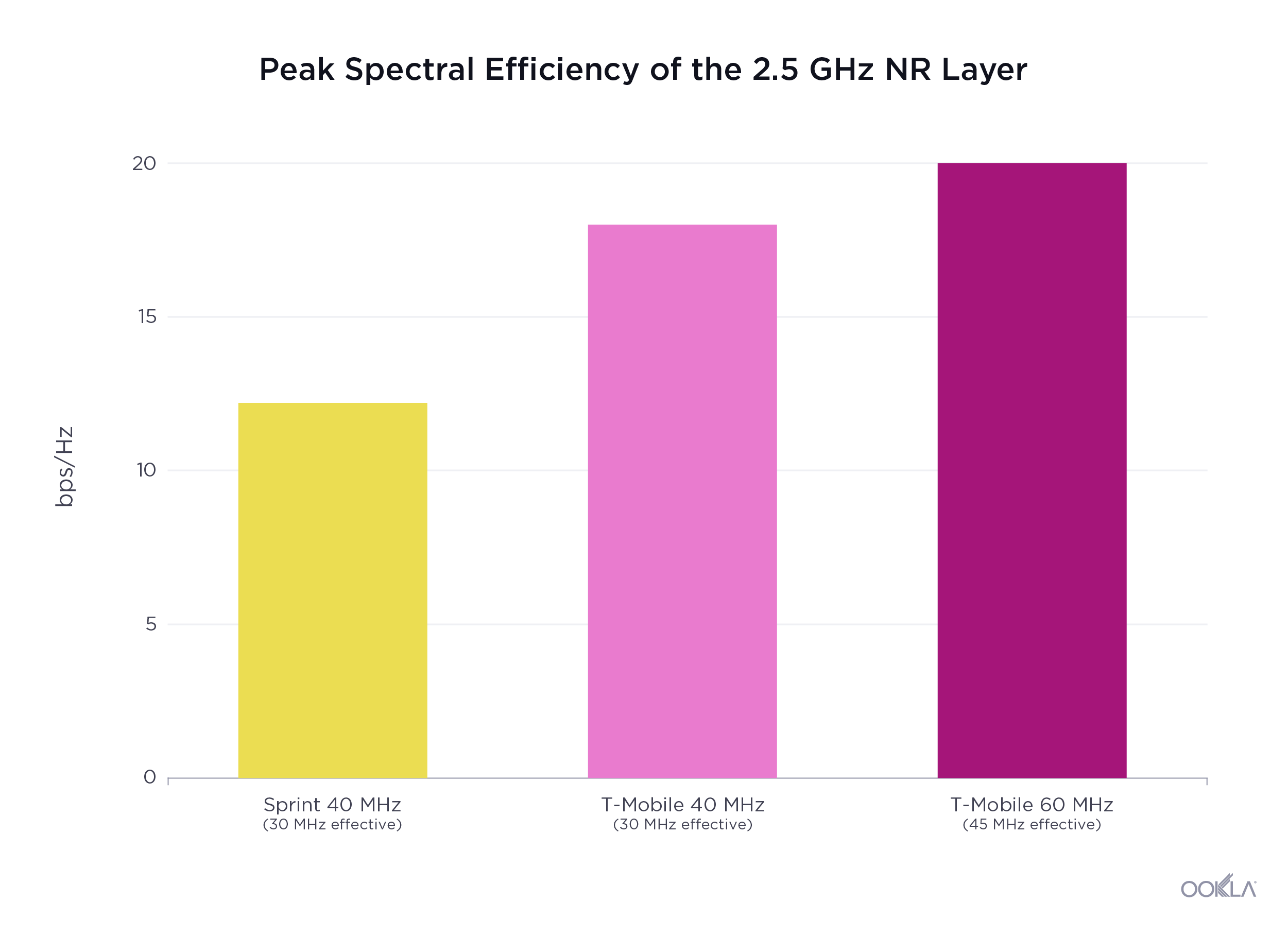

When taking into account the 3:1 TDD frame configuration (75% downlink 25% uplink), the effective peak downlink spectral efficiency of the 2.5 GHz NR layer looks like this:

Lower spectral efficiency on Sprint’s legacy network could be attributed to the lower distribution of 256 QAM and MIMO (Rank 3, 4). Granted, there could have been a potential performance penalty associated with an earlier software load on Nokia’s massive MIMO radios running in split-mode. These radios were logically partitioned for both n41 and LTE B41 concurrent operation, while pushing carrier aggregation across three LTE CCs and using 100-120MHz of spectrum in total. In contrast, T-Mobile’s existing deployment consists of Ericsson AIR 6488 radios delivering only n41, while LTE mid-band anchor bands are delivered from separate radios (B2, B66).

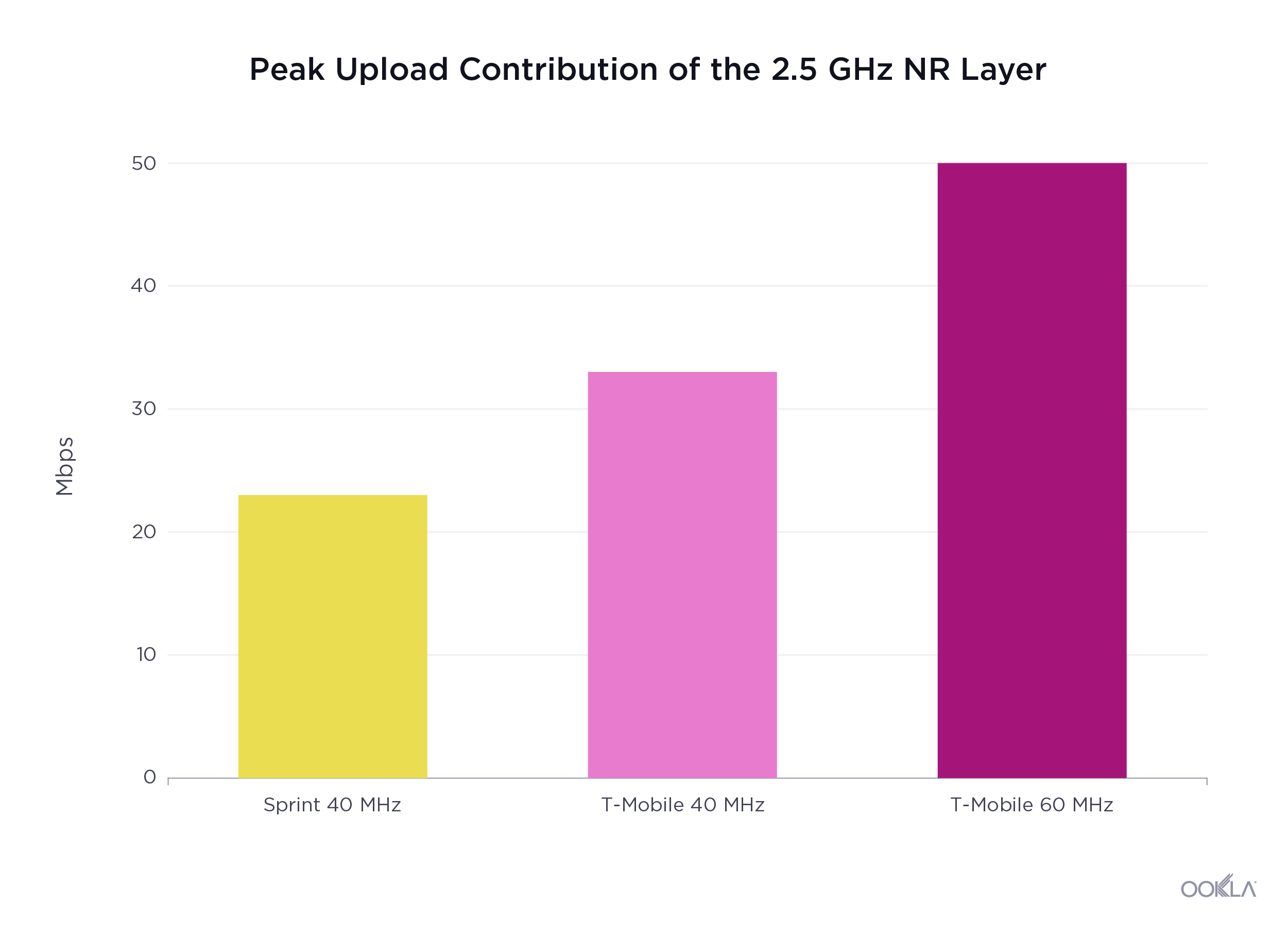

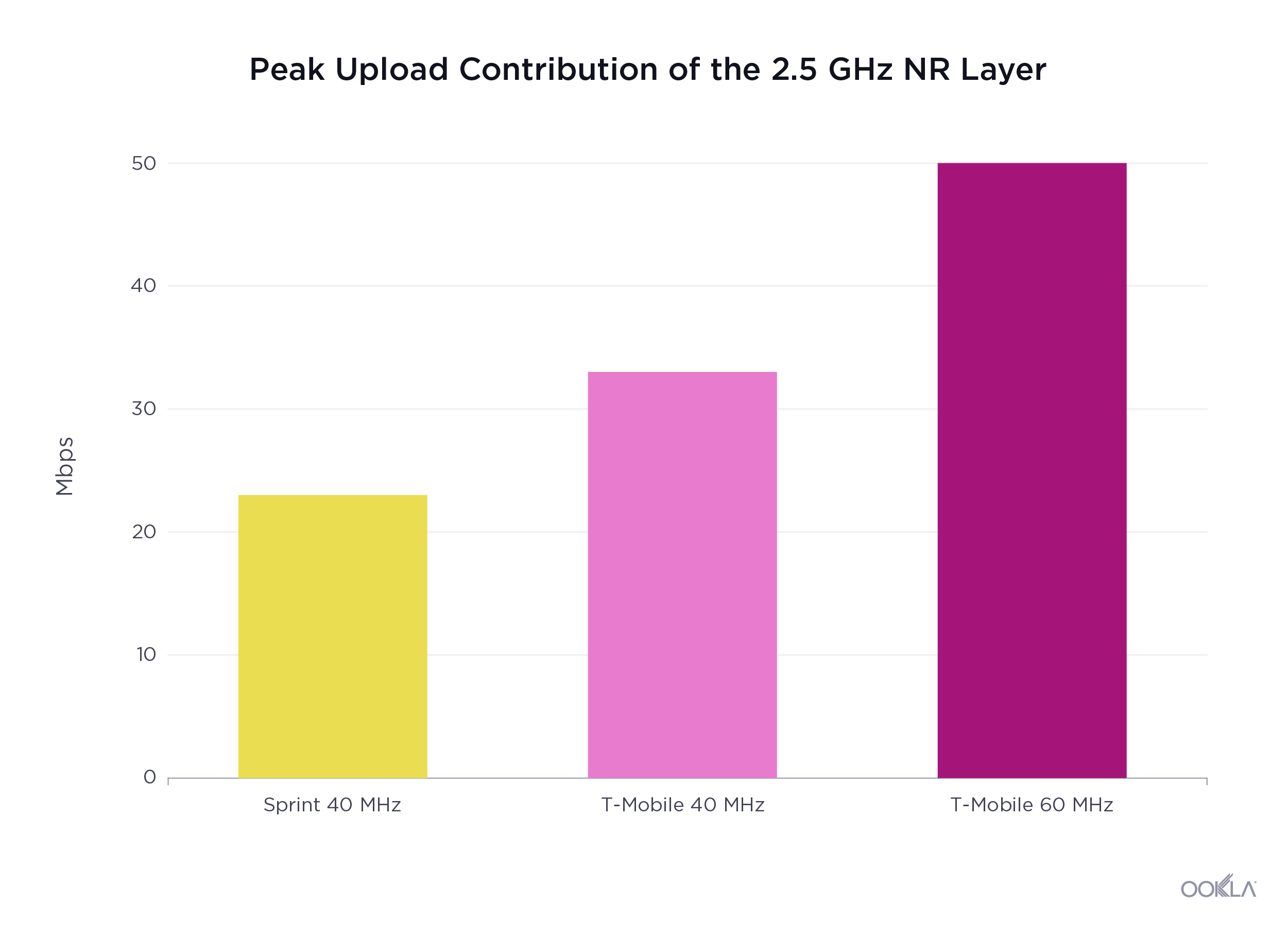

40 MHz of n41 delivered NR upload speeds of 33 Mbps on T-Mobile vs. 23 Mbps on Sprint, a 43.5% increase. Tests from May 19 using 60 MHz wide NR channel produced consistent speeds of 50 Mbps arriving from the NR layer.

The benefits for both users and the operator are apparent as the aggregate (LTE B66 + NR n41) upload speeds achieved on capable user devices now well exceed 100 Mbps.

In addition to the new mid-band 5G (n41), T-Mobile’s low-band 5G (n71), which launched in early December, is providing the foundational layer for the future SA (Standalone) NR. The initial 5 MHz FDD deployment was, from my first-hand experience, capable of boosting the downlink performance at the capable user terminals with an additional 42 Mbps. As of the middle of March, that allocation was increased to 10 MHz, now delivering peak n71 speeds of roughly 100 Mbps. With wider NR channels comes an improved spectral efficiency.

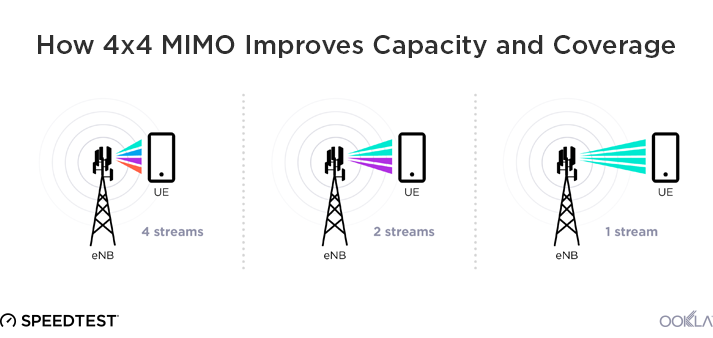

Millimeter wave adds capacity

T-Mobile’s millimeter wave (mmWave) NR layer (n261) has been available in New York City since June 2019. Leveraging the existing macro grid, T-Mobile’s Manhattan mmWave overlay, in terms of cell site density, is one of the most impressive in the world. This layer leverages 100 MHz of spectrum (2×50 MHz) in the 28 GHz band (n261), adding peak n261 speeds of over 520 Mbps in addition to the LTE anchor bands. In comparison, T-Mobile’s mid-band 2.5 GHz NR layer is able to deliver similar capacity out of just 40 MHz of spectrum. This jump in spectral efficiency is attributed to the use of up to four data streams and 256 QAM modulation in the mid-band, something the current generation of mmWave chipsets can’t do.

During my testing, the Samsung Galaxy S20 Ultra 5G was able to switch between all three NR spectrum bands seamlessly and deliver consistent performance at hundreds of megabits per second. While 100 MHz of mmWave can deliver a speed boost of a few hundred megabits per second, the full potential of this spectrum can be unlocked by deploying much wider 400 MHz or 800 MHz blocks of mmWave spectrum, which can produce speeds of multiple gigabits per second, just on that layer alone. T-Mobile now controls 1,160 MHz of mmWave spectrum nationwide, including significant amounts of not-yet-deployed 24 GHz and 47 GHz licenses won in recent auctions.

Device limitations (and opportunities)

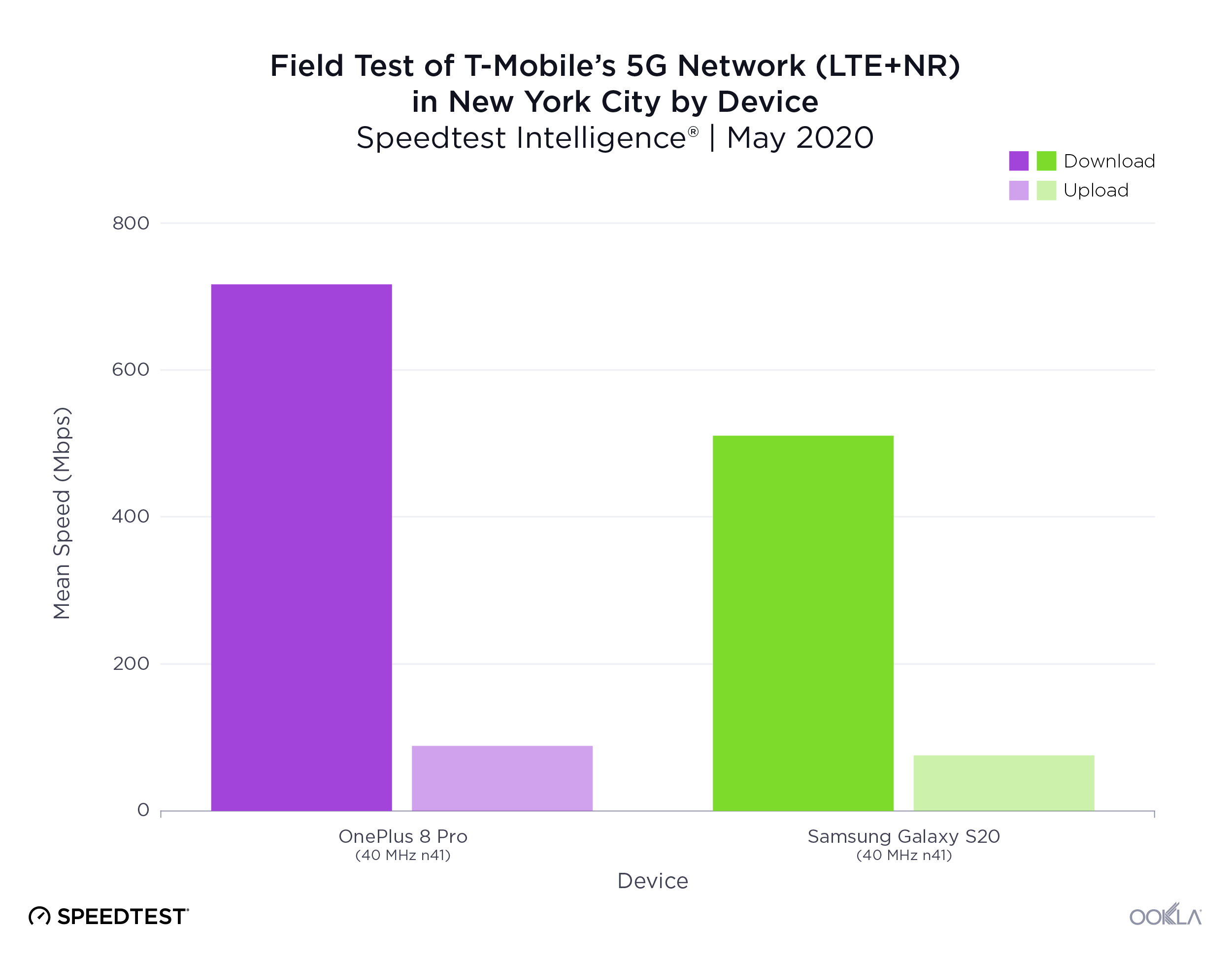

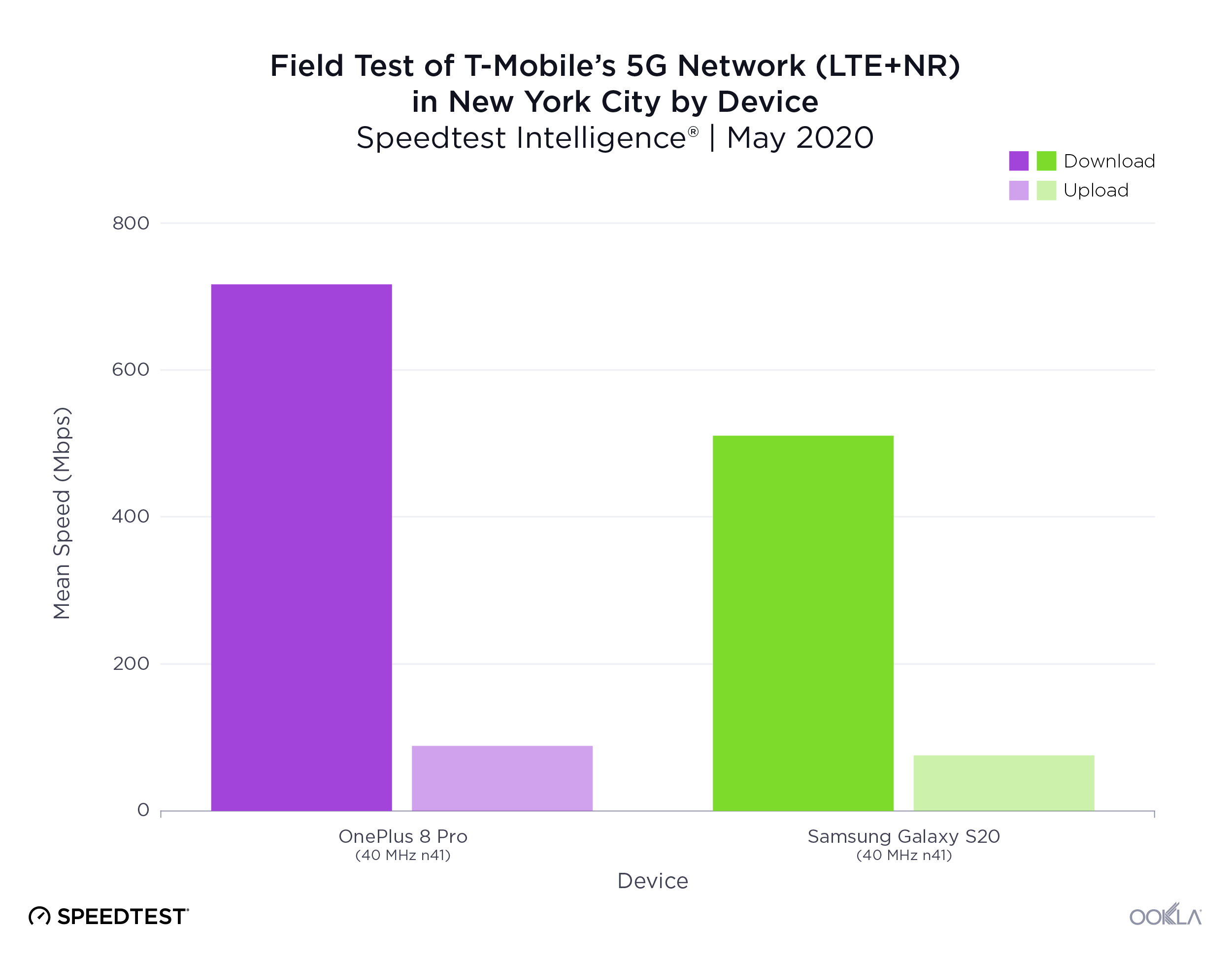

T-Mobile’s 5G network uses a mechanism called the EUTRA-NR Dual Connectivity (EN-DC) split bearer, which allows for combining of data traffic from LTE (master node) and 5G (secondary node) both on the downlink (sub-6 and mmWave) as well as on the uplink (sub-6). This improves user experience by enabling utilization of the maximum amount of data streams across two technologies supported by capable 5G devices. Both devices are capable of aggregating two mid-band LTE anchor bands (B2, B66) with sub-6 NR, but only the Samsung Galaxy S20 Ultra 5G has the ability to leverage up to four spatial streams on the two mid-band LTE bands and NR (n41) at the same time. The OnePlus 8 Pro supports EN-DC combinations with two streams per the mid-band LTE anchors paired with four streams on n41. This is likely related to the RF Front End design limitation on the OnePlus device.

In my field tests, both devices delivered excellent speeds, leveraging 40 MHz of 2.5 GHz 5G (n41) with two LTE mid-band component carriers (CC) on the downlink, while the OnePlus 8 Pro had an additional help coming from the LAA CCs. On the uplink, devices utilized dual connectivity combining one LTE CC with NR. The latency was also similar between devices, although I did observe latency as low as 7 ms.

What’s missing from the Galaxy S20 Ultra 5G — and what the OnePlus 8 Pro fully capitalizes on — is the ability to aggregate mid-band LTE with LAA and mid-band NR. As we’ve described, the existing Manhattan LAA cell sites in some areas conveniently located on every two to three city block corners are the obvious candidates for the 5G mid/high-band overlay, which is exactly what I observed on the streets of the East Village. The combination of 60 MHz of LAA, 30 MHz of mid-band LTE (B66+B2) and 60 MHz NR produced an outstanding user experience, delivering mean download speeds of 989 Mbps and mean upload speeds of 107 Mbps. During May 19 testing, I recorded peak speeds in excess of 1.2 Gbps with the NR contribution of 900 Mbps. This particular test utilized only a single LTE CC (B66), three LAA CCs and 60 MHz of NR.

Considering that Samsung’s Galaxy S20 lineup uses state-of-the-art RF Front End components and is built to provide uncompromised user experience, we really hope to see LAA EN-DC support added via the future software updates for both sub-6 and mmWave, which would unlock the device’s full potential. The business case for operators is very appealing: the ability to free up the licensed LTE spectrum in densely populated areas while at the same time providing a significant boost in user experience, as shown in this report. It’s also worth noting that the branded Samsung Galaxy S20 lineup does support the use of higher order MIMO on both LTE mid-band and n41 concurrently, which could prove to be an advantage over the OnePlus device outside of the dense urban areas where LAA isn’t available.

While most smartphones today can’t aggregate multiple low-band component carriers across multiple low-band frequencies, T-Mobile’s branded devices powered by Qualcomm’s Snapdragon X55 5G Modem-RF System are capable of aggregating multiple low-band channels within the same frequency band (600 MHz). In other words, these smartphones (including the Samsung Galaxy S20 Ultra 5G, and the OnePlus 8 Pro) are able to leverage all of the deployed downlink 600 MHz capacity by way of EN-DC, which allows for concurrent use of LTE band 71 and n71, in addition to the use of mid-band LTE anchors (Band 2 and Band 66). These devices also support uplink carrier aggregation of the LTE anchor band and sub-6 NR.

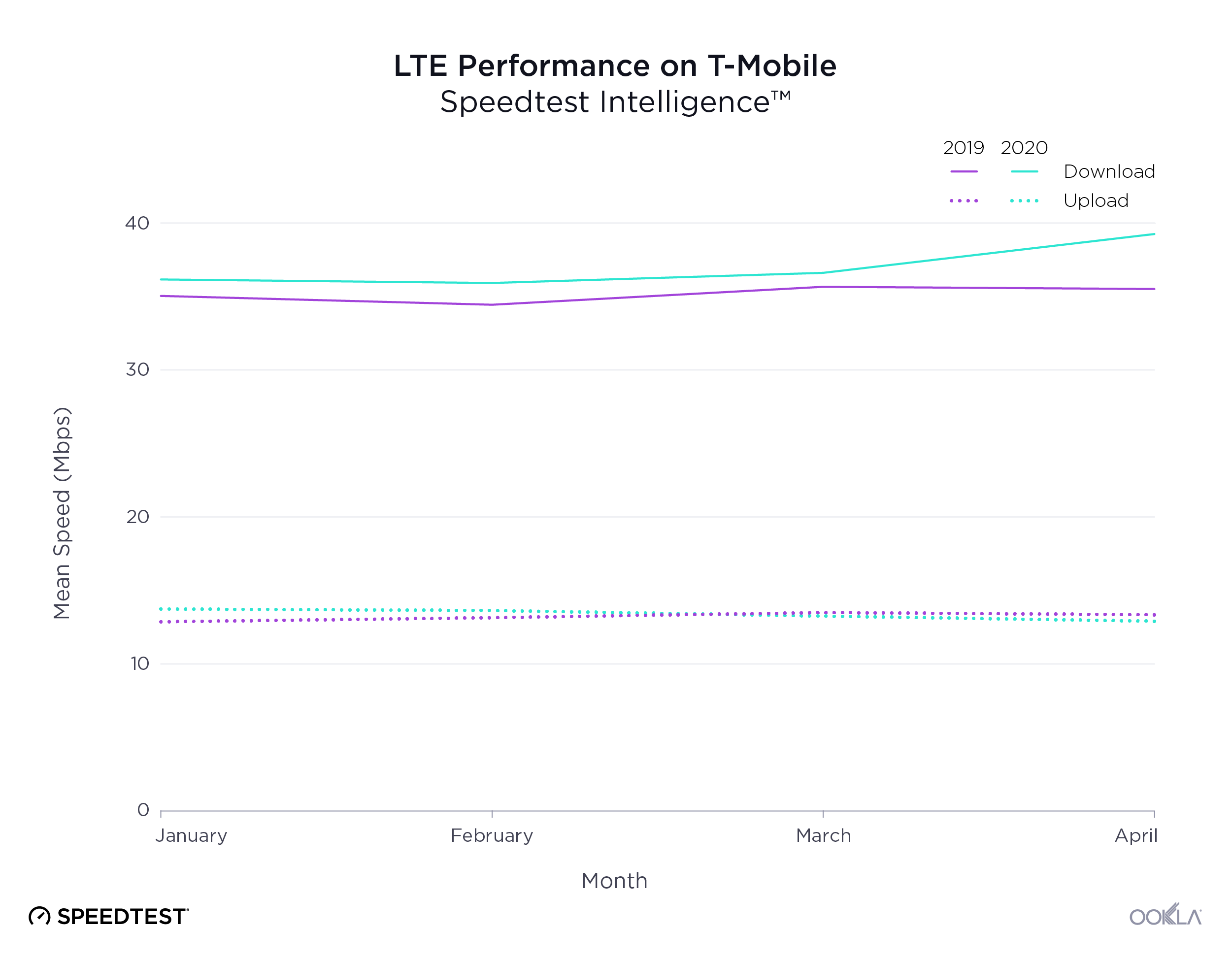

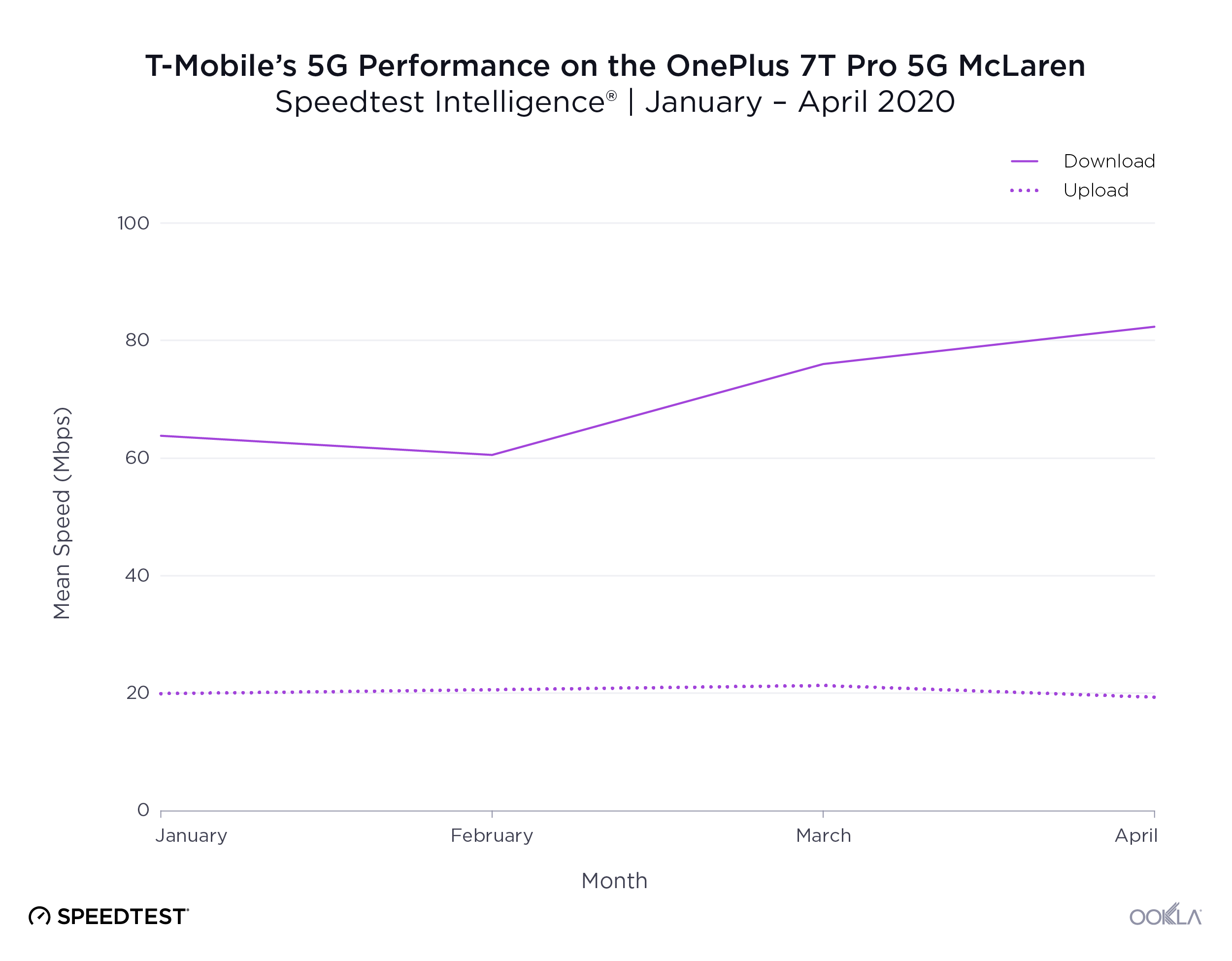

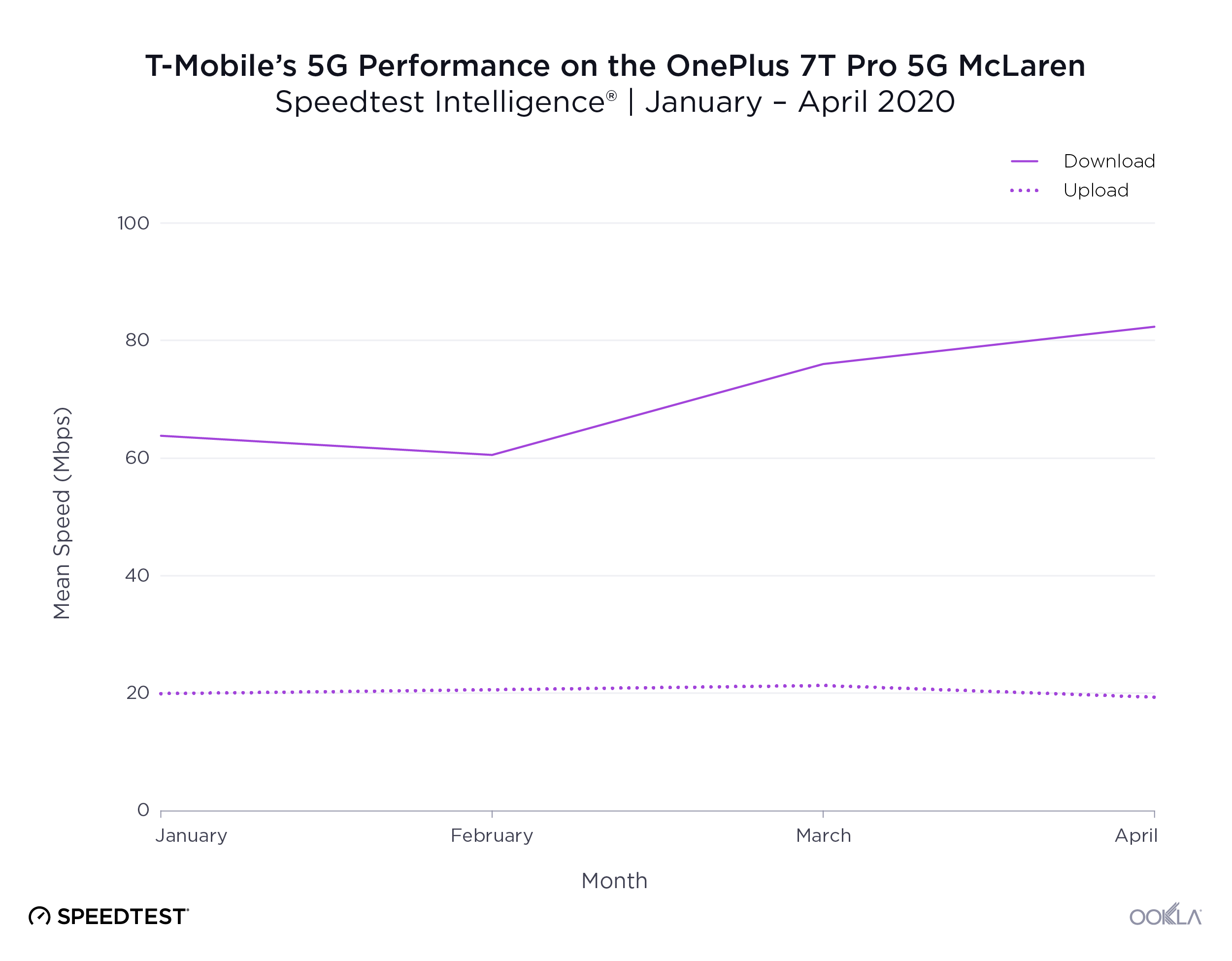

Because the OnePlus 7T Pro 5G McLaren Edition was the first device to receive this feature, we analyzed its performance in the U.S. as a whole during the first four months of 2020. The software update on February 13 resulted in an improvement of over 30% in mean download speeds from those seen in January 2020. The concurrent use of multiple 600 MHz channels produced mean download speeds of 82.35 Mbps and a latency of 32 ms in April.

What the future holds

In markets like New York City, Sprint’s legacy 2.5 GHz LTE network (for the most part) operates on a 60 MHz contiguous chunk of spectrum (3CC LTE carrier aggregation) adjacent to T-Mobile’s 40 MHz (in some parts 60 MHz) NR. In addition to this 100 MHz contiguous spectrum block, Sprint uses a separate 20 MHz slice for its small cells applications, for a total of 80 MHz of deployed 2.5 GHz LTE capacity. Repurposing 20 MHz (or more) of LTE channels and widening the 2.5 GHz NR capacity could easily provide a quick incremental capacity gain for T-Mobile, as already seen on some sites in Manhattan.

Furthermore, the existing Nokia 64T64R massive MIMO radios used on Sprint’s sites still operate in split-mode (32T32R for LTE, 32T32R for NR), but the NR logical partition is not in use. These could have the NR portion of antenna elements remapped for 64T64R LTE which should, in theory, further enhance the LTE coverage through the use of beamforming and deliver an improved LTE sector capacity for users with legacy Sprint LTE B41 devices. When we consider that over 80% of Sprint’s postpaid subscribers own smartphones capable of accessing the T-Mobile network, and 10 million unique Sprint subscribers already utilize T-Mobile’s LTE network on a weekly basis, the accelerated refarm of the 2.5 GHz spectrum makes even more sense.

While T-Mobile could easily add LTE B41 capability to its n41 sites, most (if not all) T-Mobile branded devices aren’t currently capable of aggregating LTE B41 channels with all of T-Mobile’s existing LTE spectrum bands. Therefore, adding LTE B41 wouldn’t provide any immediate capacity gain to T-Mobile’s user base. To achieve that capacity gain, Class II Permissive Change would have to be filed with the FCC for the entire portfolio of T-Mobile’s branded devices and then T-Mobile would have to perform a large-scale software update push, which could be a massive undertaking, and frankly isn’t necessary.

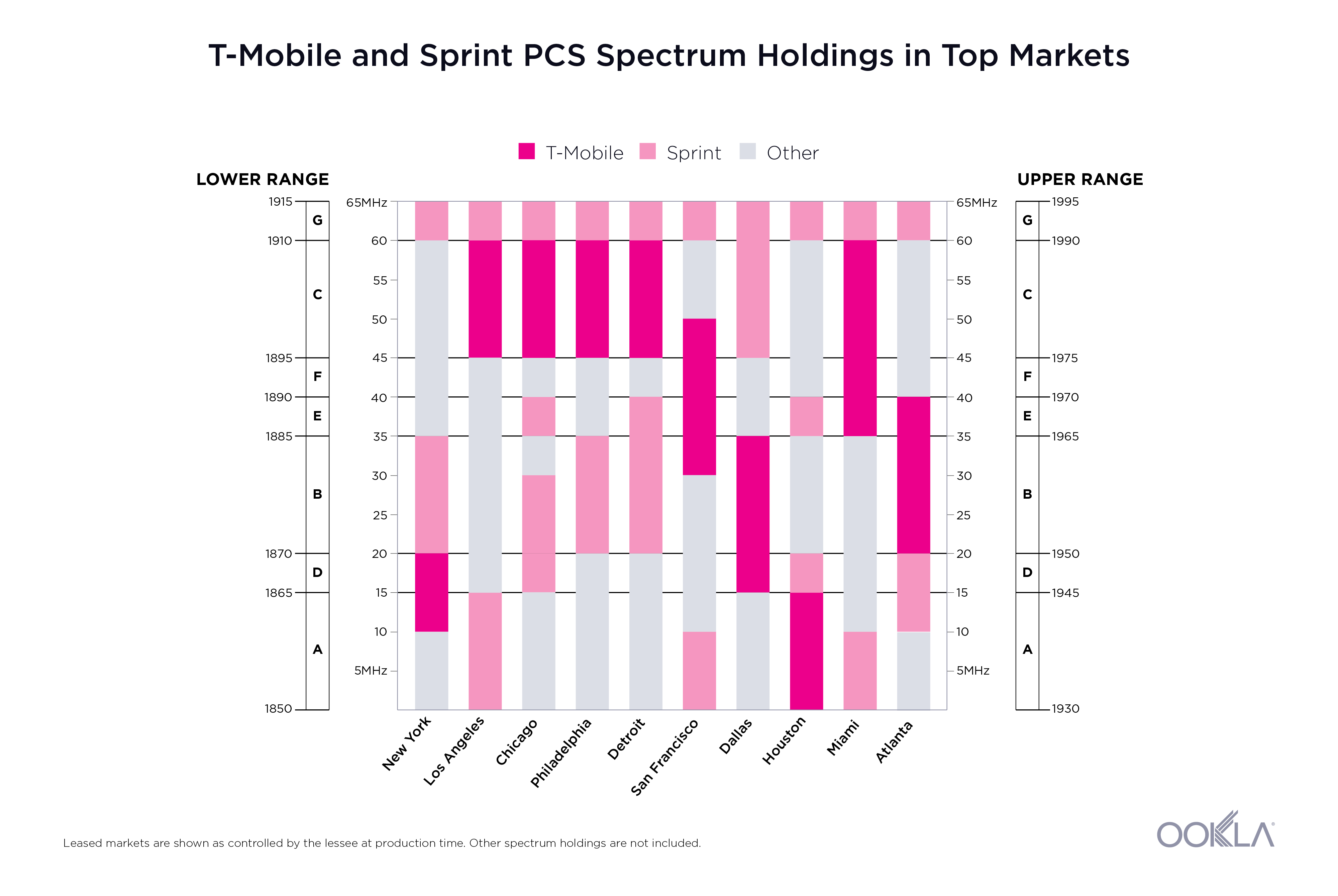

As we described back in August integrating a portion of Sprint’s PCS spectrum onto T-Mobile’s network and widening the existing PCS channels to 15 or 20 MHz could further improve user experience and overall network efficiency for the combined network. This could be highly beneficial in markets with a high uptake of Sprint customers where Sprint’s PCS spectrum holdings sit adjacent to T-Mobile’s. Alternatively, PCS spectrum swap with other operators could produce similar results.

Over the past few years, Sprint has done a lot of work to densify its network using small cells and distributed antenna systems (DAS). These nodes provide added coverage and capacity, but often operate on their own separate 2.5 GHz frequency block, different from the blocks used on Sprint’s macro sites. Repurposing Sprint’s network of small cells and outdoor DAS (oDAS) and retrofitting for T-Mobile’s LTE/NR at some point in the future could provide additional capacity in urban and suburban areas.

Finally, the launch of the Standalone (SA) 5G slated for later this year will offer many core benefits, such as reduced latency, improved speeds and network slicing, to name a few. With the introduction of VoNR (Voice over NR), SA 5G should provide an improved 5G coverage, especially for customers in rural America, as the need for mid-band LTE anchors would be removed.

The existing portfolio of branded devices powered by the 2nd generation Qualcomm Snapdragon X55 5G Modem-RF System has the support for Standalone 5G, but will require a software update. Recent announcements of SA 5G lab and field testing using a commercial OnePlus 8 device indicate that T-Mobile is inching closer to commercializing this service. The upcoming 3rd generation Qualcomm Snapdragon X60 Modem-RF System will fully set the stage for standalone 5G deployments around the world by enabling mmWave-sub6 aggregation, as well as sub-6 carrier aggregation across FDD and TDD bands. This means that the upcoming portfolio of T-Mobile’s 5G devices will be able to combine n71 with n41, n261 with n41, and so on. The Dynamic Spectrum Sharing (DSS) feature, which enables coexistence of LTE and 5G in the same frequency channel at the same time, will likely find its purpose in T-Mobile’s toolbox by enabling the use of n2 and n66 frequency bands.

Two weeks of testing T-Mobile’s 5G in New York City delivered an impressive user experience, and it was just an early taste of a 5G layer cake that could continue to improve. Low-band 5G provides the foundational layer of the cake, the mid-band filling is already thickening and the mmWave at the moment is the cherry on top, with the potential to become a much bigger layer. We’re excited to see how other operators can learn from this approach and improve 5G performance across the globe.