The year 2024 is anticipated to be another challenging year as the world continues to struggle with economic downturns, political unrest, and military conflicts. Despite this, digital transformation is making strides in various sectors, leading to greater efficiency, innovation, and the emergence of new business models. There is also a continued focus on sustainability and addressing climate change, as well as enhancing the adaptability and resilience of supply chains. Given this context, we have compiled some predictions for what we can expect in 2024 across a number of themes:

Future Ready Connectivity

5G rollout continues but user satisfaction and profitability miss the mark

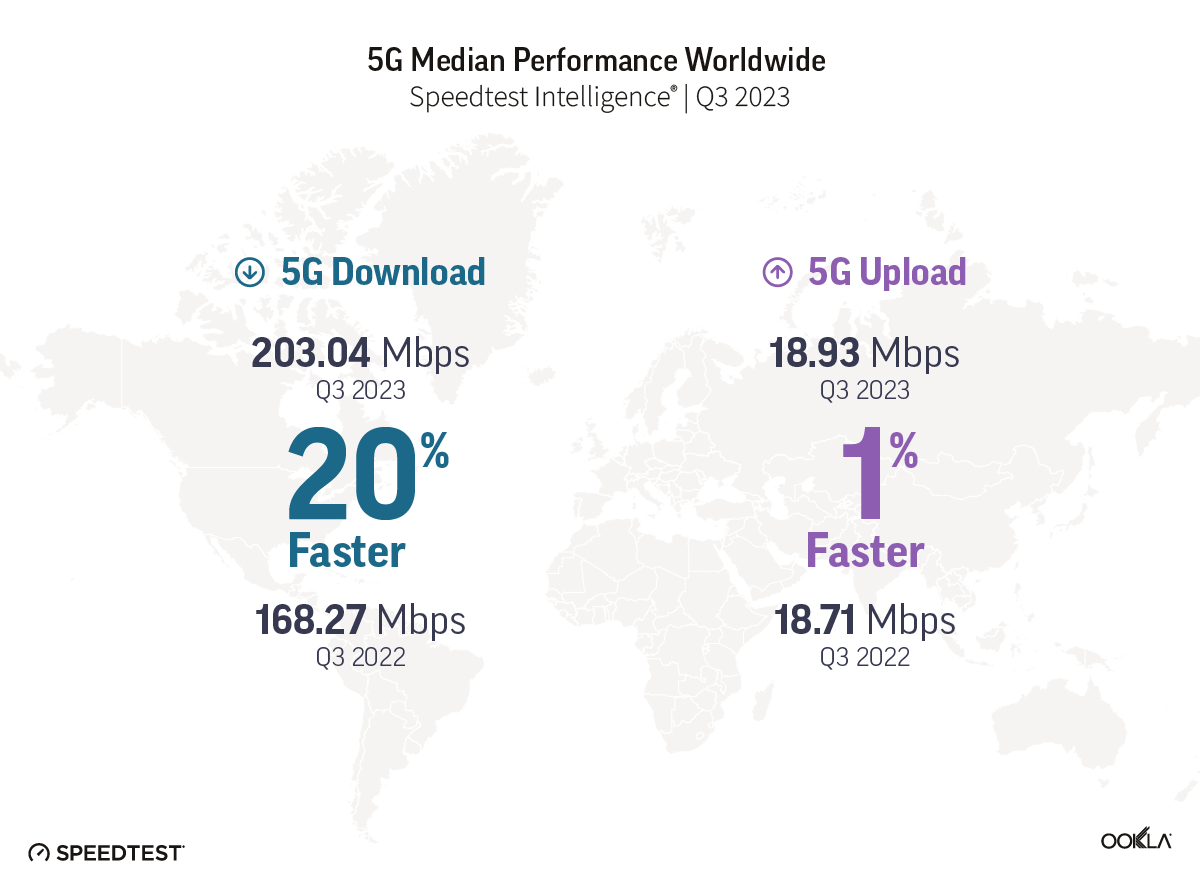

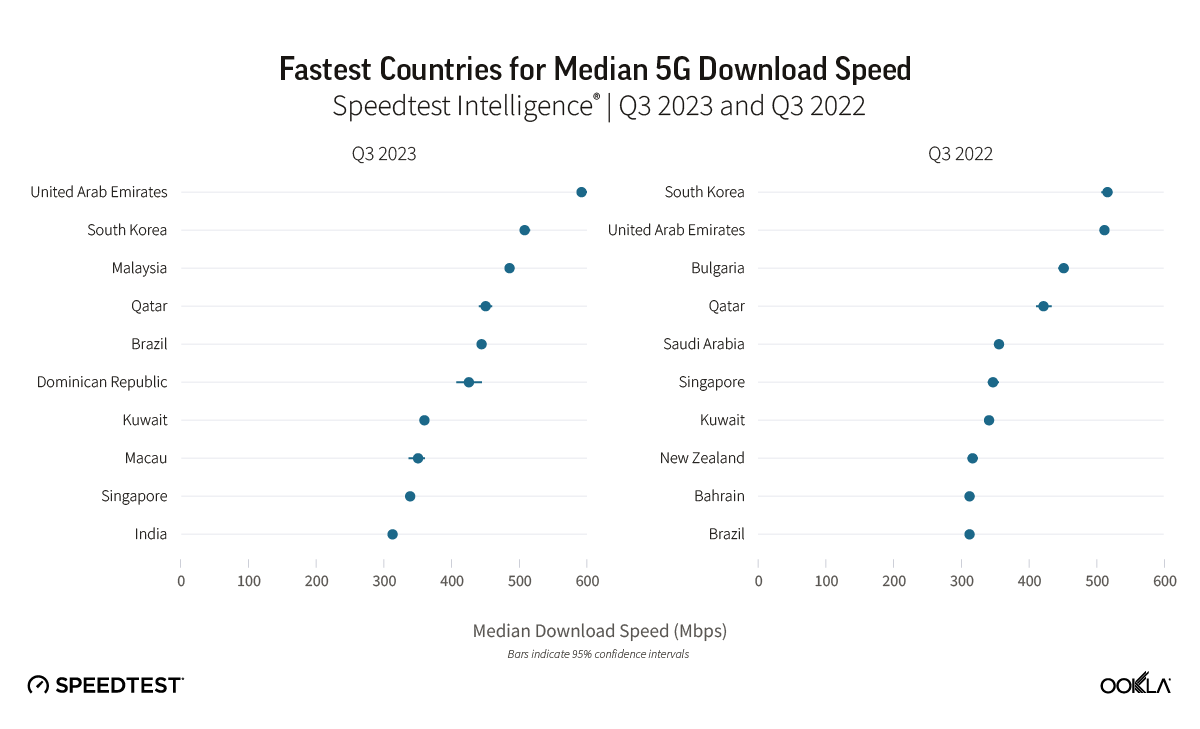

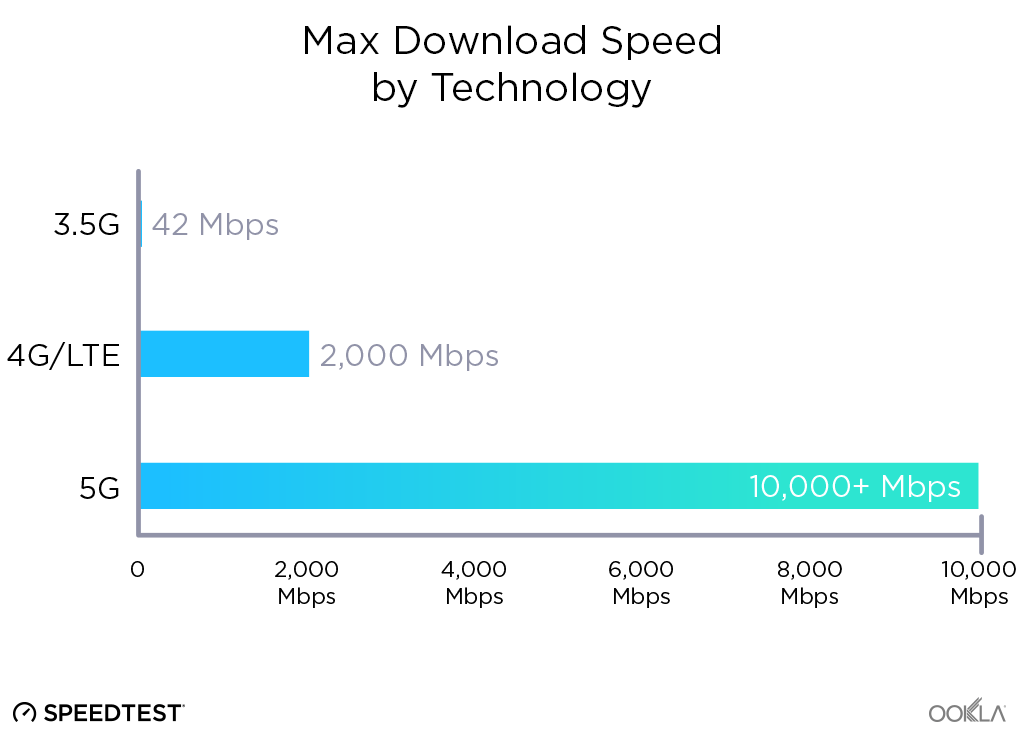

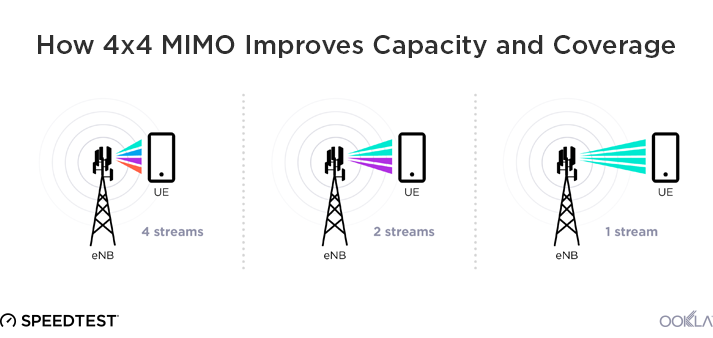

The pace of 5G rollout remains robust, reaching 1.4 billion subscriptions globally, according to Ericsson’s latest Mobility Report. However, most of 5G today isn’t ‘true 5G’ as the majority of 5G networks have been deployed in non-standalone (NSA) mode, meaning they rely on a 4G LTE network core. Although 5G performance has shown improvement in 2023, not all consumers are satisfied with it. According to Speedtest Intelligence® Q3 2023 data, the global median 5G download speeds were 7.37 times faster than 4G (203.04 Mbps compared to 27.51 Mbps), and uplink was 2.3 times faster (18.93 Mbps compared to 8.21 Mbps).

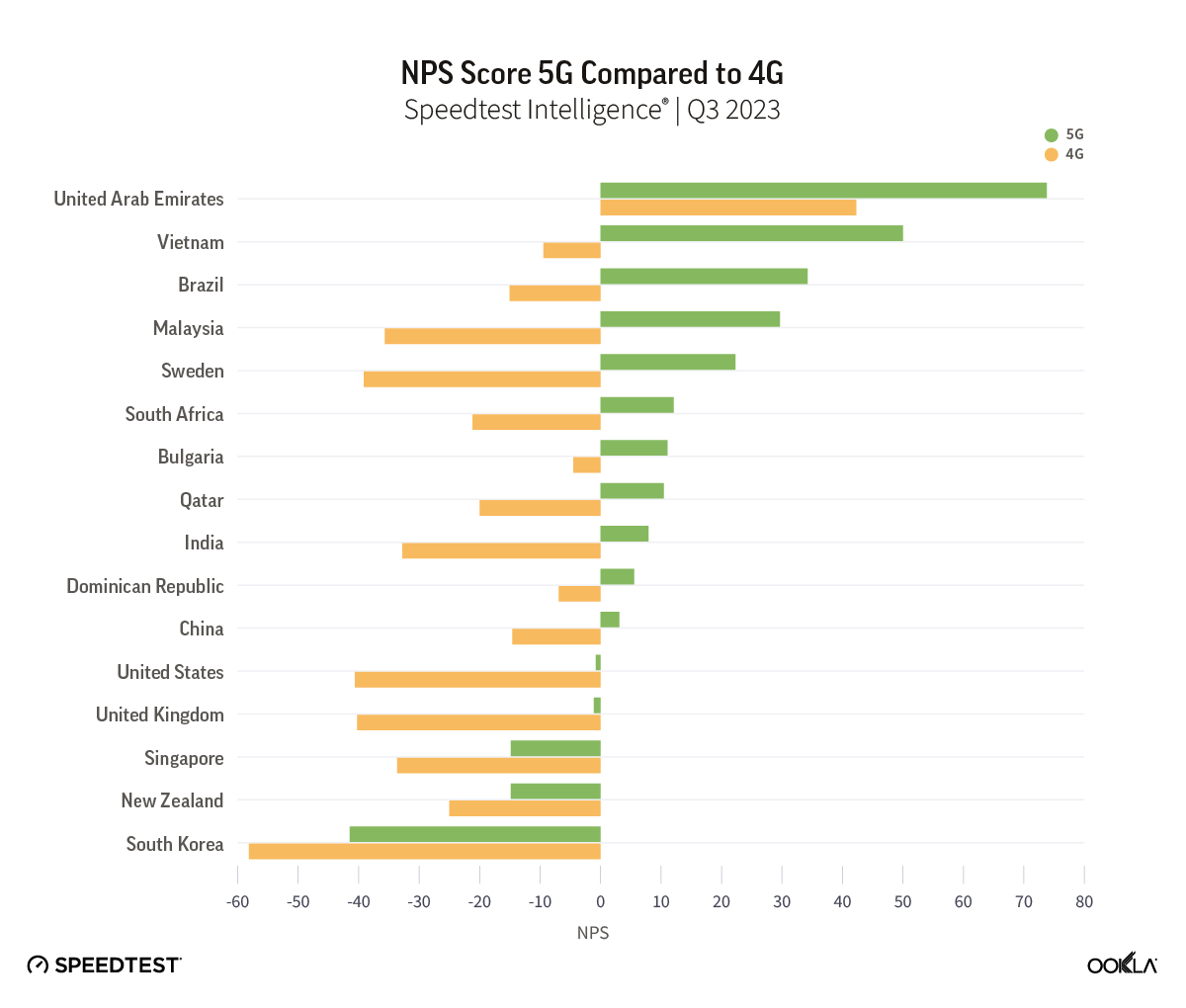

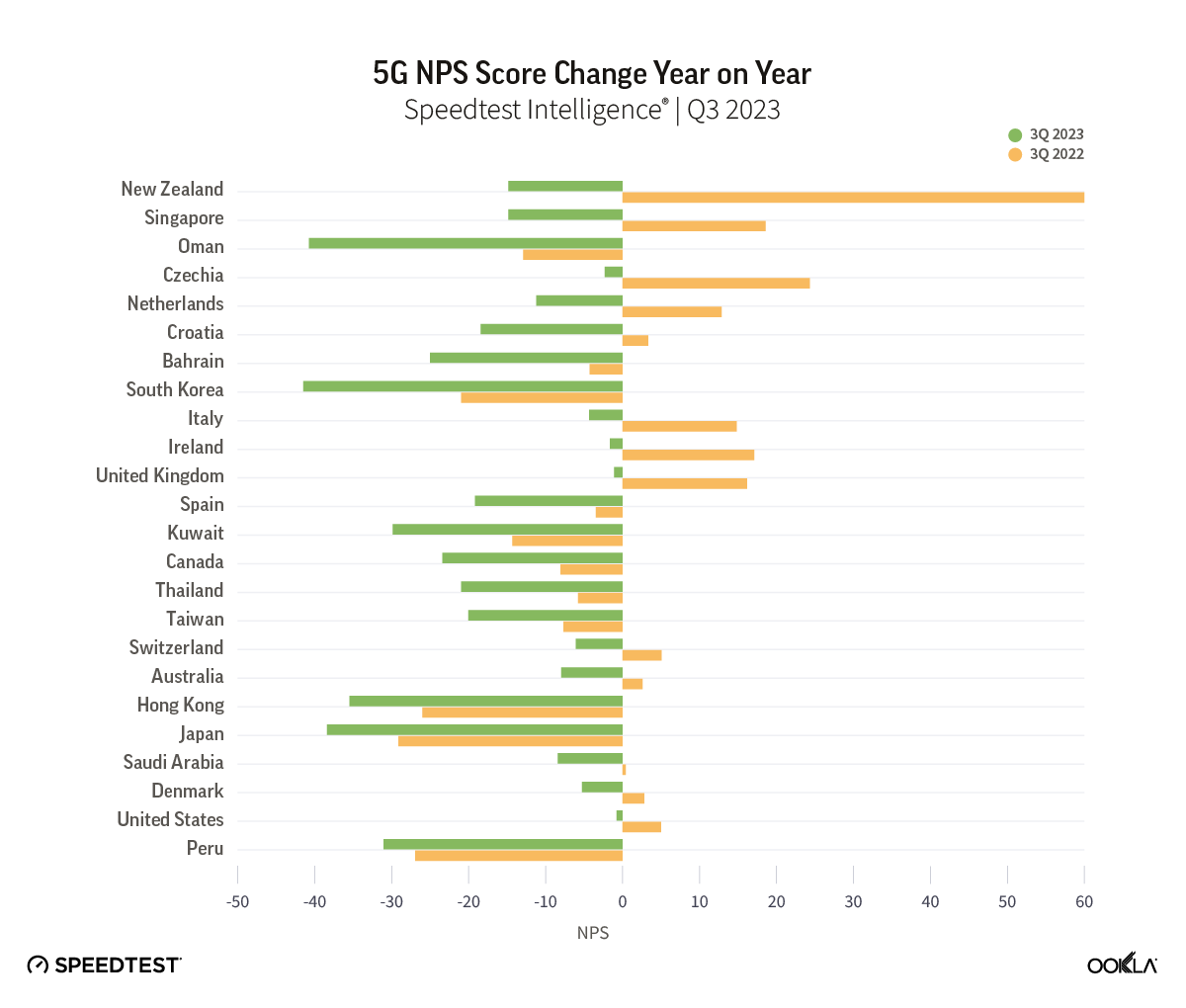

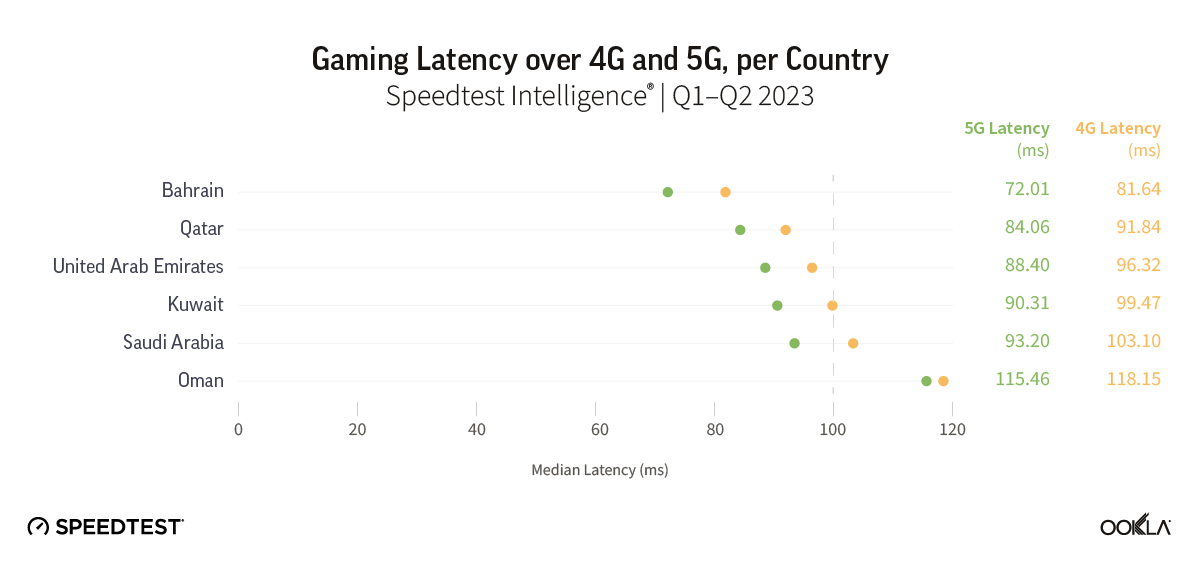

However, 5G latency failed to impress, with global median 5G multi-server latency at 44 ms compared to 52 ms for 4G, showing a mere 1% year-on-year improvement. Telecom operators have invested heavily in 5G infrastructure, but they find it challenging to recover these investments. Without new value-added services that use 5G bandwidth, consumer sentiment looks bleak, with the Net Promoter Score (NPS) for 5G falling in mature markets. The challenge for the 5G industry in the year ahead will be to find ways to monetize 5G beyond Fixed Wireless Access (FWA) use cases and to support investment into standalone (SA) 5G as the industry readies for 5G Advanced ahead of the 6G era.

Phasing out legacy networks for spectrum efficiency

As 5G takes center stage, legacy networks such as 2G and 3G will gradually fade away. Similarly, the copper switch-off will continue. As 4G LTE and 5G technologies are much more efficient in terms of spectrum, network operators are phasing out their legacy networks. This move is motivated by freeing up spectrum and refarming it to deliver faster, more advanced, and more efficient networks. In our recent webinar, we shared how operators can use Ookla Cell Analytics™ to identify areas with high dependency on 3G networks, where consumers use older devices, and locations in need of improved 4G coverage. In 2024, operators in Europe and APAC, in particular, will continue to migrate customers away from 3G as they witness a decline in network traffic over 3G and seek to achieve efficiency gains and Capex reduction.

Private networks steadily carry on

Private mobile networks have become increasingly important for organizations with growing data and security needs as they cater to their specific Industry 4.0 goals. As enterprises of all shapes and sizes increasingly rely on data-intensive applications and IoT devices, legacy networks may struggle to keep up with the growing demand. WiFi and 5G technologies complement each other in modern enterprise networks, with 5G adding a new dynamic to replace legacy network functions where greater flexibility is required. GSA has recognised 1,279 customers deploying private mobile networks in Q3 2023, of which 45% using 5G. .3GPP Release 16 of 5G New Radio (NR) supports a wider set of industrial IoT use cases which should come to the fore in 2024 as more industrial 5G-ready devices that use chipsets based on the Release 16 standards enter the market. Moreover, the industry is already discussing NR Reduced Capability (RedCap), which is specifically designed for devices that do not require the full capabilities of 5G to further enhance cost efficiency and offer precise positioning. Those enterprises that base their networking strategy on problem-solving are well-positioned to meet their objectives no matter the technology they choose.

Telco Evolution

5G SA is still at the Proof of Technology stage

Although 5G Standalone represents the true potential of 5G, its rollout has been slow due to the extensive investments required and a challenging macroeconomic environment. As of October 2023, only 7% of global mobile network operators (43 operators) in 29 counties have launched 5G SA networks. On the public network side, early network performance data from RootMetrics® indicates that 5G SA outperforms its NSA 5G counterpart across various metrics, including latency and time to start playing video and start the file download. However, speeds remain similar due to identical NR bandwidth. In 2023, the focus was on demonstrating the power of 5G SA, including network slicing, through demos and proof-of-concepts. The crucial task for operators now is to translate these promising developments from controlled environments like laboratories and testing into real-world commercialization.

Open RAN faces a challenging year ahead

Beyond continued questions on its performance and limited traction beyond greenfield networks, there is growing concern over how open Open RAN will really become. Industry skeptics point to solving interoperability challenges across hardware and software stacks, slowing down its progress and adding to implementation timelines. AT&T has recently outlined a plan where 70% of its wireless network traffic will flow across open-capable platforms by 2026. The company plans to start fully integrated Open RAN sites in collaboration with Ericsson and Fujitsu starting in 2024. AT&T also plans to ramp up its Open RAN deployments from 2025 using technology from multiple suppliers, signifying a move away from closed proprietary systems. This move highlights the fact that, indeed, the industry’s direction of travel continues to be virtualizing network functions as they allow for greater flexibility, scalability, and cost-efficiency in network operations.

GenAI capturing attention

GenAI, short for Generative AI, like ChatGPT, has seen recently increased acceptance, particularly during 2023. Telecom operators can benefit from using GenAI in various ways, such as optimizing and managing their network without human intervention (zero-touch network management). When implementing GenAI, telecom operators usually follow a phased approach. They start by experimenting with GenAI for internal processes, such as marketing tasks like creating promotional content or analyzing market trends. After successfully implementing and experimenting with internal processes, telecom operators can gradually introduce GenAI into customer-facing functions. For instance, GenAI could automate customer support, offer personalized service recommendations, or manage network aspects based on customer usage patterns. 2024, however, will bring a degree of scrutiny. As the capabilities of Generative AI continue to expand, there will likely be an increase in calls for tighter regulation due to concerns about accuracy and potential harm. Industries, including telecom, must navigate these regulatory challenges and use GenAI responsibly.

Customer Impact

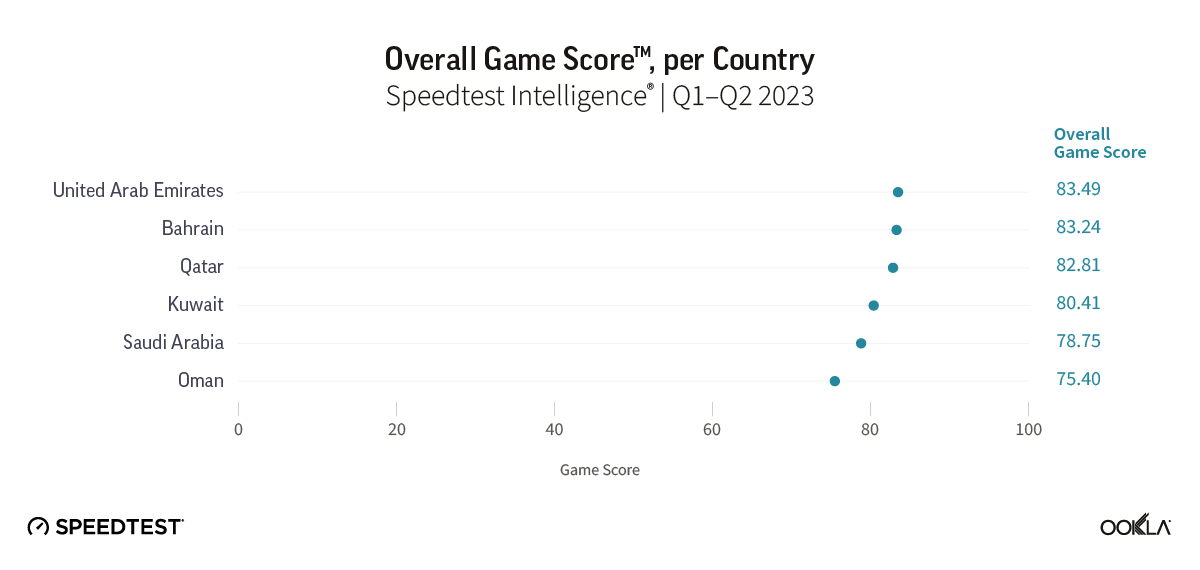

Cloud gaming market bounces back after a brief hitch

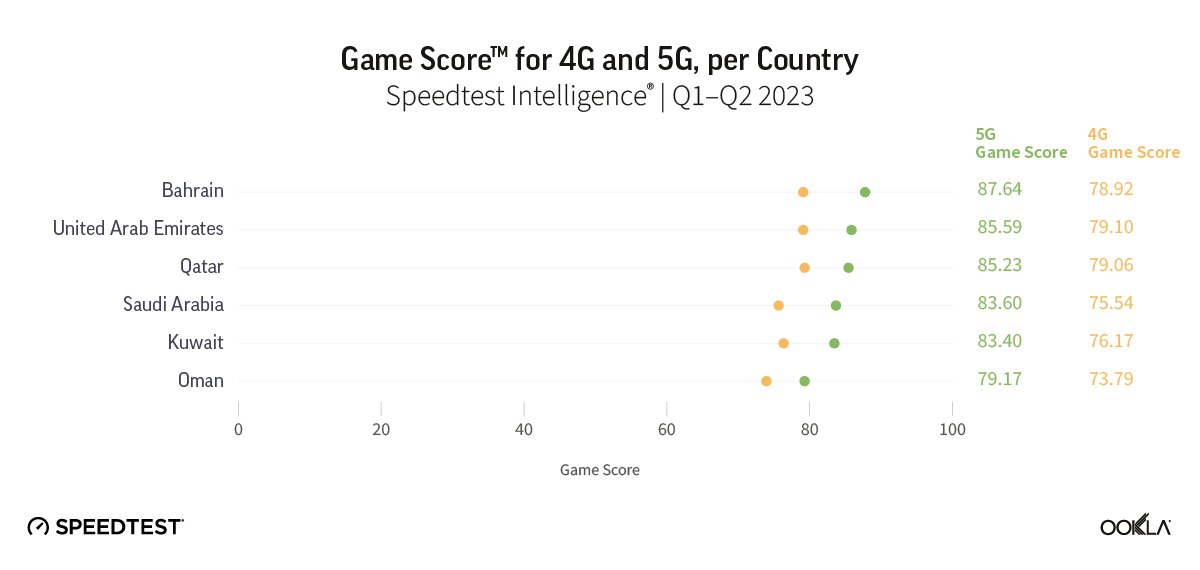

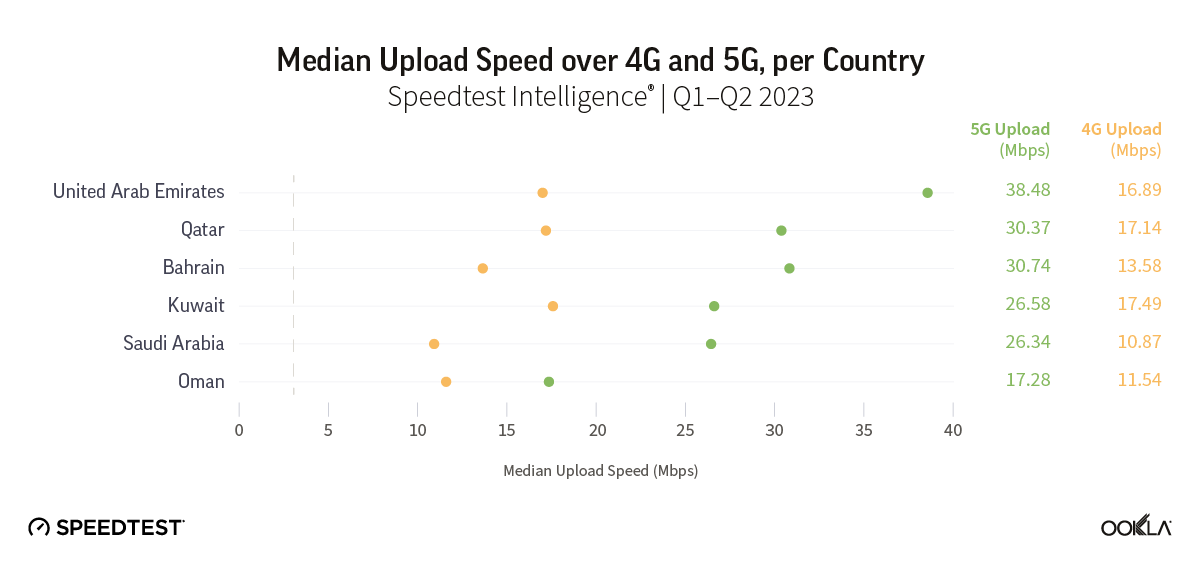

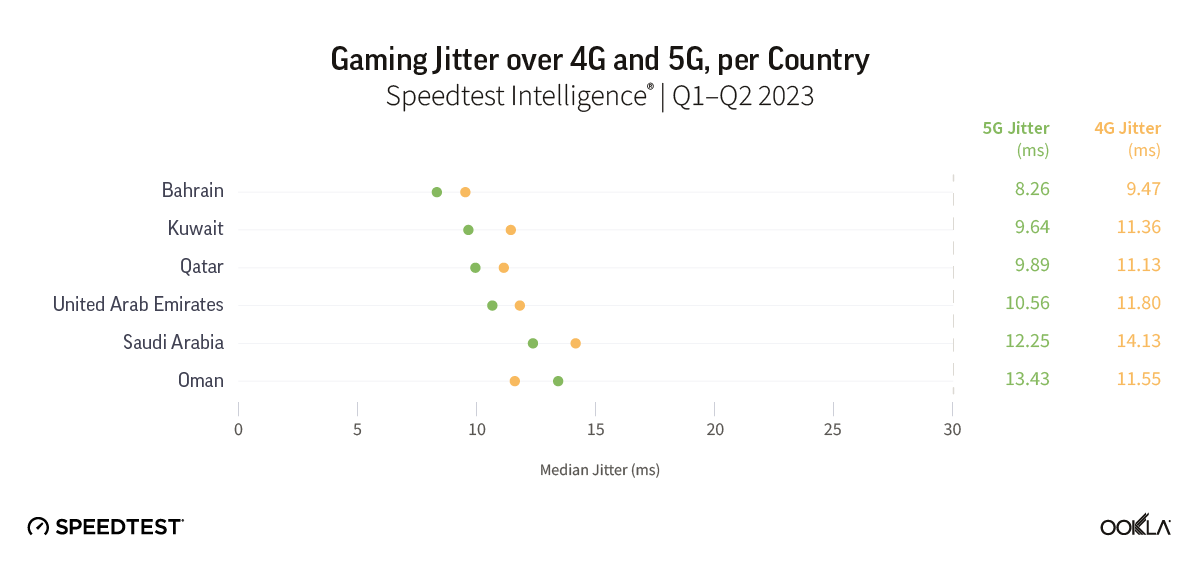

Mobile cloud gaming provides an accessible alternative for casual gamers who cannot afford or do not have access to a dedicated game console. By eliminating the cost barrier, it considerably expands the addressable market for gaming services. It allows for direct monetization and presents opportunities to generate revenue through advertising. Recognizing this potential, Samsung could launch its cloud gaming service in Q1 2024 to reach over 1 billion handset and tablet users worldwide. Netflix also started testing its cloud gaming service in 2023, targeting casual gamers on larger screens with nearly 250 million paying subscribers to its video streaming services in Q3 2023. The adoption of cloud gaming services will stimulate the demand for high-speed and low-latency connectivity at home and on the go. Operators can also leverage their edge computing capabilities and connectivity infrastructure to deliver an immersive and lag-free gaming experience.

Connectivity for All

Satellite technology coming of age

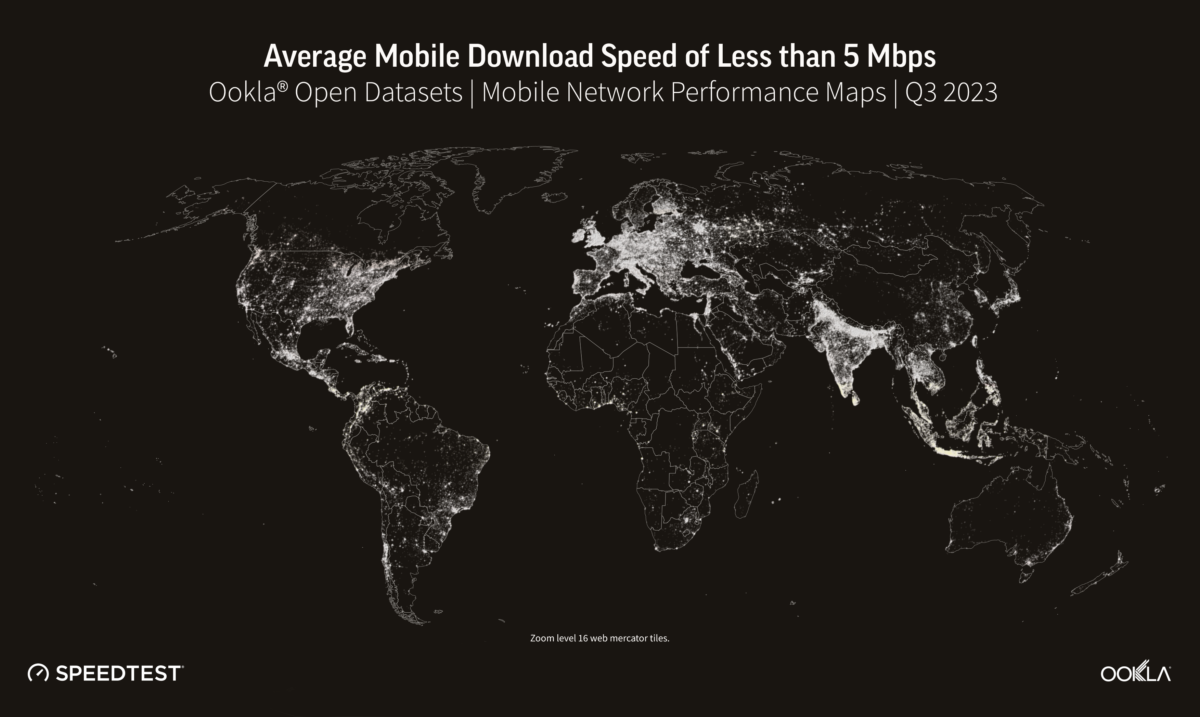

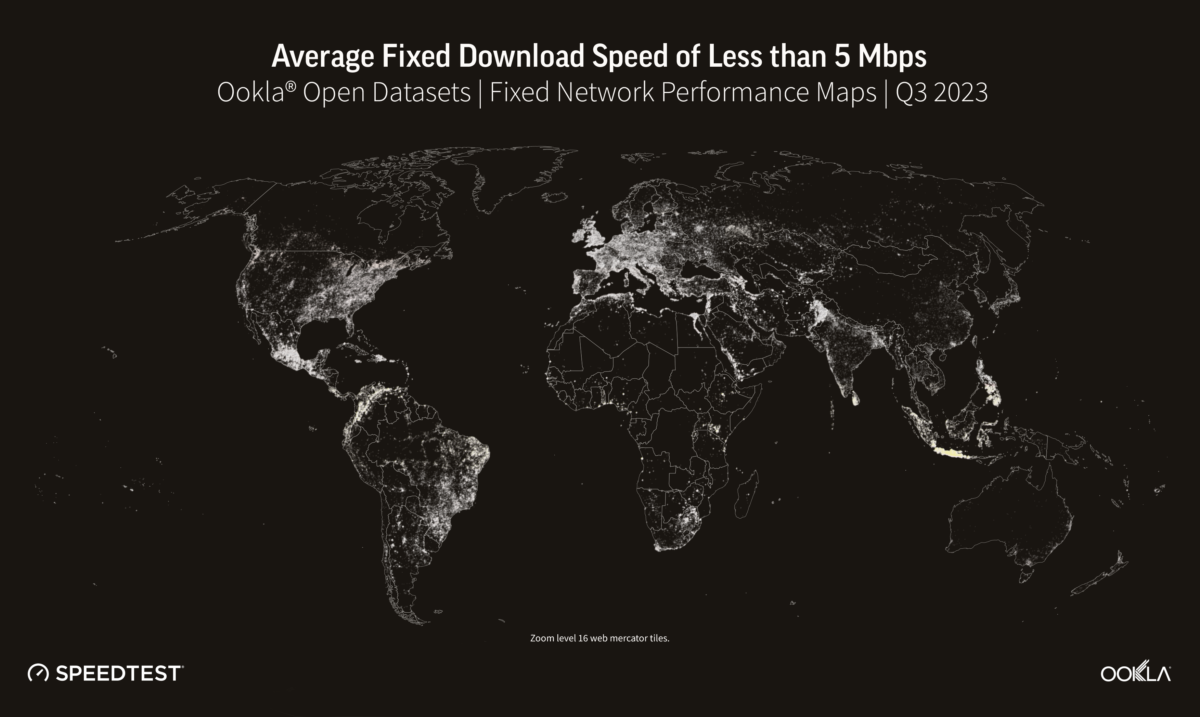

Globally, satellite already plays an important role in providing network backhaul for 2G, 3G, and 4G technologies in rural and remote areas while also connecting a range of enterprise verticals such as logistics. Starlink, which uses Low Earth Orbit (LEO) satellites, has proven that it performs better than GEO satellites and offers a viable alternative in locations where terrestrial networks aren’t present. Despite Qualcomm and Iridium terminating their partnership, the excitement around satellite will continue in 2024 and we anticipate greater terrestrial and non-terrestrial network (NTN) integration. We also expect more partnerships between satellite providers and telecom operators to build a seamless and robust communication infrastructure that can address connectivity challenges in underserved regions.

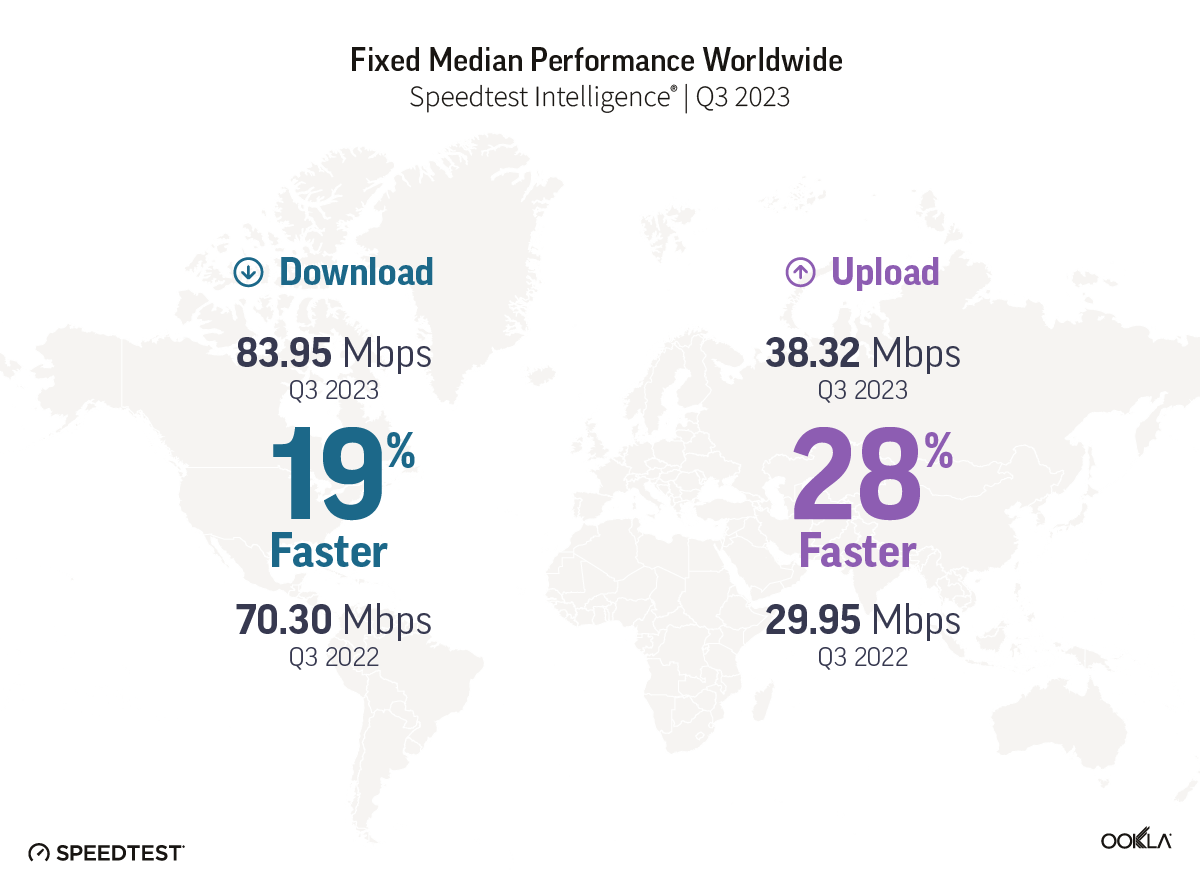

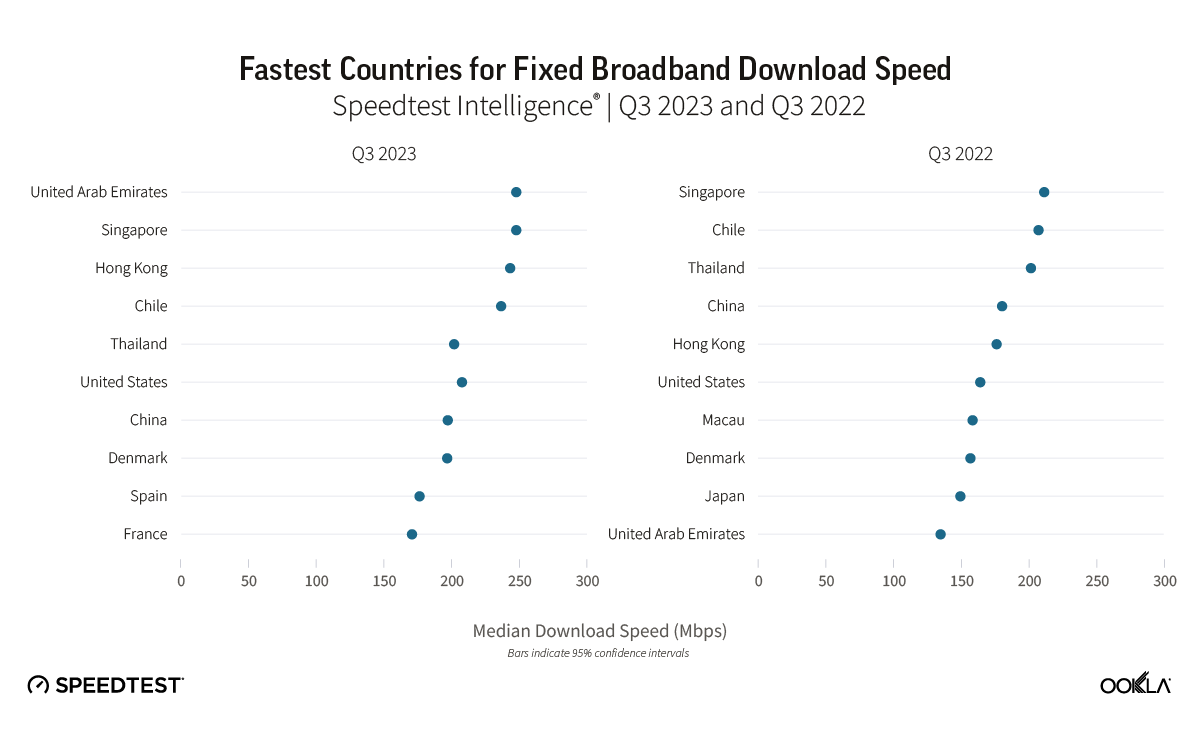

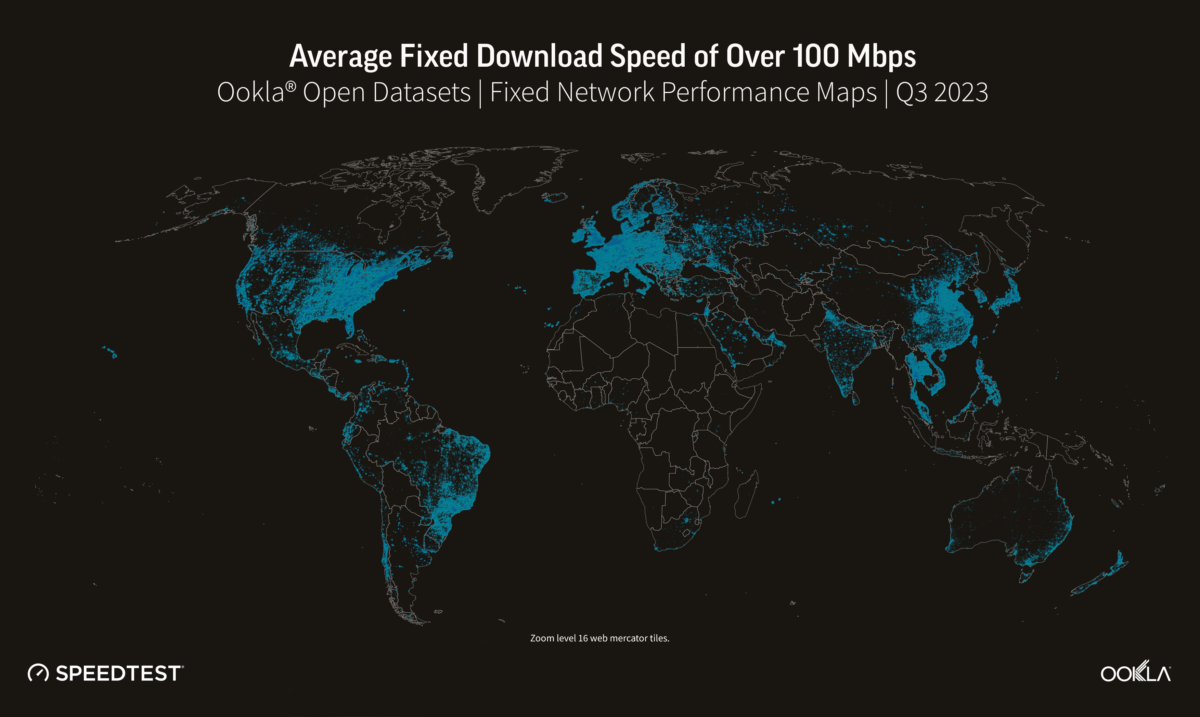

Monetizing 5G through FWA

Fixed Wireless Access (FWA) continues to be a poster child for 5G, as it is one of the only ways carriers have found to monetize 5G separately, leading many operators to pursue FWA actively as part of their 5G strategies. According to Ericsson, there are 121 service providers offering FWA services over 5G, representing 50% of all FWA service providers. FWA provides an opportunity for telecom operators to serve rural locations better and offer an alternative for customers dissatisfied with cable or other incumbent broadband providers. Operators leverage FWA as a part of their 5G monetization strategy, and as Verizon put it “It’s simple. It’s plug-in and go. And that resonates with customers”.

Navigating fair share and regulatory horizons

With the threat landscape and communication networks evolving, governments and regulatory bodies need to keep up with the rapid advancements in telecommunications. The ongoing “fair share” debate centers around how networks are funded and the contributions of different entities toward telecom network costs. The European Union is discussing the contributions of Big Tech companies to the costs of the telecom networks they benefit from, while in the United States, a similar debate centers around net neutrality, financial contributions for network infrastructure, and how to ensure a level playing field for various stakeholders in the telecom space. In 2023, Ookla was actively involved in discussing best practices for ensuring digital transformation and connectivity for all in the APAC region, Central Asia, and Europe. Our data and analysis have shown that regulatory support has been fundamental in promoting the growth of 4G in Africa and informing policy decisions across the Middle East and North Africa. Looking ahead, we will continue to lend a hand in shaping the digital future, offering insights and expertise to foster connectivity, navigate policy decisions, and propel global telecommunications into new and exciting territories.

Ookla will be at MWC Barcelona 2024 – visit us at our Stand 2I28 in Hall 2 to talk with us about telco trends. In the meantime, if you’re interested to find out more about Ookla Speedtest Intelligence and its wealth of fixed and mobile consumer-initiated data and insights, please get in touch.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.