High-speed Wi-Fi has become essential for guest satisfaction in luxury hospitality to attract more tourists and business travelers, particularly in the Middle East and North Africa (MENA). Whether you’re a leisure traveler trying to find your next home away from home or a digital nomad looking for the ideal remote work location, this article offers insights into Wi-Fi performance in MENA’s luxury hospitality market. It also discusses how hotels can improve their Wi-Fi network and use it as a differentiator to attract and retain guests.

Key Takeaways:

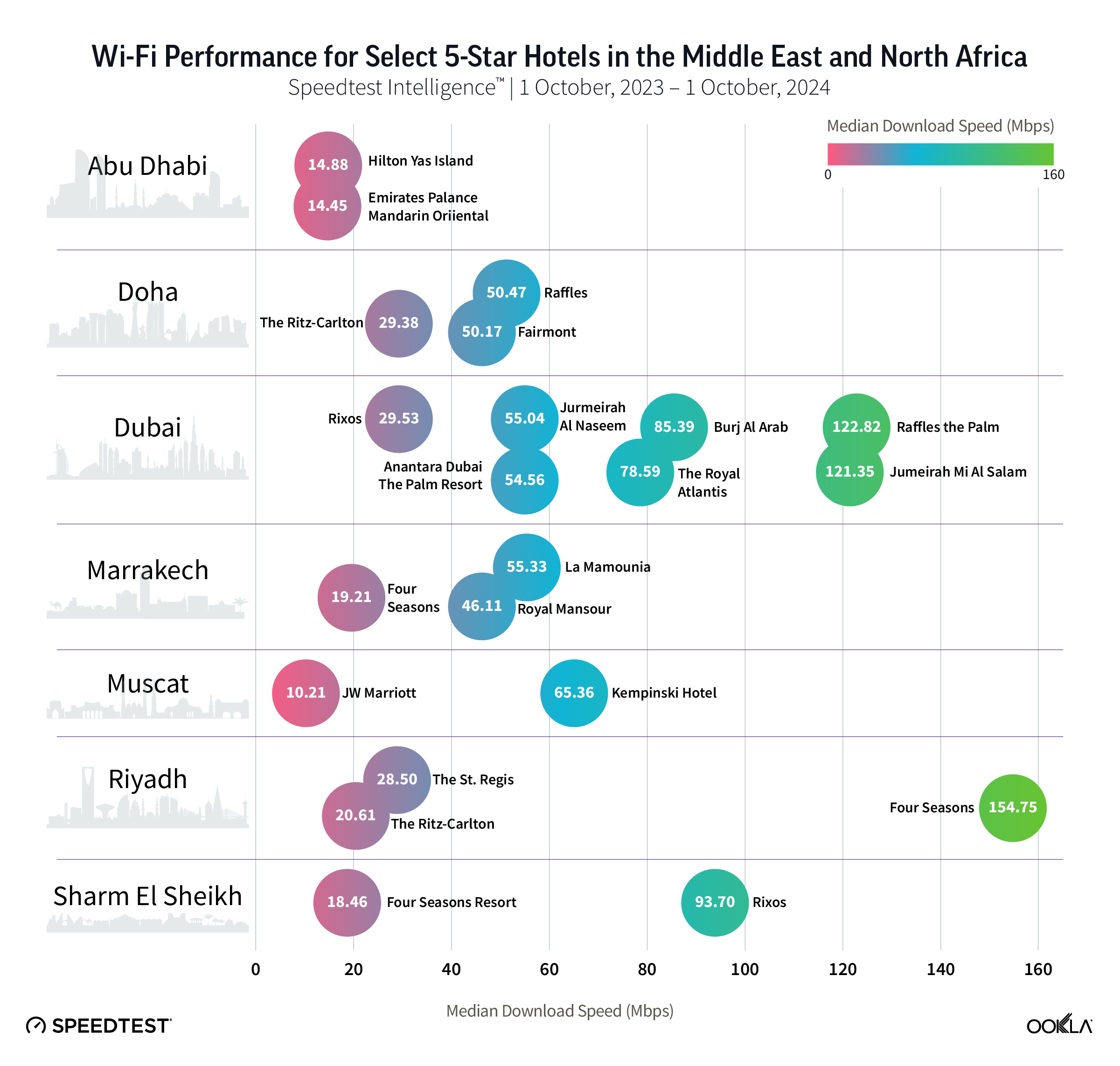

- Luxury hotels in Riyadh and Dubai offer some of the fastest Wi-Fi in MENA. Only three of the 22 properties and resorts reviewed achieved a median download speed of over 100 Mbps between October 2023 and October 2024. They include Four Seasons in Riyad, with a median speed of 154.75 Mbps, Raffles The Palm, and Jumeirah Mina Al Salam, both in Dubai, with 122.82 Mbps and 121.35 Mbps, respectively.

- Just over half of the reviewed hotels provided Wi-Fi with a median download speed of at least 50 Mbps. 41% of the properties provided a speed between 50 Mbps and 100 Mbps; these include iconic hotels, such as Burj Al Arab and the Royal Atlantis in Dubai. The remaining 45% of hotels offered a speed below 50 Mbps, including those in the Gulf region, suggesting that the issue is with the Wi-Fi network and not with the capacity of the broadband connection.

- Hotels should actively monitor and improve their Wi-Fi to remain competitive. Hotels can enhance Wi-Fi performance by increasing bandwidth, upgrading modern networking equipment, optimizing access point placement, performing regular maintenance, and gathering guest feedback to inform improvements.

Fast and reliable Wi-Fi is critical to the experience of tourists, business travelers, and remote workers

Fast and reliable Wi-Fi is essential for the hospitality industry, particularly in the MENA region, where tourists and business travelers expect seamless internet access to stream their favorite TV shows, have virtual meetings, and stay in touch. The COVID-19 pandemic accelerated this trend, making remote work the new normal. Some cities, such as Dubai and Abu Dhabi, rolled out the red carpet to digital nomads and professionals, offering special visas and incentives to attract them. Even holidaygoers and families require more bandwidth to enjoy premium video streaming services and connect multiple devices simultaneously.

As the luxury hospitality sector is booming in the region, the quality of Wi-Fi can be a decisive factor in travelers’ decision to select a property over another in a highly competitive market. According to a survey conducted in the USA, 74% of panelists believe that Wi-Fi quality is important to attract guests and maintain their loyalty. Poor Wi-Fi can negatively impact guest experiences, review scores, and occupancy rates.

Luxury hotels in Riyadh and Dubai have among the fastest Wi-Fi networks in MENA

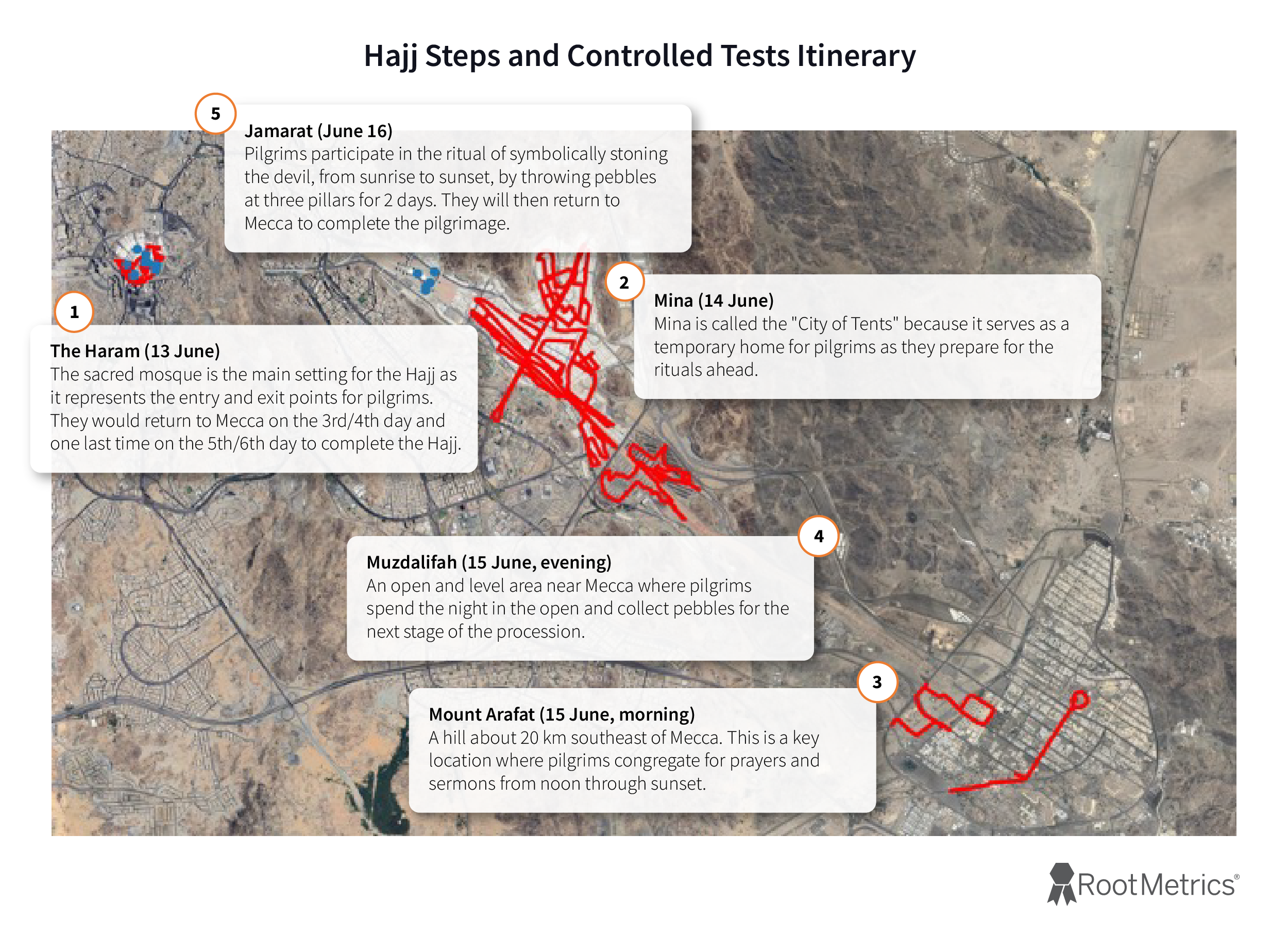

Using Speedtest Intelligence® data, we analyzed Wi-Fi performance across 22 top-rated five-star hotels and resorts shortlisted based on desk research for the most popular properties and recent recommendations from Condé Nast Traveler, Travel + Leisure, and Business Traveller Middle East. We also aimed to have representation from the Gulf region, Middle East, and North Africa.

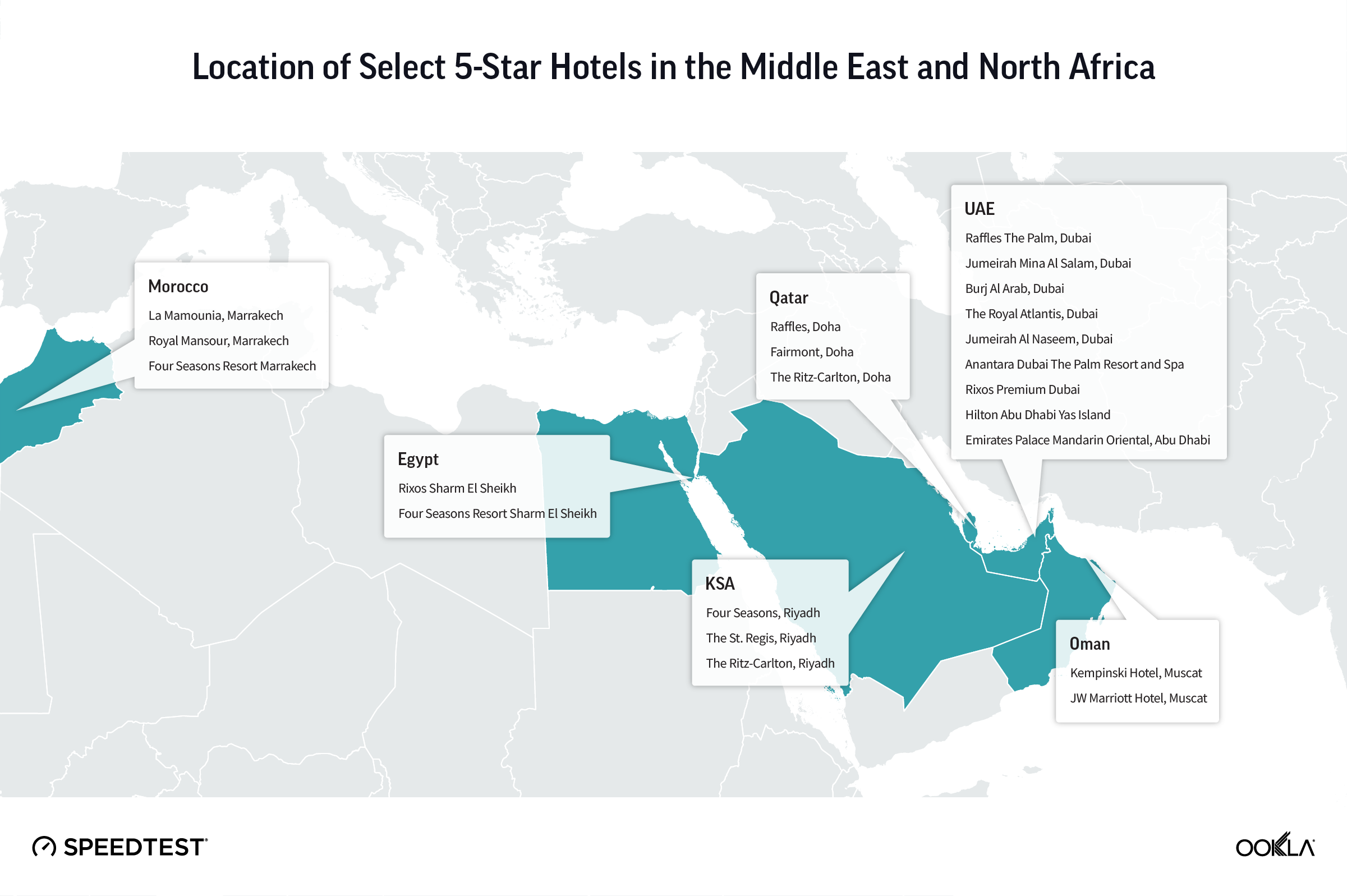

The map below shows the city distribution of the hotels selected. The U.A.E. is most represented, with nine properties and resorts spread across Dubai and Abu Dhabi. Riyadh, Doha, and Marrakesh contributed three hotels each, followed by Muscat in Oman and Sharm El Sheikh in Egypt, with two hotels each.

We benchmarked median download speeds inside and around the properties over one year (October 2023 and October 2024). This period helps us gauge the performance and stability of the Wi-Fi network with different levels of hotel occupancy and guest profiles. We excluded hotels with low measurement sample counts and considered only the most common Wi-Fi network name in each hotel, which is usually freely accessible to guests. To this end, we excluded Wi-Fi networks set up specifically for special events like sporting competitions.

Data analysis revealed three groups of hotels based on Wi-Fi download speed:

- Top performers include hotels with a median download speed exceeding 100Mbps. These speeds facilitate multiple 4K streams, ultra-fast downloads, and lag-free video conferencing, catering to the most demanding digital needs.

- Good performers include hotels with a median download speed between 50Mbps and 100Mbps. These represent 41% of the properties reviewed. This group comprises iconic hotels such as Burj Al Arab and the Royal Atlantis in Dubai.

- Performance laggards include hotels with a median download speed below 50 Mbps, representing more than 45% of the properties reviewed. This speed may be suitable for single high-definition to 4K streaming but struggles with more data-intensive activities at busy times.

Four Seasons in Riyadh, Raffles The Palm, and Jumeirah Mina Al Salam, both in Dubai, top the list with a median download speed of 154.75 Mbps, 122.82 Mbps, and 121.35 Mbps, respectively. The download speeds of good-performing hotels range from just over 50 Mbps for Raffles and Fairmont, colocated in Doha’s Katara Towers, to 93.70 Mbps for Rixos Sharm El Sheikh. The other hotels in this category are located in Dubai, Muscat, and Marrakesh.

Every city has hotels in the laggards’ category, with speeds ranging from 10.21 Mbps to 46.11 Mbps. At the bottom of the list, we find two in Abu Dhabi, Hilton Yas Island and Emirates Palace Mandarin Oriental, with speeds of 14.88 Mbps and 14.45 Mbps, respectively, and JW Marriott Hotel Muscat, at 10.21 Mbps.

For reference, Netflix recommends a minimum of 15 Mbps for 4K video streaming. More specifically, in the hospitality industry, and based on a survey, 56% of hotel guests in the USA expected hotels to offer Wi-Fi speeds of at least 50 Mbps for the service to be acceptable. Speedtest results show that over half of the reviewed hotels in MENA meet or exceed that threshold.

While Gulf countries top the Speedtest Global Index, we note that many hotels in that region offer sub-50 Mbps, suggesting that the issue is with the Wi-Fi network and not with the capacity of the broadband connection. Conversely, hotels in Sharm El Sheikh and Marrakesh outperformed many of their peers in Gulf countries, suggesting a combination of good internet capacity and optimal Wi-Fi installation.

Deploying modern and well-configured Wi-Fi equipment helps to realize speed gains

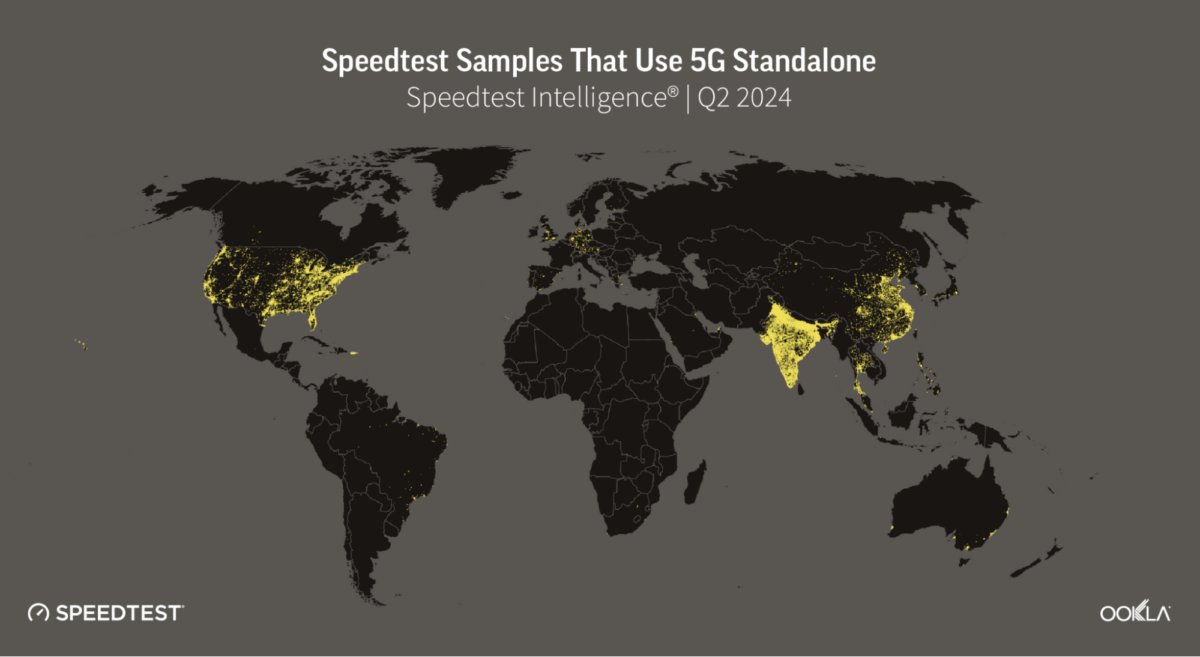

The placement and configuration of Wi-Fi access points influence the speed and coverage guests can experience. Speedtest data shows that Wi-Fi 6 standard (802.11ax) and 5 GHz frequency spectrum, which privileges speed over coverage, are more commonly found in top-performing hotels than lower-performing ones.

Speed gains of Wi-Fi 6 over Wi-Fi 5 (802.11ac) and Wi-Fi 5 over Wi-Fi 4 (802.11n) are more significant at higher speed ranges (above 75 Mbps). Furthermore, tests that used the 5 GHz frequency consistently outperformed those over 2.4 GHz (which provides better coverage but with lower performance) across a wide range of speeds, with more substantial improvements at higher speeds.

Hotels should actively monitor and improve their Wi-Fi to remain competitive

Delivering high-speed and consistent Wi-Fi across different parts of a hotel is challenging because of the inherent design and structure of the property. The size and layout of the hotel play a crucial role; larger establishments with multiple floors and large common areas can create dead zones where the signal weakens or fails. Additionally, the materials used in construction—such as concrete, metal, and glass—can significantly attenuate Wi-Fi signals, leading to inconsistent connectivity in certain areas. Furthermore, the high density of guests during peak seasons can strain the network, resulting in slower speeds and dropped connections.

In addition to upgrading networking equipment, including routers and access points that support the latest Wi-Fi standards, hotels can improve network experience by adopting the following steps:

- Increase bandwidth: Ensure sufficient internet bandwidth to accommodate the number of guests and their usage patterns.

- Conduct a site survey to identify dead zones and areas with weak signals and interference. This will help in planning the placement of access points for optimal coverage.

- Optimize placement of access points: Distribute access points throughout the hotel to ensure consistent coverage reduce congestion, and upgrade cables to take advantage of increased bandwidth.

- Regular maintenance and updates: Update firmware and software for networking equipment to ensure security and performance.

- Monitor network performance: Use monitoring tools to track performance metrics like speed and coverage to identify problems and inform future upgrades.

- Gather guest feedback: Include questions about Wi-Fi quality in the checkout surveys to better understand their needs and make necessary adjustments.

As the luxury hospitality sector in the MENA region continues to flourish, hotels must recognize that high-speed and reliable Wi-Fi is no longer just a nice-to-have feature but a critical expectation of their guests. Investing in connectivity and optimizing Wi-Fi infrastructure will not only enhance guest experience and satisfaction but also help stand out in the competitive market in MENA.

By investing in providing seamless connectivity, hotels can attract a broader range of travelers—including digital nomads and business professionals—and foster loyalty among guests. This will also help local luxury hotels become sought-after destinations for luxury holidays and remote work.

Ookla can assist hospitality property managers in designing Wi-Fi networks, monitoring their performance, and optimizing them. Please contact us to learn more about Speedtest Intelligence and Ekahau.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.