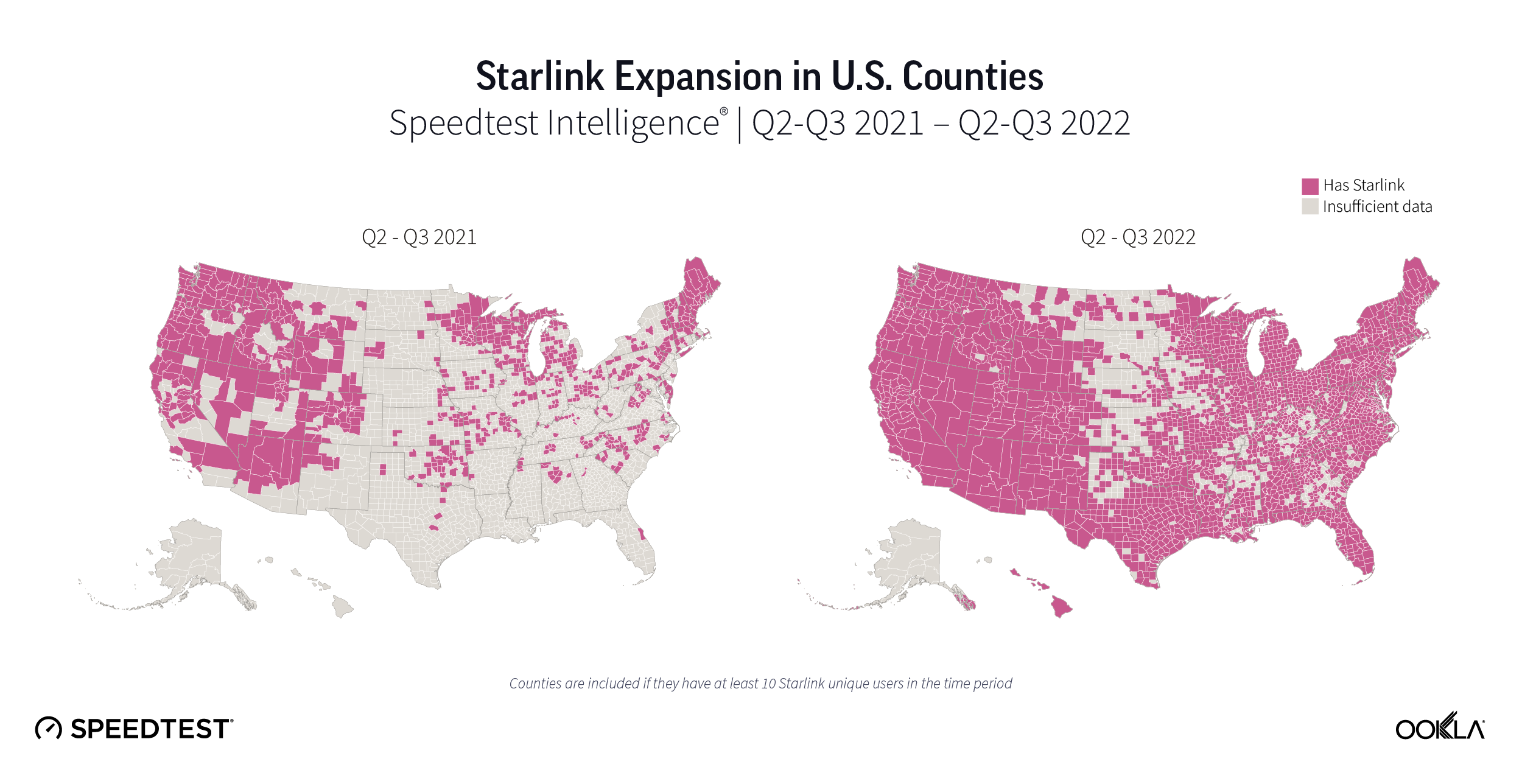

Satellite internet competition is heating up and Ookla® has exciting, fresh data from Q4 2022 and Q1 2023 for HughesNet, SpaceX’s Starlink, and Viasat in North America, South America, and the Caribbean, as well as new Starlink markets we haven’t yet featured in our ongoing satellite internet series.

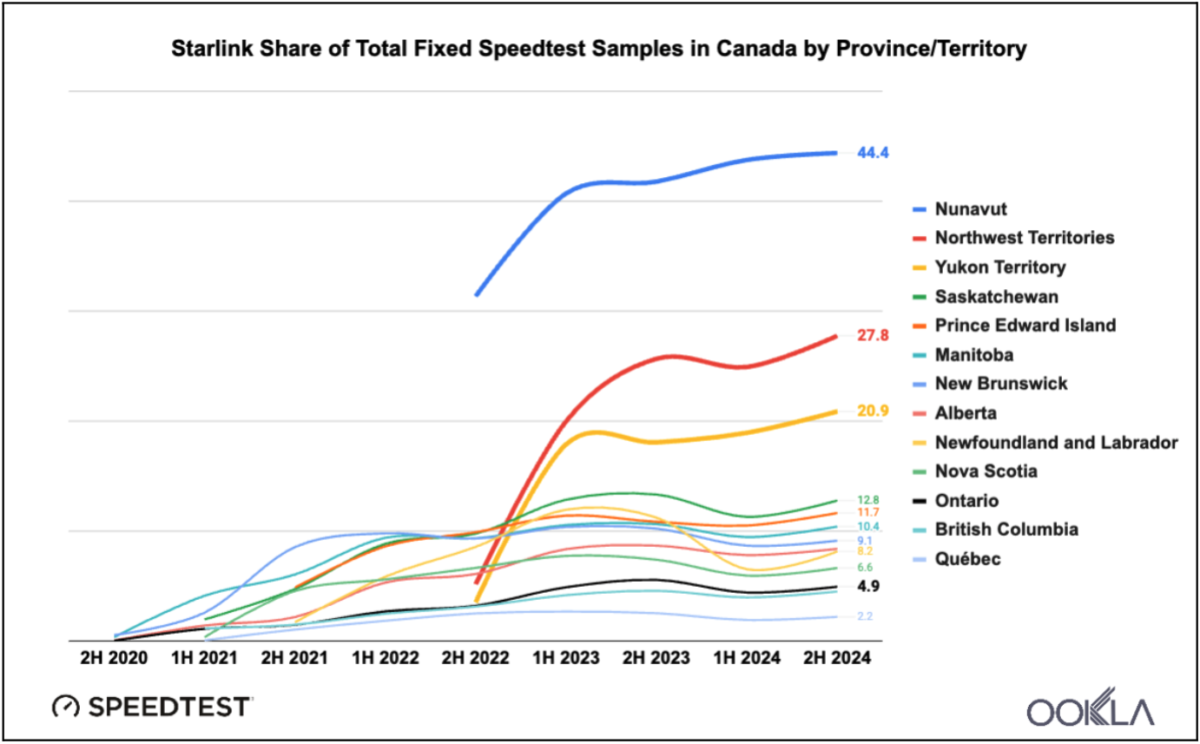

This analysis includes Starlink Net Promoter Score (NPS) for metro and nonmetro internet connections in the United States, year-over-year data for Starlink in Canada, Chile, Mexico, and the U.S., and Starlink results from three new countries (Philippines, Nigeria, and Peru).

Starlink users in metro and nonmetro areas love Starlink, fixed broadband users dislike their internet service providers

Using Speedtest Intelligence®, we examined NPS ratings by Starlink users and all fixed broadband providers combined for “metropolitan” and “nonmetropolitan” counties as defined by the U.S. Office of Management and Budget. NPS based on Speedtest® user responses after being asked how likely they are to recommend their provider to friends or family on a 0 to 10 scale. NPS ratings are categorized into Detractors (score 0-6), Passives (score 7-8), and Promoters (score 9-10), and is calculated as (% Promoters – % Detractors) x 100. Any NPS score above 0 indicates that a provider’s audience is more loyal than not.

As you see above, the difference in NPS between Starlink and all fixed broadband providers combined is stark: both metro and nonmetro Starlink far outperformed metro and nonmetro ISPs combined for NPS. Metro Starlink had a score of 31.94 compared to -23.62 for all metro fixed broadband providers combined, despite Starlink having a median download speed of 65.29 Mbps compared to 203.93 Mbps for all metro fixed broadband providers combined. Nonmetro Starlink had an even higher NPS at 42.21 compared to nonmetro ISPs at -21.27 — that’s especially notable given that Starlink’s median download speed was much closer to the median nonmetro fixed broadband speed at 72.18 Mbps to 100.41 Mbps.

Clearly, Starlink provides a much loved option for more rural, nonmetro users who often don’t have many good — if any — internet options. And the message is loud and clear: Starlink users are more than willing to recommend the service and love the internet they are getting.

Starlink speeds increased in Canada and the U.S. over the past two quarters, but are mixed year-over-year

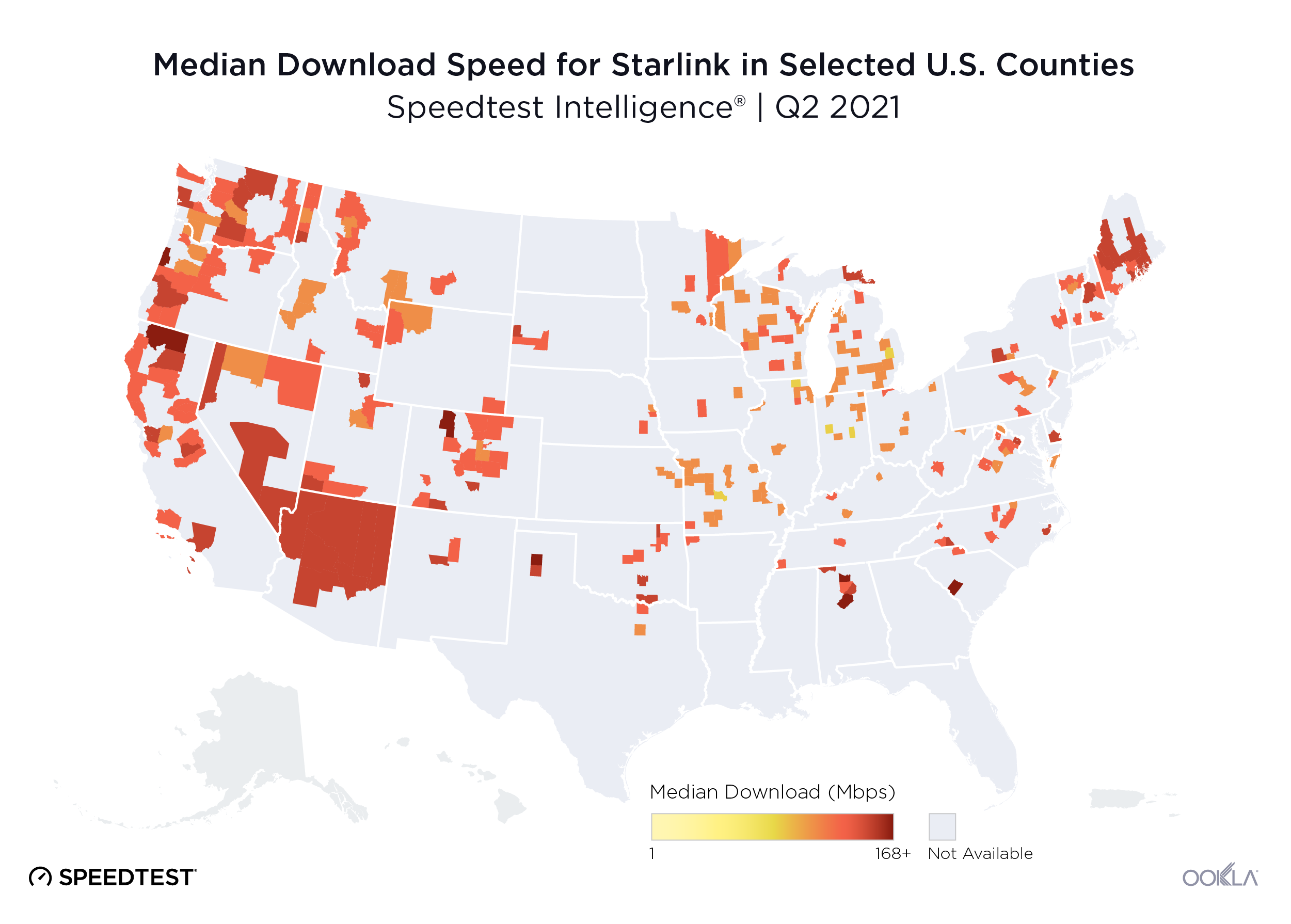

As Starlink continues to become an increasingly popular and beloved option for users, especially those in more rural areas, steady increases in speeds in two large markets like Canada and the U.S. bode well for the internet provider. These increases come as major upgrades to Starlink’s satellite array are beginning, with Starlink having just launched 46 nextgen satellites on April 27, so we wouldn’t be surprised if speeds keep climbing across the globe.

In North America, all of the countries we surveyed saw slower median download and upload speeds during Q1 2023 than Q1 2022. However, Canada saw just about a 3 Mbps decrease in download speed from Q1 2022 to Q1 2023, with about a 28 Mbps increase over the past two quarters. The U.S., where Starlink has many more users, saw about a 24 Mbps decrease year-over-year for median download speeds, but at least a 13 Mbps increase during Q4 2022 and Q1 2023. Mexico, which saw 100+ Mbps median download speeds during Q1 2022, saw a roughly 49 Mbps dip year-over-year as more users signed up for the service; however, speeds leveled slightly with only an overall dip of about 8 Mbps during the past two quarters.

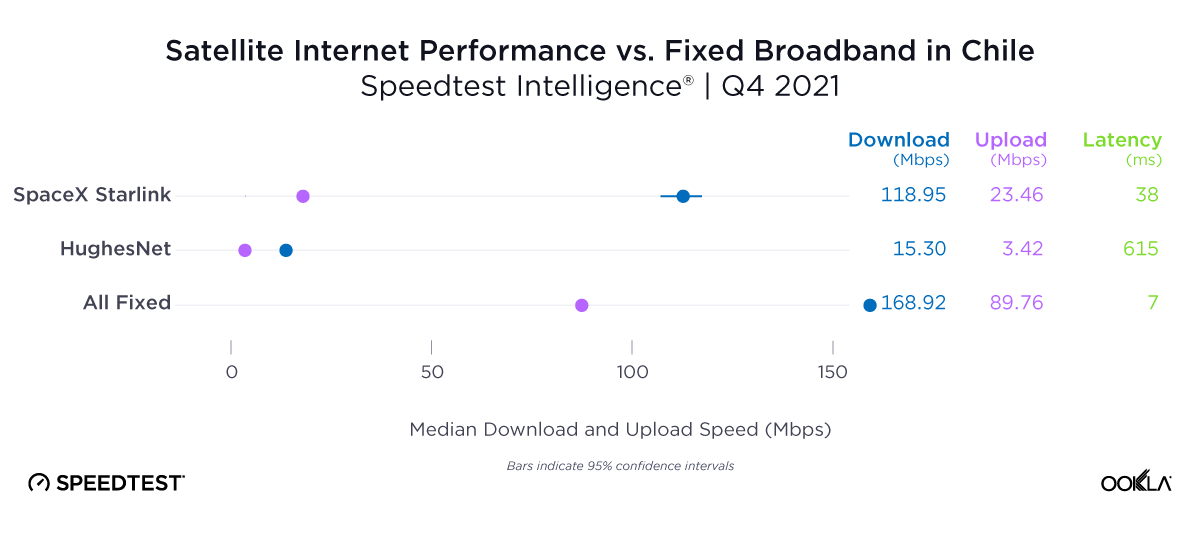

In South America, Chilean Starlink speeds slowed about 22 Mbps from Q1 2022 to Q1 2023, however, speeds only slowed about 8 Mbps over the past two quarters. Chile has continually ranked in the top four for fastest fixed broadband speeds on the Speedtest Global Index™ for over a year now.

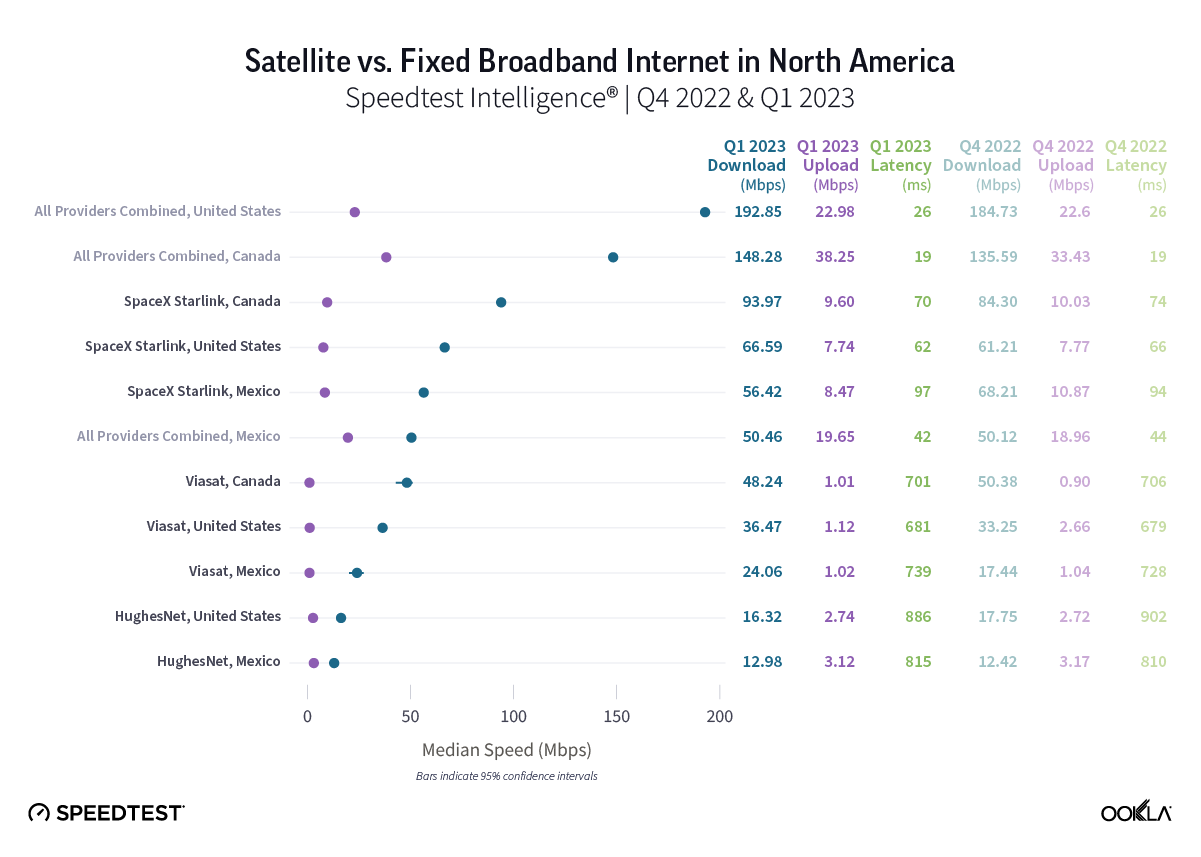

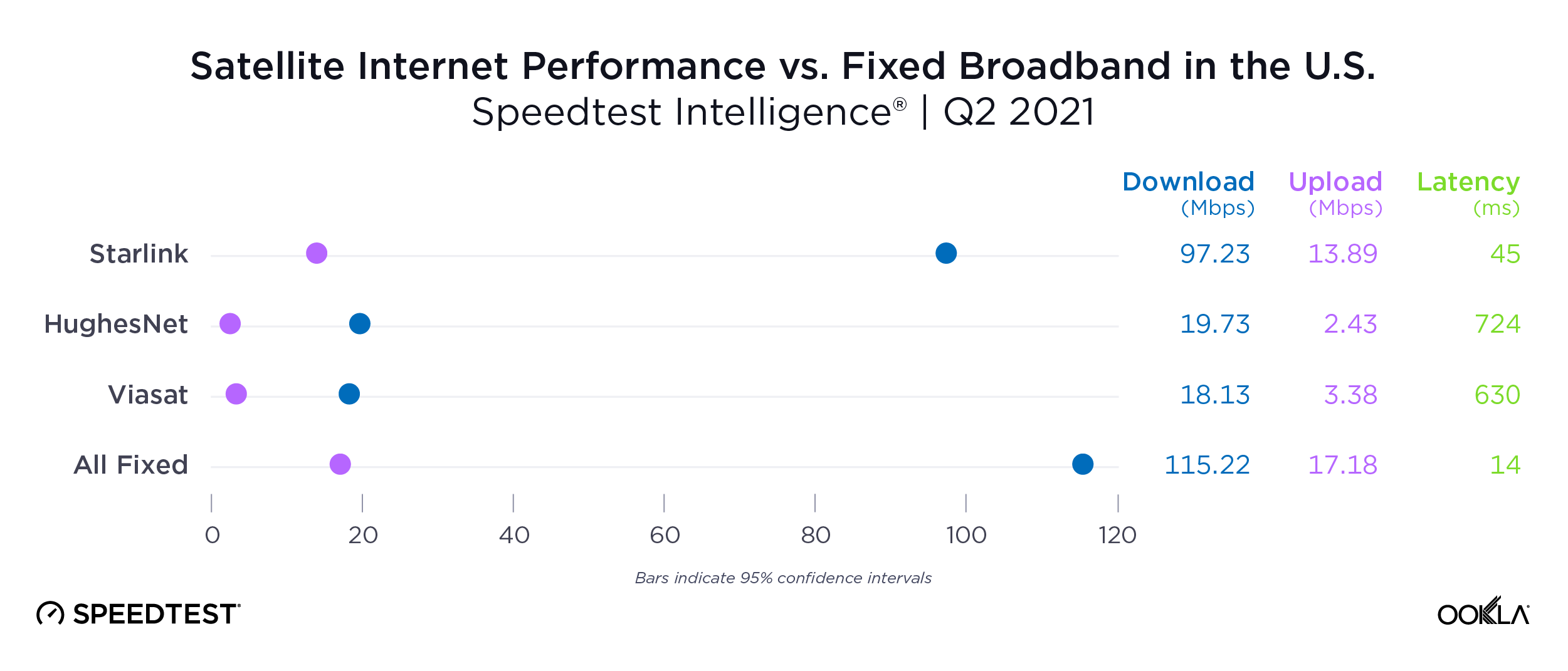

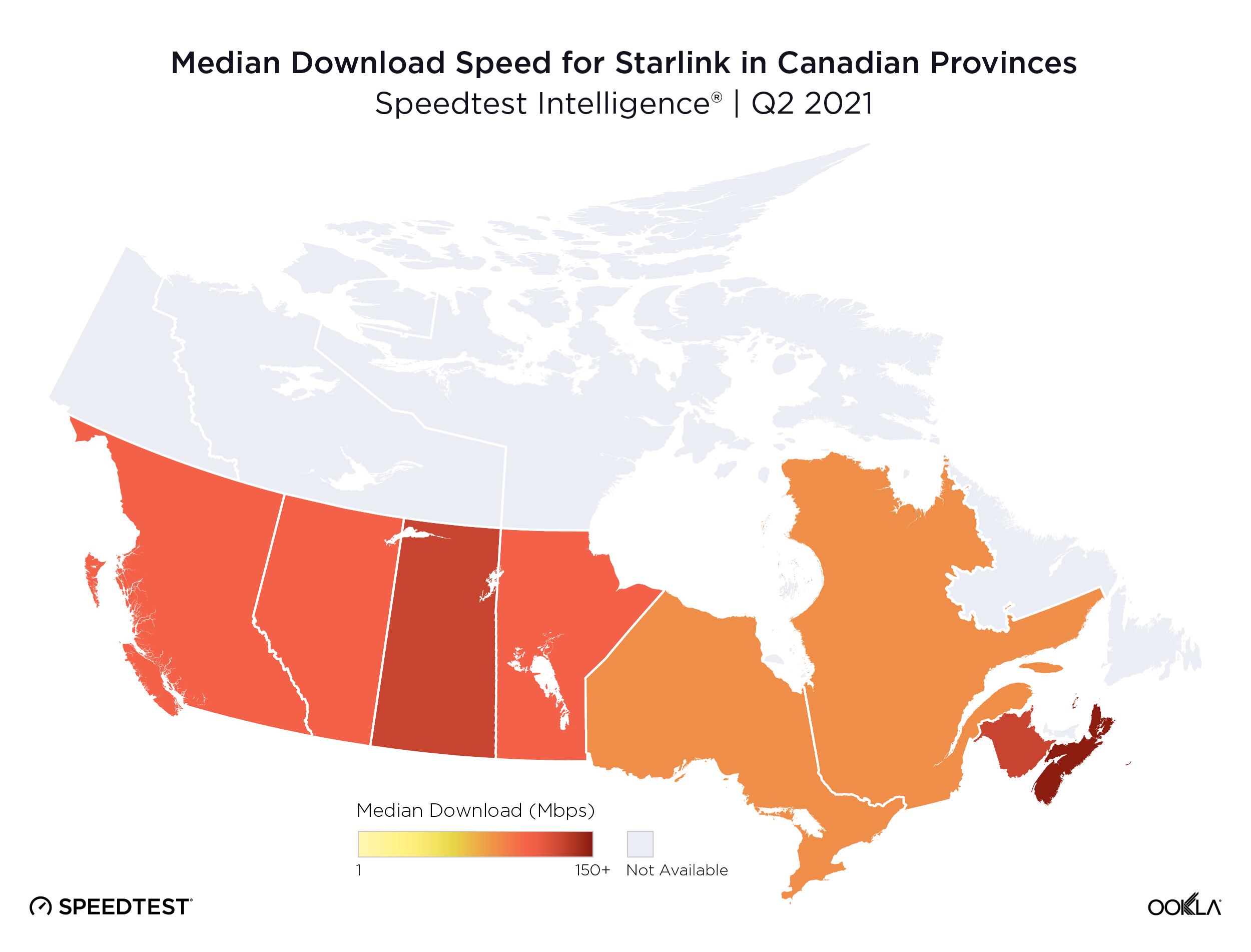

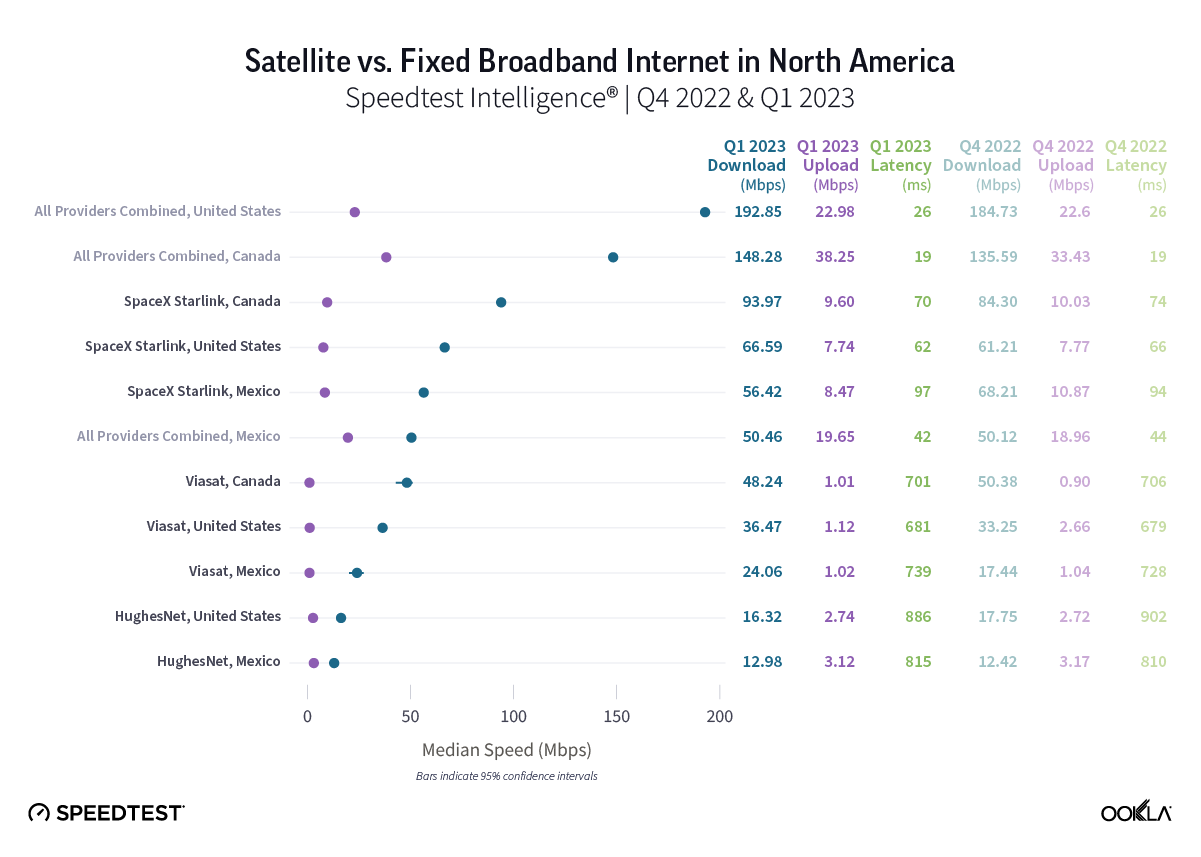

Starlink in Canada blazed ahead as the fastest satellite provider in mainland North America

Speedtest Intelligence reveals that Starlink in Canada had the fastest download speed among satellite providers in mainland North America at 93.97 Mbps. That was about 40% faster than the runner-up, which was Starlink in the U.S. at 66.59 Mbps. Starlink in Mexico was next at 56.42 Mbps, and was faster than all fixed broadband providers in Mexico combined at 50.46 Mbps.

Viasat in Canada, Mexico, and the U.S. made noticeable performance leaps over download speed from Q3 2022 when we last measured North American satellite providers. Canada went from 24.36 Mbps in Q3 2022 to 48.24 Mbps in Q1 2023, the U.S. from 28.07 Mbps to 36.47 Mbps, and Mexico from 16.14 Mbps to 24.06 Mbps. Hughesnet trailed over download speed in the U.S. (16.32 Mbps) and in Mexico (12.98 Mbps).

For upload speeds, all satellite providers trailed fixed broadband speeds in their respective countries, with Starlink in Canada achieving the fastest satellite upload speed at 9.60 Mbps, followed by Starlink in Mexico (8.47 Mbps) and the U.S. (7.74 Mbps). Viasat and HughesNet trailed behind.

Multi-server latency showed the stark difference of satellite internet’s real limitations, with the huge distances between satellite and users adding up to longer lag times than fixed broadband. Starlink had the only latencies under 100 ms among satellite providers, with Starlink in the U.S. having the lowest latency at 62 ms, followed by Canada (70 ms) and Mexico (97 ms). Viasat and HughesNet, which have farther geosynchronous orbits (GEO) than Starlink’s low-earth orbit (LEO), had much higher latencies.

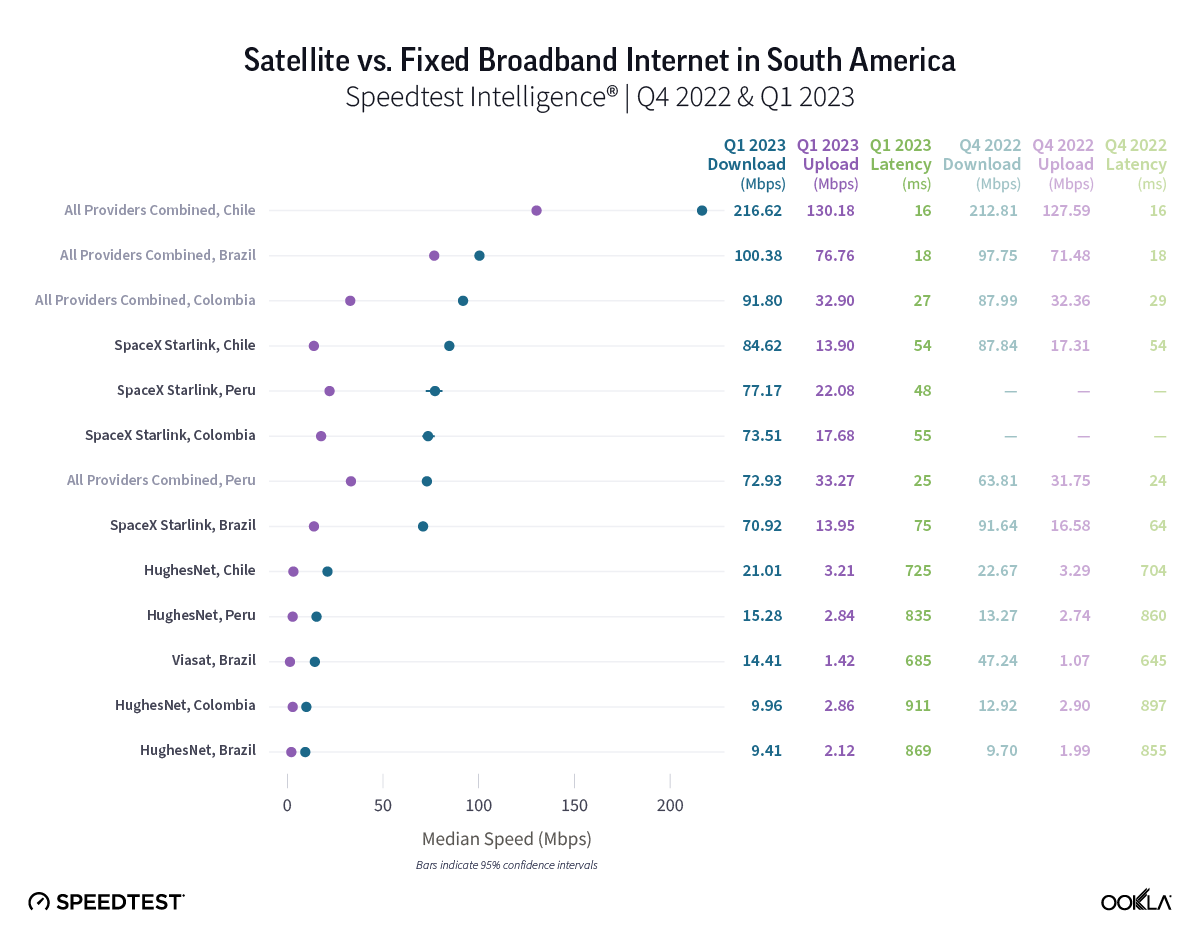

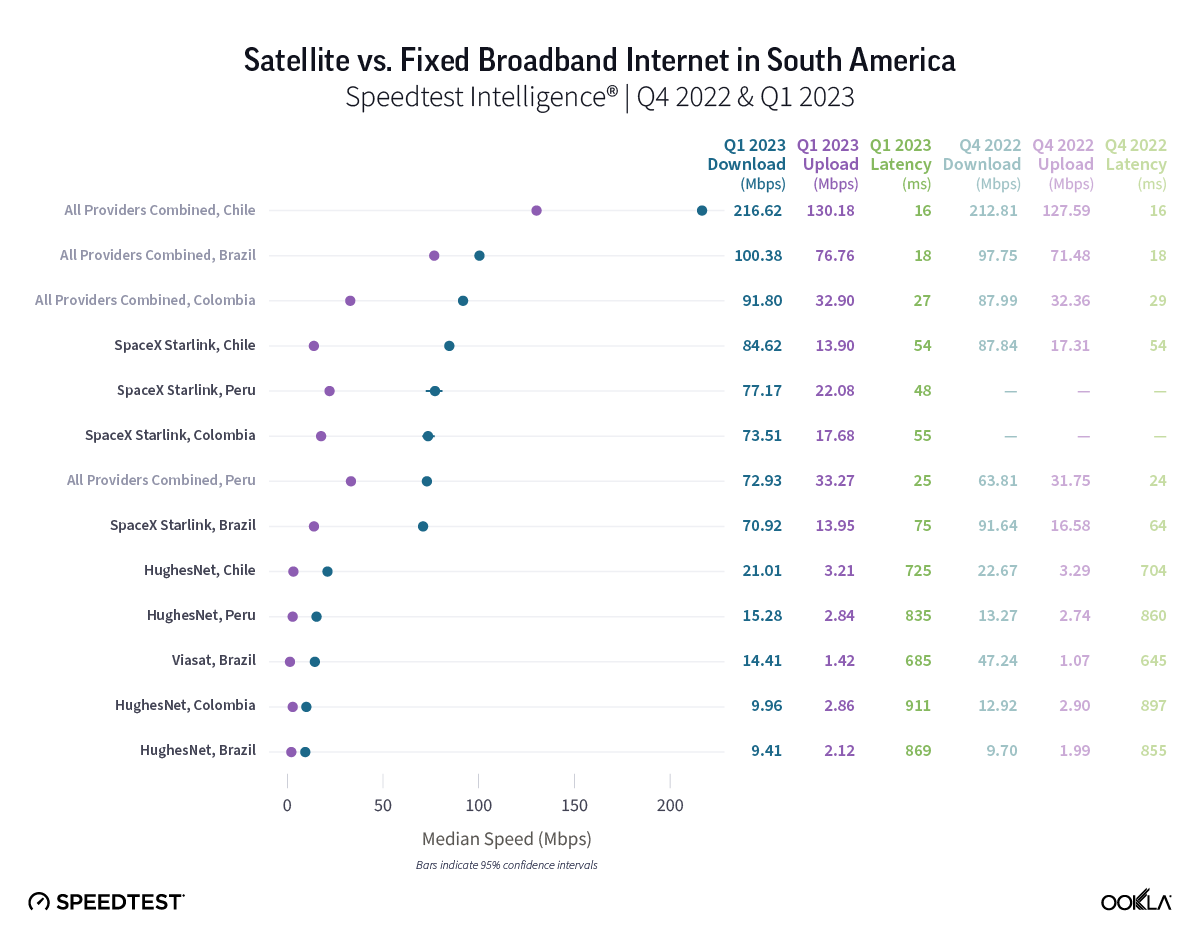

Starlink in Chile raced ahead as the fastest satellite provider in South America

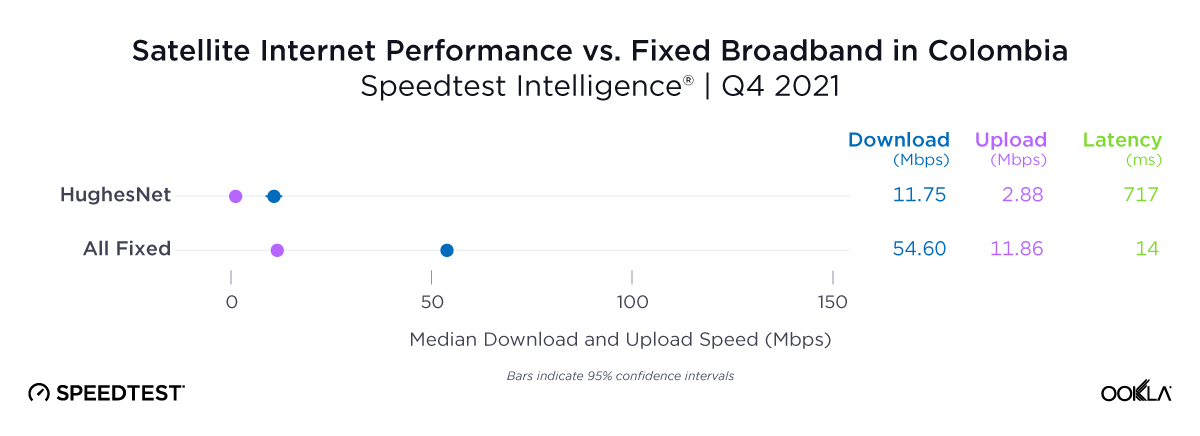

Starlink in Chile was the fastest satellite provider in South America during Q1 2023, edging out Starlink in Peru by about 5% with a median download speed at 84.62 Mbps to 77.17 Mbps. No satellite provider outperformed all fixed broadband providers combined in Q1 2023, but Starlink in Colombia and Brazil both reached median download speeds above 70 Mbps at 73.51 Mbps and 70.92 Mbps, respectively. HughesNet in Chile broke 20 Mbps at 21.01 Mbps, while Viasat in Brazil only reached 14.41 Mbps.

Satellites were outperformed by fixed broadband over upload speed in South America during Q1 2023, but Starlink had median upload speeds that ranged from 13.90 Mbps to 22.08 Mbps, the fastest being in Peru. HughesNet ranged from 2.12 Mbps to 3.21 Mbps, and Viasat in Brazil was at 1.42 Mbps.

Starlink’s multi-server latency dipped below 60 ms in three South American markets during Q1 2023: Peru (48 ms), Chile (54 ms), and Colombia (55 ms). Brazil followed at 75 ms, which was the next lowest. Viasat and HughesNet trailed far behind.

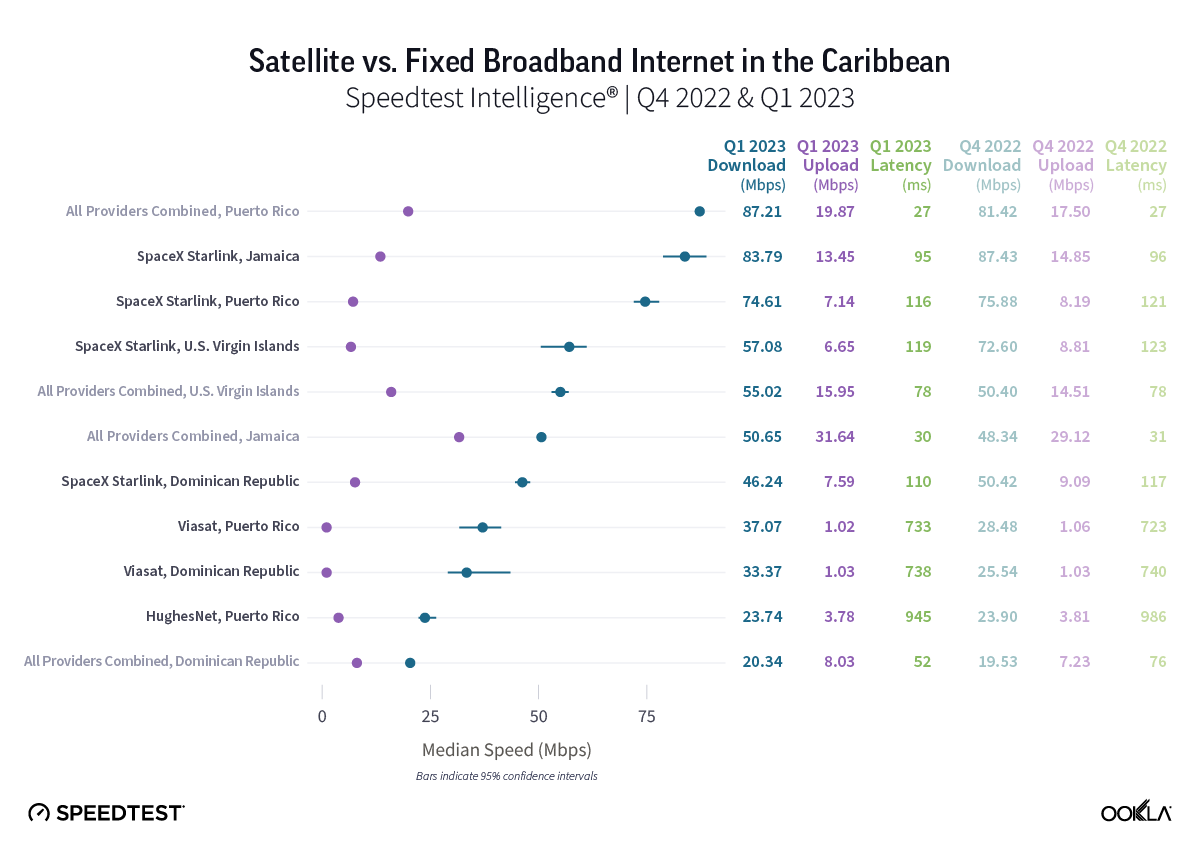

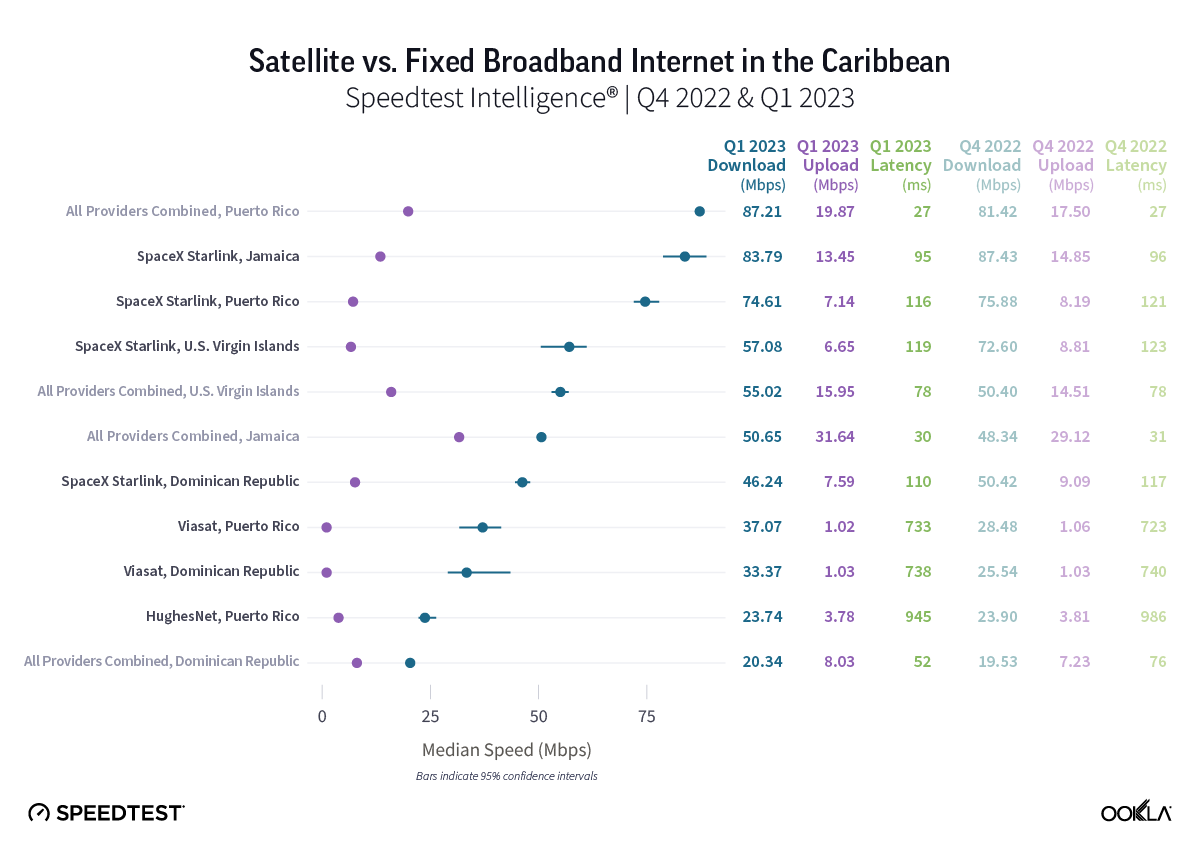

Starlink in Jamaica was the fastest Caribbean satellite provider

Speedtest Intelligence reveals that Starlink in Jamaica was the fastest satellite provider in the Caribbean at 83.79 Mbps during Q1 2023. Starlink was faster than all fixed broadband providers in Jamaica, and both Starlink and Viasat were faster than all providers combined in the Dominican Republic during Q1 2023. Starlink reached median download speeds of over 50 Mbps during Q1 2023 in Jamaica (83.79 Mbps), Puerto Rico (74.61 Mbps), and the U.S. Virgin Islands (57.08 Mbps), while it fell just short of that benchmark in the Dominican Republic (46.24 Mbps). Viasat had median download speeds of 37.07 Mbps and 33.37 Mbps in Puerto Rico and the Dominican Republic, respectively, during Q1 2023, while HughesNet had a median download speed of 23.74 Mbps in Puerto Rico during Q1 2023.

Upload speeds showed a bit more parity between satellite providers with only Starlink in Jamaica rising above 10 Mbps with a median upload speed of 13.45 Mbps during Q1 2023. Starlink had median upload speeds ranging from 6.65 Mbps to 13.45 Mbps, HughesNet had a median upload speed at 3.78 Mbps in Puerto Rico, and Viasat had upload speeds of 1.02 Mbps and 1.03 Mbps in Puerto Rico and the Dominican Republic, respectively, during Q1 2023.

For multi-server latency, Caribbean satellite users saw higher multi-server latencies than mainland North and South America with only Starlink in Jamaica breaking under 100 ms. While fast speeds for remote users are always going to be appreciated, multi-server latencies of over 100 ms do make some internet uses much harder to do well like live gaming and video conferencing.

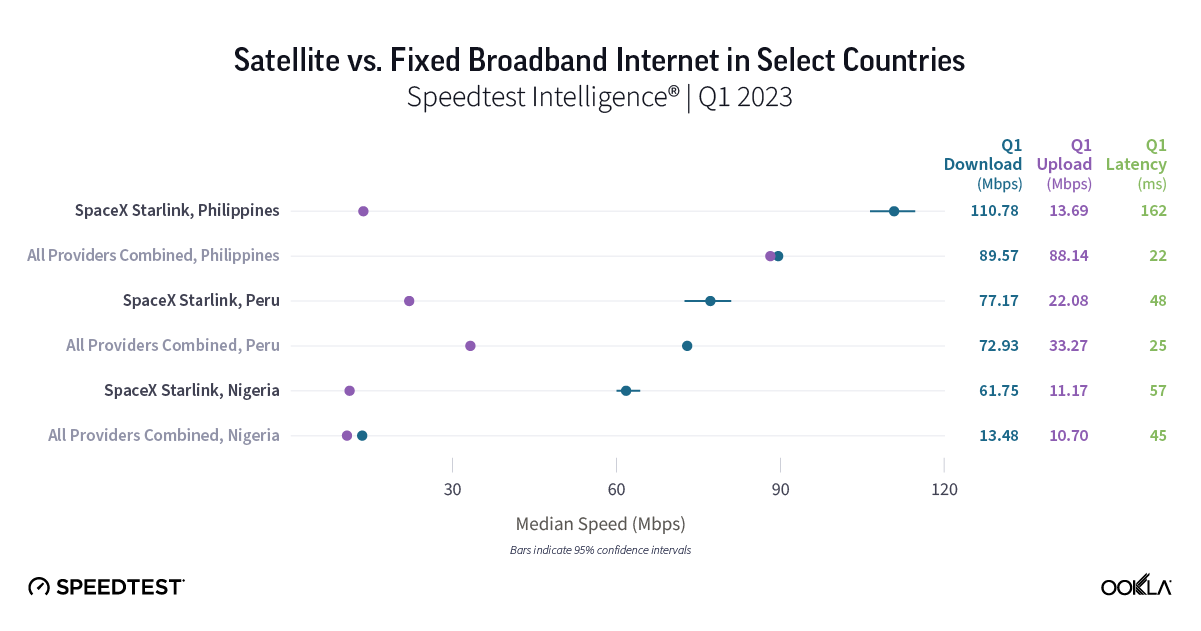

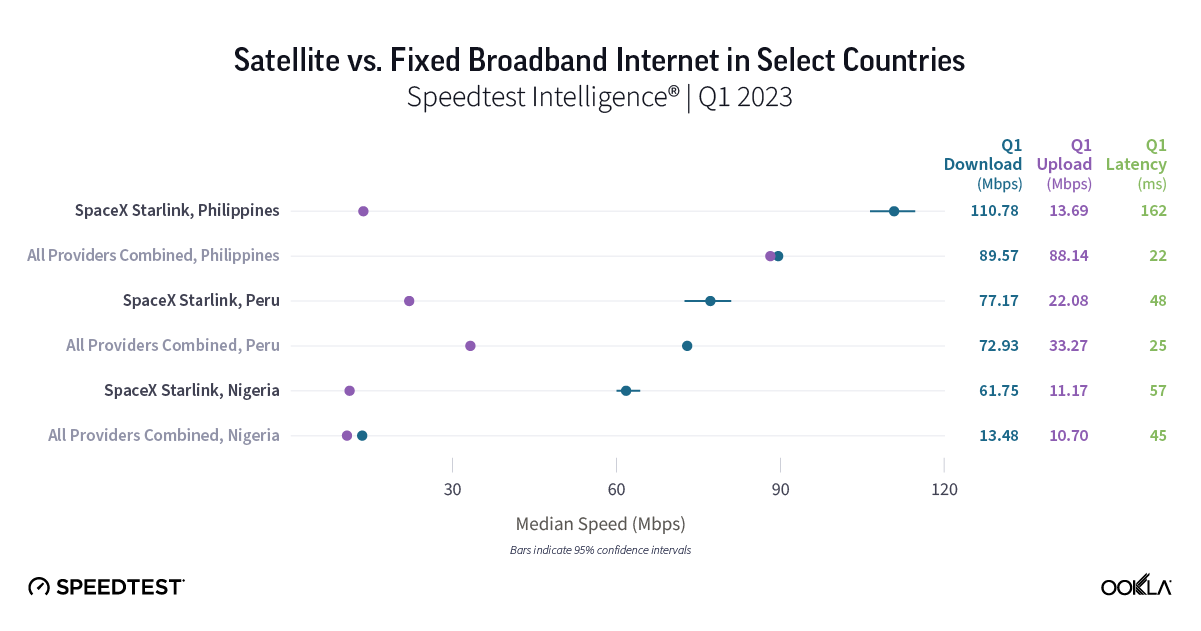

New Q1 2023 Starlink countries show promising initial results

Speedtest Intelligence data shows new Starlink data in three countries during Q1 2023, including Nigeria, Peru, and the Philippines, where Starlink is still a nascent provider with limited market share. Median download speeds for new Starlink countries were: 110.78 Mbps in the Philippines, 77.17 Mbps in Peru, and 61.75 Mbps in Nigeria during Q1 2023.

Starlink had slower upload speeds than all fixed broadband providers combined in all of the new countries except Nigeria, which was too close to call at 11.17 Mbps to 10.70 Mbps. Starlink had a much higher latency than fixed broadband providers in the Philippines (162 ms) in Q1 2023, though it came very close in Nigeria 57 ms to 46 ms.

It should be noted that satellite constellations have limited network bandwidth capacity, which may affect the consumer experience as more users sign up for the service. Starlink’s reach within these markets will also be limited by the cost of equipment (CPE) in particular, which ranges from PEN 1,750 ($470) in Peru, to PHP 29,320 ($530) in the Philippines and NGN 268,584 ($590) in Nigeria (prices correct at time of publication).

The 2023 space revolution is off to a huge start

Here are some major updates about what’s next for various different satellite competitors:

Amazon’s Project Kuiper showcases low-cost customer satellite terminals

After Amazon’s Project Kuiper 3,236 satellite LEO constellation was greenlit by the FCC, Amazon swiftly moved to showcase its consumer terminals in March. These new terminals have different tiered models, which are promised to deliver 100 Mbps and 400 Mbps models for consumers and businesses, and 1 Gbps models for “enterprise, government, and telecommunications applications that require even more bandwidth.” Furthermore, Amazon is getting into the chipset business and producing their own 5G modem chip, which will feature in each terminal.

Viasat launched its Viasat-3 arrays

On April 30, 2023, Viasat launched the first of three long-awaited Viasat-3 arrays, which aims to provide 1 Terabit per second (Tbps) of network capacity on each satellite, double that of the entire operating fleet. Add two more satellites and Viasat could raise the throughput up to 500-600% of its current network capacity. That could allow its users to experience 100+ Mbps connections — a huge improvement for many consumers. We’ll be eagerly anticipating results in the coming quarters.

Eutelsat, OneWeb, and Intelsat are making big moves

While the merger of Eutelsat and OneWeb has yet to be fully completed, both satellite operators inked major deals with Intelsat to add more global satellite capacity. Furthermore, OneWeb launched an additional 36 LEO satellites into orbit in late March 2023, providing additional options for many of its resellers.

European Union greenlights multi-orbit constellation

The European Union has approved its multi-orbit, €6 billion constellation plan, which includes GEO, MEO, and LEO arrays, and will offer connectivity to all EU citizens. The project will support EU connectivity priorities including the economy, environment, security and defense, and is hoping to launch in 2024, and be fully operational by 2027.

HughesNet aiming to launch Jupiter 3 array in Q2 2023

Incumbent satellite internet provider HughesNet has revealed its new Jupiter 3 array, which is designed to offer 500 Gbps over Ka-band and will allow HughesNet to provide consumers offerings of 50 Mbps and 100 Mbps. While the array still doesn’t have an official launch, the Jupiter 3 array is “doubling the size of the Hughes JUPITER fleet over North and South America.”

Ookla will continue monitoring new satellite internet developments

As 2023 continues to shape up as a pivotal year for satellite internet providers, we’ll be watching the sky to make sure providers are providing the connectivity consumers need. We’ll continue our series next quarter with Q1 and Q2 2023 data from Asia, Europe, Oceania, and any new countries where Starlink launches, and be back with Africa, North America, and South America data in Q4 2023. In the meantime, be sure to download the Speedtest® app for Windows and Mac computers or for iOS or Android for devices and see how your satellite internet stacks up to our findings.

Editor’s note: This article was updated on May 10 with clarifying details and an updated chart.