Gulf countries improved fiber coverage and adoption by investing in fixed infrastructure, raising entry-level speeds, and making fiber services more affordable. Their efforts paid off, as evidenced by their improved position in Ookla’s Speedtest Global Index™. However, the persistent use of legacy and underperforming Wi-Fi standards in home networks can hamper efforts to provide the best network experience to customers.

Key messages

- Wi-Fi 4 is still prevalent in the region which limits fiber’s potential. Many customers cannot get close to headline fixed broadband speeds because of the widespread use of Wi-Fi 4. Indeed, more than one-third of Speedtest® samples during Q2 2023 were using this old Wi-Fi standard. That means that a sizable proportion of users are not utilizing broadband services to their full potential.

- Migrating to modern Wi-Fi standards can bring significant speed gains. On average, customers who used Wi-Fi 5 had a median download speed that was more than five times higher than those on Wi-Fi 4 in Q2 2023. Likewise, the speed over Wi-Fi 6 was 1.2 times faster on average than with Wi-Fi 5. Therefore, fixed broadband subscribers in the Gulf (most of whom use fiber services) with routers that only support Wi-Fi 4 would benefit the most from a CPE (Customer Premise Equipment) upgrade.

- ISPs should do more to ensure their customers’ routers and smartphones are configured correctly. Even if consumers in the Gulf region own modern smartphones and Wi-Fi routers, they may still unknowingly use Wi-Fi 4 due to device misconfiguration and coverage constraints. ISPs can help educate consumers about how to correctly set up their home Wi-Fi routers and offer solutions to improve their indoor connectivity in order to use the more efficient 5 GHz spectrum band.

Most Gulf countries improved their global fixed broadband speed ranking since 2020

The GCC (Gulf Cooperation Council) region which comprises Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the U.A.E. leads the Middle East in fiber coverage and adoption. Local ISPs, backed by the government, accelerated fiber roll-outs to keep pace with the demand for data services and to ensure universal access to high-speed internet as part of national broadband development strategies. According to the FTTH Council industry body, the U.A.E. topped the global rankings for fiber household coverage, reaching 98.1% in September 2022, a position it has maintained since 2016. Qatar closely followed in the second position with 97.8% coverage.

These two GCC countries ranked ahead of Singapore (96.5%), Hong Kong (91.6%), and China (89.4%). In Bahrain, meanwhile, more than 88% of households were connected to the fiber infrastructure, whereas fiber coverage exceeded 60% in Saudi Arabia and reached 52% in Oman.

According to Speedtest Intelligence®, the U.A.E. leads the Gulf region in median download speeds at 236.67 Mbps in Q2 2023, a number that doubled since Q2 2022. Bahrain saw another story of improvement, with its median download speed reaching 70.17 Mbps, an increase of 46% year-on-year since Q2 2023. ISPs also saw significant improvements in upload speeds. Fixed upload speeds increased by 61% and 40% in Oman and Qatar, respectively, reaching 29.27 Mbps and 73.21 Mbps. Users in Bahrain experienced the biggest jump in median upload speed, which doubled between Q2 2022 and Q2 2023 to 20.37 Mbps.

As a result, most Gulf countries boosted their ranking in the Ookla Speedtest Global Index™. The U.A.E was ranked second in the Speedtest Global Index™ for median download speeds over fixed broadband in June 2023. Other GCC countries improved their rankings as well but trailed the U.A.E.

The telecom regulatory regimes and policies also helped, to different degrees, stimulate competition in the market, raise minimum broadband speeds, and reduce broadband tariffs. For example, in April 2023, Bahrain’s Telecommunications Regulatory Authority (TRA) approved an offer from BNET, the wholesale fixed infrastructure provider, to double the speed of entry-level fiber packages while maintaining the same wholesale prices. In the U.A.E., Etisalat by e& and du increased minimum download speeds to 500 Mbps and offered discounts on higher-tier fiber plans in 2022.

Wi-Fi 4 is still prevalent in the region which limits fiber’s potential

The choice of Wi-Fi standards and spectrum bands has a direct impact on connectivity quality, throughput, and network coverage. Indeed, Wi-Fi 5 (802.11ac) significantly increases the maximum theoretical throughput speed of the access point to 3.5 Gbps, compared to 600 Mbps supported by the old Wi-Fi 4 (802.11n) standard.

Wi-Fi 6/6E (802.11ax) supports even faster maximum data rates (up to 9.6 Gbps) and lower latency than earlier generations. It also combines 2.4 GHz, 5 GHz, and 6 GHz spectrum bands and wider channels for better throughput and less interference. Note that achievable speeds in real life will be much lower than these theoretical limits because of signal attenuation, interference, and the hardware and software variety of connected devices.

The rest of the analysis focuses on the most penetrated fiber markets in the region: Bahrain, Qatar, Saudi Arabia, and the U.A.E. We used the percentage of samples that used a particular Wi-Fi standard and frequency band when connecting to the CPE as a proxy for their adoption by wired broadband customers in each country. We assume that most of the results reflect the performance of fiber services given that fiber represents the majority of fixed broadband connections in these four markets.

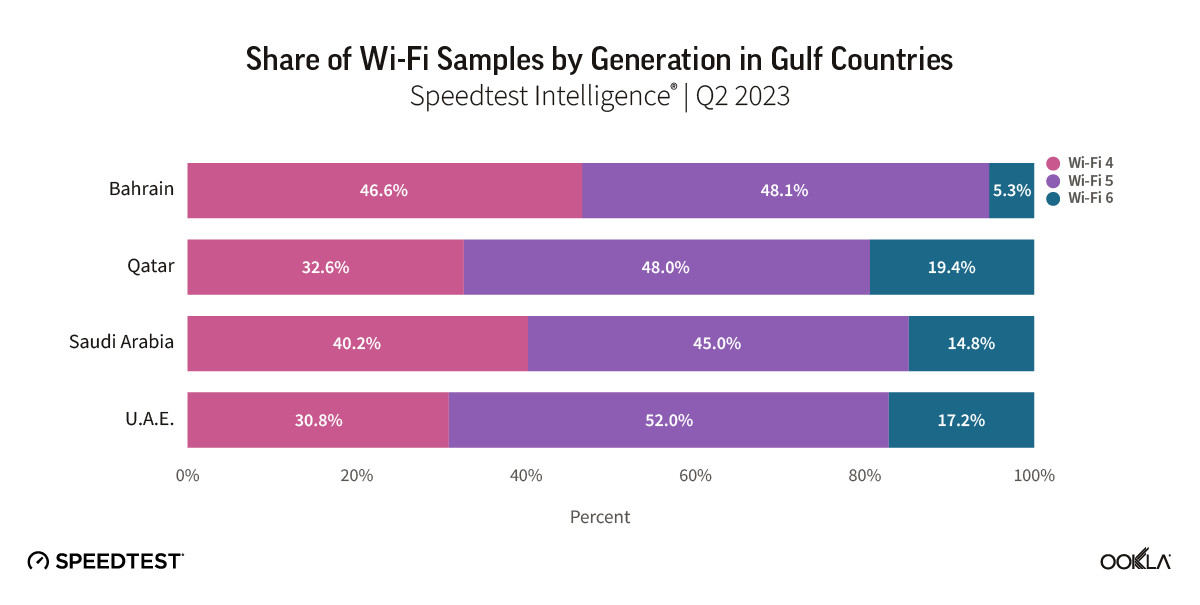

Our results show that more than one-third of test samples reported using Wi-Fi 4 to connect to the fixed CPE, but this varies considerably by country. Bahrain has the highest incidence of samples that use Wi-Fi 4 and the lowest proportion of Wi-Fi 6. Wi-Fi 4 was more prevalent in the U.A.E. than Wi-Fi 6 (30.8% compared to 17.2% in Q2 2023). This suggests that the ISPs have an opportunity to improve the network experience for nearly a third of their customer base and extend their lead in the speed leaderboard if they can address that CPE speed bottleneck.

The distribution of samples by Wi-Fi standard is largely similar between the U.A.E and Saudi Arabia. The minimum broadband speed currently offered by ISPs in Saudi Arabia is 100 Mbps, while the median download speed on fixed broadband measured by Speedtest Intelligence data was 93.85 Mbps in Q2 2023. This suggests that many customers might still be on legacy, lower-speed plans, but the more likely case is that home Wi-Fi CPEs are limiting speeds in users’ homes. Indeed, 40.2% of Speedtest samples used Wi-Fi 4 in Saudi Arabia, limiting maximum achievable speeds.

Migrating to modern Wi-Fi standards can bring significant speed gains

Consumer-initiated speed tests confirm that users’ experience of network speed is significantly affected by how their devices connect to Wi-Fi access points. The chart below shows the median download speed distribution by Wi-Fi standard used.

Median download speeds for devices that use Wi-Fi 4 topped out at 37.18 Mbps in Bahrain, and dropped to a low of 28.47 Mbps in Saudi Arabia. Contrary to what some might think, speed improvements were far more pronounced when looking at results on Wi-Fi 4 compared to those on Wi-Fi 5, rather than comparing speeds on Wi-Fi 5 and Wi-Fi 6. Users who connected to Wi-Fi 5 had a median download speed that was more than five times higher on average than those on Wi-Fi 4. While download speeds over Wi-Fi 6 were 1.2 times faster than with Wi-Fi 5.

Wi-Fi 5 users in the UAE had the largest speed lead over Wi-Fi 4 users (6.5x). With Wi-Fi 6, median download speeds more than doubled to 251.68 Mbps for users in Qatar compared to those on Wi-Fi 5. Bahrain and Saudi Arabia were outliers, with speeds largely similar regardless of whether test samples were with Wi-Fi 5 or Wi-Fi 6. This is because these three countries have the lowest reported median download speeds (below 100 Mbps), and many users who consider upgrading from Wi-Fi 5 to Wi-Fi 6 are unlikely to see a difference in their home network performance.

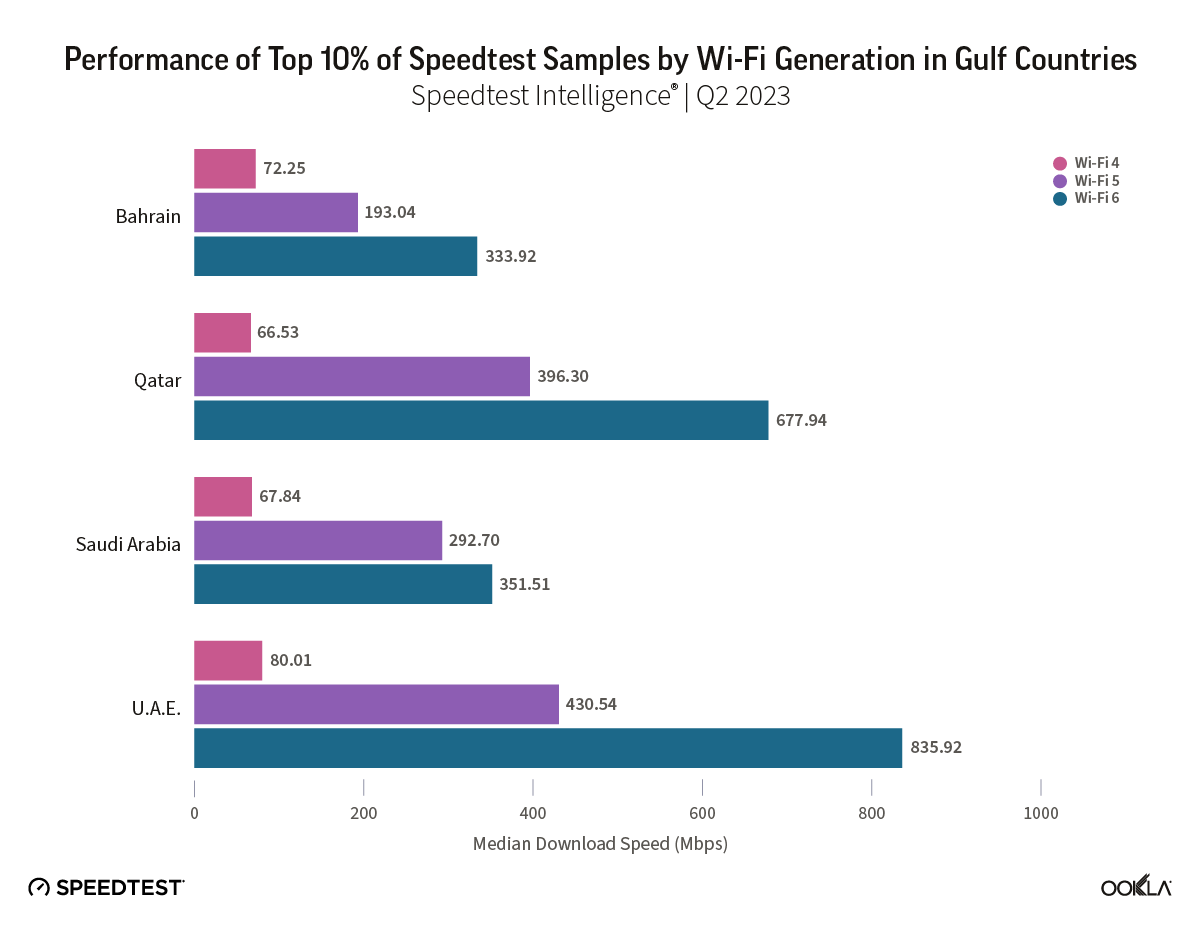

Looking at the performance of the fastest 10% samples in Q2 2023 reveals a more significant potential speed uplift for data-heavy users when using modern Wi-Fi standards. Users in the top 10% of our results experience the best performance, so it is possible to gauge from their results what speeds are achievable with each Wi-Fi standard. To that end, the median download speed of the 10th percentile results on Wi-Fi 4 users across Bahrain, Qatar, Saudi Arabia, and the U.A.E. was 71.60 Mbps, compared to 330.91 Mbps on Wi-Fi 5 and 693.48 Mbps on Wi-Fi 6. Wi-Fi 5 was 2.7x faster than Wi-Fi 4 in Bahrain and 5.9x faster in Qatar, while the speed ratios of Wi-Fi 6 to Wi-Fi 5 ranged from 1.2 in Saudi Arabia to 1.9 in the UAE.

Given the clear performance advantages of Wi-Fi 5, ISPs should encourage customers to migrate from Wi-Fi 4 to Wi-Fi 5 because it will significantly impact the end-user network experience. It’s also important to note that our data confirms that fiber broadband subscribers who continue using Wi-Fi 4 are the most penalized, especially if they subscribe to a service that is advertised as offering hundreds of megabits per second.

The persistent usage of legacy Wi-Fi is likely due to incorrectly configured routers

Huawei and TP-Link are the top router brands reported by Gulf users utilizing Wi-Fi 4. However, their popularity can vary vastly by market depending on the equipment bundled by ISPs with their broadband offerings, as well as the ability of consumers to use third-party routers (some ISPs allow only their own routers). Our data shows that Bahrain and Saudi Arabia have the highest proportion of samples connected to a Huawei CPE. TP-Link routers are most common in Qatar and the U.A.E.

The U.A.E. has the highest proportion of routers from D-Link, Cisco, and less popular brands used with Wi-Fi 4 (nearly 64% of samples reported using ‘other’ manufacturers). This high level of market fragmentation is likely due to users replacing routers provided by their ISP or installing refurbished routers to extend coverage indoors. Such fragmentation complicates the task of ISPs to ensure that their customers use more recent routers or that they configure them correctly to use more modern Wi-Fi standards.

Our research showed that most commercial CPEs in the region introduced since 2020 likely support Wi-Fi 5 (if not Wi-Fi 6). Further, tests also showed that most Android-based smartphones that used Wi-Fi 4 were equipped with Wi-Fi 5-capable chipsets. Therefore, many users in the region are capable of using Wi-Fi 5 but are still on Wi-Fi 4. We believe that misconfigured routers could be the primary cause of such a high prevalence of legacy Wi-Fi 4 technology among Gulf countries.

ISPs can address the factors that favor Wi-Fi 4 and 2.4 GHz spectrum usage, for example, by working more closely with device manufacturers, supporting customers to acquire newer Wi-Fi routers, and correctly configuring them, as shown in the table below.

Factors that lead to Wi-Fi 4 usage and how ISPs can address them

| Legacy equipment |

|

|---|---|

| Solutions |

|

| Configuration issues |

|

| Solutions |

|

| Coverage and performance issues |

|

| Solutions |

|

Gulf-based IPSs have managed to rapidly grow their fiber footprint and migrate their customers to faster broadband services. However, a substantial portion of subscribers may not benefit from these speed increases due to the prevailing usage of Wi-Fi 4. As many ISPs in the region already offer a minimum fiber speed of 250 Mbps, they should, as a priority, migrate existing customers with legacy Wi-Fi routers to more modern models and educate customers with newer routers on how to correctly configure them. ISPs’ efforts to introduce newer CPEs will help improve the end-user experience, boost global speed rankings in the region, and ensure that their routers are more future-proof as gigabit speeds become more widespread.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.