The Gulf region and Turkey have experienced a surge in air passenger traffic. The growth is expected to remain robust in key hubs such as Dubai, Doha, and Istanbul. As airports prepare to accommodate this influx of travelers, reliable and high-performance cellular networks have become increasingly important in shaping the overall passenger experience. This article benchmarks the network performance of the busiest airports in the Gulf region and Turkey, in terms of download and upload speeds, as well as latency, based on Speedtest Intelligence® data. It also provides recommendations on where travelers may get the best online experience.

Key Takeaways:

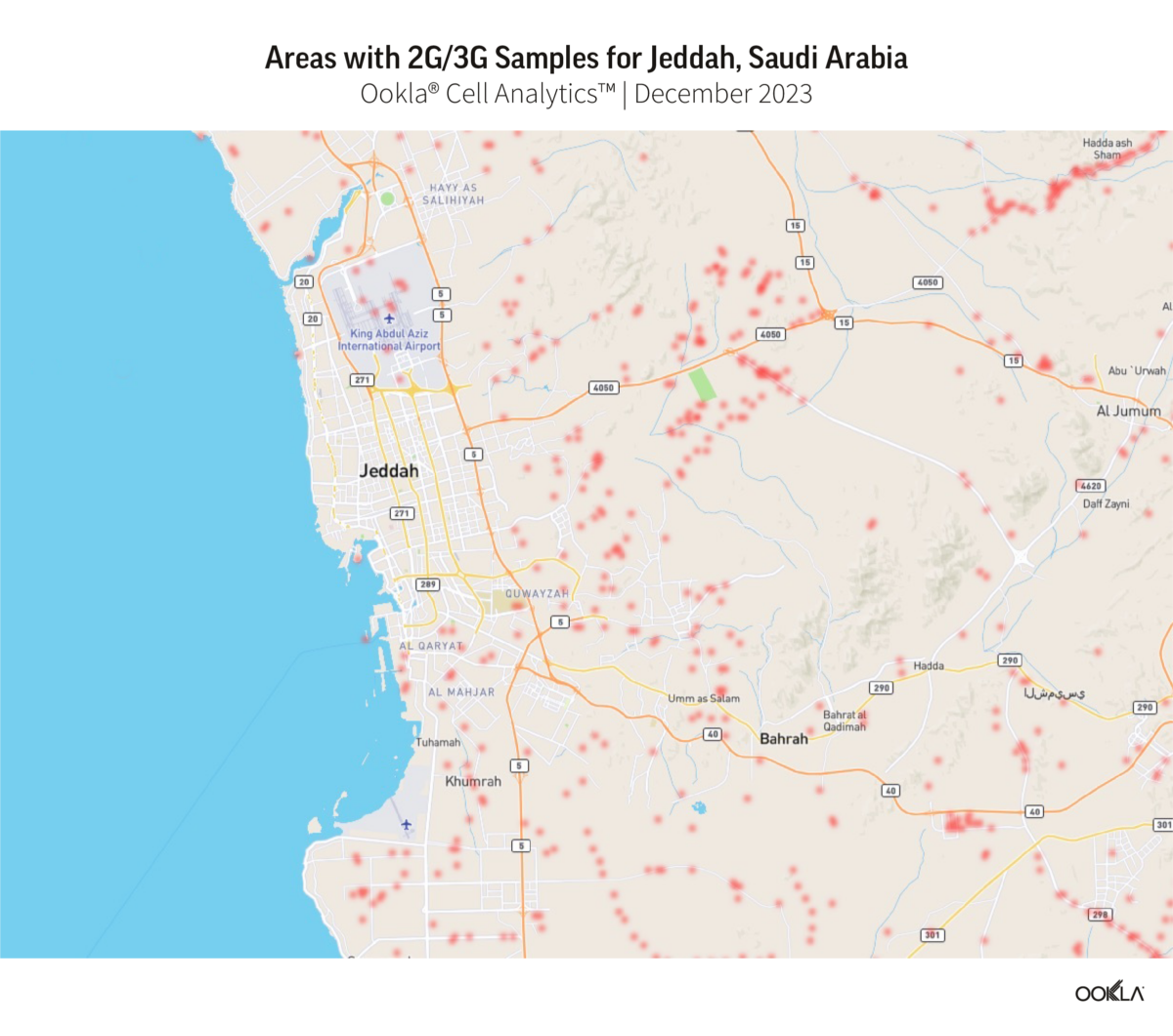

- Zayed International Airport (AUH) achieves top-tier mobile download speeds of over 450 Mbps. Istanbul Airport (IST) excels in upload speed at 58.40 Mbps, making it particularly suitable for travelers who need to share content efficiently. On the other end, King Abdulaziz International Airport (JED) in Jeddah consistently underperforms across all metrics, with the highest latency and lowest upload speed.

- Istanbul Airport significantly leads in 5G performance thanks to a dedicated 5G indoor network: IST achieved the highest download and upload speeds at 861.98 Mbps and 101.96 Mbps, respectively. Gulf-based airports showed a high contrast in median 5G download speeds, with those in Qatar and the UAE offering the fastest speeds at over 500 Mbps.

Most airports provided a median download speed of at least 200 Mbps, enabling an excellent online experience for passengers

While Turkey has long been a magnet for tourists, the Gulf region has emerged as one of the world’s premier travel hubs, attracting hundreds of millions of passengers annually. As a result, airport operators in the region face a pressing need to deliver seamless web browsing, lag-free online gaming, and high-quality streaming experiences to enhance the overall passenger experience and set a new standard for airport facilities. We used Speedtest Intelligence to analyze cellular network performance in the busiest airports in the Gulf region and Turkey.

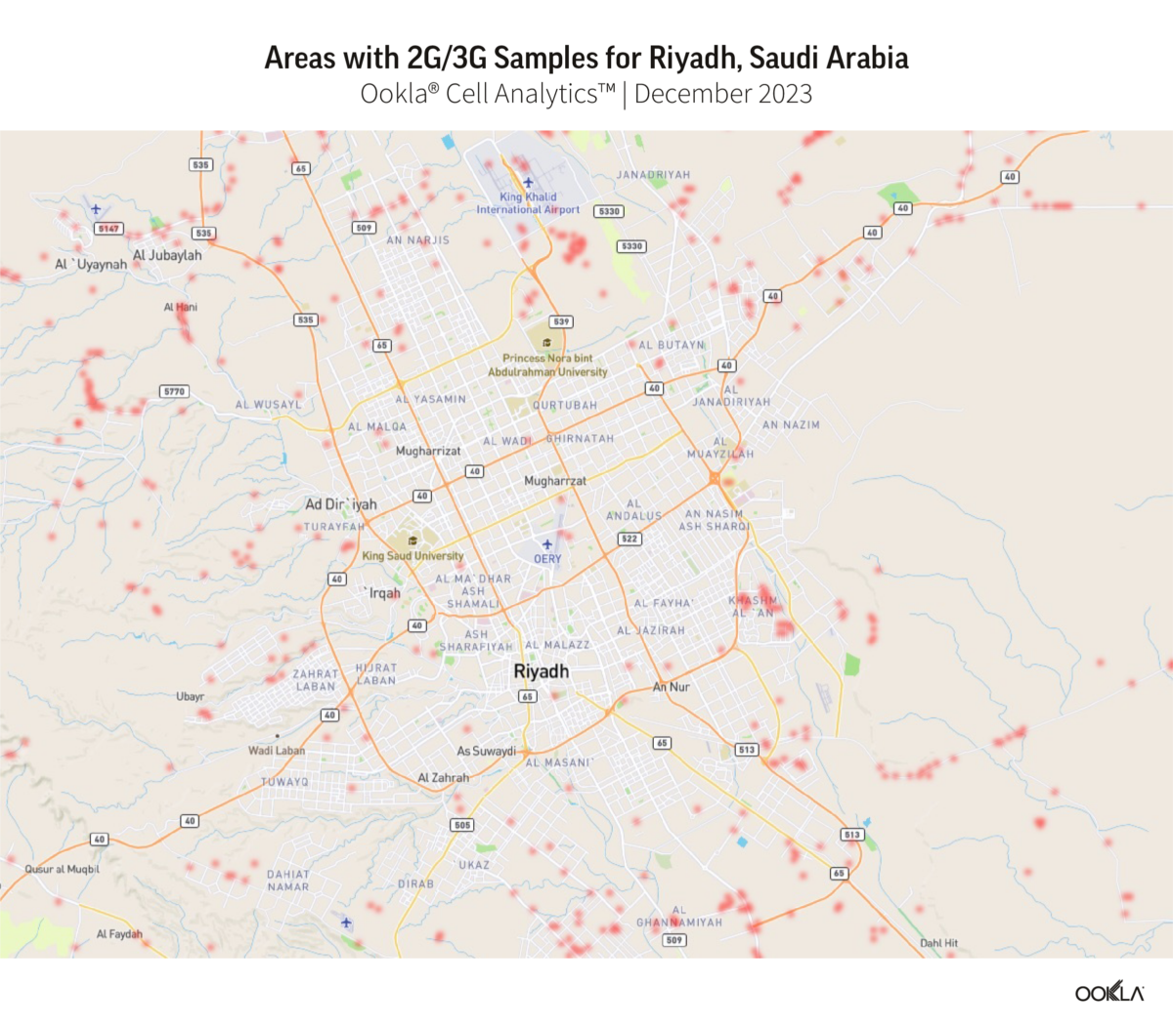

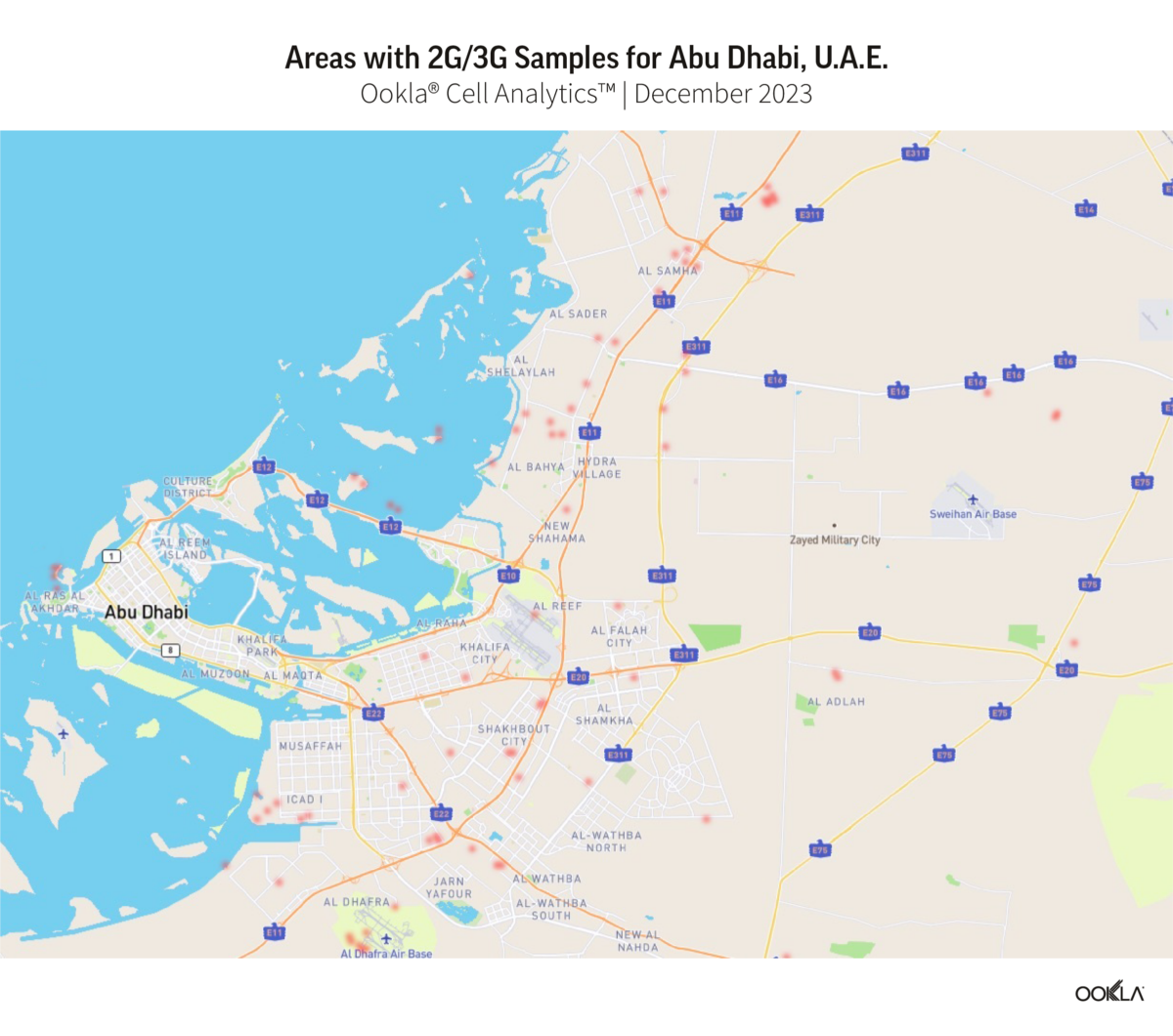

Download speed is the most important metric for content consumption and online experience. Zayed International Airport (AUH) had a median download speed of 453.18 Mbps. It was closely followed by Hamad International Airport (DOH), with a speed of 426.43 Mbps. King Khalid International Airport (RUH) and Istanbul International Airport (IST) also delivered excellent download speed performances at 329.04 Mbps and 314.84 Mbps, respectively.

In contrast, Sabiha Gökçen Airport (SAW) and Muscat International Airport (MCT) delivered sub-100Mbps speeds of 78.67 Mbps and 95.95 Mbps, respectively. Airports based in Dubai and Kuwait fall into the mid-range, with download speeds of around 250 Mbps.

Upload speed is important as it determines how efficiently users can upload documents, photos, and videos. IST stands out with a median upload speed of 58.40 Mbps, surpassing all other airports. RUH in Riyadh, DOH in Doha, and SAW in Istanbul follow with upload speeds of 32.83 Mbps, 30.10 Mbps, and 29.10 Mbps, respectively. King Abdul Aziz International Airport (JED) in Jeddah falls short, delivering the lowest upload speed of just 16.11 Mbps, while DXB pulls slightly ahead with 18.99 Mbps.

Latency measures the delay in transferring data and affects real-time services such as video calls, online gaming, and media streaming. Most airports offer a sub-40 ms latency, which ensures acceptable responsiveness for users. IST and Kuwait International Airport (KWT) have somewhat better conditions, with a delay of under 32 ms. JED stood out again as a poor performer with a latency of 89.98 ms, suggesting a significant impact on real-time applications such as gaming and video conferencing.

Istanbul Airport significantly leads the region in 5G performance thanks to a dedicated 5G indoor network

As 5G adoption increases, consumers and businesses expect the same level of coverage and performance wherever they go. Yet, the characteristics of ‘outdoor’ 5G, which typically operates in mid-band frequencies of 1.8 GHz to 3.5 GHz, pose a challenge for indoor coverage, as these frequencies struggle to penetrate walls and windows, particularly those built of glass and steel. Furthermore, telecom operators have prioritized outdoor coverage because it requires less CAPEX and OPEX per subscriber than indoor coverage and has a better return on investment. In addition, the traffic patterns in the airport are highly variable, which means that the network must be capable of accommodating different connectivity levels.

The introduction of 5G in Turkey lags significantly behind as 700 MHz, 3.5 GHz, and 26 GHz frequencies will be auctioned in 2025, with commercial launch expected in 2026. However, Istanbul International Airport (IST) deployed a dedicated indoor 5G network that serves only users within the airport’s premises. This deployment gives it performance advantages compared to public 5G networks. Speedtest Intelligence data shows that IST secured the top spot for 5G median download and upload speeds at 861.98 Mbps and 101.96 Mbps, respectively.

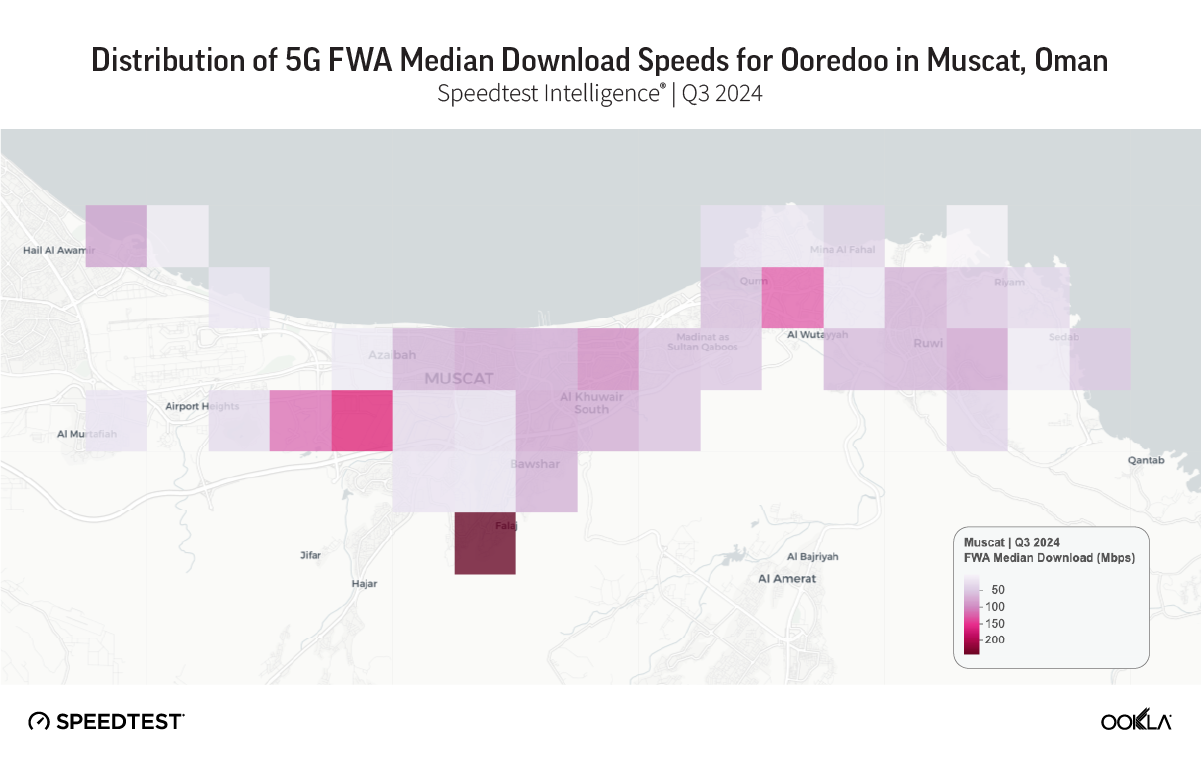

Airports in Abu Dhabi (AUH) and Doha (DOH) also have high 5G download speeds, at 678.11 Mbps and 657.56 Mbps, respectively. All other Gulf-based airports provided a median download speed of at least 107 Mbps, enabling users to stream multiple 4K videos over 5G.

Gulf airports lagged significantly behind IST in upload speeds, with four locations’ speeds ranging from around 30 Mbps to 45 Mbps. The other four Gulf-based airports underperformed, with MCT and JED at the bottom of the list with a median upload speed of 15.09 Mbps and 17.84 Mbps, respectively, despite deploying solutions to improve indoor network coverage and capacity.

Most airports offer a relatively low 5G latency, around 30 ms to 36 ms, suggesting good service responsiveness. The only exception is JED, with a median latency of 86.59 ms, likely degrading the customer experience of real-time services such as video streaming.

As the results show, airports in the Gulf region and Turkey generally have excellent mobile network performance inside and around these facilities. These achievements were realized thanks to the deployment of 5G and investment in solutions to improve indoor coverage and capacity.

The tourism boom in Turkey and the Gulf region is set to continue and will drive infrastructure investment and economic growth

According to GlobalData, the number of international arrivals into the GCC (Gulf Cooperation Council) reached 73.64 million travelers in 2023. The U.A.E. leads the GCC in terms of tourist numbers with 28.2 million visitors in the city during H1 2024, while Saudi Arabia received 27.4 million visitors (including pilgrims) with the ambition to grow to 150 million by 2030. The tourism sector in Qatar is also a promising destination, with 3 million visitors in 2023, benefiting from the successful hosting of the World Cup in 2022. Oman welcomed 3.4 million tourists in 2023 and plans to attract 11.7 million by 2040.

These countries have invested heavily in infrastructure, including transport, to address the growing influx of tourists and translate into economic growth. They have also built new airports and upgraded existing ones to cater to the rise in air passenger traffic, which is expected to surge to 449 million in 2024, more than double its 2019 level.

The new Istanbul airport was inaugurated in 2018 to make Turkey’s capital one of the world’s largest financial and economic centers. It had an initial capacity of 90 million passengers annually, making it a major gateway for international visitors and contributing to the country’s economy. According to the Ministry of Culture and Tourism, the number of tourist arrivals in the country increased by 7% to 47.3 million during the first 10 months of 2024 compared to the same period the previous year. It plans to expand its capacity to 120 million passengers in 2025.

As the Gulf region and Turkey continue to experience a surge in air passenger traffic, it is essential to meet their expectations for fast and reliable connectivity to enhance their overall experience and gain a competitive edge over other airports. By doing so, they can unlock new growth opportunities, improve customer loyalty, and strengthen their position as major global travel hubs.We will continue to monitor network performance in key locations where people spend their time and how it impacts their online experience. If you are interested in Speedtest Intelligence, please contact us.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.