The fact that Malaysian consumers are still waiting for nationwide 5G hasn’t stopped mobile providers from implementing other network improvements to provide better performance in the interim. This article explores how Malaysia compares to other major markets in Southeast Asia for mobile network performance and availability. We also analyze the current state of Malaysia’s mobile market. This includes 4G speeds and 4G Availability, insights into regional coverage, and what 5G looks like across the regions during the initial roll out phase in Malaysia.

Key takeaways

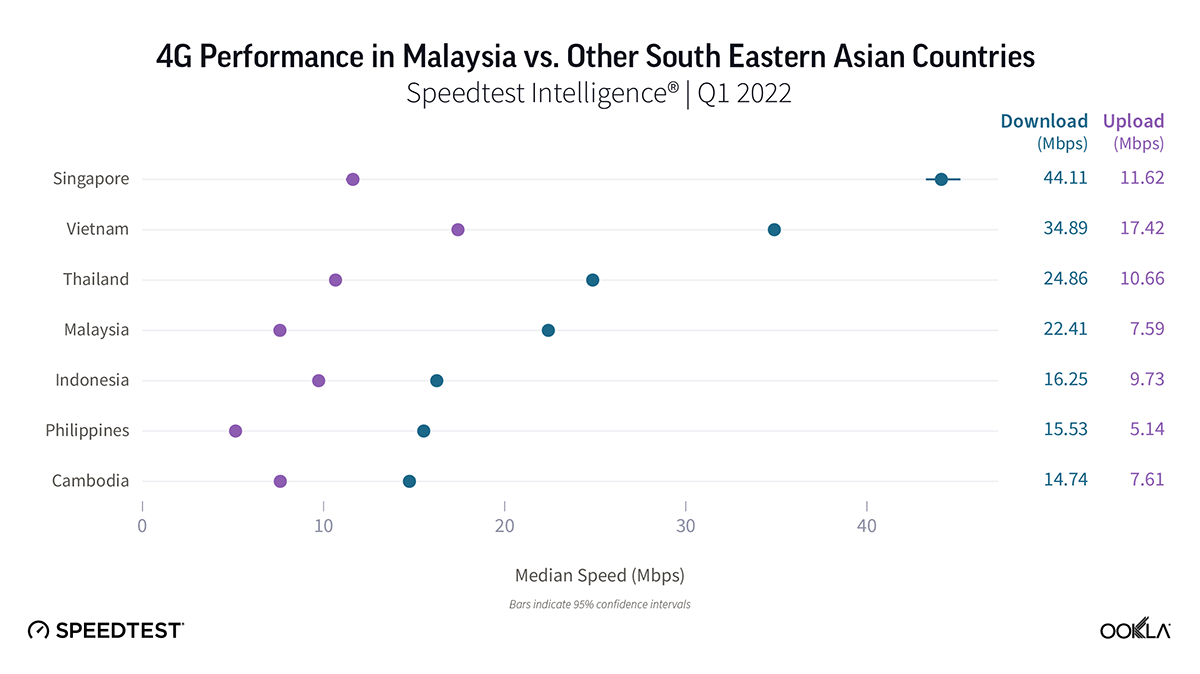

- When comparing 4G performance across select South Eastern Asian markets, in terms of median 4G download speeds, Singapore comes first at 44.11 Mbps, ahead of Vietnam (34.89 Mbps) in Q1 2022. For upload speeds, the ranking is reversed for the top two: Vietnam is top with 17.49 Mbps, followed by Singapore at 11.62 Mbps.

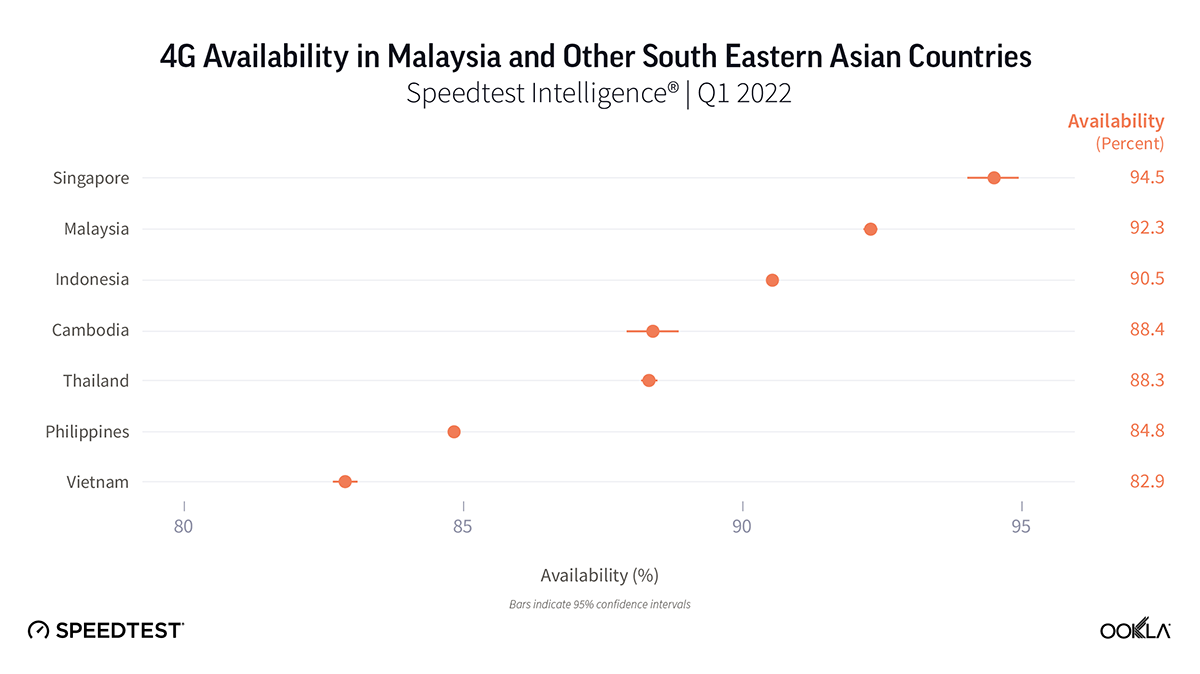

- 4G Availability across the seven Southeast Asian countries is above 80%. Singapore leads, achieving 94.5% 4G Availability in Q1 2022, followed by Malaysia (92.3%).

- Across Malaysia, 4G Availability increased from 86.7% in Q1 2021 to 92.3% in Q1 2022. This is predominantly driven by two factors: increased availability of networks and devices.

- In Malaysia, Digi had the fastest 4G download speeds; Maxis won on upload.

- Putrajaya had the highest 4G Availability across the regions with 96.4% of tested locations showing access to 4G during Q1 2022.

- The 5G rollout in Malaysia is still facing challenges. The 5G wholesale network is not yet fully commercialized and there are ongoing discussions around operators joining in.

Fastest 4G speeds were in Singapore, while the fastest LTE upload speeds were in Vietnam

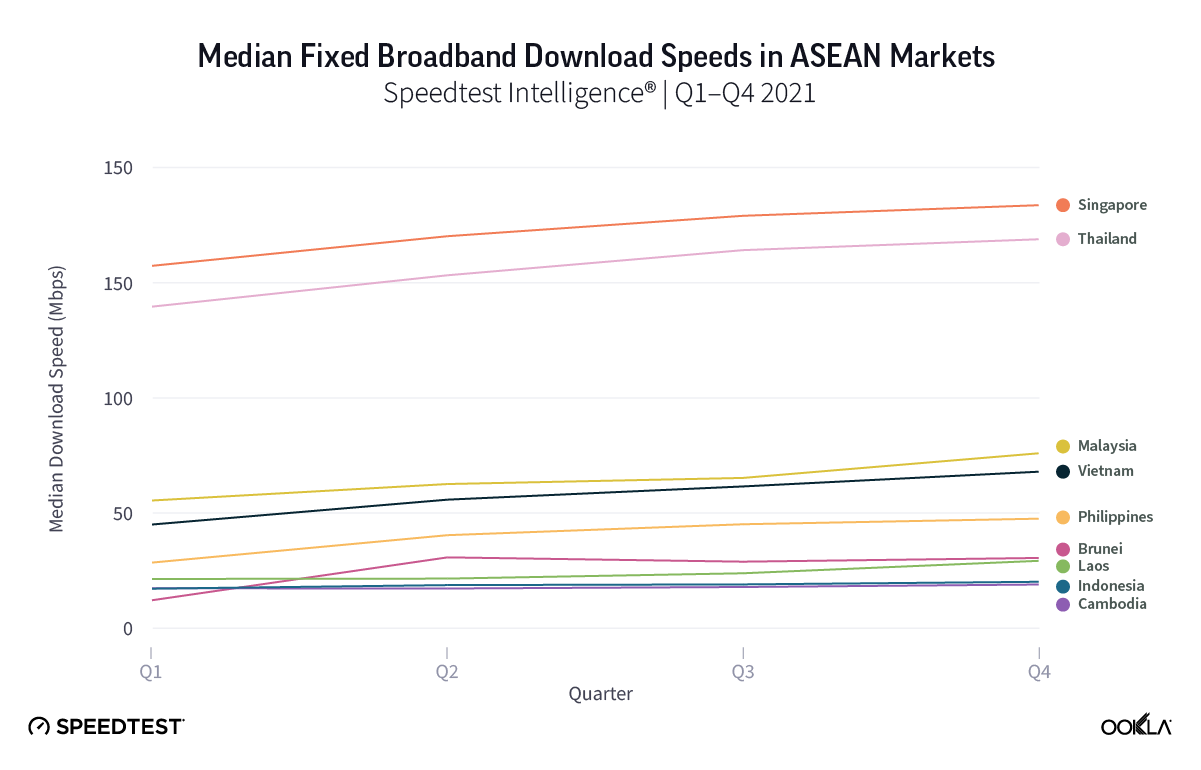

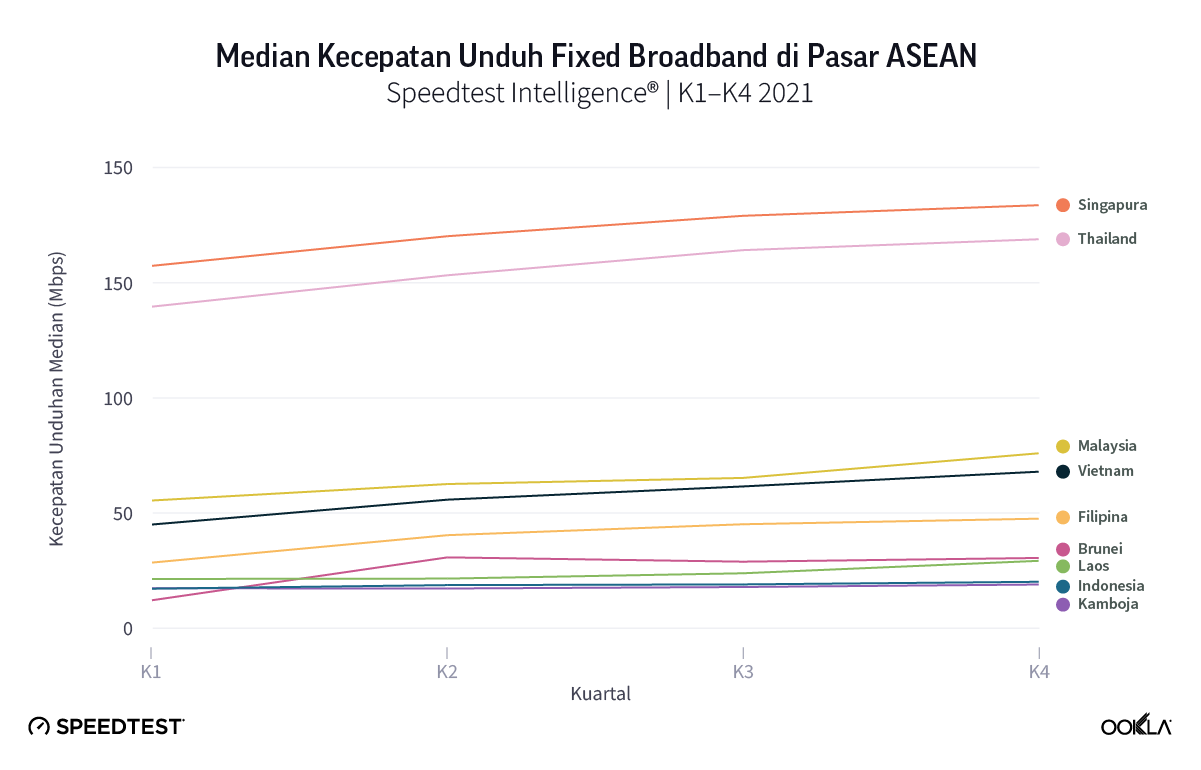

Using Speedtest Intelligence® data, we compared Malaysia’s 4G performance against that of its regional peers in Q1 2022. Singapore came first with 44.11 Mbps median 4G download speed ahead of Vietnam (34.89 Mbps), followed by Thailand (24.86 Mbps) and Malaysia (22.41 Mbps). Across Indonesia, the Philippines, and Cambodia, the 4G median speeds were well under 20 Mbps.

Vietnam performed well in the 4G download speeds ranking and it also had the highest median upload speed across the seven Southeast Asian countries surveyed – 17.49 Mbps, ahead of Singapore, which trailed at 11.62 Mbps.

It is also worth noting that the Vietnamese government promotes smartphone use. In July 2021, a telecom law, Circular 43, came into effect, which states that devices either imported to or made in Vietnam must support 4G technology. This stimulated customer migration to 4G technology. Furthermore, in December 2021, the Ministry of Information and Communication proposed that Vietnam stop using 2G and 3G technologies from 2022 in a bid to propel digital transformation. The government has made provisions in a draft public utility telecommunication program in 2021–2025 to support “poor and near-poor households” and give them access to 2.1 million smartphones.

Other countries in the region, e.g. Malaysia and Indonesia, look to migrate users away from 3G too, and put in place initiatives to support that. For example, Malaysian government and operators introduced initiatives to help Malaysians, especially those in the B40 category (lower-income group, with a monthly household gross income of RM 1/$0.23–RM 4,850/ $1107 representing 40% of Malaysians) to get internet access and portable and affordable 4G-capable smart devices. These include Pakej Remaja Keluarga Malaysia and Pakej Peranti Keluarga Malaysia launched in October 2021, and the Pakej Perantisiswa Keluarga Malaysia, which is part of Budget 2022.

4G Availability above 80% across Southeast Asia

When it comes to 4G Availability — the proportion of users who spend the majority of their time on 4G technology — all countries surveyed were above the 80% mark in Q1 2022. Singapore lead, achieving 94.5% 4G Availability in Q1 2022. This isn’t surprising since as a condition of the 4G spectrum allocation, mobile operators were required to provide nationwide 4G outdoor service coverage by end of June 2016, and within road and Mass Rapid Transit (MRT) tunnels by June 30, 2018.

When it comes to 4G Availability — the proportion of users who spend the majority of their time on 4G technology — all countries surveyed were above the 80% mark in Q1 2022. Singapore lead, achieving 94.5% 4G Availability in Q1 2022. This isn’t surprising since as a condition of the 4G spectrum allocation, mobile operators were required to provide nationwide 4G outdoor service coverage by end of June 2016, and within road and Mass Rapid Transit (MRT) tunnels by June 30, 2018.

Malaysia ranked well too, propelled by government initiatives. As part of the12th Malaysia Plan (2021–2025), the government is implementing the Jalinan Digital Negara (Jendela) initiative, which aims to address the need and demand for better quality fixed and mobile broadband coverage. The objectives of the first phase are to increase 4G coverage from 91.8% to 96.9% by the end of 2022, mobile broadband speeds from a mean download speed of 25 Mbps to 35 Mbps, and switch-off 3G networks by the end of 2021. The next Phase, Phase 2 (initially planned for 2023–2025 but already kicked off with a roll out of 5G in Q4 2021) focuses on deploying 5G network services to boost digital connectivity nationwide.

4G Availability in Malaysia heading toward 100%

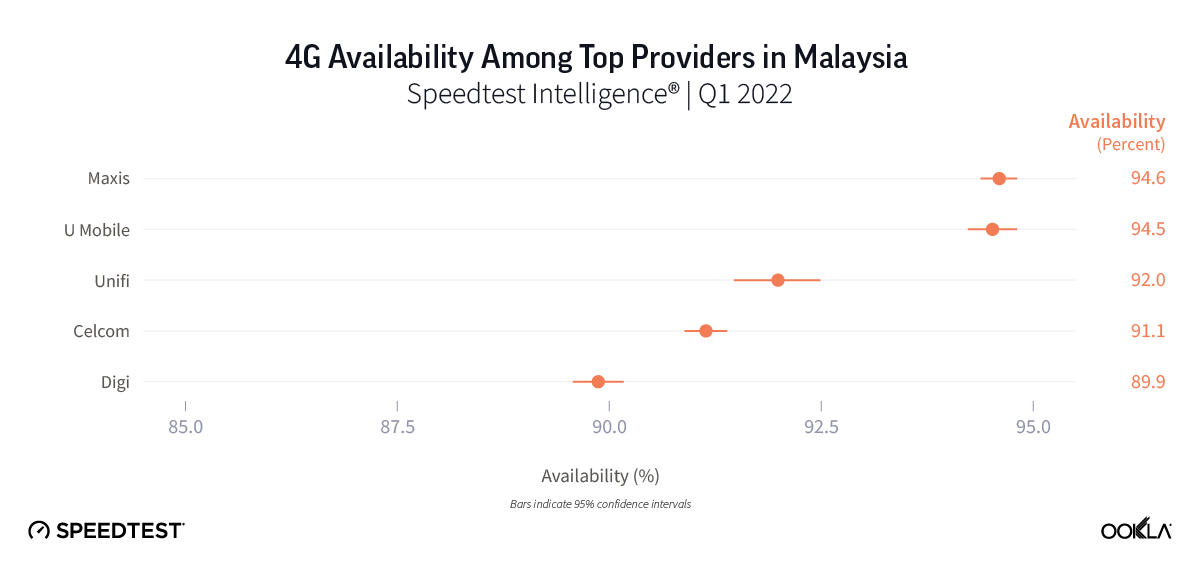

When comparing 4G Availability across operators in Malaysia, the differences are minor. At a country level, the average 4G Availability increased from 86.7% in Q1 2021 to 92.3% in Q1 2022. This was predominantly driven by two factors: increased availability of networks and devices.

When comparing 4G Availability across operators in Malaysia, the differences are minor. At a country level, the average 4G Availability increased from 86.7% in Q1 2021 to 92.3% in Q1 2022. This was predominantly driven by two factors: increased availability of networks and devices.

Operators across Malaysia continue to roll out 4G to adhere to Jendela roll out targets. According to Jendela’s Q1 2022 report, the four main mobile broadband service providers have collectively achieved their Q1 2022 target by building 60 new 4G towers. Celcom beat targets by 25%, while Digi met 94% of its target as it encountered permit approval issues with the Sabah Local Council. 4G population coverage was also on track, increasing to 95.5% in Q1 2022, and is on a good path to achieve its 96.9% populated area coverage target by the end 2022.

In addition to setting up targets related to 4G network deployments to free up more spectrum for 4G, the Malaysian government expected to retire 3G spectrum at the end of 2021 but is yet to be completed. According to the Malaysian Communications and Multimedia Commission (MCMC), 20% of 3G sites still remained operational at the deadline. Flooding and the monsoon season are cited as the reasons for the delay in retiring 3G sites. Almost all 3G carriers will have completed shutdown by Q2 2022, except a few sites located in remote areas, which are set to be shut down in December 2022.

In terms of end user migration, 86.6% of 3G customers in Malaysia have already moved to 4G while the rest do “not see the need for the switch over.” The remaining users will be able to use their existing devices even after the network shutdown, but they will be connected to 2G, which will only serve their basic connectivity needs (SMS and voice calls). The operators’ support for customer migration away from 3G devices includes promotional offers on 4G-enabled devices and subscription plans. For instance, Maxis launched campaigns like “Zerolution” device plan and “Balas Budi dengan 4G” campaign to encourage 4G users to help their families and friends upgrade. Digi, on the other hand, initiated a nationwide campaign (#BuatLebihL4Gi) to drive awareness for customers to adopt 4G, coupled with affordable device plans to drive greater adoption. U Mobile encourages its customers to upgrade by offering an upgrade for as little as 99sen ($0.23).

Digi has the fastest 4G download speeds; Maxis wins on upload

We compared 4G performance in Q1 2022 across Malaysian operators using Speedtest Intelligence. Digi came first with a 28.08 Mbps median download speed. The operator reported that most of its MYR 815 million (US$185.42 million) capital expenditure in 2021 was spent to improve its 4G network to respond to increased data consumption (more than 20GB per user, up 8.9% versus 2020) and deliver on the Jendela commitments. U Mobile and Celcom were head to head in terms of median 4G download speeds at 20.09 Mbps and 20.02 Mbps, respectively.

The largest operator by number of subscribers — Maxis — came first when it comes to upload speeds, with a median upload speed of 10.59 Mbps, a 12% year-over-year increase. The operator invested MYR 1.2 billion ($273 million) in capex in 2021, with MYR 597 million ($136 million) in Q4 2021 alone, the highest in a single quarter.

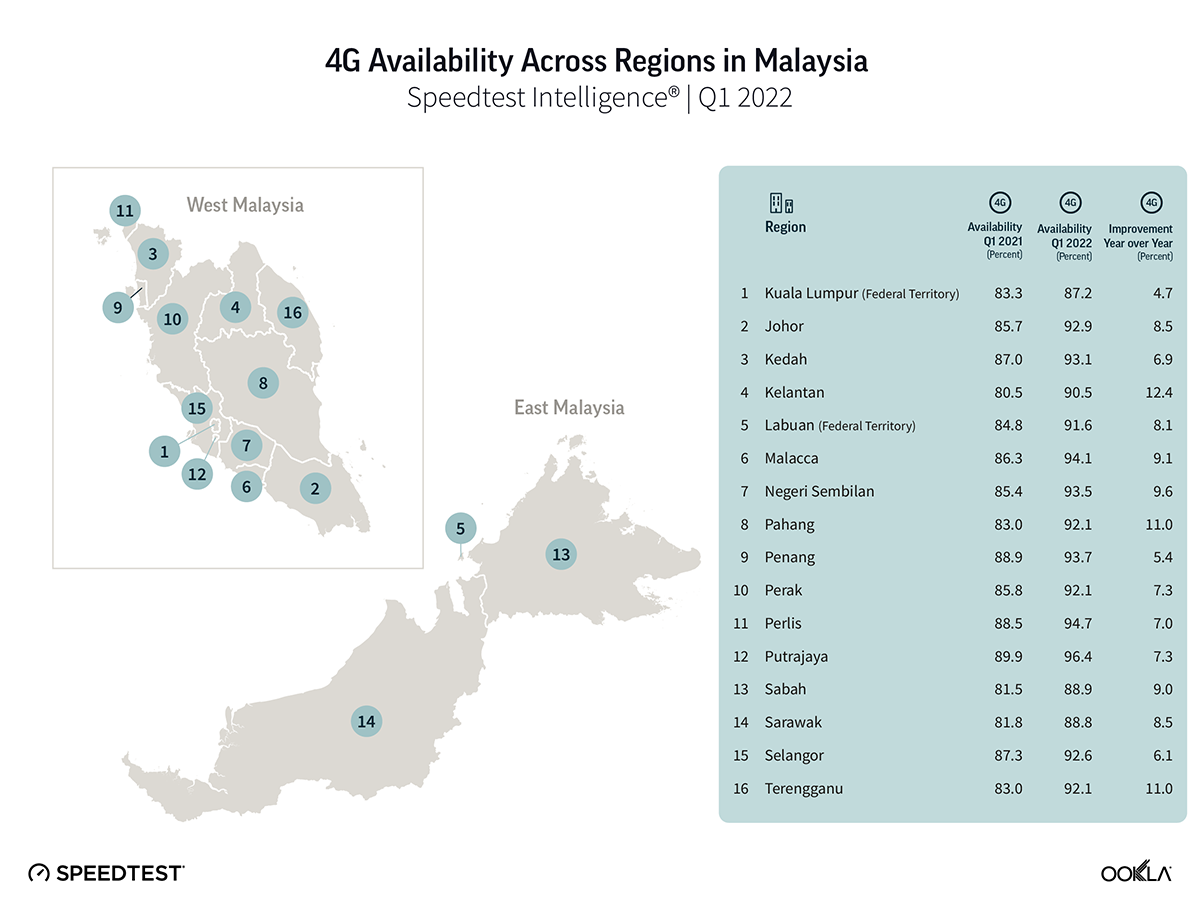

Putrajaya leads 4G Availability performance for Malaysia’s regions

We explored 4G Availability in Malaysia’s 13 states and 3 federal territories using Speedtest data from Q1 2022. It is important to note that 4G Availability is not a direct reflection of 4G coverage. Instead, this is a reflection of the network technology, e.g. 4G users spend the majority of their time connected to. Putrajaya had the highest 4G Availability with 96.4% of tested locations showing access to 4G during Q1 2022, while the Federal Territory of Kuala Lumpur had the lowest 4G Availability at 87.2%. Kelantan, Terengganu, and Pahang witnessed over 10% increases in 4G Availability between Q1 2021 and Q1 2022.  Looking at the operators’ 4G Availability during Q1 2022 across different geographic areas, 4G Availability didn’t statistically differ in most cases. However, there were a few exceptions: Maxis won in the Federal Territory of Kuala Lumpur, Pahang and Selangor, while U Mobile had the highest availability in Johor. Maxis has also committed to expanding its coverage in Sabah and Sarawak as stated by the Chief Network Officer.

Looking at the operators’ 4G Availability during Q1 2022 across different geographic areas, 4G Availability didn’t statistically differ in most cases. However, there were a few exceptions: Maxis won in the Federal Territory of Kuala Lumpur, Pahang and Selangor, while U Mobile had the highest availability in Johor. Maxis has also committed to expanding its coverage in Sabah and Sarawak as stated by the Chief Network Officer.

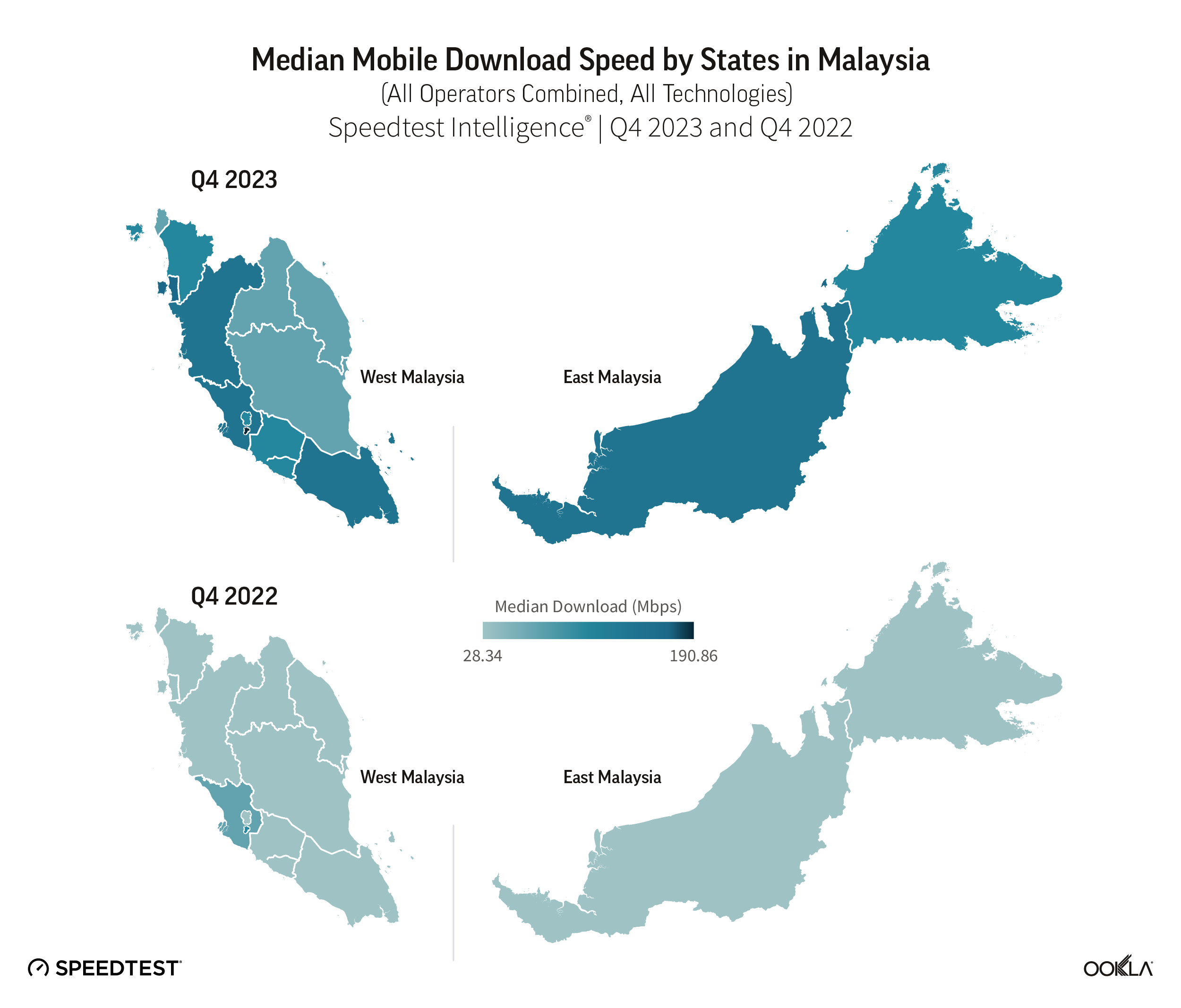

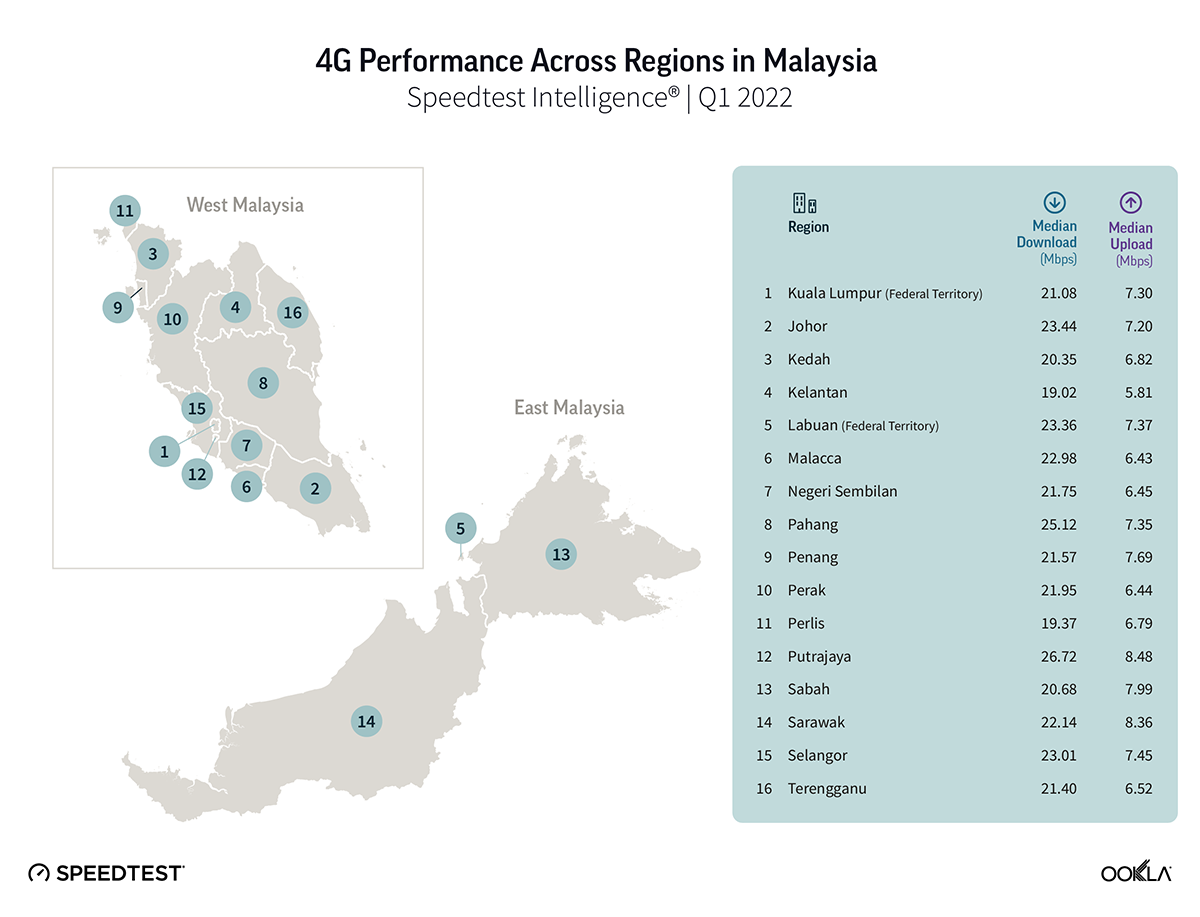

4G performs well across all of Malaysia’s regions

Not only did availability improve across these regions, but speeds also increased. However there was no statistical winner in Q1 2022 for the fastest median 4G download and upload speeds across the provinces.

According to the Ministry of Communications and Multimedia (K-KOMM), Selangor has been a priority market in terms of funding; it received a high allocation of MYR 5.34 billion to upgrade telecommunications infrastructure. So far 313 new towers have been built and 7,197 transmitter stations upgraded to 4G already with 652 in progress.

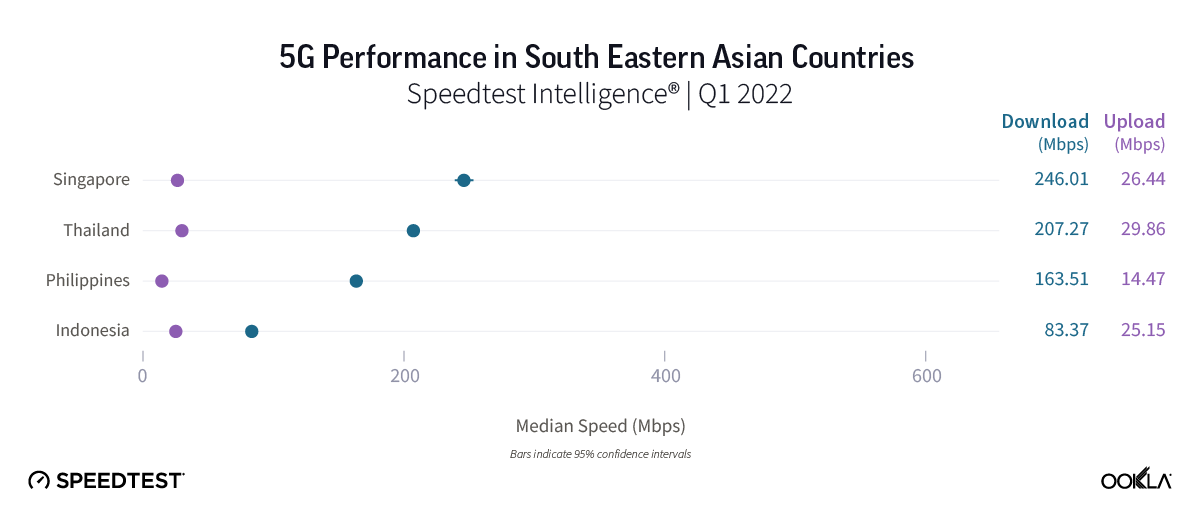

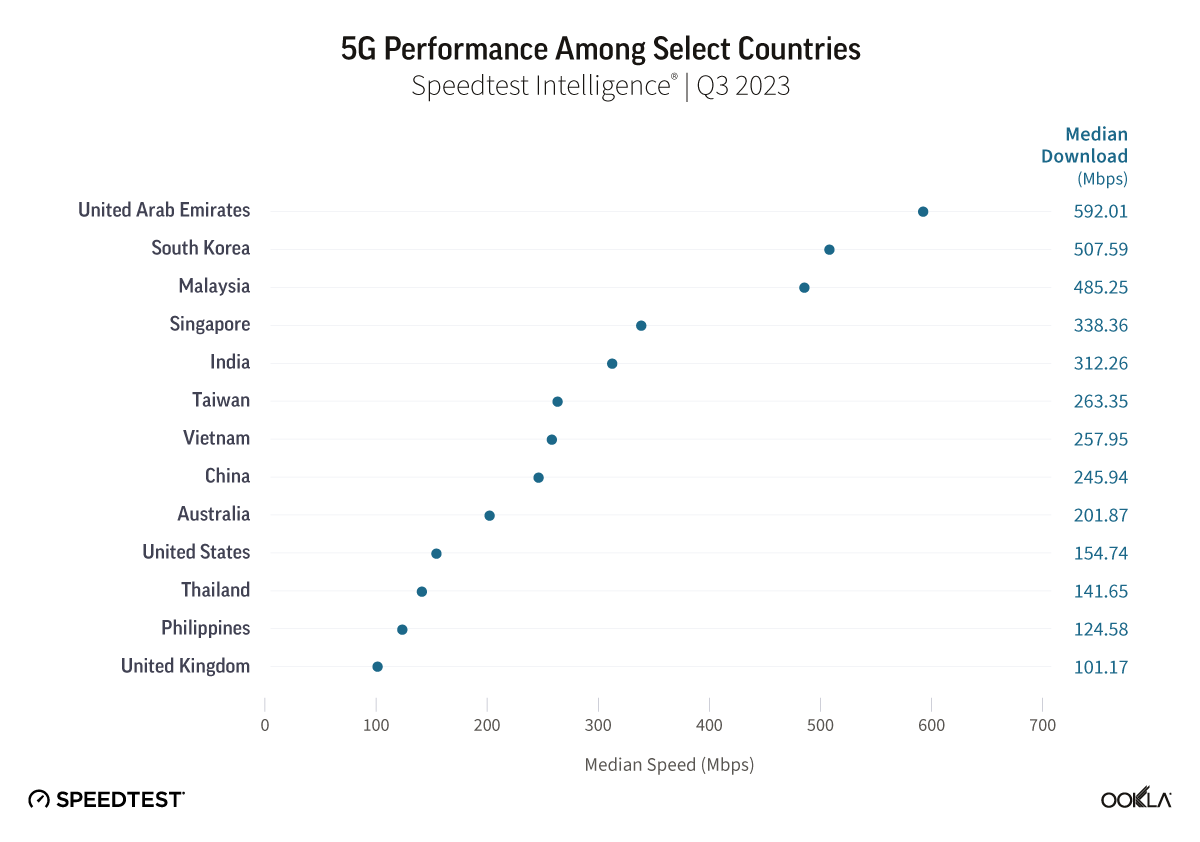

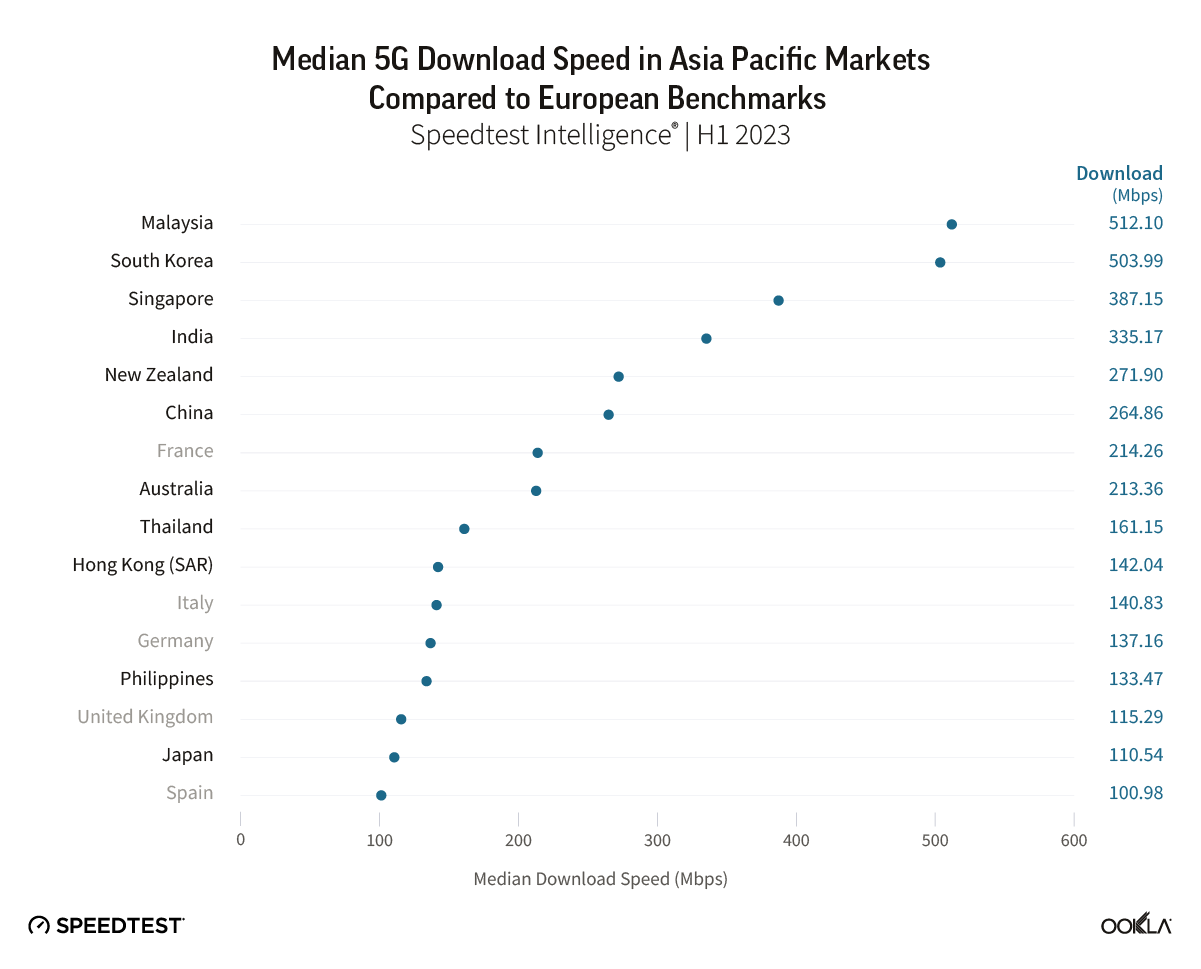

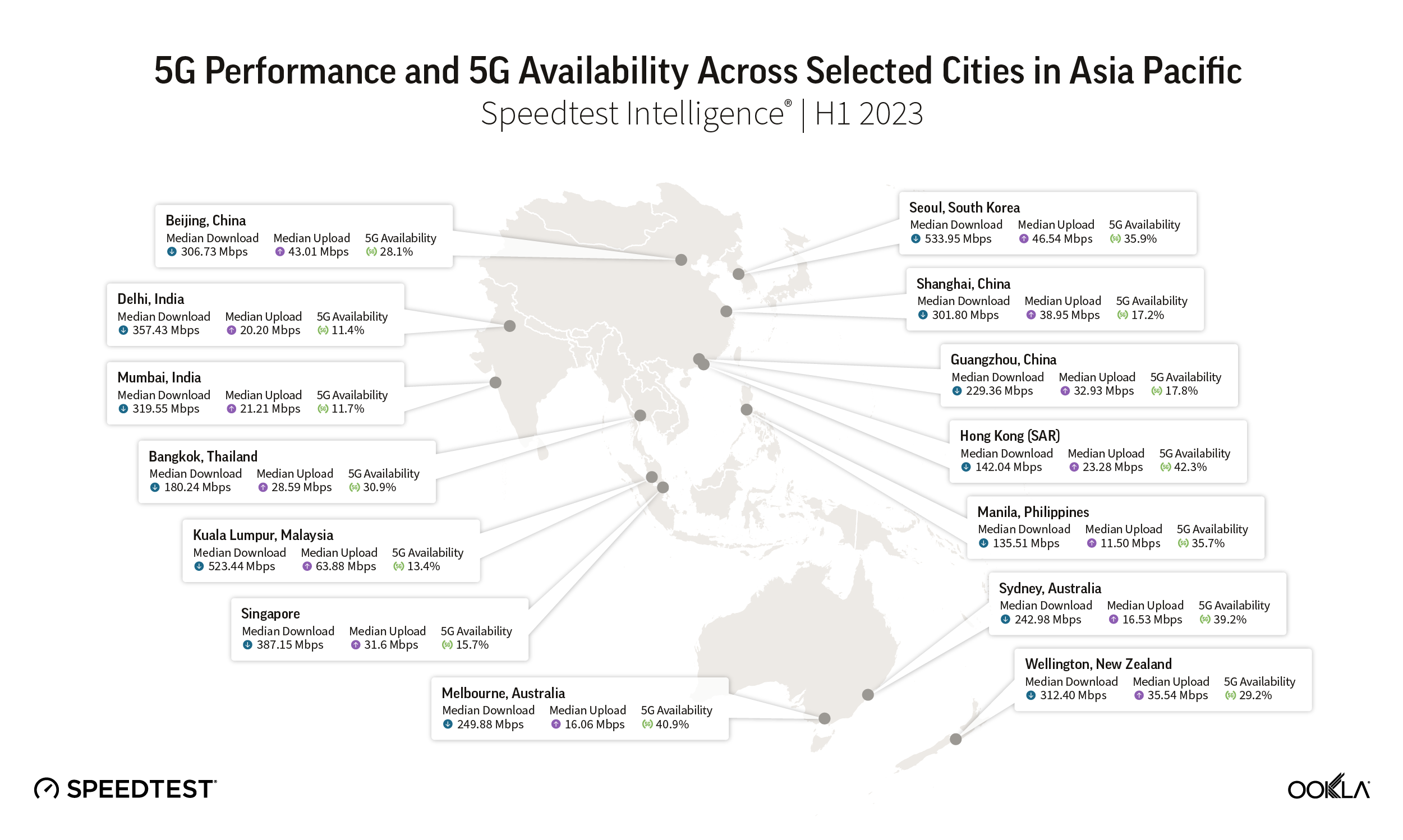

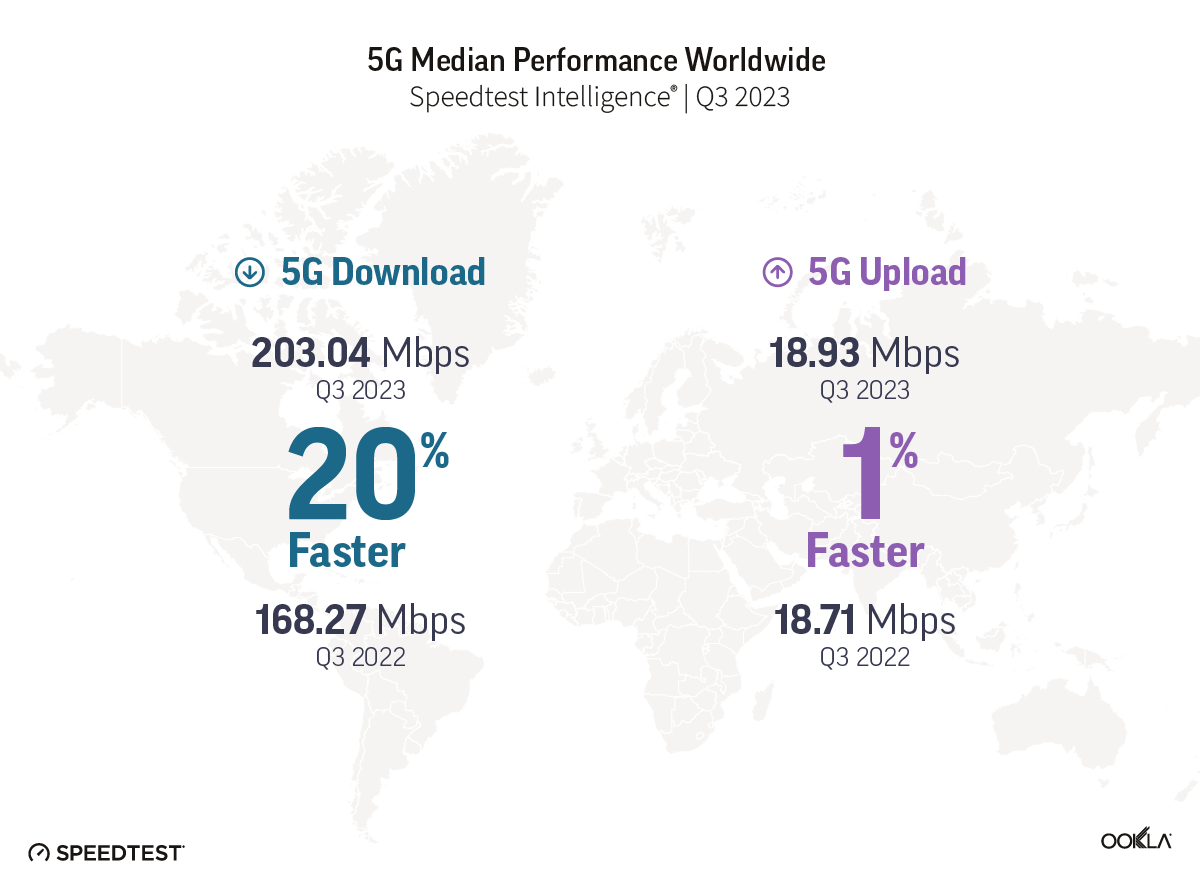

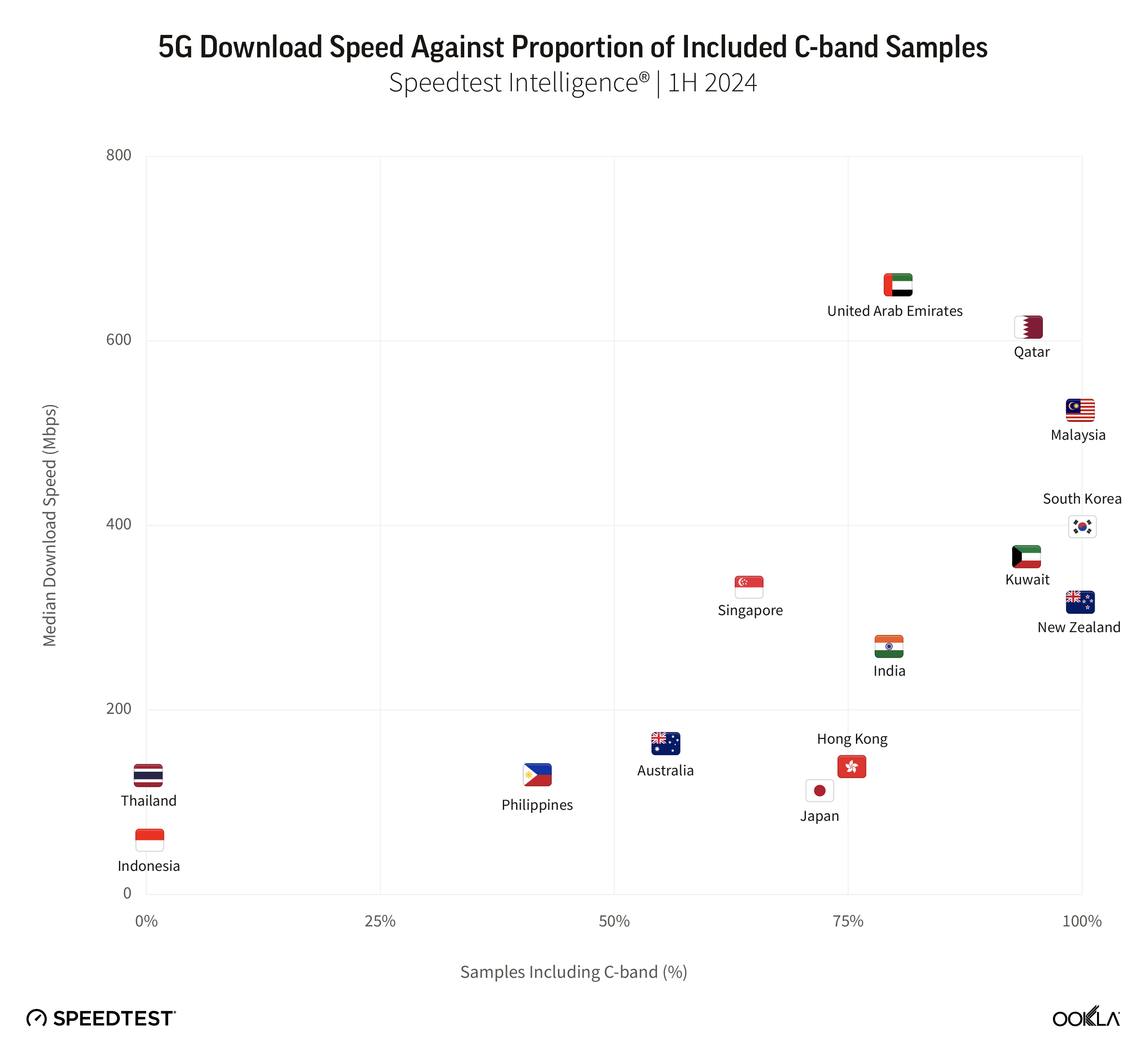

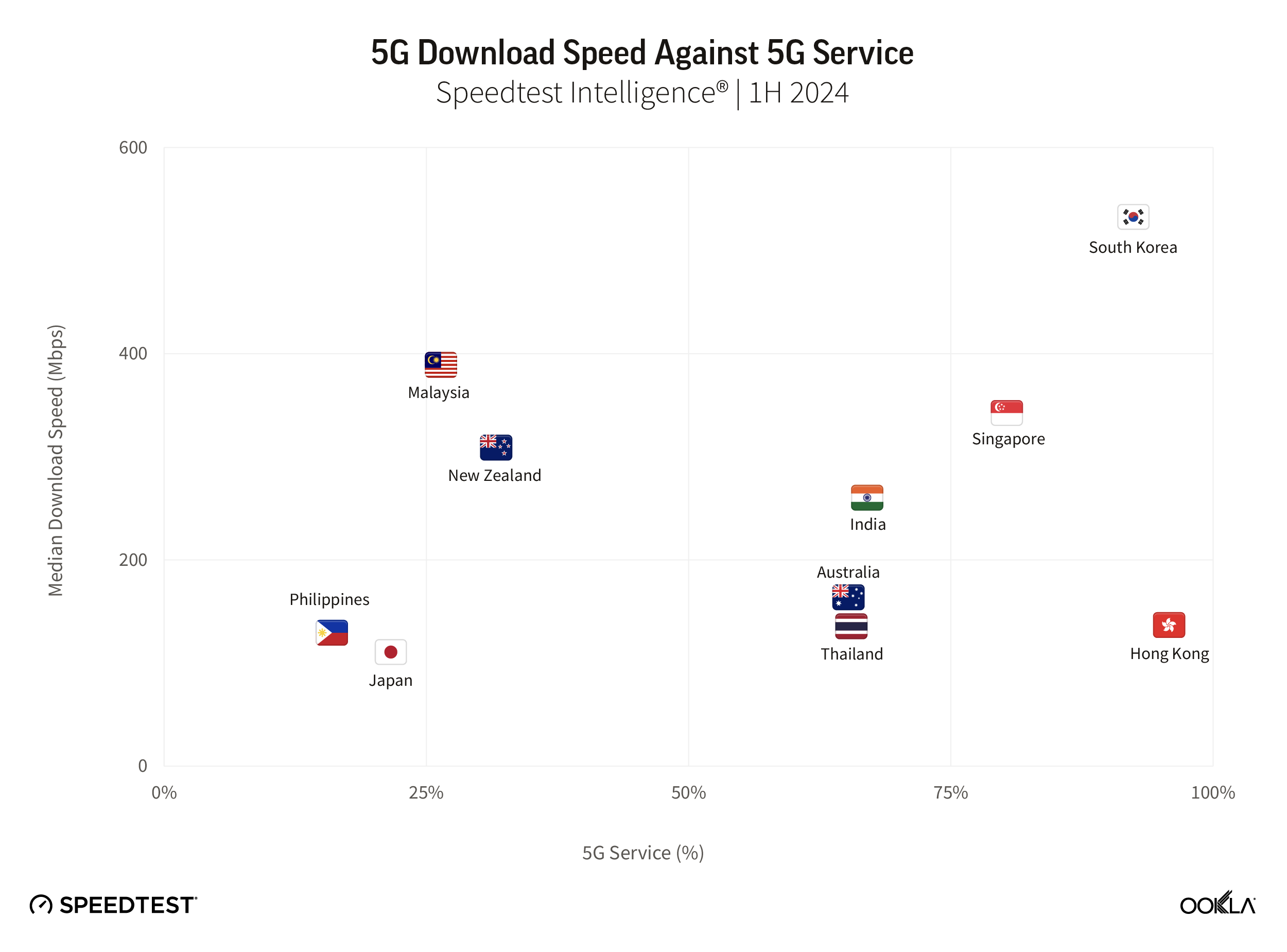

Singapore led Southeast Asia on 5G speeds

While median 5G download speed was 246.01 Mbps in Q1 2022, this differed by operator with Singtel being the clear winner as it recorded 360.31 Mbps median download speed in Q1 2022. Singapore’s 5G story began in 2020 when two wholesale networks launched — Singtel and Antina (Starhub-M1 consortium). IMDA, Singapore’s telecom regulator, aims for 50% 5G coverage of Singapore by 2022 and nationwide 5G coverage by 2025. Singtel recently announced the first rollout for an MRT line, while its 5G indoor coverage is spread over 300 locations across the island, including all malls along the NEL, bringing indoor/outdoor coverage to 75% of Singapore. Singtel is also busy rolling out 5G Standalone (SA) in partnership with Ericsson running on 3.5 GHz spectrum. The other operators — StarHub and M1 — are also “on track” to roll out 5G services to MRT tunnels in the next few months and reach “nationwide outdoor 5G coverage” in 2022. In March 2022, StarHub reported its 5G network had more than 75% of outdoor coverage, with M1 claiming the same. In November 2021, Singaporean operators also received additional spectrum in the 2100 MHz band, in addition to the first tranche of 3.5 GHz spectrum issued in June 2020 for the deployment of 5G nationwide networks.

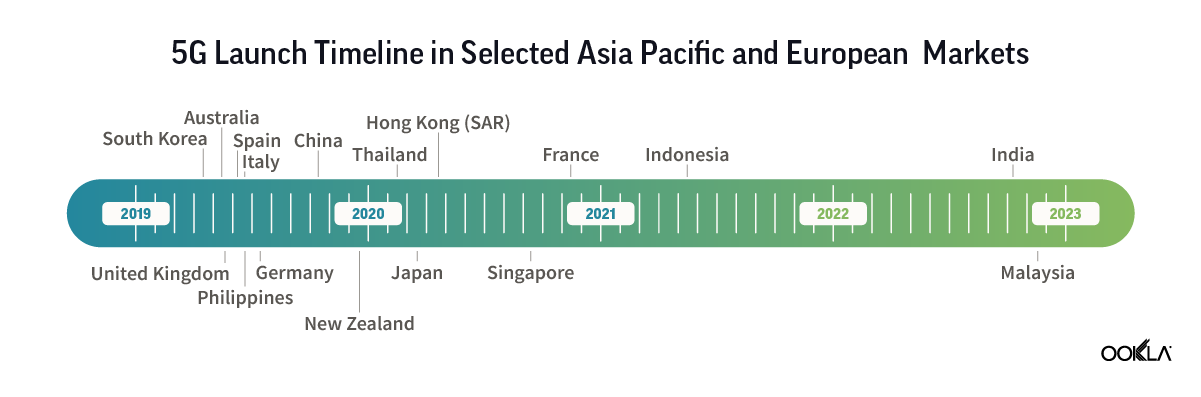

Cambodia’s 5G is expected in 2023; currently, there is no spectrum availability. In Vietnam, 5G was launched in 2020 but using spectrum assigned on a trial basis, and is not commercially available as of yet. With long-term spectrum availability still unclear, Vietnam is missing from the 5G ranking. Malaysia’s wholesale network is not yet fully commercialized, 5G is available in selected areas of Malaysia, so we excluded it from the ranking. Only two operators — Yes and Unifi Mobile — signed up for the free trial on the network when it was launched in December 2021. The network is expected to be fully commercialized in July 2022 by all Malaysian operators.

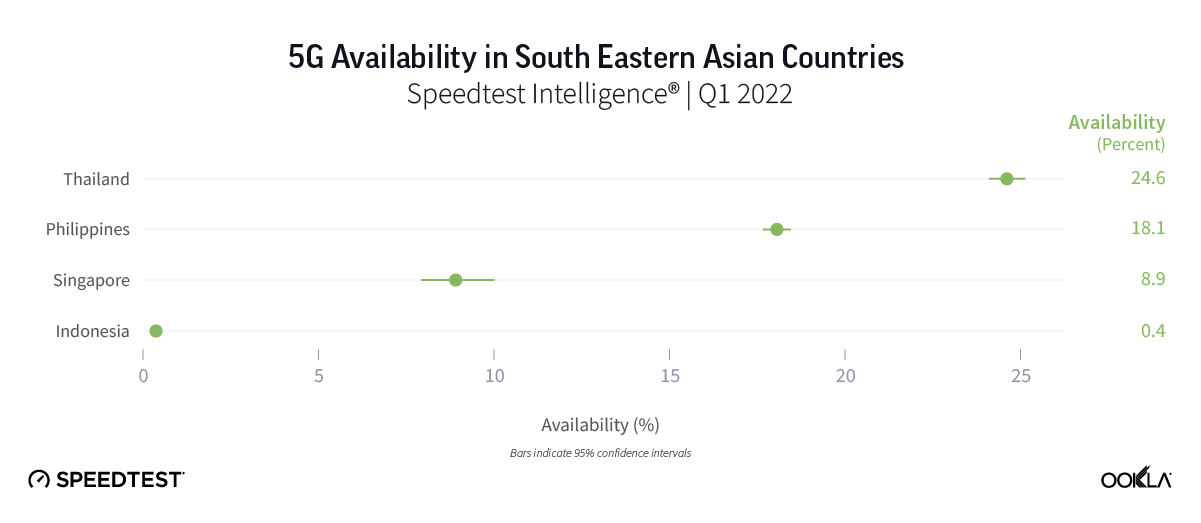

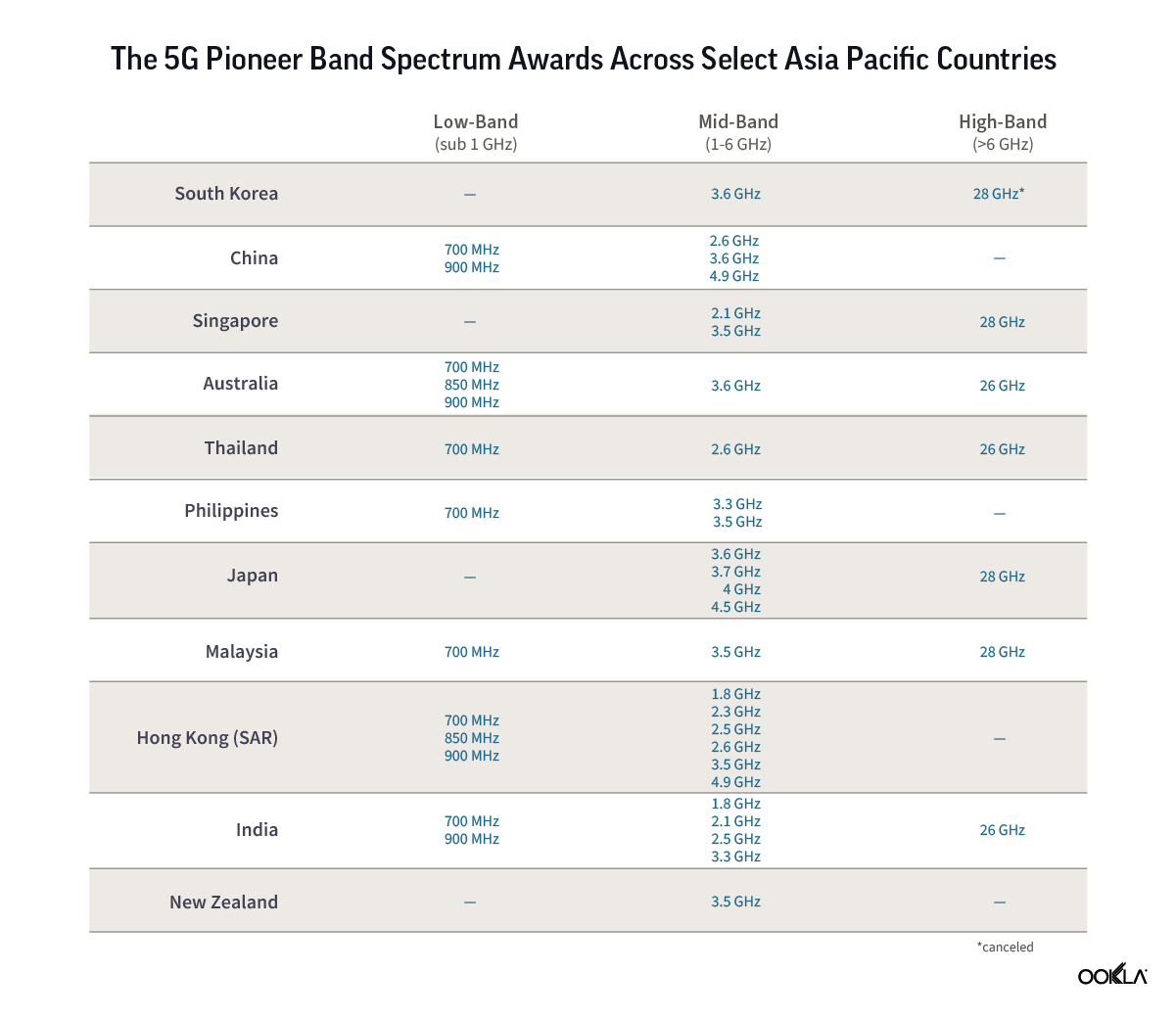

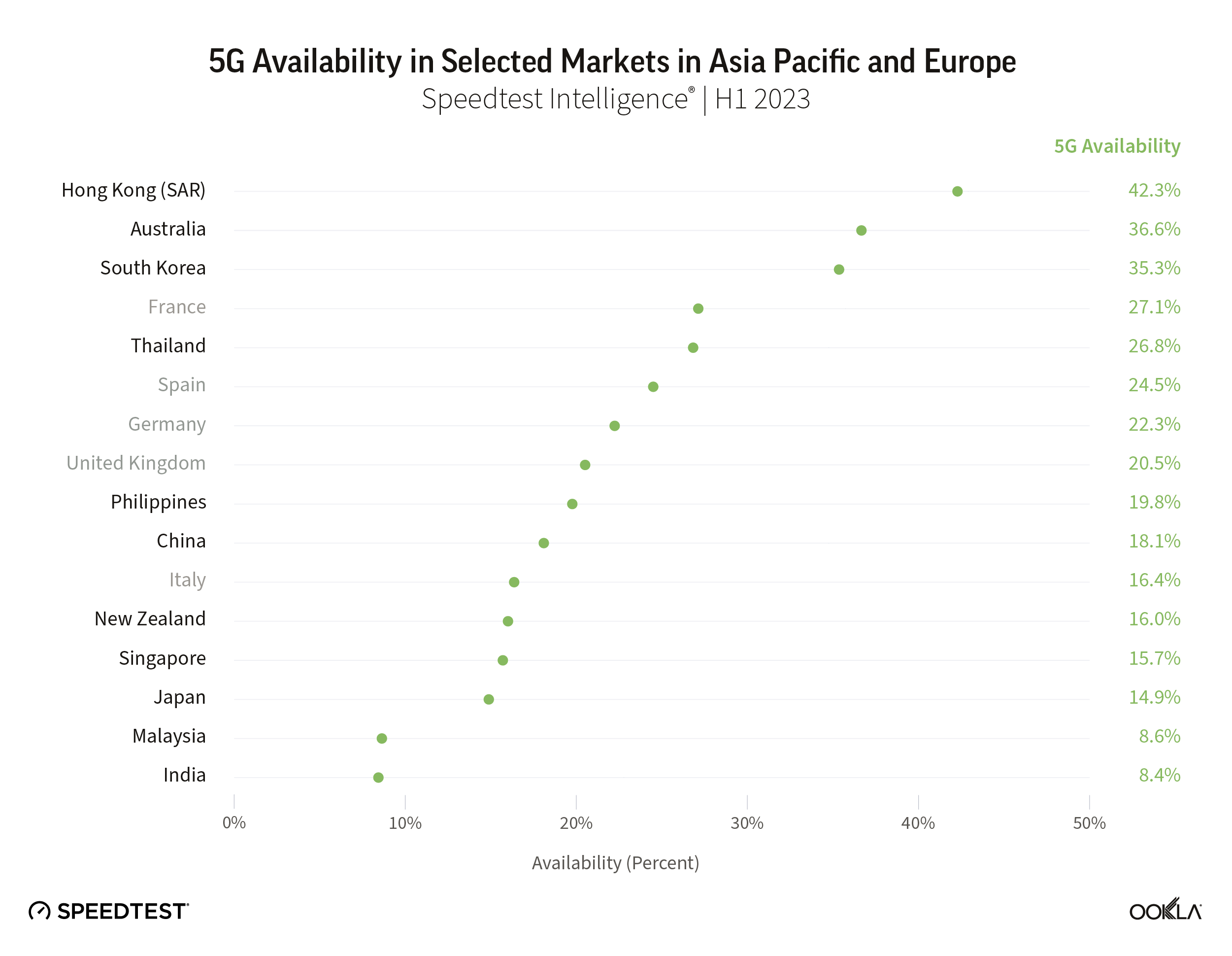

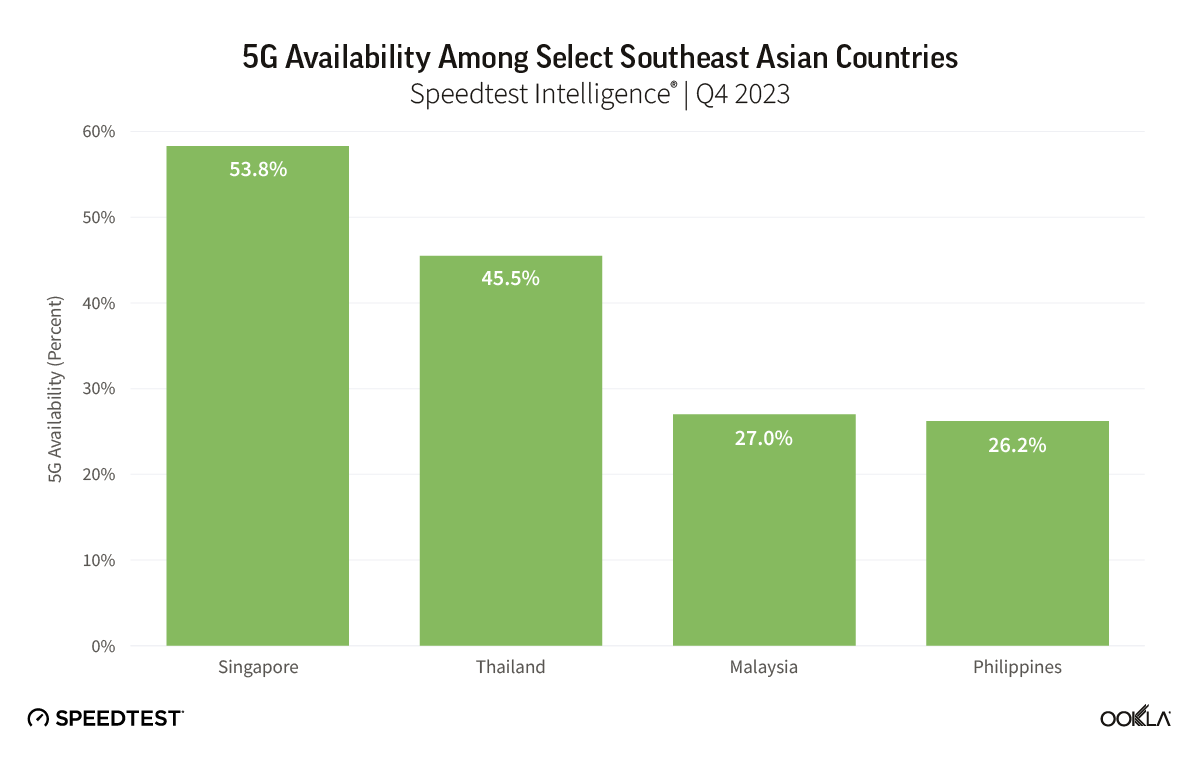

Thailand came first for 5G Availability in Southeast Asia

Speedtest Intelligence data put Thailand first in terms of 5G Availability (the proportion of users on 5G-capable devices who spend a majority of their time on 5G networks) among its regional peers. Thailand was one of the first markets to launch 5G in the Asia Pacific region, with AIS and TrueMove H both launching commercial 5G services inQ1 2020, shortly after the conclusion of the country’s 5G auction. AIS performed well when it comes to median 5G download speeds (261.19 Mbps download speed/40.57 Mbps upload speed) and it was the fastest operator in Thailand in Q1 2022. In our recent article, we concluded that the country’s regulator, The National Broadcasting and Telecommunications Commission (NBTC), has been instrumental in establishing Thailand as a leading 5G market in the region. In February 2020, NBTC assigned spectrum for 5G use across low- (700 MHz), mid- (2,600 MHz), and high- (26 GHz) frequency bands. It also plans a further auction of mid-band spectrum in 2022 in the 3.5 GHz band, which was vacated in September 2021 by Thaicom, a satellite provider.

In Indonesia, operators launched 5G in select cities in June 2021, which explains the very low 5G Availability in Q1 2022 at 0.37%.

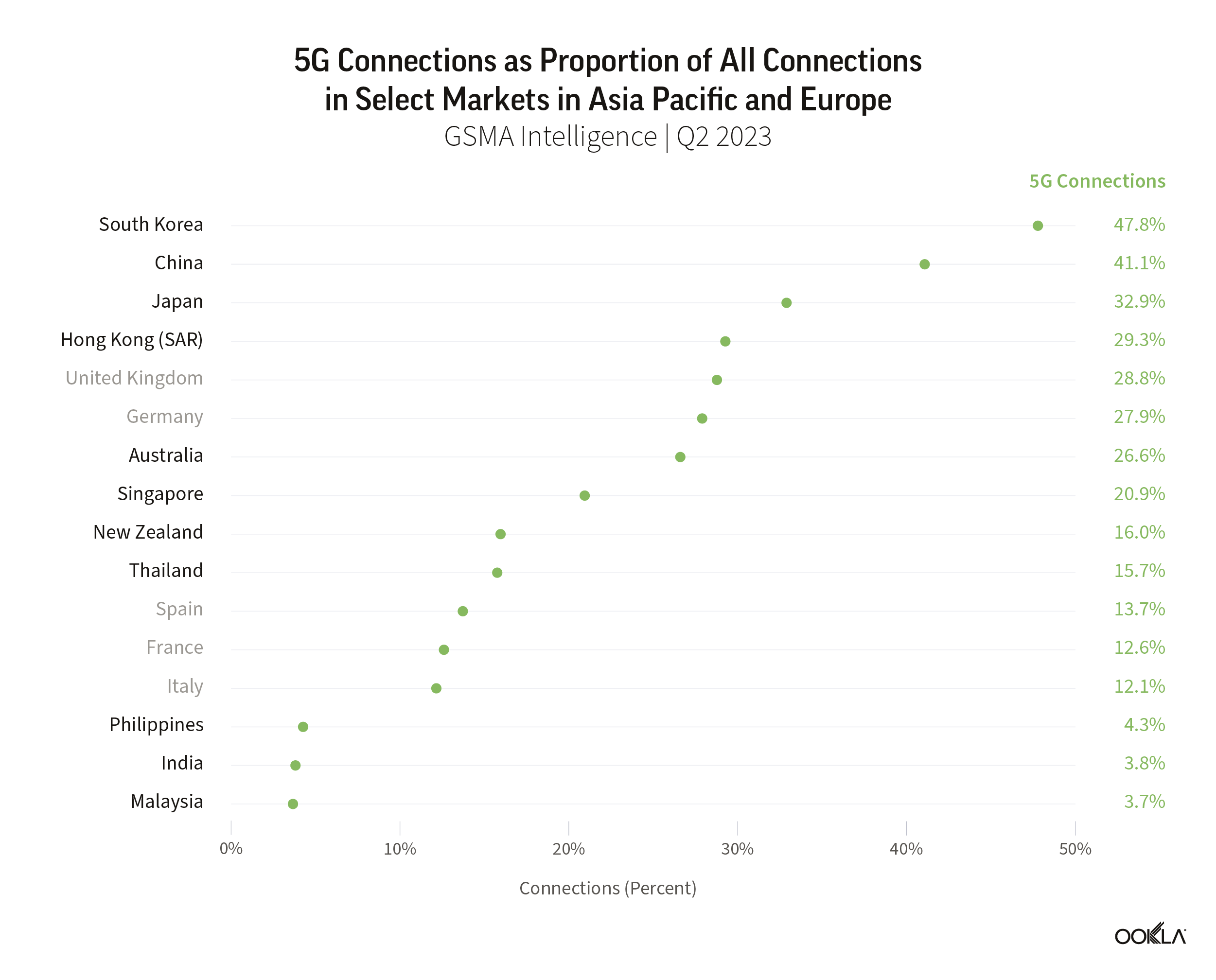

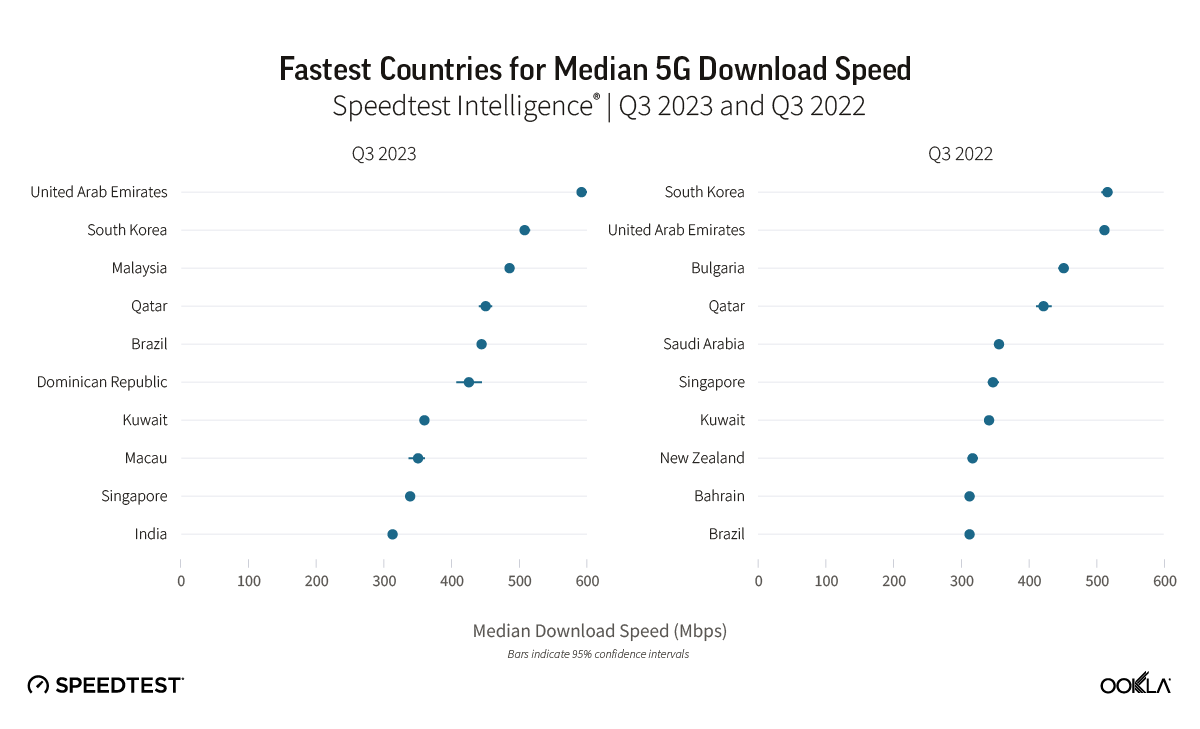

Greater 5G Availability on the Malaysian horizon

The 5G situation in Malaysia is rather unique and requires a bit of an explanation. In February 2021, the Malaysian Ministry of Finance announced during the launch of the Prime Minister’s Malaysia Digital Economy Blueprint (MyDIGITAL) that a government-owned Special Purpose Vehicle (SPV) would be responsible for rolling out a nationwide single wholesale network (SWN) to deliver 5G. This led to the establishment of Digital National Berhad (DNB), responsible for the 5G network rollout and providing wholesale services to operators on an open, fair, and non-discriminatory basis over the next 10 years.

The DNB has been assigned spectrum in the 700 MHz, 3.5 GHz, and 26-28 GHz bands. Currently, the 5G network has been deployed utilizing 3.5 GHz spectrum across selected areas of Putrajaya, Cyberjaya, Johor and Selangor and Kuala Lumpur. However, the DNB has aggressive timelines to reach 80% of populated areas by 2024, while the goal is to cover 40% of the population by the end of 2022.

There are still a few pieces of the puzzle that need to fall into place before 5G can be widely available in Malaysia. First, in March 2022, the government upheld its position that the SWN will in fact be the model for the 5G network deployment. Despite backing an alternative — the Dual Wholesale Network (DWN) rather than SWN — the four leading telcos (Celcom Axiata, Digi, Maxis and U Mobile) have announced that they are supporting the government’s decision. On its part, the government offered up to 70% of DNB equity to operators, while it will retain a 30% stake. The four operators, although open to the proposal, would prefer to go through a merger and acquisition process. Only two local operators, Telekom Malaysia (TM) and YTL Communications, signed agreements to acquire an equity stake. The discussions are currently in place with a target date to be completed by the end of June 2022.

On March 31 2022, DNB Reference Access Offer (RAO) was released. Despite hopes that the concerns raised by the operators regarding the RAO could be sorted within weeks, there are still ongoing discussions around RAO. In a joint statement, the operators stated that RAO will not enable affordable and good quality 5G services.

The big four telecom operators are eager to provide commercial 5G services and test different 5G use cases. For instance, Maxis partnered with Malaysia Airports Holdings Berhad and Proton for 5G services and solutions, as well as the deployment of 5G use cases. The operator also launched a 5G and AI innovation lab.

We will continue to follow the Malaysian market to see how the 5G situation will unravel and how it affects their ranking among Southeast Asian countries. Once we know the outcome of the conversations regarding DNB we will be sure to comment on that. If you’d like to learn more about internet speeds and performance in other markets around the world, visit the Speedtest Global Index™.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.