Lire en français

Mobile and fixed broadband speeds in North Africa currently lag behind much of the world, though that may soon change. To better understand the current and future states of the internet in North Africa, we examined Speedtest® data from Q2-Q3 2019 in Algeria, Egypt, Libya, Morocco and Tunisia. Our analysis includes data on download speeds, 4G Availability and Time Spent on various mobile technologies. We’ve also included data on internet speeds in some of the largest cities in the region.

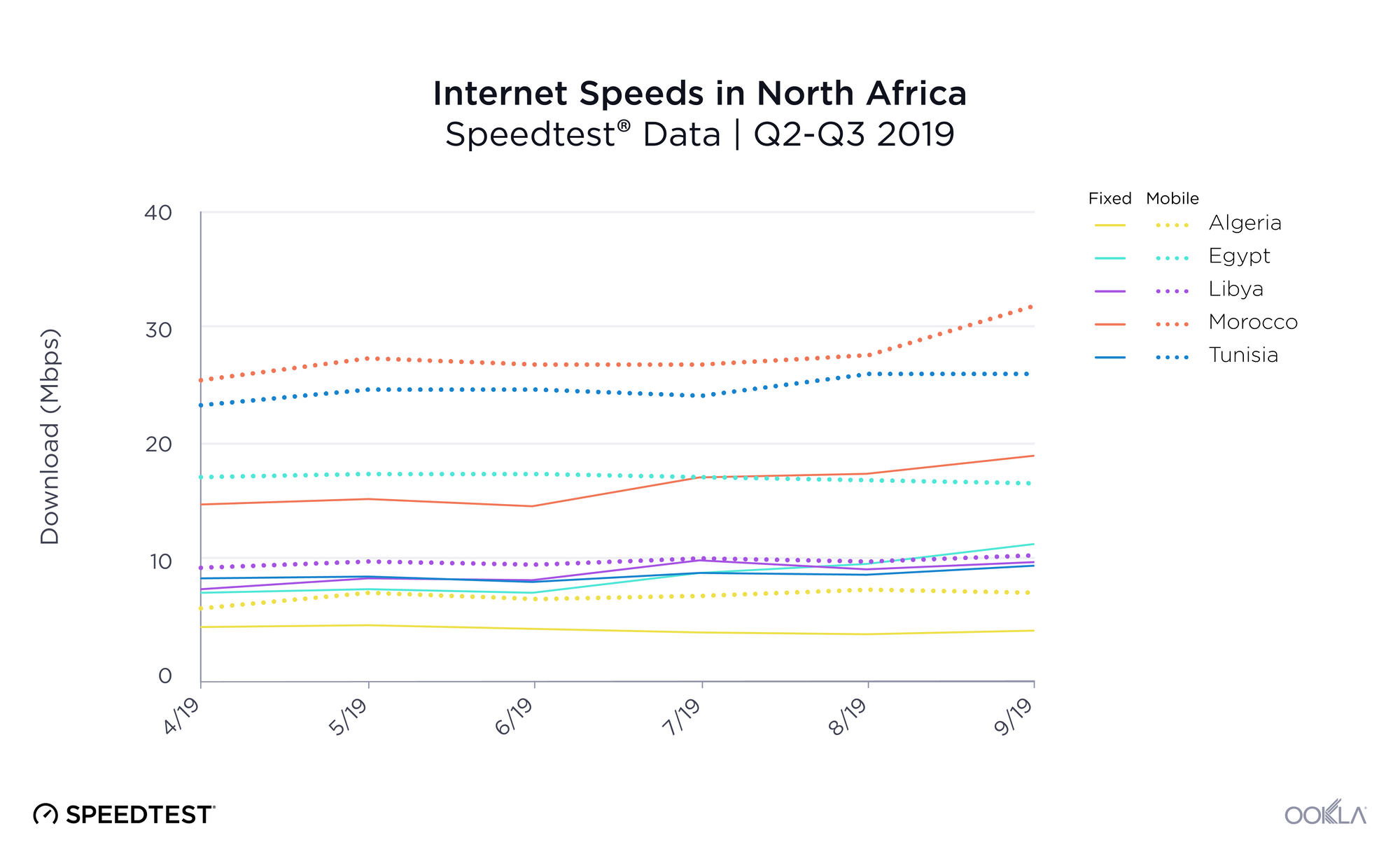

Morocco leads fixed broadband download speeds, Egypt most improved

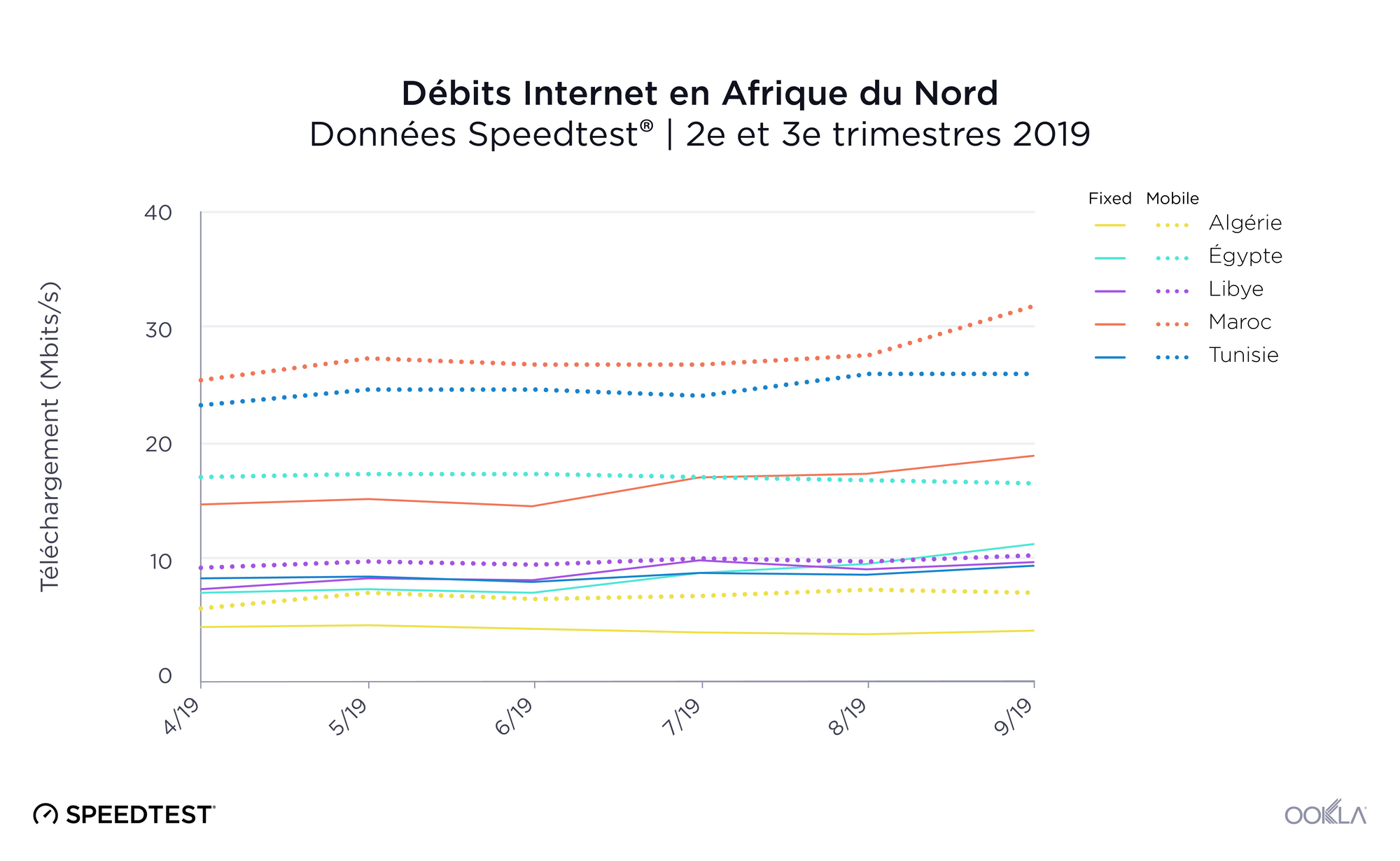

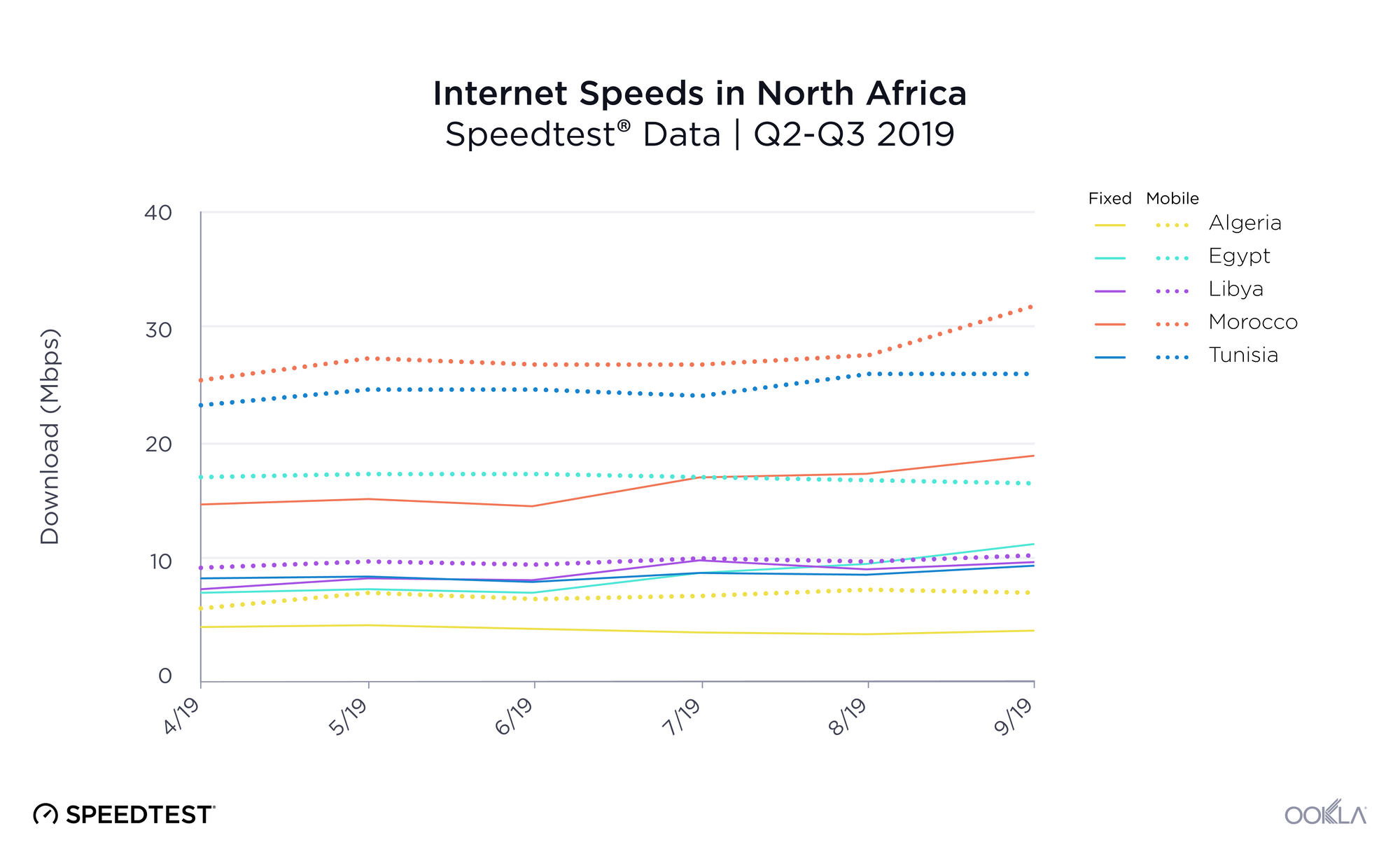

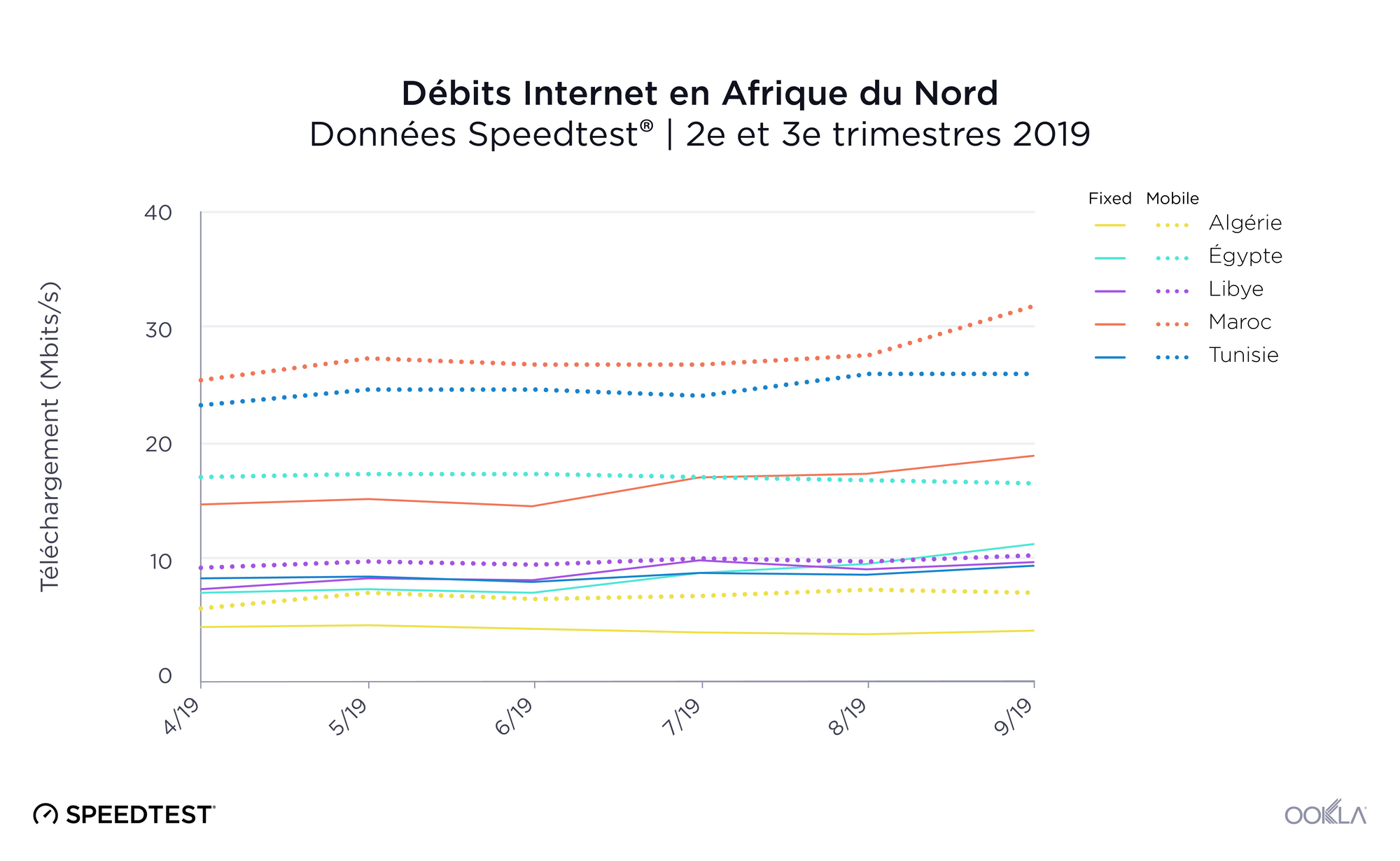

As of October 2019, countries in North Africa ranked no higher than 123rd in the world for fixed broadband speeds on the Speedtest Global IndexTM. Morocco had the fastest mean download speed over fixed broadband in North Africa during Q2-Q3 2019 at 15.38 Mbps, 69.0% faster than second-place Egypt’s 9.10 Mbps. Libya was third fastest at 8.92 Mbps, Tunisia fourth at 8.64 Mbps and Algeria fifth at 4.55 Mbps.

However, Egypt saw the most improvement in fixed broadband download speed with a remarkable 55.5% increase during Q2-Q3 2019. All four of the major ISPs in Egypt saw increased speeds during this period with mean download speeds rising 59.2% for WE Internet, 55.4% for Orange, 21.7% for Etisalat and 17.1% for Vodafone.

Libya showed the second highest improvement in fixed broadband download speed in North Africa during this period with a 29.9% gain. Morocco’s download speed went up 27.2% and Tunisia 10.8%. Mean download speed over fixed broadband declined 6.2% during Q2-Q3 2019 in Algeria.

Morocco has the fastest mean download speed on mobile and it’s improving rapidly

North Africa’s fastest country, Morocco, ranked 54th on the Speedtest Global Index in October 2019. Morocco’s mean download speed over mobile during Q2-Q3 2019 was 27.01 Mbps. Tunisia was second at 24.50 Mbps, Egypt third at 16.86 Mbps, and Algeria and Libya virtually tied at 9.63 Mbps and 9.62 Mbps, respectively.

Morocco showed the greatest improvement in mean mobile download speed among countries in North Africa during Q2-Q3 2019 with a 24.5% increase. All three of the major providers saw advances in speed during this period with Maroc Telecom seeing a 40.1% rise in mean download speed, inwi gained 11.9% and Orange 5.5%. Algeria had the second highest gain in mean download speed at 20.5%, Tunisia third at 12.1% and Libya fourth at 8.6%. Mean download speed over mobile decreased 3.4% in Egypt during Q2-Q3 2019.

4G Availability varies widely among countries in North Africa

| Country |

4G Availability |

| Morocco |

83.3% |

| Tunisia |

64.4% |

| Egypt |

60.9% |

| Algeria |

45.5% |

| Libya |

15.6% |

Morocco had the highest 4G Availability in North Africa during Q2-Q3 2019, with consumers able to access 4G LTE in 83.3% of surveyed locations. Tunisia had the second highest 4G Availability at 64.4%, Egypt third at 60.9%, Algeria fourth at 45.5% and Libya fifth at 15.6%.

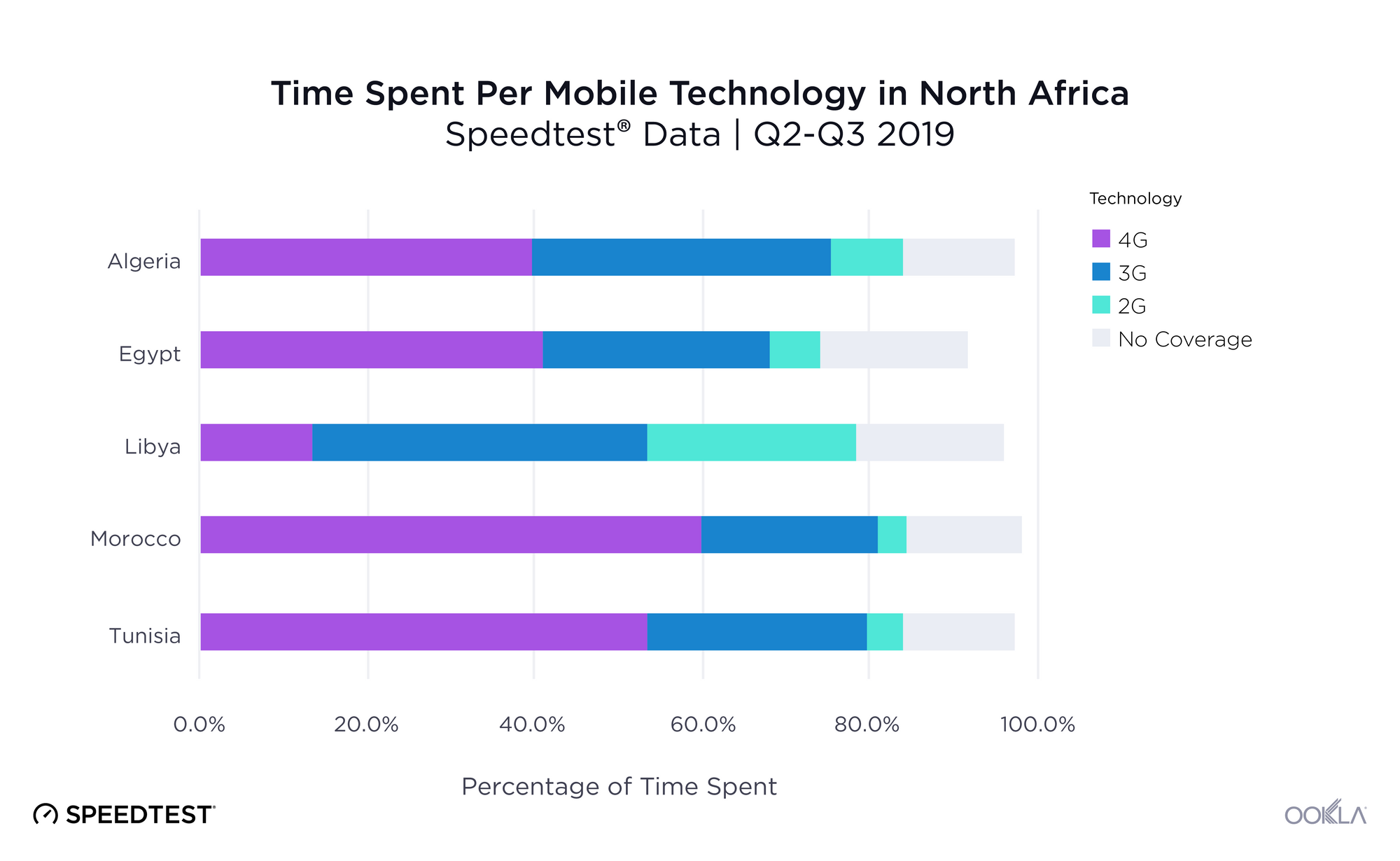

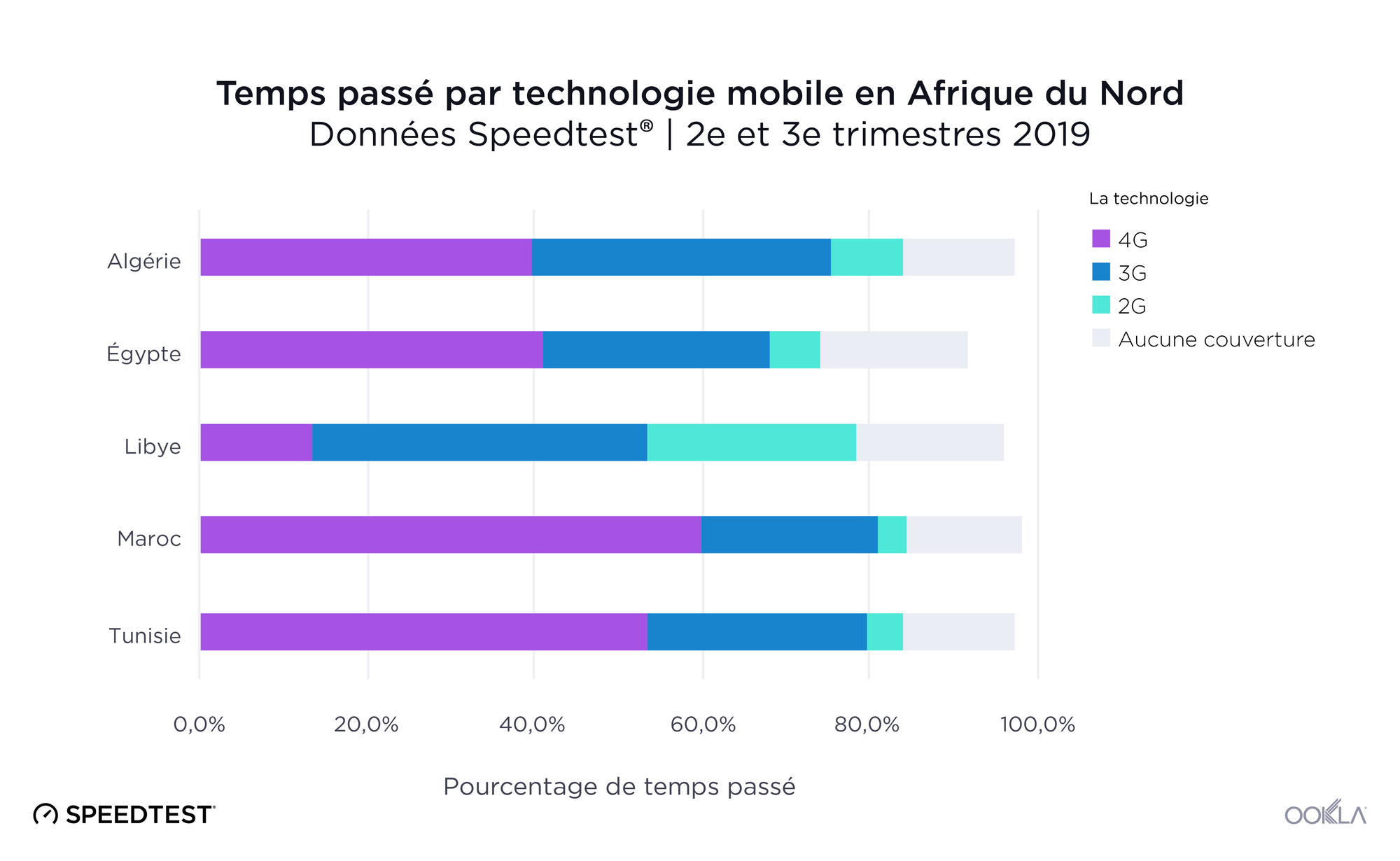

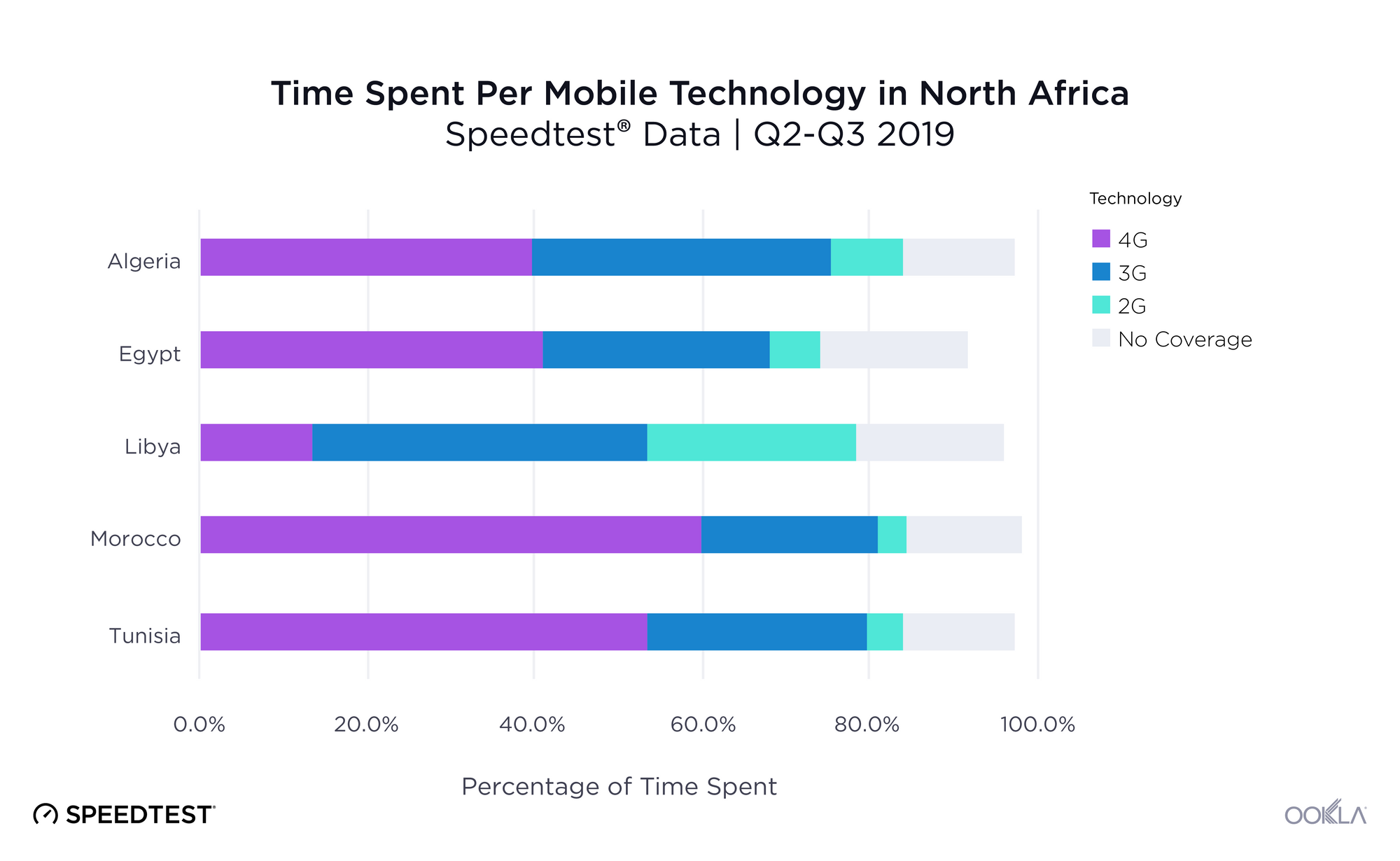

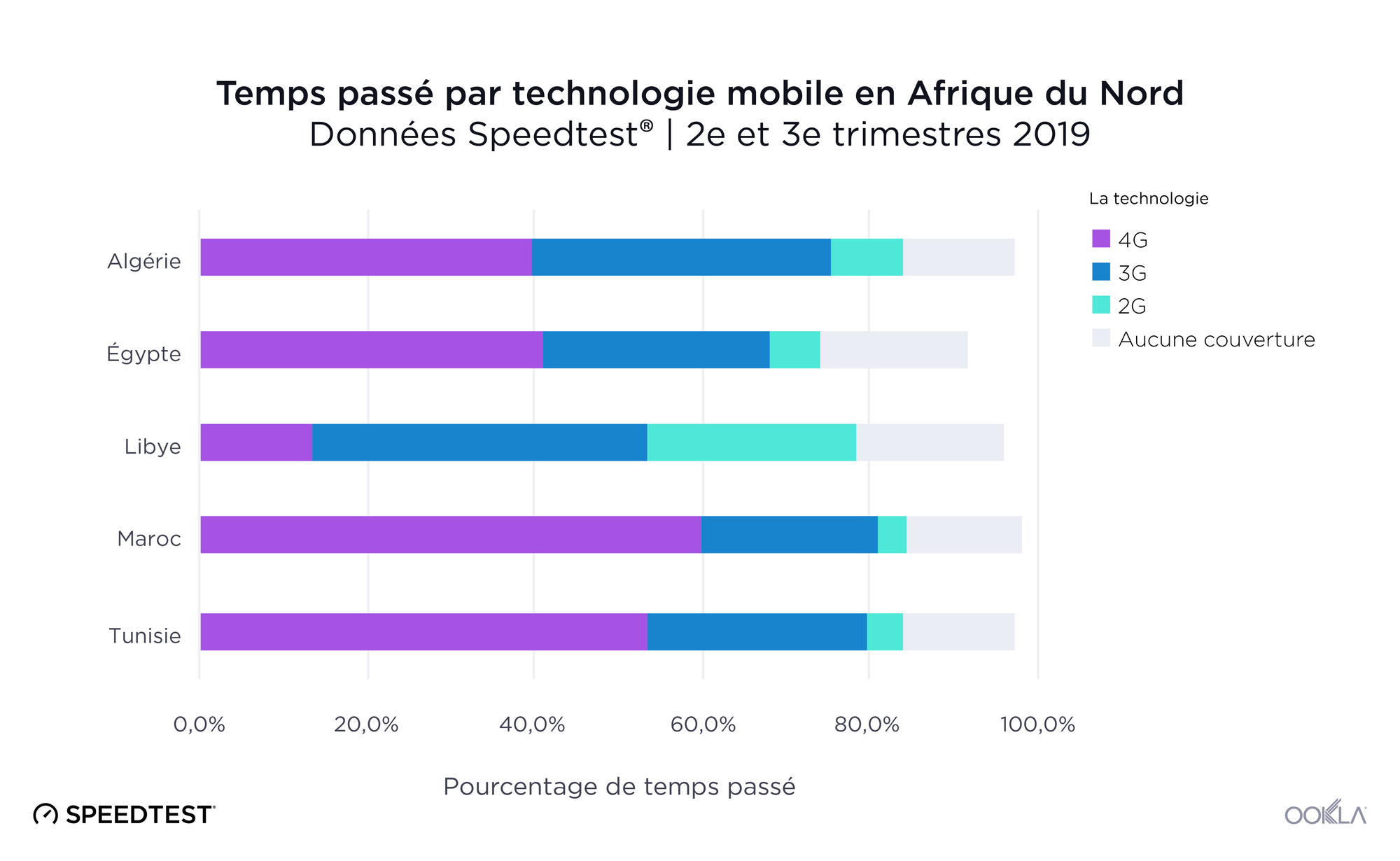

Only two countries show majority of Time Spent on 4G

We used Speedtest data on Time Spent to measure how often, on average, consumers were able to connect to various technologies in North Africa during Q2-Q3 2019. Morocco had the highest Time Spent on 4G at 59.7%, followed by Tunisia (53.4%), Egypt (41.1%), Algeria (39.8%) and Libya (13.3%). Libya had the highest Time Spent on 3G at 40.2%, followed by Algeria (35.5%), Egypt (27.0%), Tunisia (26.1%) and Morocco (21.1%). Libya had the highest Time Spent on 2G at 25.1%, distantly followed by Algeria (8.8%), Egypt (6.0%), Tunisia (4.3%) and Morocco (3.7%).

Libya had the highest Time Spent with no coverage at 17.6%, followed closely by Egypt (17.5%), Morocco (13.9%), Tunisia (13.5%) and Algeria (13.2%).

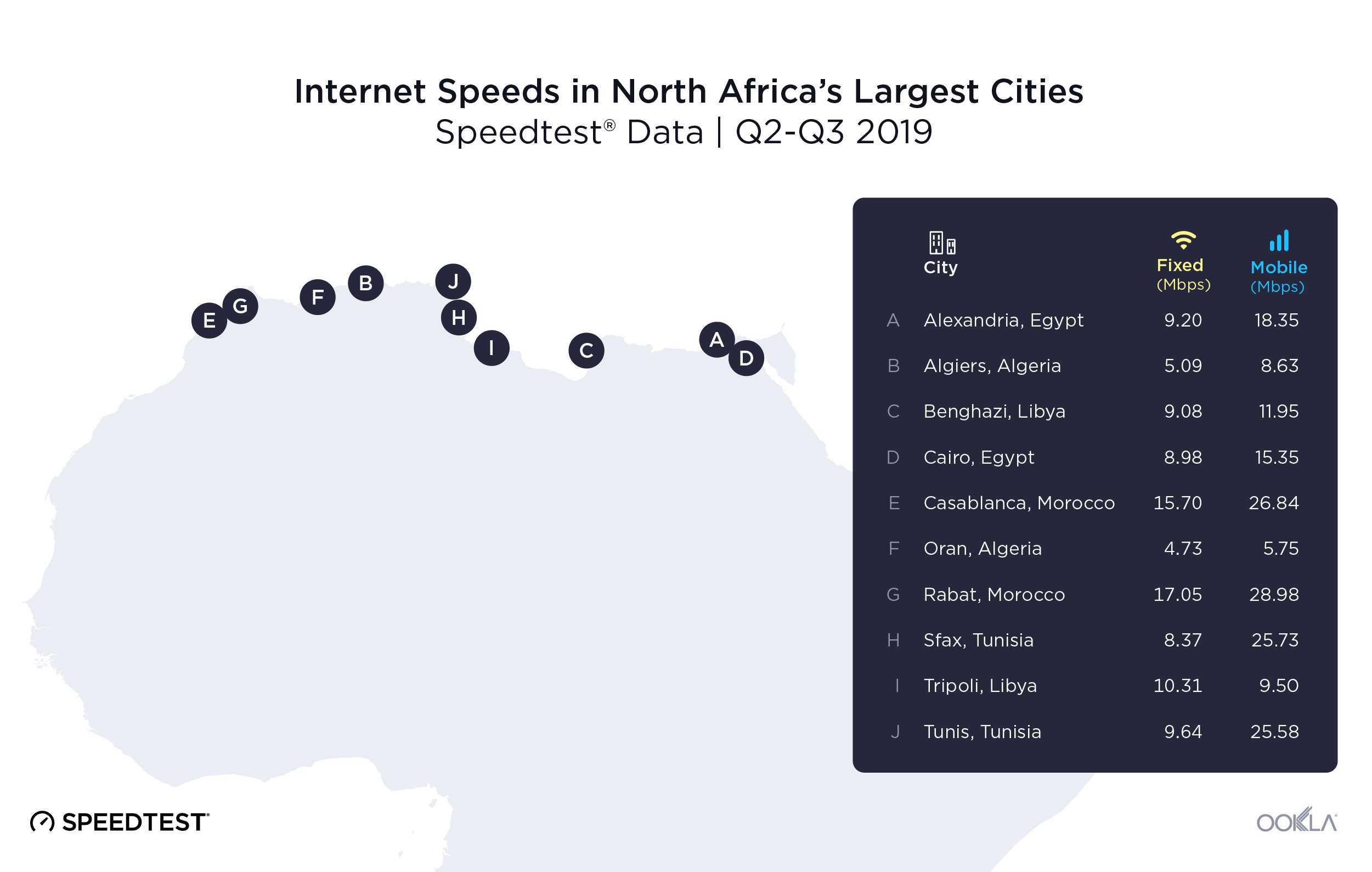

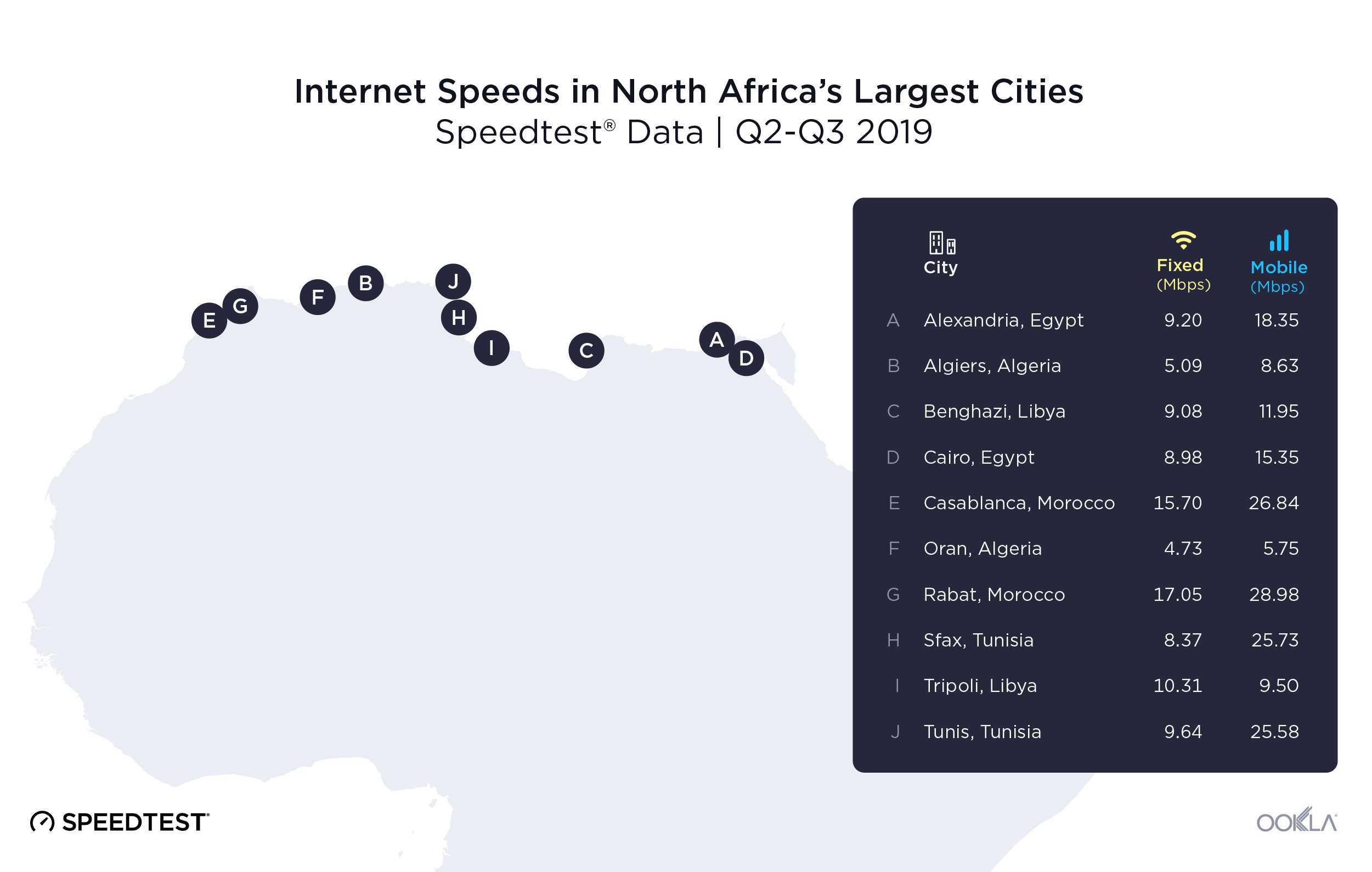

Rabat shows fastest mean fixed broadband and mobile download speeds

Looking at some of the largest cities in North Africa we found that the Moroccan cities of Rabat and Casablanca had the fastest mean download speeds over fixed broadband during Q2-Q3 2019. Tripoli, Libya was third. On the other end of the spectrum, Oran, Algeria had the slowest mean download over fixed broadband during Q2-Q3 2019. Data for the province of Algiers, Algeria revealed that to be the second slowest location on the list for download speed over fixed broadband. Sfax, Tunisia was the third slowest.

On the mobile side, Rabat and Casablanca again ranked first and second for mean download speed during Q2-Q3 2019. Sfax was third. Oran and Algiers showed the slowest and second slowest, respectively, mean download speeds over mobile during Q2-Q3 2019 of all the locations on this list. Tripoli was the third slowest.

The rollouts of fiber and 5G have the potential to radically improve internet speeds and availability across North Africa. The gains in speeds we saw in many North African countries during Q2-Q3 2019 could revolutionize consumers’ internet experience if they continue. If you’re an internet provider or mobile operator who would like more information on how our data can help you improve your network, contact us.

Analyse des débits Internet et de la 4G en Afrique du Nord

Actuellement, la vitesse des connexions haut débit fixes et mobiles en Afrique du Nord est bien en deçà de celle enregistrée dans une grande partie du monde, même si cela devrait bientôt changer. Pour mieux comprendre la situation actuelle et future d’Internet en Afrique du Nord, nous avons étudié les données Speedtest® entre le 2e et le 3e trimestre 2019 en Algérie, en Égypte, en Libye, au Maroc et en Tunisie. Notre analyse inclut des informations sur les vitesses de téléchargement, la disponibilité de la 4G et le temps passé sur diverses technologies mobiles. Nous avons également ajouté des données sur les débits Internet de quelques-unes des plus grandes villes de la région.

Le Maroc est premier en matière de vitesse de téléchargement haut débit fixe, et l’Égypte enregistre la plus importante progression

En octobre 2019, les pays d’Afrique du Nord atteignaient seulement la 123e place mondiale du classement Speedtest Global IndexTM s’intéressant aux vitesses de téléchargement haut débit fixe. Dans la région Afrique du Nord et entre le 2e et le 3e trimestre 2019, c’est le Maroc qui affichait la vitesse de téléchargement moyenne la plus rapide pour le haut débit fixe avec une valeur de 15,38 Mbits/s. L’Internet du pays est donc 69,0 % plus rapide qu’en Égypte, qui occupait la 2e place avec une vitesse de 9,10 Mbits/s. La Libye se classait 3e avec une vitesse de 8,92 Mbits/s, suivie par la Tunisie et l’Algérie avec une vitesse de 8,64 Mbits/s et 4,55 Mbits/s, respectivement.

Toutefois, c’est l’Égypte qui a le plus progressé en matière de vitesse de téléchargement haut débit fixe avec une augmentation incroyable de 55,5 % entre le 2e et le 3e trimestre 2019. Les quatre principaux fournisseurs d’accès à Internet en Égypte ont enregistré des débits plus élevés au cours de cette période avec des vitesses de téléchargement moyennes augmentant de 59,2 % pour WE Internet, 55,4 % pour Orange, 21,7 % pour Etisalat et 17,1 % pour Vodafone.

La Libye est le deuxième pays en Afrique du Nord dont la vitesse de téléchargement haut débit fixe s’est nettement améliorée avec une hausse de 29,9 %. La vitesse de téléchargement a augmenté de 27,2 % pour le Maroc et de 10,8 % pour la Tunisie. Pour le 2e et le 3e trimestre 2019, la vitesse de téléchargement moyenne pour le haut débit fixe a diminué de 6,2 % en Algérie.

Le Maroc affiche la vitesse de téléchargement moyenne sur mobile la plus rapide et progresse vite

Le Maroc, pays avec le débit Internet le plus rapide d’Afrique du Nord, était classé 54e du Speedtest Global Index en octobre 2019. La vitesse de téléchargement moyenne sur mobile du Maroc entre le 2e et le 3e trimestre 2019 était de 27,01 Mbits/s. Après le Maroc, la Tunisie était 2e avec une vitesse de 24,50 Mbits/s, l’Égypte 3e avec une vitesse de 16,86 Mbits/s, tandis que l’Algérie et la Libye étaient pratiquement ex aequo avec une vitesse de 9,63 Mbits/s et 9,62 Mbits/s respectivement.

Entre le 2e et le 3e trimestre 2019, le Maroc a enregistré la progression la plus importante en termes de vitesse de téléchargement moyenne sur mobile par rapport aux autres pays d’Afrique du Nord, avec une hausse de 24,5 %. Les trois principaux fournisseurs ont constaté des progrès en termes de vitesse pendant cette période : Maroc Telecom a rapporté une augmentation de 40,1 % pour la vitesse de téléchargement moyenne, tandis qu’inwi et Orange ont fait part d’une hausse de 11,9 % et 5,5 %, respectivement. La deuxième augmentation la plus importante en matière de vitesse de téléchargement moyenne a été enregistrée en Algérie avec une valeur de 20,5 %, suivie par la Tunisie (12,1 %) et la Libye (8,6 %). La vitesse de téléchargement moyenne sur mobile a diminué de 3,4 % en Égypte au cours de la même période.

La disponibilité de la 4G est très variable entre les pays d’Afrique du Nord

| Pays |

Disponibilité de la 4G |

| Maroc |

83,3% |

| Tunisie |

64,4% |

| Égypte |

60,9% |

| Algérie |

45,5% |

| Libye |

15,6% |

Entre le 2e et le 3e trimestre 2019, c’est au Maroc que la 4G était la plus disponible : les utilisateurs pouvaient accéder à la 4G LTE dans 83,3 % des emplacements étudiés. La Tunisie se classait 2e avec une disponibilité de la 4G égale à 64,4 %, l’Égypte était 3e avec 60,9 %, l’Algérie 4e avec 45,5 % et la Libye 5e avec 15,6 %.

Seuls deux pays affichent une majorité de temps passé sur la 4G

Nous avons exploité les données Speedtest relatives au temps passé pour mesurer la fréquence moyenne à laquelle les utilisateurs pouvaient se connecter à diverses technologies en Afrique du Nord entre le 2e et le 3e trimestre 2019. Le temps passé sur la 4G était plus important au Maroc avec 59,7 %, suivi par la Tunisie (53,4 %), l’Égypte (41,1 %), l’Algérie (39,8 %) et la Libye (13,3 %). Le temps passé sur la 3G était plus important en Libye avec 40,2 %, suivie par l’Algérie (35,5 %), l’Égypte (27,0 %), la Tunisie (26,1 %) et le Maroc (21,1 %). Le temps passé sur la 2G était plus important en Libye avec 25,1 %, suivie de très loin par l’Algérie (8,8 %), l’Égypte (6,0 %), la Tunisie (4,3 %) et le Maroc (3,7 %).

Le temps passé sans couverture était plus important en Libye avec 17,6 %, suivie par l’Égypte (17,5 %), le Maroc (13,9 %), la Tunisie (13,5 %) et l’Algérie (13,2 %).

Rabat enregistre les vitesses de téléchargement haut débit fixe et mobile moyennes les plus rapides

En étudiant certaines des plus grandes villes d’Afrique du Nord, nous avons constaté que Rabat et Casablanca (Maroc) présentaient les vitesses de téléchargement haut débit fixe moyennes les plus rapides entre le 2e et le 3e trimestre 2019. Tripoli (Libye) arrivait en 3e place. Si l’on s’intéresse aux autres extrêmes, c’est Oran (Algérie) qui présentait la vitesse de téléchargement haut débit fixe moyenne la plus lente pour la même période. Les données de la province d’Alger (Algérie) ont révélé que celle-ci était la deuxième ville avec la vitesse de téléchargement haut débit fixe la plus lente. Sfax (Tunisie) était la 3e ville avec la vitesse la plus lente.

Côté mobile, les villes de Rabat et de Casablanca se classaient encore 1re et 2e, respectivement, pour la vitesse de téléchargement moyenne la plus rapide entre le 2e et 3e trimestre 2019. Sfax atteignait la 3e place. Oran et Alger occupaient respectivement la 1re et la 2e place de la liste en matière de vitesses de téléchargement sur mobile moyennes les plus lentes pendant cette période. Tripoli était la 3e ville avec la vitesse la plus lente.

Les déploiements de la fibre et de la 5G ont le potentiel d’améliorer de façon notable la disponibilité et les débits Internet dans toute l’Afrique du Nord. Les augmentations de débits que nous avons constatées dans de nombreux pays de cette région entre le 2e et le 3e trimestre 2019 peuvent, si elles continuent, révolutionner l’expérience Internet des utilisateurs. Si vous êtes un fournisseur d’accès à Internet ou un opérateur mobile et que vous souhaitez plus d’informations sur comment nos données peuvent améliorer votre réseau, contactez-nous.