2020 was a difficult year for almost every nation in the world due to the ongoing COVID-19 pandemic. On the bright side, Speedtest Intelligence® reveals that every North African nation improved their mobile and fixed broadband speeds from Q2 2020 to Q1 2021, despite huge setbacks in the global economy.

This article explores the state of internet performance in the North African countries of Algeria, Egypt, Libya, Morocco and Tunisia from Q2 2020 through Q1 2021. We further examine which mobile and fixed broadband providers in those countries had the best speeds, consistency and 4G Availability during Q1 2021. Finally, we investigate internet performance and coverage in the largest metropolitan areas, and look at cell signal strength using data from Ookla Cell Analytics™.

Morocco has the fastest mobile download speeds in North Africa, Egypt is fastest for fixed broadband

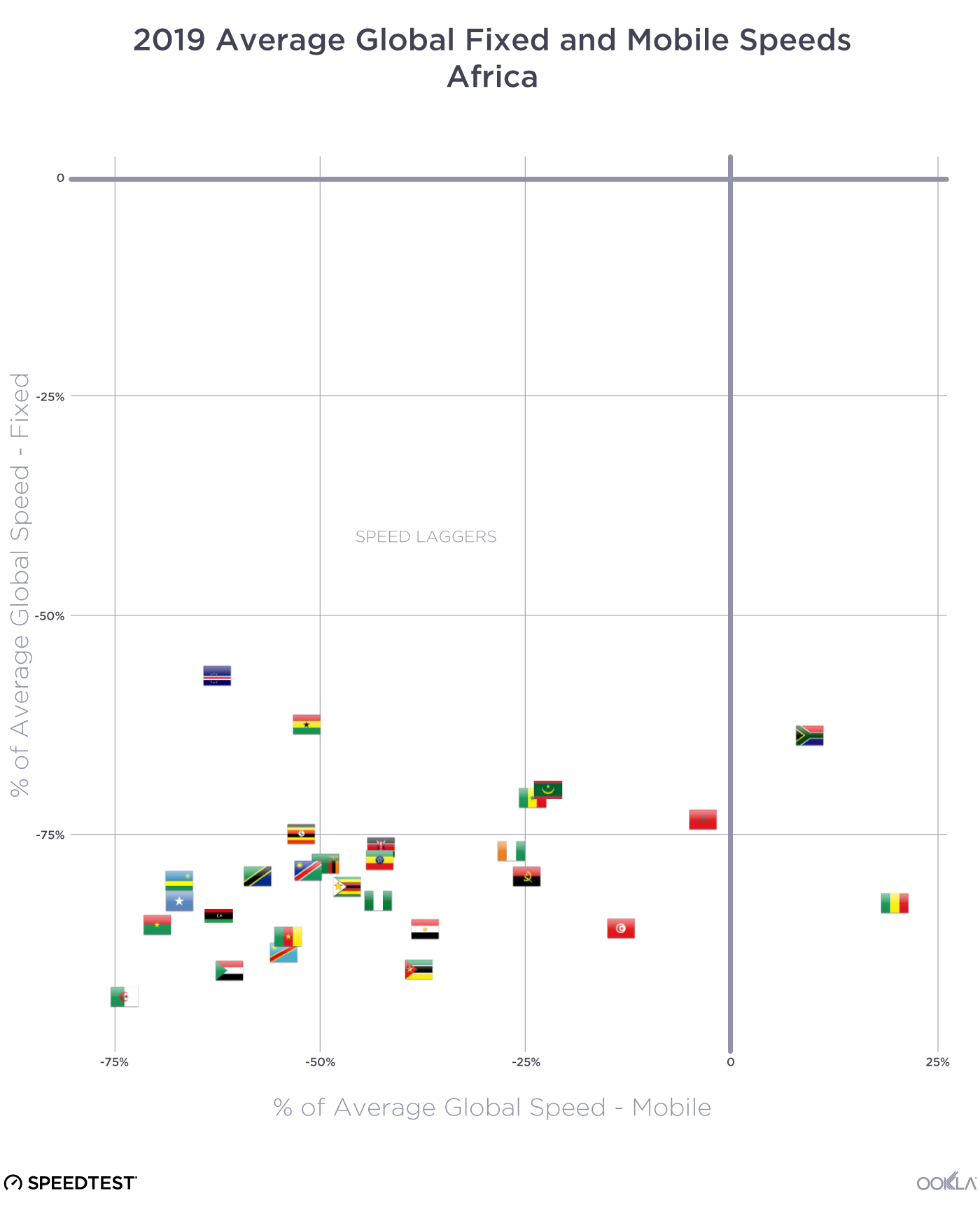

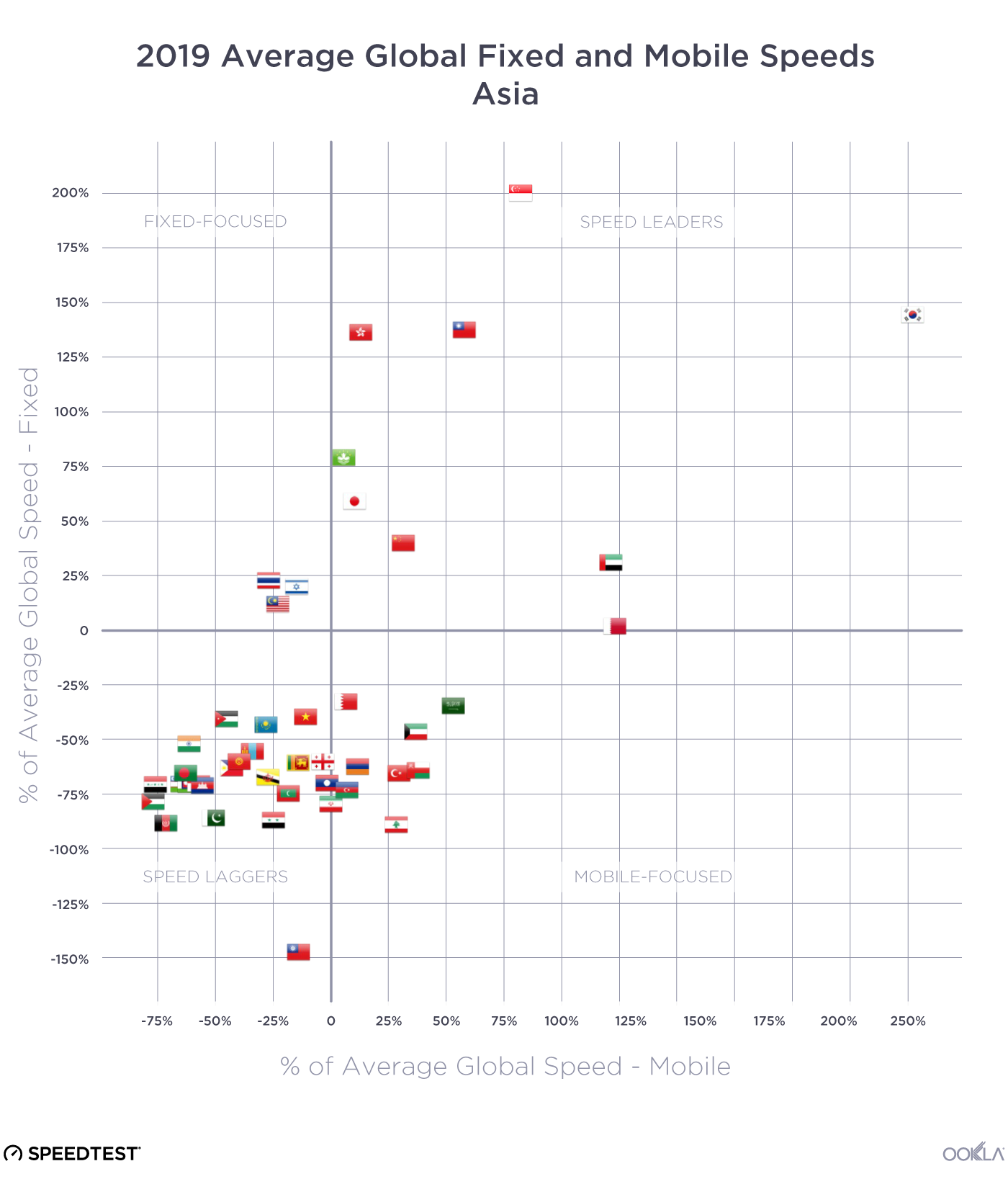

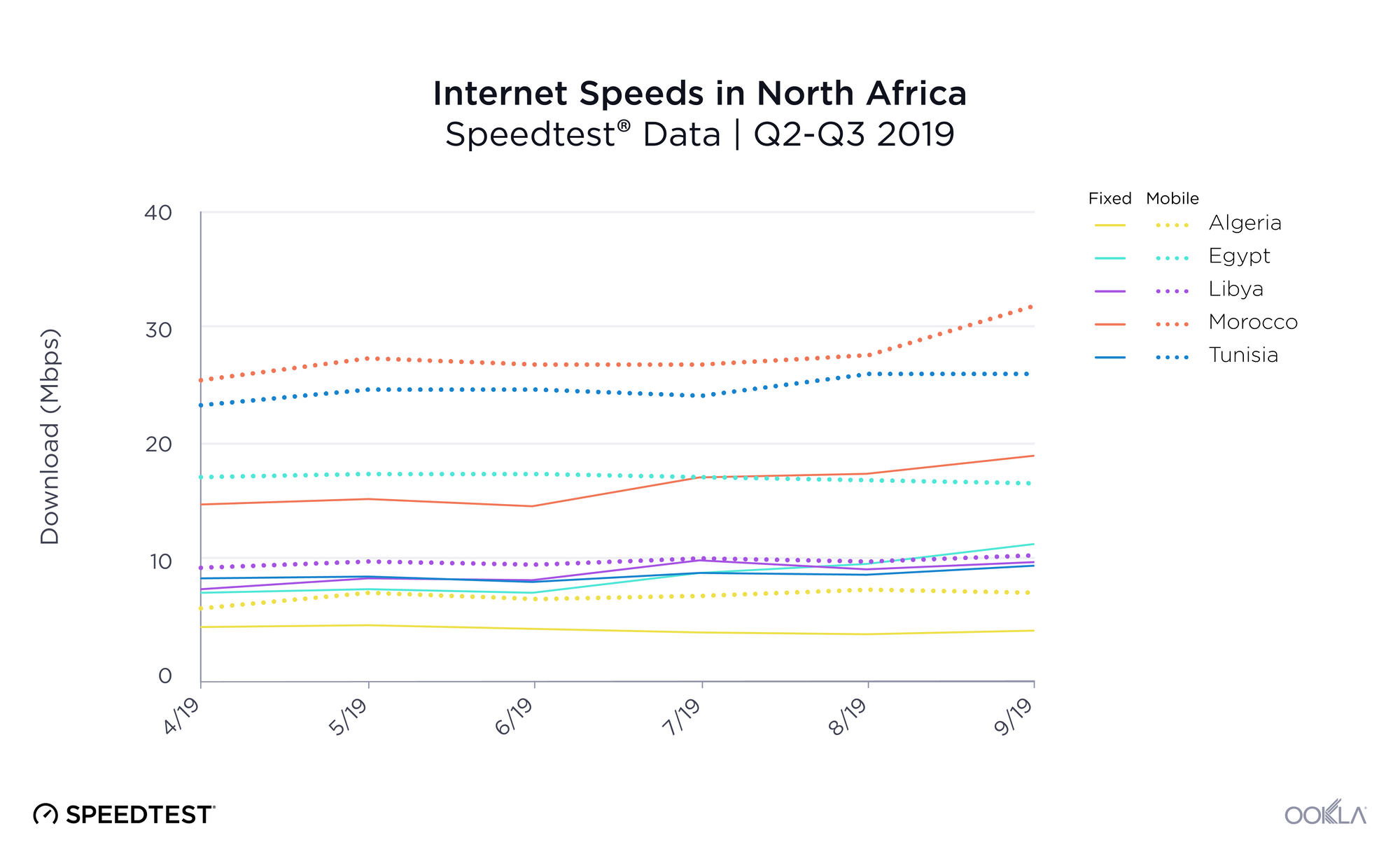

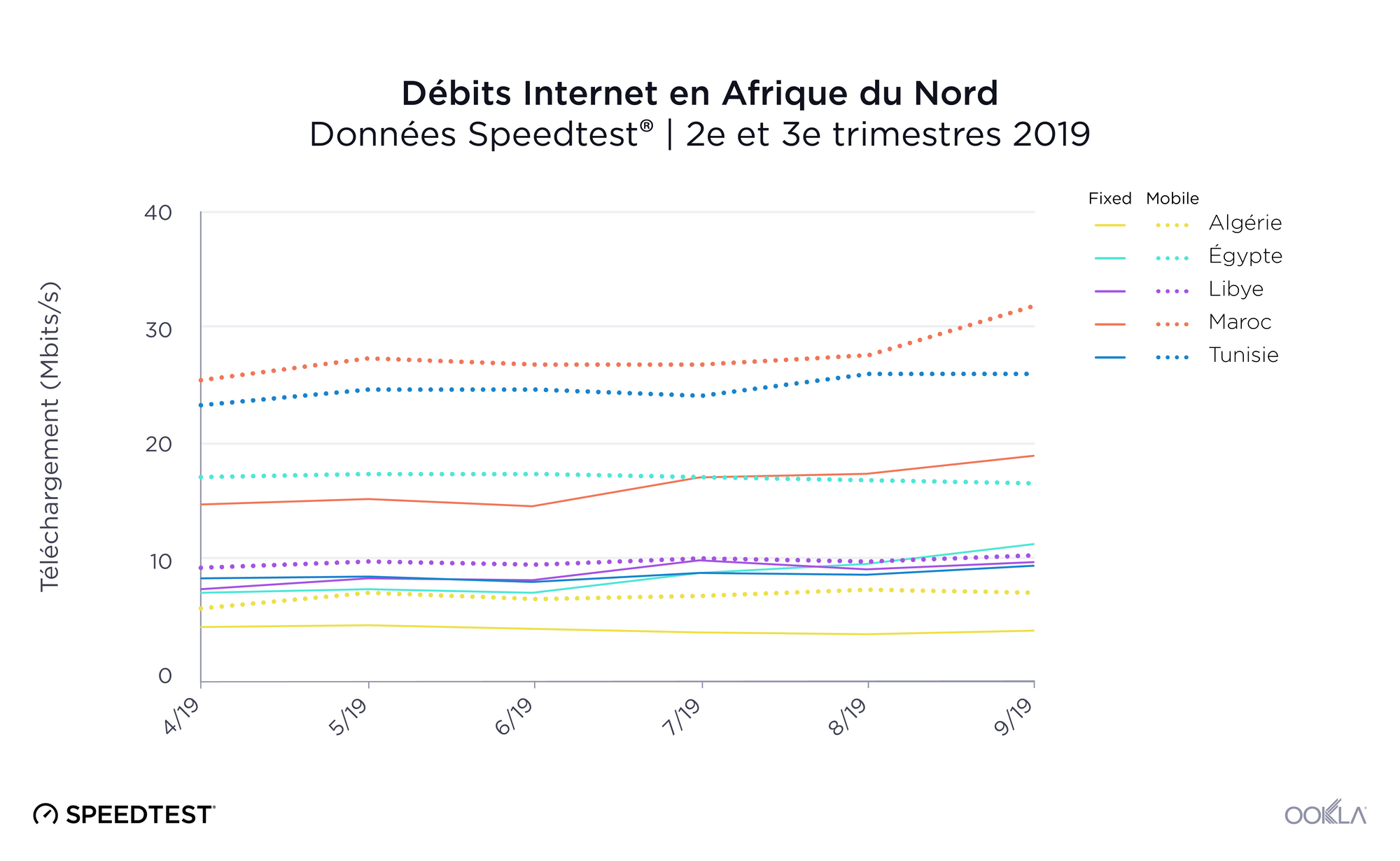

Analysis based on data from Speedtest Intelligence shows internet speeds varied widely across North Africa during Q1 2021, with every country except Egypt experiencing faster median mobile download speeds than fixed broadband speeds. Internet speeds over the past year — Q2 2020 to Q1 2021 — increased for both mobile and fixed broadband in every country in North Africa.

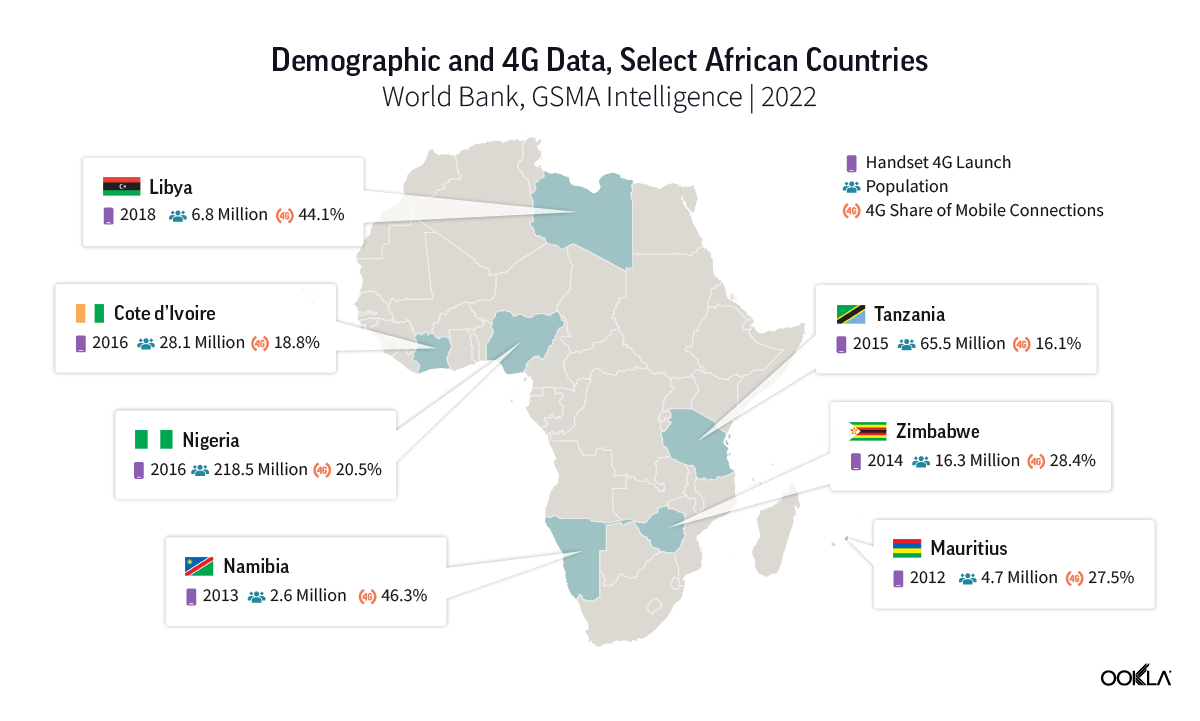

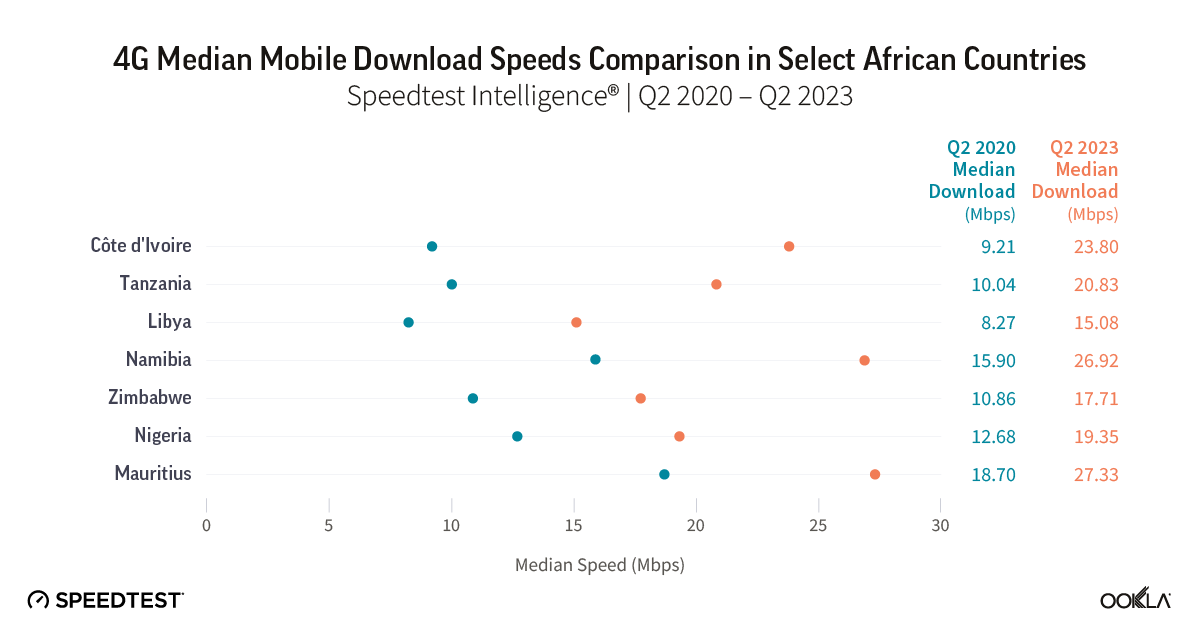

North Africa isn’t isolated in this improvement: earlier this year, Ookla® partnered with the World Bank to analyze internet performance in 18 African countries during the COVID-19 pandemic. This study showed that overall internet speeds slowed during lockdowns.

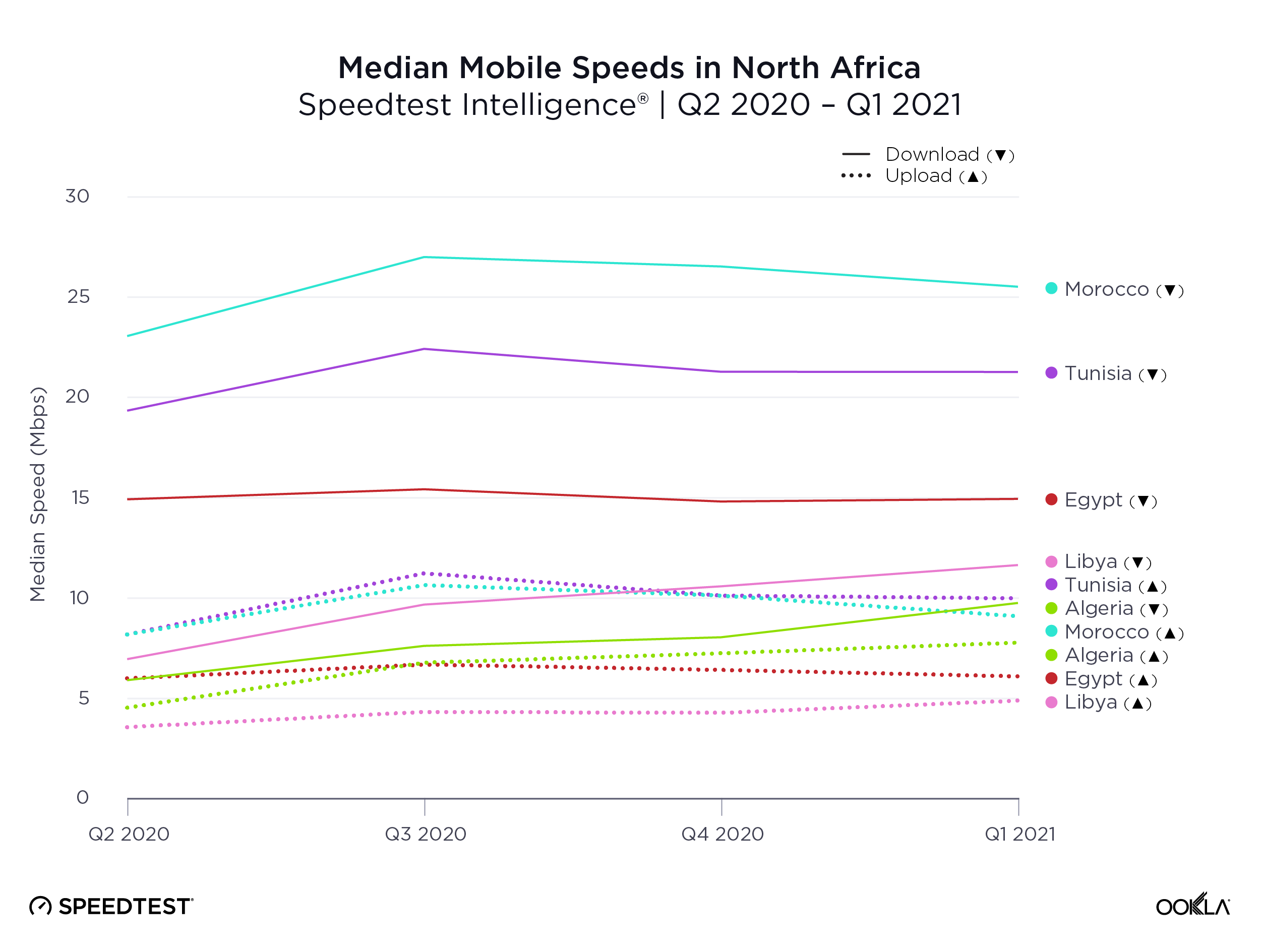

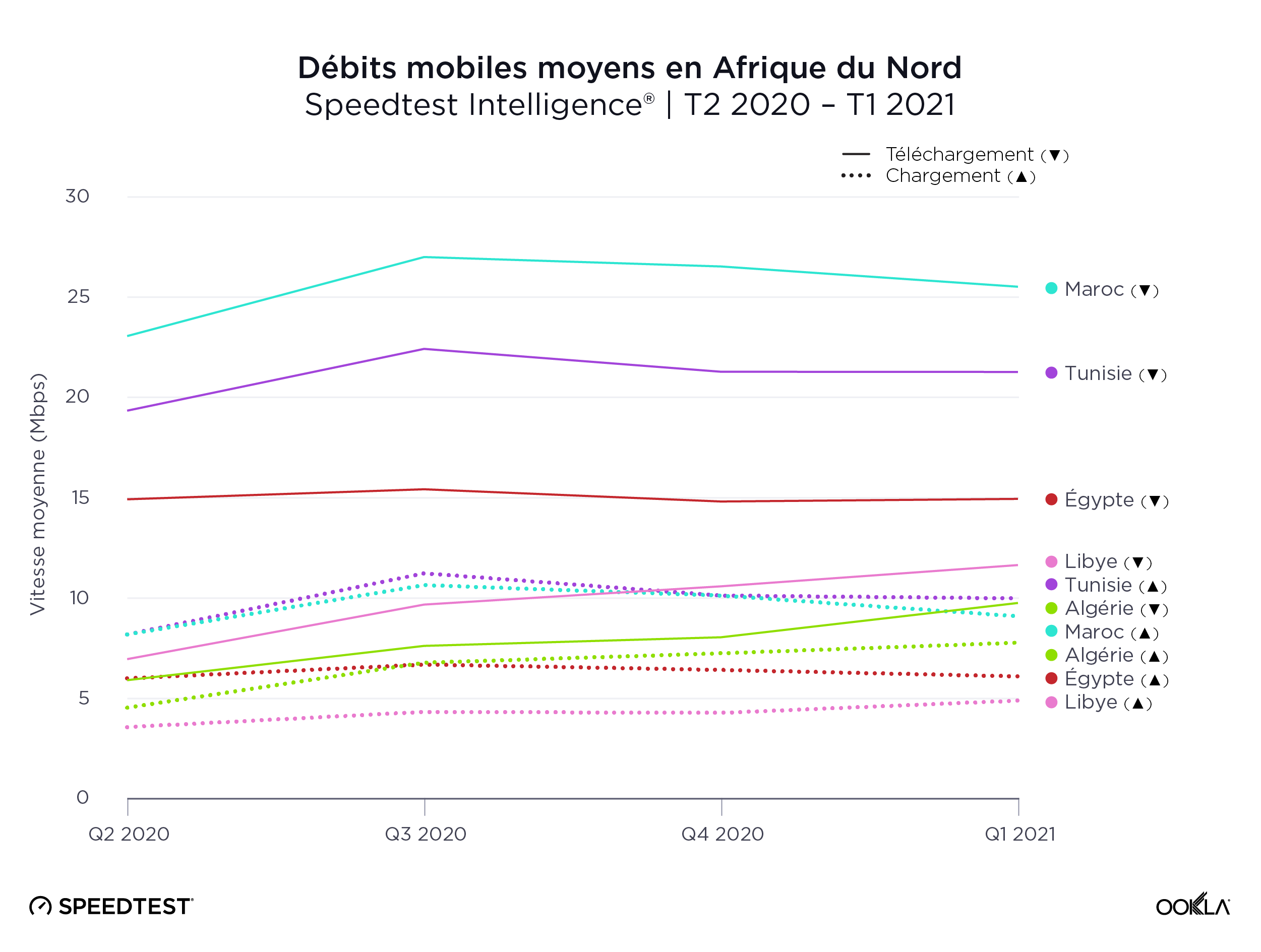

Mobile speeds increased across most of North Africa

Morocco had the fastest median mobile download speed (25.53 Mbps). Tunisia was second (21.28 Mbps), Egypt third (14.95 Mbps), Libya fourth (11.65 Mbps) and Algeria fifth (9.76 Mbps).

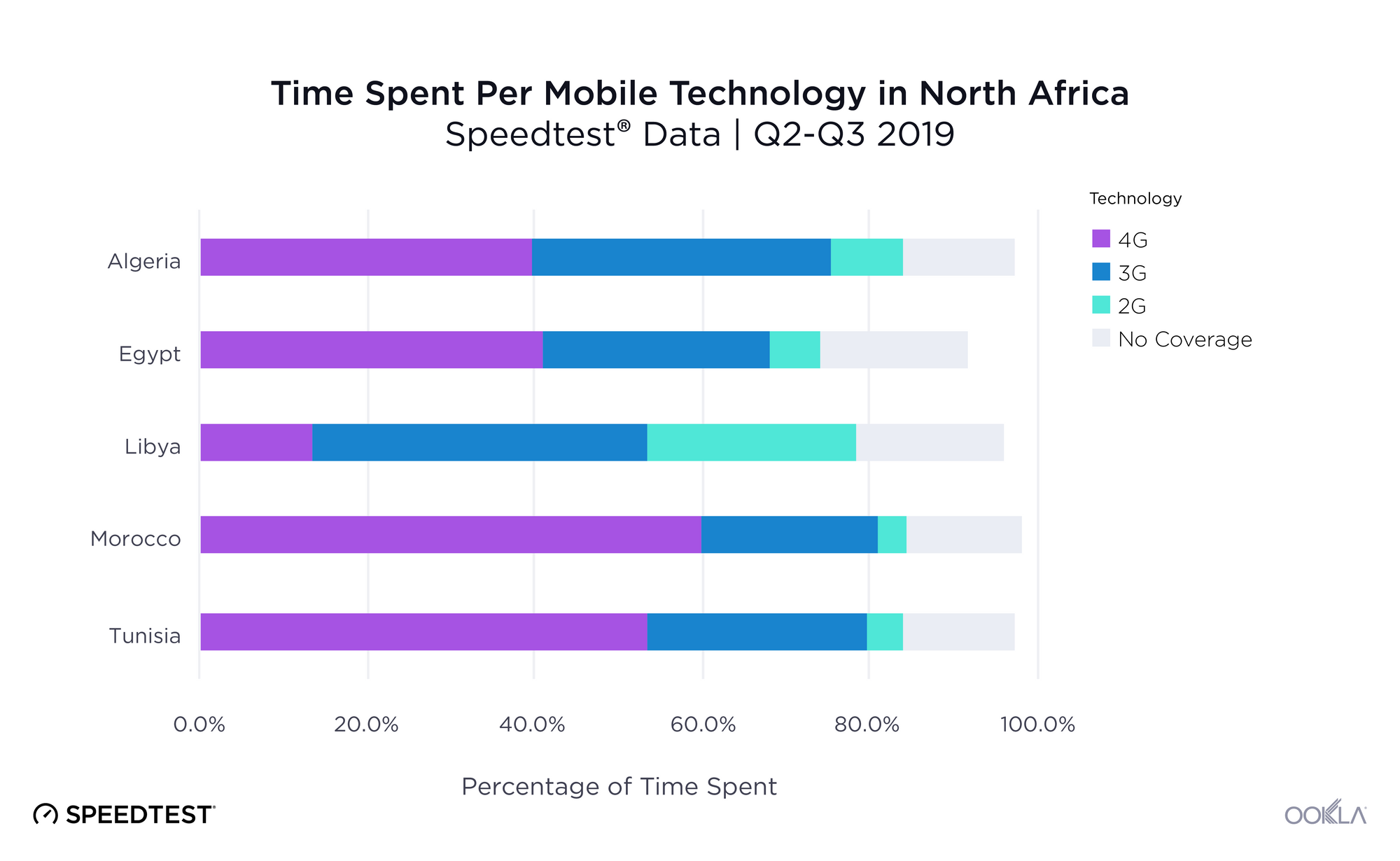

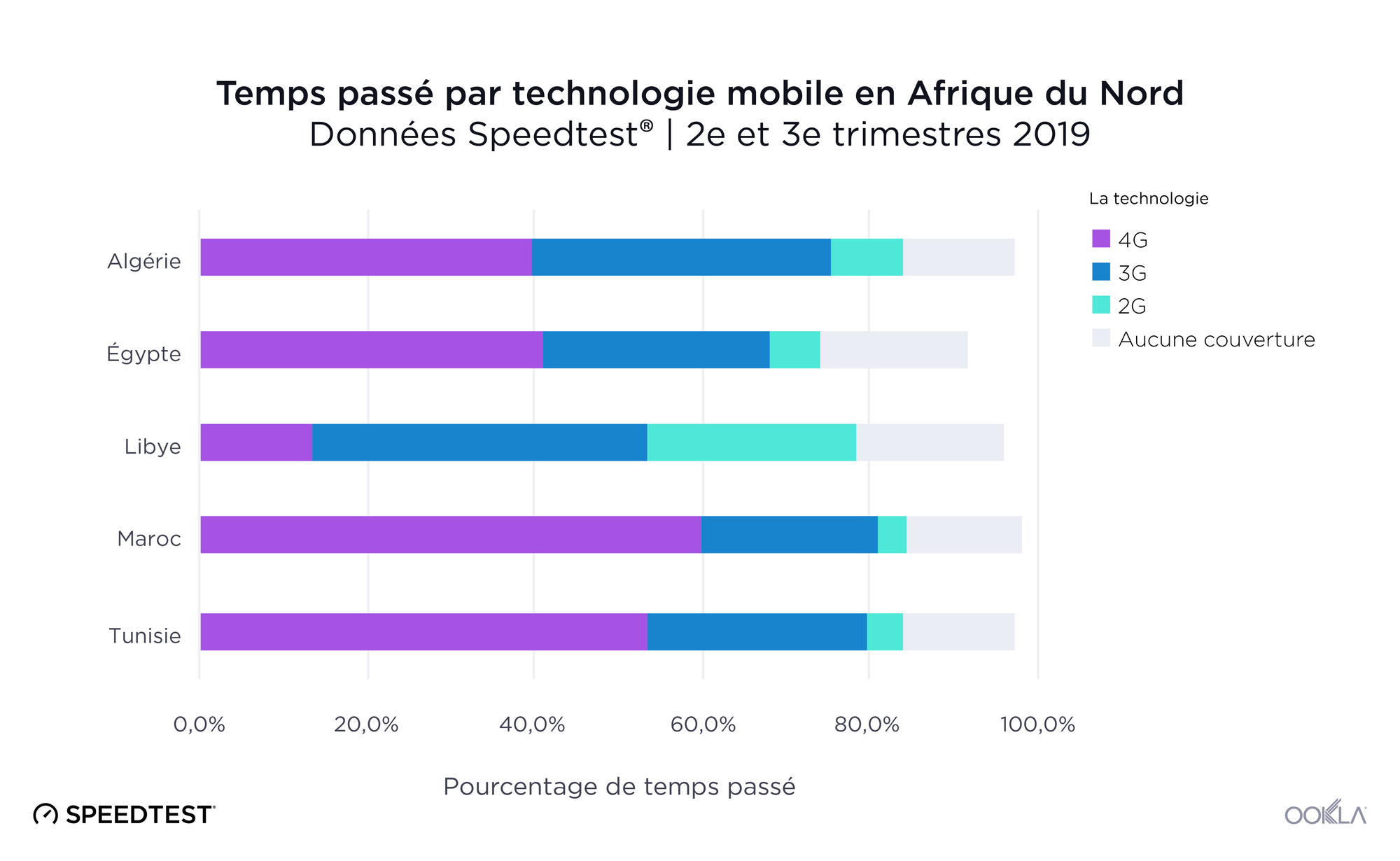

Many North Africans have become mobile-first internet users as 3G and 4G performance and coverage continue to improve. From Q2 2020 to Q1 2021, every North African country (except Egypt) saw large increases in median mobile download speeds, with Libya showing the largest percentage increase (67.4%) followed by Algeria (65.1%), Morocco (10.7%), Tunisia (10.0%) and Egypt (0.1%).

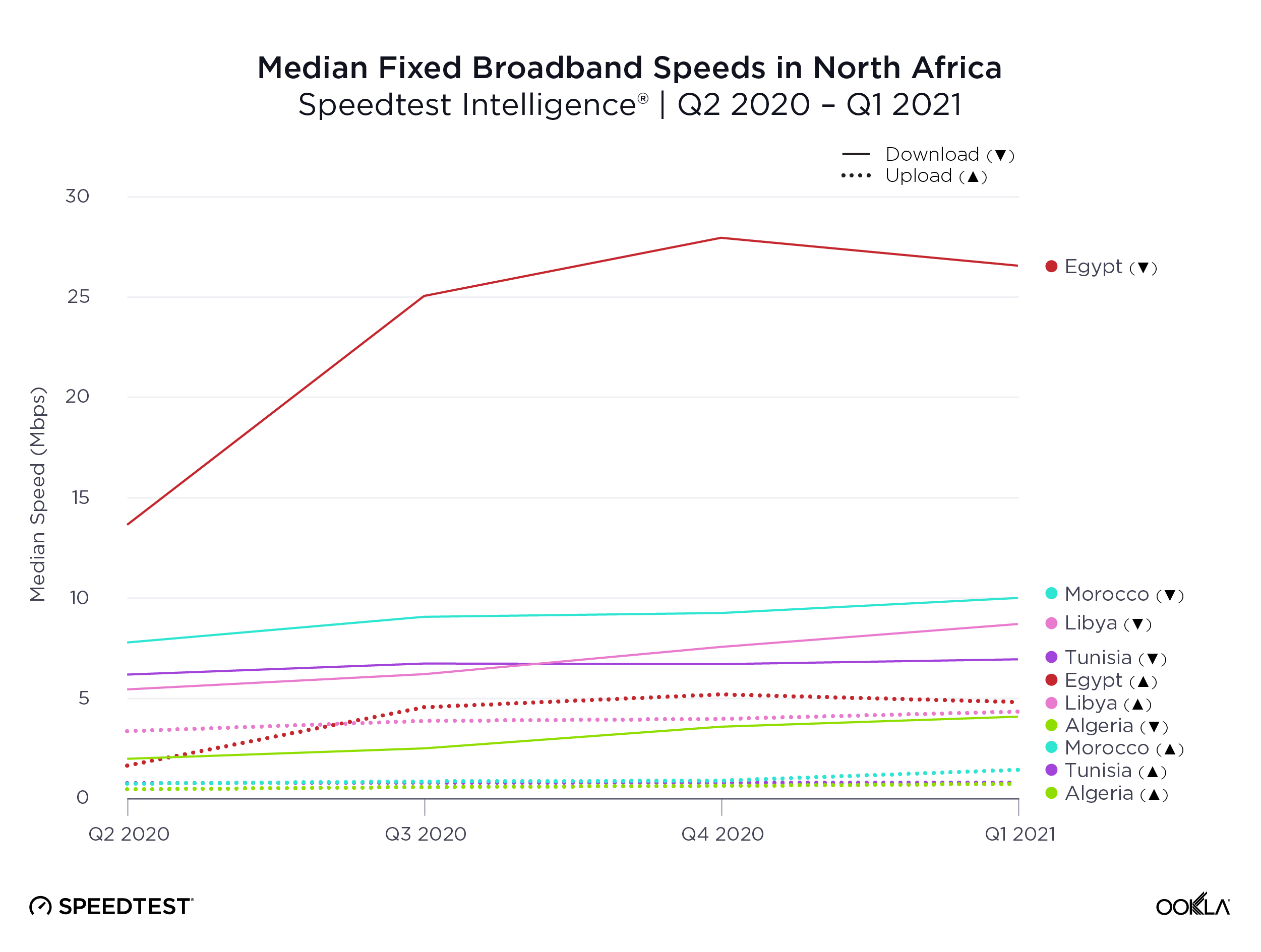

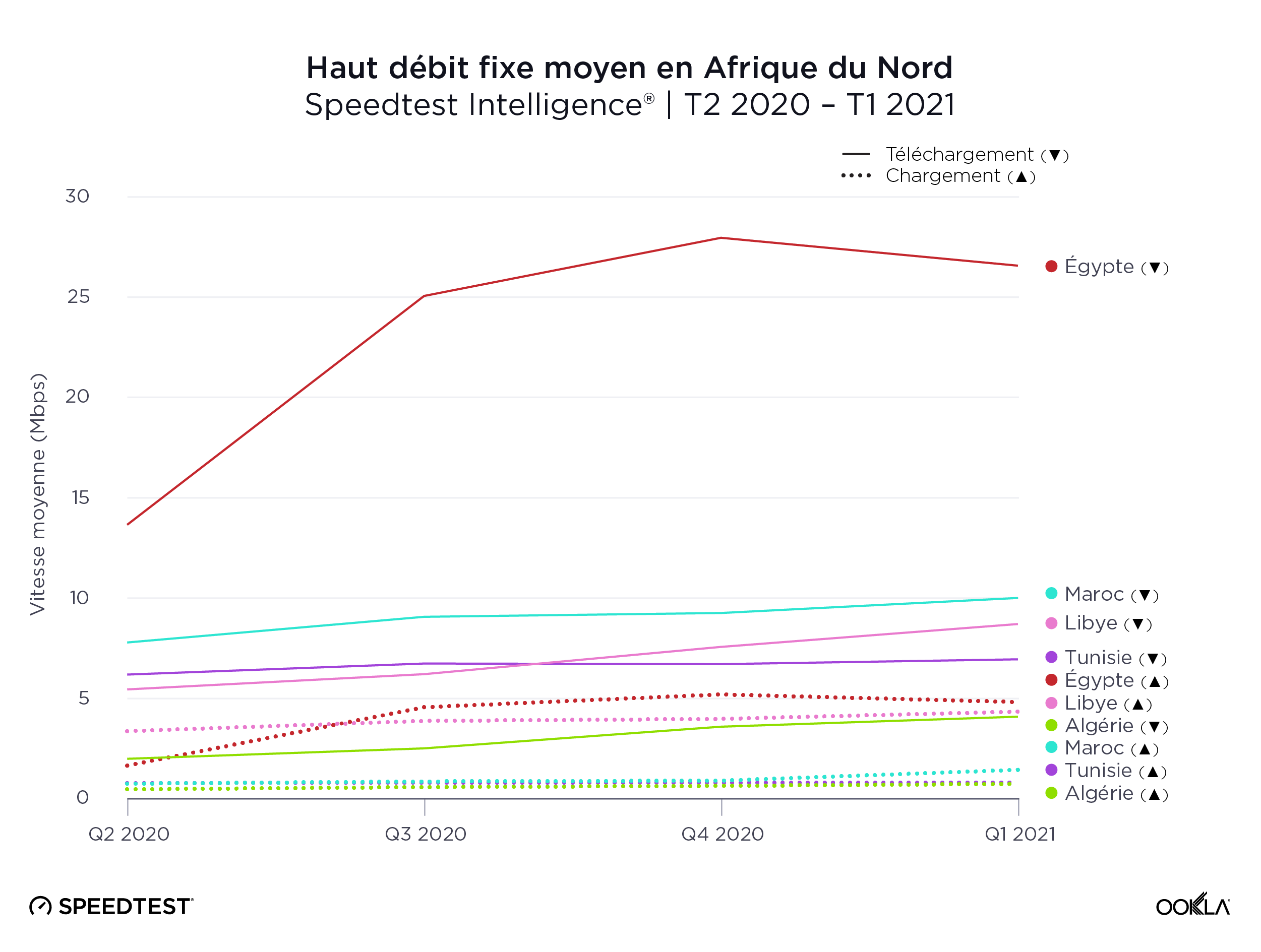

Egypt showed the fastest broadband speeds

While Egypt trails in mobile internet speeds, it excels for fixed broadband speeds. During Q1 2021, Egypt had the fastest median download speed over fixed broadband in North Africa at 26.58Mbps (4.82 Mbps upload). Morocco was second for download (10.01 Mbps), Libya was third (8.71 Mbps), Tunisia was fourth (6.95 Mbps) and Algeria fifth (4.09 Mbps).

Every country in North Africa, with the exception of Tunisia, saw its median fixed broadband speeds improve more than 25% from Q2 2020 to Q1 2021, with Algeria more than doubling its median fixed broadband download speed at 105.5%. Egypt was second most improved at 94.6%, Libya was third (59.8%), Morocco was fourth (28.5%) and Tunisia was fifth at 12.3%.

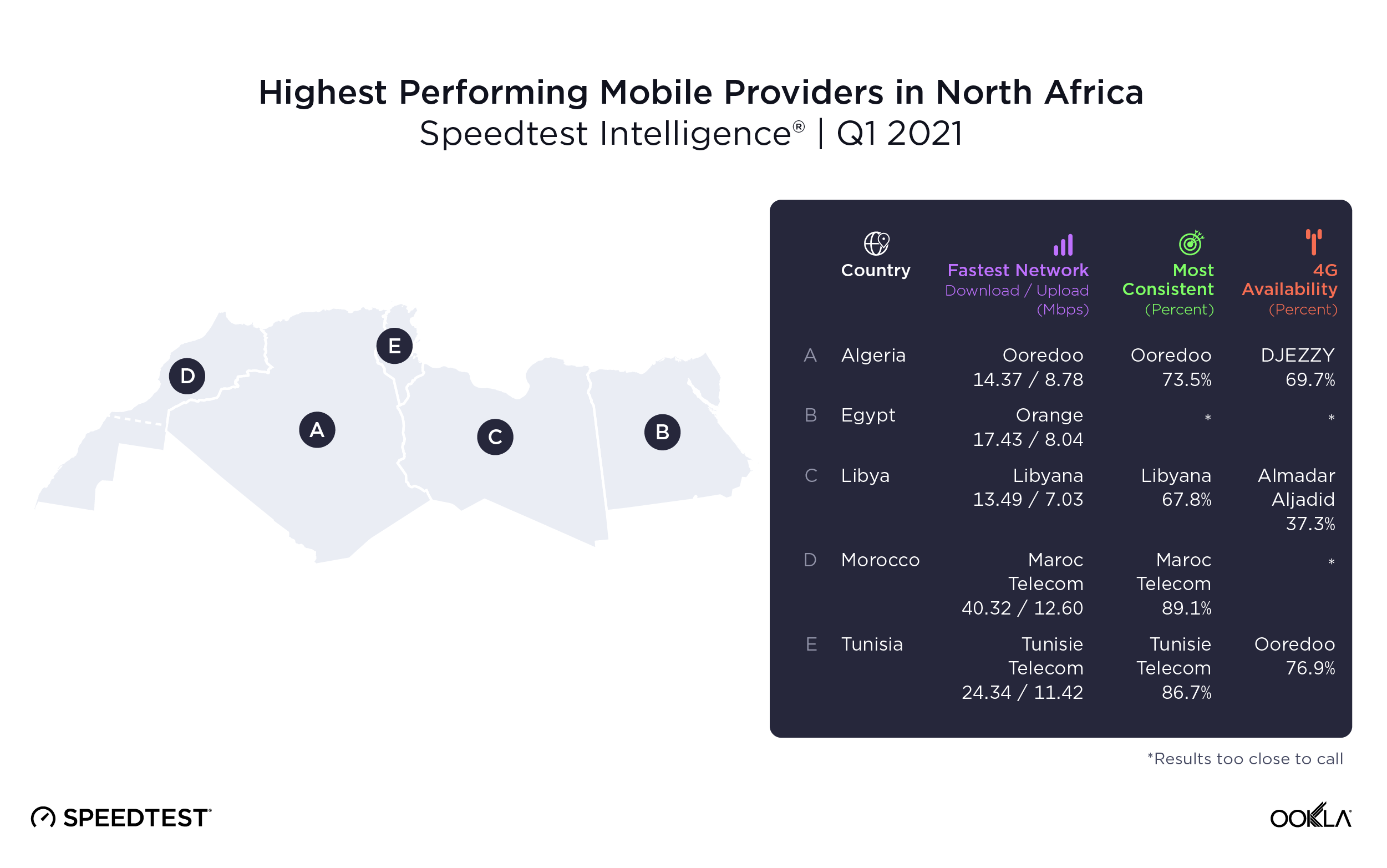

Performance by provider varied widely by country

During Q1 2021, North African mobile operators showed a wide range of performance across the region. Morocco’s Maroc Telecom had the fastest median mobile download and upload speeds in North Africa during Q1 2021 at 40.32 Mbps and 12.60 Mbps, respectively. Egypt’s WE Internet had the fastest median download speed over fixed broadband at 30.60 Mbps while Libya’s LTC had the fastest median upload speed at 7.46 Mbps.

Morocco had the best 4G Availability in North Africa during Q1 2021 with all three of its top providers leading the region, including: inwi (78.6%), Maroc Telecom (78.0%) and Orange (77.4%). Outside of Morocco, Tunisia’s Ooredoo had the next best 4G Availability at 76.9%.

Mobile consistency varied widely across North Africa during Q1 2021, with Morocco’s Maroc Telecom showing the best consistency at 89.1%. Tunisia’s Tunisie Telecom had the next best consistency at 86.7%.

Fastest mobile operator in North African countries often showed highest consistency

Here’s how mobile in each North African country fared during Q1 2021:

Algeria | Egypt | Libya | Morocco | Tunisia

Algeria

Ooredoo had the fastest median mobile speeds in Algeria during Q1 2021 (14.37 Mbps download // 8.78 Mbps upload). DJEZZY ranked second (8.15 Mbps download // 7.68 Mbps upload) and Mobilis was third (6.46 Mbps download // 6.03 Mbps upload). Ooredoo had the highest mobile Consistency Score™ (73.5%) followed by DJEZZY in second (55.9%) and Mobilis in third (51.9%). DJEZZY had the best 4G Availability at 69.7%, followed by Ooredoo in second (65.8%) and Mobilis in third (54.5%).

Egypt

During Q1 2021, Orange had the fastest median download and upload speeds over mobile in Egypt at 17.43 Mbps and 8.04 Mbps, respectively. Coming in second fastest, We had a median download speed at 15.56 Mbps (6.95 Mbps upload). Etisalat was third (15.20 Mbps download // 7.28 Mbps upload). Vodafone ranked last among top providers (13.11 Mbps download and 4.67 Mbps upload).

There was no clear statistical winner for mobile consistency in Egypt during Q1 2021: Orange had a Consistency Score of 77.8% and We had 77.7%. Etisalat ranked third at 74.7% while Vodafone came in last at 69.5%. There was also no statistical winner for 4G Availability, though Etisalat achieved 68.3%, Vodafone 67.7% and We 67.4%. Orange showed the lowest 4G Availability at 61.1%.

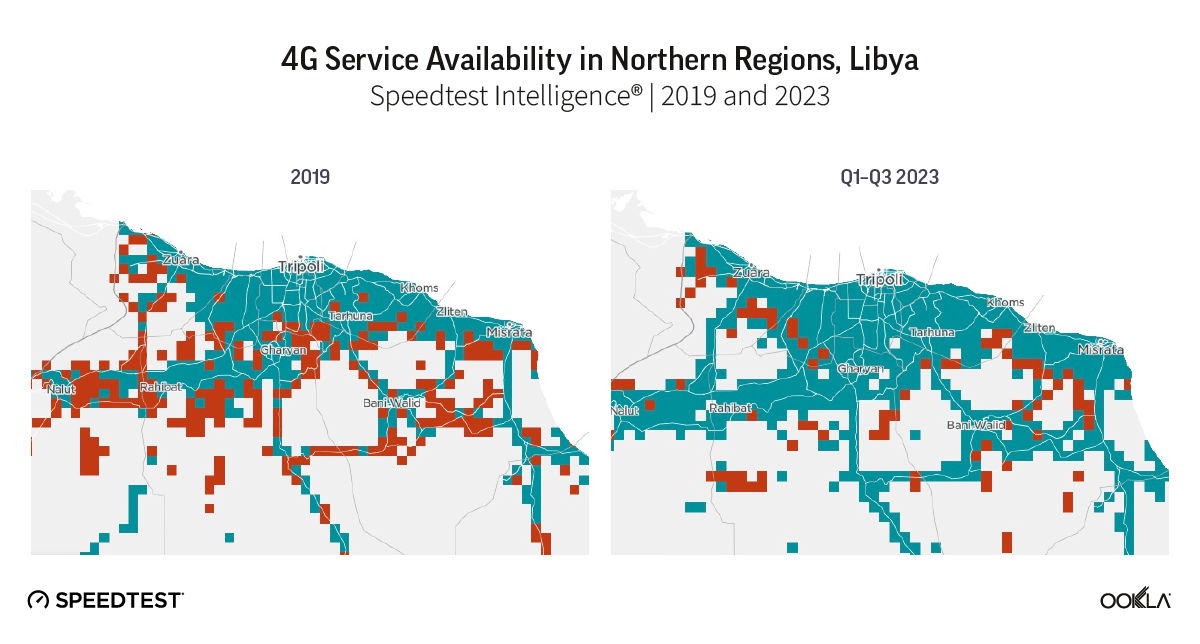

Libya

During Q1 2021, Libyana had the fastest median download and upload speeds over mobile in Libya at 13.49 Mbps and 7.03 Mbps, respectively, as well as the best mobile consistency with a Consistency Score of 67.8%. Almadar Aljadid came in second for speeds (10.71 Mbps download // 3.62 Mbps upload) and mobile consistency (63.8%). Almadar Aljadid had the best 4G Availability at 37.3% while Libyana showed 30.5%.

Morocco

During Q1 2021, Maroc Telecom had the fastest median mobile download and upload speeds in Morocco, attaining 40.32 Mbps and 12.60 Mbps, respectively. inwi was second (19.00 Mbps download // 7.90 Mbps upload) and Orange was third (15.84 Mbps download // 6.17 Mbps upload).

Maroc Telecom also had the best mobile consistency with a Consistency Score of 89.1%, followed by inwi (74.8%) and Orange (71.0%). There was no statistical winner for best 4G Availability, though inwi achieved 78.6%, Maroc Telecom achieved 78.0% and Orange achieved 77.4% — all of which were some of the best 4G Availability scores in North Africa.

Tunisia

Tunisie Telecom has the fastest median mobile download and upload speeds in Tunisia during Q1 2021 at 24.34 Mbps and 11.42 Mbps, respectively. Ooredoo was second with 22.50 Mbps download and 10.26 Mbps upload. Orange was third with 16.24 Mbps download and 8.25 Mbps upload.

Tunisie Telecom also had the best mobile consistency with a Consistency Score of 86.7%. Ooredoo was second at 83.3% and Orange was third at 78.1%. Ooredoo had the best 4G Availability at 76.9%, while Tunisie Telecom and Orange trailed at 72.4% and 72.3%, respectively.

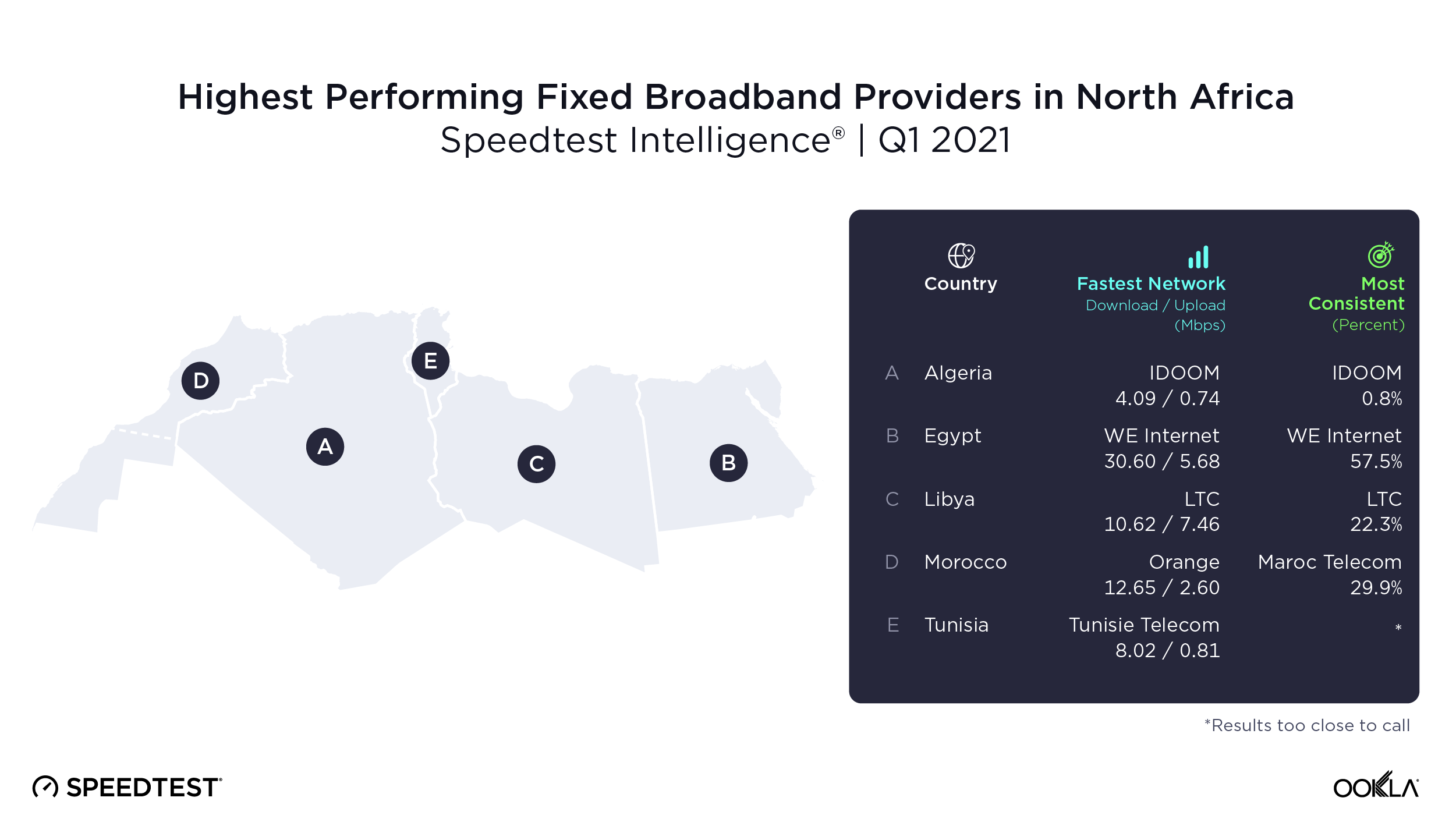

Fixed broadband in North Africa is slow, but Egyptian providers have the fastest speeds

Algeria | Egypt | Libya | Morocco | Tunisia

Algeria

IDOOM — the only fixed broadband provider that meets Ookla’s criteria as a top provider in Algeria in Q1 2021 — had a download speed of 4.09 Mbps (0.74 Mbps upload) and a Consistency Score of 0.8%.

Egypt

During Q1 2021, WE Internet led Egypt and North Africa with the fastest median fixed broadband download speed at 30.60 Mbps (5.68 Mbps upload), and the highest Consistency Score (57.5%). Vodafone was second for speeds (13.16 Mbps download // 1.65 Mbps upload), Orange was third (10.97 Mbps download // 0.82 Mbps upload) and Etisalat was fourth among top providers at 6.70 Mbps download and 0.81 Mbps upload.

Libya

LTC had the fastest median download and upload speeds over fixed broadband in Libya during Q1 2021 at 10.62 Mbps and 7.46 Mbps. LTC also had the highest fixed broadband Consistency Score at 22.3%. Libya Telecom followed at 8.31 Mbps download, 4.02 Mbps upload and a Consistency Score of 18.0%.

Morocco

Orange had the fastest median download speed over fixed broadband in Morocco during Q1 2021 at 12.65 Mbps (2.60 Mbps upload), while inwi had the best median upload speed at 4.18 Mbps (11.33 Mbps download). Maroc Telecom was third for fixed broadband speeds at 9.63 Mbps download and 0.81 Mbps upload. Maroc Telecom had the highest Consistency Score at 29.9%. Orange was second for consistency at 24.7% and inwi was third at 16.9%.

Tunisia

Tunisie Telecom had the fastest median download speed over fixed broadband in Tunisia during Q1 2021 at 8.02 Mbps (0.81 Mbps upload), while Ooredoo had the fastest median upload at 3.91 Mbps (7.03 Mbps download). TOPNET attained 7.12 Mbps download and 0.78 Mbps upload, followed by Orange (6.73 Mbps download // 0.94 Mbps upload) and Gnet (6.59 Mbps download // 0.77 Mbps upload).

There was no clear statistical winner for fixed broadband consistency, with Tunisie Telecom showing a Consistency Score of 10.6% and Ooredoo 10.1%. Orange was third at 4.6%, followed by Gnet (3.7%) and TOPNET (3.4%).

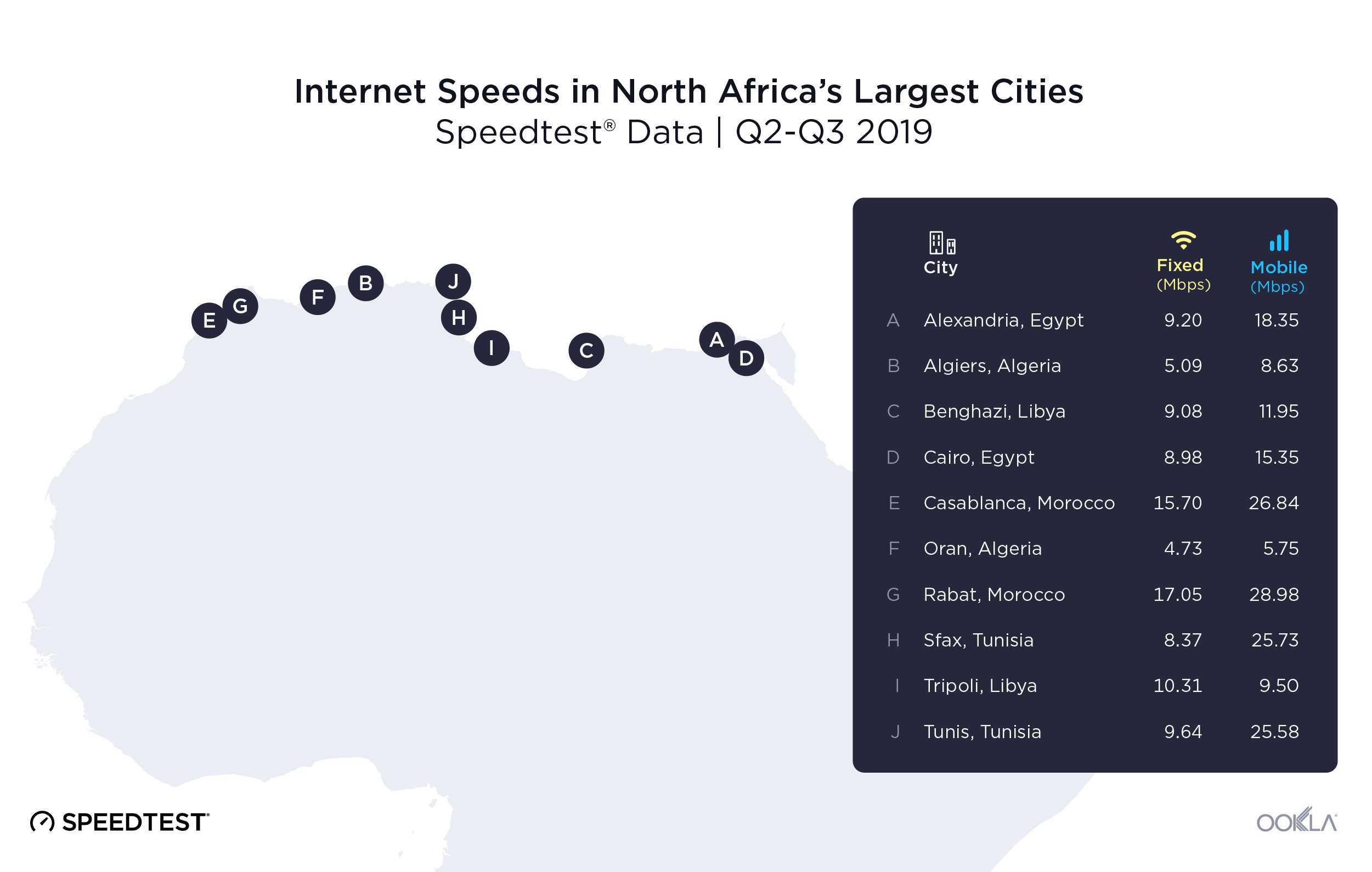

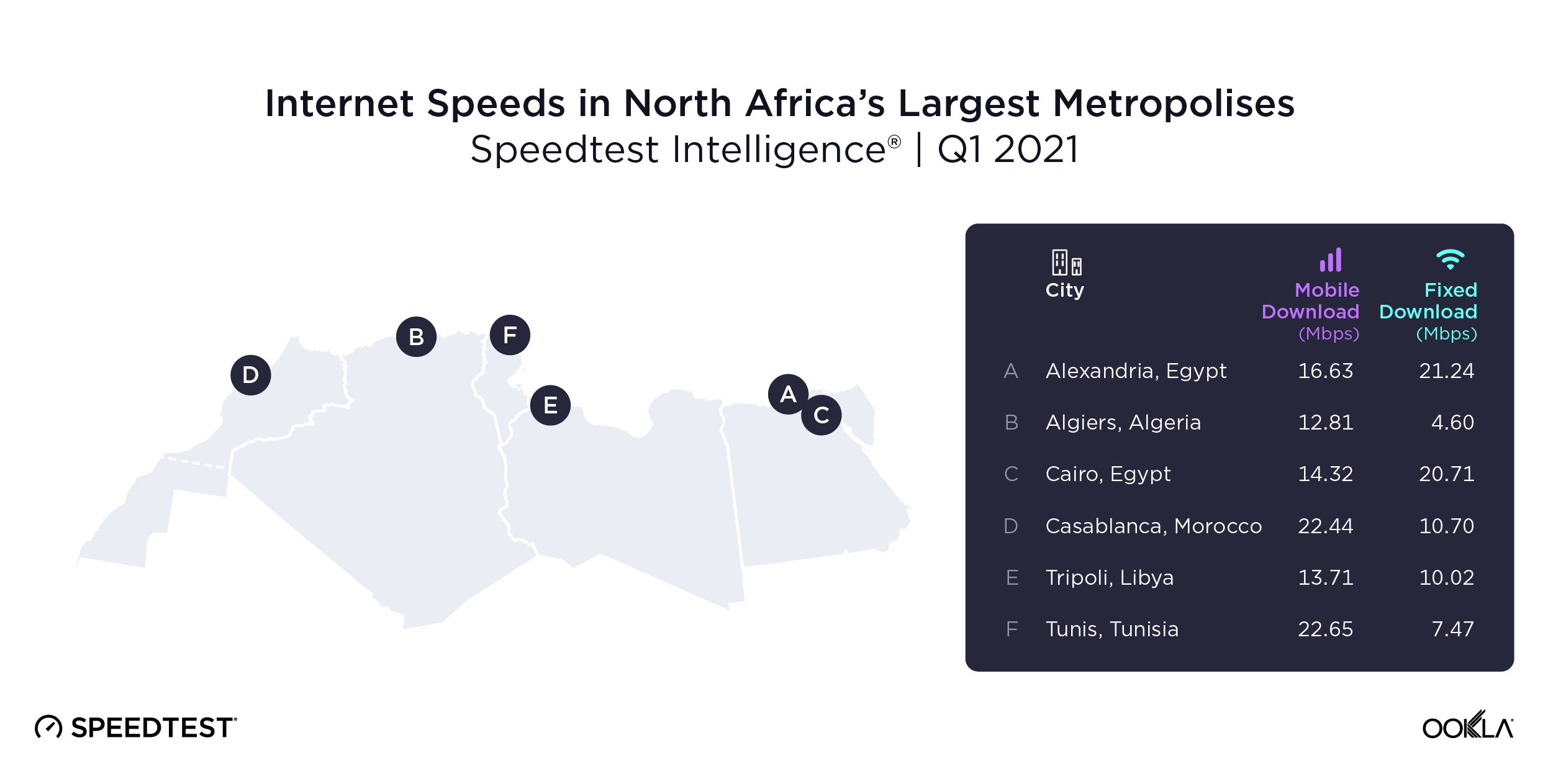

Tunis and Grand Casablanca had the fastest median mobile download speeds in North Africa, Alexandria Governorate had the fastest median fixed broadband speed

According to Speedtest Intelligence, Tunis, Tunisia and Grand Casablanca, Morocco had the fastest median mobile download speeds among North Africa’s most populous metropolitan areas during Q1 2021 at 22.65 Mbps and 22.44 Mbps, respectively. Alexandria Governorate, Egypt was third at 16.63 Mbps, followed by Cairo Governorate, Egypt (14.32 Mbps), Tripoli, Libya (13.71 Mbps) and Algiers, Algeria (12.81 Mbps).

Alexandria Governorate had the fastest median download speed over fixed broadband at 21.24 Mbps. Cairo Governorate was second at 20.71 Mbps, Grand Casablanca third (10.70 Mbps), Tripoli fourth (10.02 Mbps), Tunis fifth (7.47 Mbps) and Algiers sixth (4.60 Mbps).

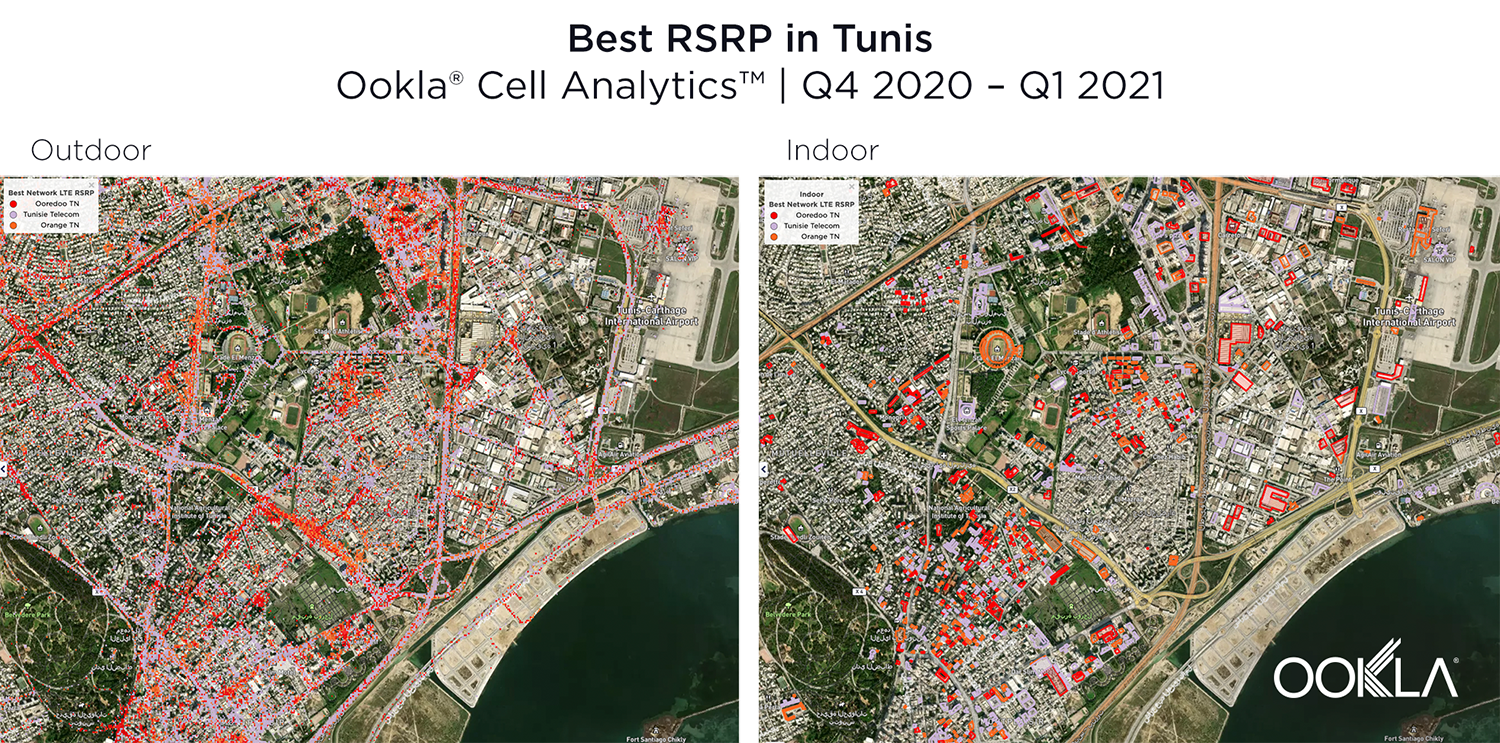

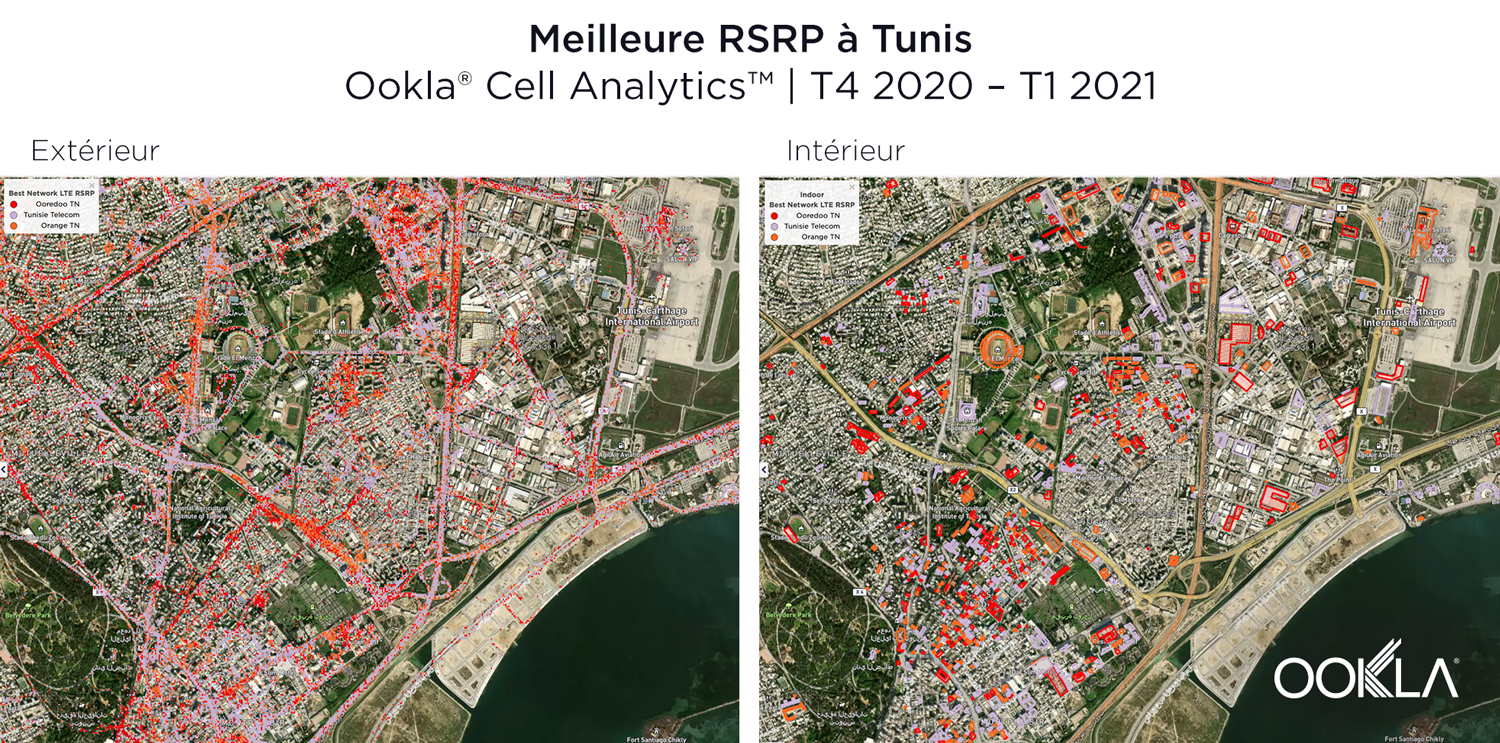

Cell Analytics paints a fascinating picture of North Africa cities

Ookla’s Cell Analytics™, is an invaluable tool to identify intelligence about wireless service quality, RF measurements (signal strength), data usage, user density (indoors and outdoors) and cell site locations for a given area. Cell Analytics can help mobile network operators improve their network and identify areas that need improvement with granular precision.

The maps below use Cell Analytics data from Q4 2020 to Q1 2021 to identify two items of interest in major North African cities: best provider for indoor and outdoor 4G LTE RSRP signal strength in a given area, and provider-level 4G LTE RSRP signal strength around key areas of interest. For indoor and outdoor 4G LTE RSRP maps, Cell Analytics identifies the best mobile network provider for a given area or building by color if there is a statistically significant winner. Provider-level maps show the performance of individual providers for a given area, with pink and red colors showing a strong signal and blue colors indicating a weak signal.

Scroll down for Cell Analytics maps of major North African cities or click on a city below:

Alexandria | Algiers | Cairo | Casablanca | Tripoli | Tunis

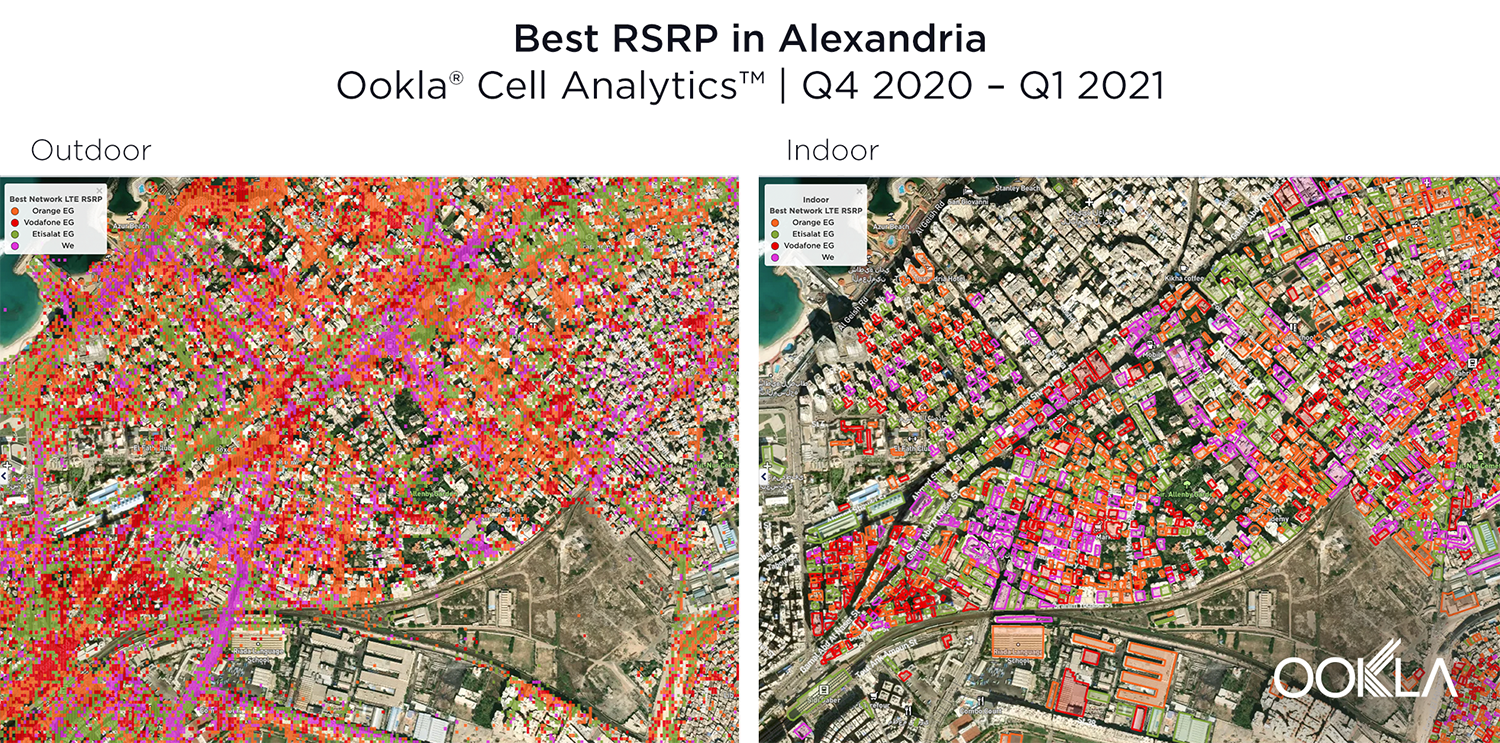

Alexandria

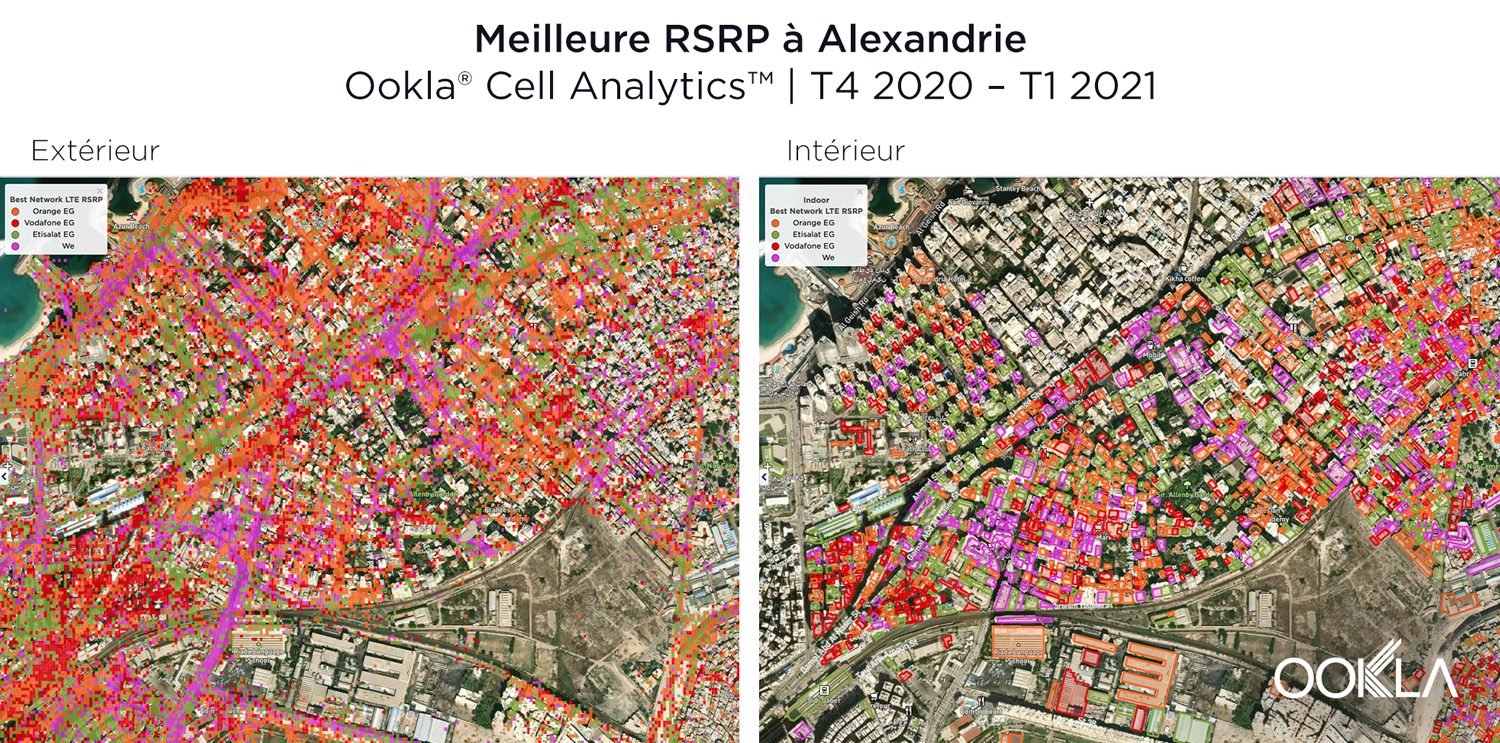

The Library of Alexandria has been lost to time but Bibliotheca Alexandrina stands as a testament to what the world has lost and as a major cultural center for Egypt. In the bustling metropolis, the 4G LTE RSRP maps below paint two different stories: the best mobile outdoor network signal strength and the best indoor network signal strength in Alexandria during Q4 2020 to Q1 2021. It’s clear that different providers provide the strongest cell signal in different parts of the city and that some buildings are better served than others.

While it’s good to know where the best provider is in the places you frequent, Ookla Cell Analytics can also map 4G LTE RSRP (signal strength) results from each provider, shown below. The red areas show strong signals, while the blue areas show weak signals.

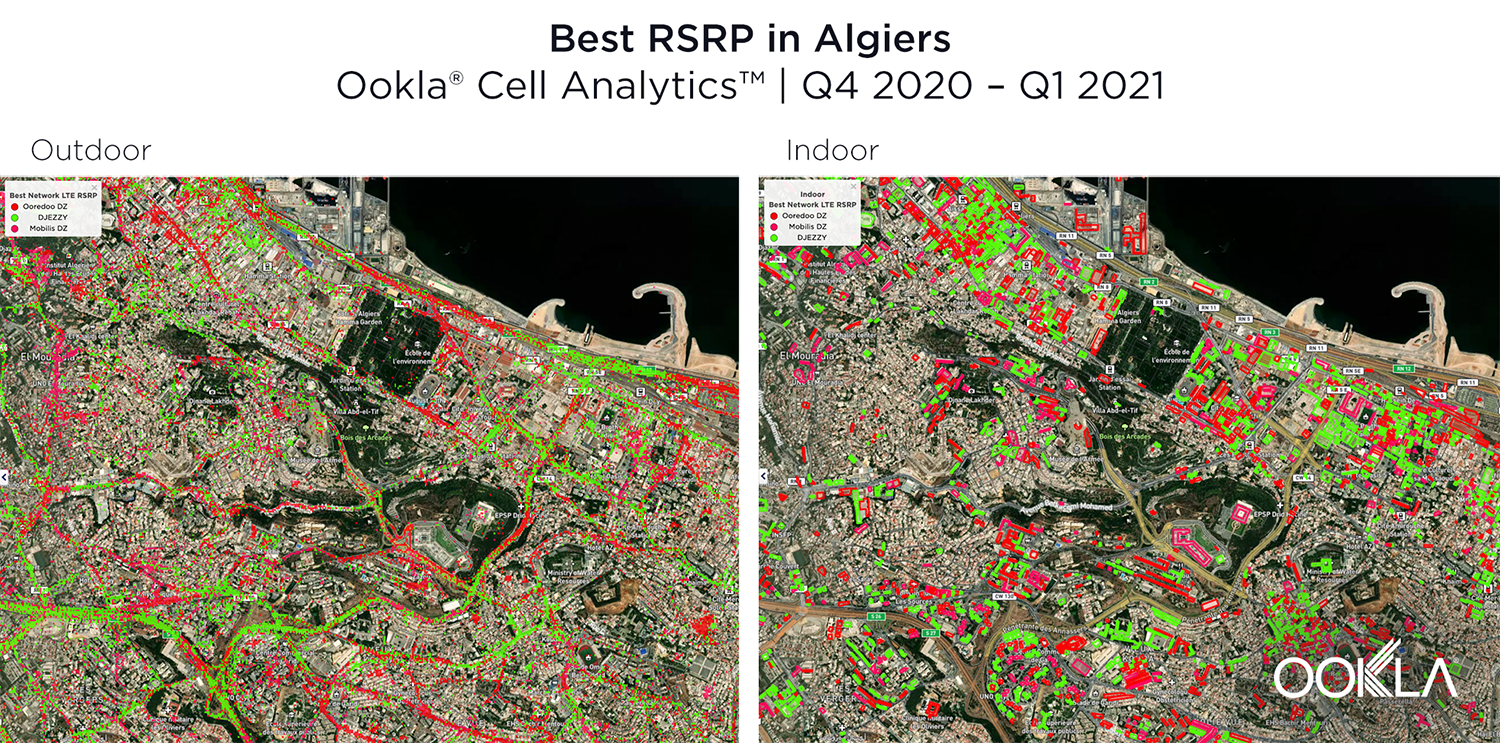

Algiers

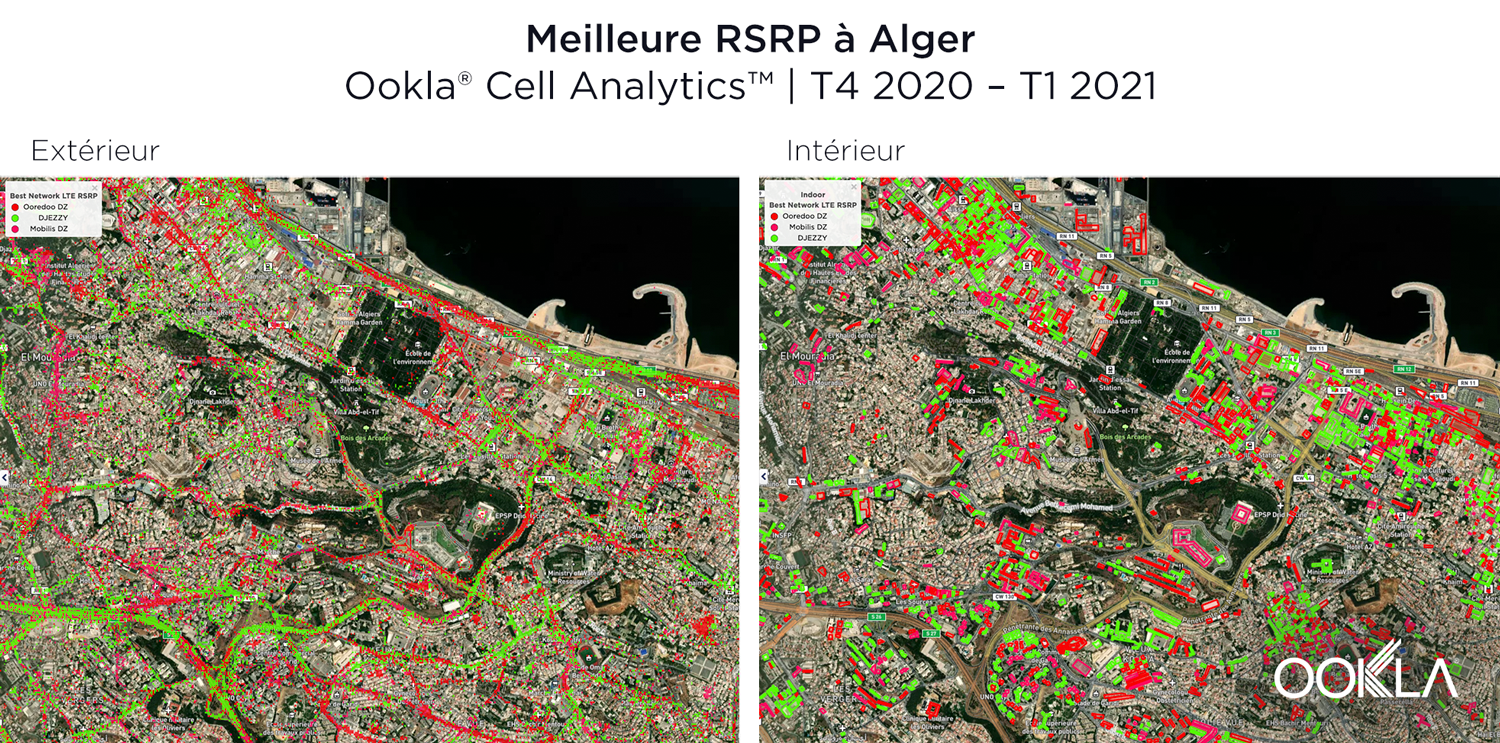

Algiers’ Botanical Garden Hamma is a vibrant green space in a thriving city. It’s also a good geographic point to test mobile performance. The first two maps below show the best network providers for outdoor (left) and indoor (right) 4G LTE RSRP signal strength in the area.

The next three maps show individual providers’ 4G LTE RSRP signal strength, with red being the strongest signals and blue being the weakest signals.

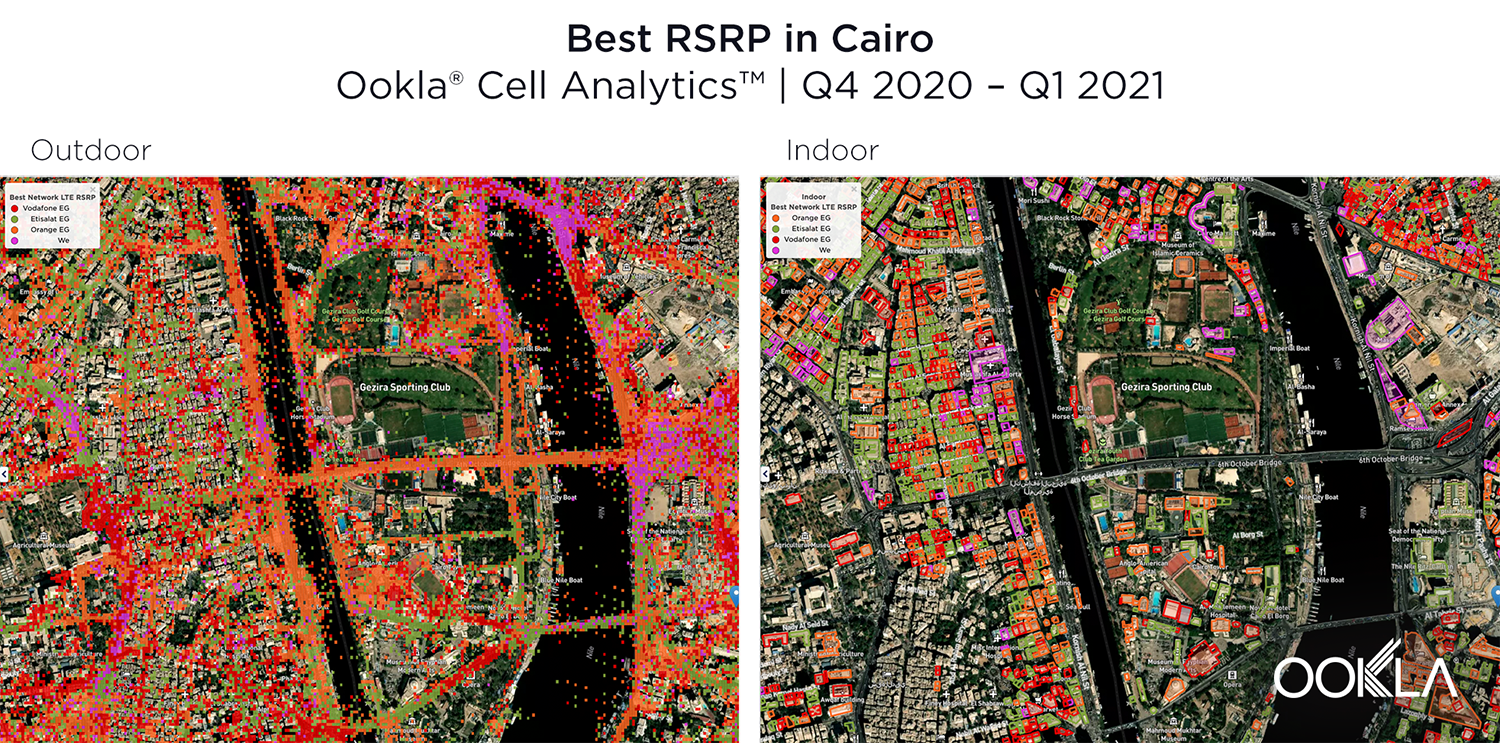

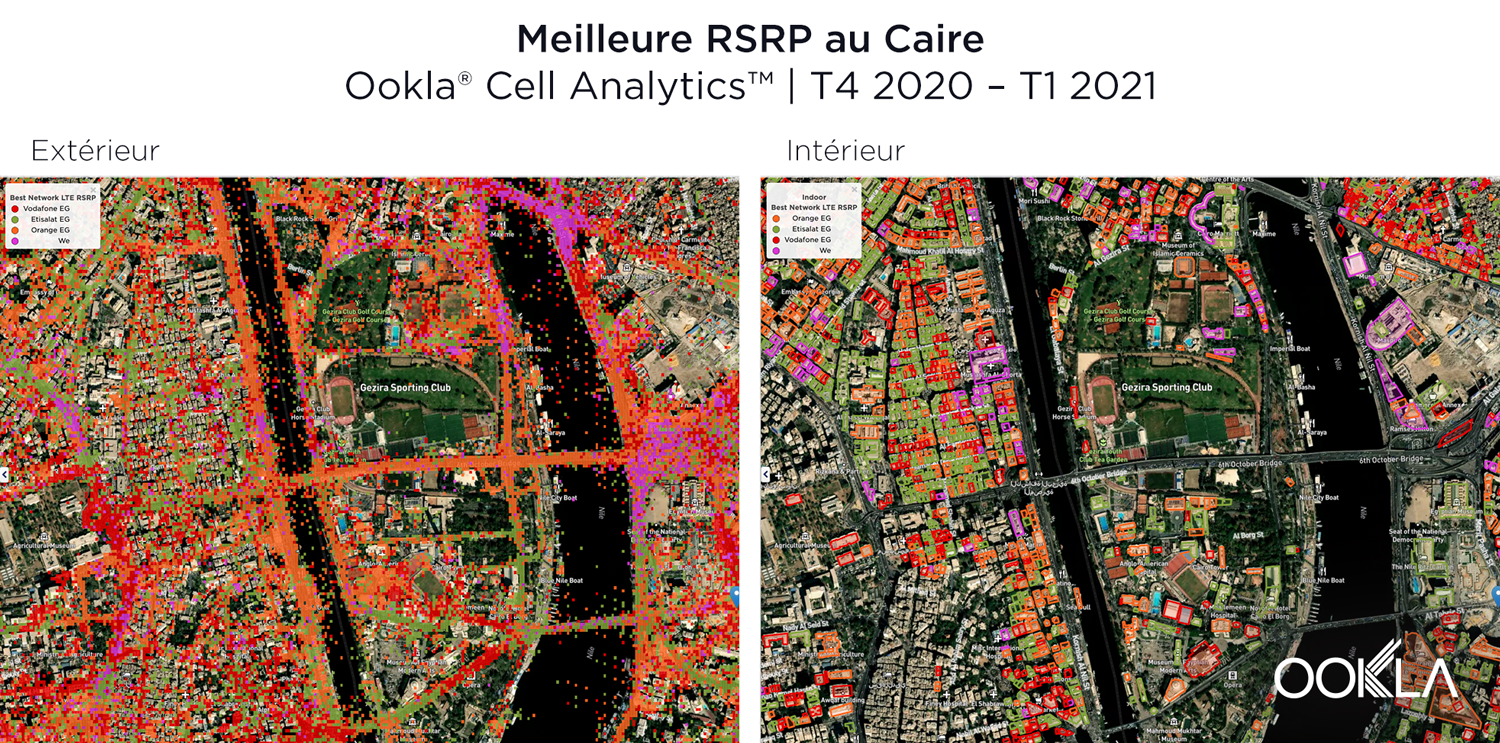

Cairo

Located in the heart of Cairo, the Gezira Sporting Club offers an island view of the bustling city. The following maps show the best network providers for outdoor (left) and indoor (right) 4G LTE RSRP signal strength in the area:

Across the river just to the east of Gezira Sporting Club lies the world famous Egyptian Museum. With mobile service at a premium in the busy area, Cell Analytics shows the 4G LTE RSRP signal strength for top providers. The following maps show red areas where the signal is strongest to blue areas where the signal is weakest.

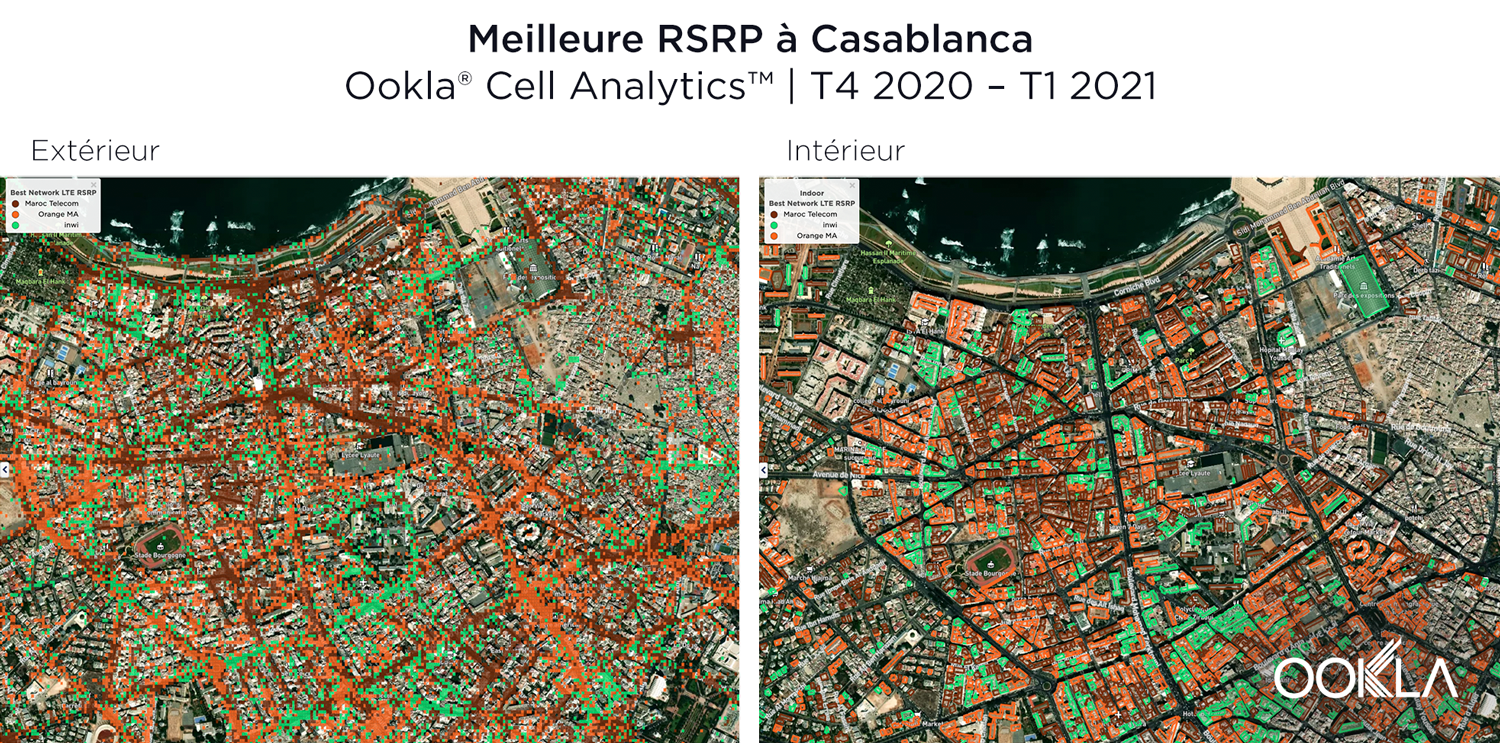

Casablanca

The Hassan II Mosque located near Casablanca’s northern coast is a major tourist hub, which makes it a prime location for strong mobile performance. The two maps below show the best 4G LTE RSRP signal strengths by top providers for outdoor and indoor areas:

The next series of maps visualizes each top provider’s 4G LTE RSRP signal strengths in the area slightly southeast of the maps above. The signal is strongest in areas colored red and weakest areas in the blue areas.

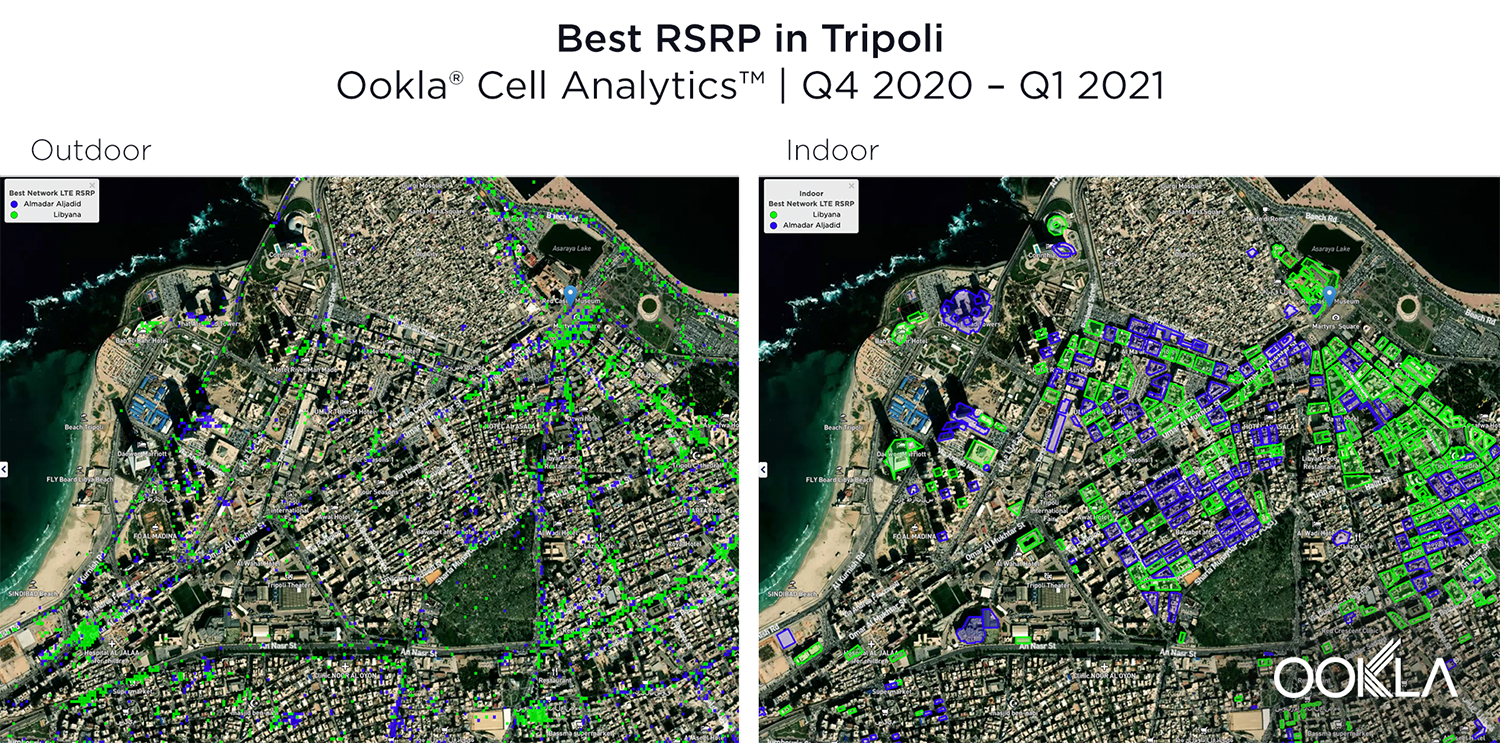

Tripoli

Tripoli’s northern coastline is an important cultural treasure. The maps below show Tripoli’s best 4G LTE RSRP providers for indoor and outdoor signal strength:

The Saraya Museum, also known as the Red Castle Museum, is one of Tripoli’s most prized attractions. The following maps show areas in red where the signal is strongest and areas in blue where the signal is weakest for Tripoli’s top providers:

Tunis

Tunis Centre is the heart of Tunis’ thriving culture. The maps below show the best providers for outdoor and indoor 4G LTE RSRP signal strength in the area.

Zooming in further, we are able to see top providers’ individual 4G LTE RSRP signal strengths in a given area. Red areas show where the signal is strongest, while blue areas show the weakest signal for a given provider:

North Africa internet performance is rapidly improving, and 5G is just around the corner

Internet performance in North Africa is rapidly improving, and with further operator and government investments in 4G and 5G networks — as well as expanded fixed broadband access — North Africa has a bright outlook for its internet users. We’ll continue monitoring the data from Speedtest Intelligence and Cell Analytics to see how internet performance changes during the year to come. If you’re in North Africa and want to see how your internet compares, take a Speedtest® on Android or iOS.

Le débit Internet s’accélère sensiblement en Afrique du Nord, mais accuse toujours un retard sur la plupart des régions du monde

2020 a été une année difficile dans presque tous les pays du monde en raison de la pandémie de COVID-19. Le bon côté, c’est que Speedtest Intelligence® révèle que chaque nation africaine a accéléré la vitesse des communications haut débit mobiles et fixes entre le deuxième trimestre 2020 et le premier trimestre 2021, malgré les graves difficultés subies par l’économie mondiale.

Le présent article dresse l’état des lieux du réseau Internet dans les pays d’Afrique du Nord que sont l’Algérie, l’Égypte, la Libye, le Maroc et la Tunisie entre le deuxième trimestre 2020 et le premier trimestre 2021. Nous examinons quels fournisseurs de haut débit mobile et fixe offrent les meilleures performances, la plus grande stabilité et la meilleure couverture 4G au premier trimestre 2021. Enfin, nous évaluons quelles sont les performances et la couverture Internet dans les plus grandes zones métropolitaines et étudions la force du signal cellulaire à l’aide des données d’Ookla Cell Analytics.

Le Maroc offre les vitesses de téléchargement les plus rapides d’Afrique du Nord, tandis que l’Égypte est la plus rapide en termes de haut débit fixe

L’analyse fondée sur les données de Speedtest Intelligence montre que les débits Internet varient beaucoup dans toute l’Afrique du Nord au cours du premier trimestre 2021, chaque pays, à l’exception de l’Égypte, présentant des vitesses moyennes de téléchargement mobiles supérieures à celles du haut débit fixe. Au cours de l’année dernière (du deuxième trimestre 2020 au premier trimestre 2021), le débit Internet a augmenté à la fois pour le haut débit mobile et fixe dans tous les pays d’Afrique du Nord.

L’Afrique du Nord n’est pas la seule dans ce cas : au début de l’année, Ookla® a conclu un partenariat avec la Banque mondiale dans le but d’analyser les performances Internet dans 18 pays africains pendant la pandémie de COVID-19. Cette étude a montré que les vitesses Internet ont globalement ralenti pendant les confinements successifs.

Le débit mobile a augmenté dans presque toute l’Afrique du Nord

Le Maroc offrait la vitesse de téléchargement mobile moyenne la plus rapide (25,53 Mbps). La Tunisie arrivait en deuxième position (21,28 Mbps), l’Égypte en troisième position (14,95 Mbps), la Libye en quatrième position (11,65 Mbps) et l’Algérie en cinquième position (9,76 Mbps).

De nombreux Nord-Africains ont privilégié la technologie mobile étant donné que les performances et la couverture 3G et 4G n’ont cessé de s’améliorer. Du deuxième trimestre 2020 au premier trimestre 2021, tous les pays nord-africains (à l’exception de l’Égypte) ont enregistré une forte accélération des vitesses de téléchargement, la Libye présentant le pourcentage le plus élevé (67,4 %), suivie par l’Algérie (65,1 %), le Maroc (10,7 %), la Tunisie (10,0 %) et enfin l’Égypte (0,1 %).

L’Égypte a enregistré le haut débit le plus rapide

Bien que l’Égypte soit à la traîne en matière de débit Internet mobile, elle excelle en ce qui concerne le haut débit fixe. Au cours du premier trimestre 2021, l’Égypte a enregistré la vitesse de téléchargement sur le réseau fixe la plus rapide d’Afrique du Nord, avec une moyenne de 26,58 Mbps (4,82 Mbps pour le chargement). Le Maroc arrivait deuxième pour le téléchargement (10,01 Mbps), la Libye troisième (8,71 Mbps), la Tunisie quatrième (6,95 Mbps) et l’Algérie cinquième (4,09 Mbps).

Tous les pays d’Afrique du Nord, à l’exception de la Tunisie, ont enregistré une augmentation moyenne du haut débit fixe de plus de 25 % du deuxième trimestre 2020 au premier trimestre 2021, l’Algérie plus que doublant sa vitesse avec une augmentation de 105,5 %. L’Égypte était deuxième avec une amélioration de 94,6 %, la Libye troisième (59,8 %), le Maroc quatrième (28,5 %) et la Tunisie cinquième (12,3 %).

Grandes variations des performances par fournisseur et par pays

Au cours du premier trimestre 2021, les opérateurs mobiles d’Afrique du Nord ont affiché des performances très variées. Maroc Telecom a enregistré les vitesses moyennes de téléchargement et de chargement mobile les plus rapides d’Afrique du Nord au cours du premier trimestre 2021 avec des vitesses respectives de 40,32 Mbps et 12,60 Mbps. WE Internet en Égypte a enregistré la vitesse moyenne de téléchargement la plus élevée pour le haut débit fixe avec 30,60 Mbps, tandis que l’opérateur lybien, LTC, enregistrait la vitesse de chargement la plus rapide, avec une moyenne de 7,46 Mbps.

Le Maroc offrait la meilleure couverture 4G d’Afrique du Nord au cours du premier trimestre 2021, avec ses trois principaux fournisseurs en tête dans la région : inwi (78,6 %), Maroc Telecom (78,0 %) et Orange (77,4 %). En dehors du Maroc, Ooredoo en Tunisie proposait la meilleure couverture 4G avec un taux de 76,9 %.

La stabilité mobile a connu d’importantes variations en Afrique du Nord au cours du premier trimestre 2021, Maroc Telecom affichant la meilleure performance avec un taux de 89,1 %. Tunisie Telecom arrivait en deuxième position avec un taux de 86,7 %.

L’opérateur mobile le plus rapide des pays d’Afrique du Nord offrait souvent la meilleure stabilité

Voici comment la téléphonie mobile s’est comportée dans chaque pays nord-africain au cours du premier trimestre 2021 :

Algérie | Égypte

| Libye | Maroc | Tunisie

Algérie

Ooredoo a enregistré les vitesses mobiles moyennes les plus rapides en Algérie au cours du premier trimestre 2021 (14,37 Mbps pour le téléchargement // 8,78 Mbps pour le chargement). DJEZZY s’est classé deuxième (avec 8,15 Mbps en téléchargement // 7,68 Mbps en chargement) et Mobilis troisième (avec 6,46 Mbps en téléchargement // 6,03 Mbps en chargement). Ooredoo a enregistré le meilleur score [en matière de stabilité mobile](/insights/blog/how-ookla-ensures-accurate-reliable-data-2021/#consistency-score] (73,5 %), suivi par DJEZZY (55,9 %) et Mobilis (51,9 %). DJEZZY offrait la meilleure couverture 4G avec un taux de 69,7 %, suivi par Ooredoo (65,8 %) et Mobilis (54,5 %).

Égypte

Au cours du premier trimestre 2021, Orange proposait les vitesses de téléchargement et de chargement les plus rapides d’Égypte, avec des moyennes respectives de 17,43 Mbps et 8,04 Mbps. En deuxième position, We enregistrait une vitesse de téléchargement moyenne de 15,56 Mbps (6,95 Mbps en chargement). Etisalat arrivait troisième (15,20 Mbps en téléchargement // 7,28 Mbps en chargement). Vodafone arrivait dernier des principaux fournisseurs (13,11 Mbps en téléchargement et 4,67 Mbps en chargement).

D’un point de vue statistique, il n’y avait pas de réel gagnant pour la stabilité mobile en Égypte au cours du premier trimestre 2021 : Orange a enregistré un score de 77,8 % et We, un score de 77,7 %. Etisalat arrivait en troisième position avec 74,7 %, tandis que Vodafone était dernier avec 69,5 %. Pas de vrai gagnant non plus en matière de couverture 4G, Etisalat obtenant un score de 68,3 %, Vodafone, 67,7 % et We, 67,4 %. Orange était à la queue avec la couverture 4G la plus faible, soit 61,1 %.

Libye

Au cours du premier trimestre 2021, Libyana a enregistré les vitesses de téléchargement et de chargement les plus rapides en Libye avec des moyennes respectives de 13,49 Mbps et 7,03 Mbps, ainsi que la meilleure stabilité mobile avec un score de 67,8 %. Almadar Aljadid arrivait deuxième pour les vitesses (10,71 Mbps en téléchargement // 3,62 Mbps en chargement) et pour la stabilité mobile (63,8 %). Almadar Aljadid offrait la meilleure couverture 4G avec un taux de 37,3 % et seulement 30,5 % pour Lybiana.

Maroc

Au cours du premier trimestre 2021, Maroc Telecom a enregistré les vitesses de téléchargement et de chargement moyennes les plus rapides au Maroc, atteignant respectivement 40,32 Mbps et 12,60 Mbps. inwi s’est classé deuxième (19,00 Mbps en téléchargement // 7,90 Mbps en chargement) et Orange a obtenu la troisième place (15,84 Mbps en téléchargement // 6,17 Mbps en chargement).

Maroc Telecom a également affiché la meilleure stabilité mobile avec un score de 89,1 %, suivi par inwi (74,8 %) et Orange (71,0 %). Du point de vue statistique, il n’y avait pas de vrai gagnant pour la couverture 4G, inwi réalisant un score de 78,6 %, Maroc Telecom un score de 78,0 % et Orange un score de 77,4 %. Tous ces fournisseurs figuraient parmi les meilleurs pour la couverture 4G en Afrique du Nord.

Tunisie

Tunisie Telecom a enregistré les vitesses moyennes de téléchargement et de chargement mobile les plus rapides en Tunisie au cours du premier trimestre 2021 avec des vitesses respectives de 24,34 Mbps et 11,42 Mbps. Ooredoo est arrivé deuxième avec 22,50 Mbps en téléchargement et 10,26 Mbps en chargement. Orange était troisième avec 16,24 Mbps en téléchargement et 8,25 Mbps en chargement.

Tunisie Telecom offrait également la meilleure stabilité mobile avec un score de 86,7 %. Ooredoo était deuxième avec 83,3 % et Orange troisième avec 78,1 %. Ooredoo affichait la meilleure couverture 4G avec un score de 76,9 %, tandis que Tunisie Telecom et Orange étaient à la traîne avec un score de 72,4 % et 72,3 %, respectivement.

Le haut débit fixe est plutôt lent en Afrique du Nord, mais les opérateurs égyptiens offrent les vitesses les plus élevées

Algérie | Égypte | Libye | Maroc | Tunisie

Algérie

IDOOM — le seul fournisseur de haut débit fixe répondant aux critères d’Ookla en tant que premier fournisseur en Algérie au premier trimestre 2021 — offrait une vitesse en téléchargement de 4,09 Mbps (0,74 Mbps en chargement) et une stabilité de 0,8 %.

Égypte

Au cours du premier trimestre 2021, WE Internet était le premier fournisseur en Égypte et en Afrique du Nord avec la vitesse de téléchargement haut débit la plus élevée atteignant une moyenne de 30,60 Mbps (5,68 Mbps en chargement), et la plus grande stabilité (57,5 %). Vodafone se classait deuxième (avec 13,16 Mbps en téléchargement // 1,65 Mbps en chargement), Orange arrivait troisième (avec 10,97 Mbps en téléchargement // 0,82 Mbps en chargement), et enfin Etisalat était quatrième parmi les plus grands fournisseurs avec 6,70 Mbps en téléchargement et 0,81 Mbps en chargement.

Libye

Au cours du premier trimestre 2021, LTC présentait les vitesses de téléchargement et de chargement moyennes les plus rapides sur le réseau fixe avec 10,62 Mbps et 7,46 Mbps respectivement. LTC enregistrait également la meilleure stabilité du haut débit fixe avec un score de 22,3 %. Suivait Libya Telecom avec une vitesse de 8,31 Mbps en téléchargement, 4,02 Mbps en chargement et une stabilité de 18,0 %.

Maroc

Au cours du premier trimestre 2021, Orange enregistrait la vitesse de téléchargement la plus rapide au Maroc pour le haut débit fixe avec une moyenne de 12,65 Mbps (2,60 Mbps en chargement), tandis qu’inwi offrait la vitesse de chargement la plus rapide avec une moyenne de 4,18 Mbps (11,33 Mbps en téléchargement). Maroc Telecom arrivait troisième avec une vitesse moyenne de 9,63 Mbps en téléchargement et 0,81 Mbps en chargement. Maroc Telecom affichait le meilleur score de stabilité avec 29,9 %. Orange était deuxième avec 24,7 %, et inwi troisième avec 16,9 %.

Tunisie

Au cours du premier trimestre 2021, Tunisie Telecom offrait la vitesse de téléchargement la plus rapide sur le réseau haut débit fixe tunisien avec une moyenne de 8,02 Mbps (0,81 Mbps en chargement), tandis qu’Ooredoo était le plus rapide pour le chargement avec une vitesse de 3,91 Mbps (7,03 Mbps en téléchargement). TOPNET a atteint 7,12 Mbps en téléchargement et 0,78 Mbps en chargement, suivi par Orange (avec 6,73 Mbps en téléchargement // 0,94 Mbps en chargement) et Gnet (avec 6,59 Mbps en téléchargement // 0,77 Mbps en chargement).

D’un point de vue statistique, il n’y avait de vrai gagnant s’agissant de la stabilité du haut débit fixe, avec Tunisie Telecom enregistrant un score de 10,6 % et Ooredoo un score de 10,1 %. Orange se classait troisième avec 4,6 %, suivi par Gnet (3,7 %) et TOPNET (3,4 %).

Tunis et Grand Casablanca ont enregistré les vitesses de téléchargement mobile les plus rapides d’Afrique du Nord. Le gouvernorat d’Alexandrie a bénéficié du haut débit fixe le plus rapide

D’après Speedtest Intelligence, Tunis, en Tunisie, et Grand Casablanca, au Maroc, ont bénéficié au cours du premier trimestre 2021 des vitesses de téléchargement mobile les plus rapides parmi les zones métropolitaines les plus populaires d’Afrique du Nord avec des moyennes de 22,65 Mbps et 22,44 Mbps, respectivement. Le gouvernorat d’Alexandrie, en Égypte, arrivait en troisième position avec 16,63 Mbps, suivi par le gouvernorat du Caire en Égypte (14,32 Mbps), Tripoli en Libye (13,71 Mbps) et Alger en Algérie (12,81 Mbps).

Le gouvernorat d’Alexandrie affichait la vitesse de téléchargement la plus rapide sur le réseau haut débit fixe avec une moyenne de 21,24 Mbps. Le gouvernorat du Caire se classait deuxième avec 20,71 Mbps, le Grand Casablanca troisième (10,70 Mbps), Tripoli quatrième (10,02 Mbps), Tunis cinquième (7,47 Mbps) et Alger sixième (4,60 Mbps).

Cell Analytics brosse un tableau édifiant des villes d’Afrique du Nord

Cell Analytics d’Ookla, est un outil inestimable qui renseigne sur la qualité du réseau sans fil, les mesures RF (force du signal), l’utilisation des données, la densité des utilisateurs (à l’intérieur et à l’extérieur) et les emplacements des sites cellulaires d’un territoire donné. Cell Analytics permet aux opérateurs mobiles de renforcer la qualité de leur réseau et d’identifier avec une extrême précision les zones à améliorer.

Les cartes ci-dessous utilisent les données Cell Analytics du quatrième trimestre 2020 et du premier trimestre 2021 pour mettre en évidence deux éléments dignes d’intérêt dans les grandes villes d’Afrique du Nord : le meilleur fournisseur en termes de force du signal 4G LTE RSRP à l’intérieur et à l’extérieur dans une zone donnée et la force du signal 4G LTE RSRP par fournisseur dans les principales zones d’intérêt. Sur les cartes 4G LTE RSRP en intérieur et en extérieur, Cell Analytics identifie le meilleur opérateur de réseau mobile d’une zone donnée ou crée des zones par couleur en cas de très net gagnant d’un point de vue statistique. Les cartes par fournisseur montrent les performances de chacun dans une zone donnée, le rose et le rouge indiquant un signal fort et le bleu, un signal faible.

Faites défiler les cartes Cell Analytics des grandes villes nord-africaines ou cliquez sur une ville ci-dessous :

Alexandrie | Alger | Le Caire | Casablanca | Tripoli | Tunis

Alexandrie

La bibliothèque d’Alexandrie a disparu mais la Bibliotheca Alexandrina fait figure de testament de ce que le monde a perdu et de centre culturel majeur en Égypte. Dans la métropole trépidante, les cartes 4G LTE RSRP ci-dessous brossent deux situations différentes : le meilleur signal réseau mobile en extérieur et le meilleur signal réseau en intérieur relevés à Alexandrie au cours du quatrième trimestre 2020 et du premier trimestre 2021. Il apparaît clairement que plusieurs opérateurs fournissent le signal cellulaire le plus fort dans différentes parties de la ville et que certains bâtiments sont mieux servis que d’autres.

Alors qu’il est utile de savoir où opère le meilleur fournisseur dans les lieux que vous fréquentez, Ookla Cell Analytics peut également cartographier les résultats 4G LTE RSRP (force du signal) pour chaque fournisseur, comme représentés ci-après. Les zones rouges correspondent à un signal fort, tandis que les zones bleues correspondent à un signal faible.

Alger

Le jardin botanique du Hamma à Alger est un espace vert luxuriant au cœur de la ville en plein essor. C’est également un excellent lieu géographique pour tester les performances mobiles. Les deux premières cartes ci-dessous représentent les meilleurs opérateurs réseau en matière de force du signal 4G LTE RSRP en extérieur (à gauche) et en intérieur (à droite) dans la zone.

Les trois cartes suivantes montrent la force du signal 4G LTE RSRP pour chaque opérateur, la couleur rouge correspondant aux signaux les plus forts et la bleue, aux signaux les plus faibles.

Le Caire

Situé en plein cœur du Caire, le Gezira Sporting Club offre une vue insulaire sur la ville en pleine effervescence. Les cartes suivantes représentent les meilleurs opérateurs réseau en matière de force du signal 4G LTE RSRP en extérieur (à gauche) et en intérieur (à droite) dans la zone :

Sur la rive opposée, à l’est du Gezira Sporting Club se trouve le célèbre musée égyptien. Avec un réseau de téléphonie mobile saturé dans le quartier animé, Cell Analytics représente la force du signal 4G LTE RSRP des meilleurs opérateurs. Les cartes suivantes font apparaître des zones rouges où le signal est le plus fort et des zones bleues où il est le plus faible.

Casablanca

La mosquée Hassan-II située en bord de mer au nord de Casablanca est un centre touristique majeur et un lieu stratégique en matière de performances mobiles. Les deux cartes ci-dessous représentent la meilleure force de signal 4G LTE RSRP atteinte par les fournisseurs les plus performants en extérieur et en intérieur :

La prochaine série de cartes représente la force du signal 4G LTE RSRP des meilleurs fournisseurs dans la zone située légèrement au sud ouest des cartes ci-dessus. Le signal est le plus fort dans les zones rouges et le plus faible dans les zones bleues.

Tripoli

Le littoral nord de Tripoli est un trésor culturel de taille. Les cartes ci-dessous représentent les meilleurs fournisseurs 4G LTE RSRP en extérieur et en intérieur :

Le musée As-Saraya al-Hamra, ou musée du Château rouge, est l’une des attractions les plus prisées de Tripoli. Les cartes suivantes font apparaître des zones rouges où le signal est le plus fort et des zones bleues où le signal est le plus faible pour les fournisseurs les plus performants de Tripoli :

Tunis

Le centre de Tunis est le cœur du développement culturel de la ville. Les cartes ci-dessous représentent les meilleurs fournisseurs 4G LTE RSRP en extérieur et en intérieur dans le quartier.

En zoomant davantage, nous pouvons voir la puissance du signal 4G LTE RSRP de chaque fournisseur dans une zone donnée. Les zones rouges représentent un signal fort, tandis que les zones bleues correspondent à un signal faible pour un fournisseur donné :

Les performances Internet en Afrique du Nord s’améliorent rapidement, et l’arrivée de la technologie 5G est imminente

Les performances Internet en Afrique du Nord s’améliorent rapidement. Grâce à d’autres investissements de la part des opérateurs et des gouvernements dans les réseaux 4G et 5G, ainsi que dans l’extension de l’accès au haut débit fixe, l’Afrique du Nord offre des perspectives prometteuses à ses internautes. Nous continuerons à surveiller les données depuis Speedtest Intelligence et Cell Analytics pour suivre l’évolution des performances Internet au cours de l’année à venir. Si vous vous trouvez en Afrique du Nord et souhaitez connaître les performances de votre fournisseur, procédez à un Speedtest sur Android ou iOS.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.

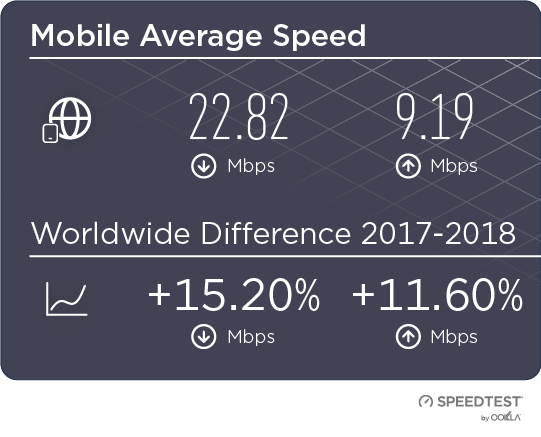

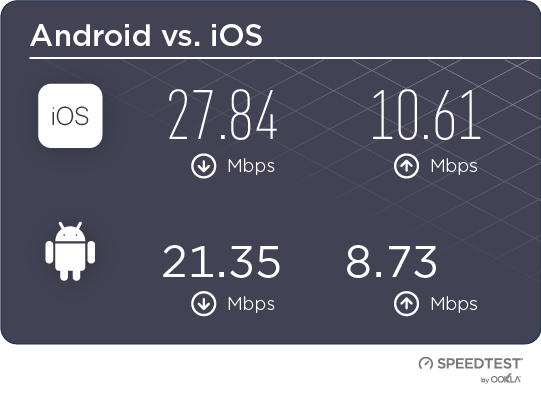

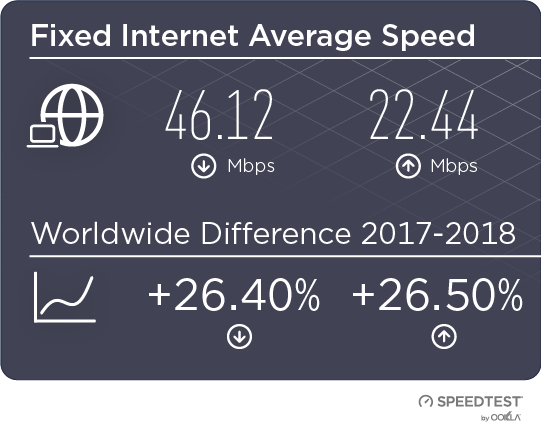

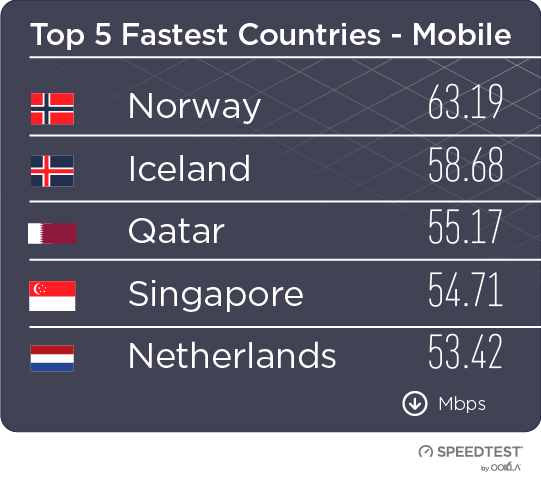

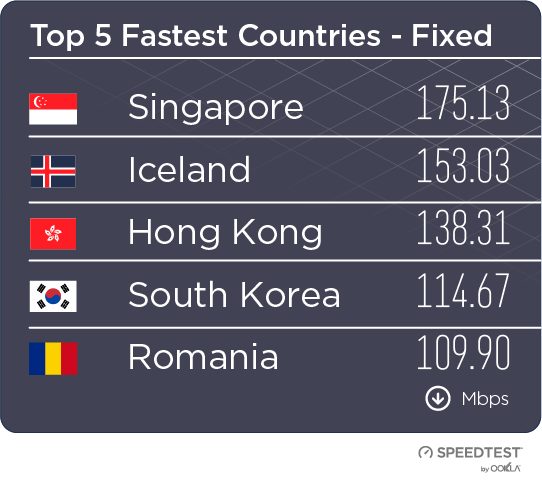

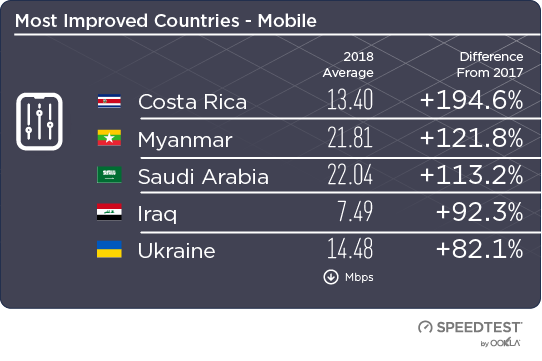

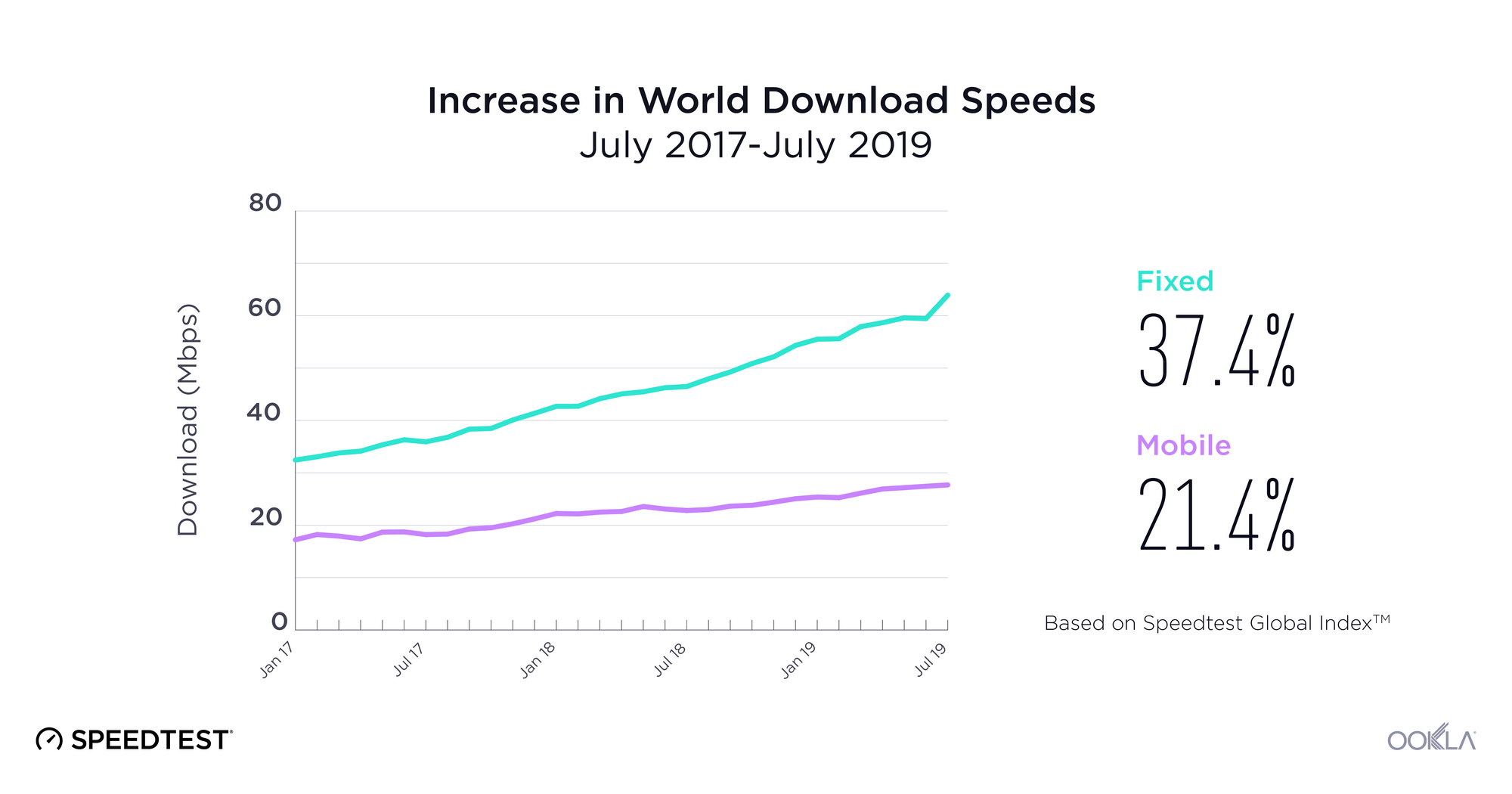

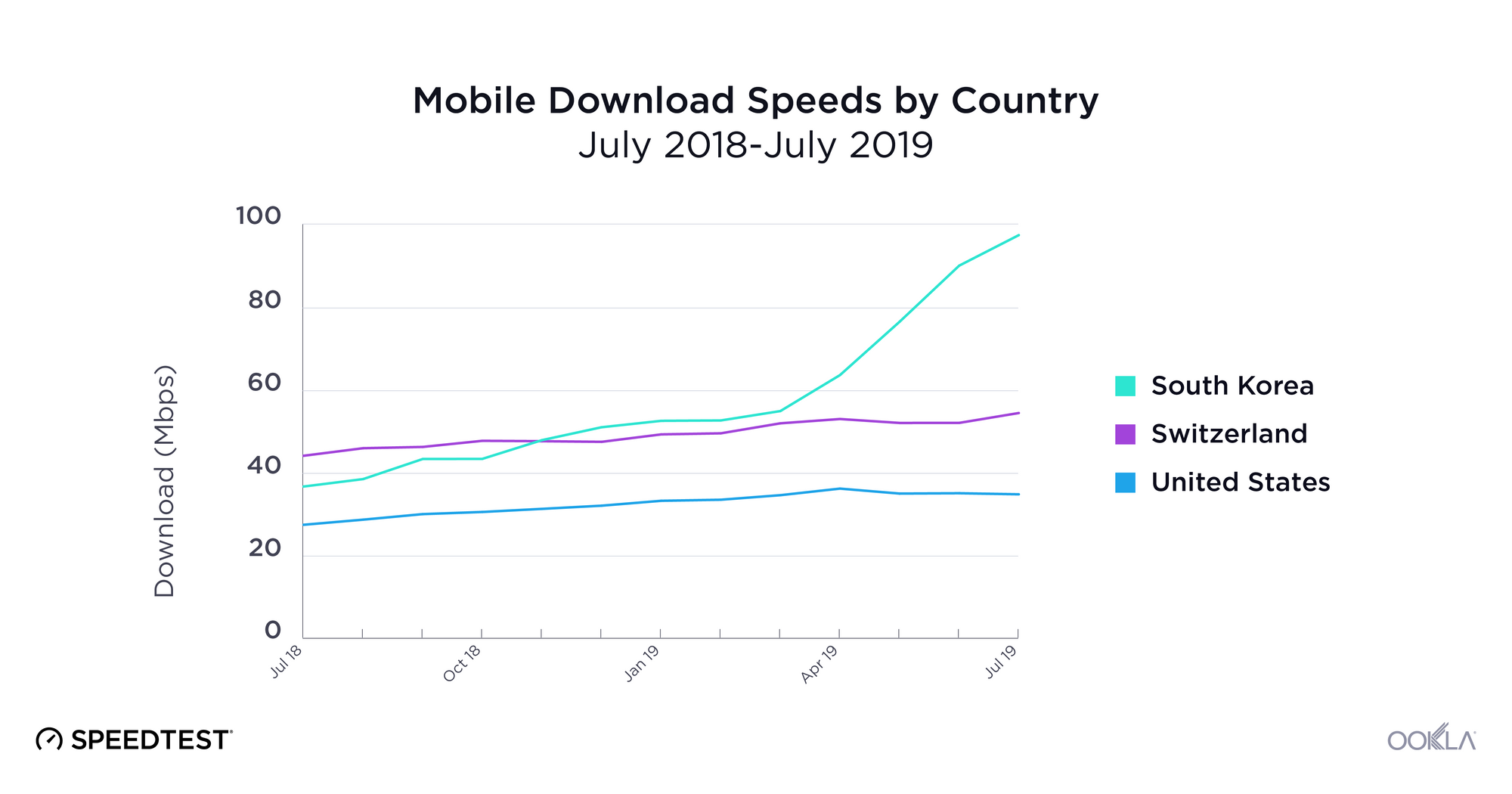

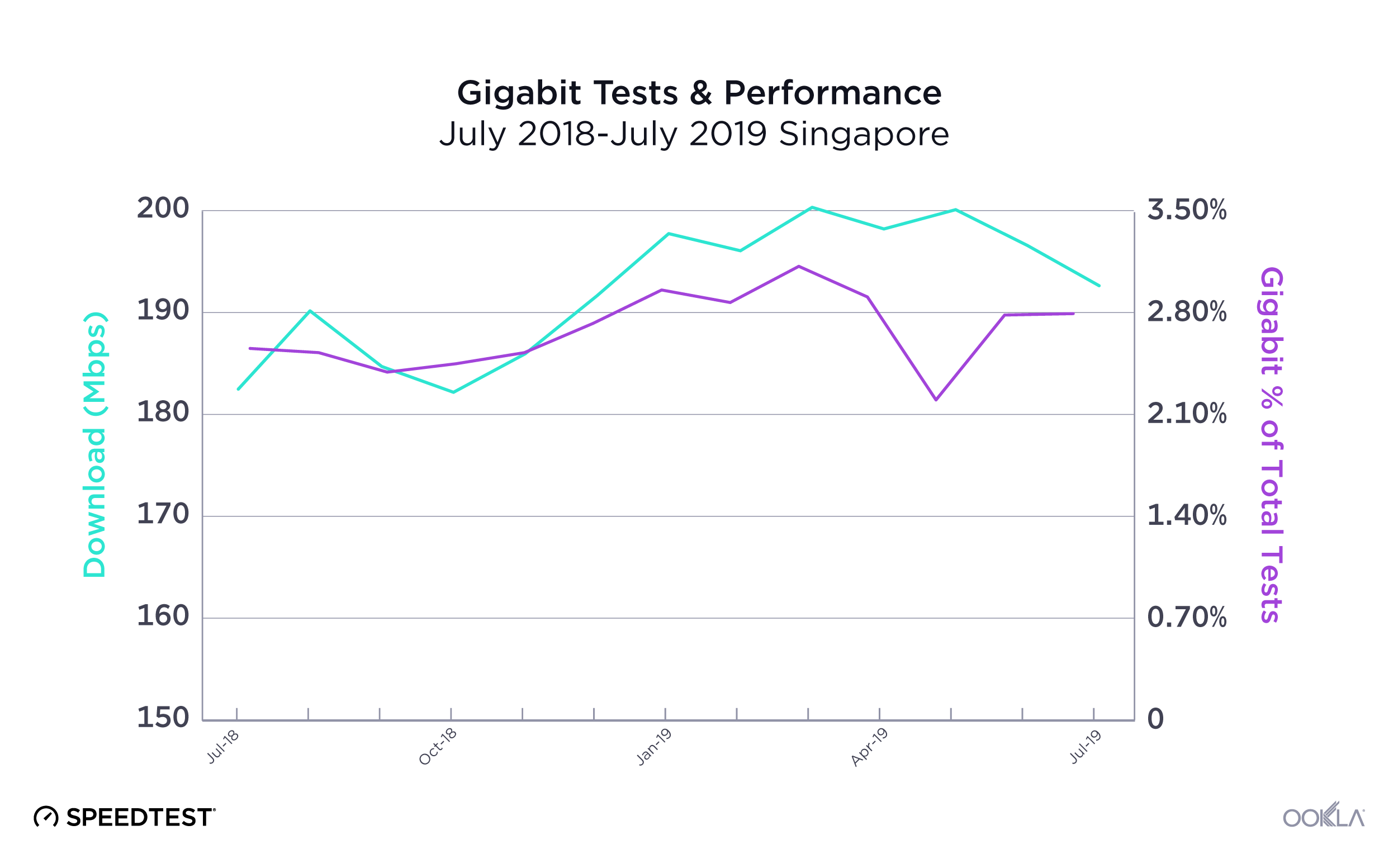

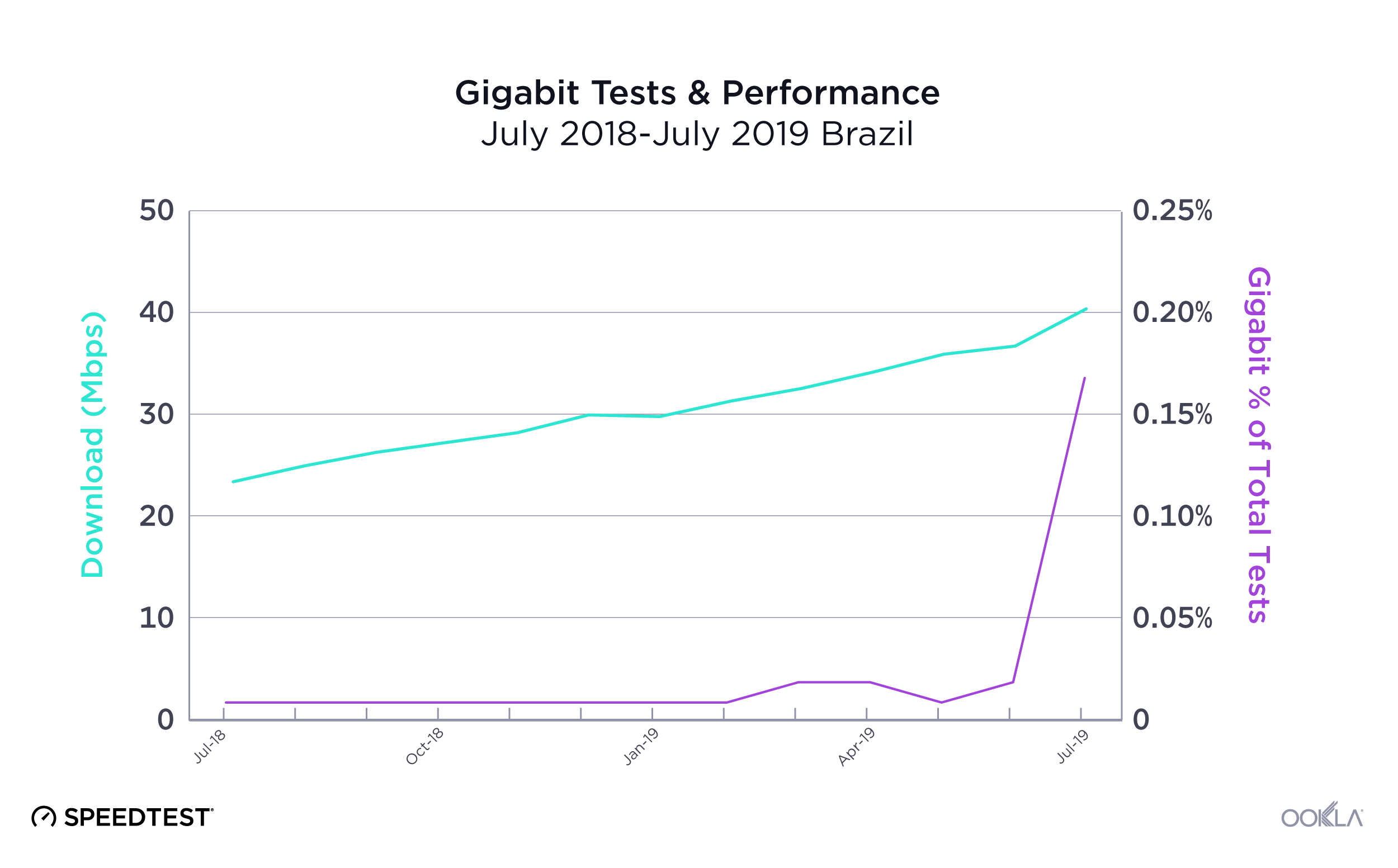

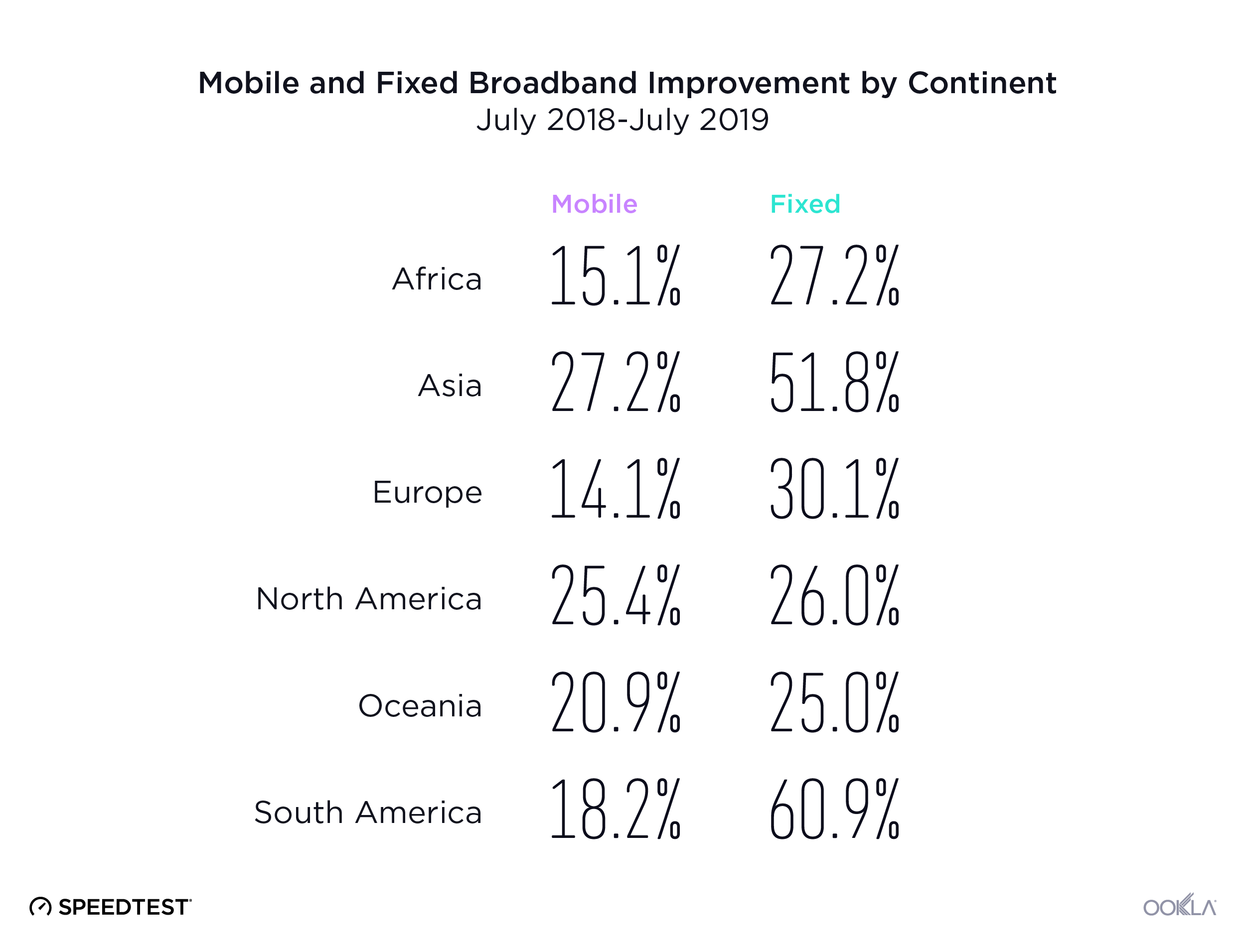

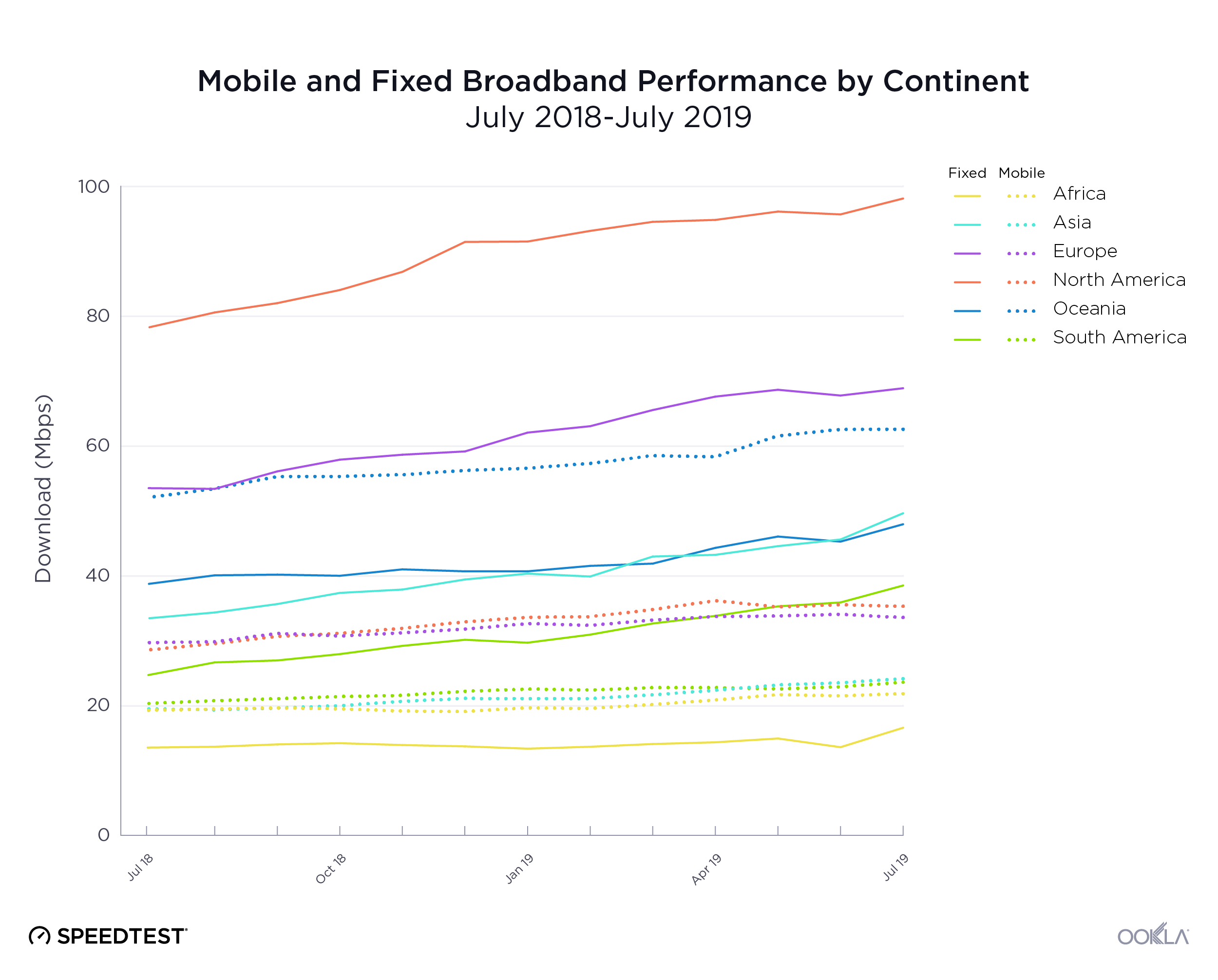

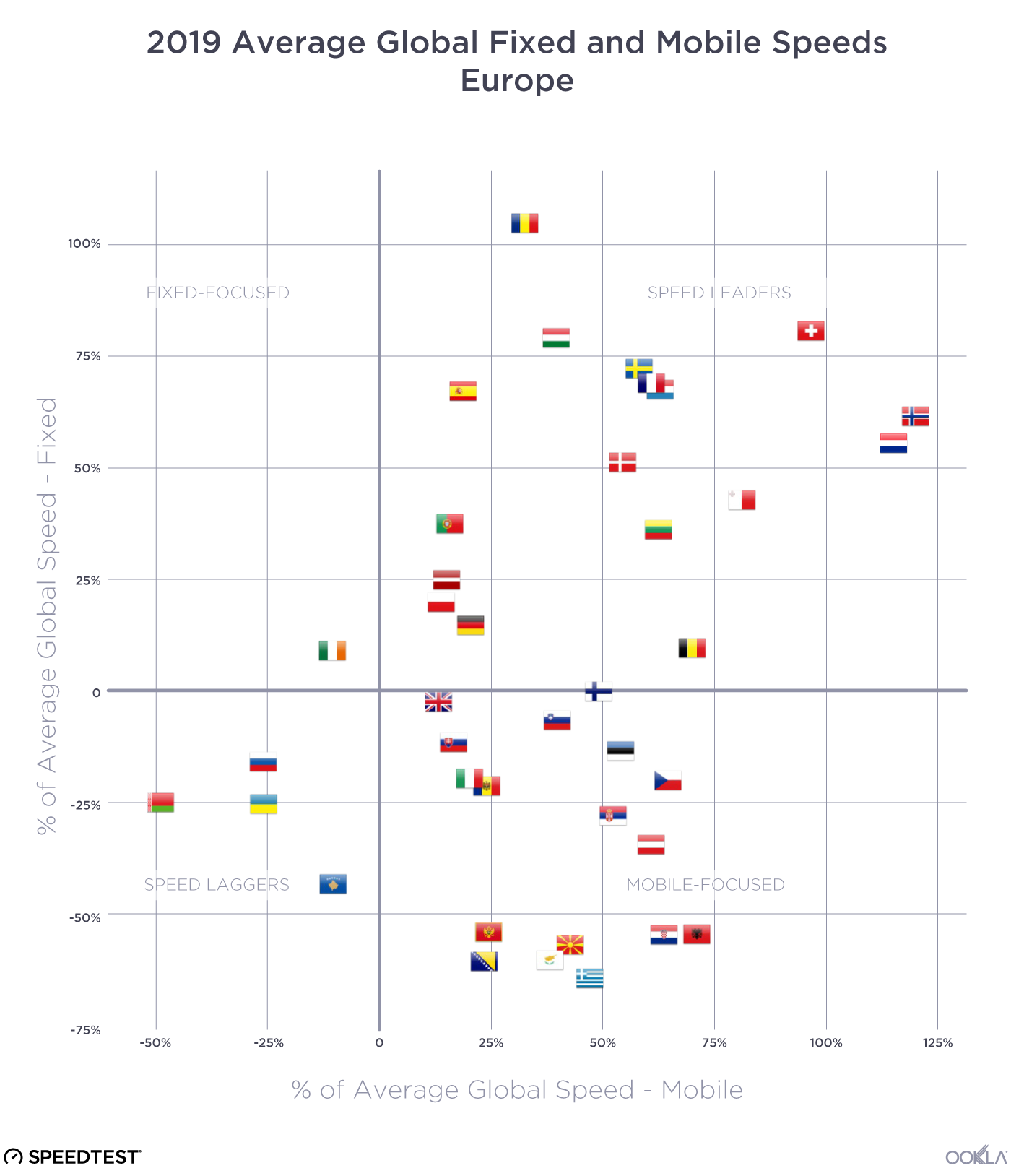

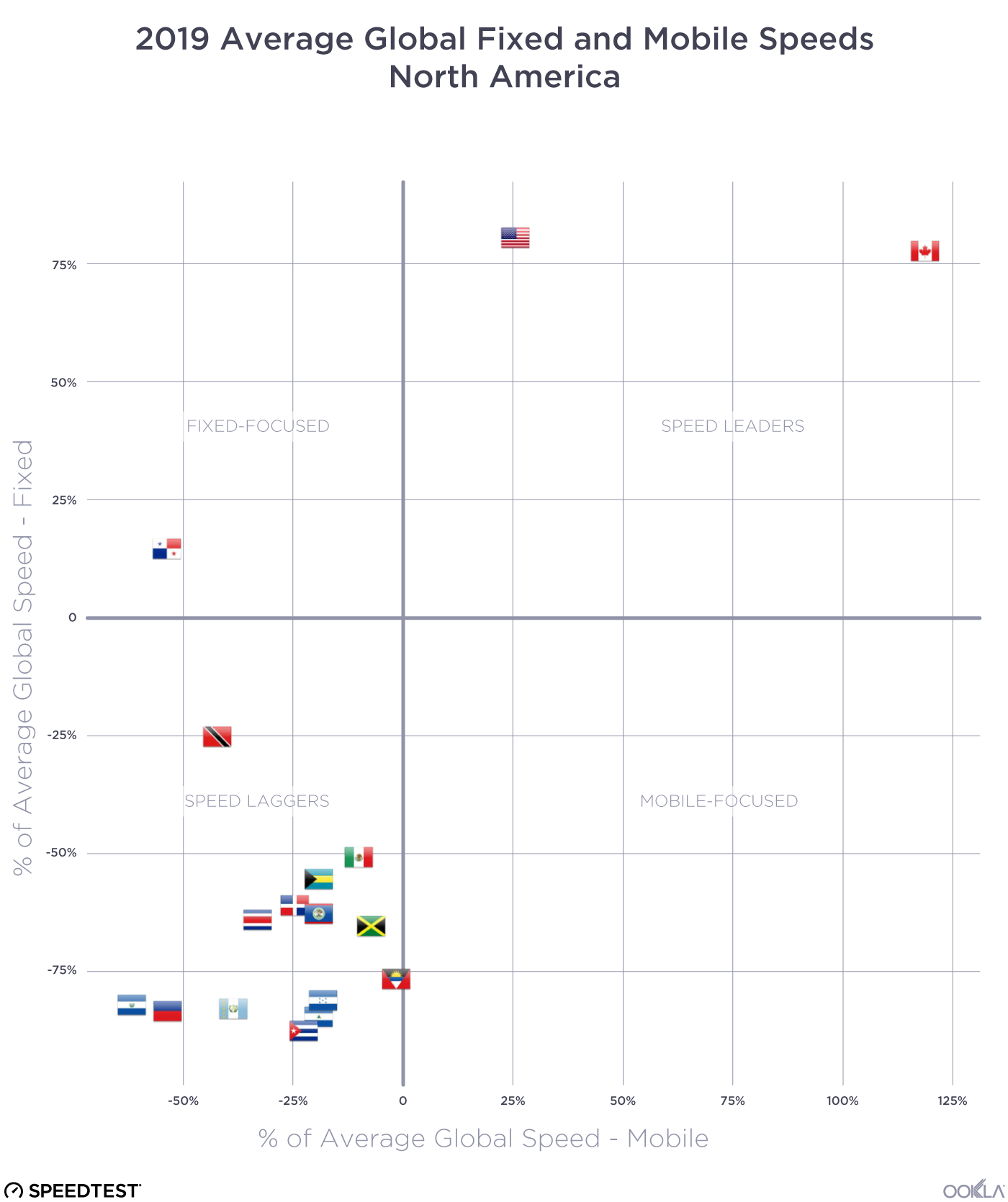

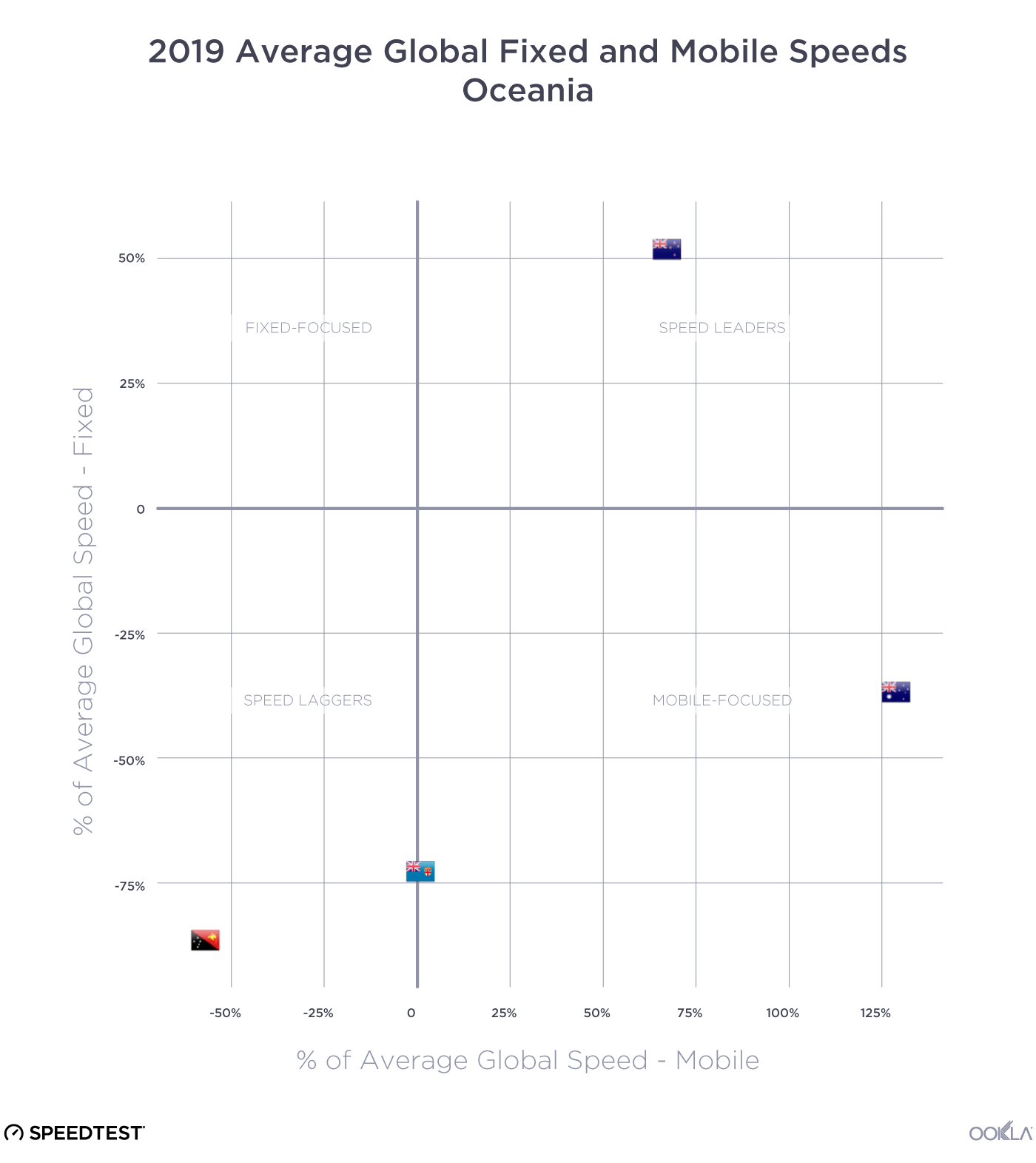

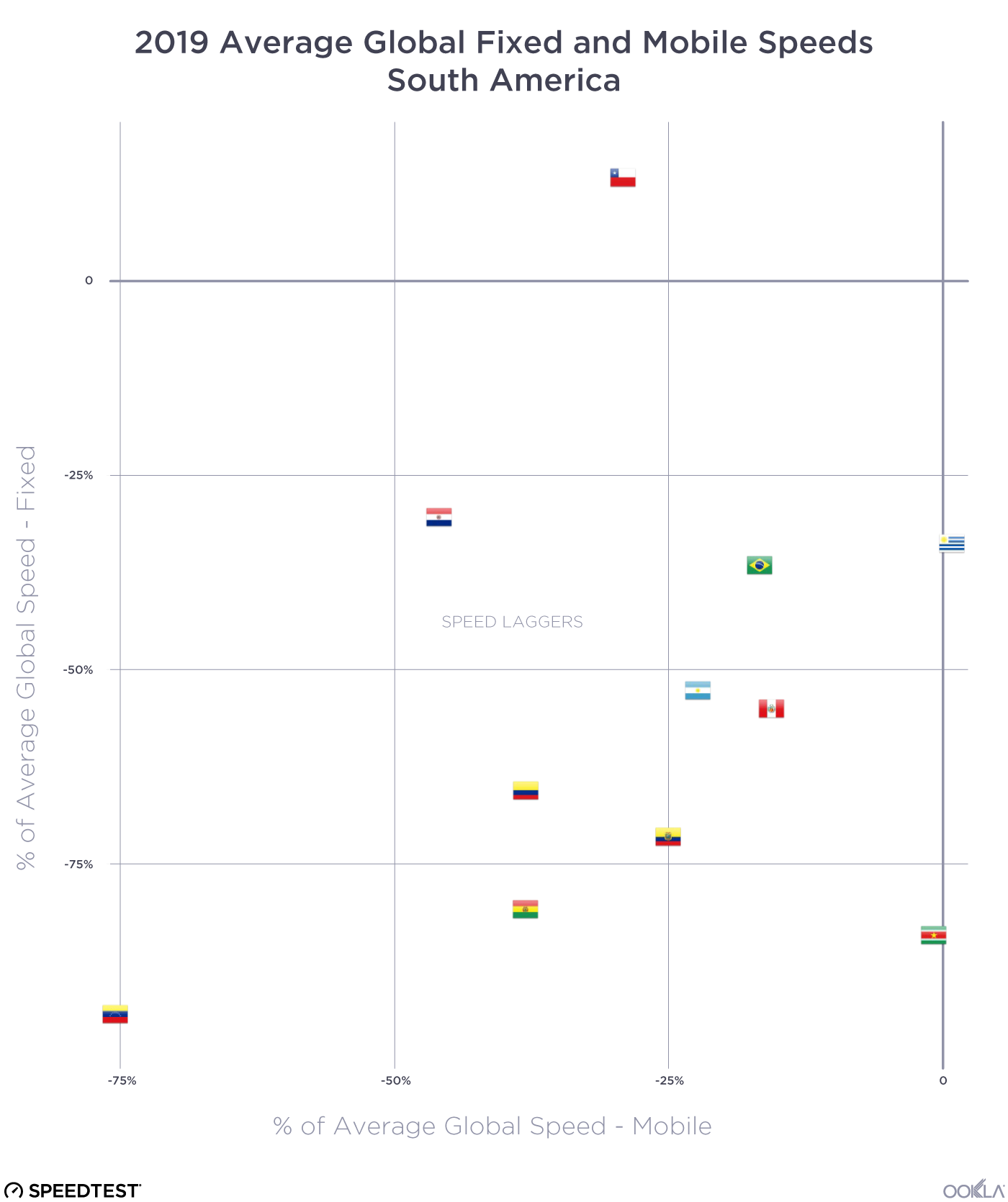

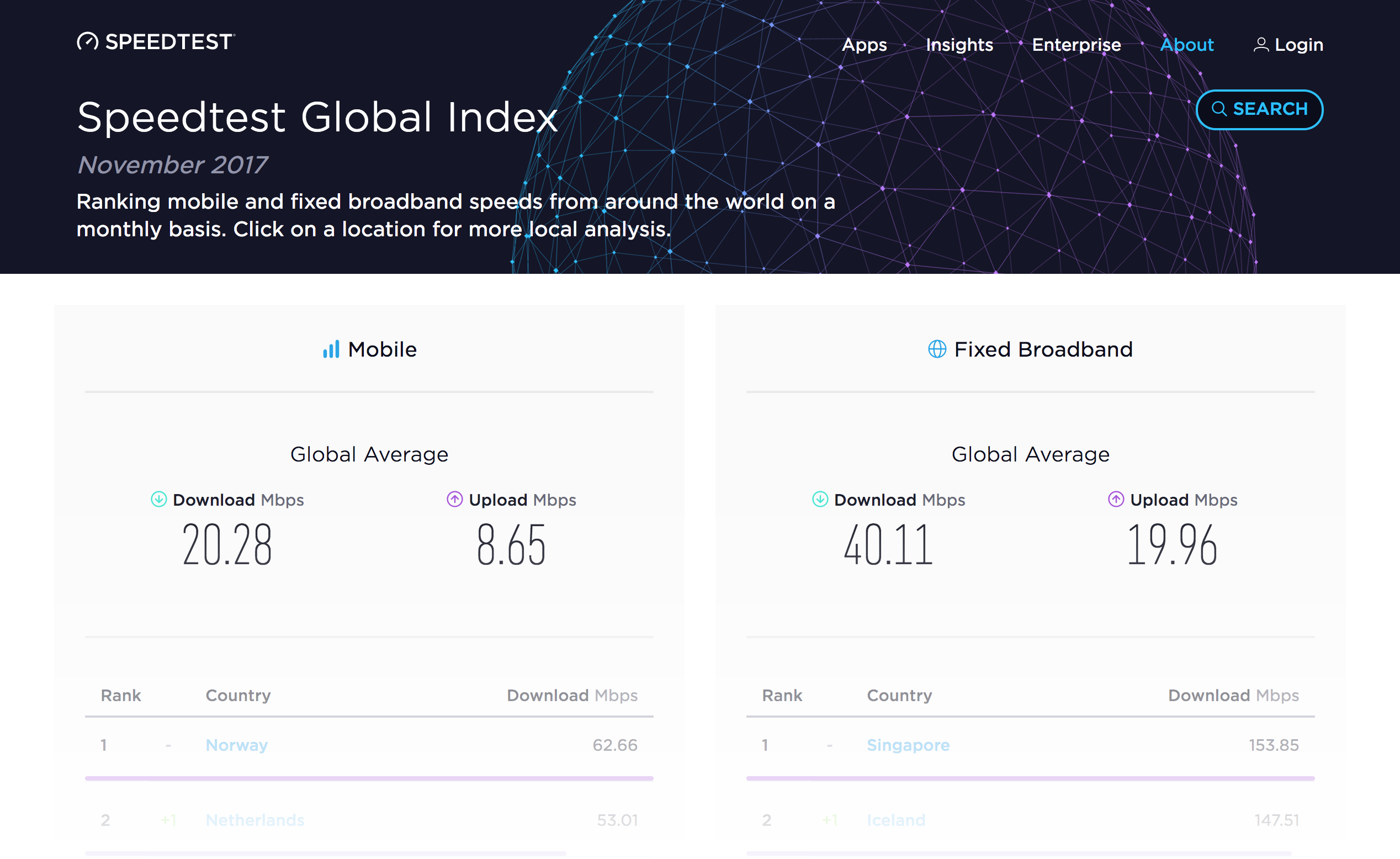

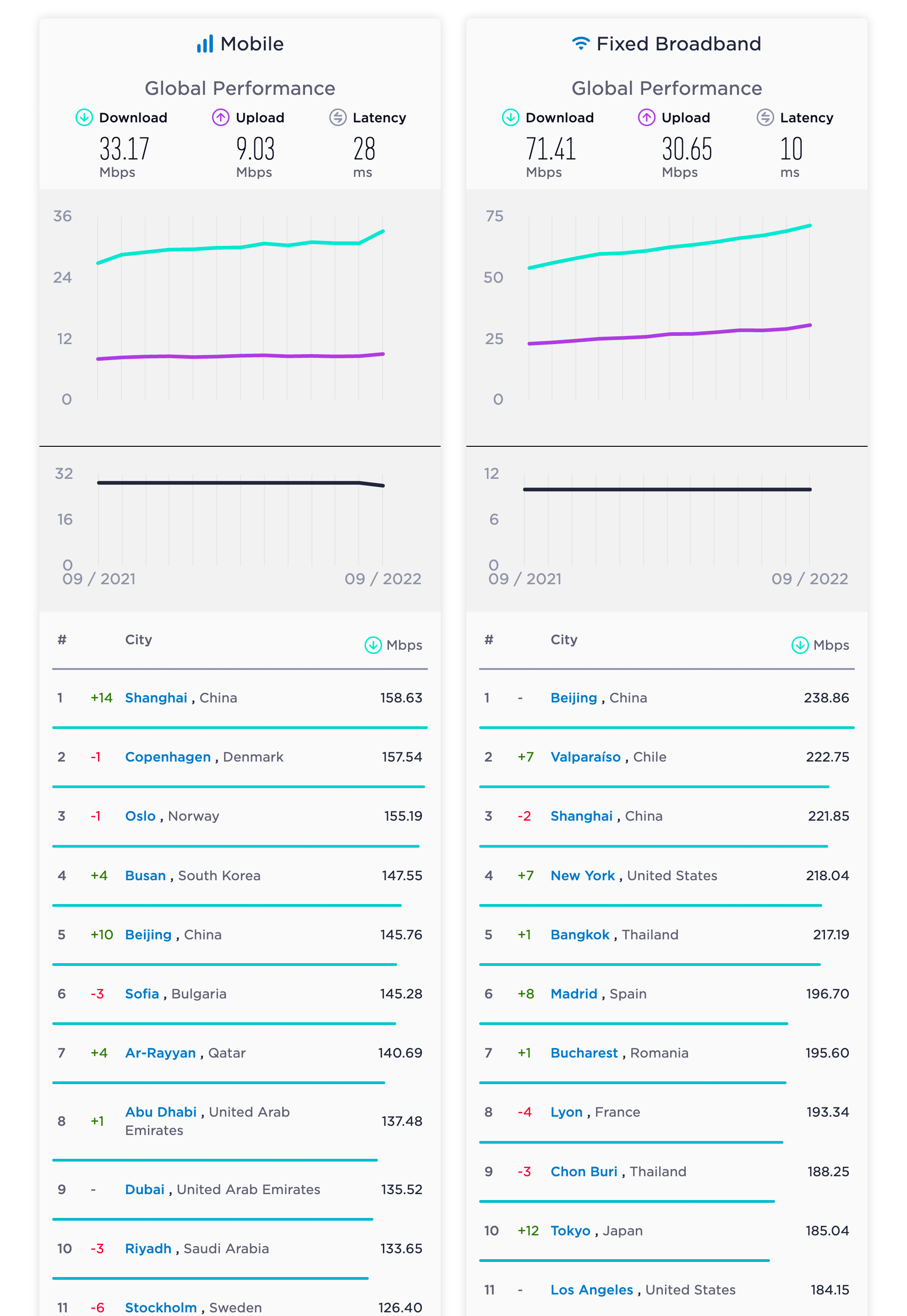

When it comes to the internet, the news is mostly good for 2018. Download and upload speeds are increasing across the globe on both mobile and fixed broadband. 5G is on the horizon and gigabit service is expanding.

When it comes to the internet, the news is mostly good for 2018. Download and upload speeds are increasing across the globe on both mobile and fixed broadband. 5G is on the horizon and gigabit service is expanding.