Operators seek additional spectrum, a generally scarce and costly resource, to improve the coverage and capacity of 4G and 5G networks. This need led to the decommissioning of legacy technologies and the refarming (i.e. repurposing) of existing spectrum. In this article, we examine operators’ plans for sunsetting 2G and 3G networks in the Middle East and North Africa (MENA), focusing on developments in Oman, Saudi Arabia, and the U.A.E. We evaluate the impact of network shutdowns on performance and customer satisfaction for operators that completed the process and highlight key considerations for a successful network transition to mitigate commercial and brand risks.

Key Takeaways:

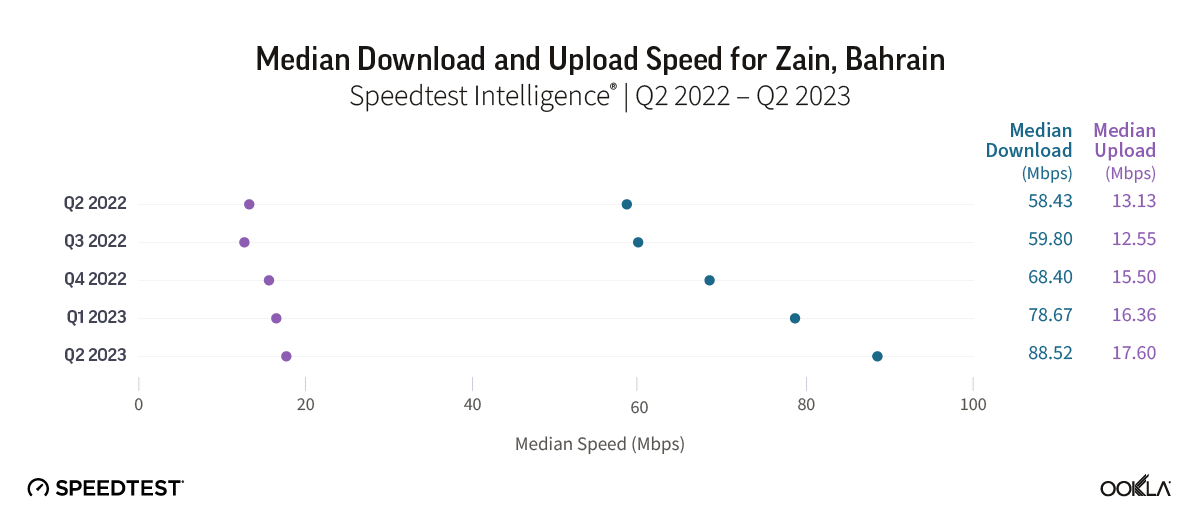

- Sunsetting legacy networks contribute to improvements in performance and customer satisfaction. For example, Zain Bahrain, which decommissioned its 3G at the end of 2022, saw its median download speed increase from 58.43 Mbps in Q2 2022 to 88.52 Mbps in Q2 2023, while customer satisfaction ratings climbed steadily throughout 2023.

- Gulf operators are generally on track to phase out their old networks by the end of 2024. Our data indicate that 3G share of samples in Oman dropped to 4.7% by the close of 2023 in anticipation of the scheduled shutdown of 3G services by Q3 2024. In Saudi Arabia, stc saw its 3G share of samples fall sharply in 2023, suggesting that the phase-out process is nearing completion. Meanwhile, 2G share of samples in the UAE dropped rapidly in 2023 as operators planned to turn off 2G by the end of the year.

- A carefully managed, phased approach is crucial to minimize service disruption during the transition from 2G/3G to advanced networks. Retiring old technology can reduce operating and maintenance costs, optimize spectrum use, simplify network management, and accelerate service innovation. However, operators need to take into consideration existing deployments, potential revenue loss, traffic on older networks, and market readiness for 4G and 5G.

Network sunsetting – still an emerging trend in MENA

Operators across the globe are prioritizing the retirement of 2G and 3G networks to refarm spectrum for the more efficient 4G and 5G technologies. This shift aims to lower their operating costs and direct investments from maintaining outdated systems to deploying more efficient networks that support faster speeds and greater capacity.

The decision of which network to turn off first and the associated timeline varies depending on market conditions and operator readiness. In Asia, operators in China and Japan opted to decommission 2G networks while in Europe, operators typically retire (or plan to retire) 3G before 2G due to the latter’s widespread use in Internet of Things (IoT) applications in the utility and automotive industries. In the U.S.A., the three main operators, AT&T, T-Mobile, and Verizon completed their 3G sunsetting in 2022. However, that has not happened without hiccups. For example, carmakers including BMW, Ford, Porsche, and Volkswagen faced lawsuits because some of their car models’ connected services were rendered obsolete due to the 3G shutdown

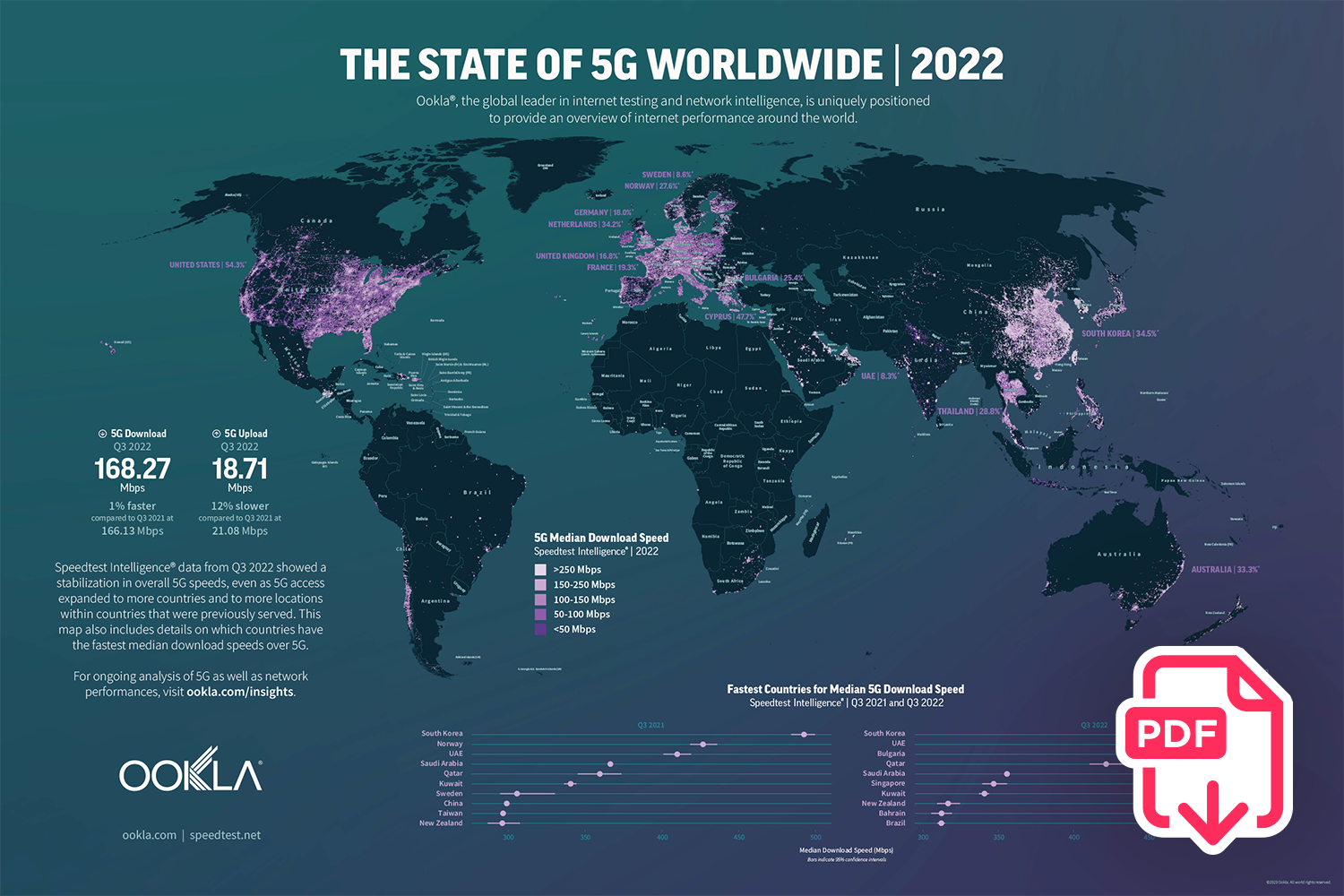

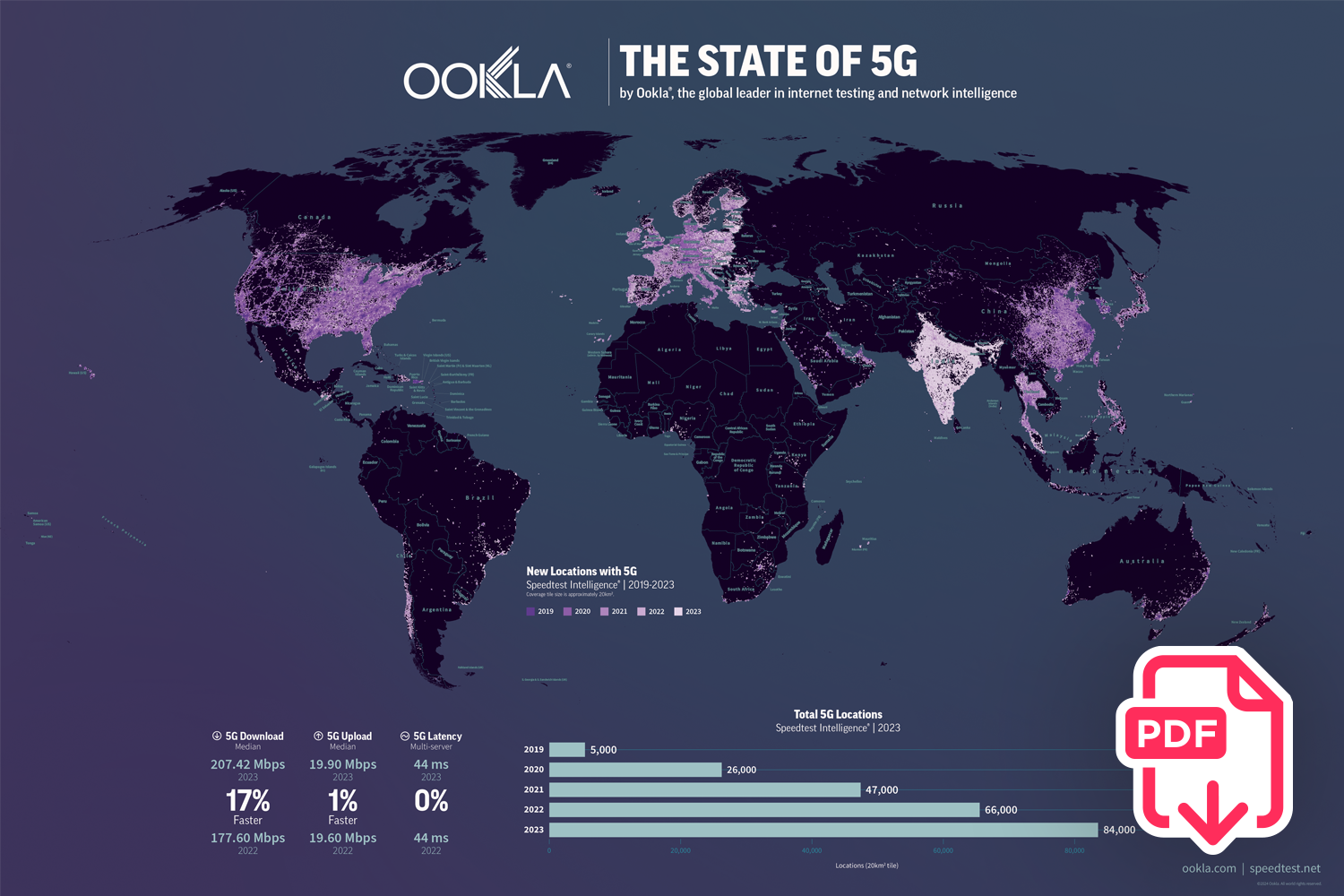

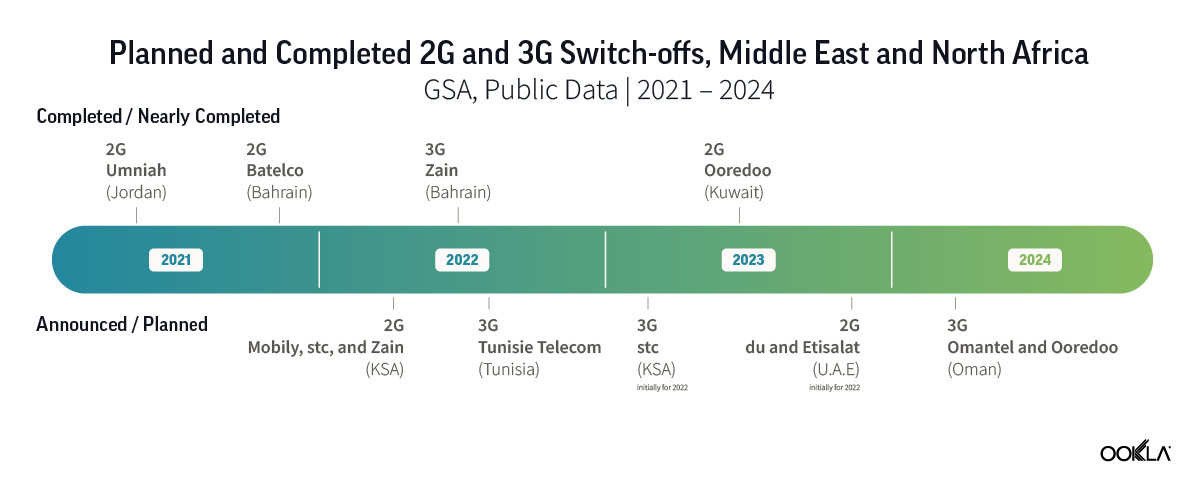

The MENA region had fewer completed and planned legacy sunsets compared to Asia and Europe, with diverse strategies between and within markets. For example, in Bahrain, Batelco shut down its 2G network in November 2021, while competitors, stc and Zain, turned off their 3G networks in 2022. We expect network sunsets to peak by 2025 in the region as 4G becomes more prevalent, and 5G gathers momentum in the region. Some operators in Bahrain and Jordan, have either completed or made significant progress in their sunsetting efforts. Operators in Oman, Saudi Arabia, Tunisia, and the U.A.E. either initiated the process of sunsetting 2G or 3G or will do so within 1 to 2 years.

Network sunsetting can increase efficiency, reduce costs, and improve customer satisfaction

The phasing out of older technologies enables operators to greatly simplify network management since maintaining multiple radio technologies requires significant resources and personnel expertise. By streamlining their infrastructure, operators can reduce operational costs, direct resources towards optimizing 4G and 5G networks, and deploy innovative services based on newer technologies.

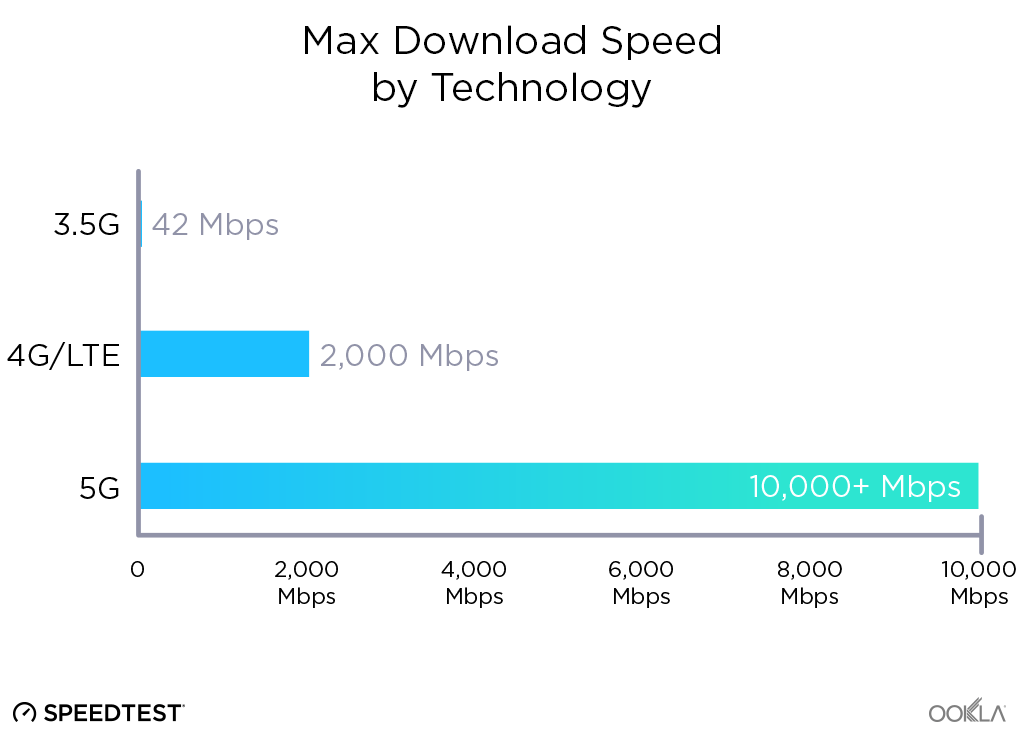

4G and 5G are also many times more spectral efficient than their predecessors. That means that modern networks can transmit much more data over the same spectrum than previous standards, and support more users per cell site. According to Coleago Consulting, while 2G and 3G can deliver 0.16 and 0.8 bits/Hz, respectively, 4G with a 2×2 MIMO antenna can deliver 1.9 bits/Hz, and the figure jumps to 4.8 bits per hertz for 5G with advanced 16×16 MIMO. This efficiency gain is important as the demand for high-speed and low-latency services grows in the MENA region. GSMA Intelligence expects mobile data traffic per smartphone will quadruple in Sub-Saharan Africa by 2028 to 19 GB per month, while the Middle East and North Africa will experience more than a threefold increase to 37 GB per month.

Refarming spectrum for 4G or 5G not only boosts capacity and expands service coverage but also saves operators from the expensive process of bidding for new spectrum. By freeing up the 900 MHz, 1800 MHz, and 2100 MHz bands, commonly used for 2G and 3G, operators can take advantage of their superior propagation characteristics to extend 4G/5G reach with fewer sites.

Furthermore, modern network equipment is more energy-efficient than older systems. This can help operators reduce their energy costs, lower OPEX, and progress towards sustainability goals. Case in point, Vodafone (UK) reported that sending 1 TB of data across 5G will use just 7% of the energy required for the same transfer over 3G. O2 Telefónica (UK) claimed a 90% reduction in power consumption per transmitted byte following the retirement of its 3G network in 2021.

The deployment of modern technologies also translates to greater throughput and potentially reduced costs for end-users. Ookla’s Speedtest Intelligence® data shows that operators that deactivated 2G or 3G networks improved their median download and upload speeds. For example, Zain Bahrain began 3G sunsetting in February 2022, refarmed the 2100 MHz spectrum, and gained access to 20 MHz bandwidth of contiguous spectrum. This move improved 4G capacity and spectral efficiency compared to using carrier aggregation. Switching off the 3G network at the end of 2022 (the first in the Middle East) combined with more 4G sites deployed resulted in increasing the operator’s median download speed from 58.43 Mbps in Q2 2022 to 88.52 Mbps in Q2 2023 while customer satisfaction ratings climbed steadily throughout 2023.

Operators should carefully plan the network sunsetting process to minimize service disruption

Careful planning is essential to minimize service disruption and negative impacts on finances and brand. Since this process should involve many stakeholders, including enterprise customers, and consumers, operators should expect 2 to 4 years to complete the switch-off.

Pulling the plug on 2G or 3G means disconnecting many consumers who use voice and SMS, potentially leading to massive churn and exacerbating the digital divide. The question becomes then whether these users can afford to acquire a feature phone or a smartphone and upgrade to 4G and 5G plans. The impact on inbound roamers, who might face connectivity issues or be unable to access emergency services, and the potential loss of roaming revenue are additional considerations.

Insights into the usage patterns of 2G and 3G services and the volume of inbound roamers lacking LTE roaming agreements with local operators are vital to assess the financial impact. Operators should gradually turn off their legacy networks based on traffic, prioritizing areas with minimum 2G/3G activity and excellent 4G/5G coverage. Regions with high 2G/3G presence should be last to transition.

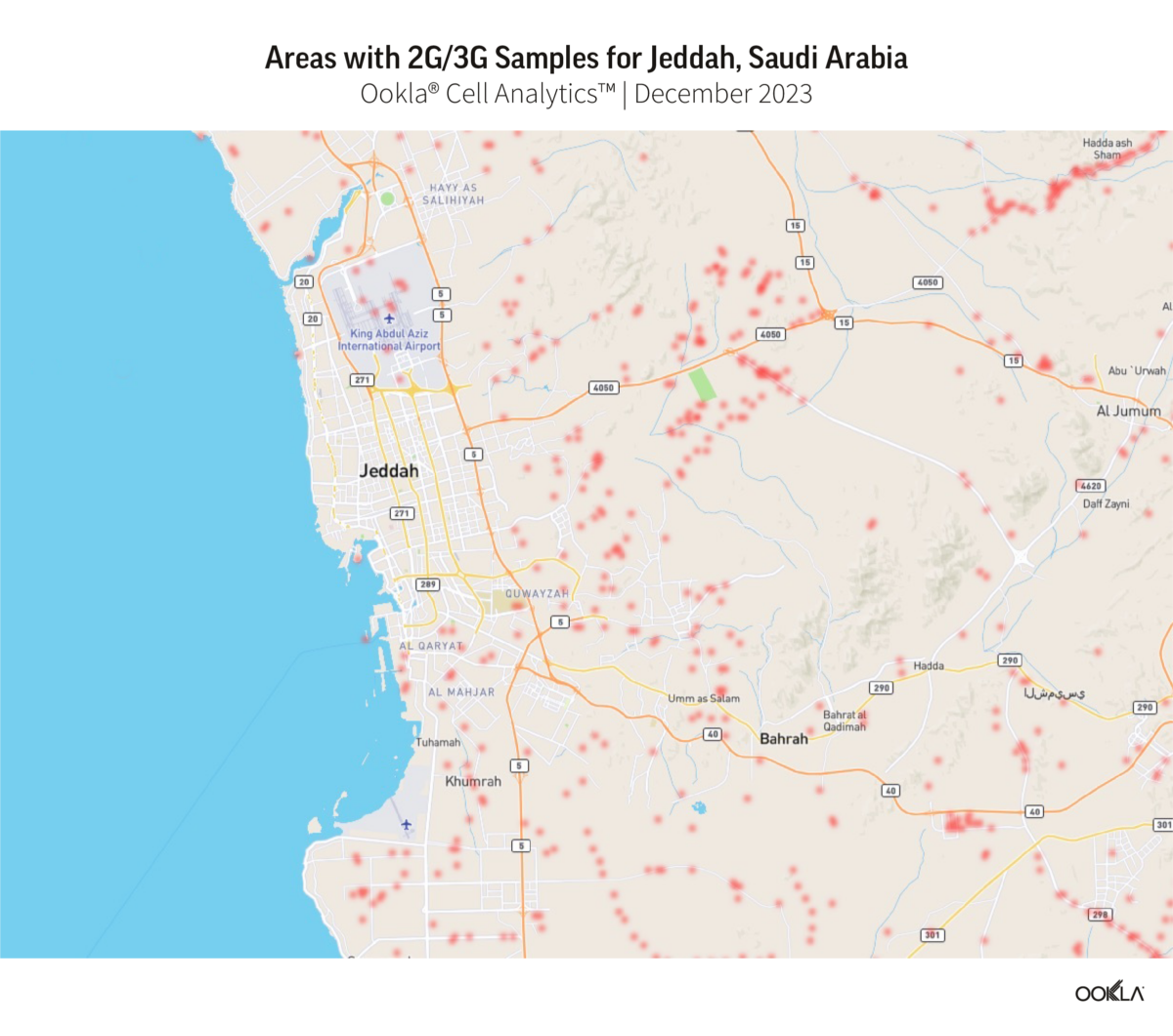

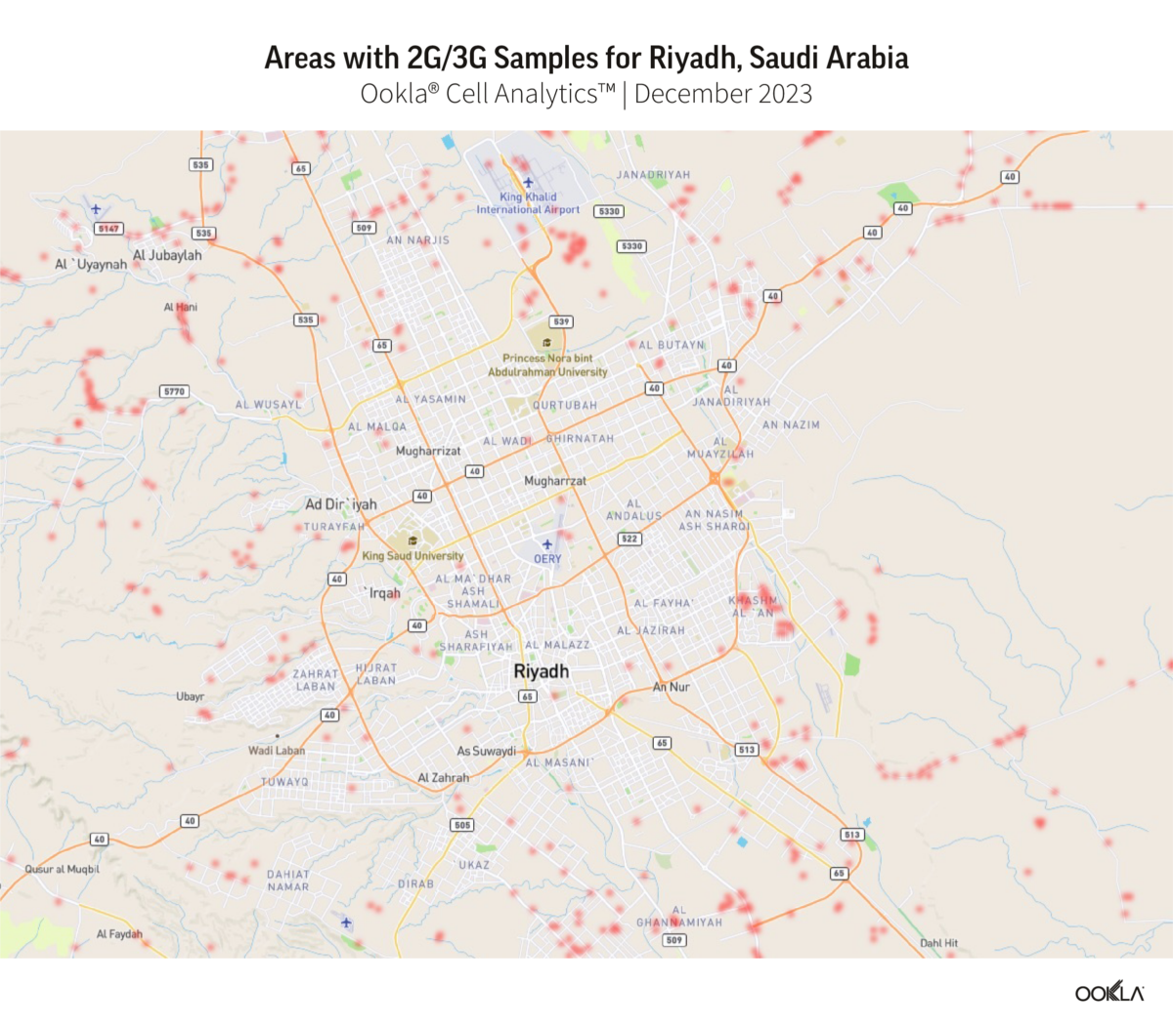

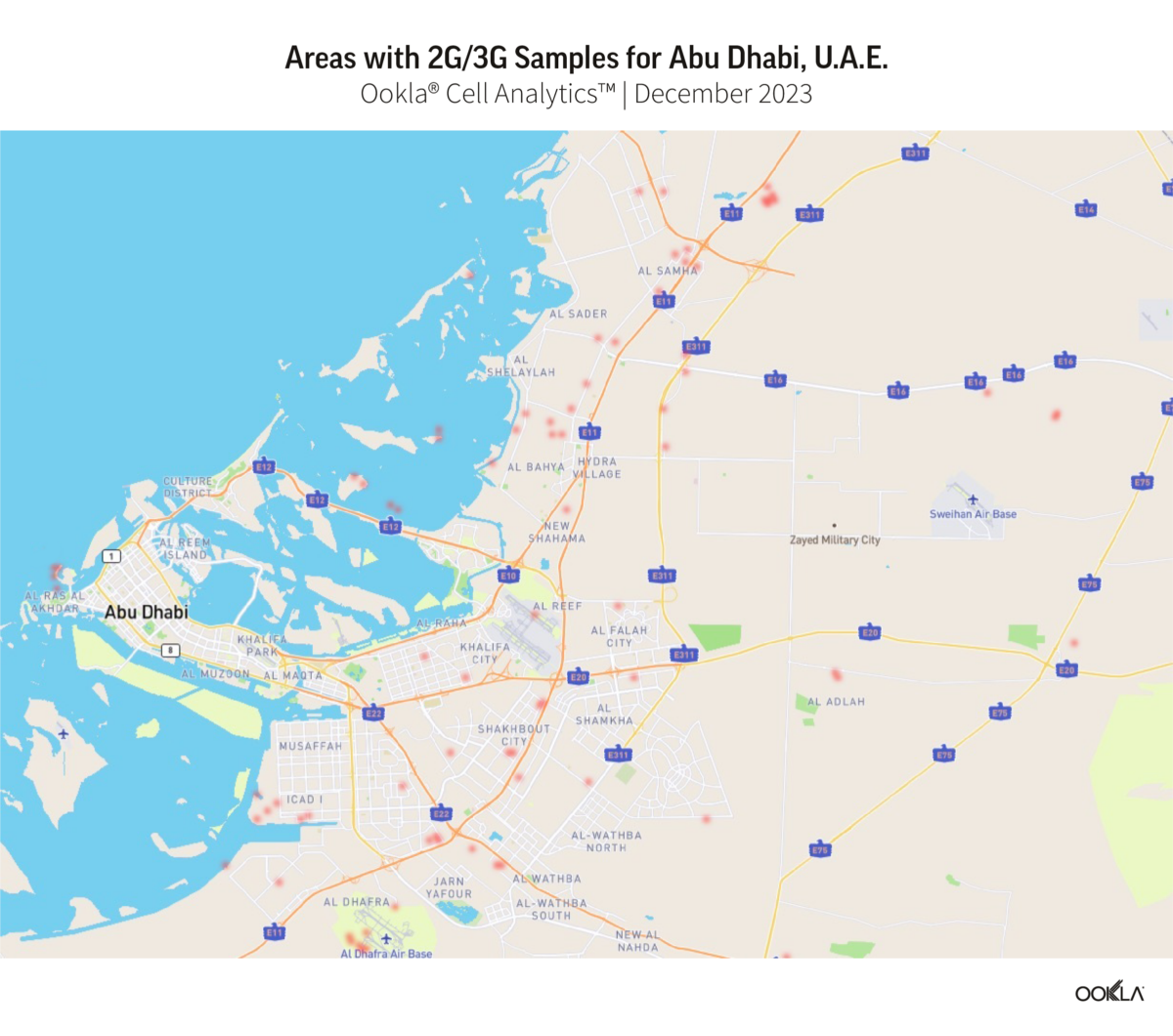

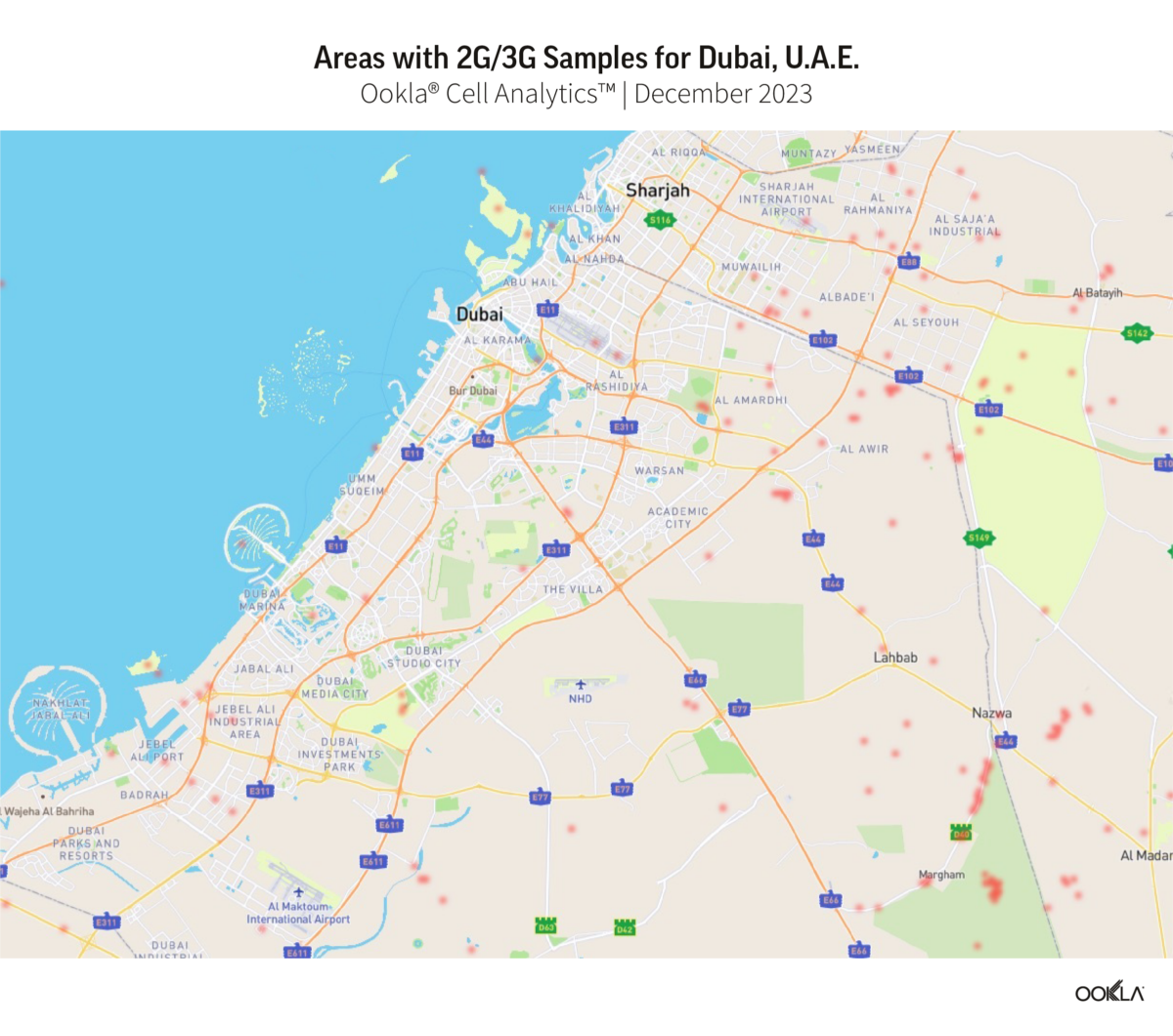

We used Ookla’s Cell Analytics™ to identify geographical regions with a concentration of 2G and 3G users in three countries, Oman, Saudi Arabia, and the U.A.E., that plan to sunset either or both technologies. The red dots on the map pinpoint customers connected to 2G and 3G because they have SIM cards not provisioned for LTE (including roamers), lack 4G coverage, or use devices incompatible with 4G. The maps below provide a high-level view of the coverage and activity level of the legacy network in each city. We used background measurements captured in December 2023.

The analysis reveals that operators in Oman and the U.A.E. are ahead in migrating customers from 2G/3G and ensuring comprehensive 4G/5G coverage, even in rural areas and along highways. In contrast, Saudi Arabia still relies significantly on 2G and 3G networks for connectivity within city centers, suburban areas, rural regions, and along transport corridors. Given the vast geography of this market, the full transition to modern networks is likely to take longer than in Oman and the U.A.E.

Operators in MENA are at different stages of decommissioning their 2G and 3G networks

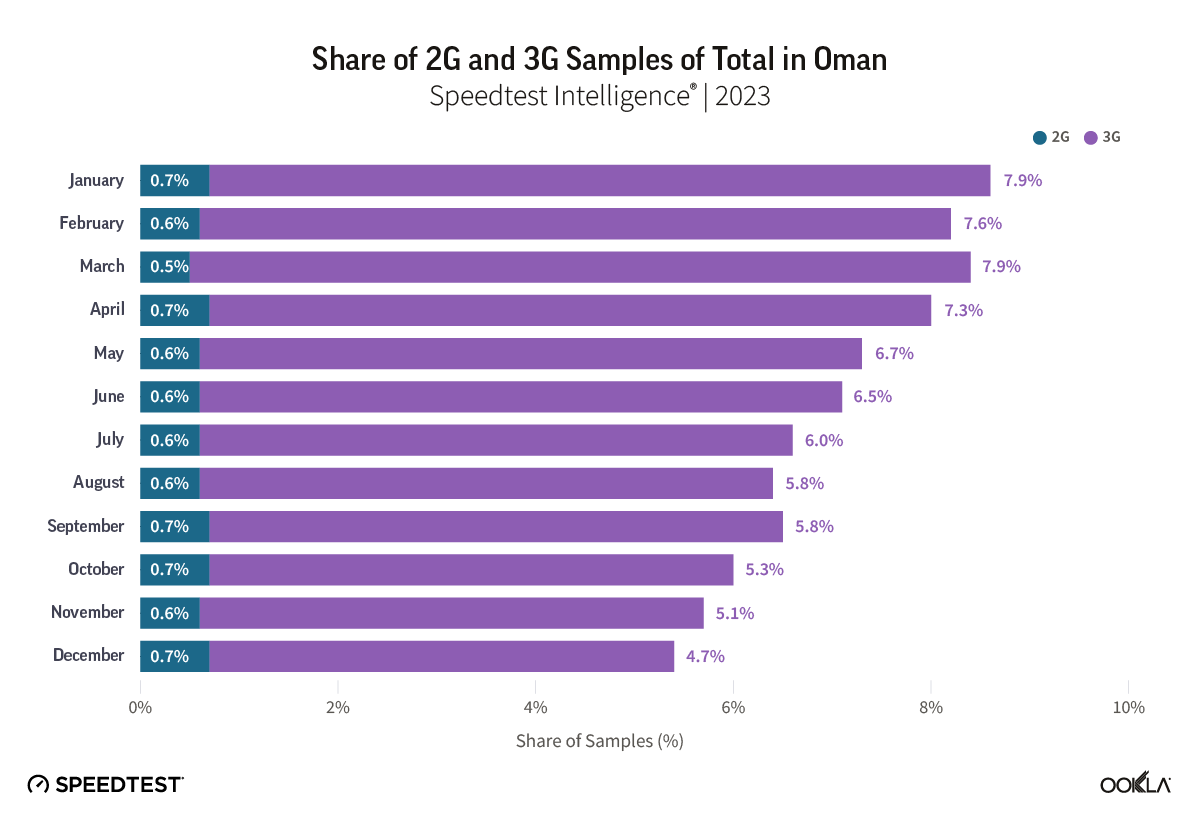

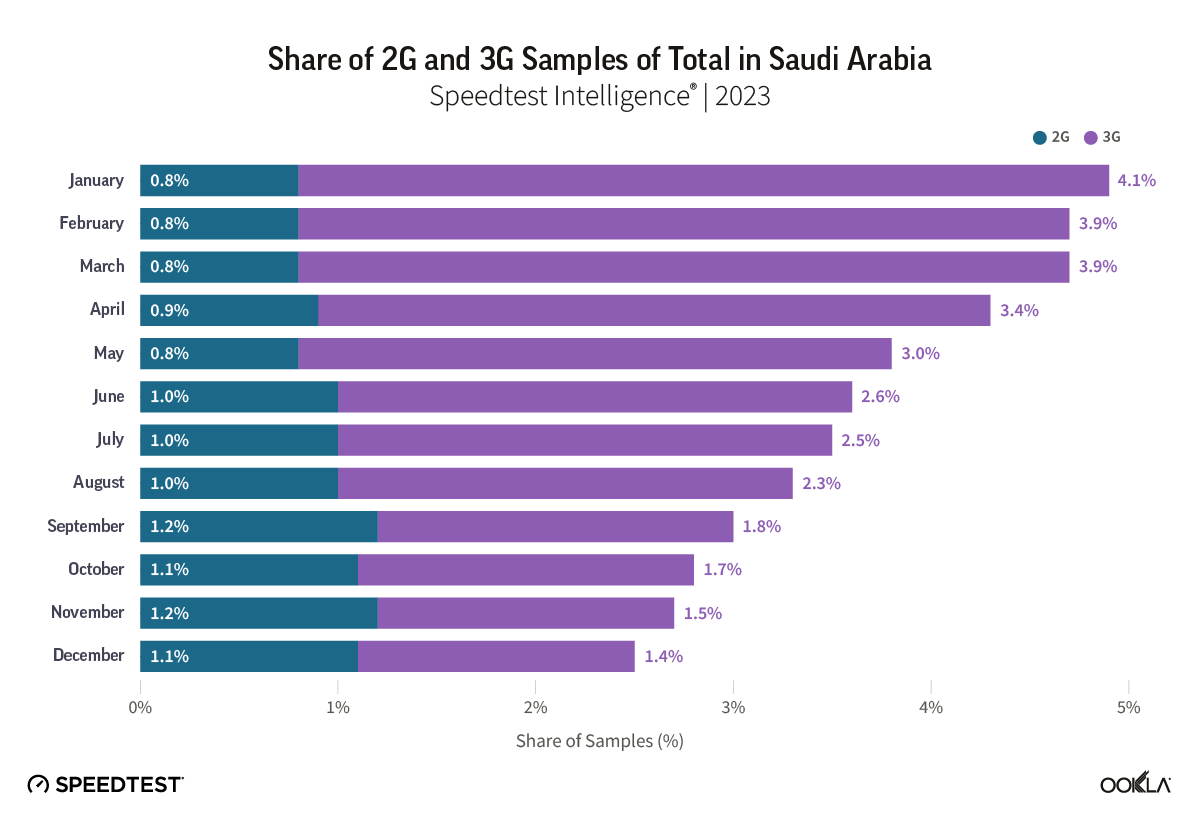

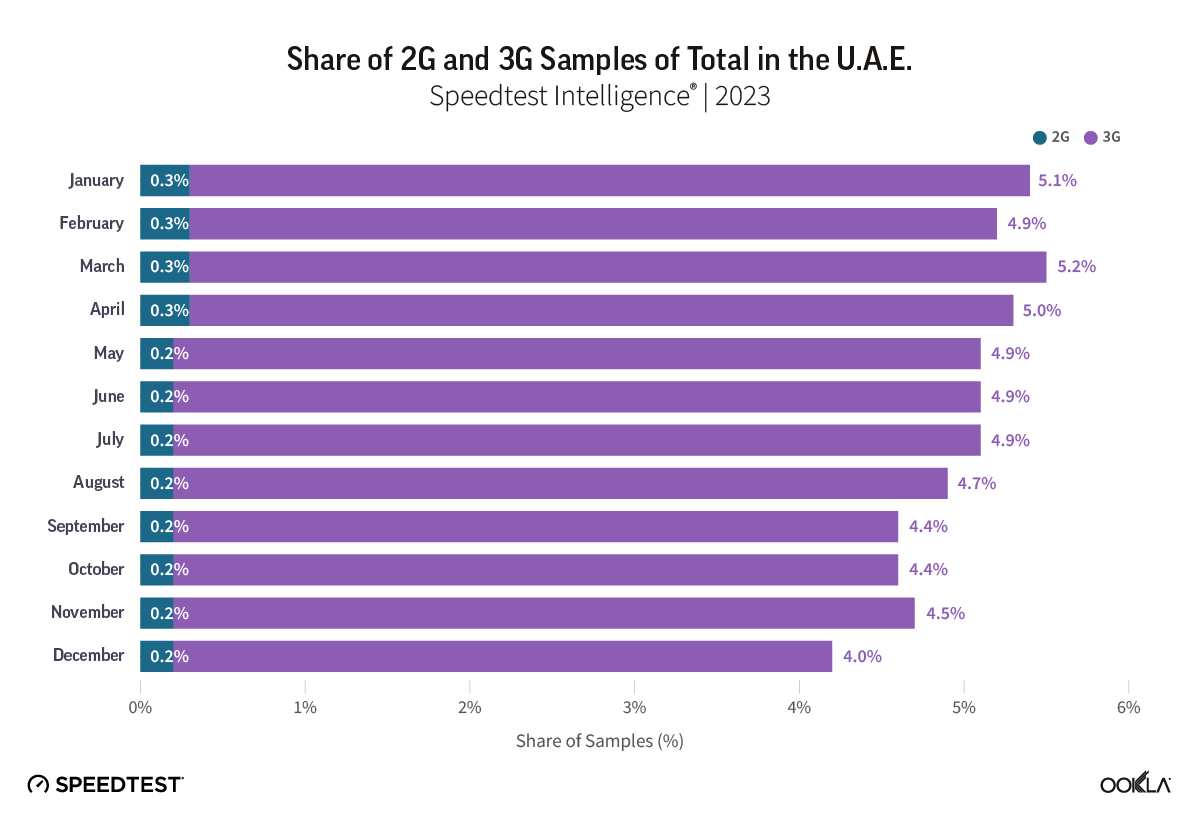

We used network “Availability” data from Speedtest Intelligence to get the percentage of users with a service-active device who spend the majority of their time connected to 2G and 3G (including while roaming) between January and December 2023 in Oman, Saudi Arabia, and the U.A.E.. This data serves as a proxy for the proportion of samples that accessed 2G or 3G networks out of all network measurements.

In Oman, 3G usage has been steadily decreasing. The percentage of 3G samples dropped from 7.9% in January 2023 to 4.7% in December of the same year. If this trend continues, operators should be well-positioned to turn off 3G around Q3 2024 as planned with little disruption to customer experience. Indeed, in 2023, Ooredoo initiated the process of ‘future-proofing’ IoT devices, such as home security systems and fitness trackers, that use 3G networks. The telecoms regulator TRA also plans a trial to gauge the challenges of a 3G shutdown, alongside mandating VoLTE enablement on all smartphones to facilitate a smooth transition.

In Saudi Arabia, despite initial plans to sunset 2G networks in 2022, a substantial segment of the market continues to use 2G SIMs according to our data, fluctuating around 1% throughout 2023. Mobily had the lowest proportion of 2G samples at 0.4% in December 2023, and Zain had the highest at 1.7%.

In 2020, stc planned to switch off its 3G network in 2022, later postponed to 2023. Speedtest Intelligence data revealed that 3G share of 4.3% at stc in January 2023 before falling sharply throughout the rest of 2023. This suggests that stc nearly completed or has already completed its 3G shutdown. Mobily and Zain have yet to announce their 3G decommissioning plans, with the technology representing 3.9% and 3.6% of total samples, respectively, at the end of 2023.

The U.A.E. telecoms regulator, TRA, initially set a deadline for the 2G shutdown by the end of 2022, which was later deferred to the end of 2023 to allow operators to coordinate with businesses that rely on 2G for equipment connectivity, such as vehicle-tracking devices and POS devices. Operators have been offering to upgrade or replace those devices to support LTE CAT-M1 (LTE-M), a category of 4G that is adapted for IoT. While Speedtest Intelligence data does not capture IoT connections, it shows that 2G share of samples has dwindled rapidly in 2023, representing around 0.2% of samples in December 2023.

Operators need to consider various aspects before phasing out legacy networks

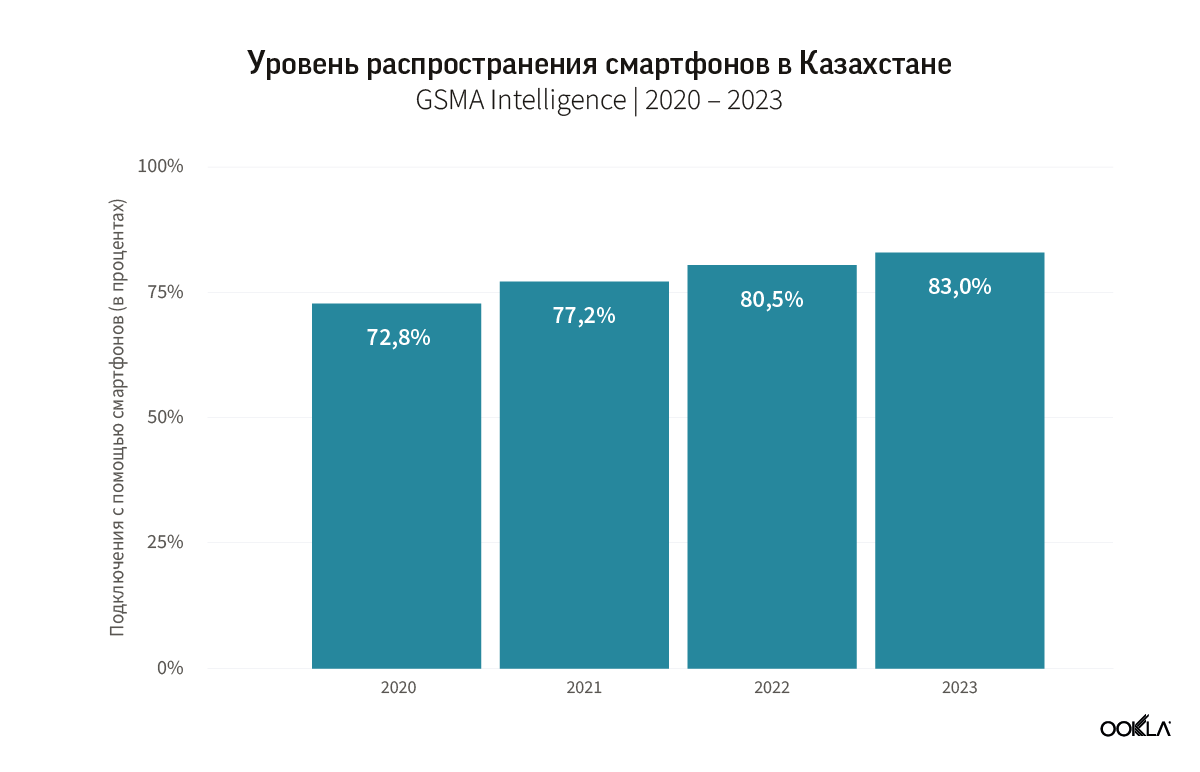

The decision to sunset one network before another should be informed by market conditions including the number of customers that use legacy networks, the cost of maintaining their operations, and the reliance of enterprise services on these networks. In markets with high smartphone penetration, such as those in the Gulf region, the phasing of 2G and 3G effectively began years ago. In those markets, operators have stopped activating new 2G/3G SIMs. In less mature markets, operators need to check that there is a sufficiently large base of 4G or 5G-enabled handsets in the market before the transition.

Communication is critical regardless of how the market and customers are ready. Operators should engage with subscribers well ahead of planned shutdowns to facilitate a smooth migration and prevent connectivity disruptions. Some customers might not realize that their handsets are still connected to 2G/3G even with modern handsets. Most operators we analyzed started communicating about the shutdown of their legacy networks and addressing common concerns about the upcoming changes.

Operators can also facilitate and accelerate this process by making available a range of affordable feature phones and smartphones, for example, by partnering with handset manufacturers. They could also offer financing schemes to support their acquisition, particularly, for those who cannot afford outright purchases. Regulators can also restrict or prohibit the sale and distribution of basic and feature phones before the decommissioning of 2G and 3G networks.

Finally, voice services, a critical revenue stream for MENA operators, can be particularly affected by sunsetting. That is why operators need to carefully consider their options. They could switch off 3G and keep 2G as a fallback network for voice despite potential quality degradation. A better alternative would be to migrate customers to use 4G for voice with VoLTE. However, VoLTE adoption is generally slow, so operators need to raise awareness and encourage subscribers to enable the technology on their handsets.

The situation is more challenging considering international roaming. Visitors from countries where VoLTE is disabled may struggle to access voice services, even on VoLTE-compatible phones. Solutions exist to convert traditional circuit-switched voice calls to VoLTE to establish a connection between the home and host networks. However, they require testing to ensure network interoperability and device compatibility, as well as a review of roaming terms such as pricing. Alternatively, operators can sign national roaming agreements with their competitors that maintain an active legacy infrastructure to support 2G subscribers, like in Jordan.

Operators should work with other industry stakeholders on the network sunsetting process to avoid delays

Sunsetting legacy networks can bring many benefits to the operators, such as lowering operating and maintenance costs, optimizing spectrum usage, streamlining network management, and accelerating service innovation.

Another advantage of sunsetting older networks is the opportunity to repurpose low-frequency bands, which cuts down deployment costs and also enhances network coverage and capacity. This, in turn, can lead to more affordable services for end-users, contributing to the narrowing of coverage and data usage disparities.

However, the process of sunsetting legacy networks is complex and lengthy. That is why operators should plan the transition well ahead to prevent unnecessary delays and execute it properly to minimize the risk of losing customers and revenue and damaging brand reputation. This planning process should include discussions with various stakeholders, including other mobile network operators, consumers, enterprise customers, wholesaler partners, and regulators.

To find out how Ookla’s crowdsourced data and analytical tools can help you as you evaluate, implement, and track network sunsetting, contact us.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.

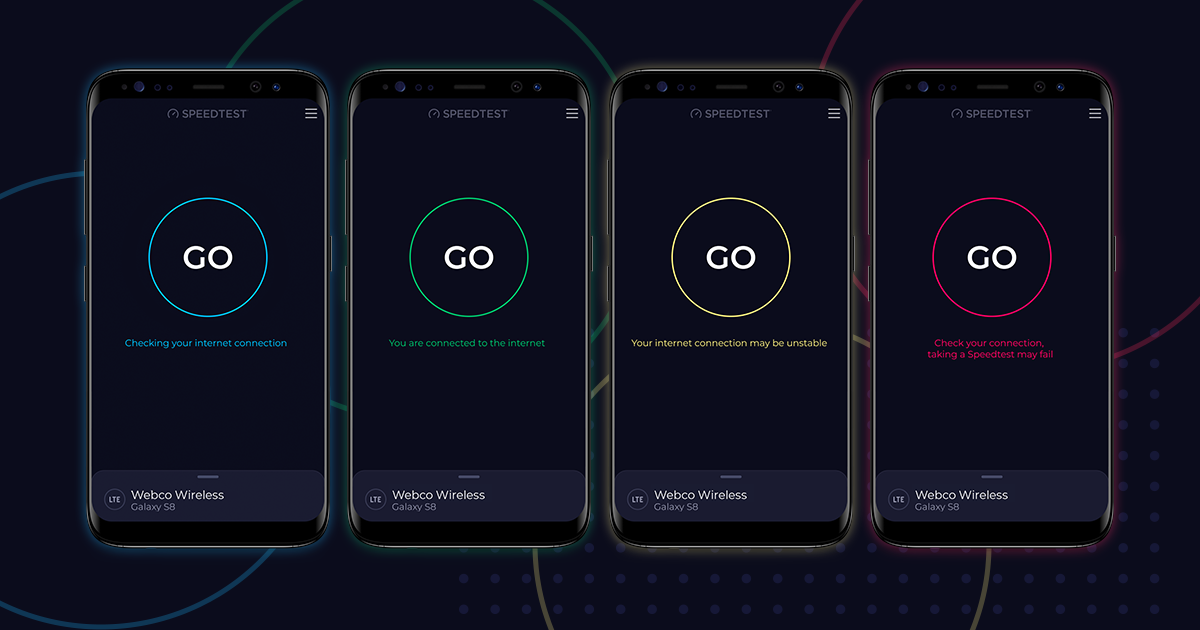

First, a blue circle

First, a blue circle A green circle confirms you’re connected

A green circle confirms you’re connected A yellow circle means something isn’t quite right

A yellow circle means something isn’t quite right A red circle indicates you’re probably disconnected

A red circle indicates you’re probably disconnected