日本語

Japanese companies have often been at the forefront of applying innovative new technology to improve the everyday lives of their customers. For example, the world’s very first 1G phone service was pioneered and launched in Japan in 1979. So it’s no surprise that the most cutting-edge approach to mobile is already underway in Japan as Rakuten embraces the Open Radio Access Network (O-RAN) standard to build a cloud-native mobile network, Rakuten Mobile. This fully virtual mobile network allows Rakuten to reduce the costs associated with building and upgrading a network and also offers Rakuten Mobile’s customers a complete beginning-to-end user experience for their online activities.

Rakuten disrupts a well-established market

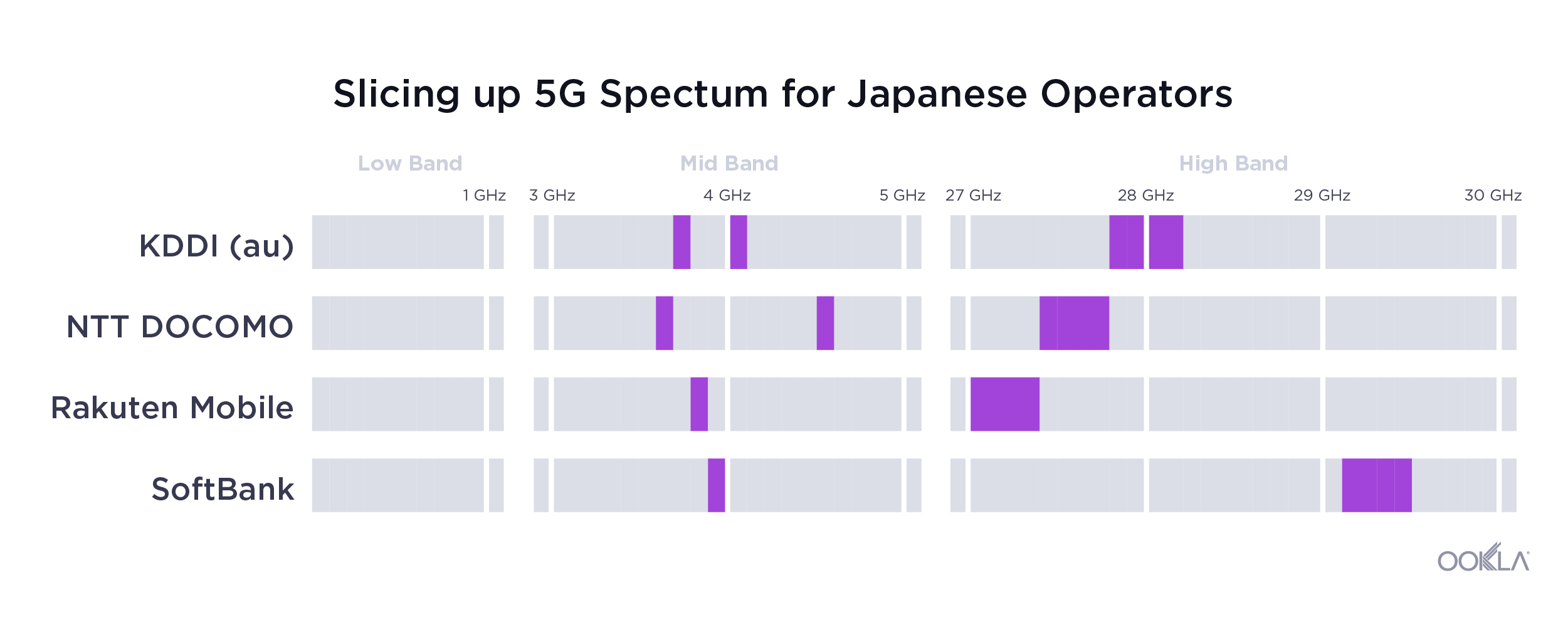

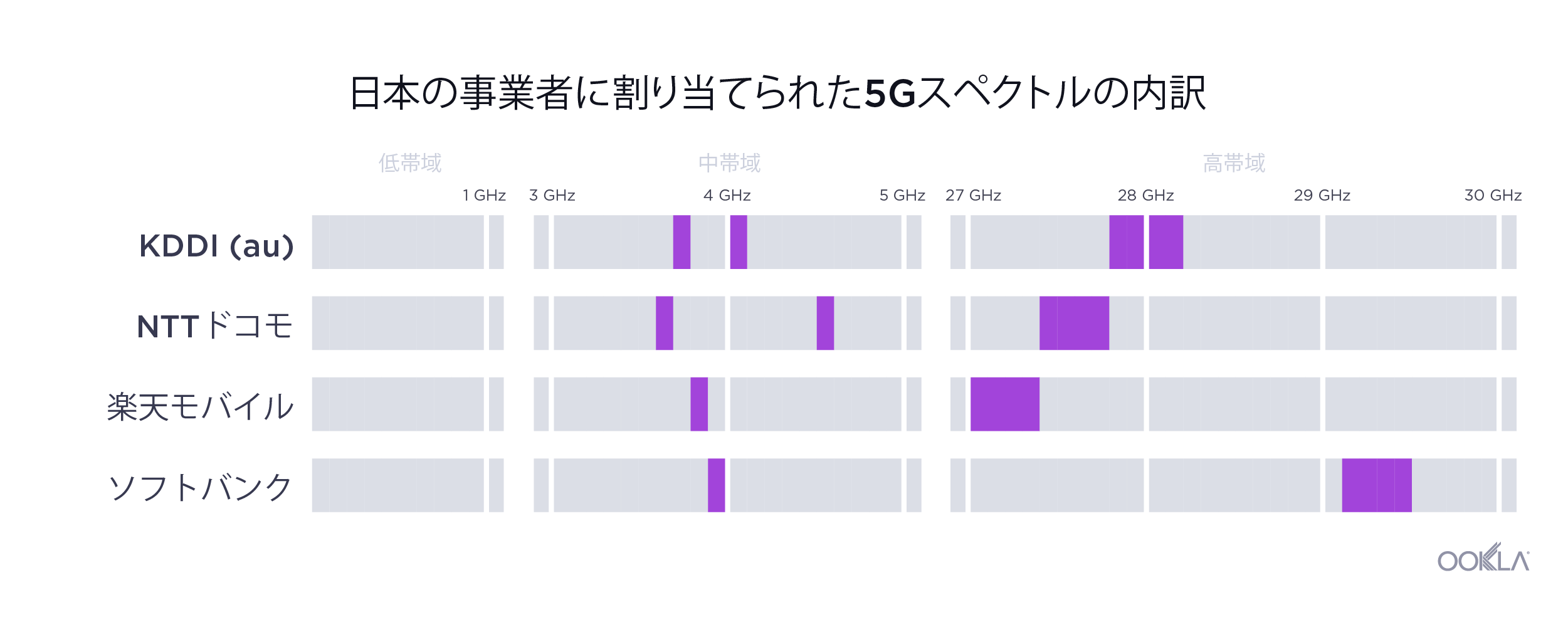

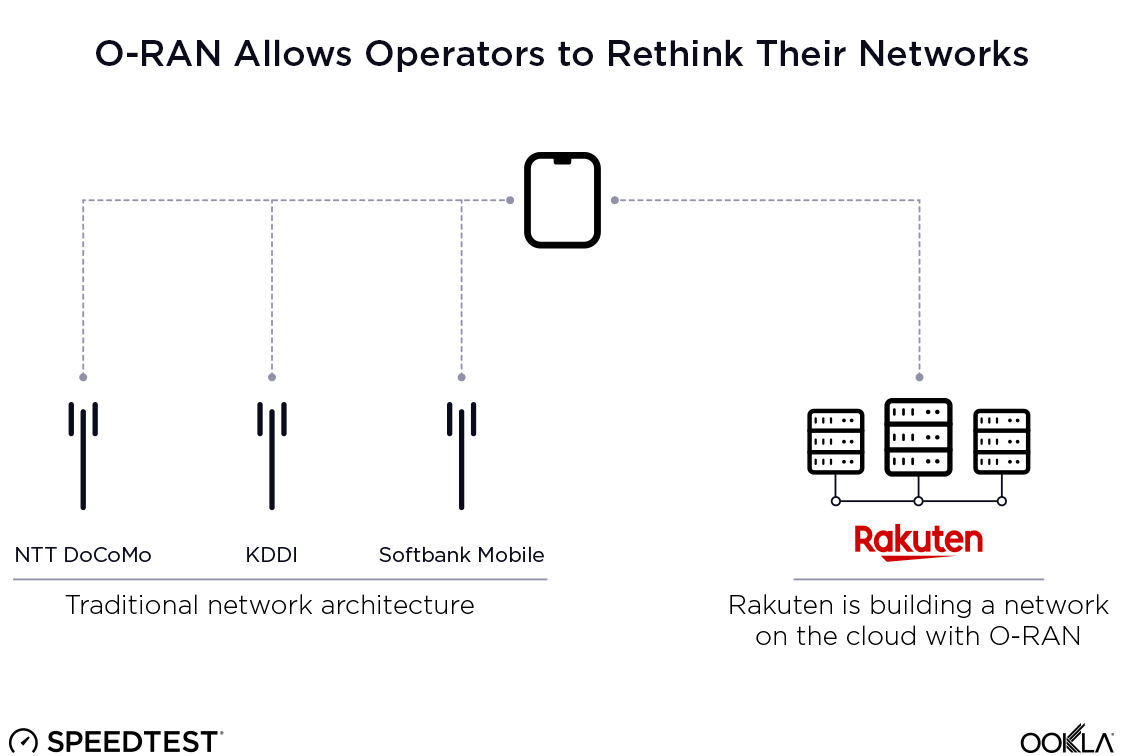

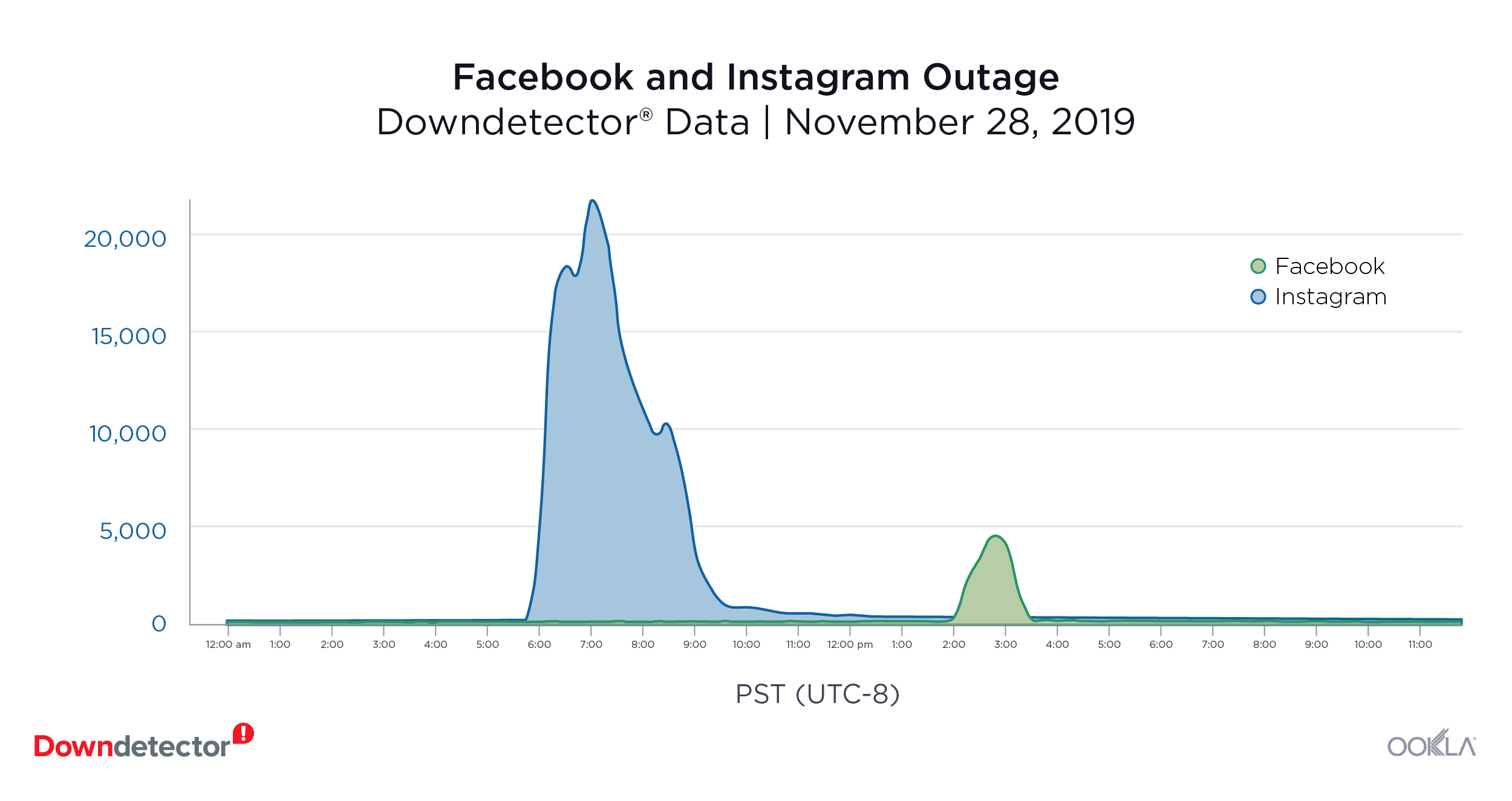

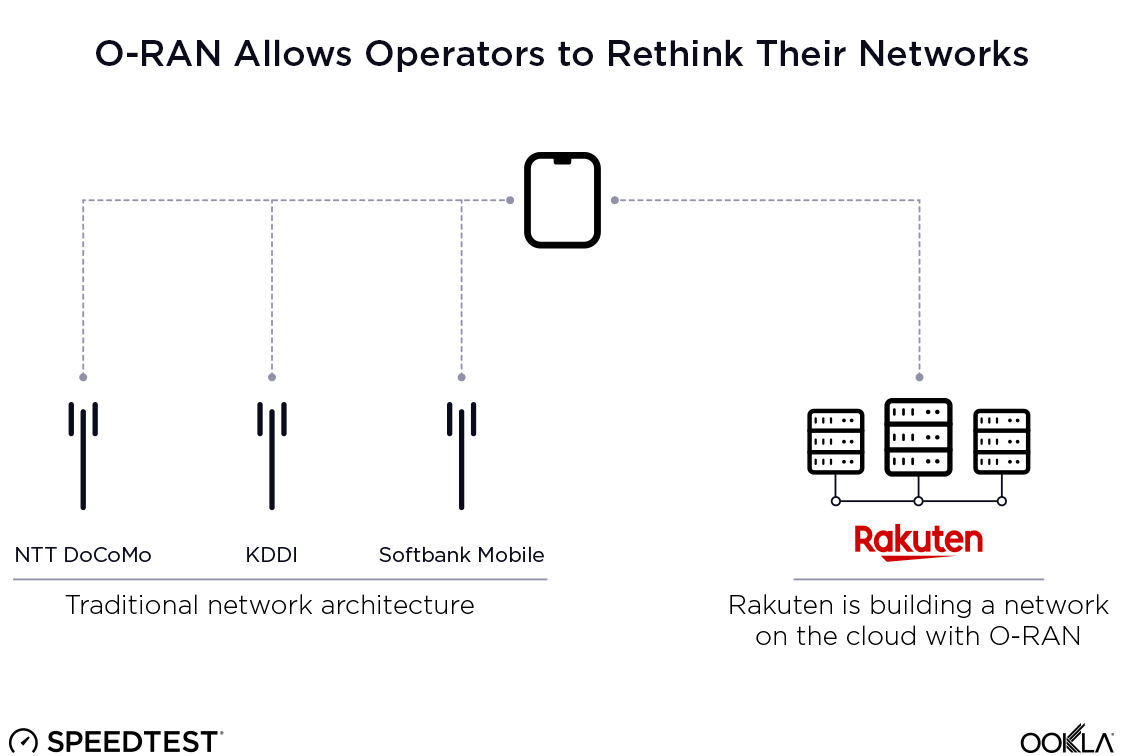

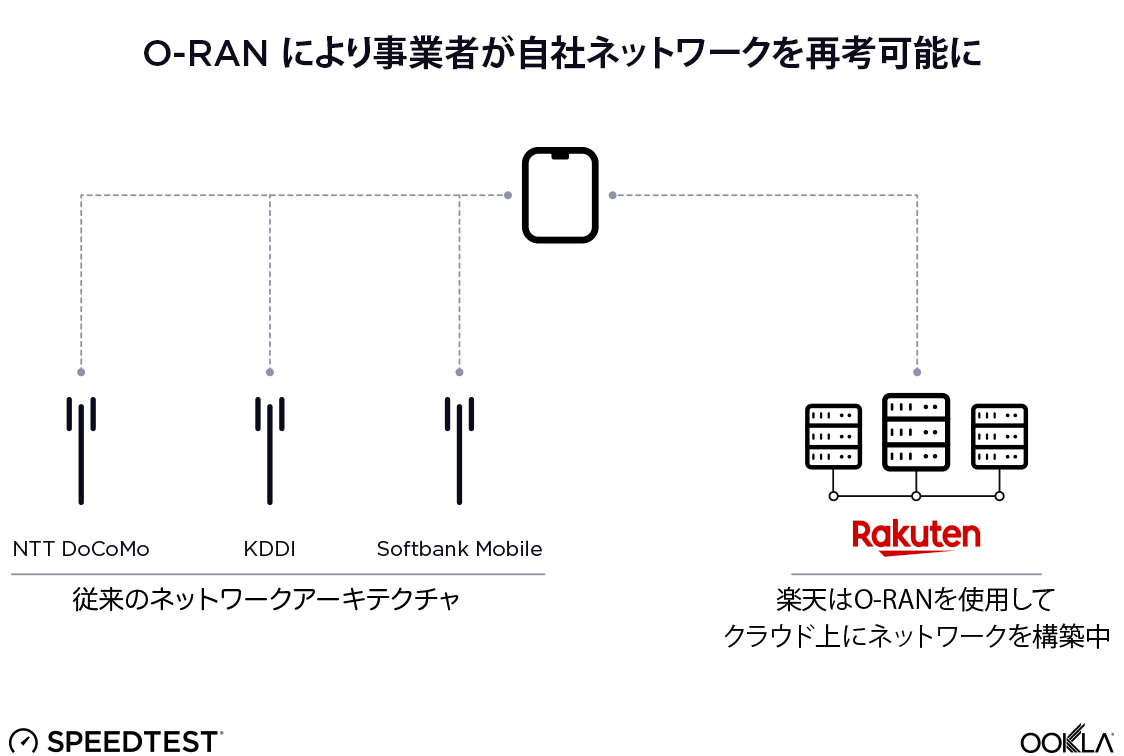

Prior to Rakuten Mobile’s entry, the Japanese mobile market was dominated by three major operators: NTT Docomo, au by KDDI and Softbank Mobile. All three have been in operation for over a decade and have deployed 5G throughout Japan.

NTT DoCoMo was spun off from Nippon Telegraph and Telephone (NTT) with 2G service in 1991. Over the next decade, the company transitioned to 3G. It currently offers LTE service on a combination of 700 MHz, 800 MHz, 1.5 GHz, 1.8 GHz, 2.1 GHz and 3.5 GHz bands. Recently the company has launched 5G service on 3.6GHz, 4.5GHz and mmWave.

KDDI was created in 2000 as a result of a merger of three companies: KDD, DDI and IDO. The company used CDMA technology for its 2G and 3G services, and currently offers LTE services using 700 MHz, 800 MHz, 1.4 GHz, 2.1 GHz and 3.5 GHz. Recently launched 5G service is rolled out on 3.8 GHz, 4.1 GHz and mmWave.

Softbank Mobile, the third major operator in Japan, entered the Japanese market in 2006 with the purchase of Vodafone Japan. Softbank Mobile’s LTE frequency bands span from 700 MHz to 3.5 GHz, and 5G is rolled out on 3.9 GHz and mmWave.

Rakuten is new to mobile, but this is only one part of a well-established business. Founded in 1997 as an e-commerce company with only six employees and one server, the company now has a global reach with a portfolio of over 70 companies and more than a billion membership and loyalty program customers worldwide. The enterprise now covers a wide variety of industries including banking, travel, online shopping, advertising, global messaging, video delivery, data analysis and now wireless, just to name a few.

What’s extremely interesting about Rakuten as a wireless operator is the company’s culture and decades of data-centric expertise in the cloud space. Offering end-to-end user experience and controlling the entire customers’ online journey certainly brings tremendous value to the company, but it also opens the idea of other tech giants like Amazon, Google and Apple entering the mobile telecom space. With the promise of running fully virtualized network functions, the costs associated with network rollouts and operational expenditure may be significantly reduced, and any new entrants to the telecom space may bring fresh perspectives on running and operating a mobile network.

Rakuten leverages the cloud to break the chains of infrastructure

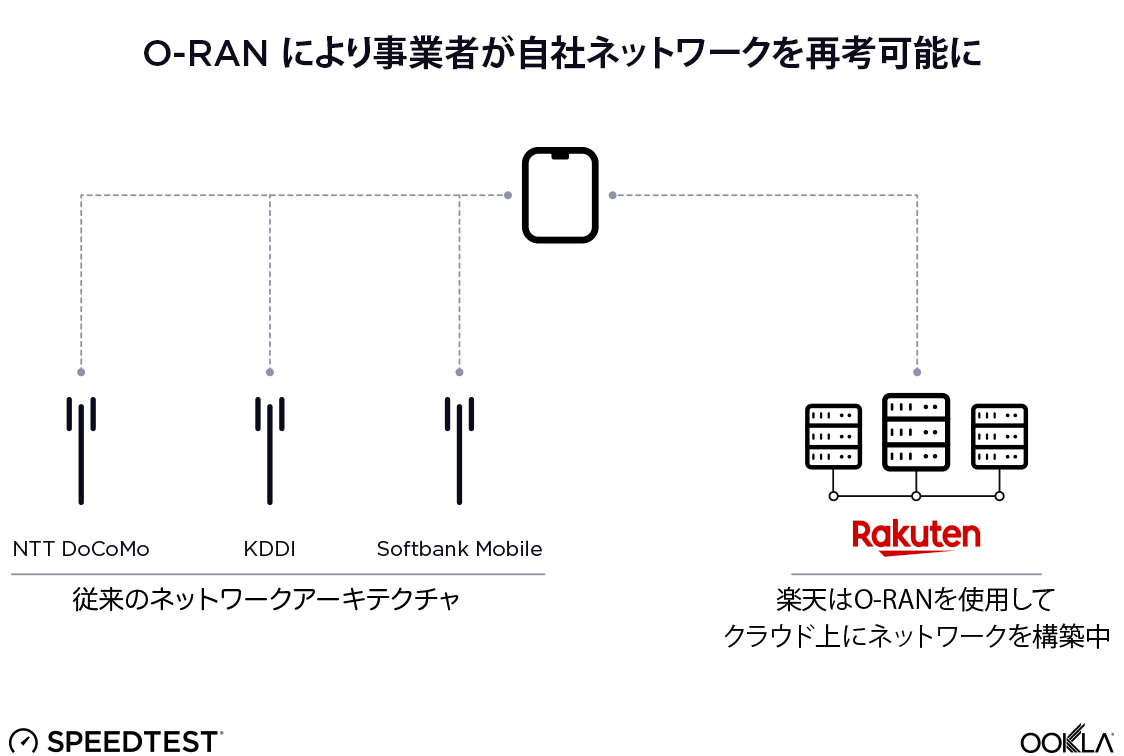

Rakuten opted for a cloud-native mobile network approach using O-RAN instead of relying entirely on traditional network infrastructure equipment vendors for core and radio access technology. This means Rakuten is decoupling radio access from baseband processing and virtualizing a large amount of network functions. This approach relies on data centers and the cloud, which are Rakuten’s strengths.

In the traditional telco world, infrastructure vendors’ solutions typically provide an end-to-end vertical stack, which includes everything from radio access and baseband processing to the transport and core. This means that when operators lock into a contract with infrastructure giants like Huawei, Nokia and Ericsson, they are locked into a proprietary closed ecosystem of software and hardware.

Once hardware and software are disaggregated, operators will be free to deploy any software-defined functions offered by any company, small or large, following “white-box” O-RAN guidelines. This approach, called “virtualization,” can be run on any off-the-shelf computer server. Virtualization reduces the importance of traditional telco hardware, speeds up rollouts, drives innovation and significantly reduces the operator’s capital expenditures. Virtualization can quickly and easily disrupt the economics of traditional operators, paving the way for fresh opportunities both for new entrants and the industry as a whole. With O-RAN, operators can work with major infrastructure vendors like Nokia, NEC, Fujitsu, Cisco and Intel and smaller companies like Airspan and Altiostar to choose custom solutions.

This also means that multi-vendor interoperability and a multitude of innovations like virtualization and automation will largely depend on a vendor’s nimbleness in the research and development space.

The innovations behind O-RAN

O-RAN architecture is a concept designed to address the future needs of mobile network providers based on openness, interoperability and industry collaboration as a whole. Traditional network deployments rely on 3GPP-compliant hardware, typically designed by a single vendor providing a closed-box software and hardware solution as well as security aspects of the networks. On the other hand, the O-RAN Alliance and its members (which include leading telecom, cloud and chipset suppliers, as well as network operators) have been leading an effort to standardize virtual RAN functions and open interfaces to enable cloud-native deployments and multi-vendor interoperability.

O-RAN opens the door to new solutions

One of the goals of this initiative is to maximize the openness and use of common off-the-shelf hardware while minimizing the use of the proprietary telecom hardware. Creating a standardized multi-vendor virtual RAN environment allows third parties to access what used to be closed vendor RAN data and create a multitude of innovative services and applications.

O-RAN promises open interfaces that enable smaller vendors to introduce their products and services in ways that are tailored to suit operators’ unique needs. This should foster vendor diversity and infrastructure robustness while allowing the operators to minimize security risks by controlling all aspects of the network.

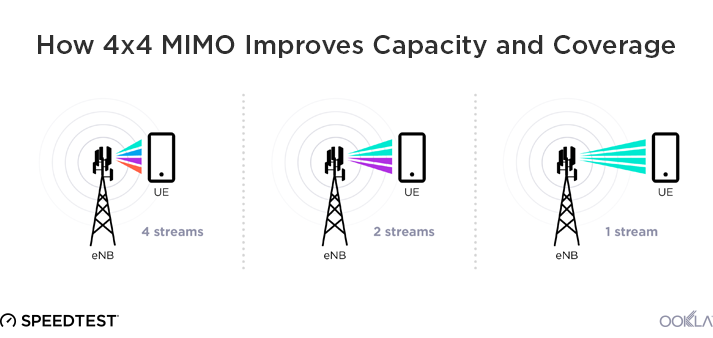

By using commercial off-the-shelf (COTS) hardware with virtualization software in the form of containers and virtual machines (VM), the Radio Access Network basically becomes the first app in the O-RAN app store.

Improving network security and agility

Another major aspect of O-RAN is the unparalleled view it provides into the security apparatus of the network, allowing the operator to have full end-to-end visibility and transparency into the entire stack — and to control the entire supply chain for each and every component. Furthermore, because of the software-based nature of O-RAN, the operator has the ability to add, inspect or replace network functions much faster than with traditional deployments which often require physical visits for upgrades. In this way O-RAN improves the efficacy and agility of the network.

This is potentially the first time in the history of the mobile industry where operators will be given the voice and the ability to custom-build networks. From an engineering perspective, moving hardware-based baseband to the virtual world is challenging, but also fun. With recent advancements in software-defined networks and virtualization, LTE and 5G networks have the potential to behave like Wi-Fi networks from installation through integration. The concept of a telecom app store will continue driving innovation, collaboration and industry support, while both private and government sectors will need to be engaged to drive this ongoing transformation in the industry.

Allowing applications to program the network

During the last decade, progress has been made on building applications that can run on top of the network. O-RAN promises to take this to the next level by allowing applications to actually program and run the network itself, which introduces the importance of artificial intelligence (AI). The use of AI to program a network could dramatically simplify the rollout and operation of 5G networks.

Leveraging automation, virtualization and artificial intelligence could also enable self-driving network operations and reduce operating expense. Future deployments could (ideally) depend on virtualized network elements and a standardized white-box approach, which would foster a multi-vendor, interoperable and autonomous RAN.

One of the main propositions of O-RAN architecture is to extend the software-defined network (SDN) concept of decoupling the control-plane (CP) from the user-plane (UP) into RAN, while bringing in embedded intelligence. Separating UP from CP allows for more scalability and cost-effectiveness on the UP. According to the O-RAN Alliance White Paper, this new architecture introduces a set of key interfaces between multiple decoupled RAN components. These include enhanced 3GPP interfaces (F1, W1, E1, X2, Xn) to enable multi-vendor interoperability. In addition to the proposed white-box hardware, many software components will be delivered on an open-source basis like the RAN intelligent controller, protocol stack, PHY layer processing and virtualization platform.

How Rakuten made the world’s first Open Radio Access Network

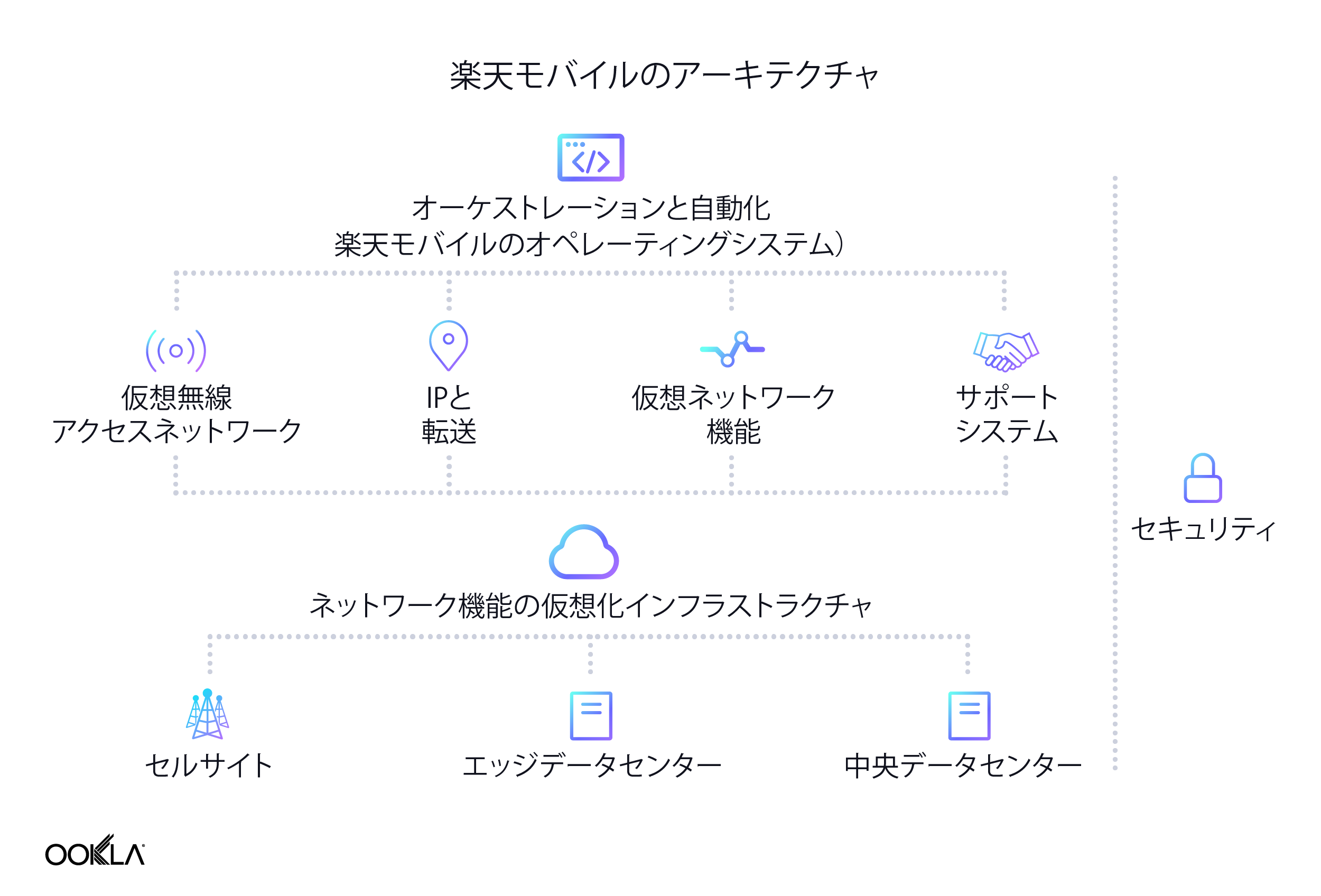

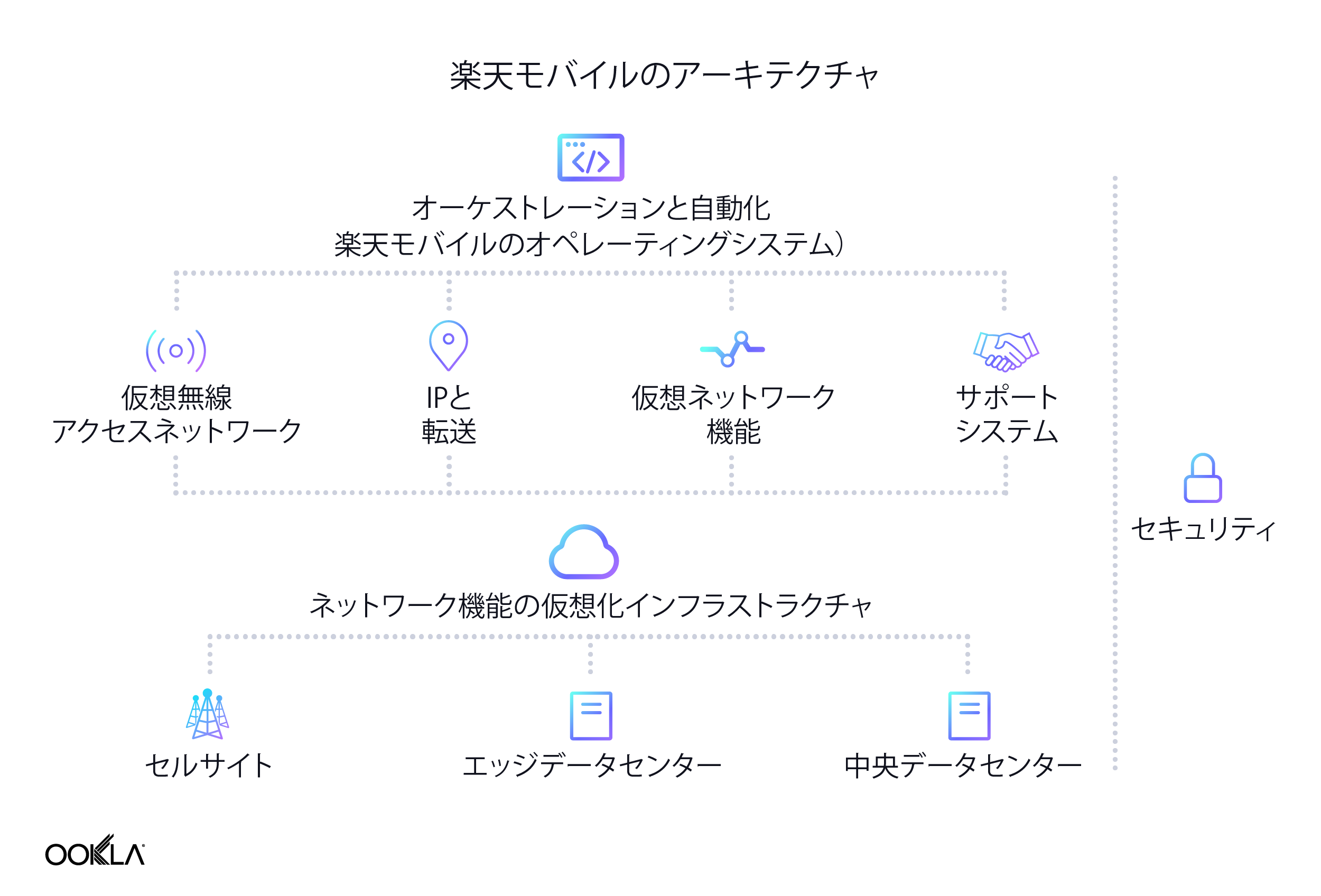

As a brand new entrant in the Japanese mobile space, Rakuten took its cloud-centric approach and virtualized everything from radio to the core with hundreds of virtual functions implemented. These functions are delivered from multiple computing centers leveraging COTS hardware.

Rakuten has also fostered innovation on the radio access side by having infrastructure giants like Nokia agree to open up the radio, which is typically a black box. This allows Rakuten to control all the hardware that goes into the network, the supply chain, the ecosystem as well as the security aspect of this platform. Rakuten prides itself in the “zero touch provisioning” which breaks free from traditional network rollouts, drastically speeds up the deployment process and requirements, and redefines the way telecom operators can architect, provision and deploy the network.

A company like Rakuten — with decades of experience running server-centric IP-based services — already has an advantage over traditional telcos because of the hundreds of edge data centers they operate. At this time, Rakuten has an infrastructure of nearly 300 edge data centers that can bring content geographically closer to the user and drastically reduce latency. The CP workloads are handled by central data servers, and the entire operation is managed by the horizontal cloud. Everything from radio access, transport and network functions are virtualized and orchestrated by the Rakuten Mobile operating system.

The process of activating and provisioning a new site takes minutes, rather than hours or days, bringing significant savings in capital and operational expenditures. For the field technicians this means all they have to do is hang radio units, connect the fiber and power, and the new cell site will be up and running.

Rakuten began initial trials late last year. Using an app-based approach, they onboarded 5,000 customers to test and validate the world’s first end-to-end cloud-native architecture. The official April 2020 launch was on LTE only, and the initial network service area covers Tokyo, Nagoya City and Osaka City. Outside of the native coverage area, users will have the ability to roam on KDDI and Okinawa Cellular. Since the operator owns the end-to-end orchestration and automation of eNodeB as a virtual network function, and both hardware and software is 5G-ready from the get-go. This also means that new network feature rollouts and fixes are significantly easier than they are for a traditional telco. On September 30, Rakuten rolled out a commercial 5G network which will be the test of how easy this flexible software-based architecture makes rolling out core and network functions.

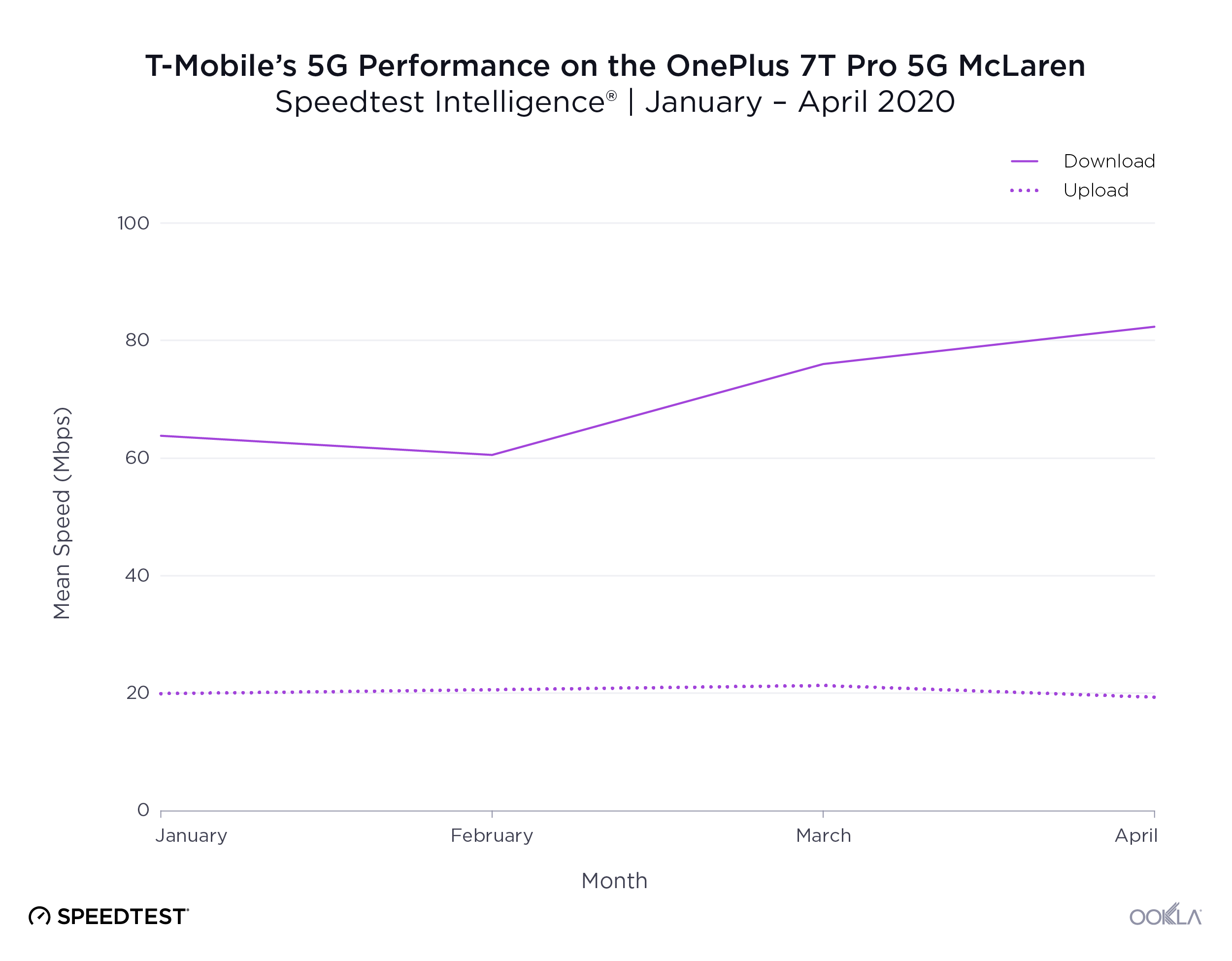

As revolutionary as Rakuten’s approach is, end users are more likely to care about performance than how the network is configured. We took a look at Rakuten’s performance over 4G LTE and 5G in Tokyo during Q2-Q3 2020. Data for 5G is limited to Q3 as Rakuten’s 5G is only newly commercially available.

|

Download (Mbps) |

Upload (Mbps) |

| Q2 LTE |

38.05 |

18.28 |

| Q3 LTE |

31.68 |

19.51 |

| Q3 5G |

101.33 |

18.78 |

Rakuten delivered a median LTE download speed of 38.05 Mbps in Q2 2020. However, LTE download speed was 16.7% lower in Q3 2020. Upload speed over LTE increased slightly. Users with access to the 5G network layer that launched at the end of Q3 2020 experienced a median download speed of 101.33 Mbps, 166.3% faster than the median download speed over LTE in Q2 and 219.9% faster than median download speed over LTE in Q3. The median upload speed on 5G was slower than on LTE.

What operators can learn from the Rakuten model

The Rakuten model is a very early dive into the world of O-RAN architecture. It went from a proof-of-concept to a fully fledged commercial mobile network serving millions of customers in what felt like the blink of an eye. There are still many unknowns, in particular in terms of future scalability and security, but the operator seems to be very confident with its own Rakuten Mobile Platform (RMP). In fact, that same platform is being offered as a turn-key solution to existing mobile operators and new entrants.

This model promises a significant cost reduction in both capital and operating expense, including head count (due to the data-centric nature and the level of automation). This approach seems to pose a threat to the traditional telecom giants like Ericsson, Nokia and Huawei in terms of revenue. However, these companies’ willingness to open their radio components and allow customization for Rakuten’s specific needs implies that broader change is coming in the telecom world.

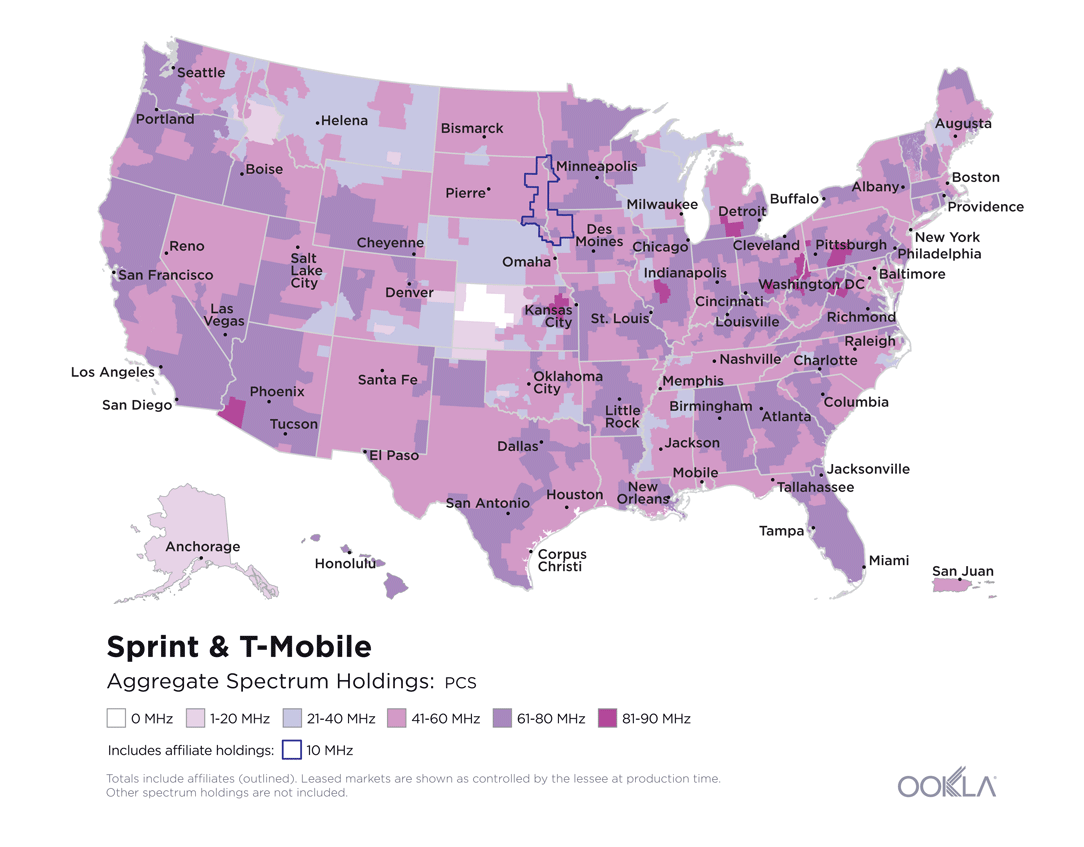

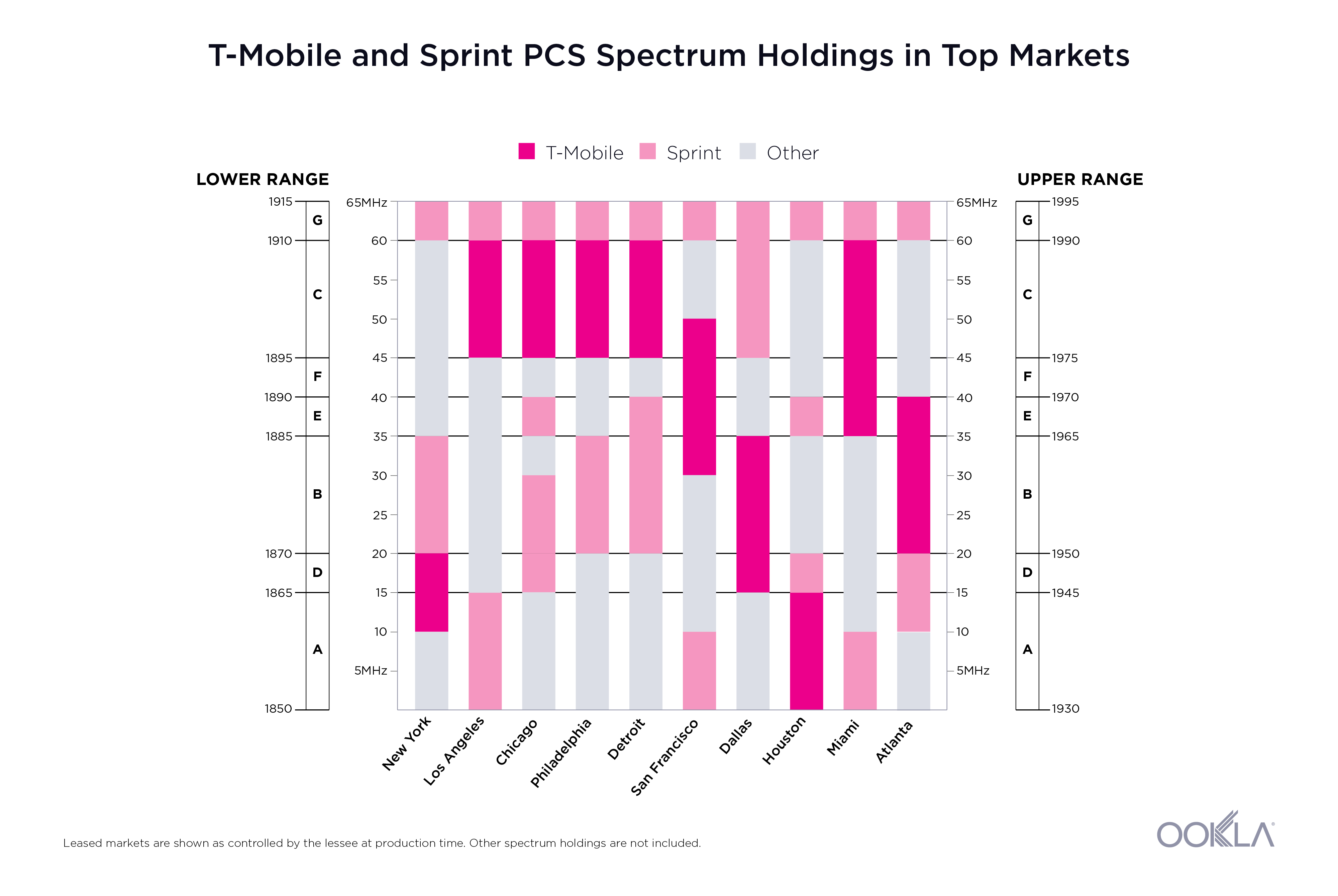

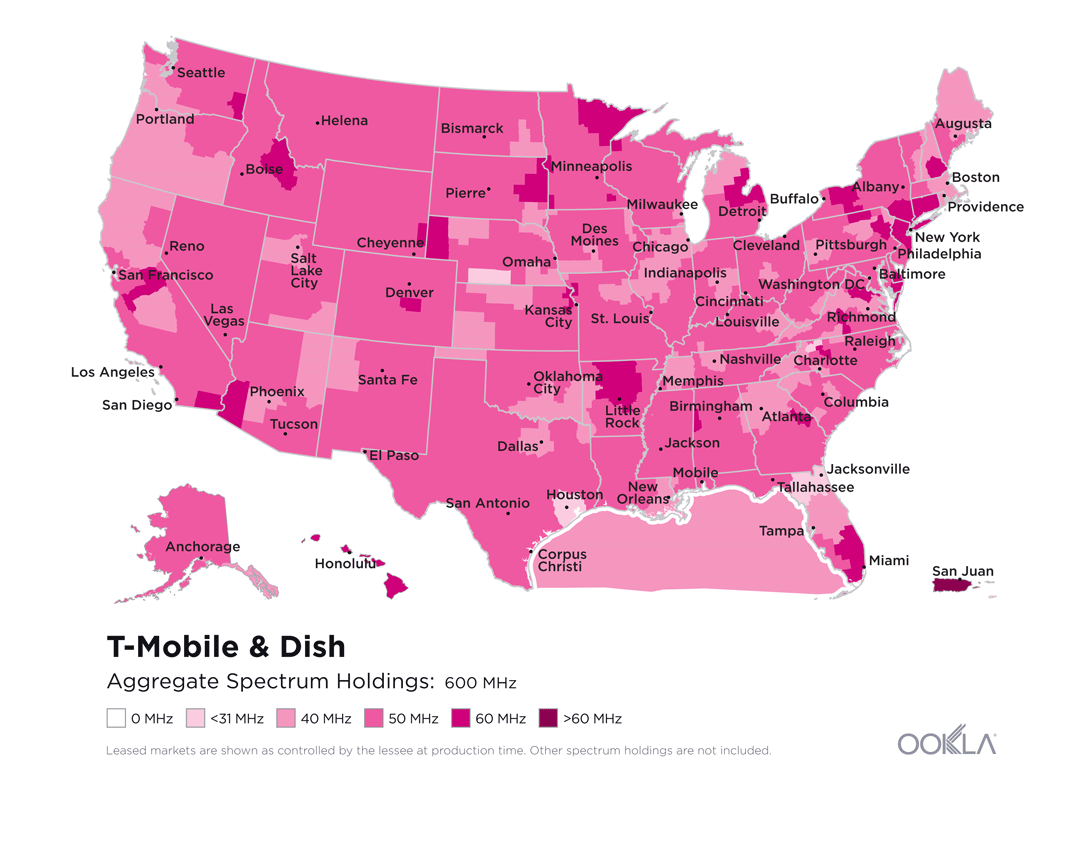

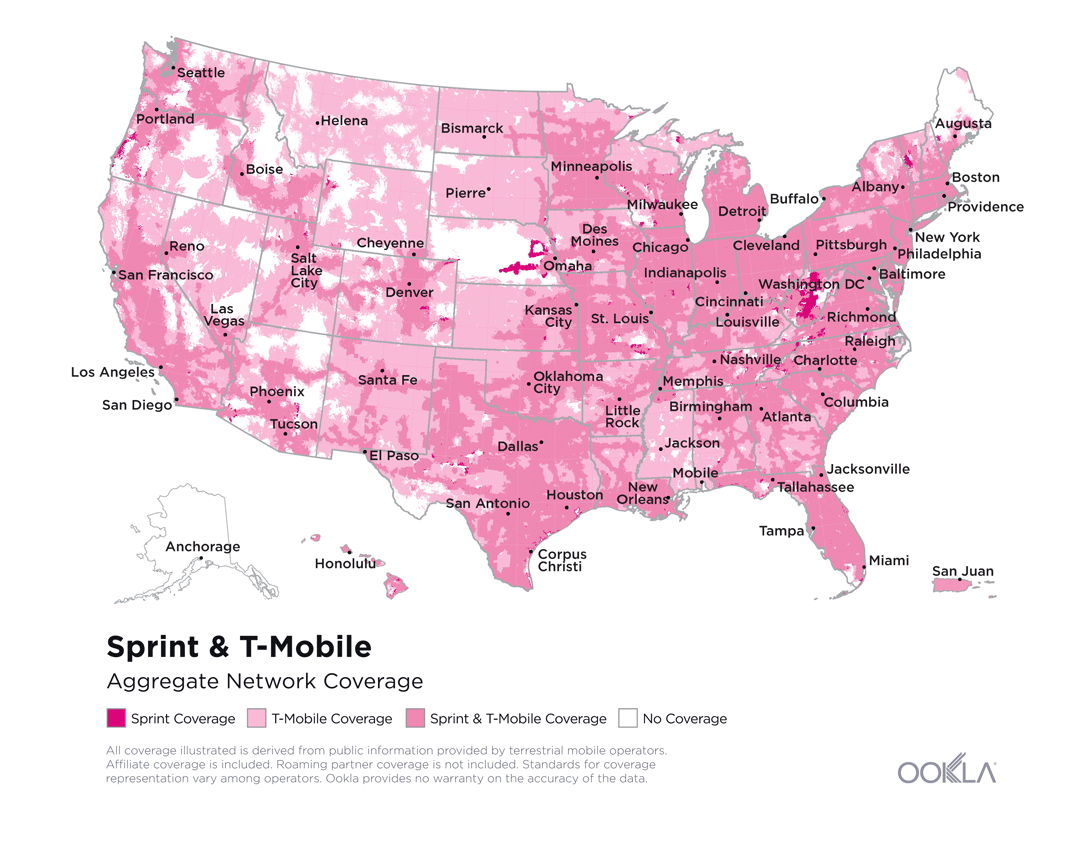

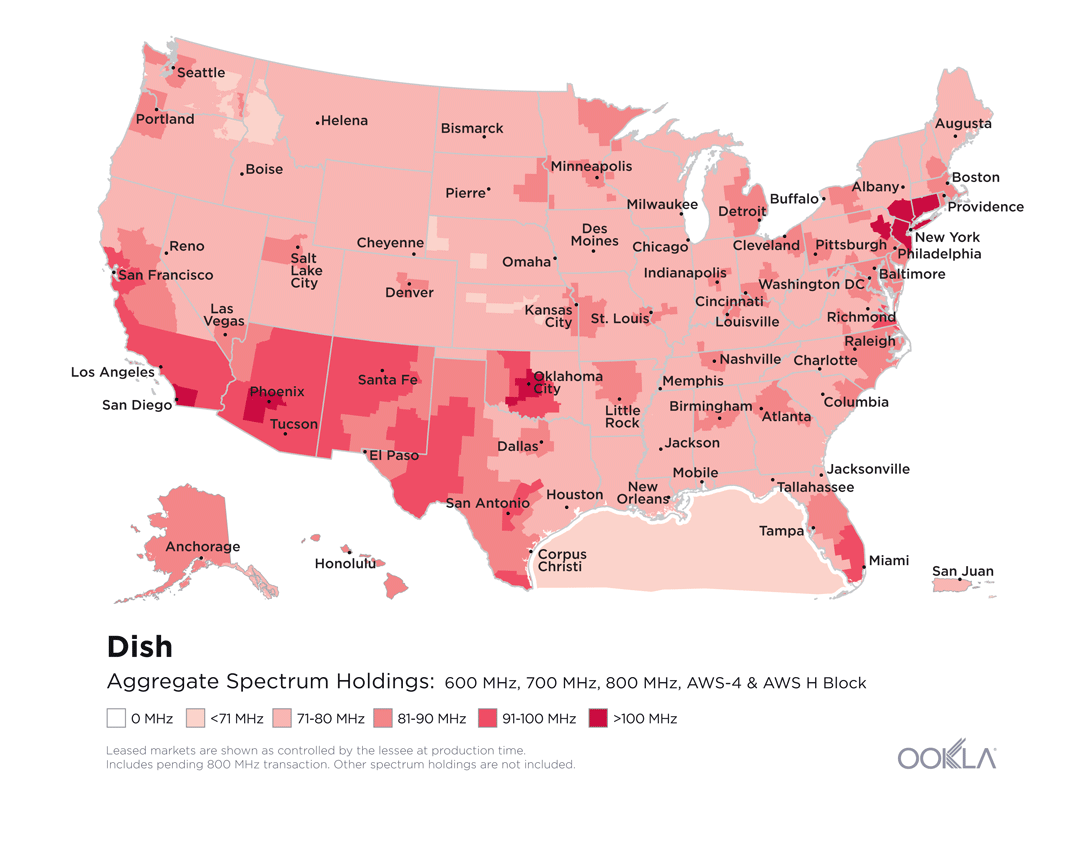

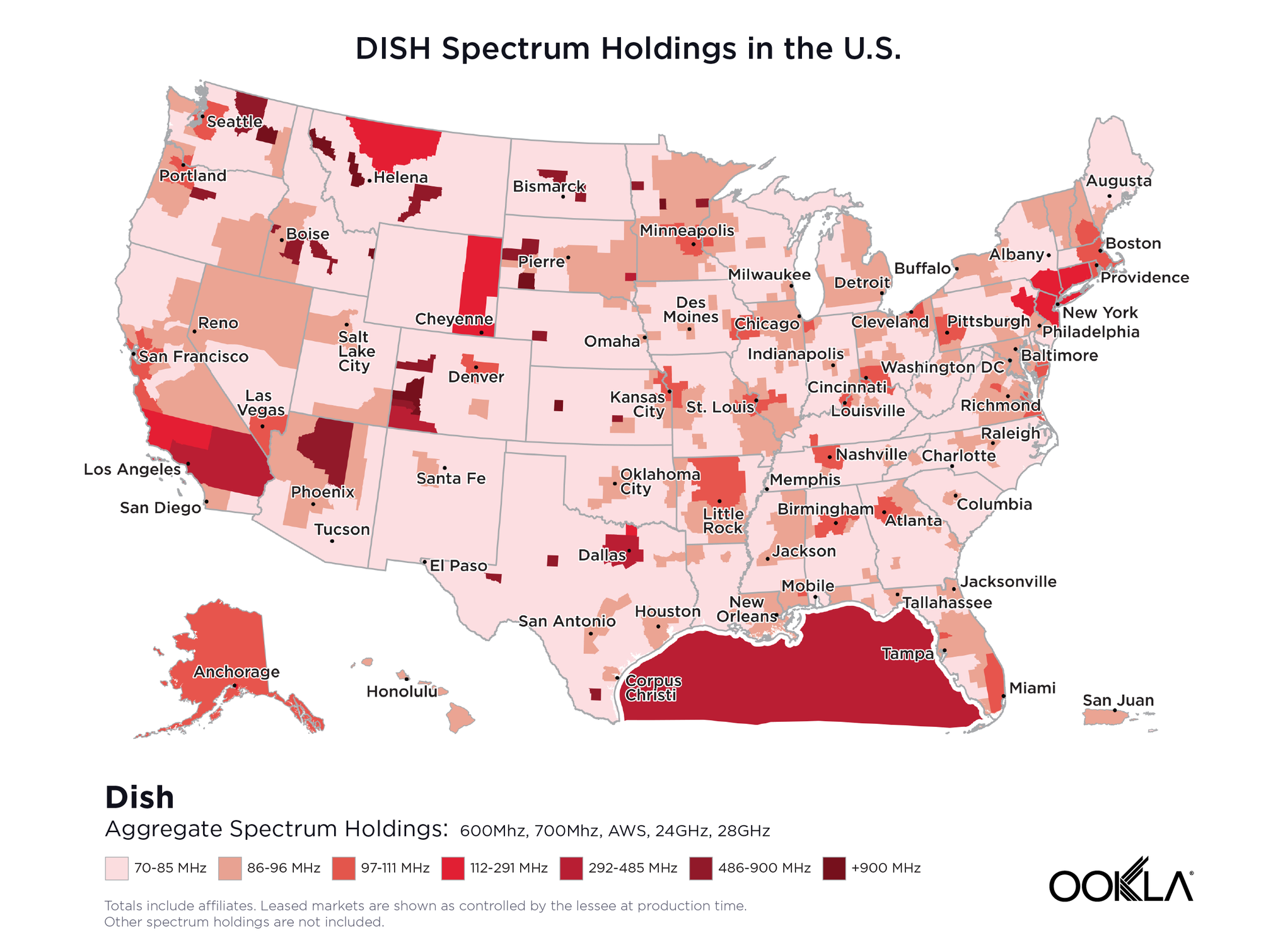

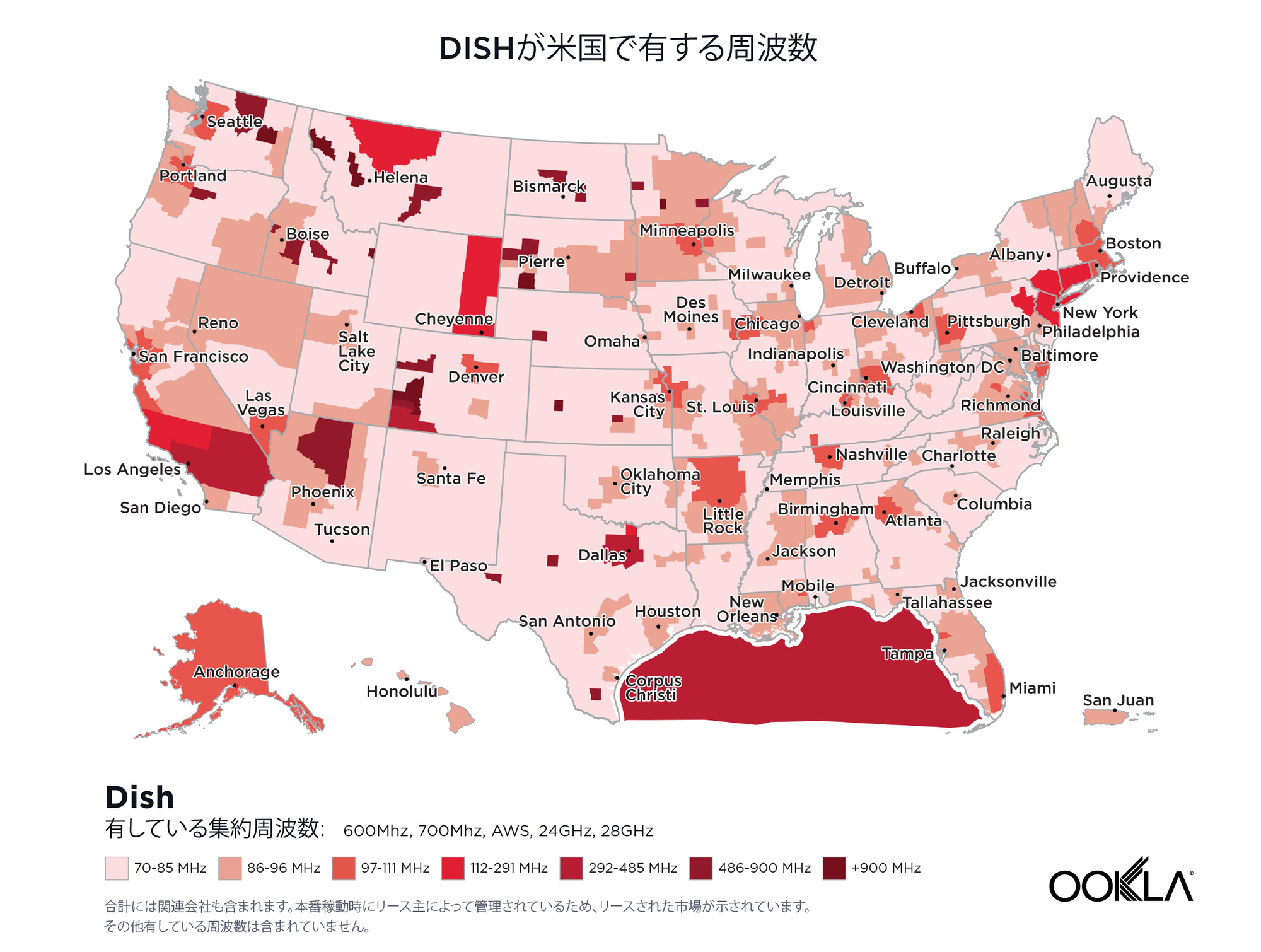

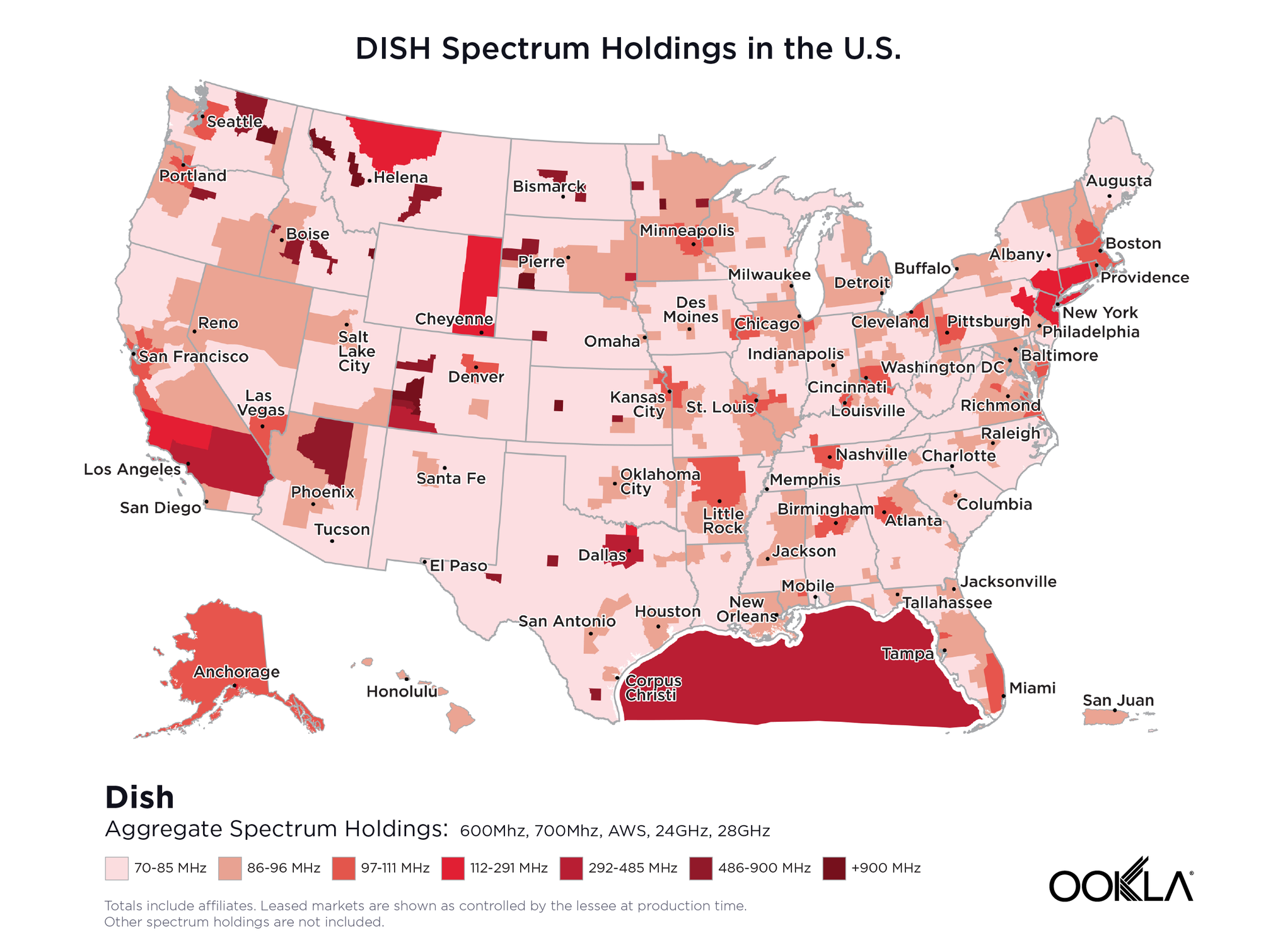

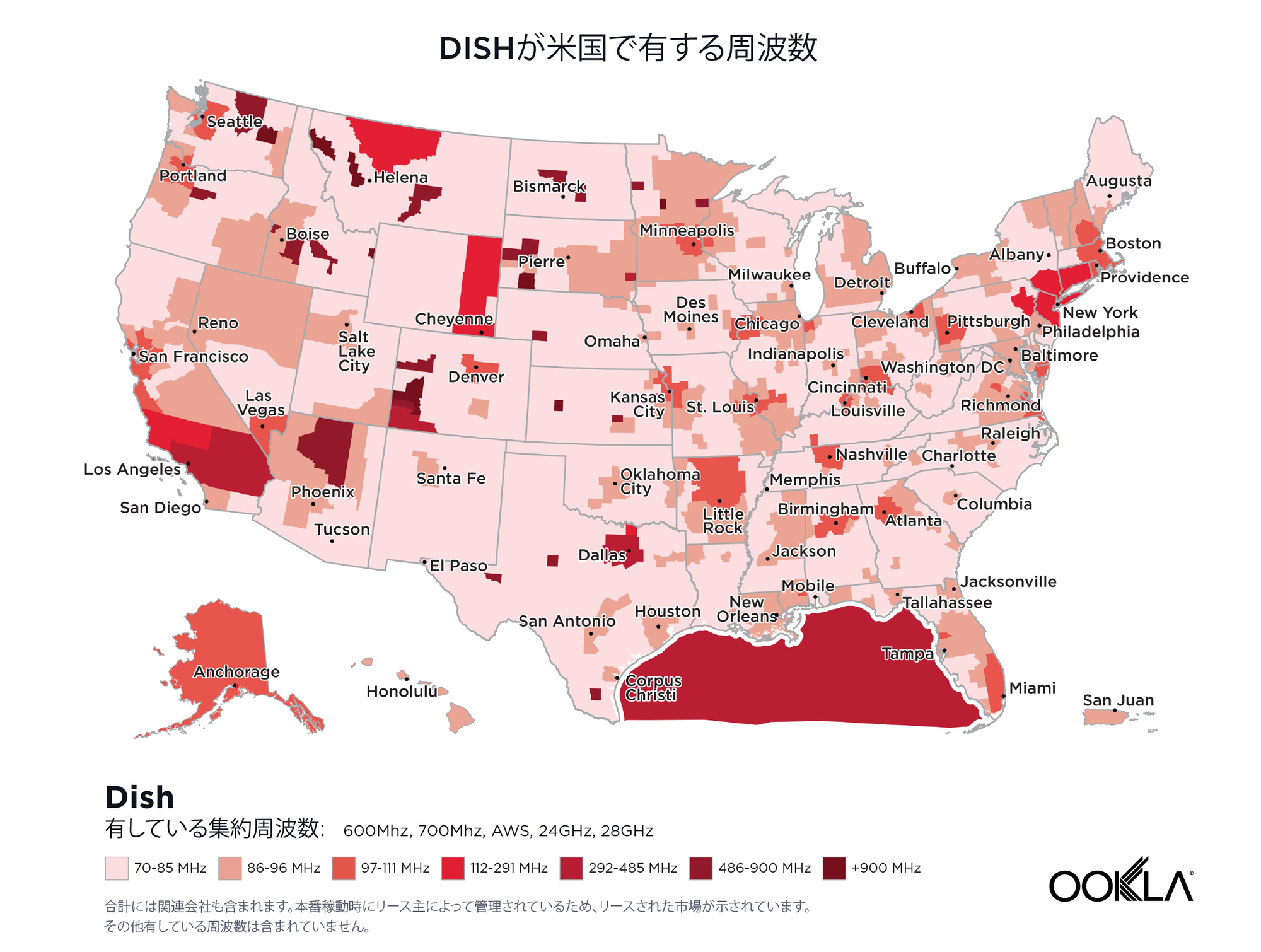

An operator that could benefit from the extension of this experiment is DISH, a recent entrant to the U.S. mobile market. Over the past few decades, DISH has acquired significant amounts of spectrum that spans from 600 MHz all the way up to the mmWave, including the potential acquisition of Sprint’s 800 MHz spectrum assets. Similar to Rakuten Mobile, DISH could potentially combine fallow spectrum and the promise of building and deploying a facilities-based O-RAN 5G network. Deploying a lean network could, at least in theory, enable a rapid deployment of DISH’s assets, which could create many new jobs while leveraging American companies that are eager to innovate and disrupt, such as Cisco, Altiostar, Mavenir, Qualcomm, Intel and Airspan (to name a few).

A recent announcement reveals VMWare as a strategic partner in providing a cloud-based abstraction layer, which is essentially a 5G operating system that will hold the silicon, software and cloud together, and will enable a hyper-scale of public cloud capacity where needed.

O-RAN would allow DISH and other mobile operators to expand beyond the constraints of vertical solutions provided by traditional telco vendors like Ericsson, Huawei and Nokia. The O-RAN concept would simplify and fully automate the network deployment using DISH’s greenfield environment. Nokia has been the most receptive to the O-RAN approach, agreeing to provide 5G core applications including subscriber management, device management and integration services (among others). DISH has recently signed a deal with Japanese giant Fujitsu, securing a large order of O-RAN-compliant radios while Altiostar and Mavenir will also be providing O-RAN software.

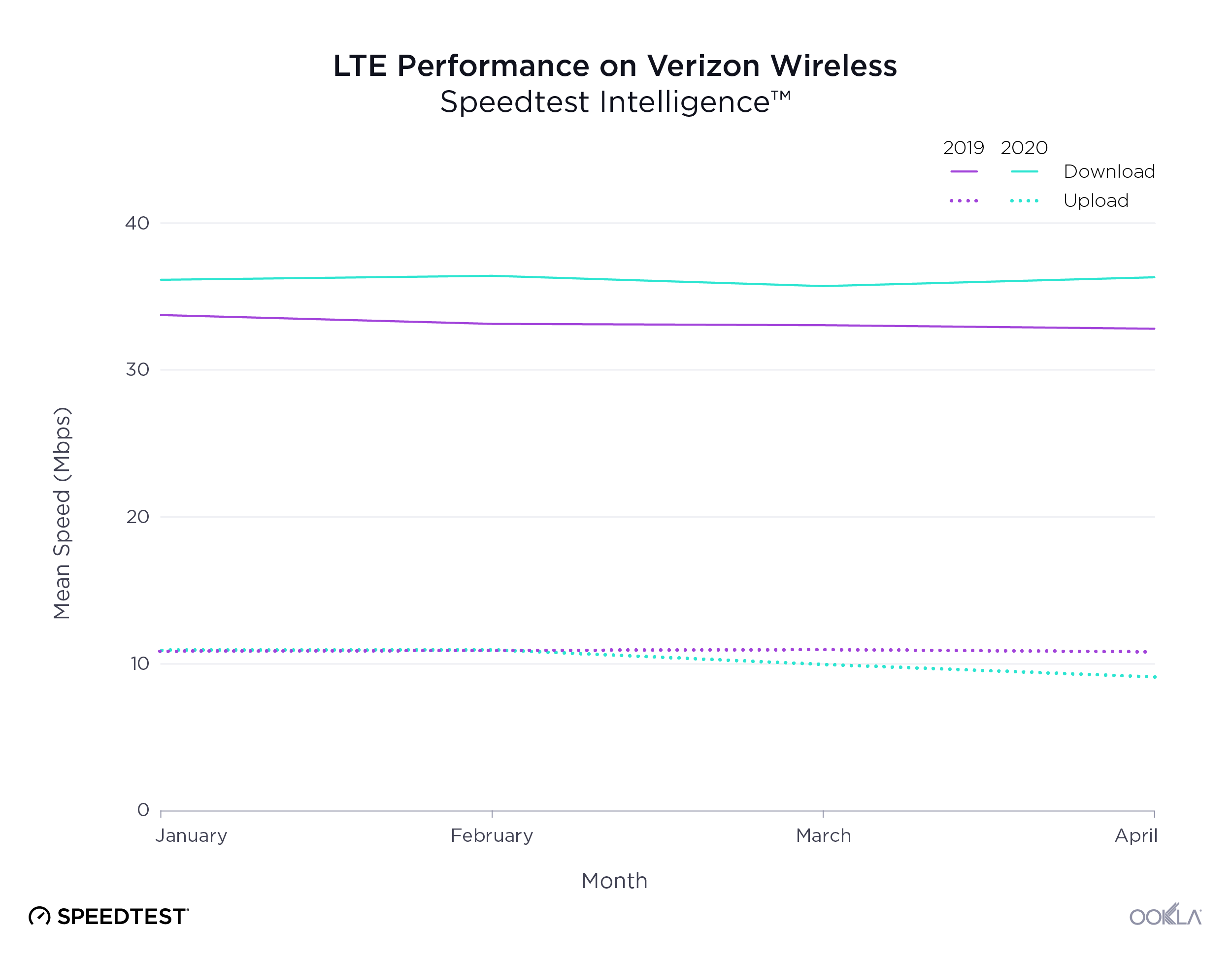

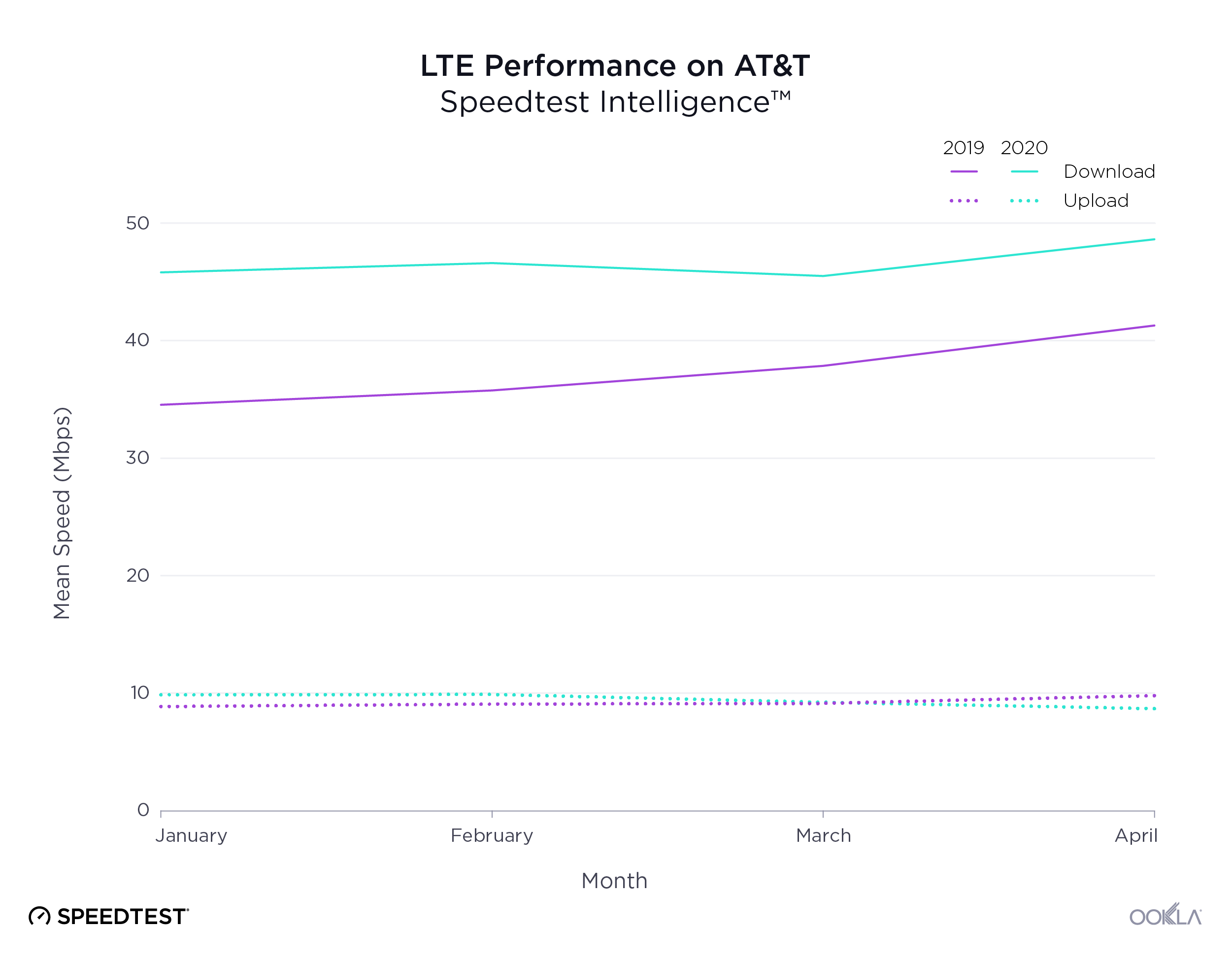

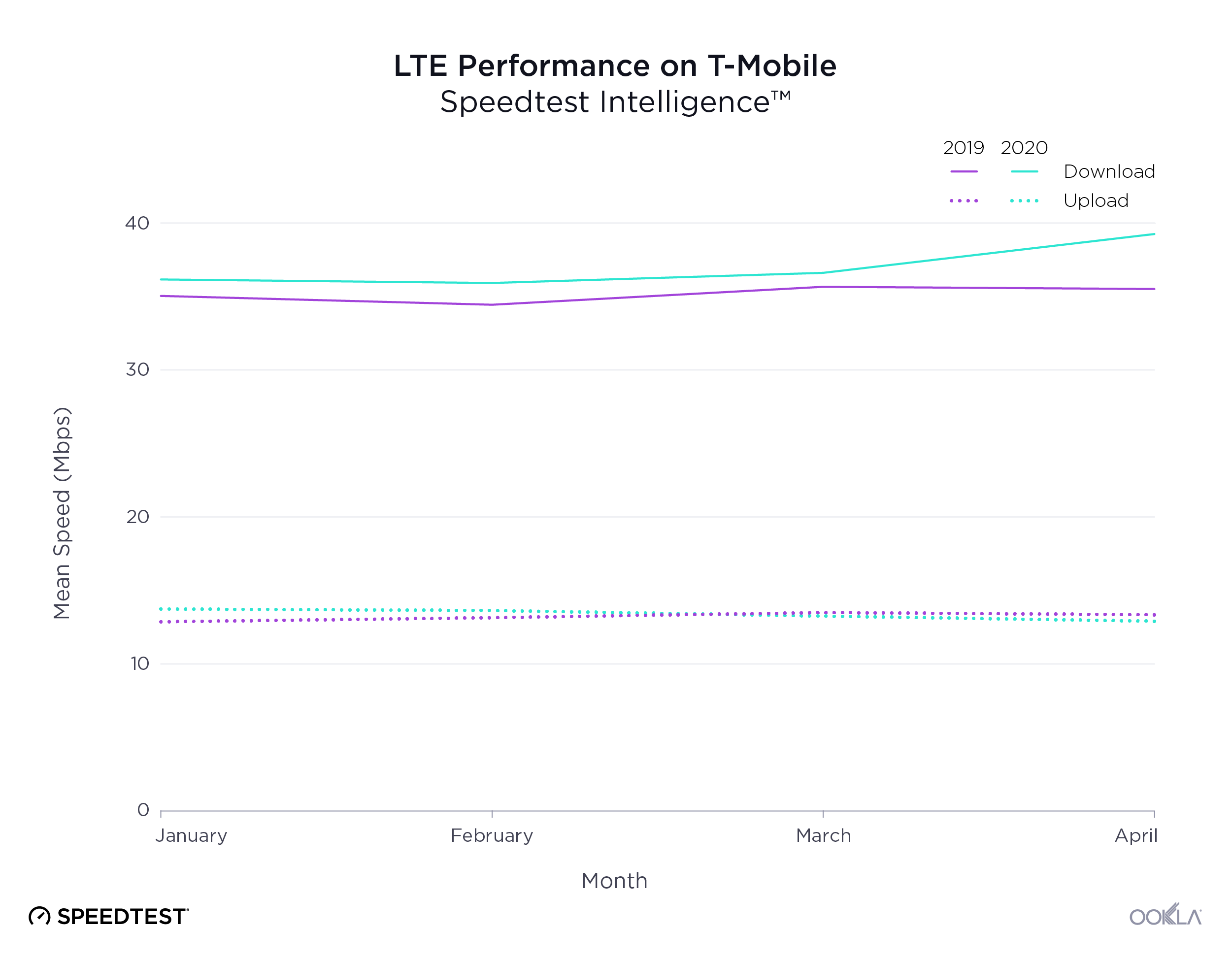

While all eyes will be immediately focused on Rakuten Mobile and its cloud-native O-RAN 5G network, operators and infrastructure vendors around the world are working together to improve the O-RAN concept. From a financial and operational standpoint, the O-RAN model makes a lot of sense, and a few operators are already looking into leveraging at least some tools from the O-RAN toolbox. India’s Reliance Jio has plans for a deployment similar to Rakuten’s, while U.S. telcos Verizon and AT&T are already making steps to allow for multi-vendor 5G interoperability in some markets. Recently, Telefónica Spain and STC in Saudi Arabia have shown interest in Rakuten’s mobile platform.

We are likely to see a lot more O-RAN announcements in the coming year, and we at Ookla will continue monitoring Rakuten’s network performance, so stay tuned.

日本の企業はこれまでに何度も、顧客の生活を豊かにする革新的な新技術導入の最前線にいました。たとえば、世界初の1Gの通話サービスは1979年に日本で初めて始まりました。そのため、楽天がOpen Radio Access Network(O-RAN)標準を採用し、クラウドネイティブなモバイルネットワークとして楽天モバイルを構築することで、携帯通信への最先端のアプローチがすでに日本で始まっていることも驚きではありません。楽天は、この完全に仮想的なモバイルネットワークにより、ネットワークの構築とアップグレードにかかるコストを削減し、さらに、楽天モバイルの顧客にオンラインでのアクティビティにおける一貫したユーザーエクスペリエンスを提供できるようになりました。

楽天が確立された市場を打破

楽天モバイルの参入以前、日本の携帯通信市場はNTT Docomo、au by KDDI、Softbankモバイルの3社の主要な事業者によって支配されていました。これら3社すべては10年以上運営されており、日本全国で5Gを展開しています。

NTT DoCoMoは日本電信電話(NTT)から派生し、1991年に2Gサービスを開始しました。その後10年間で、同社は3Gに移行しています。現在は、700MHz、800MHz、1.5GHz、1.8GHz、2.1GHz、3.5GHzのバンドでLTEサービスを提供しています。現在、同社は3.6GHz、4.5GHz、ミリ波で5Gサービスを開始しています。

KDDIは、KDD、DDI、IDOの3社が合併して2000年に設立されました。同社は2Gと3GサービスにCDMA技術を使用し、現在では700MHz、800MHz、1.4GHz、2.1GHz、3.5GHzを使用してLTEサービスを提供しています。最近開始された5Gサービスは、3.8GHz、4.1GHz、ミリ波で展開されています。

日本の3つめのキャリアであるSoftbankモバイルは、Vodafone Japanを買収して2006年に日本市場に参入しました。SoftbankモバイルのLTE周波数バンドは700MHzから3.5GHzで、5Gは3.9GHzとミリ波で展開されています。

楽天は携帯通信事業に初参入ですが、同事業は確立されたビジネスの一部となっています。1997年にわずか6名の従業員と1台のサーバーでEコマース企業として設立された同社は、現在では70社以上の企業のポートフォリオと、10億人以上の会員とポイントプログラムの顧客を世界中に抱え、グローバルに展開しています。同社は現在幅広い業界に展開しており、いくつか例を挙げると、銀行、旅行、オンラインショッピング、広告、グローバルメッセージ機能、動画配信、データ解析、そして携帯通信などです。

楽天が携帯通信事業者として非常に興味深い点は、同社の文化とクラウド事業における数十年分のデータ中心のノウハウです。エンドツーエンドのユーザーエクスペリエンスの提供と顧客のオンラインジャーニー全体の制御は、確かに多大な価値をもたらしていますが、同時に、Amazon、Google、Appleなどの情報技術系最大手企業が携帯通信事業に参入したことを連想させます。完全に仮想化されたネットワーク機能を実行するという約束のもと、ネットワークの展開と運用費用に関連するコストが大幅に削減され、新規通信事業者が増えることでモバイルネットワークの実行と運用に新しい展望をもたらすでしょう。

楽天はクラウドを活用してインフラストラクチャの鎖を解く

楽天は、核となる技術と無線アクセス技術について従来のネットワークインフラストラクチャの設備ベンダーに完全に依存するのではなく、O-RANを使用してクラウドネイティブなモバイルネットワークへのアプローチを採用しました。これは、楽天が無線アクセスをベースバンド処理から分離させ、多数のネットワーク機能を仮想化していることを意味します。このアプローチでは、楽天の強みであるデータセンターとクラウドを基盤としています。

従来の携帯通信業界では、インフラストラクチャベンダーのソリューションがエンドツーエンドの垂直スタックを提供することが一般的でした。これには、無線アクセスとベースバンド処理から、転送とコアに至るまでのすべてが含まれています。これは、事業者がHuawei、Nokia、Ericssonなどのインフラストラクチャの大手企業との契約に縛られると、ソフトウェアとハードウェアの私的に閉じられたエコシステムに閉じ込められることを意味します。

ハードウェアとソフトウェアが分離されると、事業者は大小あらゆる企業によって提供される、あらゆるソフトウェア定義機能を自由に展開できます。これは「ホワイトボックス化」されたO-RANのガイドラインに従っています。「仮想化」と呼ばれるこのアプローチは、あらゆる既成のコンピューターサーバー上で実行可能です。仮想化は従来の携帯通信ハードウェアの重要性を低減し、展開を高速化し、イノベーションを促進して事業者の資本支出を大幅に減らします。仮想化は従来の事業者の経済を一瞬で簡単に破壊させ得るため、新たな参入企業と業界全体の両方で新鮮な機会を創出しています。O-RANを使用することで、事業者は、Nokia、NEC、富士通、Cisco、Intelなどの大手インフラストラクチャベンダー、およびAirspanやAltiostarなどの小規模な企業と提携し、カスタムのソリューションを選択できます。

これは同時に、マルチベンダーの相互運用性と、仮想化や自動化などのイノベーションの数が、研究と開発分野におけるベンダーの俊敏性に大きく依存することも意味します。

O-RANの背景にあるイノベーション

O-RANアーキテクチャは、モバイルネットワークプロバイダーの将来のニーズに対応するために設計されたコンセプトで、オープン性、相互運用性、業界全体の協業性に基づいています。従来のネットワーク展開は3GPP準拠のハードウェアに依存しており、これは通常、クローズボックスのソフトウェアとハードウェアソリューション、およびネットワークのセキュリティ面を提供する単一のベンダーにより設計されています。一方で、O-RANアライアンスとそのメンバー(大手通信企業、クラウドおよびチップセットのサプライヤー、携帯通信事業者を含む)は、仮想RAN機能とオープンインフラストラクチャを標準化し、クラウドネイティブな展開とマルチベンダーの相互運用性を実現するための取り組みを進めています。

新たなソリューションへの扉を開くO-RAN

このイニシアチブの目標の1つに、私的な携帯通信ハードウェアの使用を最小限にしながら、オープン性と一般的な既成ハードウェアの使用を最大限にすることが挙げられます。標準化されたマルチベンダーの仮想RAN環境を作り上げることにより、サードパーティがかつてはクローズドだったベンダーのRANデータにアクセスし、多くの革新的なサービスとアプリケーションを作成できるようになります。

O-RANは、小規模なベンダーが、事業者固有のニーズに合うようにカスタマイズされた、自社の製品とサービスを導入できるようにするオープンなインターフェイスを確約します。これにより、事業者がネットワークのすべての側面を制御することでセキュリティのリスクを最小限に抑えながら、ベンダーの多様性を広げ、インフラストラクチャの堅牢性を強化することにつながります。

商用の既成(COTS)ハードウェアを、コンテナと仮想マシン(VM)の形で仮想化ソフトウェアとともに使用することで、基本的に無線アクセスネットワークがO-RANのアプリストア内の最初のアプリとなります。

ネットワークのセキュリティと俊敏性を向上

O-RANの他の大きな側面として、ネットワークのセキュリティ組織にもたらされる他にはない視点があります。これにより、事業者はスタック全体に完全なエンドツーエンドの視認性と透明性を手に入れることができます。そして、各コンポーネントすべてに対するサプライチェーン全体を管理できます。さらに、O-RANのソフトウェアベースの性質によって、アップグレードのために物理的に訪れる必要があった従来の展開よりもはるかに高速にネットワーク機能を追加、点検、交換することができます。このようにして、O-RANはネットワークの有効性と俊敏性を高めることができます。

事業者がカスタムに構築されたネットワークを表明し実行できるのは、携帯通信業界においてこれが初めてかもしれません。エンジニアリングの観点からは、ハードウェアベースのベースバンドを仮想世界に移行するのは困難ですが、同時に楽しさもあります。最近のソフトウェア定義ネットワークと仮想化の進歩により、LTEおよび5Gネットワークは、設置から統合までWi-Fiネットワークのように機能する可能性を秘めています。携帯通信アプリストアのコンセプトはこれからもイノベーション、コラボレーション、業界のサポートを推進しつづけます。一方で一般部門と政府部門の両方が業界におけるこの継続的な転換の促進に従事する必要があります。

アプリケーションによるネットワークのプログラミングを実現

ここ10年間で、ネットワークの上層で実行可能なアプリケーションの構築は進歩しています。O-RANは、アプリケーションが実際にネットワークそのものをプログラミングおよび実行できるようにすることで、これを次のレベルへと高めます。これは、人工知能(AI)の重要性につながります。ネットワークのプログラミングにAIを使用することで、5Gネットワークの展開と運用が劇的に簡素化できます。

自動化、仮想化、人工知能の活用により、自己駆動形のネットワーク運用が実現し、運用コストを削減できます。将来の展開は(理想的には)、仮想化ネットワーク要素と標準化されたホワイトボックスのアプローチに基づく可能性があり、これにより、マルチベンダー化、相互運用性、自律型RANが推進されます。

O-RANアーキテクチャの主な課題の1つに、埋め込みインテリジェンスをもたらしながら、同時に制御プレーン(CP)をユーザープレーン(UP)からRANに分離させるという、ソフトウェア定義ネットワーク(SDN)の概念を拡大することが挙げられます。UPをCPから分離させることにより、UPでのスケーラビリティとコスト効率性が高まります。O-RANアライアンスのホワイトペーパーによると、この新たなアーキテクチャによって、複数の分離されたRANコンポーネント間の一連の主なインターフェイスが導入されます。これには、マルチベンダーの相互運用性を実現するための3GPPインターフェイス(F1、W1、E1、X2、Xn)が含まれます。提唱されたホワイトボックスのハードウェアに加えて、多くのソフトウェアコンポーネントは、RANインテリジェントコントローラー、プロトコルスタック、PHYレイヤー処理、仮想化プラットフォームのように、オープンソースベースで提供されます。

楽天はいかにして世界初のオープン無線アクセスネットワークを作り上げたか

日本の携帯通信事業への新たな参入企業として、楽天はそのクラウド中心のアプローチを採用し、数百の仮想化機能を実装して無線からコアにいたるまでのすべてを仮想化しました。これらの機能は、COTSハードウェアを活用した複数のコンピューティングセンターから提供されます。

また楽天は、Nokiaのようなインフラストラクチャ大手企業の周波数を利用可能にすることについて合意を得ることで、無線アクセスにおける革新を促進しました。これは、通常はブラックボックスとなっています。これにより、楽天はネットワーク、サプライチェーン、エコシステム、そしてこのプラットフォームのセキュリティ面に使用されるすべてのハードウェアを制御できます。楽天は、従来のネットワーク展開から解放し、展開プロセスと要件を劇的に高速化させ、携帯通信事業者がネットワークを設計、プロビジョニング、展開する方法を再定義する「ゼロタッチプロビジョニング」に自信を持っています。

サーバー中心のIPベースのサービスを運用してきた数十年の経験を持つ楽天のような企業は、同社が運用する数百のエッジデータセンターにより、従来の携帯通信よりもすでに優位に立っています。現時点で、楽天は300か所近いエッジデータセンターのインフラストラクチャを有しており、地理的にユーザーに近い場所にコンテンツを配信することで、遅延を劇的に低減しています。CPのワークロードは中央データサーバーによって処理され、運用全体は水平的なクラウドによって管理されます。無線アクセス、転送、ネットワーク機能のすべては仮想化され、楽天モバイルのオペレーティングシステムによってオーケストレーションされます。

新たなサイトの有効化とプロビジョニングのプロセスは、数時間も数日もかかることなく、数分で完了し、資本コストおよび運用コストを大幅に削減できます。現場技術者にとってこれは、無線ユニットを吊るし、ケーブルと電源を接続するだけで、新たなセルサイトを稼動できることを意味します。

楽天は初期テストを昨年後半に開始しています。アプリベースのアプローチを使用することで、5,000人の顧客を招待して世界初のエンドツーエンドのクラウドネイティブなアーキテクチャをテストおよび検証しました。2020年4月に公式に運用開始したのはLTEのみで、当初のネットワークサービスでは東京、名古屋市、大阪市のエリアをカバーしています。ネイティブにカバーされているエリアの外では、ユーザーはKDDIおよび沖縄セルラーからローミングできます。事業者は、eNodeBのエンドツーエンドのオーケストレーションと自動化を仮想ネットワーク機能として所有しており、ハードウェアとソフトウェアの両方が最初から5Gに対応しています。これは、新たなネットワーク機能の展開と修正が従来の携帯通信よりも大幅に簡単であることも意味します。9月30日に、楽天は商用の5Gネットワークを展開しました。これは、この柔軟なソフトウェアベースのアーキテクチャによって、コアとネットワーク機能の展開がどれくらい簡単になるかのテストです。

楽天モバイルのパフォーマンスは順調

楽天のアプローチは革命的ですが、エンドユーザーはネットワーク構成の仕組みよりもパフォーマンスを気にします。2020年第2四半期から第3四半期の、東京における4G LTEと5Gの楽天のパフォーマンスを確認してみました。楽天の5Gは商用的に開始されたばかりのため、5Gのデータは第3四半期のみとなっています。

|

下り(Mbps) |

上り(Mbps) |

| 第2四半期LTE |

38.05 |

18.28 |

| 第3四半期LTE |

31.68 |

19.51 |

| 第3四半期5G |

101.33 |

18.78 |

楽天は、2020年第2四半期のLTEの中央速度が下り38.05Mbpsでした。しかし、2020年第3四半期にはLTEの下り速度は16.7%落ちています。LTEでの上り速度はわずかに上昇しています。2020年第3四半期の終わりに開始された、5Gネットワークレイヤーにアクセスできるユーザーは、101.33Mbpsの下り中央速度で利用しています。これは、第2四半期のLTEでの下り中央速度よりも166.3%速く、さらに第3四半期の下り中央速度よりも219.9%速くなっています。5Gの上り中央速度はLTEよりも低速でした。

事業者が楽天モデルから学べること

楽天モデルでは、O-RANアーキテクチャの世界へかなり早い段階で踏み入りました。そこから概念実証が始まり、あっという間に数百万人のユーザーにサービスを提供する、完全に実用的な商用モバイルネットワークになりました。特に将来のスケーラビリティとセキュリティに関しては、まだ数多くの未知の部分があるものの、楽天は独自の楽天モバイルプラットフォーム(RMP)に非常に信頼を置いているように見えます。実際、この同じプラットフォームが既存の携帯通信事業者と新たな参入企業に対して、ターンキーソリューションとして提供されています。

このモデルでは、社員数を含む、資本コストと運用コストの両方の大幅な削減が確約されています(データ中心の性質と自動化のレベルによるものです)。このアプローチは、Ericsson、Nokia、Huaweiのような従来の携帯通信大手企業にとって、収益の観点からは脅威となる可能性を秘めているでしょう。ただし、これらの企業が無線コンポーネントを開放し、楽天固有のニーズに対するカスタマイズを快く許可したことは、携帯通信業界において大きな変化が訪れることを示唆しています。

この試みが広がることでメリットを享受できる可能性のある事業者にDISHが挙げられます。同社は、米国の携帯通信市場に最近参入しました。過去数十年間で、DISHは600MHzからミリ波にいたるまでの十分な周波数を獲得しています。また、Sprintの800MHz周波数アセットも獲得予定です。楽天モバイルと同様に、DISHでは、使用されていない周波数と、施設ベースのO-RAN 5Gネットワークを構築および展開するという契約を組みわせることが検討されています。無駄のないネットワークの展開によって、少なくとも理論的には、DISHのアセットの迅速な展開が可能になります。これにより、Cisco、Altiostar、Mavenir、Qualcomm、Intel、Airspanなど(ごく一部の例ですが)の、革新と打破に意欲的な米国企業を活用しながら、多くの業務が新たに創出される可能性があります。

最近の発表では、VMwareが、シリコン、ソフトウェア、クラウドをまとめて有する本質的な5Gオペレーティングシステムであり、必要な場合にパブリッククラウドのキャパシティを拡大できるようにする、クラウドベースの抽象化レイヤーの提供における戦略的パートナーとなっています。

O-RANにより、DISHなどの携帯通信事業者が、Ericsson、Huawei、Nokiaなどの従来の携帯通信ベンダーにより提供されている垂直的なソリューションの制約を超えて拡張することができるようになります。O-RANの概念は、DISHの未開発環境を使用したネットワーク展開を簡素化し、完全に自動化するものになるでしょう。NokiaはO-RANアプローチを最も受け入れている企業であり、とりわけ登録者管理、デバイス管理、統合サービスなどの5Gコアアプリケーションの提供に合意しています。DISHは最近、O-RANに準拠した大量の無線を有している日本の大手企業である富士通との契約に署名しています。一方、AltiostarとMavenirもO-RANソフトウェアを提供予定です。

楽天モバイルとそのクラウドネイティブなO-RAN 5Gネットワークに多くの注目が集まる一方で、世界中の事業者とインフラストラクチャベンダーが協力してO-RANの概念を向上させています。経済的および運用的な観点からは、O-RANモデルは大変理にかなっており、小数の事業者はすでにO-RANツールボックスの少なくとも一部のツールを活用することを検討しています。インドのReliance Jioでは楽天に似た展開を計画しており、米国の携帯通信事業者であるVerizonとAT&Tではすでに一部の市場でマルチベンダーの5G相互運用性を許可するための手順を踏んでいます。最近では、サウジアラビアのTelefónica SpainおよびSTCが楽天のモバイルプラットフォームに興味を示しています。

来年にはさらに多くのO-RAN関連の発表があると思われます。Ooklaでは楽天のネットワークのパフォーマンスを引き続き注視していく予定です。