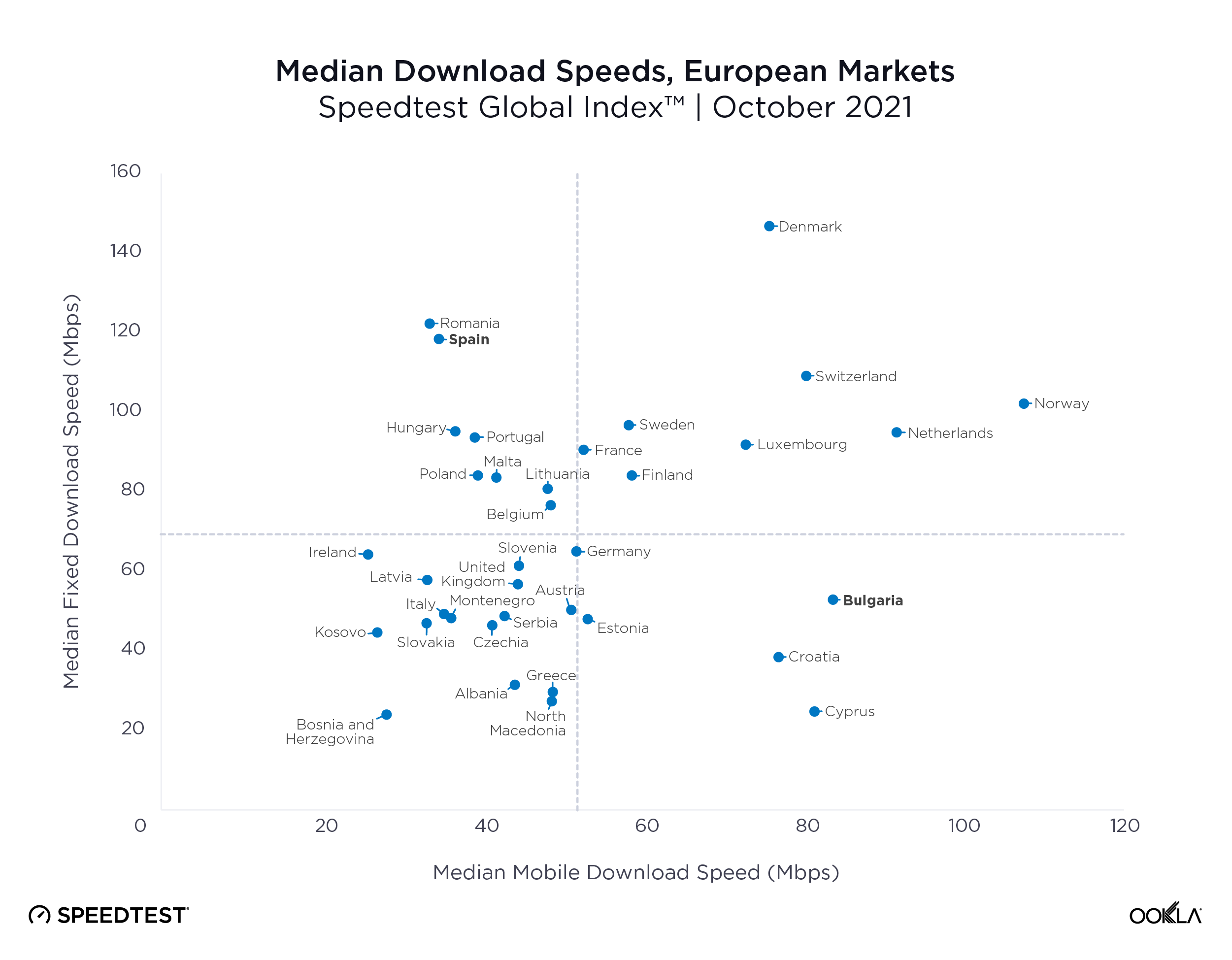

The Nordic region performs well when it comes to median mobile download speeds according to the Speedtest Global Index™. In June 2022, Norway took the top spot in the world in terms of median download speed with 129.96 Mbps, Denmark was eighth place (100.25 Mbps), Sweden ranked 17th and Finland 22nd. Having ambitious digital strategies in terms of bringing high-speed networks to households and businesses, those countries look to 5G too as a driver of digital transformation. To achieve that and enable collaboration across the region, the prime ministers of the Nordic countries signed a letter of intent (LOI) April 2018, which stated that the Nordic region should be the “first and most integrated 5G region in the world,” and the region should become a “common Nordic 5G space.” In this article we examine 5G performance across the region, including the state of 5G spectrum awards, private networks status, 5G mobile performance and 5G Availability at the country and city-level.

Key takeaways

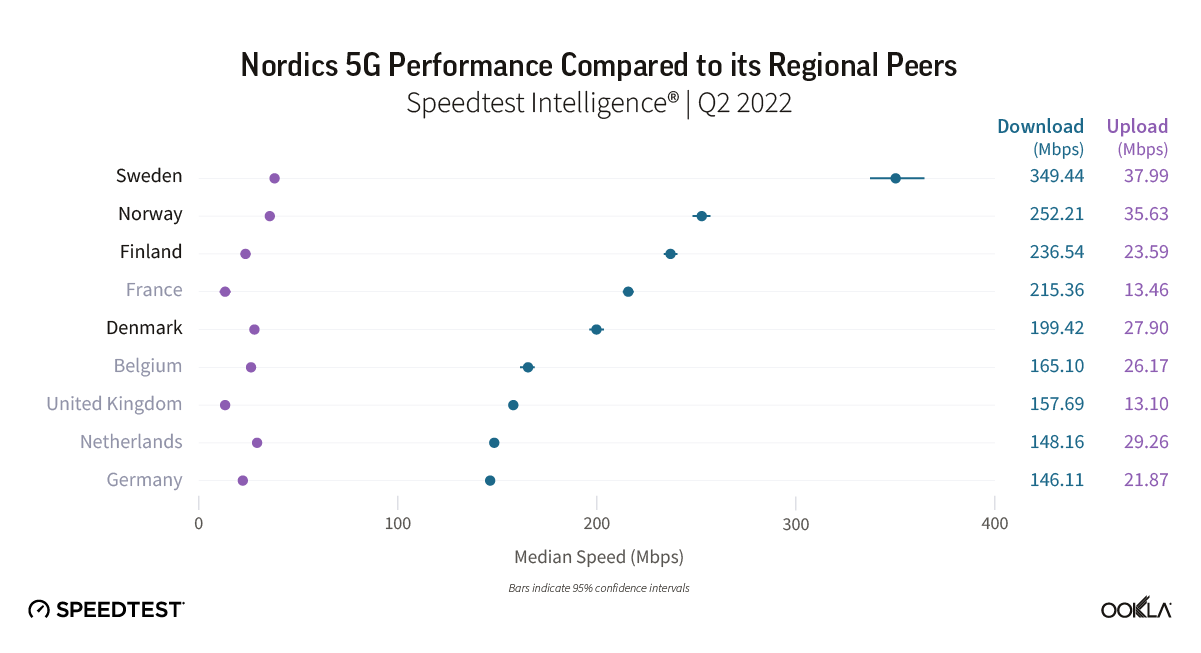

- Sweden led the Nordics in 5G median download speeds in Q2 2022, which is partially driven by the Swedish digitalization strategy.

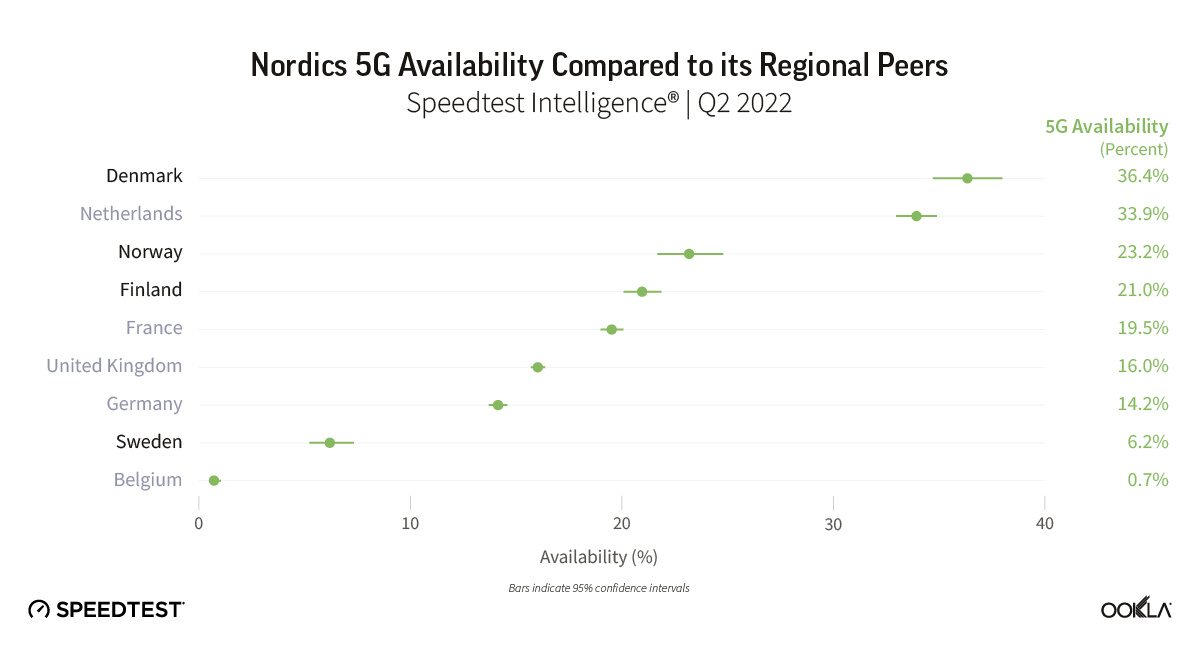

- Using Speedtest Intelligence®, we compared 5G Availability, which refers to the percentage of users on 5G-capable devices that spend most of the time with access to 5G networks. In Q2 2022, Denmark’s 5G Availability stood at 36.4%, Norway at 23.3%, Finland at 21.0% while Sweden at 6.2%.

- Swedish operators — Telenor, 3, and Tele 2 — topped the median 5G download rankings in Q2 2022, YouSee Denmark inched away in 5G Availability with 61.3% 5G Availability.

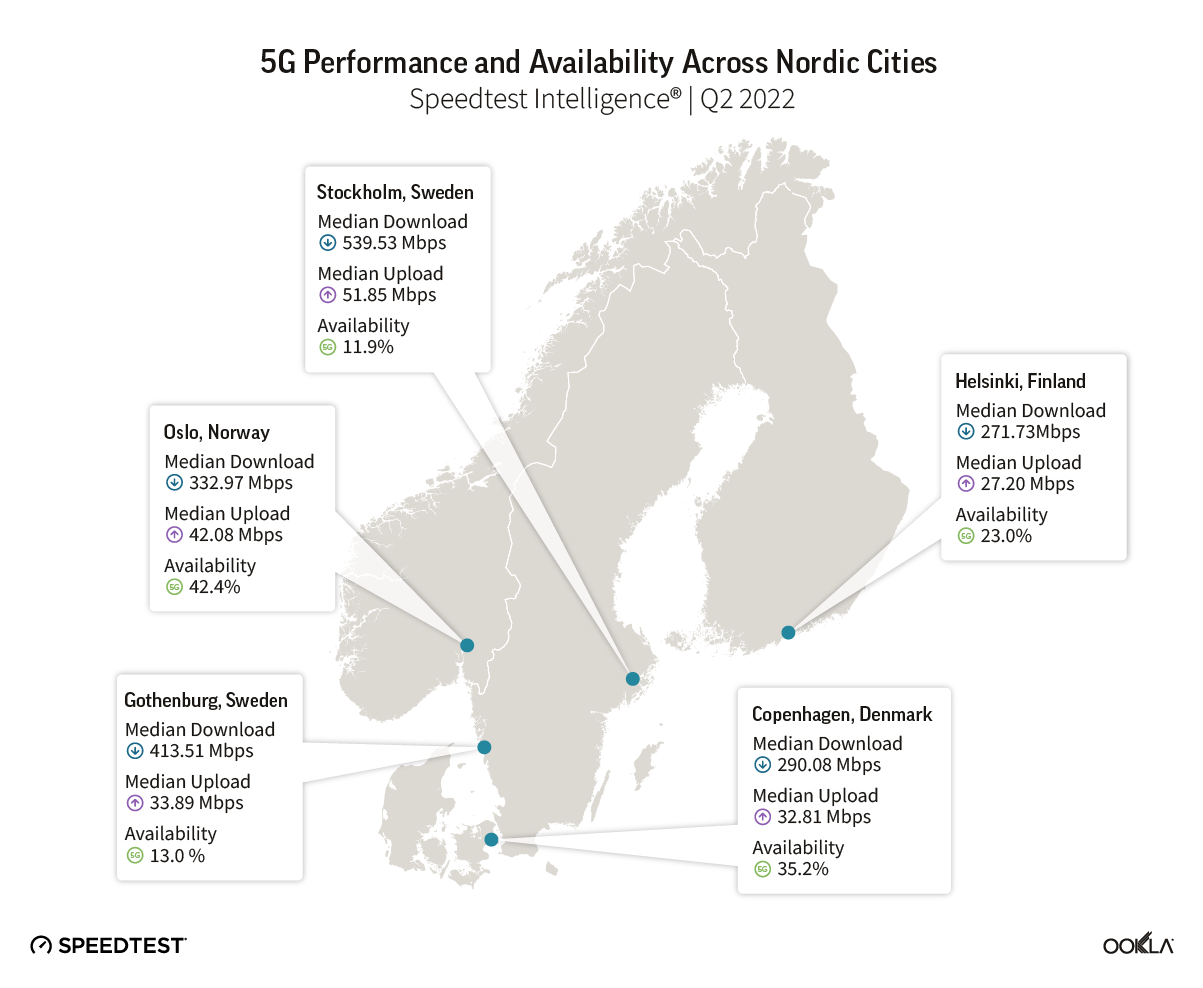

- The Swedish capital of Stockholm had the fastest median 5G download speed across five cities, whereas Oslo, the capital of Norway, had the best 5G Availability.

- Nordic 5G performance benefits from having allocated low-band and mid-band spectrum.

- Operators and enterprises in the Nordics look to 5G as a tool to enable digital transformation.

Sweden leads on median 5G download speed

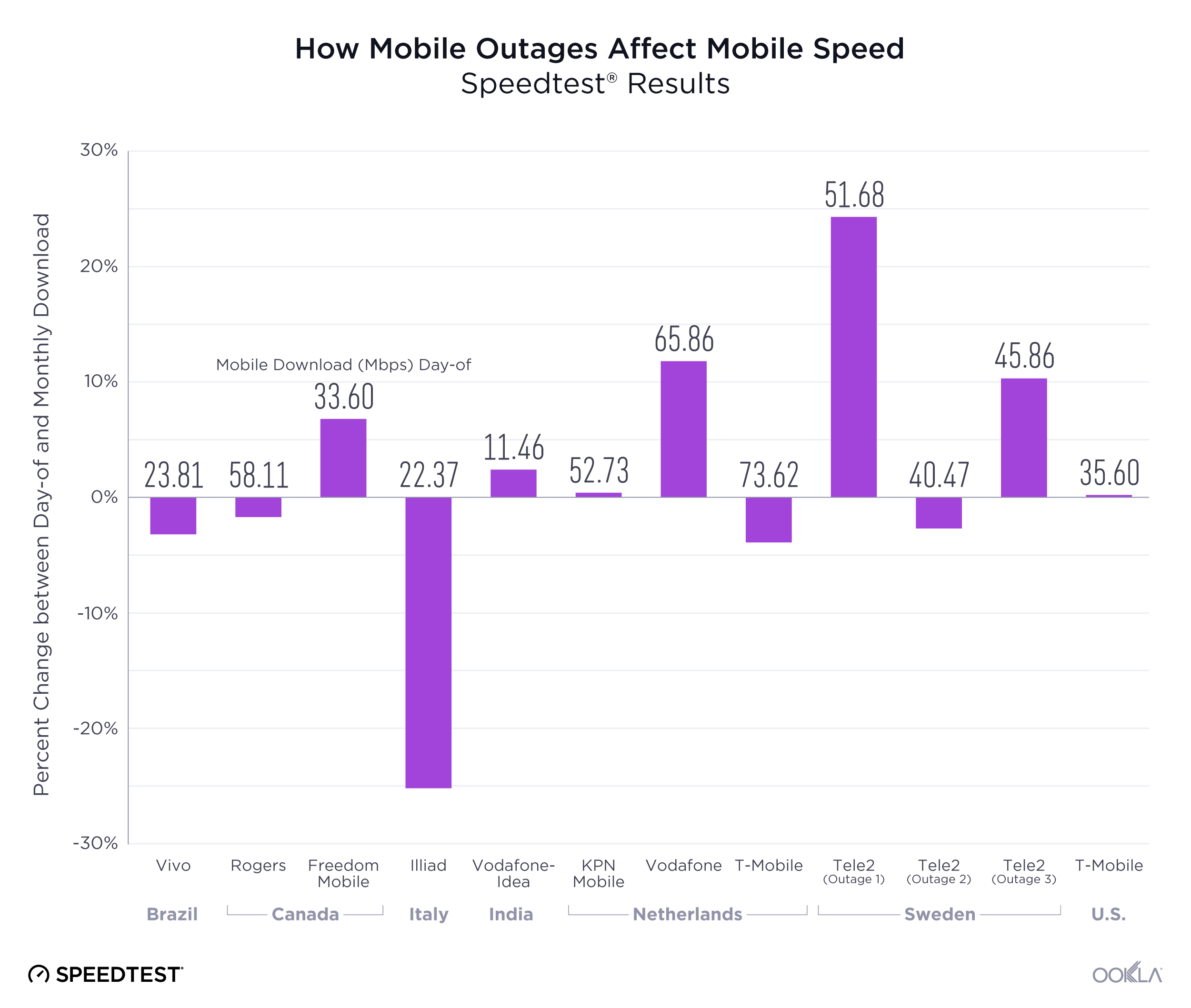

We compared 5G performance using Speedtest Intelligence data from Q2 2022 in the Nordic countries against other European countries. The Nordic region performs well in this ranking, with Sweden first amongst the countries in the chart above. Noteworthy is the fact that only Nordic countries have digital strategies in place, as outlined below, that shape their strategies around networks rolled out to meet their digital goals. While most of these policies focus on fixed broadband, in Sweden 5G was identified as a key technology in Sweden’s quest to achieve 100% high speed broadband access.

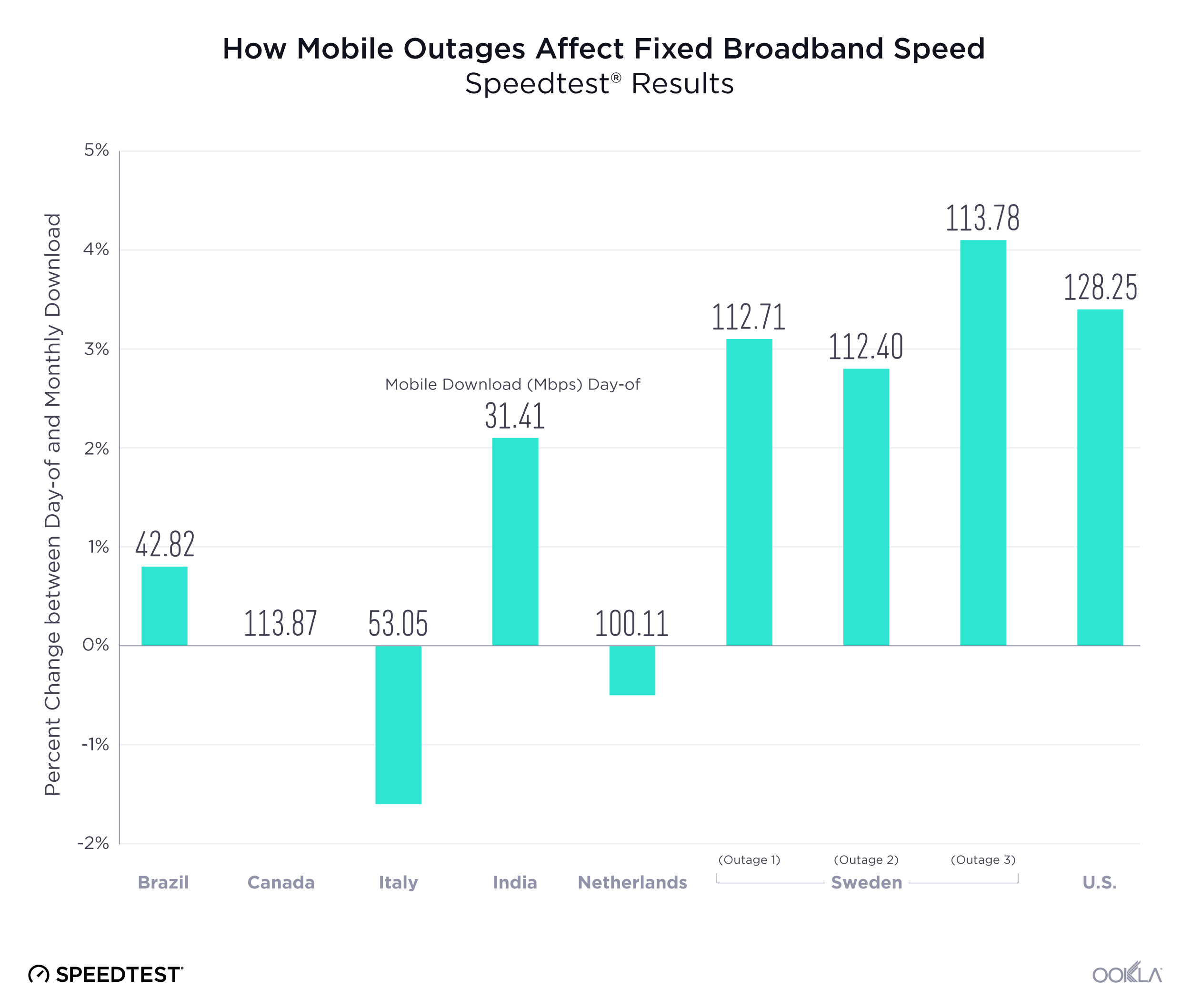

Denmark’s 5G Availability on par with the Netherlands

Using Speedtest Intelligence, we compared 5G Availability, which refers to the percentage of users on 5G-capable devices that spend most of the time with access to 5G networks, across Nordic countries and a select sample of European markets. In Q2 2022, Denmark’s 5G Availability stood at 36.4%, Norway at 23.3%, Finland at 21%, and Sweden at 6.2%. Both Denmark and Netherland benefit from being flatter and more densely populated, which in turn results in a greater ability to expand 5G coverage. Other Scandinavian countries have much lower population density than Denmark (139.9 people per km2): Sweden (25.5), Finland (18.2), and Norway (17.7). Denmark has been active in prompting 5G adoption, case in point the Danish Energy Agency published a 5G Action Plan for Denmark, which zeroes in on four building blocks: frequencies, roll-out, regulation, and use cases as foundations for a successful roll-out and utilization of 5G.

Swedish operators top the median 5G download rankings in Q2 2022, YouSee Denmark inched away in the 5G Availability

The majority of the 14 players operating across the four countries launched commercial 5G networks in 2020, apart from Elisa Finland (July 2019), Telia Finland (October 2019), and Ice Norway (November 2021).

Sweden tops the charts for 5G speeds but lags on 5G Availability

Swedish operators perform well when it comes to 5G speeds, not so much on the 5G Availability, which was below 10% as of Q2 2022. 5G Availability is a function of 5G network coverage, 5G tariffs, and 5G-capable devices adoption. Operators are taking steps to increase across all of these components. According to Swedish communications regulator PTS, just over one million subscriptions used the 5G mobile network in 2021 (four times more than a year before), which is equivalent to 8% of all mobile subscriptions. Operators are intensifying their network investments to expand 5G network coverage as follows:

- Net4Mobility is a joint venture between Tele2 and Telenor. Tele2 and Telenor Sweden committed to intensifying 5G network roll out during 2022, planning to extend the reach of Net4Mobility to 90% of Swedish population by the end of 2023 and the rest in 2024.

- Telia Sweden in collaboration with its long standing partner, Ericsson, plans to match 5G coverage to that of its 4G network by 2025. The short term target is to cover more than 90% of the population with 5G by 2023; in the longer term extending to 90% geographical and over 99% population coverage.

- 3 Sweden has a few milestones over the next couple of years: finalizing 5G deployment on its existing network in 2022, upgrading its core to 5G for lower latency (2022-23), network expansion and densification (2023-24), and rolling out network slicing to serve enterprises needs such as hospitals, airports, and factories.

3 Sweden is also taking steps to allow customers to test and become familiar with its 5G network during 2022. It offers at no additional cost its newly launched services called “3Fullfart” that uses the 3.5GHz band, priced at a cost of SEK49 ($5.13) a month.

Denmark performs better than others in 5G data experience but yet to match Swedish operators’ 5G speeds

Networks have evolved to become increasingly complex, catering to both the wealth of new services and increasing consumer demand for data. 5G heightened this complexity, therefore it is ever so important to be able to measure the actual end user experience. To achieve that, CellRebel® developed a scoring framework to allow its customers to benchmark different services and to combine various KPIs into composite KPIs and scores. The 5G Data Experience score consists of real user experience for four different popular services: web browsing, YouTube video streaming, gaming, and video conferencing.

- YouTube Video Streaming Score is a weighted average of the proportion of samples with video start time better than two seconds, those that had no rebuffering events, and had a video resolution better than 240P.

- Web Browsing Score is a percentage of web pages loaded in less than 1.5 seconds.

- Gaming Score is a weighted average of the percentage of samples with a gaming latency better than 60 ms, proportion of those with no packet loss, and percentage of measurement samples with a jitter lower than 10 ms.

- Video Conferencing Score is a weighted average of the percentage of samples with latencies of less than 60 ms to popular video conferencing services infrastructure, the percentage of measurements with no packet loss, and the percentage of measurement samples with a jitter lower than 10 ms.

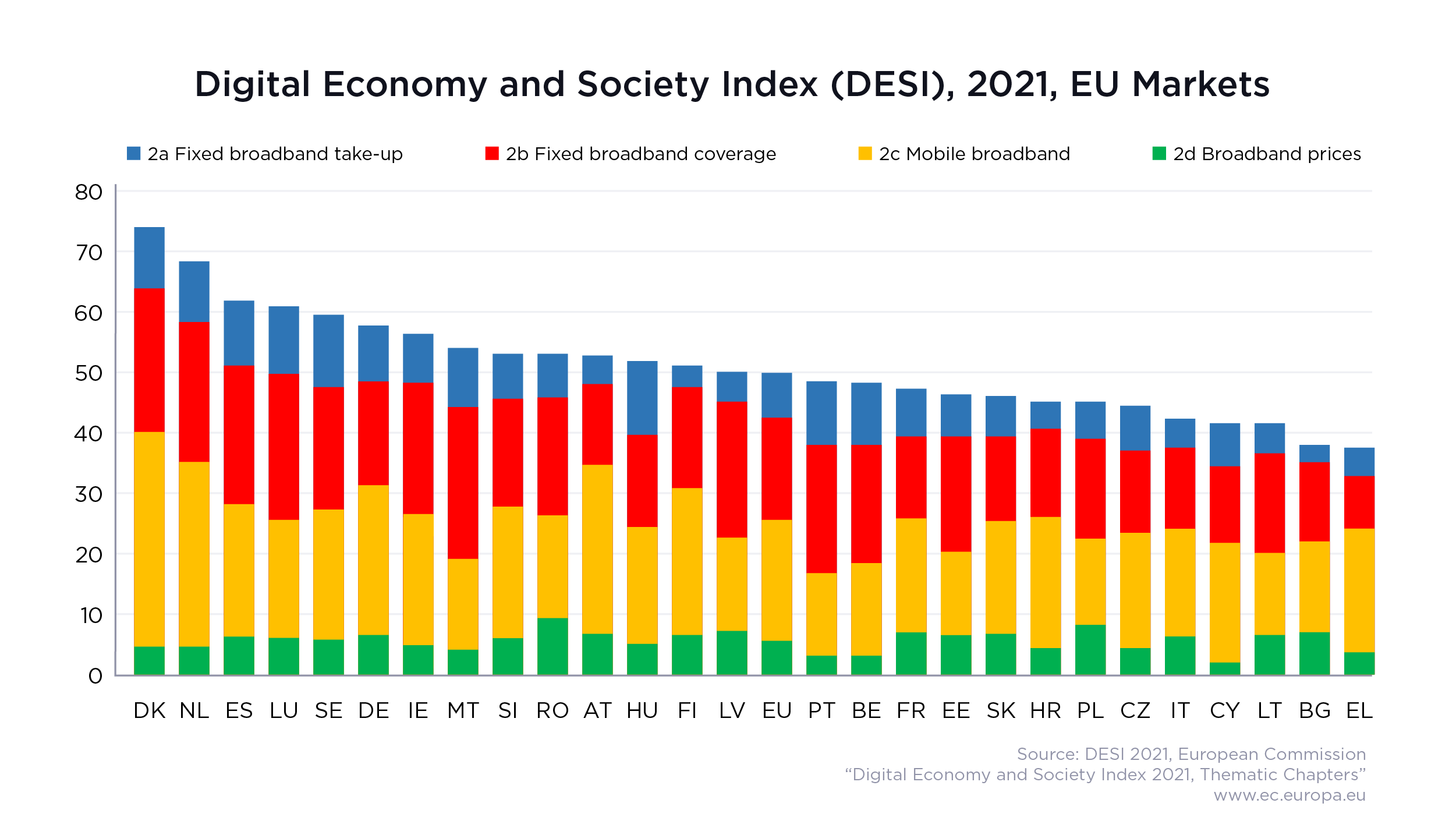

All of these measures are combined into an individual score where 0 is the worst experience and 100 corresponds to the best experience. Looking at the four Nordics markets, Denmark had the best 5G Data Experience score in Q2 2022 but other countries are not far behind. Denmark’s good performance is not a surprise if we consider the fact that it took the top spot across the 27 EU Member States, according to the European Commission’s 2021 edition of the “Digital Economy and Society Index” (DESI). Denmark came first in connectivity, ranked second in integration of digital technology and in digital public services, and fourth in human capital.

Danish operators continue to upgrade their network taking advantage of their spectrum assignments.

- Speedtest Intelligence data puts YouSee Denmark as the operator that had best 5G Availability across the Nordics in Q2 2022, with a 61.3% 5G Availability. YouSee (part of TDC Group) partners with TDC NET for 5G network, a legally separate wholesale network operator within TDC Group, which reached 99% of Denmark with 5G in 2021 compared to 78% in 2020 as reported in its 2021 Annual Report.

- 3 Denmark stated that 60% of its network was 5G-enabled in July 2022, as it continues the upgrade of its 5G network using 2100 MHz and 3.5 GHz frequencies, as well as modernizing 4G.

- TT Network (TTN), a joint network between Telia and Telenor, started upgrading the network to 5G following the mid-band spectrum award. In 2021 it upgraded 1,000 mobile masts and an additional 1,400 masts will be upgraded during 2022 out of a total 4,300 sites.

- Telenor Denmark’s plans to shut down its 3G network in 2022, which operates using spectrum in the 900 MHz and 2.1 GHz band and refarm the frequencies for 5G. The operator also plans to deploy 5G SA and address the enterprise use case through the recently created separate division for private networks. The first example of such collaboration is connecting robots via a Telenor private 4G network rather than via Wi-Fi for Danish company Mobile Industrial Robots (MiR).

Finland’s 5G coverage is on the rise, other building blocks such as 5G tariffs and handsets need to fall into place to increase 5G Availability

The Finnish Transport and Communications Agency, Traficom, reported that at the end of 2021, 5G network coverage has extended to 82% of Finish households (a six percentage point increase over the previous year). At the same time, 4% of mobile data was transmitted over the 5G network, which means that only a small proportion have so far started using subscriptions or devices supported by the 5G network despite the increase in 5G coverage. Finnish operators are working to increase customer access to smartphones but also working on enabling new use cases with 5G SA.

- Elisa’s 5G network reached over 80% of the Finnish population in more than 180 municipalities as of the end of Q2 2022. The operator also reported that 5G smartphones accounted for 10% of smartphones in Q1 2022 compared to 7% in Q1 2021. In June 2022, Elisa in partnership with Nokia and Qualcomm conducted a 5G live demonstration at the Nokia Arena in Tampere in Finland achieving uplink speeds of 2.1 Gbps utilizing Nokia’s AirScale base station in 26 GHz mmWave spectrum, seemingly as the first operator across the region.

- In November 2021, Telia Finland launched the first commercially available 5G standalone (SA) core network in the Nordic and Baltic region, creating the opportunity for advanced 5G use cases and a strengthened position in the Enterprise segment. According to Telia’s Q2 Report, the operator achieved a 70% population coverage in Finland, and in Norway.

- DNA reported that during the first half of the year, almost 80% of all the phones sold by DNA were already 5G-capable, compared to just over 50% in 1H 2021. Following the activation of the 700 MHz frequency band for 5G use, the 5G network coverage extended to 70% of the population at the end of June 2022. Although all DNA 5G base stations are connected to a standalone 5G core network, the preparation for the 5G SA commercial offering to customers is still underway.

- Suomen Yhteisverkko Oy (Finnish Shared Network) has been building a mobile network on behalf of DNA and Telia in northern and eastern Finland. The construction of the Finnish Shared 5G Network started in 2021 and its coverage area was extended towards the inland of Finland. During the spring of 2022, the Finnish Shared Network carried out large-scale 5G network deployment on the 700 MHz frequency in South Savo region, thanks to which 5G coverage has also spread to sparsely populated areas.

Norway shines the brightest when it comes to mobile speeds with good 5G performance

Norwegian operators perform well on 5G speeds and 5G Availability, without being the top providers. Yet, Norway took the first spot in June’s Speedtest Global Index performance ranking for global median mobile speeds, which points to a strong 4G performance and a potential challenge Norwegian operators face in trying to convince its customer base to upgrade to 5G. However, according to Nkom’s “Internet in Norway — Annual Report 2022” 5G traffic is growing as mobile operators continue to roll out 5G and introduce 5G-enabled smartphones. In Q1 2022, around 25% of connected handsets were ready for 5G technology, and 5G connections account for around 5% of total internet traffic. Additionally, operators are expanding into 700 MHz and 2100 MHz bands; during the spectrum auction the winning bidders were able to obtain a discount of up to NOK 40 million ($4 million) if they agreed to certain coverage obligations, e.g. Telia to cover “selected railway lines” and Telenor to cover major roadways including “European roads and the coastal road from Mo i Rana to Bodo.”

- Telenor Norway is upgrading its 8,500 base stations, with over 2,500 already modernized resulting in a 5G coverage reaching 50% of population. The operator plans to complete the 5G rollout in 1H 2024, with a total number of 9,000 base stations. Telenor was the fastest 5G operator in Norway in terms of 5G mobile network speed in Q1-Q2 2022, but the operator is also eyeing an enterprise opportunity. Telenor Norway set its sight to become the leading player in private mobile networks in Norway, a business opportunity which it values at over NOK 5 billion in 2025. To achieve that it will provide consultancy services for industrial 5G networks edge computing and private mobile networks. It has begun a trial with Yeti Move to run automated bulldozers at Gardermoen Airport.

- Telia Norway plans to have nationwide 5G network coverage by 2023. At the end of Q2 2022, 70% of the population was within its 5G network’s reach. The operator began tests in the 26 GHz band with Ericsson aiming to provide service at almost 4 Gbps. Telia targets the corporate market with the 26 GHz spectrum and is currently testing different use cases for companies across various industries.

- Despite being a late entrant into the market, Norway’s third mobile network operator – Ice Norway — recorded a 20.8% 5G Availability. Initially, the operator launched in Oslo across 14 cell sites using 2100 MHz and 700 MHz spectrum bands, which was accessible for most 5G-enabled Android phones. In the short term, the coverage will be extended to the country’s 4-5 largest cities with a longer term plan of reaching 75% population coverage. Alongside other Norwegian operators Ice had opted to undertake regional coverage obligation to receive a discount on the spectrum license fee. Stockholm was the fastest city, Oslo had the best 5G Availability.

Stockholm was the fastest city, Oslo had the best 5G Availability

Stockholm came first across five cities in the Nordics in Q2 2022, with 3 and Telenor achieving mind-blowing download speeds of over 600 Mbps at 637.14 Mbps and 614.48 Mbps, respectively. It is not surprising that Stockholm performs well as it is often a testing ground for innovation — hosting a number of tech startups and scale-ups (such as Skype and Spotify) and one in ten people working in the digital tech sector.

During Q1-Q2 2021 Oslo had the title of the fastest 5G of any world capital across 15 world capitals we analyzed in this article. While this is no longer the case, Oslo took the top spot for 5G Availability across the five Nordic cities in Q2 2022.

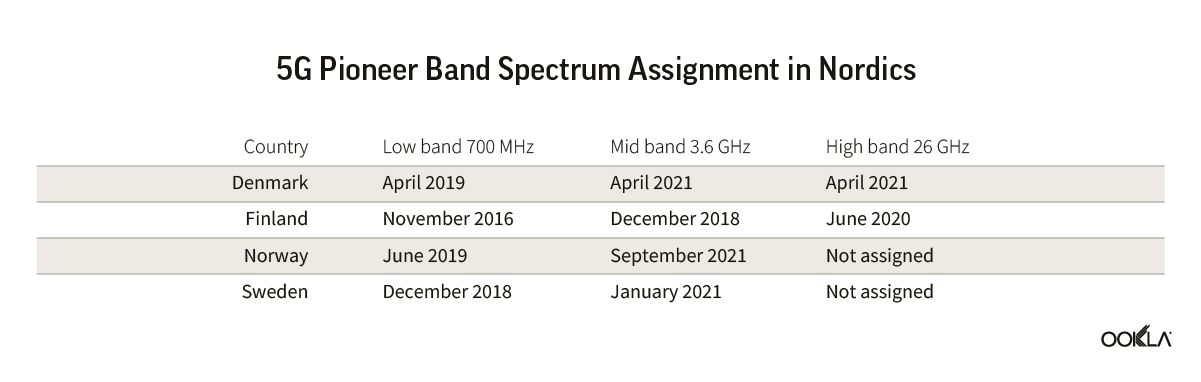

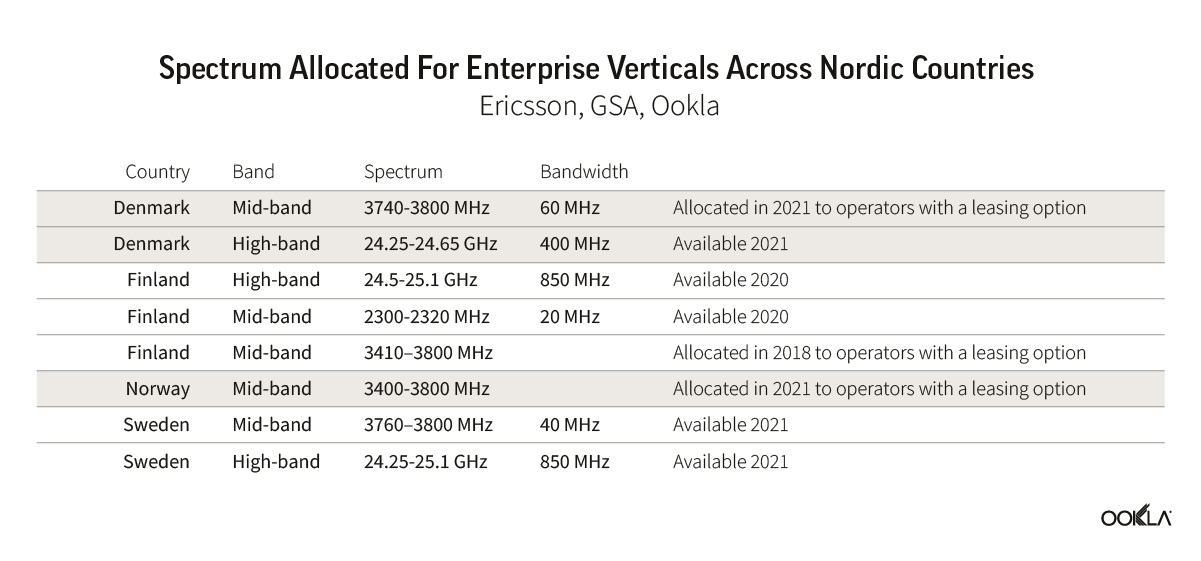

Nordic 5G performance benefits from having allocated low-band and mid-band spectrum

Within Europe, the Nordics stand out on 5G performance. Part of this is because of 5G spectrum availability as all four of the Nordic countries on the continent have already assigned low-band and mid-band spectrum. This is ahead of the rest of Europe, as we have reflected on the 5G progress across Europe. Denmark and Finland had also awarded mmWave spectrum. In fact, Denmark scored 99% in the 5G readiness indicator and ranked first on 5G mobile-broadband coverage (with 80% of households covered) as per Digital Economy and Society Index (DESI) 2021. Norway’s National Communications Authority (Nkom) and Sweden’s Post and Telecom Agency (PTS), are also looking to make spectrum available for 5G across low and mid-band spectrum.

Of course, 5G pioneer bands are not the only frequencies that operators use to deploy 5G, as operators shut down legacy networks, they can also refarm sub 3GHz frequencies for 4G or 5G. European operators tend to support 2G in the short term, phasing out 3G networks instead. The primary reason being long term M2M/IoT contracts with enterprises such as utility providers. In Norway and Sweden, a significant portion of smart meters already deployed are connected to 2G networks, therefore operators are obliged to support millions of 2G smart meters until the end of their lifecycle. Case in point: Telenor Norway switched off 3G in 2021 — five years ahead of their planned switch off of 2G, in fact all of the Norwegian operators have switched off 3G networks in 2021 and all of the Finnish operators plan to do so by 2023, while the Danish and Swedish will follow by 2025.

Operators and enterprises in the Nordics look to 5G as a tool to enable digital transformation

As 5G technology will go beyond pockets of high-speed mobile broadband to deliver low latency, high density, industry-specific applications that make use of cloud and edge technologies, it will also play a role in driving digital transformation. Digitization of different sectors of the economy is key to supporting sustainable development and climate goals. However, enterprise requirements differ. Some prefer to retain control over their networks, isolating them from the public network to address higher availability, lower latency, and enhanced privacy needs. We have commented on how the private networks landscape is developing in Europe here. Like other nations, the Nordics are also looking to private networks to address Industry 4.0 objectives as 5G plays an important role in the digital transformation and creating new services and solutions across a variety of sectors, especially manufacturing.

Nordic regulators created an encouraging environment for enterprises to deploy their own networks; all countries have already allocated spectrum for vertical use across mid- and high-frequency bands. It is worth noting that a vertical set aside is not the only option telecom regulators have at their disposal in addressing enterprise requirements. For example, the Finnish regulator in addition to allocating spectrum in the 2300-2320 MHz and 24.5-25.1 GHz band on a first-come, first-served basis, had also included a leasing option provision in the 3.5 GHz band license. Mobile operators are obliged to lease their spectrum assets: either participate in tenders for vertical contracts in localized areas or sub-license their spectrum to the vertical so they can build their own network.

However, simply assigning or making spectrum available to verticals isn’t enough to drive market adoption. Global Mobile Suppliers Association (GSA) in its report on Private Mobile Networks released in June 2022, identified 794 organizations deploying private mobile networks. In terms of a number of private networks, the United States ranked first internationally, Germany was second, while Finland came in sixth (with 20 networks).

Finland actively promotes the development of 5G services, via 5G Momentum, driven by the Finnish Transport and Communications Agency Traficom. The main target of the initiative is to bring together vertical industries stakeholders — Finnish companies, research organizations, and the public sector — to run 5G trials and develop new 5G solutions and use cases. On its home turf of Finland, Nokia has been working on a number of private LTE projects, together with edge connectivity provider Edzcom (formerly Ukkoverkot), port machinery maker Kalmar, and port operator Steveco, delivering private networks in the ports of Kokkola and Oulu, as well as Steveco Kotka harbor. Although mobile operators are no longer the de facto service providers, they are involved in delivery of private networks. We have collated a few recent deals with regards to private 5G networks in the region, which show a growing demand from enterprises and also increased operators involvement. Furthemore, despite the fact that the majority of private networks across the Nordics are currently LTE-only (55.3%), a growing proportion is 5G ready (LTE and 5G, 21%), with a few deployed as 5G from the get go.

| Location | Partners | Solution | Details | Date |

| Finland | Edzcom and lighting company Signify | A private 5G wireless smart network in the city of Tampere | A long-term project to use the Tampere’s streetscape assets to create a high-performance wireless private network. | June 2022 |

| Norway | Telia and the Norwegian Defense Materiel Agency | A private 5G network for the Armed Forces as part of a cooperation with the Defense Materiel Agency. | A pilot private and separate 5G mobile network to run alongside a military slice within Telenor’s commercial network. | June 2022 |

| Norway | Telia and Herøya Industrial Park | A strategic cooperation within 5G and private mobile networks. | Telia will roll out a private mobile network on the new industrial spectrum 3.8-4.2 GHz and in the industrial park’s test laboratory there will be a separate 5G facility with the option of edge computing. | May 2022 |

| Norway | Telenor and the Norwegian Defense Materiel Agency | A private autonomous 5G network will be established for the Armed Forces. | The partnerships involve planning, designing, developing, and operating a pilot on a mobile, autonomous private 5G network, which cooperates with a defense-specific network slice (‘Defense slice’) in the public mobile network. | May 2022 |

| Sweden | Tele2 and X Shore | A private 5G network in X Shore newly built factory in Nyköping. | X Shore will use its 5G network to wirelessly connect production equipment to collect data and maintain and control production. | May 2022 |

| Finland | Telia, Nokia and Digita | A 5G private network for Posiva Oy for the needs of the nuclear fuel disposal process in Eurajoki. | The private 5G network will enable the operation of an advanced automation system in the disposal process as well as improve safety and processes for employees. | May 2022 |

| Sweden | Telia and Svenska Cellulosa AB (SCA) | Dedicated LTE private mobile network, which is a 5G ready. | Telia supplies an Enterprise Mobile Network (EMN) with Local Breakout, based on 4G equipment that can be upgraded to 5G. The solution leverages the scalability and operational reliability of the public mobile network, but with dedicated capacity. | January 2022 |

Operators in the region continue to roll out 5G but they are also casting their eyes on 5G SA, which offers the most benefits related to eMBB, massive IoT, and critical IoT. This in turn allows support for a wide range of devices and applications with more demanding bandwidth and latency requirements. The recent acquisition of CellRebel by Ookla® helps us expand our ability to help improve the end-user experience. We’re at a key inflection point in which the industry is recognizing the importance of assuring that any network expansion or optimization is actually tied to improving the customer experience. Looking only at network KPIs without understanding their impact on what the customer experiences isn’t enough. Network complexity, moreover, is only increasing with 5G deployments. With CellRebel, we will be able to better monitor and help improve not just radio networks but the entire end-to-end chain, which in turn leads to a stronger customer experience.

We’ll be watching 5G performance closely across the Nordics using Speedtest Intelligence. If you want to learn more about how Speedtest Intelligence can help you benchmark your 5G performance against competitors, please inquire here. If you are interested in how CellRebel can help you measure your network please inquire here.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.