Indonesia represents a fascinating technical challenge for mobile operators working to advance the country to 5G when parts are still only receiving 3G. With over 17,000 islands — and over half the population living on Java — this nation of over 270 million people represents stark mobile challenges of urban density and rural remoteness. We used data from Speedtest Intelligence® to evaluate mobile performance in Indonesia during Q1-Q2 2021. Our analysis examines mobile speeds and 4G Availability at the country-and provider-level and includes a performance snapshot of each of Indonesia’s 34 provinces. We also used Ookla’s Cell Analytics™ to spotlight how users’ mobile experience compares between operators in a few key locations in Indonesia.

Indonesia’s mobile performance lags behind most trading partners, but speeds are improving

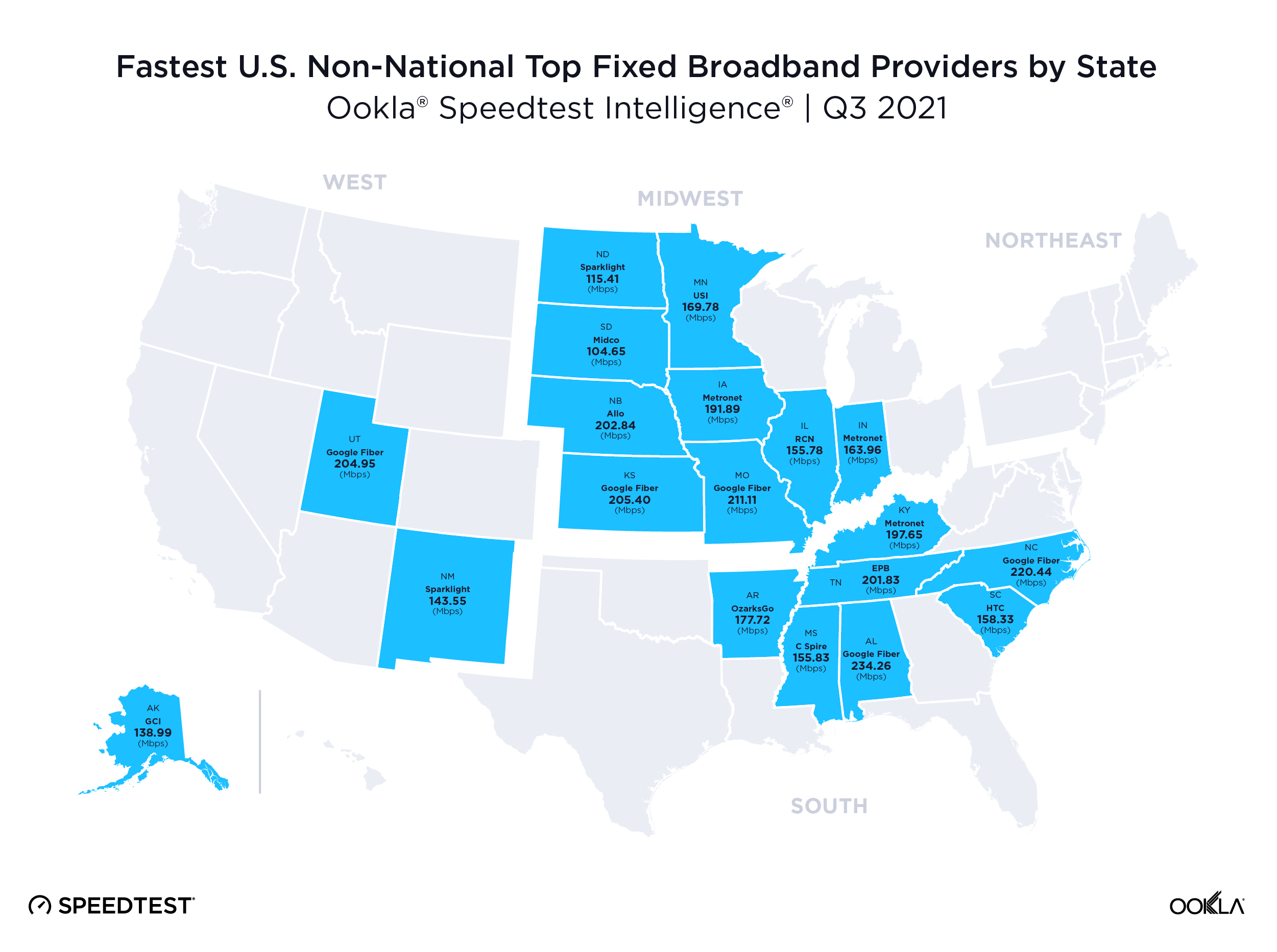

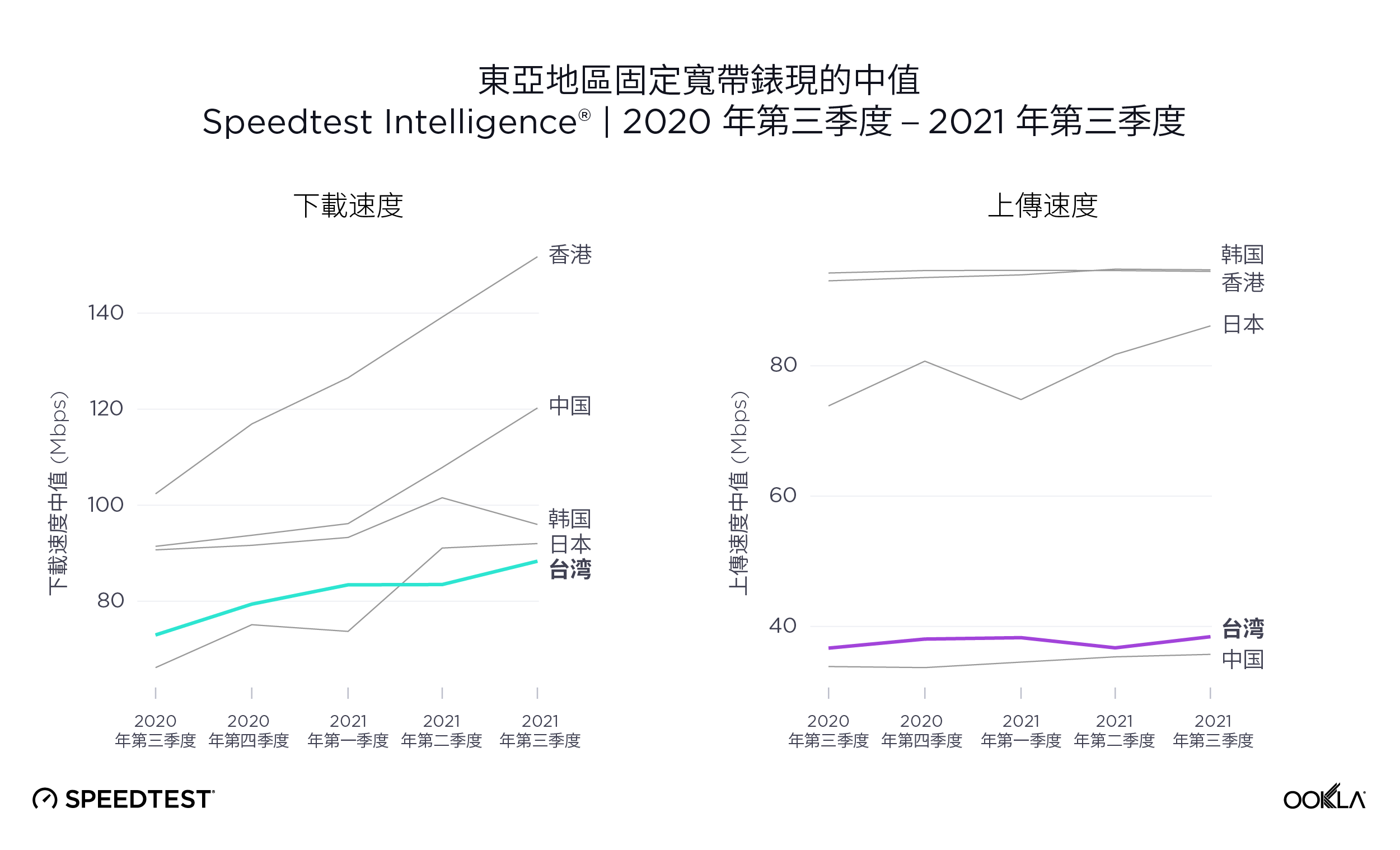

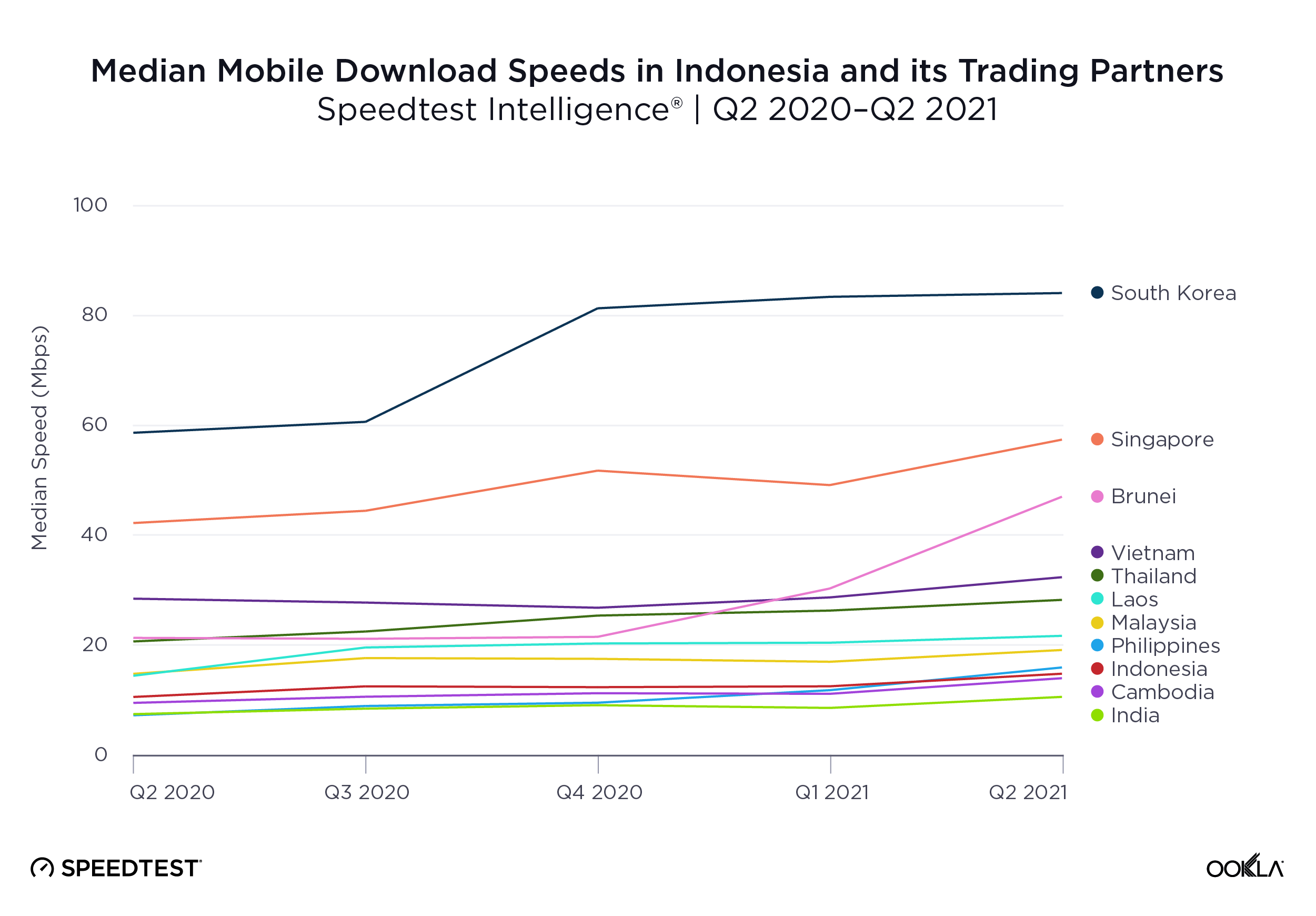

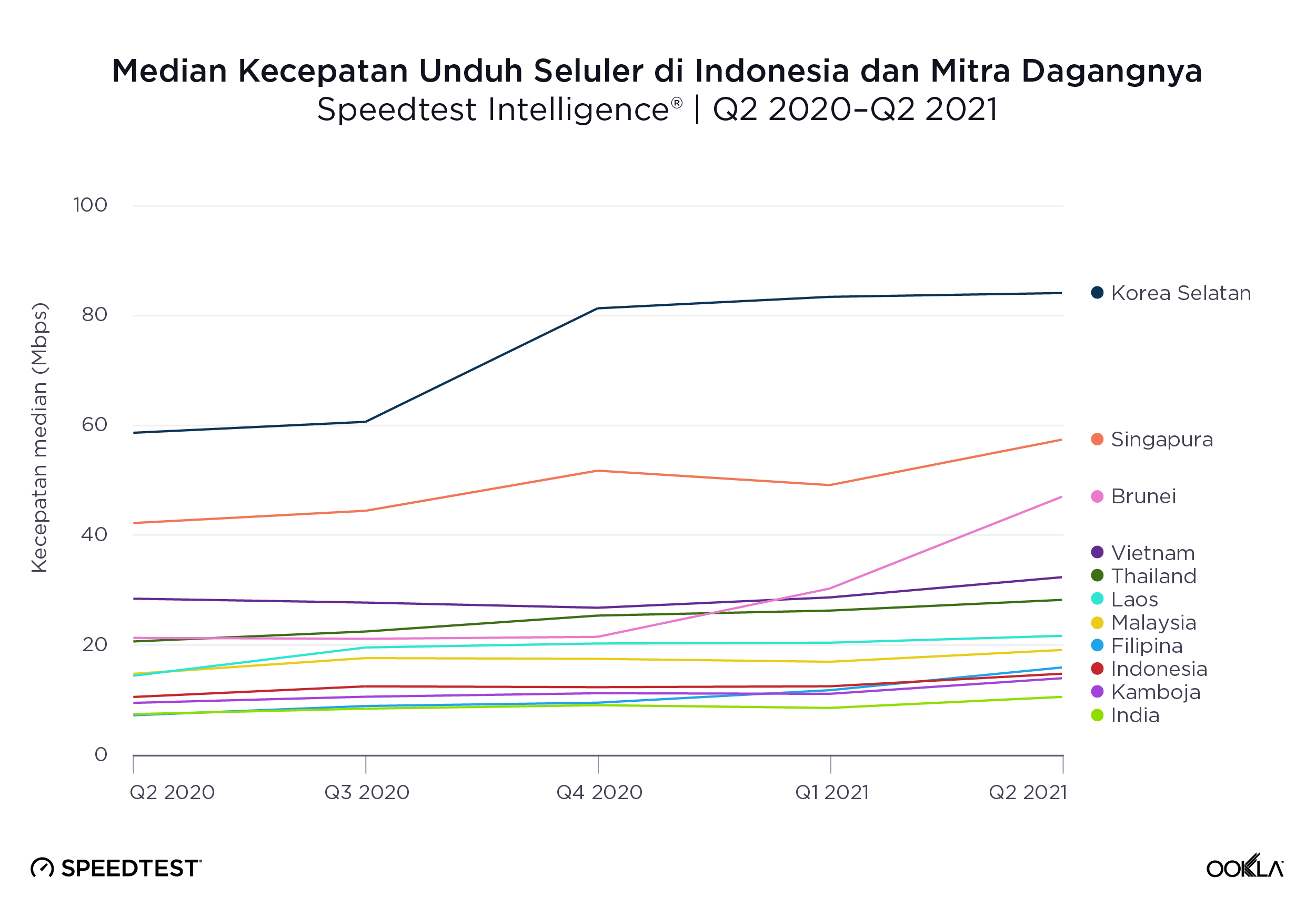

Comparing Indonesia’s major trading partners, including ASEAN countries and India and South Korea, mobile download speed varied widely between countries over the last year. We have excluded Myanmar from this analysis due to the political situation. South Korea had the highest median download speed during Q2 2021 at 84.12 Mbps, according to Speedtest Intelligence. Singapore was second at 57.42 Mbps, followed by Brunei (47.02 Mbps). Indonesia showed one of the slowest median download speeds on the list at 14.78 Mbps. Only Cambodia and India were slower at 13.96 Mbps and 10.56 Mbps, respectively. Indonesia saw a gain of 4.23 Mbps in median download speed from 10.55 Mbps in Q2 2020 to 14.78 Mbps Q2 2021.

Indonesia’s 4G Availability ranked fourth compared to major trading partners

Speedtest Intelligence shows every country we surveyed had 4G Availability — the percent of users on all devices that spend the majority of their time on 4G and above, both roaming and on-network — near or above 80% during Q2 2021. South Korea rose to the top at 95.7% 4G Availability during Q2 2021, followed by Singapore (93.9%) and India (91.7%). Indonesia was fourth at 89.2%.

Telkomsel was the fastest and top-rated mobile provider in Indonesia during Q1-Q2 2021, SmartFren had the highest 4G Availability

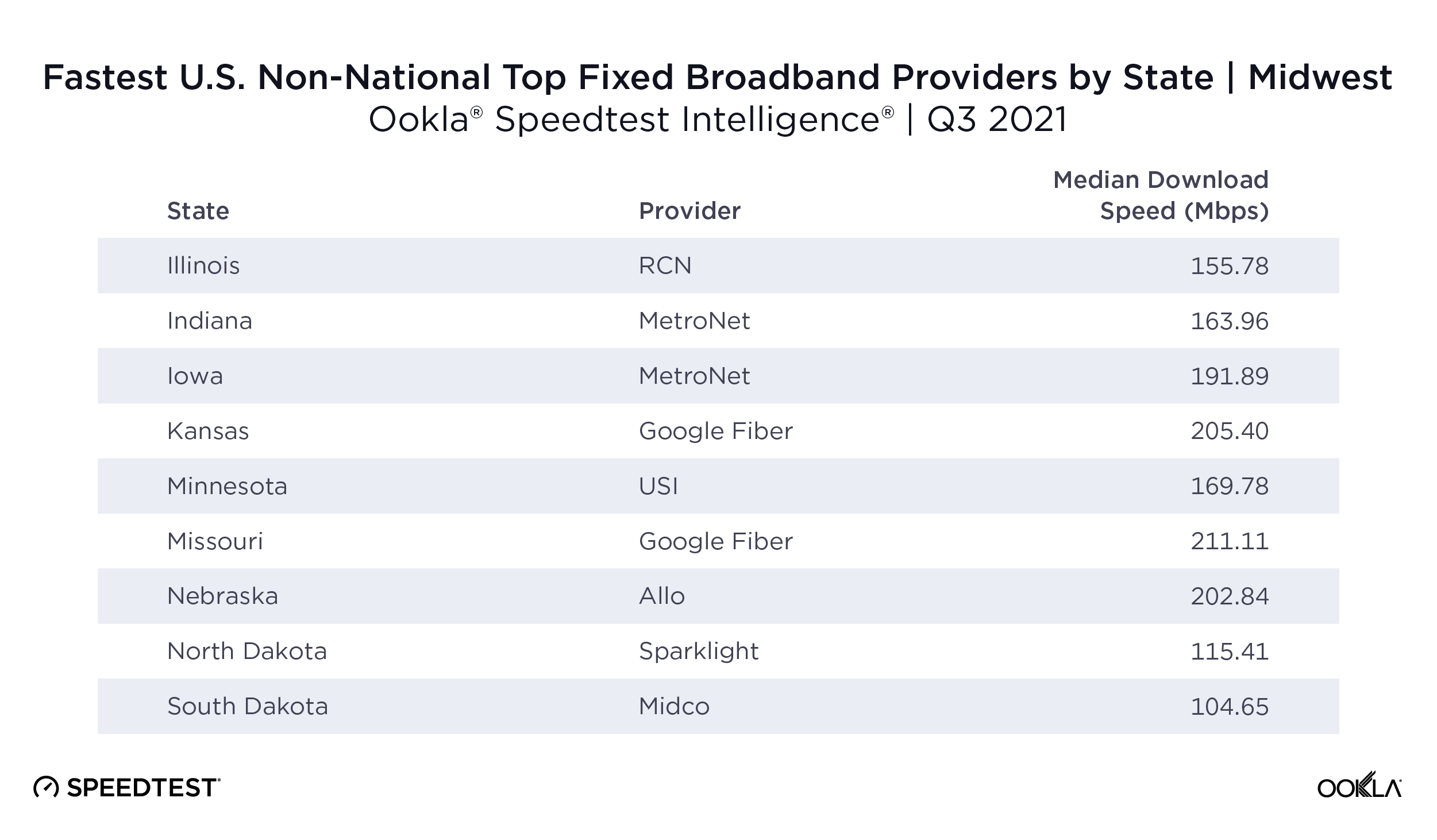

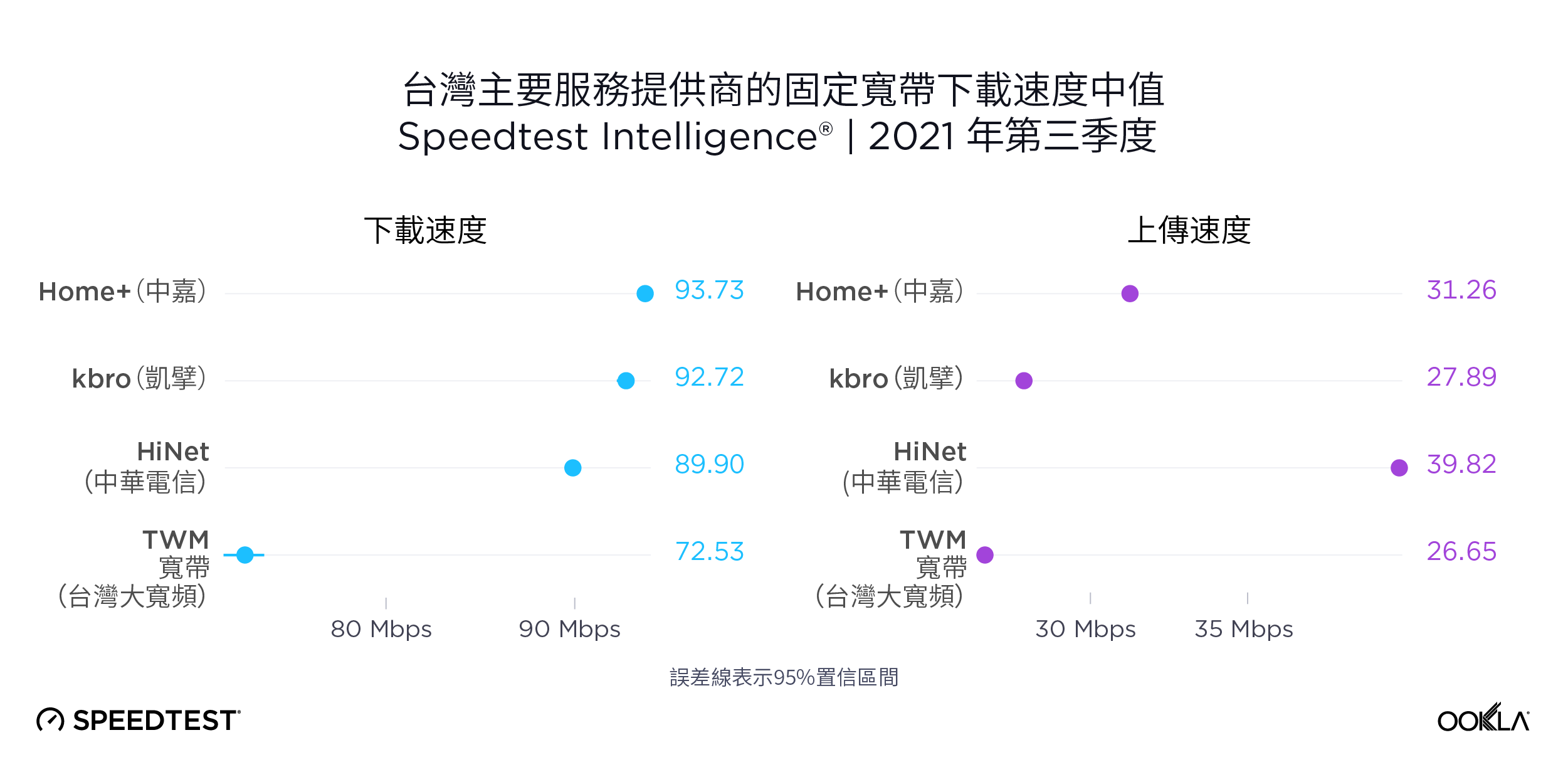

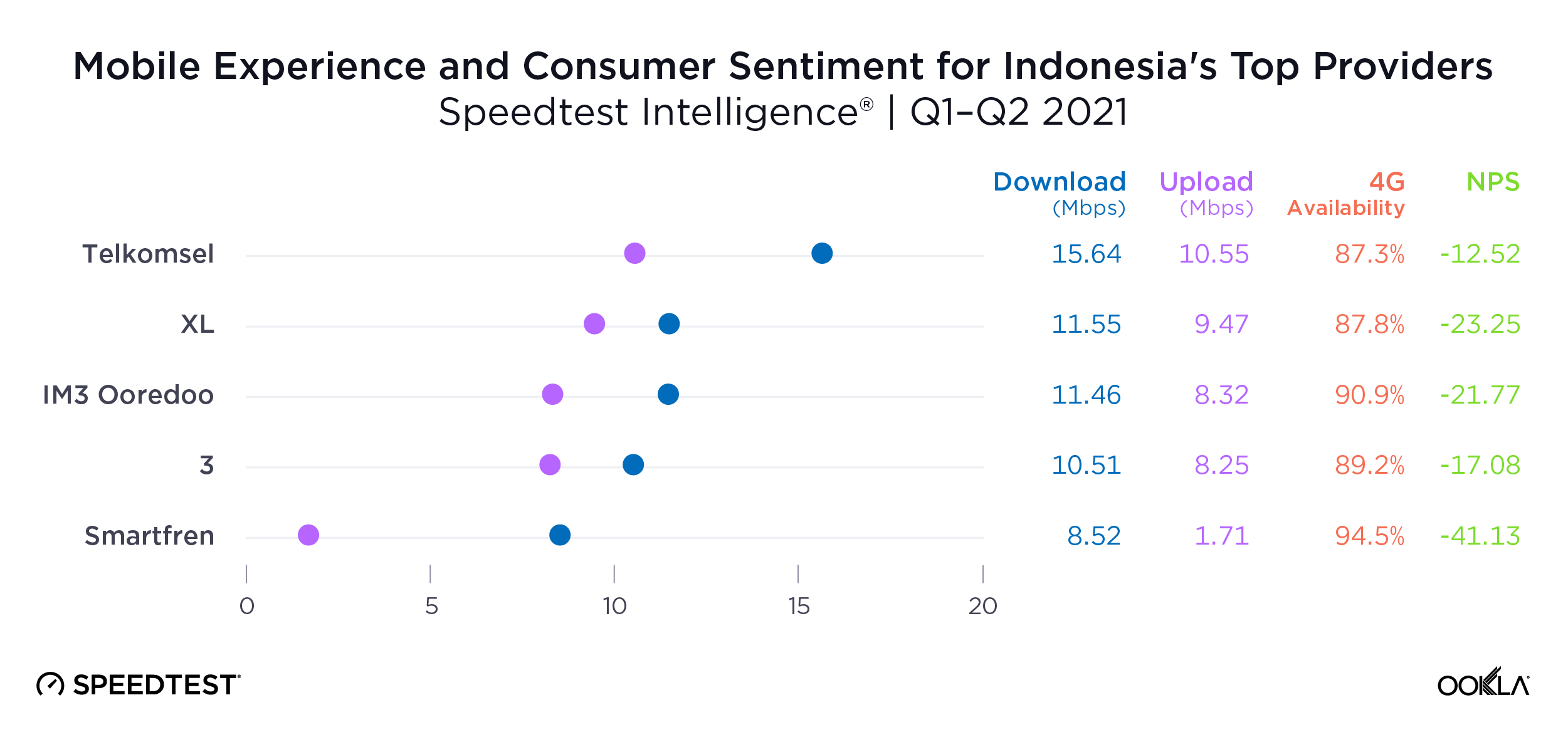

Indonesia’s fastest mobile operator during Q1-Q2 2021 was Telkomsel with the fastest median download speed (15.64 Mbps) and upload speed (10.55 Mbps). XL was second for both download and upload speeds, followed by IM3 Ooredoo, 3 and Smartfren.

According to Speedtest Consumer Sentiment™ Telkomsel also had the top-rated Net Promoter Score (NPS) at -12.52. 3 was second for this measure of customer satisfaction with their mobile operator, IM3 Ooredoo third, XL fourth and Smartfren fifth.

The race for the best 4G Availability was competitive in Indonesia during Q1-Q2 2021 with every top provider achieving at least 87%. However, SmartFren — which operates exclusively on 4G LTE — achieved the highest 4G Availability at 94.5%. IM3 Ooredoo was next at 90.9%, followed by 3 (89.2%), XL (87.8%) and Telkomsel (87.3%).

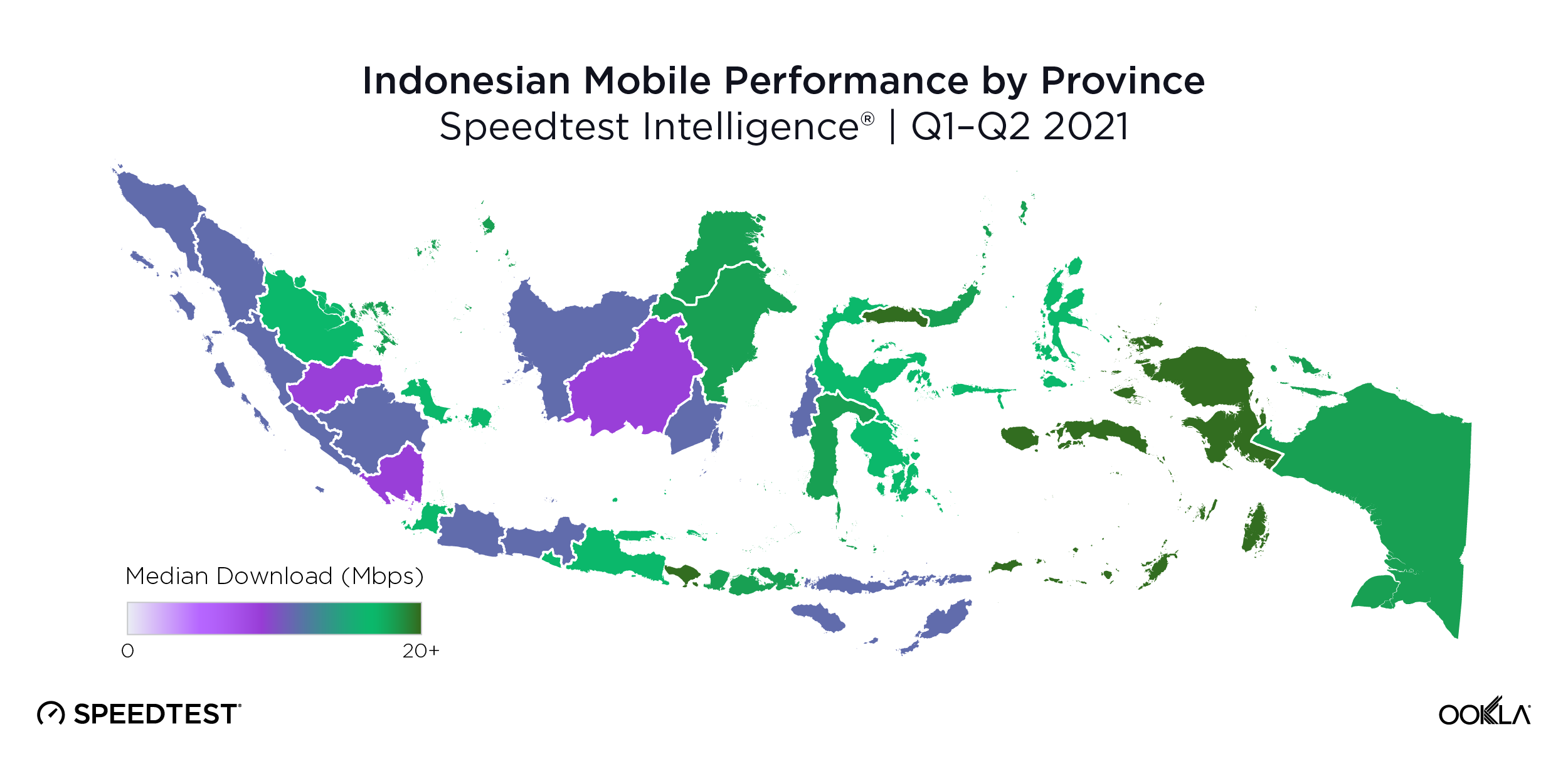

Mobile performance and 4G Availability varied widely across Indonesia’s rural and urban provinces during Q1-Q2 2021

23 of Indonesia’s 34 provinces experienced median download speeds between 12.00 Mbps and 19.00 Mbps during Q1-Q2 2021

Speedtest Intelligence reveals there was no statistically significant fastest province in Indonesia during Q1-Q2 2021, though four provinces had median mobile download speeds greater than 19.00 Mbps: West Papua (20.14 Mbps), Bali (19.68 Mbps), Maluku (19.43 Mbps) and Gorontalo (19.32 Mbps). East Kalimantan — home to Indonesia’s future new capital — followed at 18.48 Mbps.

During Q2 2021, there was no statistically slowest province, though four provinces had median mobile download speeds less than 11.00 Mbps: Jambi (9.20 Mbps), Lampung (9.29 Mbps), Central Kalimantan (9.90 Mbps) and West Sumatra (10.64 Mbps).

There was also no province with the statistically fastest median mobile upload speed, though four provinces had median upload speeds greater than 12.50 Mbps: West Papua (12.97 Mbps), East Nusa Tenggara (12.89 Mbps), Bangka Belitung Islands (12.84 Mbps) and Bali (12.55 Mbps). Every province had a median upload speed greater than 7.50 Mbps, except West Sumatra (6.92 Mbps), Central Java (7.34 Mbps) and North Maluku (7.36 Mbps).

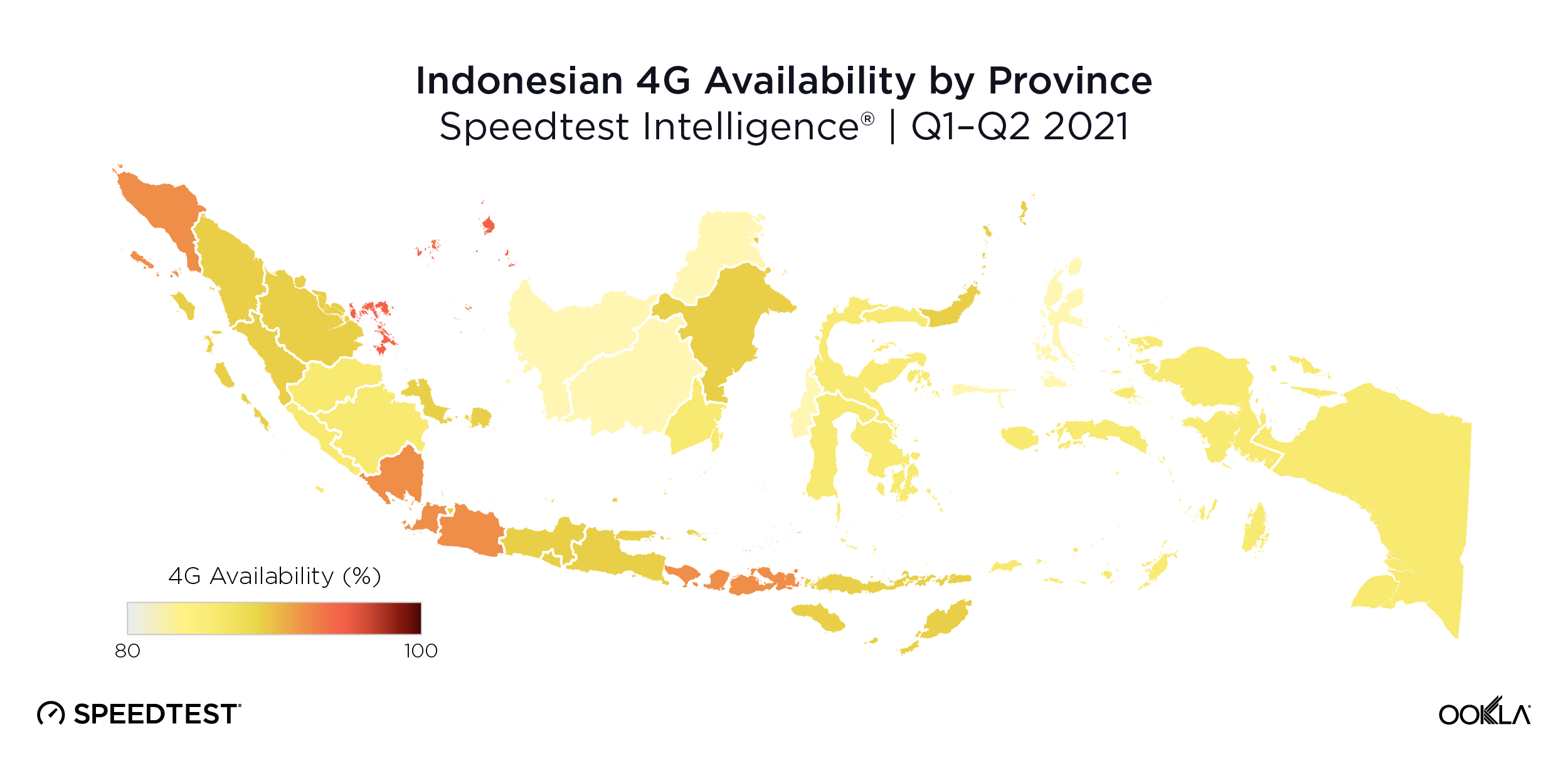

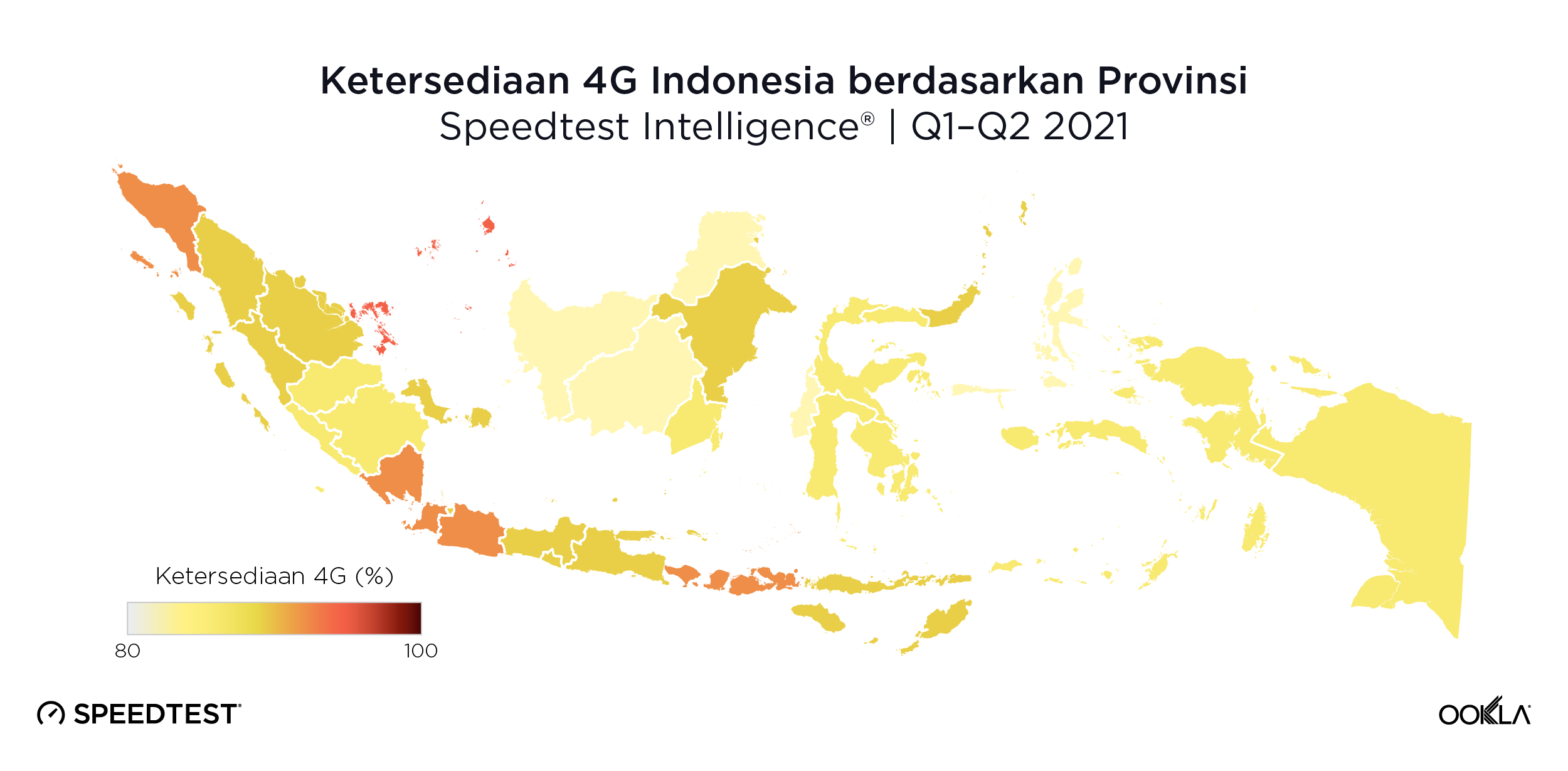

27 of Indonesia’s provinces showed 4G Availability above 84% during Q1-Q2 2021

Much like Indonesia’s mobile performance, Indonesia’s 4G Availability varied from province to province during Q1-Q2 2021. All but 10 provinces achieved 4G Availability between 84.0% and 89.0%, with four provinces standing out from the rest of the country by achieving 4G Availability greater than 89.0%: Riau Islands (90.5%), West Java (89.8%), Banten (89.7%) and Bali (88.7%). Provinces with higher urban density often displayed higher 4G Availability, but that wasn’t always the case during Q1-Q2 2021, with less urban and less populated provinces like Aceh achieving 88.5% 4G Availability.

North Kalimantan — the least populous province in Indonesia — had the lowest 4G Availability of any province during Q1-Q2 2021 at 79.7%. West Sulawesi had the second lowest 4G Availability at 80.1%. Central Kalimantan, North Maluku and West Kalimantan were the remaining provinces with 4G Availability under 83.0%.

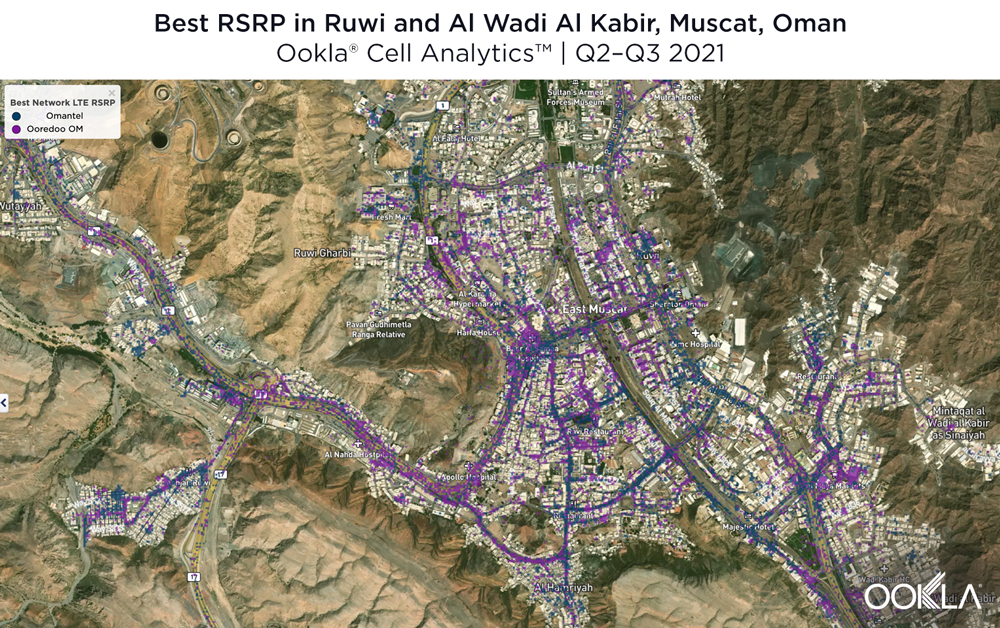

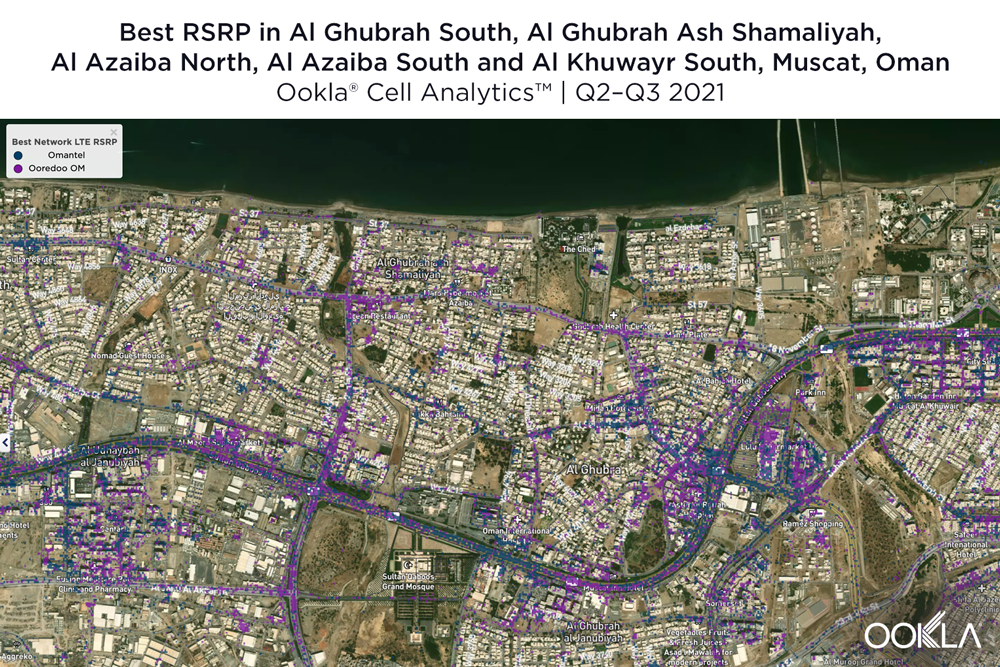

Indoor and outdoor signal strength varies widely by location and provider

We identified several key locations in Indonesia to highlight mobile performance using Cell Analytics data from Q1-Q2 2021. Each of these maps shows the best provider for indoor and outdoor 4G RSRP signal strength in a given area, as well as provider-level 4G RSRP signal strength. For indoor and outdoor 4G RSRP maps, Cell Analytics identifies the best mobile network provider for a given area or building by color if there is a statistically significant winner. Provider-level maps show the performance of individual providers for a given area, with pink and red showing a strong signal and blue indicating a weak signal.

Monas — Gambir, Jakarta

Situated in the heart of Central Jakarta, Monas stands 137 meters tall and is a monument to Indonesia’s struggle for independence. With nearly 11 million people in Jakarta — and over 900,000 people in the roughly 18.5 square mile Special Capital Region alone — knowing if you can rely on your mobile operator is incredibly important.

The images below show the best 4G LTE RSRP signal strength by provider for a given area outdoors and indoors within a specific building. As evidenced by the colorful array throughout the map, Monas is widely covered with 4G LTE, though some providers have a bigger footprint than others in various areas.

The maps below show the areas of high and low signal strengths for every top provider. Telkomsel users have the most comprehensive signal, although there are areas with room for improvement. IM3 Ooredoo shows areas of strong signal strength east of the Monas monument, though a few blocks over there is an area where users experience low RSRP signal strength, which undoubtedly affects mobile performance. XL has adequate RSRP in the areas to the east and west of Monas, but also shows weak signals in the east, southeast and north areas. 3 shows areas of strong signal strength in localized areas located in red, while Smartfren’s map shows areas of moderate intensity with many areas of low signal strength.

Bajra Sandhi Monument — Denpasar, Bali

With more than 900,000 people, the Balinese capital Denpasar is an important regional hub and growing tourist destination. Located in downtown Denpasar in front of the Bali Governor’s Office, the Bajra Sandhi is a monument to the people of Bali and their fights throughout history. It’s a prime location to show how each top mobile operator is performing in the area.

As evidenced by the data below, Telkomsel had many locations with the best RSRP 4G LTE signal strength around the Bajra Sandhi Monument for both indoor and outdoor areas.

The RSRP maps for providers paint an interesting picture of Denpasar: While Telkomsel shows many strong areas, IM3 Ooredoo shows few weak RSRP areas near the Bajra Sandhi monument with a large blue cluster showing strong 4G LTE signals near the center of the map. XL shows areas of localized strength, though the major roads to the west appear to have areas of low strength. 3’s strongest signals are centered around the major roads within the area, with room for improvement in the central core. Smartfren has adequate strength throughout, but much fewer samples than the rest of the providers.

Plaza Balikpapan — Balikpapan, East Kalimantan

In the near future, Indonesia’s government will be moving its capital from Jakarta to a yet-to-be-named area in East Kalimantan between the province’s two largest cities, Samarinda and Balikpapan. To better determine how mobile operators are already performing in the region, we examined the busy shopping mall Plaza Balikpapan near the shoreline in Balikpapan.

With many key shopping locations on the waterfront, Telkomsel has a strong presence in the east and north of the area, as well as key locations on the waterfront. XL has some of the best 4G LTE signal strength in the center of the map and eastern waterfront. IM3 Ooredoo has the best signal strength in key indoor areas north of the waterfront. 3 has the best RSRP in various locations throughout the map, including the waterfront. Smartfren samples are largely absent from the area.

The following maps show Telkomsel coverage throughout much of the area. IM3 Ooredoo seems to be the operator of choice for boaters and has strong 4G LTE RSRP near the central waterfront and east of the map. XL has strong locations near the waterfront and north of the map. 3 has strong localized areas near the waterfront and east but has many areas that lack good strength around the map. Smartfren does not have much of a footprint in Balikpapan according to this data.

The future of Indonesia’s mobile experience depends on 4G and 5G expansion

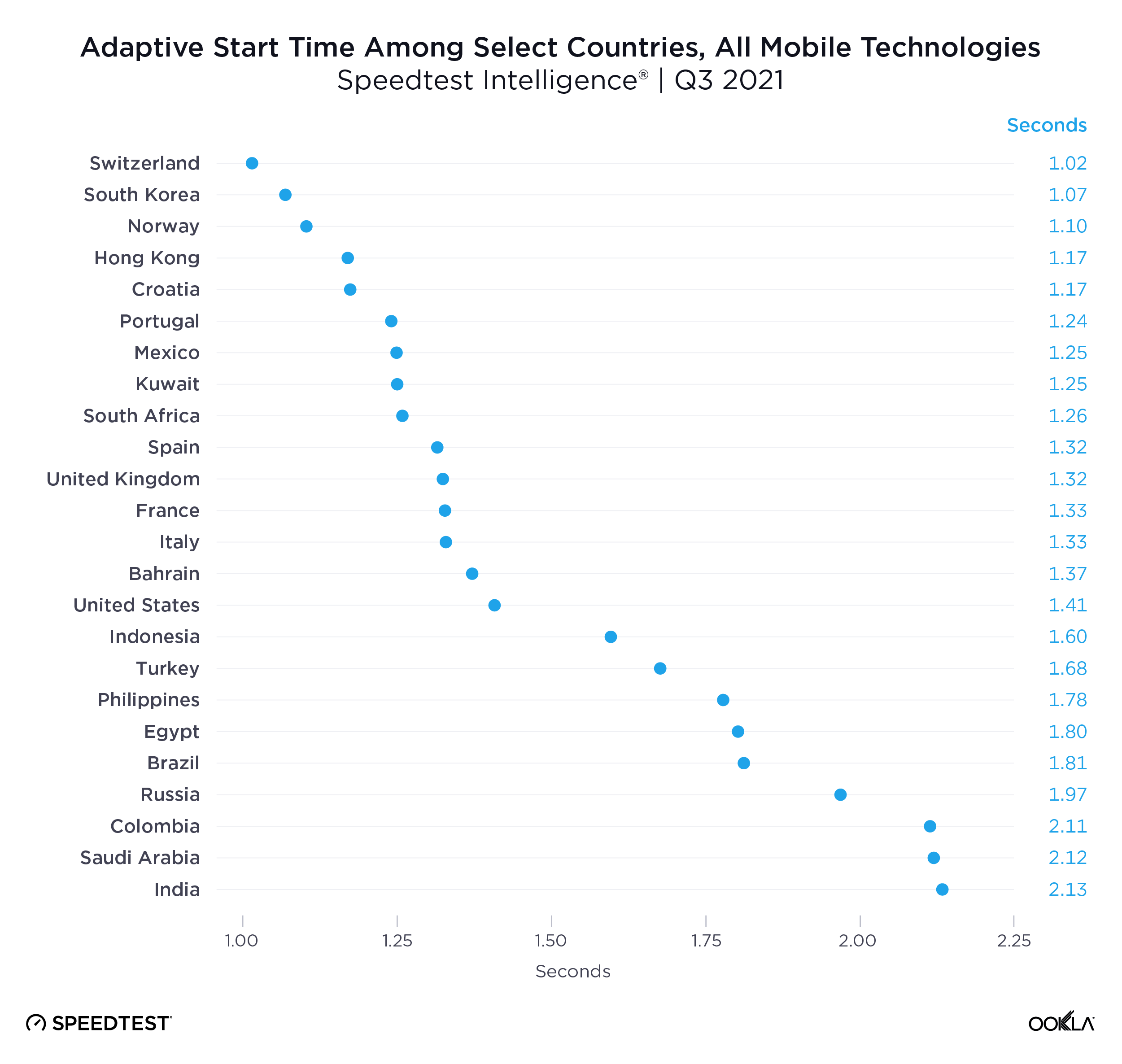

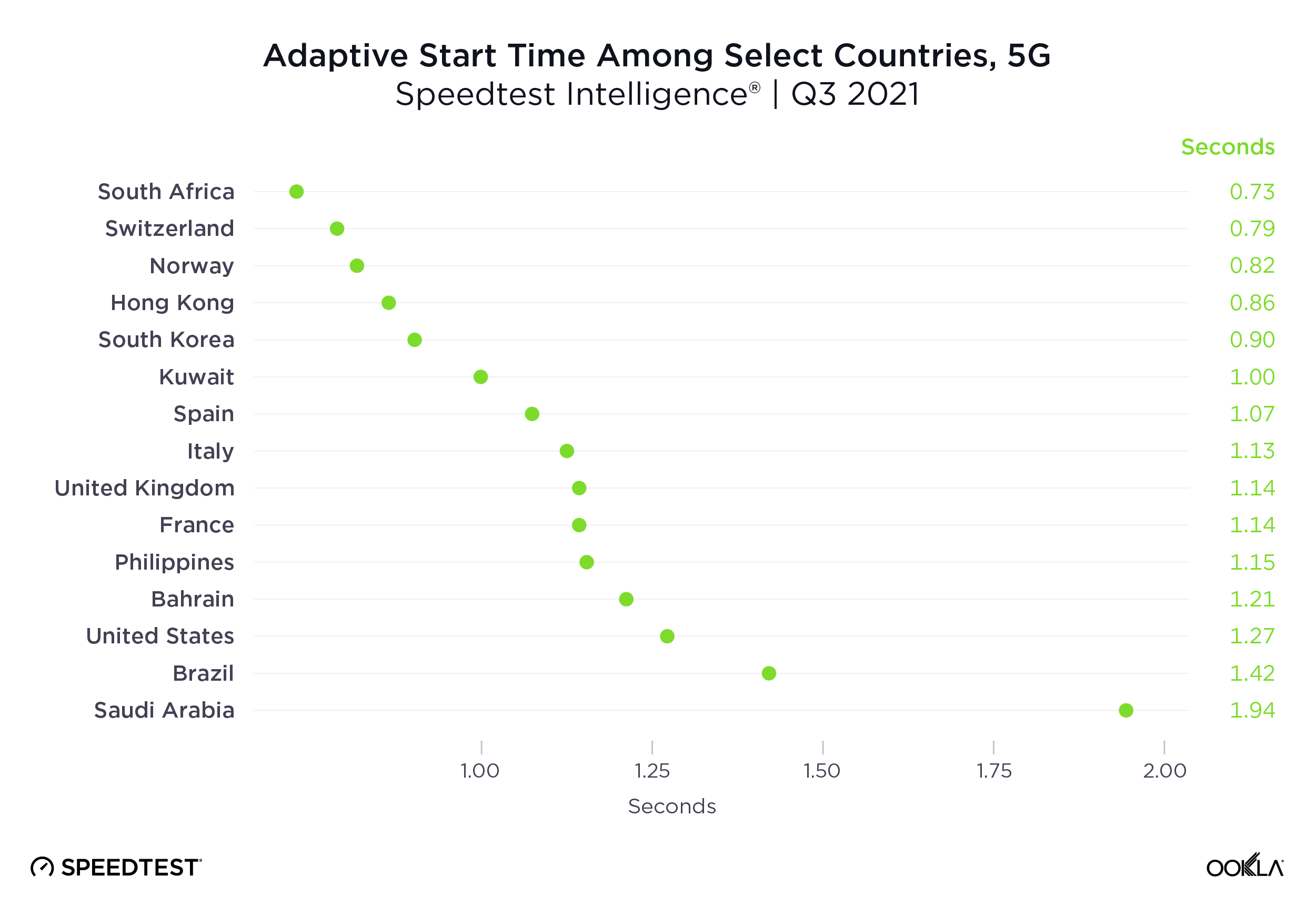

With 5G officially launched in Indonesia in May 2021 and Ooredo recently launching in August, we’re looking forward to seeing how speeds improve — especially as some countries have seen 5G deliver speeds up to 10 times faster than 4G. But without any C-band currently being commercially utilized or up for auction, Indonesians may not see the lightning fast 5G speeds its trading partners like Vietnam and South Korea experience. Instead, Indonesia’s C-band spectrum is currently occupied by satellite operators, which play an important role in connecting remote towns and villages that are not served by terrestrial telecoms networks. With a lack of spectrum available for mobile in this key 5G band, and significant challenges in terms of coexistence, the Ministry of Communication and Information has sought to drive more efficient use of existing spectrum, most recently through:

- Refarming spectrum in the 2.3 GHz band — a key band which will help increase existing 4G capacity and in time support 5G services — with both Telkomsel and Smartfren successfully acquiring blocks at auction in April 2021.

- Proceeding with plans to complete analogue switch-off in the country, despite COVID-19 related delays, which will free up spectrum in the 700 MHz band, which will be critical in driving improved mobile coverage.

- The introduction of the Omnibus Law, which mandates the sharing of passive network infrastructure to facilitate new network rollouts while also allowing for spectrum trading and sharing between network operators.

The silver lining to Indonesia’s slow 5G rollout lies in cost benefits — 5G equipment will become cheaper over time, and the demand for 5G could be greater; particularly as 5G devices become cheaper and cheaper. As the government and mobile operators continue to push to expand 4G LTE access to rural and remote areas, Indonesia will reap the benefits of lower cost technologies while being able to prime deployments for future 5G upgrades. However, those expansions will only be in demand if consumers can afford them or see the benefit of upgrading their devices to a 4G minimum — while there is supply, mobile operators should drive demand and Indonesian regulators should help make the switch to 4G easier for consumers.

We’ll be monitoring Indonesia’s mobile experience closely and keep you up-to-date on newsworthy events. To learn more about Speedtest Intelligence and Cell Analytics, please contact us. If you want to see how your mobile performance stacks up, take a Speedtest®.

Seiring Kecepatan Seluler di Indonesia Makin Meningkat, Akses Masih Menjadi Penghalang untuk Populasi Indonesia

Indonesia mempunyai tantangan teknis menarik bagi operator seluler yang bekerja untuk menghadirkan 5G walaupun sebahagian kotanya masih hanya menerima 3G. Dengan lebih dari 17.000 pulau — dan setengah dari populasinya di Jawa — negara dengan populasi sebanyak 270 juta ini mempunyai tantangan seluler terkait kepadatan provinsi dan kotanya. Kami menggunakan data dari Speedtest Intelligence® untuk mengevaluasi kinerja seluler di Indonesia selama Q1-Q2 tahun 2021. Analisis kami memeriksa kecepatan seluler dan Ketersediaan 4G di tingkat negara dan penyedia jasa serta mencakup potret kinerja setiap 34 provinsi di Indonesia. Kami juga menggunakan Cell Analytics™ untuk menunjukan perbandingan pengalaman pengguna seluler antara satu operator dengan yang lain di beberapa lokasi penting di Indonesia.

Kinerja seluler di Indonesia masih di belakang sebagian besar mitra dagang tetapi kecepatannya sudah meningkat

Membandingkan mitra dagang utama Indonesia, termasuk negara-negara ASEAN dan India dan Korea Selatan, kecepatan unduh seluler antara negara-negara tersebut selama satu tahun lalu berbeda-beda. Kami tidak memasukkan Myanmar karena situasi politis. Korea Selatan mempunyai median kecepatan unduh tertinggi selama Q2 2021 dengan 84,12 Mbps menurut Speedtest Intelligence. Singapura berada di peringkat kedua dengan 57,42 Mbps, diikuti dengan Brunei (47,02 Mbps). Indonesia mempunyai salah satu median kecepatan unduh terendah dengan 14,78 Mbps. Hanya Kamboja dan India yang lebih rendah, masing-masing dengan 13,96 Mbps dan 10,56 Mbps. Indonesia menunjukan peningkatan sebesar 4,23 Mbps dalam median kecepatan unduh dari 10,55 Mbps di Q2 2020 menjadi 14,78 Mbps di Q2 2021.

Ketersediaan 4G di Indonesia di peringkat keempat dibandingkan mitra-mitra dagangnya

Speedtest Intelligence menunjukan bahwa setiap negara yang kita survei telah mempunyai Ketersediaan 4G — persentase pengguna di semua perangkat yang menghabiskan sebagian besar waktunya dengan 4G dan di atasnya, baik secara roaming dan on-network — mendekati atau di atas 80% selama Q2 2021. Korea Selatan menjadi peringkat pertama dengan 95,7% Ketersediaan 4G selama Q2 2021, diikuti dengan Singapura (93,9%) dan India (91,7%). Indonesia berada di peringkat keempat dengan 89,2%.

Telkomsel adalah penyedia seluler tercepat dan terutamas di Indonesia selama Q1-Q2 2021, SmartFren mempunyai Ketersediaan 4G yang paling tinggi

Operator seluler tercepat di Indonesia selama Q1-Q2 2021 adalah Telkomsel dengan kecepatan median unduh tercepat (15,64 Mbps) dan unggah tercepat (10,55 Mbps). XL berada di peringkat kedua dengan kecepatan unduh dan unggahnya, diikuti dengan IM3 Ooredoo, 3 dan Smartfren.

Menurut Speedtest Consumer Sentiment™ Telkomsel juga mempunyai Net Promoter Score (NPS) tertinggi dengan -12,52. 3 berada di peringkat kedua untuk pengukuran kepuasan konsumen terhadap operator seluler mereka, IM3 Ooredoo ketiga, XL keempat dan Smartfren kelima.

Perlombaan untuk Ketersediaan 4G sangat kompetitif di Indonesia selama Q1-Q2 2021 dengan setiap penyedia utama mencapai paling tidak 87%. Tetapi, SmartFren — yang beroperasi khusus dalam 4G LTE — mencapai ketersediaan 4G tertinggi di angka 94,5%. IM3 Ooredoo di peringkat selanjutnya di 90,9%, diikuti dengan 3 (89,2%), XL (87,8%) dan Telkomsel (87,3%).

Kinerja seluler dan Ketersediaan 4G sangat beragam di antara provinsi-provinsi perkotaan dan pedesaan di Indonesia selama Q1-Q2 2021

23 dari 34 provinsi di Indonesia mempunyai kecepatan median unduh yang sama antara 12,00 Mbps dan 19,00 Mbps Q1-Q2 2021

Hasil Speedtest Intelligence menunjukan tidak ada provinsi di Indonesia yang secara statistik sangat cepat selama Q1-Q2 2021, meskipun empat provinsi mempunyai median kecepatan unduh seluler lebih dari 19,00 Mbps: Papua Barat (20,14 Mbps), Bali (19,68 Mbps), Maluku (19,43 Mbps) dan Gorontalo (19,32 Mbps). Kalimantan Timur — tempat ibu kota negara baru Indonesia nantinya — berada tepat di bawahnya dengan 18,48 Mbps.

Selama Q2 2021, tidak terdapat provinsi yang secara statistik sangat lambat, meskipun terdapat empat provinsi yang mempunyai median kecepatan unduh seluler kurang dari 11,00 Mbps: Jambi (9,20 Mbps), Lampung (9,29 Mbps), Kalimantan Tengah (9,90 Mbps) and Sumatra Barat (10,64 Mbps).

Tidak terdapat juga provinsi dengan median kecepatan unggah seluler yang secara statistik sangat cepat, meskipun empat provinsi mempunyai median kecepatan unggah seluler lebih dari 12,50 Mbps: Papua Barat (12,97 Mbps), Nusa Tenggara Timur (12,89 Mbps), Kepulauan Bangka Belitung (12,84 Mbps) dan Bali (12,55 Mbps). Setiap provinsi mempunyai median kecepatan unggah lebih dari 7,50 Mbps, kecuali Sumatra Barat (6,92 Mbps), Java Tengah (7,34 Mbps) dan Maluku Utara (7,36 Mbps).

27 provinsi di Indonesia menunjukkan Ketersediaan 4G di atas 84% selama Q1-Q2 2021

Seperti kinerja seluler Indonesia, Ketersediaan 4G Indonesia beragam dari satu provinsi ke provinsi lainnya selama Q1-Q2 2021. Semua provinsi kecuali 10 provinsi mencapai Ketersediaan 4G antara 84,0% dan 89,0%, dengan empat provinsi menonjol dari provinsi lain, mencapai Ketersediaan 4G lebih dari 89,0%: Kepulauan Riau (90,5%), Jawa Barat (89,8%), Banten (89,7%) dan Bali (88,7%). Provinsi-provinsi dengan kepadatan urban lebih tinggi menunjukkan Ketersediaan 4G yang lebih tinggi, tetapi tidak selalu begitu keadaannya untuk provinsi-provinsi yang tidak urban dan tidak padat penduduk seperti Aceh yang mencapai Ketersediaan 4G sebesar 88,5%.

Kalimantan Utara — provinsi dengan kepadatan penduduk terendah di Indonesia — mempunyai Ketersediaan 4G terendah dibandingkan dengan provinsi mana pun selama Q1-Q2 2021 di 79,7%. Sulawesi Barat mempunyai Ketersediaan 4G terendah kedua di 80,1%. Kalimantan Tengah, Maluku Utara and Kalimantan Barat adalah provinsi-provinsi lainnya dengan Ketersediaan 4G di bawah 83,0%.

Kekuatan sinyal dalam dan luar ruangan bermacam-macam berdasar lokasi dan penyedia

Kami menemukan beberapa lokasi penting di Indonesia untuk menunjukkan kinerja seluler menggunakan data Cell Analytics dari Q1-Q2 2021. Setiap peta ini menunjukkan penyedia terbaik untuk kekuatan sinyal 4G RSRP dalam ruangan dan luar ruangan di daerah tertentu, termasuk di tingkat penyedia kekuatan sinyal 4G RSRP. Untuk peta 4G RSRP dalam ruangan dan luar ruangan, Cell Analytics mengidentifikasi penyedia jaringan seluler terbaik untuk area atau gedung tertentu berdasarkan warna jika terdapat penyedia yang unggul secara statistik. Peta tingkat penyedia menunjukkan kinerja masing-masing penyedia untuk area tertentu, dengan warna merah muda dan merah yang menampilkan sinyal kuat, dan biru menampilkan sinyal lemah.

Monas — Gambir, Jakarta

Berada di jantung kota Jakarta Pusat, Monas setinggi 137 meter adalah monumen perjuangan kemerdekaan Indonesia. Dengan hampir 11 juta manusia di Jakarta — dan lebih dari 900,000 jiwa kira-kira di setiap 18,5 mil persegi Daerah Ibu Kota saja — mengetahui apakah Anda dapat mengandalkan operator seluler Anda adalah hal yang penting.

Gambar-gambar berikut menunjukan kekuatan sinyal 4G LTE RSRP terbaik berdasarkan penyedia untuk area luar ruangan dan dalam ruangan di dalam suatu gedung. Seperti dibuktikan susunan warna-warni di seluruh peta, Monas secara luas dicakup 4G LTE, meskipun beberapa provider mempunyai jejak yang lebih besar dibandingkan dengan yang lain di beberapa tempat.

Peta-peta di bawah menunjukkan tempat dengan kekuatan sinyal yang tinggi dan rendah untuk setiap penyedia terbaik. Pengguna Telkomsel mempunyai sinyal yang paling komprehensif, meskipun terdapat beberapa hal yang bisa diperbaiki. IM3 Ooredoo menunjukkan area-area dengan kekuatan sinyal yang kuat dari timur monumen Monas, meskipun beberapa blok dari sana terdapat area di mana pengguna mengalamai kekuatan sinyal RSRP rendah, yang secara jelas memengaruhi kinerja seluler. XL mempunyai RSRP yang cukup di area-area ke timur dan barat Monas, tetapi juga menunjukkan sinyal yang rendah di area timur, tenggara, dan utara. 3 menunjukkan area dengan kekuatan sinyal yang kuat di area terlokalisasi yang berada di merah yang, sementara peta Smartfren menunjukkan area dengan intensitas menengah dengan banyak area yang memiliki kekuatan sinyal rendah.

Monumen Bajra Sandhi — Denpasar, Bali

Dengan lebih dari 900,000 jiwa, Denpasar ibu kota Bali adalah pusat regional yang penting dan tujuan wisata yang berkembang. Berlokasi di pusat kota Denpasar di depan Kantor Gubernur Bali, Bajra Sandhi adalah monumen penting bagi warga Bali dan perjuangan mereka sepanjang sejarah pulau tersebut. Denpasar merupakan lokasi penting untuk menunjukkan kinerja setiap operator seluler di area tersebut.

Dibuktikan dengan data di bawah ini, Telkomsel mempunyai banyak lokasi dengan kekuatan sinyal 4G LTE RSRP terbaik di sekitar Monumen Bajra Sandhi baik untuk area dalam ruang dan luar ruangan.

Peta RSRP untuk penyedia menampilkan gambaran yang menarik tentang Denpasar: Meskipun Telkomsel menunjukkan banyak area yang kuat, IM3 Ooredoo menunjukkan beberapa area RSRP yang rendah di dekat Monumen Bajra Sandhi dengan kluster biru besar yang menunjukkan sinyal 4G LTE yang kuat di dekat titik tengah peta. XL menunjukkan area dengan kekuatan yang terlokalisasi, meskipun jalan-jalan besar ke barat menunjukkan area dengan kekuatan rendah. Sinyal terkuat 3 terpusat di sekitar jalan-jalan besar di area tersebut, dengan ruang untuk perbaikan di titik pusat. Smartfren mempunyai kekuatan yang memadai di seluruh peta, tetapi dengan sampel yang jauh lebih sedikit daripada penyedia-penyedia lain.

Plaza Balikpapan — Balikpapan, Kalimantan Timur

Di masa mendatang, pemerintah Indonesia akan memindahkan ibu kota negara dari Jakarta ke daerah yang belum dinamai di Kalimantan Timur antara dua kota terbesar di provinsi tersebut, Samarinda dan Balikpapan. Untuk menentukan dengan lebih baik bagaimana kinerja operator seluler di daerah tersebut, kami memeriksa mall perbelanjaan yang ramai, Plaza Balikpapan, di dekat garis pantang di Balikpapan.

Dengan banyak lokasi perbelanjaan yang penting di tepi laut, Telkomsel mempunyai keberadaan yang kuat di bagian timur dan utara area, termasuk lokasi-lokasi penting di tepi laut. XL mempunyai beberapa kekuatan sinyal 4G LTE terbaik di titik pusat peta dan di tepi laut bagian timur. IM3 Ooredoo mempunyai kekuatan sinyal terbaik di area dalam ruang yang penting di utara dari tepi laut. 3 mempunyai RSRP terbaik di beberapa lokasi di seluruh peta, termasuk di tepi laut. Sampel-sampel Smartfren sebagian besar tidak tersedia di area.

Peta-peta berikut menunjukkan cakupan Telkomsel di sebagian besar area. IM3 Ooredoo nampaknya menjadi pilihan operator bagi pelaut dan mempunyai RSRP 4G LTE terkuat di dekat pusat tepi laut dan di timur peta. XL mempunyai lokasi-lokasi dekat tepi laut dan di utara peta. 3 mempunyai area-area terlokalisasi yang kuat di dekat tepi laut dan di timur tetapi memiliki banyak area dengan kekuatan buruk di sekitar peta. Smartfren tidak mempunyai banyak jejak di Balikpapan menurut data ini.

Pengalaman seluler di Indonesia di masa mendatang bergantung pada ekspansi 4G dan 5G

Dengan 5G secara resmi diluncurkan di Indonesia pada bulan Mei 2021 dan Ooredo baru saja diluncurkan pada bulan Agustus, kami menantikan perbaikan kecepatan — terutama ketika beberapa negara telah menunjukkan 5G memberi kecepatan hingga 10 kali lebih cepat dari 4G. Tetapi tanpa adanya C-band yang saat ini dimanfaatkan secara komersial atau siap dilelang, warga Indonesia mungkin belum akan menikmati kecepatan 5G yang sangat cepat seperti mitra dagangnya yaitu Vietnam dan Korea Selatan. Tetapi, spektrum C-band di Indonesia saat ini diduduki oleh operator satelit, yang berpengaruh penting dalam menghubungan kota dan desa terjauh yang tidak dilayani oleh jaringan telekomunikasi darat. Dengan kurangnya ketersediaan spektrum untuk seluler di band 5G penting ini, dan tantangan-tantangan penting dalam hal koeksistensi, Kementerian Komunikasi dan Informasi telah berupaya untuk mendorong penggunaan yang lebih efisien atas spektrum yang ada saat ini, dengan yang paling baru melalui:

- Memperbarui spektrum di band 2,3 GHz — band penting yang membantu meningkatkan kapasitas 4G saat ini dan pada saatnya akan mendukung layanan 5G — dengan Telkomsel dan Smartfren secara sukses memperoleh blok dalam lelang pada April 2021.

- Melanjutkan rencana pelengkapan analog switch-off di Indonesia, terlepas dari ketertundaan terkait COVID-19 yang akan mengosongkan spektrum di band 700 MHz, yang akan penting dalam mendorong cakupan seluler yang lebih baik.

- Diperkenalkannya Omnibus Law, yang mewajibkan pembagian infrastruktur jaringan pasif untuk membantu penyediaan jaringan baru dengan juga mengizinkan perdagangan dan pembagian spektrum antara operator jaringan.

Hal positif dari peluncuran 5G di Indonesia yang lambat adalah mengenai manfaat biaya — peralatan 5G akan menjadi lebih murah kedepannya, dan permintaan 5G akan lebih besar; khususnya ketika perangkat 5G menjadi lebih murah. Seiring pemerintah dan operator seluler terus mendorong perluasan akses 4G LTE ke area-area desa dan terpencil, Indonesia akan memanen manfaat dari teknologi dengan biaya yang lebih rendah dan juga dapat mempersiapkan untuk penyebaran upgrade 5G di masa mendatang. Tetapi, perluasan-perluasan tersebut hanya akan diminta jika konsumen dapat membelinya atau melihat manfaat dari upgrade perangkat mereka minimal dari 4G — ketika ada suplai, operator seluler harus mendorong permintaan dan regulator di Indonesia harus membantu penggantian ke 4G secara lebih mudah bagi konsumen.

Kami akan memonitor pengalaman seluler di Indonesia secara lebih dekat dan membuat Anda tetap up-to-date mengenai peristiwa-peristiwa penting. Untuk mengetahui lebih lanjut mengenai Speedtest Intelligence dan Cell Analytics, silakan hubungi kami. Jika Anda ingin melihat perbandingan kinerja seluler Anda, coba Speedtest®.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.