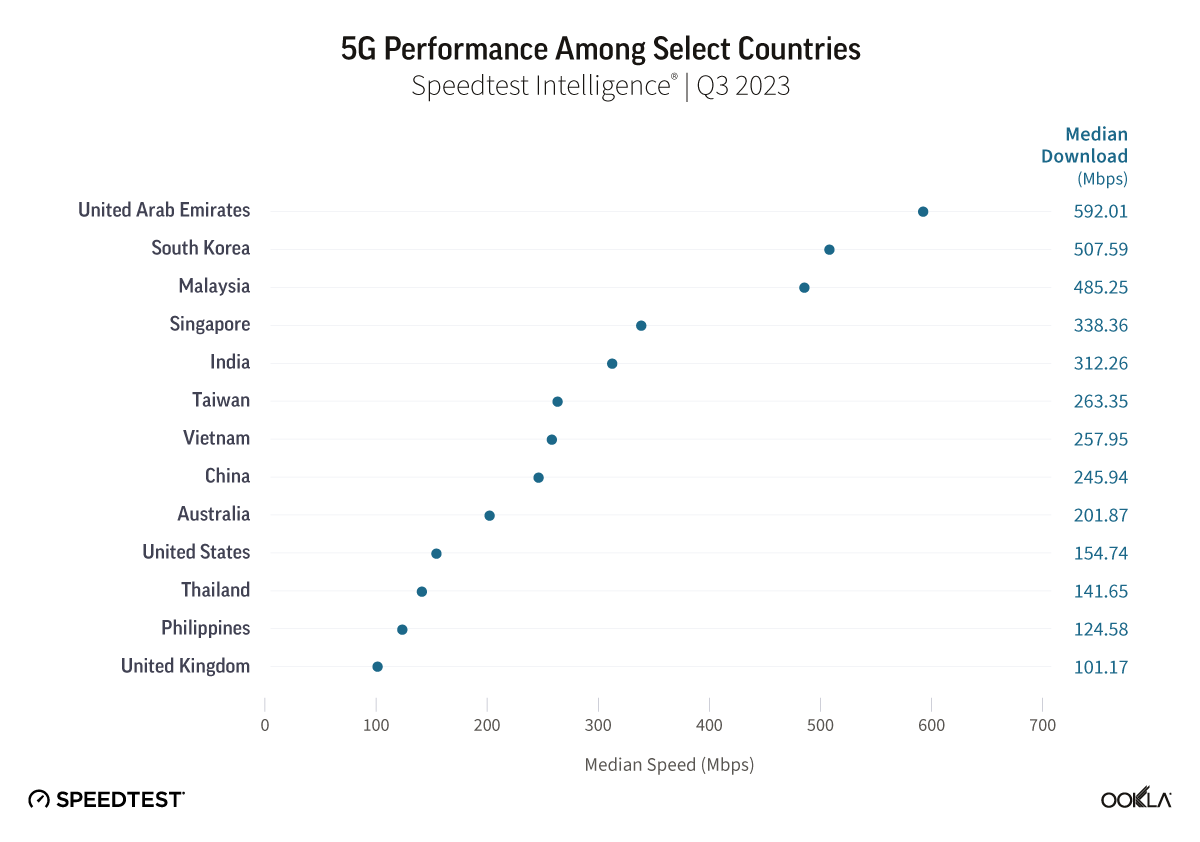

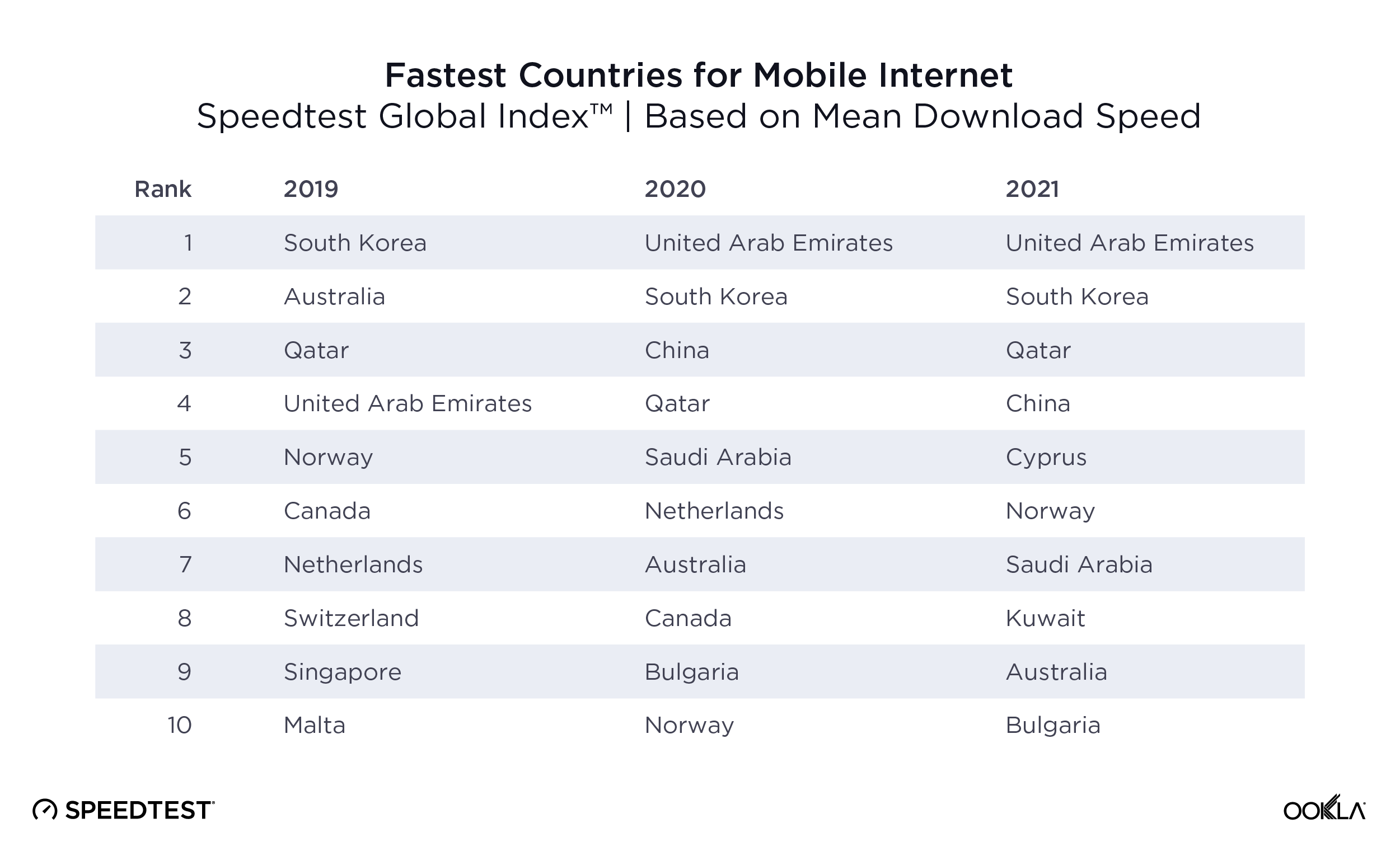

Roaming is a significant revenue stream for operators. As international travel returns to pre-COVID-19 levels and 5G sees wider adoption, we expect more revenue growth opportunities and heightened consumer expectations for network quality when they travel abroad. This article uses Ookla’s Speedtest Intelligence® data to assess the 5G experience of outbound roamers from select Gulf countries (Kuwait, Qatar, Saudi Arabia, and the U.A.E.) during Q1-Q3 2023 and compare their experience across different destinations and to their home network.

Key messages:

- Travelers from Qatar and the U.A.E. had the best 5G roaming performance within the Gulf region. According to Ookla’s Speedtest Intelligence data, roamers from Qatar enjoyed the fastest median download speed in Saudi Arabia at 362.93 Mbps. Those from the U.A.E. experienced a download speed of 225.46 Mbps in Qatar. Roamers from both countries also observed the lowest multi-server latency in the region at 76 ms and 75 ms, respectively.

- Qatar is the fastest destination for 5G roamers from within the region. Visitors from Kuwait, Saudi Arabia, and the U.A.E. enjoyed a median download speed of at least 195.55 Mbps when roaming in Qatar. Outside the Gulf, Switzerland emerged as one of the fastest destinations for U.A.E. travelers, while the U.K. topped the list for Qatari travelers. Saudis traveling to Thailand enjoyed high download and upload speeds at 158.69 Mbps and 21.03 Mbps, respectively.

- Roamers from Kuwait and the U.A.E. experienced a significant drop in 5G network performance when roaming. Travelers from these two countries perceived a notable decrease in download and upload speeds compared to their home networks. Kuwaiti travelers were also more likely to experience a degradation in streaming and online gaming experience abroad because roaming latency is at least four times higher than in their home network.

5G is a key driver for roaming revenue growth and customer retention for Gulf operators

Operators aim to leverage 5G technology to offset revenue lost due to COVID-19. As international travel rebounds and 5G adoption rises, roaming is projected to become an increasingly significant source of revenue. Juniper Research predicts that the global retail roaming market will nearly double from its 2022 level to $19 billion by 2027.

Gulf operators are well-positioned to benefit from the recovery of the travel industry given the region’s large expatriate population, its status as the Middle East’s business hub, and the increased economic activity spurred by high crude oil prices. These factors are contributing to revitalizing travel to and from the Gulf region.

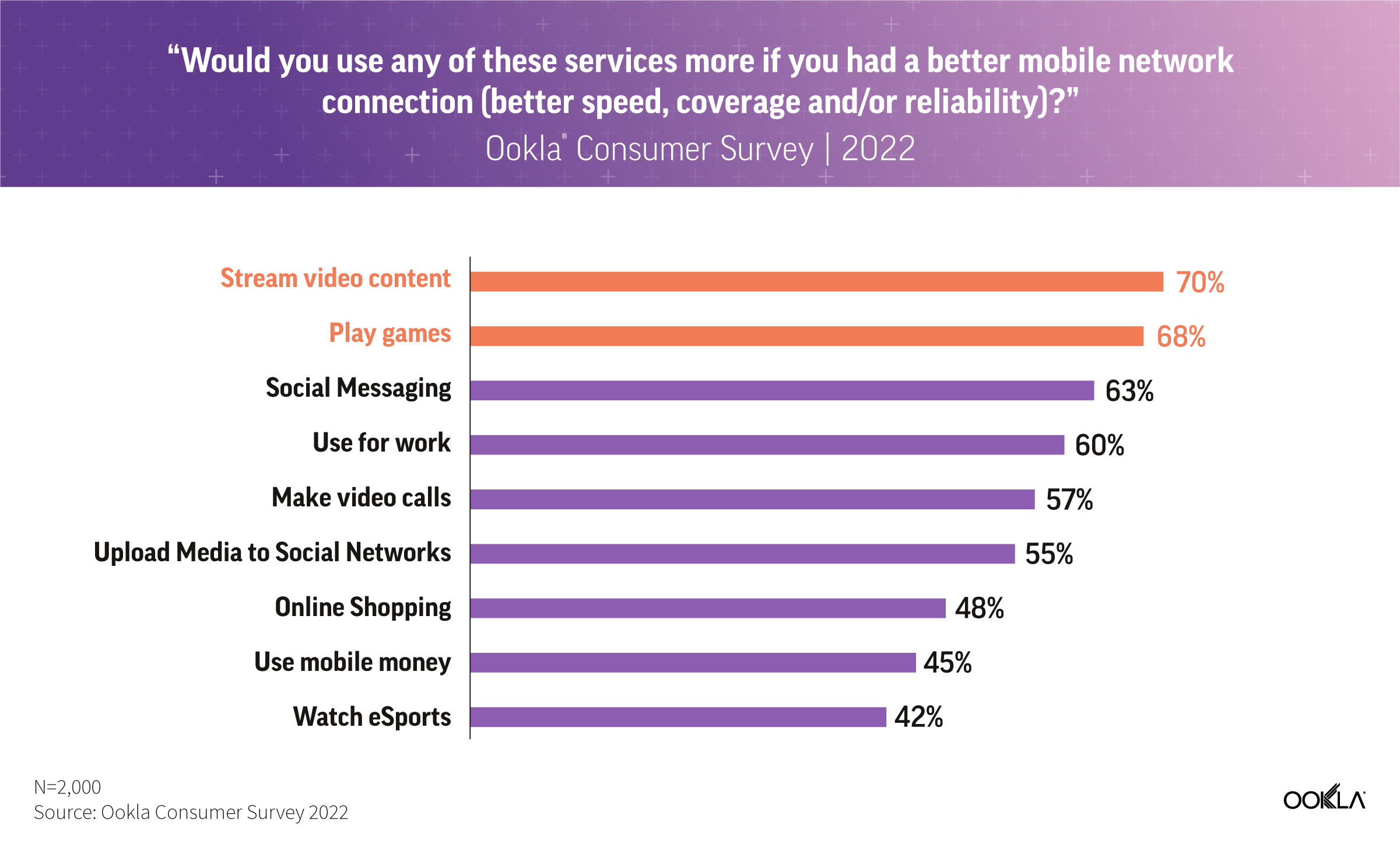

5G adoption is poised to boost roaming revenue, thanks to increased data consumption and the emergence of new use cases like mobile cloud gaming. Therefore, operators should ensure that their premium 5G customers receive a consistent roaming experience comparable to their home network. This strategy can improve customer satisfaction and retention and present opportunities to upsell larger data roaming packages.

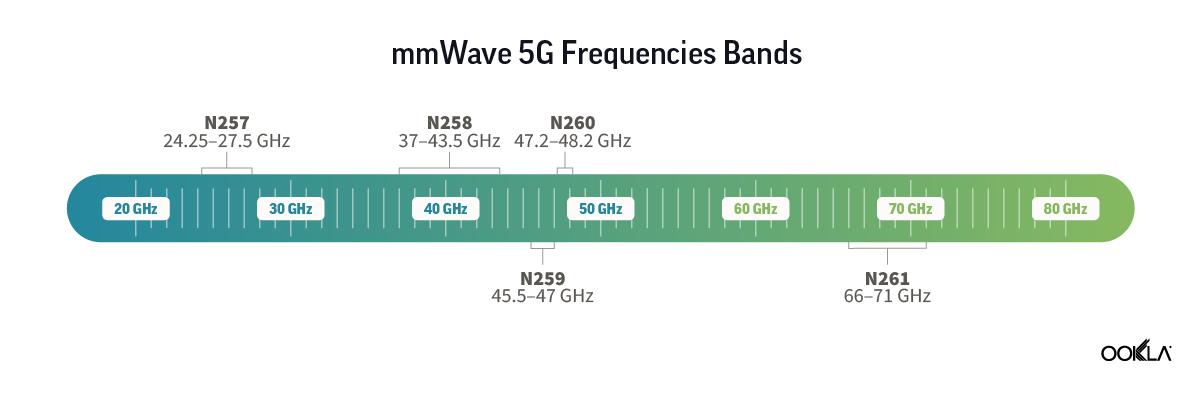

However, 5G roaming is still in its nascent stages. Current 5G roaming agreements require minimal system upgrades and changes to existing 4G agreements because most 5G networks deployed are ‘non-standalone’ (NSA), where 5G traffic is routed as 4G traffic in the core network.

Operators should start assessing the quality and consistency of 5G NSA roaming services in preparation for the gradual introduction of 5G standalone (SA) roaming agreements. The migration to a 5G SA architecture requires radio access and core network upgrades. This shift means new roaming agreements and thorough testing and validation to ensure optimal network performance.

Gulf operators are early adopters of 5G SA and 5G SA roaming. According to the Global mobile Suppliers Association (GSA), five operators in the Gulf Cooperation Council (GCC) region were evaluating 5G SA, six either deployed or launched the service, and three were in the planning phase. stc Kuwait and Belgian operator Proximus announced one of the earliest 5G SA roaming connections in the GCC in November 2022. stc Kuwait and AIS Thailand set up a new 5G SA roaming connection the following year.Kaleido Intelligence reports that 88% of surveyed mobile network operators worldwide plan to launch 5G SA roaming by the end of 2025. By 2024, around 98% of operators are expected to have some form of 5G NSA roaming agreement in place.

Users are more likely to use 5G roaming services when traveling within the GCC

We used Ookla’s Speedtest Intelligence® to assess 5G network performance of outbound mobile roamers from Gulf countries to various destinations during the first nine months of 2023. We also benchmarked roaming network performance against home network performance for each country of departure.

We selected destination countries with at least 30 distinct outbound roamers from any individual Gulf country that ran Ookla Speedtests to ensure that it is a representative sample. We also excluded Bahrain and Oman from this analysis due to insufficient data points from destinations outside the Gulf region.

Our findings reveal that Gulf-based travelers were more likely to use 5G roaming services when traveling within the region than outside. It could be due to local operators offering more affordable and generous data allowances within the region, thereby encouraging roaming usage. It could also be that many travelers are migrant workers returning to their home countries and, therefore, are more likely to use a local SIM to avoid roaming charges.

The U.A.E. stands out as the top roaming destination for GCC users, based on Speedtest Intelligence® data, followed by Bahrain, Saudi Arabia, and Qatar. Europe and the U.S.A. were the next main destinations, with the U.K. leading this group, ranked fifth overall. The propensity to roam was less prominent in these countries than within the GCC, likely due to high roaming data fees. Asian countries, such as China, Thailand, and the Philippines, have the smallest representation in our data sample

Top Destinations for Roamers from all Gulf Countries, by Share of Samples

Speedtest Intelligence® | Q1-Q3 2023

Top Destinations for Roamers from all Gulf Countries, by Share of Samples

The sections below analyze 5G network performance for international roamers from Kuwait, Qatar, Saudi Arabia, and the U.A.E. For each country of origin and destination, we include median 5G download speed, upload speed, and multi-server latency results for roamers during travel, and upon returning to their home 5G network.

Roamers from Qatar and the U.A.E. enjoy the best 5G download speed and latency when traveling

Roamers may experience different levels of network QoS when traveling abroad due to several factors, such as whether host operators enable 5G roaming, the terms of roaming agreements between the home mobile operator and host operators, and the partner’s network capacity allocated to roamers. For example, telecom groups active in the region, such as e&, Ooredoo, stc, and Zain, can leverage their presence in different markets to provide superior network performance to visitors and offer lower data fees than if they were partnering with a third-party host.

Data from Ookla Speedtest Intelligence reveals that customers from Qatar and the U.A.E. experienced the fastest median 5G download speeds when roaming (362.93 Mbps and 225.46 Mbps, respectively) and the lowest latency (76 ms and 75 ms, respectively) among the countries analyzed during Q1-Q3 2023.

5G Network Performance for Roamers from Qatar

Speedtest Intelligence® | Q1-Q3 2023

5G Network Performance for Roamers from Qatar

Latency increased significantly in other locations for visitors from Qatar, ranging from 255 ms in the U.A.E. to 310 ms in Bahrain. For U.A.E. travelers, the second-best latency was in Saudi Arabia at 236 ms, way higher than in Oman where it was 75 ms.

5G Network Performance for Roamers from the U.A.E.

Speedtest Intelligence® | Q1-Q3 2023

5G Network Performance for Roamers from the U.A.E.

Mobile users from Qatar traveling outside the GCC witnessed a significant decrease in network performance. For example, median download and upload speeds dropped to 31.59 Mbps and 4.55 Mbps in the U.K. Switzerland emerged as one of the fastest destinations for download speed outside the GCC for U.A.E. travelers at 132.34 Mbps and an upload speed of 15.66 Mbps. Outbound roamers from the U.A.E. experienced more drastic deterioration in 5G upload speeds outside the GCC region than those from Qatar, reaching a maximum of 4.67 Mbps recorded in the U.S.A.

Qatar also delivered impressive download speeds, exceeding 195 Mbps, to tourists from Kuwait, Saudi Arabia, and the U.A.E. Furthermore, it provided an upload speed of more than 15.66 Mbps for visitors from Kuwait and Saudi Arabia. By contrast, U.A.E. operators provided a download speed of 176.37 Mbps to Kuwaiti travelers but only 108.78 Mbps for Saudi roamers.

Travelers from Saudi Arabia get the highest 5G download speeds when roaming in Qatar and Thailand

Outbound roamers from Saudi Arabia get high 5G download and upload speeds in Qatar, at 199.15 Mbps and 25.93 Mbps, respectively. Thailand also offers a high 5G median download and upload speeds of 158.69 Mbps and 21.03 Mbps, respectively, outperforming other GCC and European countries.

5G latency experienced by Saudi roamers varied greatly depending on the destination. When visiting Bahrain, Kuwait, and Qatar, the median latency was very low, ranging from 87 ms to 109 ms. This response time is suitable for activities like streaming and online gaming. However, latency more than doubled when Saudi travelers visited European destinations and the U.A.E.

5G Network Performance for Roamers from Saudi Arabia

Speedtest Intelligence® | Q1-Q3 2023

5G Network Performance for Roamers from Saudi Arabia

As for the internet speeds experienced by roamers from other countries in Saudi Arabia, Qatari travelers get the best download speed at 362.93 Mbps. Travelers from the U.A.E. also experienced good download speeds at 212.72 Mbps, while those from Kuwait achieved a more modest median download speed of 83.53 Mbps. Notably, Saudi Arabia offers lower latency for roamers from Qatar and Kuwait than any other country, at 76 ms and 132 ms, respectively.

Outbound roamers from Kuwait experience worse 5G performance than their peers from Qatar, Saudi Arabia, and the U.A.E.

Kuwaiti tourists experienced less impressive 5G performance than their peers in the region. Kuwaiti roamers in Qatar achieved download and upload speeds of 195.55 Mbps and 16.87 Mbps, respectively. The U.A.E. followed closely in second place for roaming download and upload speeds for visitors from Kuwait.

Saudi Arabia would be the preferred destination for Kuwaiti users seeking lower latency at 132 ms, roughly half of other Gulf and European destinations. In this analysis, Kuwait appears as a roaming destination for inbound travelers from Saudi Arabia only due to the small number of Kuwaiti samples in other GCC destinations.

5G Network Performance for Roamers from Kuwait

Speedtest Intelligence® | Q1-Q3 2023

5G Network Performance for Roamers from Kuwait

Roamers from Kuwait and the U.A.E. saw a significant performance decline compared to their home networks

Mobile network operators strive to offer excellent network performance to their customers when they travel abroad to enhance customer satisfaction and retention. This is especially true for high-value customers, as operators aim to provide at least a comparable experience to what they get on their home network.

Data from Speedtest Intelligence confirms that GCC residents traveling abroad experience better download/upload speeds and latency on their home networks than when they roam. However, it’s more insightful to analyze and contrast the performance gap in each country to reveal where customers are likely to be dissatisfied with their network experience when traveling. The charts below show the median download/upload speeds and latency experienced by users on their home networks and how they compare to the best-performing roaming destinations for each metric.

5G Network Performance While Roaming Compared to Home Network, Select GCC Countries

Speedtest Intelligence® | Q1-Q3 2023

5G Network Performance While Roaming Compared to Home Network, Select GCC Countries

Visitors from Kuwait and the U.A.E. experienced a notable decrease in download speeds when roaming compared to their home network. The ratio of home-to-best-roaming-destination download speed was 2.3x. in the U.A.E. and 1.9x in Kuwait.

Qatari travelers to Saudi Arabia witnessed minor changes in network performance. In fact, they enjoyed the highest download speed in the group, both at home and when roaming, at 550.61 Mbps and 362.93 Mbps, respectively.

The median upload speed differences follow largely the same trend. Users in the U.A.E. encountered more than a 50% drop in upload speed when roaming outside the country. The home-to-best-roaming-destination upload speed ratio was 1.6x in Kuwait and 1.4x in Qatar.

Saudi Arabian travelers in Qatar were more likely to notice a drop in download speeds as the home network’s download speed was 340.64 Mbps compared to 199.15 Mbps when roaming in Qatar. On the other hand, upload speeds remained more consistent between the home network and roaming in Qatar at around 26 Mbps.

Latency is generally more impacted by roaming because signaling needs to be routed back to the user’s home network. That is why we see larger latency differences between home and the best roaming networks. For example, the best-roaming-destination-to-home ratio was high for Kuwaiti roaming in Saudi Arabia (3.8x), resulting in a minimum latency of 132 ms, higher than in the other countries. That means that Kuwaitis were more likely to experience more degradation in their streaming and online gaming experience when traveling.

The response time of roamers from Qatar and the U.A.E., at best, more than doubled compared to 76 ms and 75 ms in their home network, respectively. The gap widens if we consider other destinations where roaming latency jumps to a minimum of 255 ms for Qataris and 235 ms for U.A.E. travelers. In other words, most roamers from Qatar and the U.A.E. will experience subpar performance of lag-sensitive services such as video streaming in many destinations.

The exception is Saudi Arabia, where travelers could enjoy similar response times (87 ms in Bahrain compared to 78 ms in the home network). Latency remained acceptable when traveling to Qatar and Kuwait (below 110 ms), but then it increased to beyond 233 ms for the U.A.E. and other European destinations.

Ookla provides unique insights into 5G roaming performance

This analysis shows that travelers from the Gulf generally enjoy better network performance when they travel within the region than outside. Two notable exceptions are Switzerland for the U.A.E. roamers and Thailand for Saudi travelers.

This difference in performance may be due to non-GCC countries having lower 5G coverage and local operators having unfavorable roaming agreements with host networks and potential speed throttling.

Roaming performance is also not reciprocal within the Gulf region. For example, travelers to Qatar enjoy much faster download and upload speeds than Qatari visitors roaming on their neighboring countries’ networks.

Ookla can provide visibility on outbound roamers’ experience and carry out country-level and operator-level benchmarks. It can also help identify potential network issues to improve roaming agreements with current partners. Finally, it enables operators to compare users’ experience between home and roaming networks.