The Maha Kumbh Mela, which took place in Prayagraj between January 12 and February 26, 2025, was one of the biggest religious gatherings in history. This event also served as a large-scale stress test for India’s 5G networks, which launched commercially in October 2022. With millions relying on mobile connectivity in a high-density environment, telecom operators faced the challenge of ensuring uninterrupted service amid surging network traffic.

Key Takeaways

- 5G maintained a significant performance advantage over 4G during Maha Kumbh 2025, despite periods of congestion. While 5G download speeds dropped from 259.67 Mbps in early January to 151.09 Mbps at peak congestion on January 26, it later recovered to 206.82 Mbps by the end of the event. In contrast, 4G speeds remained consistently lower, ranging from 13.38 Mbps to 21.68 Mbps, making 5G at least nine times faster even at its lowest point.

- Jio led 5G performance, with a median download speed of 201.87 Mbps, followed by Airtel at 165.23 Mbps. Meanwhile, 4G networks struggled under heavy user density, with Vi India recording 4G median download speed at just 20.06 Mbps, followed by Jio (18.19 Mbps), Airtel (17.65 Mbps), and BSNL (11.64 Mbps).

- Jio reported 83.9% 5G availability, nearly twice that of Airtel’s 42.4%, ensuring broader coverage and more consistent connectivity for users. Jio’s aggressive 5G rollout leveraged the 700 MHz low-band spectrum, enabling wider signal coverage across the densely packed mela ground.

- 5G significantly improved response times, reducing delays in browsing and video playback even under heavy network congestion. Jio and Airtel reported 5G page load times of 1.99 seconds, compared to longer 4G load times, with Jio at 2.40 seconds, Airtel at 2.36 seconds, Vi India at 2.44 seconds, and BSNL at 2.70 seconds. A similar trend was seen in video streaming, where Jio and Airtel reported 5G video start times of 1.79 seconds. While 4G remained functional, its higher latency and slower response times made it less effective for web browsing and video streaming at such a large-scale event.

A Massive Gathering with High Connectivity Demand

The Kumbh Mela, held every 12 years at rotating locations in India, is one of the largest religious gatherings in the world. The 2025 Maha Kumbh Mela, a special occasion occurring once every 144 years, took place in Prayagraj, Uttar Pradesh, from January 13 to February 26. The event attracted over 660 million devotees by the concluding day, creating an unprecedented demand for mobile connectivity as attendees relied on their devices for communication, navigation, and digital transactions.

The sheer scale of the event presents unique challenges for telecom providers, as mobile networks will need to support massive spikes in voice and data traffic. The increasing penetration of smartphones, coupled with the rising demand for high-speed internet, has made telecom infrastructure a key enabler of the modern Kumbh experience. To address these demands, telecom operators deployed temporary network infrastructure, and enhanced radio and backhaul capacity.

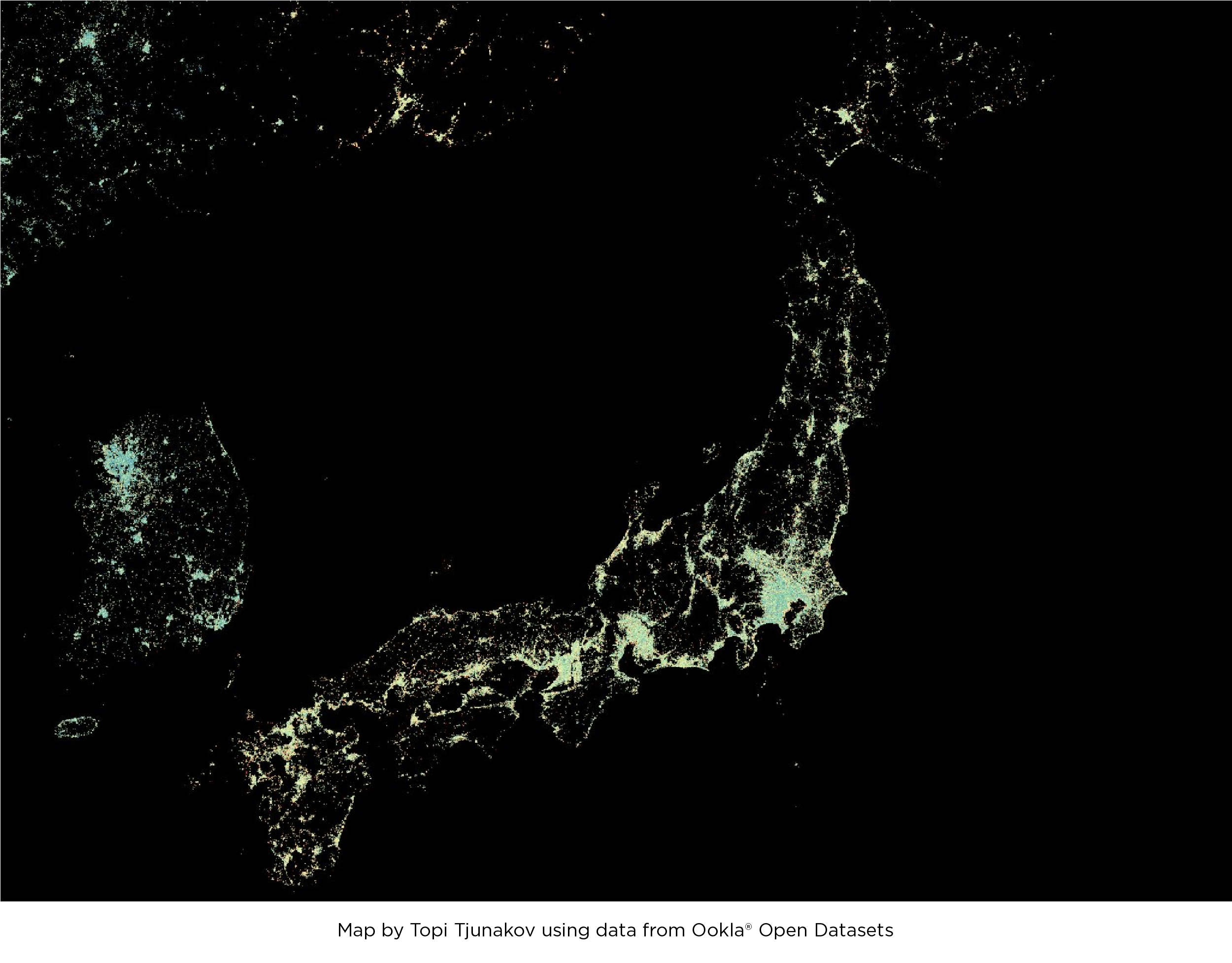

The Speedtest® sample density shows a gradual increase in activity around the Triveni Sangam, the confluence point of the three holy rivers, as the Maha Kumbh 2025 progresses. Sample density remains low in early January but rises significantly from January 20 onward, peaking between January 27 and February 17 during key bathing dates. Elevated sample density persists until the last week of the festival.

The Department of Telecommunications (DoT), have instructed telecom operators to implement extensive infrastructure enhancements. In Prayagraj city, 328 new towers have been installed. Additionally, 575 new Base Transceiver Stations (BTS) have been deployed, and 1,462 existing BTS units have been upgraded, as well as tens of Cells on Wheels deployed to bolster network capacity.

To further enhance connectivity and crowd management, Maha Kumbh 2025 integrated advanced technological innovations, including AI-powered surveillance cameras for real-time crowd monitoring and RFID wristbands to track missing individuals. A dedicated mobile app provided real-time location tracking, emergency alerts, and navigation assistance for pilgrims. Additionally, disaster management centers were equipped with satellite communication systems and emergency response kiosks to ensure uninterrupted communication in case of network failures. These combined efforts played a crucial role in managing the massive crowds while maintaining network efficiency and ensuring public safety.

5G performance stands up to demand surge

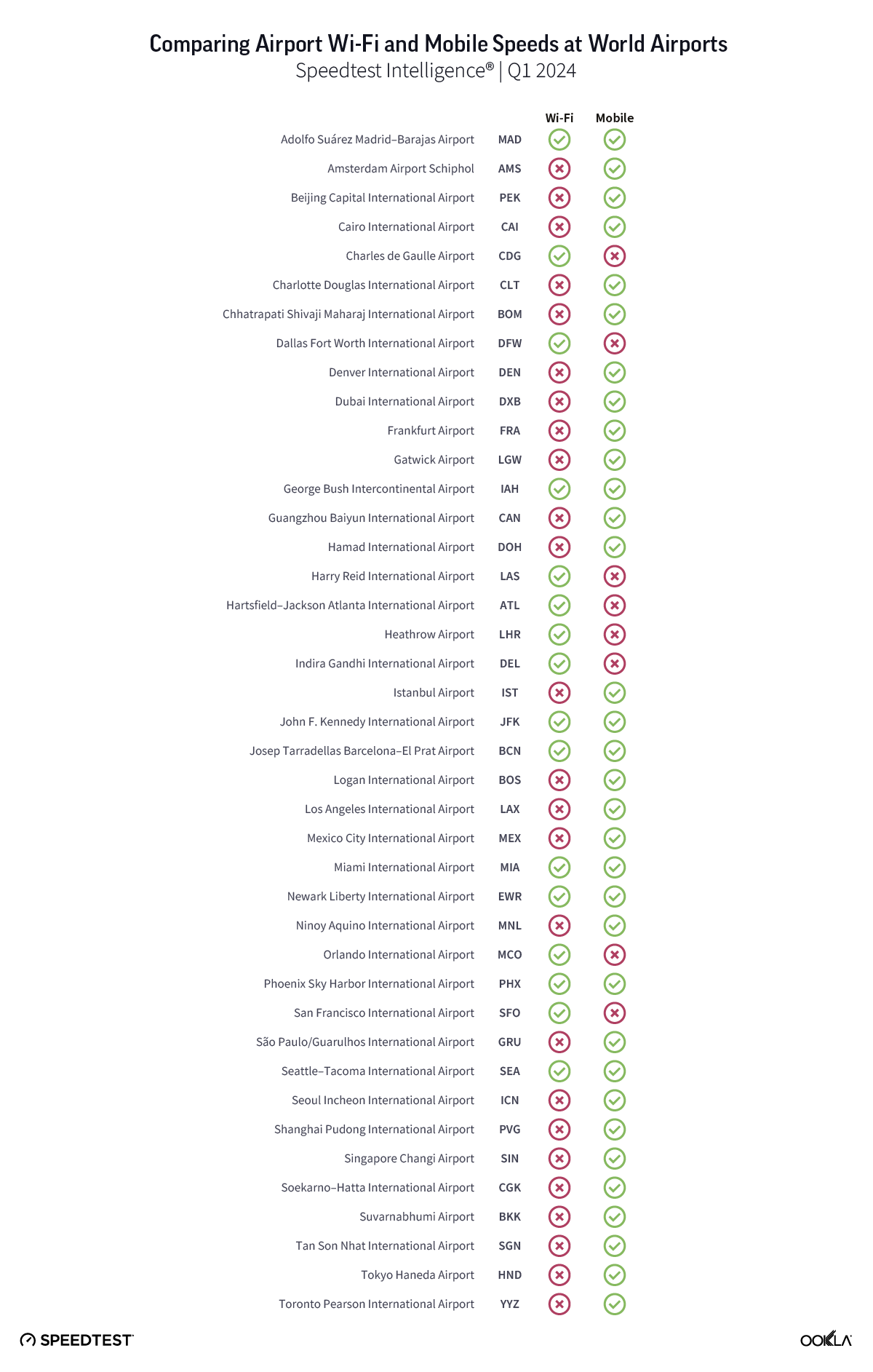

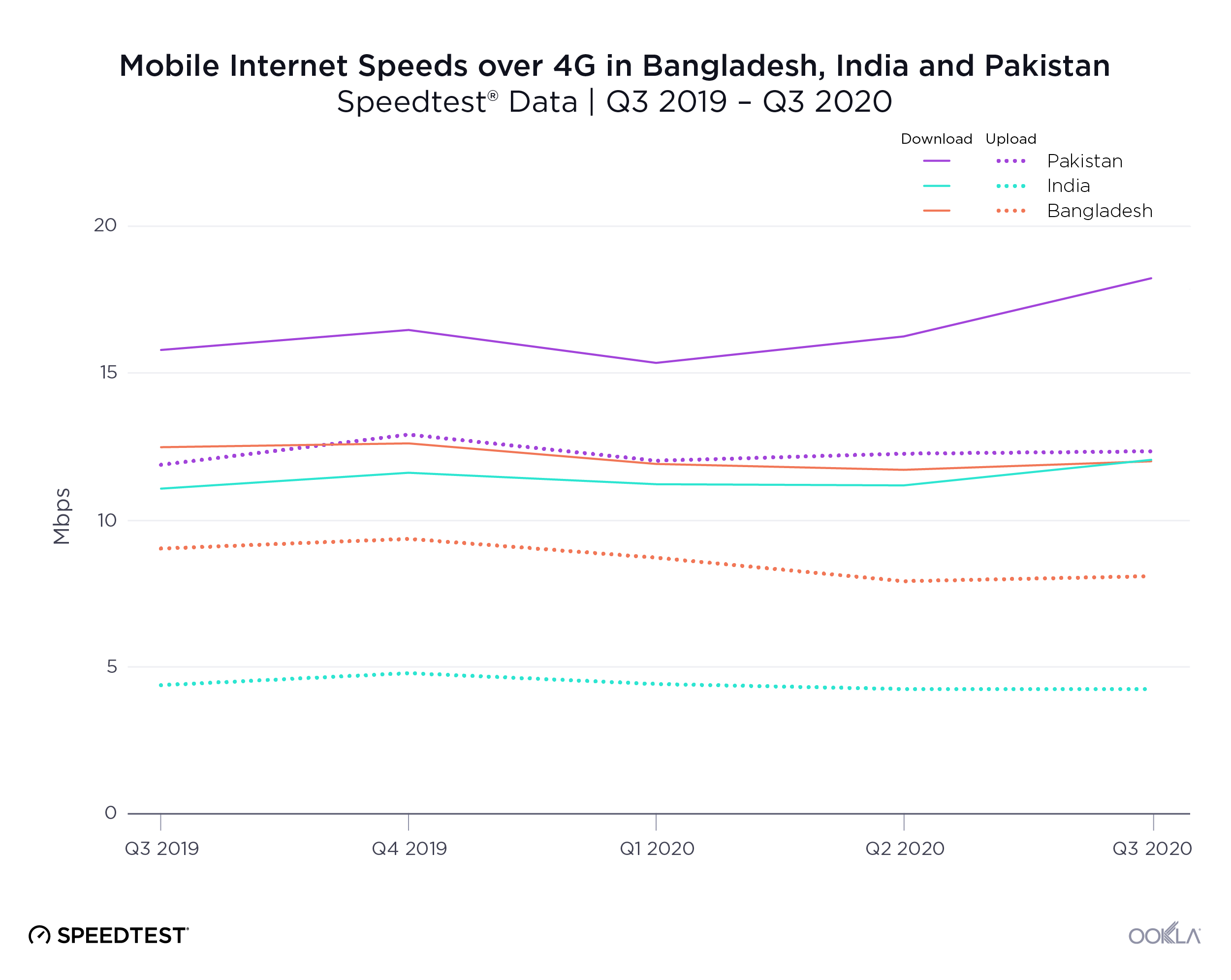

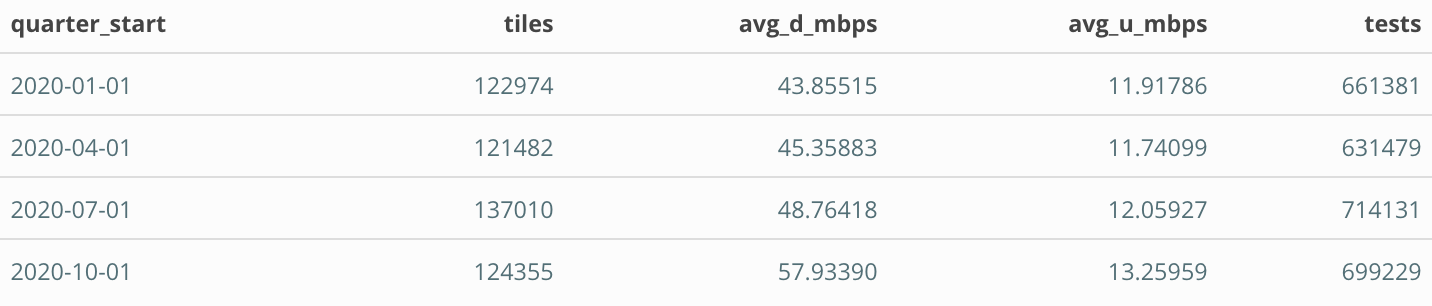

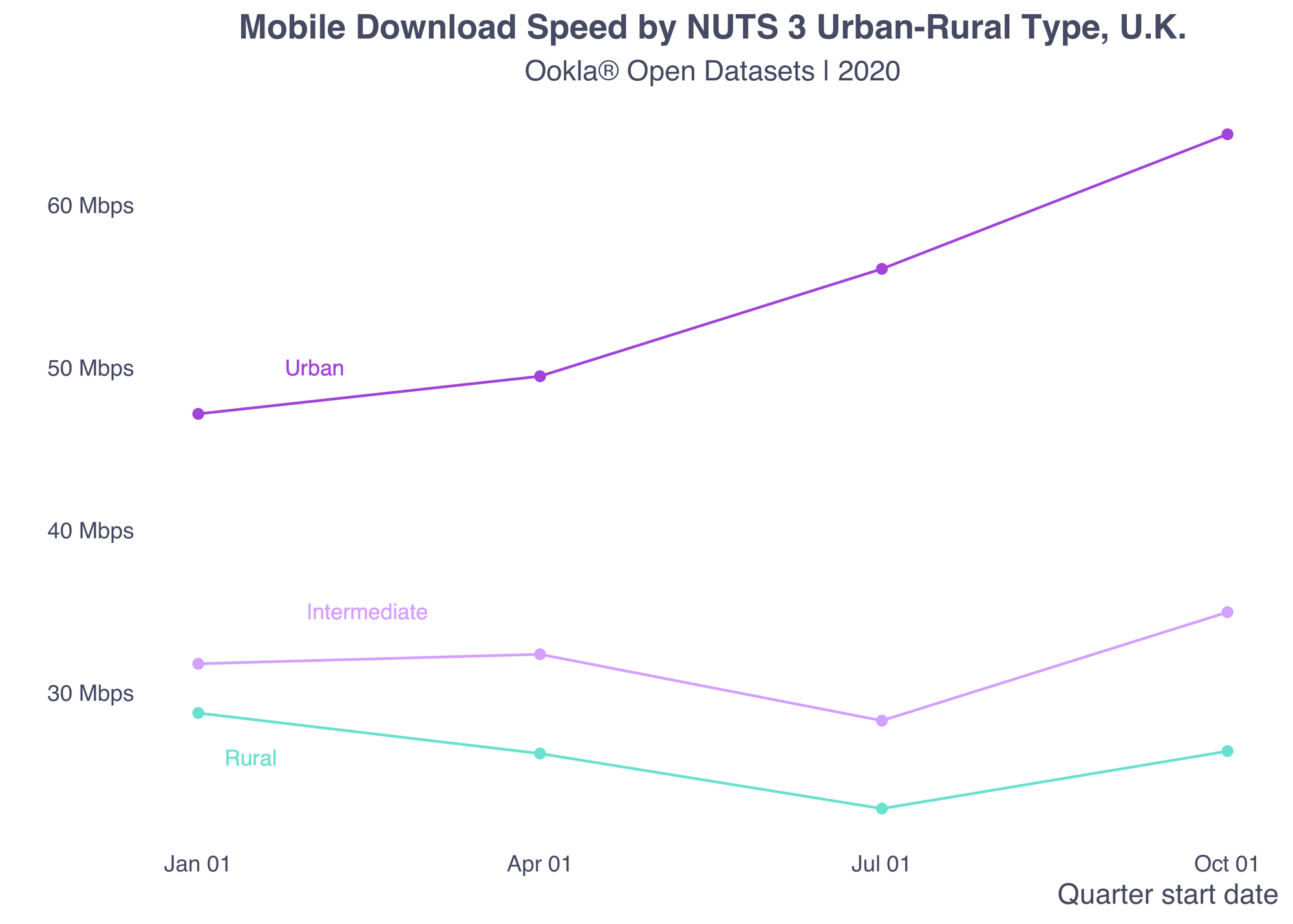

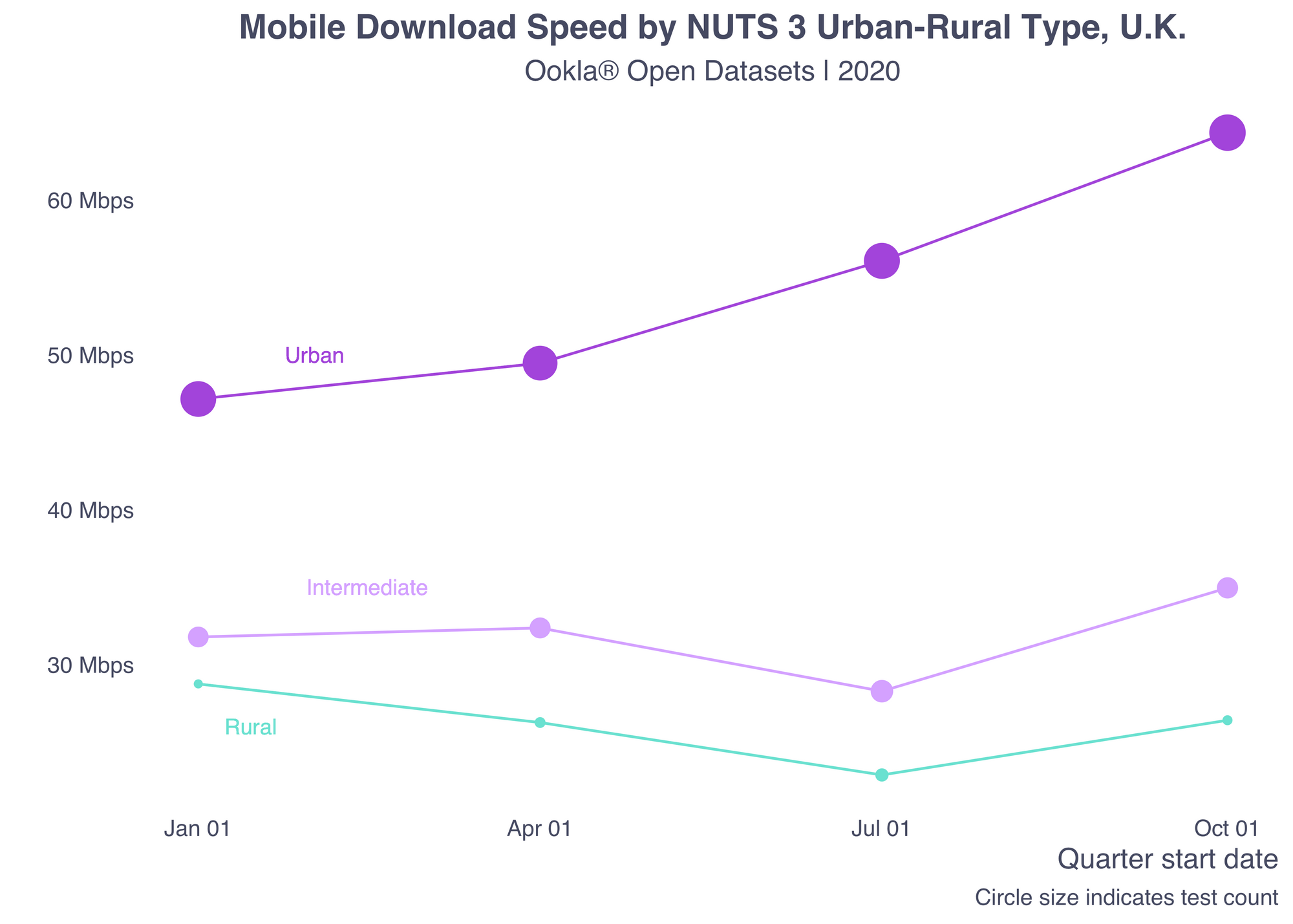

Speedtest Intelligence® data reveals variations in the weekly median download and upload speeds for 5G and 4G networks in Prayagraj, starting from the first week of January 2025 before the festival began until the end of the Maha Kumbh event. 5G median download speeds started at 259.67 Mbps in early January but declined by over 40% to 151.09 Mbps on January 26, coinciding with peak pilgrimage days and increased network congestion. 5G speeds recovered to 201.43 Mbps by February 9 and further improved to 206.82 Mbps by February 23, during the final week of the festival. In contrast, 4G speeds remained consistently lower, ranging between 13.38 Mbps (January 19) and 21.68 Mbps (February 23). Even at its lowest, 5G was still 9.5 times faster than 4G, highlighting its ability to handle high traffic demand more effectively.

5G upload speeds followed a similar pattern, starting at 19.71 Mbps, declining to 12.99 Mbps on January 26, and recovering to 17.95 Mbps by the end of February. 4G upload speeds remained below 5 Mbps, peaking at 4.85 Mbps. The three to five times difference in upload speeds allowed 5G users to share information and content faster, which was critical for pilgrims relying on mobile connectivity. While both networks experienced slowdowns, 5G provided more uplift in performance compared to 4G, reinforcing its role in supporting high-density events like Maha Kumbh.

5G and 4G Performance Weekly Trend of All Providers Combined in Prayagraj, India

Speedtest Intelligence® | Week of Dec 30 2024 till Feb 24 2025

5G Sustains High Performance Despite Unprecedented Mobile Traffic

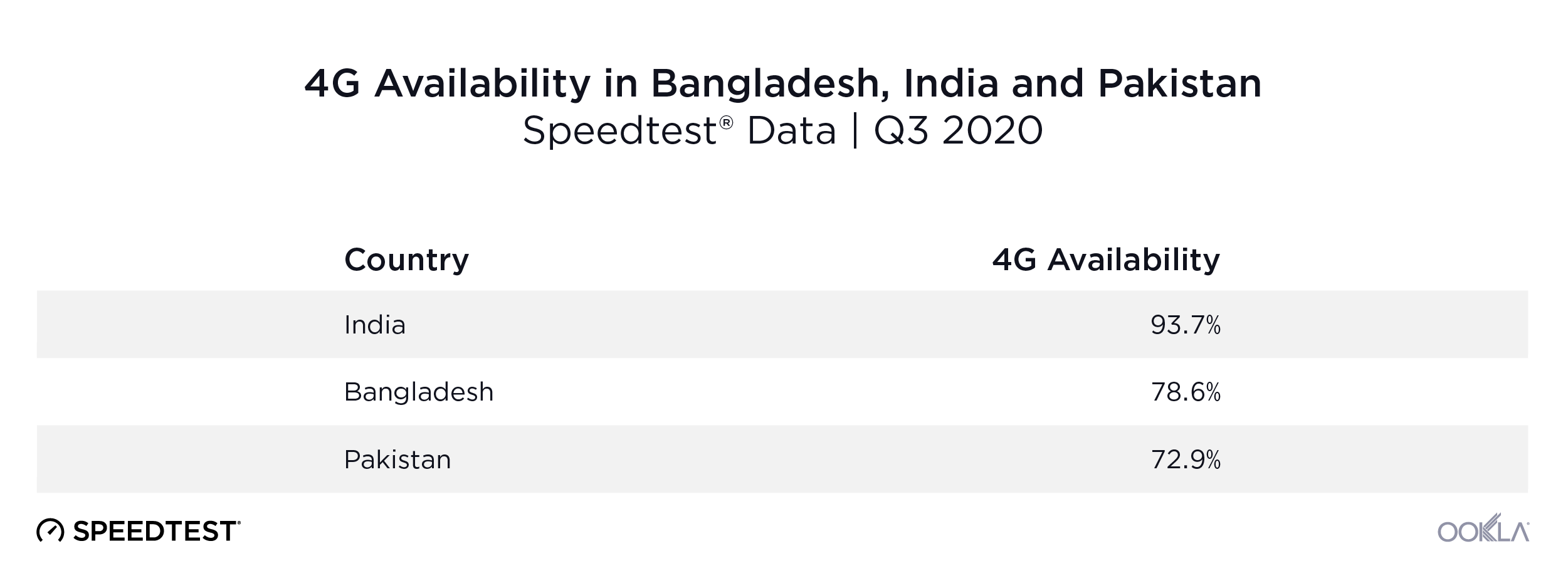

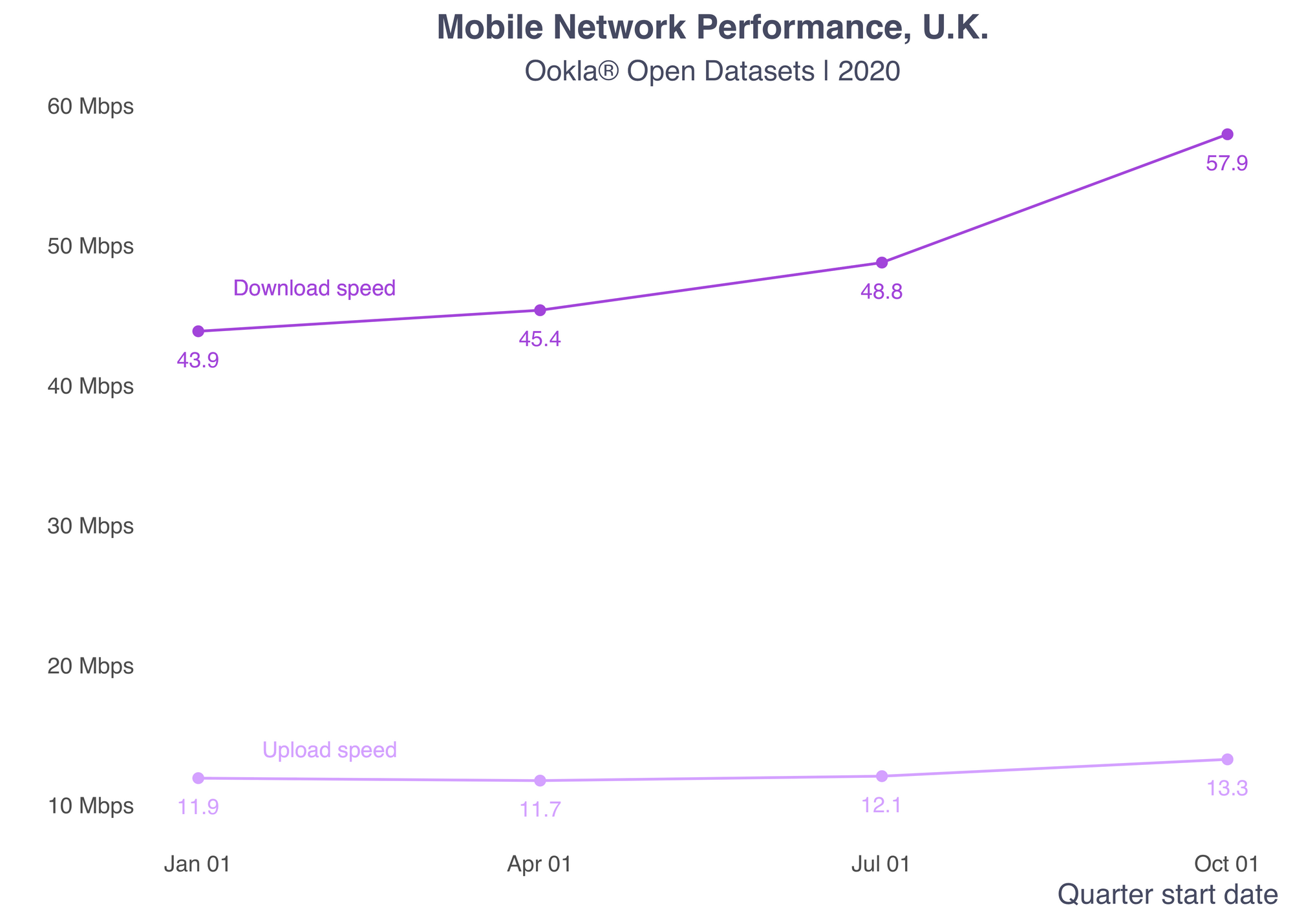

Operators network performance during the event varied based on infrastructure deployment and congestion levels. Reliance Jio delivered the highest 5G median download speeds at 201.87 Mbps, followed by Airtel at 165.23 Mbps. The strong 5G speeds indicate successful deployment of high-capacity networks designed to handle the surge in data demand. Jio’s 5G Standalone (SA) network played a crucial role, efficiently managing 20 million voice calls and 400 million data service requests at peak times.

Airtel has also taken several measures to enhance the connectivity experience for its customers. To support the increased capacity demand, Airtel enhanced its network by deploying 287 new sites, optimizing over 340 existing ones, and laying an additional 74 kilometers of fiber in Prayagraj. These efforts contributed to maintaining strong 5G speeds despite heavy usage.

5G and 4G Performance by Providers in Prayagraj

Speedtest Intelligence® | Jan 13 – Feb 27 2025

While 5G provided high-speed connectivity, 4G speeds were significantly lower across all operators, reflecting network congestion and capacity limitations. Vi India recorded the 4G median download speed at 20.06 Mbps, followed by Jio (18.19 Mbps), Airtel (17.65 Mbps), and BSNL (11.64 Mbps). The slower speeds suggest that 4G networks struggled under high user density, as a large portion of attendees still relied on 4G devices.

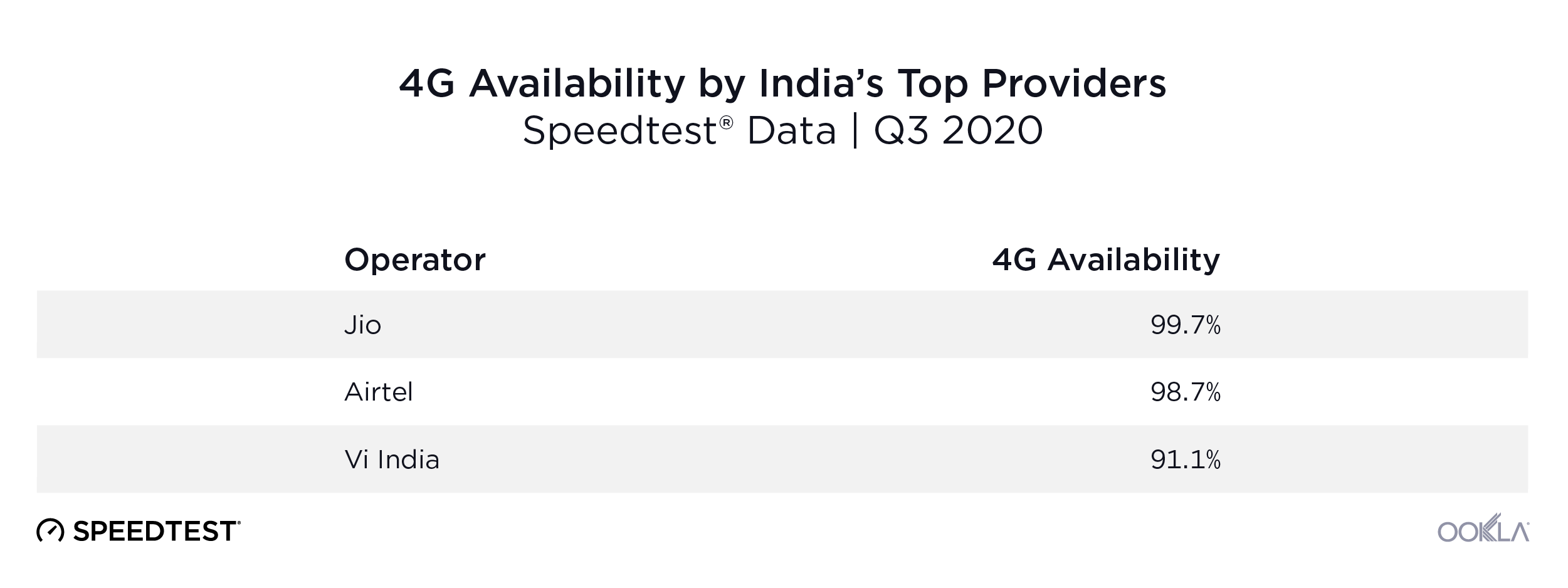

Jio’s 5G Availability Nearly Twice That of Airtel

Ookla’s 5G Availability data from Speedtest Intelligence represents the percentage of 5G-active devices that spend the majority of their time connected to 5G networks. Analysis of the data indicates that Jio achieved 83.9% 5G Availability throughout the Maha Kumbh period. This was significantly higher than Airtel’s 42.4%. This reflects Jio’s aggressive deployment of 5G infrastructure in Prayagraj, supported by its use of the 700 MHz low-band spectrum further enhanced its reach, allowing for stronger signal penetration across the vast mela grounds, where millions were densely packed.

5G Availability by Providers in Prayagraj, India

Speedtest Intelligence® | Jan 13 – Feb 27 2025

In contrast, Airtel’s 5G Non-Standalone (NSA) network, while delivering strong 5G speeds, had lower availability. This is most likely due to its reliance on mid-band spectrum, which has a shorter coverage range compared to low-band frequency deployment.

5G Improves Response Time, Delivering a Better User Experience

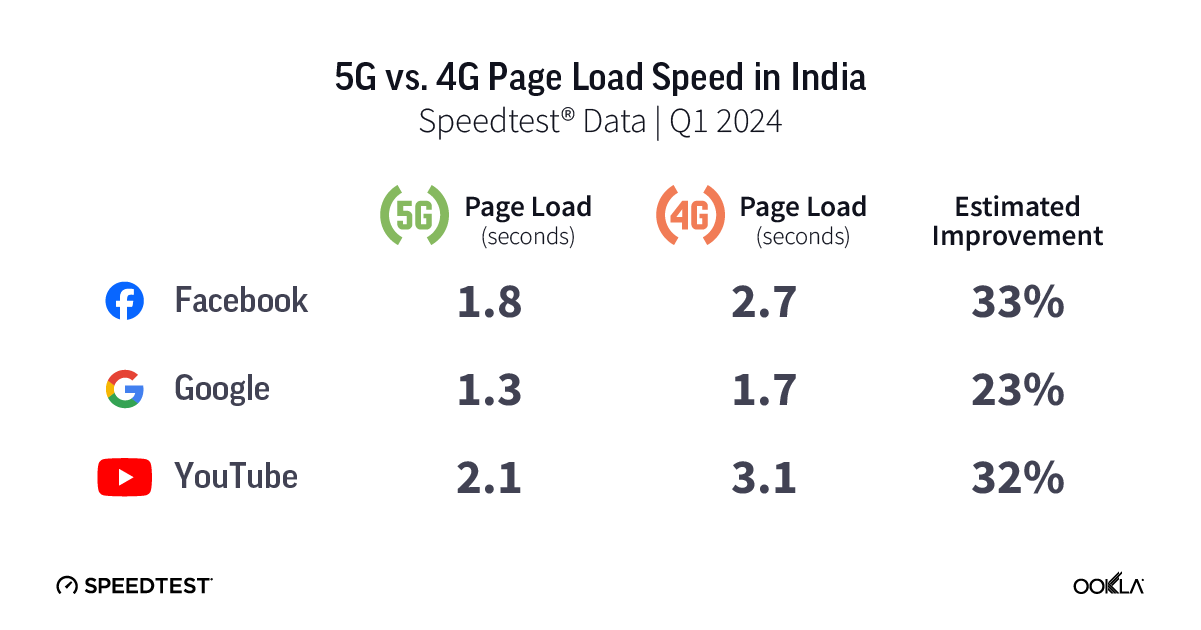

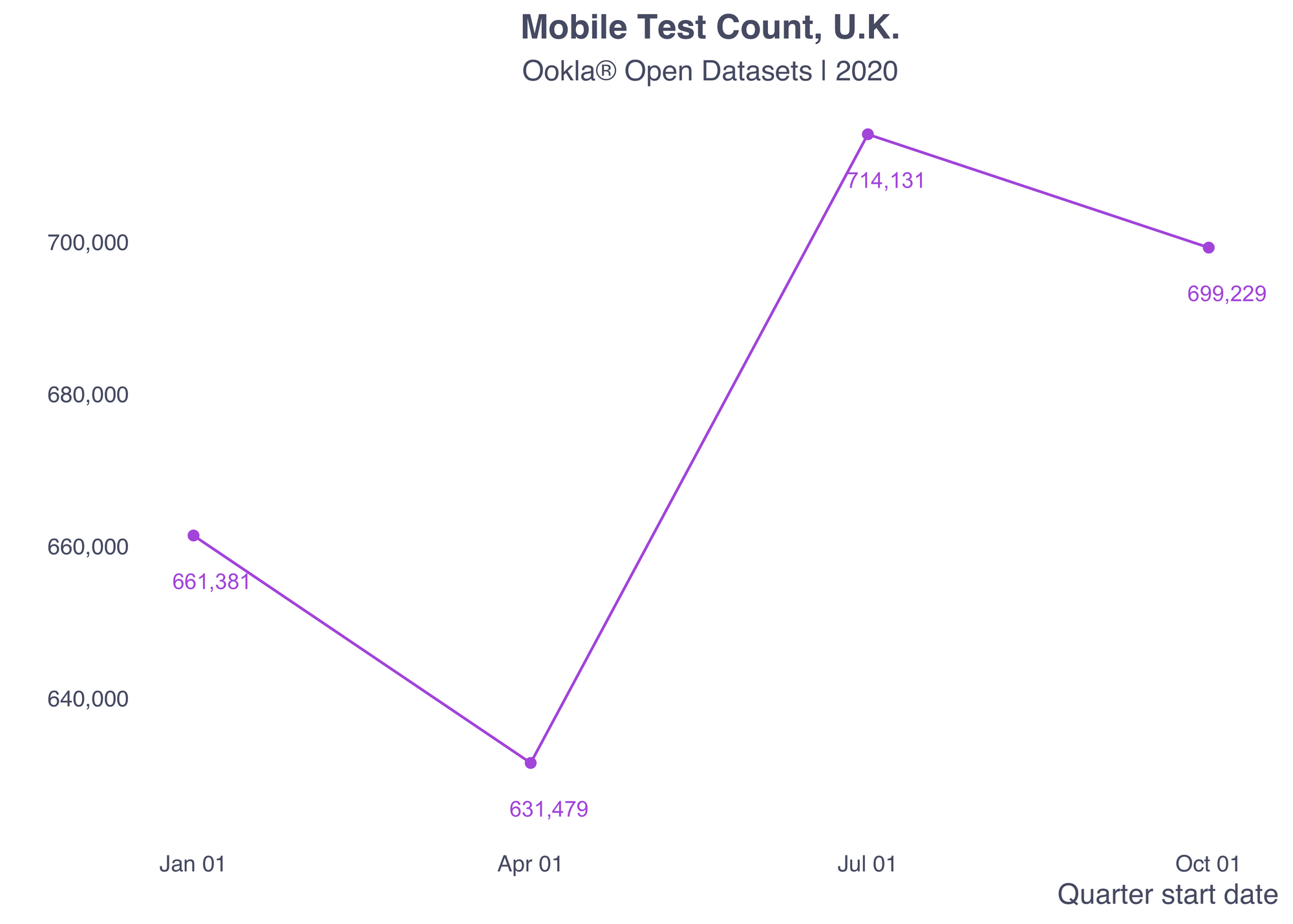

Speedtest Intelligence Quality of Experience data was used to assess web page load times and video start times on 5G and 4G networks during the Maha Kumbh 2025 in Prayagraj. These measurements reflect real-world user experiences, such as accessing social media, browsing websites, and streaming videos. Faster page and video load times contribute to better user experience, reducing frustration and enhancing the overall digital experience in high-traffic environments.

5G and 4G Page Download Time and Video Start Time by Providers in Prayagraj, India

Speedtest Intelligence® | Jan 13 – Feb 27 2025

The data shows that 5G reduced page load times across all operators compared to 4G, demonstrating its performance uplift even in high traffic demand situations. Jio and Airtel recorded similar 5G page load times at 1.99 seconds, while 4G networks experienced longer load times, with Jio at 2.40 seconds, Airtel at 2.36 seconds, Vi India at 2.44 seconds, and BSNL at 2.70 seconds.

The video start time data also reflects a difference in performance between 5G and 4G. Jio and Airtel had similar video start times on 5G at 1.79 seconds, allowing for quicker video playback. The difference between 5G and 4G video start times was 0.75 seconds for Jio, and 0.78 seconds for Airtel, showing that 5G reduced buffering delays and improved streaming efficiency.

These results highlight how 5G networks managed digital demand more effectively than 4G during the Maha Kumbh. While 4G networks remained functional, their higher latency and longer load times made them less efficient for web browsing and video playback in a high-density setting.

Ensuring Robust Network Performance Amidst Massive Gatherings

The Maha Kumbh 2025 in Prayagraj presented one of the most significant challenges for telecom operators, with over 660 million attendees relying on mobile connectivity. Despite the extreme demand, operators successfully maintained strong network performance through strategic infrastructure upgrades and advanced technologies.

The introduction of 5G technology significantly enhanced user experiences at the event. A study by Ericsson revealed that 5G users reported 20% higher satisfaction compared to their 4G counterparts at major events in 2024. This improvement is attributed to 5G’s higher data transfer speeds and lower latency, facilitating smoother and faster streaming of high-quality video content. The deployment of 5G SA, particularly on Jio’s 700 MHz spectrum, contributed to broader coverage and improved network responsiveness, while Airtel’s 5G NSA, operating on mid-band frequencies, provided high speeds in select locations.

The strategies deployed during Maha Kumbh 2025 demonstrate that proactive planning, infrastructure expansion, and the integration of advanced technologies are key to ensuring robust mobile network performance in large-scale public gatherings. Upcoming global gatherings, such as the 2028 Olympics, will require similarly advanced planning and network expansion to accommodate millions of attendees. We’ll continue to benchmark and track network performance during major events, based on Speedtest Intelligence data. For more information, please contact us.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.