Fixed-wireless access (FWA) has emerged as a key 5G use case. Cellular providers in many markets are using FWA to easily enter and compete in fixed broadband markets, while fixed ISPs with access to 5G spectrum are utilizing it as a complementary access technology, allowing them to target locations where fiber access networks are not present. FWA can also be a solution to help bridge the digital divide in more remote locations where it’s uneconomical to lay fiber to connect premises.

The U.S. is at the forefront of fixed wireless access (FWA) development, with many of its major wireless carriers, including T-Mobile, Verizon, AT&T and UScellular targeting expansion. T-Mobile has built up a lead in terms of 5G fixed-wireless market share, with Verizon following closely, and AT&T recently launching a new FWA service – AT&T Internet Air. We examined Ookla Speedtest data to understand how FWA performance is evolving in the U.S., and how it is impacting churn in the market.

Key takeaways

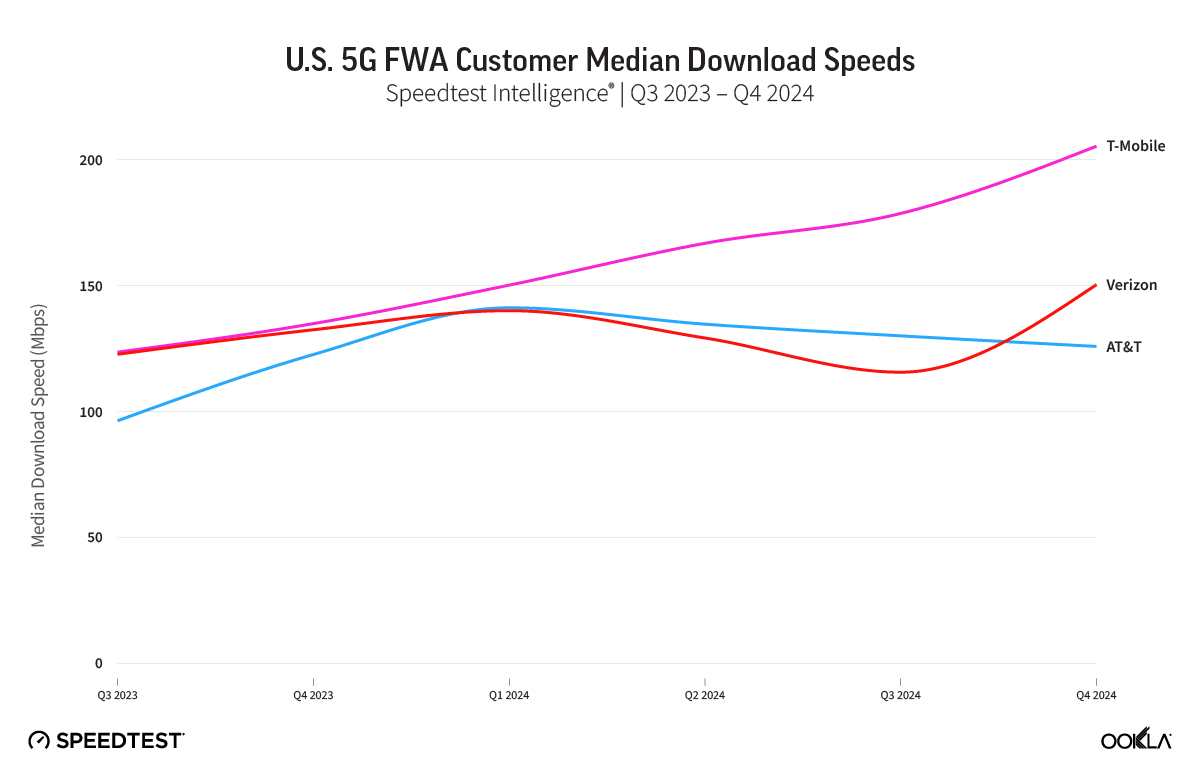

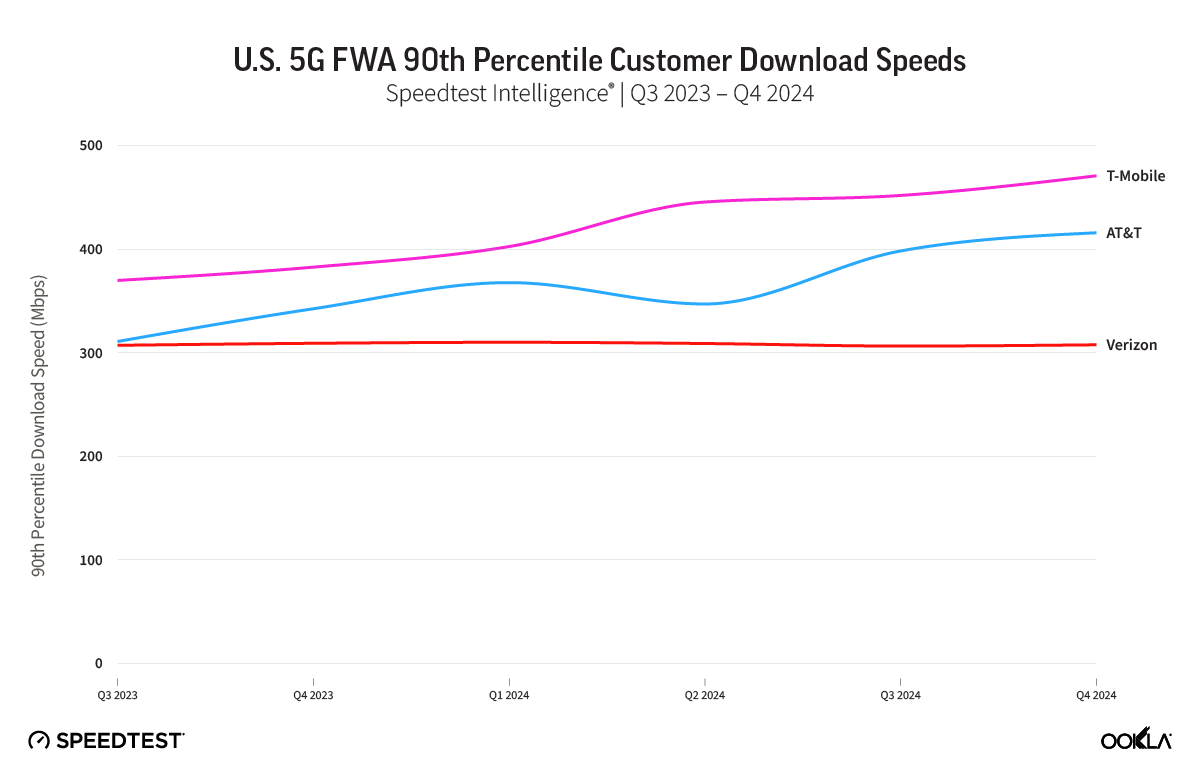

- T-Mobile & Verizon 5G FWA performance holding up well nationally. Despite strong customer growth, both T-Mobile and Verizon have maintained performance levels over the past year according to Speedtest data. Both ISPs recorded similar median download speeds in Q3 2023, although T-Mobile maintains an edge on median upload performance. Despite this, there are significant differences in performance at a State-level, and for urban versus rural locations.

- Cable & DSL providers bear the brunt of user churn. The FWA value proposition is clearly resonating most with existing cable and DSL customers, which make up the vast bulk of churners to both T-Mobile’s and Verizon’s FWA services. It’s not one-way traffic however, with T-Mobile’s larger user base in particular showing some attrition to cable providers. In rural locations where options are more limited, FWA services are increasingly going head to head, with over 10% of users joining Verizon’s FWA service coming from T-Mobile.

- Clear signs that download performance could be a key contributor to churn in the market. Our analysis of the customers of major ISPs in the US that have churned to T-Mobile’s FWA service shows that their median download performance before churning was below the median performance of all customers of these ISPs, indicating a performance short-fall that is likely contributing towards churn.

- Further C-band spectrum will serve to strengthen FWA’s case. The release and deployment of additional C-band spectrum for all three national cellular carriers, and AT&T’s new FWA service will drive further performance gains, and further competitive pressure in 2024.

T-Mobile and Verizon FWA scaling strongly and national performance holding up well

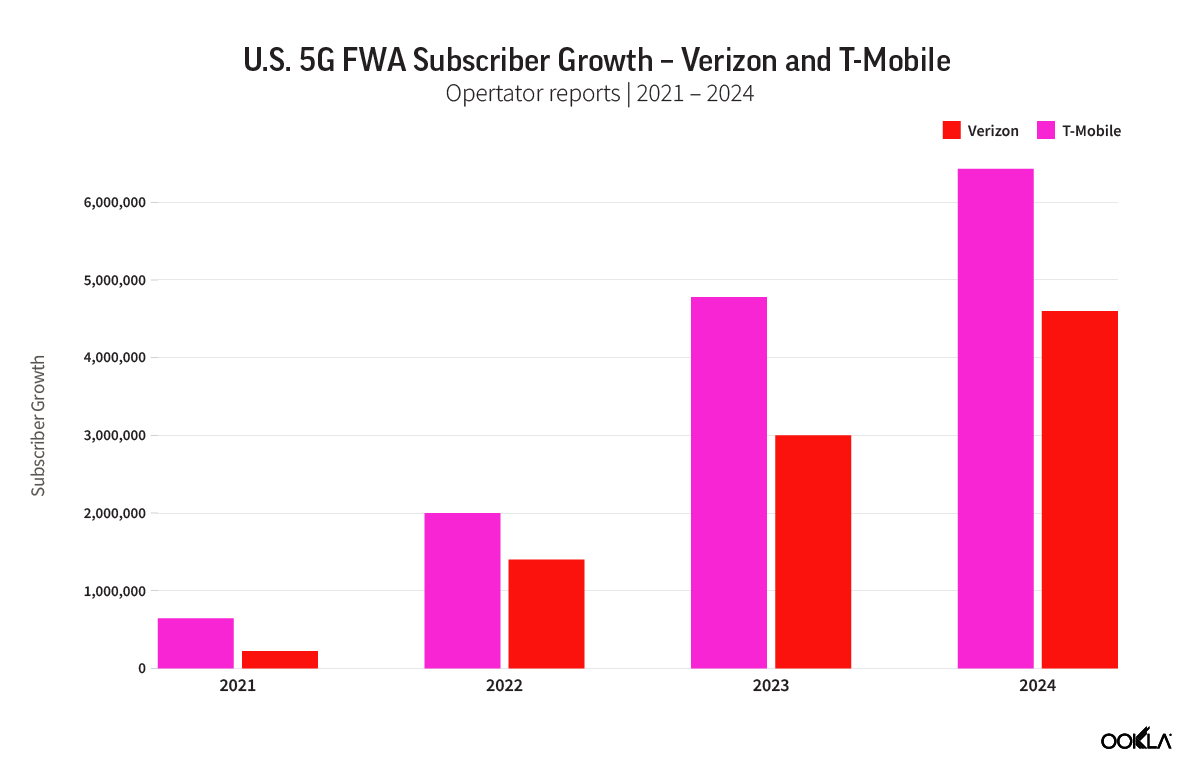

Launched during the COVID-19 pandemic, FWA services from T-Mobile and Verizon have seen strong growth over the past three years. Aided by disruptive pricing strategies, no annual contracts, and ease of installation (self-install), net additions remain strong for both ISPs. T-Mobile’s current FWA plan retails for $50/month, but that falls to $30/month for customers subscribing to its Magenta MAX mobile plan. Verizon prices at a slight premium to T-Mobile, with its FWA service currently retailing for $60/month, but falling to $35/month with select 5G mobile plans. On the back of their success we’ve also recently seen AT&T update its FWA strategy, launching AT&T Internet Air in August 2023, with a similar pricing strategy.

Fixed Wireless Access (FWA) Customers – T-Mobile & Verizon

Company Reporting | Q3 2020 – Q3 2023

Utilizing the same 5G spectrum that its mobile customer base accesses, both T-Mobile and Verizon have been at pains to point out how they manage the on-boarding of new FWA customers, in order to limit any negative impact on performance for both cellular and FWA customers. The release and rollout of additional C-band spectrum for all three operators will provide extra headroom and the potential for improved 5G FWA performance, while T-Mobile has begun testing 5G Standalone mmWave, and has indicated that this could be utilized for 5G FWA in the future.

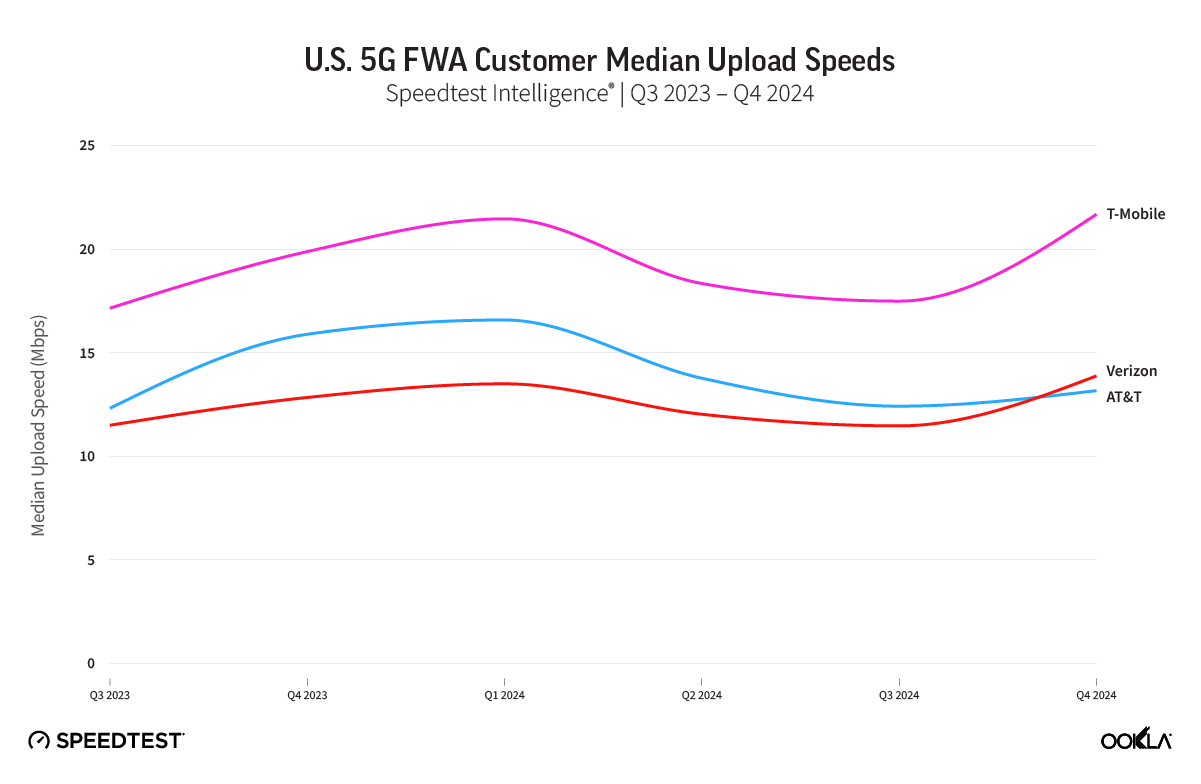

Performance on T-Mobile’s and Verizon’s 5G FWA services has held up well to date, although it lags behind median download performance of the major cable and fiber ISPs. The median download speed across the US for all fixed providers combined in Q3 2023 was 207.42 Mbps. T-Mobile has recorded consistent median download speed over the past four quarters, reaching 122.48 Mbps in Q3 2023 based on Speedtest data, but saw its median upload performance erode slightly, down from 19.76 Mbps in Q4 2022, to 17.09 Mbps in Q3 2023. Verizon on the other hand improved its median download performance when compared to Q4 2022, reaching a similar level to T-Mobile, of 121.23 Mbps in Q3 2023. However, its upload performance remained lower than T-Mobile’s, at 11.53 Mbps.

U.S. 5G Fixed Wireless Access (FWA) Performance

Speedtest® Data – Custom Analysis | Q4 2022 – Q3 2023

Churn data shows Cable & DSL providers losing out to FWA

In order to understand the impact of these 5G FWA services on the U.S. fixed broadband market, we examined Speedtest data to identify users that had churned since Q2 2022 – when these services started to scale and really impact the rest of the market.

Our data shows that the bulk of churn to both T-Mobile’s and Verizon’s 5G FWA services in that time was from cable and DSL providers. Furthermore, it doesn’t skew towards rural locations, with both T-Mobile and Verizon seeing approximately 80% of their gross additions in urban locations. The aggressive pricing strategies of FWA providers have driven prices down across the market, with cable providers for example offering slimmed down broadband and content packages at competitive prices, while AT&T Fiber now prices its entry fiber package of 300 Mbps at $55/month.

Fixed Wireless Access New Recruits – Distribution of 5G FWA Gross Additions by ISP

Speedtest® Data – Custom Analysis | Q2 2022 – Q3 2023

While cable operators bear the brunt of churn to 5G FWA services at present, their strategic response in competing on price is seeing some FWA subscribers move back to cable – a trend which the availability of FWA services with no annual contracts makes easier. Speedtest data shows that Cox for example, saw 7.3% of gross additions come from previous users of T-Mobile’s FWA service, while for Spectrum and XFINITY, former T-Mobile FWA users accounted for 6.3% and 6.0%, respectively.

In rural locations where FWA performance lags that of urban locations, and where cable providers have less overlap with FWA service, there is a more even spread of churn to FWA, between cable and DSL providers. In addition, we see stronger churn to rival FWA services, with Verizon’s FWA service attracting 11.1% of its gross additions from T-Mobile, and T-Mobile recording 2.7% of its gross additions from Verizon’s FWA users.

Users that churn experience improved network performance

With the larger FWA customer base, we ran an analysis of Speedtest data of users churning to and from T-Mobile’s 5G FWA service over the period Q2 2022 – Q3 3023, to understand if there were clear drivers for this churn. We found that the median download speed for the subset of users churning to T-Mobile, was consistently below the median of all users, for each ISP, highlighting the importance of ISPs ensuring consistent performance across their user base.

Users moving to T-Mobile’s 5G FWA service, and those churning away from it, experienced an increase in median download performance. Those users joining T-Mobile’s FWA service over the period Q2 2022 – Q3 2023, recorded an increase in their median download speed of 13.04 Mbps. On the other hand, those users churning away from T-Mobile saw their median download performance increase by 85.53 Mbps. Users joining Spectrum, Optimum, Cox and XFINITY from T-Mobile’s 5G FWA service experienced median download speeds in excess of 100 Mbps faster, highlighting the significant performance advantages that cable and fiber providers maintain over FWA.

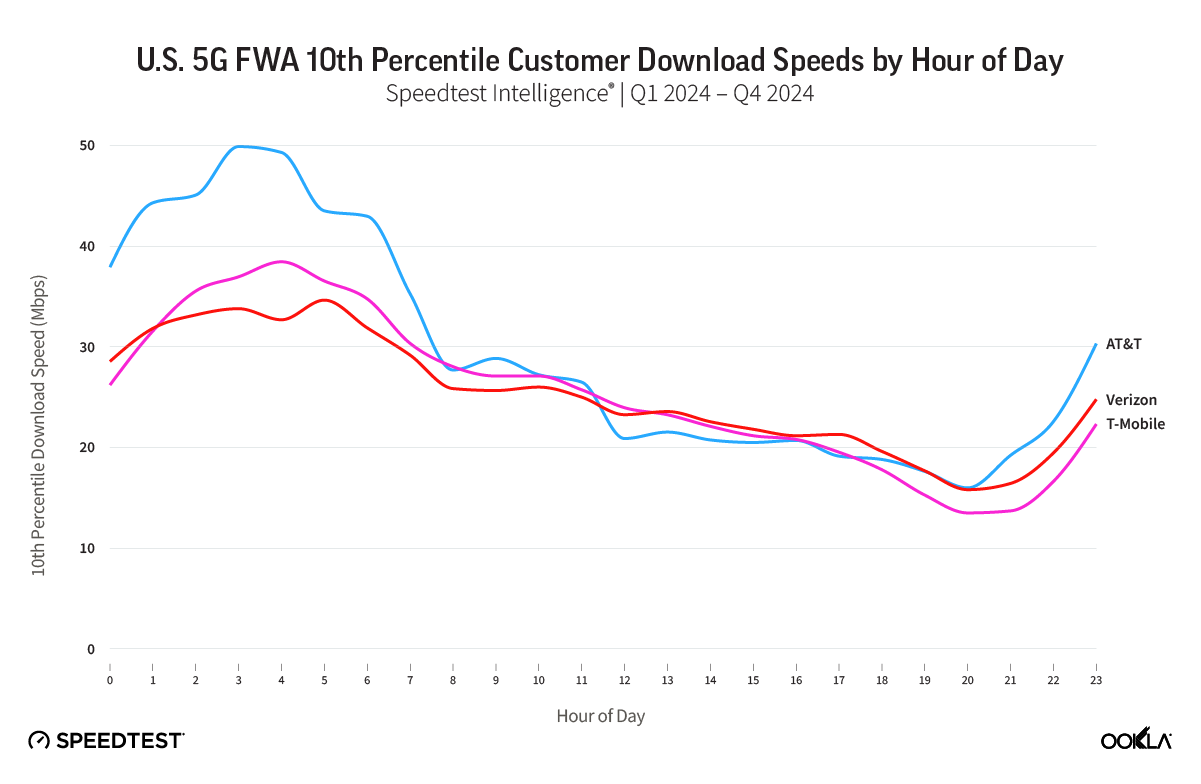

State and urban/rural analysis reveal 5G FWA performance gaps

While median performance has remained relatively stable for both operators over the past year, regional performance, and between urban and rural locations, varies significantly. The performance of 5G FWA services depends heavily on the spectrum bands available in each location, as well as the fact these FWA services do not rely on outdoor consumer premise equipment (CPE), with wireless signals having to navigate into the home. The deployment of additional C-band spectrum will help improve performance over time, however, users and ISPs who do not locate CPE externally, will have to continue to navigate the intricacies of available spectrum bands and CPE positioning within the home.

Rural locations predictably fared worse than urban locations for both T-Mobile and Verizon 5G FWA service, given differences in spectrum availability, and also distance from cell sites, although the difference was starker for Verizon’s FWA service, which recorded a median of 155.77 Mbps in urban locations during Q3 2023, but only 51.41 Mbps in rural locations. T-Mobile increased rural FWA performance, up from 82.20 Mbps in Q4 2022, to 91.96 Mbps in Q3 2023. Verizon on the other hand focussed more heavily on urban locations, with the 155.77 Mbps it achieved in Q3 2023 a sizeable increase on the 125.55 Mbps it recorded in Q4 2022.

Setting a minimum threshold of 100 samples for Q3 2023, Speedtest data showed Verizon recorded a median 5G FWA download speed of 181.77 Mbps in Nebraska, followed by 160.56 Mbps in Colorado, and 150.24 Mbps in Kansas. At the other end of the scale, Verizon 5G FWA users in Mississippi recorded median download speeds of 31.54 Mbps, of 36.72 Mbps in Wyoming, and 46.92 Mbps in West Virginia. Upload performance followed a similar trend, with a high of 16.74 Mbps in Nebraska, and a low of 4.20 in Mississippi.

T-Mobile’s 5G FWA service saw median download performance hit a high of 189.58 Mbps in Hawaii during Q3 2023, and like Verizon was strong in Nebraska, with 150.53 Mbps, while Oregon followed with 145.11 Mbps. States with lower median download speeds for T-Mobile included Vermont with 63.31 Mbps, South Dakota with 65.38 Mbps, and like T-Mobile, West Virginia with 67.23 Mbps. Median upload performance for T-Mobile’s 5G FWA service also varied significantly, reaching 41.62 Mbps in Hawaii, but falling to 9.74 Mbps in North Dakota.

We’ll continue to monitor the progress of FWA in the U.S., and the competitive response from cable, DSL, fiber and even satellite providers, as the battle for users intensifies. To find out more about Speedtest Intelligence data and insights, please contact us here.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.