Leer en español | Leia em Português

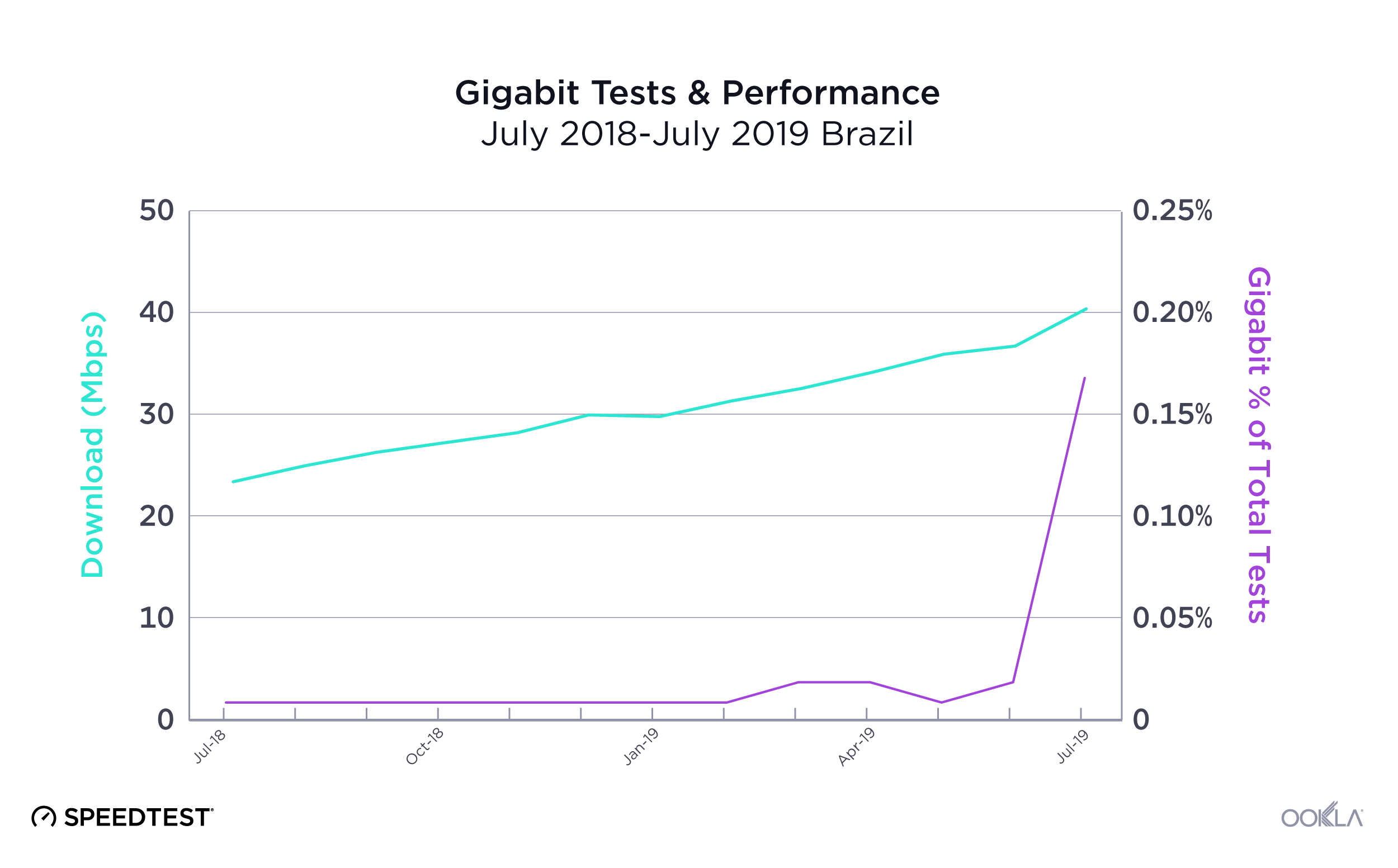

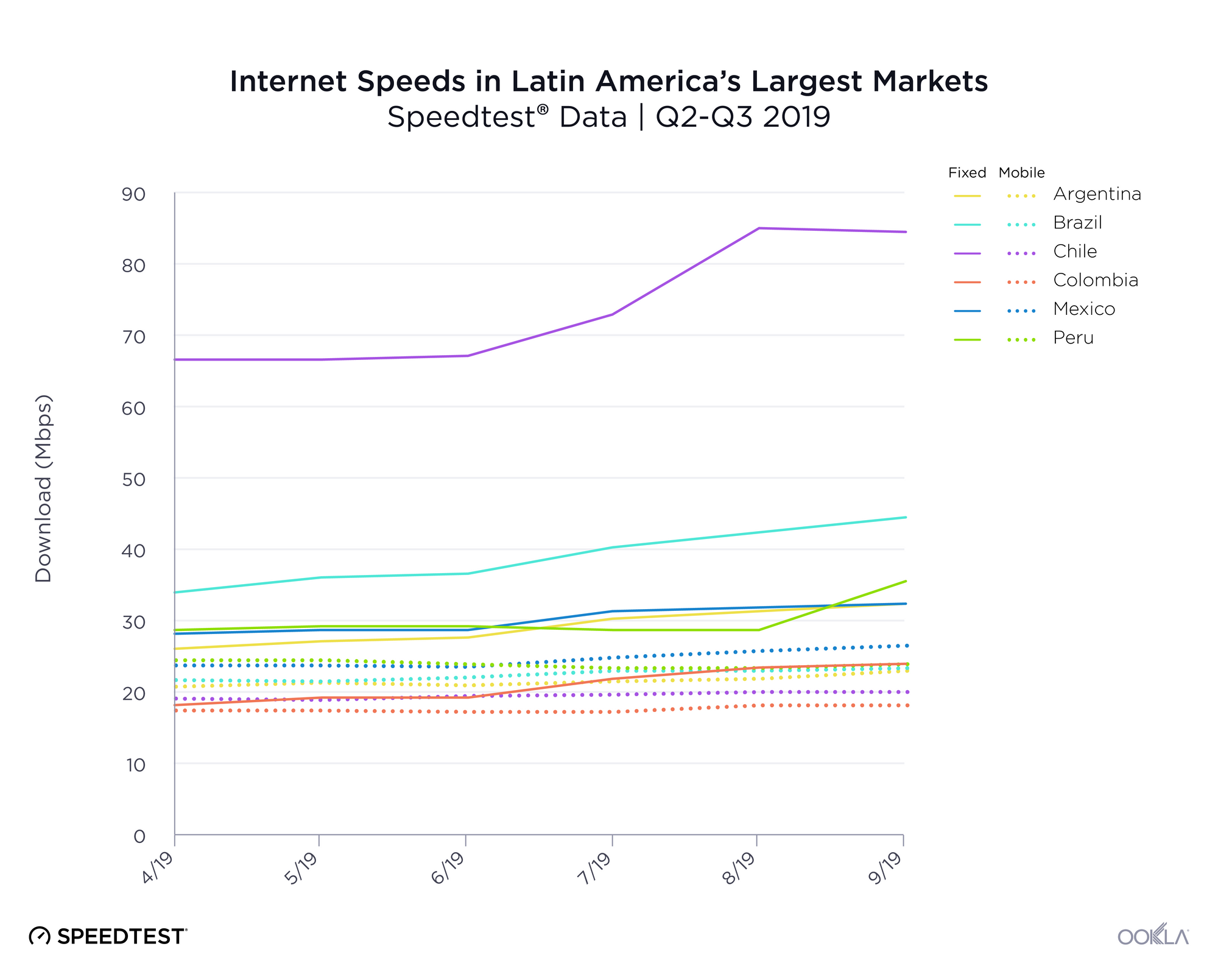

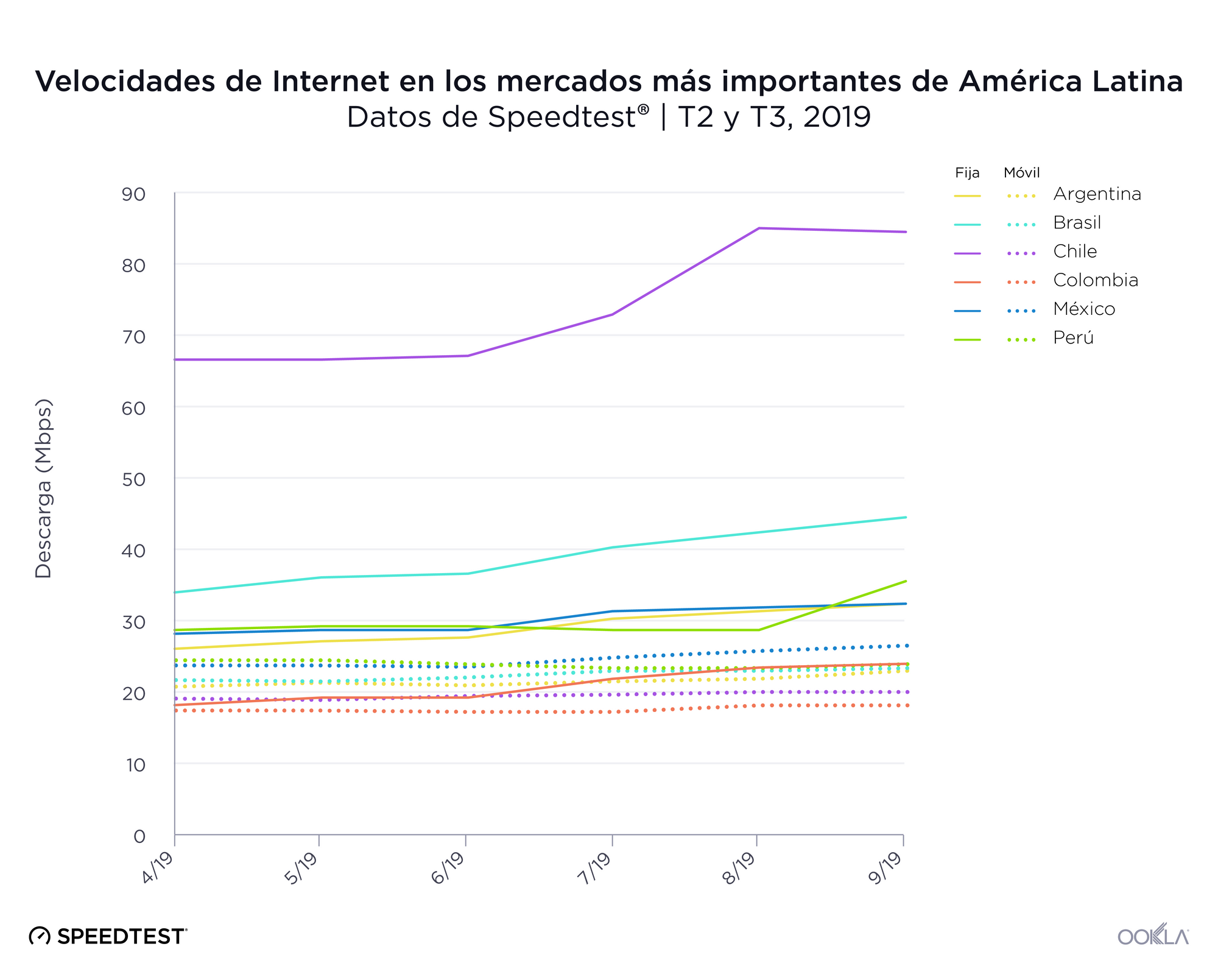

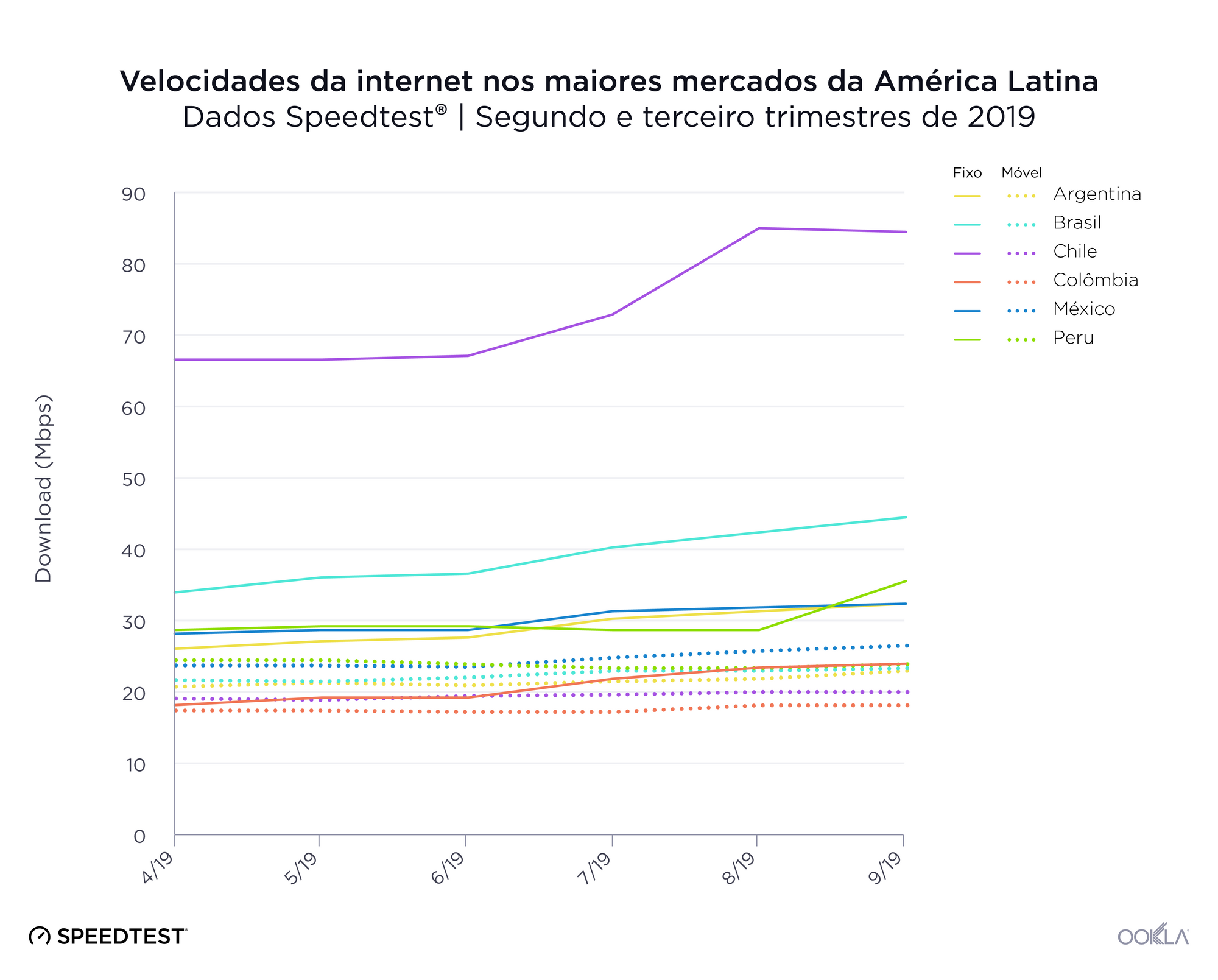

Major markets in Latin America, in most cases, saw double-digit percent increases in mean mobile download speeds during the past year. While the only 5G deployments we’ve yet seen in Latin America are in Uruguay and Brazil, operators across the continent are working to expand 4G LTE and prepare for future technologies. Using data from Speedtest IntelligenceⓇ we’ve examined mobile download speeds to see which countries are fastest and which are quickly improving. We’ve also analyzed which countries offer the best access to 4G and which operators are leading the way in speeds and coverage. For further context, we’ve included a look at speeds and 4G Availability in Central America.

Mobile speeds improved in most of Latin America’s major markets

As we saw last year, Peru had the fastest mean download speed of the group during Q1 2019, and the third largest year-over-year increase. Argentina showed the largest percentage increase and came in fourth during Q1 2019. Mexico is the exception with a second-place download speed but a 4% decline in mobile speed since last year.

Mobile Speeds in Latin America’s Largest Markets

Q1 2019 | SpeedtestⓇ Data

| Country |

Mean Download (Mbps) |

% Change YOY |

| Peru |

23.07 |

15.4% |

| Mexico |

22.02 |

-4.0% |

| Brazil |

21.30 |

25.7% |

| Argentina |

19.78 |

37.5% |

| Chile |

18.47 |

13.6% |

| Colombia |

17.36 |

10.3% |

Fastest mobile operators

We also looked at the fastest mobile operator in each country during Q1 2019 using Speed ScoreTM (a weighted trimean that combines download and upload speeds) for top providers (operators with 3% or larger market share) on modern devices.

Claro, the Mexican-owned telecommunications company, achieved the highest Speed Score in Peru, Chile and Brazil. In Peru this was due to the combination of 700 MHz LTE and 300 Mbps LTE-A service. In Chile, Claro is mainly using the 700 MHz and 2600 MHz spectrum. Claro uses 700 MHz in Brazil to augment the existing 1800 MHz and 2600 MHz networks, and additional capacity is available in places like Rio de Janeiro where Claro has deployed a 1 Gbps capable License Assisted Access (LAA) network in select locations.

Fastest Operators in Latin America’s Largest Markets

Q1 2019 | SpeedtestⓇ Data

| Country |

Mobile Operator |

Speed ScoreTM |

| Argentina |

Personal |

23.16 |

| Brazil |

Claro |

29.48 |

| Chile |

Claro |

23.53 |

| Colombia |

TigoUNE |

17.78 |

| Mexico |

Telcel |

26.20 |

| Peru |

Claro |

28.43 |

Personal delivered the fastest speeds in Argentina via 700 MHz, 1700 MHz and 2600 MHz plus carrier aggregation. Personal now provides service in over 1,350 towns and cities, having added 390 new locations in 2018. TigoUNE in Colombia launched LTE-Advanced speeds of up to 230 Mbps in parts of Bogota and Medellín. Mexico’s fastest operator, Telcel, has quietly started deploying gigabit class LTE to 76 cities throughout Mexico.

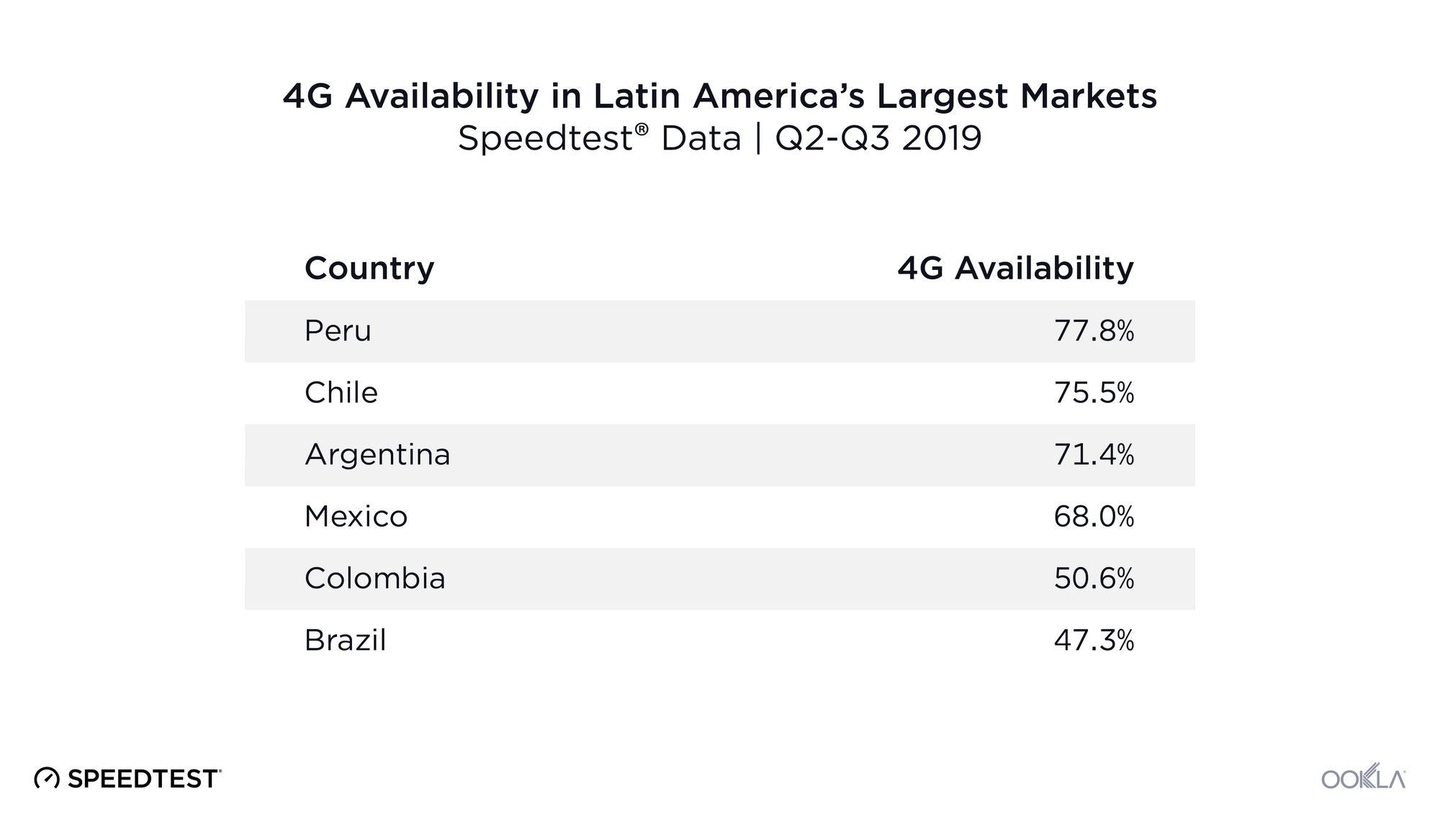

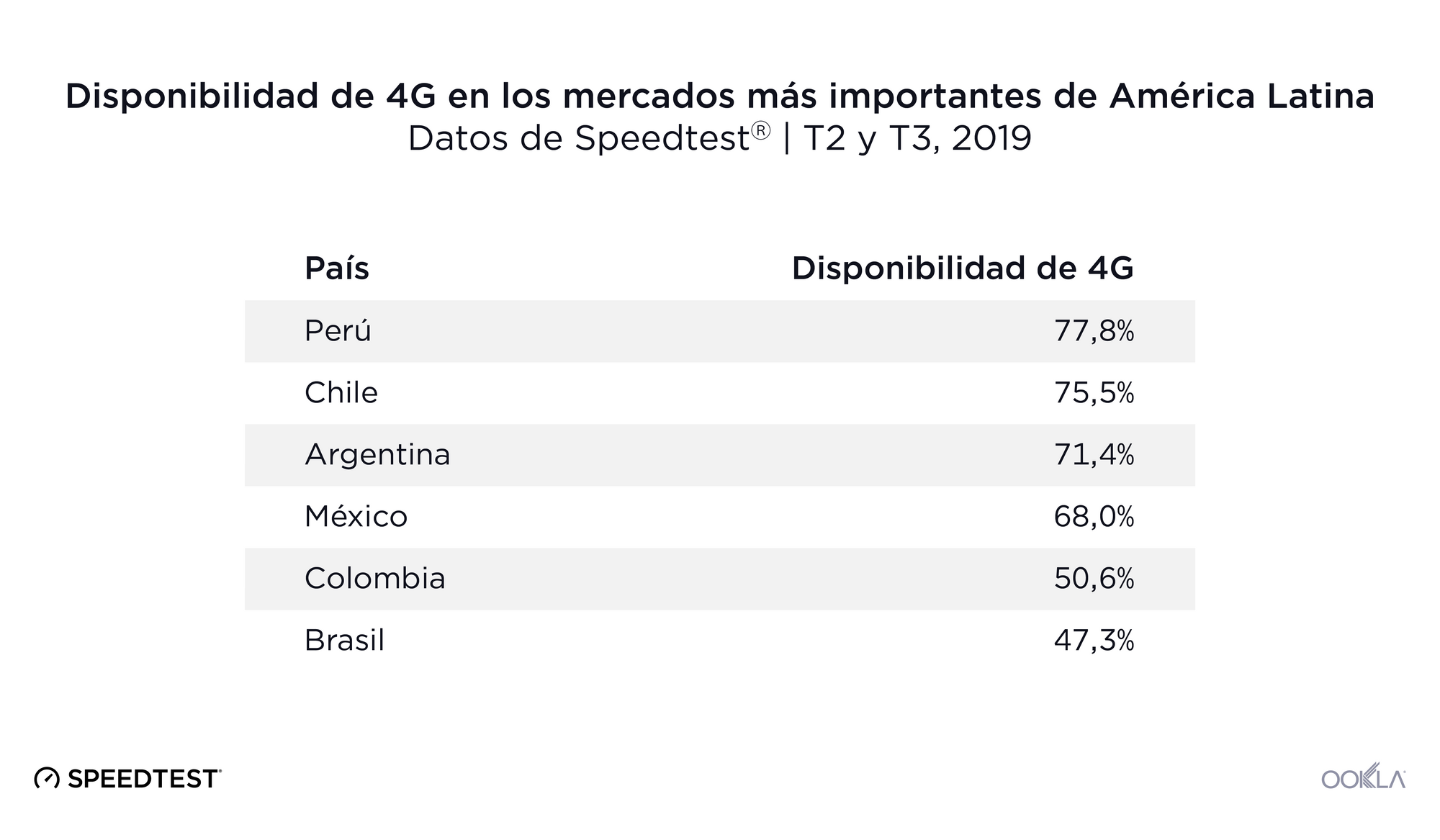

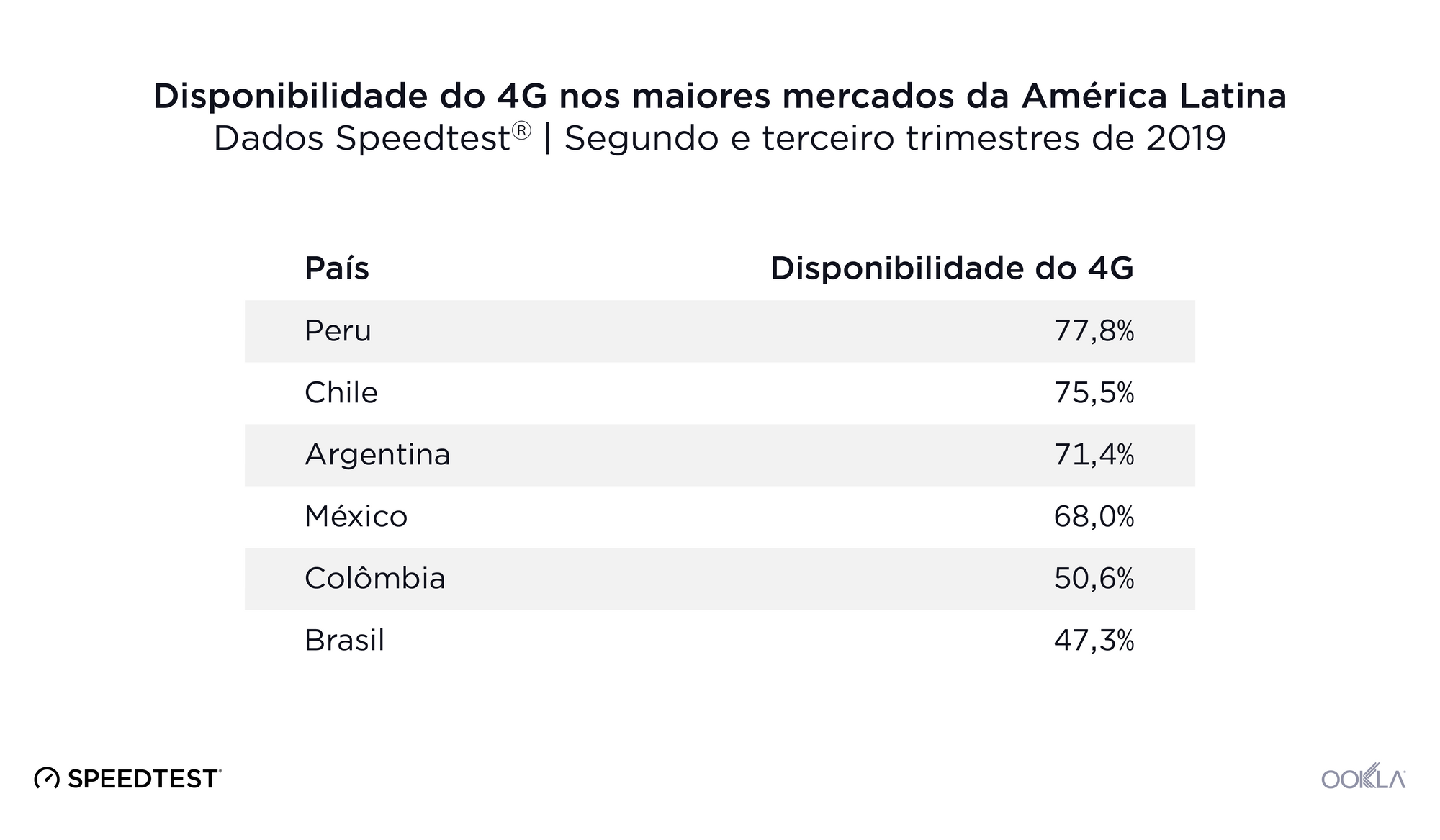

Cellular service is widely available while 4G Availability varies

Speedtest data shows that mobile users in Latin America’s largest markets were able to find service in 96% or more of surveyed locations. Chile showed the best General Availability at 99.7%. Colombia was second and Peru third. Brazil came in last for General Availability with 96.9%.

4G Availability in Latin America’s Largest Markets

Q1 2019 | SpeedtestⓇ Data

| Country |

General Availability |

4G Availability |

| Chile |

99.7% |

78.9% |

| Colombia |

99.3% |

59.3% |

| Peru |

99.2% |

87.4% |

| Argentina |

98.7% |

76.9% |

| Mexico |

98.3% |

76.7% |

| Brazil |

96.9% |

54.9% |

On the other hand, a mobile user’s ability to consistently access 4G is highly dependent on which country they live in. Customers in Peru have the best chance of connecting to LTE with a 4G Availability of 87.4%. Chile, Argentina and Mexico all show 4G Availability in the mid- to upper-70s. Brazil showed the worst 4G Availability in Latin America’s largest markets with mobile users accessing LTE a majority of the time in only 54.9% of surveyed locations.

Mobile operators with the best coverage

Coverage can be as important as speeds, especially in countries with large rural areas and/or difficult terrains. To better understand who offers the best coverage in a country, Ookla aggregates a score for coverage based on where each operator offers service and the average quality of service in those areas. The higher an operator’s Coverage ScoreTM for a given area, the more locations in that overall area where the operator has high quality service.

We looked at which of the top providers showed the best coverage in each country and found that Telcel, a subsidiary of América Móvil, in had the highest Coverage Score in Mexico during Q1 2019. Another América Móvil subsidiary, Claro had the best coverage in both Colombia and Argentina. Telefónica subsidiary Movistar topped the list in Peru and Chile and Vivo, also a subsidiary of Telefónica, had the best coverage in Brazil. Coverage Score is not comparable across countries due to differing geographies.

Operators with Best Coverage in Latin America’s Largest Markets

Q1 2019 | SpeedtestⓇ Data

| Country |

Mobile Operator |

Coverage ScoreTM |

| Argentina |

Claro |

570 |

| Brazil |

Vivo |

547 |

| Chile |

Movistar |

690 |

| Colombia |

Claro |

638 |

| Mexico |

Telcel |

816 |

| Peru |

Movistar |

697 |

How Central American mobile speeds and availability compare

Smaller markets in Latin America also show interesting dynamics. While some parts of Central America have struggled with poverty, political unrest and corruption, others have not. What’s interesting is that mobile speeds and 4G Availability aren’t always hindered by these conditions in the ways that we might expect.

Mobile Speeds and Availability in Central America

Q1 2019 | SpeedtestⓇ Data

| Country |

Mean Download (Mbps) |

General Availability |

4G Availability |

| Belize |

23.30 |

99.4% |

67.5% |

| Costa Rica |

19.22 |

99.5% |

45.7% |

| El Salvador |

8.79 |

99.9% |

34.9% |

| Guatemala |

16.75 |

99.9% |

65.9% |

| Honduras |

21.29 |

99.5% |

51.4% |

| Nicaragua |

20.13 |

99.8% |

45.8% |

| Panama |

9.74 |

99.8% |

74.4% |

The good news is good. Belize showed the fastest mean download speeds over mobile in Central America in Q1 2019, faster even than those in Peru. Mobile download speeds in Honduras, Nicaragua and Costa Rica were also particularly strong and would place them in the mid- to upper-range if we combined Central America with the list of largest markets. General Availability is above 99% in all Central American countries and Panama showed the best 4G Availability at 74.4%.

The bad news is not great. While mean mobile download speeds in Panama and El Salvador are fast enough to stream HD video, they are much slower than in Latin America’s largest markets and place these countries in line with speeds experienced in Haiti. El Salvador also showed the lowest 4G Availability in Central America at 34.9%. 4G Availability in Nicaragua and Costa Rica was also relatively low at 45.8% and 45.7%, respectively.

We’ll continue watching these markets to see how improving speeds change rankings and how network enhancements affect 4G Availability. If you are interested in detailed views of these metrics and more, learn more about Speedtest Intelligence.

En la mayoría de los casos, los principales mercados de América Latina experimentaron aumentos de dos dígitos en las velocidades medias de descarga móvil durante el año pasado. Mientras que la única implementación de 5G que se ha visto en América Latina se realizó en Uruguay, los operadores de todo el continente están trabajando para expandir el 4G LTE y prepararse para las tecnologías futuras. Con datos de Speedtest IntelligenceⓇ, examinamos las velocidades de descarga móvil para ver en qué países son más rápidas y en cuáles están mejorando rápidamente. También analizamos qué países ofrecen el mejor acceso al 4G y qué operadores son los líderes en velocidad y cobertura. Para ofrecer un mayor contexto, incluimos un breve análisis de la disponibilidad de 4G en América Central.

Las velocidades móviles mejoraron en la mayoría de los principales mercados de América Latina

Como observamos el año pasado, Perú tuvo la velocidad media de descarga más rápida del grupo durante el primer trimestre de 2019 y el tercer mayor aumento interanual. Argentina mostró el mayor aumento porcentual y quedó cuarta durante el primer trimestre de 2019. México es la excepción, con el segundo lugar en velocidad de descarga, pero una disminución del 4 % en la velocidad móvil respecto del año pasado.

Velocidades móviles en los mercados más importantes de América Latina

Primer trimestre de 2019 | Datos de SpeedtestⓇ

| País |

Descarga media (Mbps) |

Porcentaje de cambio interanual |

| Perú |

23,07 |

15,4% |

| México |

22,02 |

-4,0% |

| Brasil |

21,30 |

25,7% |

| Argentina |

19,78 |

37,5% |

| Chile |

18,47 |

13,6% |

| Colombia |

17,36 |

10,3% |

Operadores de telefonía móvil más rápidos

También analizamos el operador de telefonía móvil más rápido en cada país durante el primer trimestre de 2019 con Speed ScoreTM (un trimeano ponderado que combina las velocidades de carga y descarga) entre los principales proveedores (operadores con una cuota de mercado del 3 % o superior) en dispositivos modernos.

Claro, la compañía de telecomunicaciones mexicana, logró el mayor Speed Score en Perú, Chile y Brasil. En Perú, esto se debió a la combinación de los servicios LTE de 700 MHz y LTE-A de 300 Mbps. En Chile, Claro utiliza principalmente el espectro de 700 MHz y 2600 MHz. Claro emplea 700 MHz en Brasil para aumentar las redes existentes de 1800 MHz y 2600 MHz, y ofrece capacidad adicional disponible en lugares como Río de Janeiro, donde ha implementado una red de acceso asistido por licencia (LAA, License Assisted Access) con capacidad de 1 Gbps en lugares seleccionados.

Operadores de telefonía móvil más rápidos en los mercados más importantes de América Latina

Primer trimestre de 2019 | Datos de SpeedtestⓇ

| País |

Operador de telefonía móvil |

Speed ScoreTM |

| Argentina |

Personal |

23,16 |

| Brasil |

Claro |

29,48 |

| Chile |

Claro |

23,53 |

| Colombia |

TigoUNE |

17,78 |

| México |

Telcel |

26,20 |

| Perú |

Claro |

28,43 |

Personal ofreció las velocidades más rápidas en Argentina con 700 MHz, 1700 MHz y 2600 MHz más Carrier Aggregation. Personal ya brinda sus servicios en más de 1350 pueblos y ciudades, después de sumar 390 nuevas localidades en 2018. En Colombia, TigoUNE lanzó velocidades de LTE-Advanced de hasta 230 Mbps en áreas de Bogotá y Medellín. El operador más rápido de México, Telcel, ha comenzado a implementar LTE de clase Gigabit en 76 ciudades de todo México.

El servicio celular está ampliamente disponible, pero la disponibilidad de 4G varía

Según los datos de Speedtest, los usuarios de telefonía móvil en los mercados más importantes de América Latina pudieron encontrar servicio en el 96 % o más de los lugares encuestados. Chile mostró la mejor disponibilidad general, con el 99,7 %. Colombia ocupó el segundo lugar y Perú, el tercero. Brasil quedó último en disponibilidad general, con el 96,9 %.

Disponibilidad de 4G en los mercados más importantes de América Latina

Primer trimestre de 2019 | Datos de SpeedtestⓇ

| País |

Disponibilidad general |

Disponibilidad de 4G |

| Chile |

99,7% |

78,9% |

| Colombia |

99,3% |

59,3% |

| Perú |

99,2% |

87,4% |

| Argentina |

98,7% |

76,9% |

| México |

98,3% |

76,7% |

| Brasil |

96,9% |

54,9% |

Por otro lado, la capacidad de un usuario móvil de obtener un acceso constante a 4G depende ampliamente del país en el que vive. Los clientes en Perú tienen la mayor probabilidad de conectarse a LTE con una disponibilidad de 4G del 87,4 %. Chile, Argentina y México muestran una disponibilidad de 4G de entre el 75 y el 79 %. Brasil tuvo la peor disponibilidad de 4G entre los mercados más importantes de América Latina, ya que los usuarios de telefonía móvil obtuvieron acceso a LTE la mayor parte del tiempo en solo el 54,9 % de los lugares encuestados.

Operadores de telefonía móvil con la mejor cobertura

La cobertura puede ser tan importante como las velocidades, especialmente en países con grandes zonas rurales o terrenos difíciles. Para ayudar a comprender mejor quién ofrece la mejor cobertura en cada país, Ookla calcula una puntuación por cobertura basada en dónde brinda servicio cada operador y la calidad promedio del servicio en esas áreas. Cuanto mayor es la puntuación de Coverage ScoreTM de un operador para un área determinada, más son las ubicaciones de esa área general en las que el operador presta un servicio de alta calidad.

Analizamos cuál de los principales operadores brindó la mejor cobertura en cada país y concluimos que Telcel, una subsidiaria de América Móvil, obtuvo la mayor puntuación de Coverage Score en México durante el primer trimestre de 2019. Otra subsidiaria de América Móvil, Claro, tuvo la mejor cobertura tanto en Colombia como en Argentina. Una subsidiaria de Telefónica, Movistar, encabezó la lista en Perú y Chile, y Vivo, también subsidiaria de Telefónica, tuvo la mejor cobertura en Brasil. Debido a las diferentes geografías, las puntuaciones de Coverage Score no son comparables entre diferentes países.

Operador con mejor cobertura en los mercados más importantes de América Latina

Primer trimestre de 2019 | Datos de SpeedtestⓇ

| País |

Operador de telefonía móvil |

Coverage ScoreTM |

| Argentina |

Claro |

570 |

| Brasil |

Vivo |

547 |

| Chile |

Movistar |

690 |

| Colombia |

Claro |

638 |

| México |

Telcel |

816 |

| Perú |

Movistar |

697 |

Comparación con las velocidades y la disponibilidad de la telefonía móvil en América Central

Los mercados más pequeños de América Latina también muestran dinámicas interesantes. Si bien en algunas partes de América Central ha habido dificultades relacionadas con la pobreza, la inestabilidad política y la corrupción, en otras no ha sido así. Resulta interesante destacar que las velocidades móviles y la disponibilidad de 4G no siempre se ven afectadas por estas condiciones de la manera que se podría esperar.

Velocidades y disponibilidad móviles en América Central

Primer trimestre de 2019 | Datos de SpeedtestⓇ

| País |

Descarga media (Mbps) |

Disponibilidad general |

Disponibilidad de 4G |

| Belice |

23,30 |

99,4% |

67,5% |

| Costa Rica |

19,22 |

99,5% |

45,7% |

| El Salvador |

8,79 |

99,9% |

34,9% |

| Guatemala |

16,75 |

99,9% |

65,9% |

| Honduras |

21,29 |

99,5% |

51,4% |

| Nicaragua |

20,13 |

99,8% |

45,8% |

| Panamá |

9,74 |

99,8% |

74,4% |

Las buenas noticias son buenas. Belice exhibió las velocidades medias de descarga más rápidas de la telefonía móvil en América Central en el primer trimestre de 2019, superando incluso a las de Perú. Las velocidades de descarga móvil en Honduras, Nicaragua y Costa Rica también fueron especialmente potentes y colocarían a estos países en el rango medio a superior si combináramos América Central con la lista de los mercados más importantes. La disponibilidad general supera el 99 % en todos los países centroamericanos, y Panamá exhibió la mejor disponibilidad de 4G, con el 74,4 %.

Las malas noticias no son alentadoras. Si bien las velocidades medias de descarga móvil en Panamá y El Salvador son lo suficientemente rápidas como para transmitir videos en HD, son mucho más lentas que en los mercados más importantes de América Latina y colocan a estos países en línea con las velocidades experimentadas en Haití. El Salvador también exhibió la menor disponibilidad de 4G en América Central, con el 34,9 %. La disponibilidad de 4G en Nicaragua y Costa Rica también fue baja en términos relativos, con el 45,8 % y el 45,7 %, respectivamente.

Continuaremos atentos a estos mercados para ver cómo la mejora de las velocidades cambia las clasificaciones y de qué manera las mejoras en la red afectan la disponibilidad de 4G. Si desea obtener un análisis detallado de estas métricas y datos adicionales, consulte más información sobre Speedtest Intelligence.

Os principais mercados da América Latina, na maioria dos casos, registraram aumentos de dois dígitos nas velocidades médias de download de dispositivos móveis durante o ano passado. Embora as únicas implantaçãoes 5G vistas na América Latina tenham sido realizadas no Uruguai e no Brasil, operadoras de todo o continente estão trabalhando para expandir o 4G LTE e se preparar para as próximas tecnologias. Usando dados do Speedtest IntelligenceⓇ, examinamos as velocidades de download de dispositivos móveis para ver quais países são mais rápidos e quais estão melhorando rapidamente. Analisamos também quais países oferecem o melhor acesso ao 4G e quais operadoras lideram em termos de velocidade e cobertura. Por conta de um contexto mais abrangente, incluímos as velocidades e a disponibilidade do 4G na América Central.

As velocidades de dispositivos móveis melhoraram na maioria dos principais mercados da América Latina

Como vimos no ano passado, o Peru teve a velocidade média de download mais rápida do grupo durante o primeiro trimestre de 2019, e o terceiro maior aumento em relação ao ano anterior. A Argentina apresentou o maior aumento percentual e ficou em quarto lugar no primeiro trimestre de 2019. O México é a exceção, com o segundo lugar em velocidade de download, mas uma queda de 4% na velocidade de dispositivos móveis desde o ano passado.

Velocidades móveis nos maiores mercados da América Latina

1º trimestre de 2019 | Dados do SpeedtestⓇ

| País |

Download médio (Mbps) |

% de alteração de ano a ano |

| Peru |

23,07 |

15,4% |

| México |

22,02 |

-4,0% |

| Brasil |

21,30 |

25,7% |

| Argentina |

19,78 |

37,5% |

| Chile |

18,47 |

13,6% |

| Colômbia |

17,36 |

10,3% |

Operadoras móveis mais rápidas

Também analisamos a operadora móvel mais rápida em cada país durante o primeiro trimestre de 2019 usando o Speed ScoreTM (um ajuste ponderado que combina velocidades de download e upload) para os principais provedores (operadoras com participação de mercado de 3% ou mais) em dispositivos modernos.

A Claro, empresa de telecomunicações mexicana, alcançou o maior Speed Score no Peru, no Chile e no Brasil. No Peru, isso se deveu àcombinação do serviço LTE de 700 MHz e LTE-A de 300 Mbps. No Chile, a Claro utiliza principalmente o espectro de 700 MHz e 2600 MHz. A Claro usa 700 MHz no Brasil para aumentar as redes existentes de 1800 MHz e 2600 MHz, e há mais capacidade disponível em lugares como o Rio de Janeiro, onde a Claro implantou uma rede de Acesso Licenciado e Assistido (LAA) com capacidade de 1 Gbps em locais selecionados.

Operadoras mais rápidas nos maiores mercados da América Latina

1º trimestre de 2019 | Dados do SpeedtestⓇ

| País |

Operadora móvel |

Speed ScoreTM |

| Argentina |

Personal |

23,16 |

| Brasil |

Claro |

29,48 |

| Chile |

Claro |

23,53 |

| Colômbia |

TigoUNE |

17,78 |

| México |

Telcel |

26,20 |

| Peru |

Claro |

28,43 |

A Personal forneceu as velocidades mais rápidas na Argentina com 700 MHz, 1700 MHz e 2600 MHz, além da agregação de operadoras. A Personal presta serviços em mais de 1.350 cidades, com 390 novos locais em 2018. A TigoUNE, na Colômbia, lançou velocidades LTE-Advanced de até 230 Mbps em partes de Bogotá e Medellín. A operadora mais rápida do México, a Telcel, começou sem alarde a implantar o LTE de classe gigabit em 76 cidades em todo o México.

O serviço de celulares está amplamente disponível, enquanto a disponibilidade do 4G varia

Os dados do Speedtest mostram que os usuários de dispositivos móveis nos maiores mercados da América Latina conseguiram encontrar serviços em 96% ou mais dos locais pesquisados. O Chile apresentou a melhor disponibilidade geral, com 99,7%. A Colômbia ficou em segundo e o Peru em terceiro. O Brasil ficou em último lugar, com disponibilidade geral de 96,9%.

Disponibilidade do 4G nos maiores mercados da América Latina

1º trimestre de 2019 | Dados do SpeedtestⓇ

| País |

Disponibilidade geral |

Disponibilidade do 4G |

| Chile |

99,7% |

78,9% |

| Colômbia |

99,3% |

59,3% |

| Peru |

99,2% |

87,4% |

| Argentina |

98,7% |

76,9% |

| México |

98,3% |

76,7% |

| Brasil |

96,9% |

54,9% |

Por outro lado, a capacidade de um usuário de dispositivos móveis de acessar de modo consistente o 4G depende muito do país em que ele mora. Os clientes do Peru têm a melhor chance de se conectar ao LTE, com uma disponibilidade de 87,4% para o 4G. A disponibilidade do 4G no Chile, na Argentina e no México ultrapassa os 70%. O Brasil tem a pior disponibilidade do 4G entre os maiores mercados da América Latina, com usuários móveis acessando o LTE na maior parte do tempo em apenas 54,9% dos locais pesquisados.

A cobertura pode ser tão importante quanto a velocidade, especialmente em países com grandes áreas rurais e/ou terrenos de difícil acesso. Para entender melhor quem oferece a melhor cobertura em um país, a Ookla agrega uma pontuação para cobertura com base no local em que cada operadora oferece serviço e na qualidade média do serviço nessas áreas. Quanto maior o Coverage ScoreTM de um operador para uma determinada área, mais locais nessa área geral o operador terá um serviço de alta qualidade.

Analisamos quais dos principais provedores apresentaram a melhor cobertura em cada país e descobrimos que a Telcel, uma subsidiária da América Móvil, teve o maior Coverage Score no México durante o primeiro trimestre de 2019. Outra subsidiária da América Móvil, a Claro, teve a melhor cobertura na Colômbia e na Argentina. A Movistar, subsidiária da Telefónica, liderou a lista no Peru e no Chile, e a Vivo, também subsidiária da Telefónica, teve a melhor cobertura no Brasil. O Coverage Score não é comparável entre países por causa das diferenças entre as regiões geográficas.

Operadora com melhor cobertura nos maiores mercados da América Latina

1º trimestre de 2019 | Dados do SpeedtestⓇ

| País |

Operadora móvel |

Coverage ScoreTM |

| Argentina |

Claro |

570 |

| Brasil |

Vivo |

547 |

| Chile |

Movistar |

690 |

| Colômbia |

Claro |

638 |

| México |

Telcel |

816 |

| Peru |

Movistar |

697 |

Como as velocidades e a disponibilidade dos dispositivos móveis da América Central se saem na comparação

Os mercados menores na América Latina também apresentam dinâmicas interessantes. Enquanto algumas partes da América Central lutam contra a pobreza, a agitação política e a corrupção, outras não têm esses problemas. O interessante é que a disponibilidade do 4G e as velocidades dos dispositivos móveis nem sempre são prejudicadas por essas condições da maneira que poderíamos esperar.

Velocidades móveis e disponibilidade na América Central

1º trimestre de 2019 | Dados do SpeedtestⓇ

| País |

Download médio (Mbps) |

Disponibilidade geral |

Disponibilidade do 4G |

| Belize |

23,30 |

99,4% |

67,5% |

| Costa Rica |

19,22 |

99,5% |

45,7% |

| El Salvador |

8,79 |

99,9% |

34,9% |

| Guatemala |

16,75 |

99,9% |

65,9% |

| Honduras |

21,29 |

99,5% |

51,4% |

| Nicarágua |

20,13 |

99,8% |

45,8% |

| Panamá |

9,74 |

99,8% |

74,4% |

A boa notícia é boa. Belize mostrou a mais rápida média de velocidade de download em dispositivos móveis da América Central no primeiro trimestre de 2019, mais rápida até do que no Peru. As velocidades de download em dispositivos móveis em Honduras, na Nicarágua e na Costa Rica também foram bem sólidas e colocariam esses países em uma faixa de média a alta se combinássemos a América Central com a lista dos maiores mercados. A disponibilidade geral está acima de 99% em todos os países da América Central, e o Panamá mostrou a melhor disponibilidade do 4G, com 74,4%.

A má notícia não é nada boa. Embora as velocidades médias de download em dispositivos móveis no Panamá e em El Salvador sejam rápidas o suficiente para transmitir vídeo em alta definição, elas são muito mais lentas do que nos maiores mercados da América Latina e colocam esses países alinhados com as velocidades experimentadas no Haiti. El Salvador também apresentou a menor disponibilidade de 4G da América Central, com 34,9%. A disponibilidade do 4G na Nicarágua e na Costa Rica também foi relativamente baixa, com 45,8% e 45,7%, respectivamente.

Continuaremos prestando atenção a esses mercados para ver como a melhoria da velocidade muda a classificação e como os aprimoramentos da rede afetam a disponibilidade do 4G. Se você estiver interessado em visualizações detalhadas dessas métricas e muito mais, saiba mais sobre o Speedtest Intelligence.