Deutsche

While cultural ties bind the three countries in the DACH region (Germany, Austria and Switzerland), internet performance varies widely between them. Using data from Speedtest Intelligence®, we compared performance for mobile network operators (MNOs) and fixed broadband internet service providers (ISPs) across countries and at the provider level during Q3 2020. We also compared provider performance to Speedtest Consumer SentimentTM data on five-star ratings and Net Promoter Score (NPS) to understand how network performance impacts customer satisfaction.

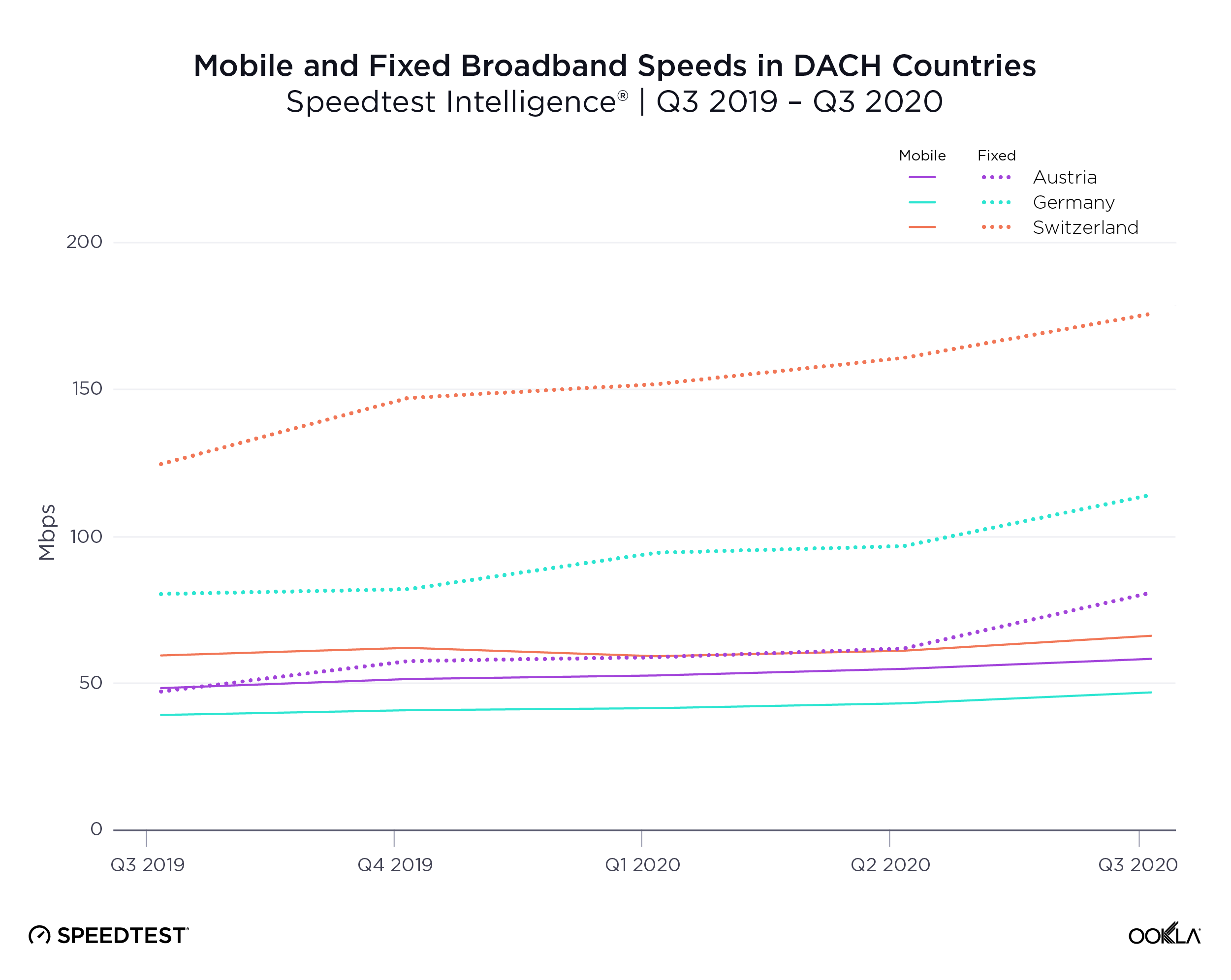

Switzerland boasts the highest mobile and fixed broadband download speeds

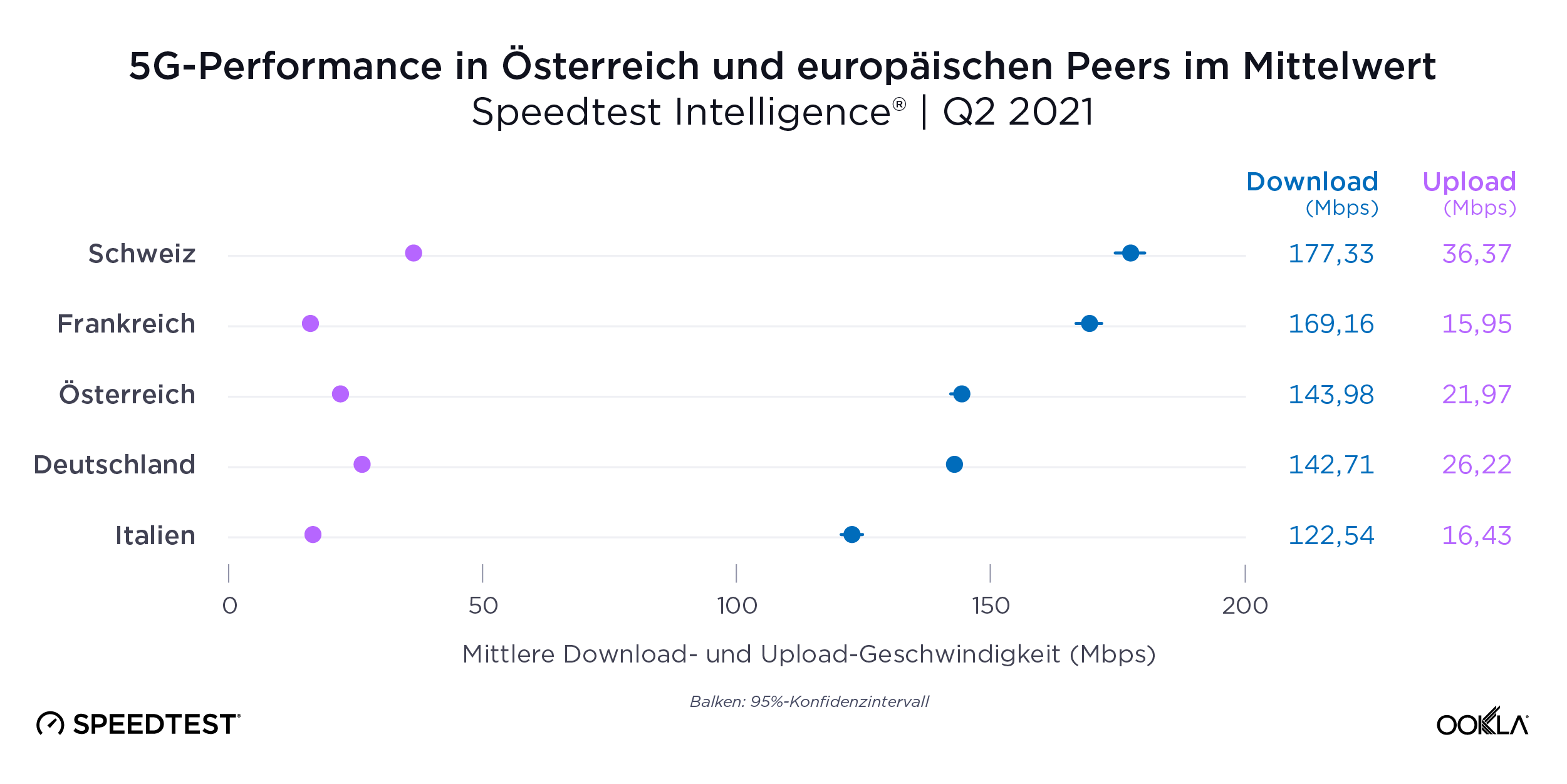

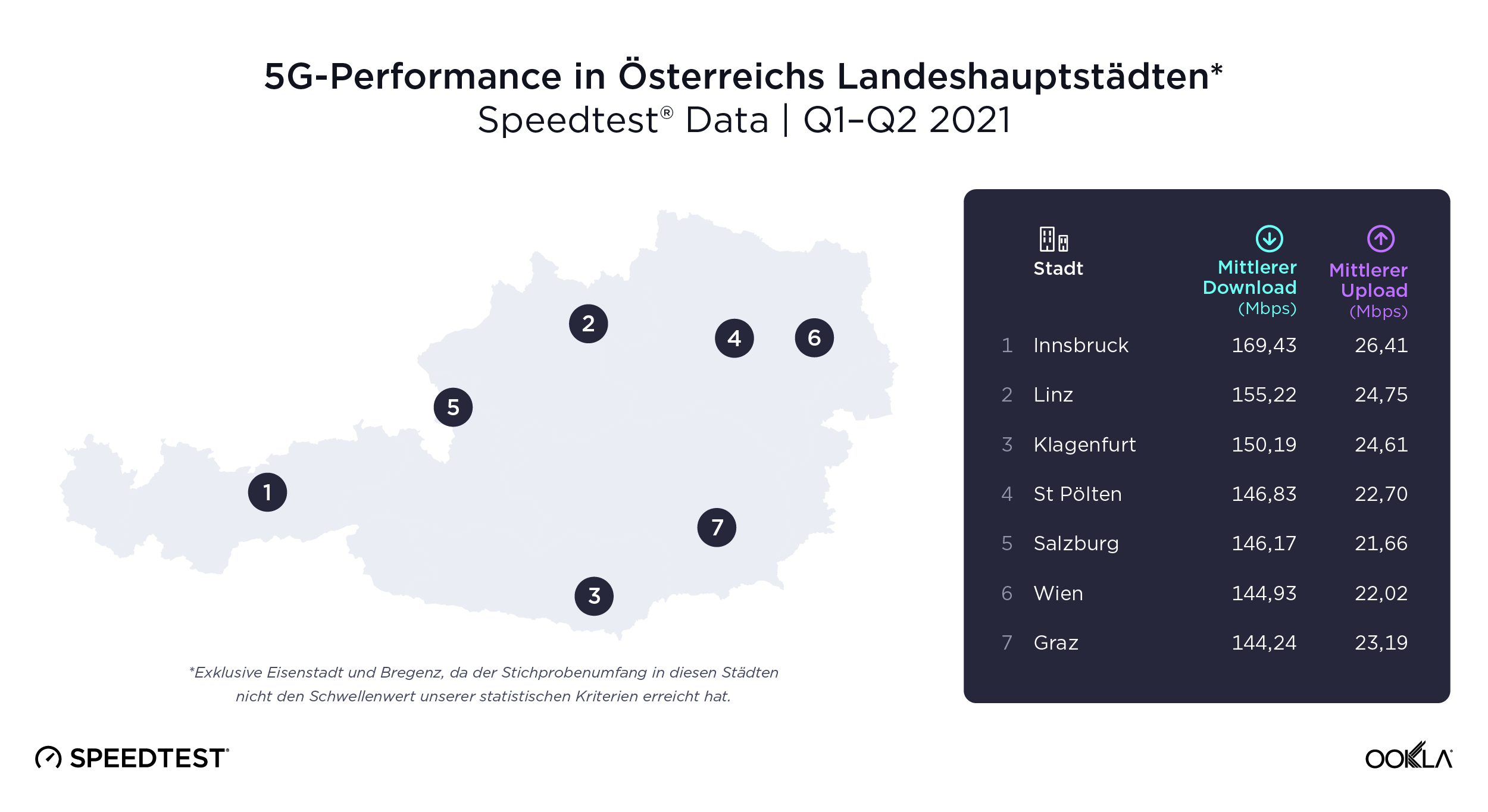

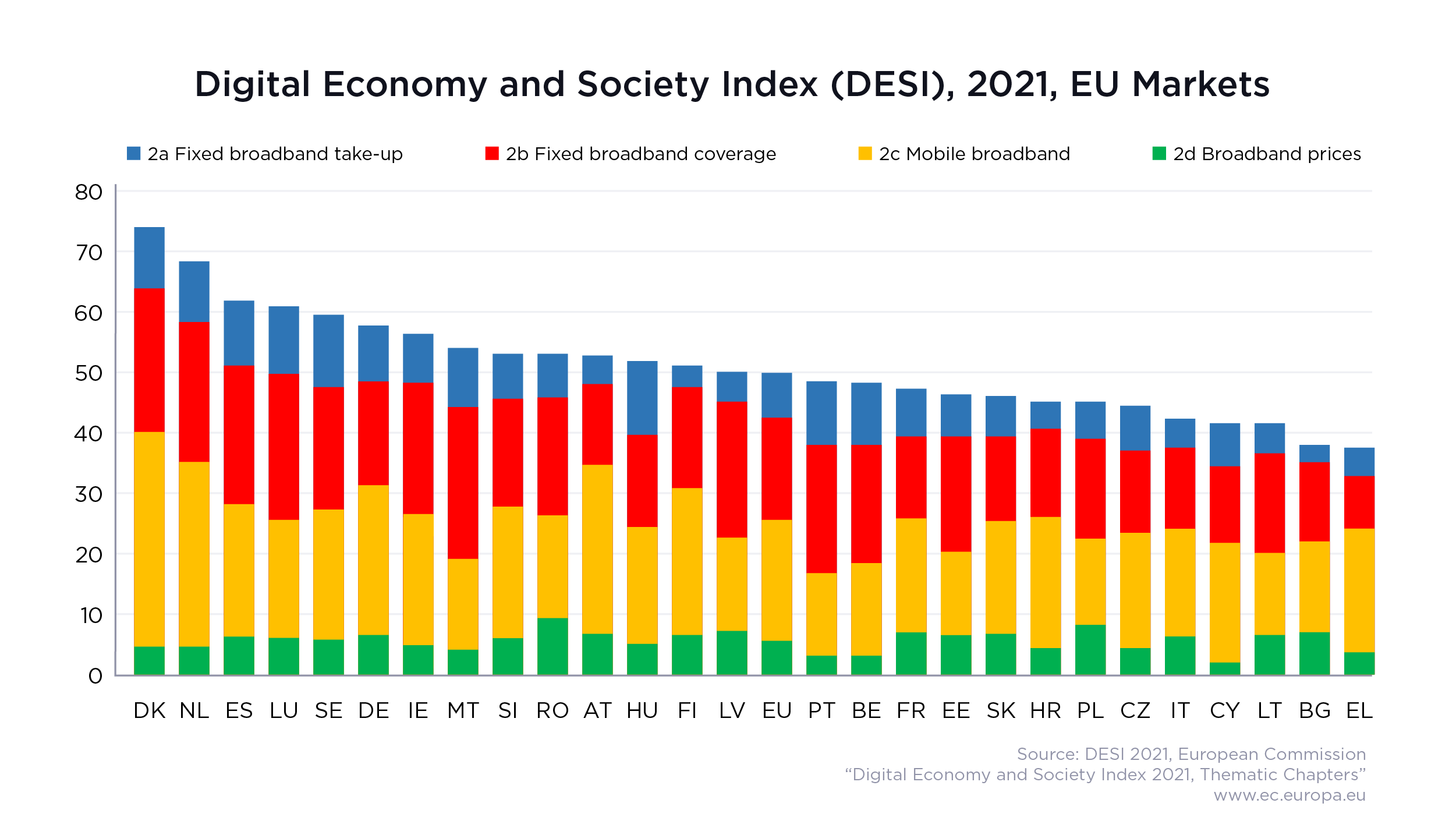

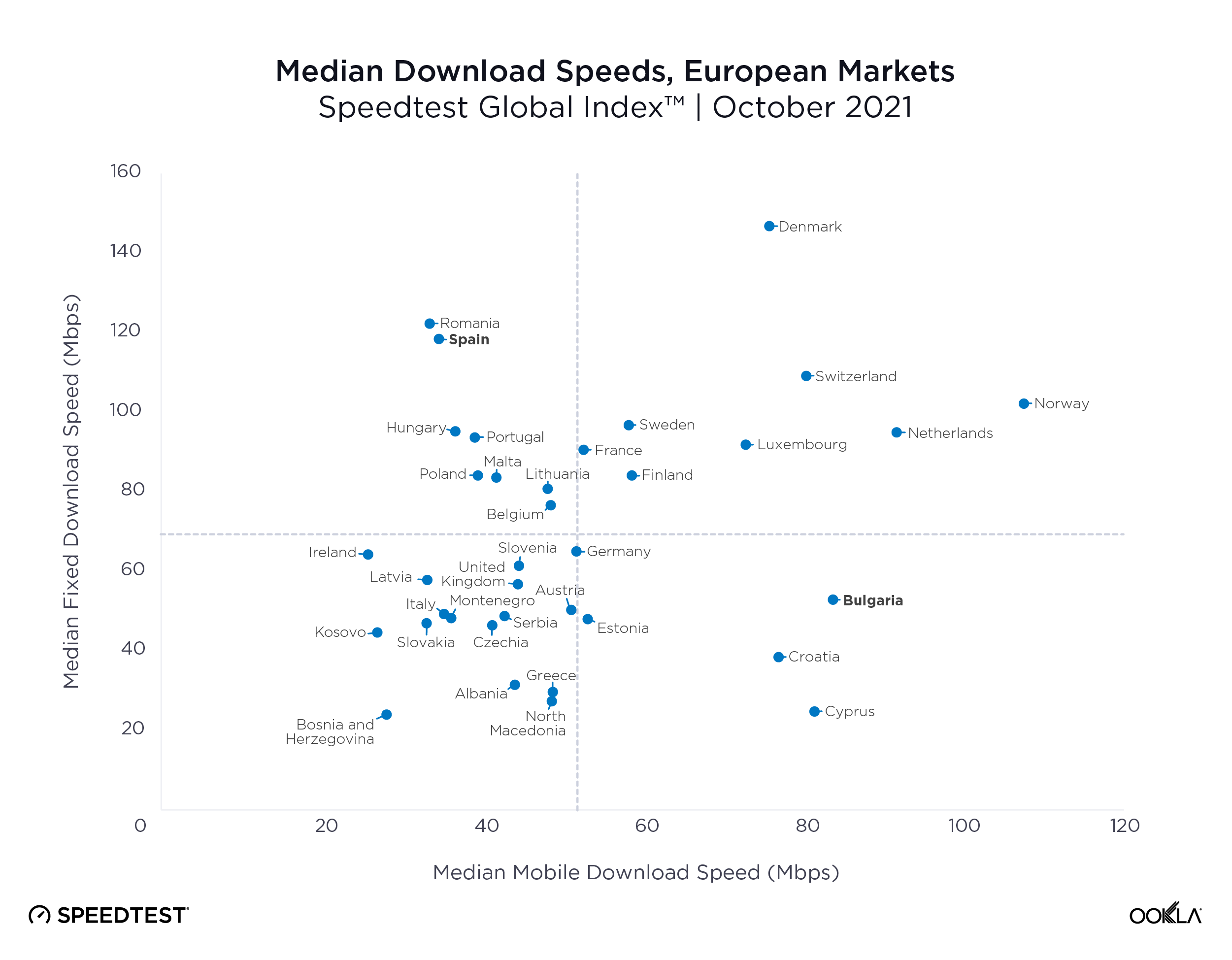

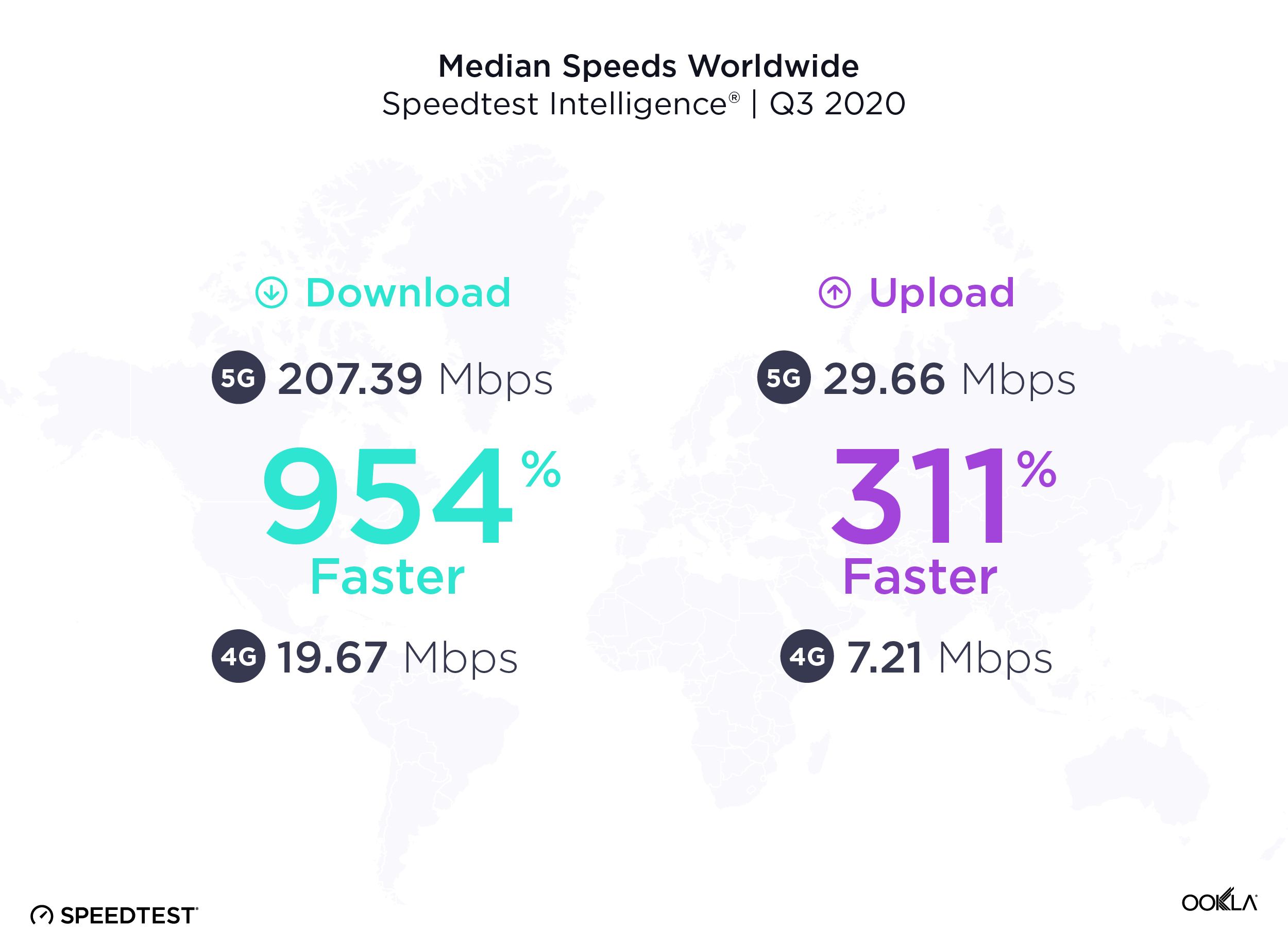

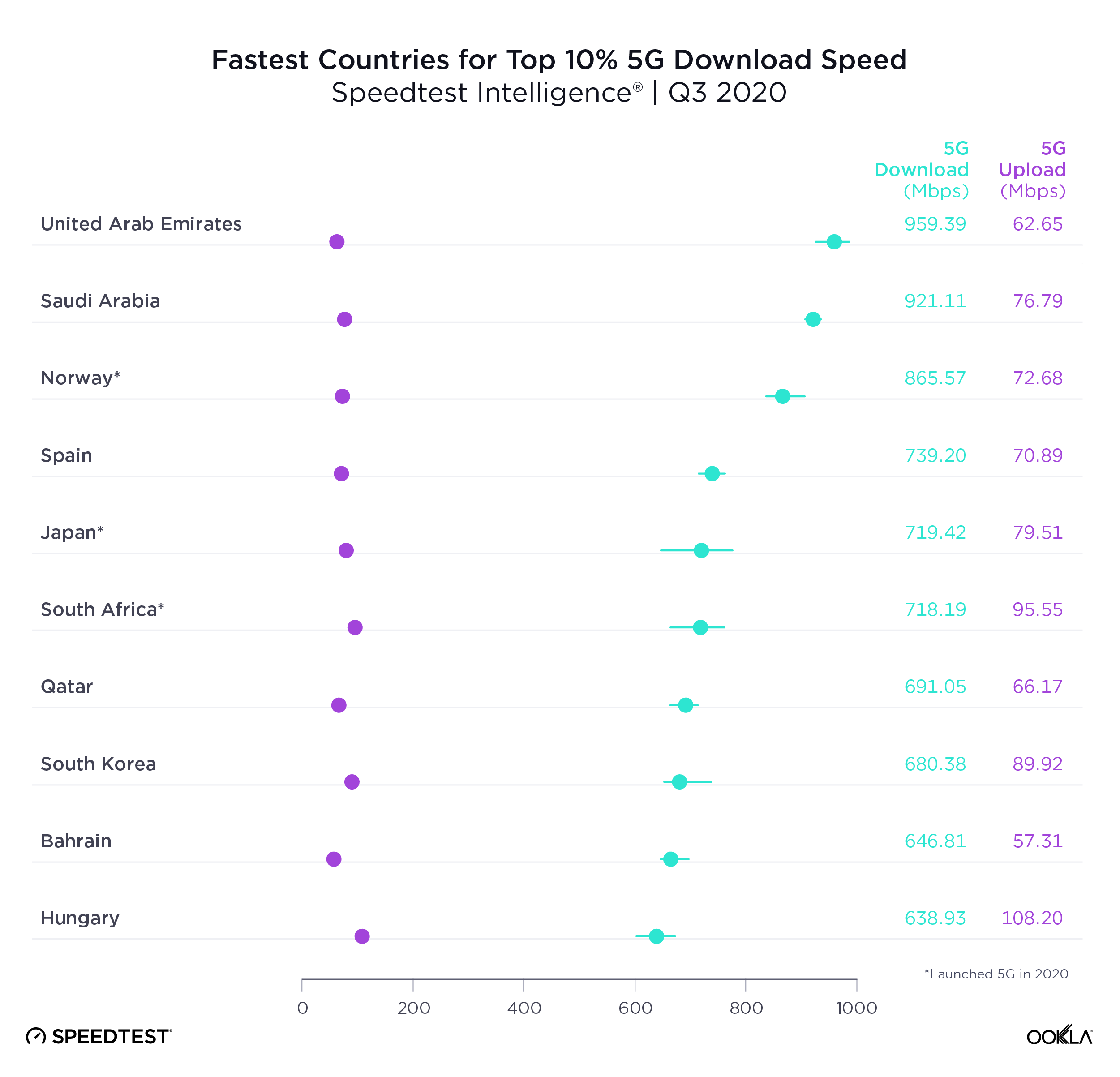

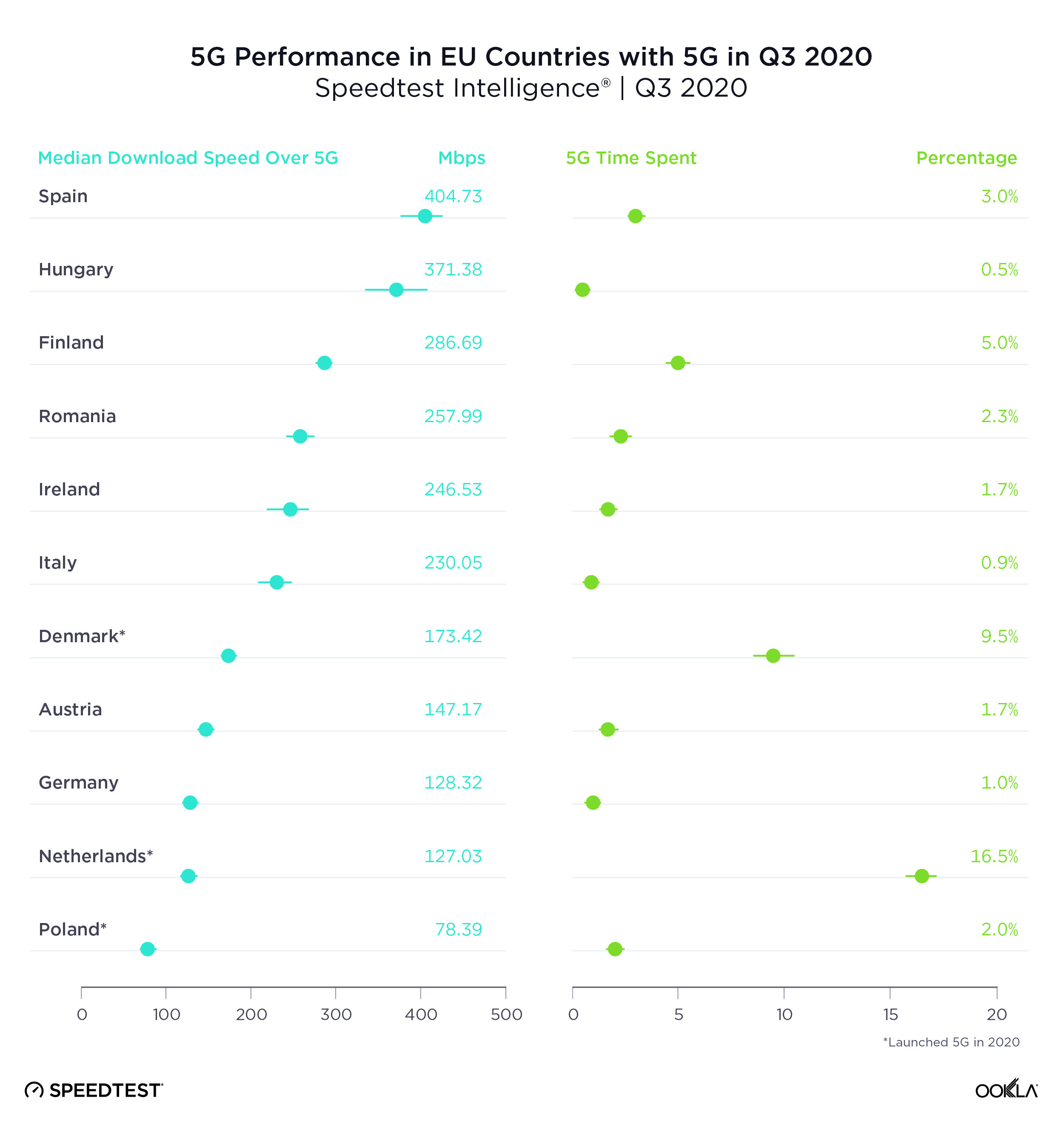

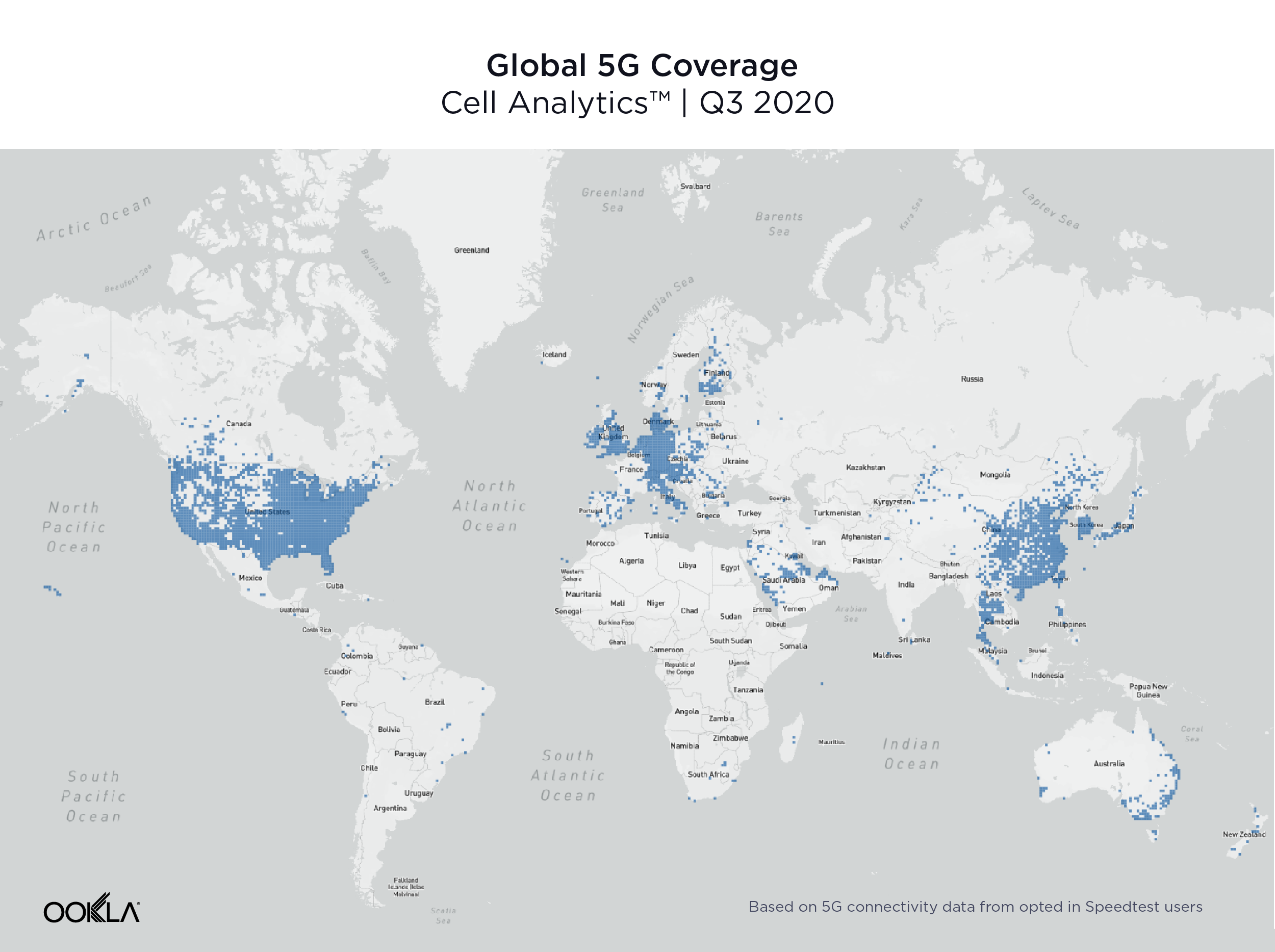

Switzerland outperformed Austria and Germany for mean mobile download speed with a mean download speed over mobile of 60.61 Mbps in Q3. Switzerland ranked 12th in the world on the Speedtest Global IndexTM as of September 2020. Austria, which had a mobile download speed of 52.76 Mbps in Q3 2020, ranked 20th in the world for mobile. Germany’s mobile download speed during Q3 2020 was 41.34 Mbps and the country ranked 35th. All three countries have invested heavily in 5G with Germany showing the largest number of cities with 5G deployments as of November 4, 2020, according to the Ookla 5G MapTM at 2,311. Switzerland had 554 and Austria 1,104. Interestingly, Switzerland actually saw a peak in mobile download speed during Q3 2020 after a decrease in Q1-Q2 2020.

On the fixed side, Switzerland fared even better with a mean download speed of 170.21 Mbps during Q3. Switzerland ranked 4th in the world for fixed broadband according to the Speedtest Global Index as of September 2020. Germany’s Q3 2020 download speed over fixed broadband was 108.57 Mbps and the country ranked 29th in the world. Austria had the lowest download speed over fixed broadband at 75.27 Mbps during Q3 2020 and ranked 50th for fixed broadband download speed. Switzerland was the only country of the three to show parity between download and upload speed over fixed broadband with a mean upload speed of 110.09 Mbps during Q3 2020. For comparison, Germany showed 25.84 Mbps and Austria was at 18.42 Mbps during the same period.

Fastest providers in Austria, Germany and Switzerland

We compared Q3 2020 internet performance for top providers in Austria, Germany and Switzerland using Speed ScoreTM. On mobile, these results consider only devices that use modern chipsets.

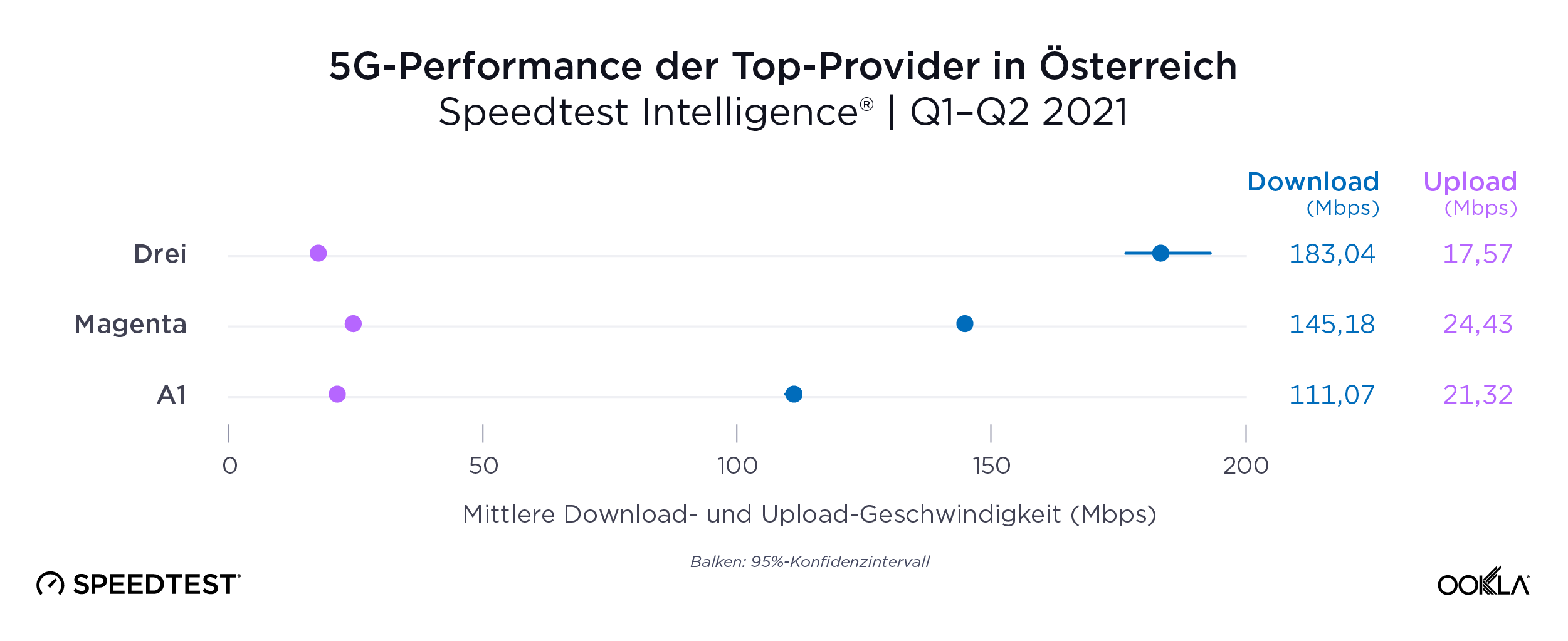

A1 (mobile) and Magenta (fixed broadband) are fastest in Austria

| Provider |

Speed Score™ |

| A1 |

61.55 |

| 3 |

43.55 |

| Magenta Telekom |

41.00 |

A1 had the fastest Speed Score among Austrian mobile operators at 61.55 during Q3 2020. Three showed the second fastest Speed Score, followed by Magenta Telekom.

| Provider |

Speed Score™ |

| Magenta |

81.21 |

| 3 |

26.39 |

| A1 |

24.84 |

On the fixed broadband side at the national level, Magenta was the fastest provider in Austria during Q3 2020. Three was second, while A1 was third. While LIWEST, kabelplus and CableLink had higher Speed Scores than both 3 and A1, these regional providers are only available in select portions of the country.

Telekom (mobile) and Vodafone (fixed broadband) are fastest in Germany

| Provider |

Speed Score™ |

| Telekom |

49.09 |

| Vodafone |

29.69 |

| 1&1 |

23.18 |

| O2 |

22.65 |

Telekom was the fastest mobile operator in Germany during Q3 2020 with a Speed Score of 49.09, far above second-place Vodafone. 1&1 was third and O2 was fourth.

| Provider |

Speed Score™ |

| Vodafone |

103.57 |

| Telekom |

44.28 |

| O2 |

38.38 |

Vodafone was the fastest fixed broadband provider in Germany during Q3 2020 with a Speed Score of 103.57. This was more than double that of second-place Telekom. O2 was third.

Switzerland’s fastest providers are Swisscom (mobile) and Salt (fixed broadband)

| Provider |

Speed Score™ |

| Swisscom |

57.10 |

| Sunrise |

46.13 |

| Salt |

38.79 |

The fastest mobile operator in Switzerland during Q3 2020 was Swisscom with a Speed Score of 57.10. Sunrise was second and Salt third.

| Provider |

Speed Score™ |

| Salt |

290.89

|

| UPC |

150.45

|

| Quickline |

95.18 |

| net+ |

82.98 |

| Sunrise |

79.40 |

| Swisscom |

76.73 |

Salt was the fastest fixed broadband provider in Switzerland during Q3 2020 with a Speed Score of 290.89 — nearly twice as high as second-place UPC. Quickline was third, net+ was fourth, Sunrise fifth and Swisscom sixth.

We compared five-star ratings and NPS data to providers’ performance to understand how speeds impacted customer perceptions of German, Austrian and Swiss providers. Speedtest Consumer Sentiment data is gathered from single-question surveys presented to users at the end of a Speedtest®. This data set provides rich insights into customer satisfaction over time, as well as competitive benchmarking, by providing data on both Net Promoter Score (NPS) and customers’ overall satisfaction with their network providers.

Consumer Sentiment includes data on how users rate providers on a five-star scale. We compared ratings data from Austrian, German and Swiss providers in Q3 2020 with Speed Score to better understand the relationship between network performance and customers’ overall satisfaction with their network providers.

| Provider |

Speed Score™ |

Rating |

| A1 |

61.55 |

3.8 |

| 3 |

43.55 |

3.3 |

| Magenta Telekom |

41.00 |

3.4 |

Ratings aligned with performance in Austria during Q3 2020 with A1 coming first for ratings and Speed Score among Austrian mobile operators.

| Provider |

Speed Score™ |

Rating |

| Magenta |

81.21 |

3.2 |

| 3 |

26.39 |

3.0 |

| A1 |

24.84 |

2.7 |

On fixed broadband, Magenta showed the highest rating among users in Austria during Q3 2020. Three was second and A1 was third for ratings on fixed broadband.

| Provider |

Speed Score™ |

Rating |

| Tekelom |

49.09 |

3.9 |

| Vodafone |

29.69 |

3.1 |

| 1&1 |

23.18 |

3.0 |

| O2 |

22.65 |

3.2 |

In Germany, the mobile operator with the highest rating, Telekom, was also the fastest provider during Q3 2020. The rest of the rankings did not follow the order of network performance, but the spread between rankings was relatively small.

| Provider |

Speed Score™ |

Rating |

| Vodafone |

103.57 |

2.9 |

| Telekom |

44.28 |

3.3 |

| O2 |

38.38 |

3.1 |

On fixed broadband, the highest-rated provider in Germany during Q3 2020 was Telekom. Despite having a much higher Speed Score than competitors, Vodafone was rated lowest by consumers.

Speedtest Intelligence® | Modern Chipsets in Q3 2020

| Provider |

Speed Score™ |

Rating |

| Swisscom |

57.10 |

3.6 |

| Sunrise |

46.13 |

3.2 |

| Salt |

38.79 |

2.9 |

Swisscom was both the highest-rated mobile operator in Switzerland during Q3 2020 and the operator with the best Speed Score. The spread between highest- and lowest-rated mobile operators was very narrow at less than a star.

| Provider |

Speed Score™ |

Rating |

| Salt |

290.89 |

3.5 |

| UPC |

150.45 |

3.2 |

| Quickline |

95.18 |

3.5 |

| net+ |

82.98 |

3.5 |

| Sunrise |

79.40 |

3.4 |

| Swisscom |

76.73 |

3.5 |

On the fixed broadband side, Salt, net+, and Swisscom and Quickline tied for the highest rating in Switzerland during Q3 2020 despite a wide difference in Speed Score. The difference between the highest-rated provider and lowest-rated was again very small on fixed broadband.

Speedtest users are also asked how likely they are to recommend their provider to friends or family on a 0 to 10 scale. NPS ratings are categorized into Detractors (score 0-6), Passives (score 7-8), and Promoters (score 9-10). NPS is calculated as (% Promoters – % Detractors) x 100. Any NPS score above 0 indicates that a provider’s audience is more loyal than not. We compared the resulting Net Promoter Score (NPS) with Speed Score to see how performance relates to a user’s likelihood of recommending a provider.

A1 had highest NPS on mobile in Austria, kabelplus highest on fixed broadband

| Provider |

Speed Score™ |

NPS |

| A1 |

61.55 |

1.58 |

| 3 |

43.55 |

-39.67 |

| Magenta Telekom |

41.00 |

-20.18 |

A1 showed the highest NPS among mobile operators in Austria in Q3 2020, while Magenta Telekom and 3 showed negative NPS. This suggests that users were not to recommend these operators.

| Provider |

Speed Score™ |

NPS |

| Magenta |

81.21 |

-28.97 |

| 3 |

26.39 |

-36.00 |

| A1 |

24.84 |

-51.63 |

Magenta had the highest NPS among fixed broadband providers in Austria in Q3 2020, followed by 3 and A1. No providers had positive NPS values.

Telekom had highest NPS on mobile and fixed broadband in Germany

| Provider |

Speed Score™ |

NPS |

| Tekelom |

49.09 |

14.82 |

| Vodafone |

29.69 |

-37.74 |

| 1&1 |

23.18 |

-58.65 |

| O2 |

22.65 |

-34.59 |

Not only did Telekom have the highest NPS on mobile in Germany during Q3 2020, it was also the only mobile operator with a positive NPS, indicating consumers were likely to recommend the operator. As we saw above, Telekom was also the fastest operator and the most highly rated.

| Provider |

Speed Score™ |

NPS |

| Vodafone |

103.57 |

-50.26 |

| Telekom |

44.28 |

-27.10 |

| O2 |

38.38 |

-40.76 |

Telekom had the highest NPS among fixed broadband providers in Germany during Q3 2020. However, all fixed broadband providers showed negative NPS values.

Swisscom had highest NPS on mobile in Switzerland, Salt on fixed broadband

| Provider |

Speed Score™ |

NPS |

| Swisscom |

57.10 |

-2.74 |

| Sunrise |

46.13 |

-24.66 |

| Salt |

38.79 |

-46.75 |

Along with having the highest Speed Score in Switzerland and earning the highest ratings from customers, Swisscom had the highest NPS on mobile in Switzerland during Q3 2020. That said, all Swiss mobile operators showed negative NPS values, suggesting that consumers were not likely to recommend these operators to friends or family.

| Provider |

Speed Score™ |

NPS |

| Salt |

290.89 |

-1.24 |

| UPC |

150.45 |

-23.70 |

| Quickline |

95.18 |

-18.29 |

| net+ |

82.98 |

-8.33 |

| Sunrise |

79.40 |

-10.93 |

| Swisscom |

76.73 |

-10.34 |

Salt, whose Speed Score was almost double that of its nearest competitor, had the highest NPS of any fixed broadband provider in Switzerland during Q3 2020. Among the other providers, speed rankings did not otherwise match the provider rankings for NPS in Switzerland, with second-fastest UPC showing the lowest NPS.

While the fastest speeds don’t always correlate to the highest ratings from customers, there is a clear relationship between the performance, quality and availability of networks and customer satisfaction. As more mobile operators in the DACH countries continue to deploy 5G — and high-speed fiber internet becomes more available in the region — it will be interesting to watch speeds continue to climb. We will continue to monitor both network metrics and Consumer Sentiment data for the region and to surface these insights so providers can understand how and where to improve their networks.

Die drei Länder der DACH-Region (Deutschland, Österreich und die Schweiz) sind zwar kulturell miteinander verbunden, aber die Leistungsfähigkeit des Internets ist sehr unterschiedlich. Mithilfe von Daten von Speedtest Intelligence® haben wir die Leistung von Mobilfunknetzbetreibern (MNOs) und Festnetz-Breitband-Internetdienstanbietern (ISPs) in verschiedenen Ländern und auf Anbieterebene im 3. Quartal 2020 verglichen. Wir haben auch die Leistung der Anbieter mit Speedtest Consumer Sentiment™-Daten zu Fünf-Sterne-Ratings und dem Net Promoter Score (NPS) verglichen, um zu verstehen, wie sich die Netzleistung auf die Kundenzufriedenheit auswirkt.

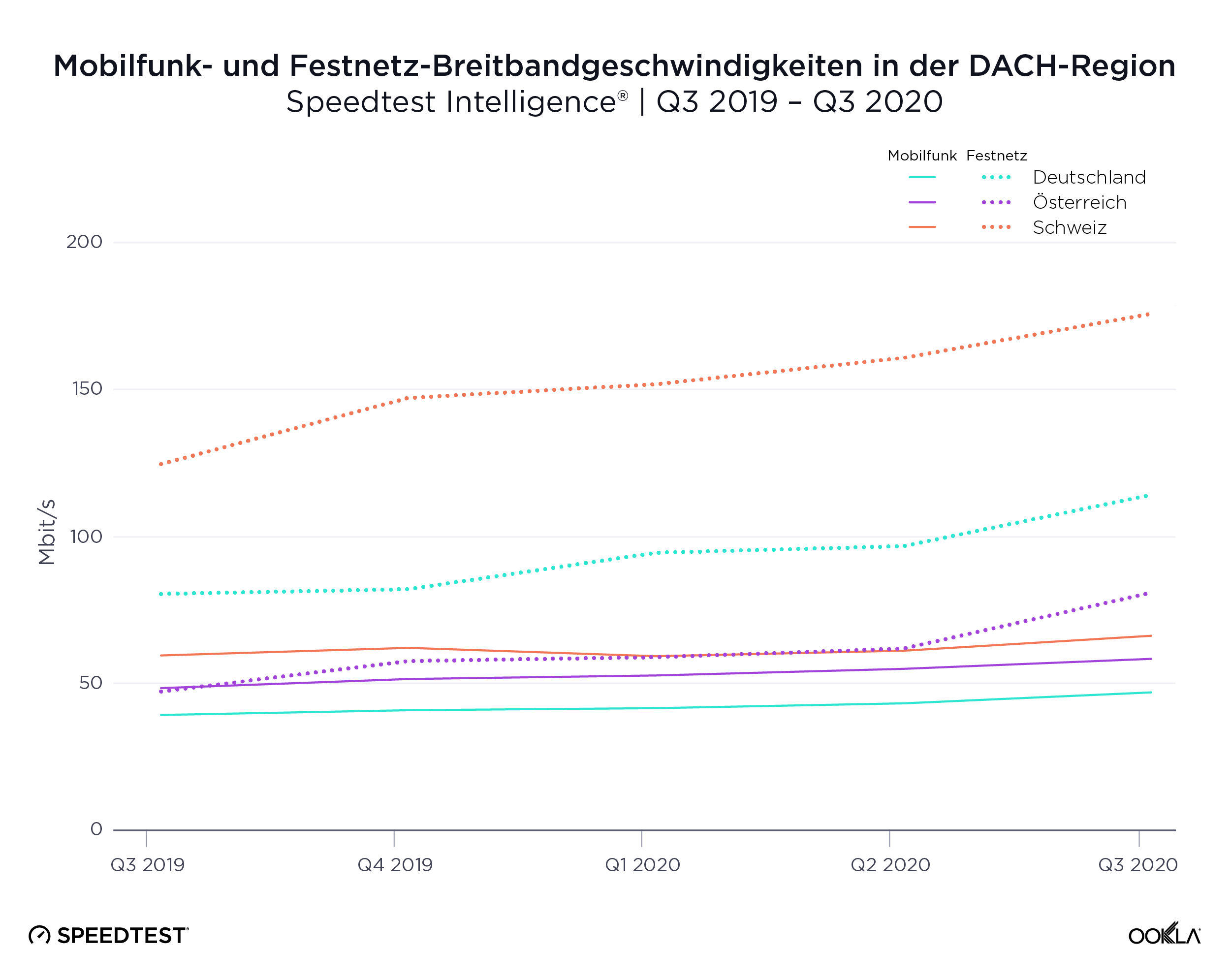

Die Schweiz verfügt über die höchsten Geschwindigkeiten beim Mobilfunk- und Festnetz-Breitband-Download

Die Schweiz übertraf Österreich und Deutschland in Bezug auf die durchschnittliche mobile Downloadgeschwindigkeit: Sie erreichte einen Durchschnittswert von 60,61 Mbit/s im dritten Quartal. Die Schweiz belegte im September 2020 weltweit Platz 12 im Speedtest Global IndexTM. Österreich schaffte es mit einer Downloadgeschwindigkeit von 52,76 Mbit/s im Mobilfunk im 3. Quartal 2020 weltweit auf Platz 20. Deutschland wies im 3. Quartal 2020 eine Mobilfunk-Downloadgeschwindigkeit von 41,34 Mbit/s auf und belegte Platz 35. Alle drei Länder haben in großem Umfang in 5G investiert, wobei Deutschland laut der Europäischen Kommission am 4. November 2020 die größte Anzahl von Städten mit 5G-Installationen aufwies. Laut der Ookla 5G MapTM belief sich die Zahl der Installationen auf 2.311. In der Schweiz waren es 554, in Österreich 1.104. Interessanterweise erlebte die Schweiz nach einem Rückgang im Q1-Q2 2020 in Q3 2020 sogar einen Höhepunkt der mobilen Downloadgeschwindigkeit.

Auf der Festnetzseite schnitt die Schweiz mit einer durchschnittlichen Downloadgeschwindigkeit von 170,21 Mbit/s im dritten Quartal noch besser ab. Laut dem Speedtest Global Index vom September 2020 belegte die Schweiz weltweit den 4. Platz im Bereich Festnetz-Breitband. Deutschlands Downloadgeschwindigkeit im 3. Quartal 2020 über Festnetz-Breitband betrug 108,57 Mbit/s und das Land belegte weltweit Platz 29. Österreich hatte im 3. Quartal 2020 mit 75,27 Mbit/s die niedrigste Downloadgeschwindigkeit über Festnetz-Breitband und belegte damit Platz 50. Die Schweiz war das einzige der drei Länder, das im 3. Quartal 2020 mit einer durchschnittlichen Upload-Geschwindigkeit von 110,09 Mbit/s einen gleichen Wert für die Download- und Upload-Geschwindigkeit über Festnetz-Breitband-Verbindungen aufwies. Zum Vergleich: Im selben Zeitraum beliefen sich die Werte in Deutschland auf 25,84 Mbit/s und in Österreich auf 18,42 Mbit/s.

Schnellste Anbieter in Österreich, Deutschland und der Schweiz

Wir verglichen die Internetleistung in Q3 2020 der Top-Anbieter in Österreich, Deutschland und der Schweiz mit Speed ScoreTM. Im Mobilfunkbereich werden hier nur Geräte berücksichtigt, die moderne Chipsätze verwenden.

A1 (Mobilfunk) und Magenta (Festnetz-Breitband) sind in Österreich am schnellsten

| Anbieter |

Speed Score™ |

| A1 |

61,55 |

| 3 |

43,55 |

| Magenta Telekom |

41,00 |

A1 hatte von allen Mobilfunkanbietern in Österreich in Q3 2020 mit 61,55 den schnellsten Speed Score. Three erreichte den zweitschnellsten Speed Score, gefolgt von Magenta Telekom.

| Anbieter |

Speed Score™ |

| Magenta |

81,21 |

| 3 |

26,39 |

| A1 |

24,84 |

Auf der Festnetz-Breitband-Seite auf nationaler Ebene war Magenta im 3. Quartal 2020 der schnellste Anbieter in Österreich. Three belegte den zweiten und A1 den dritten Platz. LIWEST, kabelplus und CableLink hatten zwar höhere Speed Scores als 3 und A1, aber diese regionalen Anbieter sind nur in Teilen Österreichs verfügbar.

Telekom (Mobilfunk) und Vodafone (Festnetz-Breitband) sind in Deutschland am schnellsten

| Anbieter |

Speed Score™ |

| Telekom |

49,09 |

| Vodafone |

29,69 |

| 1&1 |

23,18 |

| O2 |

22,65 |

Telekom war in Q3 2020 der schnellste Mobilfunkanbieter in Deutschland und lag mit einem Speed Score von 49,09 weit vor dem Zweitplatzierten Vodafone. Platz 3 belegt 1&1 und O2 war auf dem vierten Platz.

| Anbieter |

Speed Score™ |

| Vodafone |

103,57 |

| Telekom |

44,28 |

| O2 |

38,38 |

Vodafone war mit einem Speed Score von 103,57 der schnellste Festnetz-Breitband-Anbieter in Deutschland in Q3 2020. Der Speed Score war doppelt so hoch wie beim Zweitplatzierten, der Telekom. O2 belegte Platz 3.

Die schnellsten Anbieter in der Schweiz sind Swisscom (Mobilfunk) und Salt (Festnetz-Breitband)

| Anbieter |

Speed Score™ |

| Swisscom |

57,10 |

| Sunrise |

46,13 |

| Salt |

38,79 |

Der schnellste Mobilfunkanbieter in der Schweiz in Q3 2020 war Swisscom mit einem Speed Score von 57,10. Sunrise war zweiter und Salt dritter.

| Anbieter |

Speed Score™ |

| Salt |

290,89

|

| UPC |

150,45

|

| Quickline |

95,18 |

| net+ |

82,98 |

| Sunrise |

79,40 |

| Swisscom |

76,73 |

Salt war in Q3 2020 der schnellste Festnetz-Breitband-Anbieter in der Schweiz und erreichte einen Speed Score von 290,89, fast zweimal so viel wie der Zweitplatzierte UPC. Quickline belegte Platz 3, net+ Platz 4, Sunrise Platz 5 und Swisscom Platz 6.

Wir haben Fünf-Sterne-Ratings und NPS-Daten mit der Leistung der Anbieter verglichen, um zu verstehen, wie sich die Geschwindigkeit auf die Kundenwahrnehmung deutscher, österreichischer und schweizerischer Anbieter auswirkte. Speedtest Consumer Sentiment-Daten werden über Umfragen mit einer einzigen Frage gesammelt, die den Anwendern am Ende eines Speedtest® angezeigt werden. Dieser Datensatz bietet wertvolle Einblicke in die Kundenzufriedenheit im Laufe der Zeit sowie Wettbewerbsvergleiche, indem er Daten sowohl zum Net Promoter Score (NPS) als auch zur Gesamtzufriedenheit der Kunden mit ihren Netzbetreibern liefert.

Anbieterleistung vs. Bewertungen

Consumer Sentiment erfasst Daten darüber, wie Anwender Anbieter auf einer Skala von eins bis fünf bewerten. Wir haben Bewertungsdaten aus österreichischen, deutschen und schweizer Anbietern in Q3 2020 mit Speed Score verglichen, um die Beziehung zwischen Netzwerkleistung und der Zufriedenheit der Kunden insgesamt mit ihren Netzwerkanbietern zu analysieren.

In Österreich bekam A1 die besten Bewertungen für Mobilfunk und kabelplus schnitt am besten beim Festnetz-Breitband ab

| Anbieter |

Speed Score™ |

Bewertung |

| A1 |

61,55 |

3,8 |

| 3 |

43,55 |

3,3 |

| Magenta Telekom |

41,00 |

3,4 |

Die Bewertungen deckten sich in Österreich im 3. Quartal 2020 mit der Leistung, wobei A1 bei den Bewertungen und beim Speed Score unter den österreichischen Mobilfunkbetreibern den ersten Platz belegt.

| Anbieter |

Speed Score™ |

Bewertung |

| Magenta |

81,21 |

3,2 |

| 3 |

26,39 |

3,0 |

| A1 |

24,84 |

2,7 |

Im Festnetz-Breitband-Bereich erhielt Magenta die besten Anwenderbewertungen in Q3 2020. Three belegte bei den Bewertungen für Festnetz-Breitband den zweiten Platz und A1 den dritten.

In Deutschland schnitt die Telekom bei den Bewertungen für Mobilfunk und Festnetz-Breitband am besten ab

| Anbieter |

Speed Score™ |

Bewertung |

| Tekelom |

49,09 |

3,9 |

| Vodafone |

29,69 |

3,1 |

| 1&1 |

23,18 |

3,0 |

| O2 |

22,65 |

3,2 |

In Deutschland war der Mobilfunkbetreiber mit den besten Bewertungen, die Telekom, gleichzeitig auch der schnellste Anbieter in Q3 2020. Die weitere Platzverteilung entsprach nicht der Reihenfolge der Netzwerkleistung, aber die Spanne zwischen den Platzierungen war relativ gering.

| Anbieter |

Speed Score™ |

Bewertung |

| Vodafone |

103,57 |

2,9 |

| Telekom |

44,28 |

3,3 |

| O2 |

38,38 |

3,1 |

Im Bereich Festnetz-Breitband schnitt die Telekom in Deutschland bei den Bewertungen in Q3 2020 am besten ab. Obwohl der Speed Score von Vodafone deutlich höher war, als bei anderen Mitbewerbern, fielen die Bewertungen der Verbraucher hier am niedrigsten aus.

Swisscom erhielt die besten Bewertungen für den Mobilfunkbereich in der Schweiz und Salt schnitt am besten bei Festnetz-Breitband ab

| Anbieter |

Speed Score™ |

Bewertung |

| Swisscom |

57,10 |

3,6 |

| Sunrise |

46,13 |

3,2 |

| Salt |

38,79 |

2,9 |

Swiscom wurde in Q3 2020 als bester Mobilfunkbetreiber in der Schweiz bewertet und hatte auch den besten Speed Score. Die Differenz zwischen den am besten und am schlechtesten bewerteten Mobilfunkbetreibern war sehr knapp und betrug weniger als einen Stern.

| Anbieter |

Speed Score™ |

Bewertung |

| Salt |

290,89 |

3,5 |

| UPC |

150,45 |

3,2 |

| Quickline |

95,18 |

3,5 |

| net+ |

82,98 |

3,5 |

| Sunrise |

79,40 |

3,4 |

| Swisscom |

76,73 |

3,5 |

Im Bereich Festnetz-Breitband gab es bei den Bewertungen einen Gleichstand: Salt, net+, Swisscom und Quickline belegten in Q3 2020 alle den ersten Platz, obwohl es einen großen Unterschied beim Speed Score gab. Die Differenz zwischen dem am besten und dem am schlechtesten bewerteten Anbieter war auch hier im Bereich Festnetz-Breitband sehr gering.

Anbieterleistung vs. NPS

Die Anwender von Speedtest werden auch gefragt, wie wahrscheinlich sie ihren Anbieter ihren Freunden oder ihrer Familie weiterempfehlen würden (Skala von 0 bis 10). NPS-Bewertungen werden in Kritiker (Punktzahl 0-6), Passive (Punktzahl 7-8) und Befürworter (Punktzahl 9-10) eingeteilt. Der NPS wird berechnet aus (% Unterstützer – % Kritiker) x 100. Jeder NPS-Wert über 0 zeigt an, dass die Kunden eines Anbieters eher loyal sind. Wir haben den erzielten Net Promoter Score (NPS) mit dem Speed Score verglichen, um zu sehen, wie die Leistung mit der Wahrscheinlichkeit, dass ein Anwender, einen Anbieter weiterempfiehlt, zusammenhängt.

A1 erzielte den höchsten NPS im Bereich Mobilfunk in Österreich, kabelplus erhielt den besten Wert im Bereich Festnetz-Breitband

| Anbieter |

Speed Score™ |

NPS |

| A1 |

61,55 |

1,58 |

| 3 |

43,55 |

-39,67 |

| Magenta Telekom |

41,00 |

-20,18 |

A1 erzielte den höchsten NPS bei den Mobilfunkbetreibern in Österreich in Q3 2020, während Magenta Telekom und 3 negative NPS-Ergebnisse aufwiesen. Daraus lässt sich schließen, dass Anwender diese Betreiber nicht weiterempfehlen würden.

| Anbieter |

Speed Score™ |

NPS |

| Magenta |

81,21 |

-28,97 |

| 3 |

26,39 |

-36,00 |

| A1 |

24,84 |

-51,63 |

Magenta hatte unter den Festnetz-Breitband-Anbietern den höchsten NPS in Österreich in Q3 2020, gefolgt von 3 und A1. Keiner der Anbieter erzielte positive NPS-Werte.

Die Telekom erzielte den höchsten NPS im Bereich Mobilfunk und Festnetz-Breitband in Deutschland

| Anbieter |

Speed Score™ |

NPS |

| Tekelom |

49,09 |

14,82 |

| Vodafone |

29,69 |

-37,74 |

| 1&1 |

23,18 |

-58,65 |

| O2 |

22,65 |

-34,59 |

Die Telekom erzielte nicht nur den höchsten NPS im Bereich Mobilfunk in Deutschland in Q3 2020, das Unternehmen war auch der einzige Mobilfunkbetreiber mit einem positiven NPS, was bedeutet, dass die Verbraucher den Betreiber wahrscheinlich weiterempfehlen würden. Wie wir bereits gesehen haben, war die Telekom auch der schnellste Anbieter und der am besten bewertete.

| Anbieter |

Speed Score™ |

NPS |

| Vodafone |

103,57 |

-50,26 |

| Telekom |

44,28 |

-27,10 |

| O2 |

38,38 |

-40,76 |

Die Telekom verzeichnete den höchsten NPS unter den Anbietern von Festnetz-Breitband in Deutschland in Q3 2020. Alle Festnetz-Breitband-Anbieter erzielten jedoch negative NPS-Werte.

Swisscom holte den höchsten NPS im Mobilfunkbereich in der Schweiz ein, Salt im Festnetz-Breitband

| Anbieter |

Speed Score™ |

NPS |

| Swisscom |

57,10 |

-2,74 |

| Sunrise |

46,13 |

-24,66 |

| Salt |

38,79 |

-46,75 |

Neben dem höchsten Speed Score in der Schweiz und den besten Bewertungen von Kunden erzielte Swisscom auch den höchsten NPS im Mobilfunkbereich in der Schweiz in Q3 2020. Dennoch wiesen alle schweizer Mobilfunkbetreiber negative NPS-Werte auf, was darauf hindeutet, dass die Verbraucher diese Betreiber wahrscheinlich nicht an Freunde oder Verwandte weiterempfehlen würden.

| Anbieter |

Speed Score™ |

NPS |

| Salt |

290,89 |

-1,24 |

| UPC |

150,45 |

-23,70 |

| Quickline |

95,18 |

-18,29 |

| net+ |

82,98 |

-8,33 |

| Sunrise |

79,40 |

-10,93 |

| Swisscom |

76,73 |

-10,34 |

Salt, dessen Speed Score fast doppelt so hoch war wie der, des nächsten Mitbewerbers, hatte unter den Festnetz-Breitband-Anbietern in der Schweiz in Q3 2020 den höchsten NPS. Unter den anderen Anbietern entsprach die Geschwindigkeitsrangliste ansonsten nicht den NPS-Anbieterrankings in der Schweiz, wobei der zweitschnellste, UPC, den niedrigsten NPS aufweist.

Zwar entsprechen die schnellsten Geschwindigkeiten nicht immer den besten Kundenbewertungen, aber es besteht ein klarer Zusammenhang zwischen der Leistung, Qualität und Verfügbarkeit der Netze und der Kundenzufriedenheit. Da immer mehr Mobilfunkbetreiber in der DACH-Region zunehmend 5G bereitstellen – und das Hochgeschwindigkeits-Glasfaser-Internet in der Region immer besser verfügbar wird – ist es interessant zu beobachten, wie die Geschwindigkeiten weiter steigen. Wir werden weiterhin sowohl Netzwerkmetriken als auch die Verbraucherstimmung in der Region beobachten und diese Erkenntnisse aufbereiten, damit die Anbieter erkennen können, wie und wo Verbesserungsbedarf für ihre Netzwerke besteht.