The Philippines is a country with the highest number of social media users globally. Filipinos also spend a lot of time online —according to the Digital 2022 report, internet users aged 16 to 64 spent an average of 10 hours and 27 minutes using the internet each day. Yet, the Philippines suffer in terms of having relatively low mobile internet speeds due to challenging geography and affordability. Recently, the Filipino mobile market witnessed the arrival of a third mobile player, DITO whose ambitions are to disrupt a duopoly of Globe and Smart, owned by PLDT (Philippine Long Distance Telephone Company). In this article we will review the current state of the Filipino mobile market, one year after it became a three-player market.

Key takeaways

- The third operator, DITO, entered the market in March 2021 and is working to expand its market share. The operator has met all of its coverage and performance obligations, and it plans further investment and expansion of its 4G and 5G networks.

- Overall 4G performance improved in the country thanks to a mix of more operator investments and regulatory reforms. Smart led on median 4G download speed in Q1 2022 at 18.57 Mbps. DITO, a 4G/5G player, had the best 4G Availability in Q1 2022 at 91.2%.

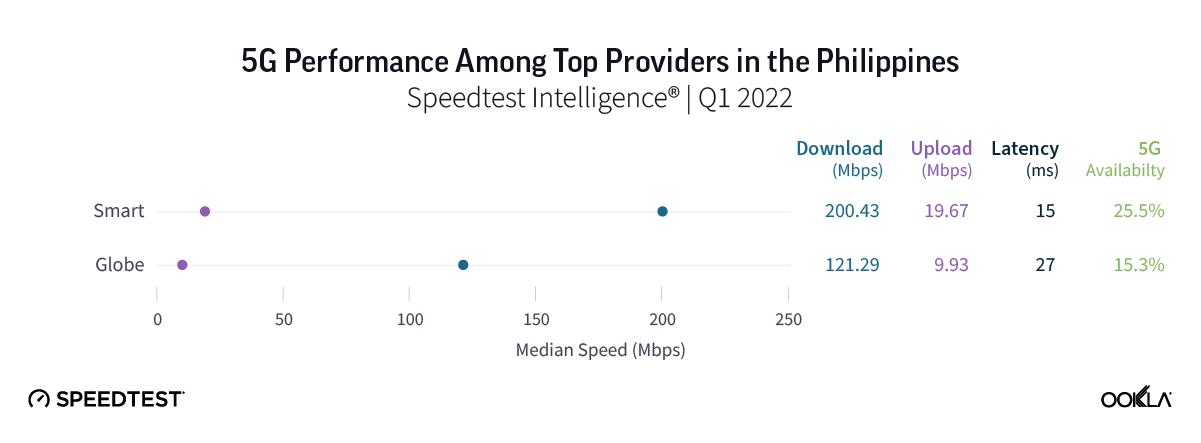

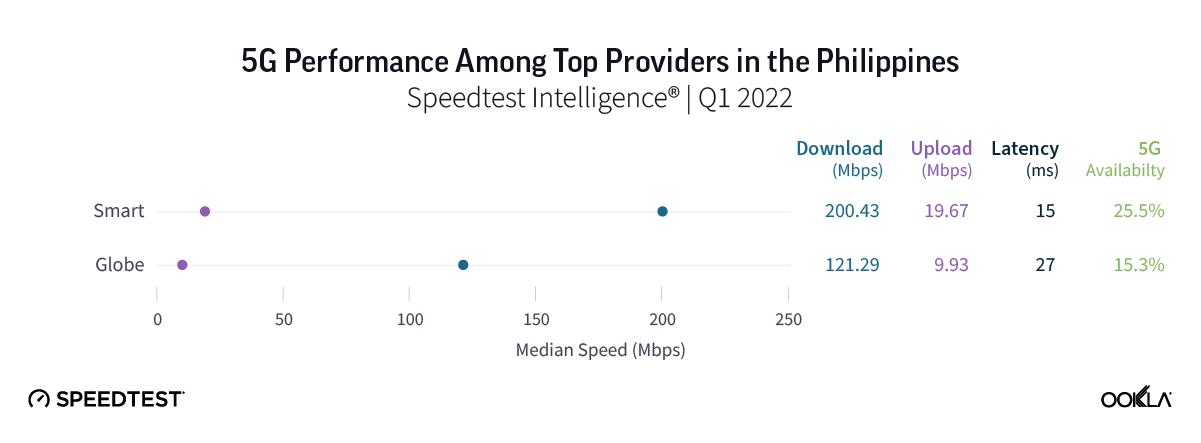

- 5G Availability improved partially thanks to easing of the Right of Way (RoW) rules but also operators’ investment into 5G networks. Smart won both in terms of 5G speeds and 5G Availability in Q1 2022, it recorded 200.43 Mbps median download speed and 25.5% 5G Availability, ahead of Globe with 121.29 Mbps download speed and 15.3% 5G Availability. DITO has just started rolling out a 5G network.

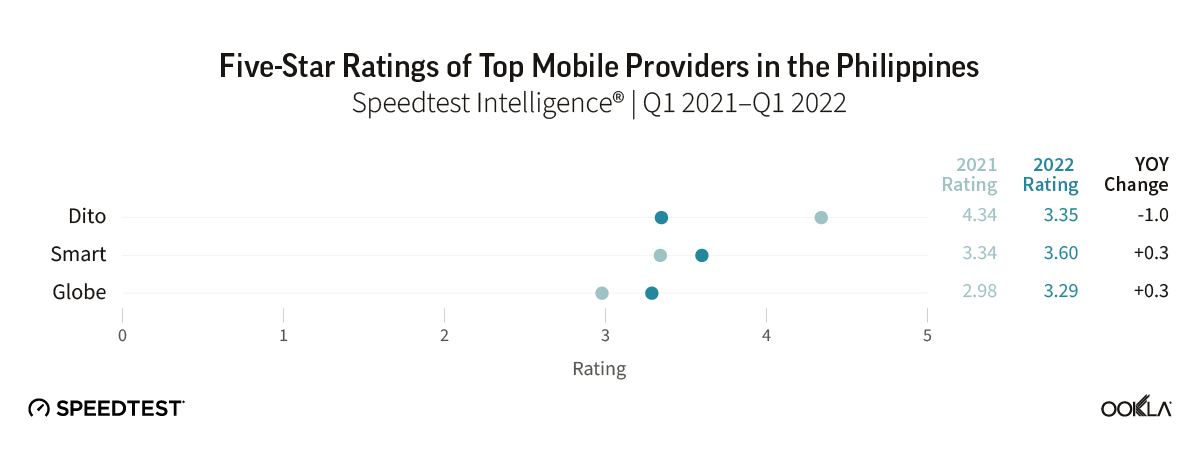

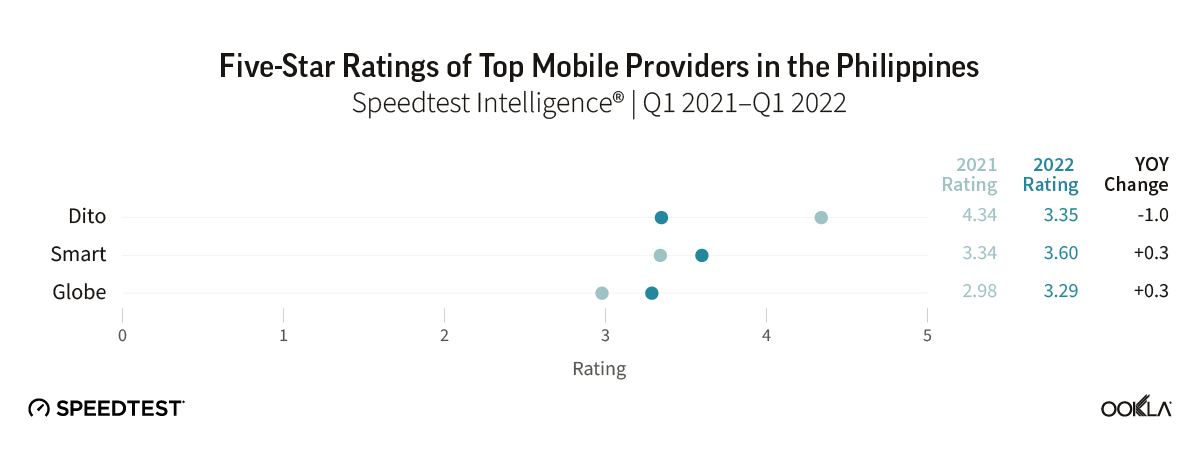

- Consumer attitudes shifted in a positive direction in the past year, both in terms of NPS score and rating of mobile operators.

Reintroducing a third player into the Filipino market

In 2011, PLDT acquired Digitel, which meant that the Philippines turned into a two-operator mobile market. This didn’t fare well for the Filipino consumers. A 2014 study by the think tank LIRNEasia found that internet users in the Philippines have paid more for worse connectivity compared to other Asian countries with investment into the telecom sector held back. A third player was introduced to the market to add competition, to improve network performance, and to reduce prices in the market. In November 2018, the Department of Information and Communications Technology (DICT) and the National Telecommunications Commission (NTC) declared Mislatel (now DITO Telecommunity Corporation), a new major telco player. DITO’s launched commercial operations in March 2021 in Visayas and Mindanao.

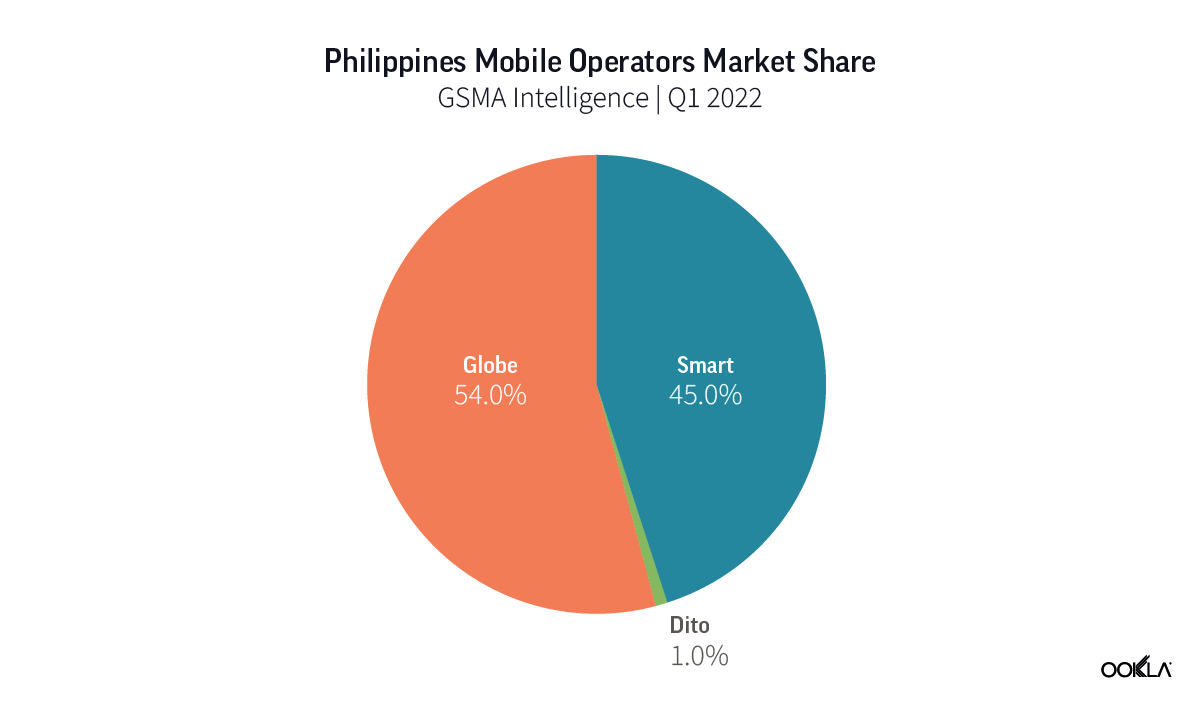

DITO market share after a year of commercial availability

Entering an already saturated telecom market wasn’t an easy task. According to GSMA Intelligence, Filipino market penetration stood at 137.5% with an average of 2.1 SIMs per user in Q1 2021. In addition, the new operator’s license came with coverage and performance obligations, which are tracked by technical audits performed on behalf of the NTC. Repetitive failure to deliver on its commitments would result in the loss of its franchise and the forfeiture of a multi-billion-Peso bond. DITO committed to a five-year network rollout plan as follows:

- First Year: commitment to reach more than 37.01% country population with a minimum average broadband speed of 27 Mbps — DITO achieved 37.48% population coverage as per February 2021 Audit

- Second Year: DITO exceeded its 51.01% population coverage target (achieved 52.57% population coverage) as per September 2021 Audit.

- Third Year: 70% population coverage audited in July 2022, DITO’s current coverage is around 64%-65%.

- Fifth Year: 84% population coverage obligation, which the operator itself has increased to over 90% by the end of its five-year network rollout program and average mobile internet speed of 55 Mbps speed.

As a result, the newcomer’s strategy wasn’t to start a price war with the incumbent operators. Rather, the goal is to win consumers’ mindshare by delivering faster speeds, differentiated customer experience and simpler products. The operator tapped into its parent company’s distribution network — retail stores of Udenna Group and gasoline stations of Phoenix Petroleum to distribute its services. It also leveraged China Telecom’s know-how and funding.

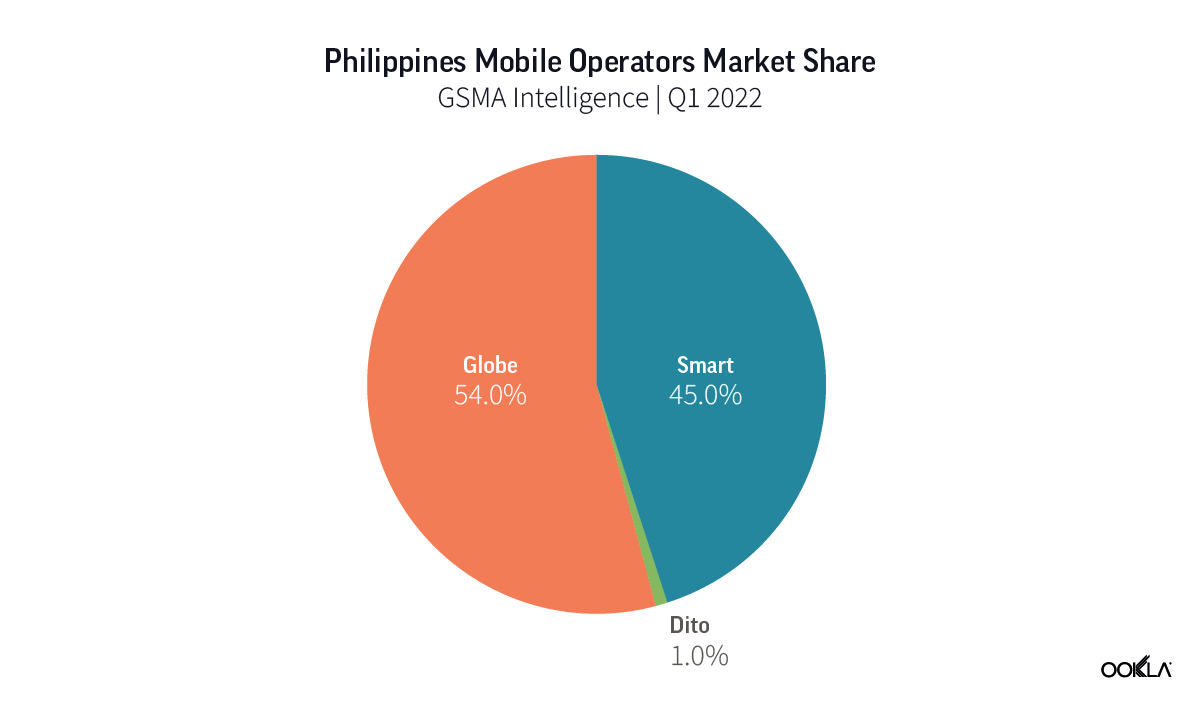

One year on, in Q1 2022, Globe was the market leader by subscriber numbers, with 87.4 million, Smart followed with 70.3 million. The newcomer, DITO, held a 1% market share — on March 15, 2022 it announced it had 7 million subscribers, which is lower than we would expect from a new market entrant. DITO targets 12 million subscribers by year end, which seems within its reach, as it has recently announced reaching 9 million customers as of June 2022. Its gains are aided by its promotional packages such as unlimited data for 30 days promotion with 25 GB of data, unlimited text and 300 minutes of calls. One of DITO’s challenges is that it doesn’t operate 2G and 3G networks so its customers have to have 4G-capable phones.

Furthermore, the introduction of Mobile Number Portability (MNP) in September 2021 could shift the landscape. MNP allows subscribers to keep their existing mobile number when changing mobile providers, helping to remove the hassle of losing an existing number when switching operators. This hasn’t been as successful as expected — with only 5,000 requests being made in a space of three months (September to December 2021). In time, and with more customer education, we foresee MNP to have more of an impact on the market.

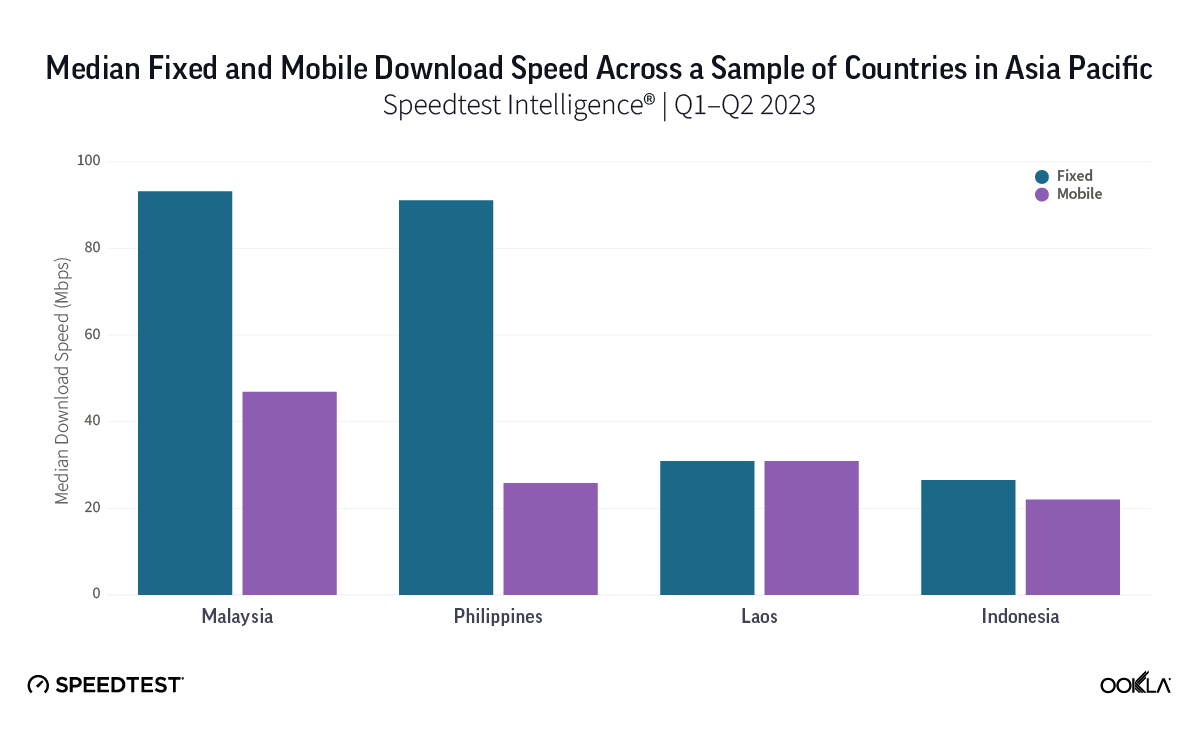

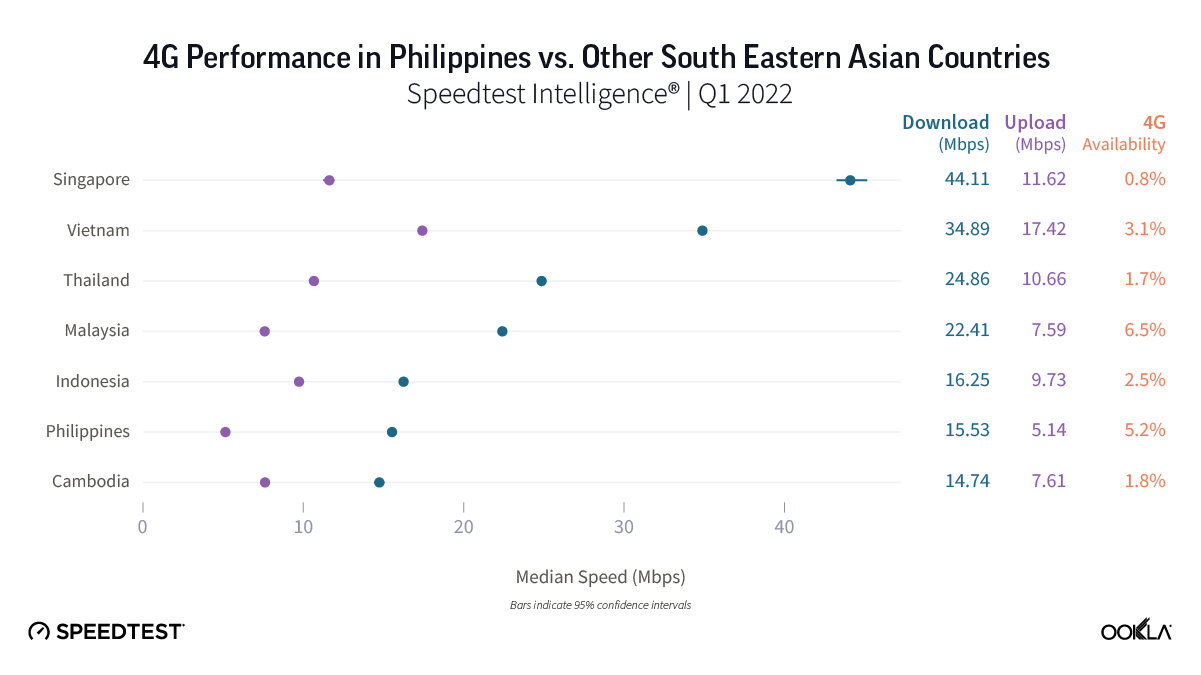

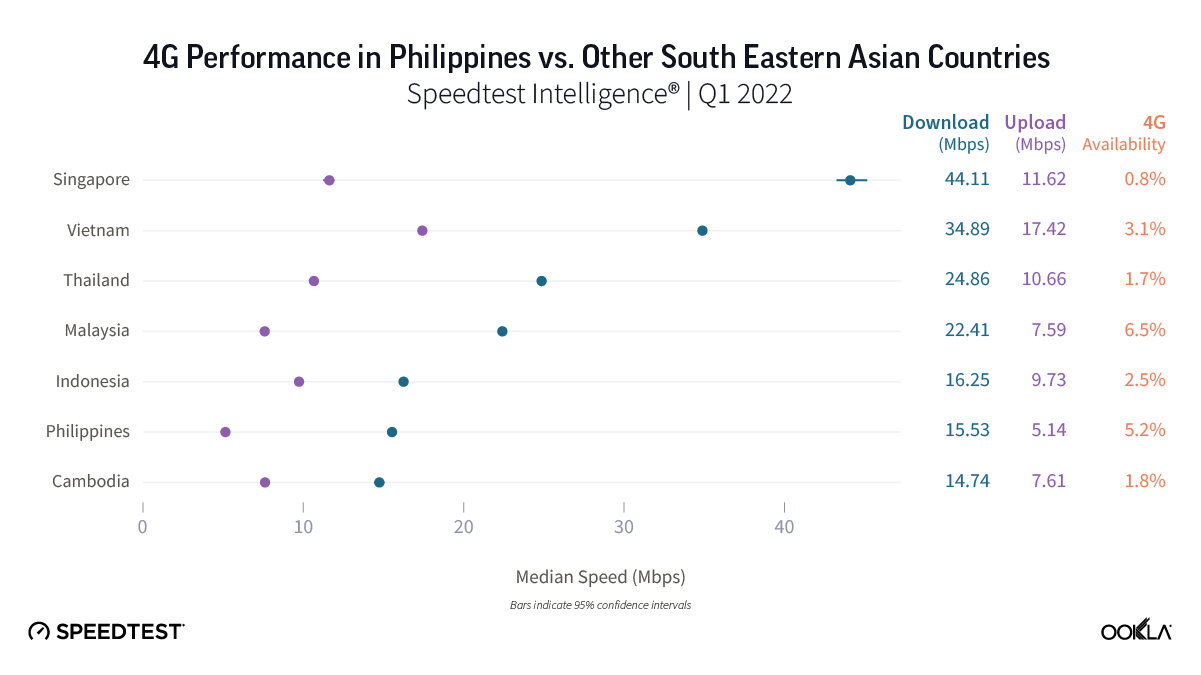

Philippines catching up on 4G

Using Speedtest Intelligence® data, we compared 4G performance in the Philippines against that of its regional peers in Q1 2022. Singapore came first with a 44.11 Mbps median 4G download speed ahead of Vietnam (34.89 Mbps), followed by Thailand (24.86 Mbps) and Malaysia (22.41 Mbps). Across Indonesia, the Philippines, and Cambodia, the 4G median speeds were well under 20 Mbps, with the Philippines coming with a 15.53 Mbps median download speed and a 5.14 Mbps median upload speed.

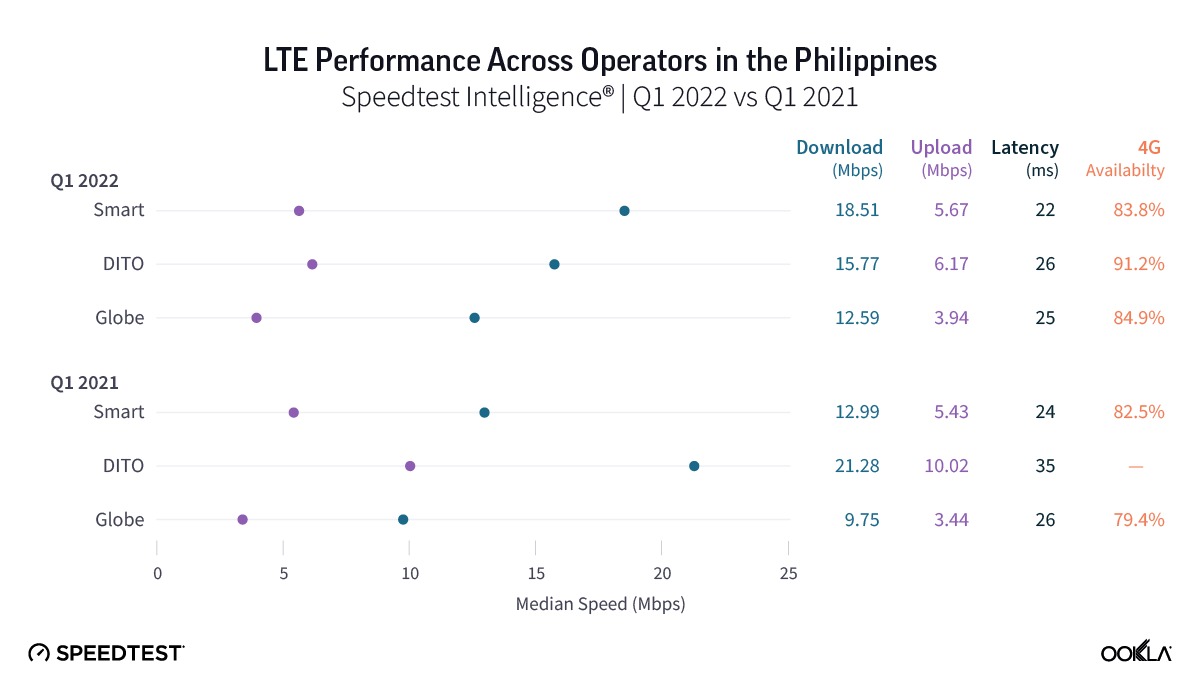

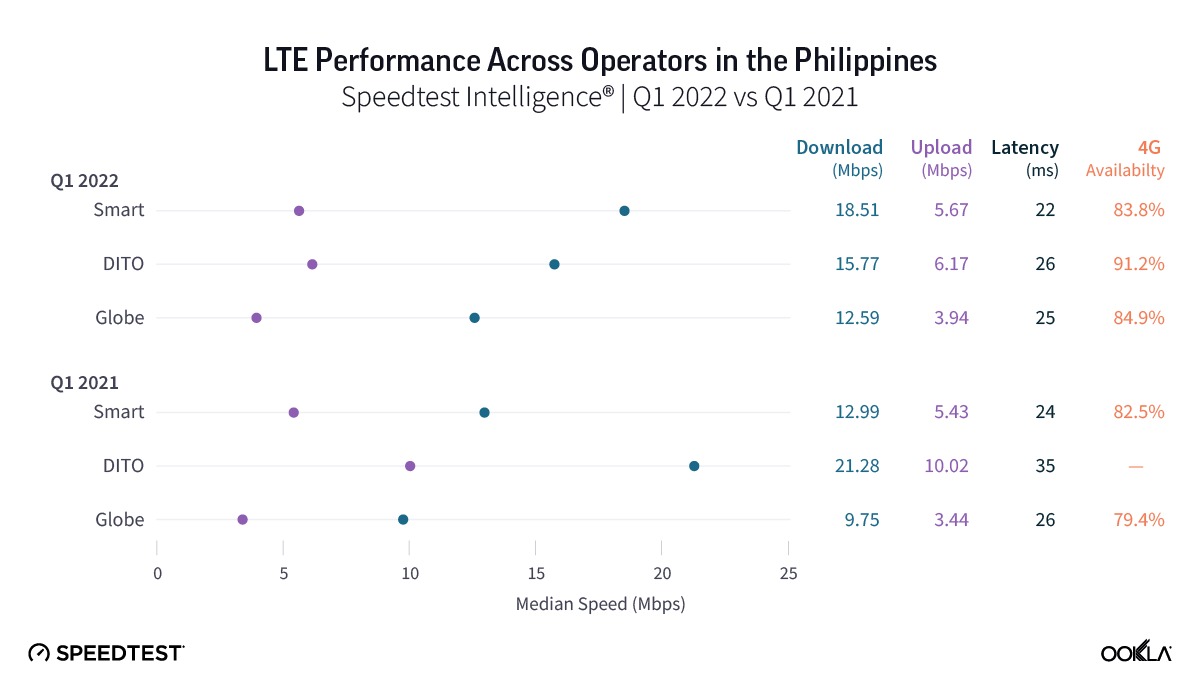

Smart leads on median 4G download speed; DITO on 4G Availability

Using Speedtest Intelligence® data, we analyzed LTE Performance in the Philippines comparing Q1 2021 (when DITO commercially launched), and Q1 2022 (almost one year of DITO being in operation). The overall LTE performance has improved — increasing from 11.15 Mbps in Q1 2021 to 15.53 Mbps in Q1 2022. Smart came first in terms of median LTE download speed in Q1 2022, at 18.51 Mbps followed by DITO (15.77 Mbps) and Globe (12.59 Mbps). However, Dito’s median 4G speeds have decreased over a space of a year, which is quite common as a network gets more congested. Latency, on the other hand, has improved across all operators, especially DITO which recorded latency of 26 ms in Q1 2022 versus 35 ms in Q1 2021.

Analysis based on data from Speedtest Intelligence shows that 4G Availability — the proportion of users on all devices who spend the majority of their time connected to 4G technology — has also improved to 84.8% in Q1 2022 from 80.6% in Q1 2021. One important distinction to bear in mind is that while 4G/5G Availability measures the time users spend on a 4G or 5G technology, coverage is a measurement of space and geo-spatial availability. Therefore, operator’s network coverage is just one part of the story. Compatible handsets, SIMs, and tariffs are important factors that influence it.

Since DITO is a 4G-only operator, it is not surprising that it also had the best 4G Availability in Q1 2022 (91.2%), ahead of Globe (84.9%) and Smart (83.8%) that provide access to all network technologies 2G, 3G, 4G, and 5G. Additionally, DITO, despite facing challenges raising funding, plans to invest PHP 50 billion ($915 million) during 2022 in the network roll out in order to adhere to its license obligations, which we outlined here, that specify its population coverage and network speeds.

Other operators also continue to commit capital expenditures for network investment. For instance, Globe Telecom earmarked PHP 89 billion ($1.6 billion) for CAPEX this year, and in Q1 2022 already spent PHP 21 billion ($384 million) — 10% higher than a year before, of which 82% was dedicated to data network builds “to help boost mobile and internet experiences for a greater number of Filipinos.” The operator has set a goal of building more than 1,700 new cell sites across the country in 2022 to extend its geographic reach and to expand beyond the 1,407 sites it deployed in FY21. In the first three months of this year it built out 234 cell sites nationwide, upgraded 2,344 mobile sites to 4G, and installed 380 5G sites.

Our analysis suggests that DITO’s entry combined with regulatory changes, resulted in more network investment and an overall improvement in 4G coverage and performance across all operators. As such, Smart reported that on December 31, 2021, Smart had a total of 38,600 4G/LTE base stations, which has further increased to 39,500 in Q1 2022. This corresponds to population coverage across Smart’s 3G, 4G and 5G networks of 97% in Q1 2022. The majority of devices (81%) are “latched” onto the operator’s 4G network.

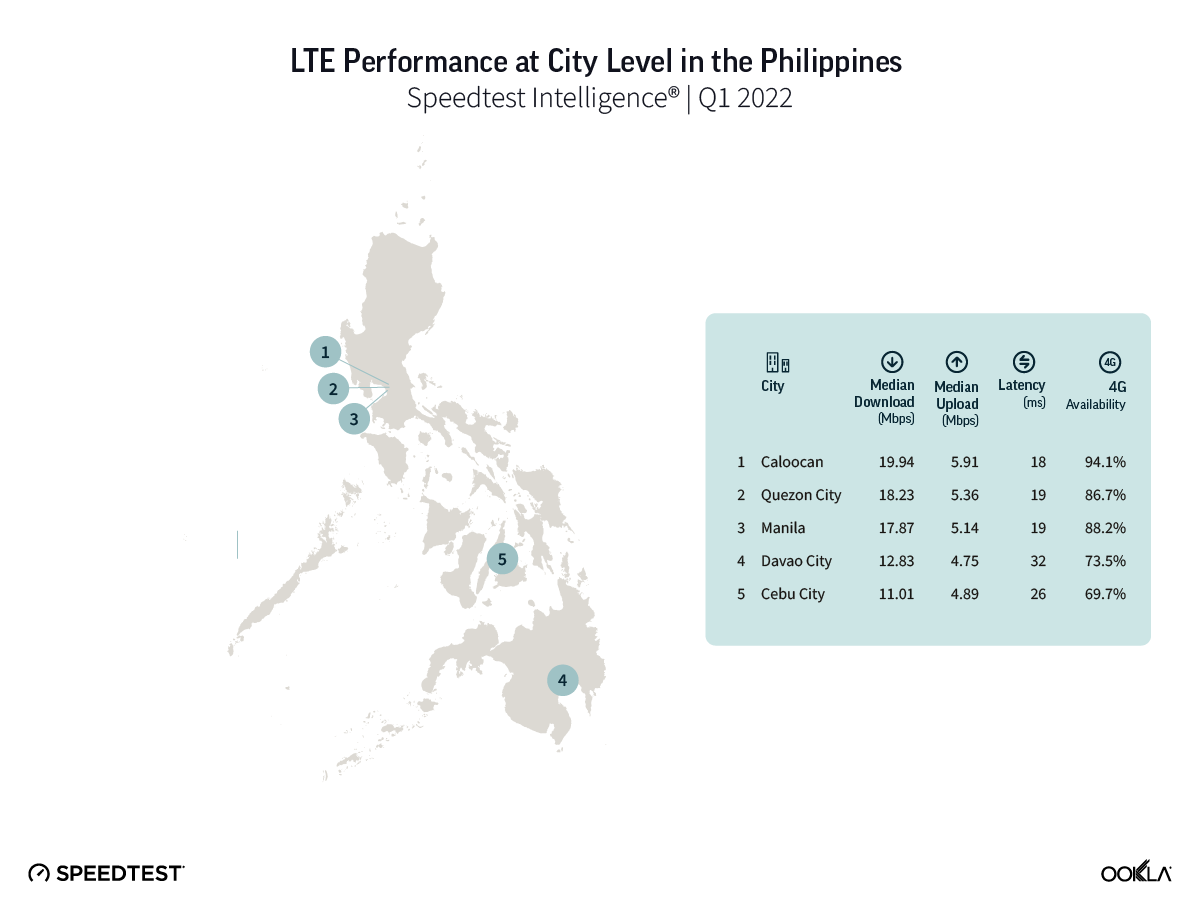

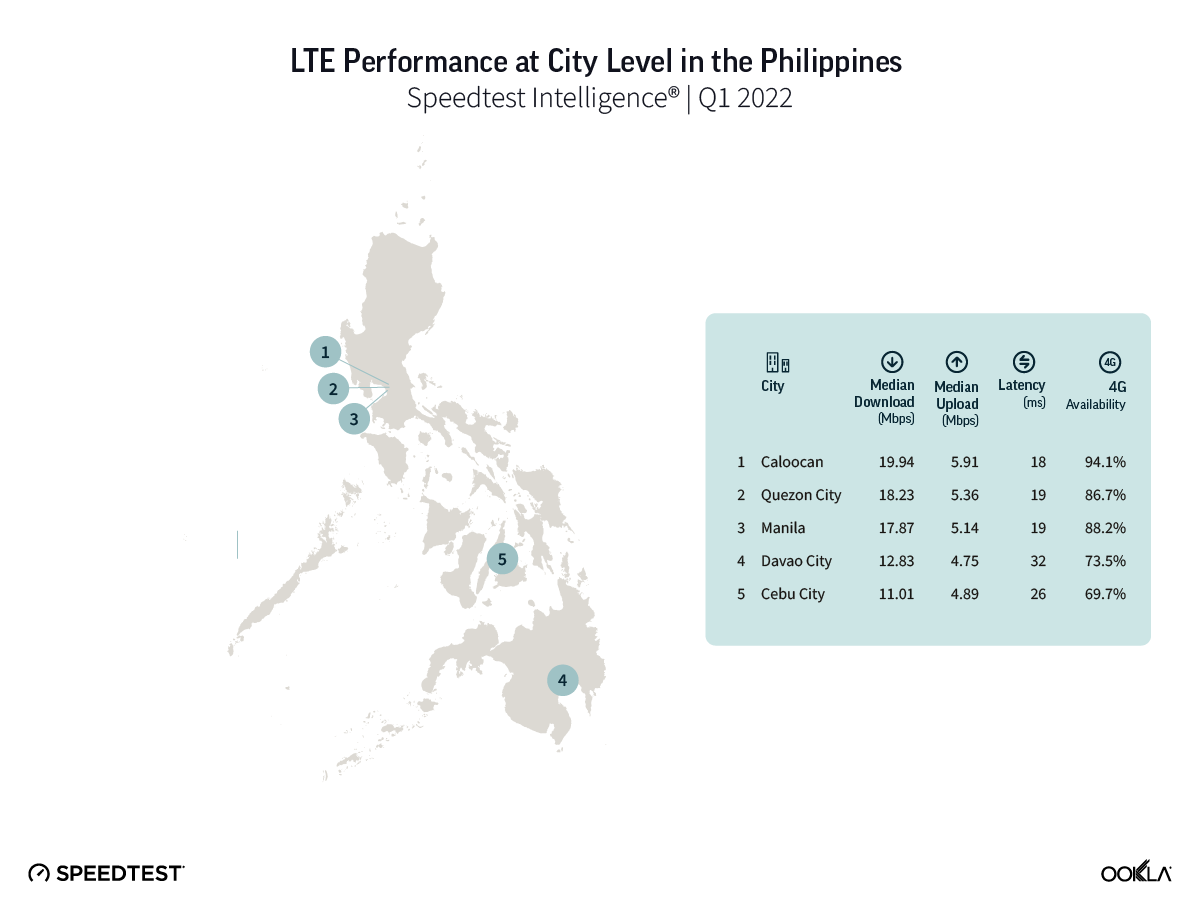

Caloocan led on 4G speeds and 4G Availability

In the Philippines, up to one third of its population resides within Metro Manila, which comprises 16 cities, including the three most populous cities: Quezon (2.9 million), Manila (1.8 million), and Caloocan (1.6 million). Manila, the capital city, is one of the most densely populated cities in the world. Caloocan, Quezon, and Manila came closely together in terms of 4G performance. Smart came first in those three cities: Caloocan (28.66 Mbps), Quezon City (28.24 Mbps), and Manila (30.88 Mbps). DITO was fastest in Cebu, it recorded a 16.60 Mbps median download speed in Q1 2022 but its median upload speed was on par with Smart. While in Davao City, the biggest city outside of Metro Manila, DITO and Smart went head to head with 7.17 Mbps and 6.86 Mbps median download speed, respectively.

Based on Speedest Intelligence data, Caloocan performed best in terms of 4G Availability but 4G Availability improved across all five cities. Quezon and Manila showed the best year-on-year improvement, increasing its 4G Availability from 81.8% in Q1 2021 to 86.7% in Q1 2022 (Quezon) and 83.5% to 88.2% (Manila). Despite being a challenger, DITO managed to come first in terms of 4G Availability in a number of locations: Caloocan (98.3%), Cebu (80.0%), and Davao City (88.9%). Globe won 4G Availability in Quezon (88.3%) while there was not a sufficient statistically significant difference in Manila to declare a winner.

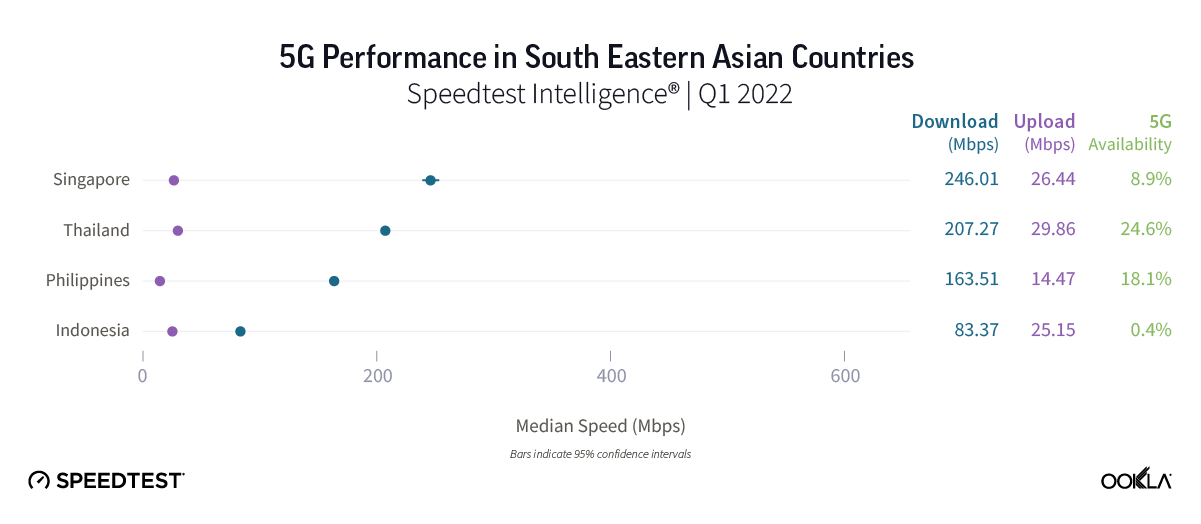

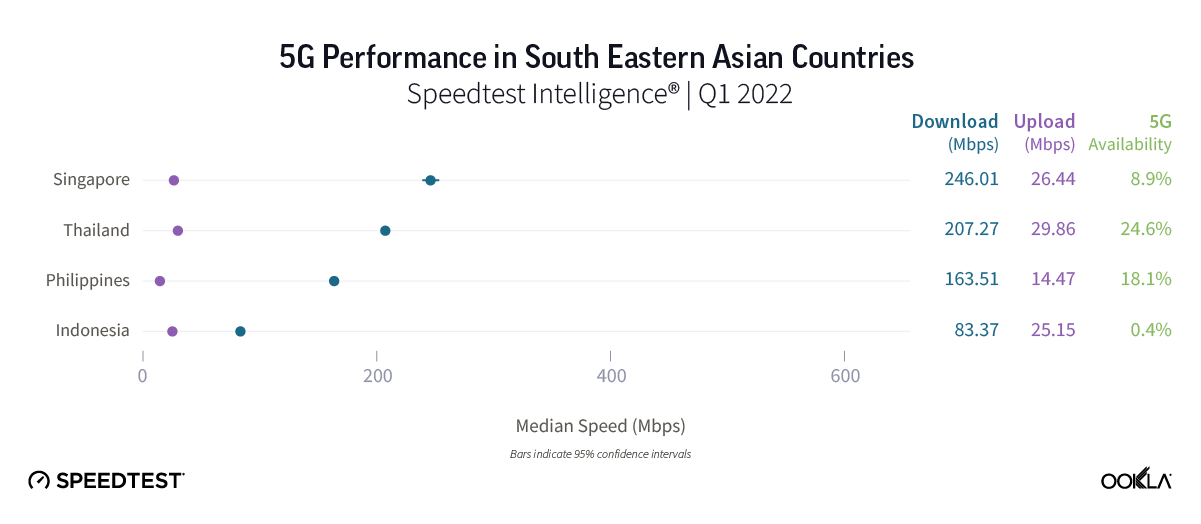

The Philippines fared well in 5G performance and 5G Availability

According to Speedtest Intelligence data, Singapore led Southeast Asian on median 5G upload speeds in Q1 2022, Thailand and the Philippines followed with 207.27 Mbps and 163.51 Mbps median download speed, respectively. We commented on the Singaporean roll out strategy in our recent article.

In terms of 5G Availability, (the proportion of users on 5G-capable devices who spend a majority of their time on 5G networks), Thailand came first among its regional peers. Thailand was one of the first markets to launch 5G in the Asia Pacific region, with AIS and TrueMove H both launching commercial 5G services in Q1 2020, shortly after the conclusion of the country’s 5G auction. In the Philippines, 5G Availability was 18.1% in Q1 2022, ahead of Singapore (8.9%) and Indonesia, where operators launched 5G in select cities in June 2021, which explains the very low 5G Availability in Q1 2022 at 0.4%.

The Philippines looks to 5G to achieve imperative digital transformation

The importance of 5G technology and its role in enabling digital transformation is one of the pillars of the National Broadband Plan (NBP) approved in 2017. It outlines strategies and initiatives that should be taken to increase accessibility, affordability, and network quality. NBP also addresses policy and regulatory issues, such as spectrum, infrastructure policy, and modernizing regulations. Apart from the release of 5G spectrum in 3.3 GHz and 3.5 GHz bands, the Filipino government also supports 5G via a technology neutral policy, where all existing frequency bands can be used for 5G deployment.

Spectrum is one part of the puzzle

Various blocks of spectrum in and around 3.5 GHz have been awarded on a technology-neutral basis and are suitable for 5G usage. For instance, Smart, in its Q1 2022 results, reported that its 1800 MHz frequencies, previously used for 2G service, were being reallocated to provide 4G LTE service to handle the increased volume of data traffic. In addition, the newcomer, DITO, was awarded various blocks of frequencies, including spectrum at 700 MHz, 900 MHz, 2000 MHz, 2100 MHz, 2600 MHz, 3300 MHz, and 3500 MHz.

Sharing passive infrastructure

The terrain of the country poses substantial challenges related to network deployments — the Philippines comprises around 7,640 islands — about 2,000 of which are inhabited. To expedite the construction of telecom towers, especially in the unserved and underserved areas, the DICT issued guidelines on Shared Passive Telecommunications Tower Infrastructure (PTTI). The Philippines government has been pushing since September 2018 to attract investment from international tower companies by promising to streamline the cumbersome procedures required to build and connect towers. Operators are also looking to rationalize their tower portfolio: in April 2022, PLDT sold its towers for PHP 77 billion ($1.4 billion) to Axiata’s Edotco unit and EdgePoint Infrastructure. This is to support DICT’s goal of improving tower density via tower sharing. PLDT/Smart retained ownership of the active infrastructure such as antennas, radios and fiber backhaul, TowerCos own the passive infrastructure. Globe isn’t averse to selling its passive infrastructure either, as it works with various tower companies for its network rollout. The newcomer, DITO, had to catch up pretty fast in terms of network buildout — since 2019 it built close to 5,000 cellular towers, over 100 data centers, and laid out more than 30,000 kilometers of fiber cable.

Fortifying infrastructure to ensure network resiliency

Another challenge is the country’s propensity to natural disasters. Ookla’s data showed that the country’s internet speed saw a slight decline in January 2022, due to infrastructure damages brought in 22 provinces by Typhoon Odette. To future-proof the network for that, PLDT launched a project to deploy additional submarine fiber links to upgrade connectivity in Luzon. The project will replace old domestic fiber optic network (DFON) links and enhance the resiliency of PLDT’s network, and fortify existing aerial cables with underground inland cables to ensure network resiliency.

Furthermore in March 2022, DICT unveiled a plan to spend PHP 50 billion ($915 million) over the next three years, to improve the country’s digital infrastructure, as within two years only 2,000 towers out of 50,000 needed have been built.

Smart wins the 5G game in the Philippines

5G continues to advance in the Philippines. The operators have launched 5G mobile networks in 2020, not long after the Thai operators. Globe initially launched 5G technology for Fixed Wireless Access (FWA) in selected towns in June 2019, followed by 5G enhanced Mobile Broadband (eMBB) in February 2020 in Metro Manila, at the start available to premium “Globe Platinum” customers. Smart launched 5G network in July 2020, originally targeting postpaid subscribers in Metro Manila that had Smart-certified handsets — including devices from Huawei, Samsung, RealMe and Vivo — and 5G-activated SIM. Both operators utilized spectrum in the 3,500 MHz band, which is considered the sweet spot in terms of 5G network capacity and coverage. Our data shows that Smart recorded 200.43 Mbps median download/19.67 Mbps median upload speed in Q1 2022 ahead of Globe’s 121.29 Mbps download/ 9.93 Mbps upload.

Country-level 5G Availability almost doubled within a space of a year — from 9.4% in Q1 2021 to 18.1% in Q1 2022. Part of this is related to easing of the Right of Way (RoW) rules, which were adapted and rewritten in March 2021, when the Department of Public Works and Highways (DPWH) issued an order lifting the ban on the construction of critical infrastructure, particularly cell sites, along national roads. The Philippines are not the only country that benefits from RoW reform. In October 2021, India’s Department of Telecommunications (DoT) revised the Indian Telegraph Act Right of Way (RoW) rules which makes it easier to install aerial optical fiber cable in the country. To circumvent digging into the streets to lay fiber, the idea of deploying overhead fiber on street furniture such as light poles and traffic lights has been put forward.

Smart led in terms of 5G Availability, it reached 25.5% in Q1 2022, ahead of Globe (15.3%), due to different spectrum deployment strategies these operators take. Smart had 1.6 million connected 5G unique devices on its network in Q1 2022, more than triple the level than a year prior (376,000 in Q1 2021) while at end-March 2022, Globe logged over 2.0 million devices in its 5G network.

The operators plan further investment in 5G. In its Q1 2022 results, Smart’s parent company — PLDT — revised its 2022 CAPEX guidance to PHP 85 billion from PHP 76-80 ($1.39 – $1.46 billion) due to increased investment in the 5G rollout in different parts of the country. In December 2021, the US Trade and Development Agency (USTDA) awarded a grant to Smart to expand 5G to 96% of population and to support Smart’s investment in equipment and services from Cisco Systems. In Q1 2022, Smart reported its mobile data traffic grew 30% year-on-year to 1,010 petabytes. The number of its 5G base stations increased from 5,000 in 2020 to 7,300 in February 2022, corresponding to 66% 5G population coverage in Q1 2022. Aside from boosting its 5G network rollout, Smart introduced new 5G services to attract and migrate more data users to 5G, Signature Plans+, the first postpaid line-up in the country featuring Unlimited 5G, and also introduced the country’s first Unli 5G data offers for prepaid subscribers in April 2021.

Globe added 390 new sites in the first three months of 2022, extending its 5G network reach to 95% of NCR (National Capital Region) and 84% of key cities in Visayas and Mindanao. In 2021, Globe spent PHP 92.8 billion to achieve 2,000 5G outdoor sites and in-building solutions, build 1,407 new cell sites, and install 1.4 million fiber-to-the-home lines. Globe’s 5G services utilize a virtual 5G core network to deliver both FWA and mobile broadband service in areas where fiber deployment is challenged by various permit and RoW issues.

DITO selected Nokia to deploy 5G services in the island of Mindanao in May 2021 to augment an existing partnership on 4G roll out. In March 2022, Dito started the rollout of its 5G home Wi-Fi service pilot in 146 villages in the Metro Manila area. Villages in the City of Manila, Caloocan City, and Quezon City will be the first to access up to 500 Mbps of download speed through the Dito 5G Home WiFi Starter Kit. DITO 5G network isn’t available widely, we have however seen some 5G tests in Caloocan, where the operator reached a 5G median download speed of 512.66 Mbps in Q1 2022.

Consumer attitudes improve

To assess whether there has been a shift in the consumer’s attitude towards mobile operators over the past year, we utilized Speedtest® Consumer Sentiment™ data, which is gathered from single-question surveys presented to users at the end of a Speedtest. This dataset provides rich insights into customer satisfaction over time, as well as competitive benchmarking, by providing data on both Net Promoter Score (NPS) and customers’ rating of their providers. Upon its entry into the market, DITO was rated most highly, which reflected its approach to winning customers’ mindshare. This, however, has changed — as of Q1 2022, Smart came first in ratings. Noteworthy though, is the overall improvement across operators, which is also linked with the mobile speeds increase.

Comparing NPS score to providers’ performance it is clear that better speeds impacted customer perception of operators. In Q1 2021, NPS for all cellular technologies was -34.53 with an average download speed of 6.47 Mbps, which improved to -25.32 in Q1 2022 (8.75 median download speed).

We’ll continue using data from Speedtest Intelligence to see how 4G and 5G in the Philippines improves with additional operator investment and how consumers benefit.

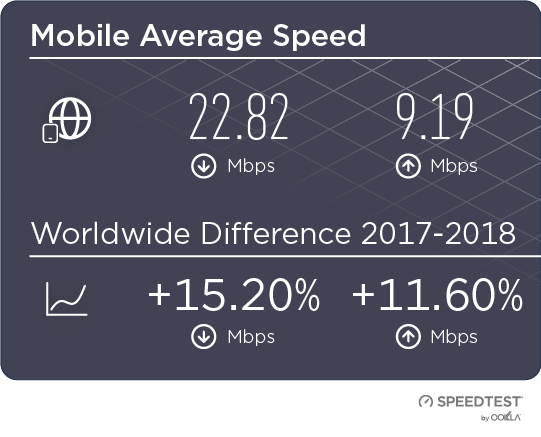

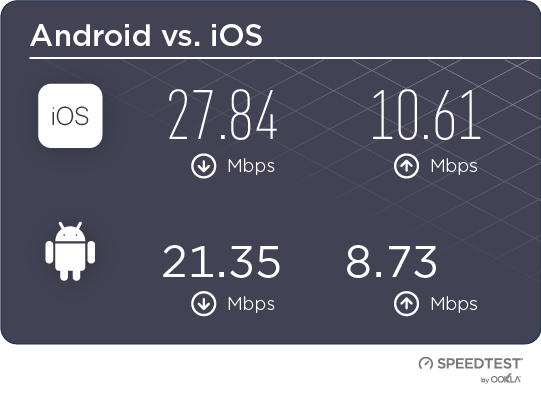

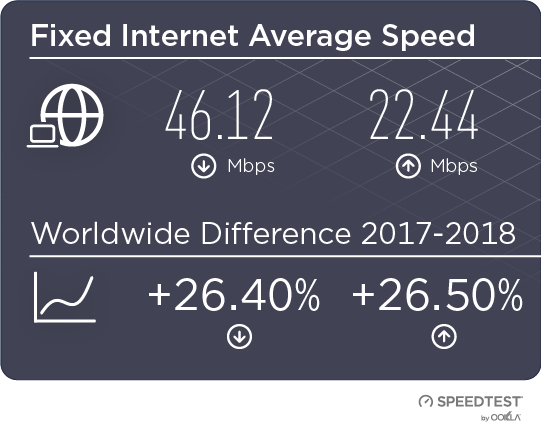

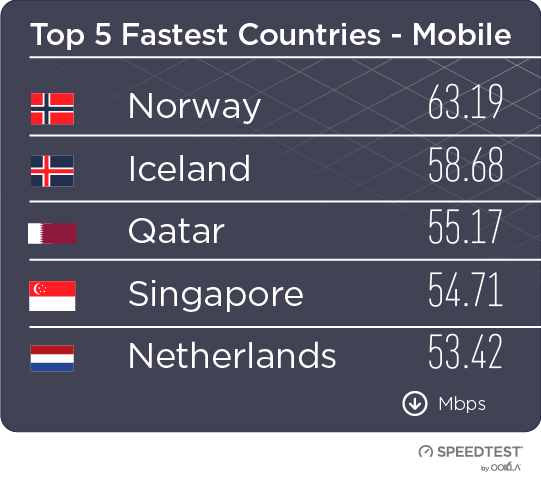

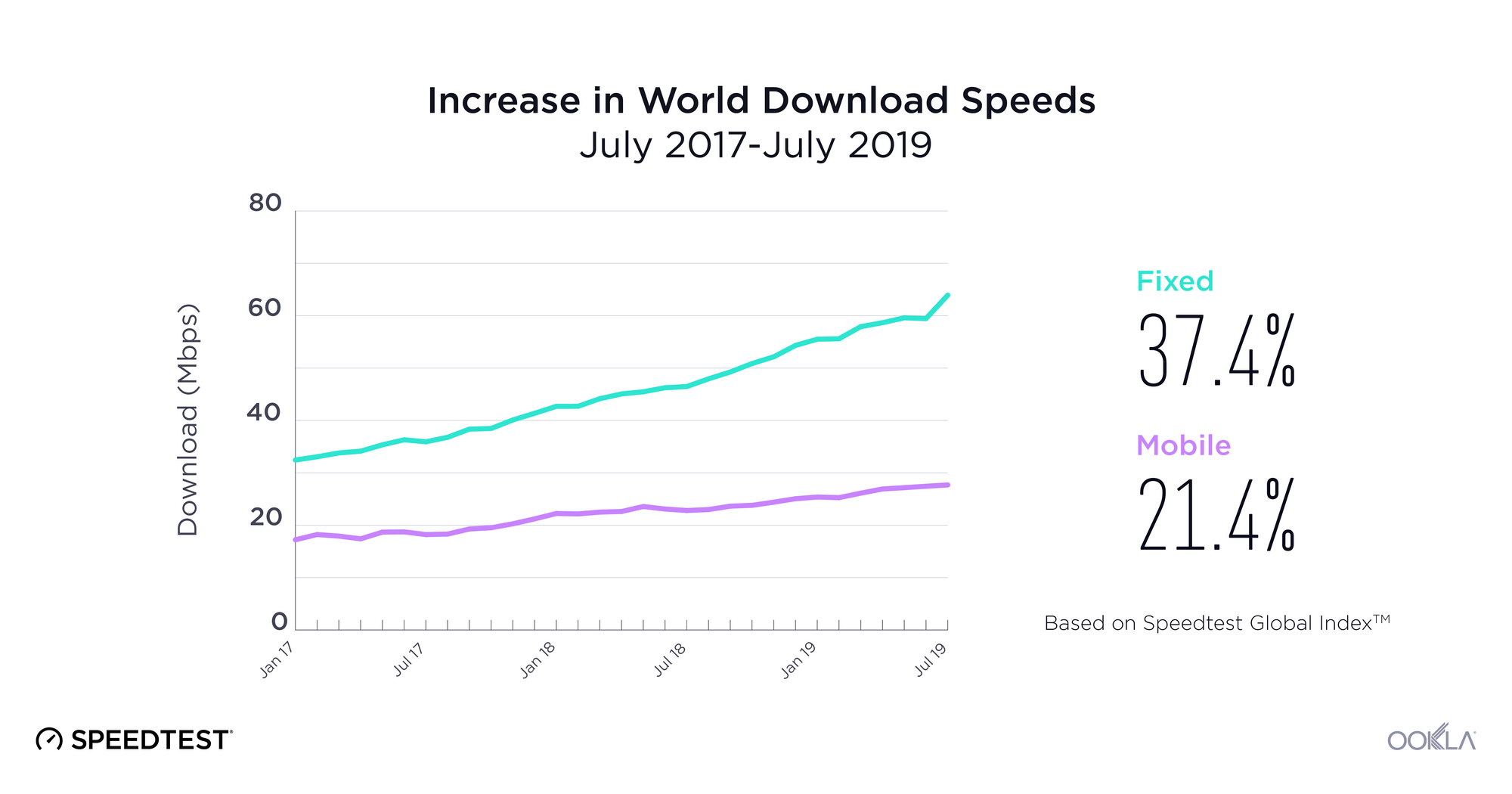

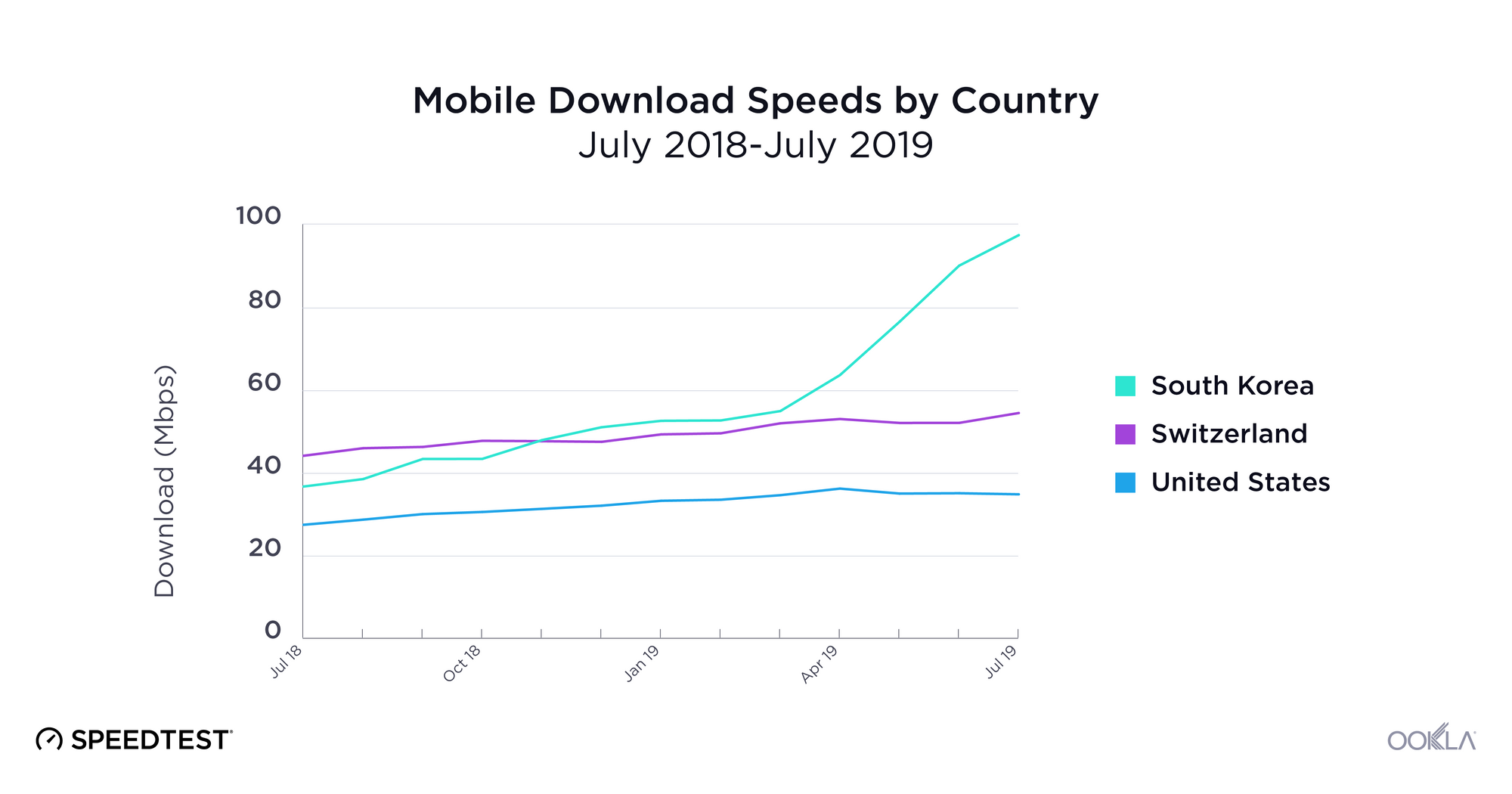

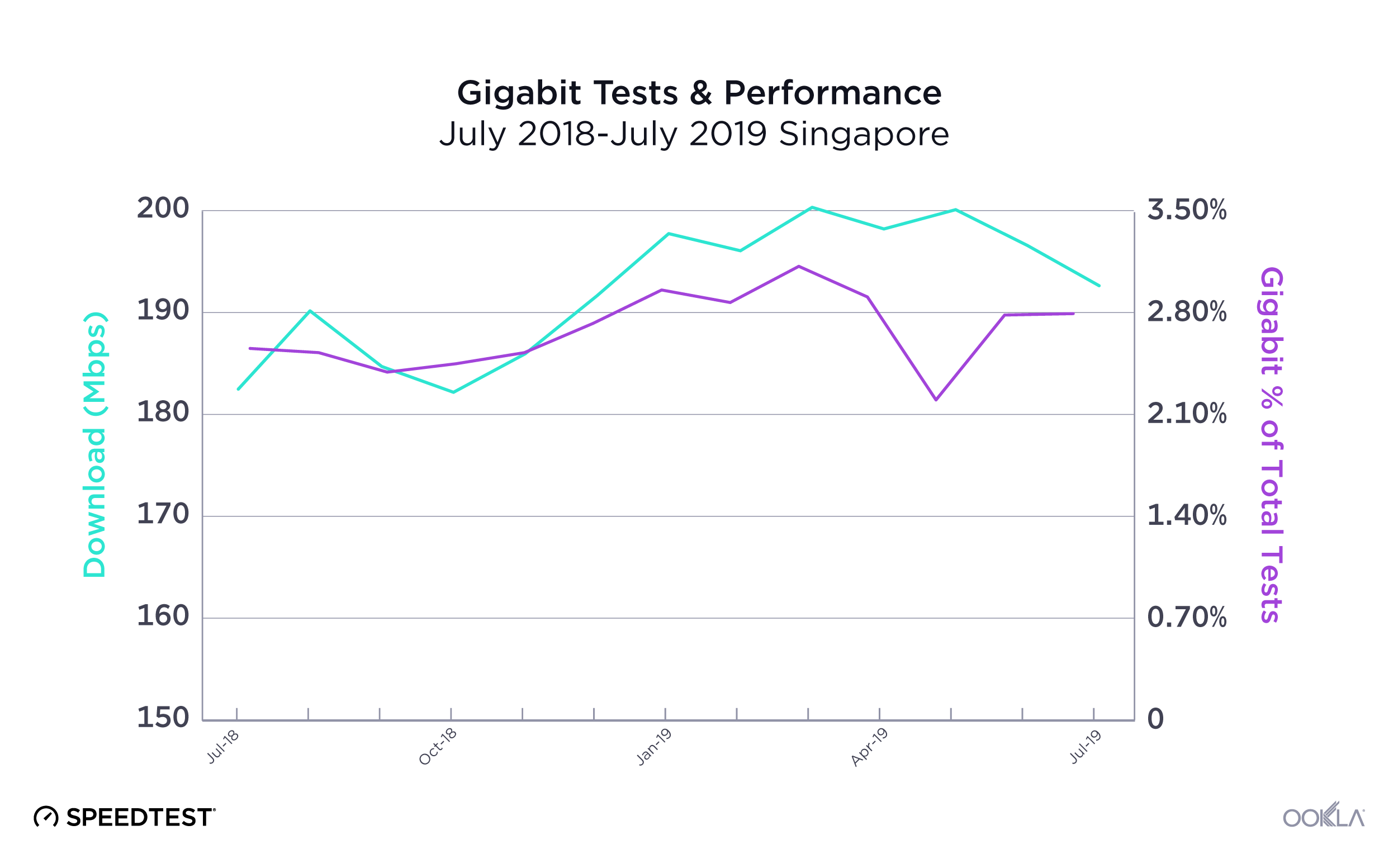

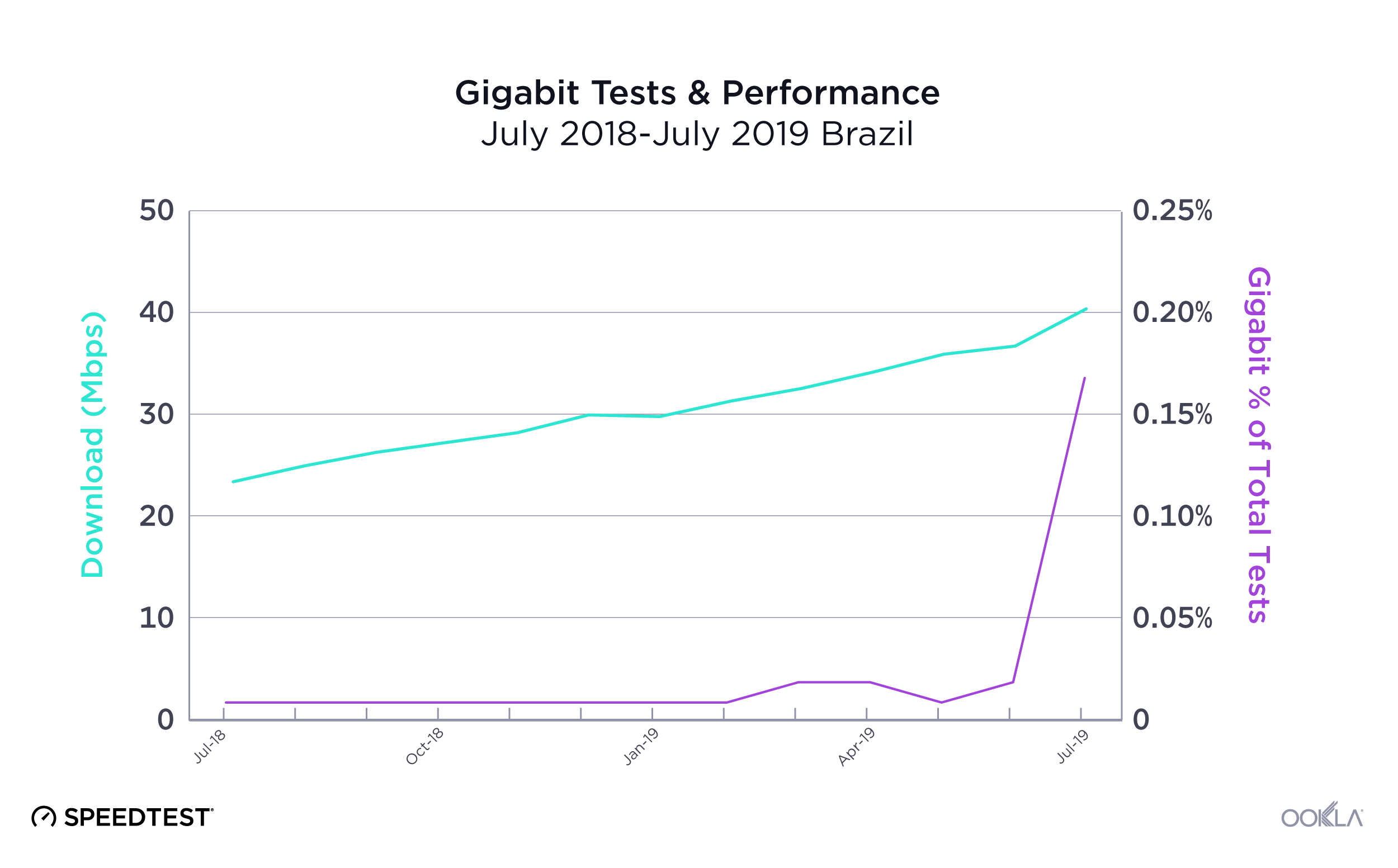

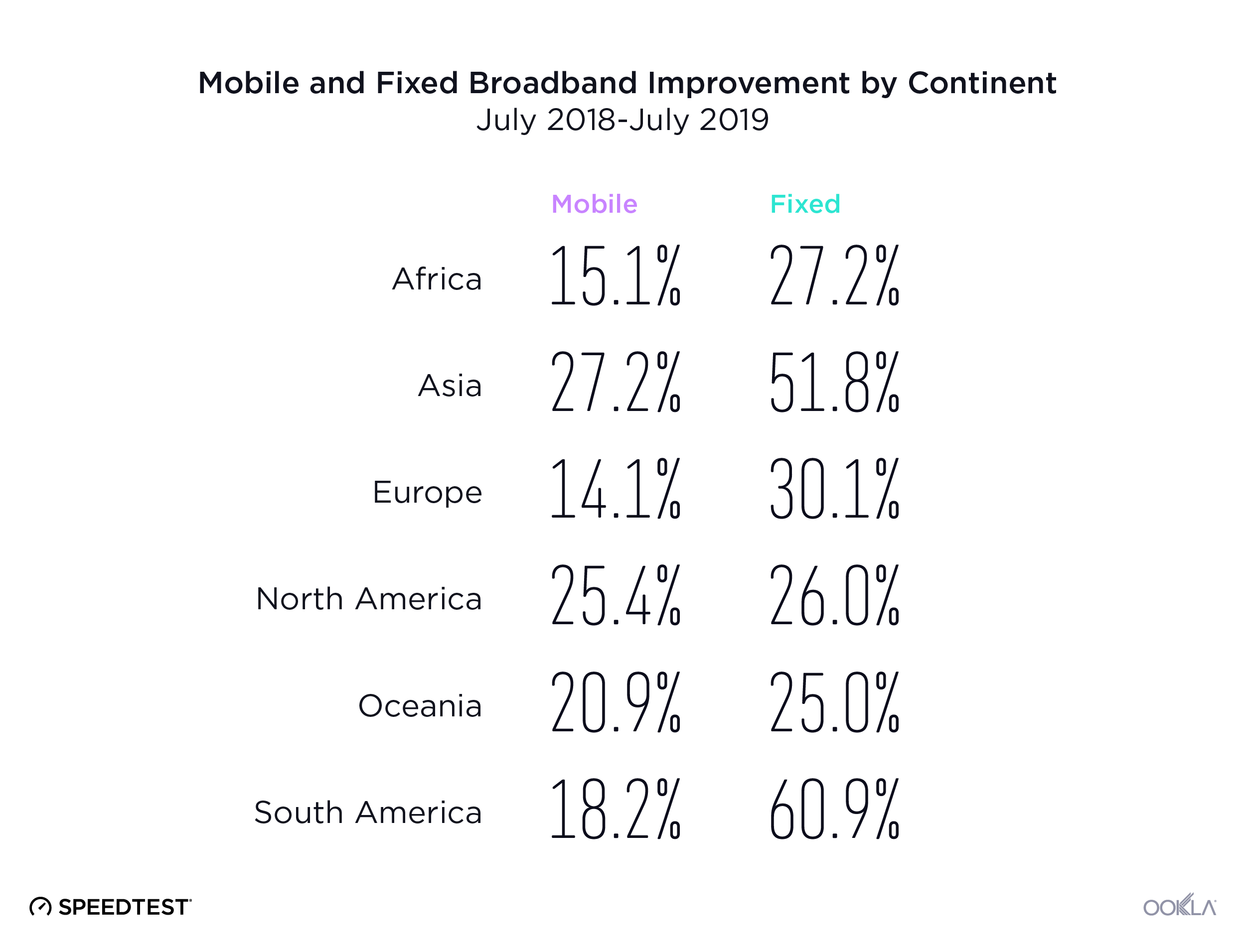

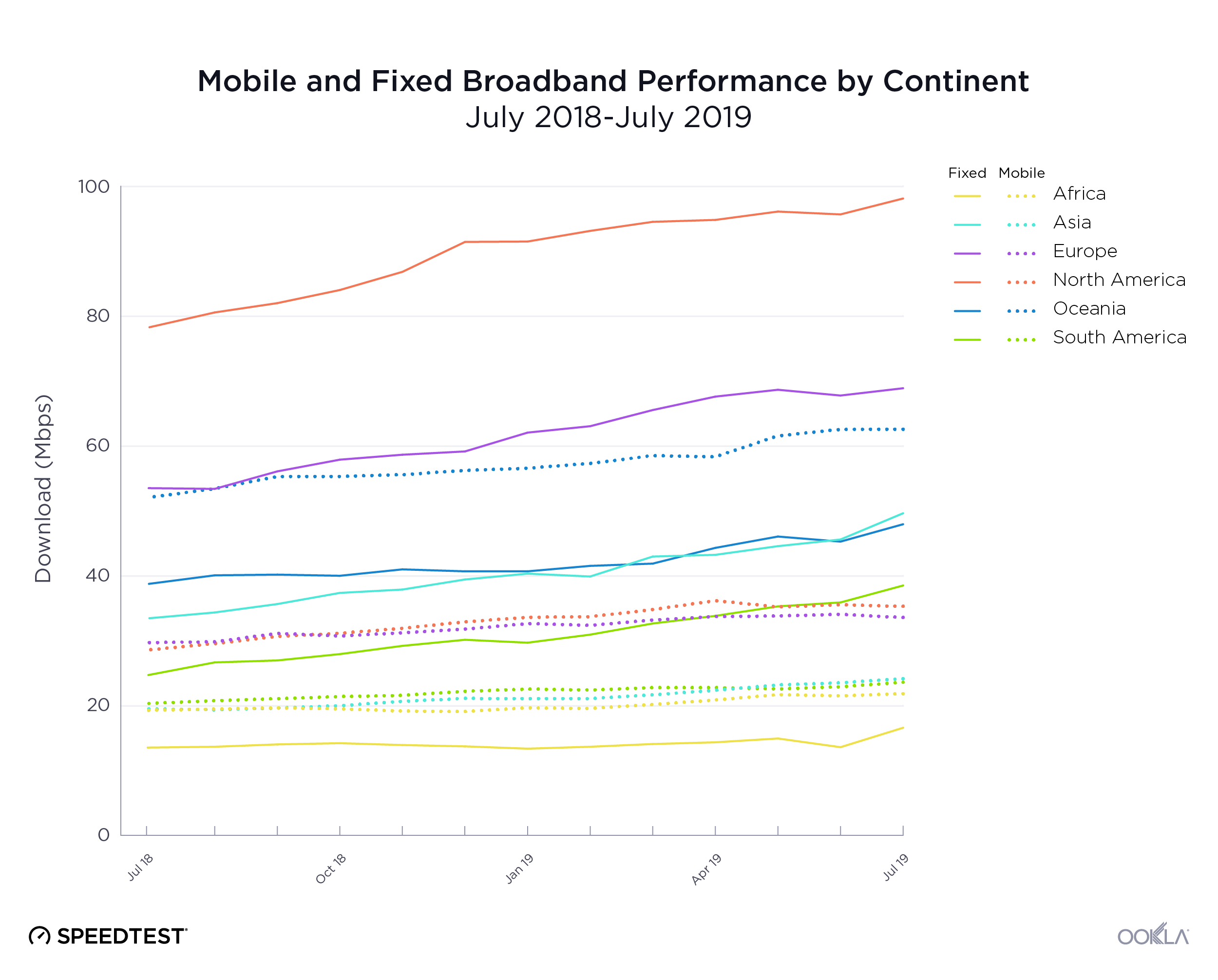

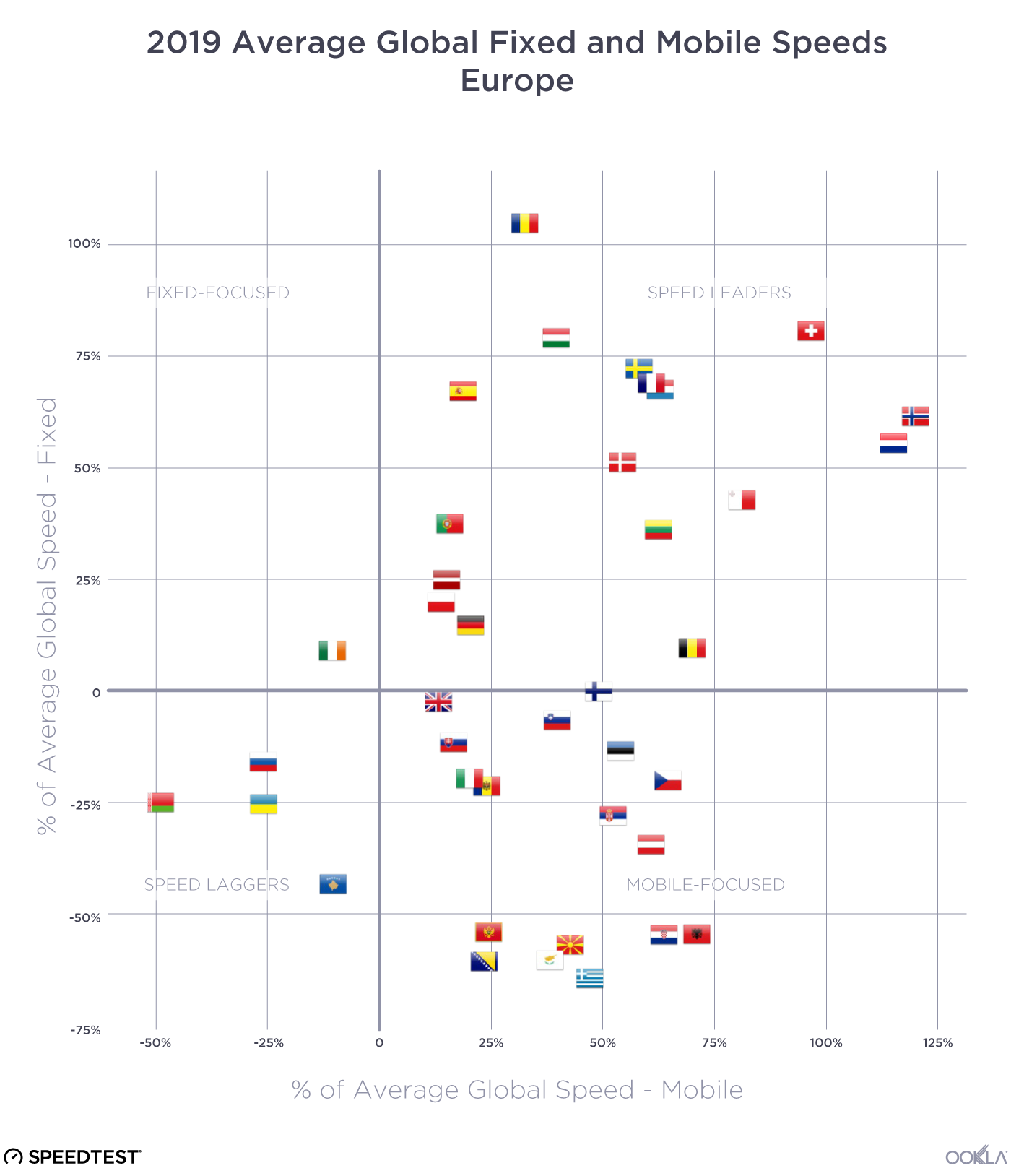

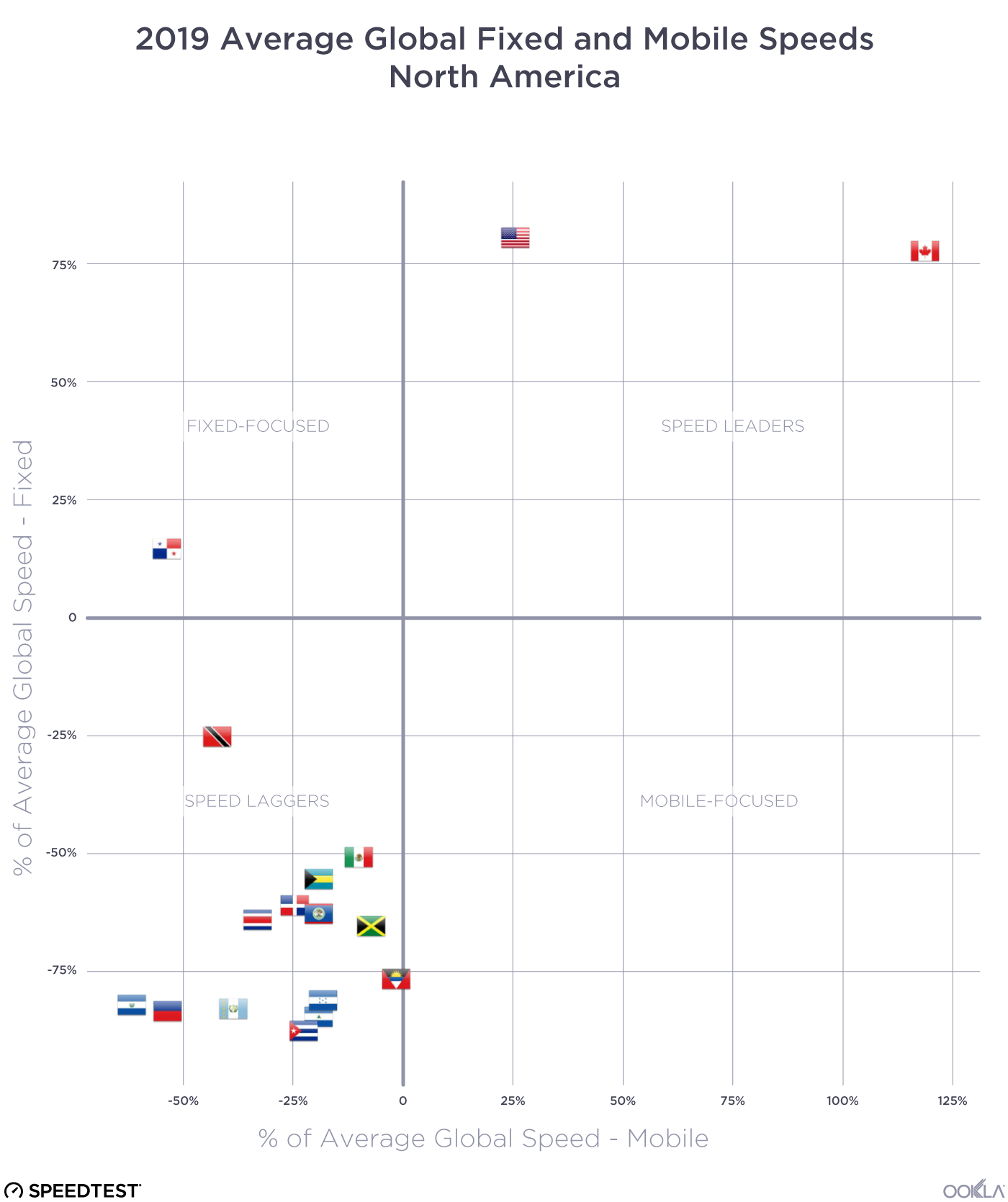

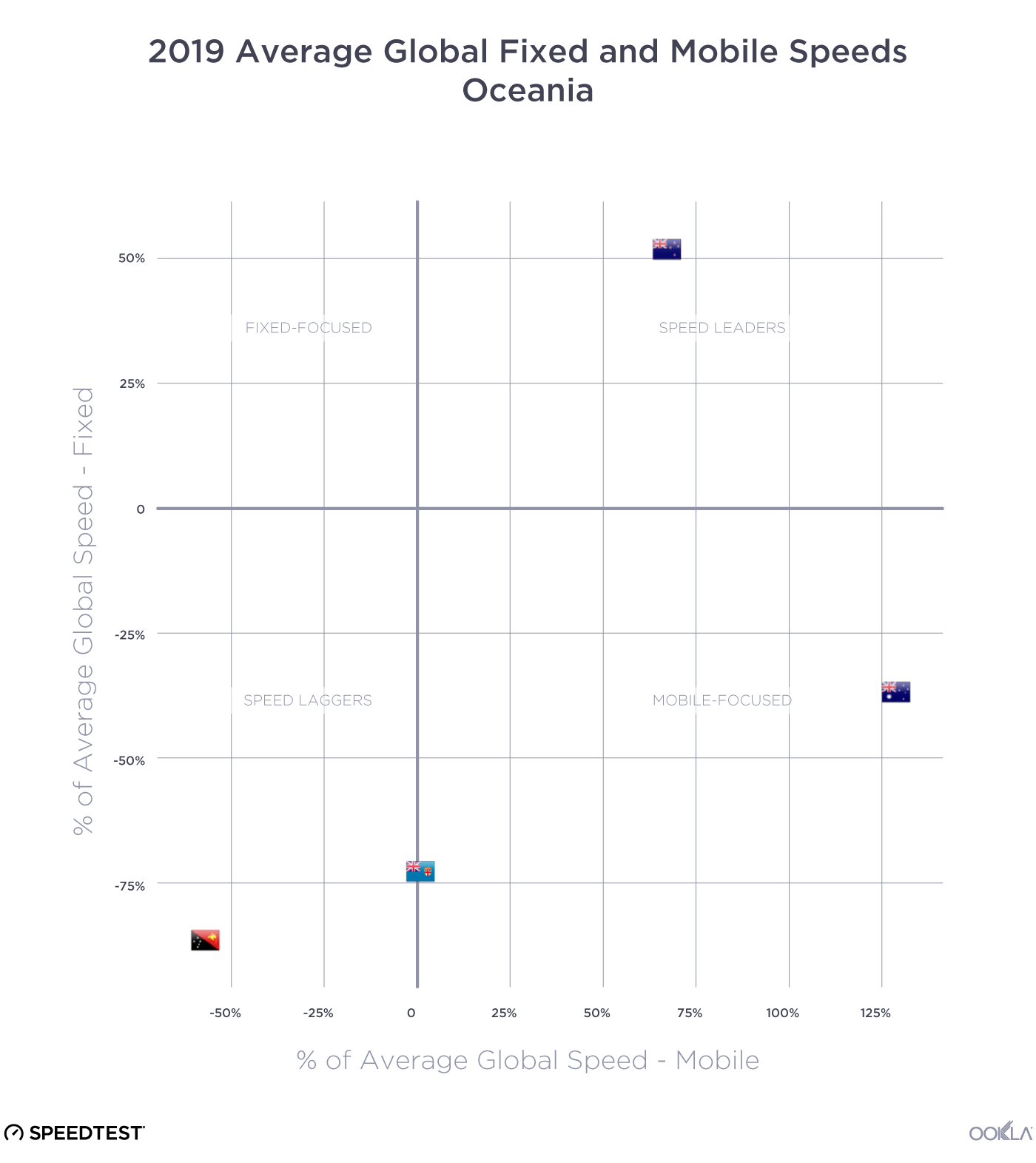

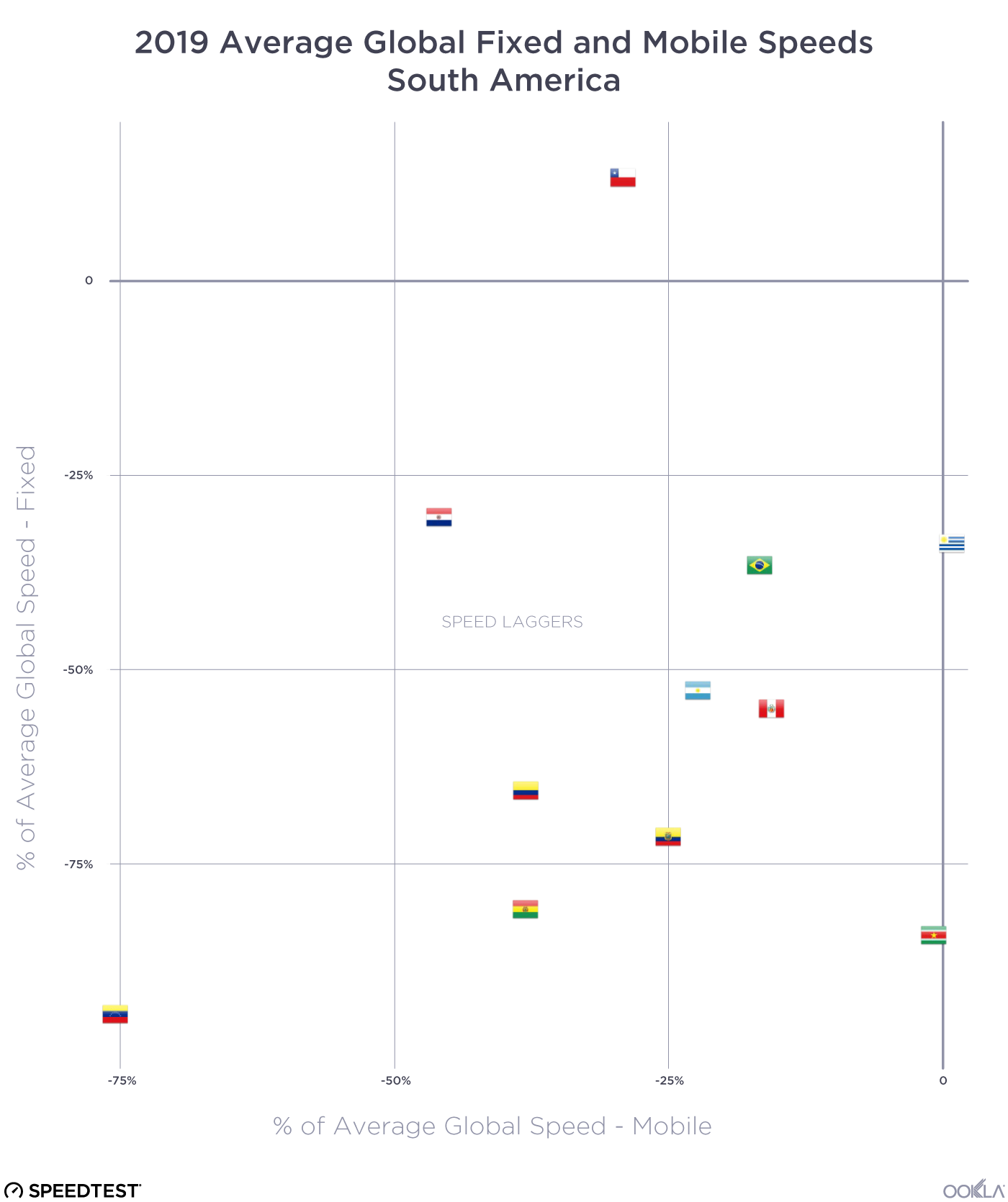

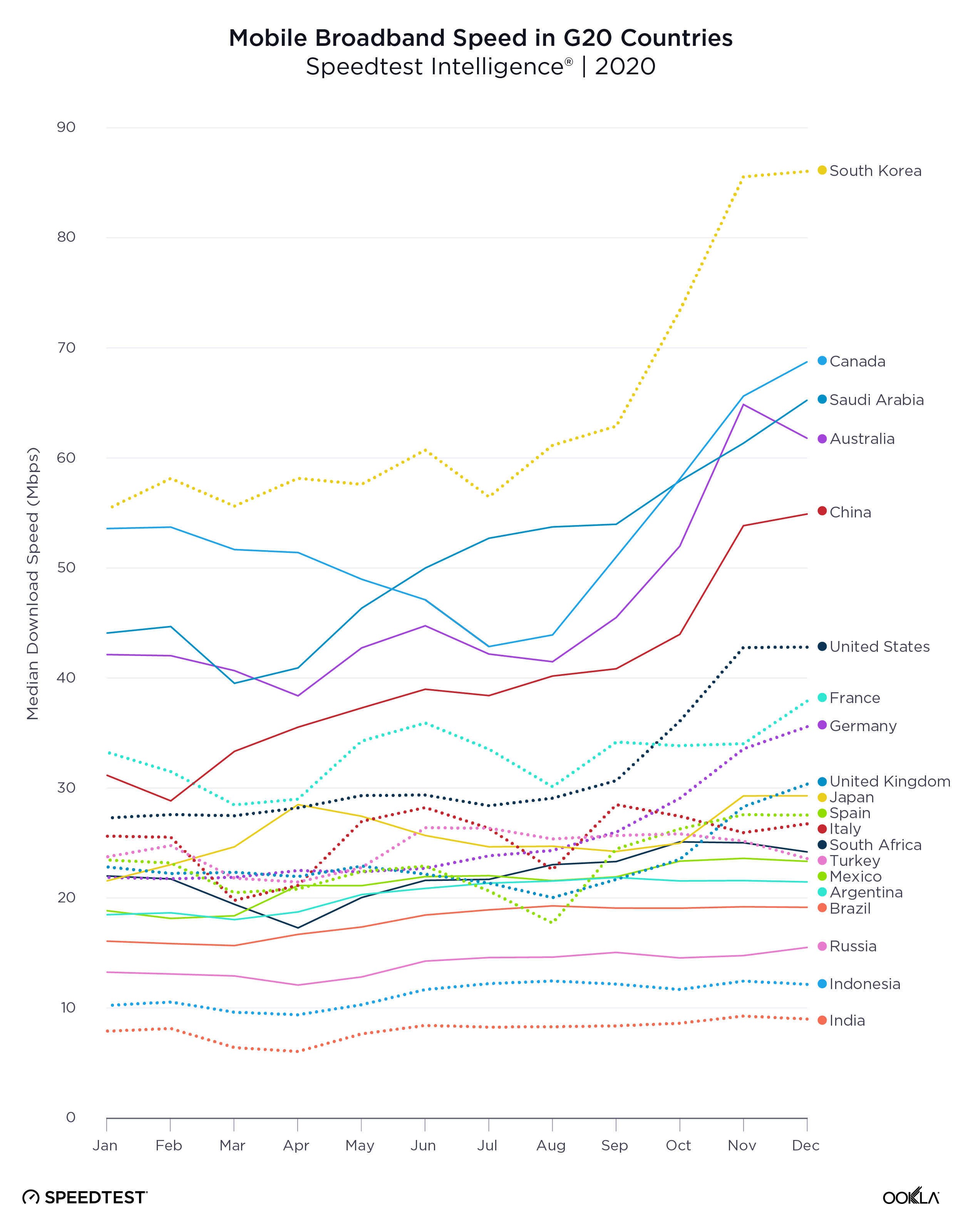

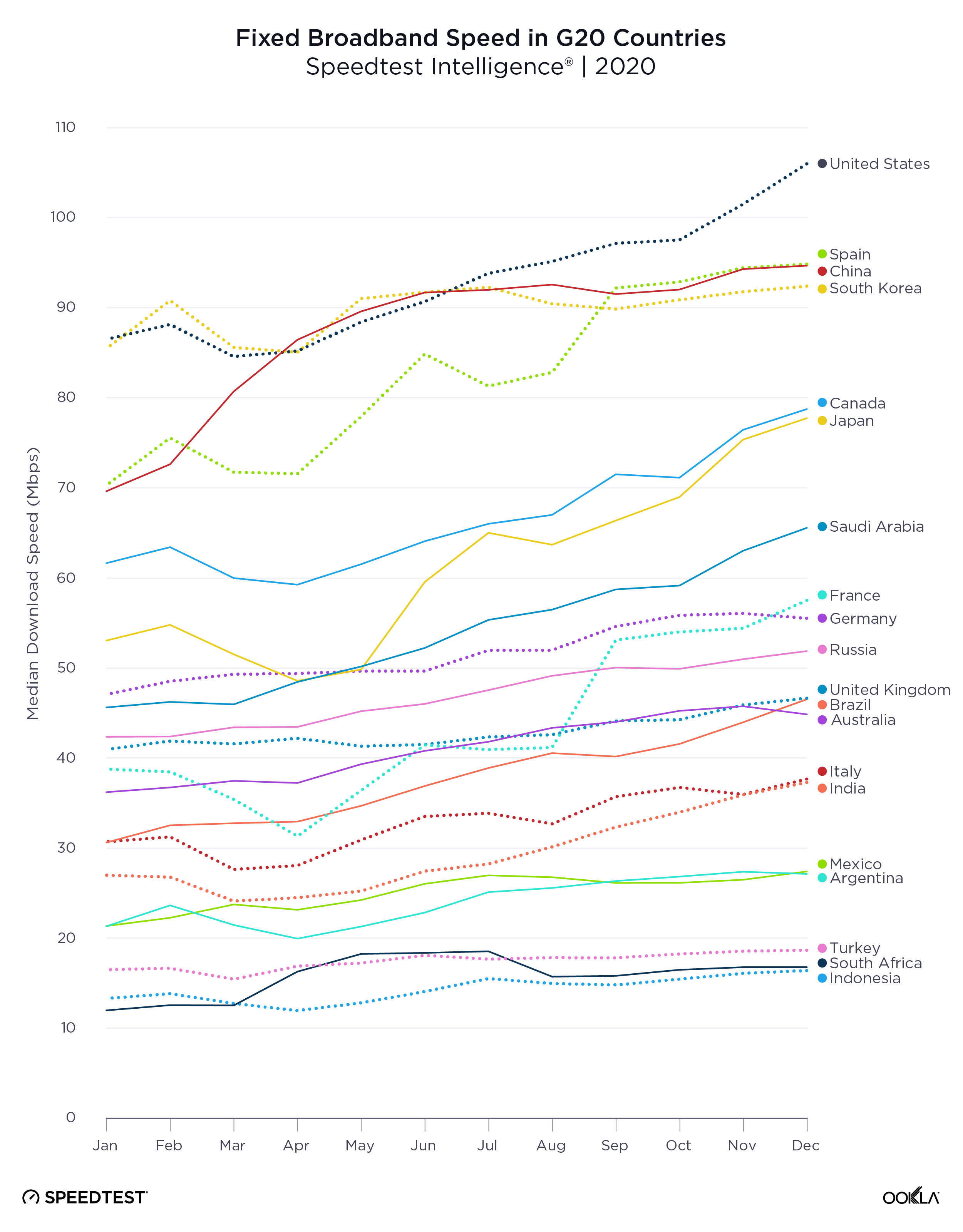

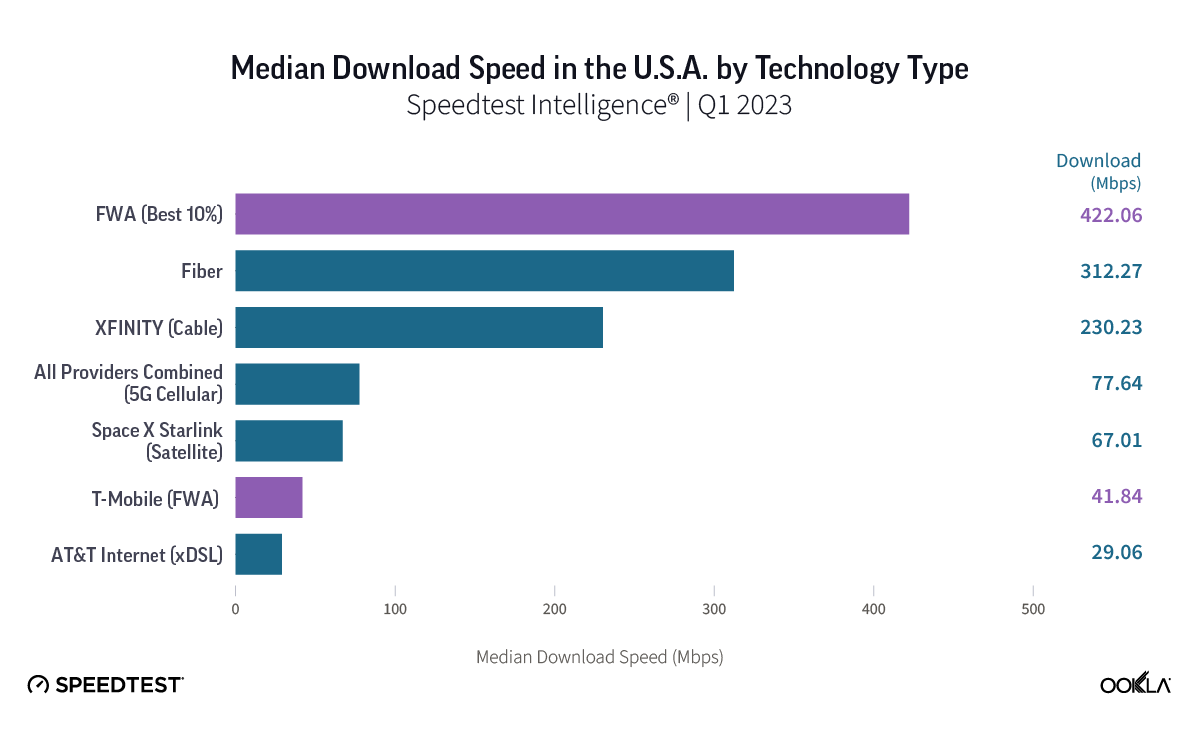

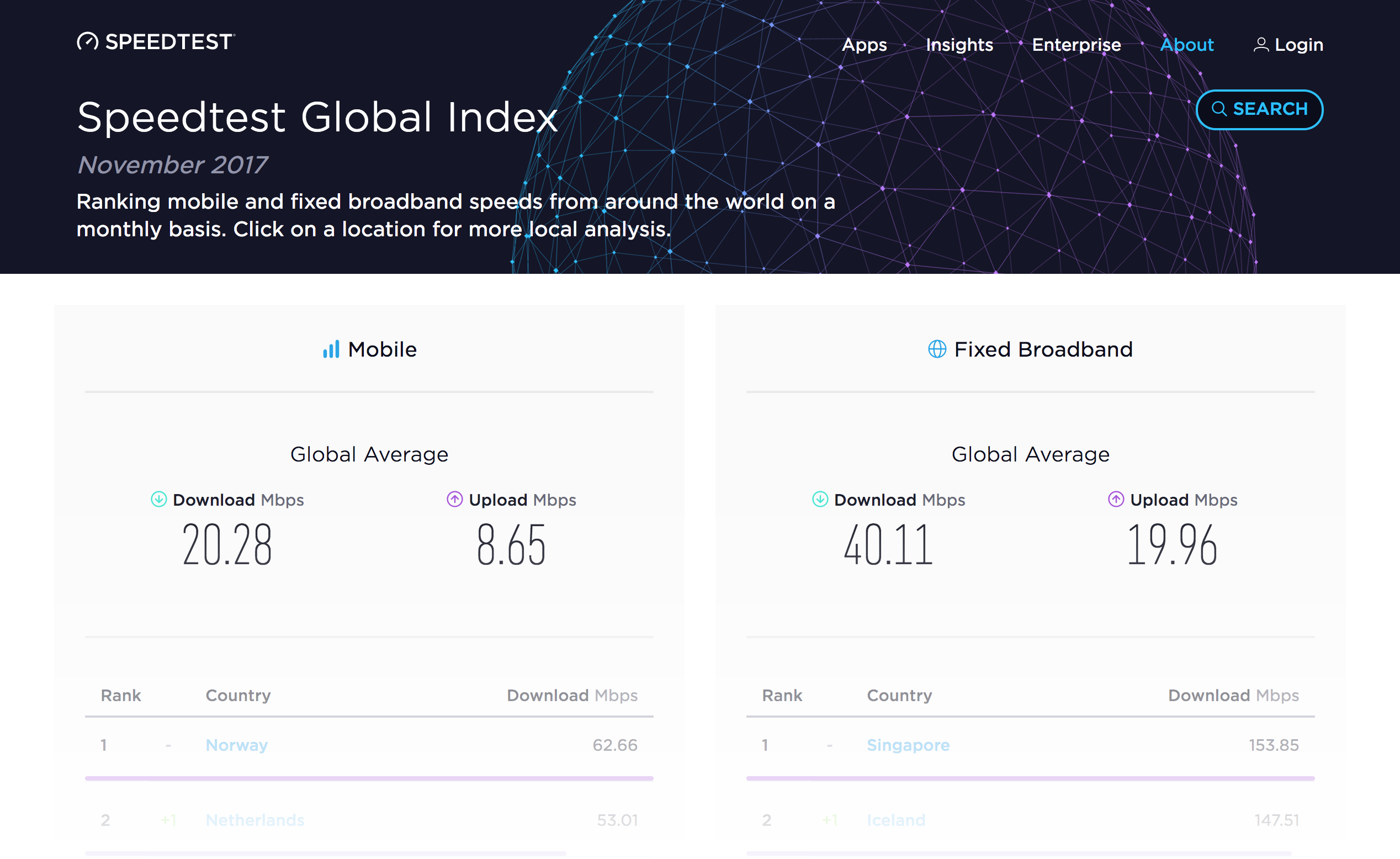

When it comes to the internet, the news is mostly good for 2018. Download and upload speeds are increasing across the globe on both mobile and fixed broadband. 5G is on the horizon and gigabit service is expanding.

When it comes to the internet, the news is mostly good for 2018. Download and upload speeds are increasing across the globe on both mobile and fixed broadband. 5G is on the horizon and gigabit service is expanding.