Ookla® Market Reports™ identify key data about internet performance in countries across the world. This quarter we’ve provided updated analyses for 48 markets using Speedtest Intelligence® and summarized a few top takeaways below. Click through to the market report to see more details and charts about the countries you’re interested in, including the fastest fixed broadband providers and mobile operators, who had the most consistent service, and 5G and device performance in select countries during Q2 2023. Jump forward to a continent using these links:

Africa | Americas | Asia | Europe | Oceania

Africa

- Cameroon: Speedtest Intelligence data showed no winner for fastest mobile operator in Cameroon during Q2 2023. blue had the lowest median mobile multi-server latency at 191 ms, while Douala had the fastest median mobile download speed among Cameroon’s most populous cities at 15.51 Mbps.

- Ethiopia: Safaricom had the fastest median mobile download speed at 35.19 Mbps during Q2 2023. Safaricom also recorded the lowest median mobile multi-server latency at 42 ms, and highest Consistency of 89.4%. Of Ethiopia’s most populous cities, Gondar had the fastest median mobile download speed of 61.22 Mbps.

- Tanzania: There were no winners over fastest mobile or fixed broadband in Tanzania during Q2 2023. Maisha Broadband registered the lowest median multi-server latency in Tanzania at 14 ms. Of Tanzania’s most populous cities, Dar es Salaam had the fastest median mobile download speed of 26.33 Mbps, while Mbeya had the fastest median fixed download speed of 21.32 Mbps.

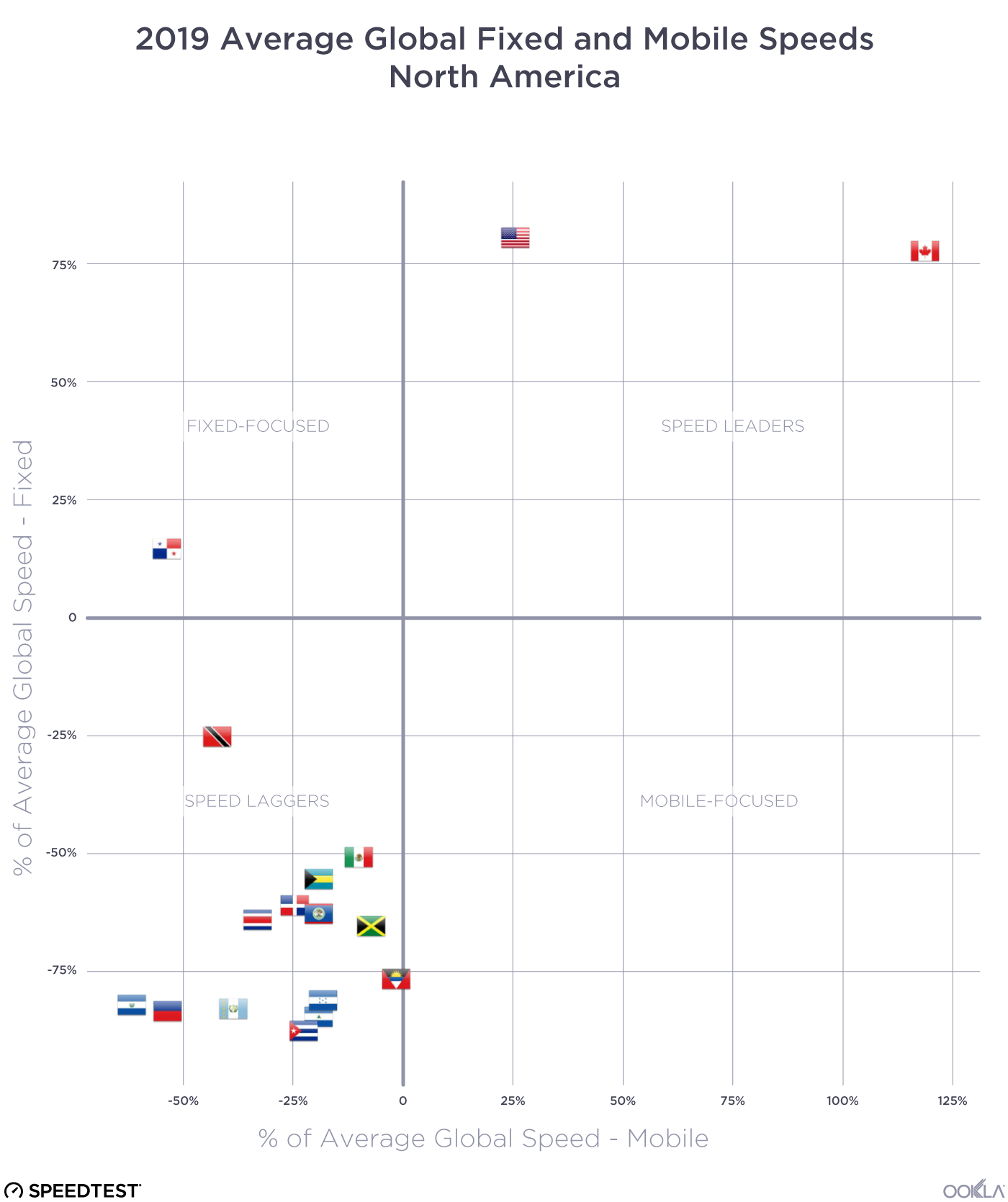

Americas

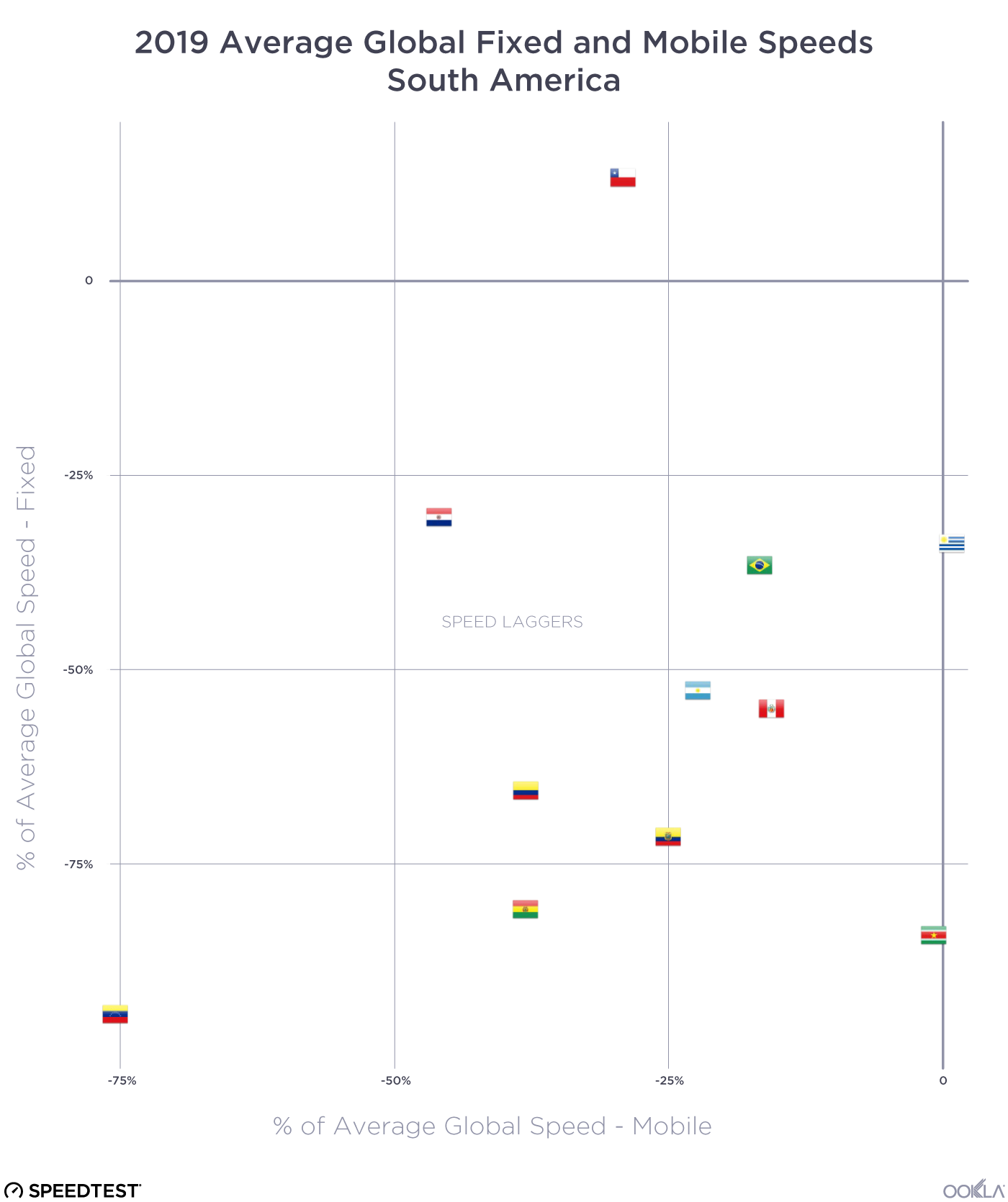

- Argentina: Personal had the fastest median download speed over mobile (35.05 Mbps) and lowest mobile multi-server latency (38 ms) during Q2 2023. In the fixed broadband market, Movistar recorded the fastest median download speed (98.37 Mbps) and lowest multi-server latency (12 ms). Among Argentina’s most populous cities, Buenos Aires recorded the fastest download speeds across mobile and fixed broadband networks.

- Belize: Digi had the fastest median mobile download and upload speeds of 17.61 Mbps and 9.88 Mbps respectively during Q2 2023. It also recorded the highest Consistency of 79.8%. smart! recorded the lowest median mobile multi-server latency, of 67 ms. NEXGEN had the fastest median download and upload performance over fixed broadband in Belize at 48.65 Mbps and 47.38 Mbps respectively.

- Canada: Bell was the fastest mobile operator in Canada with a median download speed of 116.59 Mbps in Q2 2023. Bell also had the fastest median 5G download speed at 208.05 Mbps. Rogers had the fastest median mobile upload speed of 13.29 Mbps, and the highest Consistency of 84.7%. Bell pure fibre was fastest for fixed broadband across both download (277.24 Mbps) and upload (235.27 Mbps) speeds. Of Canada’s most populous cities, St. John’s recorded the fastest median mobile download speed (214.29 Mbps) and Fredericton recorded the fastest median fixed download speed (239.28 Mbps).

- Colombia: Movistar was fastest for fixed broadband with a median download speed of 161.28 Mbps in Q2 2023. ETB had the lowest median multi-server latency over fixed broadband at 8 ms. Of Colombia’s most populous cities, Cartagena recorded the fastest median fixed download speed of 109.01 Mbps.

- Costa Rica: Claro had the fastest median download and upload speeds among mobile operators at 51.88 Mbps and 12.56 Mbps respectively. Liberty had the lowest mobile multi-server latency at 34 ms, and the highest Consistency at 79.7%. Metrocom was fastest for fixed broadband download and upload performance, at 192.00 Mbps and 143.94 Mbps respectively.

- Dominican Republic: Claro had the fastest median download and upload speeds among mobile operators at 30.60 Mbps and 8.70 Mbps respectively. Viva had the lowest mobile multi-server latency at 44 ms. SpaceX’s Starlink was fastest for fixed broadband at 57.31 Mbps.

- Ecuador: CNT was the fastest mobile operator in Ecuador with a median download speed of 28.45 Mbps in Q2 2023. It also recorded the highest Consistency of 81.5%. Movistar registered the lowest median multi-server latency in Ecuador at 39 ms. Netlife was fastest for fixed broadband, at 78.36 Mbps.

- El Salvador: Claro had the fastest median download and upload speeds among mobile operators at 42.00 Mbps and 15.42 Mbps respectively. Movistar registered the lowest median multi-server latency in El Salvador at 65 ms. Cable Color recorded the fastest median fixed download speed (51.14 Mbps), upload speed (47.58 Mbps), and lowest median multi-server latency (35 ms).

- Guatemala: Claro was the fastest mobile operator in Guatemala with a median download speed of 34.67 Mbps and median upload speed of 20.68 Mbps. Claro also had the highest Consistency with 84.4% of results showing at least a 5 Mbps minimum download speed and 1 Mbps minimum upload speed. Claro was also fastest for median fixed download performance, at 40.60 Mbps, while Cable Color was fastest for fixed upload performance, at 26.85 Mbps, and had the lowest median multi-server latency, of 35 ms.

- Guyana: ENet was the top performing operator in the market, recording a median mobile download and upload speed of 67.58 Mbps and 20.92 Mbps respectively, and a median fixed download and upload speed of 62.40 Mbps and 39.66 Mbps respectively, in Q2 2023. ENet also recorded the lowest median multi-server latency across mobile and fixed networks.

- Haiti: Digicel was the fastest mobile operator in Haiti with a median mobile download speed of 10.53 Mbps and median upload speed of 6.99 Mbps. SpaceX Starlink had the fastest median fixed download speed at 60.24 Mbps, while Natcom had the fastest median fixed upload speeds (17.76 Mbps) and lowest median fixed multi-server latency at 32 ms.

- Jamaica: Flow was the fastest mobile operator in Jamaica with a median download speed of 35.56 Mbps. Flow also had the lowest mobile median multi-server latency at 36 ms. SpaceX Starlink had the fastest median fixed speeds at 84.93 Mbps.

- Mexico: Telcel had the fastest median download speed over mobile at 48.76 Mbps, and for 5G at 223.93 Mbps. Telcel also had the lowest mobile median multi-server latency at 64 ms. Totalplay was fastest for fixed broadband (87.03 Mbps) and had the lowest median multi-server latency at 24 ms. Among Mexico’s most populous cities, Guadalajara recorded the fastest median mobile download speed of 39.13 Mbps, and Monterrey the fastest median fixed download speed of 78.30 Mbps.

- Peru: Claro was the fastest mobile operator with a median download speed of 22.67 Mbps, and had the highest mobile network Consistency in the market with 80.4%. Apple devices had the fastest median download speed among top device manufacturers at 29.68 Mbps.

- Trinidad and Tobago: Digicel had the fastest median download speed over mobile at 37.34 Mbps, and highest Consistency of 87.7%. Digicel+ had the fastest median fixed broadband download and upload speed at 99.11 Mbps and 98.32 Mbps respectively, and the lowest median multi-server latency at 7 ms.

- United States: T-Mobile was the fastest mobile operator with a median download speed of 164.76 Mbps. T-Mobile also had the fastest median 5G download speed at 220.00 Mbps, and lowest 5G multi-server latency of 51 ms. Spectrum edged out Cox as the fastest fixed broadband provider with a median download speed of 243.02 Mbps. Verizon had the lowest median multi-server latency on fixed broadband at 15 ms.

- Venezuela: Digitel was the fastest mobile operator with a median download speed of 9.53 Mbps, and had the highest mobile network Consistency in the market with 58.1%. Airtek Solutions had the fastest fixed median download speed of 73.44 Mbps, and lowest median multi-server latency at 8 ms.

Asia

- Afghanistan: The fastest mobile operator in Afghanistan was Afghan Wireless with a median download speed of 7.17 Mbps. It also had the lowest median multi-server latency at 78 ms, and highest Consistency of 58.1% in Q2 2023.

- Bangladesh: Banglalink was the fastest mobile operator in Bangladesh with a median download speed of 23.47 Mbps in Q2 2023. DOT Internet was the fastest fixed broadband provider with a median download speed of 90.88 Mbps and had the lowest median multi-server latency at 4 ms.

- Bhutan: There was no fastest mobile operator in Bhutan during Q2 2023, but TashiCell had the lowest median multi-server latency at 42 ms, and offered the highest Consistency in the market with 83.8%.

- Brunei: There was no statistical winner for fastest mobile download performance during Q2 2023 in Brunei, but Apple devices had the fastest median download speed at 143.97 Mbps.

- Cambodia: Cellcard recorded the fastest median mobile download speeds at 31.60 Mbps during Q2 2023. SINET had the fastest median fixed download speed at 42.26 Mbps.

- China: China Mobile was the fastest mobile operator with a median download speed of 132.81 Mbps. China Mobile also had the fastest median mobile 5G download speed at 279.14 Mbps. China Unicom was fastest for fixed broadband at 222.22 Mbps.

- Georgia: There was no statistical winner for fastest mobile download performance during Q2 2023 in Georgia. Geocell recorded the lowest median mobile multi-server latency at 39 ms, while Magti recorded the highest mobile Consistency with 90.0%. MagtiCom had the fastest median fixed speed at 27.81 Mbps. MagtiCom also had the lowest median multi-server latency at 11 ms.

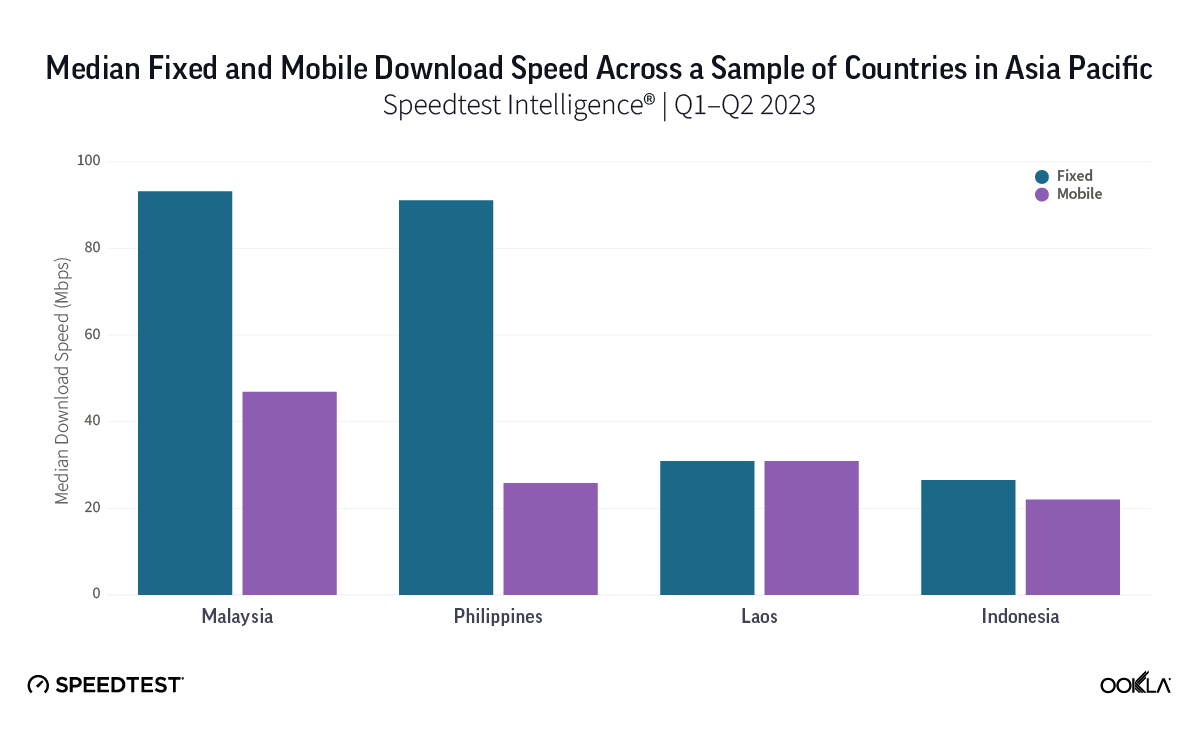

- Indonesia: Telkomsel was the fastest Indonesian mobile operator with a median download speed of 28.71 Mbps. Telkomsel also had the lowest median mobile multi-server latency at 46 ms.

- Japan: There was no statistical winner for fastest mobile download performance during Q2 2023 in Japan, however Rakuten recorded the fastest mobile upload speed at 19.90 Mbps. So-net had the fastest fixed download and upload speeds, at 276.58 Mbps and 179.51 Mbps respectively, and the lowest median multi-server latency at 9 ms.

- Malaysia: TIME was the fastest fixed provider in Malaysia with a median download speed of 108.38 Mbps, and had the lowest multi-server latency at 9 ms.

- Pakistan: Transworld had the fastest median fixed broadband download speed in Pakistan at 17.10 Mbps, and the highest Consistency, at 36.6%.

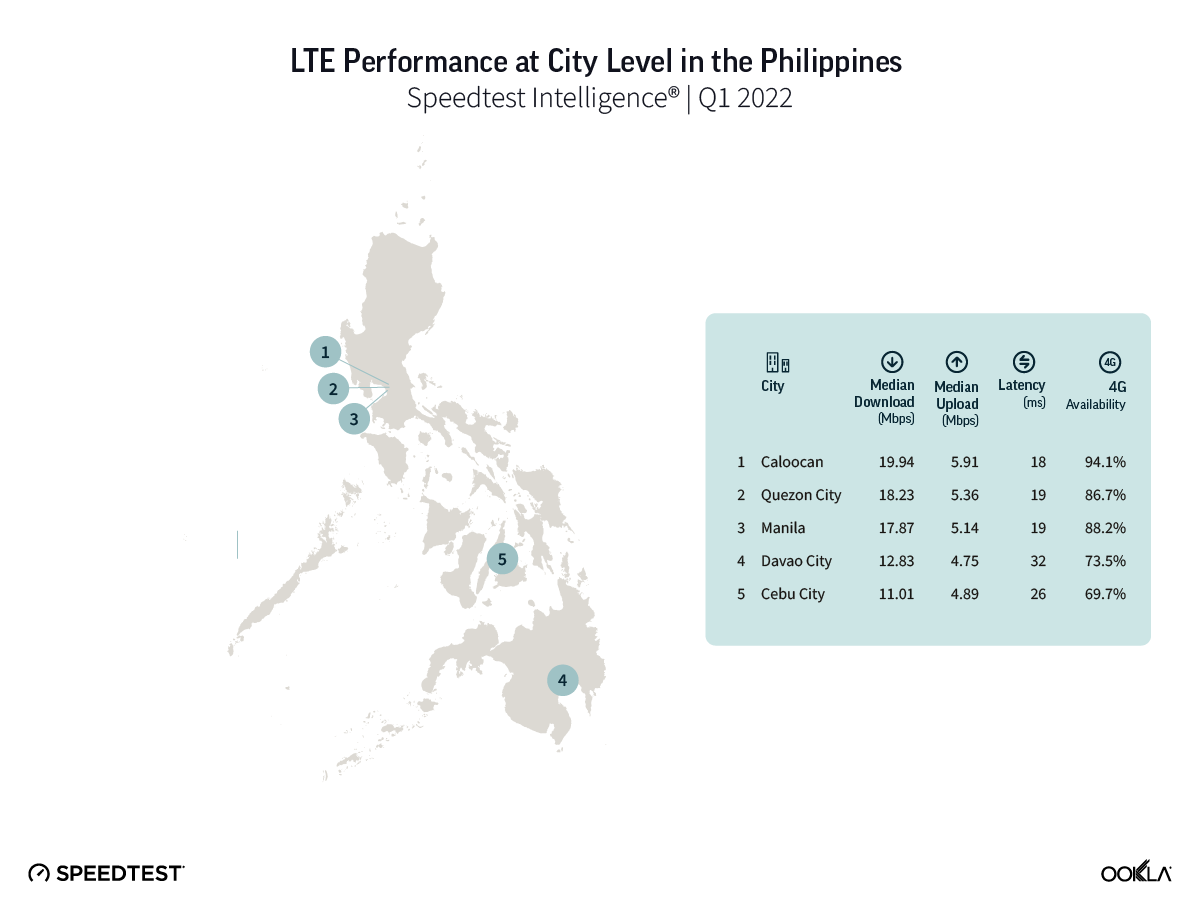

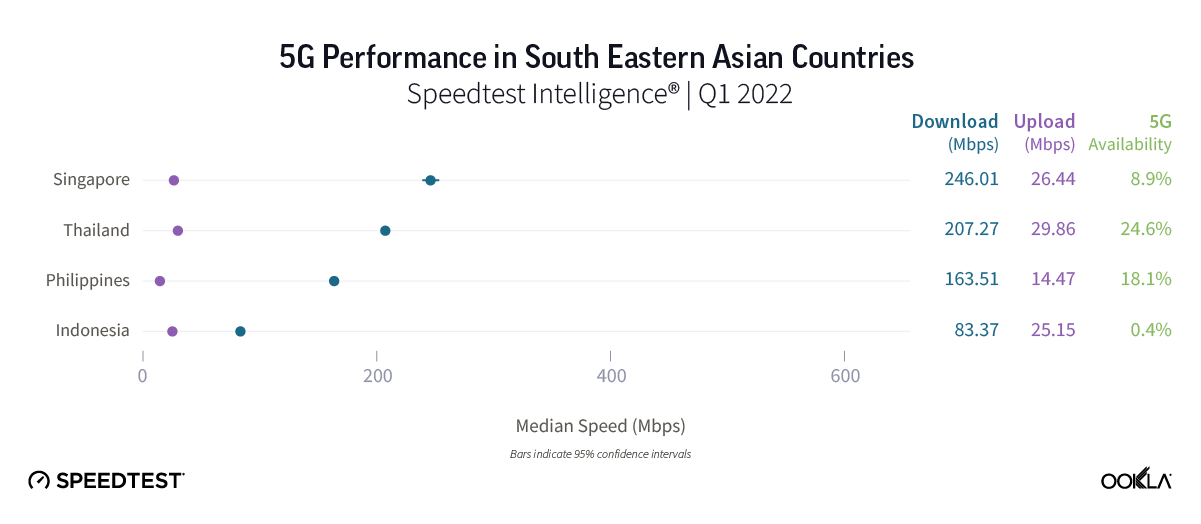

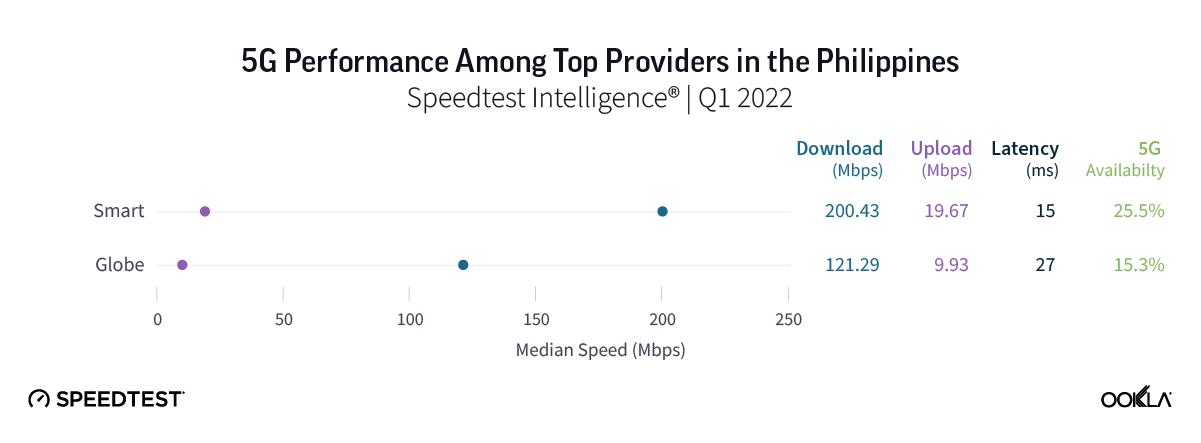

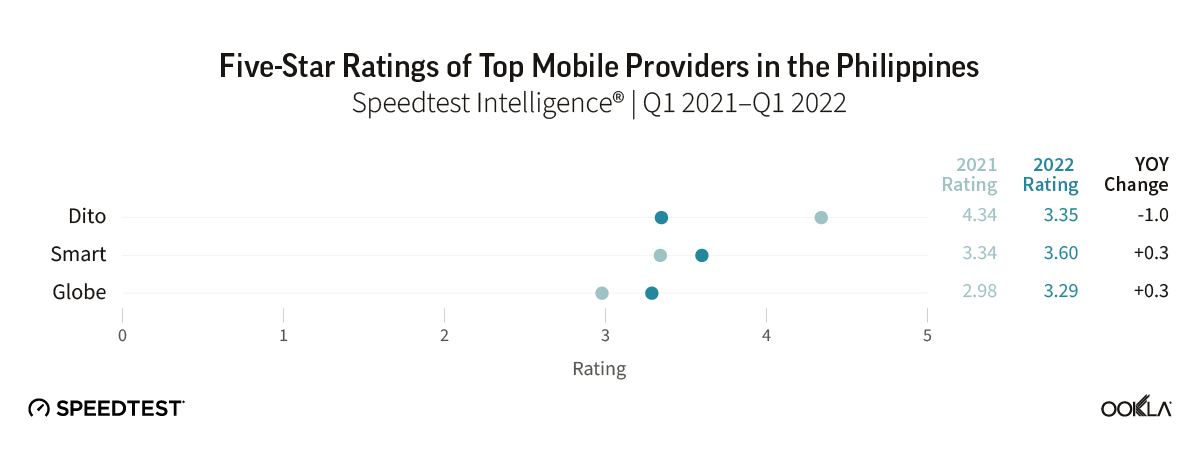

- Philippines: Smart delivered the fastest median mobile download speed in the Philippines at 35.39 Mbps.

- South Korea: SK Telecom recorded the fastest median mobile download and upload speeds at 161.16 Mbps and 16.37 Mbps respectively. LG U+ had the lowest median multi-server latency in the market at 63 ms. KT delivered the fastest median fixed download speed at 131.09 Mbps.

- Sri Lanka: SLT-Mobitel delivered the fastest mobile and fixed broadband speeds in Sri Lanka at 20.71 Mbps and 38.97 Mbps, respectively in Q2 2023. Dialog had the lowest median mobile multi-server latency at 35 ms, and the highest Consistency, at 81.8%.

- United Arab Emirates: etisalat by e& recorded the fastest median download speeds across both mobile and fixed, at 216.65 Mbps and 261.98 Mbps respectively in Q2 2023. etisalat by e& also had the fastest median 5G download speed at 680.88 Mbps and lowest median mobile multi-server latency at 35 ms. du recorded the lowest fixed multi-server latency, at 12 ms.

- Vietnam: Vinaphone had the fastest median mobile download speed in Q2 2023, at 52.58 Mbps. It also had the lowest median mobile multi-server latency at 34 ms, and highest Consistency at 94.8%. Viettel was the fastest fixed provider with a median download speed of 105.72 Mbps.

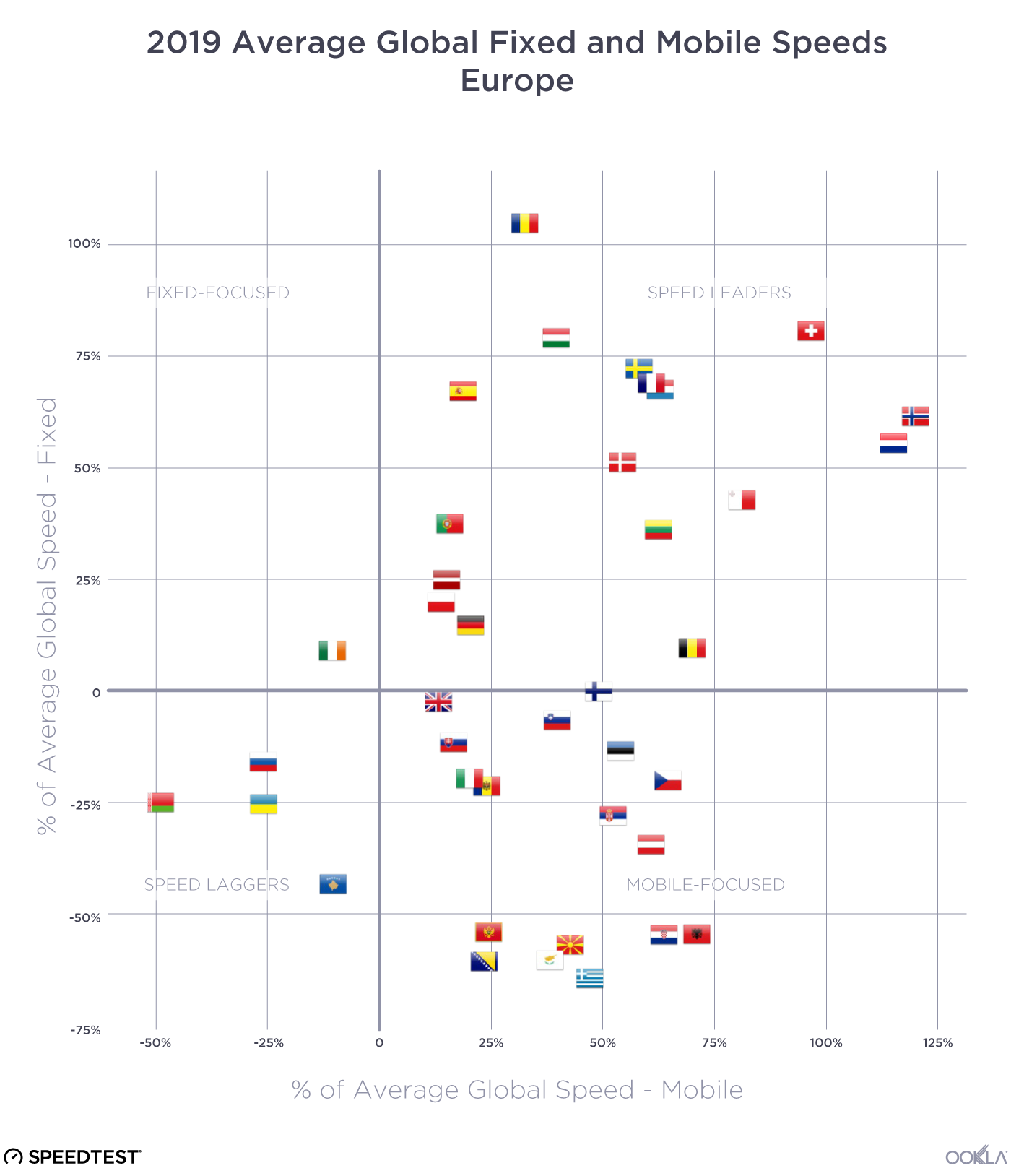

Europe

- Albania: Digicom was the fastest fixed broadband provider in Albania in Q2 2023, recording a median download speed of 93.40 Mbps. It also recorded the highest Consistency in the market, at 86.0%. There was no winner for fastest mobile operator in the market.

- Belgium: Proximus recorded the fastest median mobile download speed during Q2 2023, at 78.01 Mbps. It also recorded the highest Consistency in the market, at 90.5%. Telenet had the fastest median fixed download speed at 143.42 Mbps. Among Belgium’s most populous cities, Ghent recorded the fastest median mobile download speed of 187.90 Mbps, and Antwerp the fastest median fixed download speed of 87.72 Mbps.

- Denmark: YouSee was the fastest mobile operator in Denmark with a median download speed of 140.59 Mbps. Hiper was fastest for fixed broadband at 268.02 Mbps.

- Estonia: The fastest mobile operator in Estonia was Telia with a median download speed of 101.32 Mbps. Telia also had the lowest median multi-server latency on mobile at 31 ms. Elisa was the fastest fixed broadband provider, with a median download speed of 94.70 Mbps.

- Finland: DNA had the fastest median mobile download speed at 99.07 Mbps. Lounea was fastest for fixed broadband at 105.84 Mbps and had the lowest median multi-server latency at 11 ms.

- Germany: Telekom was the fastest mobile operator in Germany with a median download speed of 93.39 Mbps, and a median download speed with 5G at 187.25 Mbps. Vodafone recorded the fastest fixed broadband performance, with a median download speed at 121.76 Mbps. It also recorded the highest Consistency in the market, at 83.8%.

- Latvia: BITĖ was the fastest mobile operator in Latvia during Q2 2023, with a median download speed of 114.51 Mbps. LMT recorded the lowest mobile multi-server latency, at 26 ms. Balticom was fastest for fixed broadband with a median download speed of 243.92 Mbps. Balticom also had the lowest median fixed broadband multi-server latency at 4 ms.

- Lithuania: The mobile operator with the fastest median download speed was Telia at 117.68 Mbps in Q2 2023. It also recorded the highest Consistency in the market, at 95.0%. Cgates was fastest for fixed broadband with a median download speed at 161.67 Mbps.

- Poland: UPC was the fastest provider for fixed broadband with a median download speed of 223.32 Mbps in Q2 2023. There was no statistical winner for fastest mobile operator during Q2 2023, however Plus recorded the fastest median 5G download performance, at 153.19 Mbps.

- Switzerland: Salt blazed ahead for the fastest fixed broadband in Switzerland, with a median download speed of 358.73 Mbps. Salt also had the lowest median multi-server latency over fixed broadband at 8 ms, and highest Consistency in the market, at 94.1%.

- Turkey: Turkcell was the fastest mobile operator in Turkey with a median download speed of 58.52 Mbps. Türk Telekom had the lowest median mobile multi-server latency at 39 ms. TurkNet was fastest for fixed broadband, with a median download speed of 62.80 Mbps. It recorded the lowest median fixed multi-server latency, at 13 ms, and highest Consistency, at 80.5%. Among Turkey’s most populous cities, Istanbul recorded the fastest median download speeds across mobile and fixed, of 39.89 Mbps, and 40.27 Mbps respectively.

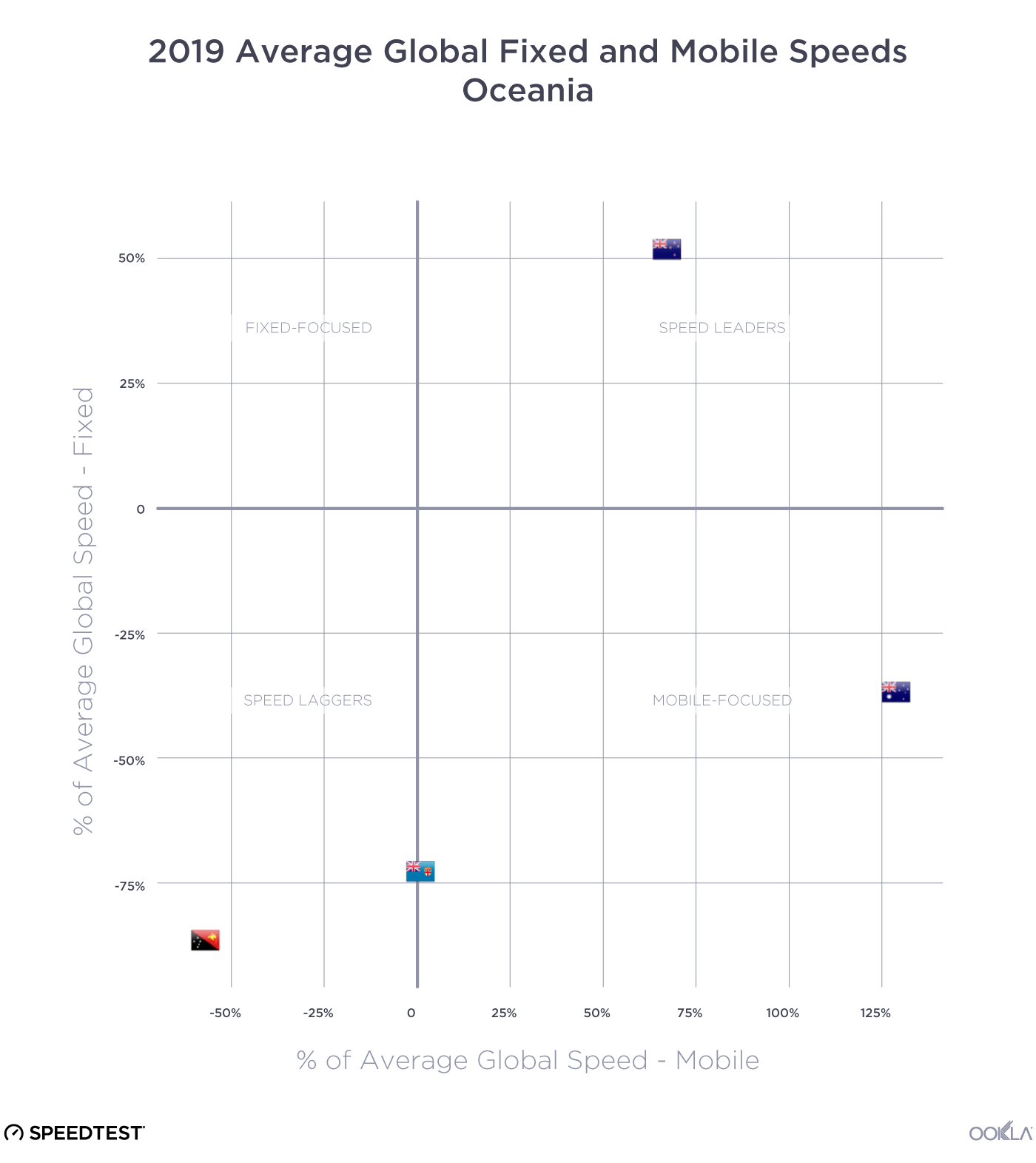

Oceania

- New Zealand: Speedtest Intelligence data showed no winner for fastest mobile operator in New Zealand during Q2 2023. 2degrees had the lowest median mobile multi-server latency at 40 ms, and the highest Consistency, at 91.6%.

The Speedtest Global Index is your resource to understand how internet connectivity compares around the world and how it’s changing. Check back next month for updated data on country and city rankings, and look for updated Ookla Market Reports with Q3 2023 data in October.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.

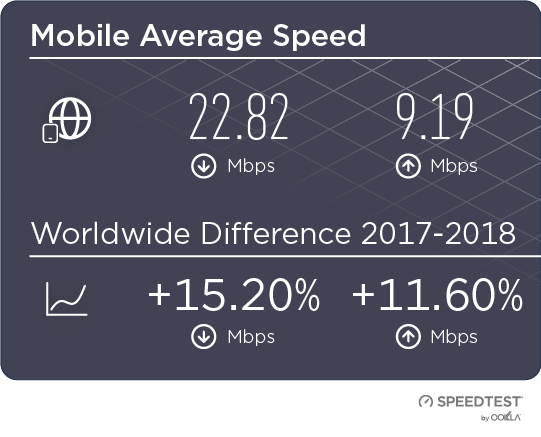

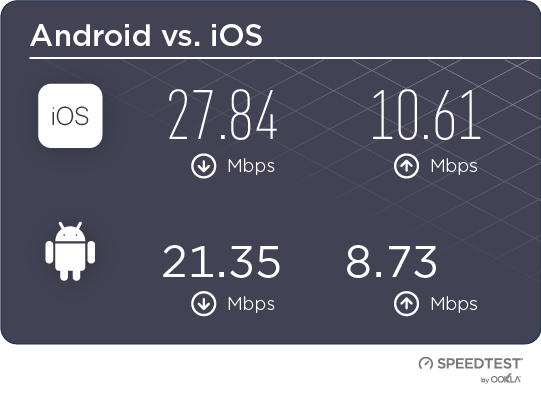

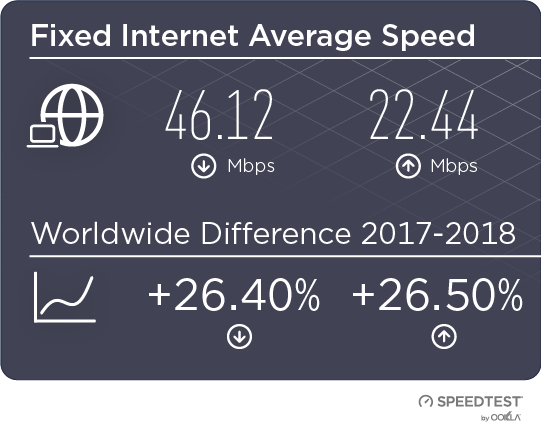

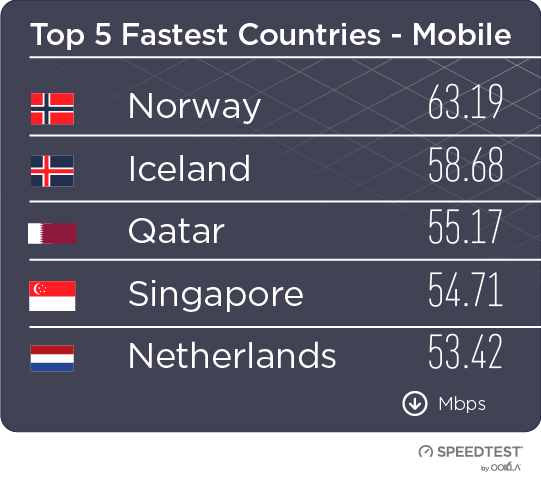

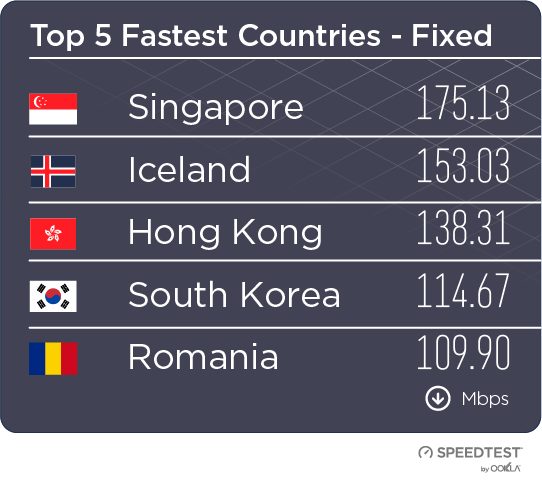

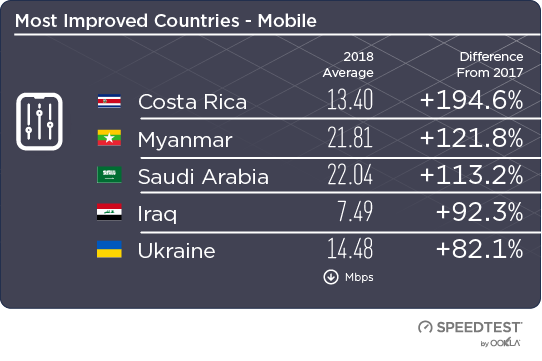

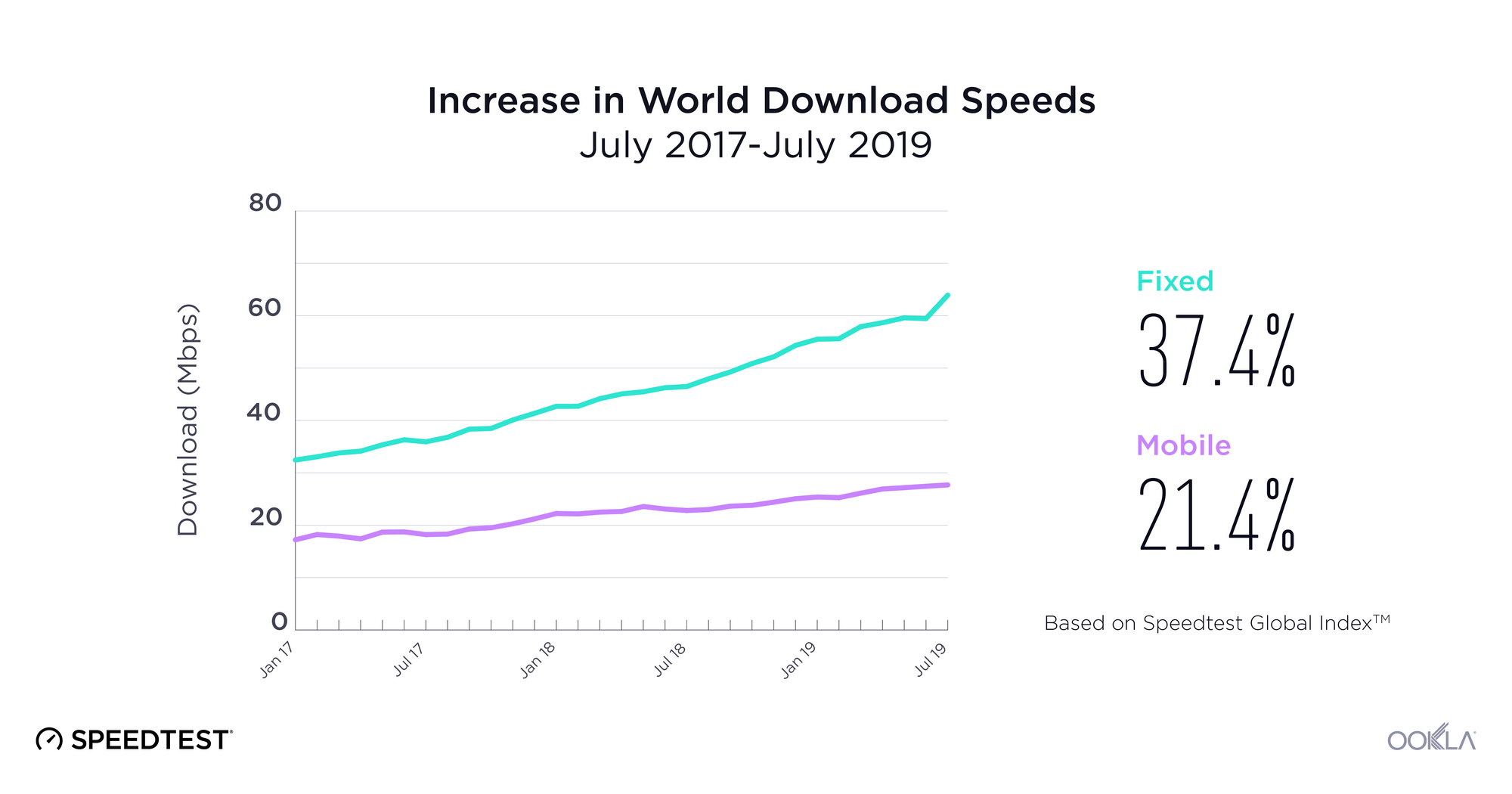

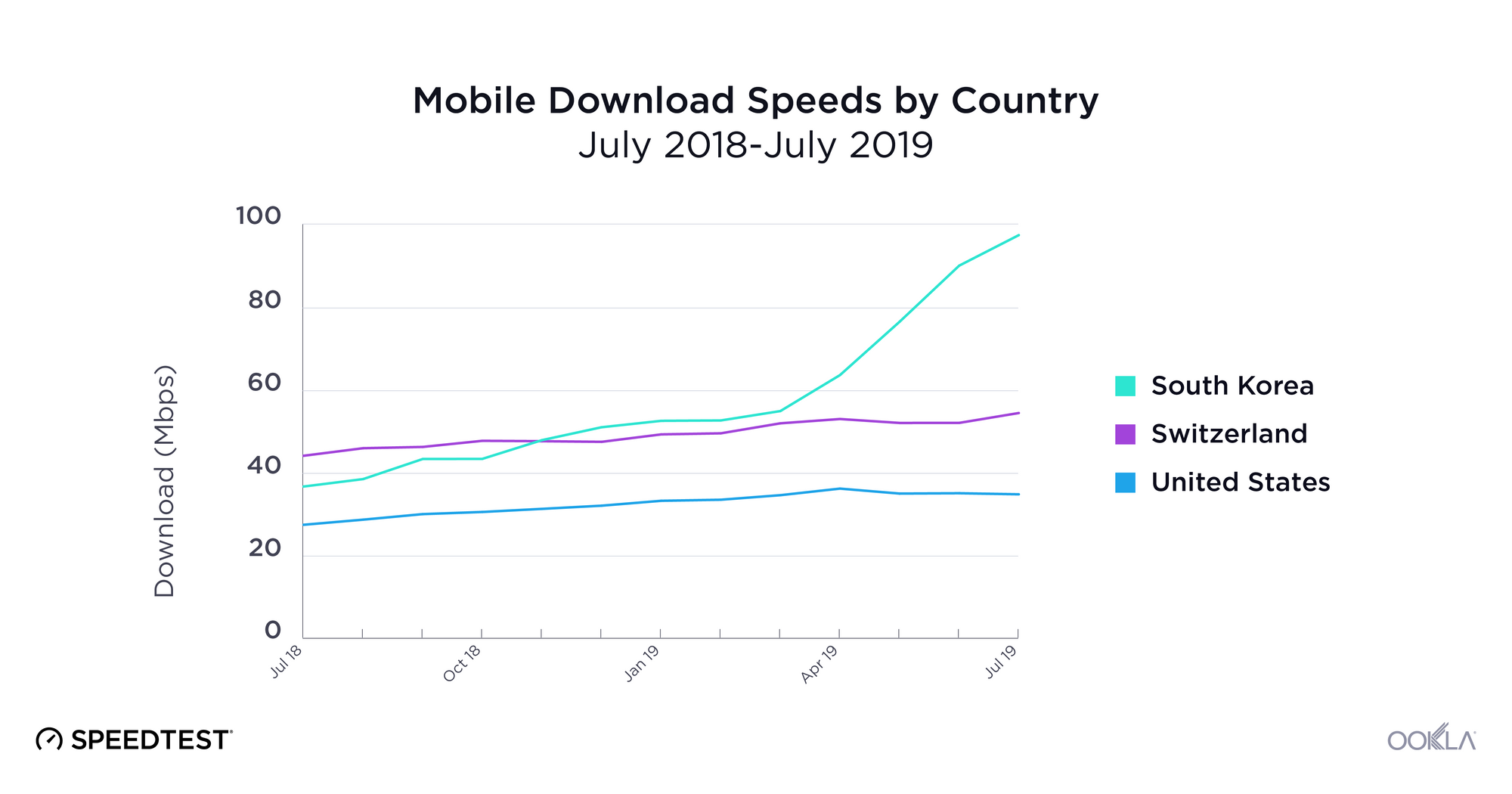

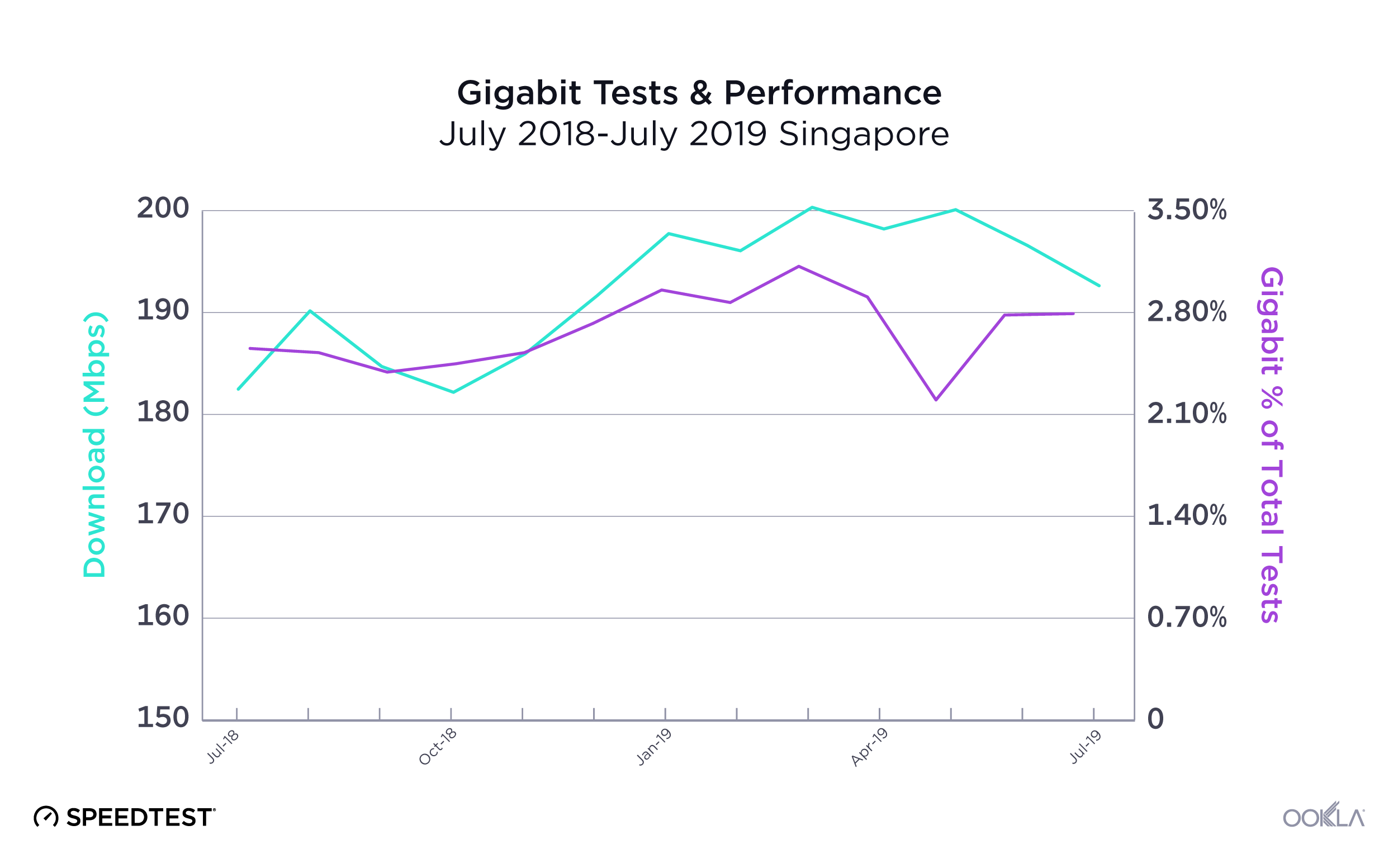

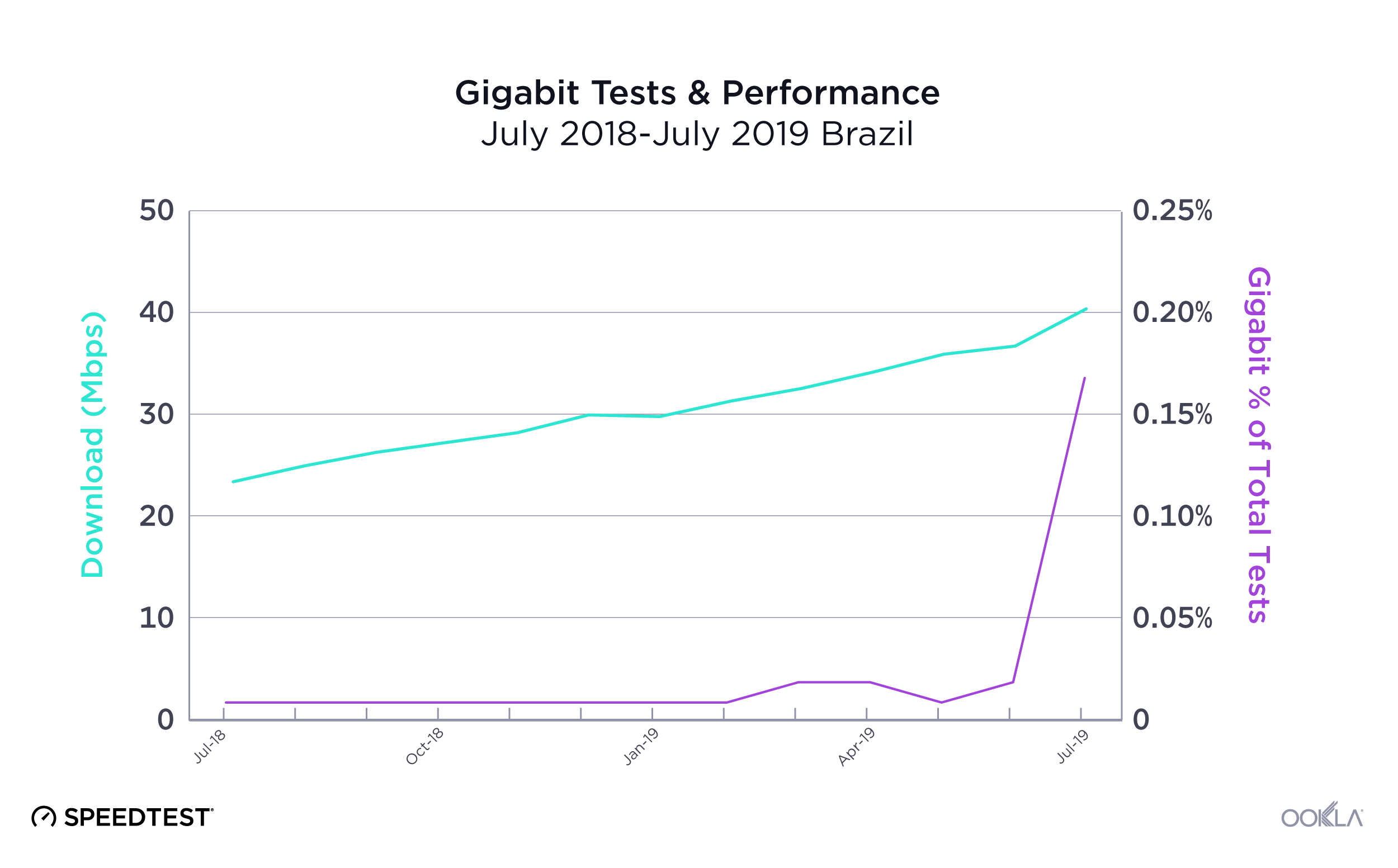

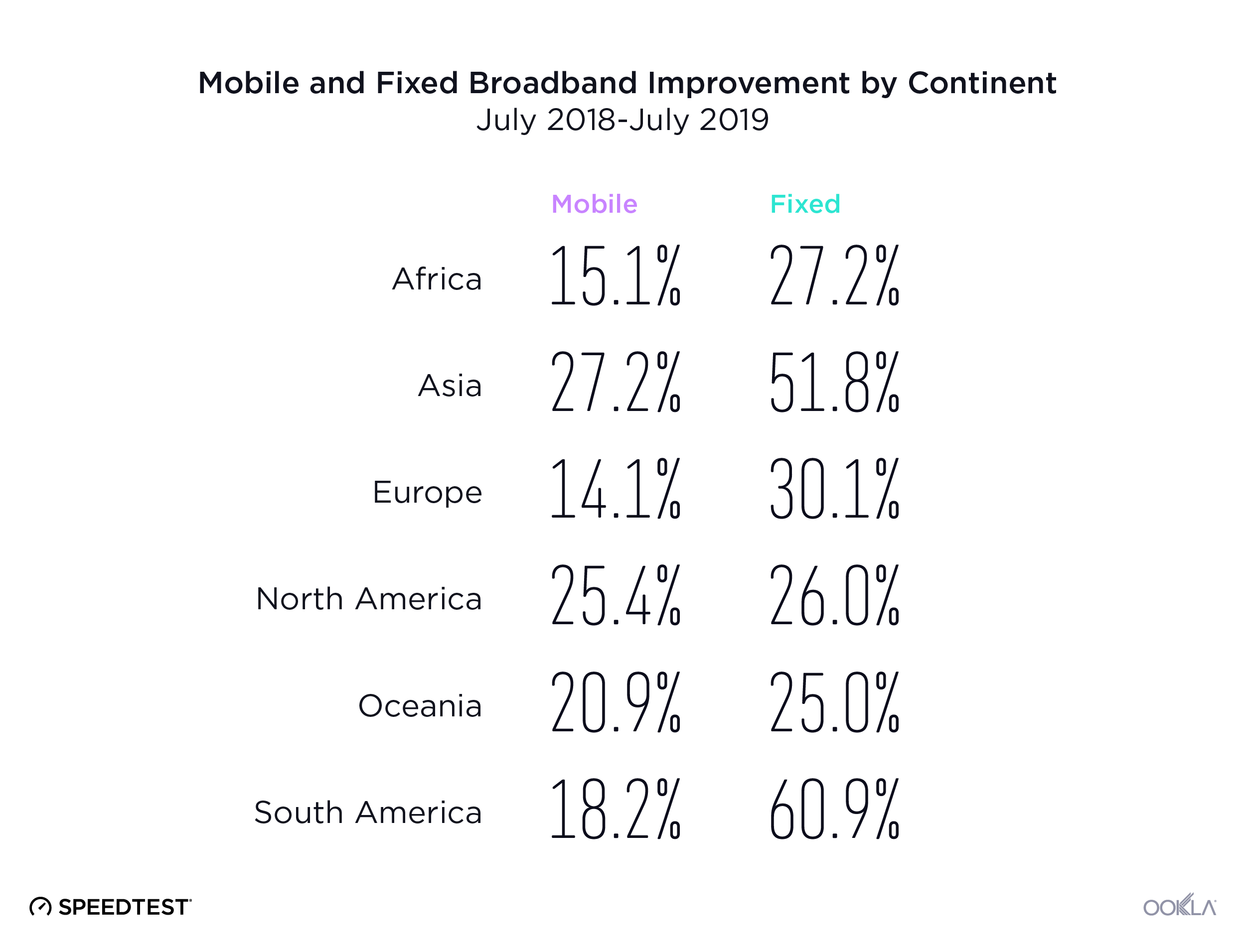

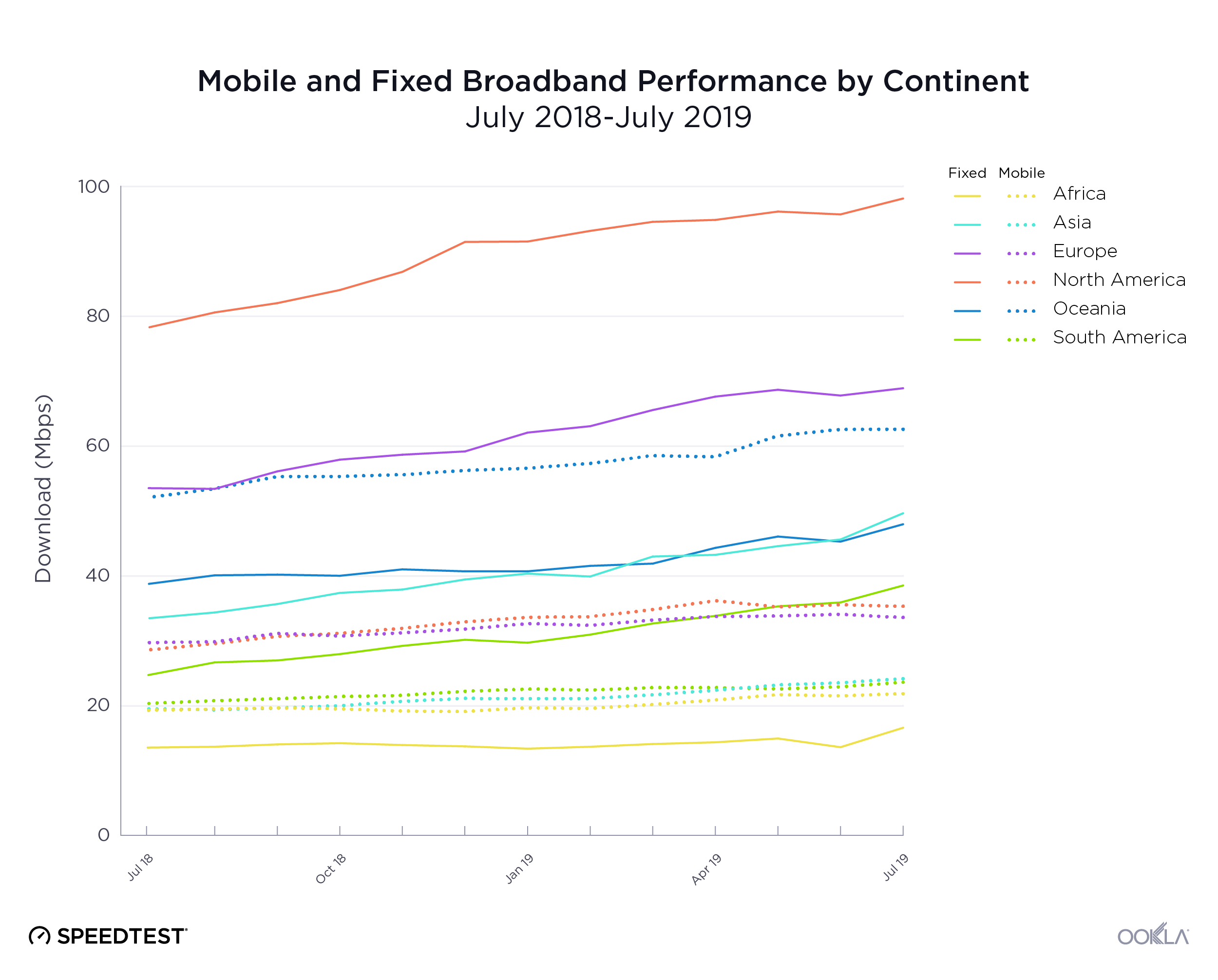

When it comes to the internet, the news is mostly good for 2018. Download and upload speeds are increasing across the globe on both mobile and fixed broadband. 5G is on the horizon and gigabit service is expanding.

When it comes to the internet, the news is mostly good for 2018. Download and upload speeds are increasing across the globe on both mobile and fixed broadband. 5G is on the horizon and gigabit service is expanding.